deaab6ff11979fa372236fab493185d4.ppt

- Количество слайдов: 63

OIL AND GAS INVESTMENT IN INDONESIA DIRECTORATE GENERAL OF OIL AND GAS DEPARTMENT OF ENERGY AND MINERAL RESOURCES

OIL AND GAS INVESTMENT IN INDONESIA DIRECTORATE GENERAL OF OIL AND GAS DEPARTMENT OF ENERGY AND MINERAL RESOURCES

INDONESIA ARCHIPELAGO NATUNA SUMATRA KALIMANTAN SULAWESI MALUKU PAPUA JAVA NUSA TENGGARA Archipelago Inhabited Total Area Water Land TOTAL POPULATIONS : 17, 508 islands : 6, 000 islands : 751, 095 sq mi : 705, 188 sq mi : 45, 907 sq mi : 220 Million Peoples

INDONESIA ARCHIPELAGO NATUNA SUMATRA KALIMANTAN SULAWESI MALUKU PAPUA JAVA NUSA TENGGARA Archipelago Inhabited Total Area Water Land TOTAL POPULATIONS : 17, 508 islands : 6, 000 islands : 751, 095 sq mi : 705, 188 sq mi : 45, 907 sq mi : 220 Million Peoples

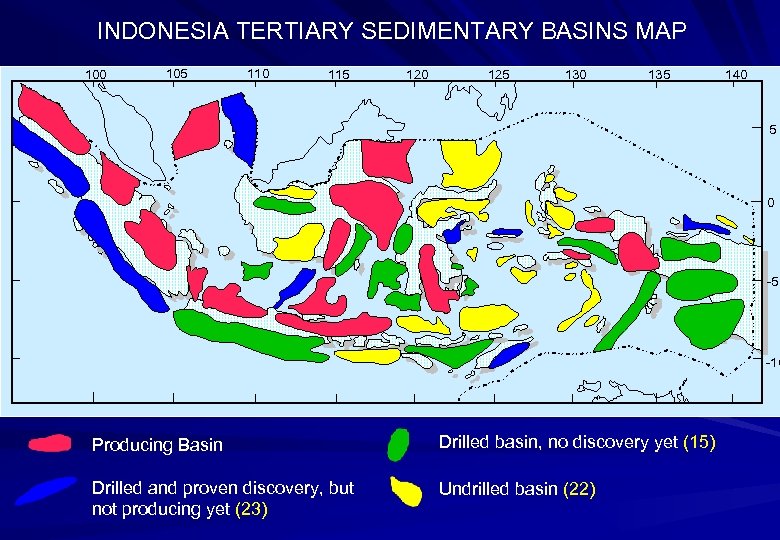

INDONESIA TERTIARY SEDIMENTARY BASINS MAP 100 105 110 115 120 125 130 135 140 5 0 -5 -10 Producing Basin Drilled basin, no discovery yet (15) Drilled and proven discovery, but not producing yet (23) Undrilled basin (22)

INDONESIA TERTIARY SEDIMENTARY BASINS MAP 100 105 110 115 120 125 130 135 140 5 0 -5 -10 Producing Basin Drilled basin, no discovery yet (15) Drilled and proven discovery, but not producing yet (23) Undrilled basin (22)

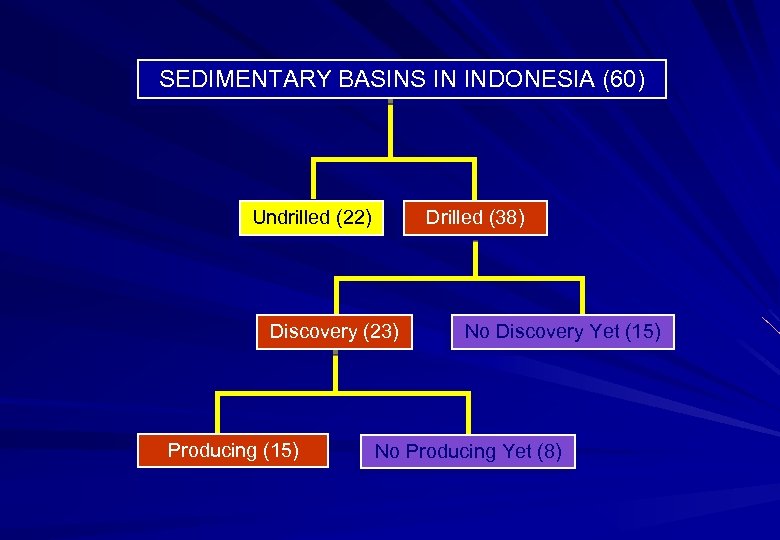

SEDIMENTARY BASINS IN INDONESIA (60) Undrilled (22) Drilled (38) Discovery (23) Producing (15) No Discovery Yet (15) No Producing Yet (8)

SEDIMENTARY BASINS IN INDONESIA (60) Undrilled (22) Drilled (38) Discovery (23) Producing (15) No Discovery Yet (15) No Producing Yet (8)

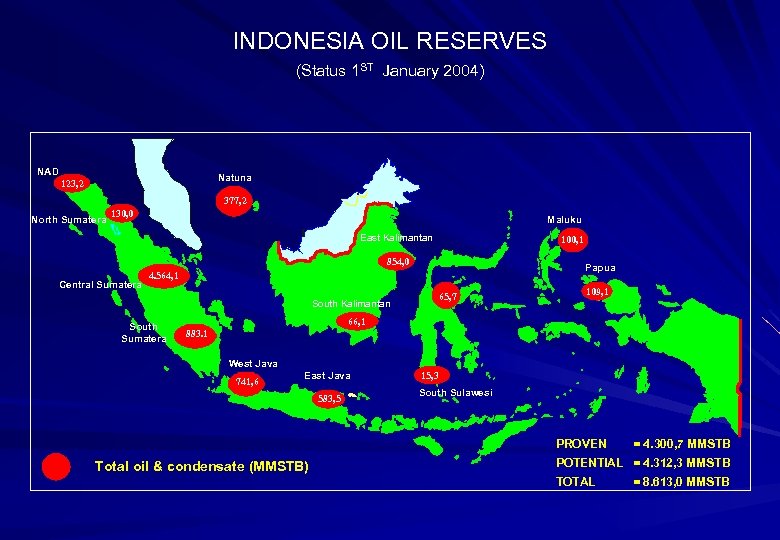

INDONESIA OIL RESERVES (Status 1 ST January 2004) NAD Natuna 123, 2 377, 2 North Sumatera 130, 0 Maluku East Kalimantan 7. 47 100, 1 854, 0 Central Sumatera Papua 4. 564, 1 65, 7 South Kalimantan South Sumatera 109, 1 66, 1 883. 1 West Java 741, 6 East Java 583, 5 15, 3 South Sulawesi PROVEN Total oil & condensate (MMSTB) = 4. 300, 7 MMSTB POTENTIAL = 4. 312, 3 MMSTB TOTAL = 8. 613, 0 MMSTB

INDONESIA OIL RESERVES (Status 1 ST January 2004) NAD Natuna 123, 2 377, 2 North Sumatera 130, 0 Maluku East Kalimantan 7. 47 100, 1 854, 0 Central Sumatera Papua 4. 564, 1 65, 7 South Kalimantan South Sumatera 109, 1 66, 1 883. 1 West Java 741, 6 East Java 583, 5 15, 3 South Sulawesi PROVEN Total oil & condensate (MMSTB) = 4. 300, 7 MMSTB POTENTIAL = 4. 312, 3 MMSTB TOTAL = 8. 613, 0 MMSTB

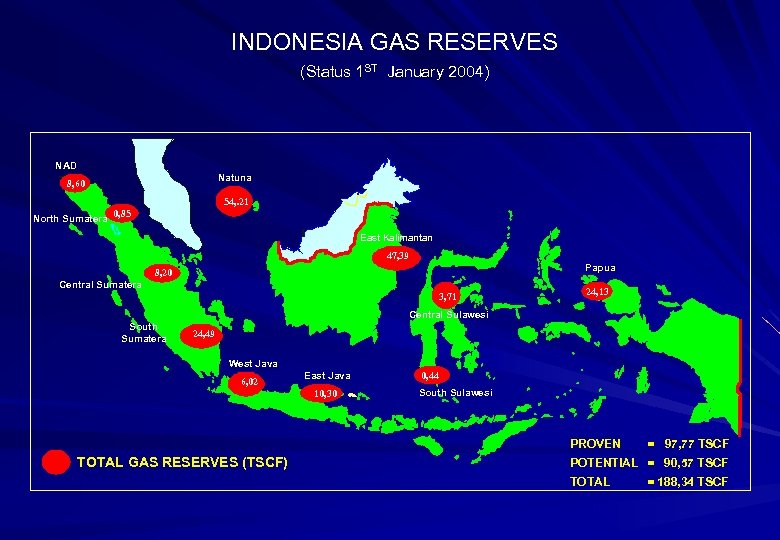

INDONESIA GAS RESERVES (Status 1 ST January 2004) NAD Natuna 8, 60 54, . 21 North Sumatera 0, 85 East Kalimantan 47, 39 Papua 8, 20 Central Sumatera 3, 71 24, 13 Central Sulawesi South Sumatera 24, 49 West Java 6, 02 East Java 10, 30 0, 44 South Sulawesi PROVEN TOTAL GAS RESERVES (TSCF) = 97, 77 TSCF POTENTIAL = 90, 57 TSCF TOTAL = 188, 34 TSCF

INDONESIA GAS RESERVES (Status 1 ST January 2004) NAD Natuna 8, 60 54, . 21 North Sumatera 0, 85 East Kalimantan 47, 39 Papua 8, 20 Central Sumatera 3, 71 24, 13 Central Sulawesi South Sumatera 24, 49 West Java 6, 02 East Java 10, 30 0, 44 South Sulawesi PROVEN TOTAL GAS RESERVES (TSCF) = 97, 77 TSCF POTENTIAL = 90, 57 TSCF TOTAL = 188, 34 TSCF

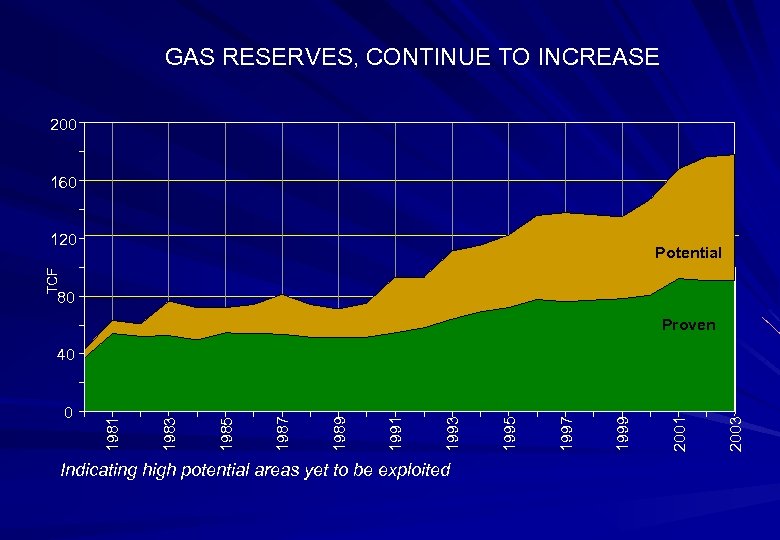

GAS RESERVES, CONTINUE TO INCREASE 200 160 120 TCF Potential 80 Proven Indicating high potential areas yet to be exploited 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 0 1981 40

GAS RESERVES, CONTINUE TO INCREASE 200 160 120 TCF Potential 80 Proven Indicating high potential areas yet to be exploited 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 0 1981 40

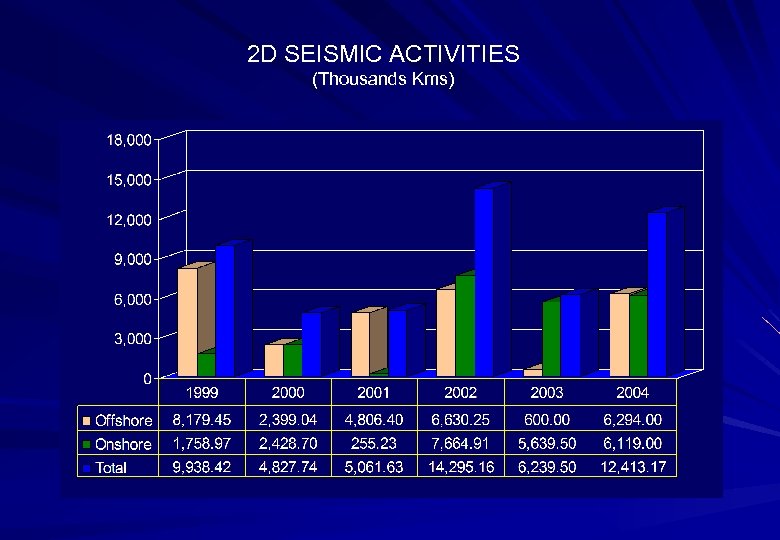

2 D SEISMIC ACTIVITIES (Thousands Kms)

2 D SEISMIC ACTIVITIES (Thousands Kms)

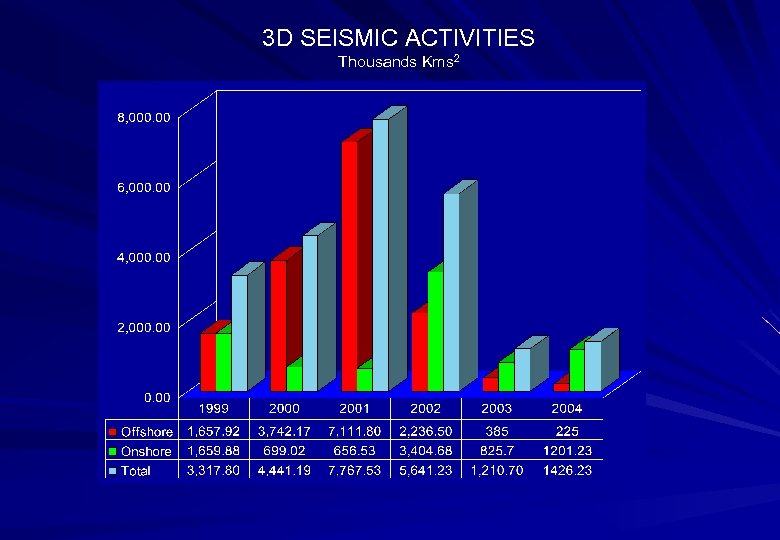

3 D SEISMIC ACTIVITIES Thousands Kms 2

3 D SEISMIC ACTIVITIES Thousands Kms 2

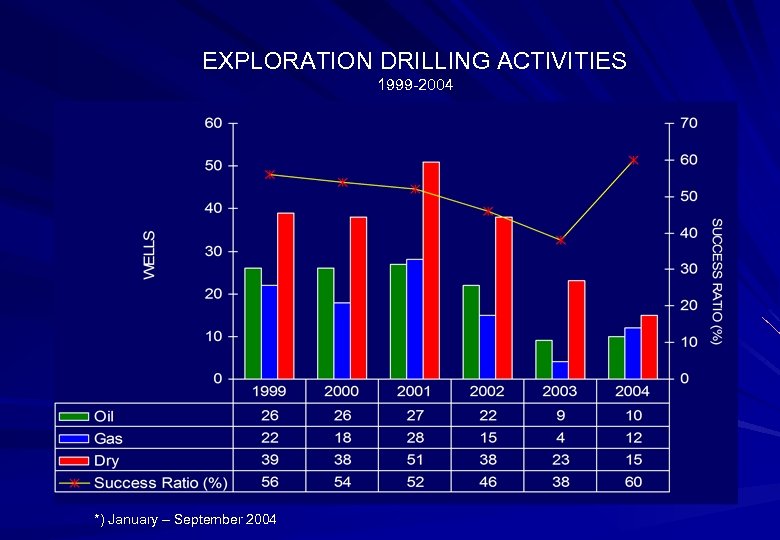

EXPLORATION DRILLING ACTIVITIES 1999 -2004 *) January – September 2004

EXPLORATION DRILLING ACTIVITIES 1999 -2004 *) January – September 2004

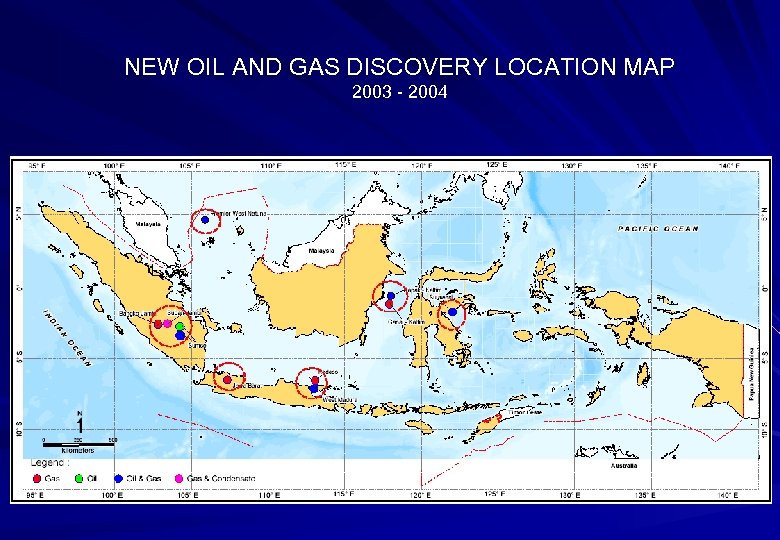

NEW OIL AND GAS DISCOVERY LOCATION MAP 2003 - 2004

NEW OIL AND GAS DISCOVERY LOCATION MAP 2003 - 2004

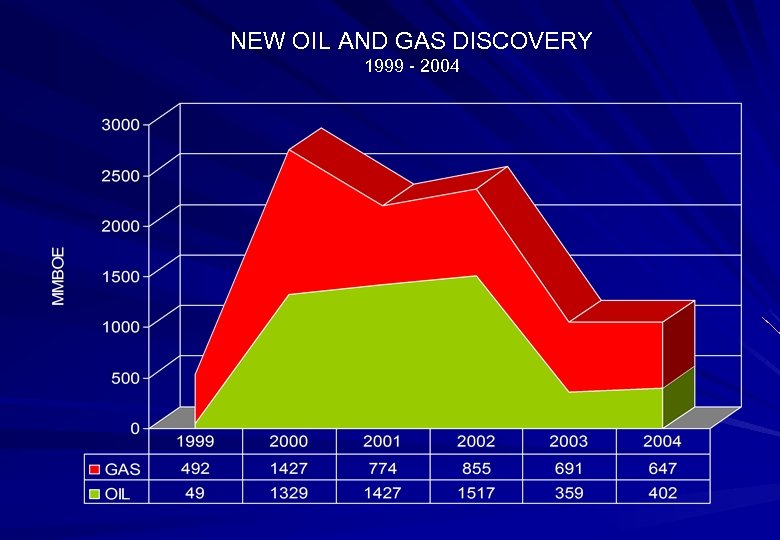

NEW OIL AND GAS DISCOVERY 1999 - 2004

NEW OIL AND GAS DISCOVERY 1999 - 2004

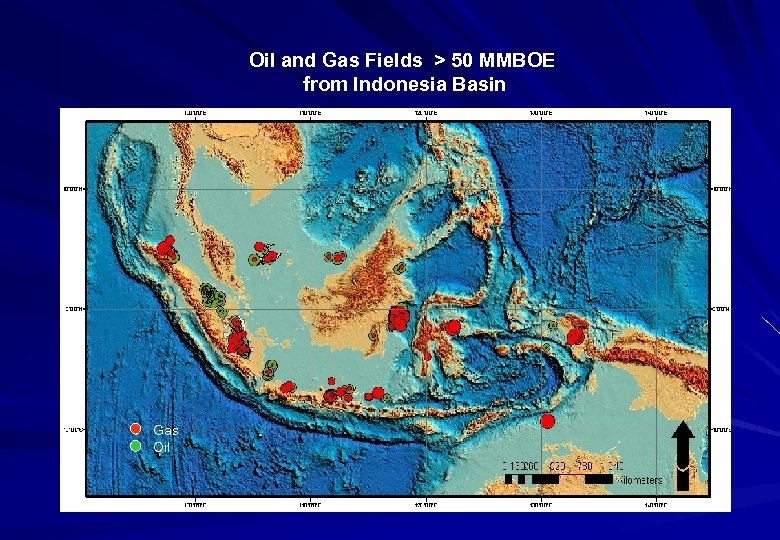

Oil and Gas Fields > 50 MMBOE from Indonesia Basin Gas Oil

Oil and Gas Fields > 50 MMBOE from Indonesia Basin Gas Oil

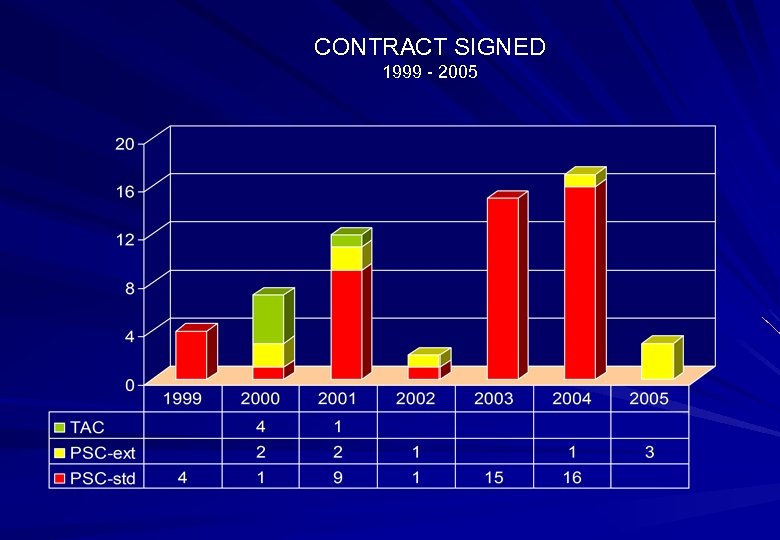

CONTRACT SIGNED 1999 - 2005

CONTRACT SIGNED 1999 - 2005

REALIZATION AND BUDGET EXPENDITURE (INVESTMENT) PRODUCTION SHARING CONTRACTOR (Million US $)

REALIZATION AND BUDGET EXPENDITURE (INVESTMENT) PRODUCTION SHARING CONTRACTOR (Million US $)

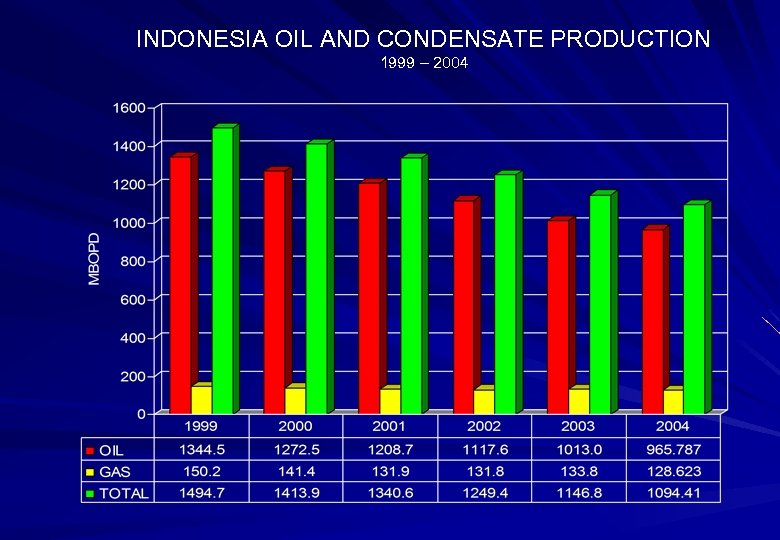

INDONESIA OIL AND CONDENSATE PRODUCTION 1999 – 2004

INDONESIA OIL AND CONDENSATE PRODUCTION 1999 – 2004

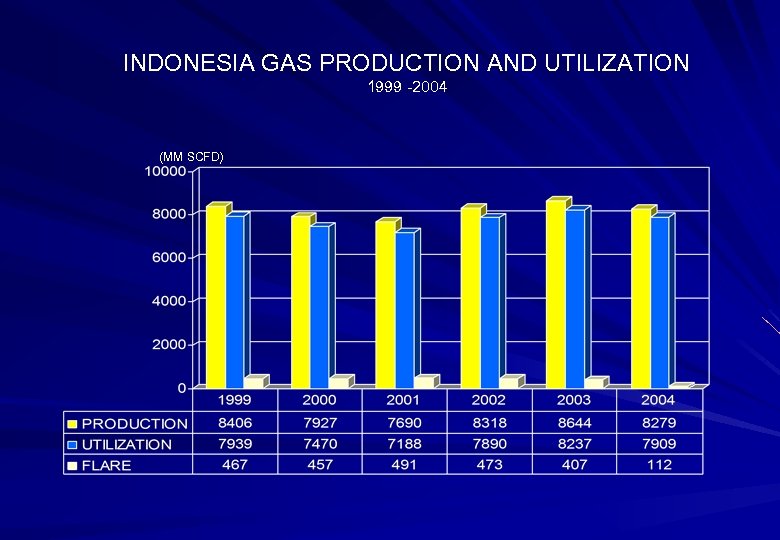

INDONESIA GAS PRODUCTION AND UTILIZATION 1999 -2004 (MM SCFD)

INDONESIA GAS PRODUCTION AND UTILIZATION 1999 -2004 (MM SCFD)

INDONESIA LNG CONTRACT VOLUME (MTPA) MARKET LNG PLANT TERM EXISTING ARUN II 3, 51 JAPAN ARUN 1/1984 – 12/2004 ARUN III 2, 33 KOREA BONTANG/ARUN 1986 – 2007 KOREA II 1, 95 KOREA BONTANG/ARUN 7/1994 – 6/2014 JAPAN 1981 (Ext) 3, 47 JAPAN BONTANG 8/1983 – 3/2003 BADAK III 1, 76 TAIWAN BONTANG 1/1990 – 12/2009 BADAK IV 2, 30 JAPAN BONTANG 1/1994 – 12/2013 JAPAN 1973 (Ext) 8, 34 JAPAN BONTANG 1/2000 – 12/2010 TAIWAN 1, 90 TAIWAN BONTANG 1/1998 – 12/2017 BADAK V 1, 05 KOREA BONTANG 1/1998 – 12/2017 MCGC 0, 34 JAPAN BONTANG 3/1996 – 12/2015 TOTAL 26, 96 NEW / EXISTING JAPAN 1981 (Ext) 3, 47 JAPAN BONTANG 4/2003 – 3/2011 ARUN (Ext) 1, 00 JAPAN BONTANG 1/2005 – 12/2009 FUJIAN 2, 60 CHINA TANGGUH 1/2007 – 12/2031 KOGAS 1, 10 KOREA TANGGUH 1/2005 – 12/2024 SEMPRA ENERGY 3, 70 US WEST COAST TANGGUH 6/2008 – 6/2028 TOTAL 11, 87

INDONESIA LNG CONTRACT VOLUME (MTPA) MARKET LNG PLANT TERM EXISTING ARUN II 3, 51 JAPAN ARUN 1/1984 – 12/2004 ARUN III 2, 33 KOREA BONTANG/ARUN 1986 – 2007 KOREA II 1, 95 KOREA BONTANG/ARUN 7/1994 – 6/2014 JAPAN 1981 (Ext) 3, 47 JAPAN BONTANG 8/1983 – 3/2003 BADAK III 1, 76 TAIWAN BONTANG 1/1990 – 12/2009 BADAK IV 2, 30 JAPAN BONTANG 1/1994 – 12/2013 JAPAN 1973 (Ext) 8, 34 JAPAN BONTANG 1/2000 – 12/2010 TAIWAN 1, 90 TAIWAN BONTANG 1/1998 – 12/2017 BADAK V 1, 05 KOREA BONTANG 1/1998 – 12/2017 MCGC 0, 34 JAPAN BONTANG 3/1996 – 12/2015 TOTAL 26, 96 NEW / EXISTING JAPAN 1981 (Ext) 3, 47 JAPAN BONTANG 4/2003 – 3/2011 ARUN (Ext) 1, 00 JAPAN BONTANG 1/2005 – 12/2009 FUJIAN 2, 60 CHINA TANGGUH 1/2007 – 12/2031 KOGAS 1, 10 KOREA TANGGUH 1/2005 – 12/2024 SEMPRA ENERGY 3, 70 US WEST COAST TANGGUH 6/2008 – 6/2028 TOTAL 11, 87

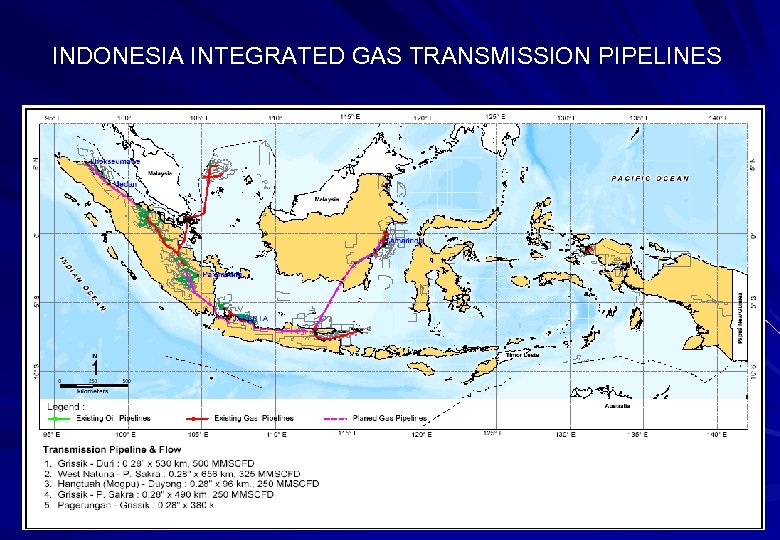

INDONESIA INTEGRATED GAS TRANSMISSION PIPELINES

INDONESIA INTEGRATED GAS TRANSMISSION PIPELINES

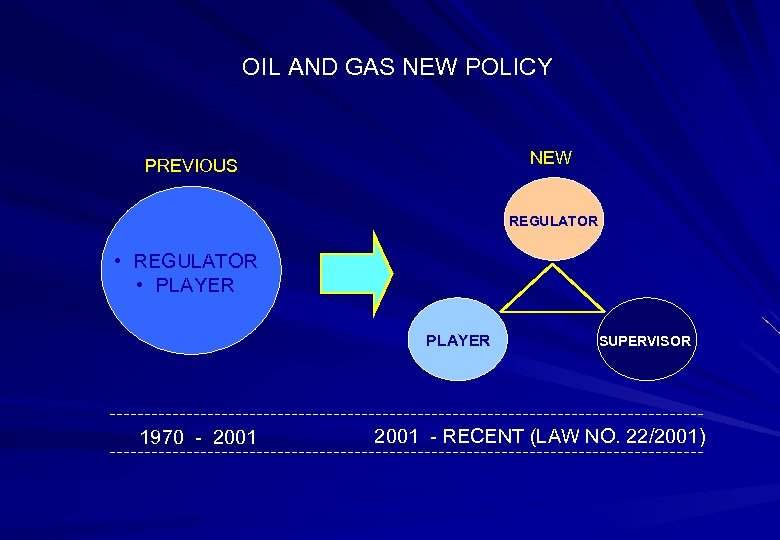

OIL AND GAS NEW POLICY NEW PREVIOUS REGULATOR • REGULATOR • PLAYER 1970 - 2001 SUPERVISOR 2001 - RECENT (LAW NO. 22/2001)

OIL AND GAS NEW POLICY NEW PREVIOUS REGULATOR • REGULATOR • PLAYER 1970 - 2001 SUPERVISOR 2001 - RECENT (LAW NO. 22/2001)

BACKGROUND To promote national welfare Strategic resources play an importance role in the national economy an important role in giving an actual added value to increased and sustainable national economic growth The previous oil and gas law is no longer suitable for development oil and gas business activities

BACKGROUND To promote national welfare Strategic resources play an importance role in the national economy an important role in giving an actual added value to increased and sustainable national economic growth The previous oil and gas law is no longer suitable for development oil and gas business activities

SECTOR REFORM • Enactment of a new oil and gas law • Ending Pertamina’s monopoly and the opening up of all aspects in the petroleum sector to create greater competition while preserving Pertamina as an important company. • Greater pricing mechanism transparency • Establishment of new institution for upstream and downstream petroleum regulation • Introduction of efficiency improvements in hydrocarbon exploration and production

SECTOR REFORM • Enactment of a new oil and gas law • Ending Pertamina’s monopoly and the opening up of all aspects in the petroleum sector to create greater competition while preserving Pertamina as an important company. • Greater pricing mechanism transparency • Establishment of new institution for upstream and downstream petroleum regulation • Introduction of efficiency improvements in hydrocarbon exploration and production

THE INTENTION OF THE IMPLEMENTATION a. To assure that the effective management of Exploration and Exploitation business activities is useful, productive, highly competitive and sustainable with respect to the State’s Oil and Natural Gas which are strategic and nonrenewable natural resources through open and transparent mechanism; b. To assure that the effective management of the business of Processing, Transportation, Storage and Trading is accountable through the mechanism of appropriate, fair and transparent business competition; c. To guarantee the efficiency and effectiveness of the availability of Oil and Natural Gas, either as energy resources or as raw material for domestic need. d. To improve national capability towards competitive environment at the national, regional, and international levels; e. To increase revenue thus giving maximum contribution to the national economy, and to develop and strengthen the position of Indonesian industry and trade; f. To create job opportunities, increase the just and even distribution of the people’s welfare and prosperity and maintain the preservation of the natural environment.

THE INTENTION OF THE IMPLEMENTATION a. To assure that the effective management of Exploration and Exploitation business activities is useful, productive, highly competitive and sustainable with respect to the State’s Oil and Natural Gas which are strategic and nonrenewable natural resources through open and transparent mechanism; b. To assure that the effective management of the business of Processing, Transportation, Storage and Trading is accountable through the mechanism of appropriate, fair and transparent business competition; c. To guarantee the efficiency and effectiveness of the availability of Oil and Natural Gas, either as energy resources or as raw material for domestic need. d. To improve national capability towards competitive environment at the national, regional, and international levels; e. To increase revenue thus giving maximum contribution to the national economy, and to develop and strengthen the position of Indonesian industry and trade; f. To create job opportunities, increase the just and even distribution of the people’s welfare and prosperity and maintain the preservation of the natural environment.

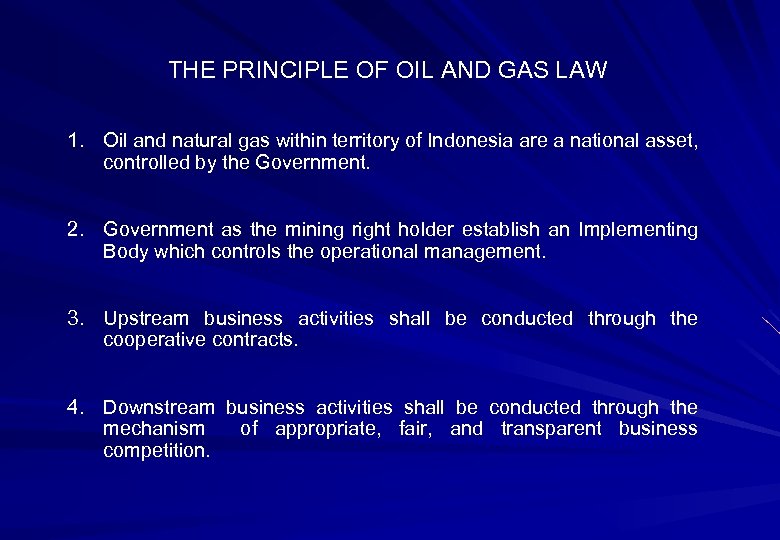

THE PRINCIPLE OF OIL AND GAS LAW 1. Oil and natural gas within territory of Indonesia are a national asset, controlled by the Government. 2. Government as the mining right holder establish an Implementing Body which controls the operational management. 3. Upstream business activities shall be conducted through the cooperative contracts. 4. Downstream business activities shall be conducted through the mechanism of appropriate, fair, and transparent business competition.

THE PRINCIPLE OF OIL AND GAS LAW 1. Oil and natural gas within territory of Indonesia are a national asset, controlled by the Government. 2. Government as the mining right holder establish an Implementing Body which controls the operational management. 3. Upstream business activities shall be conducted through the cooperative contracts. 4. Downstream business activities shall be conducted through the mechanism of appropriate, fair, and transparent business competition.

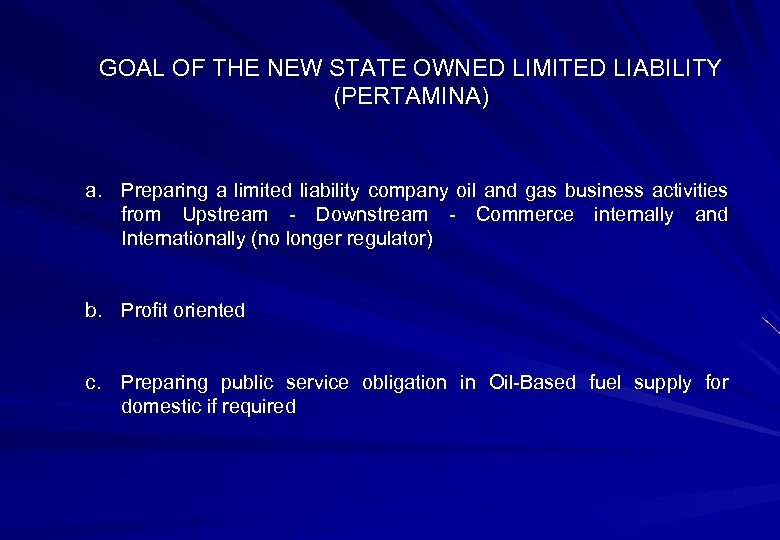

GOAL OF THE NEW STATE OWNED LIMITED LIABILITY (PERTAMINA) a. Preparing a limited liability company oil and gas business activities from Upstream - Downstream - Commerce internally and Internationally (no longer regulator) b. Profit oriented c. Preparing public service obligation in Oil-Based fuel supply for domestic if required

GOAL OF THE NEW STATE OWNED LIMITED LIABILITY (PERTAMINA) a. Preparing a limited liability company oil and gas business activities from Upstream - Downstream - Commerce internally and Internationally (no longer regulator) b. Profit oriented c. Preparing public service obligation in Oil-Based fuel supply for domestic if required

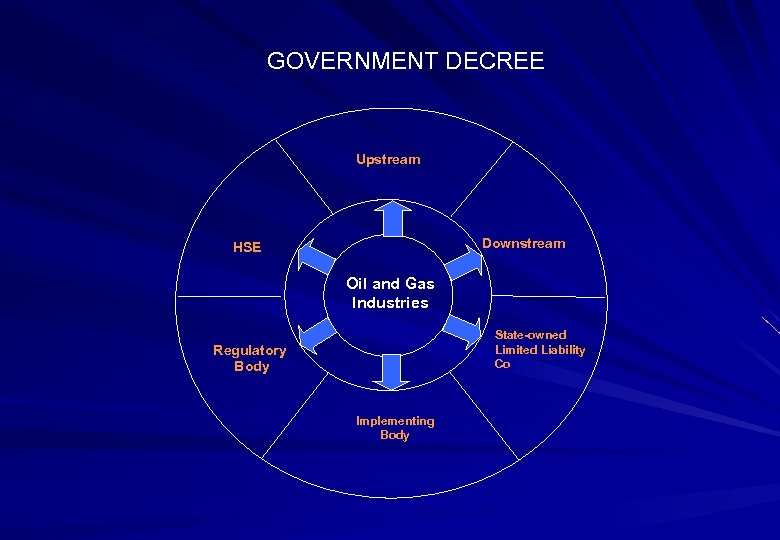

GOVERNMENT DECREE Upstream Downstream HSE Oil and Gas Industries State-owned Limited Liability Co Regulatory Body Implementing Body

GOVERNMENT DECREE Upstream Downstream HSE Oil and Gas Industries State-owned Limited Liability Co Regulatory Body Implementing Body

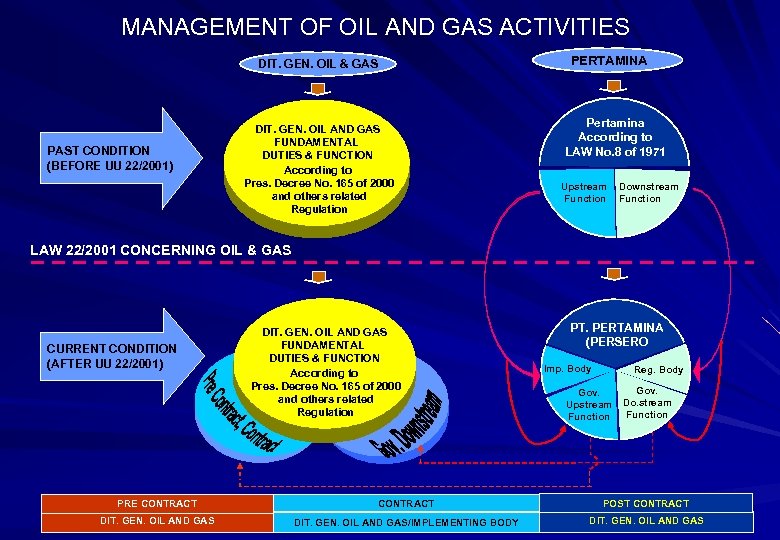

MANAGEMENT OF OIL AND GAS ACTIVITIES PERTAMINA DIT. GEN. OIL & GAS PAST CONDITION (BEFORE UU 22/2001) DIT. GEN. OIL AND GAS FUNDAMENTAL DUTIES & FUNCTION According to Pres. Decree No. 165 of 2000 and others related Regulation Pertamina According to LAW No. 8 of 1971 Upstream Function Downstream Function LAW 22/2001 CONCERNING OIL & GAS CURRENT CONDITION (AFTER UU 22/2001) DIT. GEN. OIL AND GAS FUNDAMENTAL DUTIES & FUNCTION According to Pres. Decree No. 165 of 2000 and others related Regulation PT. PERTAMINA (PERSERO Imp. Body Reg. Body Gov. Upstream Function Gov. Do. stream Function PRE CONTRACT POST CONTRACT DIT. GEN. OIL AND GAS/IMPLEMENTING BODY DIT. GEN. OIL AND GAS

MANAGEMENT OF OIL AND GAS ACTIVITIES PERTAMINA DIT. GEN. OIL & GAS PAST CONDITION (BEFORE UU 22/2001) DIT. GEN. OIL AND GAS FUNDAMENTAL DUTIES & FUNCTION According to Pres. Decree No. 165 of 2000 and others related Regulation Pertamina According to LAW No. 8 of 1971 Upstream Function Downstream Function LAW 22/2001 CONCERNING OIL & GAS CURRENT CONDITION (AFTER UU 22/2001) DIT. GEN. OIL AND GAS FUNDAMENTAL DUTIES & FUNCTION According to Pres. Decree No. 165 of 2000 and others related Regulation PT. PERTAMINA (PERSERO Imp. Body Reg. Body Gov. Upstream Function Gov. Do. stream Function PRE CONTRACT POST CONTRACT DIT. GEN. OIL AND GAS/IMPLEMENTING BODY DIT. GEN. OIL AND GAS

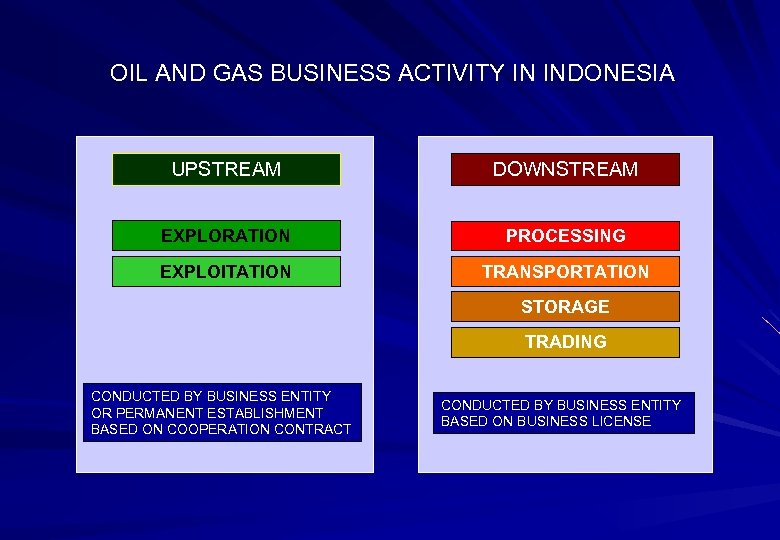

OIL AND GAS BUSINESS ACTIVITY IN INDONESIA UPSTREAM DOWNSTREAM EXPLORATION PROCESSING EXPLOITATION TRANSPORTATION STORAGE TRADING CONDUCTED BY BUSINESS ENTITY OR PERMANENT ESTABLISHMENT BASED ON COOPERATION CONTRACT CONDUCTED BY BUSINESS ENTITY BASED ON BUSINESS LICENSE

OIL AND GAS BUSINESS ACTIVITY IN INDONESIA UPSTREAM DOWNSTREAM EXPLORATION PROCESSING EXPLOITATION TRANSPORTATION STORAGE TRADING CONDUCTED BY BUSINESS ENTITY OR PERMANENT ESTABLISHMENT BASED ON COOPERATION CONTRACT CONDUCTED BY BUSINESS ENTITY BASED ON BUSINESS LICENSE

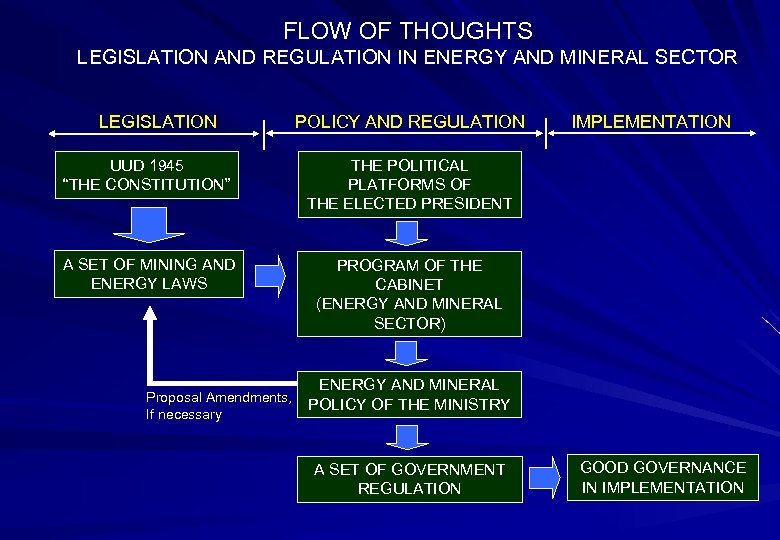

FLOW OF THOUGHTS LEGISLATION AND REGULATION IN ENERGY AND MINERAL SECTOR LEGISLATION POLICY AND REGULATION UUD 1945 “THE CONSTITUTION” THE POLITICAL PLATFORMS OF THE ELECTED PRESIDENT A SET OF MINING AND ENERGY LAWS IMPLEMENTATION PROGRAM OF THE CABINET (ENERGY AND MINERAL SECTOR) Proposal Amendments, If necessary ENERGY AND MINERAL POLICY OF THE MINISTRY A SET OF GOVERNMENT REGULATION GOOD GOVERNANCE IN IMPLEMENTATION

FLOW OF THOUGHTS LEGISLATION AND REGULATION IN ENERGY AND MINERAL SECTOR LEGISLATION POLICY AND REGULATION UUD 1945 “THE CONSTITUTION” THE POLITICAL PLATFORMS OF THE ELECTED PRESIDENT A SET OF MINING AND ENERGY LAWS IMPLEMENTATION PROGRAM OF THE CABINET (ENERGY AND MINERAL SECTOR) Proposal Amendments, If necessary ENERGY AND MINERAL POLICY OF THE MINISTRY A SET OF GOVERNMENT REGULATION GOOD GOVERNANCE IN IMPLEMENTATION

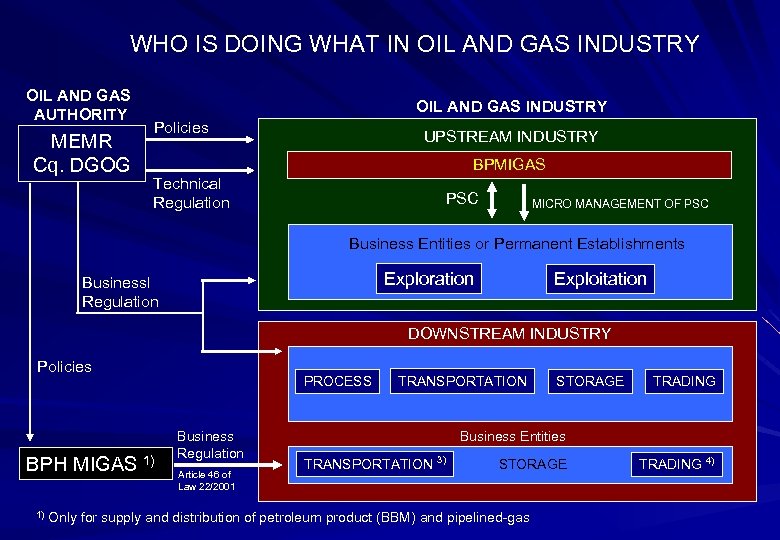

WHO IS DOING WHAT IN OIL AND GAS INDUSTRY OIL AND GAS AUTHORITY MEMR Cq. DGOG OIL AND GAS INDUSTRY Policies UPSTREAM INDUSTRY BPMIGAS Technical Regulation PSC MICRO MANAGEMENT OF PSC Business Entities or Permanent Establishments Exploration Businessl Regulation Exploitation DOWNSTREAM INDUSTRY Policies BPH MIGAS 1) PROCESS Business Regulation Article 46 of Law 22/2001 TRANSPORTATION STORAGE TRADING Business Entities TRANSPORTATION 3) STORAGE 1) Only for supply and distribution of petroleum product (BBM) and pipelined-gas TRADING 4)

WHO IS DOING WHAT IN OIL AND GAS INDUSTRY OIL AND GAS AUTHORITY MEMR Cq. DGOG OIL AND GAS INDUSTRY Policies UPSTREAM INDUSTRY BPMIGAS Technical Regulation PSC MICRO MANAGEMENT OF PSC Business Entities or Permanent Establishments Exploration Businessl Regulation Exploitation DOWNSTREAM INDUSTRY Policies BPH MIGAS 1) PROCESS Business Regulation Article 46 of Law 22/2001 TRANSPORTATION STORAGE TRADING Business Entities TRANSPORTATION 3) STORAGE 1) Only for supply and distribution of petroleum product (BBM) and pipelined-gas TRADING 4)

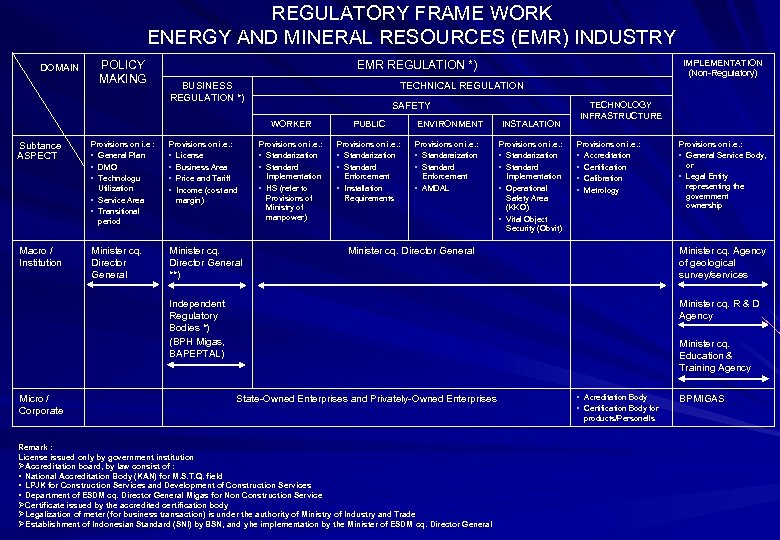

REGULATORY FRAME WORK ENERGY AND MINERAL RESOURCES (EMR) INDUSTRY DOMAIN POLICY MAKING IMPLEMENTATION (Non-Regulatory) EMR REGULATION *) BUSINESS REGULATION *) TECHNICAL REGULATION SAFETY WORKER Subtance ASPECT Provisions on i. e : • General Plan • DMO • Technologu Utilization • Service Area • Transitional period Provisions on i. e. : • License • Business Area • Price and Tariff • Income (cost and margin) Macro / Institution Minister cq. Director General **) PUBLIC Provisions on i. e. : • Standarization • Standard Implementation • HS (refer to Provisions of Ministry of manpower) Provisions on i. e. : • Standarization • Standard Enforcement • Installation Requirements ENVIRONMENT INSTALATION Provisions on i. e. : • Standaraization • Standard Enforcement • AMDAL Provisions on i. e. : • Standarization • Standard Implementation • Operational Safety Area (KKO) • Vital Object Security (Obvit) TECHNOLOGY INFRASTRUCTURE Provisions on i. e. : • Accreditation • Certification • Calibration • Metrology Minister cq. Director General Minister cq. Agency of geological survey/services Independent Regulatory Bodies *) (BPH Migas, BAPEPTAL) Micro / Corporate Provisions on i. e. : • General Service Body, or • Legal Entity representing the government ownership Minister cq. R & D Agency Minister cq. Education & Training Agency State-Owned Enterprises and Privately-Owned Enterprises Remark : License issued only by government institution Ø Accreditation board, by law consist of : • National Accreditation Body (KAN) for M. S. T. Q. field • LPJK for Construction Services and Development of Construction Services • Department of ESDM cq. Director General Migas for Non Construction Service Ø Certificate issued by the accredited certification body Ø Legalization of meter (for business transaction) is under the authority of Ministry of Industry and Trade Ø Establishment of Indonesian Standard (SNI) by BSN, and yhe implementation by the Minister of ESDM cq. Director General • Acreditation Body • Certification Body for products/Personells BPMIGAS

REGULATORY FRAME WORK ENERGY AND MINERAL RESOURCES (EMR) INDUSTRY DOMAIN POLICY MAKING IMPLEMENTATION (Non-Regulatory) EMR REGULATION *) BUSINESS REGULATION *) TECHNICAL REGULATION SAFETY WORKER Subtance ASPECT Provisions on i. e : • General Plan • DMO • Technologu Utilization • Service Area • Transitional period Provisions on i. e. : • License • Business Area • Price and Tariff • Income (cost and margin) Macro / Institution Minister cq. Director General **) PUBLIC Provisions on i. e. : • Standarization • Standard Implementation • HS (refer to Provisions of Ministry of manpower) Provisions on i. e. : • Standarization • Standard Enforcement • Installation Requirements ENVIRONMENT INSTALATION Provisions on i. e. : • Standaraization • Standard Enforcement • AMDAL Provisions on i. e. : • Standarization • Standard Implementation • Operational Safety Area (KKO) • Vital Object Security (Obvit) TECHNOLOGY INFRASTRUCTURE Provisions on i. e. : • Accreditation • Certification • Calibration • Metrology Minister cq. Director General Minister cq. Agency of geological survey/services Independent Regulatory Bodies *) (BPH Migas, BAPEPTAL) Micro / Corporate Provisions on i. e. : • General Service Body, or • Legal Entity representing the government ownership Minister cq. R & D Agency Minister cq. Education & Training Agency State-Owned Enterprises and Privately-Owned Enterprises Remark : License issued only by government institution Ø Accreditation board, by law consist of : • National Accreditation Body (KAN) for M. S. T. Q. field • LPJK for Construction Services and Development of Construction Services • Department of ESDM cq. Director General Migas for Non Construction Service Ø Certificate issued by the accredited certification body Ø Legalization of meter (for business transaction) is under the authority of Ministry of Industry and Trade Ø Establishment of Indonesian Standard (SNI) by BSN, and yhe implementation by the Minister of ESDM cq. Director General • Acreditation Body • Certification Body for products/Personells BPMIGAS

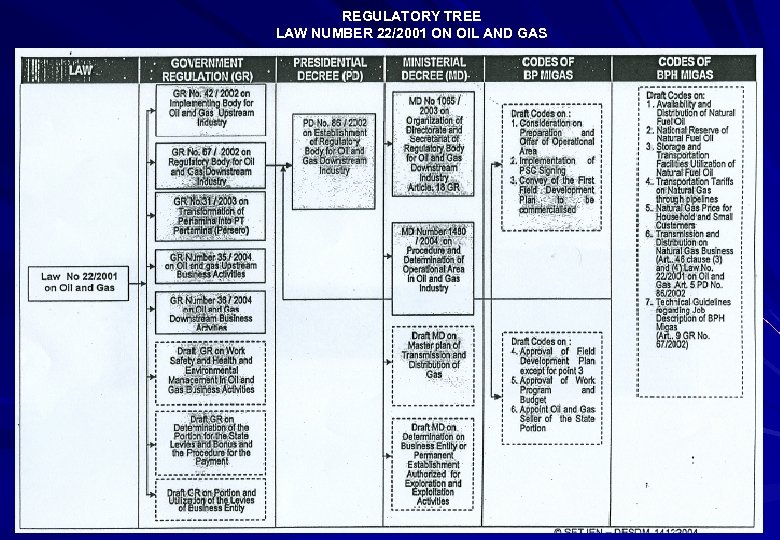

REGULATORY TREE LAW NUMBER 22/2001 ON OIL AND GAS

REGULATORY TREE LAW NUMBER 22/2001 ON OIL AND GAS

IMPLEMENTATION OF UPSTREAM OIL AND GAS BUSINESS ACTIVITIES

IMPLEMENTATION OF UPSTREAM OIL AND GAS BUSINESS ACTIVITIES

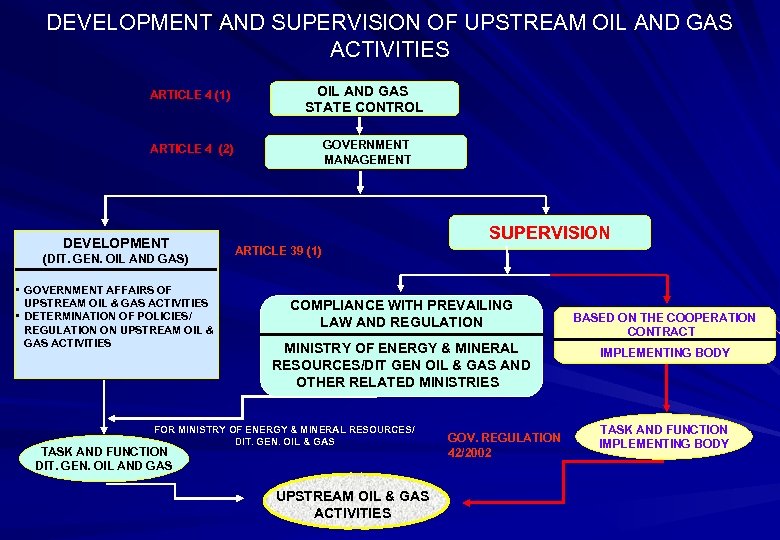

DEVELOPMENT AND SUPERVISION OF UPSTREAM OIL AND GAS ACTIVITIES ARTICLE 4 (1) OIL AND GAS STATE CONTROL ARTICLE 4 (2) GOVERNMENT MANAGEMENT DEVELOPMENT (DIT. GEN. OIL AND GAS) • GOVERNMENT AFFAIRS OF UPSTREAM OIL & GAS ACTIVITIES • DETERMINATION OF POLICIES/ REGULATION ON UPSTREAM OIL & GAS ACTIVITIES SUPERVISION ARTICLE 39 (1) COMPLIANCE WITH PREVAILING LAW AND REGULATION MINISTRY OF ENERGY & MINERAL RESOURCES/DIT GEN OIL & GAS AND OTHER RELATED MINISTRIES FOR MINISTRY OF ENERGY & MINERAL RESOURCES/ DIT. GEN. OIL & GAS TASK AND FUNCTION DIT. GEN. OIL AND GAS UPSTREAM OIL & GAS ACTIVITIES GOV. REGULATION 42/2002 BASED ON THE COOPERATION CONTRACT IMPLEMENTING BODY TASK AND FUNCTION IMPLEMENTING BODY

DEVELOPMENT AND SUPERVISION OF UPSTREAM OIL AND GAS ACTIVITIES ARTICLE 4 (1) OIL AND GAS STATE CONTROL ARTICLE 4 (2) GOVERNMENT MANAGEMENT DEVELOPMENT (DIT. GEN. OIL AND GAS) • GOVERNMENT AFFAIRS OF UPSTREAM OIL & GAS ACTIVITIES • DETERMINATION OF POLICIES/ REGULATION ON UPSTREAM OIL & GAS ACTIVITIES SUPERVISION ARTICLE 39 (1) COMPLIANCE WITH PREVAILING LAW AND REGULATION MINISTRY OF ENERGY & MINERAL RESOURCES/DIT GEN OIL & GAS AND OTHER RELATED MINISTRIES FOR MINISTRY OF ENERGY & MINERAL RESOURCES/ DIT. GEN. OIL & GAS TASK AND FUNCTION DIT. GEN. OIL AND GAS UPSTREAM OIL & GAS ACTIVITIES GOV. REGULATION 42/2002 BASED ON THE COOPERATION CONTRACT IMPLEMENTING BODY TASK AND FUNCTION IMPLEMENTING BODY

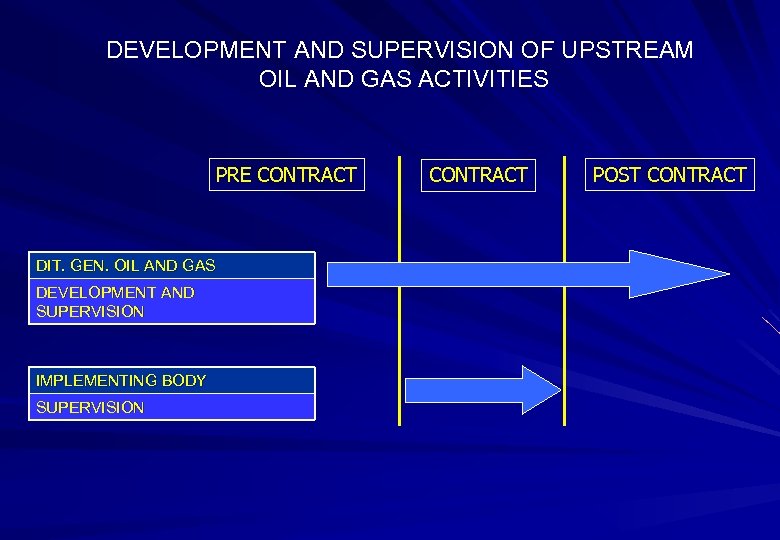

DEVELOPMENT AND SUPERVISION OF UPSTREAM OIL AND GAS ACTIVITIES PRE CONTRACT DIT. GEN. OIL AND GAS DEVELOPMENT AND SUPERVISION IMPLEMENTING BODY SUPERVISION CONTRACT POST CONTRACT

DEVELOPMENT AND SUPERVISION OF UPSTREAM OIL AND GAS ACTIVITIES PRE CONTRACT DIT. GEN. OIL AND GAS DEVELOPMENT AND SUPERVISION IMPLEMENTING BODY SUPERVISION CONTRACT POST CONTRACT

IMPLEMENTING BODY Management of implementing of the Cooperation Contract Submit management report of the Cooperation Contract to Minister Energy and Mineral Resorces Designate the seller of state’s portion of Oil and/or Natural Gas from the Cooperation Contract Control the management of operations State owned legal entity

IMPLEMENTING BODY Management of implementing of the Cooperation Contract Submit management report of the Cooperation Contract to Minister Energy and Mineral Resorces Designate the seller of state’s portion of Oil and/or Natural Gas from the Cooperation Contract Control the management of operations State owned legal entity

POLICY OFFERING OF NEW BLOCK The Department of Energy and Mineral Resources through the Directorate General of Oil and Gas (MIGAS) has the authority to administer the awarding of blocks to parties applying for oil and gas exploration and exploitation

POLICY OFFERING OF NEW BLOCK The Department of Energy and Mineral Resources through the Directorate General of Oil and Gas (MIGAS) has the authority to administer the awarding of blocks to parties applying for oil and gas exploration and exploitation

WHO ELIGIBLELY CONDUCT THE BUSINESS • STATE OWNED COMPANY • LOCAL GOVERNMENT COMPANY • COOPERATIVES / SMALL ENTERPRISE • PRIVATE COMPANY (INCLUDING PERMANENT ESTABLISHMENT)

WHO ELIGIBLELY CONDUCT THE BUSINESS • STATE OWNED COMPANY • LOCAL GOVERNMENT COMPANY • COOPERATIVES / SMALL ENTERPRISE • PRIVATE COMPANY (INCLUDING PERMANENT ESTABLISHMENT)

THE BASIC PRINCIPLE OF ACQUIRING BLOCKS No membership or being listed in a mailing list is required There will be no negotiations in the offering Firm commitment on exploration activities for the first 3 -years period is mandatory

THE BASIC PRINCIPLE OF ACQUIRING BLOCKS No membership or being listed in a mailing list is required There will be no negotiations in the offering Firm commitment on exploration activities for the first 3 -years period is mandatory

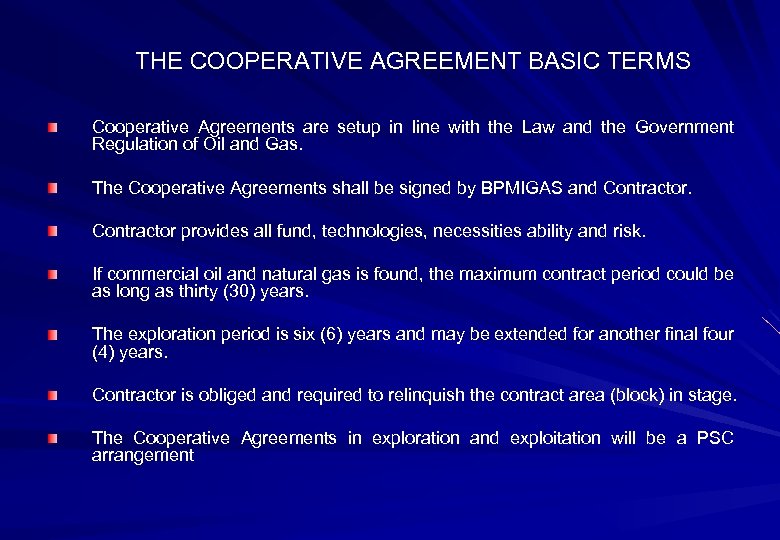

THE COOPERATIVE AGREEMENT BASIC TERMS Cooperative Agreements are setup in line with the Law and the Government Regulation of Oil and Gas. The Cooperative Agreements shall be signed by BPMIGAS and Contractor provides all fund, technologies, necessities ability and risk. If commercial oil and natural gas is found, the maximum contract period could be as long as thirty (30) years. The exploration period is six (6) years and may be extended for another final four (4) years. Contractor is obliged and required to relinquish the contract area (block) in stage. The Cooperative Agreements in exploration and exploitation will be a PSC arrangement

THE COOPERATIVE AGREEMENT BASIC TERMS Cooperative Agreements are setup in line with the Law and the Government Regulation of Oil and Gas. The Cooperative Agreements shall be signed by BPMIGAS and Contractor provides all fund, technologies, necessities ability and risk. If commercial oil and natural gas is found, the maximum contract period could be as long as thirty (30) years. The exploration period is six (6) years and may be extended for another final four (4) years. Contractor is obliged and required to relinquish the contract area (block) in stage. The Cooperative Agreements in exploration and exploitation will be a PSC arrangement

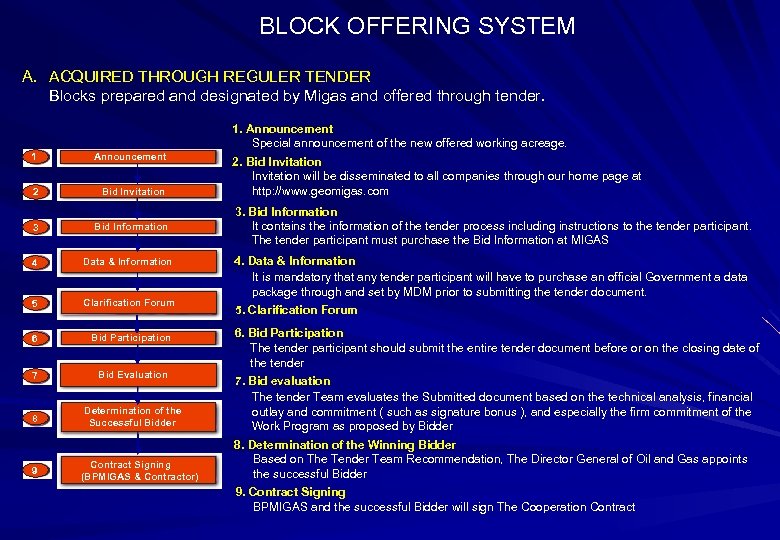

BLOCK OFFERING SYSTEM A. ACQUIRED THROUGH REGULER TENDER Blocks prepared and designated by Migas and offered through tender. 1 Bid Invitation Announcement 2 2 Bid Invitation 3 3 Bid Information 4 4 Data & Information 5 5 Clarification Forum Participation 6 6 Bid Participation Bid Evaluation 7 7 Determination of the Bid Evaluation Winning Bidder 8 8 8 9 Determination of the Successful Bidder Contract Signing (BPMIGAS & Contractor) 1. Announcement Special announcement of the new offered working acreage. 2. Bid Invitation will be disseminated to all companies through our home page at http: //www. geomigas. com 3. Bid Information It contains the information of the tender process including instructions to the tender participant. The tender participant must purchase the Bid Information at MIGAS 4. Data & Information It is mandatory that any tender participant will have to purchase an official Government a data package through and set by MDM prior to submitting the tender document. 5. Clarification Forum 6. Bid Participation The tender participant should submit the entire tender document before or on the closing date of the tender 7. Bid evaluation The tender Team evaluates the Submitted document based on the technical analysis, financial outlay and commitment ( such as signature bonus ), and especially the firm commitment of the Work Program as proposed by Bidder 8. Determination of the Winning Bidder Based on The Tender Team Recommendation, The Director General of Oil and Gas appoints the successful Bidder 9. Contract Signing BPMIGAS and the successful Bidder will sign The Cooperation Contract

BLOCK OFFERING SYSTEM A. ACQUIRED THROUGH REGULER TENDER Blocks prepared and designated by Migas and offered through tender. 1 Bid Invitation Announcement 2 2 Bid Invitation 3 3 Bid Information 4 4 Data & Information 5 5 Clarification Forum Participation 6 6 Bid Participation Bid Evaluation 7 7 Determination of the Bid Evaluation Winning Bidder 8 8 8 9 Determination of the Successful Bidder Contract Signing (BPMIGAS & Contractor) 1. Announcement Special announcement of the new offered working acreage. 2. Bid Invitation will be disseminated to all companies through our home page at http: //www. geomigas. com 3. Bid Information It contains the information of the tender process including instructions to the tender participant. The tender participant must purchase the Bid Information at MIGAS 4. Data & Information It is mandatory that any tender participant will have to purchase an official Government a data package through and set by MDM prior to submitting the tender document. 5. Clarification Forum 6. Bid Participation The tender participant should submit the entire tender document before or on the closing date of the tender 7. Bid evaluation The tender Team evaluates the Submitted document based on the technical analysis, financial outlay and commitment ( such as signature bonus ), and especially the firm commitment of the Work Program as proposed by Bidder 8. Determination of the Winning Bidder Based on The Tender Team Recommendation, The Director General of Oil and Gas appoints the successful Bidder 9. Contract Signing BPMIGAS and the successful Bidder will sign The Cooperation Contract

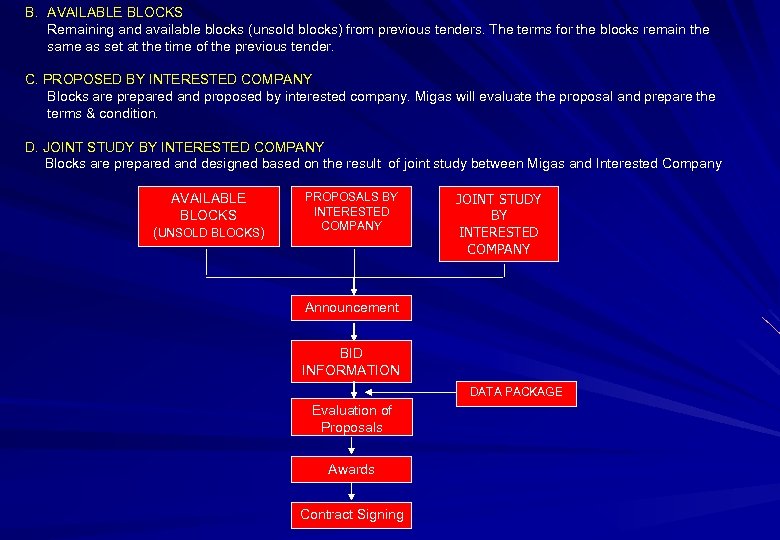

B. AVAILABLE BLOCKS Remaining and available blocks (unsold blocks) from previous tenders. The terms for the blocks remain the same as set at the time of the previous tender. C. PROPOSED BY INTERESTED COMPANY Blocks are prepared and proposed by interested company. Migas will evaluate the proposal and prepare the terms & condition. D. JOINT STUDY BY INTERESTED COMPANY Blocks are prepared and designed based on the result of joint study between Migas and Interested Company AVAILABLE BLOCKS (UNSOLD BLOCKS) PROPOSALS BY INTERESTED COMPANY JOINT STUDY BY INTERESTED COMPANY Announcement BID INFORMATION DATA PACKAGE Evaluation of Proposals Awards Contract Signing

B. AVAILABLE BLOCKS Remaining and available blocks (unsold blocks) from previous tenders. The terms for the blocks remain the same as set at the time of the previous tender. C. PROPOSED BY INTERESTED COMPANY Blocks are prepared and proposed by interested company. Migas will evaluate the proposal and prepare the terms & condition. D. JOINT STUDY BY INTERESTED COMPANY Blocks are prepared and designed based on the result of joint study between Migas and Interested Company AVAILABLE BLOCKS (UNSOLD BLOCKS) PROPOSALS BY INTERESTED COMPANY JOINT STUDY BY INTERESTED COMPANY Announcement BID INFORMATION DATA PACKAGE Evaluation of Proposals Awards Contract Signing

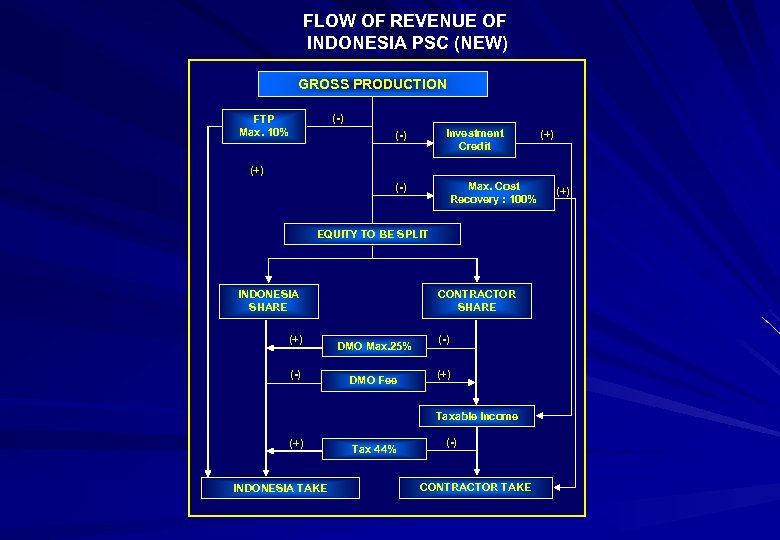

FLOW OF REVENUE OF INDONESIA PSC (NEW) GROSS PRODUCTION (-) FTP Max. 10% Investment Credit (-) (+) Max. Cost Recovery : 100% (-) EQUITY TO BE SPLIT CONTRACTOR SHARE INDONESIA SHARE (+) (-) DMO Max. 25% DMO Fee (-) (+) Taxable Income (+) INDONESIA TAKE Tax 44% (-) CONTRACTOR TAKE (+)

FLOW OF REVENUE OF INDONESIA PSC (NEW) GROSS PRODUCTION (-) FTP Max. 10% Investment Credit (-) (+) Max. Cost Recovery : 100% (-) EQUITY TO BE SPLIT CONTRACTOR SHARE INDONESIA SHARE (+) (-) DMO Max. 25% DMO Fee (-) (+) Taxable Income (+) INDONESIA TAKE Tax 44% (-) CONTRACTOR TAKE (+)

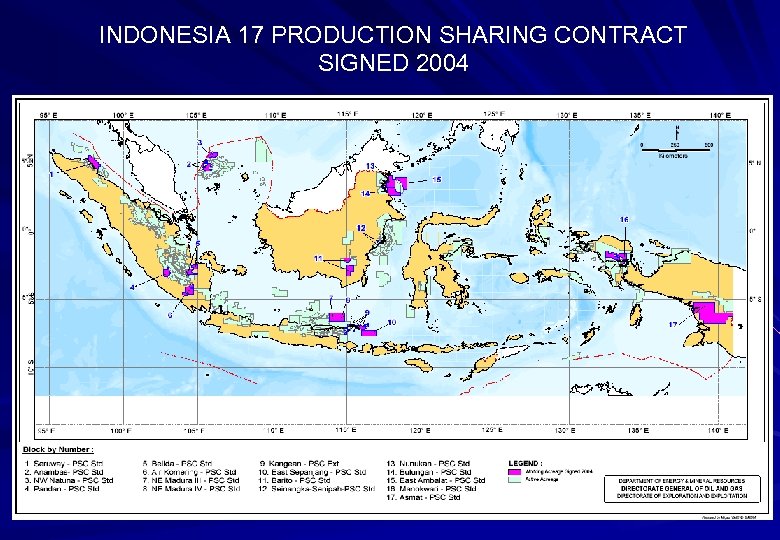

INDONESIA 17 PRODUCTION SHARING CONTRACT SIGNED 2004

INDONESIA 17 PRODUCTION SHARING CONTRACT SIGNED 2004

INDONESIA 1 ST BIDDING ROUND 2005 (14 Blocks)

INDONESIA 1 ST BIDDING ROUND 2005 (14 Blocks)

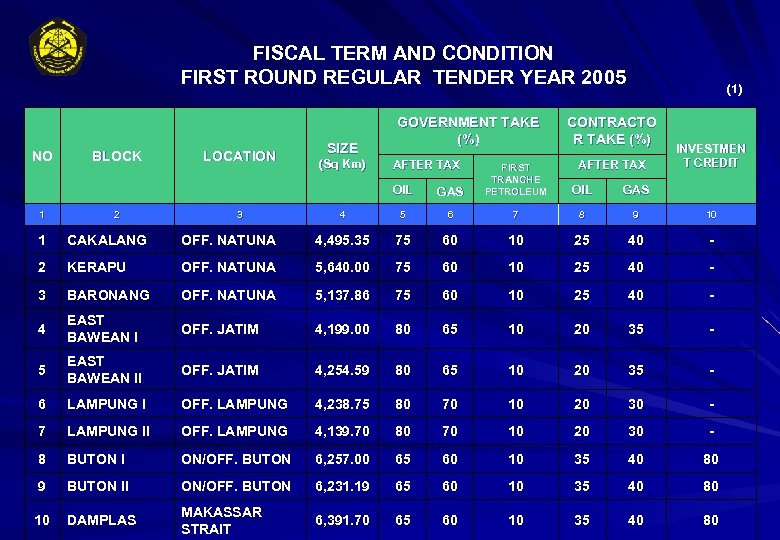

FISCAL TERM AND CONDITION FIRST ROUND REGULAR TENDER YEAR 2005 NO BLOCK LOCATION SIZE (Sq Km) GOVERNMENT TAKE (%) AFTER TAX (1) CONTRACTO R TAKE (%) AFTER TAX INVESTMEN T CREDIT OIL 1 2 3 GAS FIRST TRANCHE PETROLEUM 4 5 6 7 8 9 10 OIL GAS 1 CAKALANG OFF. NATUNA 4, 495. 35 75 60 10 25 40 - 2 KERAPU OFF. NATUNA 5, 640. 00 75 60 10 25 40 - 3 BARONANG OFF. NATUNA 5, 137. 86 75 60 10 25 40 - 4 EAST BAWEAN I OFF. JATIM 4, 199. 00 80 65 10 20 35 - 5 EAST BAWEAN II OFF. JATIM 4, 254. 59 80 65 10 20 35 - 6 LAMPUNG I OFF. LAMPUNG 4, 238. 75 80 70 10 20 30 - 7 LAMPUNG II OFF. LAMPUNG 4, 139. 70 80 70 10 20 30 - 8 BUTON I ON/OFF. BUTON 6, 257. 00 65 60 10 35 40 80 9 BUTON II ON/OFF. BUTON 6, 231. 19 65 60 10 35 40 80 10 DAMPLAS MAKASSAR STRAIT 6, 391. 70 65 60 10 35 40 80

FISCAL TERM AND CONDITION FIRST ROUND REGULAR TENDER YEAR 2005 NO BLOCK LOCATION SIZE (Sq Km) GOVERNMENT TAKE (%) AFTER TAX (1) CONTRACTO R TAKE (%) AFTER TAX INVESTMEN T CREDIT OIL 1 2 3 GAS FIRST TRANCHE PETROLEUM 4 5 6 7 8 9 10 OIL GAS 1 CAKALANG OFF. NATUNA 4, 495. 35 75 60 10 25 40 - 2 KERAPU OFF. NATUNA 5, 640. 00 75 60 10 25 40 - 3 BARONANG OFF. NATUNA 5, 137. 86 75 60 10 25 40 - 4 EAST BAWEAN I OFF. JATIM 4, 199. 00 80 65 10 20 35 - 5 EAST BAWEAN II OFF. JATIM 4, 254. 59 80 65 10 20 35 - 6 LAMPUNG I OFF. LAMPUNG 4, 238. 75 80 70 10 20 30 - 7 LAMPUNG II OFF. LAMPUNG 4, 139. 70 80 70 10 20 30 - 8 BUTON I ON/OFF. BUTON 6, 257. 00 65 60 10 35 40 80 9 BUTON II ON/OFF. BUTON 6, 231. 19 65 60 10 35 40 80 10 DAMPLAS MAKASSAR STRAIT 6, 391. 70 65 60 10 35 40 80

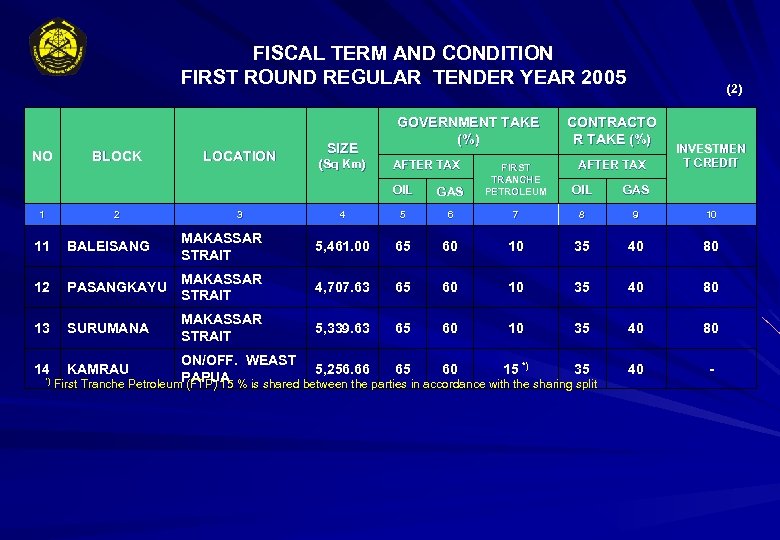

FISCAL TERM AND CONDITION FIRST ROUND REGULAR TENDER YEAR 2005 NO BLOCK LOCATION SIZE (Sq Km) GOVERNMENT TAKE (%) AFTER TAX (2) CONTRACTO R TAKE (%) AFTER TAX INVESTMEN T CREDIT OIL 1 2 3 GAS FIRST TRANCHE PETROLEUM 4 5 6 7 8 9 10 OIL GAS 11 BALEISANG MAKASSAR STRAIT 5, 461. 00 65 60 10 35 40 80 12 PASANGKAYU MAKASSAR STRAIT 4, 707. 63 65 60 10 35 40 80 13 SURUMANA MAKASSAR STRAIT 5, 339. 63 65 60 10 35 40 80 40 - ON/OFF. WEAST 5, 256. 66 65 60 15 *) 35 PAPUA *) First Tranche Petroleum (FTP) 15 % is shared between the parties in accordance with the sharing split 14 KAMRAU

FISCAL TERM AND CONDITION FIRST ROUND REGULAR TENDER YEAR 2005 NO BLOCK LOCATION SIZE (Sq Km) GOVERNMENT TAKE (%) AFTER TAX (2) CONTRACTO R TAKE (%) AFTER TAX INVESTMEN T CREDIT OIL 1 2 3 GAS FIRST TRANCHE PETROLEUM 4 5 6 7 8 9 10 OIL GAS 11 BALEISANG MAKASSAR STRAIT 5, 461. 00 65 60 10 35 40 80 12 PASANGKAYU MAKASSAR STRAIT 4, 707. 63 65 60 10 35 40 80 13 SURUMANA MAKASSAR STRAIT 5, 339. 63 65 60 10 35 40 80 40 - ON/OFF. WEAST 5, 256. 66 65 60 15 *) 35 PAPUA *) First Tranche Petroleum (FTP) 15 % is shared between the parties in accordance with the sharing split 14 KAMRAU

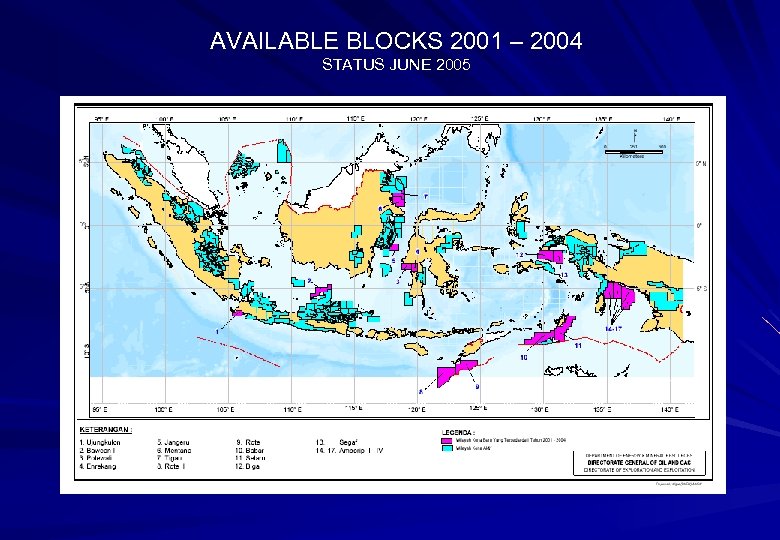

AVAILABLE BLOCKS 2001 – 2004 STATUS JUNE 2005

AVAILABLE BLOCKS 2001 – 2004 STATUS JUNE 2005

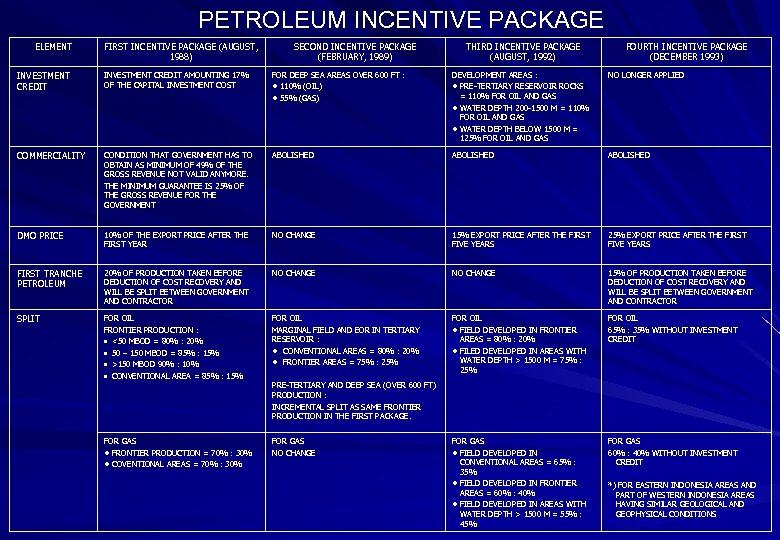

PETROLEUM INCENTIVE PACKAGE ELEMENT FIRST INCENTIVE PACKAGE (AUGUST, 1988) SECOND INCENTIVE PACKAGE (FEBRUARY, 1989) THIRD INCENTIVE PACKAGE (AUGUST, 1992) FOURTH INCENTIVE PACKAGE (DECEMBER 1993) INVESTMENT CREDIT AMOUNTING 17% OF THE CAPITAL INVESTMENT COST FOR DEEP SEA AREAS OVER 600 FT : l 110% (OIL) l 55% (GAS) DEVELOPMENT AREAS : l PRE-TERTIARY RESERVOIR ROCKS = 110% FOR OIL AND GAS l WATER DEPTH 200 -1500 M = 110% FOR OIL AND GAS l WATER DEPTH BELOW 1500 M = 125% FOR OIL AND GAS NO LONGER APPLIED COMMERCIALITY CONDITION THAT GOVERNMENT HAS TO OBTAIN AS MINIMUM OF 49% OF THE GROSS REVENUE NOT VALID ANYMORE. THE MINIMUM GUARANTEE IS 25% OF THE GROSS REVENUE FOR THE GOVERNMENT ABOLISHED DMO PRICE 10% OF THE EXPORT PRICE AFTER THE FIRST YEAR NO CHANGE 15% EXPORT PRICE AFTER THE FIRST FIVE YEARS 25% EXPORT PRICE AFTER THE FIRST FIVE YEARS FIRST TRANCHE PETROLEUM 20% OF PRODUCTION TAKEN BEFORE DEDUCTION OF COST RECOVERY AND WILL BE SPLIT BETWEEN GOVERNMENT AND CONTRACTOR NO CHANGE 15% OF PRODUCTION TAKEN BEFORE DEDUCTION OF COST RECOVERY AND WILL BE SPLIT BETWEEN GOVERNMENT AND CONTRACTOR SPLIT FOR OIL FRONTIER PRODUCTION : • <50 MBOD = 80% : 20% • 50 – 150 MBOD = 85% : 15% • >150 MBOD 90% : 10% • CONVENTIONAL AREA = 85% : 15% FOR OIL MARGINAL FIELD AND EOR IN TERTIARY RESERVOIR : l CONVENTIONAL AREAS = 80% : 20% l FRONTIER AREAS = 75% : 25% FOR OIL l FIELD DEVELOPED IN FRONTIER AREAS = 80% : 20% l FILED DEVELOPED IN AREAS WITH WATER DEPTH > 1500 M = 75% : 25% FOR OIL 65% : 35% WITHOUT INVESTMENT CREDIT FOR GAS l FRONTIER PRODUCTION = 70% : 30% l COVENTIONAL AREAS = 70% : 30% FOR GAS NO CHANGE FOR GAS l FIELD DEVELOPED IN CONVENTIONAL AREAS = 65% : 35% l FIELD DEVELOPED IN FRONTIER AREAS = 60% : 40% l FIELD DEVELOPED IN AREAS WITH WATER DEPTH > 1500 M = 55% : 45% FOR GAS 60% : 40% WITHOUT INVESTMENT CREDIT PRE-TERTIARY AND DEEP SEA (OVER 600 FT) PRODUCTION : INCREMENTAL SPLIT AS SAME FRONTIER PRODUCTION IN THE FIRST PACKAGE. *) FOR EASTERN INDONESIA AREAS AND PART OF WESTERN INDONESIA AREAS HAVING SIMILAR GEOLOGICAL AND GEOPHYSICAL CONDITIONS

PETROLEUM INCENTIVE PACKAGE ELEMENT FIRST INCENTIVE PACKAGE (AUGUST, 1988) SECOND INCENTIVE PACKAGE (FEBRUARY, 1989) THIRD INCENTIVE PACKAGE (AUGUST, 1992) FOURTH INCENTIVE PACKAGE (DECEMBER 1993) INVESTMENT CREDIT AMOUNTING 17% OF THE CAPITAL INVESTMENT COST FOR DEEP SEA AREAS OVER 600 FT : l 110% (OIL) l 55% (GAS) DEVELOPMENT AREAS : l PRE-TERTIARY RESERVOIR ROCKS = 110% FOR OIL AND GAS l WATER DEPTH 200 -1500 M = 110% FOR OIL AND GAS l WATER DEPTH BELOW 1500 M = 125% FOR OIL AND GAS NO LONGER APPLIED COMMERCIALITY CONDITION THAT GOVERNMENT HAS TO OBTAIN AS MINIMUM OF 49% OF THE GROSS REVENUE NOT VALID ANYMORE. THE MINIMUM GUARANTEE IS 25% OF THE GROSS REVENUE FOR THE GOVERNMENT ABOLISHED DMO PRICE 10% OF THE EXPORT PRICE AFTER THE FIRST YEAR NO CHANGE 15% EXPORT PRICE AFTER THE FIRST FIVE YEARS 25% EXPORT PRICE AFTER THE FIRST FIVE YEARS FIRST TRANCHE PETROLEUM 20% OF PRODUCTION TAKEN BEFORE DEDUCTION OF COST RECOVERY AND WILL BE SPLIT BETWEEN GOVERNMENT AND CONTRACTOR NO CHANGE 15% OF PRODUCTION TAKEN BEFORE DEDUCTION OF COST RECOVERY AND WILL BE SPLIT BETWEEN GOVERNMENT AND CONTRACTOR SPLIT FOR OIL FRONTIER PRODUCTION : • <50 MBOD = 80% : 20% • 50 – 150 MBOD = 85% : 15% • >150 MBOD 90% : 10% • CONVENTIONAL AREA = 85% : 15% FOR OIL MARGINAL FIELD AND EOR IN TERTIARY RESERVOIR : l CONVENTIONAL AREAS = 80% : 20% l FRONTIER AREAS = 75% : 25% FOR OIL l FIELD DEVELOPED IN FRONTIER AREAS = 80% : 20% l FILED DEVELOPED IN AREAS WITH WATER DEPTH > 1500 M = 75% : 25% FOR OIL 65% : 35% WITHOUT INVESTMENT CREDIT FOR GAS l FRONTIER PRODUCTION = 70% : 30% l COVENTIONAL AREAS = 70% : 30% FOR GAS NO CHANGE FOR GAS l FIELD DEVELOPED IN CONVENTIONAL AREAS = 65% : 35% l FIELD DEVELOPED IN FRONTIER AREAS = 60% : 40% l FIELD DEVELOPED IN AREAS WITH WATER DEPTH > 1500 M = 55% : 45% FOR GAS 60% : 40% WITHOUT INVESTMENT CREDIT PRE-TERTIARY AND DEEP SEA (OVER 600 FT) PRODUCTION : INCREMENTAL SPLIT AS SAME FRONTIER PRODUCTION IN THE FIRST PACKAGE. *) FOR EASTERN INDONESIA AREAS AND PART OF WESTERN INDONESIA AREAS HAVING SIMILAR GEOLOGICAL AND GEOPHYSICAL CONDITIONS

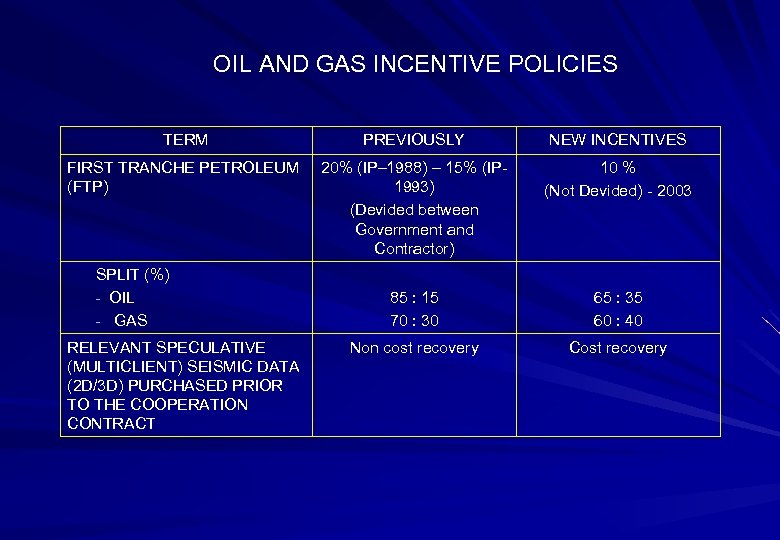

OIL AND GAS INCENTIVE POLICIES TERM PREVIOUSLY NEW INCENTIVES FIRST TRANCHE PETROLEUM (FTP) 20% (IP– 1988) – 15% (IP 1993) (Devided between Government and Contractor) 10 % (Not Devided) - 2003 85 : 15 70 : 30 65 : 35 60 : 40 Non cost recovery Cost recovery SPLIT (%) - OIL - GAS RELEVANT SPECULATIVE (MULTICLIENT) SEISMIC DATA (2 D/3 D) PURCHASED PRIOR TO THE COOPERATION CONTRACT

OIL AND GAS INCENTIVE POLICIES TERM PREVIOUSLY NEW INCENTIVES FIRST TRANCHE PETROLEUM (FTP) 20% (IP– 1988) – 15% (IP 1993) (Devided between Government and Contractor) 10 % (Not Devided) - 2003 85 : 15 70 : 30 65 : 35 60 : 40 Non cost recovery Cost recovery SPLIT (%) - OIL - GAS RELEVANT SPECULATIVE (MULTICLIENT) SEISMIC DATA (2 D/3 D) PURCHASED PRIOR TO THE COOPERATION CONTRACT

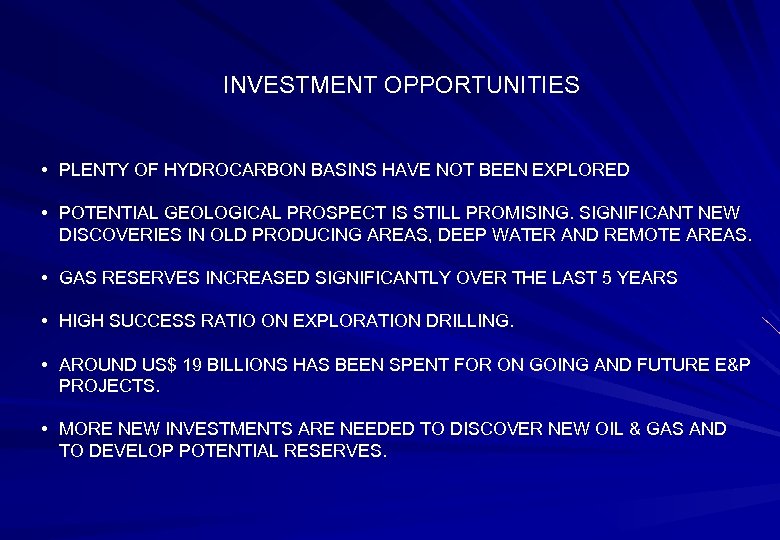

INVESTMENT OPPORTUNITIES • PLENTY OF HYDROCARBON BASINS HAVE NOT BEEN EXPLORED • POTENTIAL GEOLOGICAL PROSPECT IS STILL PROMISING. SIGNIFICANT NEW DISCOVERIES IN OLD PRODUCING AREAS, DEEP WATER AND REMOTE AREAS. • GAS RESERVES INCREASED SIGNIFICANTLY OVER THE LAST 5 YEARS • HIGH SUCCESS RATIO ON EXPLORATION DRILLING. • AROUND US$ 19 BILLIONS HAS BEEN SPENT FOR ON GOING AND FUTURE E&P PROJECTS. • MORE NEW INVESTMENTS ARE NEEDED TO DISCOVER NEW OIL & GAS AND TO DEVELOP POTENTIAL RESERVES.

INVESTMENT OPPORTUNITIES • PLENTY OF HYDROCARBON BASINS HAVE NOT BEEN EXPLORED • POTENTIAL GEOLOGICAL PROSPECT IS STILL PROMISING. SIGNIFICANT NEW DISCOVERIES IN OLD PRODUCING AREAS, DEEP WATER AND REMOTE AREAS. • GAS RESERVES INCREASED SIGNIFICANTLY OVER THE LAST 5 YEARS • HIGH SUCCESS RATIO ON EXPLORATION DRILLING. • AROUND US$ 19 BILLIONS HAS BEEN SPENT FOR ON GOING AND FUTURE E&P PROJECTS. • MORE NEW INVESTMENTS ARE NEEDED TO DISCOVER NEW OIL & GAS AND TO DEVELOP POTENTIAL RESERVES.

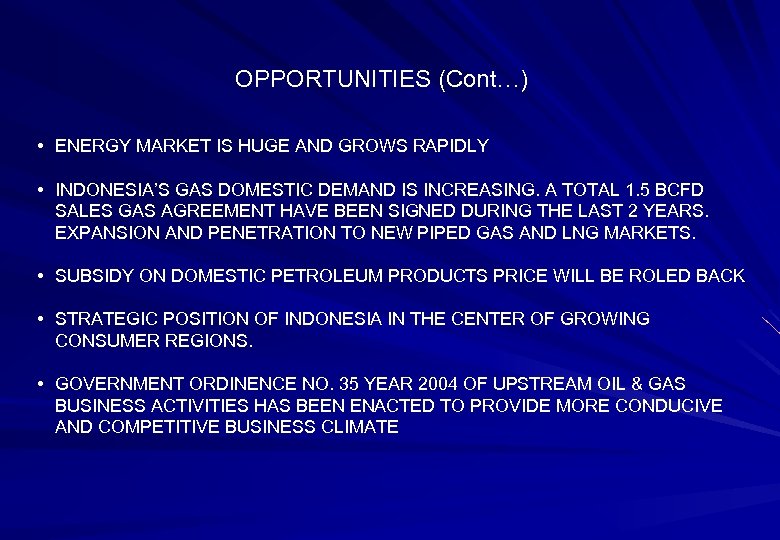

OPPORTUNITIES (Cont…) • ENERGY MARKET IS HUGE AND GROWS RAPIDLY • INDONESIA’S GAS DOMESTIC DEMAND IS INCREASING. A TOTAL 1. 5 BCFD SALES GAS AGREEMENT HAVE BEEN SIGNED DURING THE LAST 2 YEARS. EXPANSION AND PENETRATION TO NEW PIPED GAS AND LNG MARKETS. • SUBSIDY ON DOMESTIC PETROLEUM PRODUCTS PRICE WILL BE ROLED BACK • STRATEGIC POSITION OF INDONESIA IN THE CENTER OF GROWING CONSUMER REGIONS. • GOVERNMENT ORDINENCE NO. 35 YEAR 2004 OF UPSTREAM OIL & GAS BUSINESS ACTIVITIES HAS BEEN ENACTED TO PROVIDE MORE CONDUCIVE AND COMPETITIVE BUSINESS CLIMATE

OPPORTUNITIES (Cont…) • ENERGY MARKET IS HUGE AND GROWS RAPIDLY • INDONESIA’S GAS DOMESTIC DEMAND IS INCREASING. A TOTAL 1. 5 BCFD SALES GAS AGREEMENT HAVE BEEN SIGNED DURING THE LAST 2 YEARS. EXPANSION AND PENETRATION TO NEW PIPED GAS AND LNG MARKETS. • SUBSIDY ON DOMESTIC PETROLEUM PRODUCTS PRICE WILL BE ROLED BACK • STRATEGIC POSITION OF INDONESIA IN THE CENTER OF GROWING CONSUMER REGIONS. • GOVERNMENT ORDINENCE NO. 35 YEAR 2004 OF UPSTREAM OIL & GAS BUSINESS ACTIVITIES HAS BEEN ENACTED TO PROVIDE MORE CONDUCIVE AND COMPETITIVE BUSINESS CLIMATE

IMPLEMENTATION OF DWONSTREAM OIL AND GAS BUSINESS ACTIVITIES

IMPLEMENTATION OF DWONSTREAM OIL AND GAS BUSINESS ACTIVITIES

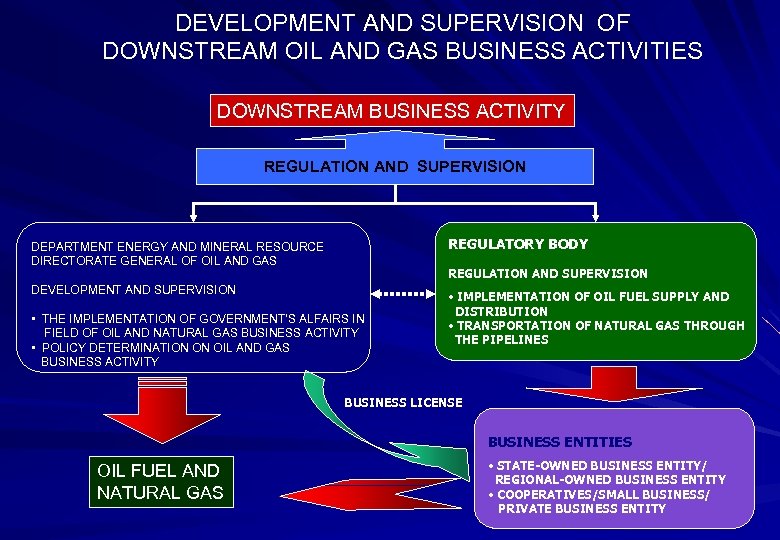

DEVELOPMENT AND SUPERVISION OF DOWNSTREAM OIL AND GAS BUSINESS ACTIVITIES DOWNSTREAM BUSINESS ACTIVITY REGULATION AND SUPERVISION DEPARTMENT ENERGY AND MINERAL RESOURCE DIRECTORATE GENERAL OF OIL AND GAS REGULATORY BODY DEVELOPMENT AND SUPERVISION • IMPLEMENTATION OF OIL FUEL SUPPLY AND DISTRIBUTION • TRANSPORTATION OF NATURAL GAS THROUGH THE PIPELINES REGULATION AND SUPERVISION • THE IMPLEMENTATION OF GOVERNMENT’S ALFAIRS IN FIELD OF OIL AND NATURAL GAS BUSINESS ACTIVITY • POLICY DETERMINATION ON OIL AND GAS BUSINESS ACTIVITY BUSINESS LICENSE BUSINESS ENTITIES OIL FUEL AND NATURAL GAS • STATE-OWNED BUSINESS ENTITY/ REGIONAL-OWNED BUSINESS ENTITY • COOPERATIVES/SMALL BUSINESS/ PRIVATE BUSINESS ENTITY

DEVELOPMENT AND SUPERVISION OF DOWNSTREAM OIL AND GAS BUSINESS ACTIVITIES DOWNSTREAM BUSINESS ACTIVITY REGULATION AND SUPERVISION DEPARTMENT ENERGY AND MINERAL RESOURCE DIRECTORATE GENERAL OF OIL AND GAS REGULATORY BODY DEVELOPMENT AND SUPERVISION • IMPLEMENTATION OF OIL FUEL SUPPLY AND DISTRIBUTION • TRANSPORTATION OF NATURAL GAS THROUGH THE PIPELINES REGULATION AND SUPERVISION • THE IMPLEMENTATION OF GOVERNMENT’S ALFAIRS IN FIELD OF OIL AND NATURAL GAS BUSINESS ACTIVITY • POLICY DETERMINATION ON OIL AND GAS BUSINESS ACTIVITY BUSINESS LICENSE BUSINESS ENTITIES OIL FUEL AND NATURAL GAS • STATE-OWNED BUSINESS ENTITY/ REGIONAL-OWNED BUSINESS ENTITY • COOPERATIVES/SMALL BUSINESS/ PRIVATE BUSINESS ENTITY

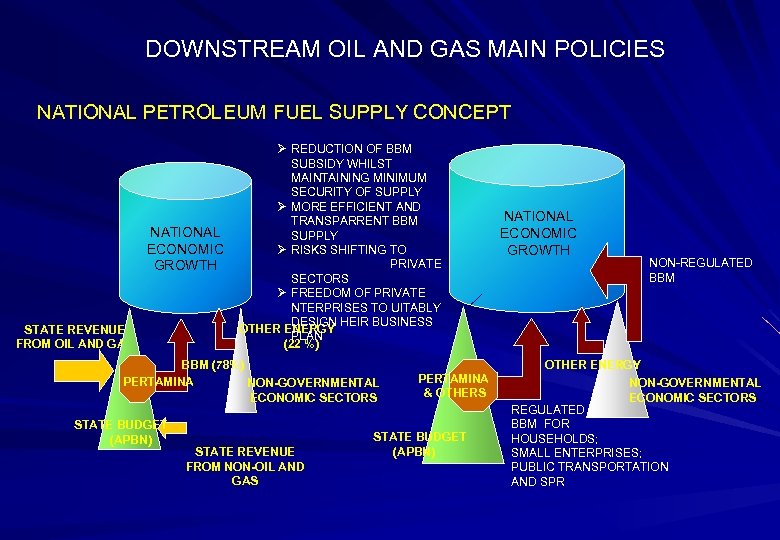

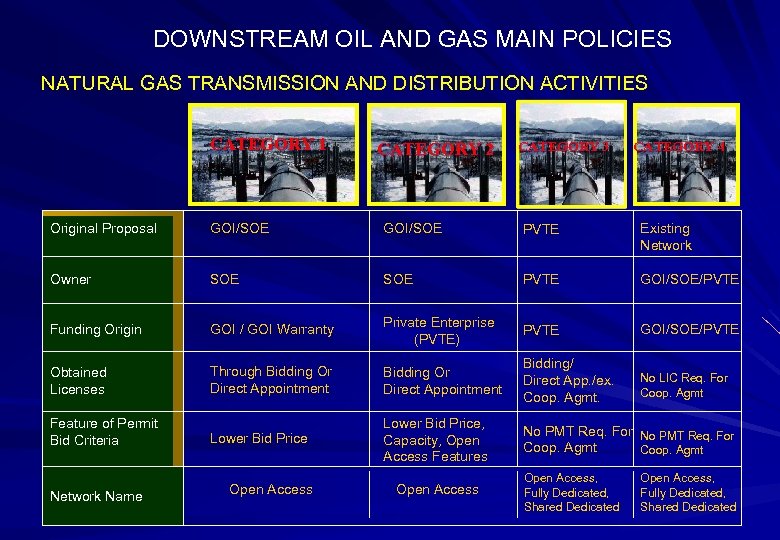

DOWNSTREAM OIL AND GAS MAIN POLICIES KEY ISSUES : Petroleum Product Business Activities - National Petroleum Fuel Supply Concept; - Category of Petroleum Fuel; - Volume, Pricing and Supply Policy. Natural Gas Transmission and Distribution Business Activities

DOWNSTREAM OIL AND GAS MAIN POLICIES KEY ISSUES : Petroleum Product Business Activities - National Petroleum Fuel Supply Concept; - Category of Petroleum Fuel; - Volume, Pricing and Supply Policy. Natural Gas Transmission and Distribution Business Activities

DOWNSTREAM POLICY q TO STIMULATE NATIONAL/INTERNATIONAL PRIVATE PARTICIPATION ON OIL AND GAS DOWN STREAM SECTORS q TO STIMULATE JOINT FACILITY UTILIZATION (OPEN ACCESS) OF OIL AND GAS STORAGE AND TRANSPORTATION FACILITY q TO ASSURE EFFECTIVITY OF IMPLEMENTATION AND BUSINESS SUPERVISION OF OIL AND GAS PROCESSING, TRANSPORTATION, STORAGE AND TRADING AS WELL AS OTHER PROCESSING RESULT FOR PUBLIC NEED SERVICE q TO STIMULATE NATURAL GAS UTILIZATION FOR ENERGY DIVERSIFICATION q TO ELIMINATE OIL FUEL SUBSIDY GRADUALLY TOWARD MARKET MECHANISM q TO BUILD INFRASTRUCTURE FOR INTEGRATED GAS NETWORK IN THE COUNTRY TO APPLY UNBUNDLING PRINCIPLE (SEPARATE PRODUCTIONTRANSPORTATION-DISTRIBUTION)

DOWNSTREAM POLICY q TO STIMULATE NATIONAL/INTERNATIONAL PRIVATE PARTICIPATION ON OIL AND GAS DOWN STREAM SECTORS q TO STIMULATE JOINT FACILITY UTILIZATION (OPEN ACCESS) OF OIL AND GAS STORAGE AND TRANSPORTATION FACILITY q TO ASSURE EFFECTIVITY OF IMPLEMENTATION AND BUSINESS SUPERVISION OF OIL AND GAS PROCESSING, TRANSPORTATION, STORAGE AND TRADING AS WELL AS OTHER PROCESSING RESULT FOR PUBLIC NEED SERVICE q TO STIMULATE NATURAL GAS UTILIZATION FOR ENERGY DIVERSIFICATION q TO ELIMINATE OIL FUEL SUBSIDY GRADUALLY TOWARD MARKET MECHANISM q TO BUILD INFRASTRUCTURE FOR INTEGRATED GAS NETWORK IN THE COUNTRY TO APPLY UNBUNDLING PRINCIPLE (SEPARATE PRODUCTIONTRANSPORTATION-DISTRIBUTION)

DOWNSTREAM OIL AND GAS MAIN POLICIES NATIONAL PETROLEUM FUEL SUPPLY CONCEPT Ø REDUCTION OF BBM SUBSIDY WHILST MAINTAINING MINIMUM SECURITY OF SUPPLY Ø MORE EFFICIENT AND NATIONAL TRANSPARRENT BBM NATIONAL ECONOMIC SUPPLY ECONOMIC Ø RISKS SHIFTING TO GROWTH NON-REGULATED PRIVATE GROWTH BBM SECTORS Ø FREEDOM OF PRIVATE NTERPRISES TO UITABLY DESIGN HEIR BUSINESS OTHER ENERGY STATE REVENUE PLAN (22 %) FROM OIL AND GAS BBM (78%) OTHER ENERGY PERTAMINA NON-GOVERNMENTAL & OTHERS ECONOMIC SECTORS REGULATED BBM FOR STATE BUDGET HOUSEHOLDS; (APBN) STATE REVENUE SMALL ENTERPRISES; FROM NON-OIL AND PUBLIC TRANSPORTATION GAS AND SPR

DOWNSTREAM OIL AND GAS MAIN POLICIES NATIONAL PETROLEUM FUEL SUPPLY CONCEPT Ø REDUCTION OF BBM SUBSIDY WHILST MAINTAINING MINIMUM SECURITY OF SUPPLY Ø MORE EFFICIENT AND NATIONAL TRANSPARRENT BBM NATIONAL ECONOMIC SUPPLY ECONOMIC Ø RISKS SHIFTING TO GROWTH NON-REGULATED PRIVATE GROWTH BBM SECTORS Ø FREEDOM OF PRIVATE NTERPRISES TO UITABLY DESIGN HEIR BUSINESS OTHER ENERGY STATE REVENUE PLAN (22 %) FROM OIL AND GAS BBM (78%) OTHER ENERGY PERTAMINA NON-GOVERNMENTAL & OTHERS ECONOMIC SECTORS REGULATED BBM FOR STATE BUDGET HOUSEHOLDS; (APBN) STATE REVENUE SMALL ENTERPRISES; FROM NON-OIL AND PUBLIC TRANSPORTATION GAS AND SPR

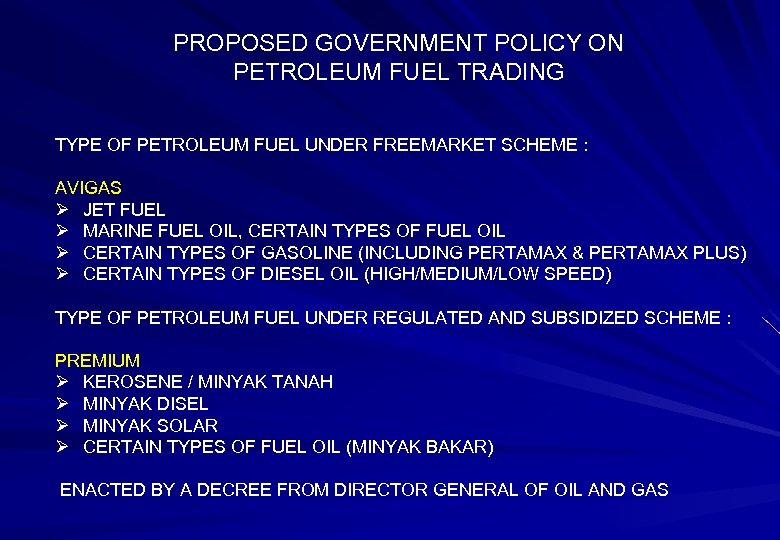

PROPOSED GOVERNMENT POLICY ON PETROLEUM FUEL TRADING TYPE OF PETROLEUM FUEL UNDER FREEMARKET SCHEME : AVIGAS Ø JET FUEL Ø MARINE FUEL OIL, CERTAIN TYPES OF FUEL OIL Ø CERTAIN TYPES OF GASOLINE (INCLUDING PERTAMAX & PERTAMAX PLUS) Ø CERTAIN TYPES OF DIESEL OIL (HIGH/MEDIUM/LOW SPEED) TYPE OF PETROLEUM FUEL UNDER REGULATED AND SUBSIDIZED SCHEME : PREMIUM Ø KEROSENE / MINYAK TANAH Ø MINYAK DISEL Ø MINYAK SOLAR Ø CERTAIN TYPES OF FUEL OIL (MINYAK BAKAR) ENACTED BY A DECREE FROM DIRECTOR GENERAL OF OIL AND GAS

PROPOSED GOVERNMENT POLICY ON PETROLEUM FUEL TRADING TYPE OF PETROLEUM FUEL UNDER FREEMARKET SCHEME : AVIGAS Ø JET FUEL Ø MARINE FUEL OIL, CERTAIN TYPES OF FUEL OIL Ø CERTAIN TYPES OF GASOLINE (INCLUDING PERTAMAX & PERTAMAX PLUS) Ø CERTAIN TYPES OF DIESEL OIL (HIGH/MEDIUM/LOW SPEED) TYPE OF PETROLEUM FUEL UNDER REGULATED AND SUBSIDIZED SCHEME : PREMIUM Ø KEROSENE / MINYAK TANAH Ø MINYAK DISEL Ø MINYAK SOLAR Ø CERTAIN TYPES OF FUEL OIL (MINYAK BAKAR) ENACTED BY A DECREE FROM DIRECTOR GENERAL OF OIL AND GAS

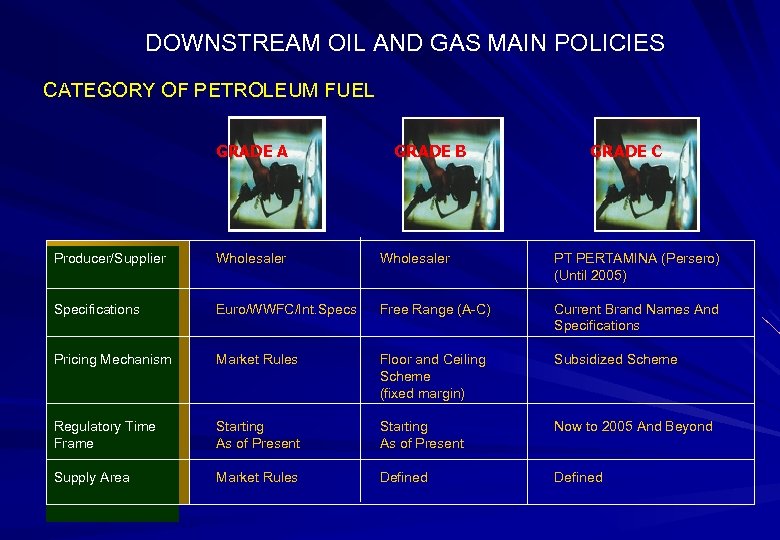

DOWNSTREAM OIL AND GAS MAIN POLICIES CATEGORY OF PETROLEUM FUEL GRADE A GRADE B GRADE C Producer/Supplier Wholesaler PT PERTAMINA (Persero) (Until 2005) Specifications Euro/WWFC/Int. Specs Free Range (A-C) Current Brand Names And Specifications Pricing Mechanism Market Rules Floor and Ceiling Scheme (fixed margin) Subsidized Scheme Regulatory Time Frame Starting As of Present Now to 2005 And Beyond Supply Area Market Rules Defined

DOWNSTREAM OIL AND GAS MAIN POLICIES CATEGORY OF PETROLEUM FUEL GRADE A GRADE B GRADE C Producer/Supplier Wholesaler PT PERTAMINA (Persero) (Until 2005) Specifications Euro/WWFC/Int. Specs Free Range (A-C) Current Brand Names And Specifications Pricing Mechanism Market Rules Floor and Ceiling Scheme (fixed margin) Subsidized Scheme Regulatory Time Frame Starting As of Present Now to 2005 And Beyond Supply Area Market Rules Defined

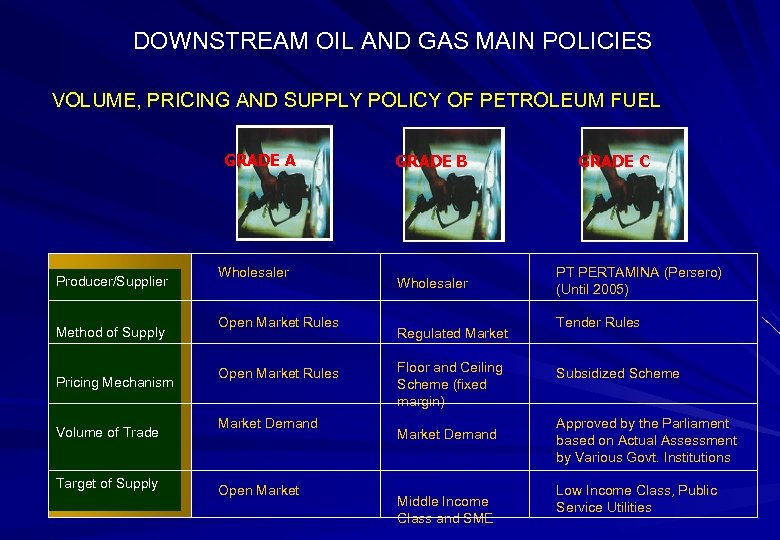

DOWNSTREAM OIL AND GAS MAIN POLICIES VOLUME, PRICING AND SUPPLY POLICY OF PETROLEUM FUEL GRADE A Producer/Supplier Method of Supply Pricing Mechanism Volume of Trade Target of Supply Wholesaler Open Market Rules Market Demand Open Market GRADE B Wholesaler Regulated Market Floor and Ceiling Scheme (fixed margin) Market Demand Middle Income Class and SME GRADE C PT PERTAMINA (Persero) (Until 2005) Tender Rules Subsidized Scheme Approved by the Parliament based on Actual Assessment by Various Govt. Institutions Low Income Class, Public Service Utilities

DOWNSTREAM OIL AND GAS MAIN POLICIES VOLUME, PRICING AND SUPPLY POLICY OF PETROLEUM FUEL GRADE A Producer/Supplier Method of Supply Pricing Mechanism Volume of Trade Target of Supply Wholesaler Open Market Rules Market Demand Open Market GRADE B Wholesaler Regulated Market Floor and Ceiling Scheme (fixed margin) Market Demand Middle Income Class and SME GRADE C PT PERTAMINA (Persero) (Until 2005) Tender Rules Subsidized Scheme Approved by the Parliament based on Actual Assessment by Various Govt. Institutions Low Income Class, Public Service Utilities

DOWNSTREAM OIL AND GAS MAIN POLICIES NATURAL GAS TRANSMISSION AND DISTRIBUTION ACTIVITIES CATEGORY 1 CATEGORY 2 CATEGORY 3 CATEGORY 4 Original Proposal GOI/SOE PVTE Existing Network Owner SOE PVTE GOI/SOE/PVTE Funding Origin GOI / GOI Warranty Private Enterprise (PVTE) PVTE GOI/SOE/PVTE Obtained Licenses Through Bidding Or Direct Appointment Bidding/ Direct App. /ex. Coop. Agmt. No LIC Req. For Coop. Agmt Lower Bid Price, Capacity, Open Access Features No PMT Req. For Coop. Agmt Feature of Permit Bid Criteria Network Name Open Access, Fully Dedicated, Shared Dedicated

DOWNSTREAM OIL AND GAS MAIN POLICIES NATURAL GAS TRANSMISSION AND DISTRIBUTION ACTIVITIES CATEGORY 1 CATEGORY 2 CATEGORY 3 CATEGORY 4 Original Proposal GOI/SOE PVTE Existing Network Owner SOE PVTE GOI/SOE/PVTE Funding Origin GOI / GOI Warranty Private Enterprise (PVTE) PVTE GOI/SOE/PVTE Obtained Licenses Through Bidding Or Direct Appointment Bidding/ Direct App. /ex. Coop. Agmt. No LIC Req. For Coop. Agmt Lower Bid Price, Capacity, Open Access Features No PMT Req. For Coop. Agmt Feature of Permit Bid Criteria Network Name Open Access, Fully Dedicated, Shared Dedicated

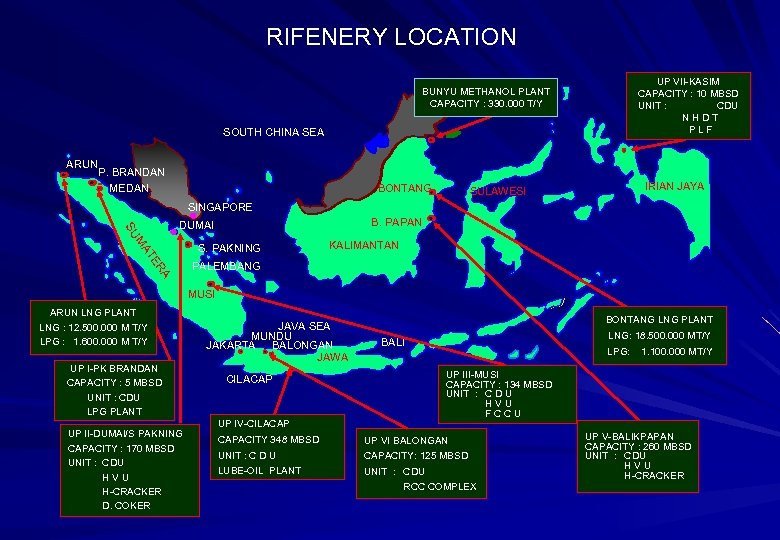

RIFENERY LOCATION BUNYU METHANOL PLANT CAPACITY : 330. 000 T/Y SOUTH CHINA SEA ARUN P. BRANDAN MEDAN BONTANG SULAWESI UP VII-KASIM CAPACITY : 10 MBSD UNIT : CDU N H D T P L F IRIAN JAYA SINGAPORE B. PAPAN M SU DUMAI KALIMANTAN PALEMBANG A ER AT S. PAKNING MUSI ARUN LNG PLANT LNG : 12. 500. 000 M T/Y LPG : 1. 600. 000 M T/Y UP I-PK BRANDAN CAPACITY : 5 MBSD UNIT : CDU LPG PLANT UP II-DUMAI/S PAKNING CAPACITY : 170 MBSD UNIT : CDU H V U H-CRACKER D. COKER JAVA SEA MUNDU JAKARTA BALONGAN JAWA BONTANG LNG PLANT LNG: 18. 500. 000 MT/Y BALI LPG: 1. 100. 000 MT/Y UP III-MUSI CAPACITY : 134 MBSD UNIT : C D U H V U F C C U CILACAP UP IV-CILACAP CAPACITY 348 MBSD UP VI BALONGAN UNIT : C D U CAPACITY: 125 MBSD LUBE-OIL PLANT UNIT : CDU RCC COMPLEX UP V-BALIKPAPAN CAPACITY : 260 MBSD UNIT : CDU H V U H-CRACKER

RIFENERY LOCATION BUNYU METHANOL PLANT CAPACITY : 330. 000 T/Y SOUTH CHINA SEA ARUN P. BRANDAN MEDAN BONTANG SULAWESI UP VII-KASIM CAPACITY : 10 MBSD UNIT : CDU N H D T P L F IRIAN JAYA SINGAPORE B. PAPAN M SU DUMAI KALIMANTAN PALEMBANG A ER AT S. PAKNING MUSI ARUN LNG PLANT LNG : 12. 500. 000 M T/Y LPG : 1. 600. 000 M T/Y UP I-PK BRANDAN CAPACITY : 5 MBSD UNIT : CDU LPG PLANT UP II-DUMAI/S PAKNING CAPACITY : 170 MBSD UNIT : CDU H V U H-CRACKER D. COKER JAVA SEA MUNDU JAKARTA BALONGAN JAWA BONTANG LNG PLANT LNG: 18. 500. 000 MT/Y BALI LPG: 1. 100. 000 MT/Y UP III-MUSI CAPACITY : 134 MBSD UNIT : C D U H V U F C C U CILACAP UP IV-CILACAP CAPACITY 348 MBSD UP VI BALONGAN UNIT : C D U CAPACITY: 125 MBSD LUBE-OIL PLANT UNIT : CDU RCC COMPLEX UP V-BALIKPAPAN CAPACITY : 260 MBSD UNIT : CDU H V U H-CRACKER

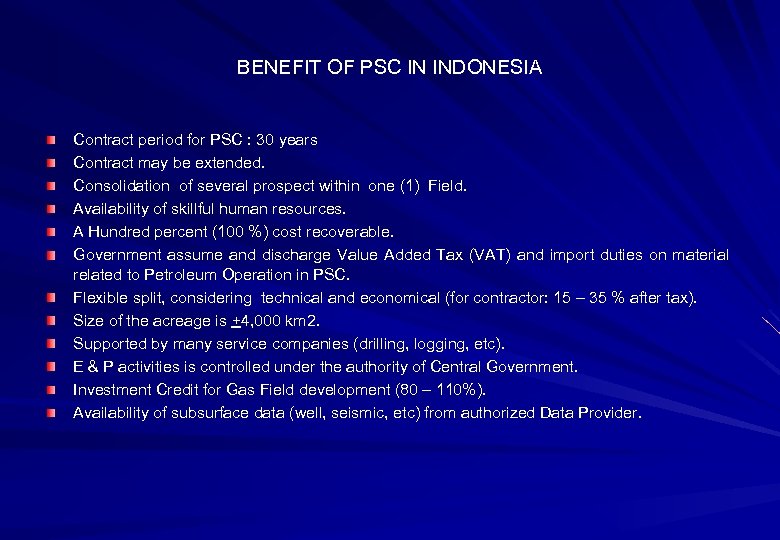

BENEFIT OF PSC IN INDONESIA Contract period for PSC : 30 years Contract may be extended. Consolidation of several prospect within one (1) Field. Availability of skillful human resources. A Hundred percent (100 %) cost recoverable. Government assume and discharge Value Added Tax (VAT) and import duties on material related to Petroleum Operation in PSC. Flexible split, considering technical and economical (for contractor: 15 – 35 % after tax). Size of the acreage is +4, 000 km 2. Supported by many service companies (drilling, logging, etc). E & P activities is controlled under the authority of Central Government. Investment Credit for Gas Field development (80 – 110%). Availability of subsurface data (well, seismic, etc) from authorized Data Provider.

BENEFIT OF PSC IN INDONESIA Contract period for PSC : 30 years Contract may be extended. Consolidation of several prospect within one (1) Field. Availability of skillful human resources. A Hundred percent (100 %) cost recoverable. Government assume and discharge Value Added Tax (VAT) and import duties on material related to Petroleum Operation in PSC. Flexible split, considering technical and economical (for contractor: 15 – 35 % after tax). Size of the acreage is +4, 000 km 2. Supported by many service companies (drilling, logging, etc). E & P activities is controlled under the authority of Central Government. Investment Credit for Gas Field development (80 – 110%). Availability of subsurface data (well, seismic, etc) from authorized Data Provider.