1a14f630dba95653847c753c19294bf2.ppt

- Количество слайдов: 17

Oligopoly & Game Theory Lecture 27 Dr. Jennifer P. Wissink © 2017 John M. Abowd and Jennifer P. Wissink, all rights reserved. May 10, 2017

Oligopoly & Game Theory Lecture 27 Dr. Jennifer P. Wissink © 2017 John M. Abowd and Jennifer P. Wissink, all rights reserved. May 10, 2017

Funny Story u Guido Menzio, an Italian economist from the University of Pennsylvania – – u Ph. D. Economics, Northwestern University Evanston, IL, 2005 Thesis: The Wage Policy of the Firm: Micro-foundations and Macro Implications Committee Chairperson: Professor Dale T. Mortensen Carlo Alberto Medal for Best Italian Economist Under 40, 2015 Ten ways to tell you might be sitting next to an economist – – – http: //www. economist. com/blogs/buttonwood/2016/05/airline-safety 1. He refuses to listen to the safety announcement because "in the long run, we're all dead" 2. He keeps telling you that "there is no such thing" as a "complimentary refreshment service" 3. He avoids prolonged conversation with you because he has a "rational expectation" that you're an idiot since you chose the middle seat 4. But he offers to trade his aisle seat for yours in a competitive auction with the woman sitting behind you 5. He plonks his elbow on the arm rest because space has a "higher marginal utility" for him than for you 6. When he elbows you in the ribs, he says he is simply trying to "nudge" you into better behaviour 7. When he opens the overhead locker, a copy of Thomas Piketty's "Capital in the 21 st century" falls out and hits you on the head 8. But then he uses the book as a footrest 9. He only relaxes when the plane reaches 35, 000 feet because then it's in "general equilibrium" 10. Spends all the flight scribbling Greek letters into a notebook. Turns out it's not a series of equations; he's part of the IMF negotiating team en route to Athens 11. Adds an extra point to a "top 10 list" because he believes in "quantitative reasoning"

Funny Story u Guido Menzio, an Italian economist from the University of Pennsylvania – – u Ph. D. Economics, Northwestern University Evanston, IL, 2005 Thesis: The Wage Policy of the Firm: Micro-foundations and Macro Implications Committee Chairperson: Professor Dale T. Mortensen Carlo Alberto Medal for Best Italian Economist Under 40, 2015 Ten ways to tell you might be sitting next to an economist – – – http: //www. economist. com/blogs/buttonwood/2016/05/airline-safety 1. He refuses to listen to the safety announcement because "in the long run, we're all dead" 2. He keeps telling you that "there is no such thing" as a "complimentary refreshment service" 3. He avoids prolonged conversation with you because he has a "rational expectation" that you're an idiot since you chose the middle seat 4. But he offers to trade his aisle seat for yours in a competitive auction with the woman sitting behind you 5. He plonks his elbow on the arm rest because space has a "higher marginal utility" for him than for you 6. When he elbows you in the ribs, he says he is simply trying to "nudge" you into better behaviour 7. When he opens the overhead locker, a copy of Thomas Piketty's "Capital in the 21 st century" falls out and hits you on the head 8. But then he uses the book as a footrest 9. He only relaxes when the plane reaches 35, 000 feet because then it's in "general equilibrium" 10. Spends all the flight scribbling Greek letters into a notebook. Turns out it's not a series of equations; he's part of the IMF negotiating team en route to Athens 11. Adds an extra point to a "top 10 list" because he believes in "quantitative reasoning"

#1 Cournot-Nash Duopoly Structure A Non-Cooperative Outcome in Quantities u u u Pioneered by Antoine Augustin Cournot, circa 1838. Duopoly an oligopoly of 2 firms. Firms selling identical spring water. Firms have identical cost functions. Firms decide how many units to put on the market – Choice variables are q 1 and q 2 u Market then determines the price: – PD = f(Q) where Q=q 1+q 2 u So…, GIVEN what your rival is putting on the market, the more you put on the market, the lower the price for both of you, and vice versa.

#1 Cournot-Nash Duopoly Structure A Non-Cooperative Outcome in Quantities u u u Pioneered by Antoine Augustin Cournot, circa 1838. Duopoly an oligopoly of 2 firms. Firms selling identical spring water. Firms have identical cost functions. Firms decide how many units to put on the market – Choice variables are q 1 and q 2 u Market then determines the price: – PD = f(Q) where Q=q 1+q 2 u So…, GIVEN what your rival is putting on the market, the more you put on the market, the lower the price for both of you, and vice versa.

#1 Cournot-Nash Duopoly Conduct & Performance u Conduct: The Cournot-Nash(CN) Equilibrium – Firms’ quantities: q 1 CN and q 2 CN – Market quantity: QCN = q 1 CN + q 2 CN – Market price: » Get PCN from plugging QCN into demand: PD = f(QCN) – Firms’ profit: » Get profit for each firm: P 1 CN and P 2 CN – Joint profit: Pjoint. CN= P 1 CN + P 2 CN u Performance: Efficiency & Equity – It’s complicated.

#1 Cournot-Nash Duopoly Conduct & Performance u Conduct: The Cournot-Nash(CN) Equilibrium – Firms’ quantities: q 1 CN and q 2 CN – Market quantity: QCN = q 1 CN + q 2 CN – Market price: » Get PCN from plugging QCN into demand: PD = f(QCN) – Firms’ profit: » Get profit for each firm: P 1 CN and P 2 CN – Joint profit: Pjoint. CN= P 1 CN + P 2 CN u Performance: Efficiency & Equity – It’s complicated.

#1 Cournot-Nash Duopoly Comparisons & Extensions u Cournot Nash(CN) compared to simple monopoly(SM) and to perfect competition(*) – Q* > QCN > QSM – P* < PCN < PSM – PSM > P CN > P Joint* – Deadweight loss with CN is less than for a simple monopoly but still positive, thus greater than the deadweight loss from a competitive market. u Extensions of the model? – More than two firms? Can do. – Different cost structures? Can do.

#1 Cournot-Nash Duopoly Comparisons & Extensions u Cournot Nash(CN) compared to simple monopoly(SM) and to perfect competition(*) – Q* > QCN > QSM – P* < PCN < PSM – PSM > P CN > P Joint* – Deadweight loss with CN is less than for a simple monopoly but still positive, thus greater than the deadweight loss from a competitive market. u Extensions of the model? – More than two firms? Can do. – Different cost structures? Can do.

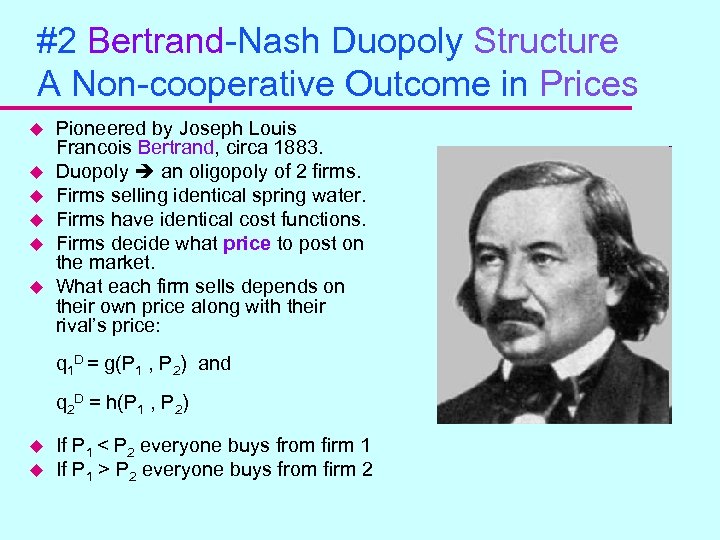

#2 Bertrand-Nash Duopoly Structure A Non-cooperative Outcome in Prices u u u Pioneered by Joseph Louis Francois Bertrand, circa 1883. Duopoly an oligopoly of 2 firms. Firms selling identical spring water. Firms have identical cost functions. Firms decide what price to post on the market. What each firm sells depends on their own price along with their rival’s price: q 1 D = g(P 1 , P 2) and q 2 D = h(P 1 , P 2) u u If P 1 < P 2 everyone buys from firm 1 If P 1 > P 2 everyone buys from firm 2

#2 Bertrand-Nash Duopoly Structure A Non-cooperative Outcome in Prices u u u Pioneered by Joseph Louis Francois Bertrand, circa 1883. Duopoly an oligopoly of 2 firms. Firms selling identical spring water. Firms have identical cost functions. Firms decide what price to post on the market. What each firm sells depends on their own price along with their rival’s price: q 1 D = g(P 1 , P 2) and q 2 D = h(P 1 , P 2) u u If P 1 < P 2 everyone buys from firm 1 If P 1 > P 2 everyone buys from firm 2

#2 Bertrand-Nash Duopoly Conduct & Performance u Recall the Tops & Wegmans story from earlier. . . – think prices instead of locations – rotate the picture 90° – So. . . you get P 1 BN = P 2 BN = PBN = 0 = the perfectly competitive price! u Bertrand-Nash(BN) Equilibrium compared to simple monopoly(SM) and to perfect competition(*) – P* = PBN < PSM – Q* = QBN > QSM – PJoint* = PJoint. BN < PSM – Deadweight loss with BN is zero! – Bertrand all you need is one competitor to get competitive results!! u Extensions of this model? – It’s complicated.

#2 Bertrand-Nash Duopoly Conduct & Performance u Recall the Tops & Wegmans story from earlier. . . – think prices instead of locations – rotate the picture 90° – So. . . you get P 1 BN = P 2 BN = PBN = 0 = the perfectly competitive price! u Bertrand-Nash(BN) Equilibrium compared to simple monopoly(SM) and to perfect competition(*) – P* = PBN < PSM – Q* = QBN > QSM – PJoint* = PJoint. BN < PSM – Deadweight loss with BN is zero! – Bertrand all you need is one competitor to get competitive results!! u Extensions of this model? – It’s complicated.

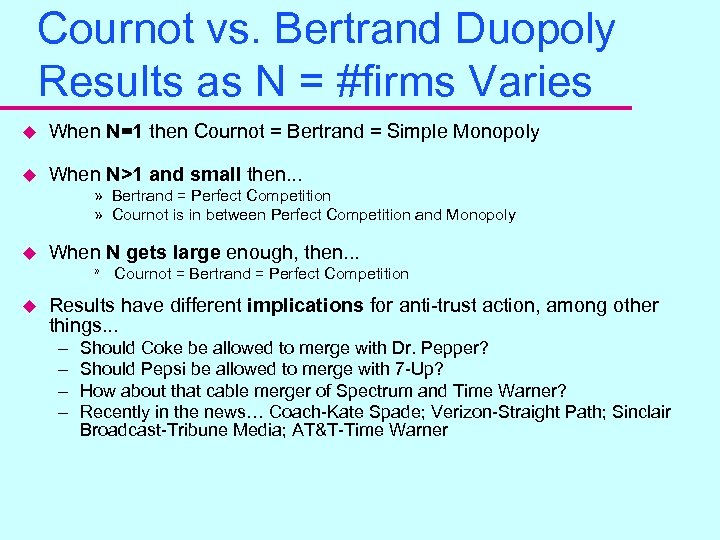

Cournot vs. Bertrand Duopoly Results as N = #firms Varies u When N=1 then Cournot = Bertrand = Simple Monopoly u When N>1 and small then. . . » Bertrand = Perfect Competition » Cournot is in between Perfect Competition and Monopoly u When N gets large enough, then. . . » u Cournot = Bertrand = Perfect Competition Results have different implications for anti-trust action, among other things. . . – – Should Coke be allowed to merge with Dr. Pepper? Should Pepsi be allowed to merge with 7 -Up? How about that cable merger of Spectrum and Time Warner? Recently in the news… Coach-Kate Spade; Verizon-Straight Path; Sinclair Broadcast-Tribune Media; AT&T-Time Warner

Cournot vs. Bertrand Duopoly Results as N = #firms Varies u When N=1 then Cournot = Bertrand = Simple Monopoly u When N>1 and small then. . . » Bertrand = Perfect Competition » Cournot is in between Perfect Competition and Monopoly u When N gets large enough, then. . . » u Cournot = Bertrand = Perfect Competition Results have different implications for anti-trust action, among other things. . . – – Should Coke be allowed to merge with Dr. Pepper? Should Pepsi be allowed to merge with 7 -Up? How about that cable merger of Spectrum and Time Warner? Recently in the news… Coach-Kate Spade; Verizon-Straight Path; Sinclair Broadcast-Tribune Media; AT&T-Time Warner

#3 Edward Chamberlin Duopoly Structure A Cooperative Outcome (Collusion) u u u u circa 1930’s The duopolists can do better than the Non-Cooperative Equilibrium – Bertrand or Cournot. So far, because the equilibrium is non-cooperative, we have ruled out the possibility of collusion between the two firms. Collusion means that the firms explicitly and/or implicitly cooperate in choosing a market output and the division of output between them. (Note, if they set the output level, then the market sets the price. ) If the duopolists collude & divide the market privately, they produce the monopoly quantity and divide the monopoly economic profits. Since the monopoly economic profits are more than the sum of the duopoly profits, the duopolists are better off if they collude. When we allow the possibility of collusion the game can turn out differently. It’s no longer a Non-Cooperative game. Chamberlin suggested duopolists would tacitly collude in this way. – conscious parallelism

#3 Edward Chamberlin Duopoly Structure A Cooperative Outcome (Collusion) u u u u circa 1930’s The duopolists can do better than the Non-Cooperative Equilibrium – Bertrand or Cournot. So far, because the equilibrium is non-cooperative, we have ruled out the possibility of collusion between the two firms. Collusion means that the firms explicitly and/or implicitly cooperate in choosing a market output and the division of output between them. (Note, if they set the output level, then the market sets the price. ) If the duopolists collude & divide the market privately, they produce the monopoly quantity and divide the monopoly economic profits. Since the monopoly economic profits are more than the sum of the duopoly profits, the duopolists are better off if they collude. When we allow the possibility of collusion the game can turn out differently. It’s no longer a Non-Cooperative game. Chamberlin suggested duopolists would tacitly collude in this way. – conscious parallelism

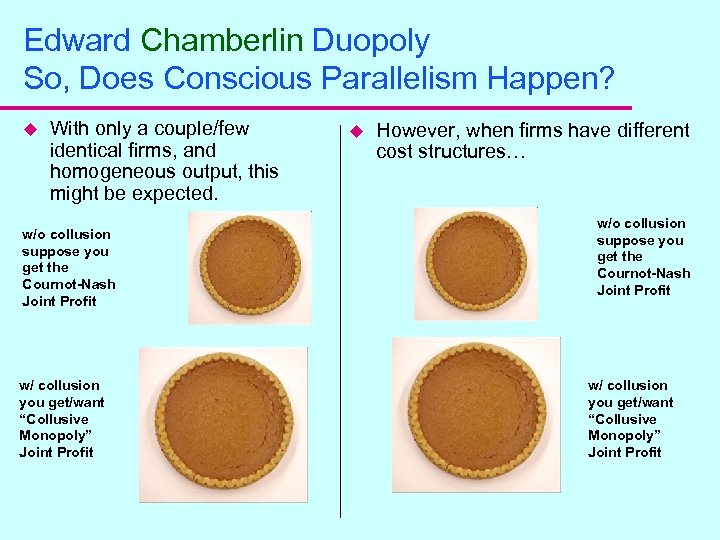

Edward Chamberlin Duopoly So, Does Conscious Parallelism Happen? u With only a couple/few identical firms, and homogeneous output, this might be expected. w/o collusion suppose you get the Cournot-Nash Joint Profit w/ collusion you get/want “Collusive Monopoly” Joint Profit u However, when firms have different cost structures… w/o collusion suppose you get the Cournot-Nash Joint Profit w/ collusion you get/want “Collusive Monopoly” Joint Profit

Edward Chamberlin Duopoly So, Does Conscious Parallelism Happen? u With only a couple/few identical firms, and homogeneous output, this might be expected. w/o collusion suppose you get the Cournot-Nash Joint Profit w/ collusion you get/want “Collusive Monopoly” Joint Profit u However, when firms have different cost structures… w/o collusion suppose you get the Cournot-Nash Joint Profit w/ collusion you get/want “Collusive Monopoly” Joint Profit

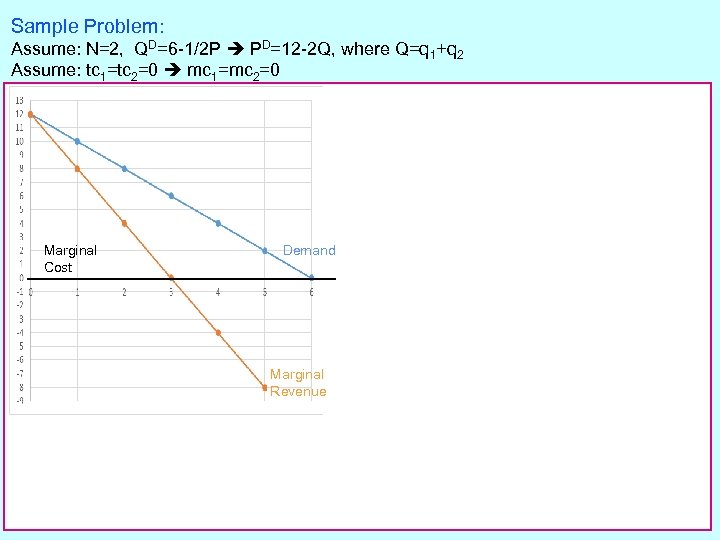

Sample Problem: Assume: N=2, QD=6 -1/2 P PD=12 -2 Q, where Q=q 1+q 2 Assume: tc 1=tc 2=0 mc 1=mc 2=0 Marginal Cost Demand Marginal Revenue

Sample Problem: Assume: N=2, QD=6 -1/2 P PD=12 -2 Q, where Q=q 1+q 2 Assume: tc 1=tc 2=0 mc 1=mc 2=0 Marginal Cost Demand Marginal Revenue

So What Oligopoly Model Is The One? u u Depends on the particular industry. Requires lots of investigation and appeals to empirical information. – Does profit look to be positive? – Does price appear to be greater than marginal cost? u Different markets require using different models of oligopoly behavior.

So What Oligopoly Model Is The One? u u Depends on the particular industry. Requires lots of investigation and appeals to empirical information. – Does profit look to be positive? – Does price appear to be greater than marginal cost? u Different markets require using different models of oligopoly behavior.

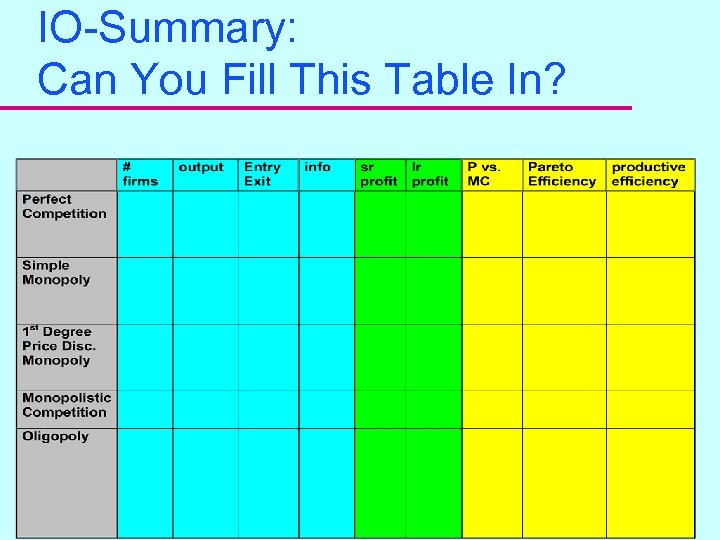

IO-Summary: Can You Fill This Table In?

IO-Summary: Can You Fill This Table In?

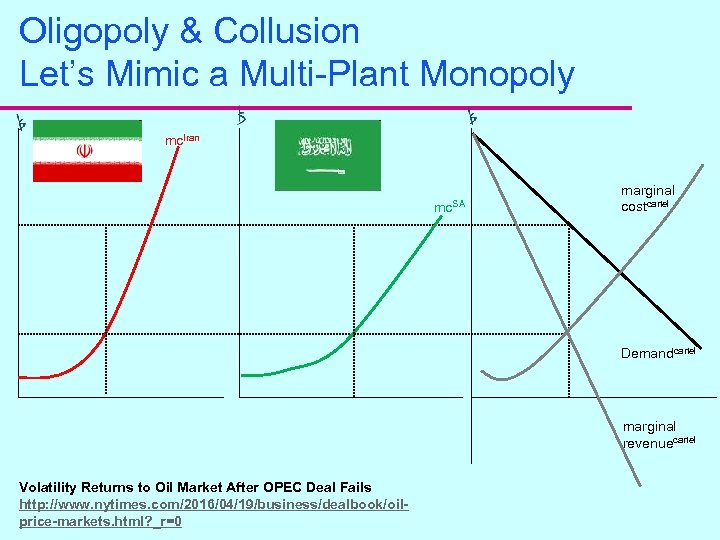

Oligopoly & Collusion Let’s Mimic a Multi-Plant Monopoly mc. Iran mc. SA marginal costcartel Demandcartel marginal revenuecartel Volatility Returns to Oil Market After OPEC Deal Fails http: //www. nytimes. com/2016/04/19/business/dealbook/oilprice-markets. html? _r=0

Oligopoly & Collusion Let’s Mimic a Multi-Plant Monopoly mc. Iran mc. SA marginal costcartel Demandcartel marginal revenuecartel Volatility Returns to Oil Market After OPEC Deal Fails http: //www. nytimes. com/2016/04/19/business/dealbook/oilprice-markets. html? _r=0

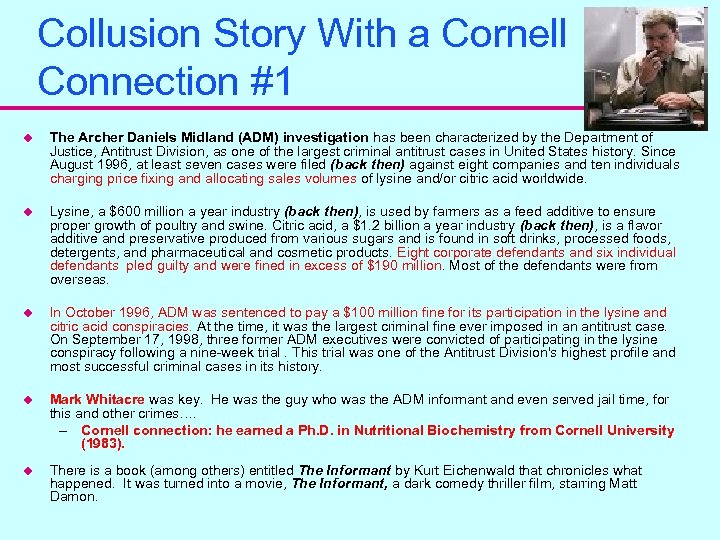

Collusion Story With a Cornell Connection #1 u The Archer Daniels Midland (ADM) investigation has been characterized by the Department of Justice, Antitrust Division, as one of the largest criminal antitrust cases in United States history. Since August 1996, at least seven cases were filed (back then) against eight companies and ten individuals charging price fixing and allocating sales volumes of lysine and/or citric acid worldwide. u Lysine, a $600 million a year industry (back then), is used by farmers as a feed additive to ensure proper growth of poultry and swine. Citric acid, a $1. 2 billion a year industry (back then), is a flavor additive and preservative produced from various sugars and is found in soft drinks, processed foods, detergents, and pharmaceutical and cosmetic products. Eight corporate defendants and six individual defendants pled guilty and were fined in excess of $190 million. Most of the defendants were from overseas. u In October 1996, ADM was sentenced to pay a $100 million fine for its participation in the lysine and citric acid conspiracies. At the time, it was the largest criminal fine ever imposed in an antitrust case. On September 17, 1998, three former ADM executives were convicted of participating in the lysine conspiracy following a nine-week trial. This trial was one of the Antitrust Division's highest profile and most successful criminal cases in its history. u Mark Whitacre was key. He was the guy who was the ADM informant and even served jail time, for this and other crimes…. – Cornell connection: he earned a Ph. D. in Nutritional Biochemistry from Cornell University (1983). u There is a book (among others) entitled The Informant by Kurt Eichenwald that chronicles what happened. It was turned into a movie, The Informant, a dark comedy thriller film, starring Matt Damon.

Collusion Story With a Cornell Connection #1 u The Archer Daniels Midland (ADM) investigation has been characterized by the Department of Justice, Antitrust Division, as one of the largest criminal antitrust cases in United States history. Since August 1996, at least seven cases were filed (back then) against eight companies and ten individuals charging price fixing and allocating sales volumes of lysine and/or citric acid worldwide. u Lysine, a $600 million a year industry (back then), is used by farmers as a feed additive to ensure proper growth of poultry and swine. Citric acid, a $1. 2 billion a year industry (back then), is a flavor additive and preservative produced from various sugars and is found in soft drinks, processed foods, detergents, and pharmaceutical and cosmetic products. Eight corporate defendants and six individual defendants pled guilty and were fined in excess of $190 million. Most of the defendants were from overseas. u In October 1996, ADM was sentenced to pay a $100 million fine for its participation in the lysine and citric acid conspiracies. At the time, it was the largest criminal fine ever imposed in an antitrust case. On September 17, 1998, three former ADM executives were convicted of participating in the lysine conspiracy following a nine-week trial. This trial was one of the Antitrust Division's highest profile and most successful criminal cases in its history. u Mark Whitacre was key. He was the guy who was the ADM informant and even served jail time, for this and other crimes…. – Cornell connection: he earned a Ph. D. in Nutritional Biochemistry from Cornell University (1983). u There is a book (among others) entitled The Informant by Kurt Eichenwald that chronicles what happened. It was turned into a movie, The Informant, a dark comedy thriller film, starring Matt Damon.

Collusion Story With a Cornell Connection #2 u Quoting… The Justice Department last week (back then) sued the eight Ivy League colleges and MIT, plus "various other. . . co-conspirators, " for allegedly violating the Sherman Antitrust Act "by illegally conspiring to restrain price competition on financial aid" to prospective undergraduate students. …The Ivy League colleges signed a consent decree that settles the suit against them. MIT declined to sign. …aides refused to say how the suit would affect the rest of the reported group of 57 colleges which have been under investigation since 1989. In the decree, the Ivy League defendants--Brown, Columbia, Cornell, Dartmouth, Harvard, Princeton, the University of Pennsylvania and Yale--agree that they will no longer collude or conspire on financial aid. They also agreed not to discuss or agree on future tuition or faculty salary increases. – MIT BALKS, Ivies Settle Antitrust Suit on Aid, By Kenneth D. Campbell – From Tech. Talk, Published by the MIT News Office at the Massachusetts Institute of Technology, Cambridge, Mass. May 29, 1991 u MIT Agrees to Settle Antitrust Suit, U. S. Says – December 23, 1993, http: //articles. latimes. com/1993 -12 -23/news/mn-4834_1_financial-aid-policy i>clicker question: Do you buy the MIT argument that price fixing was good for the students and their families? A. YES! B. Nope.

Collusion Story With a Cornell Connection #2 u Quoting… The Justice Department last week (back then) sued the eight Ivy League colleges and MIT, plus "various other. . . co-conspirators, " for allegedly violating the Sherman Antitrust Act "by illegally conspiring to restrain price competition on financial aid" to prospective undergraduate students. …The Ivy League colleges signed a consent decree that settles the suit against them. MIT declined to sign. …aides refused to say how the suit would affect the rest of the reported group of 57 colleges which have been under investigation since 1989. In the decree, the Ivy League defendants--Brown, Columbia, Cornell, Dartmouth, Harvard, Princeton, the University of Pennsylvania and Yale--agree that they will no longer collude or conspire on financial aid. They also agreed not to discuss or agree on future tuition or faculty salary increases. – MIT BALKS, Ivies Settle Antitrust Suit on Aid, By Kenneth D. Campbell – From Tech. Talk, Published by the MIT News Office at the Massachusetts Institute of Technology, Cambridge, Mass. May 29, 1991 u MIT Agrees to Settle Antitrust Suit, U. S. Says – December 23, 1993, http: //articles. latimes. com/1993 -12 -23/news/mn-4834_1_financial-aid-policy i>clicker question: Do you buy the MIT argument that price fixing was good for the students and their families? A. YES! B. Nope.

The End - Amen u u u Study hard. Use the class web pages – stay informed. Work loads of problems. Eat well. Take a walk once in a while. Get some sleep. Don’t survive on And last but not least. . Thanks to YOU ALL for a great semester!! And thanks to the TAs for all their hard work. Best of luck on all your finals. I’m looking for good things from you all in our final!!

The End - Amen u u u Study hard. Use the class web pages – stay informed. Work loads of problems. Eat well. Take a walk once in a while. Get some sleep. Don’t survive on And last but not least. . Thanks to YOU ALL for a great semester!! And thanks to the TAs for all their hard work. Best of luck on all your finals. I’m looking for good things from you all in our final!!