59d06012dab2d1a177419c5953d3964b.ppt

- Количество слайдов: 21

Oklahoma State Regents Presented on September 27, 2006 by Michael H. Strauss, Chief Economist and Chief Operating Officer of Commonfund Asset Management Company Crissie L. Tewell, Managing Director

Why Invest with Commonfund The Pillars That Support Our Mission COMMONFUND MISSION To improve investment management practices and to enhance the financial resources of the nonprofit community EDUCATIONAL PROGRAMS PERFORMANCE SERVICE STRONG FINANCIAL RESOURCES Oklahoma State Regents 2

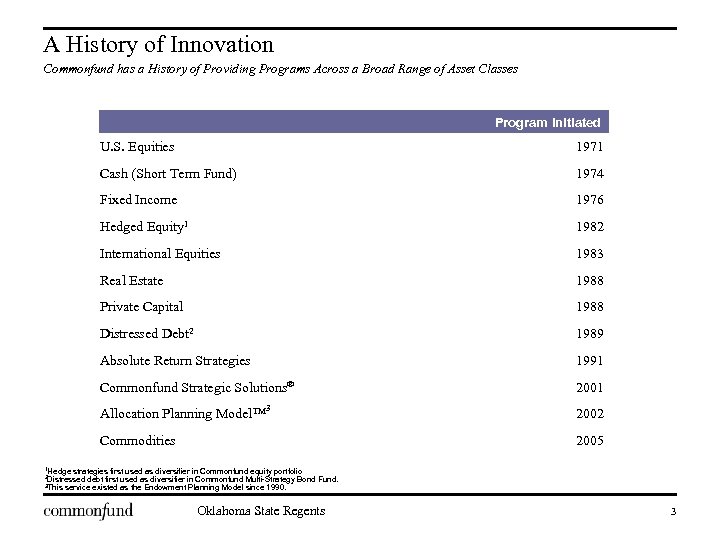

A History of Innovation Commonfund has a History of Providing Programs Across a Broad Range of Asset Classes Program Initiated U. S. Equities 1971 Cash (Short Term Fund) 1974 Fixed Income 1976 Hedged Equity 1 1982 International Equities 1983 Real Estate 1988 Private Capital 1988 Distressed Debt 2 1989 Absolute Return Strategies 1991 Commonfund Strategic Solutions® 2001 3 Allocation Planning Model. TM 2002 Commodities 2005 1 Hedge strategies first used as diversifier in Commonfund equity portfolio debt first used as diversifier in Commonfund Multi-Strategy Bond Fund. service existed as the Endowment Planning Model since 1990. 2 Distressed 3 This Oklahoma State Regents 3

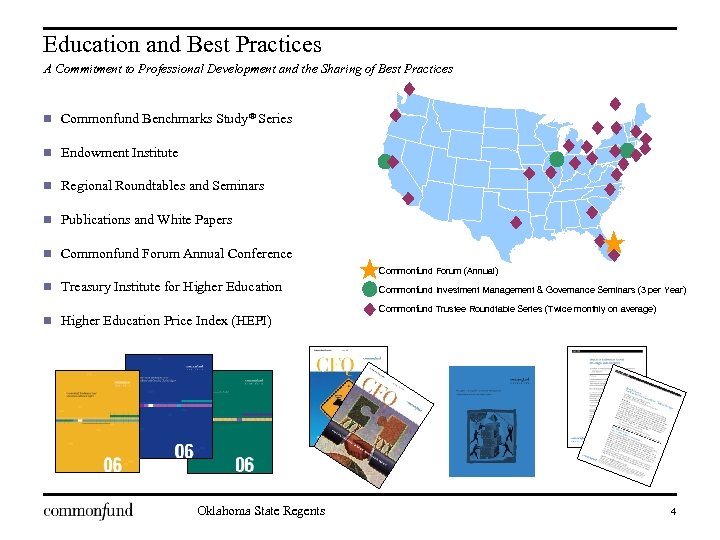

Education and Best Practices A Commitment to Professional Development and the Sharing of Best Practices n Commonfund Benchmarks Study® Series n Endowment Institute n Regional Roundtables and Seminars n Publications and White Papers n Commonfund Forum Annual Conference Commonfund Forum (Annual) n Treasury Institute for Higher Education n Higher Education Price Index (HEPI) Oklahoma State Regents Commonfund Investment Management & Governance Seminars (3 per Year) Commonfund Trustee Roundtable Series (Twice monthly on average) 4

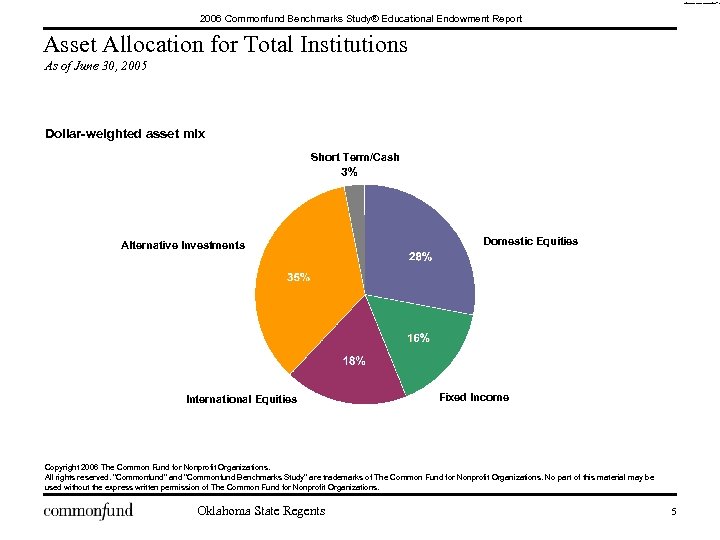

Hot ChartsCFBenchmarks_Study_2006 Commonfund Benchmarks Study® Educational Endowment Report Asset Allocation for Total Institutions As of June 30, 2005 Dollar-weighted asset mix Short Term/Cash Alternative Investments International Equities Domestic Equities Fixed Income Copyright 2006 The Common Fund for Nonprofit Organizations. All rights reserved. "Commonfund" and "Commonfund Benchmarks Study" are trademarks of The Common Fund for Nonprofit Organizations. No part of this material may be used without the express written permission of The Common Fund for Nonprofit Organizations. Oklahoma State Regents 5

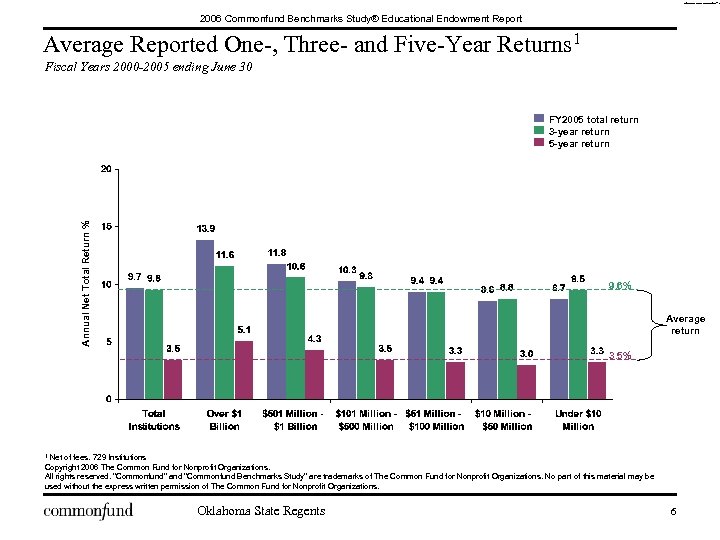

Hot ChartsCFBenchmarks_Study_2006 Commonfund Benchmarks Study® Educational Endowment Report Average Reported One-, Three- and Five-Year Returns 1 Fiscal Years 2000 -2005 ending June 30 Annual Net Total Return % FY 2005 total return 3 -year return 5 -year return 9. 6% Average return 3. 5% Net of fees. 729 Institutions Copyright 2006 The Common Fund for Nonprofit Organizations. All rights reserved. "Commonfund" and "Commonfund Benchmarks Study" are trademarks of The Common Fund for Nonprofit Organizations. No part of this material may be used without the express written permission of The Common Fund for Nonprofit Organizations. 1 Oklahoma State Regents 6

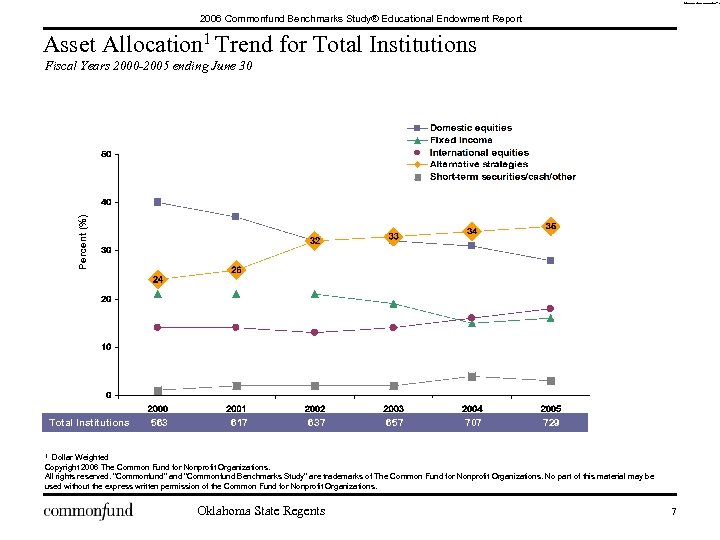

Hot ChartsCFBenchmarks_Study_2006 Commonfund Benchmarks Study® Educational Endowment Report Asset Allocation 1 Trend for Total Institutions Percent (%) Fiscal Years 2000 -2005 ending June 30 Total Institutions 563 617 637 657 707 729 Dollar Weighted Copyright 2006 The Common Fund for Nonprofit Organizations. All rights reserved. "Commonfund" and "Commonfund Benchmarks Study" are trademarks of The Common Fund for Nonprofit Organizations. No part of this material may be used without the express written permission of the Common Fund for Nonprofit Organizations. 1 Oklahoma State Regents 7

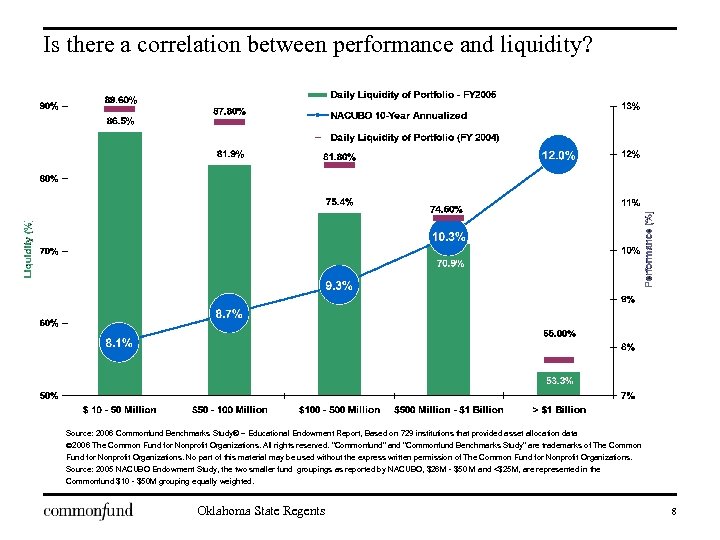

Is there a correlation between performance and liquidity? Source: 2006 Commonfund Benchmarks Study® – Educational Endowment Report, Based on 729 institutions that provided asset allocation data 2006 The Common Fund for Nonprofit Organizations. All rights reserved. "Commonfund" and "Commonfund Benchmarks Study" are trademarks of The Common Fund for Nonprofit Organizations. No part of this material may be used without the express written permission of The Common Fund for Nonprofit Organizations. Source: 2005 NACUBO Endowment Study, the two smaller fund groupings as reported by NACUBO, $26 M - $50 M and <$25 M, are represented in the Commonfund $10 - $50 M grouping equally weighted. Oklahoma State Regents 8

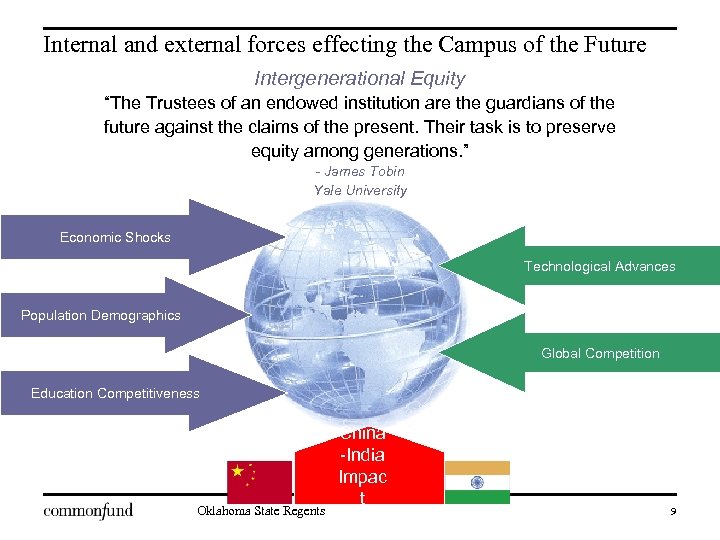

Internal and external forces effecting the Campus of the Future Intergenerational Equity “The Trustees of an endowed institution are the guardians of the future against the claims of the present. Their task is to preserve equity among generations. ” - James Tobin Yale University Economic Shocks Technological Advances Population Demographics Global Competition Education Competitiveness Oklahoma State Regents China -India Impac t 9

Hot ChartsAsset AllocationPrimary_Issues_Invst. M Primary Issues in Investment Management n Asset allocation is the key to successful investment management. n Investments should grow to offset inflation. n Over long periods of time equities typically produce higher incremental returns than cash or bonds. n Diversification among asset classes and managers is a key to increase return and reduce volatility. n Access quality portfolio managers and monitor them on a regular basis for compliance with guidelines and performance measurement. n Conduct periodic asset allocation review. n Minimize costs. Oklahoma State Regents 10

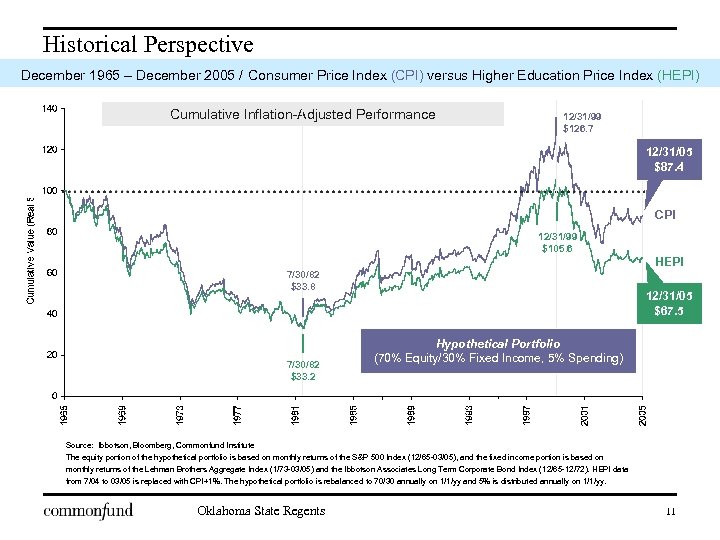

Historical Perspective December 1965 – Consumer Price Index (CPI) versus Price Index (HEPI) December 2005 / Consumer Price Higher Education Cumulative Inflation-Adjusted Performance 12/31/99 $126. 7 12/31/05 $87. 4 CPI 12/31/99 $105. 6 HEPI 7/30/82 $33. 8 7/30/82 $33. 2 12/31/05 $67. 5 Hypothetical Portfolio (70% Equity/30% Fixed Income, 5% Spending) Source: Ibbotson, Bloomberg, Commonfund Institute The equity portion of the hypothetical portfolio is based on monthly returns of the S&P 500 Index (12/65 -03/05), and the fixed income portion is based on monthly returns of the Lehman Brothers Aggregate Index (1/73 -03/05) and the Ibbotson Associates Long Term Corporate Bond Index (12/65 -12/72). HEPI data from 7/04 to 03/05 is replaced with CPI+1%. The hypothetical portfolio is rebalanced to 70/30 annually on 1/1/yy and 5% is distributed annually on 1/1/yy. Oklahoma State Regents 11

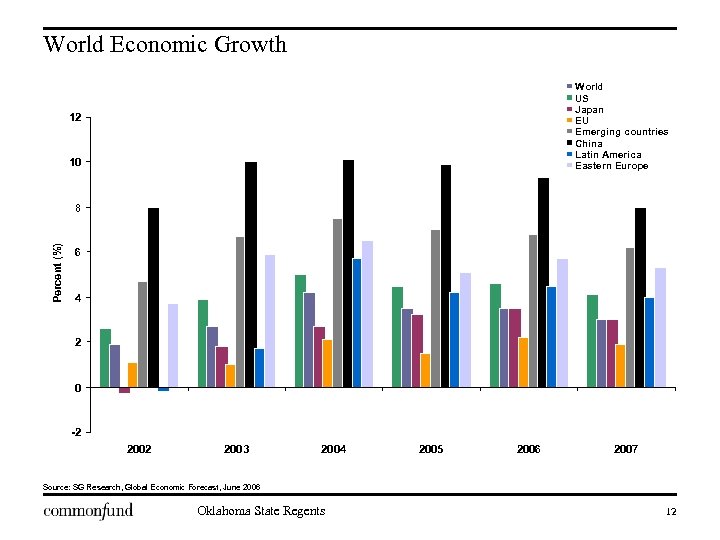

World Economic Growth World US Japan EU Emerging countries China Latin America Eastern Europe 12 10 Percent (%) 8 6 4 2 0 -2 2003 2004 2005 2006 2007 Source: SG Research, Global Economic Forecast, June 2006 Oklahoma State Regents 12

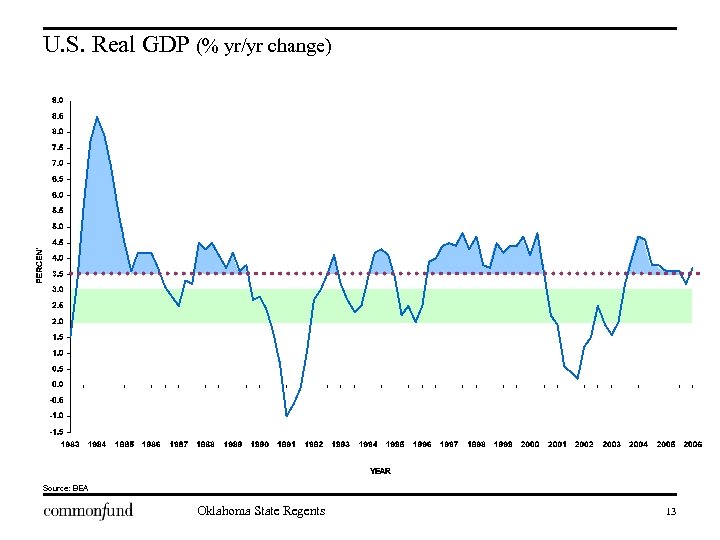

U. S. Real GDP (% yr/yr change) Source: BEA Oklahoma State Regents 13

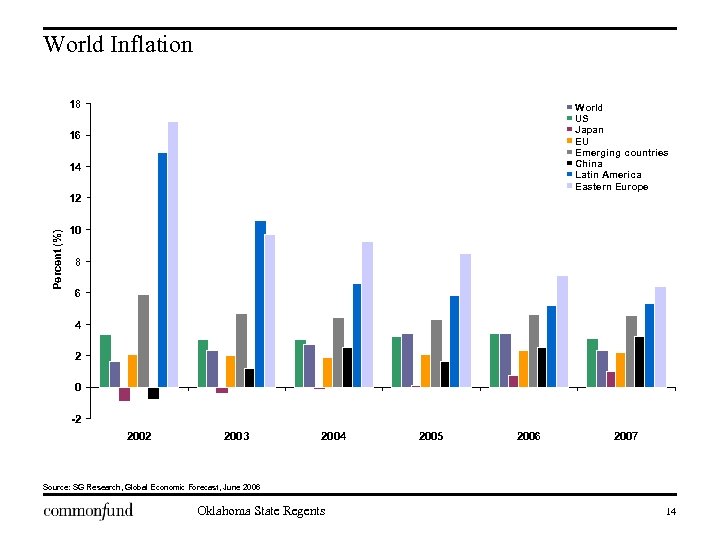

World Inflation 18 World US Japan EU Emerging countries China Latin America Eastern Europe 16 14 Percent (%) 12 10 8 6 4 2 0 -2 2003 2004 2005 2006 2007 Source: SG Research, Global Economic Forecast, June 2006 Oklahoma State Regents 14

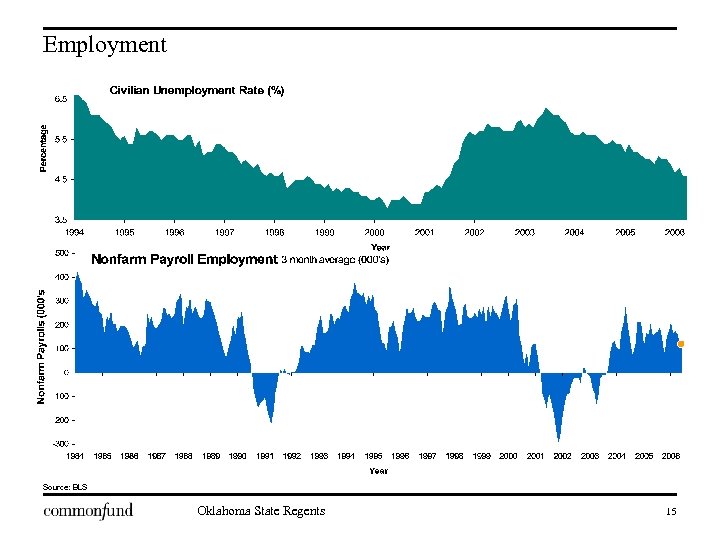

Employment Source: BLS Oklahoma State Regents 15

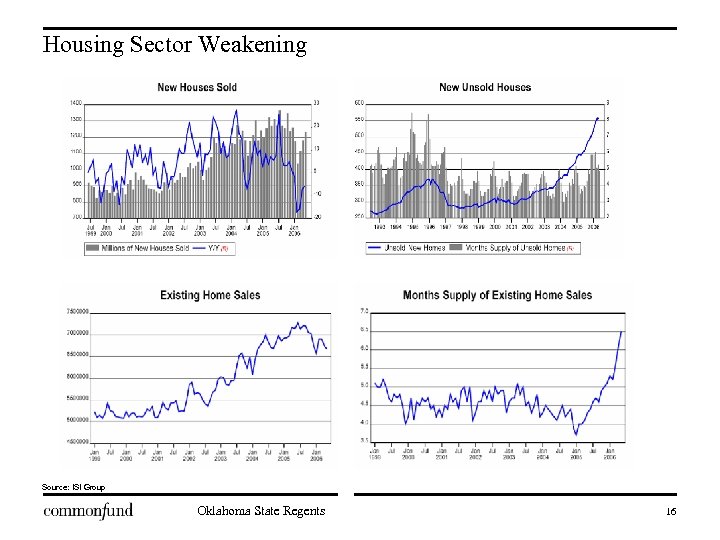

Housing Sector Weakening Source: ISI Group Oklahoma State Regents 16

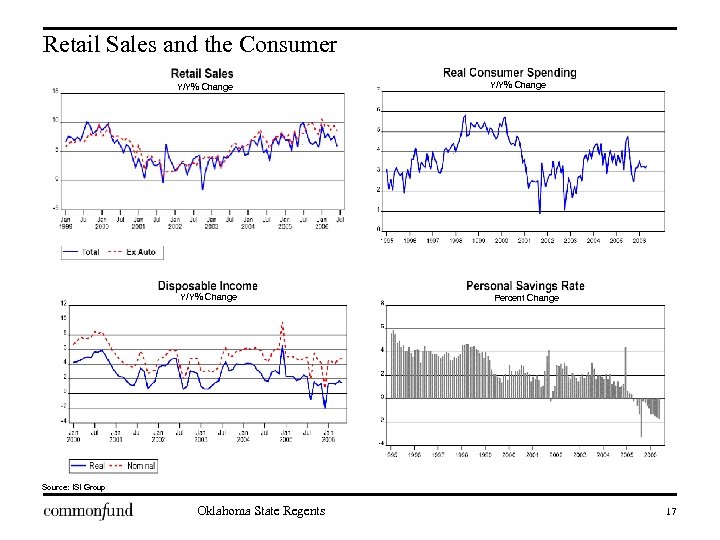

Retail Sales and the Consumer Y/Y% Change Percent Change Source: ISI Group Oklahoma State Regents 17

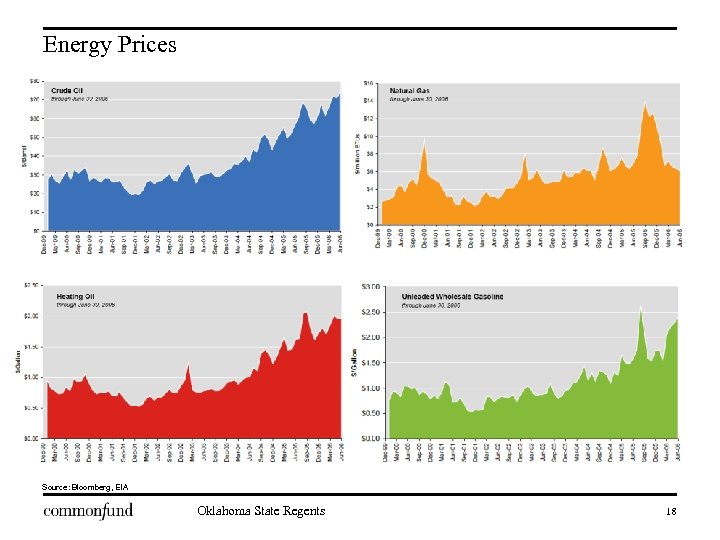

Energy Prices Source: Bloomberg, EIA Oklahoma State Regents 18

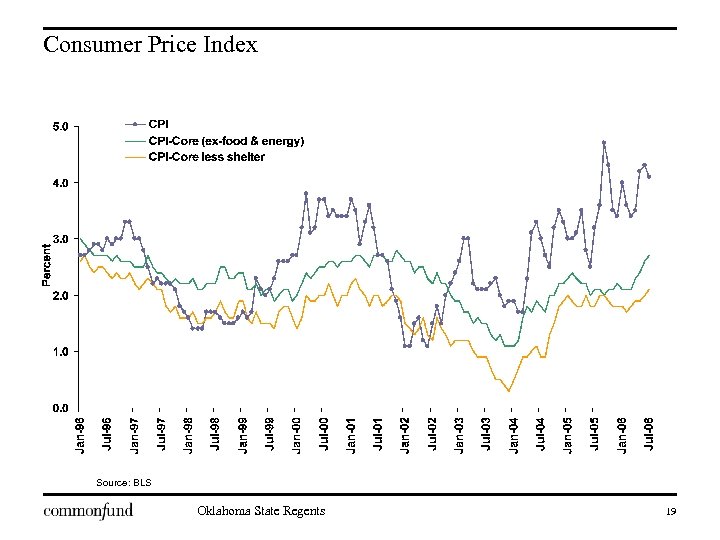

Consumer Price Index Source: BLS Oklahoma State Regents 19

The Fear of the Three Bears Oklahoma State Regents 20

Important Notes for Private Programs This document is intended only for qualified, pre-existing investors in Commonfund Capital, Commonfund Realty and Commonfund Asset Management Company programs, Members of The Common Fund For Nonprofit Organizations (“Commonfund”), or other eligible institutional investors approved by Commonfund Securities, Inc. It is not intended to constitute an offer to sell, nor the solicitation of an offer to buy, securities. Any such offerings will be made only by means of information memoranda and related subscription documents that will be made available by Commonfund Securities, Inc. (a broker-dealer affiliate of Commonfund Capital, Commonfund Realty and Commonfund Asset Management Company) only at the time an offering is in progress and only to investors qualified and eligible to invest. Important Information About Procedures for Opening a New Account: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each customer who opens an account. What this means for you: When you open an account, we may ask for documents or information related to: your principal place of business, local office or other physical location; taxpayer identification number; and other documents demonstrating your lawful existence such as certified articles of incorporation, a government-issued business license, a partnership agreement, or a trust instrument, and other identifying documents. Oklahoma State Regents 21

59d06012dab2d1a177419c5953d3964b.ppt