36e009cecd9509005afa81fee33374f6.ppt

- Количество слайдов: 18

Online Trade shows Magazines Research (NASDAQ-GS: GSOL) Global Sources’ 2009 Importer Survey

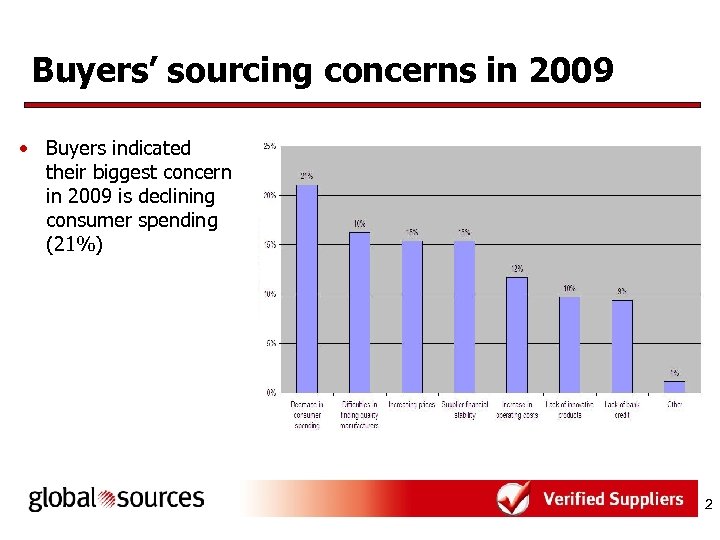

Buyers’ sourcing concerns in 2009 • Buyers indicated their biggest concern in 2009 is declining consumer spending (21%) 2

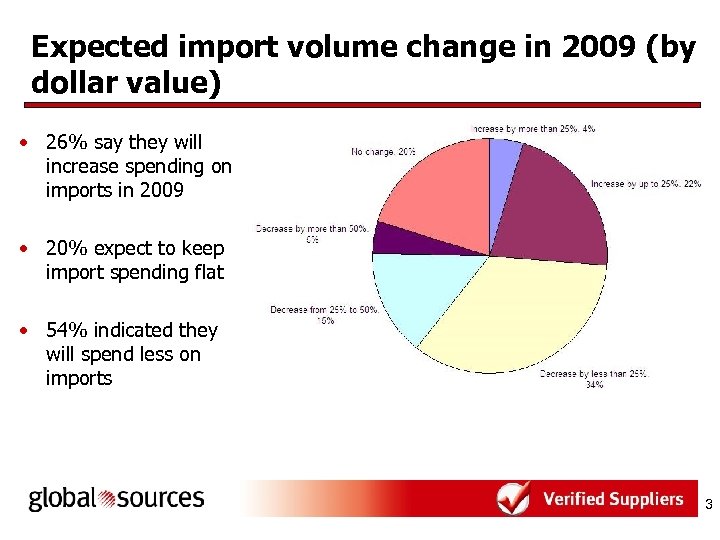

Expected import volume change in 2009 (by dollar value) • 26% say they will increase spending on imports in 2009 • 20% expect to keep import spending flat • 54% indicated they will spend less on imports 3

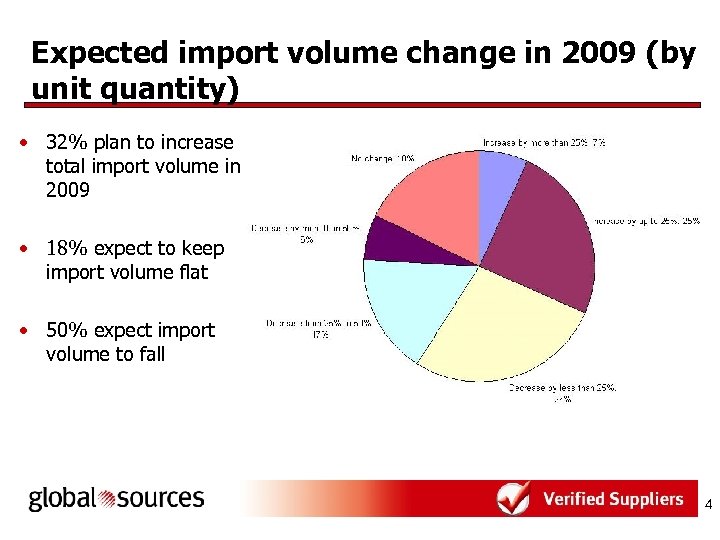

Expected import volume change in 2009 (by unit quantity) • 32% plan to increase total import volume in 2009 • 18% expect to keep import volume flat • 50% expect import volume to fall 4

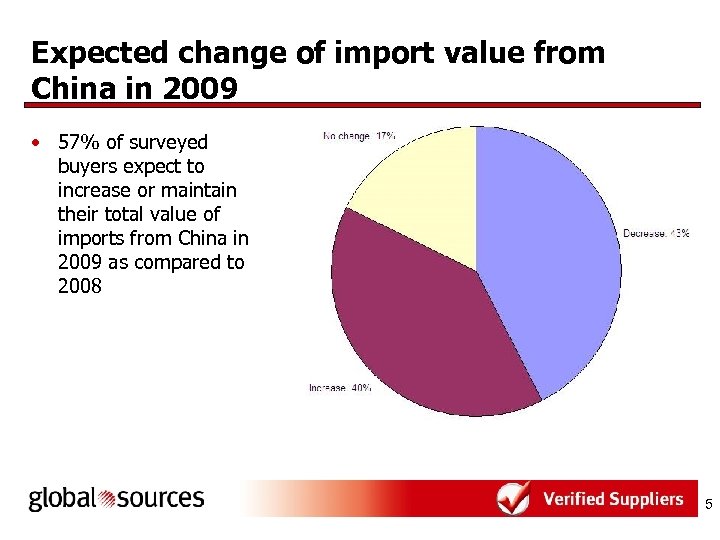

Expected change of import value from China in 2009 • 57% of surveyed buyers expect to increase or maintain their total value of imports from China in 2009 as compared to 2008 5

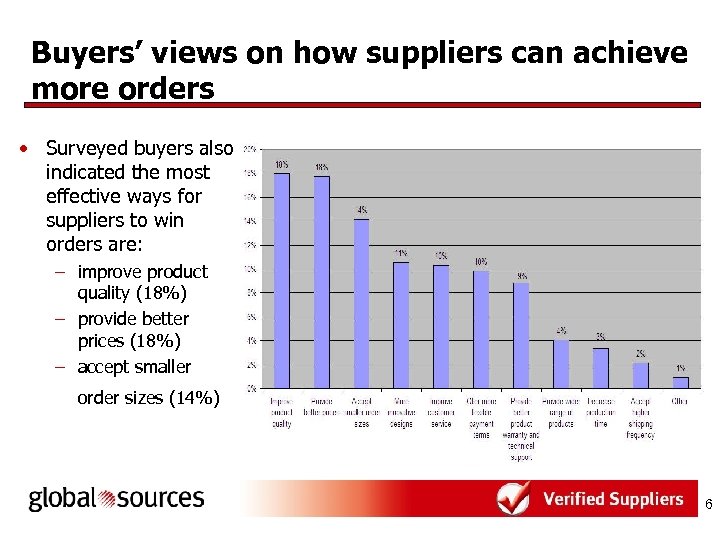

Buyers’ views on how suppliers can achieve more orders • Surveyed buyers also indicated the most effective ways for suppliers to win orders are: – improve product quality (18%) – provide better prices (18%) – accept smaller order sizes (14%) 6

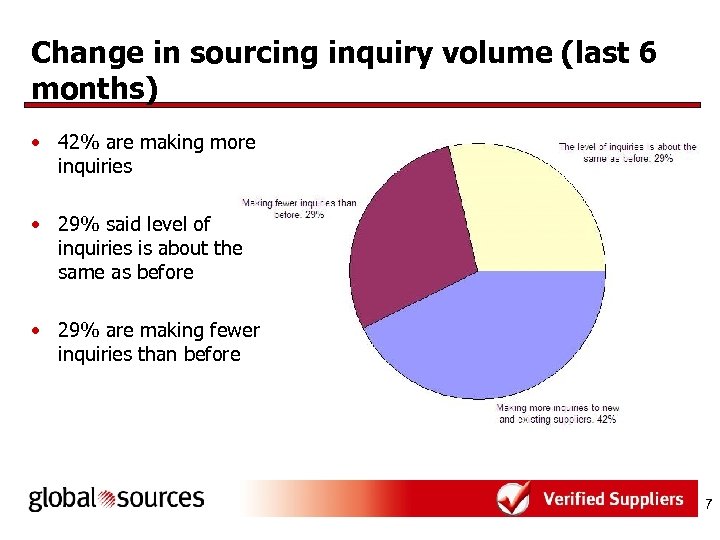

Change in sourcing inquiry volume (last 6 months) • 42% are making more inquiries • 29% said level of inquiries is about the same as before • 29% are making fewer inquiries than before 7

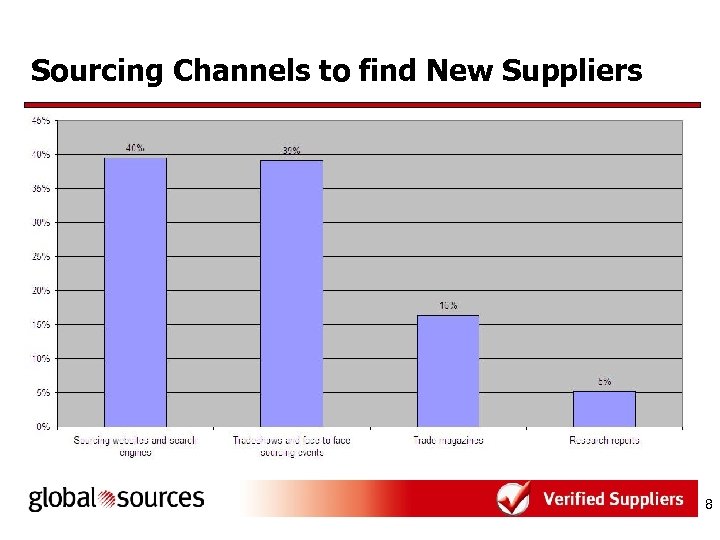

Sourcing Channels to find New Suppliers 8

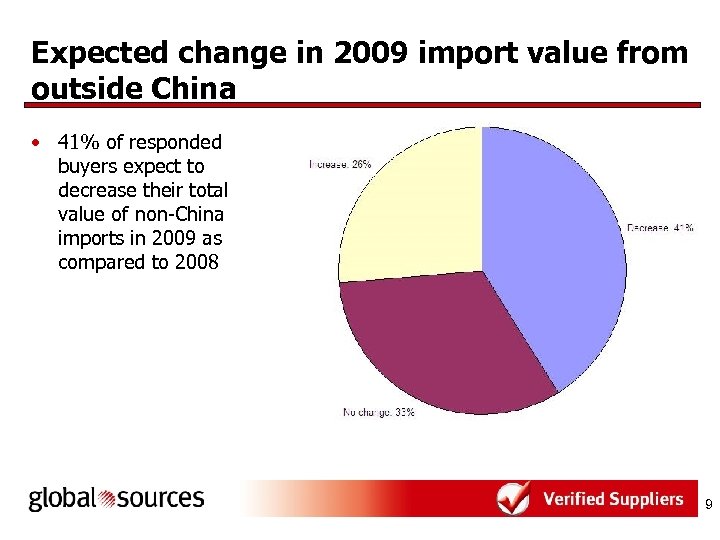

Expected change in 2009 import value from outside China • 41% of responded buyers expect to decrease their total value of non-China imports in 2009 as compared to 2008 9

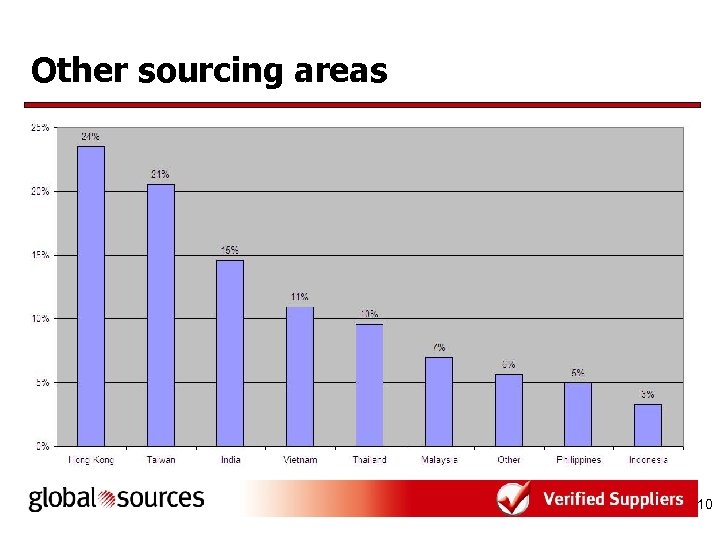

Other sourcing areas 10

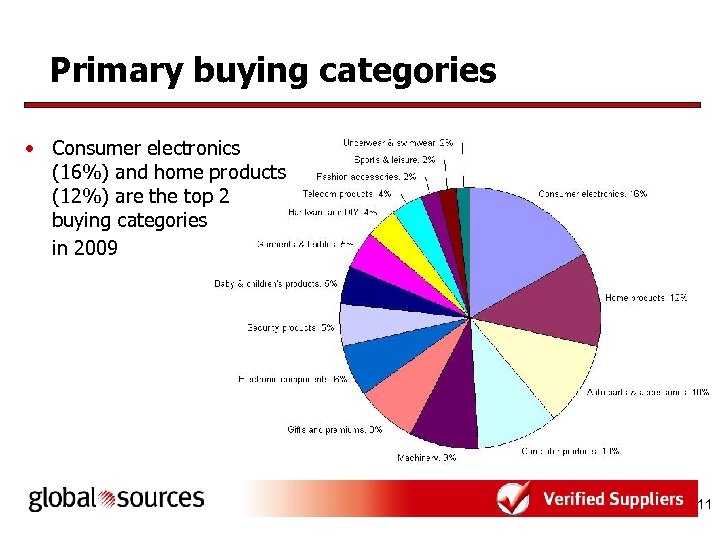

Primary buying categories • Consumer electronics (16%) and home products (12%) are the top 2 buying categories in 2009 11

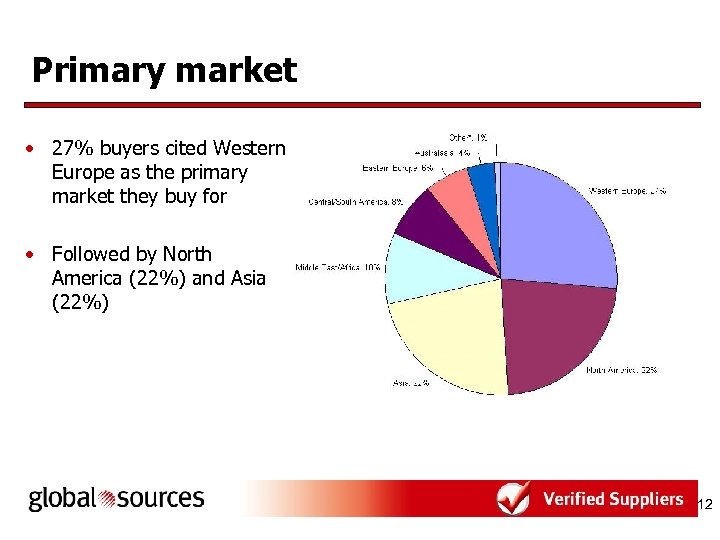

Primary market • 27% buyers cited Western Europe as the primary market they buy for • Followed by North America (22%) and Asia (22%) 12

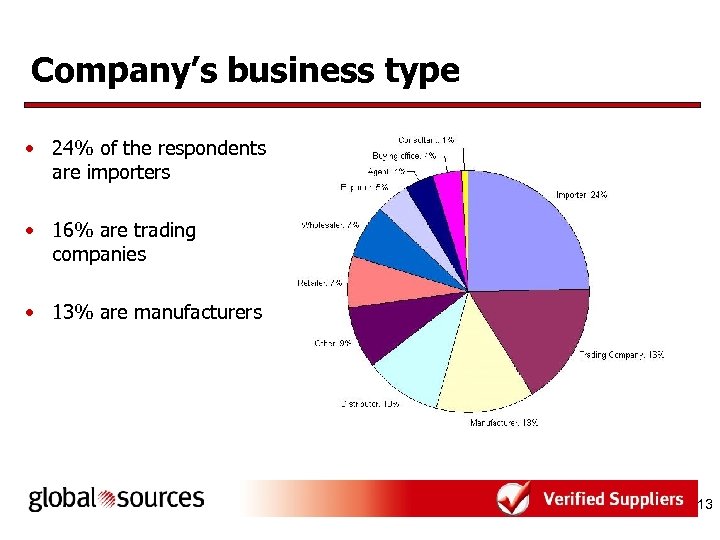

Company’s business type • 24% of the respondents are importers • 16% are trading companies • 13% are manufacturers 13

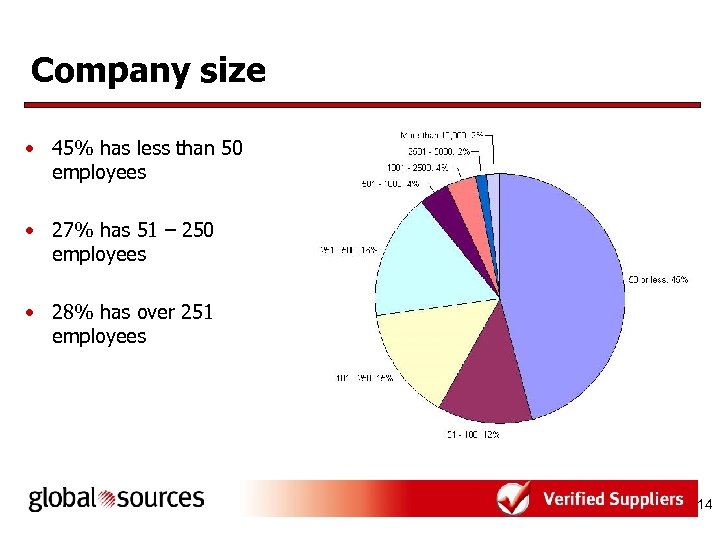

Company size • 45% has less than 50 employees • 27% has 51 – 250 employees • 28% has over 251 employees 14

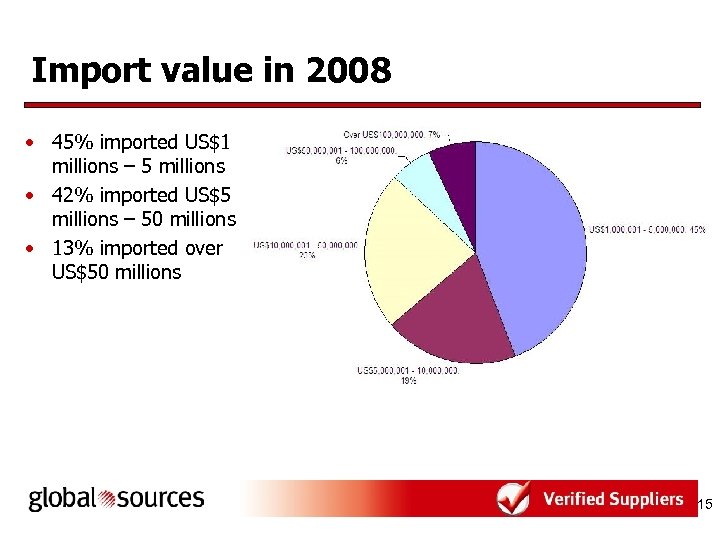

Import value in 2008 • 45% imported US$1 millions – 5 millions • 42% imported US$5 millions – 50 millions • 13% imported over US$50 millions 15

Online Trade shows Magazines Research (NASDAQ-GS: GSOL) U. S. Import Market Analysis

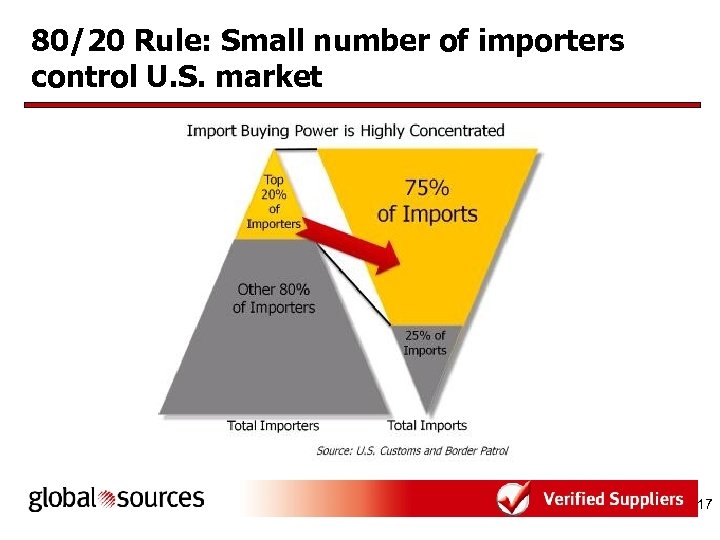

80/20 Rule: Small number of importers control U. S. market 17

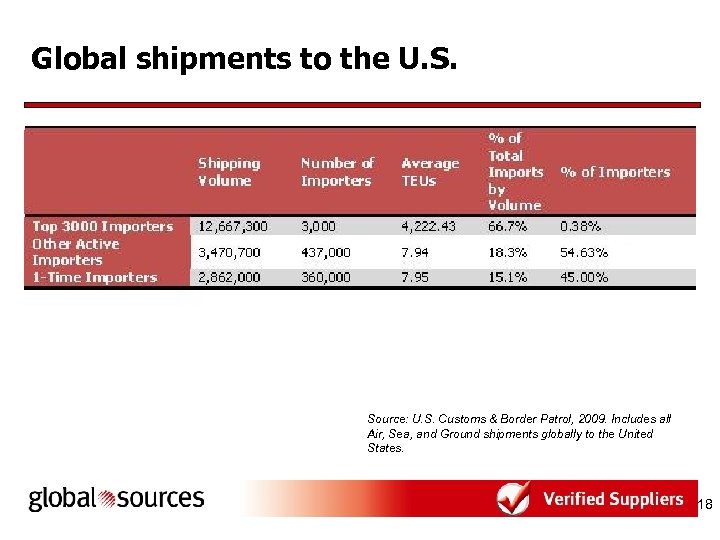

Global shipments to the U. S. Source: U. S. Customs & Border Patrol, 2009. Includes all Air, Sea, and Ground shipments globally to the United States. 18

36e009cecd9509005afa81fee33374f6.ppt