9413923a419eec8f5cff0a74284b8ed2.ppt

- Количество слайдов: 37

On the Liquidation of Government Debt under A Debt-Free Money System - Modeling the American Monetary Act. The 6 th Annual AMI Monetary Reform Conference At University Center in Downtown Chicago Sept. 30 – Oct. 3, 2010 Prof. Kaoru Yamaguchi, Ph. D. Doshisha Business School Doshisha University, Kyoto, Japan E-mail: kaoyamag@mail. doshisha. ac. jp

Background: SD Macroeconomic Modeling Series 2003 - 2008

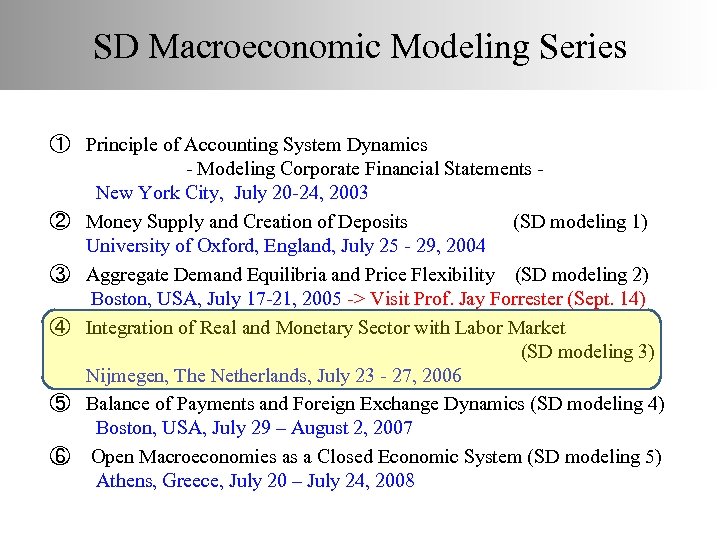

SD Macroeconomic Modeling Series ① Principle of Accounting System Dynamics - Modeling Corporate Financial Statements New York City, July 20 -24, 2003 ② Money Supply and Creation of Deposits (SD modeling 1) University of Oxford, England, July 25 - 29, 2004 ③ Aggregate Demand Equilibria and Price Flexibility (SD modeling 2) Boston, USA, July 17 -21, 2005 -> Visit Prof. Jay Forrester (Sept. 14) ④ Integration of Real and Monetary Sector with Labor Market (SD modeling 3) Nijmegen, The Netherlands, July 23 - 27, 2006 ⑤ Balance of Payments and Foreign Exchange Dynamics (SD modeling 4) Boston, USA, July 29 – August 2, 2007 ⑥ Open Macroeconomies as a Closed Economic System (SD modeling 5) Athens, Greece, July 20 – July 24, 2008

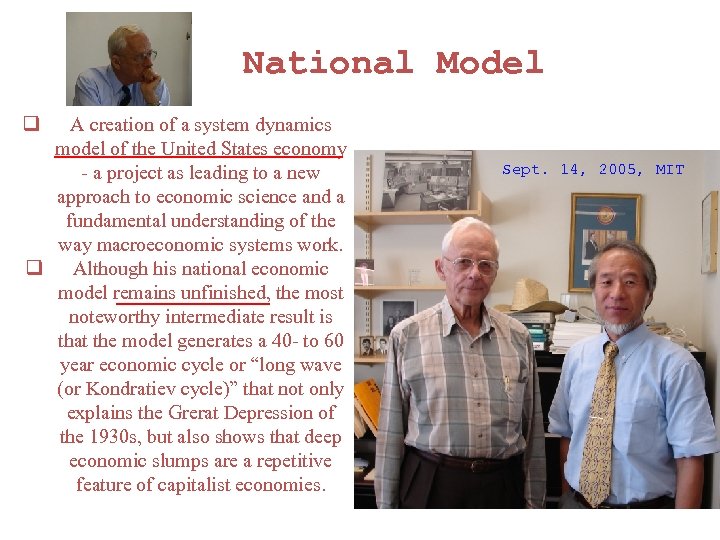

National Model q A creation of a system dynamics model of the United States economy - a project as leading to a new approach to economic science and a fundamental understanding of the way macroeconomic systems work. q Although his national economic model remains unfinished, the most noteworthy intermediate result is that the model generates a 40 - to 60 year economic cycle or “long wave (or Kondratiev cycle)” that not only explains the Grerat Depression of the 1930 s, but also shows that deep economic slumps are a repetitive feature of capitalist economies. Sept. 14, 2005, MIT

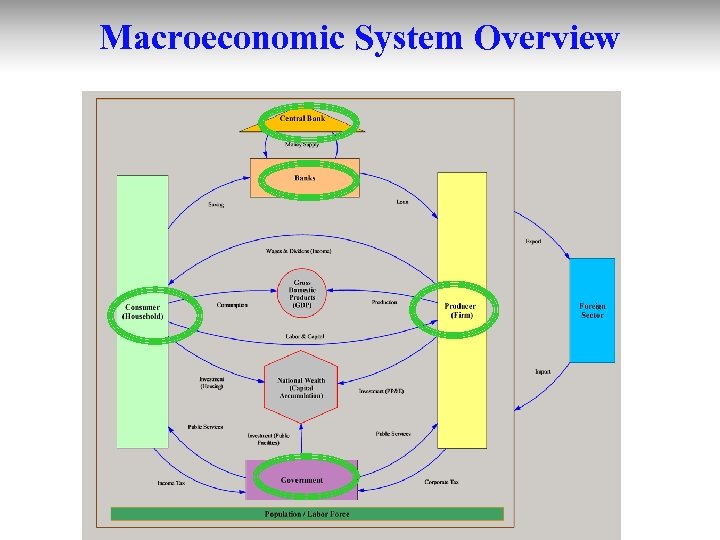

Macroeconomic System Overview

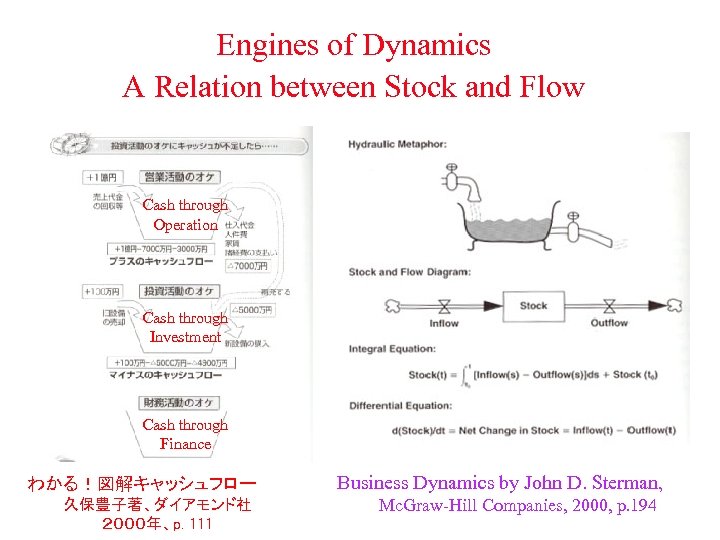

Engines of Dynamics A Relation between Stock and Flow Cash through Operation Cash through Investment Cash through Finance わかる!図解キャッシュフロー Business Dynamics by John D. Sterman, 久保豊子著、ダイアモンド社 2000年、p. 111 Mc. Graw-Hill Companies, 2000, p. 194

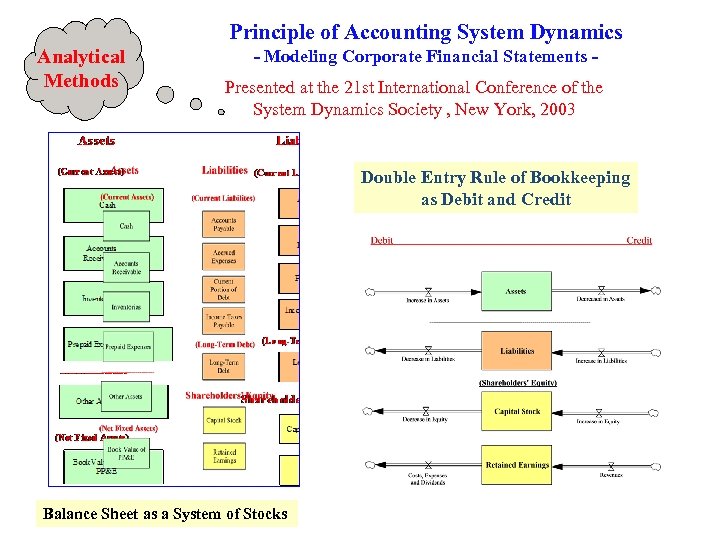

Principle of Accounting System Dynamics Analytical Methods - Modeling Corporate Financial Statements Presented at the 21 st International Conference of the System Dynamics Society , New York, 2003 Double Entry Rule of Bookkeeping as Debit and Credit Balance Sheet as a System of Stocks

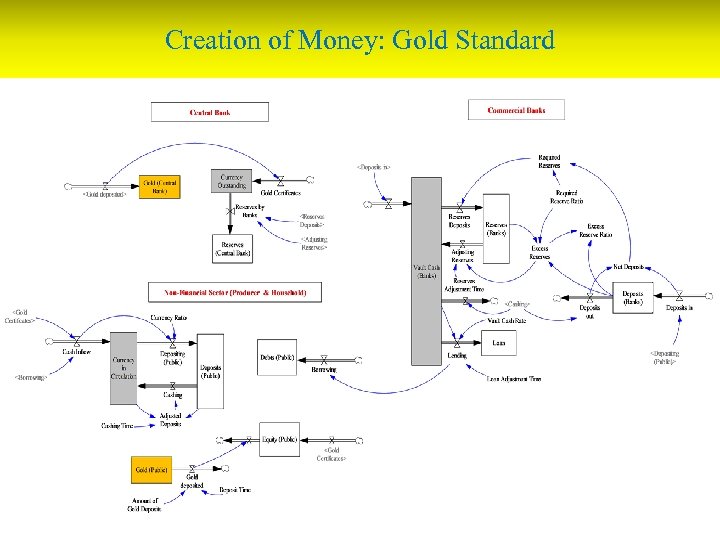

Creation of Money: Gold Standard

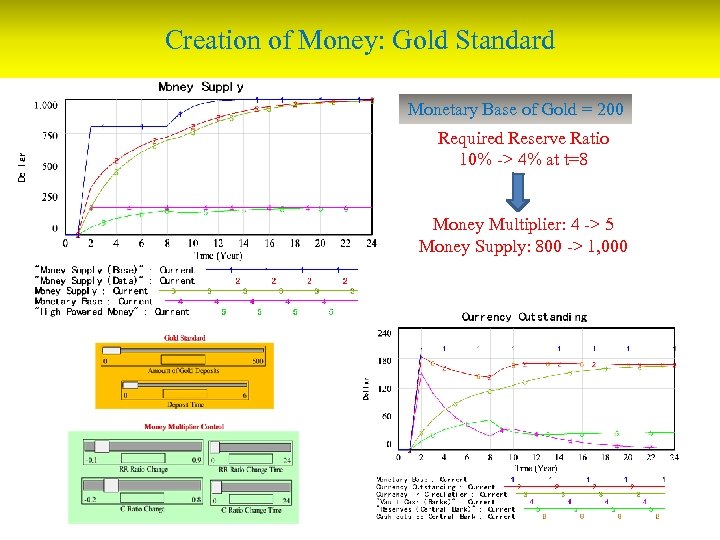

Creation of Money: Gold Standard Monetary Base of Gold = 200 Required Reserve Ratio 10% -> 4% at t=8 Money Multiplier: 4 -> 5 Money Supply: 800 -> 1, 000

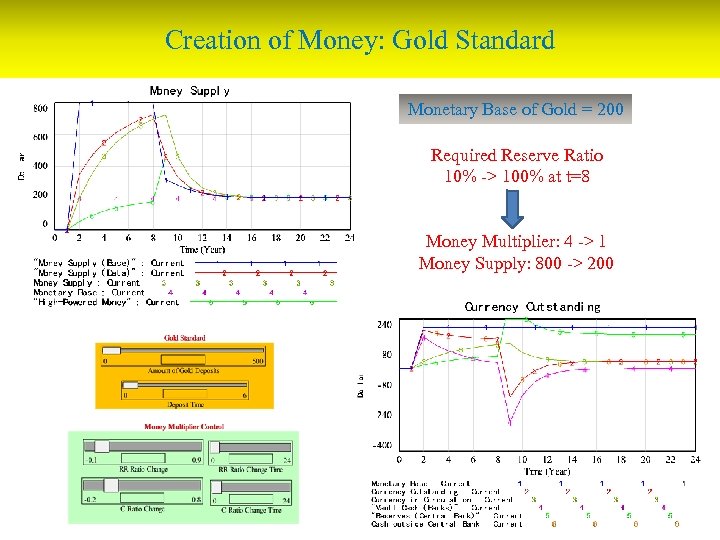

Creation of Money: Gold Standard Monetary Base of Gold = 200 Required Reserve Ratio 10% -> 100% at t=8 Money Multiplier: 4 -> 1 Money Supply: 800 -> 200

Macroeconomic System Design - American Monetary Act -

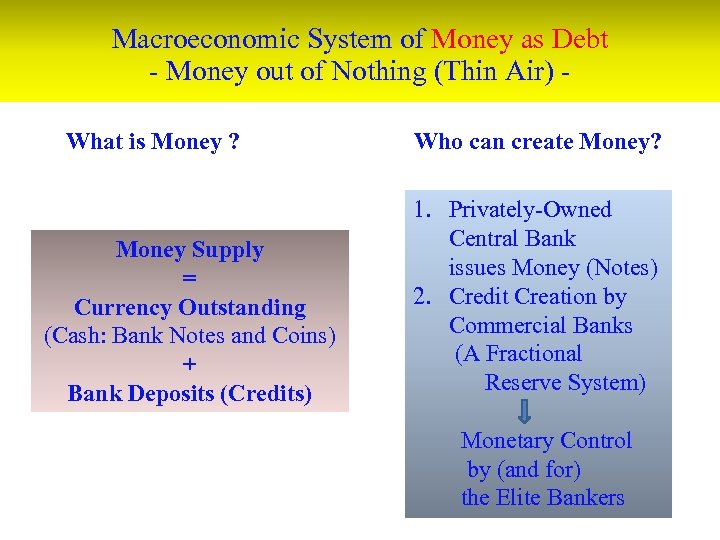

Macroeconomic System of Money as Debt - Money out of Nothing (Thin Air) What is Money ? Money Supply = Currency Outstanding (Cash: Bank Notes and Coins) + Bank Deposits (Credits) Who can create Money? 1. Privately-Owned Central Bank issues Money (Notes) 2. Credit Creation by Commercial Banks (A Fractional Reserve System) Monetary Control by (and for) the Elite Bankers

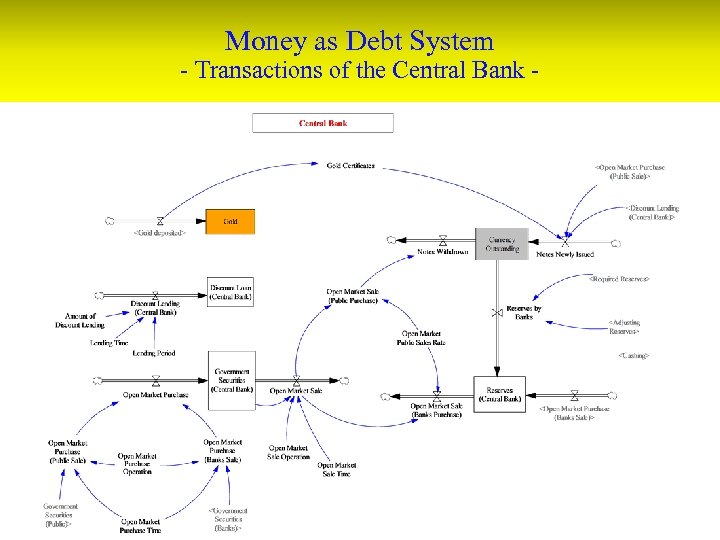

Money as Debt System - Transactions of the Central Bank -

Expert Ideas for Macroeconomic System Design 608 pages, 4 th ed. 2002 724 pages, 2002

A New Macroeconomic System Design Money as Debt System - Money out of Nothing - A Debt-Free Money System - the American Monetary Act - 1. Privately-Owned Central Bank issues Money (Notes) 1. Government Issues Money (Nationalization of the Central Bank) 2. Credit Creation by Commercial Banks (A Fractional Reserve System) 2. 100% Fractional Reserve( Abolishment of the Credit Creation) 3. Monetary Growth for the Economic Growth and Public Welfare 3. Monetary Control by (and for) the Elite Bankers

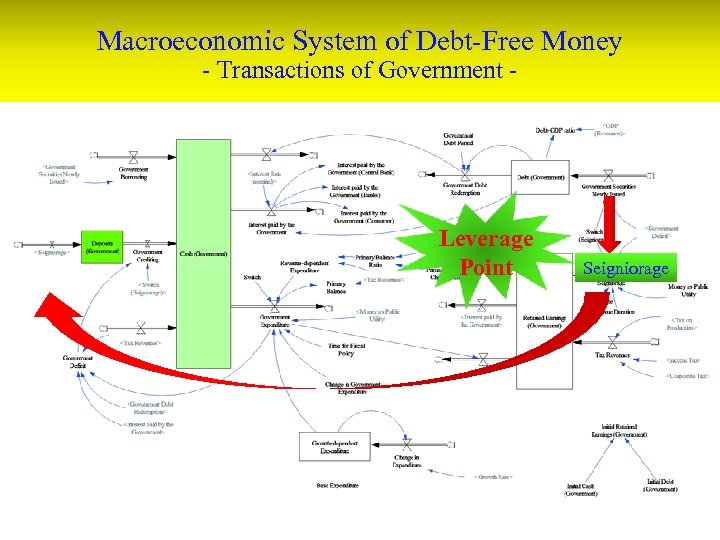

Macroeconomic System of Debt-Free Money - Transactions of Government - Leverage Point Seigniorage

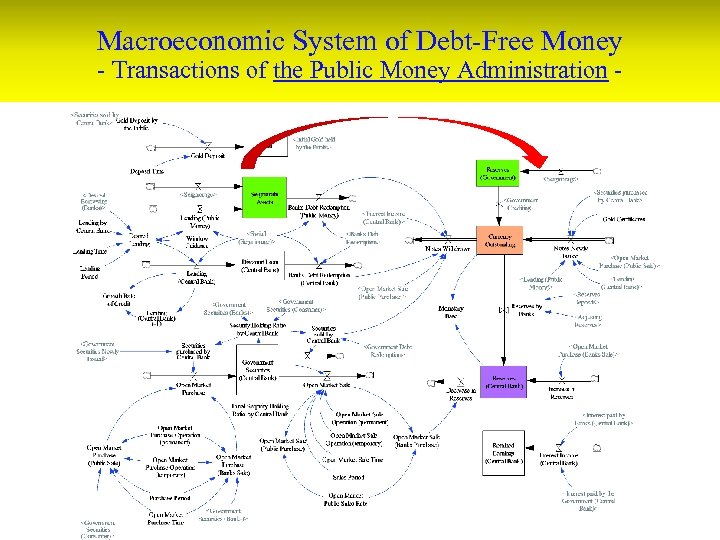

Macroeconomic System of Debt-Free Money - Transactions of the Public Money Administration -

The Issue We are Facing • Repeated Financial Crises (in September 2008) • Government has no money! Why can’t they borrow or tax? • Run-away Debt Crises (in Japan, USA, Greece, etc. )

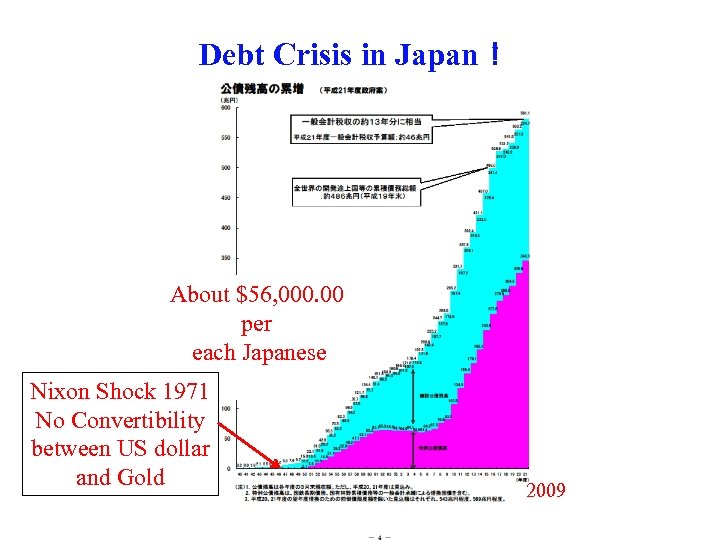

Debt Crisis in Japan! About $56, 000. 00 per each Japanese Nixon Shock 1971 No Convertibility between US dollar and Gold 2009

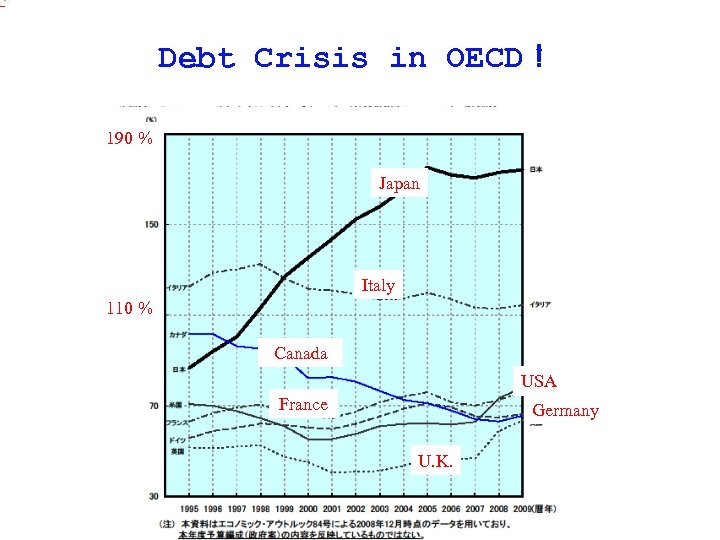

of annual gross domestic product. Debt Crisis in OECD! 190 % Japan Italy 110 % Canada USA France Germany U. K.

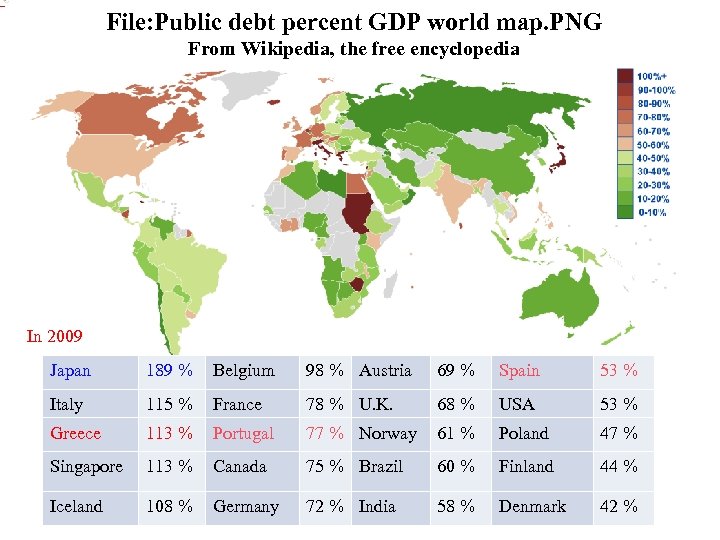

File: Public debt percent GDP world map. PNG From Wikipedia, the free encyclopedia In 2009 Japan 189 % Belgium 98 % Austria 69 % Spain 53 % Italy 115 % France 78 % U. K. 68 % USA 53 % Greece 113 % Portugal 77 % Norway 61 % Poland 47 % Singapore 113 % Canada 75 % Brazil 60 % Finland 44 % Iceland 108 % Germany 72 % India 58 % Denmark 42 %

Solutions under the current Macroeconomic System of Money as Debt

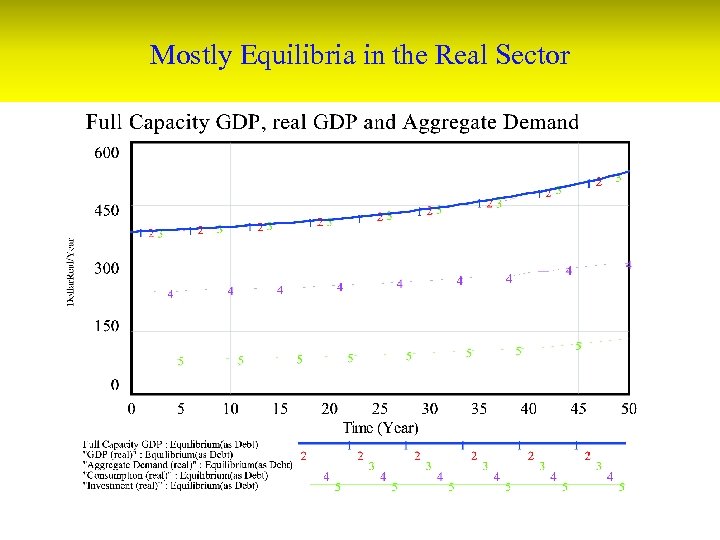

Mostly Equilibria in the Real Sector

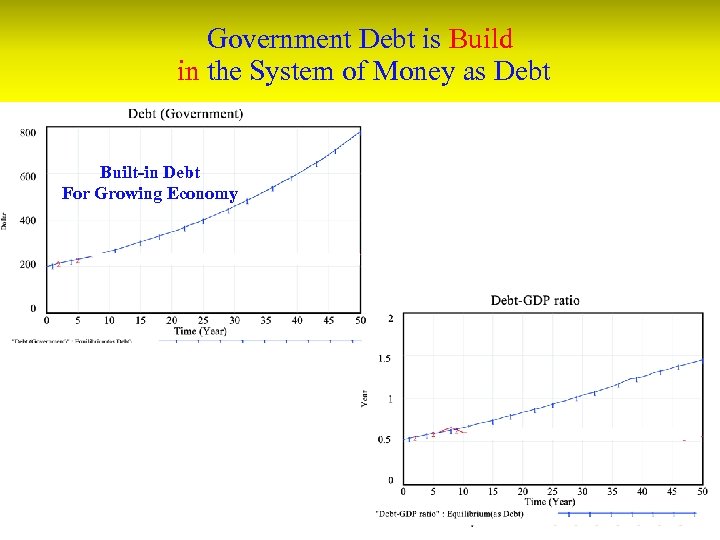

Government Debt is Build in the System of Money as Debt Built-in Debt For Growing Economy

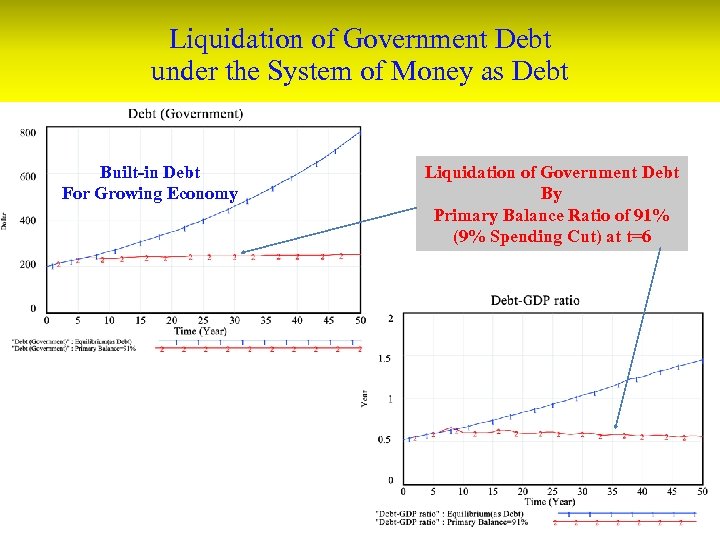

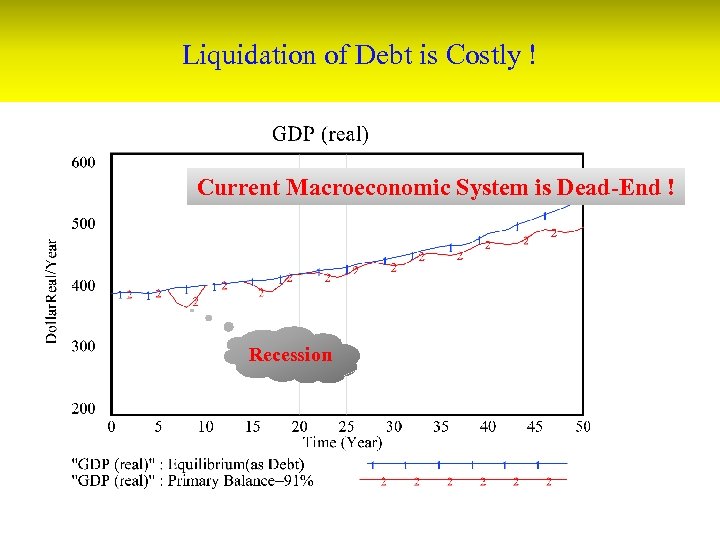

Liquidation of Government Debt under the System of Money as Debt Built-in Debt For Growing Economy Liquidation of Government Debt By Primary Balance Ratio of 91% (9% Spending Cut) at t=6

Liquidation of Debt is Costly ! Current Macroeconomic System is Dead-End ! Recession

Solutions under the Macroeconomic System of Debt-free Money

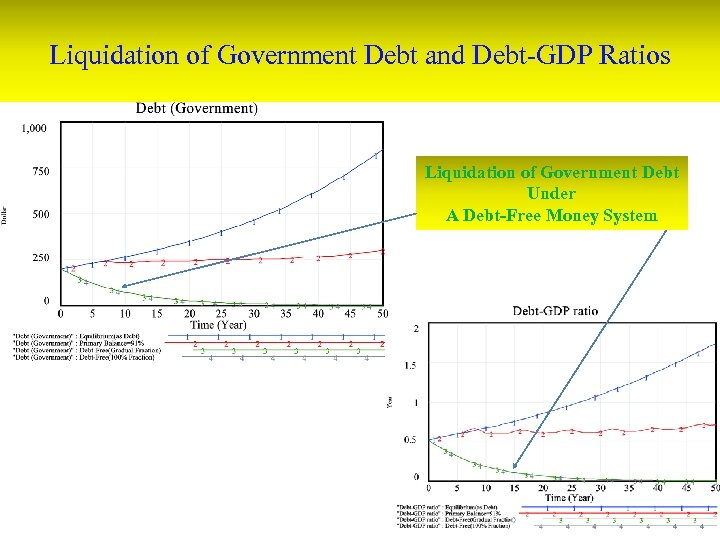

Liquidation of Government Debt and Debt-GDP Ratios Liquidation of Government Debt Under A Debt-Free Money System

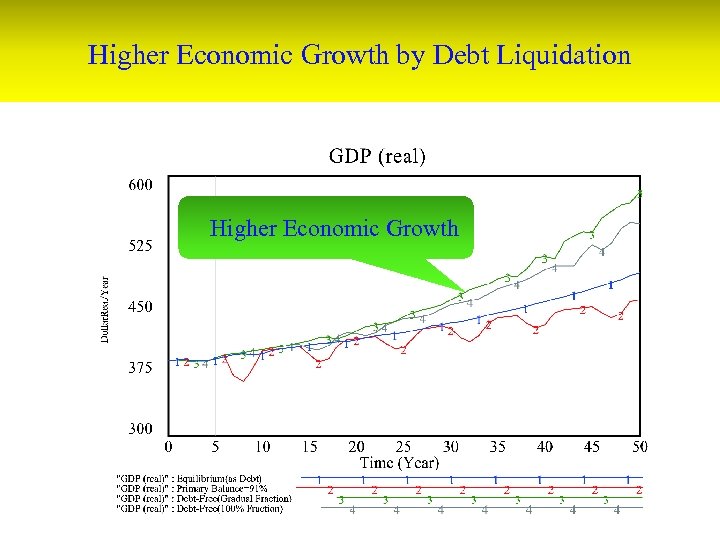

Higher Economic Growth by Debt Liquidation Higher Economic Growth

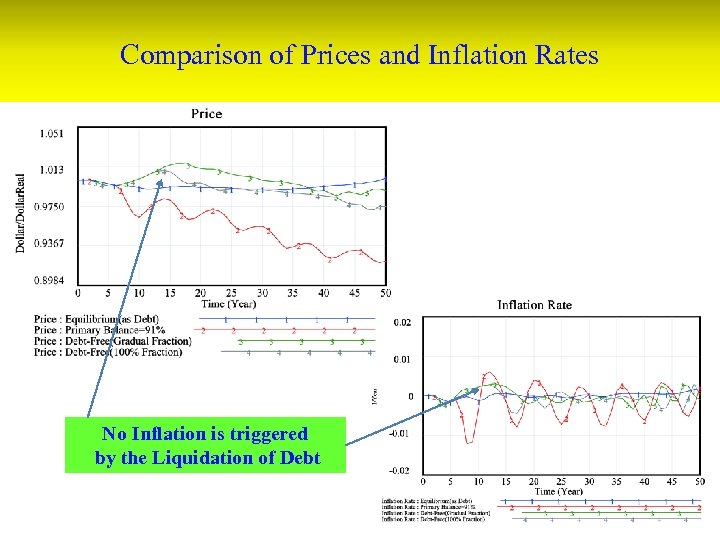

Comparison of Prices and Inflation Rates No Inflation is triggered by the Liquidation of Debt

Criticism of Debt-Free Money System: Inflation !!! Can we trust the Government ? No: Political business cycle proves it. Then Can we trust privately-owned Central Bank ? No: History of economic crises proves it. So, what can be trusted? Gov’t Policies based on SD models

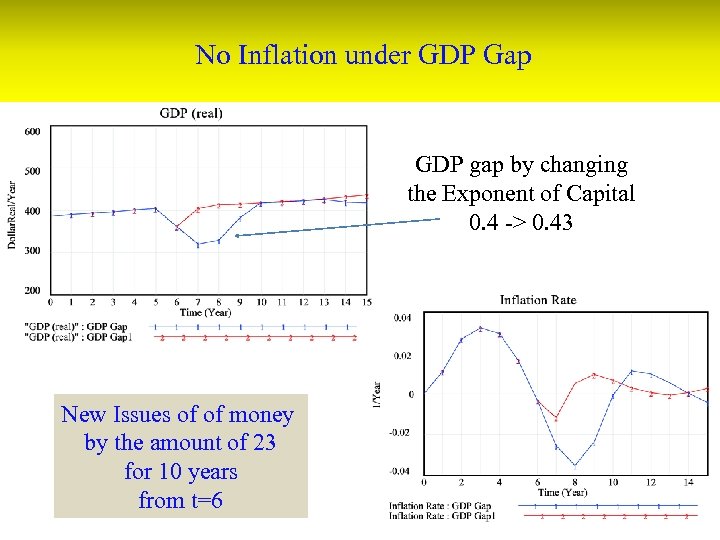

No Inflation under GDP Gap GDP gap by changing the Exponent of Capital 0. 4 -> 0. 43 New Issues of of money by the amount of 23 for 10 years from t=6

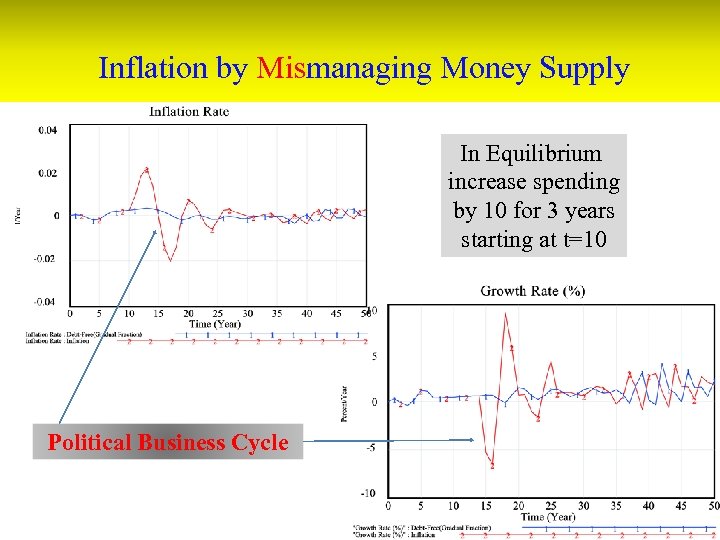

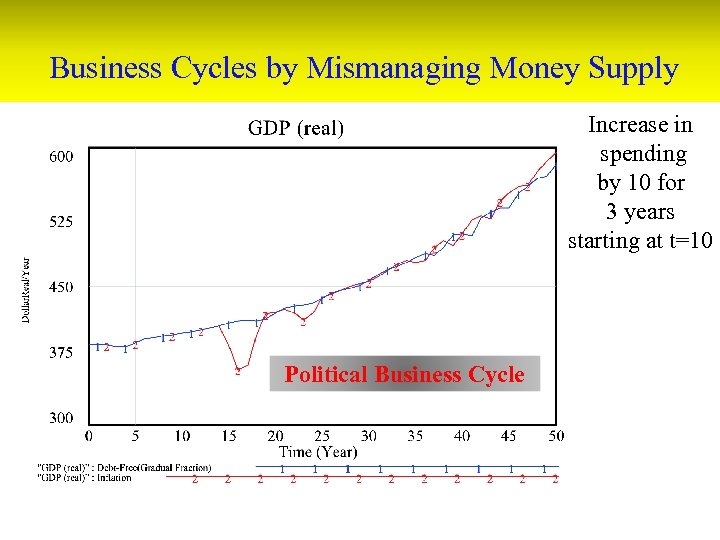

Inflation by Mismanaging Money Supply In Equilibrium increase spending by 10 for 3 years starting at t=10 Political Business Cycle

Business Cycles by Mismanaging Money Supply Increase in spending by 10 for 3 years starting at t=10 Political Business Cycle

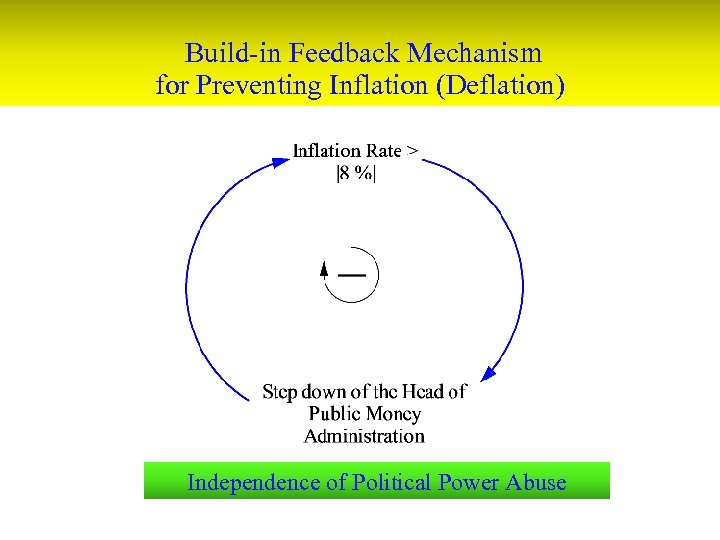

Build-in Feedback Mechanism for Preventing Inflation (Deflation) Independence of Political Power Abuse

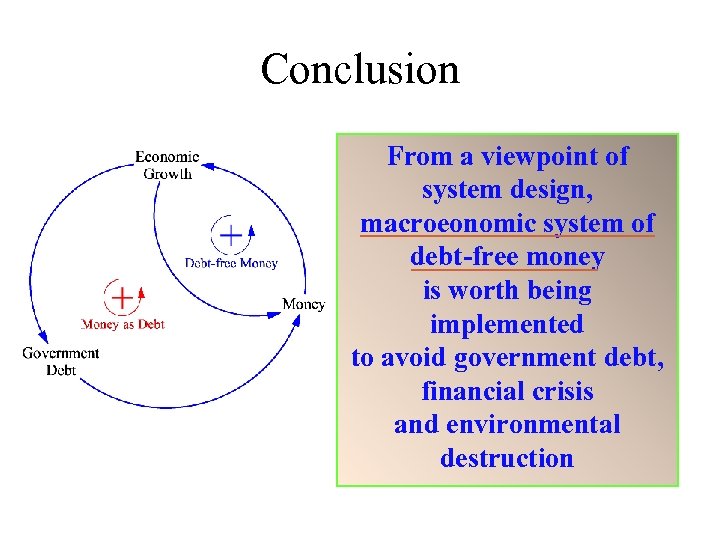

Conclusion From a viewpoint of system design, macroeonomic system of debt-free money is worth being implemented to avoid government debt, financial crisis and environmental destruction

Thank you for your attention ! Macroeconomic Dynamics - Accounting System Dynamics Approach. On-going Draft (v. 2, 350 pages) and SD Simulation Models are available at Session A, 5 PM, Oct. 2.

9413923a419eec8f5cff0a74284b8ed2.ppt