ae474f3f5f634a9d8282b9447da36081.ppt

- Количество слайдов: 23

On Predictability and Profitability: Would AI induced Trading Rules be Sensitive to the Entropy of time Series Nicolas NAVET INRIA – France nnavet@loria. fr Shu-Heng. CHEN – AIECON/NCCU Taiwan chchen@nccu. edu. tw 09/04/2008

Outline

Estimating entropy

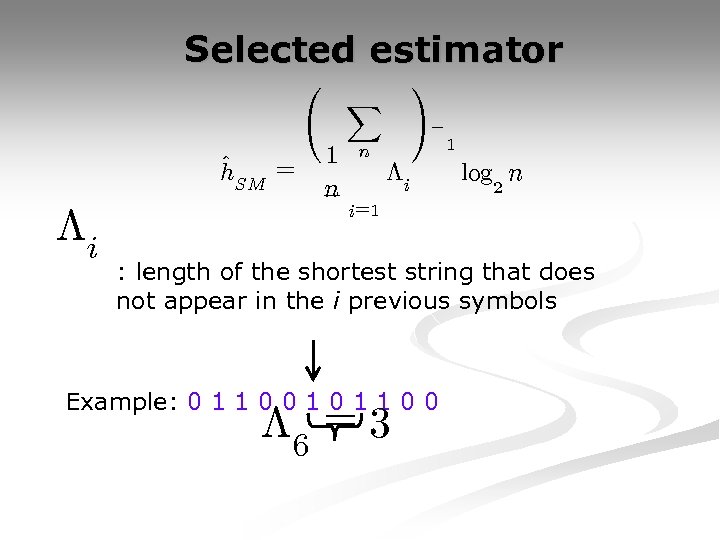

Selected estimator ^ h. SM = ¤i à 1 n X ! ¡ n ¤i 1 log n 2 i= 1 : length of the shortest string that does not appear in the i previous symbols Example: 0 1 1 0 0 ¤ 6 = 3

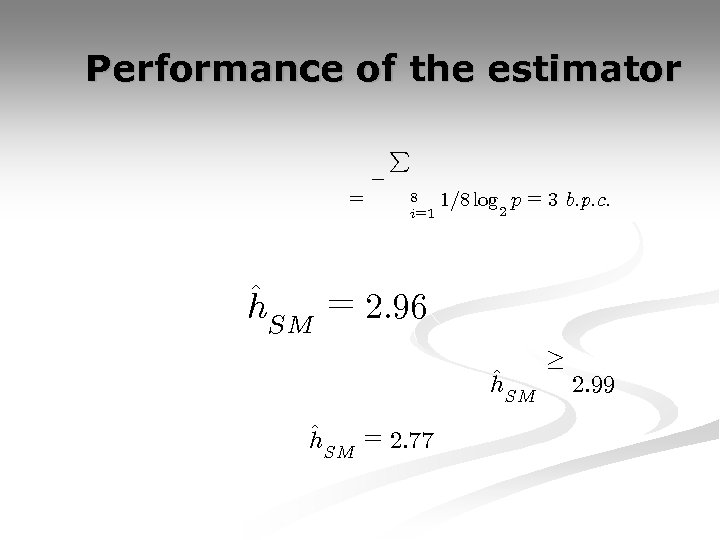

Performance of the estimator = ¡ P 8 i=1 1=8 log p = 3 b. p. c. 2 ^ h. SM = 2: 96 ^ h. SM = 2: 77 ¸ 2: 99

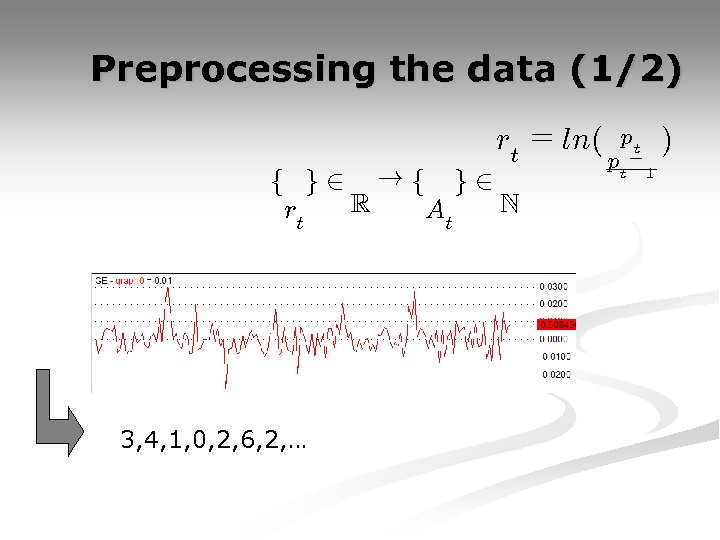

Preprocessing the data (1/2) rt = ln( f g 2 !f g 2 R N rt At 3, 4, 1, 0, 2, 6, 2, … ) pt pt ¡ 1

Preprocessing the data (2/2)

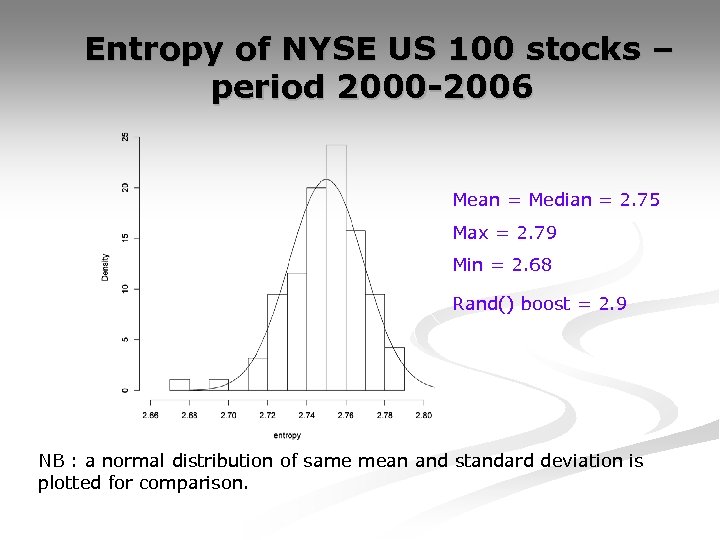

Entropy of NYSE US 100 stocks – period 2000 -2006 Mean = Median = 2. 75 Max = 2. 79 Min = 2. 68 Rand() boost = 2. 9 NB : a normal distribution of same mean and standard deviation is plotted for comparison.

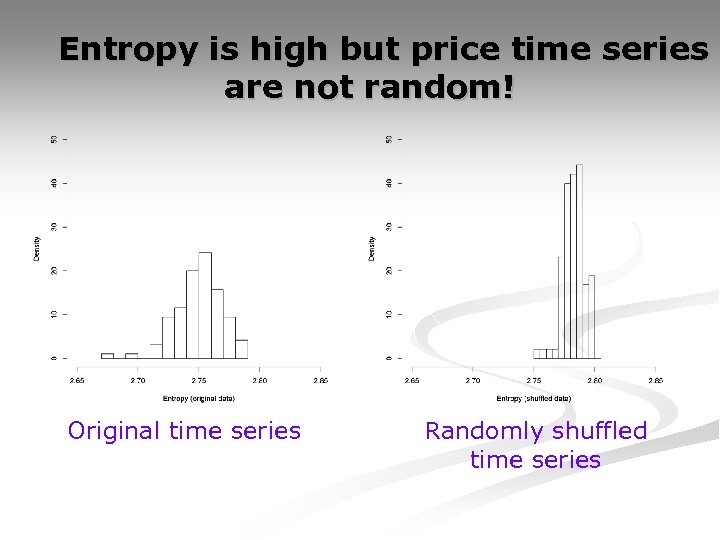

Entropy is high but price time series are not random! Original time series Randomly shuffled time series

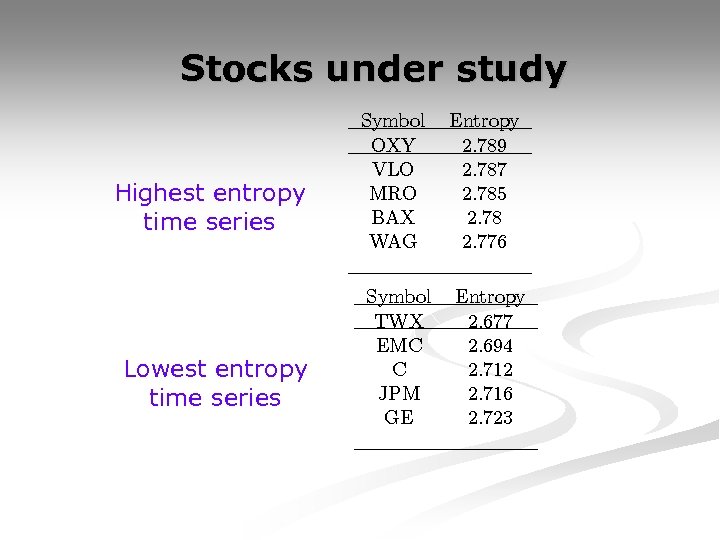

Stocks under study Highest entropy time series Lowest entropy time series Symbol OXY VLO MRO BAX WAG Entropy 2: 789 2: 787 2: 785 2: 78 2: 776 Symbol TWX EMC C JPM GE Entropy 2: 677 2: 694 2: 712 2: 716 2: 723

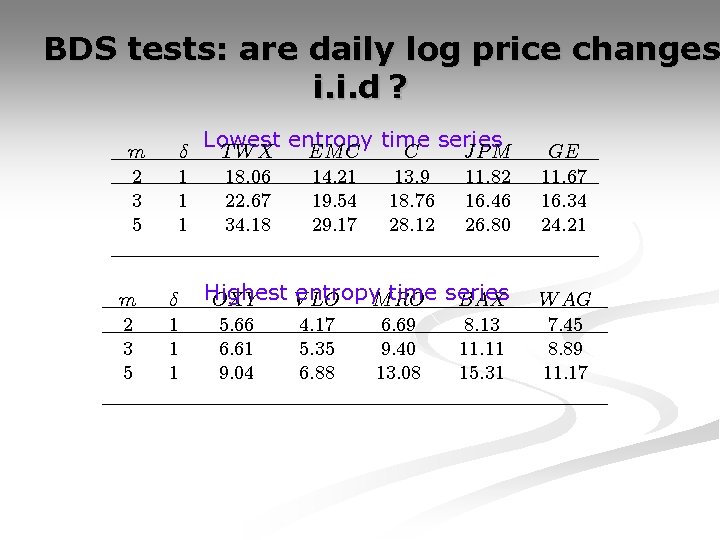

BDS tests: are daily log price changes i. i. d ? m 2 3 5 ± 1 1 1 Lowest entropy time series TWX 18. 06 22. 67 34. 18 EM C 14. 21 19. 54 29. 17 C 13. 9 18. 76 28. 12 JP M 11. 82 16. 46 26. 80 Highest V LO entropy time series OXY M RO BAX 5. 66 6. 61 9. 04 4. 17 5. 35 6. 88 6. 69 9. 40 13. 08 8. 13 11. 11 15. 31 GE 11. 67 16. 34 24. 21 W AG 7. 45 8. 89 11. 17

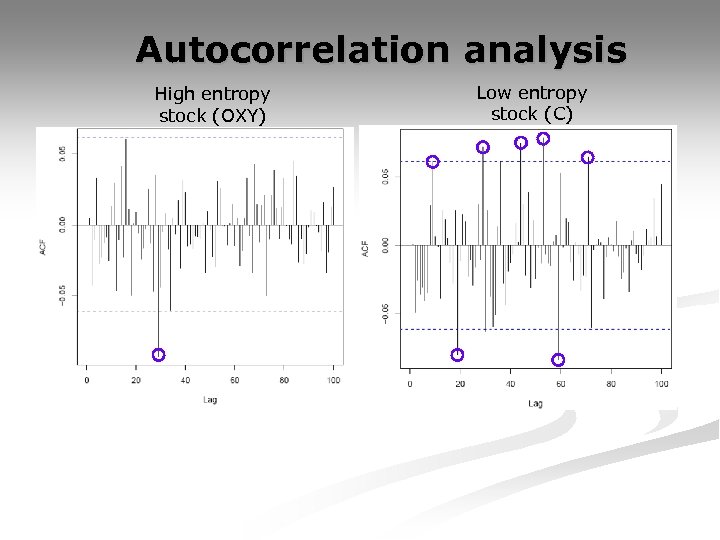

Autocorrelation analysis High entropy stock (OXY) Low entropy stock (C)

Part 2 : does low entropy imply better profitability of TA? Addressed here: are GP-induced rules more efficient on low-entropy stocks ?

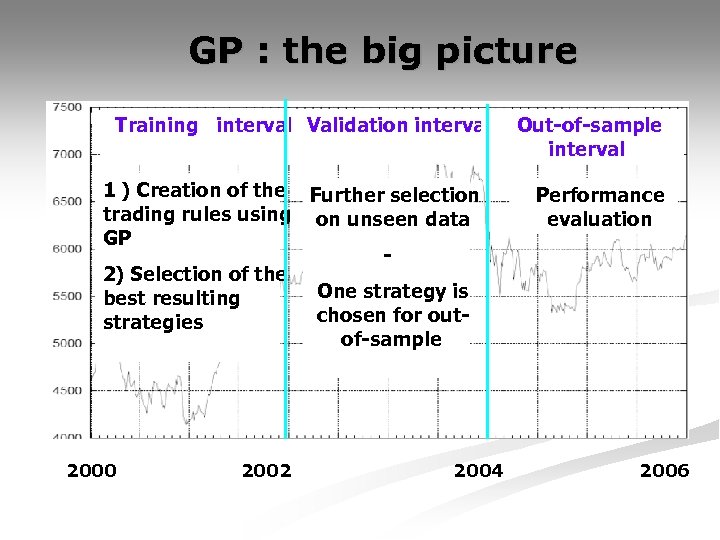

GP : the big picture Training interval Validation interval 1 ) Creation of the Further selection trading rules using on unseen data GP 2) Selection of the One strategy is best resulting chosen for outstrategies of-sample 2000 2002 2004 Out-of-sample interval Performance evaluation 2006

GP performance assessment

Experimental setup

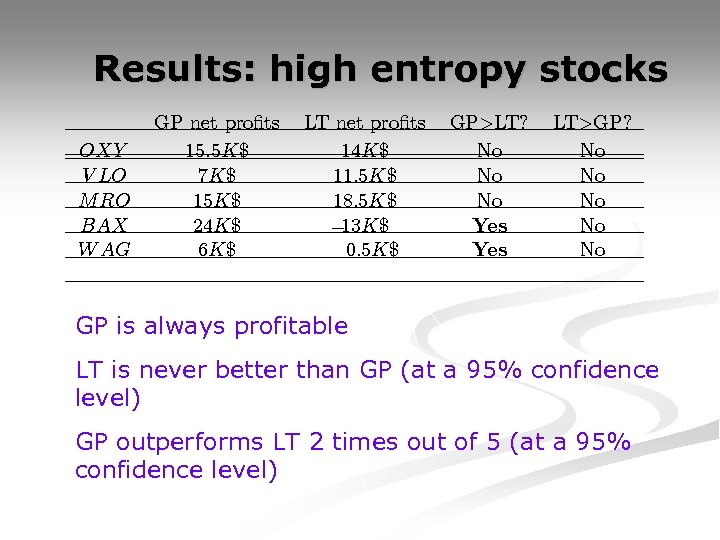

Results: high entropy stocks OXY V LO M RO BAX W AG GP net pro¯ts 15: 5 K$ 7 K$ 15 K$ 24 K$ 6 K$ LT net pro¯ts 14 K$ 11: 5 K$ 18: 5 K$ 13 K$ ¡ 0: 5 K$ GP>LT? No No No Yes LT>GP? No No No GP is always profitable LT is never better than GP (at a 95% confidence level) GP outperforms LT 2 times out of 5 (at a 95% confidence level)

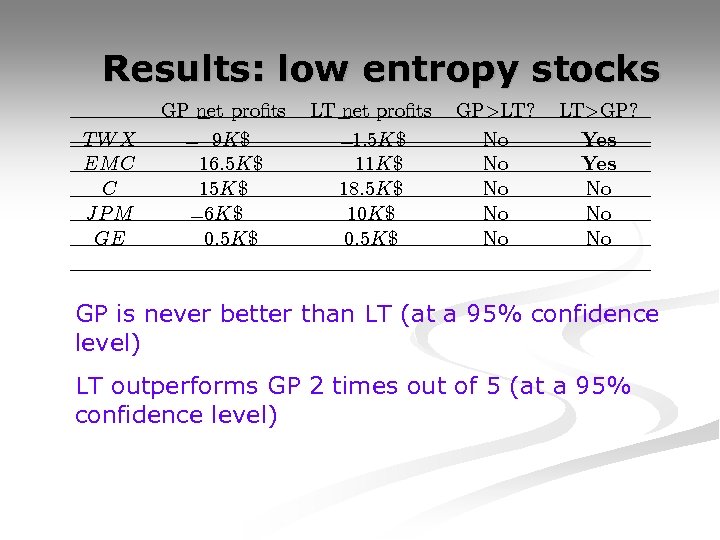

Results: low entropy stocks TWX EM C C JP M GE GP net pro¯ts ¡ ¡ 9 K$ 16: 5 K$ 15 K$ ¡ 6 K$ 0: 5 K$ LT ¡ pro¯ts net ¡ 1: 5 K$ 11 K$ 18: 5 K$ 10 K$ 0: 5 K$ GP>LT? No No No LT>GP? Yes No No No GP is never better than LT (at a 95% confidence level) LT outperforms GP 2 times out of 5 (at a 95% confidence level)

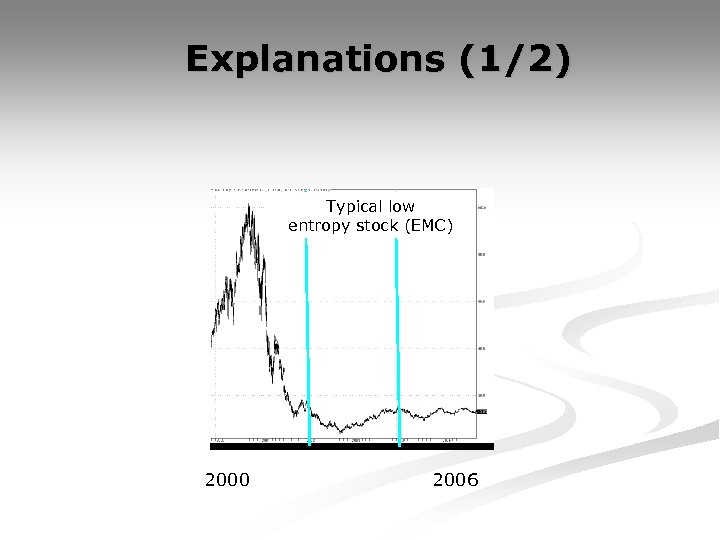

Explanations (1/2) Typical low entropy stock (EMC) 2000 2006

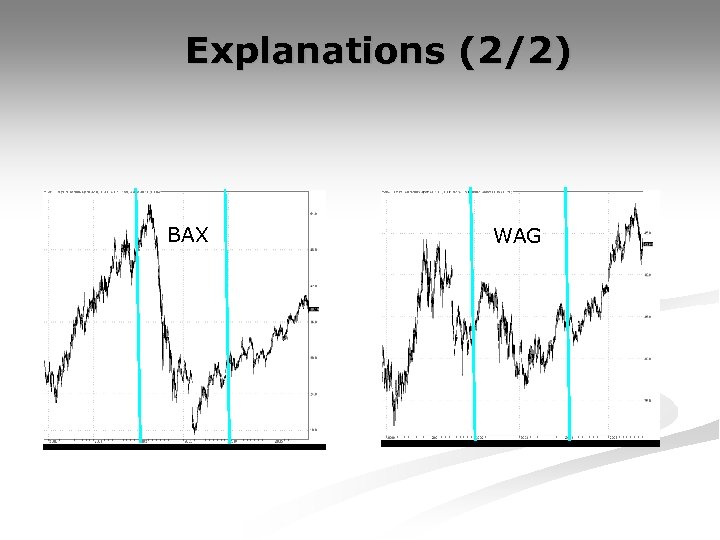

Explanations (2/2) BAX WAG

Conclusions

Perspectives

?

ae474f3f5f634a9d8282b9447da36081.ppt