5a884b330d691f66a203504e2731677b.ppt

- Количество слайдов: 22

OLIGOPOLY-II

OLIGOPOLY-II

Overview • Comparison of Duopoly with Collusion & Competition in a reaction curve framework • Price competition – Bertrand Model • Competition vs. collusion in a game theoretic framework • Kinked demand curve model • Price signaling & price leadership • Dominant firm model • Cartels

Overview • Comparison of Duopoly with Collusion & Competition in a reaction curve framework • Price competition – Bertrand Model • Competition vs. collusion in a game theoretic framework • Kinked demand curve model • Price signaling & price leadership • Dominant firm model • Cartels

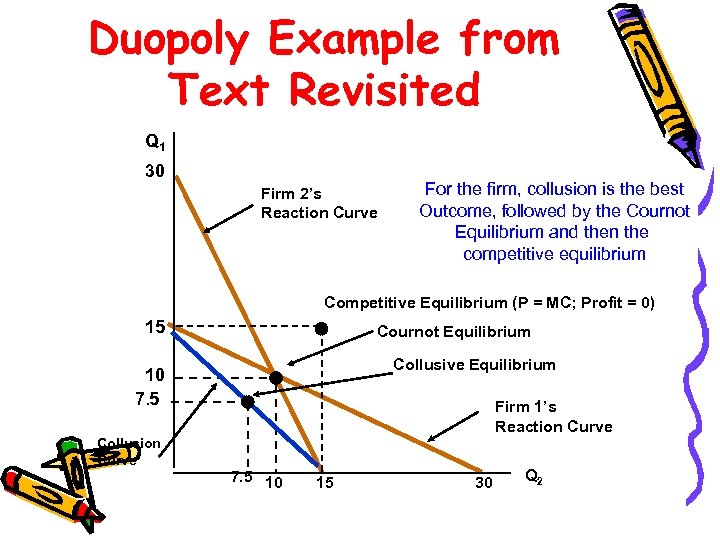

Duopoly Example from Text Revisited Q 1 30 Firm 2’s Reaction Curve For the firm, collusion is the best Outcome, followed by the Cournot Equilibrium and then the competitive equilibrium Competitive Equilibrium (P = MC; Profit = 0) 15 Cournot Equilibrium Collusive Equilibrium 10 7. 5 Collusion Curve Firm 1’s Reaction Curve 7. 5 10 15 30 Q 2

Duopoly Example from Text Revisited Q 1 30 Firm 2’s Reaction Curve For the firm, collusion is the best Outcome, followed by the Cournot Equilibrium and then the competitive equilibrium Competitive Equilibrium (P = MC; Profit = 0) 15 Cournot Equilibrium Collusive Equilibrium 10 7. 5 Collusion Curve Firm 1’s Reaction Curve 7. 5 10 15 30 Q 2

Price Competition (homogenous good) – The Bertrand Model • If two duopolists producing a homogenous good compete by simultaneously choosing price, the good being homogenous, consumers will buy from the lowest price seller – The lower priced firm will supply the entire market and the higher priced firm will sell nothing • Competitive price cutting by the firms will lead to the perfectly competitive outcome • If both firms charge the same price, consumers will be indifferent between firms and each firm will supply half the market.

Price Competition (homogenous good) – The Bertrand Model • If two duopolists producing a homogenous good compete by simultaneously choosing price, the good being homogenous, consumers will buy from the lowest price seller – The lower priced firm will supply the entire market and the higher priced firm will sell nothing • Competitive price cutting by the firms will lead to the perfectly competitive outcome • If both firms charge the same price, consumers will be indifferent between firms and each firm will supply half the market.

Criticism of Bertrand Model – Homogenous Good Case • When firms produce a homogenous good, it is more natural to compete by setting quantities rather than prices (bringing us back to the Cournot model)

Criticism of Bertrand Model – Homogenous Good Case • When firms produce a homogenous good, it is more natural to compete by setting quantities rather than prices (bringing us back to the Cournot model)

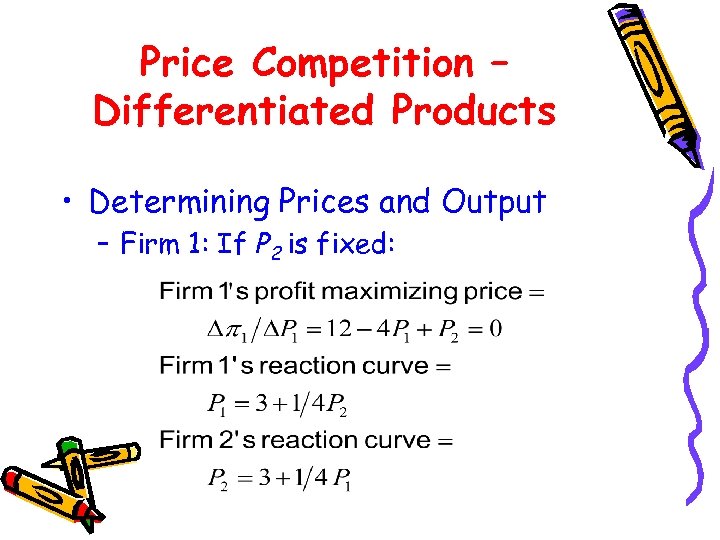

Price Competition – Differentiated Products • Determining Prices and Output – Firm 1: If P 2 is fixed:

Price Competition – Differentiated Products • Determining Prices and Output – Firm 1: If P 2 is fixed:

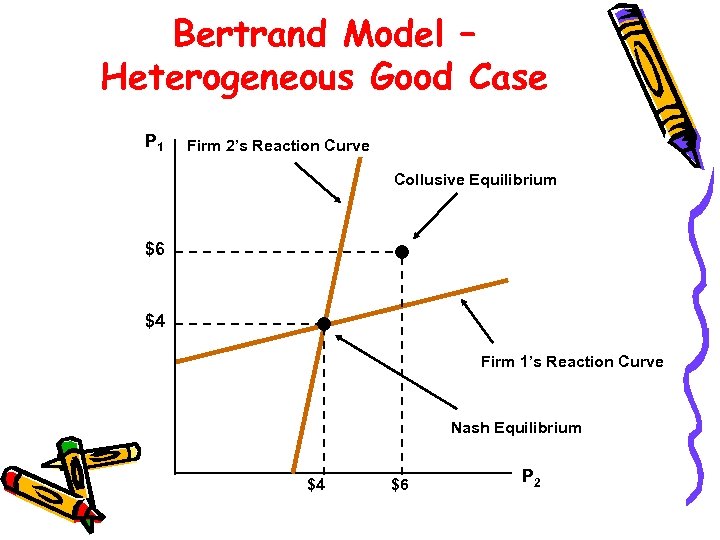

Bertrand Model – Heterogeneous Good Case P 1 Firm 2’s Reaction Curve Collusive Equilibrium $6 $4 Firm 1’s Reaction Curve Nash Equilibrium $4 $6 P 2

Bertrand Model – Heterogeneous Good Case P 1 Firm 2’s Reaction Curve Collusive Equilibrium $6 $4 Firm 1’s Reaction Curve Nash Equilibrium $4 $6 P 2

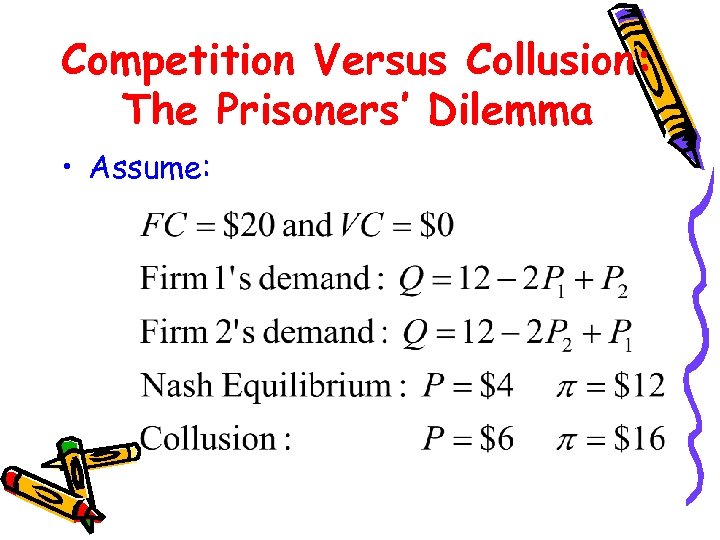

Competition Versus Collusion: The Prisoners’ Dilemma • Assume:

Competition Versus Collusion: The Prisoners’ Dilemma • Assume:

Competition Versus Collusion: The Prisoners’ Dilemma • Possible Pricing Outcomes: – –

Competition Versus Collusion: The Prisoners’ Dilemma • Possible Pricing Outcomes: – –

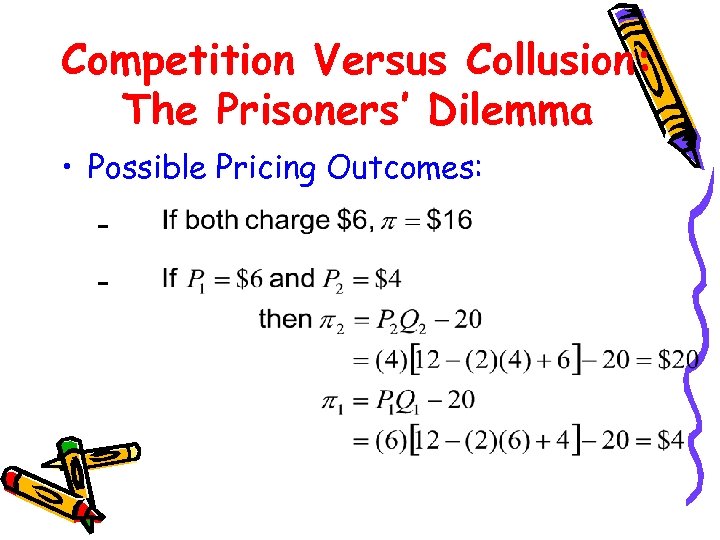

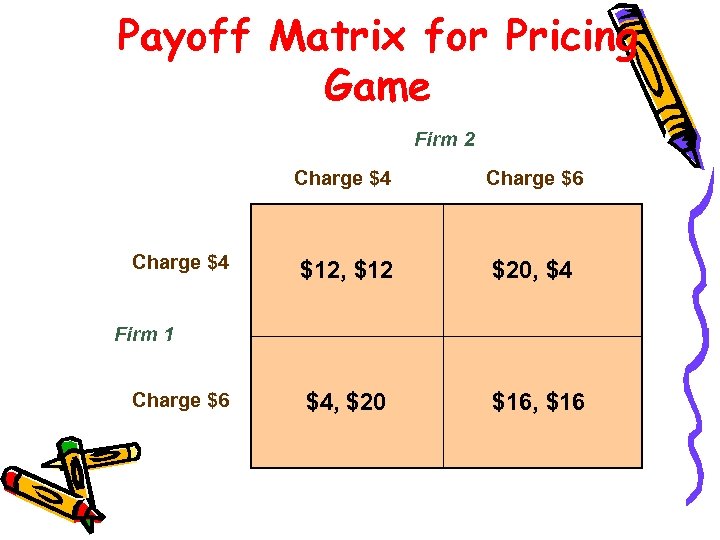

Payoff Matrix for Pricing Game Firm 2 Charge $4 Charge $6 $12, $12 $20, $4 $4, $20 $16, $16 Firm 1 Charge $6

Payoff Matrix for Pricing Game Firm 2 Charge $4 Charge $6 $12, $12 $20, $4 $4, $20 $16, $16 Firm 1 Charge $6

Competition Versus Collusion: The Prisoners’ Dilemma • These two firms are playing a noncooperative game. – Each firm independently does the best it can taking its competitor into account. • An example in game theory, called the Prisoners’ Dilemma, illustrates the problem oligopolistic firms face.

Competition Versus Collusion: The Prisoners’ Dilemma • These two firms are playing a noncooperative game. – Each firm independently does the best it can taking its competitor into account. • An example in game theory, called the Prisoners’ Dilemma, illustrates the problem oligopolistic firms face.

The Prisoners’ Dilemma • Scenario – Two prisoners have been accused of collaborating in a crime. – They are in separate jail cells and cannot communicate. – Each has been asked to confess to the crime.

The Prisoners’ Dilemma • Scenario – Two prisoners have been accused of collaborating in a crime. – They are in separate jail cells and cannot communicate. – Each has been asked to confess to the crime.

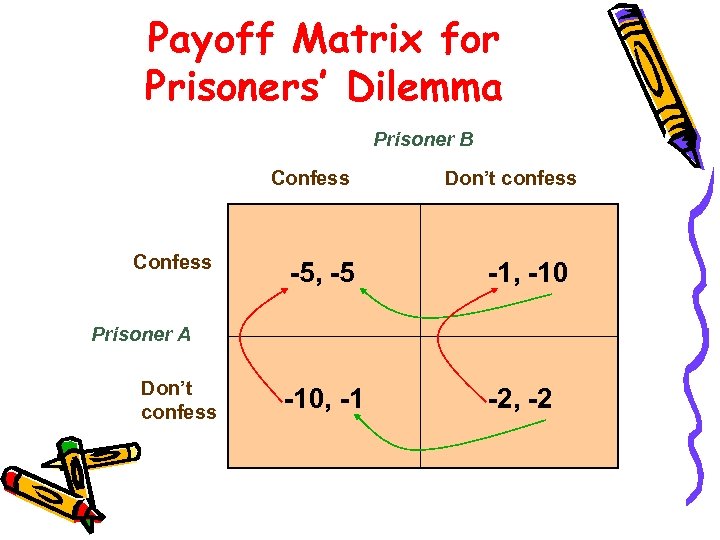

Payoff Matrix for Prisoners’ Dilemma Prisoner B Confess Don’t confess -5, -5 -1, -10, -1 -2, -2 Prisoner A Don’t confess

Payoff Matrix for Prisoners’ Dilemma Prisoner B Confess Don’t confess -5, -5 -1, -10, -1 -2, -2 Prisoner A Don’t confess

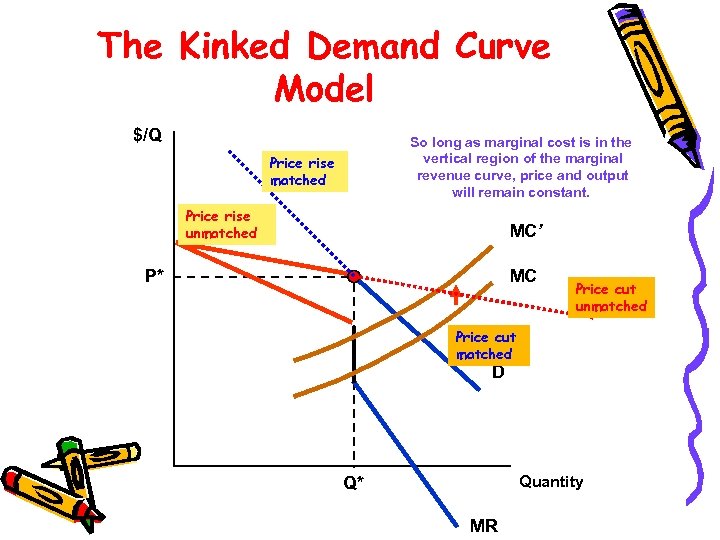

Implications of the Prisoners’ Dilemma for Oligipolistic Pricing • In some oligopoly markets, pricing behavior in time can create a predictable pricing environment and implied collusion may occur. • In other oligopoly markets, the firms are very aggressive and collusion is not possible. • Firms are reluctant to change price because of the likely response of their competitors. • In this case prices tend to be relatively rigid, leading to a kinked-demand curve model

Implications of the Prisoners’ Dilemma for Oligipolistic Pricing • In some oligopoly markets, pricing behavior in time can create a predictable pricing environment and implied collusion may occur. • In other oligopoly markets, the firms are very aggressive and collusion is not possible. • Firms are reluctant to change price because of the likely response of their competitors. • In this case prices tend to be relatively rigid, leading to a kinked-demand curve model

The Kinked Demand Curve Model $/Q So long as marginal cost is in the vertical region of the marginal revenue curve, price and output will remain constant. Price rise matched Price rise unmatched MC’ P* MC Price cut unmatched Price cut matched D Quantity Q* MR

The Kinked Demand Curve Model $/Q So long as marginal cost is in the vertical region of the marginal revenue curve, price and output will remain constant. Price rise matched Price rise unmatched MC’ P* MC Price cut unmatched Price cut matched D Quantity Q* MR

Price Signaling and Price Leadership • Price Signaling – Implicit collusion in which a firm announces a price increase in the hope that other firms will follow suit • Price Leadership – Pattern of pricing in which one firm regularly announces price changes that other firms then match

Price Signaling and Price Leadership • Price Signaling – Implicit collusion in which a firm announces a price increase in the hope that other firms will follow suit • Price Leadership – Pattern of pricing in which one firm regularly announces price changes that other firms then match

The Dominant Firm Model • In some oligopolistic markets, one large firm has a major share of total sales, and a group of smaller firms supplies the remainder of the market. • The large firm might then act as the dominant firm, setting a price that maximized its own profits.

The Dominant Firm Model • In some oligopolistic markets, one large firm has a major share of total sales, and a group of smaller firms supplies the remainder of the market. • The large firm might then act as the dominant firm, setting a price that maximized its own profits.

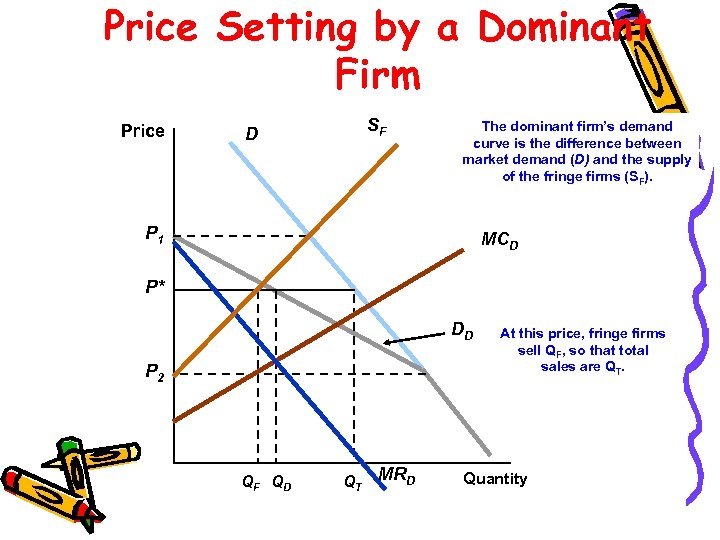

Price Setting by a Dominant Firm Price SF D The dominant firm’s demand curve is the difference between market demand (D) and the supply of the fringe firms (SF). P 1 MCD P* DD P 2 QF QD QT MRD At this price, fringe firms sell QF, so that total sales are QT. Quantity

Price Setting by a Dominant Firm Price SF D The dominant firm’s demand curve is the difference between market demand (D) and the supply of the fringe firms (SF). P 1 MCD P* DD P 2 QF QD QT MRD At this price, fringe firms sell QF, so that total sales are QT. Quantity

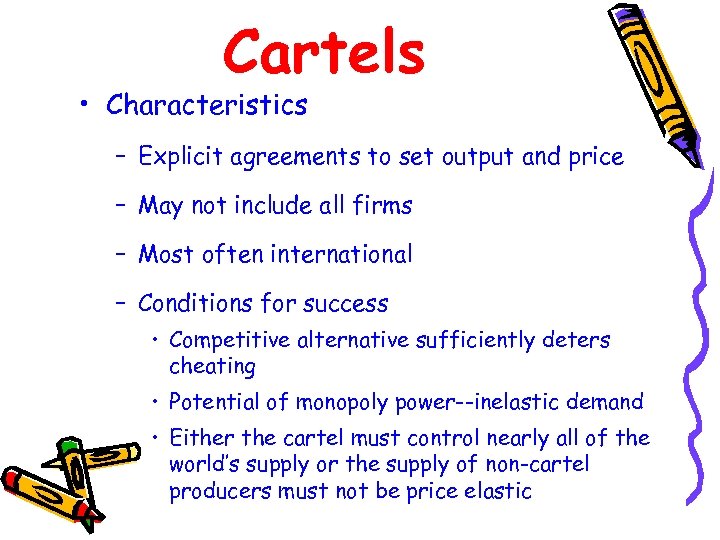

Cartels • Characteristics – Explicit agreements to set output and price – May not include all firms – Most often international – Conditions for success • Competitive alternative sufficiently deters cheating • Potential of monopoly power--inelastic demand • Either the cartel must control nearly all of the world’s supply or the supply of non-cartel producers must not be price elastic

Cartels • Characteristics – Explicit agreements to set output and price – May not include all firms – Most often international – Conditions for success • Competitive alternative sufficiently deters cheating • Potential of monopoly power--inelastic demand • Either the cartel must control nearly all of the world’s supply or the supply of non-cartel producers must not be price elastic

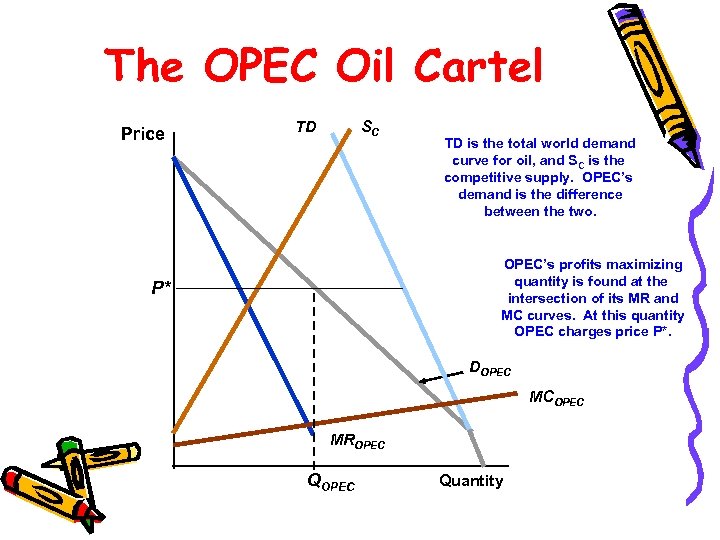

The OPEC Oil Cartel Price TD SC TD is the total world demand curve for oil, and SC is the competitive supply. OPEC’s demand is the difference between the two. OPEC’s profits maximizing quantity is found at the intersection of its MR and MC curves. At this quantity OPEC charges price P*. P* DOPEC MCOPEC MROPEC Quantity

The OPEC Oil Cartel Price TD SC TD is the total world demand curve for oil, and SC is the competitive supply. OPEC’s demand is the difference between the two. OPEC’s profits maximizing quantity is found at the intersection of its MR and MC curves. At this quantity OPEC charges price P*. P* DOPEC MCOPEC MROPEC Quantity

Cartels • About OPEC – – Very low MC TD is inelastic Non-OPEC supply is inelastic DOPEC is relatively inelastic

Cartels • About OPEC – – Very low MC TD is inelastic Non-OPEC supply is inelastic DOPEC is relatively inelastic

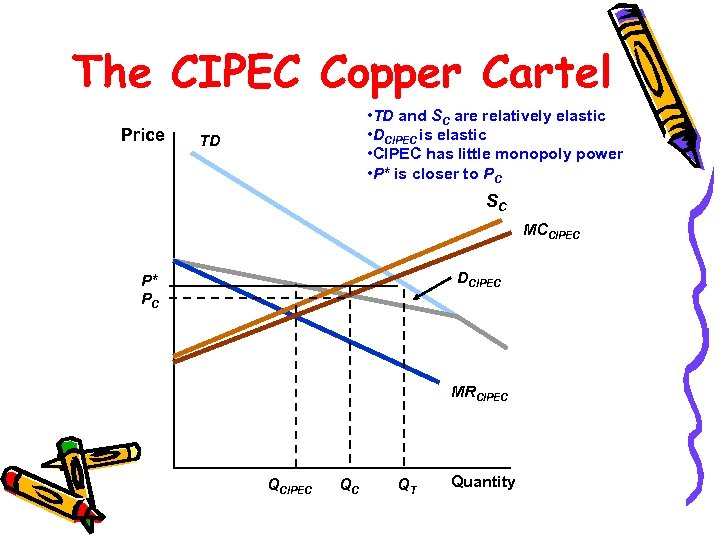

The CIPEC Copper Cartel Price • TD and SC are relatively elastic • DCIPEC is elastic • CIPEC has little monopoly power • P* is closer to PC TD SC MCCIPEC DCIPEC P* PC MRCIPEC QC QT Quantity

The CIPEC Copper Cartel Price • TD and SC are relatively elastic • DCIPEC is elastic • CIPEC has little monopoly power • P* is closer to PC TD SC MCCIPEC DCIPEC P* PC MRCIPEC QC QT Quantity