d222b4f562be3e100410c0206039f379.ppt

- Количество слайдов: 140

Online + Offline 2010 Canadian Media Usage Trends Study Commissioned By: The Interactive Advertising Bureau (IAB) of Canada www. iabcanada. com Prepared By: PHD Canada French Canada June 2011

Online + Offline 2010 Canadian Media Usage Trends Study Commissioned By: The Interactive Advertising Bureau (IAB) of Canada www. iabcanada. com Prepared By: PHD Canada French Canada June 2011

Online + Offline – Worlds Apart. On-Line Off-Line

Online + Offline – Worlds Apart. On-Line Off-Line

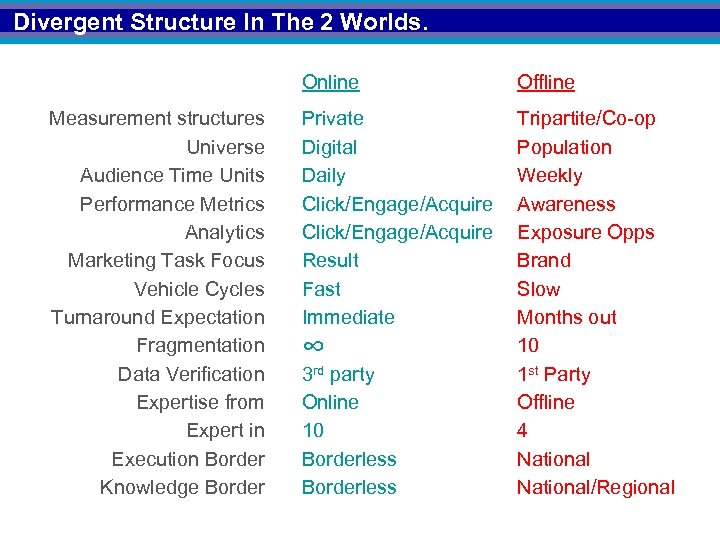

Divergent Structure In The 2 Worlds. Online Measurement structures Universe Audience Time Units Performance Metrics Analytics Marketing Task Focus Vehicle Cycles Turnaround Expectation Fragmentation Data Verification Expertise from Expert in Execution Border Knowledge Border Offline Private Digital Daily Click/Engage/Acquire Result Fast Immediate Tripartite/Co-op Population Weekly Awareness Exposure Opps Brand Slow Months out 10 1 st Party Offline 4 National/Regional ∞ 3 rd party Online 10 Borderless

Divergent Structure In The 2 Worlds. Online Measurement structures Universe Audience Time Units Performance Metrics Analytics Marketing Task Focus Vehicle Cycles Turnaround Expectation Fragmentation Data Verification Expertise from Expert in Execution Border Knowledge Border Offline Private Digital Daily Click/Engage/Acquire Result Fast Immediate Tripartite/Co-op Population Weekly Awareness Exposure Opps Brand Slow Months out 10 1 st Party Offline 4 National/Regional ∞ 3 rd party Online 10 Borderless

Must become a closer part of the “mix”. Online MARKETING INTEGRATION Offline

Must become a closer part of the “mix”. Online MARKETING INTEGRATION Offline

Common Ground For Comparison. Weekly Reach Weekly Time

Common Ground For Comparison. Weekly Reach Weekly Time

CMUST Has Changed. From: To: Internet: Single (NADbank) source Buyer currency sources BBM (TV, Radio) PMB (Magazine) NADbank (Newspaper) No weekly data from com. Score. NADbank for weekly Internet data. Use com. Score in PMB fusion data base.

CMUST Has Changed. From: To: Internet: Single (NADbank) source Buyer currency sources BBM (TV, Radio) PMB (Magazine) NADbank (Newspaper) No weekly data from com. Score. NADbank for weekly Internet data. Use com. Score in PMB fusion data base.

Six Buyer Currency Surveys Of Record. TELEVISION BBM PMT/Mark II Meter/PPM in Quebec Jan-Dec ‘ 02/Jan-Aug ’ 09 RADIO BBM Diary Fall’ 00/Fall’ 09 NEWSPAPER NADbank Telephone Readership study 2001/2009 MAGAZINE PMB Recent Reading PMB’ 01/PMB Fall’ 10 INTERNET NADbank Telephone Readership study 2001/2009 PMB/com. Score Fused Data Spring’ 10 MOBILE Nielsen Mobile Media Measurement 2 nd Quarter ’ 09/’ 10 com. Score Mobilens March ‘ 11

Six Buyer Currency Surveys Of Record. TELEVISION BBM PMT/Mark II Meter/PPM in Quebec Jan-Dec ‘ 02/Jan-Aug ’ 09 RADIO BBM Diary Fall’ 00/Fall’ 09 NEWSPAPER NADbank Telephone Readership study 2001/2009 MAGAZINE PMB Recent Reading PMB’ 01/PMB Fall’ 10 INTERNET NADbank Telephone Readership study 2001/2009 PMB/com. Score Fused Data Spring’ 10 MOBILE Nielsen Mobile Media Measurement 2 nd Quarter ’ 09/’ 10 com. Score Mobilens March ‘ 11

How Have Media Reach Levels Changed Over Last 10 Years? REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

How Have Media Reach Levels Changed Over Last 10 Years? REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

Media Habits, On- + Offline, Over Last 10 Years. REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

Media Habits, On- + Offline, Over Last 10 Years. REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

How Have Media Reach Levels Changed Over Last 10 Years? Adults 18+ Weekly Reach 100% 80% 60% 40% 20% 0% ‘ 00 Source: French Canada, see Data Source slide ‘ 09

How Have Media Reach Levels Changed Over Last 10 Years? Adults 18+ Weekly Reach 100% 80% 60% 40% 20% 0% ‘ 00 Source: French Canada, see Data Source slide ‘ 09

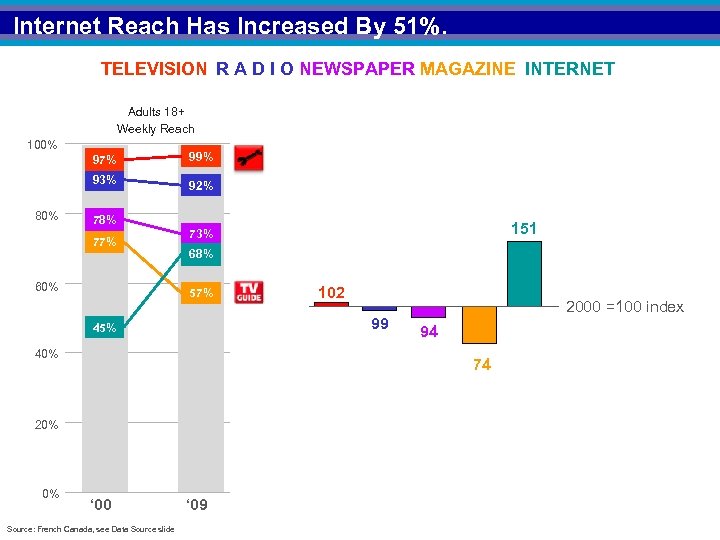

Internet Reach Has Increased By 51%. TELEVISION R A D I O NEWSPAPER MAGAZINE INTERNET Adults 18+ Weekly Reach 100% 97% 93% 80% 99% 92% 78% 77% 60% 68% 57% 102 99 45% 40% 2000 =100 index 94 74 20% 0% 151 73% ‘ 00 Source: French Canada, see Data Source slide ‘ 09

Internet Reach Has Increased By 51%. TELEVISION R A D I O NEWSPAPER MAGAZINE INTERNET Adults 18+ Weekly Reach 100% 97% 93% 80% 99% 92% 78% 77% 60% 68% 57% 102 99 45% 40% 2000 =100 index 94 74 20% 0% 151 73% ‘ 00 Source: French Canada, see Data Source slide ‘ 09

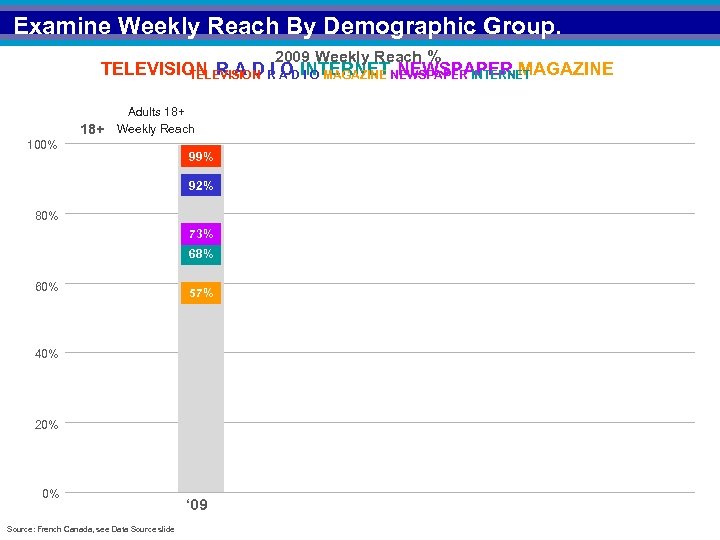

Examine Weekly Reach By Demographic Group. 2009 Weekly Reach % TELEVISION R A DINTERNET NEWSPAPER INTERNET TELEVISION I O MAGAZINE NEWSPAPER MAGAZINE 18+ Adults 18+ Weekly Reach 100% 99% 92% 80% 73% 68% 60% 57% 40% 20% 0% Source: French Canada, see Data Source slide ‘ 09

Examine Weekly Reach By Demographic Group. 2009 Weekly Reach % TELEVISION R A DINTERNET NEWSPAPER INTERNET TELEVISION I O MAGAZINE NEWSPAPER MAGAZINE 18+ Adults 18+ Weekly Reach 100% 99% 92% 80% 73% 68% 60% 57% 40% 20% 0% Source: French Canada, see Data Source slide ‘ 09

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ 99% 99% 99% 93% 96% 92% 80% 73% 84% 81% 64% 60% 80% 74% 73% 68% 57% 89% 75% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ 99% 99% 99% 93% 96% 92% 80% 73% 84% 81% 64% 60% 80% 74% 73% 68% 57% 89% 75% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide

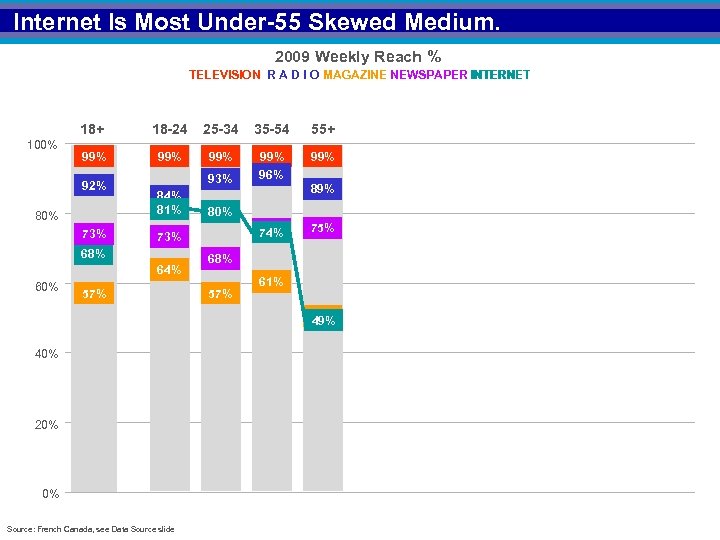

Internet Is Most Under-55 Skewed Medium. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ 99% 99% 99% 93% 96% 92% 80% 73% 84% 81% 64% 60% 80% 74% 73% 68% 57% 89% 75% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide

Internet Is Most Under-55 Skewed Medium. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ 99% 99% 99% 93% 96% 92% 80% 73% 84% 81% 64% 60% 80% 74% 73% 68% 57% 89% 75% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W 99% 99% 93% 96% 89% 91% 92% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53%

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W 99% 99% 93% 96% 89% 91% 92% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53%

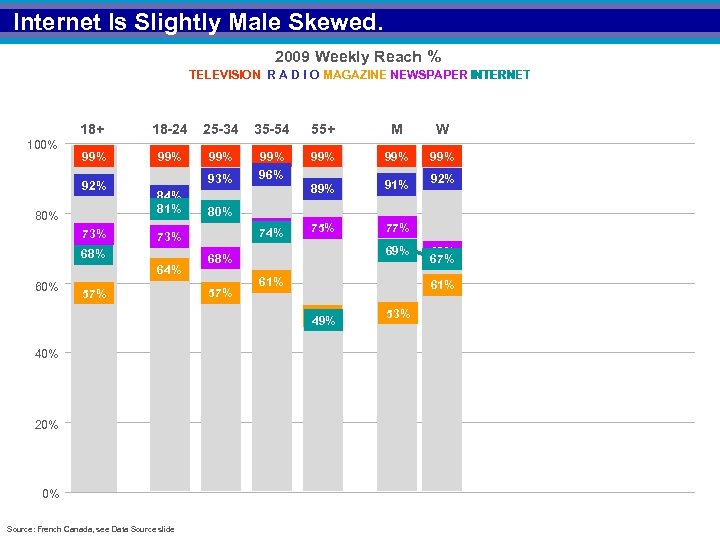

Internet Is Slightly Male Skewed. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W 99% 99% 93% 96% 89% 91% 92% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53%

Internet Is Slightly Male Skewed. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W 99% 99% 93% 96% 89% 91% 92% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53%

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ 99% 99% 93% 96% 89% 91% 92% 91% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 20% 0% Source: French Canada, see Data Source slide 69% 67% 61% 51% 49% 40% 80% 77% 53% 64%

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ 99% 99% 93% 96% 89% 91% 92% 91% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 20% 0% Source: French Canada, see Data Source slide 69% 67% 61% 51% 49% 40% 80% 77% 53% 64%

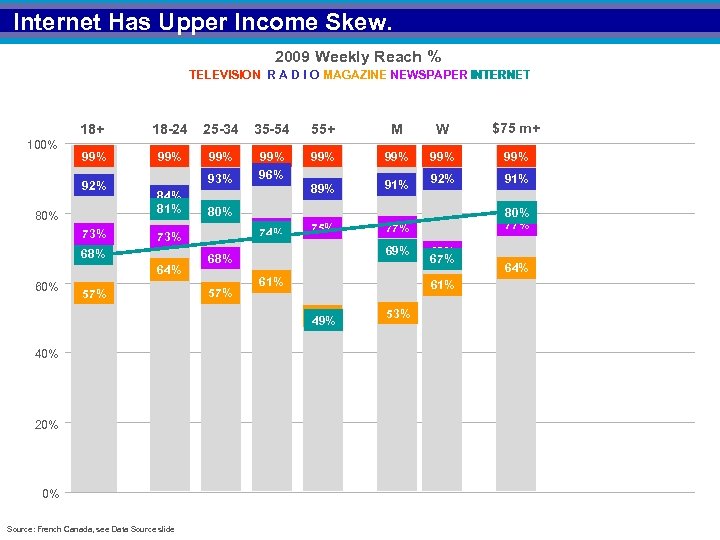

Internet Has Upper Income Skew. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ 99% 99% 93% 96% 89% 91% 92% 91% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 20% 0% Source: French Canada, see Data Source slide 69% 67% 61% 51% 49% 40% 80% 77% 53% 64%

Internet Has Upper Income Skew. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ 99% 99% 93% 96% 89% 91% 92% 91% 75% 77% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 20% 0% Source: French Canada, see Data Source slide 69% 67% 61% 51% 49% 40% 80% 77% 53% 64%

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 75% 77% 80% 77% 79% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58%

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 75% 77% 80% 77% 79% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58%

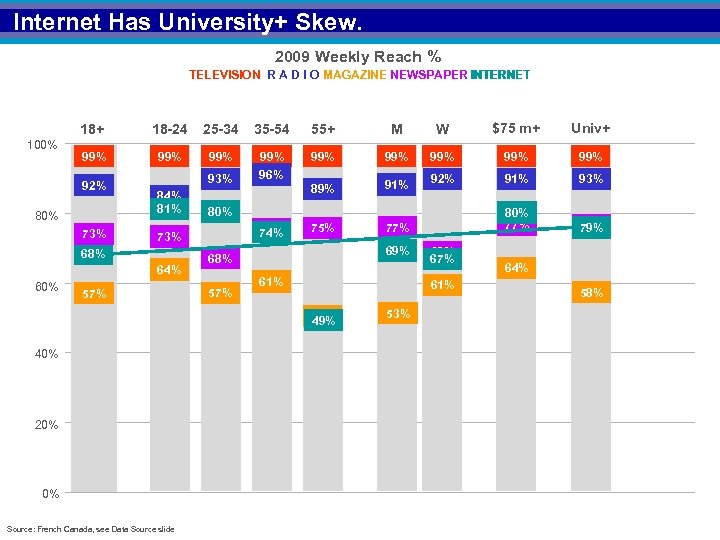

Internet Has University+ Skew. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 75% 77% 80% 77% 79% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58%

Internet Has University+ Skew. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 75% 77% 80% 77% 79% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58%

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ Total Canada 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 92% 75% 77% 80% 77% 79% 73% 71% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58% 60%

2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ Total Canada 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 92% 75% 77% 80% 77% 79% 73% 71% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58% 60%

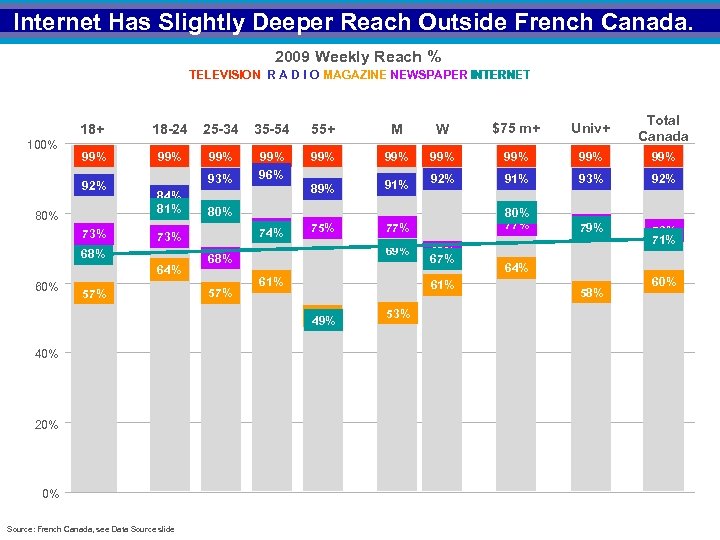

Internet Has Slightly Deeper Reach Outside French Canada. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ Total Canada 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 92% 75% 77% 80% 77% 79% 73% 71% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58% 60%

Internet Has Slightly Deeper Reach Outside French Canada. 2009 Weekly Reach % TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 100% 18 -24 25 -34 35 -54 55+ M W $75 m+ Univ+ Total Canada 99% 99% 99% 93% 96% 89% 91% 92% 91% 93% 92% 75% 77% 80% 77% 79% 73% 71% 92% 80% 73% 84% 81% 74% 73% 68% 64% 60% 80% 57% 69% 68% 57% 61% 51% 49% 40% 20% 0% Source: French Canada, see Data Source slide 69% 67% 53% 64% 58% 60%

Internet Reach… 10 YEAR GROWTH Most rapid. . . +51% AGE Most under-55 skewed. SEX Slight male skew. INCOME Upper income skew. EDUCATION University+ skew. LANGUAGE Slight French underdevelopment.

Internet Reach… 10 YEAR GROWTH Most rapid. . . +51% AGE Most under-55 skewed. SEX Slight male skew. INCOME Upper income skew. EDUCATION University+ skew. LANGUAGE Slight French underdevelopment.

Weekly Time Spent Is A Surrogate For Ad Exposure. REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

Weekly Time Spent Is A Surrogate For Ad Exposure. REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

Weekly Time Spent Per Capita Allows For Media Comparison. Adults 18+ Weekly Time (minutes) 2, 000 1, 500 1, 000 500 ‘ 00 Source: French Canada, see Data Source slide ‘ 09

Weekly Time Spent Per Capita Allows For Media Comparison. Adults 18+ Weekly Time (minutes) 2, 000 1, 500 1, 000 500 ‘ 00 Source: French Canada, see Data Source slide ‘ 09

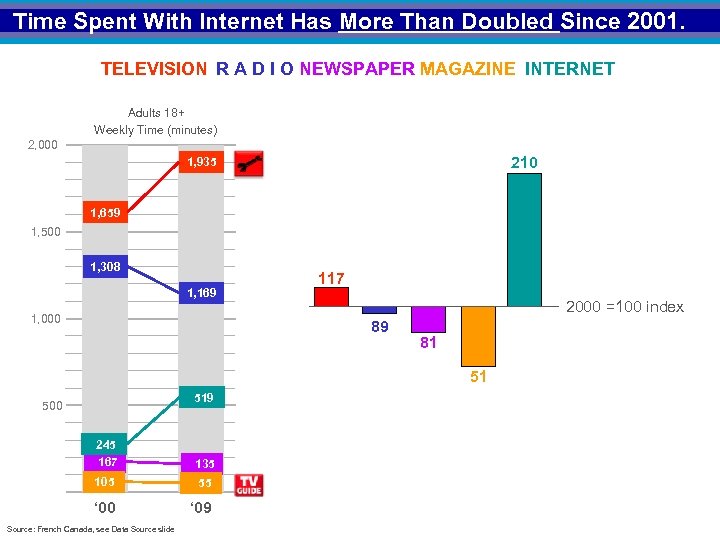

Time Spent With Internet Has More Than Doubled Since 2001. TELEVISION R A D I O NEWSPAPER MAGAZINE INTERNET Adults 18+ Weekly Time (minutes) 2, 000 210 1, 935 1, 659 1, 500 1, 308 1, 169 1, 000 117 2000 =100 index 89 81 51 519 500 245 167 135 105 55 ‘ 00 ‘ 09 Source: French Canada, see Data Source slide

Time Spent With Internet Has More Than Doubled Since 2001. TELEVISION R A D I O NEWSPAPER MAGAZINE INTERNET Adults 18+ Weekly Time (minutes) 2, 000 210 1, 935 1, 659 1, 500 1, 308 1, 169 1, 000 117 2000 =100 index 89 81 51 519 500 245 167 135 105 55 ‘ 00 ‘ 09 Source: French Canada, see Data Source slide

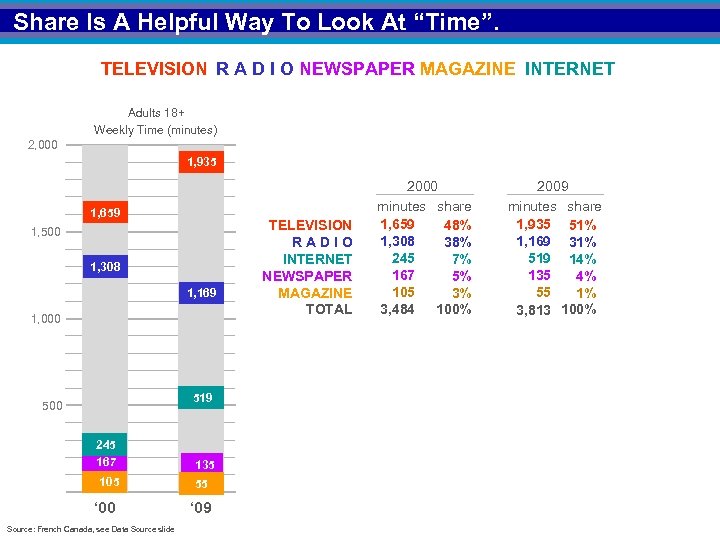

Share Is A Helpful Way To Look At “Time”. TELEVISION R A D I O NEWSPAPER MAGAZINE INTERNET Adults 18+ Weekly Time (minutes) 2, 000 1, 935 1, 659 1, 500 1, 308 1, 169 1, 000 519 500 245 167 135 105 55 ‘ 00 Source: French Canada, see Data Source slide ‘ 09 TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100%

Share Is A Helpful Way To Look At “Time”. TELEVISION R A D I O NEWSPAPER MAGAZINE INTERNET Adults 18+ Weekly Time (minutes) 2, 000 1, 935 1, 659 1, 500 1, 308 1, 169 1, 000 519 500 245 167 135 105 55 ‘ 00 Source: French Canada, see Data Source slide ‘ 09 TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100%

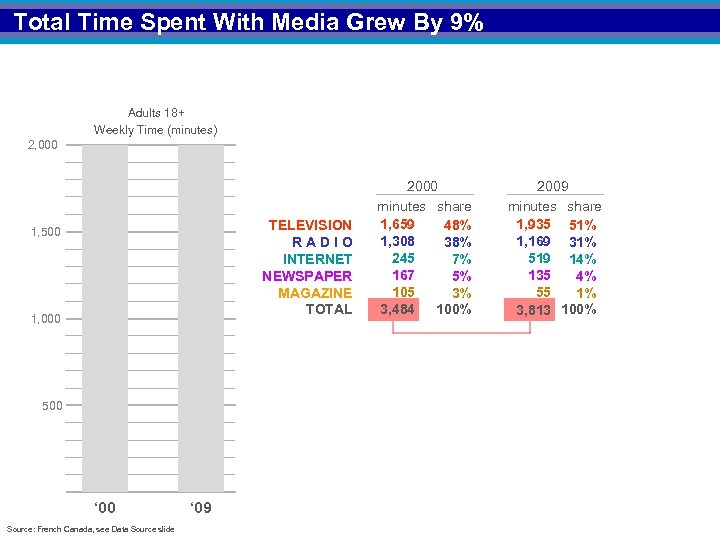

Total Time Spent With Media Grew By 9% Adults 18+ Weekly Time (minutes) 2, 000 TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 1, 500 1, 000 500 ‘ 00 Source: French Canada, see Data Source slide ‘ 09 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100%

Total Time Spent With Media Grew By 9% Adults 18+ Weekly Time (minutes) 2, 000 TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 1, 500 1, 000 500 ‘ 00 Source: French Canada, see Data Source slide ‘ 09 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100%

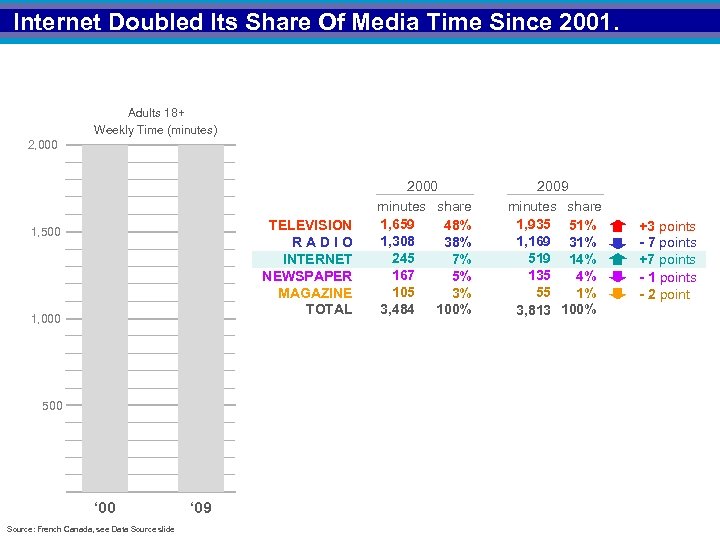

Internet Doubled Its Share Of Media Time Since 2001. Adults 18+ Weekly Time (minutes) 2, 000 TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 1, 500 1, 000 500 ‘ 00 Source: French Canada, see Data Source slide ‘ 09 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100% +3 points - 7 points +7 points - 1 points - 2 point

Internet Doubled Its Share Of Media Time Since 2001. Adults 18+ Weekly Time (minutes) 2, 000 TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 1, 500 1, 000 500 ‘ 00 Source: French Canada, see Data Source slide ‘ 09 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100% +3 points - 7 points +7 points - 1 points - 2 point

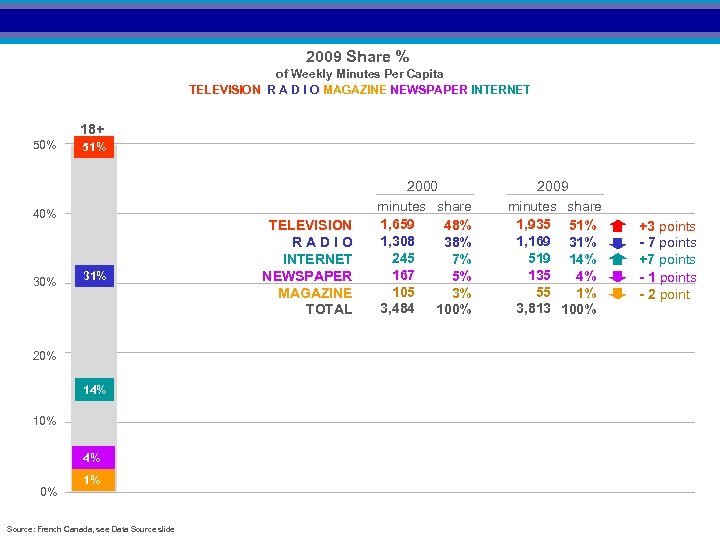

2009 Share % of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 50% 51% 40% 31% 20% 14% 10% 4% 0% 1% Source: French Canada, see Data Source slide TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100% +3 points - 7 points +7 points - 1 points - 2 point

2009 Share % of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 18+ 50% 51% 40% 31% 20% 14% 10% 4% 0% 1% Source: French Canada, see Data Source slide TELEVISION RADIO INTERNET NEWSPAPER MAGAZINE TOTAL 2000 minutes share 1, 659 48% 1, 308 38% 245 7% 167 5% 105 3% 3, 484 100% 2009 minutes share 1, 935 51% 1, 169 31% 519 14% 135 4% 55 1% 3, 813 100% +3 points - 7 points +7 points - 1 points - 2 point

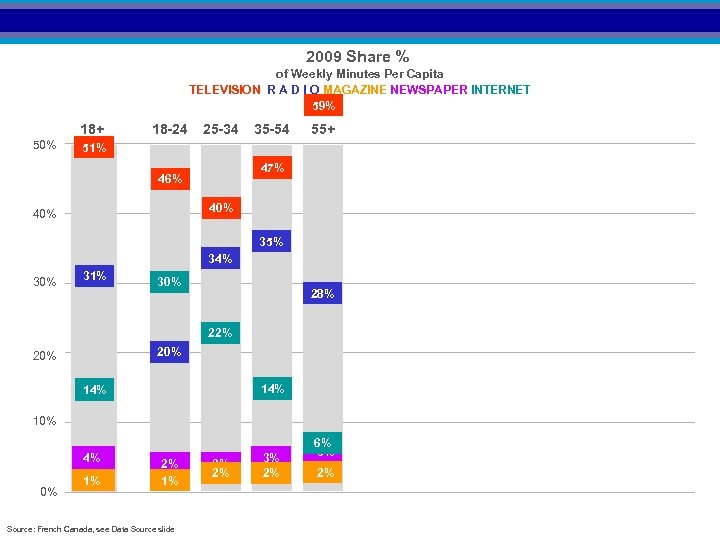

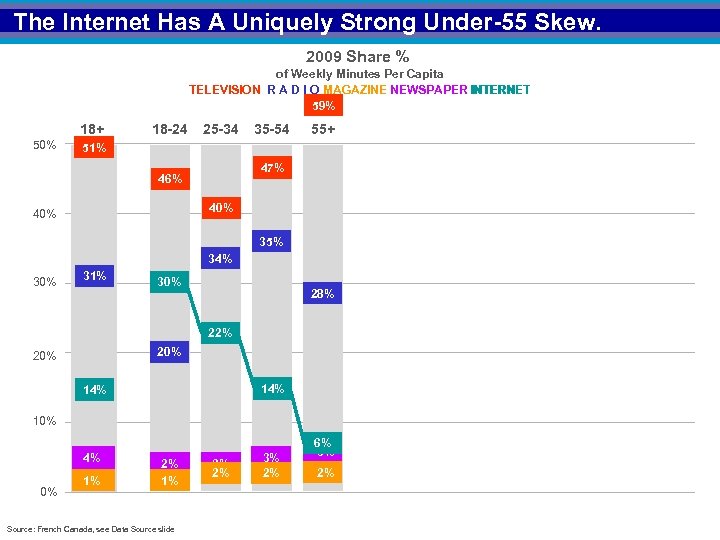

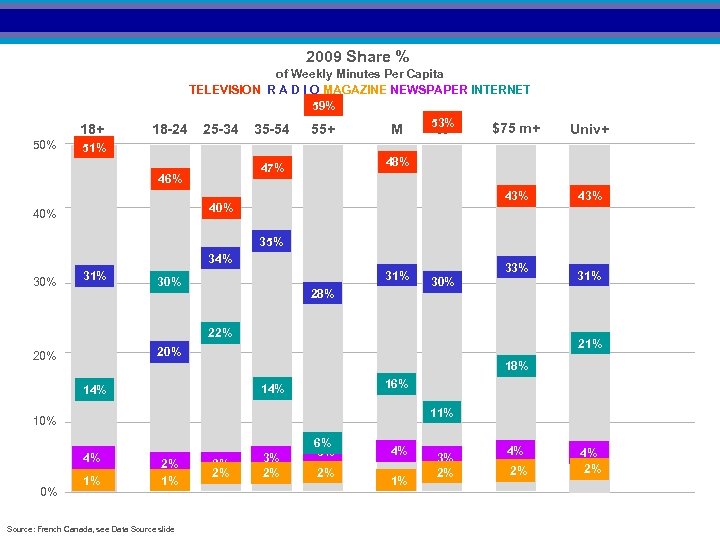

2009 Share % of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 18+ 50% 18 -24 25 -34 35 -54 55+ 51% 47% 46% 40% 35% 34% 30% 31% 30% 28% 22% 20% 14% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2%

2009 Share % of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 18+ 50% 18 -24 25 -34 35 -54 55+ 51% 47% 46% 40% 35% 34% 30% 31% 30% 28% 22% 20% 14% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2%

The Internet Has A Uniquely Strong Under-55 Skew. 2009 Share % of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 18+ 50% 18 -24 25 -34 35 -54 55+ 51% 47% 46% 40% 35% 34% 30% 31% 30% 28% 22% 20% 14% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2%

The Internet Has A Uniquely Strong Under-55 Skew. 2009 Share % of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 18+ 50% 18 -24 25 -34 35 -54 55+ 51% 47% 46% 40% 35% 34% 30% 31% 30% 28% 22% 20% 14% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2%

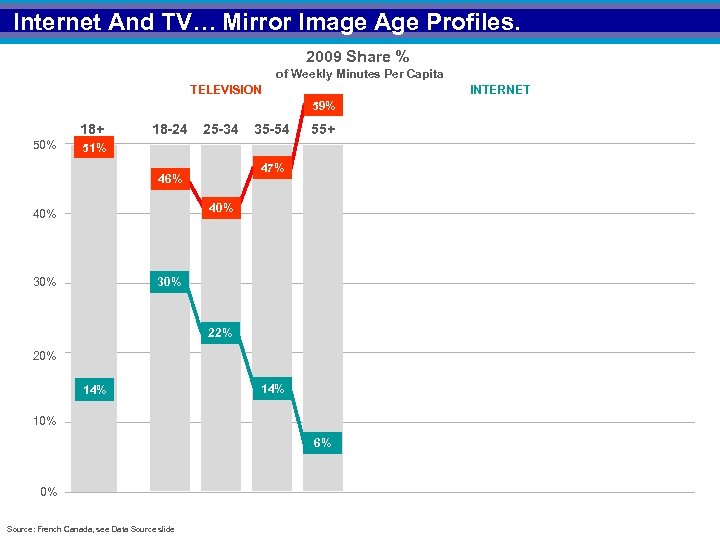

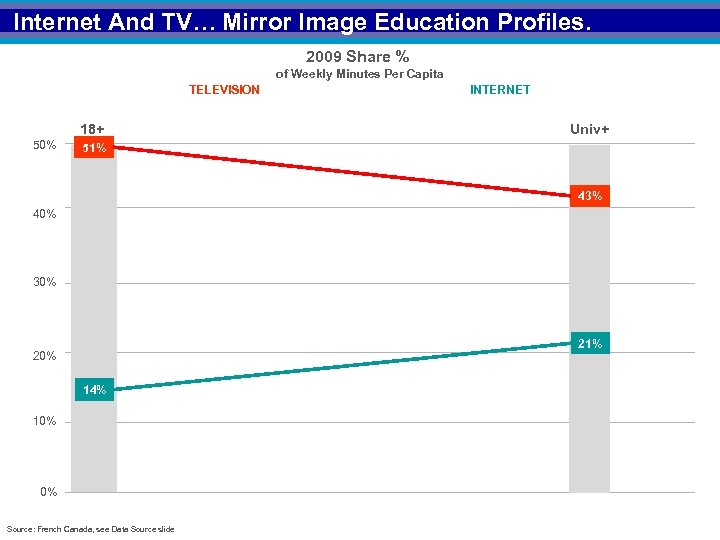

Internet And TV… Mirror Image Age Profiles. 2009 Share % of Weekly Minutes Per Capita TELEVISION INTERNET 59% 18+ 50% 18 -24 25 -34 35 -54 55+ 51% 47% 46% 40% 30% 22% 20% 14% 10% 6% 0% Source: French Canada, see Data Source slide

Internet And TV… Mirror Image Age Profiles. 2009 Share % of Weekly Minutes Per Capita TELEVISION INTERNET 59% 18+ 50% 18 -24 25 -34 35 -54 55+ 51% 47% 46% 40% 30% 22% 20% 14% 10% 6% 0% Source: French Canada, see Data Source slide

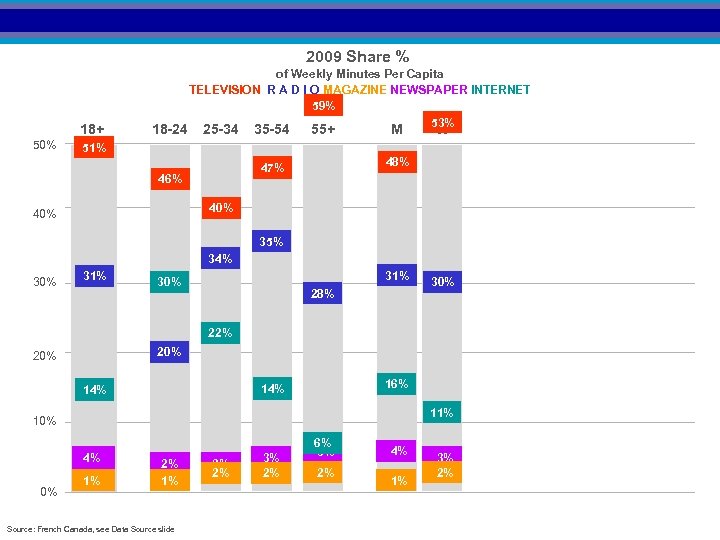

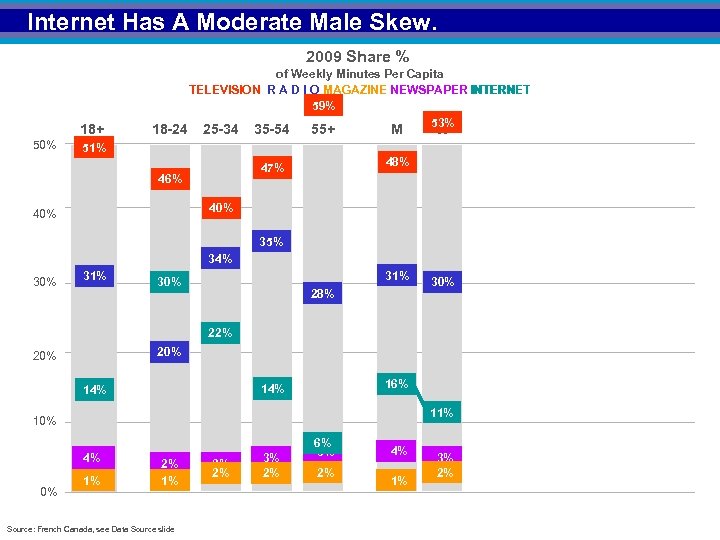

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 30% 22% 20% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2%

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 30% 22% 20% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2%

Internet Has A Moderate Male Skew. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 30% 22% 20% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2%

Internet Has A Moderate Male Skew. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 30% 22% 20% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2%

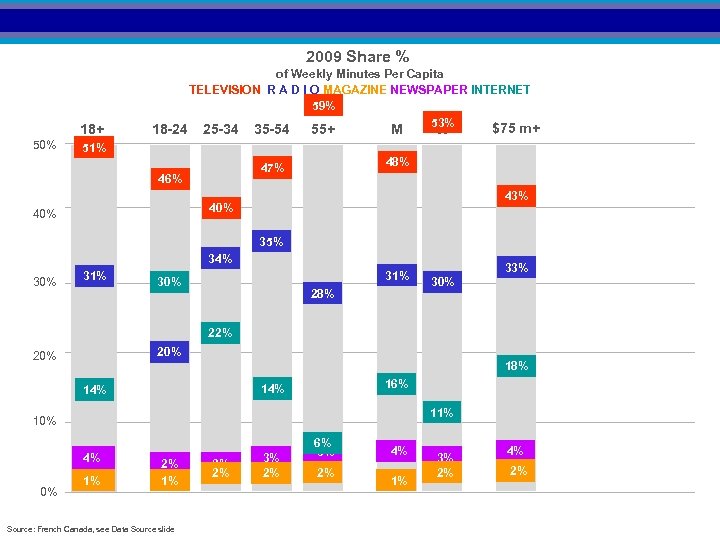

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ 51% 48% 47% 46% 43% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 20% 18% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ 51% 48% 47% 46% 43% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 20% 18% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

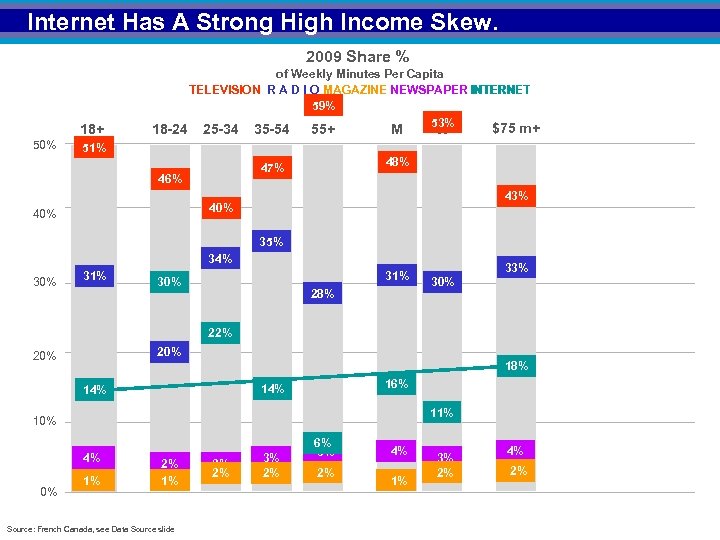

Internet Has A Strong High Income Skew. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ 51% 48% 47% 46% 43% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 20% 18% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

Internet Has A Strong High Income Skew. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ 51% 48% 47% 46% 43% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 20% 18% 16% 14% 11% 10% 4% 0% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

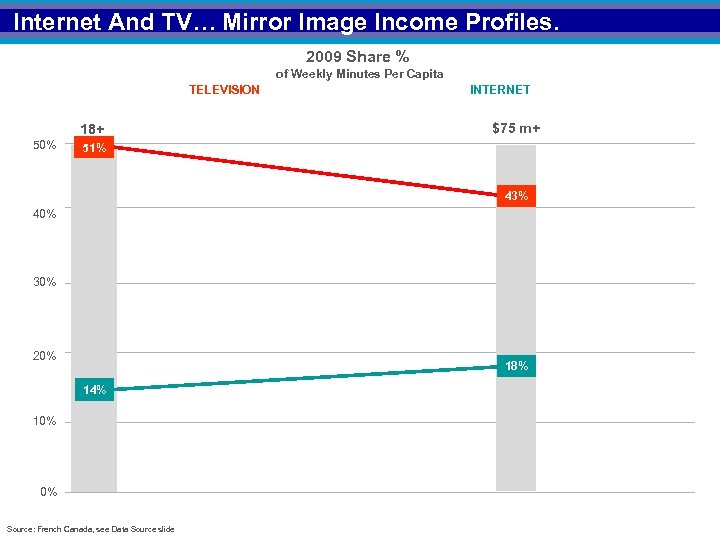

Internet And TV… Mirror Image Income Profiles. 2009 Share % of Weekly Minutes Per Capita TELEVISION 18+ 50% INTERNET $75 m+ 51% 43% 40% 30% 20% 18% 14% 10% 0% Source: French Canada, see Data Source slide

Internet And TV… Mirror Image Income Profiles. 2009 Share % of Weekly Minutes Per Capita TELEVISION 18+ 50% INTERNET $75 m+ 51% 43% 40% 30% 20% 18% 14% 10% 0% Source: French Canada, see Data Source slide

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 55+ M W $75 m+ Univ+ 43% 35 -54 43% 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 21% 20% 18% 16% 14% 11% 10% 4% 0% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 55+ M W $75 m+ Univ+ 43% 35 -54 43% 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 21% 20% 18% 16% 14% 11% 10% 4% 0% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

Internet Has A Strong University+ Skew. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 55+ M W $75 m+ Univ+ 43% 35 -54 43% 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 21% 20% 18% 16% 14% 11% 10% 4% 0% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

Internet Has A Strong University+ Skew. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 55+ M W $75 m+ Univ+ 43% 35 -54 43% 51% 48% 47% 46% 40% 35% 34% 30% 31% 30% 28% 33% 30% 22% 21% 20% 18% 16% 14% 11% 10% 4% 0% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2%

Internet And TV… Mirror Image Education Profiles. 2009 Share % of Weekly Minutes Per Capita TELEVISION 18+ 50% INTERNET Univ+ 51% 43% 40% 30% 21% 20% 14% 10% 0% Source: French Canada, see Data Source slide

Internet And TV… Mirror Image Education Profiles. 2009 Share % of Weekly Minutes Per Capita TELEVISION 18+ 50% INTERNET Univ+ 51% 43% 40% 30% 21% 20% 14% 10% 0% Source: French Canada, see Data Source slide

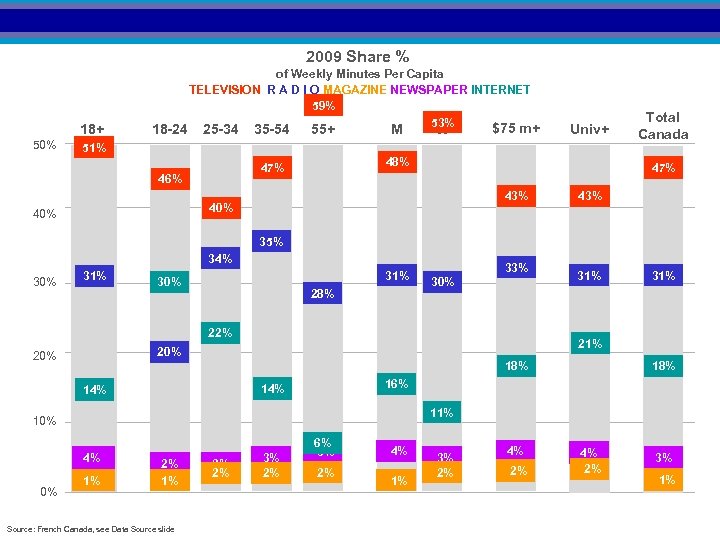

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ Univ+ 51% 48% 47% 46% 47% 43% 40% Total Canada 43% 35% 34% 30% 31% 30% 28% 33% 30% 22% 18% 11% 10% 4% 0% 18% 16% 14% 31% 20% 20% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2% 3% 1%

2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ Univ+ 51% 48% 47% 46% 47% 43% 40% Total Canada 43% 35% 34% 30% 31% 30% 28% 33% 30% 22% 18% 11% 10% 4% 0% 18% 16% 14% 31% 20% 20% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2% 3% 1%

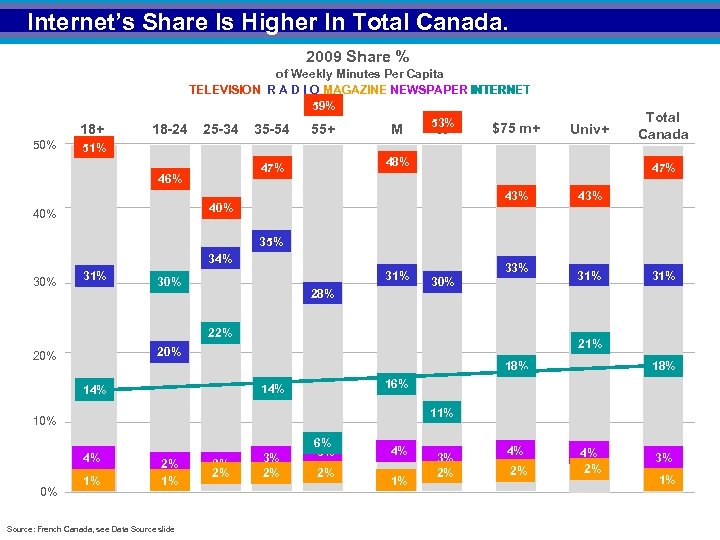

Internet’s Share Is Higher In Total Canada. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ Univ+ 51% 48% 47% 46% 47% 43% 40% Total Canada 43% 35% 34% 30% 31% 30% 28% 33% 30% 22% 18% 11% 10% 4% 0% 18% 16% 14% 31% 20% 20% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2% 3% 1%

Internet’s Share Is Higher In Total Canada. 2009 Share % 18+ 50% 18 -24 of Weekly Minutes Per Capita TELEVISION R A D I O MAGAZINE NEWSPAPER INTERNET 59% 53% 25 -34 35 -54 55+ M W $75 m+ Univ+ 51% 48% 47% 46% 47% 43% 40% Total Canada 43% 35% 34% 30% 31% 30% 28% 33% 30% 22% 18% 11% 10% 4% 0% 18% 16% 14% 31% 20% 20% 31% 1% 2% 1% Source: French Canada, see Data Source slide 2% 2% 3% 2% 6% 5% 2% 4% 1% 3% 2% 4% 2% 3% 1%

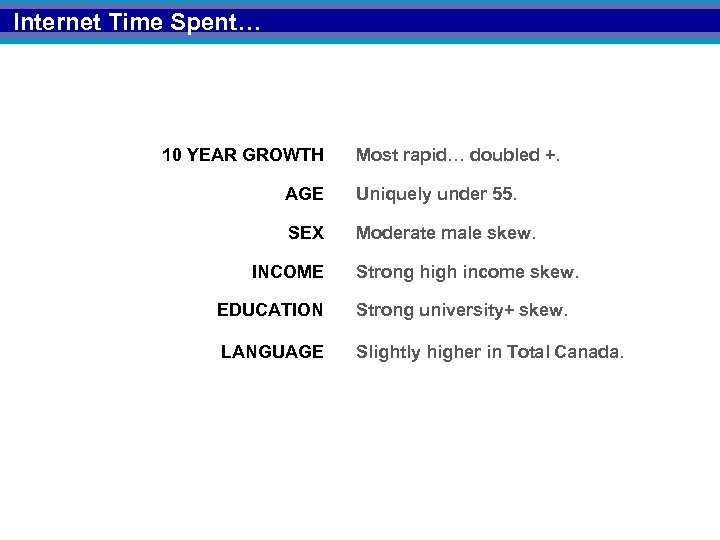

Internet Time Spent… 10 YEAR GROWTH Most rapid… doubled +. AGE Uniquely under 55. SEX Moderate male skew. INCOME Strong high income skew. EDUCATION Strong university+ skew. LANGUAGE Slightly higher in Total Canada.

Internet Time Spent… 10 YEAR GROWTH Most rapid… doubled +. AGE Uniquely under 55. SEX Moderate male skew. INCOME Strong high income skew. EDUCATION Strong university+ skew. LANGUAGE Slightly higher in Total Canada.

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

IMPERATIVES Product users gravitate towards different media.

IMPERATIVES Product users gravitate towards different media.

IAB-commisioned coding available in PMB Internet Imperativecustom coding available. ‘ 10. Internet/TV Internet/Magazine Internet/Newspaper Internet/Radio

IAB-commisioned coding available in PMB Internet Imperativecustom coding available. ‘ 10. Internet/TV Internet/Magazine Internet/Newspaper Internet/Radio

Imperatives created through media usage segmentation. LIGHTER TV HEAVIER INTERNET LIGHTER INTERNET PMB Fall ‘ 10 HEAVIER TV

Imperatives created through media usage segmentation. LIGHTER TV HEAVIER INTERNET LIGHTER INTERNET PMB Fall ‘ 10 HEAVIER TV

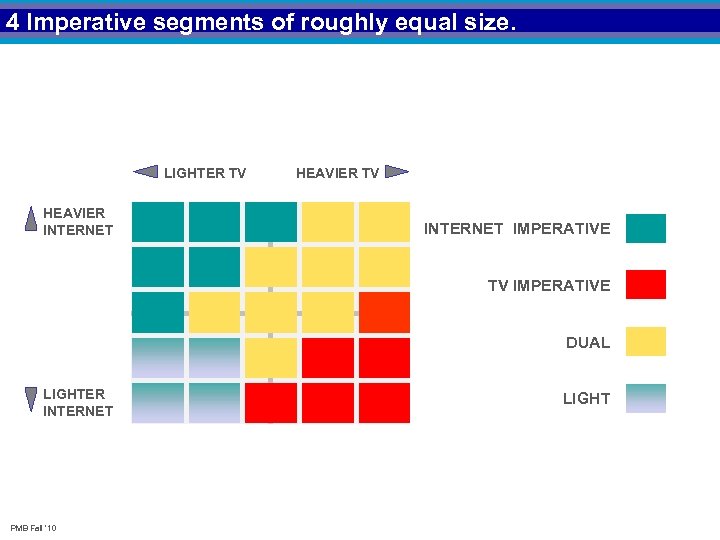

4 Imperative segments of roughly equal size. LIGHTER TV HEAVIER INTERNET HEAVIER TV INTERNET IMPERATIVE TV IMPERATIVE DUAL LIGHTER INTERNET PMB Fall ‘ 10 LIGHT

4 Imperative segments of roughly equal size. LIGHTER TV HEAVIER INTERNET HEAVIER TV INTERNET IMPERATIVE TV IMPERATIVE DUAL LIGHTER INTERNET PMB Fall ‘ 10 LIGHT

A radar chart helps to explain “propensity” indices. Internet Imperative Light Dual TV Imperative

A radar chart helps to explain “propensity” indices. Internet Imperative Light Dual TV Imperative

Propensity index increases away from centre. Internet Imperative Light Dual TV Imperative

Propensity index increases away from centre. Internet Imperative Light Dual TV Imperative

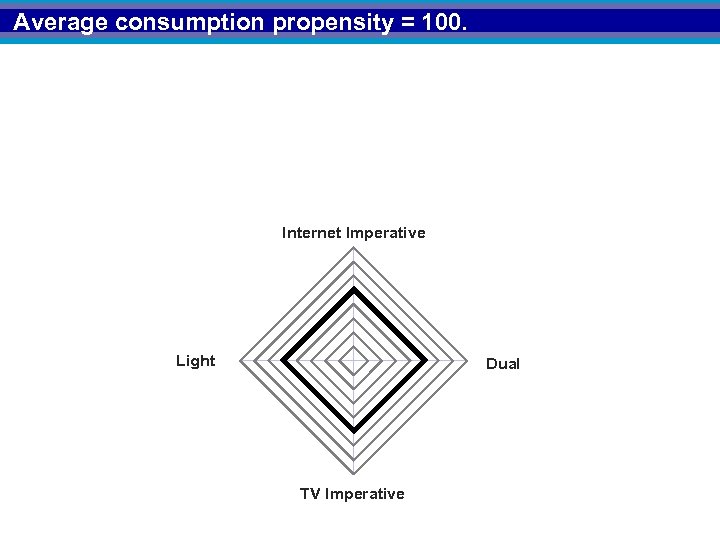

Average consumption propensity = 100. Internet Imperative Light Dual TV Imperative

Average consumption propensity = 100. Internet Imperative Light Dual TV Imperative

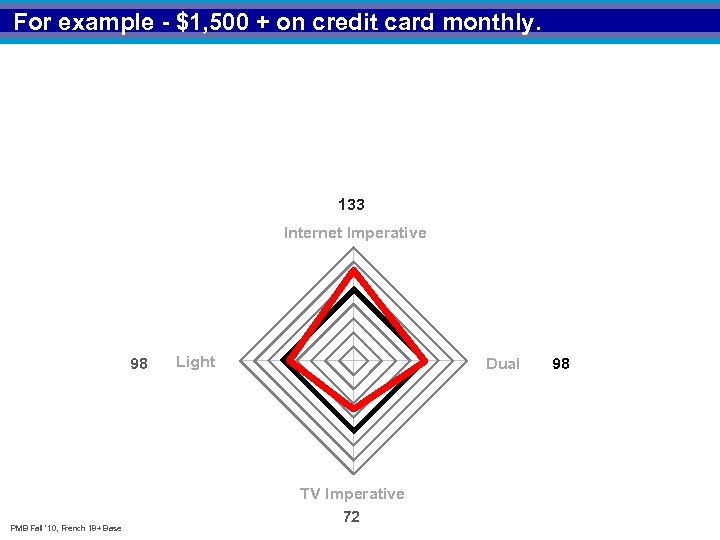

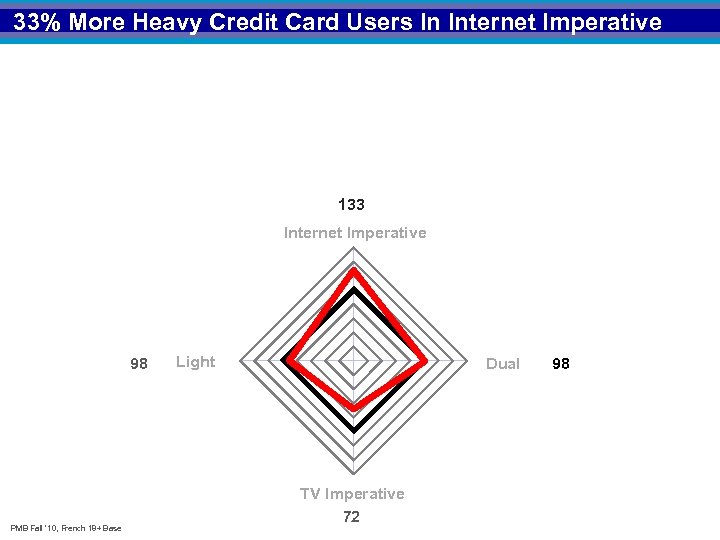

For example - $1, 500 + on credit card monthly. 133 Internet Imperative 98 PMB Fall ‘ 10, French 18+ Base Light Dual TV Imperative 72 98

For example - $1, 500 + on credit card monthly. 133 Internet Imperative 98 PMB Fall ‘ 10, French 18+ Base Light Dual TV Imperative 72 98

33% More Heavy Credit Card Users In Internet Imperative group. 133 Internet Imperative 98 PMB Fall ‘ 10, French 18+ Base Light Dual TV Imperative 72 98

33% More Heavy Credit Card Users In Internet Imperative group. 133 Internet Imperative 98 PMB Fall ‘ 10, French 18+ Base Light Dual TV Imperative 72 98

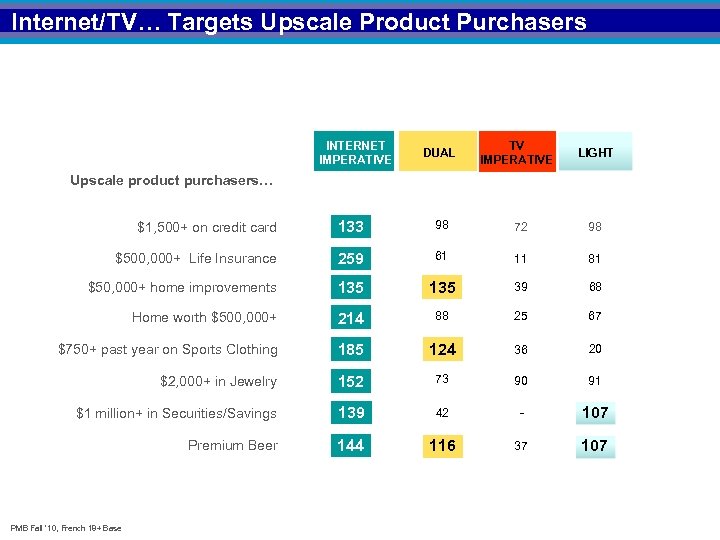

Internet/TV… Targets Upscale Product Purchasers INTERNET IMPERATIVE DUAL TV IMPERATIVE LIGHT Upscale product purchasers… $1, 500+ on credit card 133 98 72 98 $500, 000+ Life Insurance 259 61 11 81 $50, 000+ home improvements 135 39 68 Home worth $500, 000+ 214 88 25 67 $750+ past year on Sports Clothing 185 124 36 20 $2, 000+ in Jewelry 152 73 90 91 $1 million+ in Securities/Savings 139 42 - 107 Premium Beer 144 116 37 107 PMB Fall ‘ 10, French 18+ Base

Internet/TV… Targets Upscale Product Purchasers INTERNET IMPERATIVE DUAL TV IMPERATIVE LIGHT Upscale product purchasers… $1, 500+ on credit card 133 98 72 98 $500, 000+ Life Insurance 259 61 11 81 $50, 000+ home improvements 135 39 68 Home worth $500, 000+ 214 88 25 67 $750+ past year on Sports Clothing 185 124 36 20 $2, 000+ in Jewelry 152 73 90 91 $1 million+ in Securities/Savings 139 42 - 107 Premium Beer 144 116 37 107 PMB Fall ‘ 10, French 18+ Base

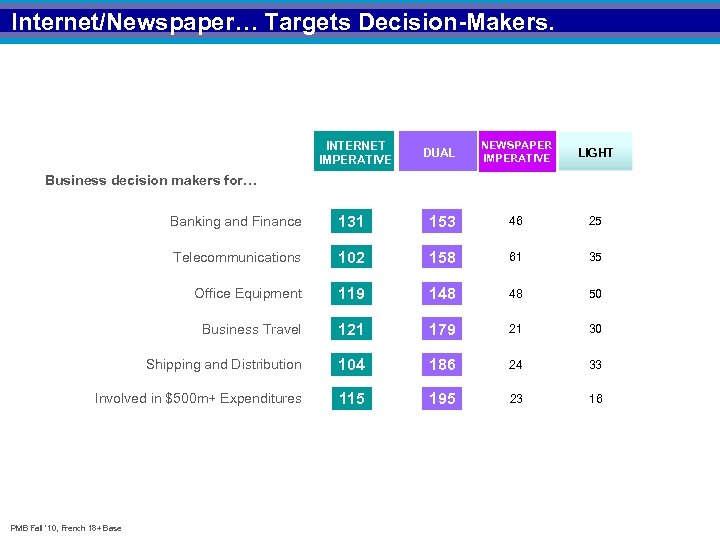

Internet/Newspaper… Targets Decision-Makers. INTERNET IMPERATIVE DUAL NEWSPAPER IMPERATIVE LIGHT Business decision makers for… Banking and Finance 131 153 46 25 Telecommunications 102 158 61 35 Office Equipment 119 148 48 50 Business Travel 121 179 21 30 Shipping and Distribution 104 186 24 33 Involved in $500 m+ Expenditures 115 195 23 16 PMB Fall ‘ 10, French 18+ Base

Internet/Newspaper… Targets Decision-Makers. INTERNET IMPERATIVE DUAL NEWSPAPER IMPERATIVE LIGHT Business decision makers for… Banking and Finance 131 153 46 25 Telecommunications 102 158 61 35 Office Equipment 119 148 48 50 Business Travel 121 179 21 30 Shipping and Distribution 104 186 24 33 Involved in $500 m+ Expenditures 115 195 23 16 PMB Fall ‘ 10, French 18+ Base

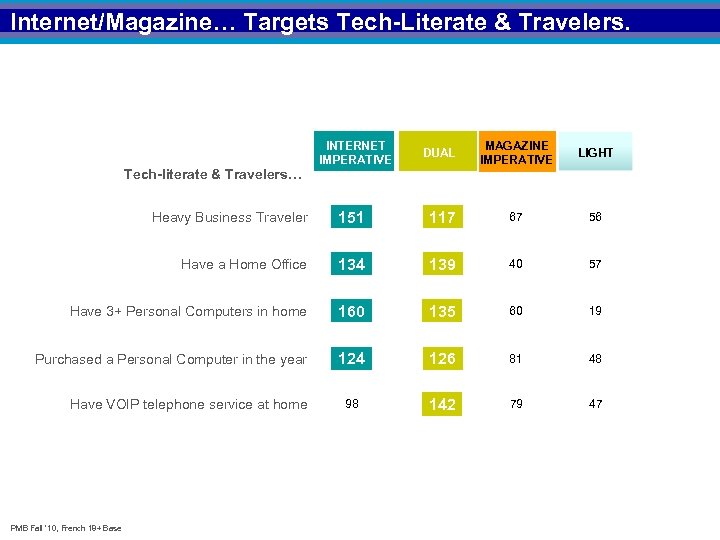

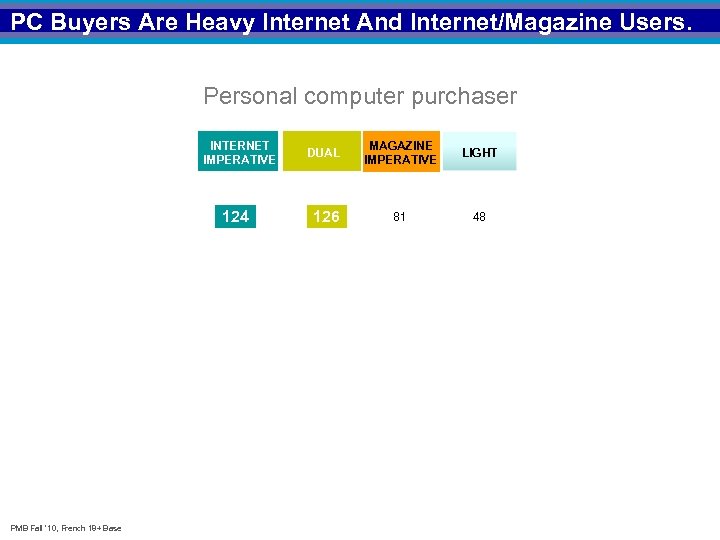

Internet/Magazine… Targets Tech-Literate & Travelers. INTERNET IMPERATIVE DUAL MAGAZINE IMPERATIVE LIGHT Tech-literate & Travelers… Heavy Business Traveler 151 117 119 67 56 Have a Home Office 134 139 40 57 Have 3+ Personal Computers in home 160 135 60 19 Purchased a Personal Computer in the year 124 126 81 48 98 142 79 47 Have VOIP telephone service at home PMB Fall ‘ 10, French 18+ Base

Internet/Magazine… Targets Tech-Literate & Travelers. INTERNET IMPERATIVE DUAL MAGAZINE IMPERATIVE LIGHT Tech-literate & Travelers… Heavy Business Traveler 151 117 119 67 56 Have a Home Office 134 139 40 57 Have 3+ Personal Computers in home 160 135 60 19 Purchased a Personal Computer in the year 124 126 81 48 98 142 79 47 Have VOIP telephone service at home PMB Fall ‘ 10, French 18+ Base

Internet/Radio… Targets Entertainment Goers. INTERNET IMPERATIVE DUAL RADIO IMPERATIVE LIGHT Entertainment goers … Attended event past year 156 157 120 80 Attended Night Clubs/Bars 10+ times past year 166 129 49 38 Went to Movies 6+ times past 3 months 102 128 70 75 Ate at sub-sandwich restaurant 5+ times/month 156 111 70 54 Ate at high quality restaurant 4+ times/month 100 118 91 76 Used health/fitness club 10+ times past year 114 97 54 33 PMB Fall ‘ 10, French 18+ Base

Internet/Radio… Targets Entertainment Goers. INTERNET IMPERATIVE DUAL RADIO IMPERATIVE LIGHT Entertainment goers … Attended event past year 156 157 120 80 Attended Night Clubs/Bars 10+ times past year 166 129 49 38 Went to Movies 6+ times past 3 months 102 128 70 75 Ate at sub-sandwich restaurant 5+ times/month 156 111 70 54 Ate at high quality restaurant 4+ times/month 100 118 91 76 Used health/fitness club 10+ times past year 114 97 54 33 PMB Fall ‘ 10, French 18+ Base

Internet Imperative… INTERNET / TV INTERNET / NEWSPAPER INTERNET / MAGAZINE INTERNET / RADIO Upscale product purchasers. Decision-makers. Tech-Literates/Travelers. Entertainment-goers.

Internet Imperative… INTERNET / TV INTERNET / NEWSPAPER INTERNET / MAGAZINE INTERNET / RADIO Upscale product purchasers. Decision-makers. Tech-Literates/Travelers. Entertainment-goers.

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

PMB created coding for 3 D Imperatives. Internet Magazine Television

PMB created coding for 3 D Imperatives. Internet Magazine Television

IAB-Commissioned Coding For 3 D Internet/Newspaper/TV. Internet Magazine Newspaper Television

IAB-Commissioned Coding For 3 D Internet/Newspaper/TV. Internet Magazine Newspaper Television

Think of 3 D Imperatives as a 3 X 3 Rubik’s Cube.

Think of 3 D Imperatives as a 3 X 3 Rubik’s Cube.

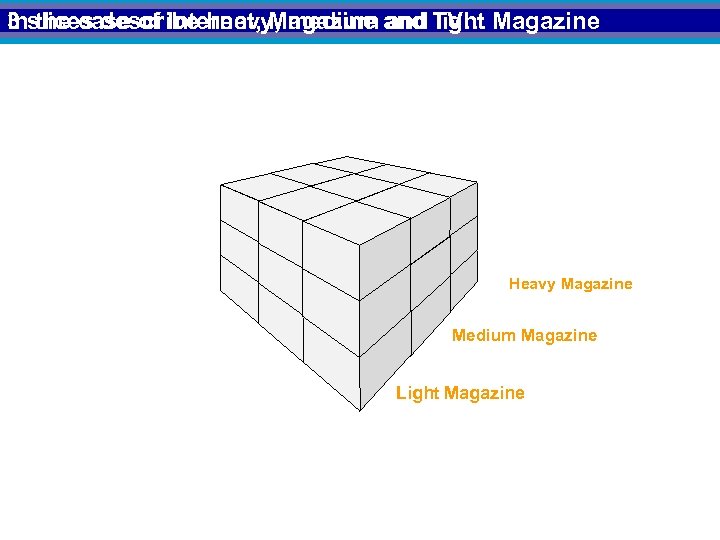

In the case of Internet, Magazine and light 3 slices describe heavy, medium and TV… Magazine Heavy Magazine Medium Magazine Light Magazine

In the case of Internet, Magazine and light 3 slices describe heavy, medium and TV… Magazine Heavy Magazine Medium Magazine Light Magazine

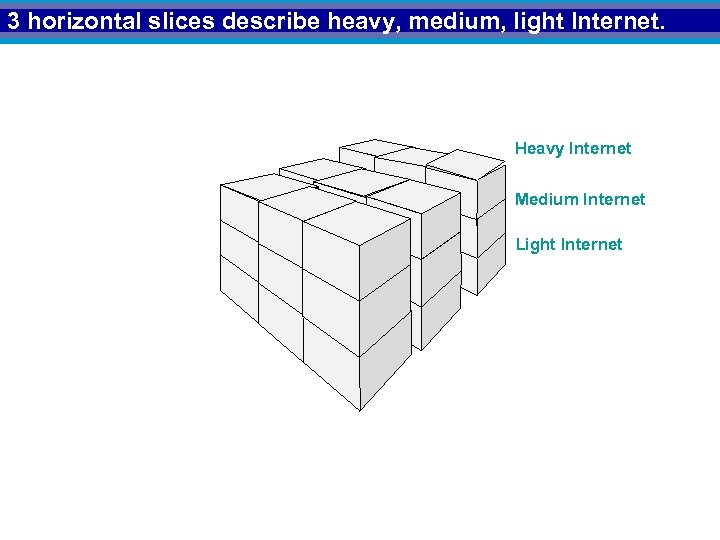

3 horizontal slices describe heavy, medium, light Internet. Heavy Internet Medium Internet Light Internet

3 horizontal slices describe heavy, medium, light Internet. Heavy Internet Medium Internet Light Internet

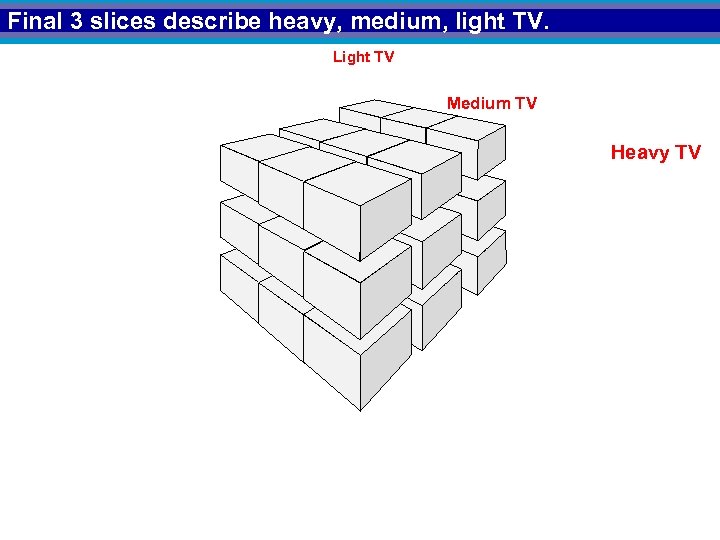

Final 3 slices describe heavy, medium, light TV. Light TV Medium TV Heavy TV

Final 3 slices describe heavy, medium, light TV. Light TV Medium TV Heavy TV

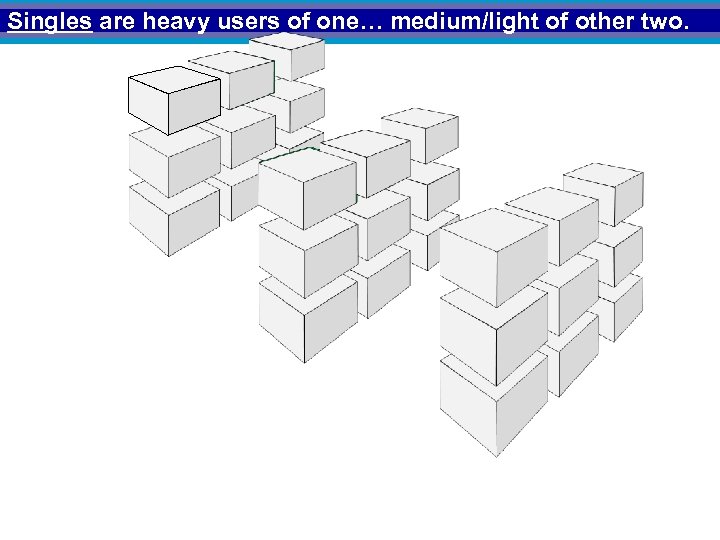

Singles are heavy users of one… medium/light of other two.

Singles are heavy users of one… medium/light of other two.

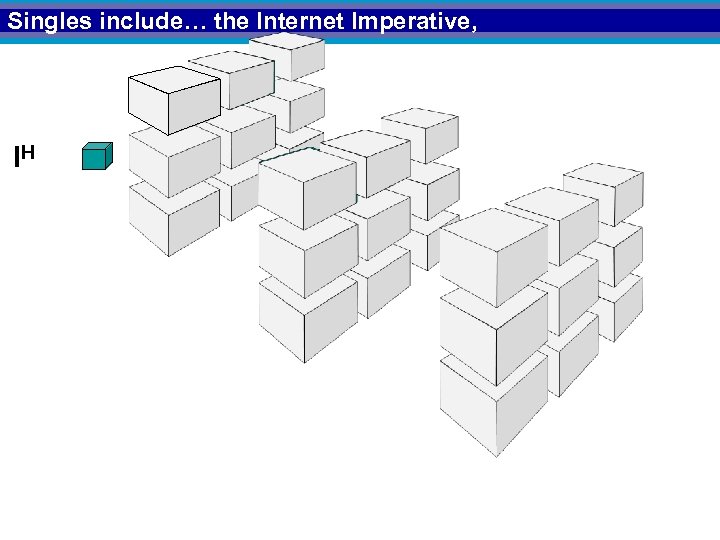

Singles include… the Internet Imperative, IH

Singles include… the Internet Imperative, IH

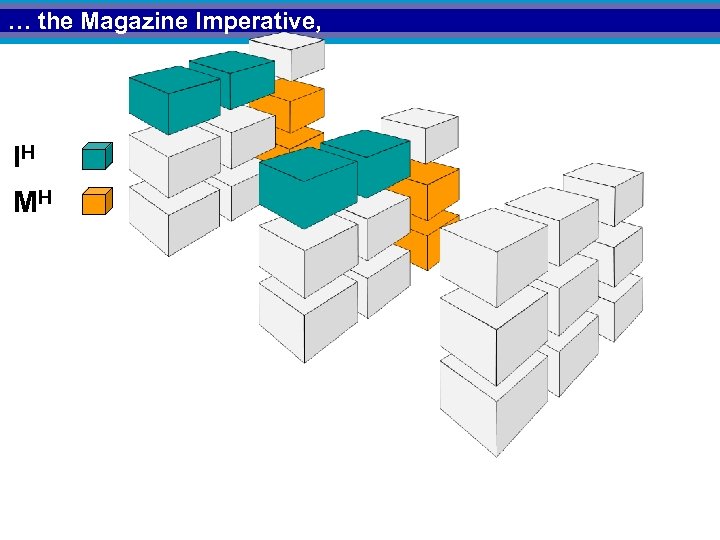

… the Magazine Imperative, IH MH

… the Magazine Imperative, IH MH

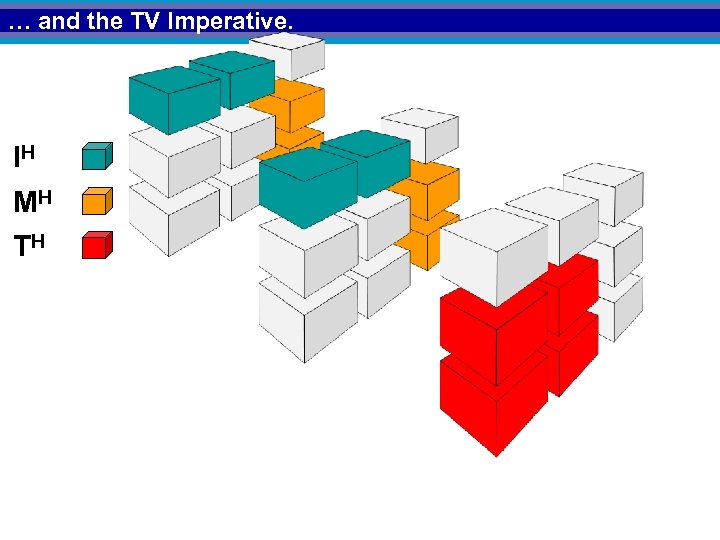

… and the TV Imperative. IH MH TH

… and the TV Imperative. IH MH TH

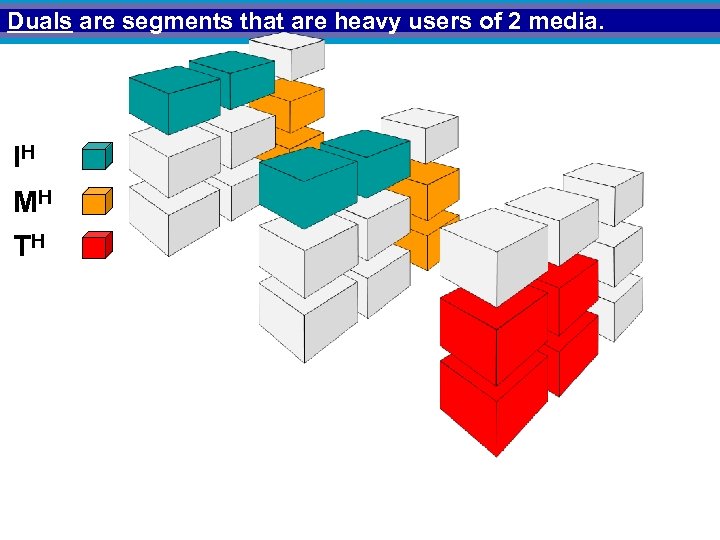

Duals are segments that are heavy users of 2 media. IH MH TH

Duals are segments that are heavy users of 2 media. IH MH TH

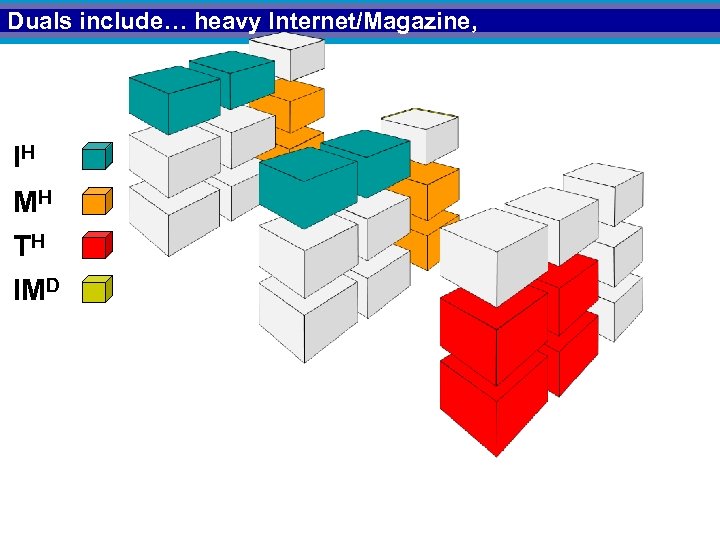

Duals include… heavy Internet/Magazine, IH MH TH IMD

Duals include… heavy Internet/Magazine, IH MH TH IMD

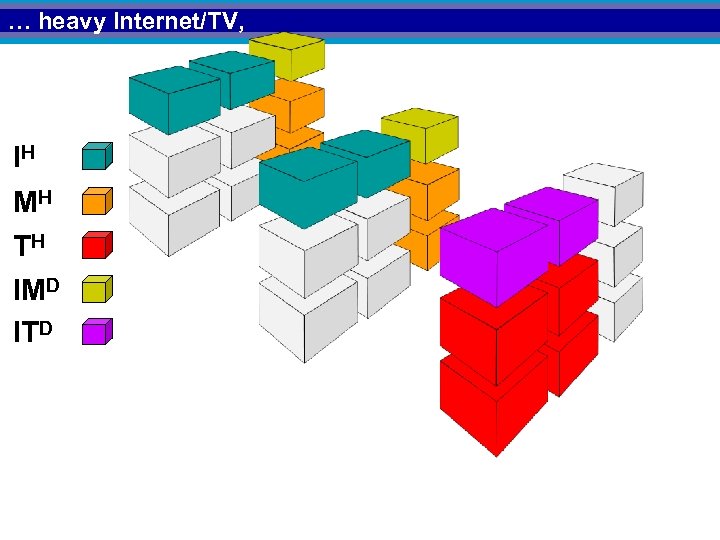

… heavy Internet/TV, IH MH TH IMD ITD

… heavy Internet/TV, IH MH TH IMD ITD

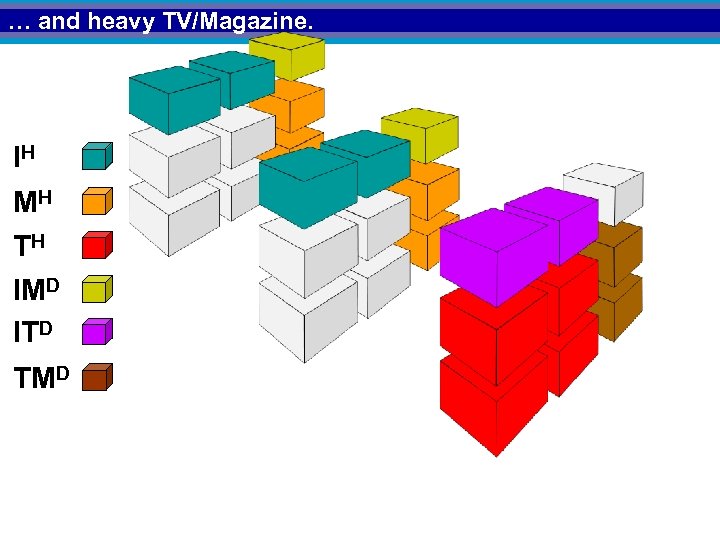

… and heavy TV/Magazine. IH MH TH IMD ITD TMD

… and heavy TV/Magazine. IH MH TH IMD ITD TMD

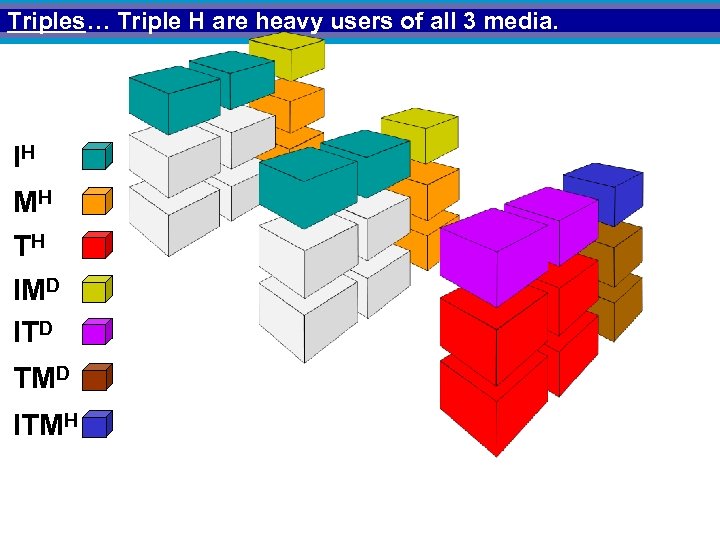

Triples… Triple H are heavy users of all 3 media. IH MH TH IMD ITD TMD ITMH

Triples… Triple H are heavy users of all 3 media. IH MH TH IMD ITD TMD ITMH

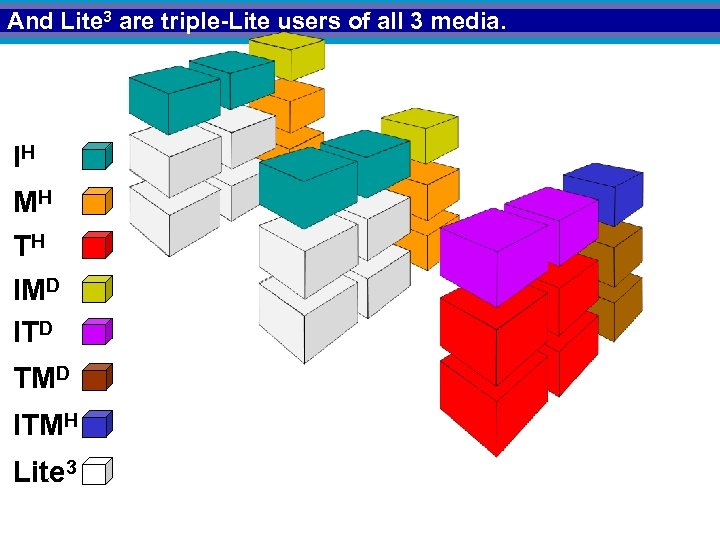

And Lite 3 are triple-Lite users of all 3 media. IH MH TH IMD ITD TMD ITMH Lite 3

And Lite 3 are triple-Lite users of all 3 media. IH MH TH IMD ITD TMD ITMH Lite 3

The Third Dimension Adds Clarity.

The Third Dimension Adds Clarity.

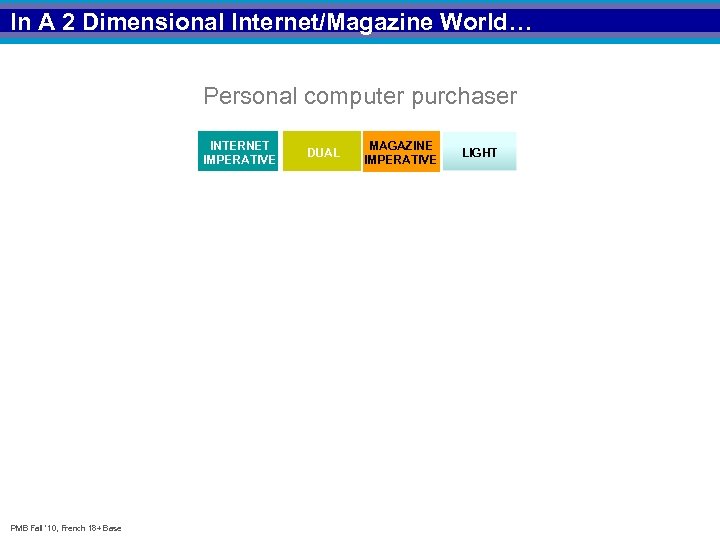

In A 2 Dimensional Internet/Magazine World… Personal computer purchaser INTERNET IMPERATIVE PMB Fall ‘ 10, French 18+ Base DUAL MAGAZINE IMPERATIVE LIGHT

In A 2 Dimensional Internet/Magazine World… Personal computer purchaser INTERNET IMPERATIVE PMB Fall ‘ 10, French 18+ Base DUAL MAGAZINE IMPERATIVE LIGHT

PC Buyers Are Heavy Internet And Internet/Magazine Users. Personal computer purchaser INTERNET IMPERATIVE 124 PMB Fall ‘ 10, French 18+ Base DUAL MAGAZINE IMPERATIVE LIGHT 126 81 48

PC Buyers Are Heavy Internet And Internet/Magazine Users. Personal computer purchaser INTERNET IMPERATIVE 124 PMB Fall ‘ 10, French 18+ Base DUAL MAGAZINE IMPERATIVE LIGHT 126 81 48

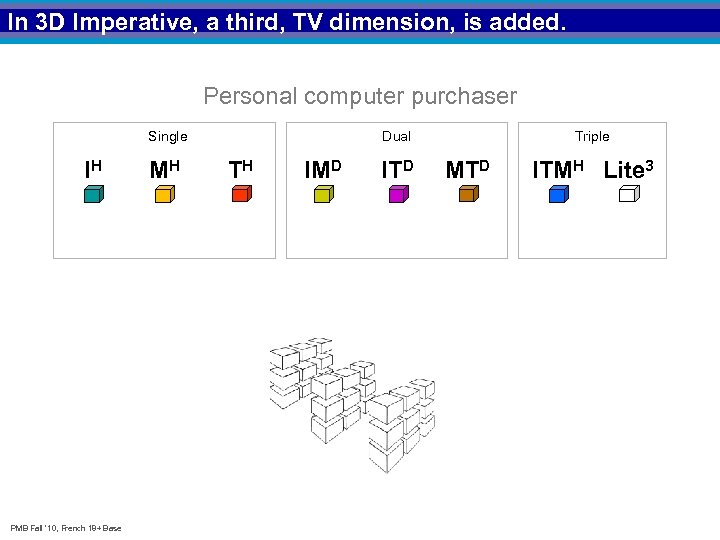

In 3 D Imperative, a third, TV dimension, is added. Personal computer purchaser Single IH PMB Fall ‘ 10, French 18+ Base MH Dual TH IMD ITD Triple MTD ITMH Lite 3

In 3 D Imperative, a third, TV dimension, is added. Personal computer purchaser Single IH PMB Fall ‘ 10, French 18+ Base MH Dual TH IMD ITD Triple MTD ITMH Lite 3

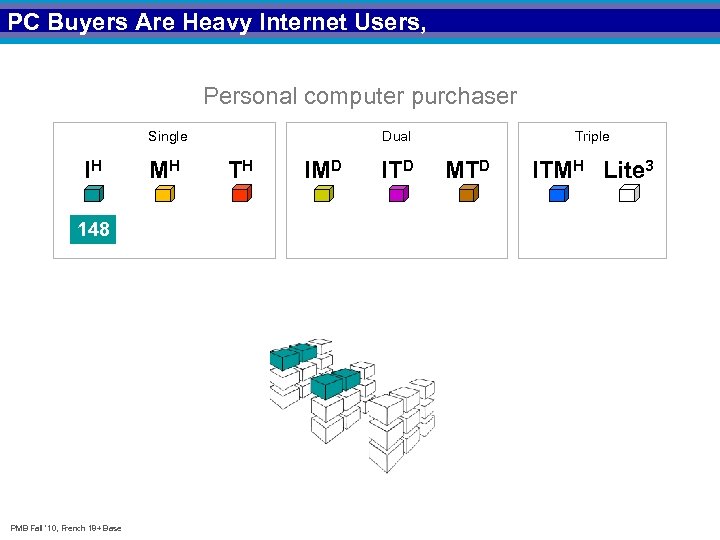

PC Buyers Are Heavy Internet Users, Personal computer purchaser Single IH 148 PMB Fall ‘ 10, French 18+ Base MH Dual TH IMD ITD Triple MTD ITMH Lite 3

PC Buyers Are Heavy Internet Users, Personal computer purchaser Single IH 148 PMB Fall ‘ 10, French 18+ Base MH Dual TH IMD ITD Triple MTD ITMH Lite 3

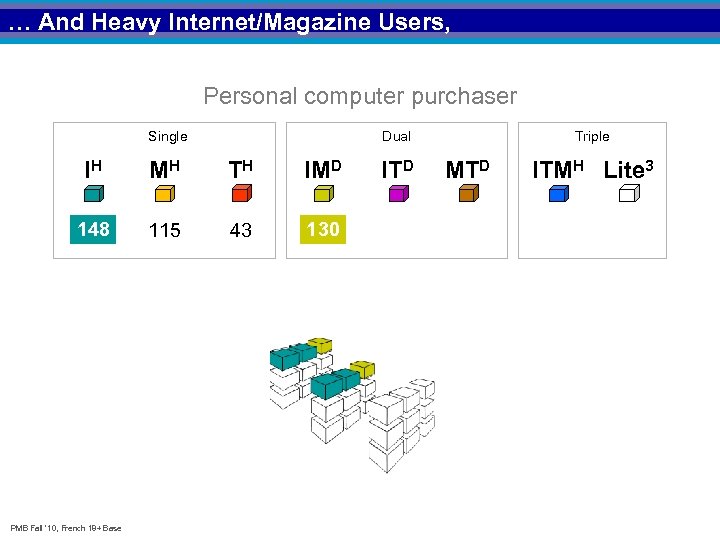

… And Heavy Internet/Magazine Users, Personal computer purchaser Single Dual IH MH TH IMD 148 115 43 130 PMB Fall ‘ 10, French 18+ Base ITD Triple MTD ITMH Lite 3

… And Heavy Internet/Magazine Users, Personal computer purchaser Single Dual IH MH TH IMD 148 115 43 130 PMB Fall ‘ 10, French 18+ Base ITD Triple MTD ITMH Lite 3

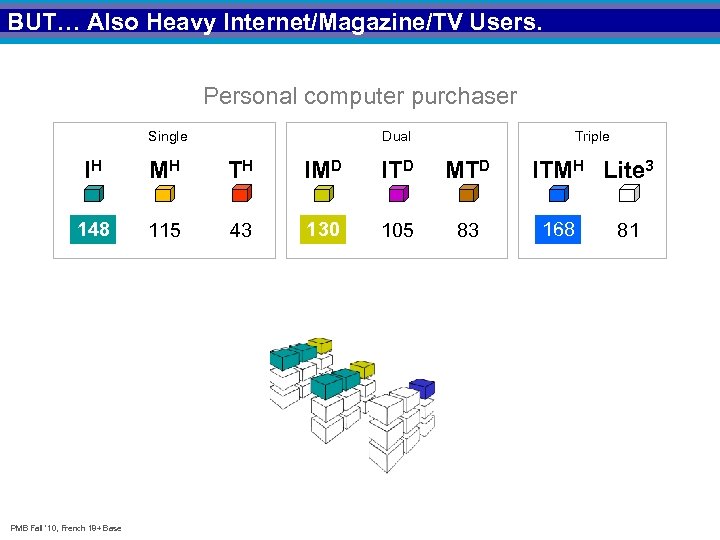

BUT… Also Heavy Internet/Magazine/TV Users. Personal computer purchaser Single Dual Triple IH MH TH IMD ITD MTD 148 115 43 130 105 83 PMB Fall ‘ 10, French 18+ Base ITMH Lite 3 168 81

BUT… Also Heavy Internet/Magazine/TV Users. Personal computer purchaser Single Dual Triple IH MH TH IMD ITD MTD 148 115 43 130 105 83 PMB Fall ‘ 10, French 18+ Base ITMH Lite 3 168 81

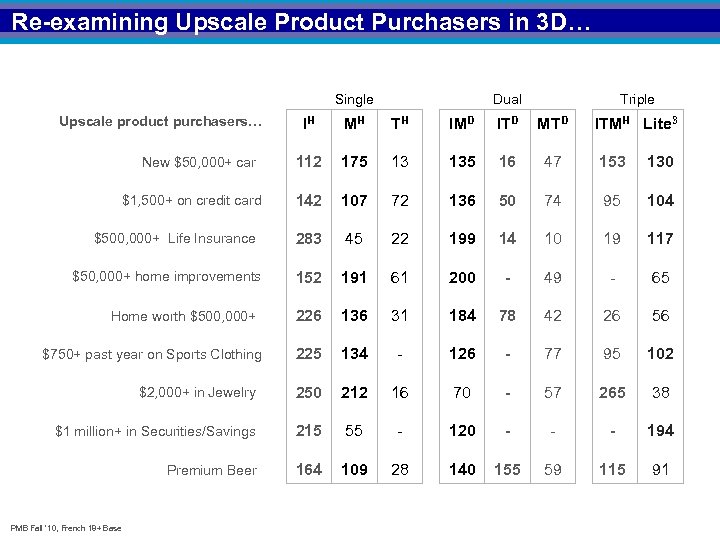

Re-examining Upscale Product Purchasers in 3 D… Single Upscale product purchasers… Dual Triple IH MH TH IMD ITD MTD 112 175 13 135 16 47 153 130 142 107 72 136 50 74 95 104 283 45 22 199 14 10 19 117 152 191 61 200 - 49 - 65 226 136 31 184 78 42 26 56 225 134 - 126 - 77 95 102 $2, 000+ in Jewelry 250 212 16 70 - 57 265 38 $1 million+ in Securities/Savings 215 55 - 120 - - - 194 Premium Beer 164 109 28 140 155 59 115 91 New $50, 000+ car $1, 500+ on credit card $500, 000+ Life Insurance $50, 000+ home improvements Home worth $500, 000+ $750+ past year on Sports Clothing PMB Fall ‘ 10, French 18+ Base ITMH Lite 3

Re-examining Upscale Product Purchasers in 3 D… Single Upscale product purchasers… Dual Triple IH MH TH IMD ITD MTD 112 175 13 135 16 47 153 130 142 107 72 136 50 74 95 104 283 45 22 199 14 10 19 117 152 191 61 200 - 49 - 65 226 136 31 184 78 42 26 56 225 134 - 126 - 77 95 102 $2, 000+ in Jewelry 250 212 16 70 - 57 265 38 $1 million+ in Securities/Savings 215 55 - 120 - - - 194 Premium Beer 164 109 28 140 155 59 115 91 New $50, 000+ car $1, 500+ on credit card $500, 000+ Life Insurance $50, 000+ home improvements Home worth $500, 000+ $750+ past year on Sports Clothing PMB Fall ‘ 10, French 18+ Base ITMH Lite 3

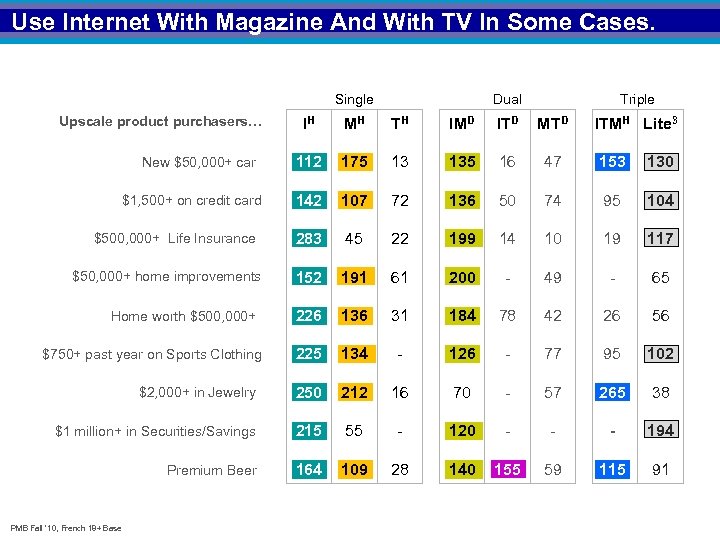

Use Internet With Magazine And With TV In Some Cases. Single Upscale product purchasers… Dual Triple IH MH TH IMD ITD MTD 112 175 13 135 16 47 153 130 142 107 72 136 50 74 95 104 283 45 22 199 14 10 19 117 152 191 61 200 - 49 - 65 226 136 31 184 78 42 26 56 225 134 - 126 - 77 95 102 $2, 000+ in Jewelry 250 212 16 70 - 57 265 38 $1 million+ in Securities/Savings 215 55 - 120 - - - 194 Premium Beer 164 109 28 140 155 59 115 91 New $50, 000+ car $1, 500+ on credit card $500, 000+ Life Insurance $50, 000+ home improvements Home worth $500, 000+ $750+ past year on Sports Clothing PMB Fall ‘ 10, French 18+ Base ITMH Lite 3

Use Internet With Magazine And With TV In Some Cases. Single Upscale product purchasers… Dual Triple IH MH TH IMD ITD MTD 112 175 13 135 16 47 153 130 142 107 72 136 50 74 95 104 283 45 22 199 14 10 19 117 152 191 61 200 - 49 - 65 226 136 31 184 78 42 26 56 225 134 - 126 - 77 95 102 $2, 000+ in Jewelry 250 212 16 70 - 57 265 38 $1 million+ in Securities/Savings 215 55 - 120 - - - 194 Premium Beer 164 109 28 140 155 59 115 91 New $50, 000+ car $1, 500+ on credit card $500, 000+ Life Insurance $50, 000+ home improvements Home worth $500, 000+ $750+ past year on Sports Clothing PMB Fall ‘ 10, French 18+ Base ITMH Lite 3

Re-examining Decision-Makers in 3 D… Dual Single Business decision makers for… Triple IH NH TH IND ITD NTD ITNH Lite 3 Banking and Finance 121 59 40 261 45 41 142 125 Computers 148 78 22 312 37 36 198 80 Office Equipment 163 80 31 270 46 23 155 92 Business Travel 162 47 20 256 40 35 106 70 Shipping and Distribution 174 44 45 346 30 - 188 81 Involved in $500 m+ Expenditures 167 42 18 238 180 22 57 133 PMB Fall ‘ 10, French 18+ Base

Re-examining Decision-Makers in 3 D… Dual Single Business decision makers for… Triple IH NH TH IND ITD NTD ITNH Lite 3 Banking and Finance 121 59 40 261 45 41 142 125 Computers 148 78 22 312 37 36 198 80 Office Equipment 163 80 31 270 46 23 155 92 Business Travel 162 47 20 256 40 35 106 70 Shipping and Distribution 174 44 45 346 30 - 188 81 Involved in $500 m+ Expenditures 167 42 18 238 180 22 57 133 PMB Fall ‘ 10, French 18+ Base

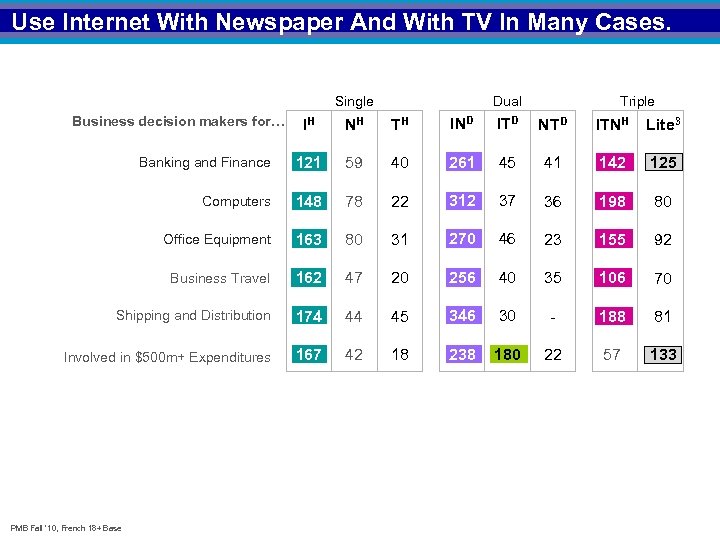

Use Internet With Newspaper And With TV In Many Cases. Dual Single Business decision makers for… Triple IH NH TH IND ITD NTD ITNH Lite 3 Banking and Finance 121 59 40 261 45 41 142 125 Computers 148 78 22 312 37 36 198 80 Office Equipment 163 80 31 270 46 23 155 92 Business Travel 162 47 20 256 40 35 106 70 Shipping and Distribution 174 44 45 346 30 - 188 81 Involved in $500 m+ Expenditures 167 42 18 238 180 22 57 133 PMB Fall ‘ 10, French 18+ Base

Use Internet With Newspaper And With TV In Many Cases. Dual Single Business decision makers for… Triple IH NH TH IND ITD NTD ITNH Lite 3 Banking and Finance 121 59 40 261 45 41 142 125 Computers 148 78 22 312 37 36 198 80 Office Equipment 163 80 31 270 46 23 155 92 Business Travel 162 47 20 256 40 35 106 70 Shipping and Distribution 174 44 45 346 30 - 188 81 Involved in $500 m+ Expenditures 167 42 18 238 180 22 57 133 PMB Fall ‘ 10, French 18+ Base

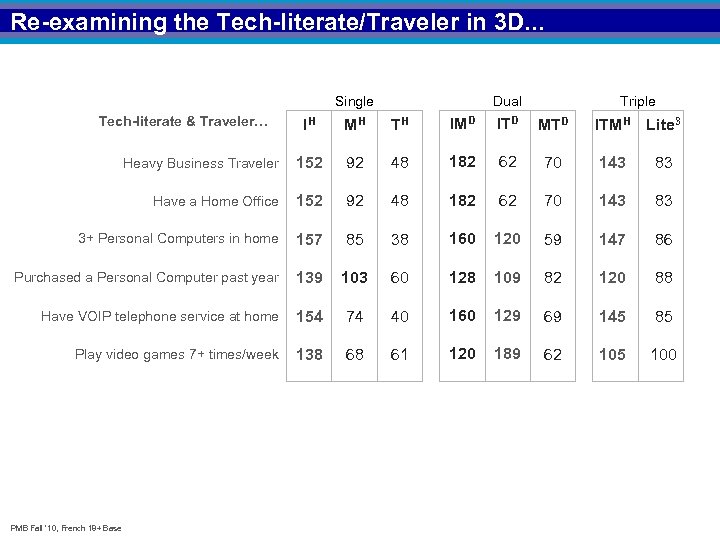

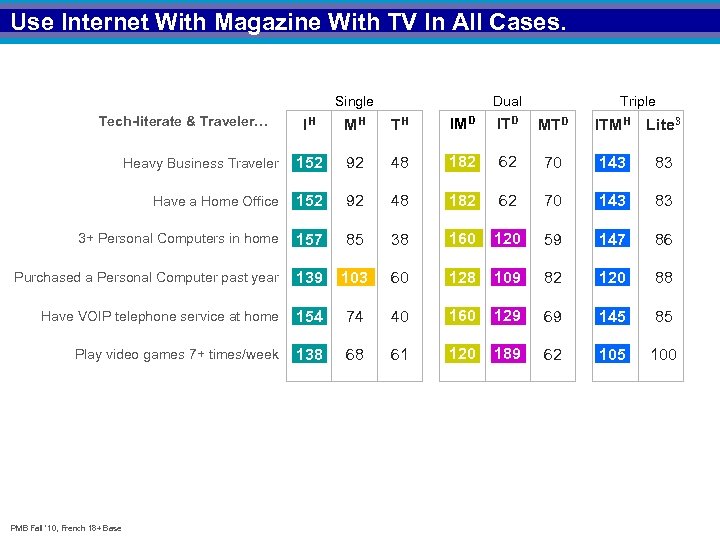

Re-examining the Tech-literate/Traveler in 3 D. . . Single Tech-literate & Traveler… Dual Triple IH MH TH IMD ITD MTD ITMH Lite 3 Heavy Business Traveler 152 92 48 182 62 70 143 83 Have a Home Office 152 92 48 182 62 70 143 83 3+ Personal Computers in home 157 85 38 160 120 59 147 86 Purchased a Personal Computer past year 139 103 60 128 109 82 120 88 Have VOIP telephone service at home 154 74 40 160 129 69 145 85 Play video games 7+ times/week 138 68 61 120 189 62 105 100 PMB Fall ‘ 10, French 18+ Base

Re-examining the Tech-literate/Traveler in 3 D. . . Single Tech-literate & Traveler… Dual Triple IH MH TH IMD ITD MTD ITMH Lite 3 Heavy Business Traveler 152 92 48 182 62 70 143 83 Have a Home Office 152 92 48 182 62 70 143 83 3+ Personal Computers in home 157 85 38 160 120 59 147 86 Purchased a Personal Computer past year 139 103 60 128 109 82 120 88 Have VOIP telephone service at home 154 74 40 160 129 69 145 85 Play video games 7+ times/week 138 68 61 120 189 62 105 100 PMB Fall ‘ 10, French 18+ Base

Use Internet With Magazine With TV In All Cases. Single Tech-literate & Traveler… Dual Triple IH MH TH IMD ITD MTD ITMH Lite 3 Heavy Business Traveler 152 92 48 182 62 70 143 83 Have a Home Office 152 92 48 182 62 70 143 83 3+ Personal Computers in home 157 85 38 160 120 59 147 86 Purchased a Personal Computer past year 139 103 60 128 109 82 120 88 Have VOIP telephone service at home 154 74 40 160 129 69 145 85 Play video games 7+ times/week 138 68 61 120 189 62 105 100 PMB Fall ‘ 10, French 18+ Base

Use Internet With Magazine With TV In All Cases. Single Tech-literate & Traveler… Dual Triple IH MH TH IMD ITD MTD ITMH Lite 3 Heavy Business Traveler 152 92 48 182 62 70 143 83 Have a Home Office 152 92 48 182 62 70 143 83 3+ Personal Computers in home 157 85 38 160 120 59 147 86 Purchased a Personal Computer past year 139 103 60 128 109 82 120 88 Have VOIP telephone service at home 154 74 40 160 129 69 145 85 Play video games 7+ times/week 138 68 61 120 189 62 105 100 PMB Fall ‘ 10, French 18+ Base

3 D Imperatives Help To Clarify Complex Media Relationships. INTERNET Often a “driver” medium. INTERNET ALONE Captures a large segment of target. INTERNET DUALS Combinations with Print is key. INTERNET TRIPLE Heavy users of 3 media often key.

3 D Imperatives Help To Clarify Complex Media Relationships. INTERNET Often a “driver” medium. INTERNET ALONE Captures a large segment of target. INTERNET DUALS Combinations with Print is key. INTERNET TRIPLE Heavy users of 3 media often key.

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

PMB U S E D F com. Score

PMB U S E D F com. Score

Can Examine com. Score Websites Through A PMB Lens. 1, 000+ web sites. 27 site “types”. 29 magazine sites.

Can Examine com. Score Websites Through A PMB Lens. 1, 000+ web sites. 27 site “types”. 29 magazine sites.

A Rank Of Website “Types” By PMB Adults 18+ Monthly Reach 70% 60% 50% 40% 30% 20% com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

A Rank Of Website “Types” By PMB Adults 18+ Monthly Reach 70% 60% 50% 40% 30% 20% com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

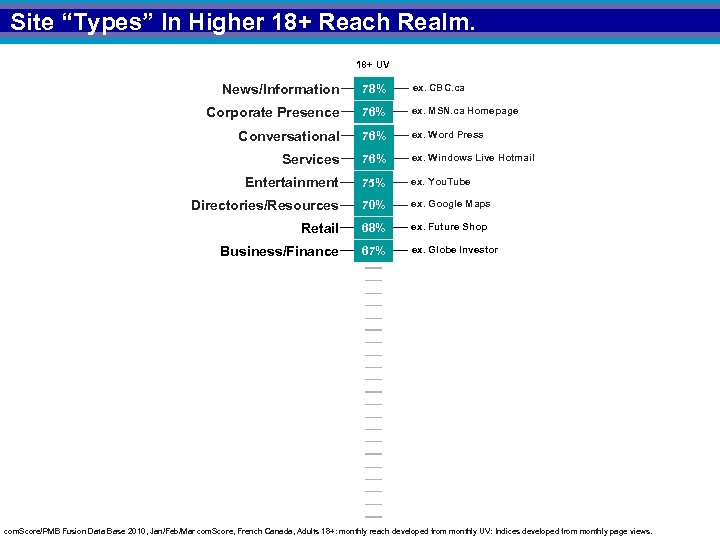

Site “Types” In Higher 18+ Reach Realm. 18+ UV News/Information 78% ex. CBC. ca Corporate Presence 76% ex. MSN. ca Homepage Conversational 76% ex. Word Press Services 76% ex. Windows Live Hotmail Entertainment 75% ex. You. Tube Directories/Resources 70% ex. Google Maps Retail 68% ex. Future Shop Business/Finance 67% ex. Globe Investor com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

Site “Types” In Higher 18+ Reach Realm. 18+ UV News/Information 78% ex. CBC. ca Corporate Presence 76% ex. MSN. ca Homepage Conversational 76% ex. Word Press Services 76% ex. Windows Live Hotmail Entertainment 75% ex. You. Tube Directories/Resources 70% ex. Google Maps Retail 68% ex. Future Shop Business/Finance 67% ex. Globe Investor com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

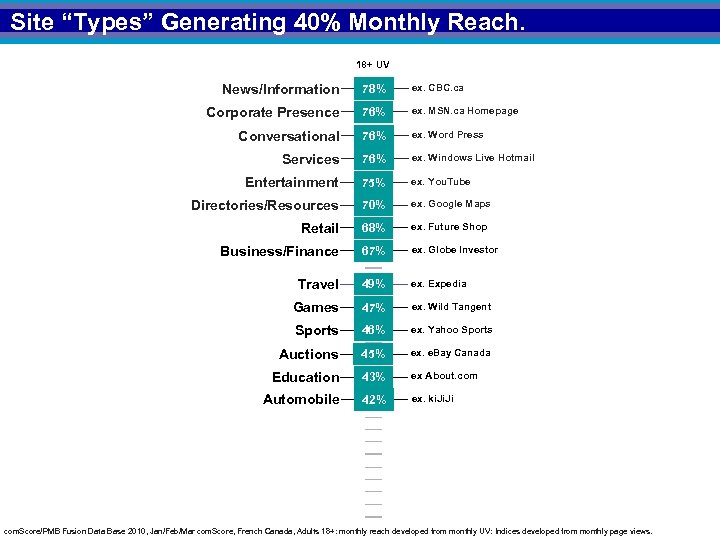

Site “Types” Generating 40% Monthly Reach. 18+ UV News/Information 78% ex. CBC. ca Corporate Presence 76% ex. MSN. ca Homepage Conversational 76% ex. Word Press Services 76% ex. Windows Live Hotmail Entertainment 75% ex. You. Tube Directories/Resources 70% ex. Google Maps Retail 68% ex. Future Shop Business/Finance 67% ex. Globe Investor Travel 49% ex. Expedia Games 47% ex. Wild Tangent Sports 46% ex. Yahoo Sports Auctions 45% ex. e. Bay Canada Education 43% ex About. com Automobile 42% ex. ki. Ji com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

Site “Types” Generating 40% Monthly Reach. 18+ UV News/Information 78% ex. CBC. ca Corporate Presence 76% ex. MSN. ca Homepage Conversational 76% ex. Word Press Services 76% ex. Windows Live Hotmail Entertainment 75% ex. You. Tube Directories/Resources 70% ex. Google Maps Retail 68% ex. Future Shop Business/Finance 67% ex. Globe Investor Travel 49% ex. Expedia Games 47% ex. Wild Tangent Sports 46% ex. Yahoo Sports Auctions 45% ex. e. Bay Canada Education 43% ex About. com Automobile 42% ex. ki. Ji com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

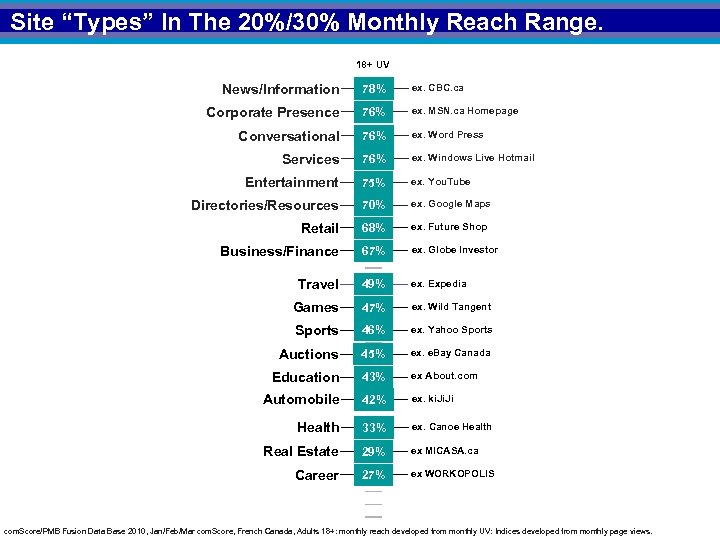

Site “Types” In The 20%/30% Monthly Reach Range. 18+ UV News/Information 78% ex. CBC. ca Corporate Presence 76% ex. MSN. ca Homepage Conversational 76% ex. Word Press Services 76% ex. Windows Live Hotmail Entertainment 75% ex. You. Tube Directories/Resources 70% ex. Google Maps Retail 68% ex. Future Shop Business/Finance 67% ex. Globe Investor Travel 49% ex. Expedia Games 47% ex. Wild Tangent Sports 46% ex. Yahoo Sports Auctions 45% ex. e. Bay Canada Education 43% ex About. com Automobile 42% ex. ki. Ji Health 33% ex. Canoe Health Real Estate 29% ex MICASA. ca Career 27% ex WORKOPOLIS com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

Site “Types” In The 20%/30% Monthly Reach Range. 18+ UV News/Information 78% ex. CBC. ca Corporate Presence 76% ex. MSN. ca Homepage Conversational 76% ex. Word Press Services 76% ex. Windows Live Hotmail Entertainment 75% ex. You. Tube Directories/Resources 70% ex. Google Maps Retail 68% ex. Future Shop Business/Finance 67% ex. Globe Investor Travel 49% ex. Expedia Games 47% ex. Wild Tangent Sports 46% ex. Yahoo Sports Auctions 45% ex. e. Bay Canada Education 43% ex About. com Automobile 42% ex. ki. Ji Health 33% ex. Canoe Health Real Estate 29% ex MICASA. ca Career 27% ex WORKOPOLIS com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

Can Website “Types” Target By Demo And Segments? Age, sex, income. PMB Life-style segments.

Can Website “Types” Target By Demo And Segments? Age, sex, income. PMB Life-style segments.

18 -24. 18+ UV Target Page View Index News/Information Corporate Presence Conversational 151 Services 153 Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 150 267 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

18 -24. 18+ UV Target Page View Index News/Information Corporate Presence Conversational 151 Services 153 Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 150 267 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

25 -34. 18+ UV Target Page View Index News/Information Corporate Presence Conversational 134 Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% 149 Sports 46% 130 Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

25 -34. 18+ UV Target Page View Index News/Information Corporate Presence Conversational 134 Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% 149 Sports 46% 130 Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

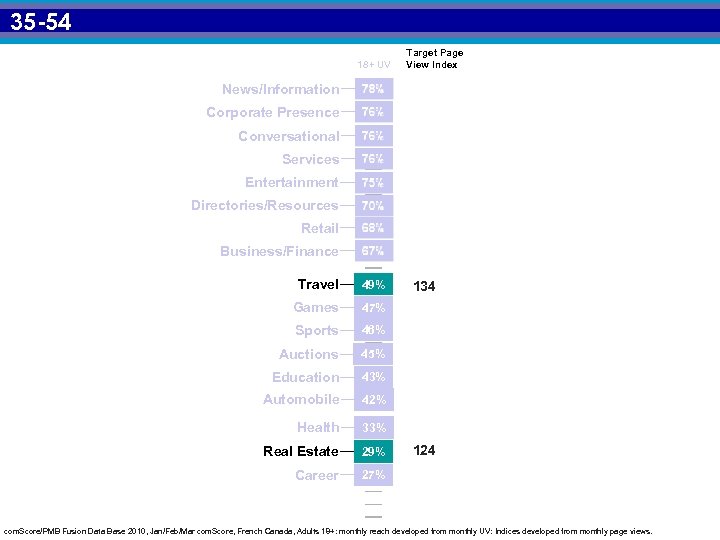

35 -54 18+ UV Target Page View Index News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 134 124 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

35 -54 18+ UV Target Page View Index News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 134 124 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

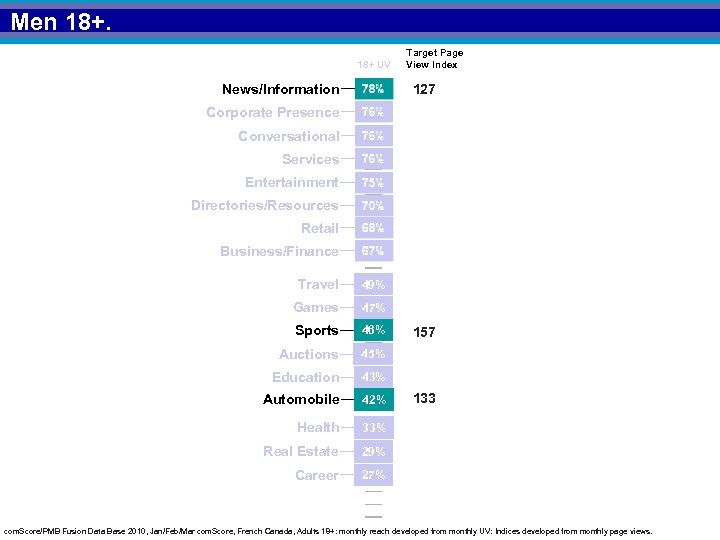

Men 18+ UV News/Information Target Page View Index 127 Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 157 133 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

Men 18+ UV News/Information Target Page View Index 127 Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 157 133 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

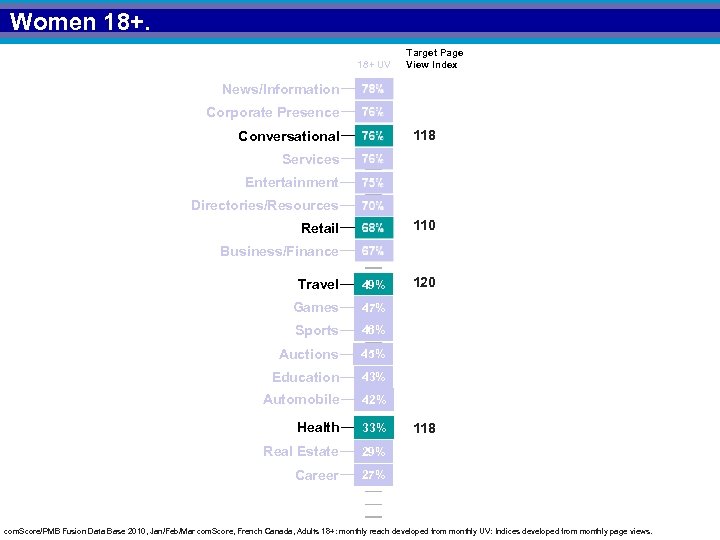

Women 18+ UV Target Page View Index News/Information Corporate Presence 118 Conversational Services Entertainment Directories/Resources 110 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 120 27% 118 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

Women 18+ UV Target Page View Index News/Information Corporate Presence 118 Conversational Services Entertainment Directories/Resources 110 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 120 27% 118 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

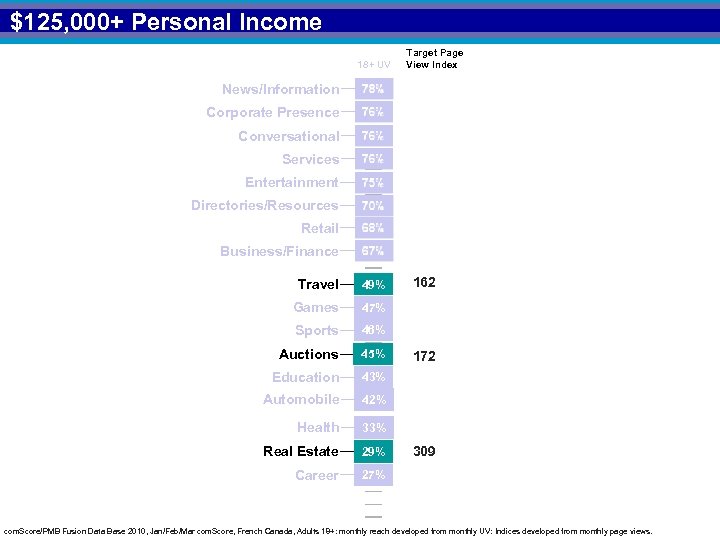

$125, 000+ Personal Income 18+ UV Target Page View Index News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 162 27% 172 309 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

$125, 000+ Personal Income 18+ UV Target Page View Index News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 162 27% 172 309 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

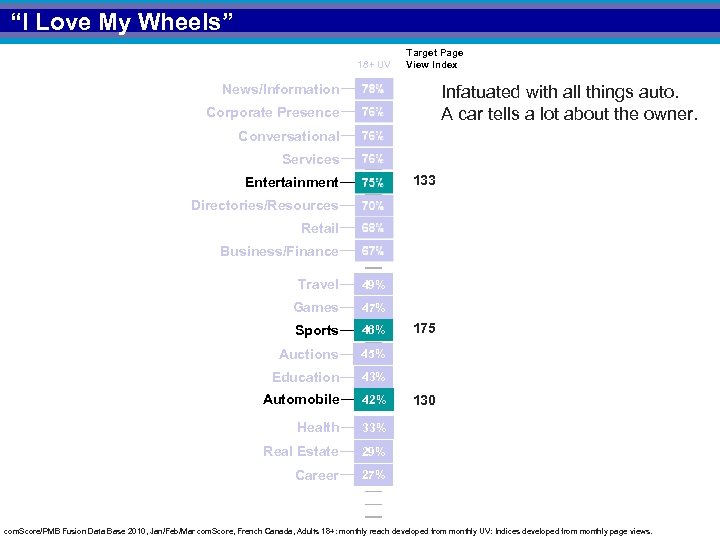

“I Love My Wheels” 18+ UV Target Page View Index News/Information Infatuated with all things auto. A car tells a lot about the owner. Corporate Presence Conversational Services 133 Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 175 130 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“I Love My Wheels” 18+ UV Target Page View Index News/Information Infatuated with all things auto. A car tells a lot about the owner. Corporate Presence Conversational Services 133 Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 175 130 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

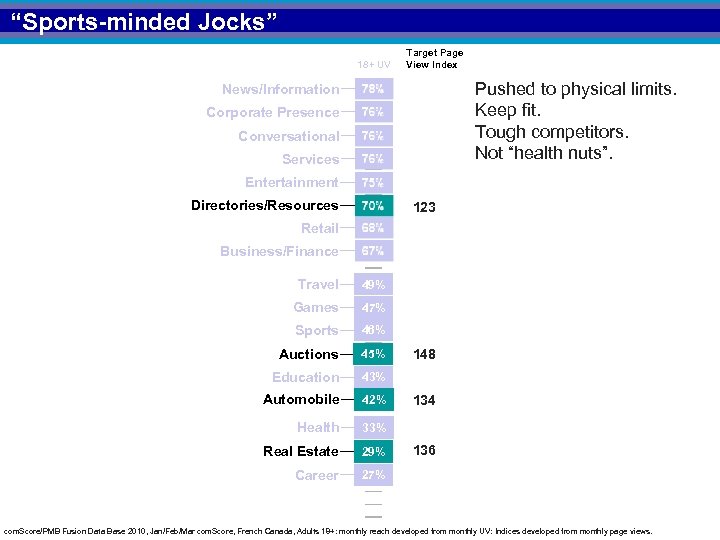

“Sports-minded Jocks” 18+ UV Target Page View Index Pushed to physical limits. Keep fit. Tough competitors. Not “health nuts”. News/Information Corporate Presence Conversational Services Entertainment Directories/Resources 123 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 148 134 136 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“Sports-minded Jocks” 18+ UV Target Page View Index Pushed to physical limits. Keep fit. Tough competitors. Not “health nuts”. News/Information Corporate Presence Conversational Services Entertainment Directories/Resources 123 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 148 134 136 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

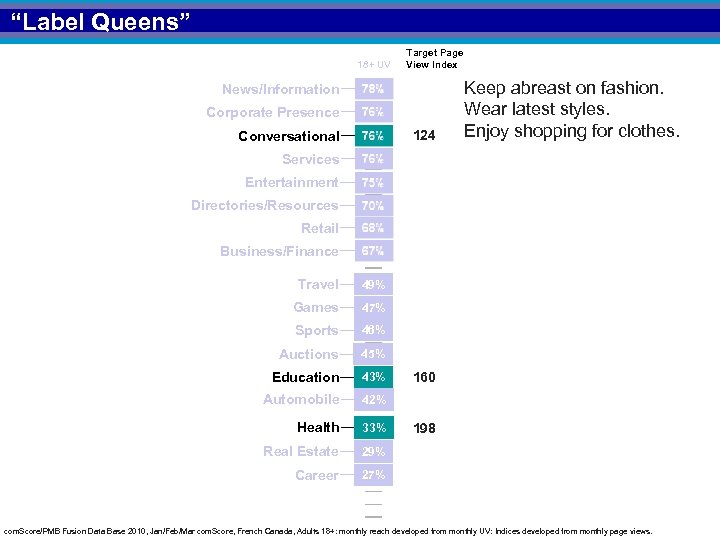

“Label Queens” 18+ UV Target Page View Index News/Information Corporate Presence 124 Conversational Keep abreast on fashion. Wear latest styles. Enjoy shopping for clothes. Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 160 198 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“Label Queens” 18+ UV Target Page View Index News/Information Corporate Presence 124 Conversational Keep abreast on fashion. Wear latest styles. Enjoy shopping for clothes. Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 160 198 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

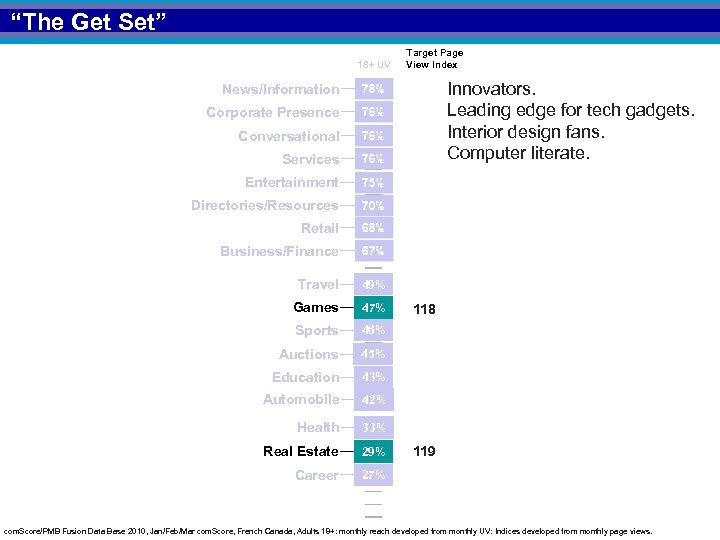

“The Get Set” 18+ UV Target Page View Index Innovators. Leading edge for tech gadgets. Interior design fans. Computer literate. News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 118 119 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“The Get Set” 18+ UV Target Page View Index Innovators. Leading edge for tech gadgets. Interior design fans. Computer literate. News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 118 119 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

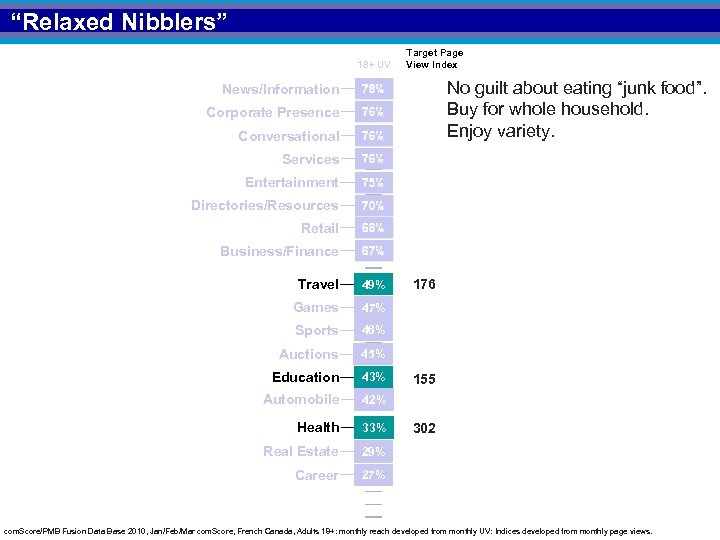

“Relaxed Nibblers” 18+ UV Target Page View Index No guilt about eating “junk food”. Buy for whole household. Enjoy variety. News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 176 155 302 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“Relaxed Nibblers” 18+ UV Target Page View Index No guilt about eating “junk food”. Buy for whole household. Enjoy variety. News/Information Corporate Presence Conversational Services Entertainment Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 176 155 302 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

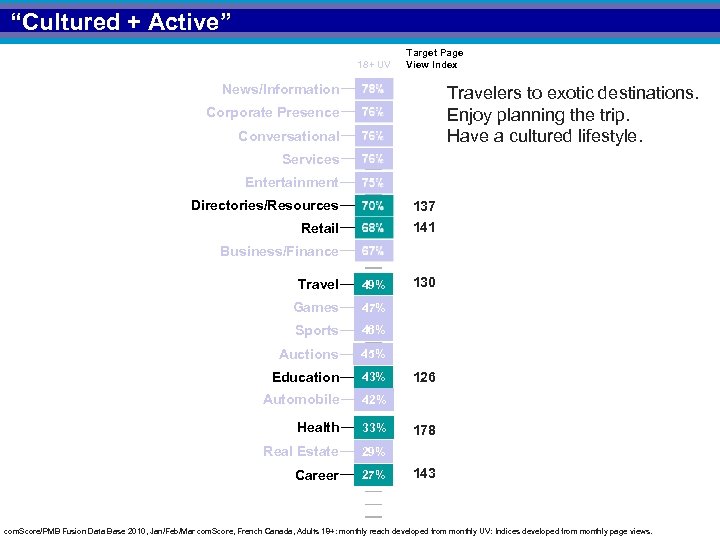

“Cultured + Active” 18+ UV Target Page View Index News/Information Travelers to exotic destinations. Enjoy planning the trip. Have a cultured lifestyle. Corporate Presence Conversational Services Entertainment Directories/Resources 137 141 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 130 126 178 143 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“Cultured + Active” 18+ UV Target Page View Index News/Information Travelers to exotic destinations. Enjoy planning the trip. Have a cultured lifestyle. Corporate Presence Conversational Services Entertainment Directories/Resources 137 141 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 130 126 178 143 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

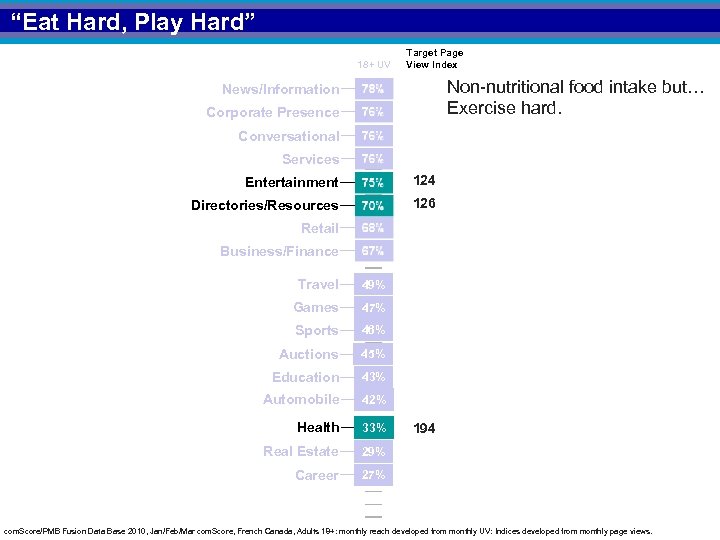

“Eat Hard, Play Hard” 18+ UV Target Page View Index Non-nutritional food intake but… Exercise hard. News/Information Corporate Presence Conversational Services Entertainment 124 Directories/Resources 126 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 194 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“Eat Hard, Play Hard” 18+ UV Target Page View Index Non-nutritional food intake but… Exercise hard. News/Information Corporate Presence Conversational Services Entertainment 124 Directories/Resources 126 Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 194 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

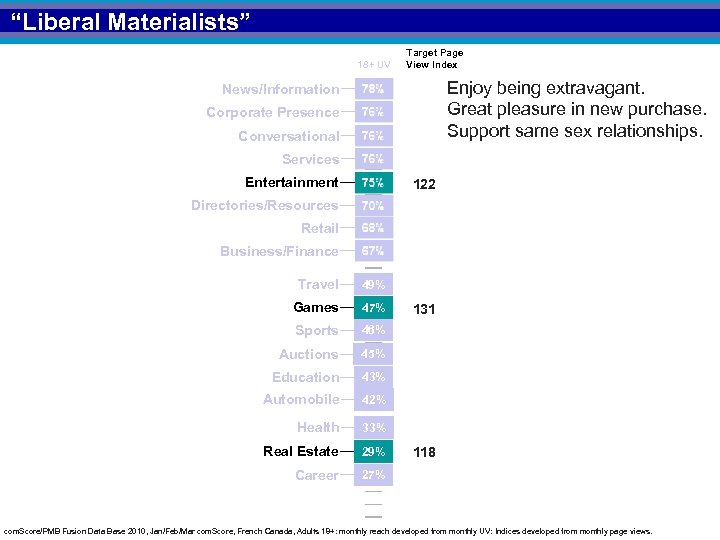

“Liberal Materialists” 18+ UV Target Page View Index Enjoy being extravagant. Great pleasure in new purchase. Support same sex relationships. News/Information Corporate Presence Conversational Services Entertainment 122 Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 131 118 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“Liberal Materialists” 18+ UV Target Page View Index Enjoy being extravagant. Great pleasure in new purchase. Support same sex relationships. News/Information Corporate Presence Conversational Services Entertainment 122 Directories/Resources Retail Business/Finance Travel 49% Games 47% Sports 46% Auctions 45% Education 43% Automobile 42% Health 33% Real Estate 29% Career 27% 131 118 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

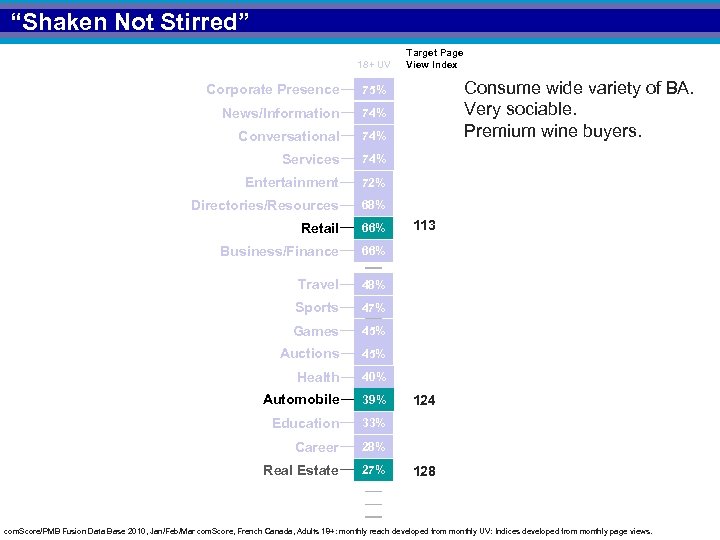

“Shaken Not Stirred” 18+ UV Corporate Presence 74% Conversational 74% Services 74% Entertainment 72% Directories/Resources 68% Retail 66% Business/Finance 66% Travel 48% Sports 47% Games 45% Auctions 45% Health 40% Automobile 39% Education 33% Career 28% Real Estate 27% Consume wide variety of BA. Very sociable. Premium wine buyers. 75% News/Information Target Page View Index 113 124 128 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

“Shaken Not Stirred” 18+ UV Corporate Presence 74% Conversational 74% Services 74% Entertainment 72% Directories/Resources 68% Retail 66% Business/Finance 66% Travel 48% Sports 47% Games 45% Auctions 45% Health 40% Automobile 39% Education 33% Career 28% Real Estate 27% Consume wide variety of BA. Very sociable. Premium wine buyers. 75% News/Information Target Page View Index 113 124 128 com. Score/PMB Fusion Data Base 2010, Jan/Feb/Mar com. Score, French Canada, Adults 18+: monthly reach developed from monthly UV: Indices developed from monthly page views.

According To FUSION, Website “Types” Can Target! CAN TARGET Age, sex, income. CAN TARGET Lifestyle segments.

According To FUSION, Website “Types” Can Target! CAN TARGET Age, sex, income. CAN TARGET Lifestyle segments.

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

REACH + TIME IMPERATIVES – 2 D and 3 D FUSION MOBILE

How Is Mobile Access Of The Internet Changing? Nielsen Mobile Media Measurement 2 nd Quarter 2010

How Is Mobile Access Of The Internet Changing? Nielsen Mobile Media Measurement 2 nd Quarter 2010

Mobile usage over two points in time. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 60% 50% 40% 30% 20% 10% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Mobile usage over two points in time. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 60% 50% 40% 30% 20% 10% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

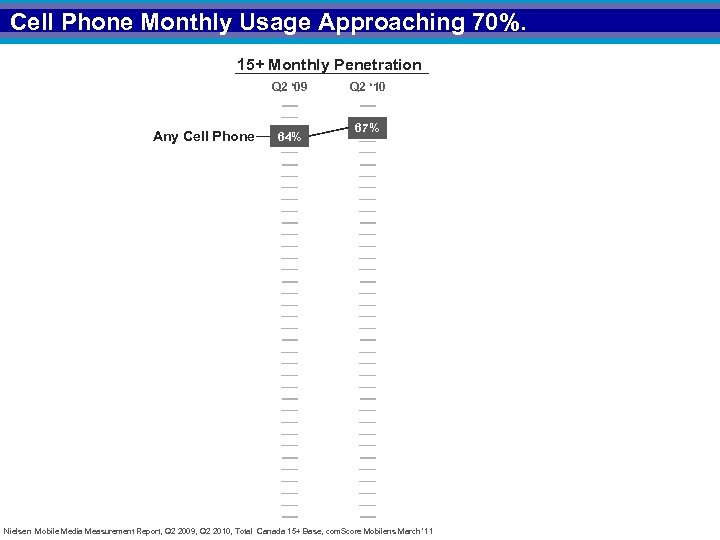

Cell Phone Monthly Usage Approaching 70%. 15+ Monthly Penetration Q 2 ‘ 09 Any Cell Phone 64% Q 2 ‘ 10 67% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Cell Phone Monthly Usage Approaching 70%. 15+ Monthly Penetration Q 2 ‘ 09 Any Cell Phone 64% Q 2 ‘ 10 67% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Additional mobile usage data recently made available. com. Score Mobi. Lens March 2011

Additional mobile usage data recently made available. com. Score Mobi. Lens March 2011

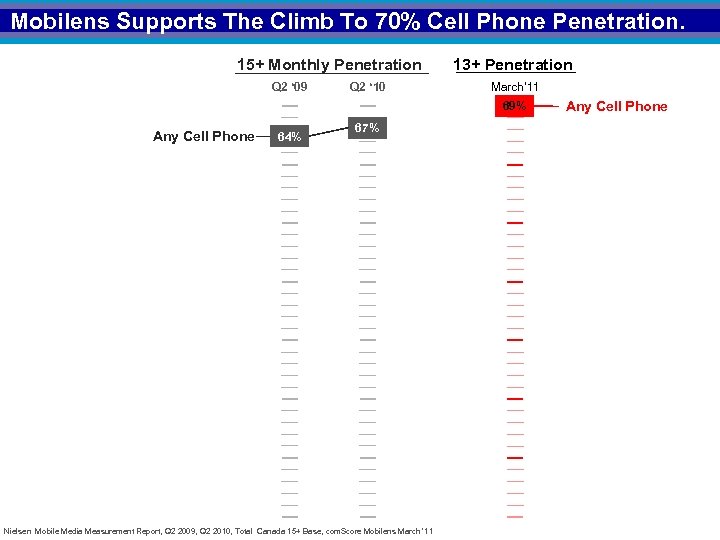

Mobilens Supports The Climb To 70% Cell Phone Penetration. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% Any Cell Phone 64% 67% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11 Any Cell Phone

Mobilens Supports The Climb To 70% Cell Phone Penetration. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% Any Cell Phone 64% 67% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11 Any Cell Phone

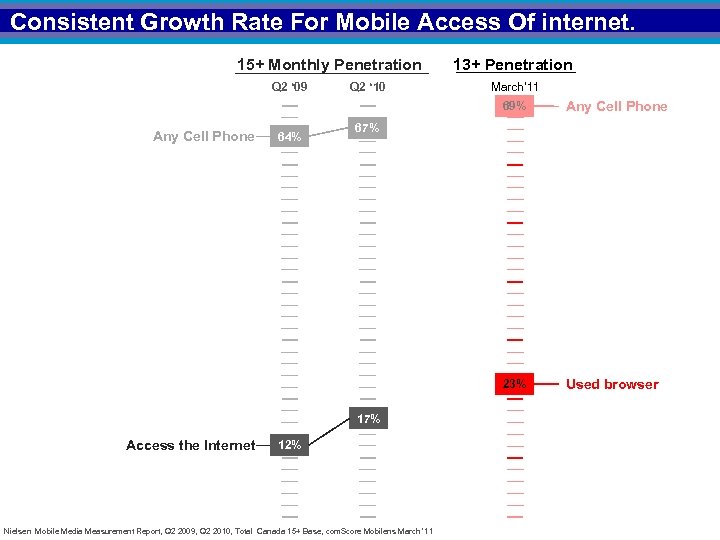

Consistent Growth Rate For Mobile Access Of internet. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 23% Any Cell Phone 64% Used browser 67% 17% Access the Internet Any Cell Phone 12% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Consistent Growth Rate For Mobile Access Of internet. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 23% Any Cell Phone 64% Used browser 67% 17% Access the Internet Any Cell Phone 12% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

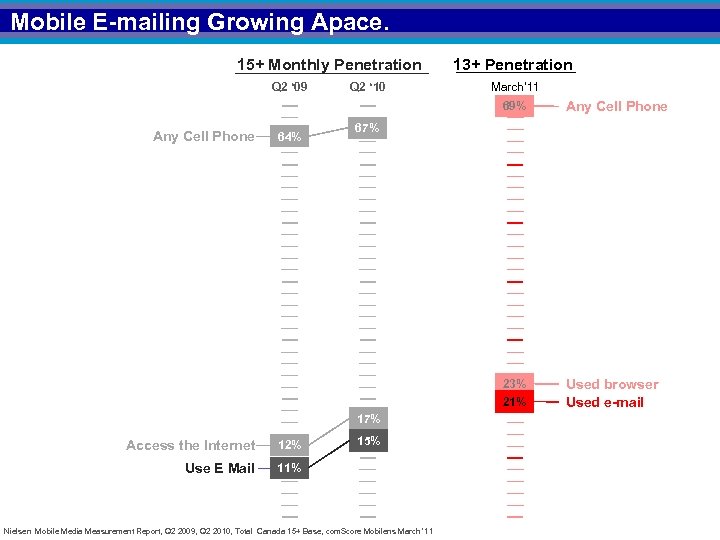

Mobile E-mailing Growing Apace. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 23% 21% Any Cell Phone 64% 12% Use E Mail Used browser Used e-mail 67% 17% Access the Internet Any Cell Phone 15% 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Mobile E-mailing Growing Apace. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 23% 21% Any Cell Phone 64% 12% Use E Mail Used browser Used e-mail 67% 17% Access the Internet Any Cell Phone 15% 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

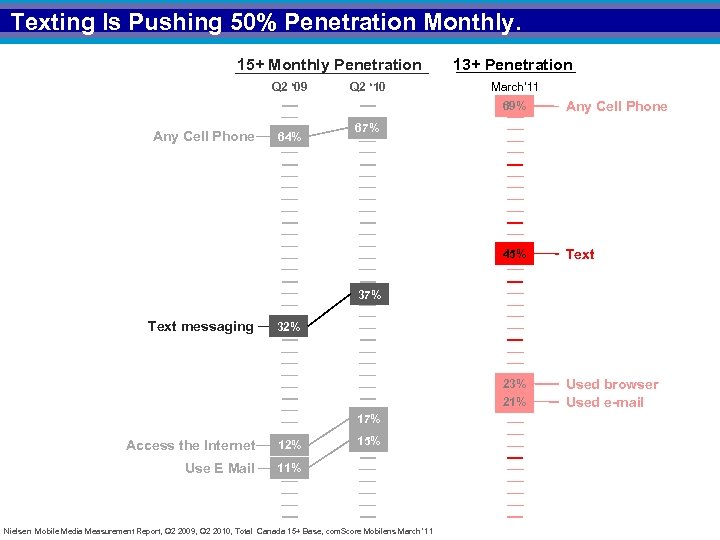

Texting Is Pushing 50% Penetration Monthly. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 45% 64% Text 23% 21% Any Cell Phone Used browser Used e-mail 67% 37% Text messaging 32% 17% Access the Internet 12% Use E Mail 15% 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Texting Is Pushing 50% Penetration Monthly. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 45% 64% Text 23% 21% Any Cell Phone Used browser Used e-mail 67% 37% Text messaging 32% 17% Access the Internet 12% Use E Mail 15% 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

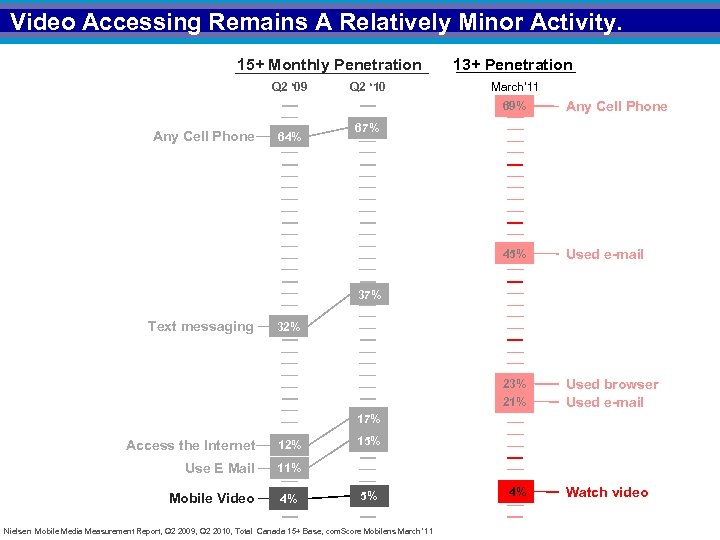

Video Accessing Remains A Relatively Minor Activity. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 45% 64% Used e-mail 23% 21% Any Cell Phone Used browser Used e-mail 67% 37% Text messaging 32% 17% Access the Internet 12% Use E Mail 15% 11% Mobile Video 4% 5% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11 4% Watch video

Video Accessing Remains A Relatively Minor Activity. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 45% 64% Used e-mail 23% 21% Any Cell Phone Used browser Used e-mail 67% 37% Text messaging 32% 17% Access the Internet 12% Use E Mail 15% 11% Mobile Video 4% 5% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11 4% Watch video

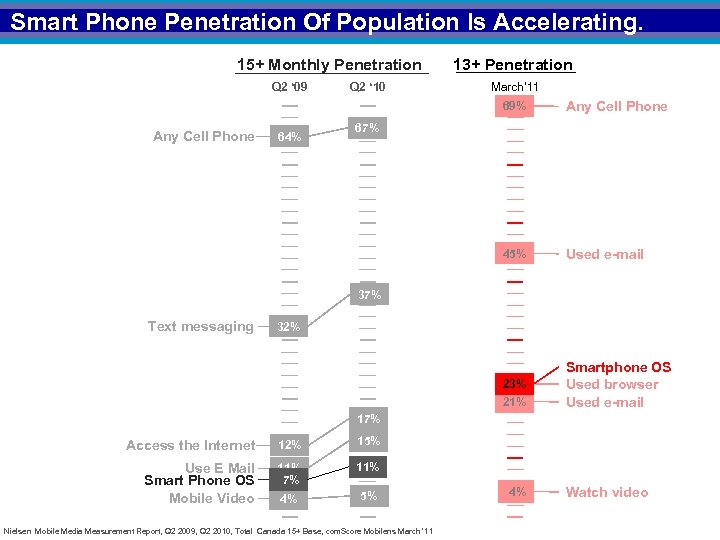

Smart Phone Penetration Of Population Is Accelerating. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 45% 64% Used e-mail 23% 21% Any Cell Phone Smartphone OS Used browser Used e-mail 67% 37% Text messaging 32% 17% Access the Internet 12% 15% Use E Mail Smart Phone OS Mobile Video 11% 7% 11% 4% 5% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11 4% Watch video

Smart Phone Penetration Of Population Is Accelerating. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% 45% 64% Used e-mail 23% 21% Any Cell Phone Smartphone OS Used browser Used e-mail 67% 37% Text messaging 32% 17% Access the Internet 12% 15% Use E Mail Smart Phone OS Mobile Video 11% 7% 11% 4% 5% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11 4% Watch video

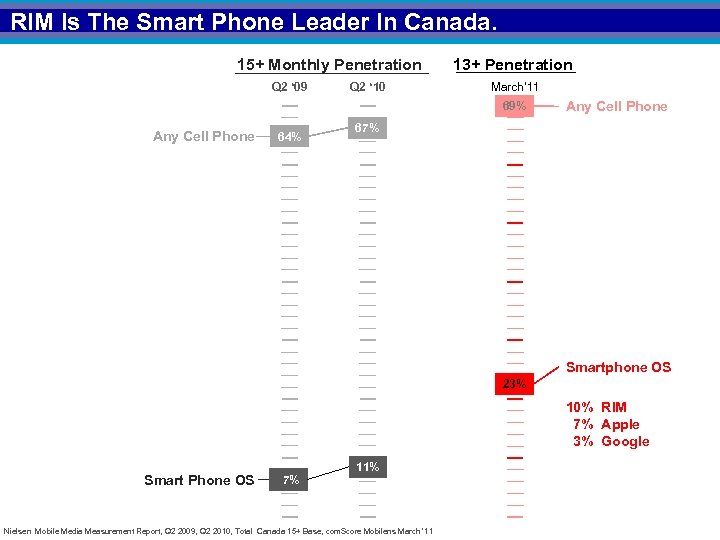

RIM Is The Smart Phone Leader In Canada. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% Any Cell Phone 64% Any Cell Phone 67% Smartphone OS 23% 10% RIM 7% Apple 3% Google Smart Phone OS 7% 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

RIM Is The Smart Phone Leader In Canada. 15+ Monthly Penetration Q 2 ‘ 09 Q 2 ‘ 10 13+ Penetration March’ 11 69% Any Cell Phone 64% Any Cell Phone 67% Smartphone OS 23% 10% RIM 7% Apple 3% Google Smart Phone OS 7% 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

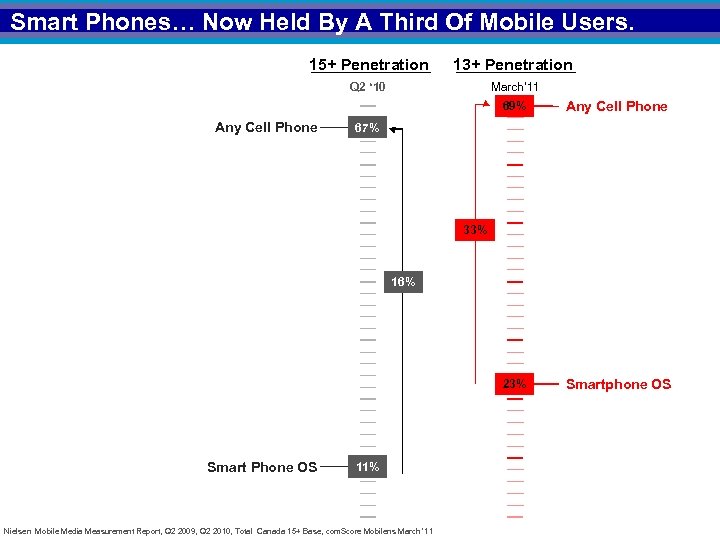

Smart Phones… Now Held By A Third Of Mobile Users. 15+ Penetration 13+ Penetration Q 2 ‘ 10 March’ 11 69% 23% Any Cell Phone Smartphone OS 67% 33% 16% Smart Phone OS 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Smart Phones… Now Held By A Third Of Mobile Users. 15+ Penetration 13+ Penetration Q 2 ‘ 10 March’ 11 69% 23% Any Cell Phone Smartphone OS 67% 33% 16% Smart Phone OS 11% Nielsen Mobile Media Measurement Report, Q 2 2009, Q 2 2010, Total Canada 15+ Base, com. Score Mobilens March ‘ 11

Mobile By The Numbers (Mobilens). 13+ Usage Levels in March ‘ 11 69% 45% Text. 23% Internet accessed. 23% Smart Phone. 33% com. Score Mobilens March ‘ 11 Using Cell Phones that are Smart.

Mobile By The Numbers (Mobilens). 13+ Usage Levels in March ‘ 11 69% 45% Text. 23% Internet accessed. 23% Smart Phone. 33% com. Score Mobilens March ‘ 11 Using Cell Phones that are Smart.

Online Occupies A Unique Position In The Integrated World. MARKETING On-Line INTEGRATION

Online Occupies A Unique Position In The Integrated World. MARKETING On-Line INTEGRATION

REACH + TIME Uniquely “under-55” age skew and growing!

REACH + TIME Uniquely “under-55” age skew and growing!

IMPERATIVES – 2 D and 3 D Uniquely predictive for a range of product purchasers.

IMPERATIVES – 2 D and 3 D Uniquely predictive for a range of product purchasers.

FUSION Uniquely capable of targeting demo/lifestyle segments

FUSION Uniquely capable of targeting demo/lifestyle segments

MOBILE Uniquely accessible.

MOBILE Uniquely accessible.

IMPERATIVE The Internet is Uniquely Imperative!

IMPERATIVE The Internet is Uniquely Imperative!

Online + Offline 2010 Canadian Media Usage Trends Study Commissioned By: The Interactive Advertising Bureau (IAB) of Canada www. iabcanada. com Prepared By: PHD Canada French Canada June 2011

Online + Offline 2010 Canadian Media Usage Trends Study Commissioned By: The Interactive Advertising Bureau (IAB) of Canada www. iabcanada. com Prepared By: PHD Canada French Canada June 2011

Definition of “French” by survey PMB Magazine Respondents in the province of Quebec, Ottawa/Gatineau CMA, Northern Ontario and New Brunswick who claim to speak French most often at home. NADbank Newspaper Respondents in Canada who claim to speak French most often at home. BBM Television French-speakers in the Province of Quebec, (excluding Montreal Anglo EM) plus Gatineau/Hull. Anglo/Franco assignment is based on the question covering language of conversation – “Which of the following languages do you speak well enough to conduct a conversation. Check only one – English – French - English and French - Neither English nor French. BBM Radio Respondents in Quebec, who claim their Official Language is “French” or “English and French”.

Definition of “French” by survey PMB Magazine Respondents in the province of Quebec, Ottawa/Gatineau CMA, Northern Ontario and New Brunswick who claim to speak French most often at home. NADbank Newspaper Respondents in Canada who claim to speak French most often at home. BBM Television French-speakers in the Province of Quebec, (excluding Montreal Anglo EM) plus Gatineau/Hull. Anglo/Franco assignment is based on the question covering language of conversation – “Which of the following languages do you speak well enough to conduct a conversation. Check only one – English – French - English and French - Neither English nor French. BBM Radio Respondents in Quebec, who claim their Official Language is “French” or “English and French”.

Newspaper and Magazine data in this study. IAB CMUST Presentation Data Sources and Definitions for CMUST 2010 Newspaper NADbank Most Recent Data Point 2009 All Market Readership Study, released March 2010. Start Data Point (10 yrs back) 2000 NADbank Study, released March 2001. Definition of weekly reach 7 day cume reflects aggregation of all measured daily newspaper titles. Definition of weekly time spent Total time spent reading last week, volume expressed per capita. Magazine PMB Most Recent Data Point Fall 2010 PMB, 2 year rolling, fieldwork in period March’ 08 -March’ 10 Start Data Point (10 yrs back) PMB 01, fieldwork in period Aug’ 97 -Sept’ 99. . Definition of Weekly Reach In Fall PMB ’ 10 generic question “When was the last time you read a magazine? Read a magazine in the past 7 days (which includes yesterday). ” In PMB’ 01 past 7 days was not available but read previous day is available. Looked at the relationship between “daily” and “weekly” in PMB ’ 05, ’ 06, and ’ 07 and applied that relationship to daily to estimate weekly reach. Definition of weekly time spent Time spent per month with PMB measured titles is aggregated in PMB’ 01 and PMB’ 10. This number is divided by 4. 3 to create a weekly time spent and then divided by the target population to create a per capita weekly time spent. The sharp decline in time spent is due to the disappearance of a number of weekly, TV listing titles.

Newspaper and Magazine data in this study. IAB CMUST Presentation Data Sources and Definitions for CMUST 2010 Newspaper NADbank Most Recent Data Point 2009 All Market Readership Study, released March 2010. Start Data Point (10 yrs back) 2000 NADbank Study, released March 2001. Definition of weekly reach 7 day cume reflects aggregation of all measured daily newspaper titles. Definition of weekly time spent Total time spent reading last week, volume expressed per capita. Magazine PMB Most Recent Data Point Fall 2010 PMB, 2 year rolling, fieldwork in period March’ 08 -March’ 10 Start Data Point (10 yrs back) PMB 01, fieldwork in period Aug’ 97 -Sept’ 99. . Definition of Weekly Reach In Fall PMB ’ 10 generic question “When was the last time you read a magazine? Read a magazine in the past 7 days (which includes yesterday). ” In PMB’ 01 past 7 days was not available but read previous day is available. Looked at the relationship between “daily” and “weekly” in PMB ’ 05, ’ 06, and ’ 07 and applied that relationship to daily to estimate weekly reach. Definition of weekly time spent Time spent per month with PMB measured titles is aggregated in PMB’ 01 and PMB’ 10. This number is divided by 4. 3 to create a weekly time spent and then divided by the target population to create a per capita weekly time spent. The sharp decline in time spent is due to the disappearance of a number of weekly, TV listing titles.

TV and Radio data in this study IAB CMUST Presentation Data Sources and Definitions for CMUST 2010 Television BBM Most Recent Data Point January-August 2009, PMT to match the technology used at the start point. Quebec is an exception. The Quebec data is based upon PPM technology. Quebec introduced PPM technology before the balance of Canada. Start Data Point (10 yrs back) st This differs between Total Canada and Quebec Franco. For Total Canada we used January 1 ’ 02 – Dec 31 ’ 02, Picture Matching Technology (PMT). National meter sample didn’t exist until Dec 31 st ’ 01. In Quebec Franco the period is August 27 ’ 01 -August 25 th ’ 02, 9 years back, because PMT was not available in ‘ 00/’ 01. Definition of weekly reach Reach is based upon average minute audience aggregated over all measured stations, spill in from US, specialty digital, traditional stations, averaged over the data point’s period of time. (Infosys TV) Definition of weekly time spent Daily minutes per capita, times 7 days. (Infosys TV) Radio BBM Most Recent Data Point Fall’ 09. The 2009 -‘ 10 Radio Data Book (that which was available in Nov 2010) contains data for the period Fall ’ 09 (Sept 7 ‘ 09 -Nov 1 ’ 09). All national data in this Radio Data Book and all of the work we did in this study is based upon Diary technology. (Micro BBM) Start Data Point (10 yrs back) Fall ’ 00 diary radio survey for Total Canada. French Canada is created by combining the target definition with official language French or official language English and French (Franc and Bilinguals). (Micro BBM) Definition of weekly reach Reach is based upon average minute audience aggregated over all measured stations, spill in fro US, specialty digital, traditional stations, averaged over the data point’s period of time. Definition of weekly time spent Daily minutes per capita, times 7 days. (Infosys TV)