a82bdf3f9a86c1755854d04813891389.ppt

- Количество слайдов: 22

Omgeo – An Industry Update Presented by: Victoria Mazza – Relationship Manager BDUG October 25, 2005

Agenda • • • Evolution of Omgeo’s Strategy Industry Update on Matching STP – Omgeo Solutions carving the way for STP • • • Fixed Income ALERT on the Web Omgeo Trade. Hub Omgeo Central Trade Manager Omgeo Connect Questions / Answers

Omgeo’s Strategy: 2005+ • Automate Investment Manager allocations across • • multiple asset classes Provide IMs with a single point of access to Omgeo and 3 rd party trade management solutions for trades across multiple asset classes Facilitate efficient trade management and settlement through Omgeo CTM and Open SI/SN Strengthen strategic relationships with key clients and partners Increase our capability and capacity by adopting a global sourcing model

Industry Update on Matching

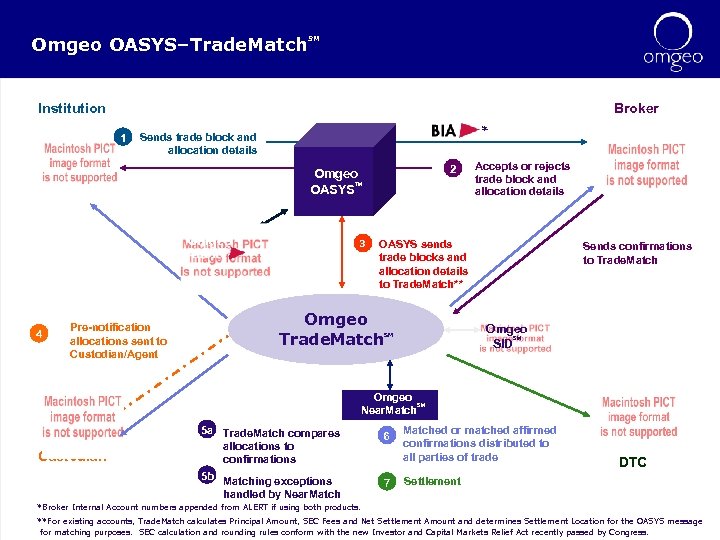

Omgeo OASYS–Trade. Match SM Institution Broker 1 * Sends trade block and allocation details 2 Omgeo TM OASYS Omgeo 4 Pre-notification allocations sent to Custodian/Agent 3 Accepts or rejects trade block and allocation details OASYS sends trade blocks and allocation details to Trade. Match** Omgeo Trade. Match Sends confirmations to Trade. Match Omgeo SM SID SM Omgeo SM Near. Match Custodian 5 a Trade. Match compares allocations to confirmations 5 b Matching exceptions handled by Near. Match 6 7 Matched or matched affirmed confirmations distributed to all parties of trade DTC Settlement *Broker Internal Account numbers appended from ALERT if using both products. **For existing accounts, Trade. Match calculates Principal Amount, SEC Fees and Net Settlement Amount and determines Settlement Location for the OASYS message for matching purposes. SEC calculation and rounding rules conform with the new Investor and Capital Markets Relief Act recently passed by Congress.

![The Case for Central Matching U. S. Trade Volumes - Trade. Suite [August 2005] The Case for Central Matching U. S. Trade Volumes - Trade. Suite [August 2005]](https://present5.com/presentation/a82bdf3f9a86c1755854d04813891389/image-6.jpg)

The Case for Central Matching U. S. Trade Volumes - Trade. Suite [August 2005] • Average Daily Trades: 916, 000 Equity: • Fixed Income: • • Confirm/Affirm (Trade. Suite): • Central Matching 812, 000 104, 000 837, 000 79, 000

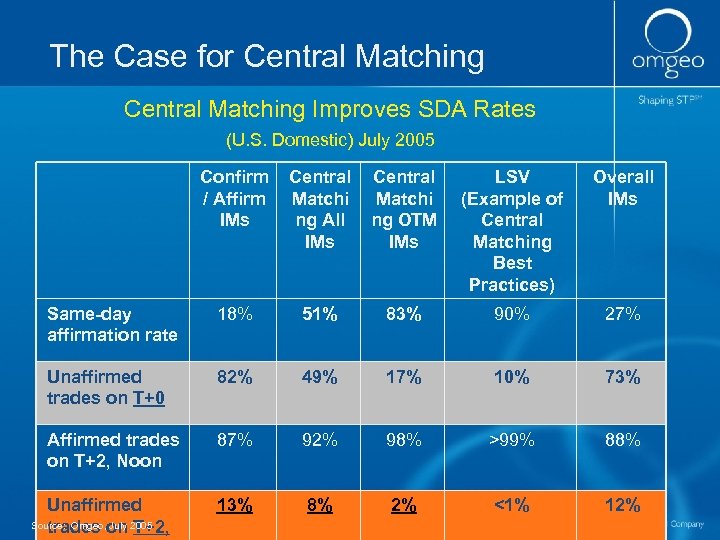

The Case for Central Matching Improves SDA Rates (U. S. Domestic) July 2005 Confirm / Affirm IMs Central Matchi ng All IMs Central Matchi ng OTM IMs LSV (Example of Central Matching Best Practices) Overall IMs Same-day affirmation rate 18% 51% 83% 90% 27% Unaffirmed trades on T+0 82% 49% 17% 10% 73% Affirmed trades on T+2, Noon 87% 92% 98% >99% 88% 13% 8% 2% <1% 12% Unaffirmed Source: Omgeo, on 2005 trades July T+2,

CTM Trade Volumes Trade Volume sinception (as of 8/31/05): 5, 619, 280

Settlement Notification Volumes

Fixed Income Initiative

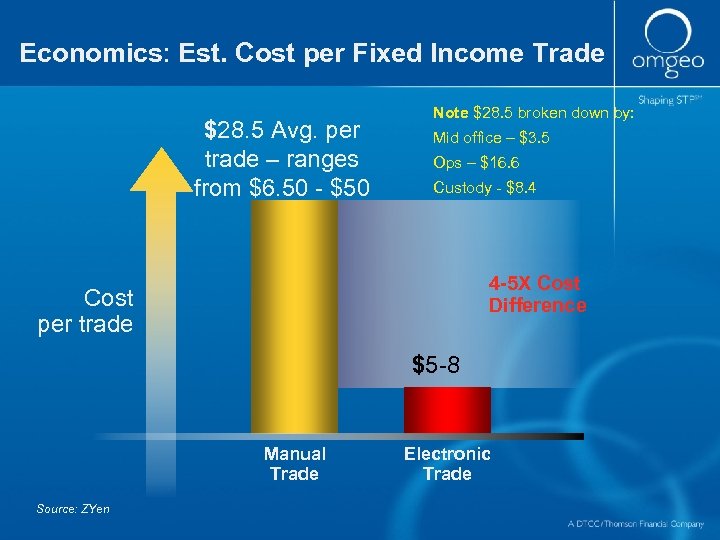

Economics: Est. Cost per Fixed Income Trade $28. 5 Avg. per trade – ranges from $6. 50 - $50 Note $28. 5 broken down by: Mid office – $3. 5 Ops – $16. 6 Custody - $8. 4 4 -5 X Cost Difference Cost per trade $5 -8 Manual Trade Source: ZYen Electronic Trade

Recent Highlights • Over 70 IMs now transacting over Omgeo OASYS, with 3 -5 new joining the community each month • Bear Stearns, Barclays are moving up automation curve with OASYS Direct in 2005, other Tier 1 workstation brokers closer to further automation • CSFB, BNP Paribas, Legg Mason, JP Morgan, Mesirow and First Tennessee, Raymond James, and Advest are live on OASYS Direct via Bloomberg TOMS • New live IM’s include: Dodge and Cox, Shenkman

Omgeo ALERT on the Web

Key Benefits to the Web Interface • Portable access to ALERT • Individual user ids and passwords • The option to authorize individual users for either full • • • access or read-only access to the information on ALERT Click-through links to fields that need to be updated to comply with the latest validation rules Easily accessible definitions for settlement instruction fields “QUICK Fields” tab that provides immediate access to the 20 most commonly used ALERT fields A new homepage with quick access to main functions, documentation and important product notices from Omgeo Ability to quickly switch from one acronym to another

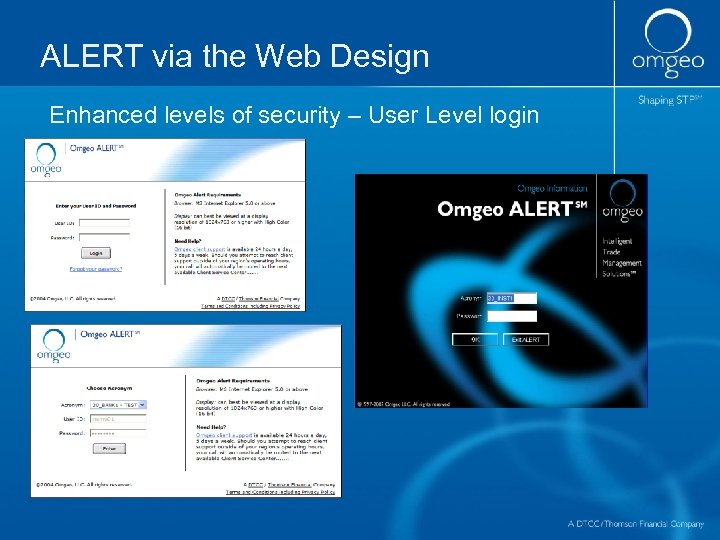

ALERT via the Web Design Enhanced levels of security – User Level login

Omgeo Trade. Hub

Omgeo Trade. Hub • Omgeo Trade. Hub: Facilitating Trade Instructions / Reconcilements • Provides IMs and Custodians with a single point of access to reliable domestic and international messaging. Settlement messages as well as reconcilement messages • Provides an open, timely and cost-effective environment • Partnerships with both Reconcilement Vendors and Trust System Vendors – Sample Trust System Vendors: SEI and ATS – Sample Reconcilement Vendors: Smart. Stream and Checkfree • Automate Omnibus/Trust trades

Omgeo Connect

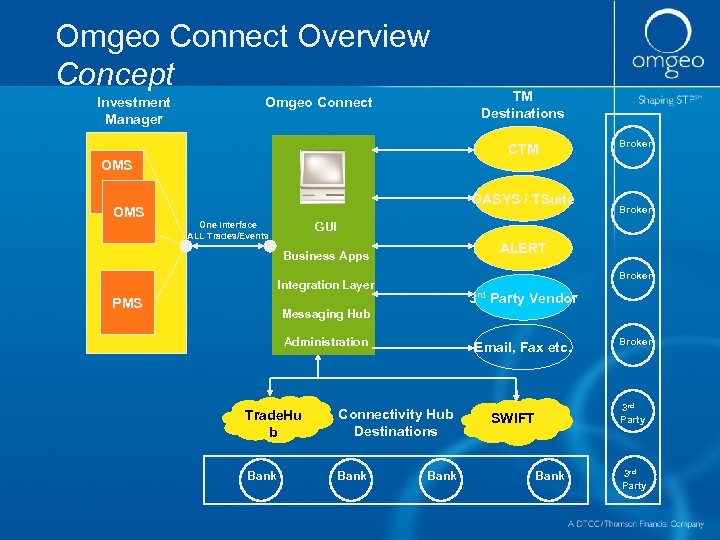

Omgeo Connect Overview Solution Overview A single point of connectivity for investment managers to access Omgeo and other posttrade solutions, enabling the trade and settlement management of multiple asset classes via an ASP environment.

Omgeo Connect Overview Solution Components • Hub solution for all trades • Common dashboard and workflow management • Trade Management • Single point of access to Omgeo services • Third party connectivity (e. g. Deriv/SERV, Trade. Web) • Settlement Management • Support SWIFT and non-SWIFT workflow • Settlement status confirmation

Omgeo Connect Overview Concept Investment Manager Omgeo Connect TM Destinations CTM Broker OMS OASYS / TSuite OMS One Interface ALL Trades/Events GUI ALERT Business Apps Broker Integration Layer PMS Broker 3 rd Party Vendor Messaging Hub Administration Email, Fax etc. Trade. Hu b Connectivity Hub Destinations Bank Broker 3 rd Party SWIFT Bank 3 rd Party

a82bdf3f9a86c1755854d04813891389.ppt