610fc8015c6362d5055cb2b7df2f65a9.ppt

- Количество слайдов: 21

on 27 th november, 2015 at Custom house, Chennai

OBJECTIVES of TRS q To identify bottlenecks affecting customs release. q Assessing newly introduced and modified techniques, procedure & technologies. q Establishment of baseline trade facilitation performance measurement. q Identifying improvements. opportunities for q Facilitates ‘ease of doing business’. trade facilitation

SCOPE of TRS üMeasures the mean average time taken in each process of Customs clearance from arrival of goods to the release of the goods (Out of Charge – OOC). üIs based on the declarations filed and processed electronically. üAbout 99. 75% of import declarations are filed electronically in Custom House.

METHODOLOGY ADOPTED Sampling methodology. v As per WCO guidelines, the sample should ideally include all the declarations processed in a period of at least 7 consecutive working days. v. The period chosen for the study of should be one of the normal traffic periods. v. Time period of 03. 11. 2015 to 09. 11. 2015, from Tuesday to next Monday was undertaken for this Analysis. v. During this period, there was no slowdown or break down of EDI System. Hence data collected reflects a fairly representative sample.

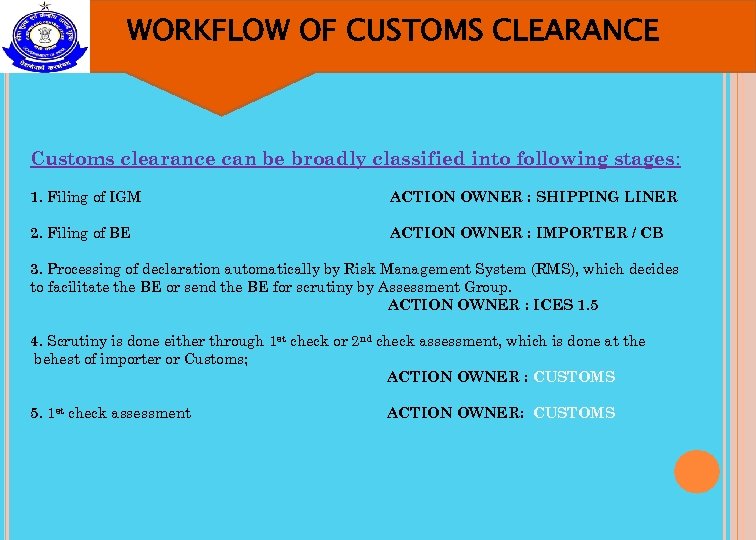

WORKFLOW OF CUSTOMS CLEARANCE Customs clearance can be broadly classified into following stages: 1. Filing of IGM ACTION OWNER : SHIPPING LINER 2. Filing of BE ACTION OWNER : IMPORTER / CB 3. Processing of declaration automatically by Risk Management System (RMS), which decides to facilitate the BE or send the BE for scrutiny by Assessment Group. ACTION OWNER : ICES 1. 5 4. Scrutiny is done either through 1 st check or 2 nd check assessment, which is done at the behest of importer or Customs; ACTION OWNER : CUSTOMS 5. 1 st check assessment ACTION OWNER: CUSTOMS

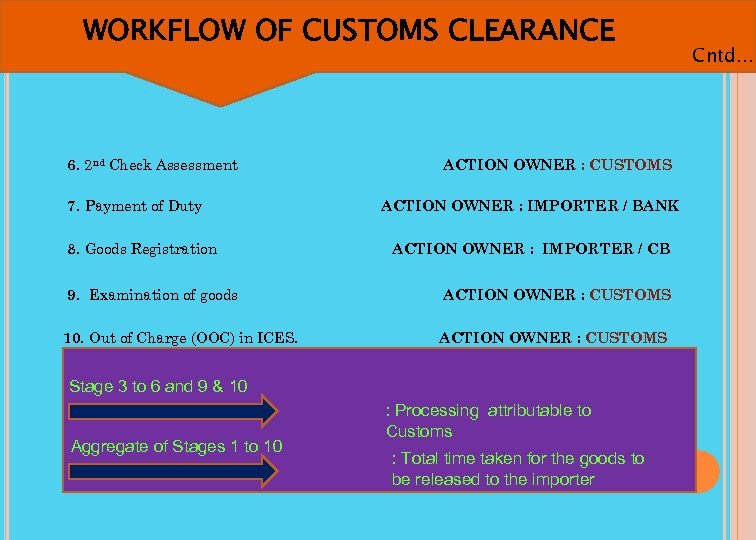

WORKFLOW OF CUSTOMS CLEARANCE 6. 2 nd Check Assessment 7. Payment of Duty 8. Goods Registration ACTION OWNER : CUSTOMS ACTION OWNER : IMPORTER / BANK ACTION OWNER : IMPORTER / CB 9. Examination of goods ACTION OWNER : CUSTOMS 10. Out of Charge (OOC) in ICES. ACTION OWNER : CUSTOMS Stage 3 to 6 and 9 & 10 Aggregate of Stages 1 to 10 : Processing attributable to Customs : Total time taken for the goods to be released to the importer Cntd. . .

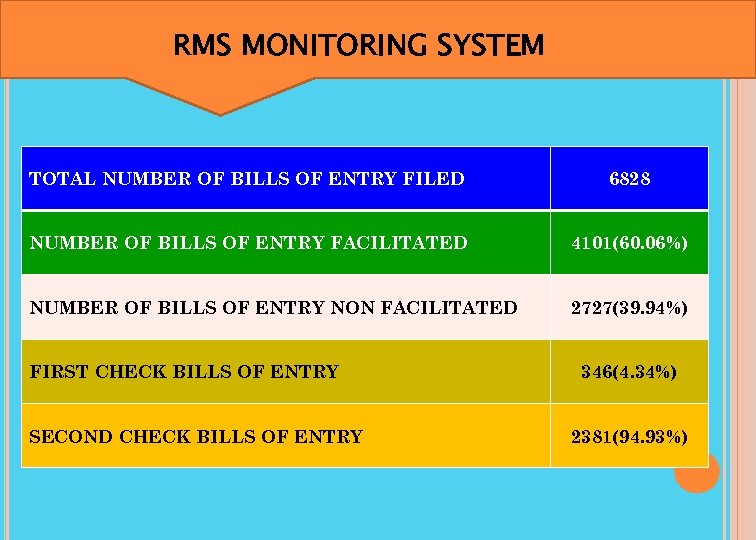

RMS MONITORING SYSTEM TOTAL NUMBER OF BILLS OF ENTRY FILED 6828 NUMBER OF BILLS OF ENTRY FACILITATED 4101(60. 06%) NUMBER OF BILLS OF ENTRY NON FACILITATED 2727(39. 94%) FIRST CHECK BILLS OF ENTRY SECOND CHECK BILLS OF ENTRY 346(4. 34%) 2381(94. 93%)

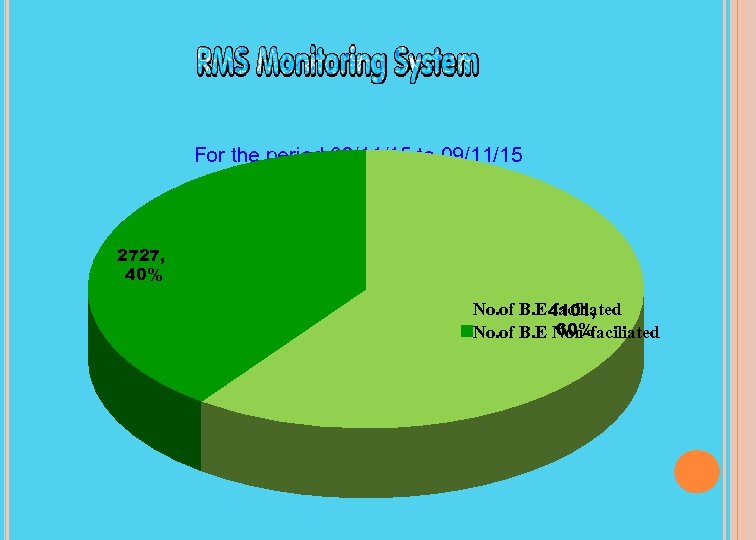

For the period 03/11/15 to 09/11/15 2727, 40% No. of B. E 4101, faciliated 60% No. of B. E Non-faciliated

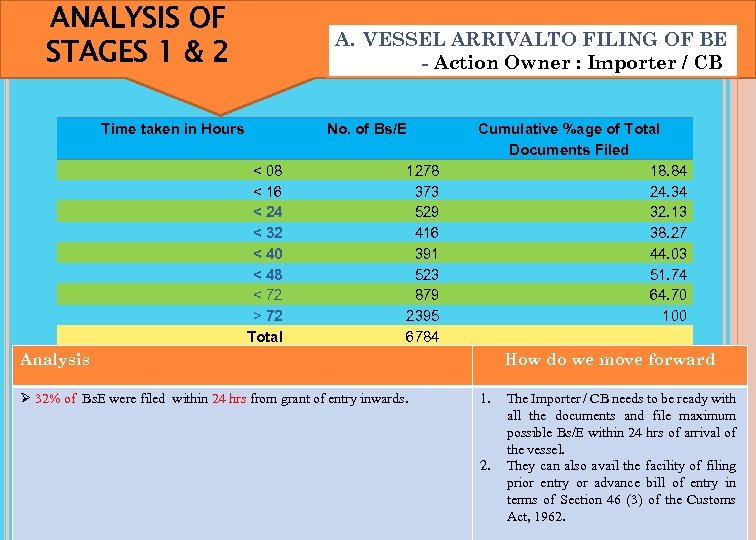

ANALYSIS OF STAGES 1 & 2 A. VESSEL ARRIVALTO FILING OF BE - Action Owner : Importer / CB Time taken in Hours No. of Bs/E < 08 < 16 < 24 < 32 < 40 < 48 < 72 > 72 Total 1278 373 529 416 391 523 879 2395 6784 Cumulative %age of Total Documents Filed 18. 84 24. 34 32. 13 38. 27 44. 03 51. 74 64. 70 100 Analysis Ø 32% of Bs. E were filed within 24 hrs from grant of entry inwards. How do we move forward 1. 2. The Importer / CB needs to be ready with all the documents and file maximum possible Bs/E within 24 hrs of arrival of the vessel. They can also avail the facility of filing prior entry or advance bill of entry in terms of Section 46 (3) of the Customs Act, 1962.

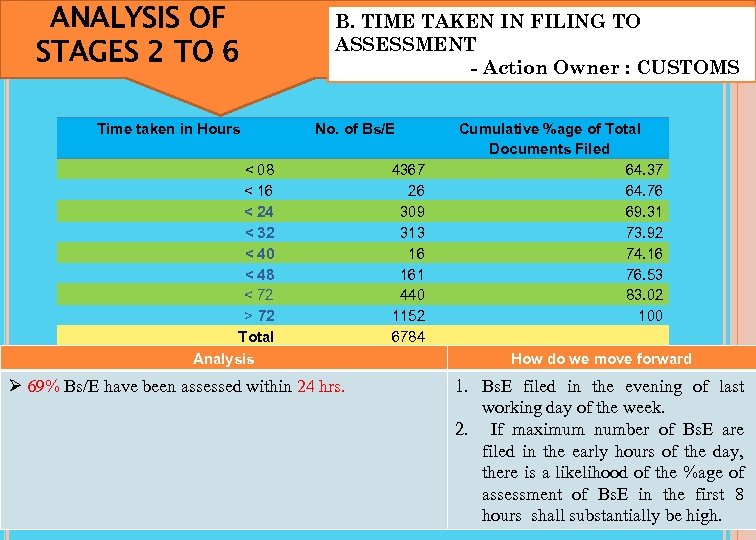

ANALYSIS OF STAGES 2 TO 6 Time taken in Hours B. TIME TAKEN IN FILING TO ASSESSMENT - Action Owner : CUSTOMS No. of Bs/E < 08 < 16 < 24 < 32 < 40 < 48 < 72 > 72 Total Analysis Ø 69% Bs/E have been assessed within 24 hrs. 4367 26 309 313 16 161 440 1152 6784 Cumulative %age of Total Documents Filed 64. 37 64. 76 69. 31 73. 92 74. 16 76. 53 83. 02 100 How do we move forward 1. Bs. E filed in the evening of last working day of the week. 2. If maximum number of Bs. E are filed in the early hours of the day, there is a likelihood of the %age of assessment of Bs. E in the first 8 hours shall substantially be high.

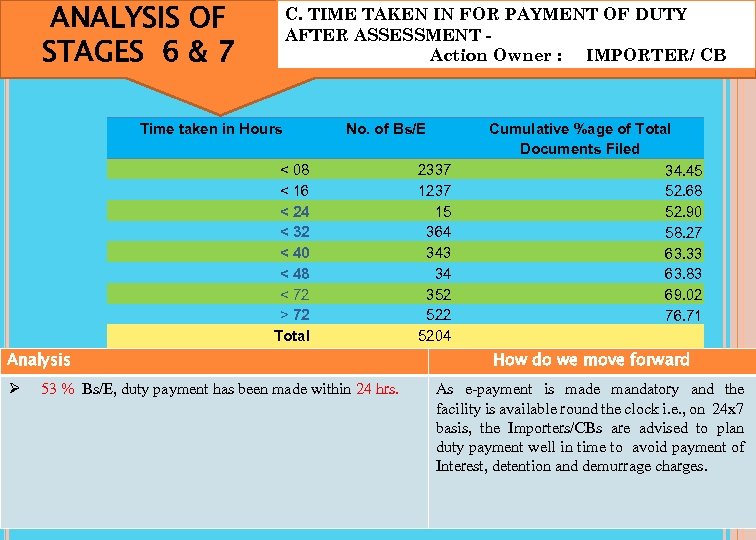

ANALYSIS OF STAGES 6 & 7 C. TIME TAKEN IN FOR PAYMENT OF DUTY AFTER ASSESSMENT Action Owner : IMPORTER/ CB Time taken in Hours No. of Bs/E < 08 < 16 < 24 < 32 < 40 < 48 < 72 > 72 Total Analysis Ø 53 % Bs/E, duty payment has been made within 24 hrs. 2337 1237 15 364 343 34 352 5204 Cumulative %age of Total Documents Filed 34. 45 52. 68 52. 90 58. 27 63. 33 63. 83 69. 02 76. 71 How do we move forward As e-payment is made mandatory and the facility is available round the clock i. e. , on 24 x 7 basis, the Importers/CBs are advised to plan duty payment well in time to avoid payment of Interest, detention and demurrage charges.

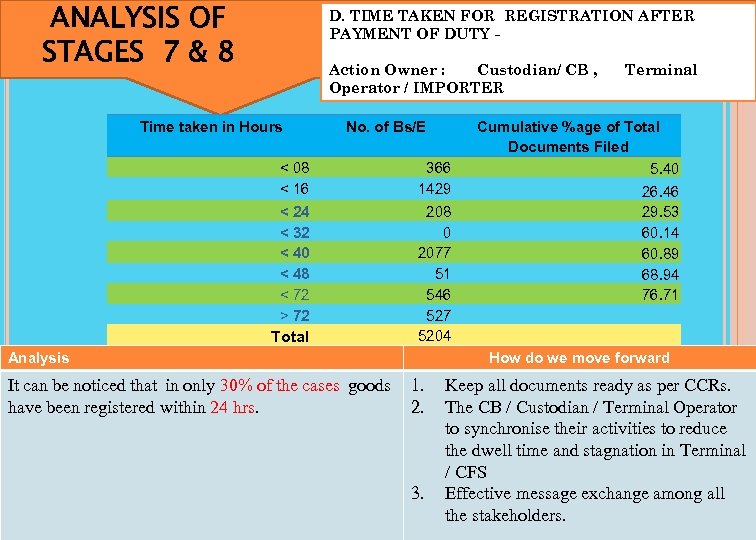

ANALYSIS OF STAGES 7 & 8 D. TIME TAKEN FOR REGISTRATION AFTER PAYMENT OF DUTY Action Owner : Custodian/ CB , Operator / IMPORTER Time taken in Hours No. of Bs/E < 08 < 16 366 1429 < 24 < 32 < 40 < 48 < 72 > 72 208 0 2077 51 546 527 5204 Total Analysis It can be noticed that in only 30% of the cases goods have been registered within 24 hrs. Terminal Cumulative %age of Total Documents Filed 5. 40 26. 46 29. 53 60. 14 60. 89 68. 94 76. 71 How do we move forward 1. 2. 3. Keep all documents ready as per CCRs. The CB / Custodian / Terminal Operator to synchronise their activities to reduce the dwell time and stagnation in Terminal / CFS Effective message exchange among all the stakeholders.

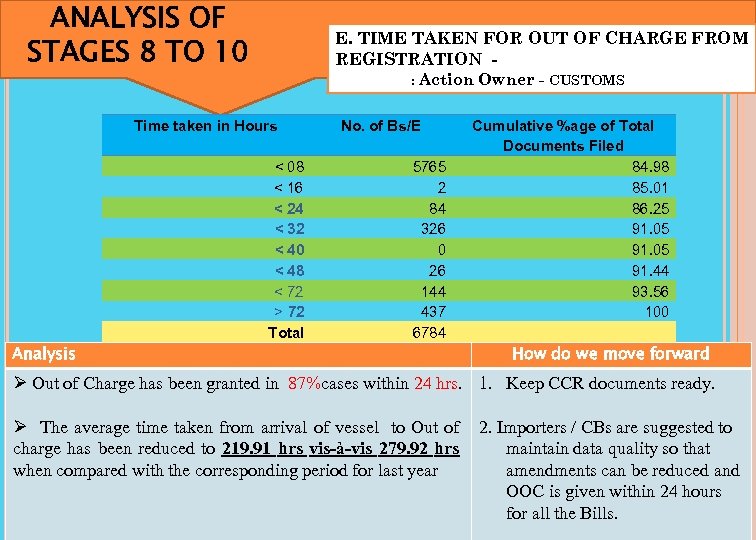

ANALYSIS OF STAGES 8 TO 10 E. TIME TAKEN FOR OUT OF CHARGE FROM REGISTRATION : Action Owner - CUSTOMS Time taken in Hours < 08 < 16 < 24 < 32 < 40 < 48 < 72 > 72 Total No. of Bs/E 5765 2 84 326 0 26 144 437 6784 Analysis Cumulative %age of Total Documents Filed 84. 98 85. 01 86. 25 91. 05 91. 44 93. 56 100 How do we move forward Ø Out of Charge has been granted in 87%cases within 24 hrs. 1. Keep CCR documents ready. Ø The average time taken from arrival of vessel to Out of charge has been reduced to 219. 91 hrs vis-à-vis 279. 92 hrs when compared with the corresponding period for last year 2. Importers / CBs are suggested to maintain data quality so that amendments can be reduced and OOC is given within 24 hours for all the Bills.

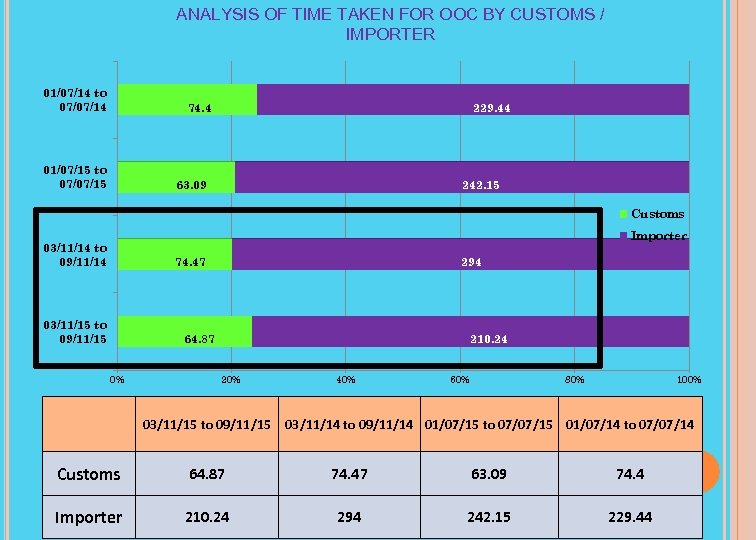

ANALYSIS OF TIME TAKEN FOR OOC BY CUSTOMS / IMPORTER 01/07/14 to 07/07/14 74. 4 01/07/15 to 07/07/15 229. 44 63. 09 242. 15 Customs Importer 03/11/14 to 09/11/14 74. 47 03/11/15 to 09/11/15 294 64. 87 0% 210. 24 20% 40% 60% 80% 100% 03/11/15 to 09/11/15 03/11/14 to 09/11/14 01/07/15 to 07/07/15 01/07/14 to 07/07/14 Customs 64. 87 74. 47 63. 09 74. 4 Importer 210. 24 294 242. 15 229. 44

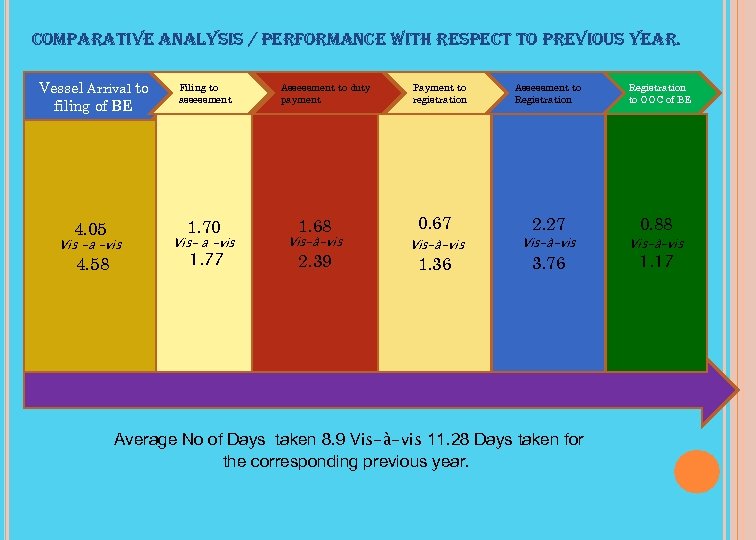

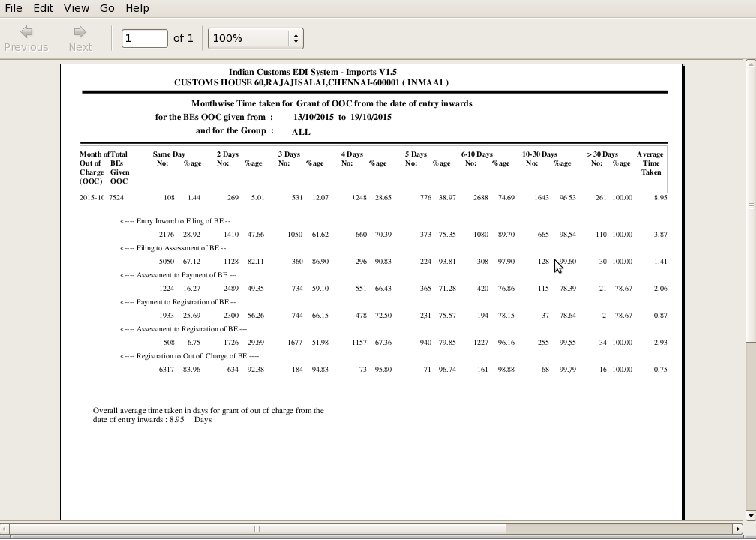

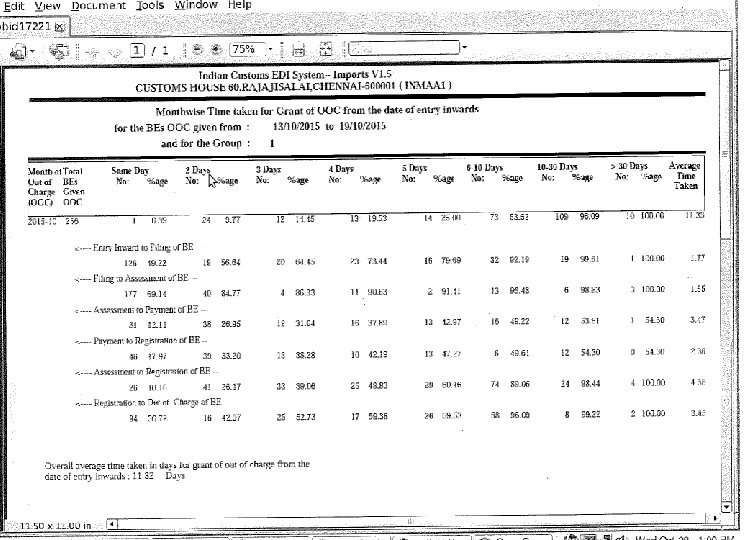

Com. Parative ana. LYsis / Per. Forman. Ce With res. Pe. Ct to Previous Year. Vessel Arrival to filing of BE 4. 05 Vis -a -vis 4. 58 Filing to assessment 1. 70 Vis- a -vis 1. 77 Assessment to duty payment 1. 68 Vis-à-vis 2. 39 Payment to registration 0. 67 Vis-à-vis 1. 36 Assessment to Registration 2. 27 Vis-à-vis 3. 76 Average No of Days taken 8. 9 Vis-à-vis 11. 28 Days taken for the corresponding previous year. Registration to OOC of BE 0. 88 Vis-à-vis 1. 17

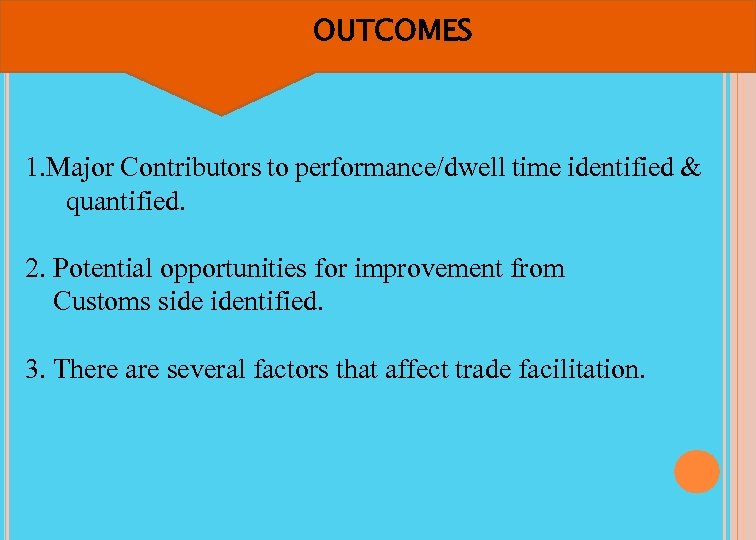

OUTCOMES 1. Major Contributors to performance/dwell time identified & quantified. 2. Potential opportunities for improvement from Customs side identified. 3. There are several factors that affect trade facilitation.

TAKEAWAY FOR CUSTOMS What cannot be measured cannot be improved Do away with the Baggage of avoidable litigations. Eliminating/Reducing printouts in Customs Viz. , TR 6 Challans, Transshipment Permit (TP), Exchange control copy Operationalization of “RFID” for seamless flow of containers. To broad base ACP status holder for startup companies also.

SUGGESTIONS/RECOMMENDATIONS FOR YOUR KIND ATTENTION

610fc8015c6362d5055cb2b7df2f65a9.ppt