39cc358d0eebad83709df61b7a2205f2.ppt

- Количество слайдов: 91

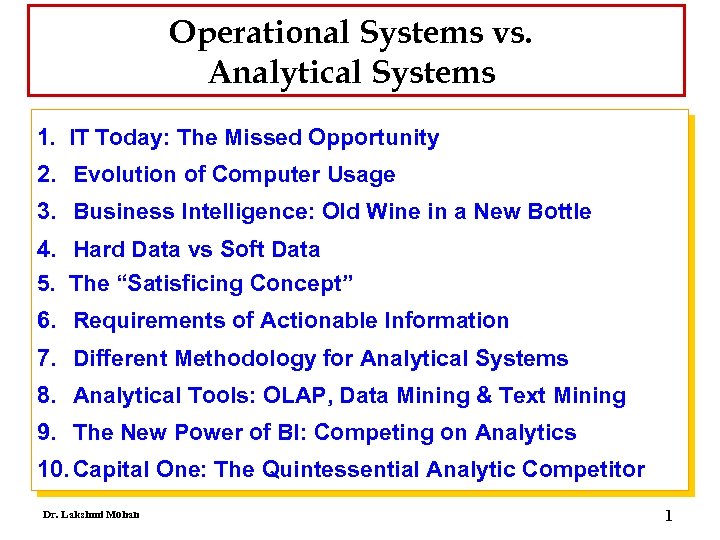

Operational Systems vs. Analytical Systems 1. IT Today: The Missed Opportunity 2. Evolution of Computer Usage 3. Business Intelligence: Old Wine in a New Bottle 4. Hard Data vs Soft Data 5. The “Satisficing Concept” 6. Requirements of Actionable Information 7. Different Methodology for Analytical Systems 8. Analytical Tools: OLAP, Data Mining & Text Mining 9. The New Power of BI: Competing on Analytics 10. Capital One: The Quintessential Analytic Competitor Dr. Lakshmi Mohan 1

Operational Systems vs. Analytical Systems 1. IT Today: The Missed Opportunity 2. Evolution of Computer Usage 3. Business Intelligence: Old Wine in a New Bottle 4. Hard Data vs Soft Data 5. The “Satisficing Concept” 6. Requirements of Actionable Information 7. Different Methodology for Analytical Systems 8. Analytical Tools: OLAP, Data Mining & Text Mining 9. The New Power of BI: Competing on Analytics 10. Capital One: The Quintessential Analytic Competitor Dr. Lakshmi Mohan 1

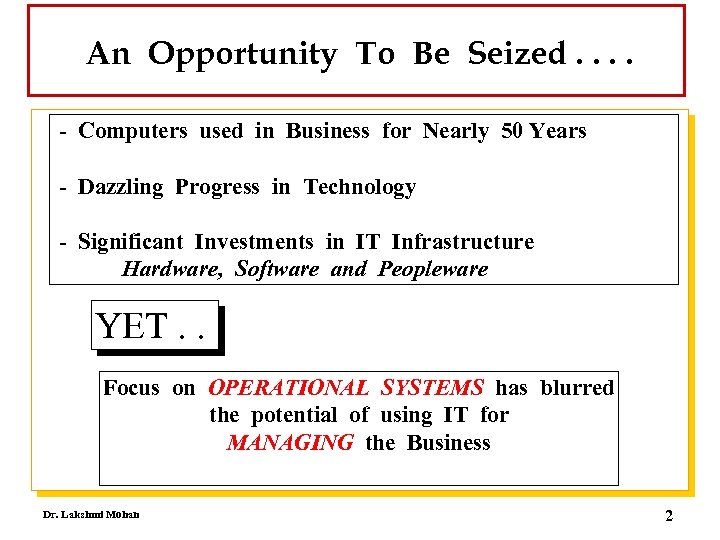

An Opportunity To Be Seized. . - Computers used in Business for Nearly 50 Years - Dazzling Progress in Technology - Significant Investments in IT Infrastructure Hardware, Software and Peopleware YET. . Focus on OPERATIONAL SYSTEMS has blurred the potential of using IT for MANAGING the Business Dr. Lakshmi Mohan 2

An Opportunity To Be Seized. . - Computers used in Business for Nearly 50 Years - Dazzling Progress in Technology - Significant Investments in IT Infrastructure Hardware, Software and Peopleware YET. . Focus on OPERATIONAL SYSTEMS has blurred the potential of using IT for MANAGING the Business Dr. Lakshmi Mohan 2

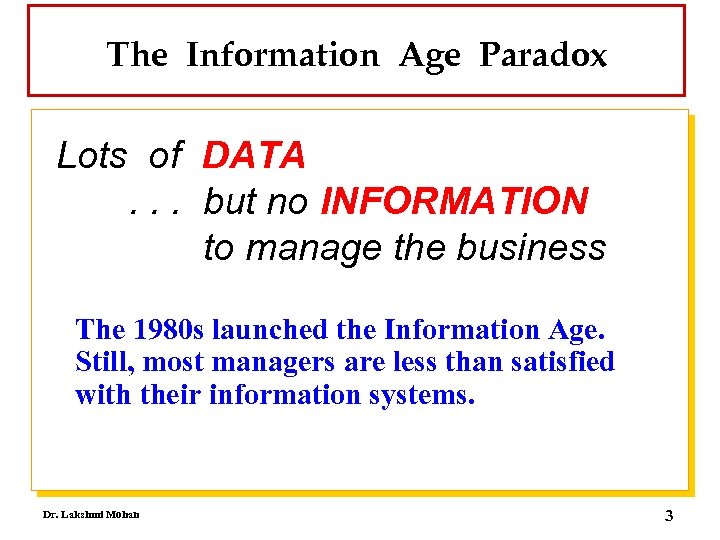

The Information Age Paradox Lots of DATA. . . but no INFORMATION to manage the business The 1980 s launched the Information Age. Still, most managers are less than satisfied with their information systems. Dr. Lakshmi Mohan 3

The Information Age Paradox Lots of DATA. . . but no INFORMATION to manage the business The 1980 s launched the Information Age. Still, most managers are less than satisfied with their information systems. Dr. Lakshmi Mohan 3

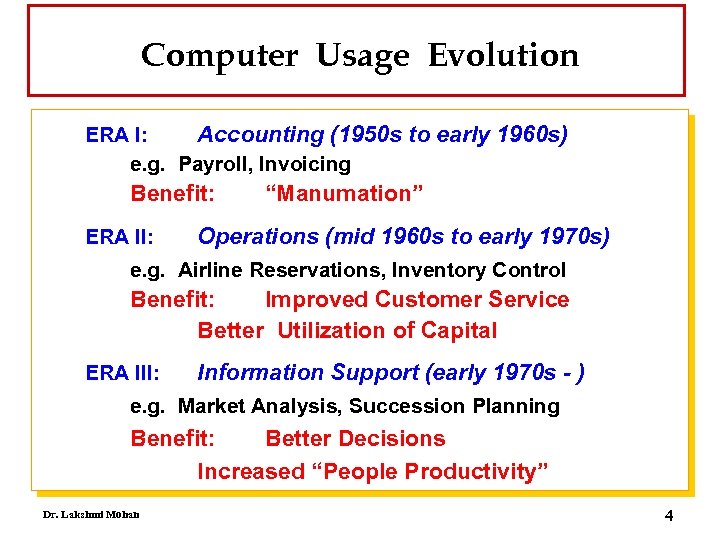

Computer Usage Evolution ERA I: Accounting (1950 s to early 1960 s) e. g. Payroll, Invoicing Benefit: ERA II: “Manumation” Operations (mid 1960 s to early 1970 s) e. g. Airline Reservations, Inventory Control Benefit: Improved Customer Service Better Utilization of Capital ERA III: Information Support (early 1970 s - ) e. g. Market Analysis, Succession Planning Benefit: Better Decisions Increased “People Productivity” Dr. Lakshmi Mohan 4

Computer Usage Evolution ERA I: Accounting (1950 s to early 1960 s) e. g. Payroll, Invoicing Benefit: ERA II: “Manumation” Operations (mid 1960 s to early 1970 s) e. g. Airline Reservations, Inventory Control Benefit: Improved Customer Service Better Utilization of Capital ERA III: Information Support (early 1970 s - ) e. g. Market Analysis, Succession Planning Benefit: Better Decisions Increased “People Productivity” Dr. Lakshmi Mohan 4

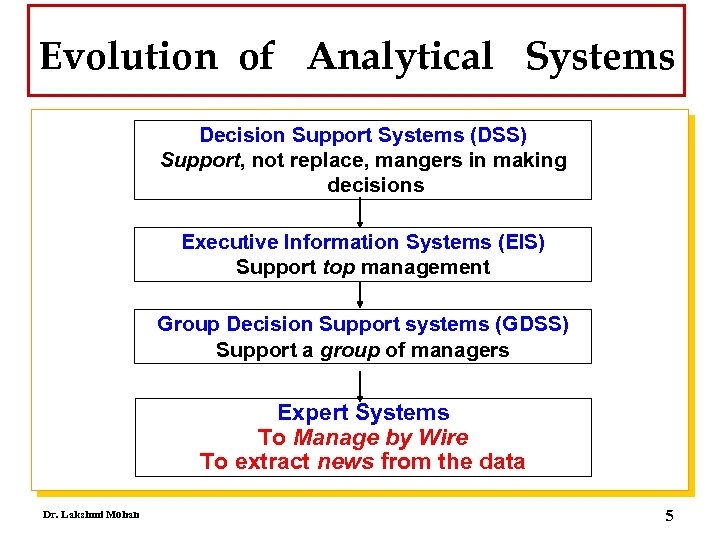

Evolution of Analytical Systems Decision Support Systems (DSS) Support, not replace, mangers in making decisions Executive Information Systems (EIS) Support top management Group Decision Support systems (GDSS) Support a group of managers Expert Systems To Manage by Wire To extract news from the data Dr. Lakshmi Mohan 5

Evolution of Analytical Systems Decision Support Systems (DSS) Support, not replace, mangers in making decisions Executive Information Systems (EIS) Support top management Group Decision Support systems (GDSS) Support a group of managers Expert Systems To Manage by Wire To extract news from the data Dr. Lakshmi Mohan 5

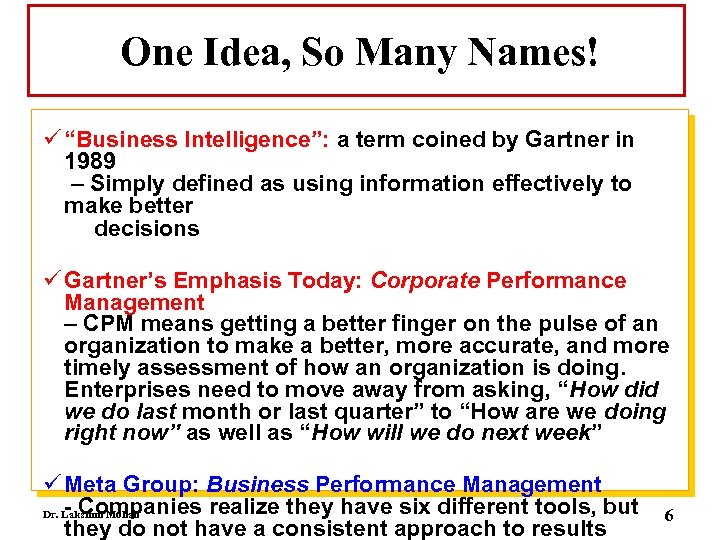

One Idea, So Many Names! ü “Business Intelligence”: a term coined by Gartner in 1989 – Simply defined as using information effectively to make better decisions ü Gartner’s Emphasis Today: Corporate Performance Management – CPM means getting a better finger on the pulse of an organization to make a better, more accurate, and more timely assessment of how an organization is doing. Enterprises need to move away from asking, “How did we do last month or last quarter” to “How are we doing right now” as well as “How will we do next week” ü Meta Group: Business Performance Management - Companies realize they have six different tools, but Dr. Lakshmi Mohan they do not have a consistent approach to results 6

One Idea, So Many Names! ü “Business Intelligence”: a term coined by Gartner in 1989 – Simply defined as using information effectively to make better decisions ü Gartner’s Emphasis Today: Corporate Performance Management – CPM means getting a better finger on the pulse of an organization to make a better, more accurate, and more timely assessment of how an organization is doing. Enterprises need to move away from asking, “How did we do last month or last quarter” to “How are we doing right now” as well as “How will we do next week” ü Meta Group: Business Performance Management - Companies realize they have six different tools, but Dr. Lakshmi Mohan they do not have a consistent approach to results 6

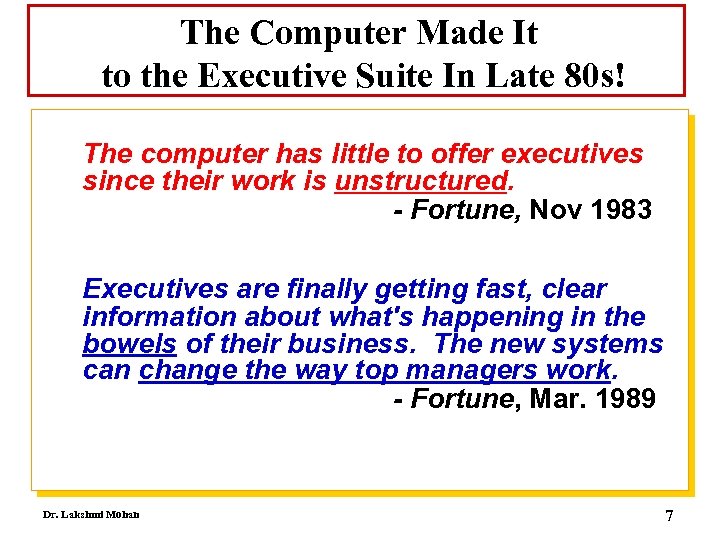

The Computer Made It to the Executive Suite In Late 80 s! The computer has little to offer executives since their work is unstructured. - Fortune, Nov 1983 Executives are finally getting fast, clear information about what's happening in the bowels of their business. The new systems can change the way top managers work. - Fortune, Mar. 1989 Dr. Lakshmi Mohan 7

The Computer Made It to the Executive Suite In Late 80 s! The computer has little to offer executives since their work is unstructured. - Fortune, Nov 1983 Executives are finally getting fast, clear information about what's happening in the bowels of their business. The new systems can change the way top managers work. - Fortune, Mar. 1989 Dr. Lakshmi Mohan 7

But Not Quite ! "Every business manager I know shares one frustration: the difficulty of obtaining fast, accurate and comprehensive market information. " President, Frito-Lay Wall St. Journal, June 11, 1990 Dr. Lakshmi Mohan 8

But Not Quite ! "Every business manager I know shares one frustration: the difficulty of obtaining fast, accurate and comprehensive market information. " President, Frito-Lay Wall St. Journal, June 11, 1990 Dr. Lakshmi Mohan 8

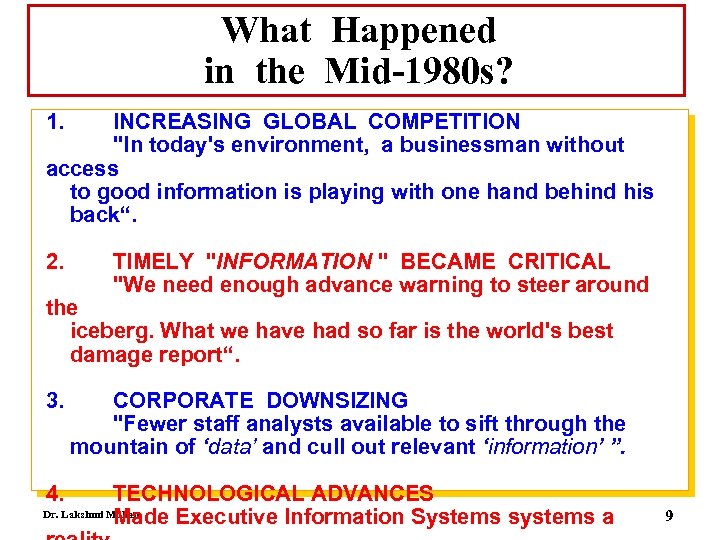

What Happened in the Mid-1980 s? 1. INCREASING GLOBAL COMPETITION "In today's environment, a businessman without access to good information is playing with one hand behind his back“. 2. TIMELY "INFORMATION " BECAME CRITICAL "We need enough advance warning to steer around the iceberg. What we have had so far is the world's best damage report“. 3. CORPORATE DOWNSIZING "Fewer staff analysts available to sift through the mountain of ‘data’ and cull out relevant ‘information’ ”. 4. TECHNOLOGICAL ADVANCES Dr. Lakshmi Mohan Made Executive Information Systems systems a 9

What Happened in the Mid-1980 s? 1. INCREASING GLOBAL COMPETITION "In today's environment, a businessman without access to good information is playing with one hand behind his back“. 2. TIMELY "INFORMATION " BECAME CRITICAL "We need enough advance warning to steer around the iceberg. What we have had so far is the world's best damage report“. 3. CORPORATE DOWNSIZING "Fewer staff analysts available to sift through the mountain of ‘data’ and cull out relevant ‘information’ ”. 4. TECHNOLOGICAL ADVANCES Dr. Lakshmi Mohan Made Executive Information Systems systems a 9

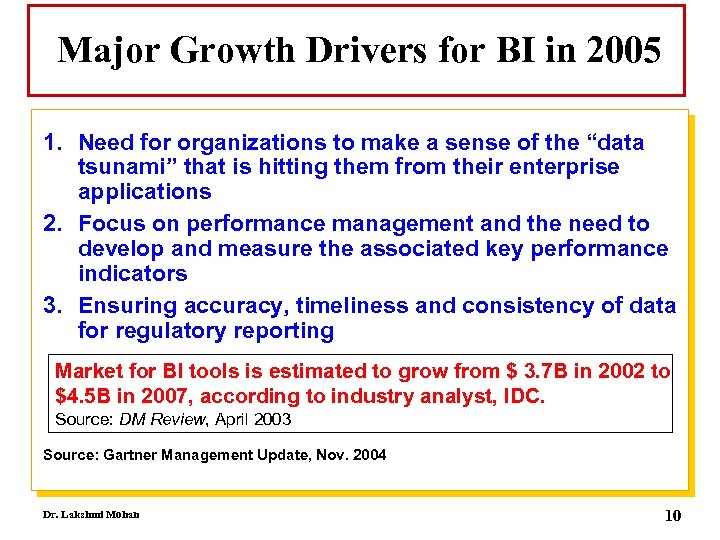

Major Growth Drivers for BI in 2005 1. Need for organizations to make a sense of the “data tsunami” that is hitting them from their enterprise applications 2. Focus on performance management and the need to develop and measure the associated key performance indicators 3. Ensuring accuracy, timeliness and consistency of data for regulatory reporting Market for BI tools is estimated to grow from $ 3. 7 B in 2002 to $4. 5 B in 2007, according to industry analyst, IDC. Source: DM Review, April 2003 Source: Gartner Management Update, Nov. 2004 Dr. Lakshmi Mohan 10

Major Growth Drivers for BI in 2005 1. Need for organizations to make a sense of the “data tsunami” that is hitting them from their enterprise applications 2. Focus on performance management and the need to develop and measure the associated key performance indicators 3. Ensuring accuracy, timeliness and consistency of data for regulatory reporting Market for BI tools is estimated to grow from $ 3. 7 B in 2002 to $4. 5 B in 2007, according to industry analyst, IDC. Source: DM Review, April 2003 Source: Gartner Management Update, Nov. 2004 Dr. Lakshmi Mohan 10

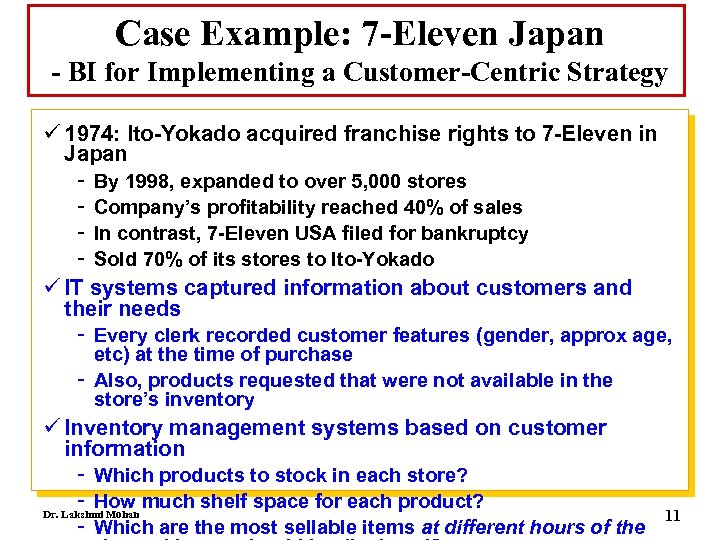

Case Example: 7 -Eleven Japan - BI for Implementing a Customer-Centric Strategy ü 1974: Ito-Yokado acquired franchise rights to 7 -Eleven in Japan By 1998, expanded to over 5, 000 stores Company’s profitability reached 40% of sales In contrast, 7 -Eleven USA filed for bankruptcy Sold 70% of its stores to Ito-Yokado ü IT systems captured information about customers and their needs Every clerk recorded customer features (gender, approx age, etc) at the time of purchase Also, products requested that were not available in the store’s inventory ü Inventory management systems based on customer information Which products to stock in each store? How much shelf space for each product? Dr. Lakshmi Mohan 11 Which are the most sellable items at different hours of the

Case Example: 7 -Eleven Japan - BI for Implementing a Customer-Centric Strategy ü 1974: Ito-Yokado acquired franchise rights to 7 -Eleven in Japan By 1998, expanded to over 5, 000 stores Company’s profitability reached 40% of sales In contrast, 7 -Eleven USA filed for bankruptcy Sold 70% of its stores to Ito-Yokado ü IT systems captured information about customers and their needs Every clerk recorded customer features (gender, approx age, etc) at the time of purchase Also, products requested that were not available in the store’s inventory ü Inventory management systems based on customer information Which products to stock in each store? How much shelf space for each product? Dr. Lakshmi Mohan 11 Which are the most sellable items at different hours of the

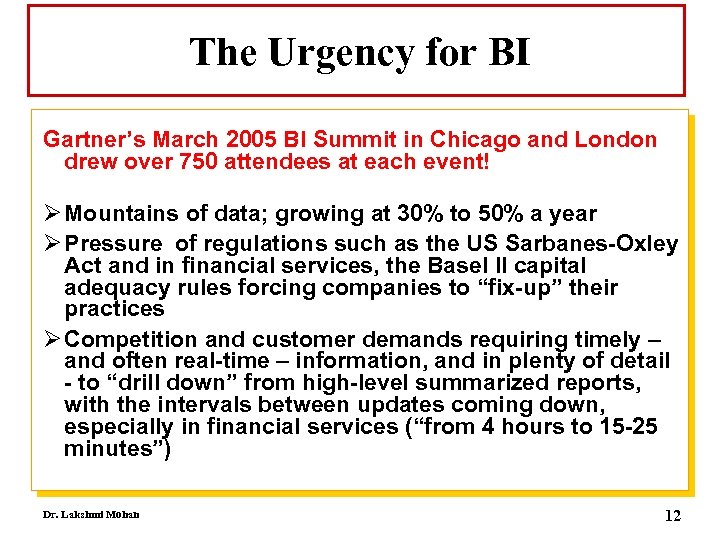

The Urgency for BI Gartner’s March 2005 BI Summit in Chicago and London drew over 750 attendees at each event! Ø Mountains of data; growing at 30% to 50% a year Ø Pressure of regulations such as the US Sarbanes-Oxley Act and in financial services, the Basel II capital adequacy rules forcing companies to “fix-up” their practices Ø Competition and customer demands requiring timely – and often real-time – information, and in plenty of detail - to “drill down” from high-level summarized reports, with the intervals between updates coming down, especially in financial services (“from 4 hours to 15 -25 minutes”) Dr. Lakshmi Mohan 12

The Urgency for BI Gartner’s March 2005 BI Summit in Chicago and London drew over 750 attendees at each event! Ø Mountains of data; growing at 30% to 50% a year Ø Pressure of regulations such as the US Sarbanes-Oxley Act and in financial services, the Basel II capital adequacy rules forcing companies to “fix-up” their practices Ø Competition and customer demands requiring timely – and often real-time – information, and in plenty of detail - to “drill down” from high-level summarized reports, with the intervals between updates coming down, especially in financial services (“from 4 hours to 15 -25 minutes”) Dr. Lakshmi Mohan 12

One Version of the Truth? Ø Data resides in disparate systems cobbled together over the years Ø Duplication of data in different systems, frequently conflicting – Which data is accurate? MIS reports causing confusion – Which report has the correct data? Ø Spreadsheet Hell! - Multiple spreadsheet databases created by users - Slow process; Prone to Error - Multiple Versions of the Truth The goal of BI systems is to pull data from all internal systems AND external sources to present a SINGLE version of the Truth. Dr. Lakshmi Mohan 13

One Version of the Truth? Ø Data resides in disparate systems cobbled together over the years Ø Duplication of data in different systems, frequently conflicting – Which data is accurate? MIS reports causing confusion – Which report has the correct data? Ø Spreadsheet Hell! - Multiple spreadsheet databases created by users - Slow process; Prone to Error - Multiple Versions of the Truth The goal of BI systems is to pull data from all internal systems AND external sources to present a SINGLE version of the Truth. Dr. Lakshmi Mohan 13

BI for the Masses - Not just for Statisticians and Corporate Analysts Ø Instead of a small number of analysts spending 100% of their time analyzing data, all managers and professionals should spend 10% of their time using BI software Ø Smart companies are democratizing data access with dashboards and other BI tools to empower everyone in the organization, at all levels, with analytics, alerts and feedback mechanisms - Transforms every employee into an “organization of one” who can make the right decisions at the right time in step with company objectives. - Everyone can work smarter! Ø Smarter Companies will ensure the payoff of investments in BI systems by making the masses accountable for datadriven action and results. Dr. Lakshmi Mohan - Accountability could be in the form of rewards, penalties 14

BI for the Masses - Not just for Statisticians and Corporate Analysts Ø Instead of a small number of analysts spending 100% of their time analyzing data, all managers and professionals should spend 10% of their time using BI software Ø Smart companies are democratizing data access with dashboards and other BI tools to empower everyone in the organization, at all levels, with analytics, alerts and feedback mechanisms - Transforms every employee into an “organization of one” who can make the right decisions at the right time in step with company objectives. - Everyone can work smarter! Ø Smarter Companies will ensure the payoff of investments in BI systems by making the masses accountable for datadriven action and results. Dr. Lakshmi Mohan - Accountability could be in the form of rewards, penalties 14

GE’s Concept of “Span” - Measures the operational reliability for meeting a customer request … the time window around the Customer Requested Delivery Date in which the delivery will happen - High Span Poor capability to meet customer need Objective Zero span - Squeeze the two sides of the delivery span - days early and days late - ever closer to the center - the exact day the customer desired RESULTS : Plastics Aircraft Engines Mortgage Insurance Dr. Lakshmi Mohan : 50 days span to 5 : 80 days span to 5 : 54 days span to 1 15

GE’s Concept of “Span” - Measures the operational reliability for meeting a customer request … the time window around the Customer Requested Delivery Date in which the delivery will happen - High Span Poor capability to meet customer need Objective Zero span - Squeeze the two sides of the delivery span - days early and days late - ever closer to the center - the exact day the customer desired RESULTS : Plastics Aircraft Engines Mortgage Insurance Dr. Lakshmi Mohan : 50 days span to 5 : 80 days span to 5 : 54 days span to 1 15

The GE Process - In the CEO’s Annual Letter (Feb 2001) When the order is taken, that date becomes known to everyone, from the first person in the process receiving the castings, circuit boards or any other components from the supplier, all the way through to the service reps who stand next to the customer as the process is started up for the first time. Every single delivery to every single customer is measured and in the line of sight of everyone; and, everyone in the process knows he or she is affecting the business-wide measurement of span with every action taken. WHAT GETS MEASURED AND REWARDED GETS DONE ! Dr. Lakshmi Mohan 16

The GE Process - In the CEO’s Annual Letter (Feb 2001) When the order is taken, that date becomes known to everyone, from the first person in the process receiving the castings, circuit boards or any other components from the supplier, all the way through to the service reps who stand next to the customer as the process is started up for the first time. Every single delivery to every single customer is measured and in the line of sight of everyone; and, everyone in the process knows he or she is affecting the business-wide measurement of span with every action taken. WHAT GETS MEASURED AND REWARDED GETS DONE ! Dr. Lakshmi Mohan 16

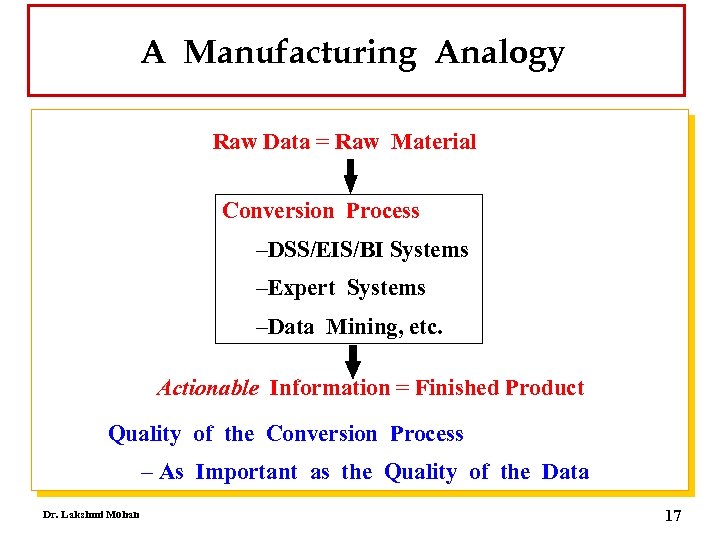

A Manufacturing Analogy Raw Data = Raw Material Conversion Process –DSS/EIS/BI Systems –Expert Systems –Data Mining, etc. Actionable Information = Finished Product Quality of the Conversion Process – As Important as the Quality of the Data Dr. Lakshmi Mohan 17

A Manufacturing Analogy Raw Data = Raw Material Conversion Process –DSS/EIS/BI Systems –Expert Systems –Data Mining, etc. Actionable Information = Finished Product Quality of the Conversion Process – As Important as the Quality of the Data Dr. Lakshmi Mohan 17

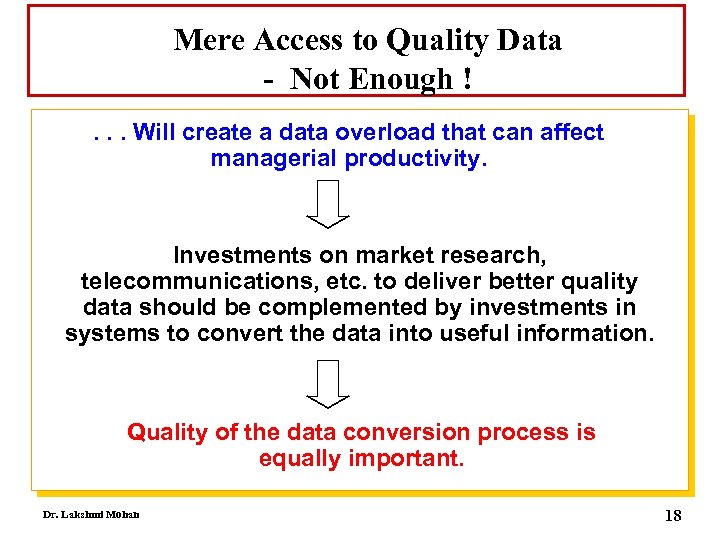

Mere Access to Quality Data - Not Enough !. . . Will create a data overload that can affect managerial productivity. Investments on market research, telecommunications, etc. to deliver better quality data should be complemented by investments in systems to convert the data into useful information. Quality of the data conversion process is equally important. Dr. Lakshmi Mohan 18

Mere Access to Quality Data - Not Enough !. . . Will create a data overload that can affect managerial productivity. Investments on market research, telecommunications, etc. to deliver better quality data should be complemented by investments in systems to convert the data into useful information. Quality of the data conversion process is equally important. Dr. Lakshmi Mohan 18

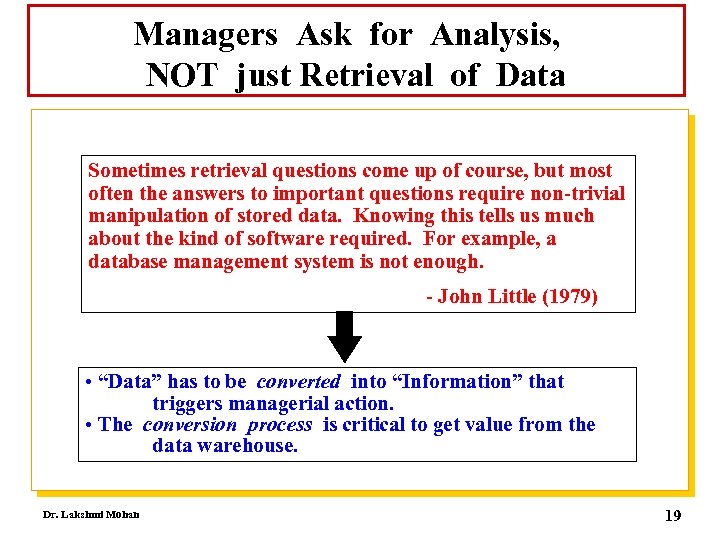

Managers Ask for Analysis, NOT just Retrieval of Data Sometimes retrieval questions come up of course, but most often the answers to important questions require non-trivial manipulation of stored data. Knowing this tells us much about the kind of software required. For example, a database management system is not enough. - John Little (1979) • “Data” has to be converted into “Information” that triggers managerial action. • The conversion process is critical to get value from the data warehouse. Dr. Lakshmi Mohan 19

Managers Ask for Analysis, NOT just Retrieval of Data Sometimes retrieval questions come up of course, but most often the answers to important questions require non-trivial manipulation of stored data. Knowing this tells us much about the kind of software required. For example, a database management system is not enough. - John Little (1979) • “Data” has to be converted into “Information” that triggers managerial action. • The conversion process is critical to get value from the data warehouse. Dr. Lakshmi Mohan 19

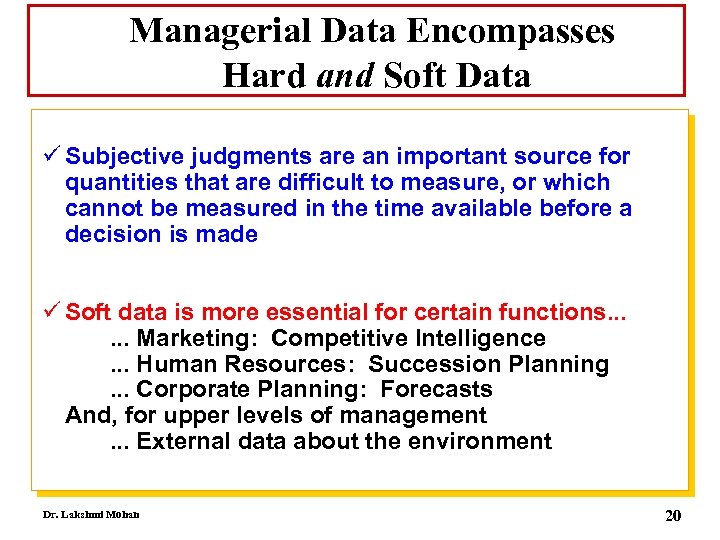

Managerial Data Encompasses Hard and Soft Data ü Subjective judgments are an important source for quantities that are difficult to measure, or which cannot be measured in the time available before a decision is made ü Soft data is more essential for certain functions. . . Marketing: Competitive Intelligence. . . Human Resources: Succession Planning. . . Corporate Planning: Forecasts And, for upper levels of management. . . External data about the environment Dr. Lakshmi Mohan 20

Managerial Data Encompasses Hard and Soft Data ü Subjective judgments are an important source for quantities that are difficult to measure, or which cannot be measured in the time available before a decision is made ü Soft data is more essential for certain functions. . . Marketing: Competitive Intelligence. . . Human Resources: Succession Planning. . . Corporate Planning: Forecasts And, for upper levels of management. . . External data about the environment Dr. Lakshmi Mohan 20

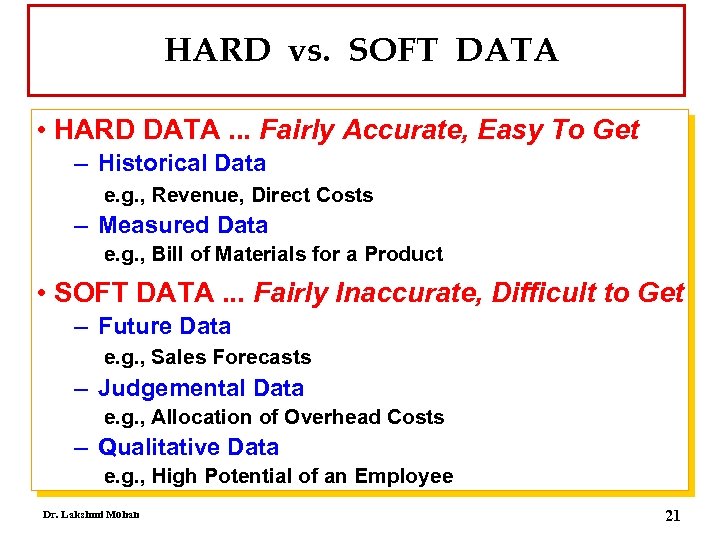

HARD vs. SOFT DATA • HARD DATA. . . Fairly Accurate, Easy To Get – Historical Data e. g. , Revenue, Direct Costs – Measured Data e. g. , Bill of Materials for a Product • SOFT DATA. . . Fairly Inaccurate, Difficult to Get – Future Data e. g. , Sales Forecasts – Judgemental Data e. g. , Allocation of Overhead Costs – Qualitative Data e. g. , High Potential of an Employee Dr. Lakshmi Mohan 21

HARD vs. SOFT DATA • HARD DATA. . . Fairly Accurate, Easy To Get – Historical Data e. g. , Revenue, Direct Costs – Measured Data e. g. , Bill of Materials for a Product • SOFT DATA. . . Fairly Inaccurate, Difficult to Get – Future Data e. g. , Sales Forecasts – Judgemental Data e. g. , Allocation of Overhead Costs – Qualitative Data e. g. , High Potential of an Employee Dr. Lakshmi Mohan 21

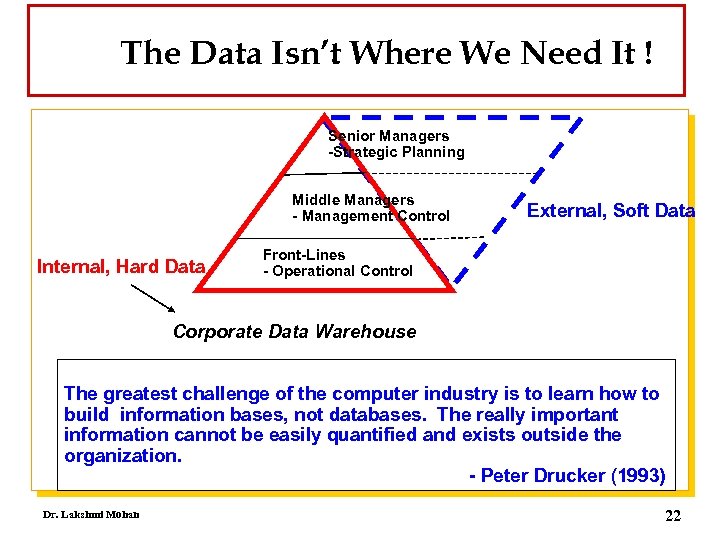

The Data Isn’t Where We Need It ! Senior Managers -Strategic Planning Middle Managers - Management Control Internal, Hard Data External, Soft Data Front-Lines - Operational Control Corporate Data Warehouse The greatest challenge of the computer industry is to learn how to build information bases, not databases. The really important information cannot be easily quantified and exists outside the organization. - Peter Drucker (1993) Dr. Lakshmi Mohan 22

The Data Isn’t Where We Need It ! Senior Managers -Strategic Planning Middle Managers - Management Control Internal, Hard Data External, Soft Data Front-Lines - Operational Control Corporate Data Warehouse The greatest challenge of the computer industry is to learn how to build information bases, not databases. The really important information cannot be easily quantified and exists outside the organization. - Peter Drucker (1993) Dr. Lakshmi Mohan 22

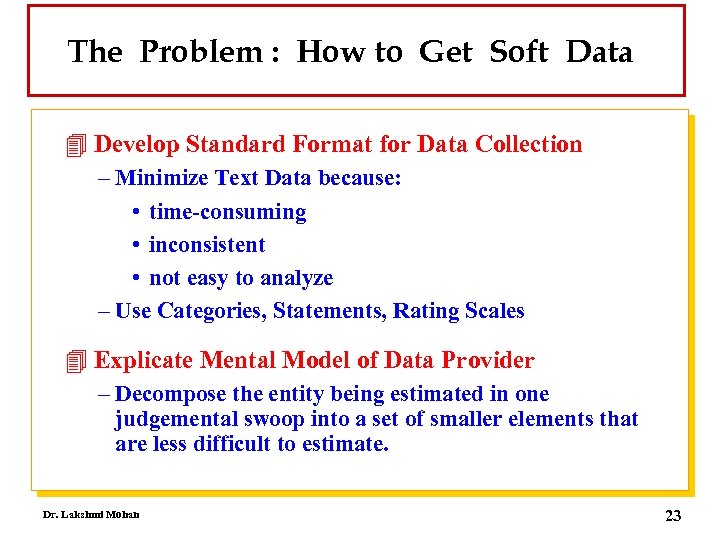

The Problem : How to Get Soft Data 4 Develop Standard Format for Data Collection – Minimize Text Data because: • time-consuming • inconsistent • not easy to analyze – Use Categories, Statements, Rating Scales 4 Explicate Mental Model of Data Provider – Decompose the entity being estimated in one judgemental swoop into a set of smaller elements that are less difficult to estimate. Dr. Lakshmi Mohan 23

The Problem : How to Get Soft Data 4 Develop Standard Format for Data Collection – Minimize Text Data because: • time-consuming • inconsistent • not easy to analyze – Use Categories, Statements, Rating Scales 4 Explicate Mental Model of Data Provider – Decompose the entity being estimated in one judgemental swoop into a set of smaller elements that are less difficult to estimate. Dr. Lakshmi Mohan 23

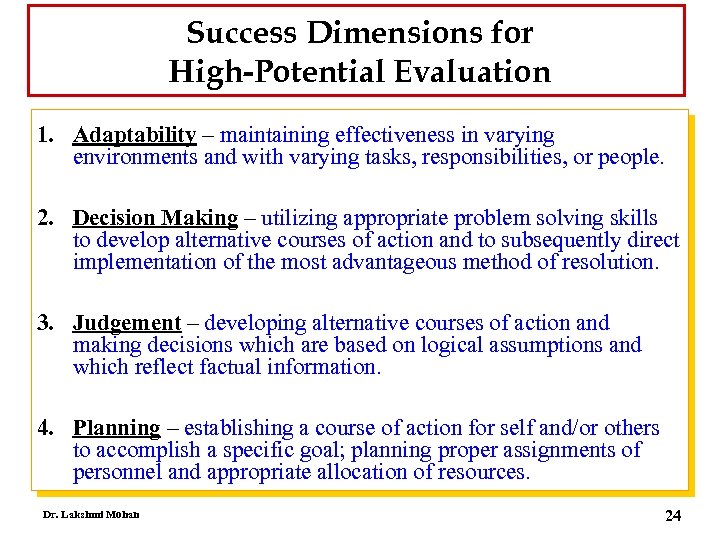

Success Dimensions for High-Potential Evaluation 1. Adaptability – maintaining effectiveness in varying environments and with varying tasks, responsibilities, or people. 2. Decision Making – utilizing appropriate problem solving skills to develop alternative courses of action and to subsequently direct implementation of the most advantageous method of resolution. 3. Judgement – developing alternative courses of action and making decisions which are based on logical assumptions and which reflect factual information. 4. Planning – establishing a course of action for self and/or others to accomplish a specific goal; planning proper assignments of personnel and appropriate allocation of resources. Dr. Lakshmi Mohan 24

Success Dimensions for High-Potential Evaluation 1. Adaptability – maintaining effectiveness in varying environments and with varying tasks, responsibilities, or people. 2. Decision Making – utilizing appropriate problem solving skills to develop alternative courses of action and to subsequently direct implementation of the most advantageous method of resolution. 3. Judgement – developing alternative courses of action and making decisions which are based on logical assumptions and which reflect factual information. 4. Planning – establishing a course of action for self and/or others to accomplish a specific goal; planning proper assignments of personnel and appropriate allocation of resources. Dr. Lakshmi Mohan 24

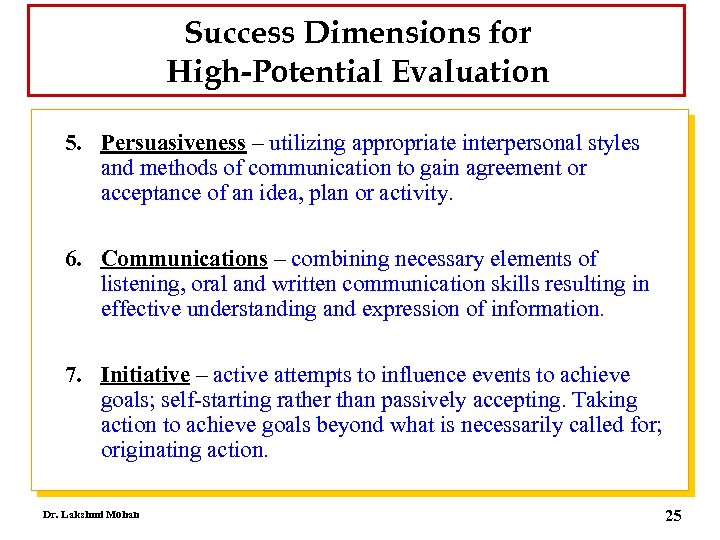

Success Dimensions for High-Potential Evaluation 5. Persuasiveness – utilizing appropriate interpersonal styles and methods of communication to gain agreement or acceptance of an idea, plan or activity. 6. Communications – combining necessary elements of listening, oral and written communication skills resulting in effective understanding and expression of information. 7. Initiative – active attempts to influence events to achieve goals; self-starting rather than passively accepting. Taking action to achieve goals beyond what is necessarily called for; originating action. Dr. Lakshmi Mohan 25

Success Dimensions for High-Potential Evaluation 5. Persuasiveness – utilizing appropriate interpersonal styles and methods of communication to gain agreement or acceptance of an idea, plan or activity. 6. Communications – combining necessary elements of listening, oral and written communication skills resulting in effective understanding and expression of information. 7. Initiative – active attempts to influence events to achieve goals; self-starting rather than passively accepting. Taking action to achieve goals beyond what is necessarily called for; originating action. Dr. Lakshmi Mohan 25

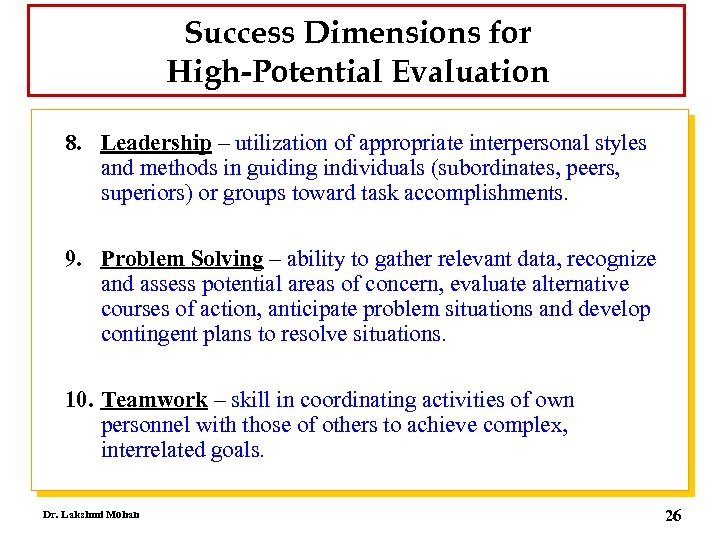

Success Dimensions for High-Potential Evaluation 8. Leadership – utilization of appropriate interpersonal styles and methods in guiding individuals (subordinates, peers, superiors) or groups toward task accomplishments. 9. Problem Solving – ability to gather relevant data, recognize and assess potential areas of concern, evaluate alternative courses of action, anticipate problem situations and develop contingent plans to resolve situations. 10. Teamwork – skill in coordinating activities of own personnel with those of others to achieve complex, interrelated goals. Dr. Lakshmi Mohan 26

Success Dimensions for High-Potential Evaluation 8. Leadership – utilization of appropriate interpersonal styles and methods in guiding individuals (subordinates, peers, superiors) or groups toward task accomplishments. 9. Problem Solving – ability to gather relevant data, recognize and assess potential areas of concern, evaluate alternative courses of action, anticipate problem situations and develop contingent plans to resolve situations. 10. Teamwork – skill in coordinating activities of own personnel with those of others to achieve complex, interrelated goals. Dr. Lakshmi Mohan 26

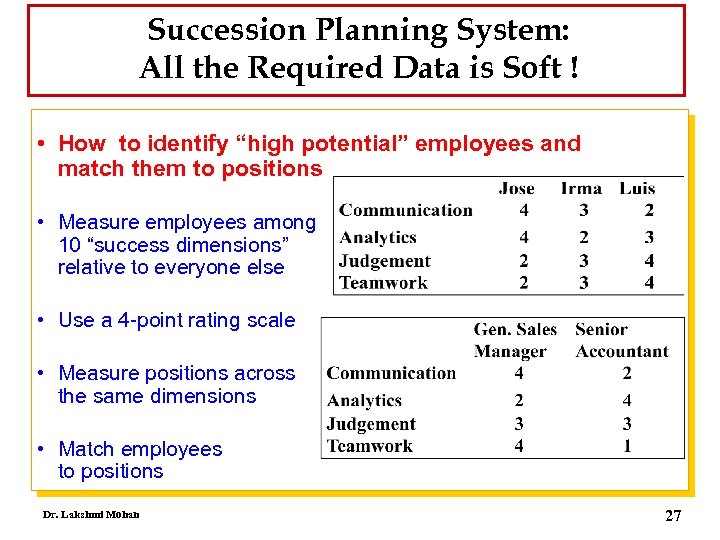

Succession Planning System: All the Required Data is Soft ! • How to identify “high potential” employees and match them to positions • Measure employees among 10 “success dimensions” relative to everyone else • Use a 4 -point rating scale • Measure positions across the same dimensions • Match employees to positions Dr. Lakshmi Mohan 27

Succession Planning System: All the Required Data is Soft ! • How to identify “high potential” employees and match them to positions • Measure employees among 10 “success dimensions” relative to everyone else • Use a 4 -point rating scale • Measure positions across the same dimensions • Match employees to positions Dr. Lakshmi Mohan 27

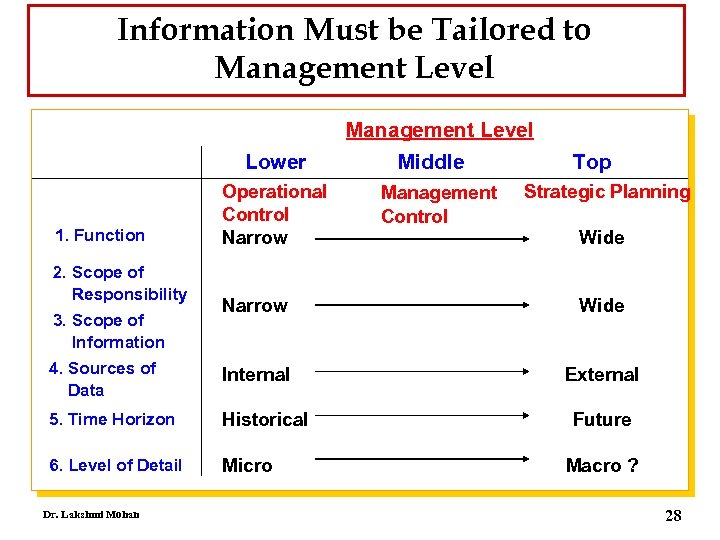

Information Must be Tailored to Management Level Lower 1. Function 2. Scope of Responsibility Operational Control Narrow Middle Management Control Top Strategic Planning Wide Narrow Wide 4. Sources of Data Internal External 5. Time Horizon Historical 6. Level of Detail Micro 3. Scope of Information Dr. Lakshmi Mohan Future Macro ? 28

Information Must be Tailored to Management Level Lower 1. Function 2. Scope of Responsibility Operational Control Narrow Middle Management Control Top Strategic Planning Wide Narrow Wide 4. Sources of Data Internal External 5. Time Horizon Historical 6. Level of Detail Micro 3. Scope of Information Dr. Lakshmi Mohan Future Macro ? 28

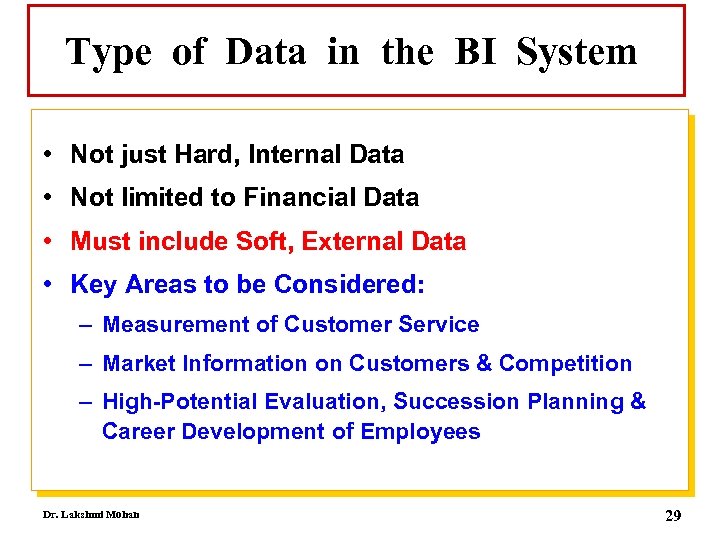

Type of Data in the BI System • Not just Hard, Internal Data • Not limited to Financial Data • Must include Soft, External Data • Key Areas to be Considered: – Measurement of Customer Service – Market Information on Customers & Competition – High-Potential Evaluation, Succession Planning & Career Development of Employees Dr. Lakshmi Mohan 29

Type of Data in the BI System • Not just Hard, Internal Data • Not limited to Financial Data • Must include Soft, External Data • Key Areas to be Considered: – Measurement of Customer Service – Market Information on Customers & Competition – High-Potential Evaluation, Succession Planning & Career Development of Employees Dr. Lakshmi Mohan 29

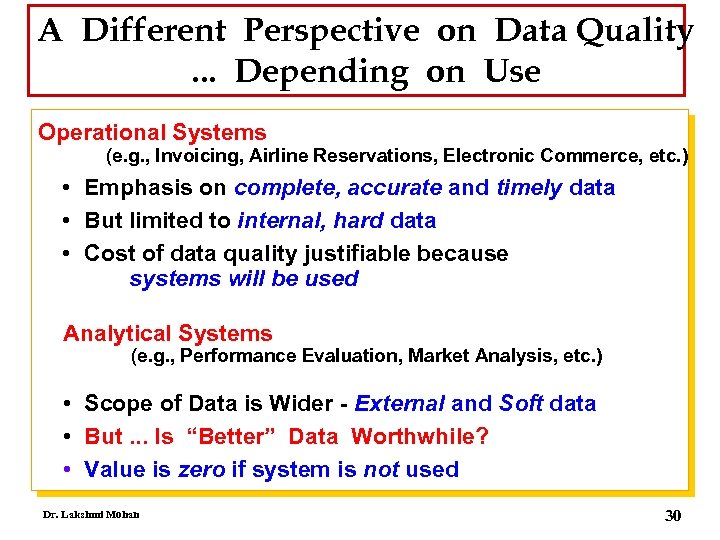

A Different Perspective on Data Quality. . . Depending on Use Operational Systems (e. g. , Invoicing, Airline Reservations, Electronic Commerce, etc. ) • Emphasis on complete, accurate and timely data • But limited to internal, hard data • Cost of data quality justifiable because systems will be used Analytical Systems (e. g. , Performance Evaluation, Market Analysis, etc. ) • Scope of Data is Wider - External and Soft data • But. . . Is “Better” Data Worthwhile? • Value is zero if system is not used Dr. Lakshmi Mohan 30

A Different Perspective on Data Quality. . . Depending on Use Operational Systems (e. g. , Invoicing, Airline Reservations, Electronic Commerce, etc. ) • Emphasis on complete, accurate and timely data • But limited to internal, hard data • Cost of data quality justifiable because systems will be used Analytical Systems (e. g. , Performance Evaluation, Market Analysis, etc. ) • Scope of Data is Wider - External and Soft data • But. . . Is “Better” Data Worthwhile? • Value is zero if system is not used Dr. Lakshmi Mohan 30

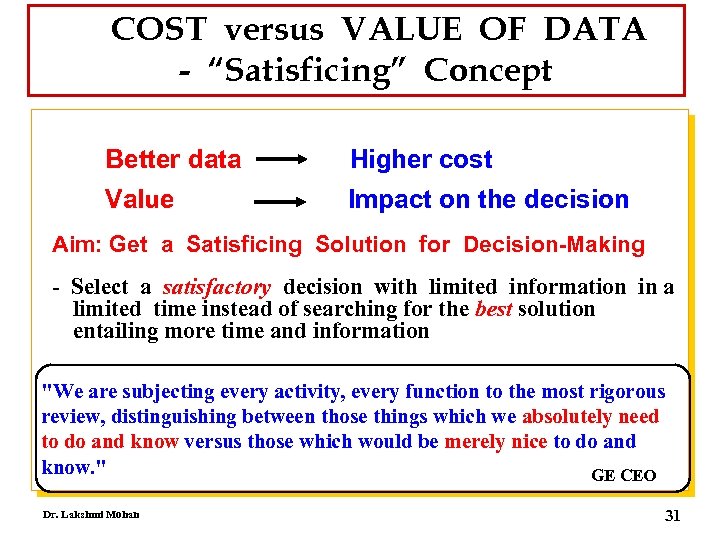

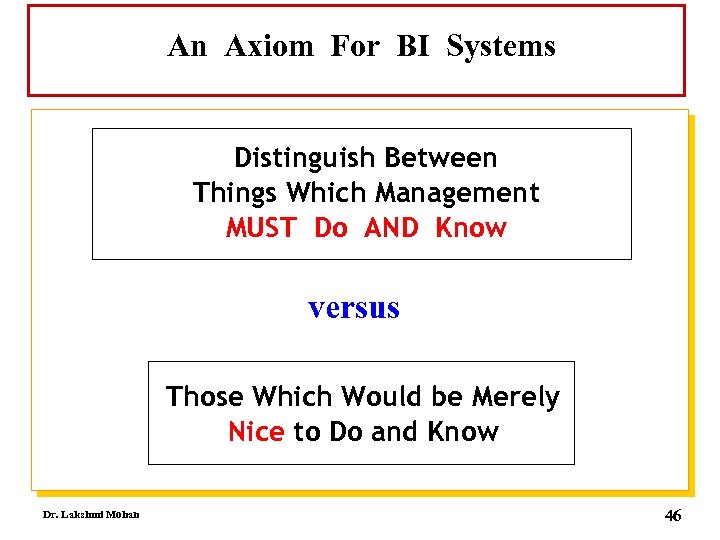

COST versus VALUE OF DATA - “Satisficing” Concept Better data Higher cost Value Impact on the decision Aim: Get a Satisficing Solution for Decision-Making - Select a satisfactory decision with limited information in a limited time instead of searching for the best solution entailing more time and information "We are subjecting every activity, every function to the most rigorous review, distinguishing between those things which we absolutely need to do and know versus those which would be merely nice to do and know. " GE CEO Dr. Lakshmi Mohan 31

COST versus VALUE OF DATA - “Satisficing” Concept Better data Higher cost Value Impact on the decision Aim: Get a Satisficing Solution for Decision-Making - Select a satisfactory decision with limited information in a limited time instead of searching for the best solution entailing more time and information "We are subjecting every activity, every function to the most rigorous review, distinguishing between those things which we absolutely need to do and know versus those which would be merely nice to do and know. " GE CEO Dr. Lakshmi Mohan 31

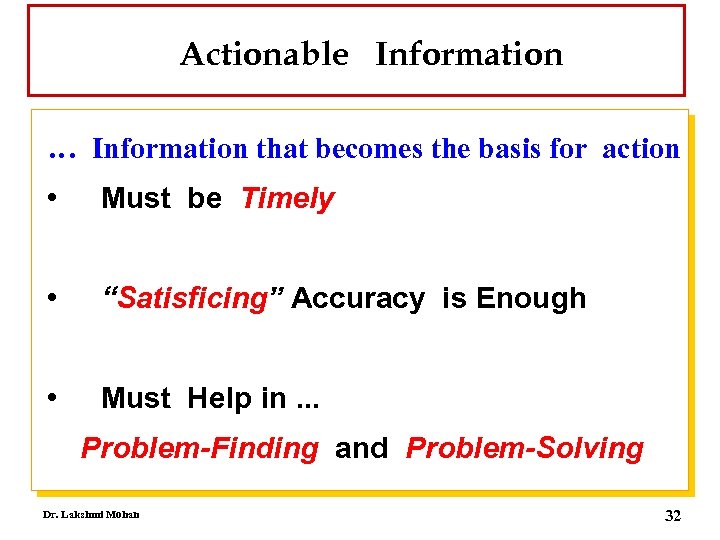

Actionable Information … Information that becomes the basis for action • Must be Timely • “Satisficing” Accuracy is Enough • Must Help in. . . Problem-Finding and Problem-Solving Dr. Lakshmi Mohan 32

Actionable Information … Information that becomes the basis for action • Must be Timely • “Satisficing” Accuracy is Enough • Must Help in. . . Problem-Finding and Problem-Solving Dr. Lakshmi Mohan 32

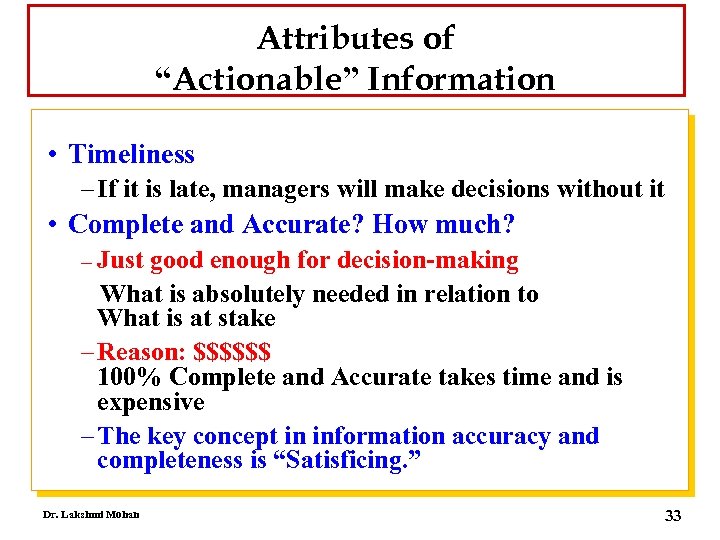

Attributes of “Actionable” Information • Timeliness – If it is late, managers will make decisions without it • Complete and Accurate? How much? – Just good enough for decision-making What is absolutely needed in relation to What is at stake – Reason: $$$$$$ 100% Complete and Accurate takes time and is expensive – The key concept in information accuracy and completeness is “Satisficing. ” Dr. Lakshmi Mohan 33

Attributes of “Actionable” Information • Timeliness – If it is late, managers will make decisions without it • Complete and Accurate? How much? – Just good enough for decision-making What is absolutely needed in relation to What is at stake – Reason: $$$$$$ 100% Complete and Accurate takes time and is expensive – The key concept in information accuracy and completeness is “Satisficing. ” Dr. Lakshmi Mohan 33

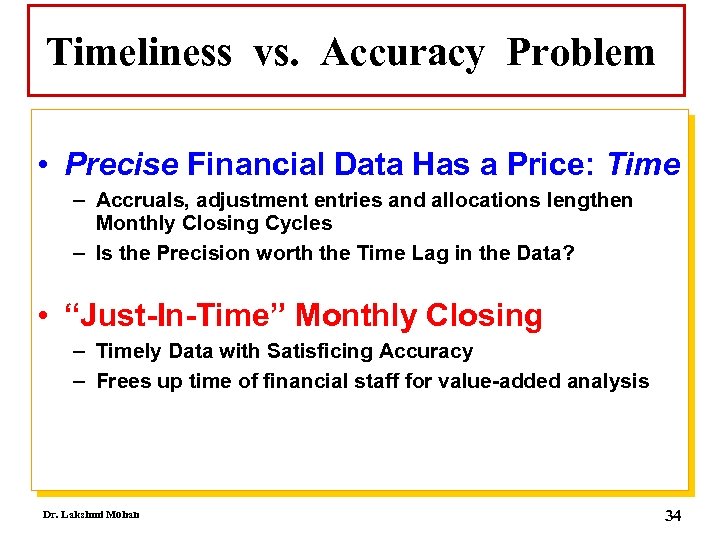

Timeliness vs. Accuracy Problem • Precise Financial Data Has a Price: Time – Accruals, adjustment entries and allocations lengthen Monthly Closing Cycles – Is the Precision worth the Time Lag in the Data? • “Just-In-Time” Monthly Closing – Timely Data with Satisficing Accuracy – Frees up time of financial staff for value-added analysis Dr. Lakshmi Mohan 34

Timeliness vs. Accuracy Problem • Precise Financial Data Has a Price: Time – Accruals, adjustment entries and allocations lengthen Monthly Closing Cycles – Is the Precision worth the Time Lag in the Data? • “Just-In-Time” Monthly Closing – Timely Data with Satisficing Accuracy – Frees up time of financial staff for value-added analysis Dr. Lakshmi Mohan 34

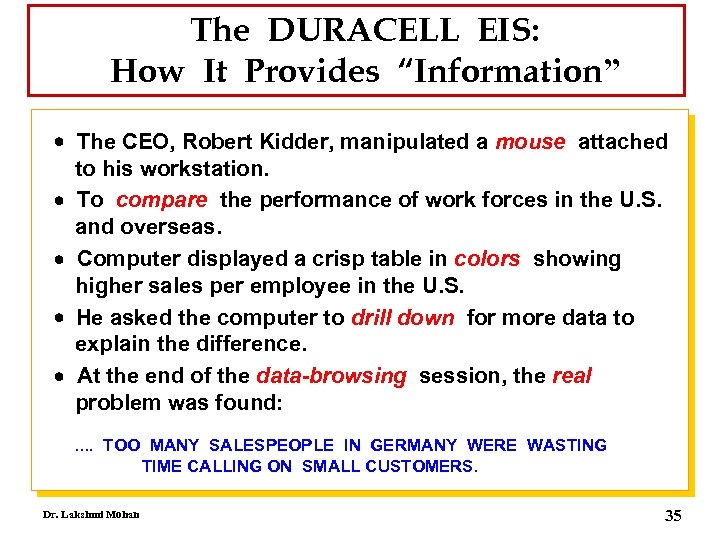

The DURACELL EIS: How It Provides “Information” The CEO, Robert Kidder, manipulated a mouse attached to his workstation. To compare the performance of work forces in the U. S. and overseas. Computer displayed a crisp table in colors showing higher sales per employee in the U. S. He asked the computer to drill down for more data to explain the difference. At the end of the data-browsing session, the real problem was found: . . TOO MANY SALESPEOPLE IN GERMANY WERE WASTING TIME CALLING ON SMALL CUSTOMERS. Dr. Lakshmi Mohan 35

The DURACELL EIS: How It Provides “Information” The CEO, Robert Kidder, manipulated a mouse attached to his workstation. To compare the performance of work forces in the U. S. and overseas. Computer displayed a crisp table in colors showing higher sales per employee in the U. S. He asked the computer to drill down for more data to explain the difference. At the end of the data-browsing session, the real problem was found: . . TOO MANY SALESPEOPLE IN GERMANY WERE WASTING TIME CALLING ON SMALL CUSTOMERS. Dr. Lakshmi Mohan 35

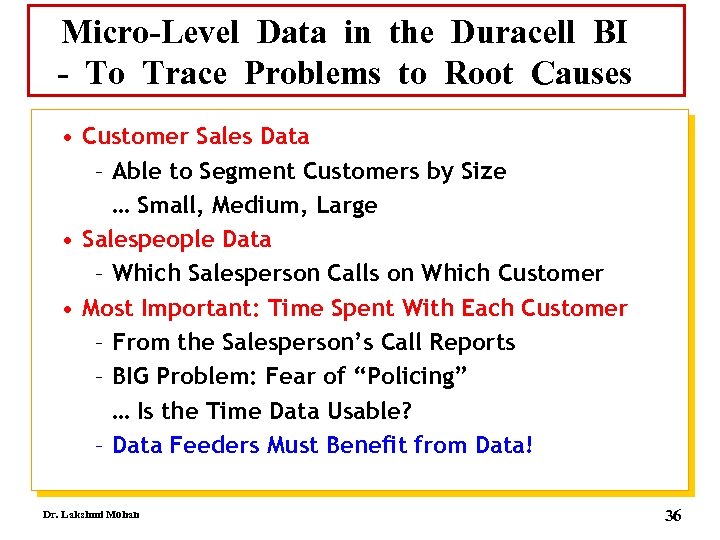

Micro-Level Data in the Duracell BI - To Trace Problems to Root Causes • Customer Sales Data – Able to Segment Customers by Size … Small, Medium, Large • Salespeople Data – Which Salesperson Calls on Which Customer • Most Important: Time Spent With Each Customer – From the Salesperson’s Call Reports – BIG Problem: Fear of “Policing” … Is the Time Data Usable? – Data Feeders Must Benefit from Data! Dr. Lakshmi Mohan 36

Micro-Level Data in the Duracell BI - To Trace Problems to Root Causes • Customer Sales Data – Able to Segment Customers by Size … Small, Medium, Large • Salespeople Data – Which Salesperson Calls on Which Customer • Most Important: Time Spent With Each Customer – From the Salesperson’s Call Reports – BIG Problem: Fear of “Policing” … Is the Time Data Usable? – Data Feeders Must Benefit from Data! Dr. Lakshmi Mohan 36

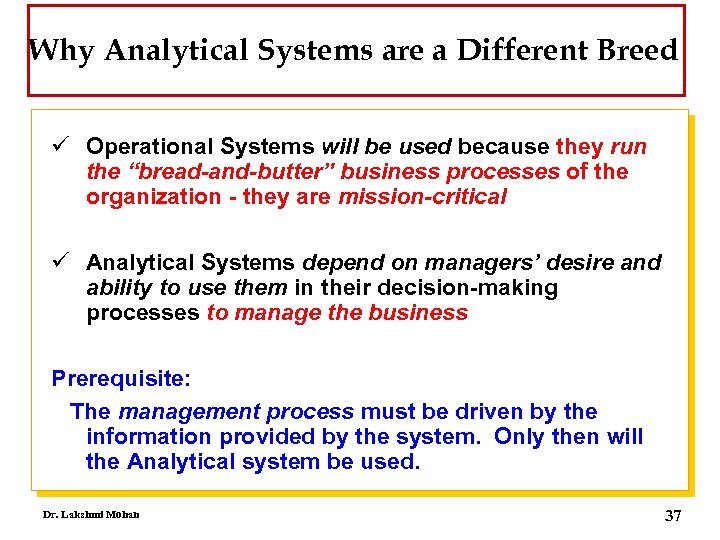

Why Analytical Systems are a Different Breed ü Operational Systems will be used because they run the “bread-and-butter” business processes of the organization - they are mission-critical ü Analytical Systems depend on managers’ desire and ability to use them in their decision-making processes to manage the business Prerequisite: The management process must be driven by the information provided by the system. Only then will the Analytical system be used. Dr. Lakshmi Mohan 37

Why Analytical Systems are a Different Breed ü Operational Systems will be used because they run the “bread-and-butter” business processes of the organization - they are mission-critical ü Analytical Systems depend on managers’ desire and ability to use them in their decision-making processes to manage the business Prerequisite: The management process must be driven by the information provided by the system. Only then will the Analytical system be used. Dr. Lakshmi Mohan 37

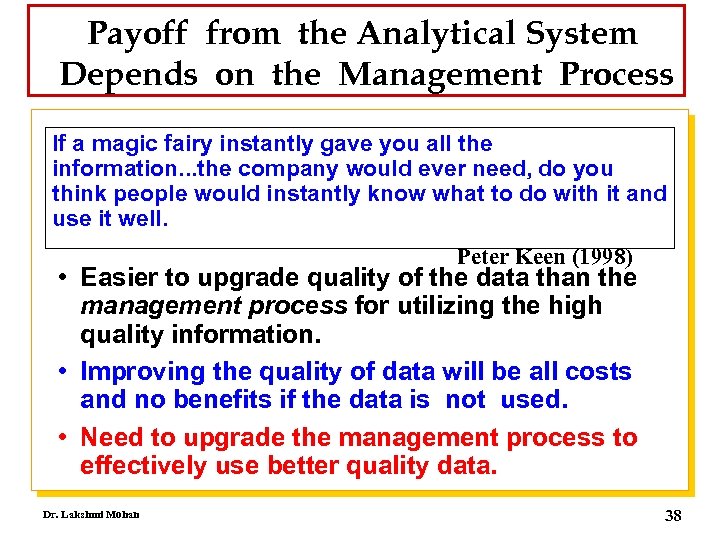

Payoff from the Analytical System Depends on the Management Process If a magic fairy instantly gave you all the information. . . the company would ever need, do you think people would instantly know what to do with it and use it well. Peter Keen (1998) • Easier to upgrade quality of the data than the management process for utilizing the high quality information. • Improving the quality of data will be all costs and no benefits if the data is not used. • Need to upgrade the management process to effectively use better quality data. Dr. Lakshmi Mohan 38

Payoff from the Analytical System Depends on the Management Process If a magic fairy instantly gave you all the information. . . the company would ever need, do you think people would instantly know what to do with it and use it well. Peter Keen (1998) • Easier to upgrade quality of the data than the management process for utilizing the high quality information. • Improving the quality of data will be all costs and no benefits if the data is not used. • Need to upgrade the management process to effectively use better quality data. Dr. Lakshmi Mohan 38

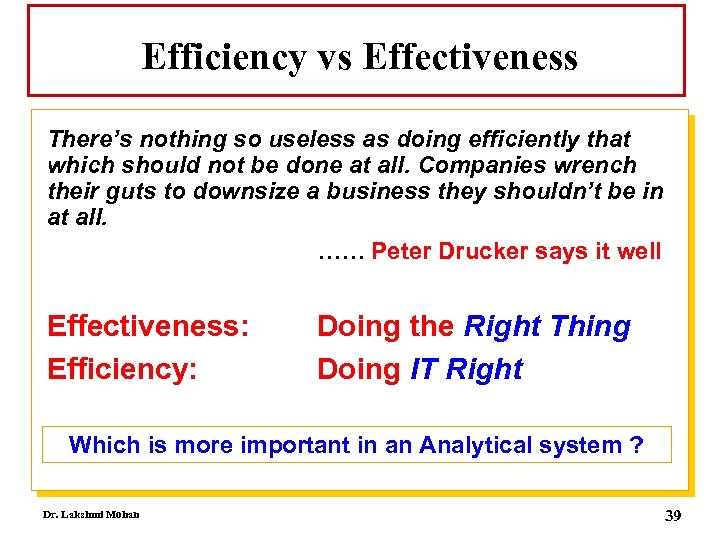

Efficiency vs Effectiveness There’s nothing so useless as doing efficiently that which should not be done at all. Companies wrench their guts to downsize a business they shouldn’t be in at all. …… Peter Drucker says it well Effectiveness: Efficiency: Doing the Right Thing Doing IT Right Which is more important in an Analytical system ? Dr. Lakshmi Mohan 39

Efficiency vs Effectiveness There’s nothing so useless as doing efficiently that which should not be done at all. Companies wrench their guts to downsize a business they shouldn’t be in at all. …… Peter Drucker says it well Effectiveness: Efficiency: Doing the Right Thing Doing IT Right Which is more important in an Analytical system ? Dr. Lakshmi Mohan 39

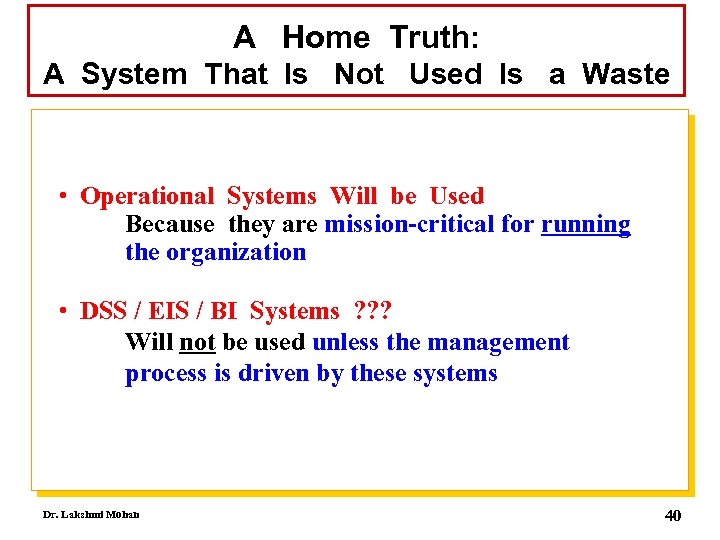

A Home Truth: A System That Is Not Used Is a Waste • Operational Systems Will be Used Because they are mission-critical for running the organization • DSS / EIS / BI Systems ? ? ? Will not be used unless the management process is driven by these systems Dr. Lakshmi Mohan 40

A Home Truth: A System That Is Not Used Is a Waste • Operational Systems Will be Used Because they are mission-critical for running the organization • DSS / EIS / BI Systems ? ? ? Will not be used unless the management process is driven by these systems Dr. Lakshmi Mohan 40

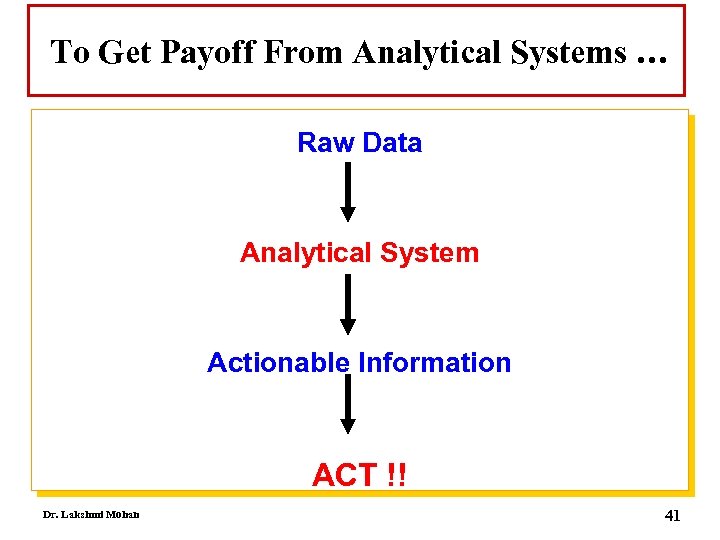

To Get Payoff From Analytical Systems … Raw Data Analytical System Actionable Information ACT !! Dr. Lakshmi Mohan 41

To Get Payoff From Analytical Systems … Raw Data Analytical System Actionable Information ACT !! Dr. Lakshmi Mohan 41

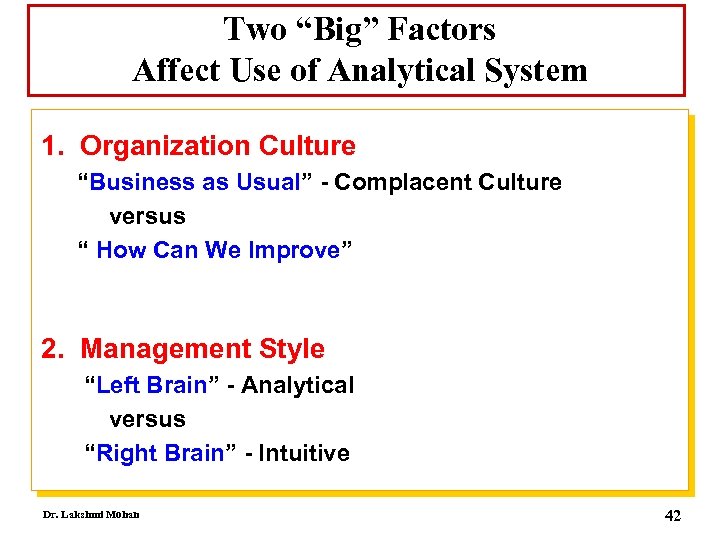

Two “Big” Factors Affect Use of Analytical System 1. Organization Culture “Business as Usual” - Complacent Culture versus “ How Can We Improve” 2. Management Style “Left Brain” - Analytical versus “Right Brain” - Intuitive Dr. Lakshmi Mohan 42

Two “Big” Factors Affect Use of Analytical System 1. Organization Culture “Business as Usual” - Complacent Culture versus “ How Can We Improve” 2. Management Style “Left Brain” - Analytical versus “Right Brain” - Intuitive Dr. Lakshmi Mohan 42

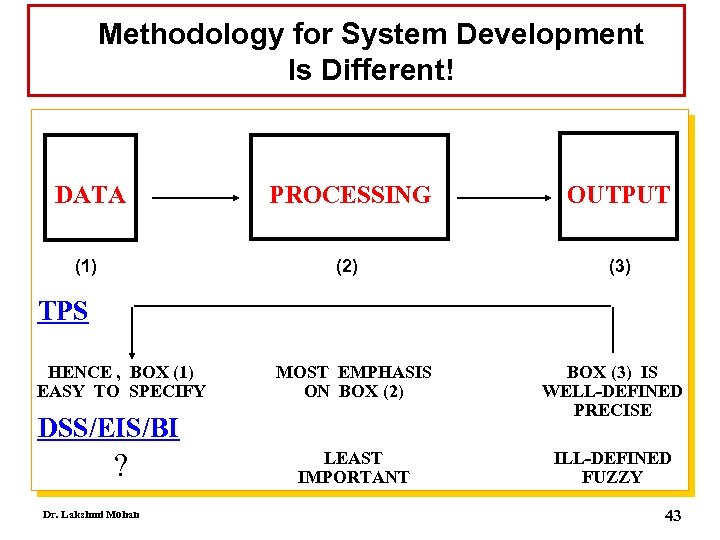

Methodology for System Development Is Different! DATA PROCESSING OUTPUT (1) (2) (3) TPS HENCE , BOX (1) EASY TO SPECIFY MOST EMPHASIS ON BOX (2) BOX (3) IS WELL-DEFINED PRECISE LEAST IMPORTANT ILL-DEFINED FUZZY DSS/EIS/BI ? Dr. Lakshmi Mohan 43

Methodology for System Development Is Different! DATA PROCESSING OUTPUT (1) (2) (3) TPS HENCE , BOX (1) EASY TO SPECIFY MOST EMPHASIS ON BOX (2) BOX (3) IS WELL-DEFINED PRECISE LEAST IMPORTANT ILL-DEFINED FUZZY DSS/EIS/BI ? Dr. Lakshmi Mohan 43

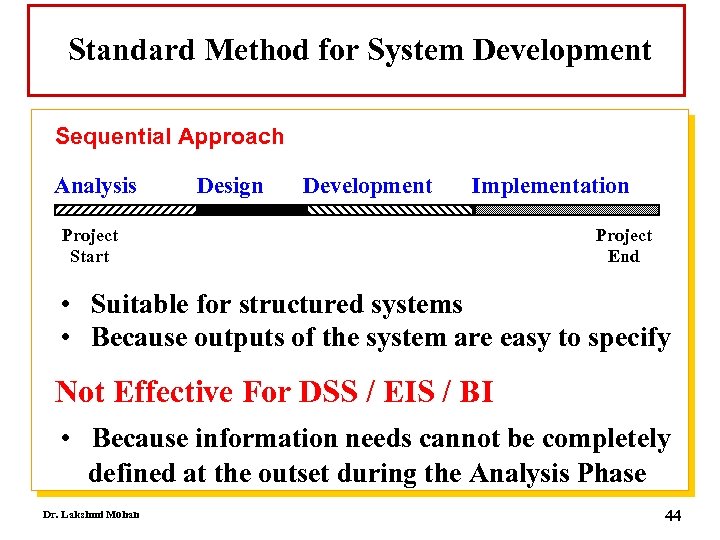

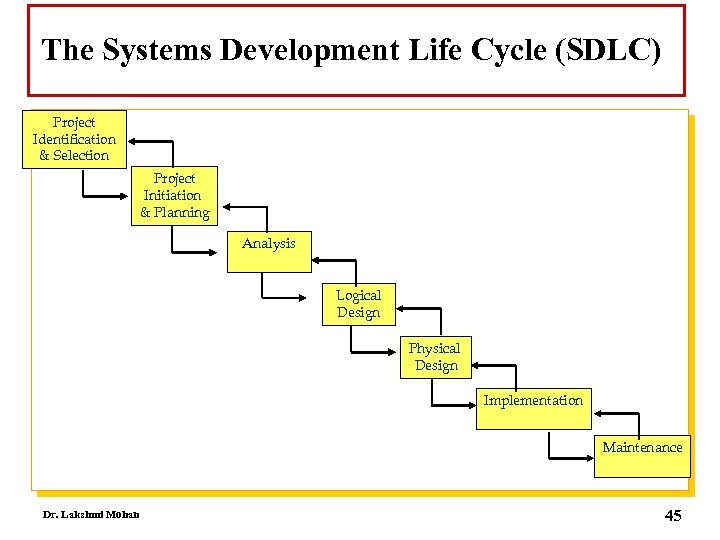

Standard Method for System Development Sequential Approach Analysis Design Development Implementation Project Start Project End • Suitable for structured systems • Because outputs of the system are easy to specify Not Effective For DSS / EIS / BI • Because information needs cannot be completely defined at the outset during the Analysis Phase Dr. Lakshmi Mohan 44

Standard Method for System Development Sequential Approach Analysis Design Development Implementation Project Start Project End • Suitable for structured systems • Because outputs of the system are easy to specify Not Effective For DSS / EIS / BI • Because information needs cannot be completely defined at the outset during the Analysis Phase Dr. Lakshmi Mohan 44

The Systems Development Life Cycle (SDLC) Project Identification & Selection Project Initiation & Planning Analysis Logical Design Physical Design Implementation Maintenance Dr. Lakshmi Mohan 45

The Systems Development Life Cycle (SDLC) Project Identification & Selection Project Initiation & Planning Analysis Logical Design Physical Design Implementation Maintenance Dr. Lakshmi Mohan 45

An Axiom For BI Systems Distinguish Between Things Which Management MUST Do AND Know versus Those Which Would be Merely Nice to Do and Know Dr. Lakshmi Mohan 46

An Axiom For BI Systems Distinguish Between Things Which Management MUST Do AND Know versus Those Which Would be Merely Nice to Do and Know Dr. Lakshmi Mohan 46

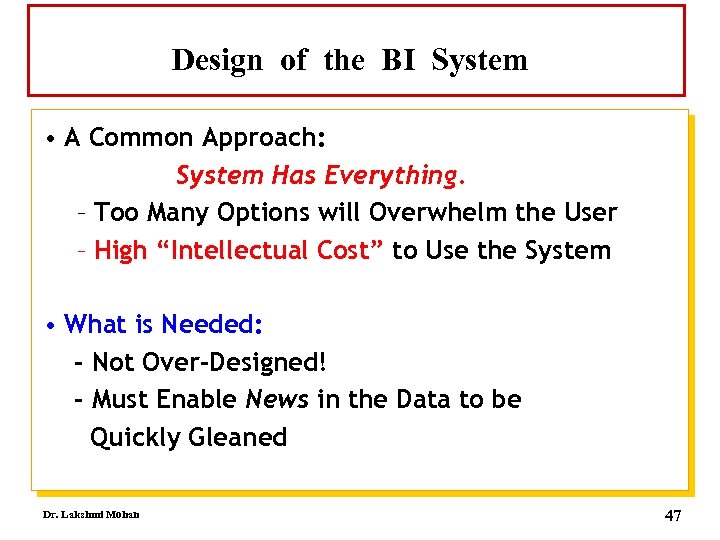

Design of the BI System • A Common Approach: System Has Everything. – Too Many Options will Overwhelm the User – High “Intellectual Cost” to Use the System • What is Needed: - Not Over-Designed! - Must Enable News in the Data to be Quickly Gleaned Dr. Lakshmi Mohan 47

Design of the BI System • A Common Approach: System Has Everything. – Too Many Options will Overwhelm the User – High “Intellectual Cost” to Use the System • What is Needed: - Not Over-Designed! - Must Enable News in the Data to be Quickly Gleaned Dr. Lakshmi Mohan 47

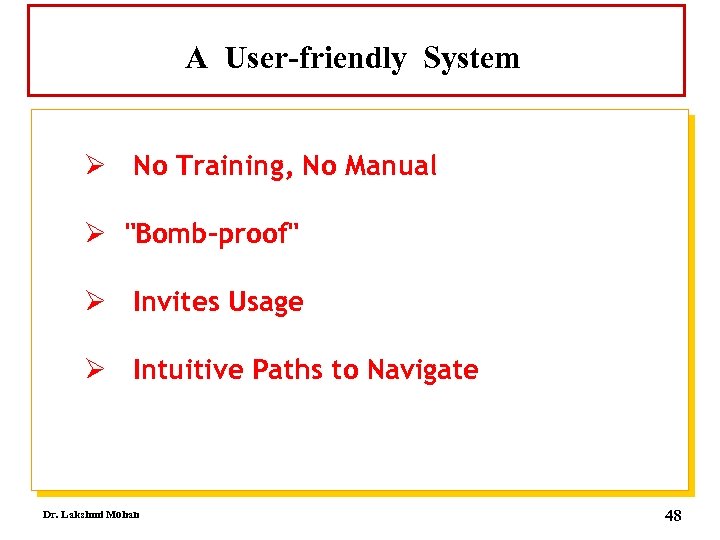

A User-friendly System Ø No Training, No Manual Ø "Bomb-proof" Ø Invites Usage Ø Intuitive Paths to Navigate Dr. Lakshmi Mohan 48

A User-friendly System Ø No Training, No Manual Ø "Bomb-proof" Ø Invites Usage Ø Intuitive Paths to Navigate Dr. Lakshmi Mohan 48

Problems with the Standard Approach for Systems Development Ø Interview users to define requirements Ø Danger: Long "Wish-list" Ø Build system to specifications What users say they want is not What they actually need Dr. Lakshmi Mohan 49

Problems with the Standard Approach for Systems Development Ø Interview users to define requirements Ø Danger: Long "Wish-list" Ø Build system to specifications What users say they want is not What they actually need Dr. Lakshmi Mohan 49

Interviewing Executives Is Difficult Because. . . • No time or patience to think through • Unable to articulate requirements "Use a lot of soft information. . . to know what to tell you" • Hard Vague about their needs "I want instant access to all relevant data" Dr. Lakshmi Mohan 50

Interviewing Executives Is Difficult Because. . . • No time or patience to think through • Unable to articulate requirements "Use a lot of soft information. . . to know what to tell you" • Hard Vague about their needs "I want instant access to all relevant data" Dr. Lakshmi Mohan 50

Prototyping - "A Must" WHY. . . ü A live system with real data ü Users can "test-drive" it ü Constructive feedback on system design A cost-effective means of ensuring value of system before making the investment on its development and implementation. Dr. Lakshmi Mohan 51

Prototyping - "A Must" WHY. . . ü A live system with real data ü Users can "test-drive" it ü Constructive feedback on system design A cost-effective means of ensuring value of system before making the investment on its development and implementation. Dr. Lakshmi Mohan 51

The “Q & D” Prototype - A "Quick and Dirty" System - For the “GO” or “NO GO” decision - To determine user needs - To ensure value of system - Low-cost System to Reduce Project Risk - Yet should spark user interest - Must use Real Data - To stimulate users - To check out potential data problem - Modify on basis of User Feedback Dr. Lakshmi Mohan 52

The “Q & D” Prototype - A "Quick and Dirty" System - For the “GO” or “NO GO” decision - To determine user needs - To ensure value of system - Low-cost System to Reduce Project Risk - Yet should spark user interest - Must use Real Data - To stimulate users - To check out potential data problem - Modify on basis of User Feedback Dr. Lakshmi Mohan 52

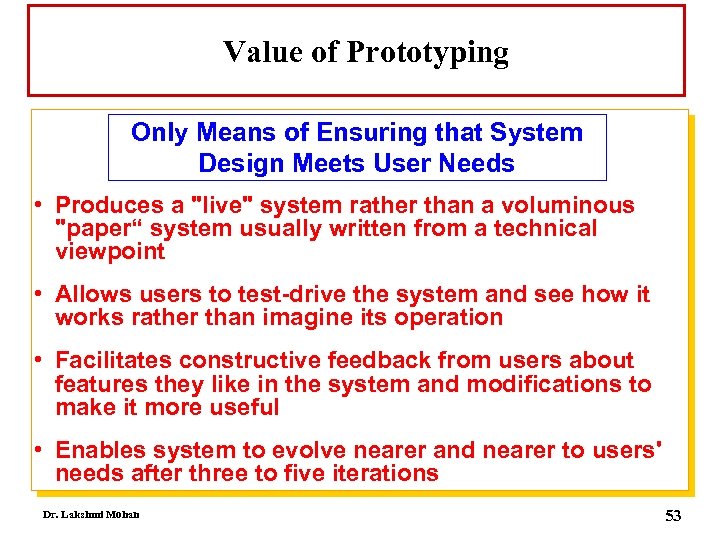

Value of Prototyping Only Means of Ensuring that System Design Meets User Needs • Produces a "live" system rather than a voluminous "paper“ system usually written from a technical viewpoint • Allows users to test-drive the system and see how it works rather than imagine its operation • Facilitates constructive feedback from users about features they like in the system and modifications to make it more useful • Enables system to evolve nearer and nearer to users' needs after three to five iterations Dr. Lakshmi Mohan 53

Value of Prototyping Only Means of Ensuring that System Design Meets User Needs • Produces a "live" system rather than a voluminous "paper“ system usually written from a technical viewpoint • Allows users to test-drive the system and see how it works rather than imagine its operation • Facilitates constructive feedback from users about features they like in the system and modifications to make it more useful • Enables system to evolve nearer and nearer to users' needs after three to five iterations Dr. Lakshmi Mohan 53

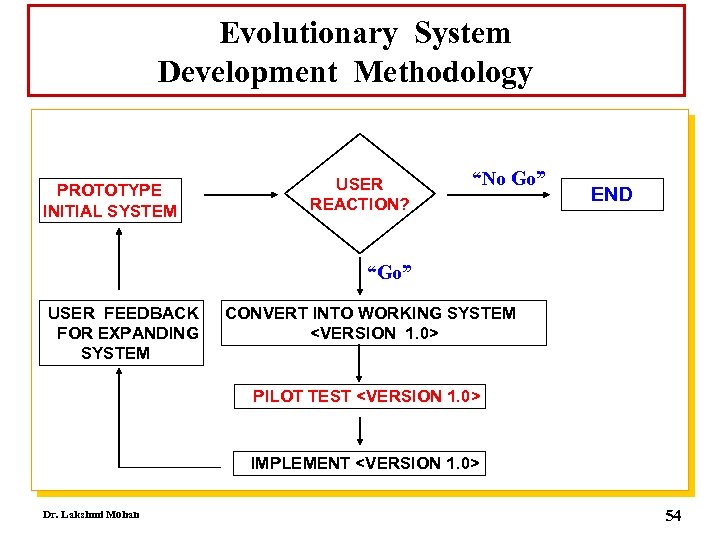

Evolutionary System Development Methodology PROTOTYPE INITIAL SYSTEM USER REACTION? “No Go” END “Go” USER FEEDBACK FOR EXPANDING SYSTEM CONVERT INTO WORKING SYSTEM

Evolutionary System Development Methodology PROTOTYPE INITIAL SYSTEM USER REACTION? “No Go” END “Go” USER FEEDBACK FOR EXPANDING SYSTEM CONVERT INTO WORKING SYSTEM

The Iterative Approach for DSS/EIS/BI • Compresses all the four phases into a short cycle • System evolves through a series of iterations • Enables users to specify information needs in concrete terms • Because they see actual outputs with live data from the initial versions of the system Dr. Lakshmi Mohan 55

The Iterative Approach for DSS/EIS/BI • Compresses all the four phases into a short cycle • System evolves through a series of iterations • Enables users to specify information needs in concrete terms • Because they see actual outputs with live data from the initial versions of the system Dr. Lakshmi Mohan 55

Benefits of the Evolutionary Approach · The system evolves through a series of iterations in short cycles, each of which results in usable versions of the system. · New features, new data and new users are added from user feedback. · The best way to build a big system is not to build one. Start Small and Let System Evolve Dr. Lakshmi Mohan 56

Benefits of the Evolutionary Approach · The system evolves through a series of iterations in short cycles, each of which results in usable versions of the system. · New features, new data and new users are added from user feedback. · The best way to build a big system is not to build one. Start Small and Let System Evolve Dr. Lakshmi Mohan 56

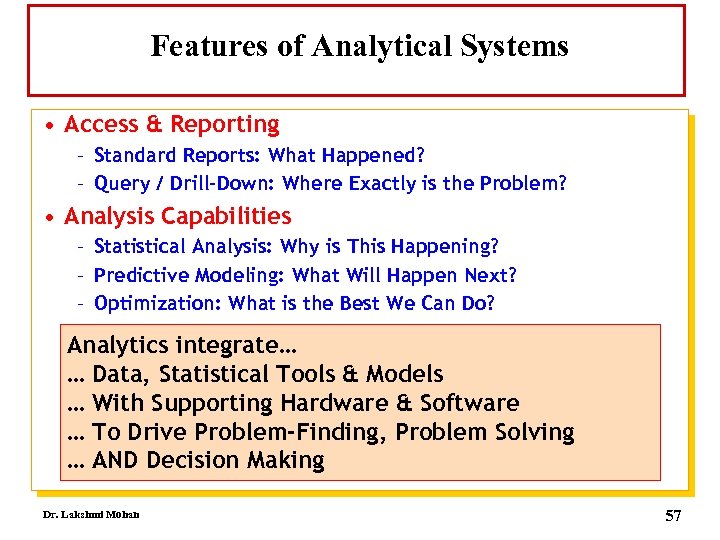

Features of Analytical Systems • Access & Reporting – Standard Reports: What Happened? – Query / Drill-Down: Where Exactly is the Problem? • Analysis Capabilities – Statistical Analysis: Why is This Happening? – Predictive Modeling: What Will Happen Next? – Optimization: What is the Best We Can Do? Analytics integrate… … Data, Statistical Tools & Models … With Supporting Hardware & Software … To Drive Problem-Finding, Problem Solving … AND Decision Making Dr. Lakshmi Mohan 57

Features of Analytical Systems • Access & Reporting – Standard Reports: What Happened? – Query / Drill-Down: Where Exactly is the Problem? • Analysis Capabilities – Statistical Analysis: Why is This Happening? – Predictive Modeling: What Will Happen Next? – Optimization: What is the Best We Can Do? Analytics integrate… … Data, Statistical Tools & Models … With Supporting Hardware & Software … To Drive Problem-Finding, Problem Solving … AND Decision Making Dr. Lakshmi Mohan 57

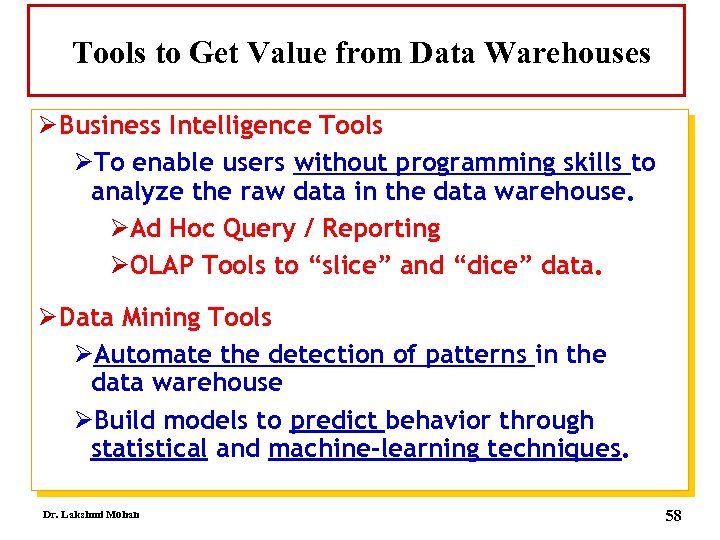

Tools to Get Value from Data Warehouses Ø Business Intelligence Tools ØTo enable users without programming skills to analyze the raw data in the data warehouse. ØAd Hoc Query / Reporting ØOLAP Tools to “slice” and “dice” data. Ø Data Mining Tools ØAutomate the detection of patterns in the data warehouse ØBuild models to predict behavior through statistical and machine-learning techniques. Dr. Lakshmi Mohan 58

Tools to Get Value from Data Warehouses Ø Business Intelligence Tools ØTo enable users without programming skills to analyze the raw data in the data warehouse. ØAd Hoc Query / Reporting ØOLAP Tools to “slice” and “dice” data. Ø Data Mining Tools ØAutomate the detection of patterns in the data warehouse ØBuild models to predict behavior through statistical and machine-learning techniques. Dr. Lakshmi Mohan 58

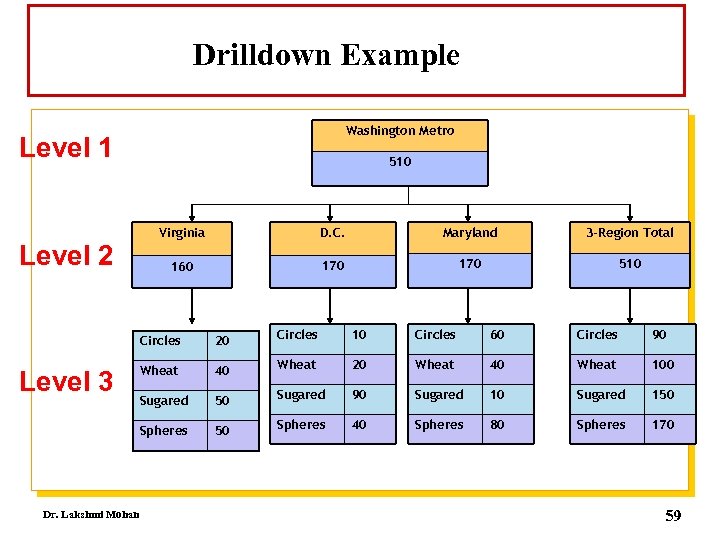

Drilldown Example Washington Metro Level 1 Level 2 510 Virginia D. C. Maryland 3 -Region Total 160 170 510 Circles Dr. Lakshmi Mohan Circles 10 Circles 60 Circles 90 Wheat 40 Wheat 20 Wheat 40 Wheat 100 Sugared 50 Sugared 90 Sugared 150 Spheres Level 3 20 50 Spheres 40 Spheres 80 Spheres 170 59

Drilldown Example Washington Metro Level 1 Level 2 510 Virginia D. C. Maryland 3 -Region Total 160 170 510 Circles Dr. Lakshmi Mohan Circles 10 Circles 60 Circles 90 Wheat 40 Wheat 20 Wheat 40 Wheat 100 Sugared 50 Sugared 90 Sugared 150 Spheres Level 3 20 50 Spheres 40 Spheres 80 Spheres 170 59

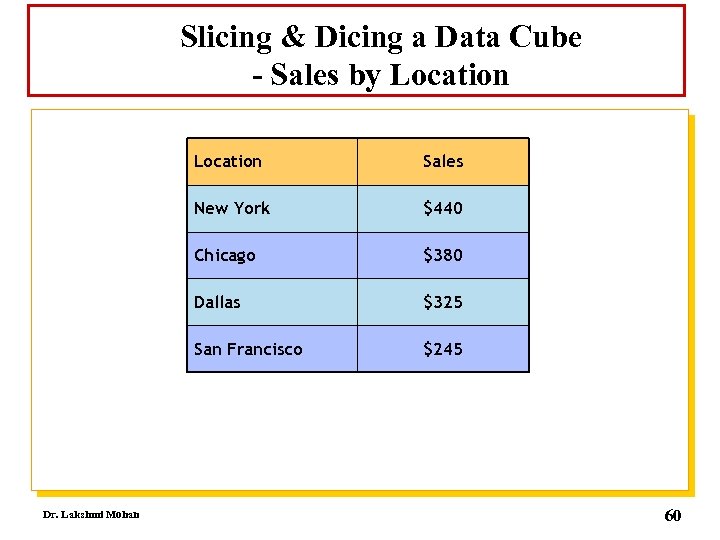

Slicing & Dicing a Data Cube - Sales by Location New York $440 Chicago $380 Dallas $325 San Francisco Dr. Lakshmi Mohan Sales $245 60

Slicing & Dicing a Data Cube - Sales by Location New York $440 Chicago $380 Dallas $325 San Francisco Dr. Lakshmi Mohan Sales $245 60

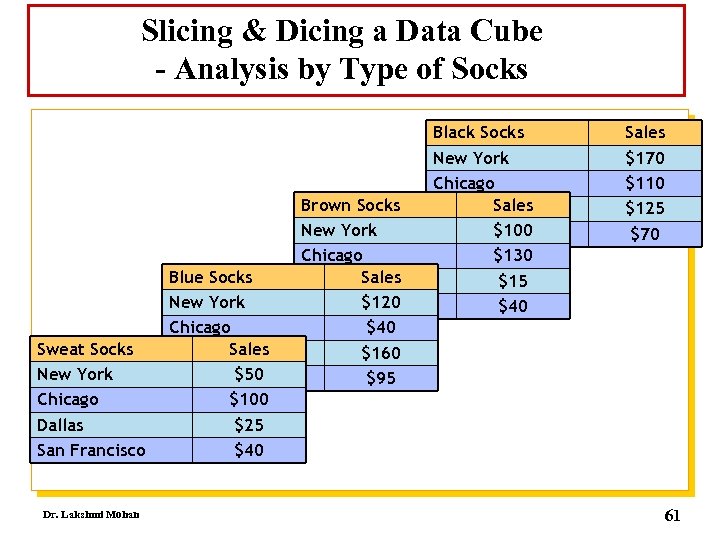

Slicing & Dicing a Data Cube - Analysis by Type of Socks Sweat Socks New York Chicago Dallas San Francisco Dr. Lakshmi Mohan Blue Socks New York Chicago Dallas Sales $50 San Francisco $100 $25 $40 Brown Socks New York Chicago Dallas Sales $120 San Francisco $40 $160 $95 Black Socks New York Chicago Dallas Sales $100 San Francisco $130 $15 $40 Sales $170 $110 $125 $70 61

Slicing & Dicing a Data Cube - Analysis by Type of Socks Sweat Socks New York Chicago Dallas San Francisco Dr. Lakshmi Mohan Blue Socks New York Chicago Dallas Sales $50 San Francisco $100 $25 $40 Brown Socks New York Chicago Dallas Sales $120 San Francisco $40 $160 $95 Black Socks New York Chicago Dallas Sales $100 San Francisco $130 $15 $40 Sales $170 $110 $125 $70 61

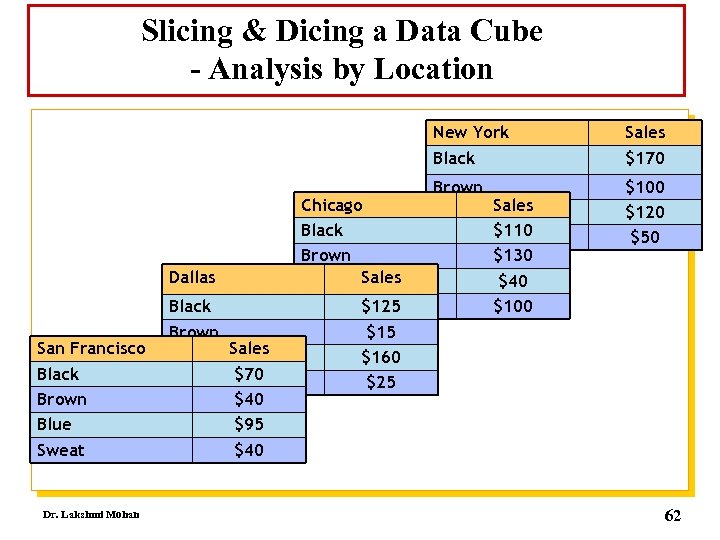

Slicing & Dicing a Data Cube - Analysis by Location New York Black Dallas San Francisco Black Brown Blue Sweat Dr. Lakshmi Mohan Black Brown Sales Blue $70 Sweat $40 $95 $40 Chicago Black Brown Blue Sales Sweat $125 Sales $170 Brown Blue Sales Sweat $110 $130 $40 $100 $120 $50 $15 $160 $25 62

Slicing & Dicing a Data Cube - Analysis by Location New York Black Dallas San Francisco Black Brown Blue Sweat Dr. Lakshmi Mohan Black Brown Sales Blue $70 Sweat $40 $95 $40 Chicago Black Brown Blue Sales Sweat $125 Sales $170 Brown Blue Sales Sweat $110 $130 $40 $100 $120 $50 $15 $160 $25 62

Why Data Mining ? “Now that we have gathered so much data, what do we do with it? ” “The datasets are of little direct value themselves. What is of value is the knowledge that can be inferred from the data and put to use. ” Ø Data volumes are TOO BIG for traditional DSS Query/ Reporting and OLAP tools. Ø Organizations have to get value from the huge investments of time and money made in building data warehouses. Dr. Lakshmi Mohan 63

Why Data Mining ? “Now that we have gathered so much data, what do we do with it? ” “The datasets are of little direct value themselves. What is of value is the knowledge that can be inferred from the data and put to use. ” Ø Data volumes are TOO BIG for traditional DSS Query/ Reporting and OLAP tools. Ø Organizations have to get value from the huge investments of time and money made in building data warehouses. Dr. Lakshmi Mohan 63

Why is Data Mining a “Hot” Topic Today? 1. Implementation of ERP, CRM & SCM systems have resulted in vast stores of operational data. 1. 2. Emergence of global competition has put the pressure on 2. companies to be “data- driven” – i. e. , make informed decisions 3. based on facts and not hunches. 4. 3. The speed of change in the marketplace demands that the pearls 5. of actionable information have to be found faster in the ocean of 6. data, for companies to be one step ahead of competition. 7. 4. The hardware needed to store and process a “ton of data” was 8. prohibitively expensive until recently – “You would have Dr. Lakshmi Mohan 64 had

Why is Data Mining a “Hot” Topic Today? 1. Implementation of ERP, CRM & SCM systems have resulted in vast stores of operational data. 1. 2. Emergence of global competition has put the pressure on 2. companies to be “data- driven” – i. e. , make informed decisions 3. based on facts and not hunches. 4. 3. The speed of change in the marketplace demands that the pearls 5. of actionable information have to be found faster in the ocean of 6. data, for companies to be one step ahead of competition. 7. 4. The hardware needed to store and process a “ton of data” was 8. prohibitively expensive until recently – “You would have Dr. Lakshmi Mohan 64 had

The Payoff from Data Mining - An Example: Farmer’s Insurance ØBased on traditional data analysis, drivers of sports cars were determined to be at higher risk for collisions than drivers of “safe” cars such as Volvos. ØHence charged them more for car insurance. ØData mining discovered a pattern that changed the pricing policy… … As long as the sports car was not the only car in the household, the driver fit the profile of the “safe” family car driver, not the risky sports car driver Dr. Lakshmi Mohan 65

The Payoff from Data Mining - An Example: Farmer’s Insurance ØBased on traditional data analysis, drivers of sports cars were determined to be at higher risk for collisions than drivers of “safe” cars such as Volvos. ØHence charged them more for car insurance. ØData mining discovered a pattern that changed the pricing policy… … As long as the sports car was not the only car in the household, the driver fit the profile of the “safe” family car driver, not the risky sports car driver Dr. Lakshmi Mohan 65

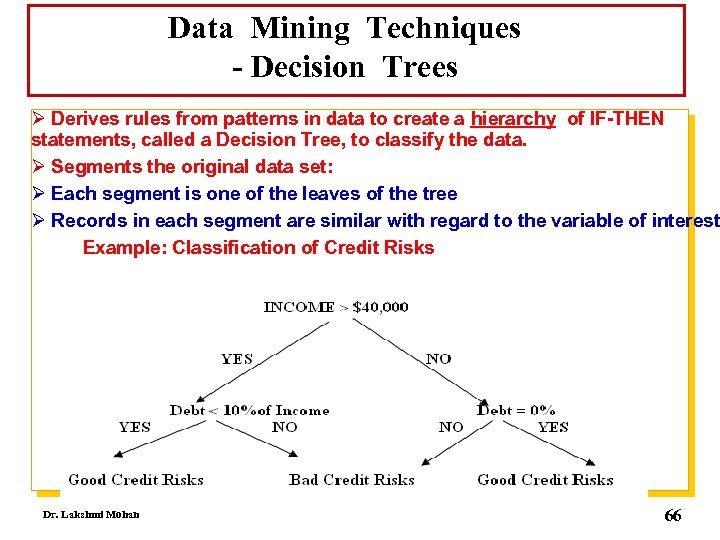

Data Mining Techniques - Decision Trees Ø Derives rules from patterns in data to create a hierarchy of IF-THEN statements, called a Decision Tree, to classify the data. Ø Segments the original data set: Ø Each segment is one of the leaves of the tree Ø Records in each segment are similar with regard to the variable of interest Example: Classification of Credit Risks Dr. Lakshmi Mohan 66

Data Mining Techniques - Decision Trees Ø Derives rules from patterns in data to create a hierarchy of IF-THEN statements, called a Decision Tree, to classify the data. Ø Segments the original data set: Ø Each segment is one of the leaves of the tree Ø Records in each segment are similar with regard to the variable of interest Example: Classification of Credit Risks Dr. Lakshmi Mohan 66

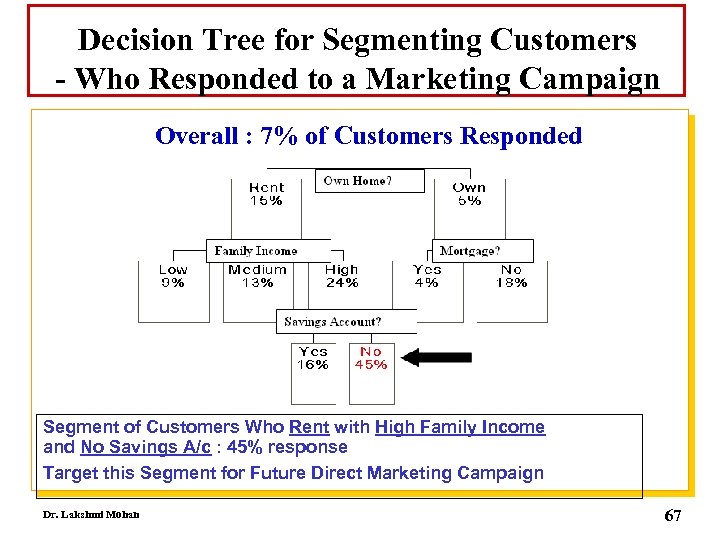

Decision Tree for Segmenting Customers - Who Responded to a Marketing Campaign Overall : 7% of Customers Responded Segment of Customers Who Rent with High Family Income and No Savings A/c : 45% response Target this Segment for Future Direct Marketing Campaign Dr. Lakshmi Mohan 67

Decision Tree for Segmenting Customers - Who Responded to a Marketing Campaign Overall : 7% of Customers Responded Segment of Customers Who Rent with High Family Income and No Savings A/c : 45% response Target this Segment for Future Direct Marketing Campaign Dr. Lakshmi Mohan 67

Text Mining: An Imperative Today “We are drowning in information, but are starving for knowledge” Unstructured data, most of it in the form of text files, typically accounts for 85% of an organization's knowledge stores, but it’s not always easy to find, access, analyze or use. Dr. Lakshmi Mohan 68

Text Mining: An Imperative Today “We are drowning in information, but are starving for knowledge” Unstructured data, most of it in the form of text files, typically accounts for 85% of an organization's knowledge stores, but it’s not always easy to find, access, analyze or use. Dr. Lakshmi Mohan 68

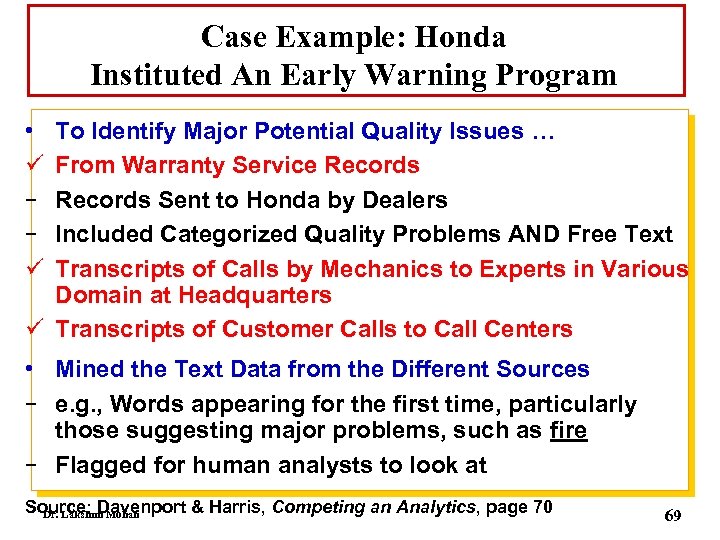

Case Example: Honda Instituted An Early Warning Program • ü − − ü To Identify Major Potential Quality Issues … From Warranty Service Records Sent to Honda by Dealers Included Categorized Quality Problems AND Free Text Transcripts of Calls by Mechanics to Experts in Various Domain at Headquarters ü Transcripts of Customer Calls to Call Centers • Mined the Text Data from the Different Sources − e. g. , Words appearing for the first time, particularly those suggesting major problems, such as fire − Flagged for human analysts to look at Source: Davenport & Harris, Competing an Analytics, page 70 Dr. Lakshmi Mohan 69

Case Example: Honda Instituted An Early Warning Program • ü − − ü To Identify Major Potential Quality Issues … From Warranty Service Records Sent to Honda by Dealers Included Categorized Quality Problems AND Free Text Transcripts of Calls by Mechanics to Experts in Various Domain at Headquarters ü Transcripts of Customer Calls to Call Centers • Mined the Text Data from the Different Sources − e. g. , Words appearing for the first time, particularly those suggesting major problems, such as fire − Flagged for human analysts to look at Source: Davenport & Harris, Competing an Analytics, page 70 Dr. Lakshmi Mohan 69

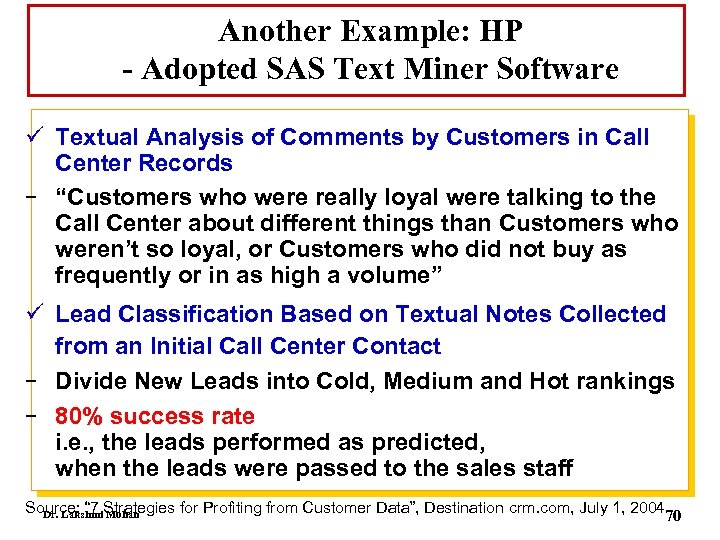

Another Example: HP - Adopted SAS Text Miner Software ü Textual Analysis of Comments by Customers in Call Center Records − “Customers who were really loyal were talking to the Call Center about different things than Customers who weren’t so loyal, or Customers who did not buy as frequently or in as high a volume” ü Lead Classification Based on Textual Notes Collected from an Initial Call Center Contact − Divide New Leads into Cold, Medium and Hot rankings − 80% success rate i. e. , the leads performed as predicted, when the leads were passed to the sales staff Source: “ 7 Strategies for Profiting from Customer Data”, Destination crm. com, July 1, 2004 Dr. Lakshmi Mohan 70

Another Example: HP - Adopted SAS Text Miner Software ü Textual Analysis of Comments by Customers in Call Center Records − “Customers who were really loyal were talking to the Call Center about different things than Customers who weren’t so loyal, or Customers who did not buy as frequently or in as high a volume” ü Lead Classification Based on Textual Notes Collected from an Initial Call Center Contact − Divide New Leads into Cold, Medium and Hot rankings − 80% success rate i. e. , the leads performed as predicted, when the leads were passed to the sales staff Source: “ 7 Strategies for Profiting from Customer Data”, Destination crm. com, July 1, 2004 Dr. Lakshmi Mohan 70

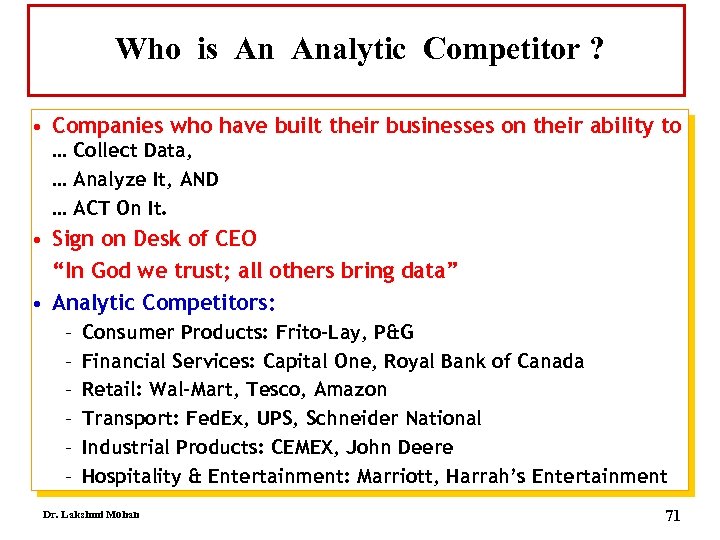

Who is An Analytic Competitor ? • Companies who have built their businesses on their ability to … Collect Data, … Analyze It, AND … ACT On It. • Sign on Desk of CEO “In God we trust; all others bring data” • Analytic Competitors: – – – Consumer Products: Frito-Lay, P&G Financial Services: Capital One, Royal Bank of Canada Retail: Wal-Mart, Tesco, Amazon Transport: Fed. Ex, UPS, Schneider National Industrial Products: CEMEX, John Deere Hospitality & Entertainment: Marriott, Harrah’s Entertainment Dr. Lakshmi Mohan 71

Who is An Analytic Competitor ? • Companies who have built their businesses on their ability to … Collect Data, … Analyze It, AND … ACT On It. • Sign on Desk of CEO “In God we trust; all others bring data” • Analytic Competitors: – – – Consumer Products: Frito-Lay, P&G Financial Services: Capital One, Royal Bank of Canada Retail: Wal-Mart, Tesco, Amazon Transport: Fed. Ex, UPS, Schneider National Industrial Products: CEMEX, John Deere Hospitality & Entertainment: Marriott, Harrah’s Entertainment Dr. Lakshmi Mohan 71

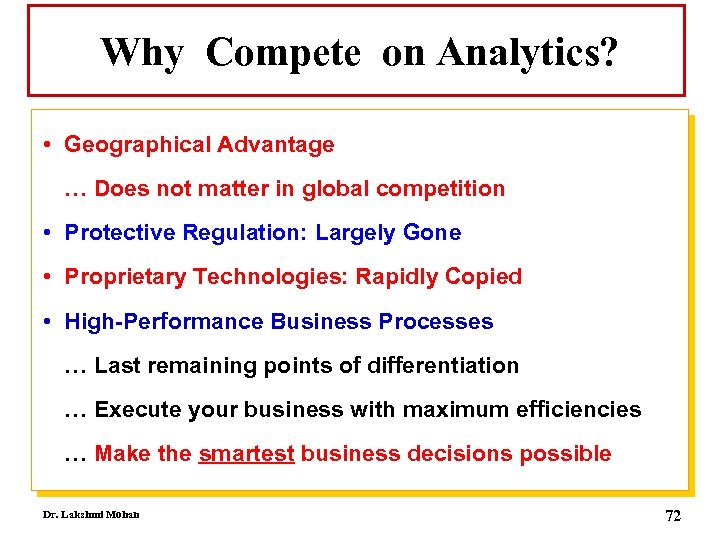

Why Compete on Analytics? • Geographical Advantage … Does not matter in global competition • Protective Regulation: Largely Gone • Proprietary Technologies: Rapidly Copied • High-Performance Business Processes … Last remaining points of differentiation … Execute your business with maximum efficiencies … Make the smartest business decisions possible Dr. Lakshmi Mohan 72

Why Compete on Analytics? • Geographical Advantage … Does not matter in global competition • Protective Regulation: Largely Gone • Proprietary Technologies: Rapidly Copied • High-Performance Business Processes … Last remaining points of differentiation … Execute your business with maximum efficiencies … Make the smartest business decisions possible Dr. Lakshmi Mohan 72

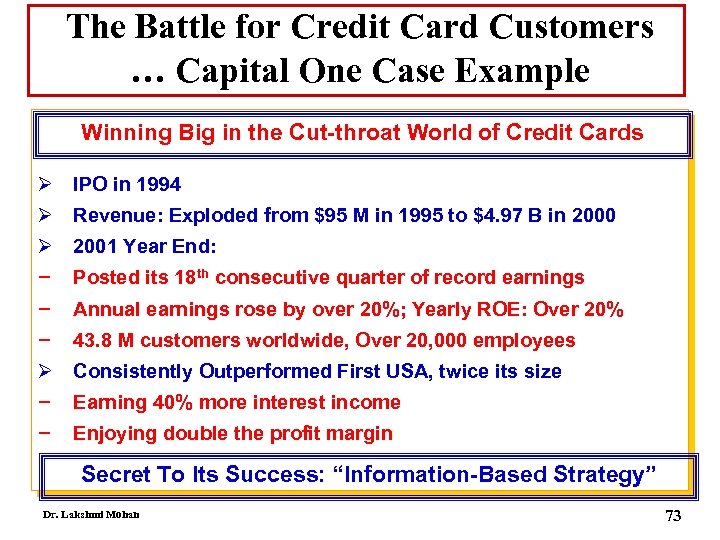

The Battle for Credit Card Customers … Capital One Case Example Winning Big in the Cut-throat World of Credit Cards Ø IPO in 1994 Ø Revenue: Exploded from $95 M in 1995 to $4. 97 B in 2000 Ø 2001 Year End: − Posted its 18 th consecutive quarter of record earnings − Annual earnings rose by over 20%; Yearly ROE: Over 20% − 43. 8 M customers worldwide, Over 20, 000 employees Ø Consistently Outperformed First USA, twice its size − Earning 40% more interest income − Enjoying double the profit margin Secret To Its Success: “Information-Based Strategy” Dr. Lakshmi Mohan 73

The Battle for Credit Card Customers … Capital One Case Example Winning Big in the Cut-throat World of Credit Cards Ø IPO in 1994 Ø Revenue: Exploded from $95 M in 1995 to $4. 97 B in 2000 Ø 2001 Year End: − Posted its 18 th consecutive quarter of record earnings − Annual earnings rose by over 20%; Yearly ROE: Over 20% − 43. 8 M customers worldwide, Over 20, 000 employees Ø Consistently Outperformed First USA, twice its size − Earning 40% more interest income − Enjoying double the profit margin Secret To Its Success: “Information-Based Strategy” Dr. Lakshmi Mohan 73

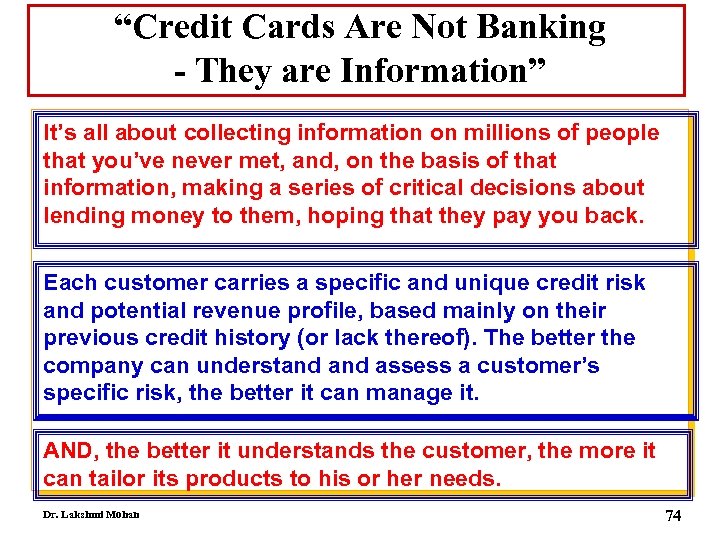

“Credit Cards Are Not Banking - They are Information” It’s all about collecting information on millions of people that you’ve never met, and, on the basis of that information, making a series of critical decisions about lending money to them, hoping that they pay you back. Each customer carries a specific and unique credit risk and potential revenue profile, based mainly on their previous credit history (or lack thereof). The better the company can understand assess a customer’s specific risk, the better it can manage it. AND, the better it understands the customer, the more it can tailor its products to his or her needs. Dr. Lakshmi Mohan 74

“Credit Cards Are Not Banking - They are Information” It’s all about collecting information on millions of people that you’ve never met, and, on the basis of that information, making a series of critical decisions about lending money to them, hoping that they pay you back. Each customer carries a specific and unique credit risk and potential revenue profile, based mainly on their previous credit history (or lack thereof). The better the company can understand assess a customer’s specific risk, the better it can manage it. AND, the better it understands the customer, the more it can tailor its products to his or her needs. Dr. Lakshmi Mohan 74

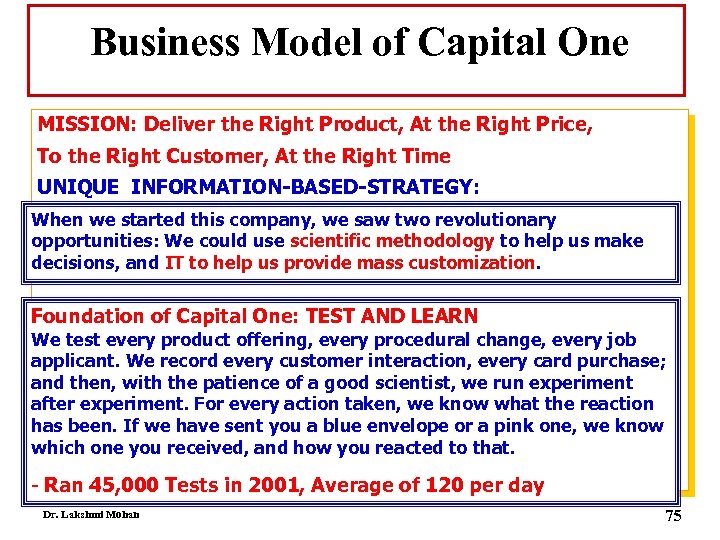

Business Model of Capital One MISSION: Deliver the Right Product, At the Right Price, To the Right Customer, At the Right Time UNIQUE INFORMATION-BASED-STRATEGY: When we started this company, we saw two revolutionary opportunities: We could use scientific methodology to help us make decisions, and IT to help us provide mass customization. Foundation of Capital One: TEST AND LEARN We test every product offering, every procedural change, every job applicant. We record every customer interaction, every card purchase; and then, with the patience of a good scientist, we run experiment after experiment. For every action taken, we know what the reaction has been. If we have sent you a blue envelope or a pink one, we know which one you received, and how you reacted to that. - Ran 45, 000 Tests in 2001, Average of 120 per day Dr. Lakshmi Mohan 75

Business Model of Capital One MISSION: Deliver the Right Product, At the Right Price, To the Right Customer, At the Right Time UNIQUE INFORMATION-BASED-STRATEGY: When we started this company, we saw two revolutionary opportunities: We could use scientific methodology to help us make decisions, and IT to help us provide mass customization. Foundation of Capital One: TEST AND LEARN We test every product offering, every procedural change, every job applicant. We record every customer interaction, every card purchase; and then, with the patience of a good scientist, we run experiment after experiment. For every action taken, we know what the reaction has been. If we have sent you a blue envelope or a pink one, we know which one you received, and how you reacted to that. - Ran 45, 000 Tests in 2001, Average of 120 per day Dr. Lakshmi Mohan 75

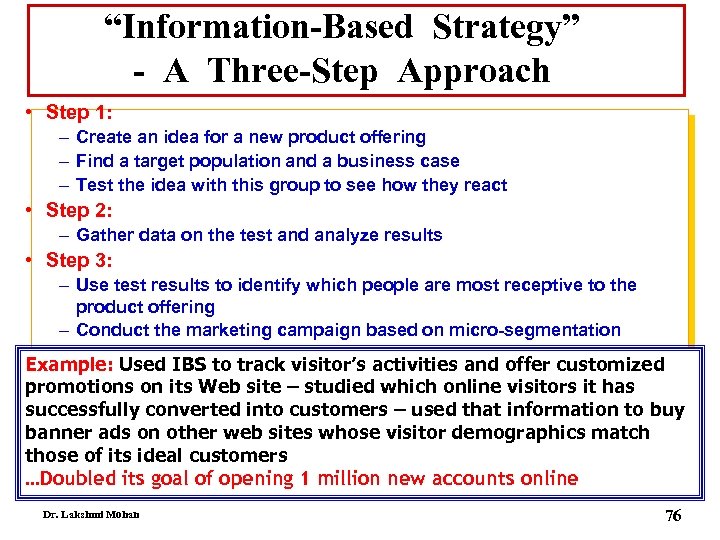

“Information-Based Strategy” - A Three-Step Approach • Step 1: – Create an idea for a new product offering – Find a target population and a business case – Test the idea with this group to see how they react • Step 2: – Gather data on the test and analyze results • Step 3: – Use test results to identify which people are most receptive to the product offering – Conduct the marketing campaign based on micro-segmentation Example: Used IBS to track visitor’s activities and offer customized promotions on its Web site – studied which online visitors it has successfully converted into customers – used that information to buy banner ads on other web sites whose visitor demographics match those of its ideal customers …Doubled its goal of opening 1 million new accounts online Dr. Lakshmi Mohan 76

“Information-Based Strategy” - A Three-Step Approach • Step 1: – Create an idea for a new product offering – Find a target population and a business case – Test the idea with this group to see how they react • Step 2: – Gather data on the test and analyze results • Step 3: – Use test results to identify which people are most receptive to the product offering – Conduct the marketing campaign based on micro-segmentation Example: Used IBS to track visitor’s activities and offer customized promotions on its Web site – studied which online visitors it has successfully converted into customers – used that information to buy banner ads on other web sites whose visitor demographics match those of its ideal customers …Doubled its goal of opening 1 million new accounts online Dr. Lakshmi Mohan 76

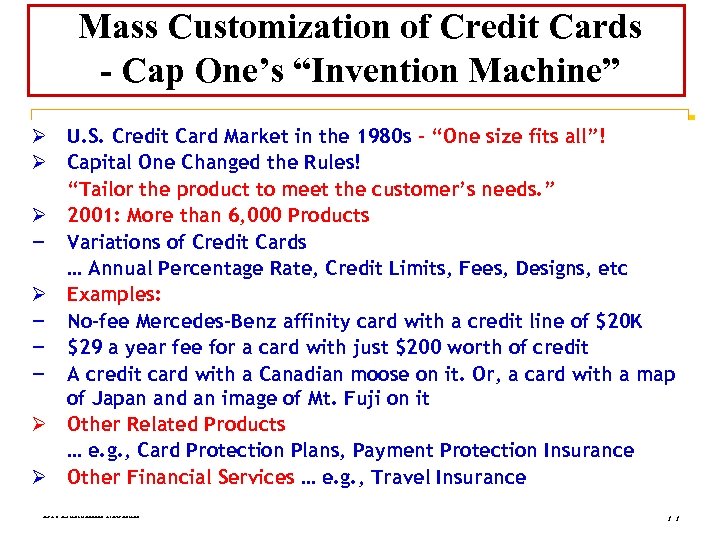

Mass Customization of Credit Cards - Cap One’s “Invention Machine” Ø U. S. Credit Card Market in the 1980 s - “One size fits all”! Ø Capital One Changed the Rules! “Tailor the product to meet the customer’s needs. ” Ø 2001: More than 6, 000 Products − Variations of Credit Cards … Annual Percentage Rate, Credit Limits, Fees, Designs, etc Ø Examples: − No-fee Mercedes-Benz affinity card with a credit line of $20 K − $29 a year fee for a card with just $200 worth of credit − A credit card with a Canadian moose on it. Or, a card with a map of Japan and an image of Mt. Fuji on it Ø Other Related Products … e. g. , Card Protection Plans, Payment Protection Insurance Ø Other Financial Services … e. g. , Travel Insurance Dr. Lakshmi Mohan 77

Mass Customization of Credit Cards - Cap One’s “Invention Machine” Ø U. S. Credit Card Market in the 1980 s - “One size fits all”! Ø Capital One Changed the Rules! “Tailor the product to meet the customer’s needs. ” Ø 2001: More than 6, 000 Products − Variations of Credit Cards … Annual Percentage Rate, Credit Limits, Fees, Designs, etc Ø Examples: − No-fee Mercedes-Benz affinity card with a credit line of $20 K − $29 a year fee for a card with just $200 worth of credit − A credit card with a Canadian moose on it. Or, a card with a map of Japan and an image of Mt. Fuji on it Ø Other Related Products … e. g. , Card Protection Plans, Payment Protection Insurance Ø Other Financial Services … e. g. , Travel Insurance Dr. Lakshmi Mohan 77

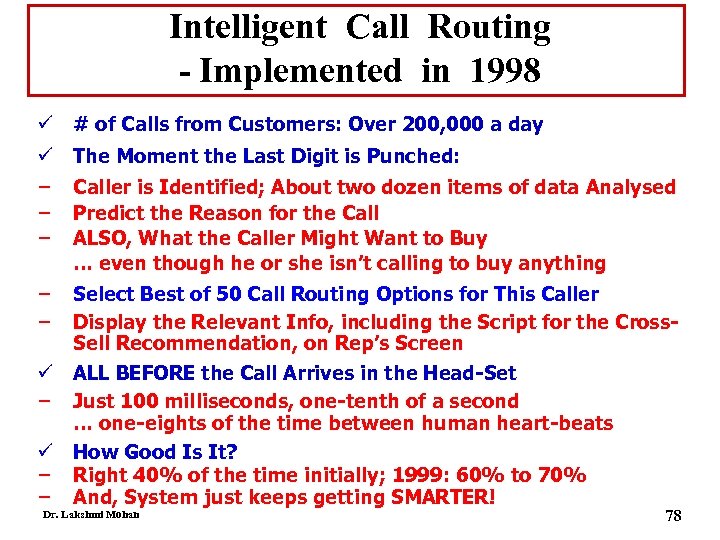

Intelligent Call Routing - Implemented in 1998 ü # of Calls from Customers: Over 200, 000 a day ü The Moment the Last Digit is Punched: − − − Caller is Identified; About two dozen items of data Analysed Predict the Reason for the Call ALSO, What the Caller Might Want to Buy … even though he or she isn’t calling to buy anything − − Select Best of 50 Call Routing Options for This Caller Display the Relevant Info, including the Script for the Cross. Sell Recommendation, on Rep’s Screen ü ALL BEFORE the Call Arrives in the Head-Set − Just 100 milliseconds, one-tenth of a second … one-eights of the time between human heart-beats ü How Good Is It? − Right 40% of the time initially; 1999: 60% to 70% − And, System just keeps getting SMARTER! Dr. Lakshmi Mohan 78

Intelligent Call Routing - Implemented in 1998 ü # of Calls from Customers: Over 200, 000 a day ü The Moment the Last Digit is Punched: − − − Caller is Identified; About two dozen items of data Analysed Predict the Reason for the Call ALSO, What the Caller Might Want to Buy … even though he or she isn’t calling to buy anything − − Select Best of 50 Call Routing Options for This Caller Display the Relevant Info, including the Script for the Cross. Sell Recommendation, on Rep’s Screen ü ALL BEFORE the Call Arrives in the Head-Set − Just 100 milliseconds, one-tenth of a second … one-eights of the time between human heart-beats ü How Good Is It? − Right 40% of the time initially; 1999: 60% to 70% − And, System just keeps getting SMARTER! Dr. Lakshmi Mohan 78

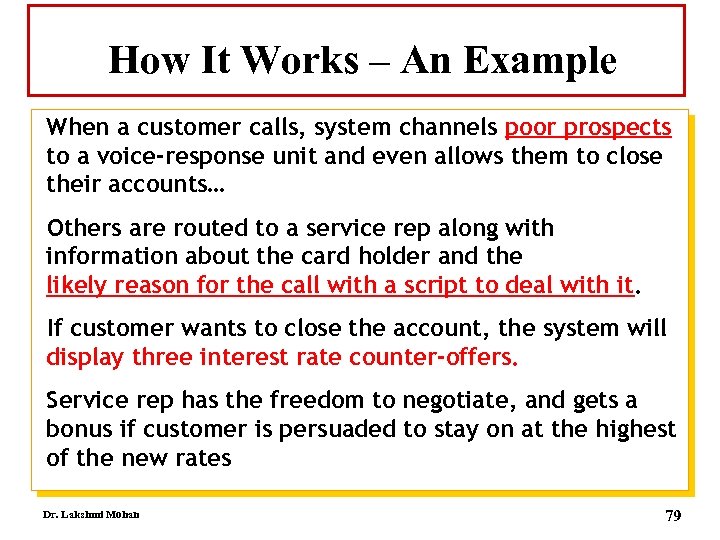

How It Works – An Example When a customer calls, system channels poor prospects to a voice-response unit and even allows them to close their accounts… Others are routed to a service rep along with information about the card holder and the likely reason for the call with a script to deal with it. If customer wants to close the account, the system will display three interest rate counter-offers. Service rep has the freedom to negotiate, and gets a bonus if customer is persuaded to stay on at the highest of the new rates Dr. Lakshmi Mohan 79

How It Works – An Example When a customer calls, system channels poor prospects to a voice-response unit and even allows them to close their accounts… Others are routed to a service rep along with information about the card holder and the likely reason for the call with a script to deal with it. If customer wants to close the account, the system will display three interest rate counter-offers. Service rep has the freedom to negotiate, and gets a bonus if customer is persuaded to stay on at the highest of the new rates Dr. Lakshmi Mohan 79

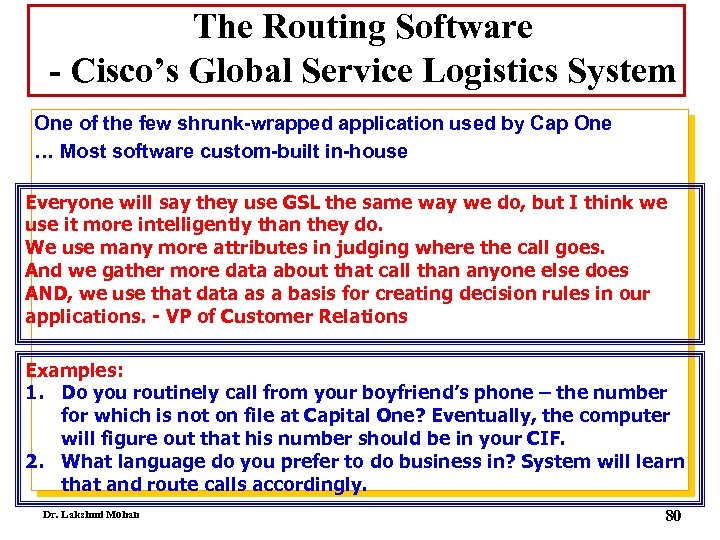

The Routing Software - Cisco’s Global Service Logistics System One of the few shrunk-wrapped application used by Cap One … Most software custom-built in-house Everyone will say they use GSL the same way we do, but I think we use it more intelligently than they do. We use many more attributes in judging where the call goes. And we gather more data about that call than anyone else does AND, we use that data as a basis for creating decision rules in our applications. - VP of Customer Relations Examples: 1. Do you routinely call from your boyfriend’s phone – the number for which is not on file at Capital One? Eventually, the computer will figure out that his number should be in your CIF. 2. What language do you prefer to do business in? System will learn that and route calls accordingly. Dr. Lakshmi Mohan 80

The Routing Software - Cisco’s Global Service Logistics System One of the few shrunk-wrapped application used by Cap One … Most software custom-built in-house Everyone will say they use GSL the same way we do, but I think we use it more intelligently than they do. We use many more attributes in judging where the call goes. And we gather more data about that call than anyone else does AND, we use that data as a basis for creating decision rules in our applications. - VP of Customer Relations Examples: 1. Do you routinely call from your boyfriend’s phone – the number for which is not on file at Capital One? Eventually, the computer will figure out that his number should be in your CIF. 2. What language do you prefer to do business in? System will learn that and route calls accordingly. Dr. Lakshmi Mohan 80

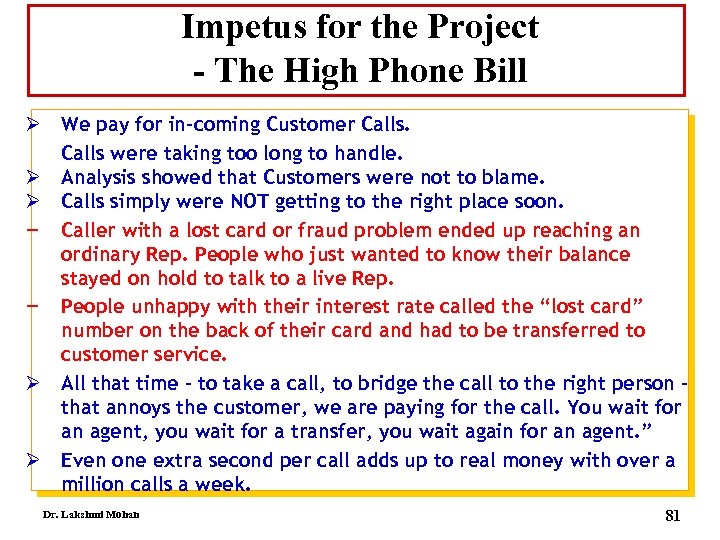

Impetus for the Project - The High Phone Bill Ø We pay for in-coming Customer Calls were taking too long to handle. Ø Analysis showed that Customers were not to blame. Ø Calls simply were NOT getting to the right place soon. − Caller with a lost card or fraud problem ended up reaching an ordinary Rep. People who just wanted to know their balance stayed on hold to talk to a live Rep. − People unhappy with their interest rate called the “lost card” number on the back of their card and had to be transferred to customer service. Ø All that time – to take a call, to bridge the call to the right person – that annoys the customer, we are paying for the call. You wait for an agent, you wait for a transfer, you wait again for an agent. ” Ø Even one extra second per call adds up to real money with over a million calls a week. Dr. Lakshmi Mohan 81

Impetus for the Project - The High Phone Bill Ø We pay for in-coming Customer Calls were taking too long to handle. Ø Analysis showed that Customers were not to blame. Ø Calls simply were NOT getting to the right place soon. − Caller with a lost card or fraud problem ended up reaching an ordinary Rep. People who just wanted to know their balance stayed on hold to talk to a live Rep. − People unhappy with their interest rate called the “lost card” number on the back of their card and had to be transferred to customer service. Ø All that time – to take a call, to bridge the call to the right person – that annoys the customer, we are paying for the call. You wait for an agent, you wait for a transfer, you wait again for an agent. ” Ø Even one extra second per call adds up to real money with over a million calls a week. Dr. Lakshmi Mohan 81

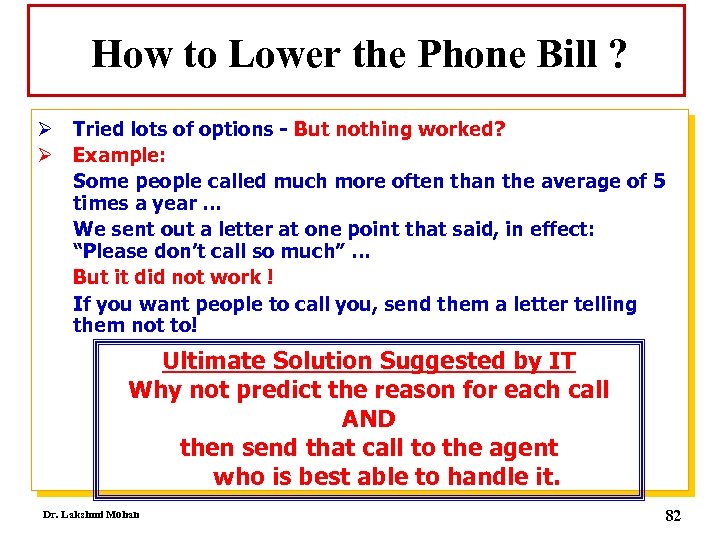

How to Lower the Phone Bill ? Ø Tried lots of options - But nothing worked? Ø Example: Some people called much more often than the average of 5 times a year … We sent out a letter at one point that said, in effect: “Please don’t call so much” … But it did not work ! If you want people to call you, send them a letter telling them not to! Ultimate Solution Suggested by IT Why not predict the reason for each call AND then send that call to the agent who is best able to handle it. Dr. Lakshmi Mohan 82

How to Lower the Phone Bill ? Ø Tried lots of options - But nothing worked? Ø Example: Some people called much more often than the average of 5 times a year … We sent out a letter at one point that said, in effect: “Please don’t call so much” … But it did not work ! If you want people to call you, send them a letter telling them not to! Ultimate Solution Suggested by IT Why not predict the reason for each call AND then send that call to the agent who is best able to handle it. Dr. Lakshmi Mohan 82

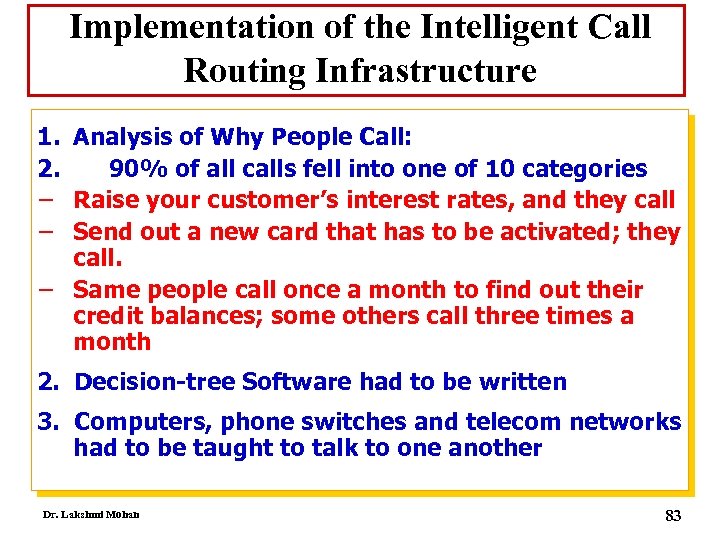

Implementation of the Intelligent Call Routing Infrastructure 1. Analysis of Why People Call: 2. 90% of all calls fell into one of 10 categories − Raise your customer’s interest rates, and they call − Send out a new card that has to be activated; they call. − Same people call once a month to find out their credit balances; some others call three times a month 2. Decision-tree Software had to be written 3. Computers, phone switches and telecom networks had to be taught to talk to one another Dr. Lakshmi Mohan 83

Implementation of the Intelligent Call Routing Infrastructure 1. Analysis of Why People Call: 2. 90% of all calls fell into one of 10 categories − Raise your customer’s interest rates, and they call − Send out a new card that has to be activated; they call. − Same people call once a month to find out their credit balances; some others call three times a month 2. Decision-tree Software had to be written 3. Computers, phone switches and telecom networks had to be taught to talk to one another Dr. Lakshmi Mohan 83

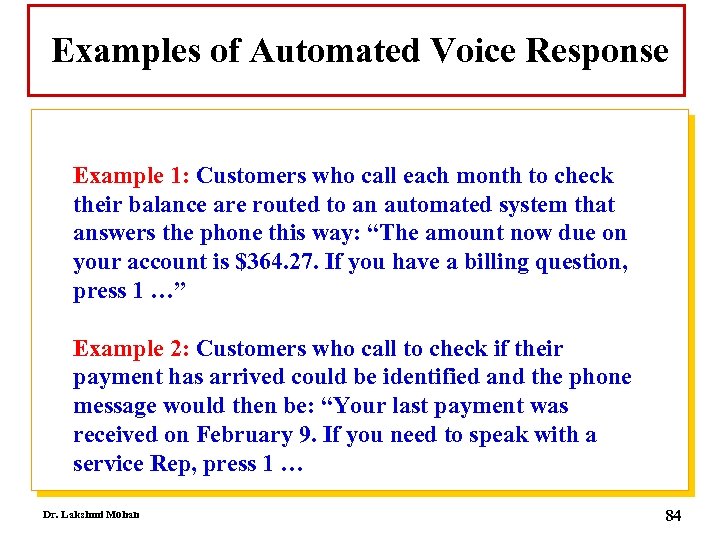

Examples of Automated Voice Response Example 1: Customers who call each month to check their balance are routed to an automated system that answers the phone this way: “The amount now due on your account is $364. 27. If you have a billing question, press 1 …” Example 2: Customers who call to check if their payment has arrived could be identified and the phone message would then be: “Your last payment was received on February 9. If you need to speak with a service Rep, press 1 … Dr. Lakshmi Mohan 84

Examples of Automated Voice Response Example 1: Customers who call each month to check their balance are routed to an automated system that answers the phone this way: “The amount now due on your account is $364. 27. If you have a billing question, press 1 …” Example 2: Customers who call to check if their payment has arrived could be identified and the phone message would then be: “Your last payment was received on February 9. If you need to speak with a service Rep, press 1 … Dr. Lakshmi Mohan 84

Everyone Wins ! Ø “We can answer your question BEFORE you ask it!” Ø “A phone call that might have taken 20 or 30 seconds, or even a minute, now lasts 10 seconds. ” Ø Customers get where they are going immediately. And, they get the information they need quickly. Ø Customer Service Reps handle those calls that need to be handled by people, and they don’t waste any time passing calls to colleagues. Ø Customers are automatically routed to the RIGHT Reps – best skilled to not only deal with the problem about which the customer is calling but also to cross-sell the product that the system predicts the customer might want to buy. Dr. Lakshmi Mohan 85

Everyone Wins ! Ø “We can answer your question BEFORE you ask it!” Ø “A phone call that might have taken 20 or 30 seconds, or even a minute, now lasts 10 seconds. ” Ø Customers get where they are going immediately. And, they get the information they need quickly. Ø Customer Service Reps handle those calls that need to be handled by people, and they don’t waste any time passing calls to colleagues. Ø Customers are automatically routed to the RIGHT Reps – best skilled to not only deal with the problem about which the customer is calling but also to cross-sell the product that the system predicts the customer might want to buy. Dr. Lakshmi Mohan 85

The Pay-Off for Capital One - Calling System Has Become A Competitive Advantage Ø Ø − − Lower Costs AND Better Service Call Centers: NOT A COST CENTRE Generate Revenues from Cross-Selling Exceeds Cost of Operations Actually MAKE MONEY! “In 1998, for the first time, half of all new Cap One customers bought another product from the company within 12 months of signing up for their credit card. That’s amazing penetration and it leads to high profitability. ” A simple, routine problem in search of a quick solution led to a whole new way of doing business. It enabled us to go back to the business side with a solution that went beyond that problem. What makes our “T” work has nothing to do with “T” – it has to do with our culture. ” Dr. Lakshmi Mohan 86

The Pay-Off for Capital One - Calling System Has Become A Competitive Advantage Ø Ø − − Lower Costs AND Better Service Call Centers: NOT A COST CENTRE Generate Revenues from Cross-Selling Exceeds Cost of Operations Actually MAKE MONEY! “In 1998, for the first time, half of all new Cap One customers bought another product from the company within 12 months of signing up for their credit card. That’s amazing penetration and it leads to high profitability. ” A simple, routine problem in search of a quick solution led to a whole new way of doing business. It enabled us to go back to the business side with a solution that went beyond that problem. What makes our “T” work has nothing to do with “T” – it has to do with our culture. ” Dr. Lakshmi Mohan 86

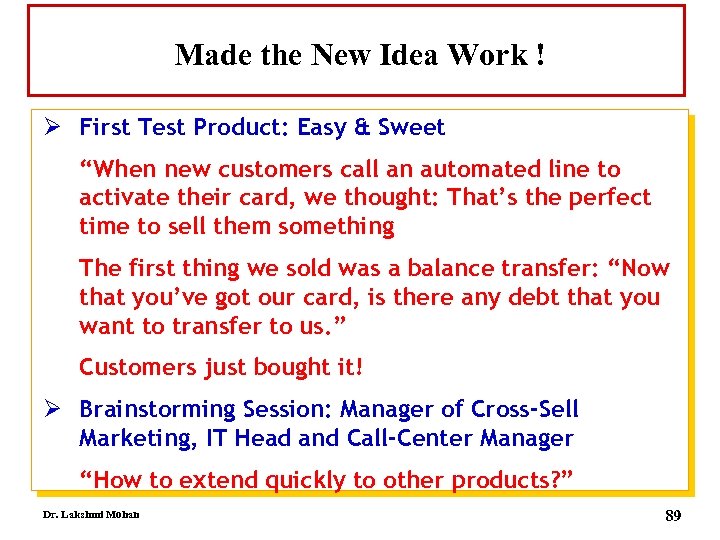

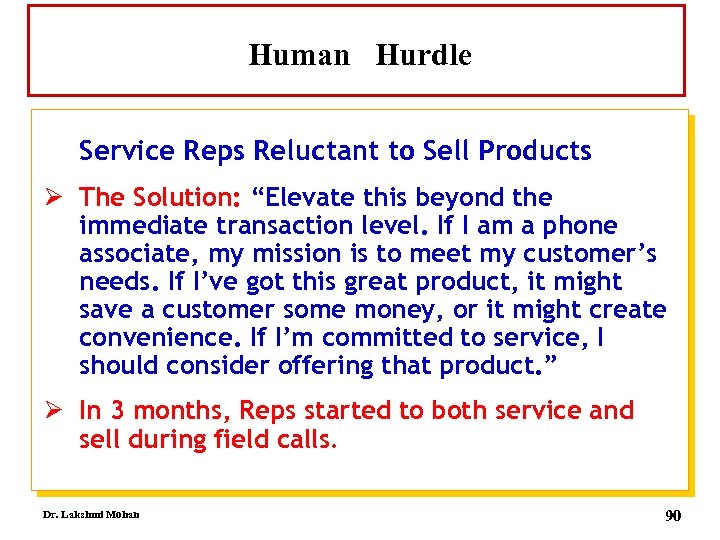

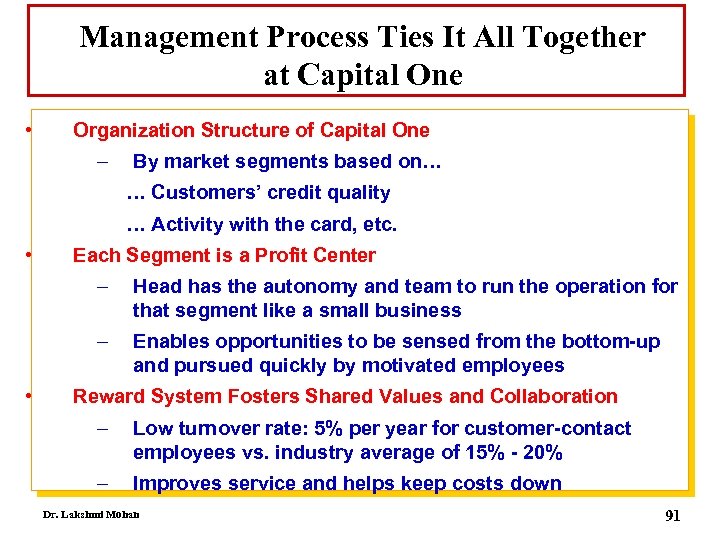

Every Interaction Is A Selling Opportunity ! Ø Most credit-card companies, including Capital One, have long tried to “Cross-Sell” their customers – often by using inserts in monthly statements to tout everything from calculators to cruises Ø Data analysis of outbound telemarketing calls (made usually at dinner time) showed it was NOT working. Ø New Idea: Sell things to customers when they call − “It seemed like a natural. If you call me and I’m trying to sell you something, then I’m going to treat you very nicely. That will promote better service. ” Dr. Lakshmi Mohan 87