98240e81484eb6f3e787fa95492069fa.ppt

- Количество слайдов: 28

One Security, Two Prices: Evidence on Stock Market Bubbles from the Shanghai-Hong Kong Stock Connect Program SHANTARAM HEGDE JIN PENG

One Security, Two Prices: Evidence on Stock Market Bubbles from the Shanghai-Hong Kong Stock Connect Program SHANTARAM HEGDE JIN PENG

Outline I. Introduction II. Literature Review and Hypothesis Development III. Price Gaps A. Summary Statistics and Univariate Test B. Serial Correlation Test IV. Price discovery Gaps A. Summary Statistics and Univariate Test B. Serial Correlation Test V. Correlation between Price Gap and Price Discovery Gap

Outline I. Introduction II. Literature Review and Hypothesis Development III. Price Gaps A. Summary Statistics and Univariate Test B. Serial Correlation Test IV. Price discovery Gaps A. Summary Statistics and Univariate Test B. Serial Correlation Test V. Correlation between Price Gap and Price Discovery Gap

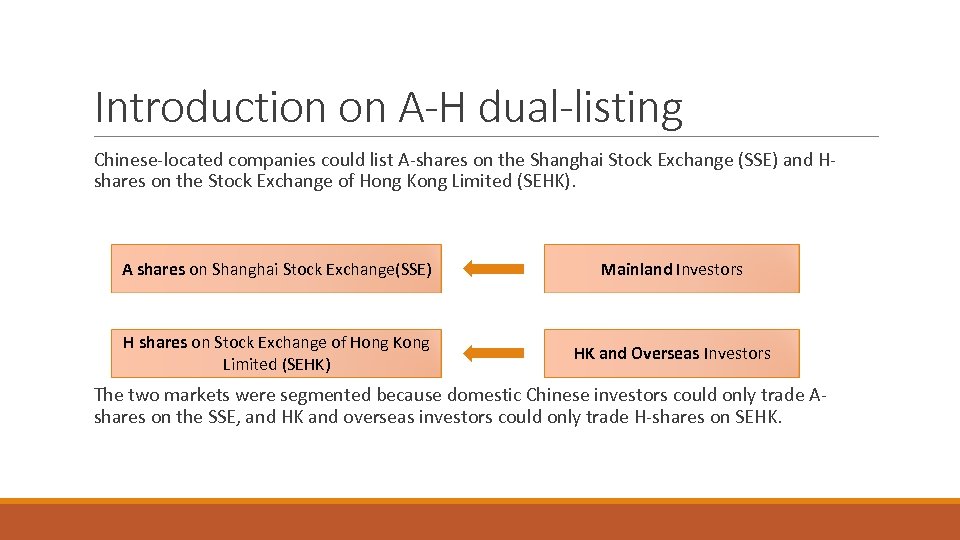

Introduction on A-H dual-listing Chinese-located companies could list A-shares on the Shanghai Stock Exchange (SSE) and Hshares on the Stock Exchange of Hong Kong Limited (SEHK). A shares on Shanghai Stock Exchange(SSE) Mainland Investors H shares on Stock Exchange of Hong Kong Limited (SEHK) HK and Overseas Investors The two markets were segmented because domestic Chinese investors could only trade Ashares on the SSE, and HK and overseas investors could only trade H-shares on SEHK.

Introduction on A-H dual-listing Chinese-located companies could list A-shares on the Shanghai Stock Exchange (SSE) and Hshares on the Stock Exchange of Hong Kong Limited (SEHK). A shares on Shanghai Stock Exchange(SSE) Mainland Investors H shares on Stock Exchange of Hong Kong Limited (SEHK) HK and Overseas Investors The two markets were segmented because domestic Chinese investors could only trade Ashares on the SSE, and HK and overseas investors could only trade H-shares on SEHK.

Introduction on A-H premium §A-H shares should have the same price but the price discrepancy between them is one of the most intriguing puzzles caused by different market regulations and investor group. A shares on Shanghai Stock Exchange(SSE) Higher Price H shares on Stock Exchange of Hong Kong Limited (SEHK) Lower Price Mainland: More regulated market With Mostly Optimistic Individual Investors HK: Less regulated market With Mostly Institution investors of better information access and process ability

Introduction on A-H premium §A-H shares should have the same price but the price discrepancy between them is one of the most intriguing puzzles caused by different market regulations and investor group. A shares on Shanghai Stock Exchange(SSE) Higher Price H shares on Stock Exchange of Hong Kong Limited (SEHK) Lower Price Mainland: More regulated market With Mostly Optimistic Individual Investors HK: Less regulated market With Mostly Institution investors of better information access and process ability

Introduction on the Stock Connect §On 17 November 2014, the Chinese government launched the Shanghai. Hong Kong Stock Connect. §Through the Connect, all Hong Kong and overseas investors are allowed to trade certain A-shares while mainland investors were able to trade ceitain H-Shares, connecting the Chinese market to the outside world.

Introduction on the Stock Connect §On 17 November 2014, the Chinese government launched the Shanghai. Hong Kong Stock Connect. §Through the Connect, all Hong Kong and overseas investors are allowed to trade certain A-shares while mainland investors were able to trade ceitain H-Shares, connecting the Chinese market to the outside world.

Literature Review 1 §Prior literature show that in the presence of tight trading restrictions and capital controls in mainland China, A share prices contain speculative bubbles, which leads to steeper demand curves and larger price-to-demand shock sensitivity than that of H shares traded on SEHK. ◦ Hong, Scheinkman and Xiong (2006) ◦ Mei, Scheinkman, and Xiong (2009) ◦ Xiong and Yu (2011) ◦ Liu, Wang and Wei (2016)

Literature Review 1 §Prior literature show that in the presence of tight trading restrictions and capital controls in mainland China, A share prices contain speculative bubbles, which leads to steeper demand curves and larger price-to-demand shock sensitivity than that of H shares traded on SEHK. ◦ Hong, Scheinkman and Xiong (2006) ◦ Mei, Scheinkman, and Xiong (2009) ◦ Xiong and Yu (2011) ◦ Liu, Wang and Wei (2016)

Hypothesis 1 §Speculative Demand Hypothesis: The launch of the Connect program increases speculative demand shocks in mainland China, resulting in higher prices, trading turnover, volatility and liquidity for A shares listed on SSE relative to their ‘twin’ H shares listed on SEHK. A share Price, Turnover, Volatility, and Liquidity H share Price, Turnover, Volatility, and Liquidity

Hypothesis 1 §Speculative Demand Hypothesis: The launch of the Connect program increases speculative demand shocks in mainland China, resulting in higher prices, trading turnover, volatility and liquidity for A shares listed on SSE relative to their ‘twin’ H shares listed on SEHK. A share Price, Turnover, Volatility, and Liquidity H share Price, Turnover, Volatility, and Liquidity

Literature Review 2 §Past studies also indicate that the price gaps between A and H shares are mainly due to different investor type, information asymmetry and limits of arbitrage. After the market integration, there should be a price convergence. ◦ ◦ ◦ Peng (2014) Shan, Paul and Ralf(2014) Chakravarty et al. (1998) Fernald and Rogers (2002) Chung, Hui and Li (2013)

Literature Review 2 §Past studies also indicate that the price gaps between A and H shares are mainly due to different investor type, information asymmetry and limits of arbitrage. After the market integration, there should be a price convergence. ◦ ◦ ◦ Peng (2014) Shan, Paul and Ralf(2014) Chakravarty et al. (1998) Fernald and Rogers (2002) Chung, Hui and Li (2013)

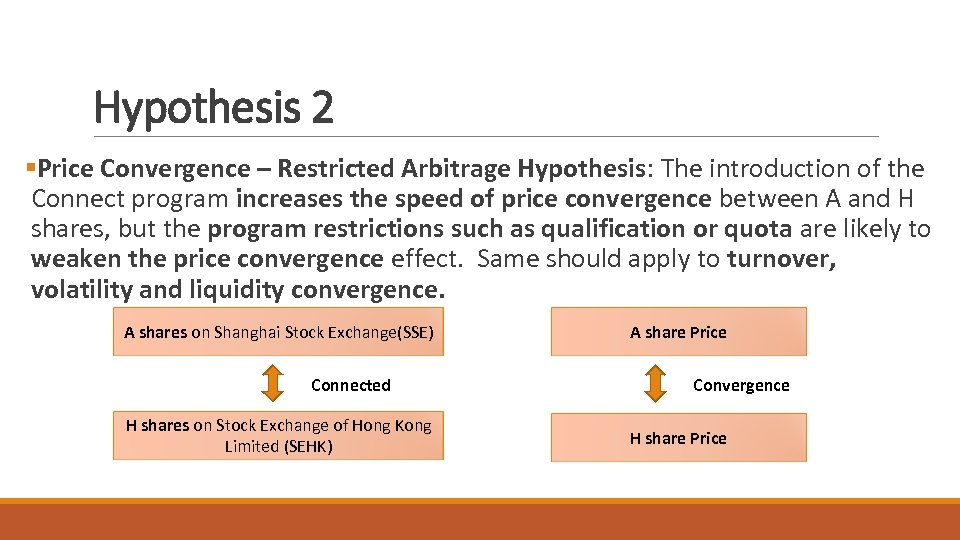

Hypothesis 2 §Price Convergence – Restricted Arbitrage Hypothesis: The introduction of the Connect program increases the speed of price convergence between A and H shares, but the program restrictions such as qualification or quota are likely to weaken the price convergence effect. Same should apply to turnover, volatility and liquidity convergence. A shares on Shanghai Stock Exchange(SSE) Connected H shares on Stock Exchange of Hong Kong Limited (SEHK) A share Price Convergence H share Price

Hypothesis 2 §Price Convergence – Restricted Arbitrage Hypothesis: The introduction of the Connect program increases the speed of price convergence between A and H shares, but the program restrictions such as qualification or quota are likely to weaken the price convergence effect. Same should apply to turnover, volatility and liquidity convergence. A shares on Shanghai Stock Exchange(SSE) Connected H shares on Stock Exchange of Hong Kong Limited (SEHK) A share Price Convergence H share Price

Literature Review 3 §The positive impact of the inter-listing, dual-listing or market integration on the price discovery process of the stock markets has been examined in many existing papers. Also, Price increase is accompanied by higher turnover, volatility and higher liquidity, which are both related to speculative trading. ◦ ◦ ◦ Foerster (1993) Noronha et al. (1996) Domowitz et al. (1997) Hargis (1997) and Sofianos(1997) Hegde, Lin and Varshney(2010)

Literature Review 3 §The positive impact of the inter-listing, dual-listing or market integration on the price discovery process of the stock markets has been examined in many existing papers. Also, Price increase is accompanied by higher turnover, volatility and higher liquidity, which are both related to speculative trading. ◦ ◦ ◦ Foerster (1993) Noronha et al. (1996) Domowitz et al. (1997) Hargis (1997) and Sofianos(1997) Hegde, Lin and Varshney(2010)

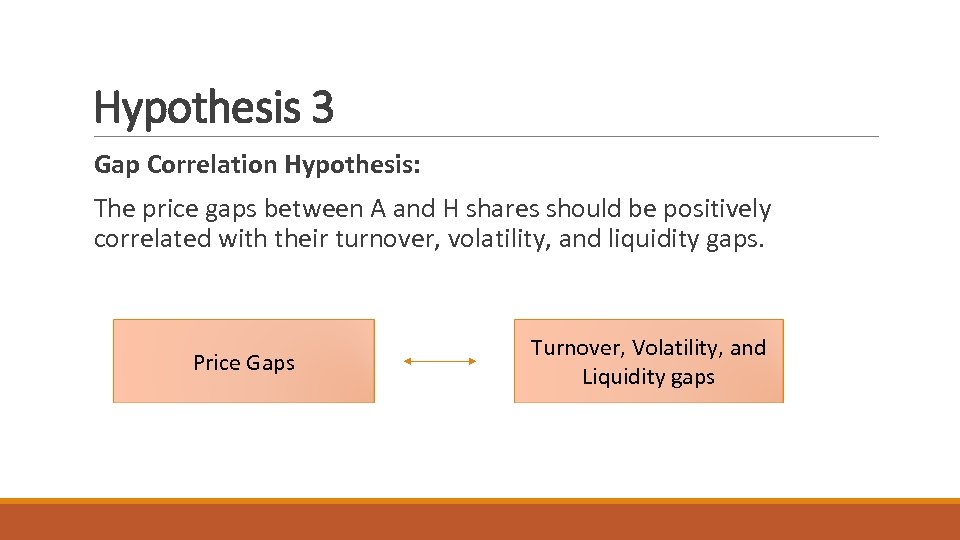

Hypothesis 3 Gap Correlation Hypothesis: The price gaps between A and H shares should be positively correlated with their turnover, volatility, and liquidity gaps. Price Gaps Turnover, Volatility, and Liquidity gaps

Hypothesis 3 Gap Correlation Hypothesis: The price gaps between A and H shares should be positively correlated with their turnover, volatility, and liquidity gaps. Price Gaps Turnover, Volatility, and Liquidity gaps

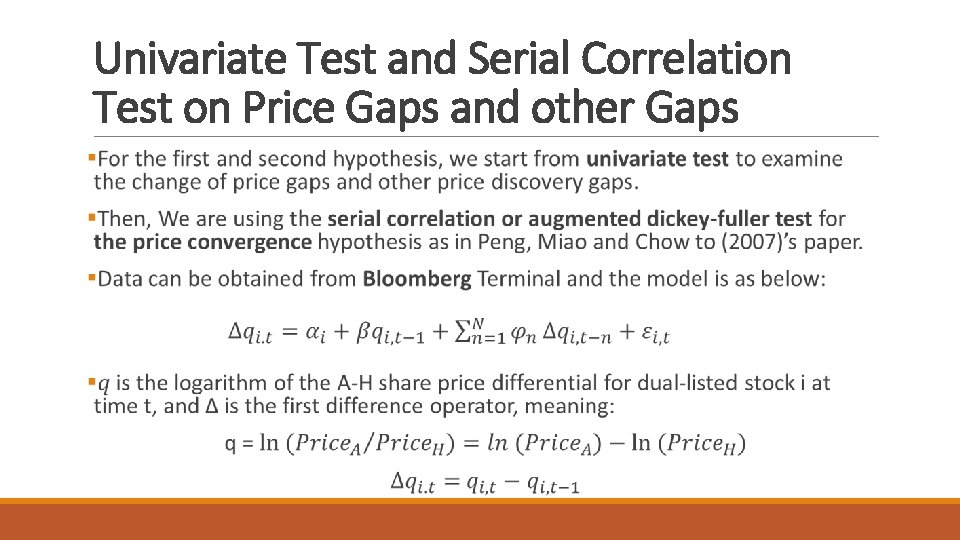

Univariate Test and Serial Correlation Test on Price Gaps and other Gaps

Univariate Test and Serial Correlation Test on Price Gaps and other Gaps

Methodology - Serial Correlation Test §Central to the test is the estimated value of β. ◦ If β ≥ 0, the price gap is non-stationary, implying price divergence. ◦ If β <0, it suggests stationarity or price convergence, and its magnitude indicates the speed of convergence

Methodology - Serial Correlation Test §Central to the test is the estimated value of β. ◦ If β ≥ 0, the price gap is non-stationary, implying price divergence. ◦ If β <0, it suggests stationarity or price convergence, and its magnitude indicates the speed of convergence

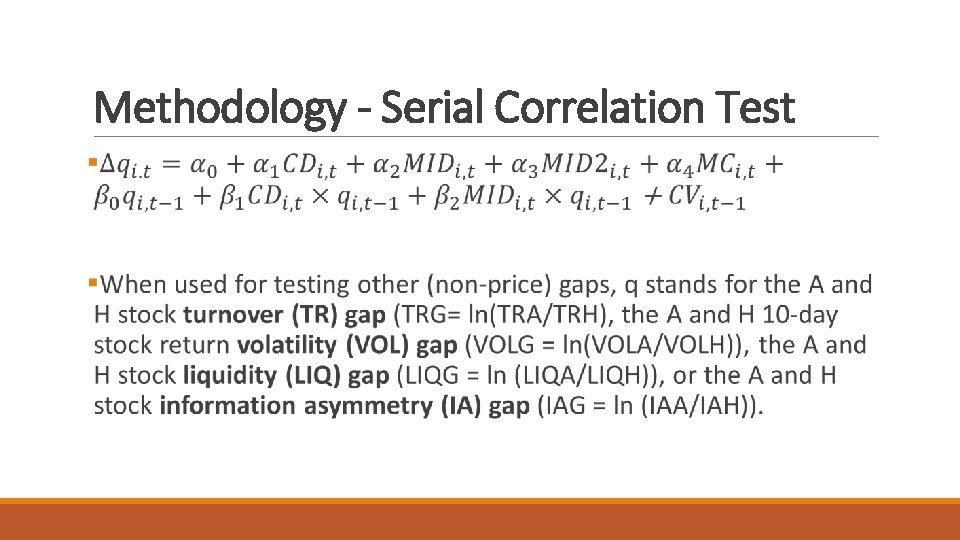

Methodology - Serial Correlation Test

Methodology - Serial Correlation Test

Methodology - Serial Correlation Test

Methodology - Serial Correlation Test

Univariate Test Results on the Price Gaps Panel B: Univariate Test Results on the Prices and Price Gaps of 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Mean Median STD. Difference of post- and pre-Connect A Share Prices “ln(post-Pa/pre-Pa)” . 34 Difference of post- and pre-Connect H Share -Connect Price Gaps Prices “ln(post-q/pre-q)” “ln(post-Ph/pre-Ph)” . 31 1. 30 A shares increased by 58% while H share only increased by 25%, leading to a 75% increase in price gap. All of the results above support H 1 that the demand shocks after the Connect lead to a larger increase in price in SSE.

Univariate Test Results on the Price Gaps Panel B: Univariate Test Results on the Prices and Price Gaps of 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Mean Median STD. Difference of post- and pre-Connect A Share Prices “ln(post-Pa/pre-Pa)” . 34 Difference of post- and pre-Connect H Share -Connect Price Gaps Prices “ln(post-q/pre-q)” “ln(post-Ph/pre-Ph)” . 31 1. 30 A shares increased by 58% while H share only increased by 25%, leading to a 75% increase in price gap. All of the results above support H 1 that the demand shocks after the Connect lead to a larger increase in price in SSE.

Univariate Test Results on Turnover Gap Panel B: Univariate Test Results on the Turnover of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Mean Median STD. Difference of post- and pre -Connect A Share Turnover “ln (post-TRA /pre- TRA)” . 70 Difference of post- and prepre-Connect H Share Connect Turnover Gaps “ln Turnover “ln (post-TRH (post-TRG /pre- TRG)” /pre- TRH)” . 51 1. 13 Turnover measure in the two markets both increased after the Connect but the increase is higher in Shanghai market, leading to a larger turnover gap after the Connect program

Univariate Test Results on Turnover Gap Panel B: Univariate Test Results on the Turnover of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Mean Median STD. Difference of post- and pre -Connect A Share Turnover “ln (post-TRA /pre- TRA)” . 70 Difference of post- and prepre-Connect H Share Connect Turnover Gaps “ln Turnover “ln (post-TRH (post-TRG /pre- TRG)” /pre- TRH)” . 51 1. 13 Turnover measure in the two markets both increased after the Connect but the increase is higher in Shanghai market, leading to a larger turnover gap after the Connect program

Univariate Test Results on Volatility Gap Panel B: Univariate Test Results on the Volatility of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Difference of post- and pre- Difference of post- and pre. Connect A Share Volatility pre-Connect H Share Connect Volatility Gaps “ln (post-VOLA /pre- Volatility “ln (post-VOLH (post-VOLG /pre- VOLG)” VOLA)” /pre- VOLH)” Mean Median STD. . 24 . 18 1. 26 Volatility measure increases after the Connect for both markets and there is a larger increase in the Shanghai market. A bigger volatility gap is found after the Connect, meaning that Shanghai market is even more volatile than HK market than ever before.

Univariate Test Results on Volatility Gap Panel B: Univariate Test Results on the Volatility of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Difference of post- and pre- Difference of post- and pre. Connect A Share Volatility pre-Connect H Share Connect Volatility Gaps “ln (post-VOLA /pre- Volatility “ln (post-VOLH (post-VOLG /pre- VOLG)” VOLA)” /pre- VOLH)” Mean Median STD. . 24 . 18 1. 26 Volatility measure increases after the Connect for both markets and there is a larger increase in the Shanghai market. A bigger volatility gap is found after the Connect, meaning that Shanghai market is even more volatile than HK market than ever before.

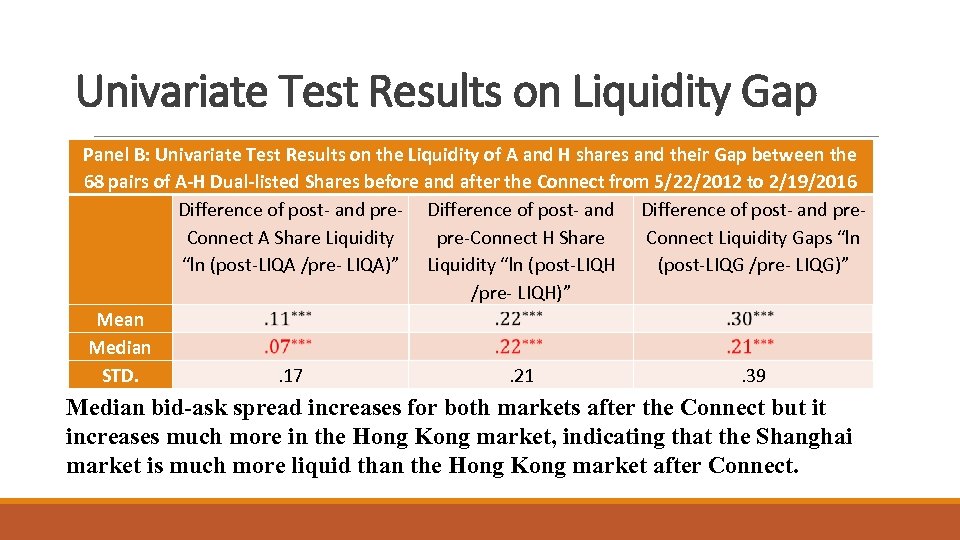

Univariate Test Results on Liquidity Gap Panel B: Univariate Test Results on the Liquidity of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Difference of post- and pre- Difference of post- and pre. Connect A Share Liquidity pre-Connect H Share Connect Liquidity Gaps “ln (post-LIQA /pre- LIQA)” Liquidity “ln (post-LIQH (post-LIQG /pre- LIQG)” /pre- LIQH)” Mean Median STD. . 17. 21. 39 Median bid-ask spread increases for both markets after the Connect but it increases much more in the Hong Kong market, indicating that the Shanghai market is much more liquid than the Hong Kong market after Connect.

Univariate Test Results on Liquidity Gap Panel B: Univariate Test Results on the Liquidity of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Difference of post- and pre- Difference of post- and pre. Connect A Share Liquidity pre-Connect H Share Connect Liquidity Gaps “ln (post-LIQA /pre- LIQA)” Liquidity “ln (post-LIQH (post-LIQG /pre- LIQG)” /pre- LIQH)” Mean Median STD. . 17. 21. 39 Median bid-ask spread increases for both markets after the Connect but it increases much more in the Hong Kong market, indicating that the Shanghai market is much more liquid than the Hong Kong market after Connect.

Univariate Test on the Information Asymmetry Gap Panel B: Univariate Test Results on the Information Asymmetry of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Difference of post- and pre-Connect A Share pre-Connect H Share Connect Information Asymmetry “ln Information Asymmetry Gaps “ln (post-IAA /pre- IAA)” “ln (post-IAH /pre- IAH)” IAG /pre- IAG)” Mean Median STD. . 62. 67. 92 After the Connect, information asymmetry decreases in both markets but it declines more in the Shanghai market. As a result, the gap increases after the Connect, and the Shanghai market seems to be more information efficient than the Hong Kong market. All of the above is consistent with H 1.

Univariate Test on the Information Asymmetry Gap Panel B: Univariate Test Results on the Information Asymmetry of A and H shares and their Gap between the 68 pairs of A-H Dual-listed Shares before and after the Connect from 5/22/2012 to 2/19/2016 Difference of post- and pre-Connect A Share pre-Connect H Share Connect Information Asymmetry “ln Information Asymmetry Gaps “ln (post-IAA /pre- IAA)” “ln (post-IAH /pre- IAH)” IAG /pre- IAG)” Mean Median STD. . 62. 67. 92 After the Connect, information asymmetry decreases in both markets but it declines more in the Shanghai market. As a result, the gap increases after the Connect, and the Shanghai market seems to be more information efficient than the Hong Kong market. All of the above is consistent with H 1.

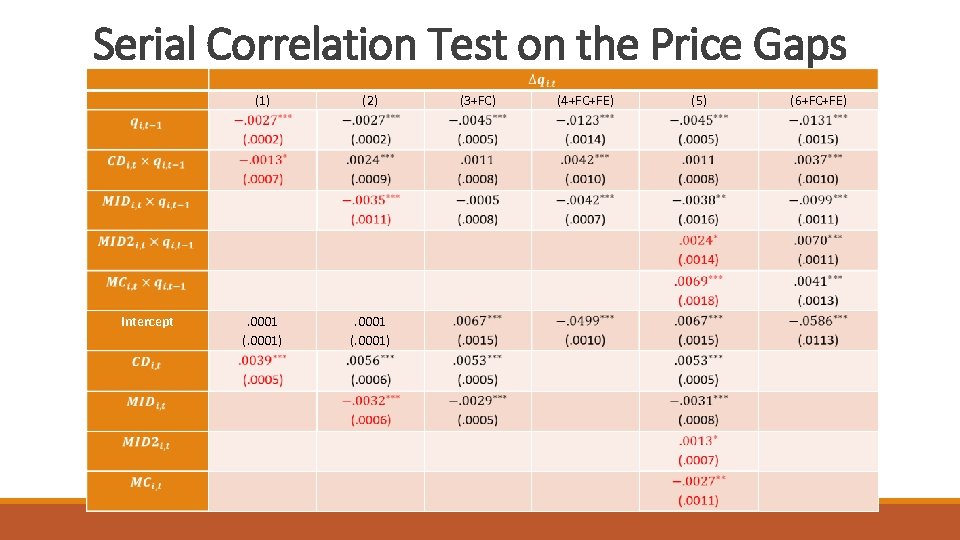

Serial Correlation Test on the Price Gaps (1) (2) (3+FC) (4+FC+FE) . 0001 (. 0001) (5) (6+FC+FE) . 0001 (. 0001) Intercept

Serial Correlation Test on the Price Gaps (1) (2) (3+FC) (4+FC+FE) . 0001 (. 0001) (5) (6+FC+FE) . 0001 (. 0001) Intercept

Serial Correlation Test on Turnover Gaps Panel A (TRG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

Serial Correlation Test on Turnover Gaps Panel A (TRG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

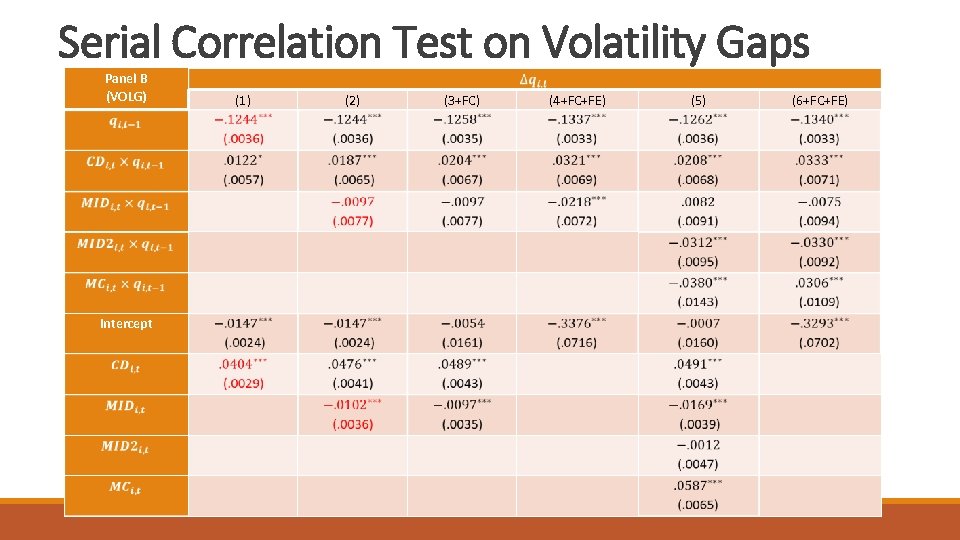

Serial Correlation Test on Volatility Gaps Panel B (VOLG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

Serial Correlation Test on Volatility Gaps Panel B (VOLG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

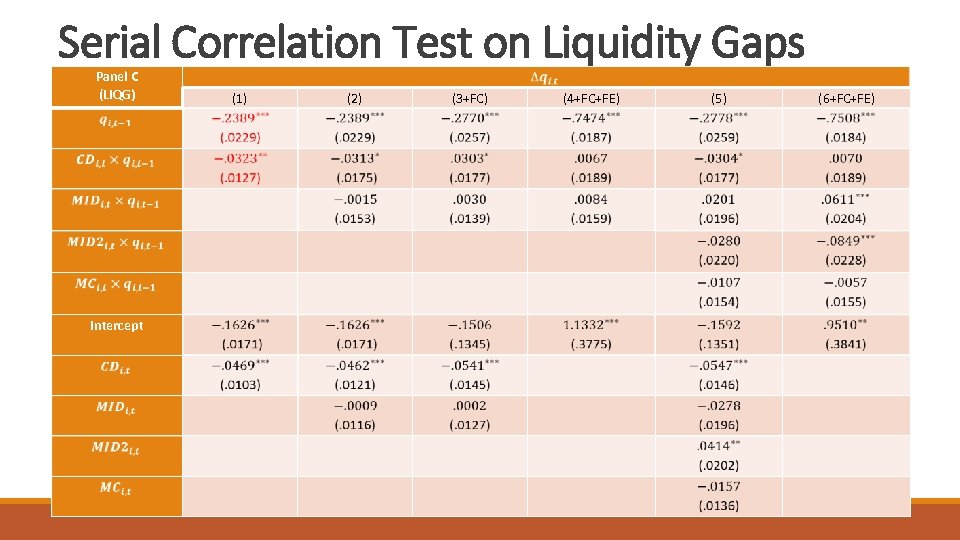

Serial Correlation Test on Liquidity Gaps Panel C (LIQG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

Serial Correlation Test on Liquidity Gaps Panel C (LIQG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

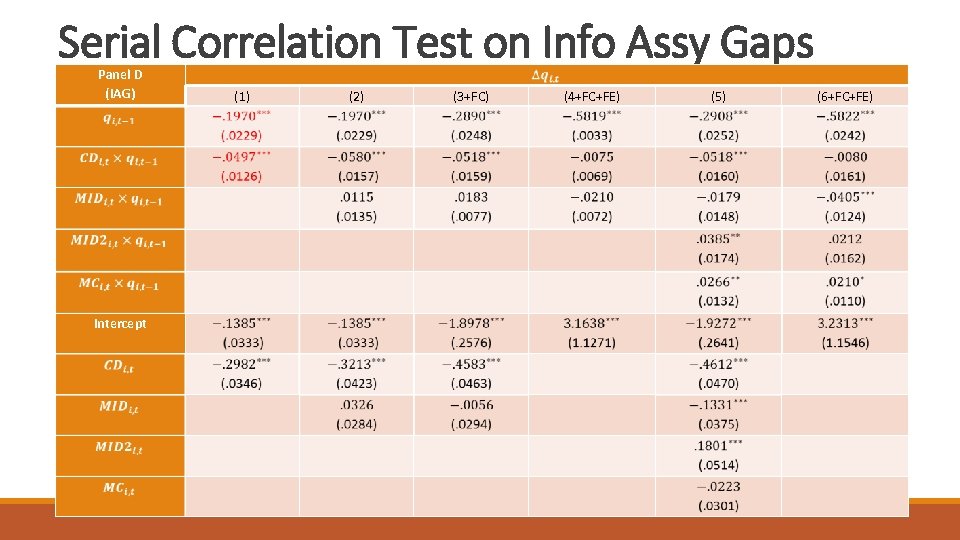

Serial Correlation Test on Info Assy Gaps Panel D (IAG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

Serial Correlation Test on Info Assy Gaps Panel D (IAG) (1) (2) (3+FC) (4+FC+FE) (5) (6+FC+FE) Intercept

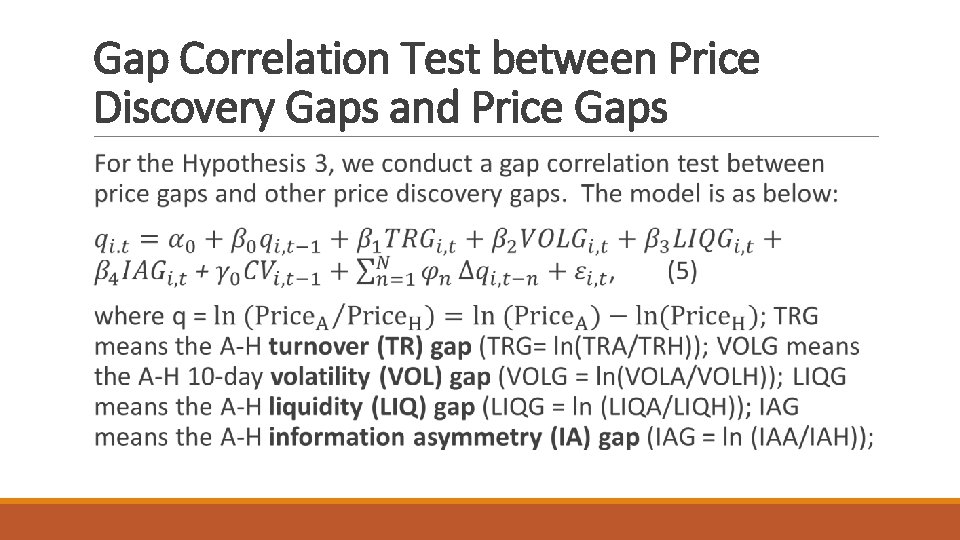

Gap Correlation Test between Price Discovery Gaps and Price Gaps

Gap Correlation Test between Price Discovery Gaps and Price Gaps

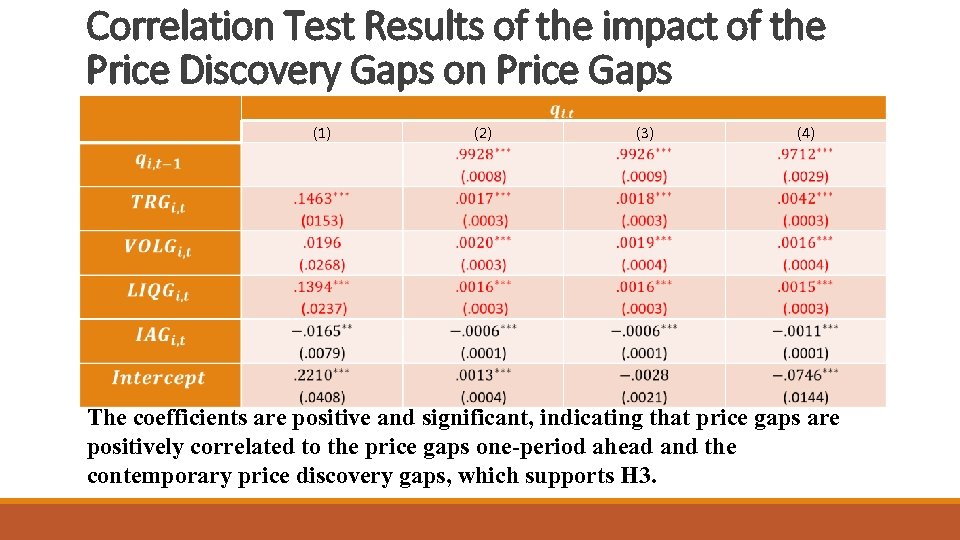

Correlation Test Results of the impact of the Price Discovery Gaps on Price Gaps (1) (2) (3) (4) The coefficients are positive and significant, indicating that price gaps are positively correlated to the price gaps one-period ahead and the contemporary price discovery gaps, which supports H 3.

Correlation Test Results of the impact of the Price Discovery Gaps on Price Gaps (1) (2) (3) (4) The coefficients are positive and significant, indicating that price gaps are positively correlated to the price gaps one-period ahead and the contemporary price discovery gaps, which supports H 3.

Thank you

Thank you