28a8a3e6b6786c9df34edd28ab18e147.ppt

- Количество слайдов: 9

Omgeo’s Role in the US and Global Settlement Landscapes Marianne Brown, Omgeo 8 October, 2007

Agenda • Who is Omgeo? • An Institutional Trade • Omgeo and the Institutional US Tradeflow • Measuring Success

Who is Omgeo? • Leading provider of post-trade, pre-settlement automated services and products to Investment Managers (“IMs”), Broker-Dealers (“BDs”) and Custodians • Global joint venture between DTCC and The Thomson Corporation’s post-trade, pre-settlement businesses. • Established in May 2001 • Over 6, 000 clients in 44 countries • Process 1. 5 million trades a day globally • Manage settlement information on over 4. 8 M accounts • 15 office locations globally

Who is Omgeo? Governance • DTCC and Thomson Financial are 50/50 joint owners • As the regulated entity, DTCC maintains control over • any matters related to US regulated aspects of Omgeo’s industry controlled Board of Managers: • Has 7 of 11 voting Managers from industry (e. g. , Merrill Lynch, Morgan Stanley, Northern Trust Company) • Plays vital role in ongoing governance and industry oversight • Represents interests of clients in decisions about strategy and operations

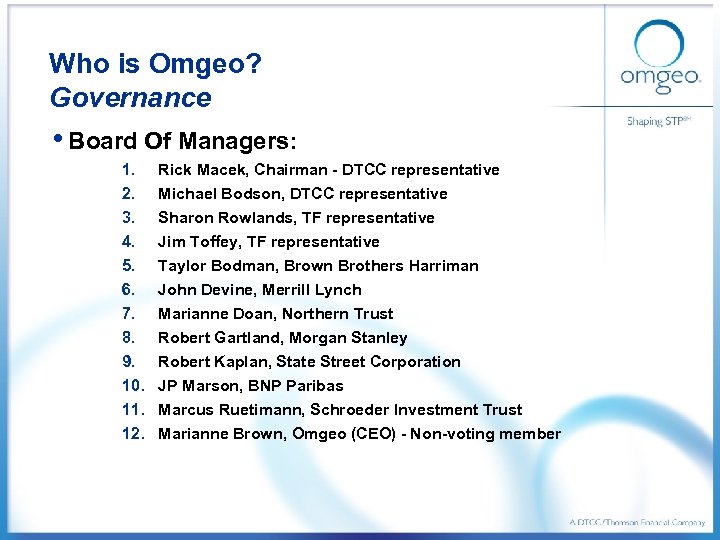

Who is Omgeo? Governance • Board Of Managers: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Rick Macek, Chairman - DTCC representative Michael Bodson, DTCC representative Sharon Rowlands, TF representative Jim Toffey, TF representative Taylor Bodman, Brown Brothers Harriman John Devine, Merrill Lynch Marianne Doan, Northern Trust Robert Gartland, Morgan Stanley Robert Kaplan, State Street Corporation JP Marson, BNP Paribas Marcus Ruetimann, Schroeder Investment Trust Marianne Brown, Omgeo (CEO) - Non-voting member

Who is Omgeo? Where We Fit in the Institutional Trade Lifecycle Pre-Trade Order Processing Trading Post. Execution Operations Settlement Omgeo Notice of Execution Trade Allocation Acceptance Confirmation Affirmation Bank Notification 6

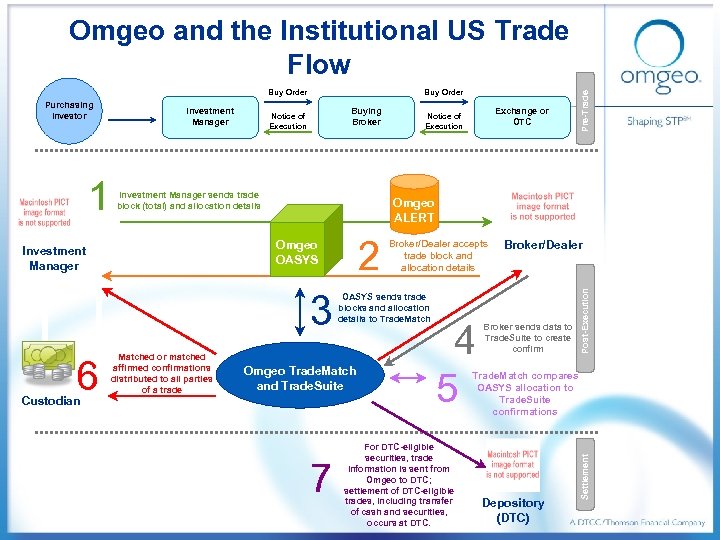

Buy Order Buying Broker Notice of Execution Investment Manager sends trade block (total) and allocation details Omgeo ALERT 3 6 Custodian 2 Omgeo OASYS Investment Manager Matched or matched affirmed confirmations distributed to all parties of a trade Exchange or OTC Notice of Execution OASYS sends trade blocks and allocation details to Trade. Match Omgeo Trade. Match and Trade. Suite 7 Broker/Dealer accepts trade block and allocation details 4 5 For DTC-eligible securities, trade information is sent from Omgeo to DTC; settlement of DTC-eligible trades, including transfer of cash and securities, occurs at DTC. Broker/Dealer Broker sends data to Trade. Suite to create confirm Post-Execution 1 Investment Manager Trade. Match compares OASYS allocation to Trade. Suite confirmations Depository (DTC) Settlement Purchasing Investor Buy Order Pre-Trade Omgeo and the Institutional US Trade Flow

Measuring Success • With the Omgeo Trade. Suite/DTCC model: Affirmed trades are 75 times less likely to be reclaimed than unaffirmed trades • 91% of trades are settled by noon on T+2 • – This allows a full day to reconcile trades, detect any errors, failures, etc. – Other methods often don’t reach DTCC until T+3 – less time rectify any errors/trade fails – Failed trades cost institutions 250 USD per domestic trade and 535 USD per cross-border trade Trades are sent to DTCC in real-time: better business continuity, greater efficiency, lower costs • Since Omgeo’s inception, volumes through Trade. Suite have doubled, but affirmation rates remain constant •

28a8a3e6b6786c9df34edd28ab18e147.ppt