a2194b7eb93eb1794cddb8b3bbad8ce1.ppt

- Количество слайдов: 23

Offshore outsourcing of production – the problem of “fabless” enterprises

“Fabless” enterprises: • Companies engaged in development of electronic components (but common for other products as well), and outsourcing production of final product to enterprises across borders to relatively low-wages countries. • Final product sent directly from sub-contractor to final customers, without registered flow of imports or exports of goods in the country of the “fabless” enterprise.

Recording “fabless” transactions • No records in Trade in Goods statistics: No goods are crossing borders • Usually: There are not other records. • First approach: Merchanting services • Problems: - Goods are not simply bought and sold - R&D heavy activity - Involvement in the whole manufacturing process

Recording “fabless” transactions • Second approach – Difference between revenues from sales to final customers and cost of goods sold recorded as services (not yet defined) – R&D classification • Problems: - Goods delivered to final customer by subcontractor and services (not yet defined) by compiling economy. - R&D classification while no R&D product is in fact delivered.

Proposed approach • Units involved in international transactions. • Economic activity of each unit. • Output of each unit.

Units involved 1. 2. R&D unit: “Fabless” companies are engaged in heavy R&D investment, which remains the property of the company. In fact, we can see R&D activity as own-account production. According to SNA and if possible – Separate establishment. Main “fabless” company, in the compiling economy. Foreign manufacturer abroad.

Economic activity of units 1. Linked establishment performing R&D activities - R&D classification 2. Main company - Two possible classifications: Trade (under ISIC G) Manufacturing (under ISIC D)

Trade classification is not suitable • Although they buy and sell products, trade classification is not suitable, because these companies are engaged in significant activities, which are usually not present in trade companies: R&D and production. management of joint In fact, the large value added obtained by “fabless” companies, can probably be attributed mainly to those activities.

The concept of “converter” • According to NACE 1. 1: “Converters are units which sell goods and services under their own name, but arrange for their production by others. These units are classified to Sector G (wholesale and retail) except when they own the legal right and the concept of the product, in which case they are classified as if they produce the goods themselves. ”

The concept of “converter” • The converter should be classified in manufacturing in the following cases : When the converter is the owner of patent rights on the products or is engaged in significant R&D activity, so it has a determining role in the conception of the good. When it is the owner of the final products, which are being sold under its name, and takes commercial risks and commercial responsibility on its products.

“Fabless” companies as converters in manufacturing • • • Are deeply involved in the production process, as R&D is a crucial input and goods are not simply ordered and re-sold. Products are sold under their name and they are taking commercial risks and responsibility on their products. The sub-contractor (the foundry) can only sell the goods to the "fabless" company that has legal rights on them.

Output produced by units • • • Output of the R&D establishment is the R&D (81 according to CPC 1. 1). The sub-contractor produces manufacturing services, which are sold to the "fabless” enterprise (could be 88 according to CPC 1. 1 although R&D is not a “physical” input). The output of the main establishment is the final product sold – the semiconductors (452 in CPC 1. 1).

Proposed registration of transactions • • Since output of sub-contractor is “manufacturing services on inputs owned by others” (R&D remains property of “fabless”), then the temporary transfer of R&D need not be registered. Two possible treatments of final output: (1) net trade balance in goods (2) as the total exports in goods.

Proposed registration of transactions • • • Registering the net balance as exports of goods could be easier, for practical reasons. But to be consistent with definition of the “fabless” enterprise as a “manufacturing converter” considered to be producing the final goods, despite the outsourcing, we propose to record the total value of goods sold to final customer as exports of the “fabless” enterprise. The acquisition of manufacturing services from the foundry should be recorded as imports from the country of the foundry.

Proposed registration of transactions • For practical reasons and to facilitate analysis, it would seem preferable to show all transactions in goods and to create a separate sub-category of goods: Goods under outsourced production. • This sub-category could be further divided between: • • Outsourced to affiliates Outsourced to non-affiliated enterprises.

Conclusion 1. Treatment of “fabless’ companies as performers of merchanting services found unsuitable, since it does not reflect their central role in the whole manufacturing process and their involvement in heavy R&D activities, which are crucial to this process. 2. Proposed to treat “fabless” companies as converters and classify their activity as manufacturing, since they own the product concept, sell the final output under their name and take commercial risk and responsibility of the products.

Conclusion 3. In line with the proposed classification of the activity of “fabless” companies as manufacturing, output should be total value of goods exported, while the subcontractor’s production should be recorded as imports of the economy, where “fabless” companies are residents.

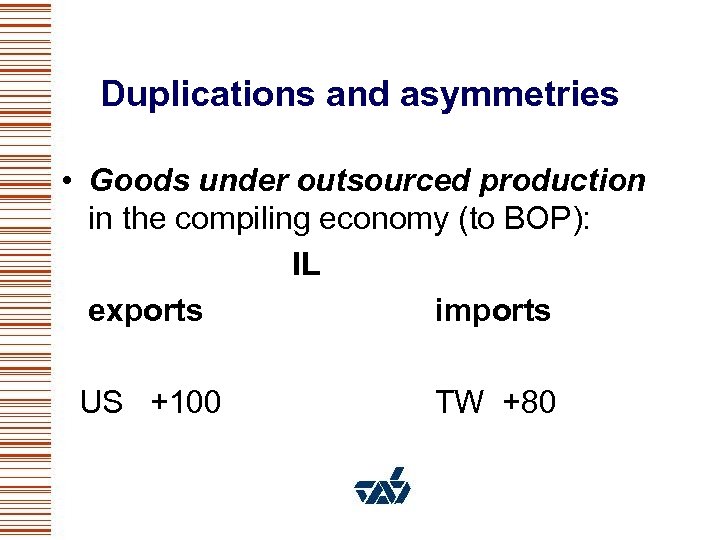

Duplications and asymmetries • Let be: US – final customer TW – “foundry”- where outsourced production takes place IS – “fabless” compiling economy

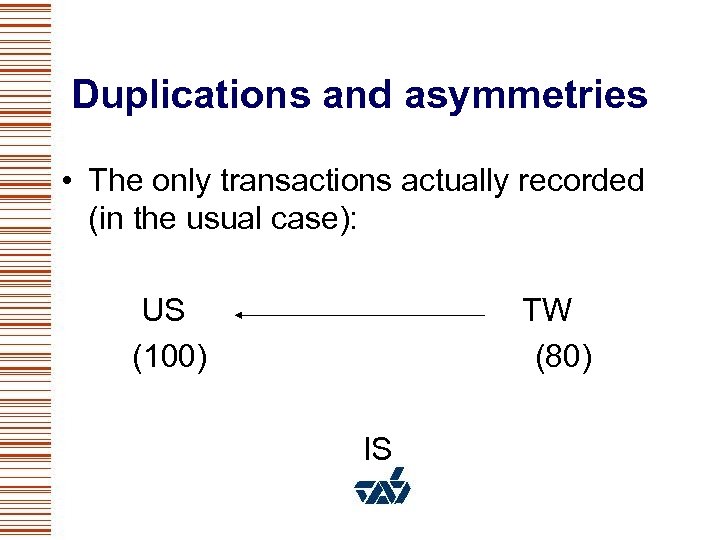

Duplications and asymmetries • The only transactions actually recorded (in the usual case): US TW (100) (80) IS

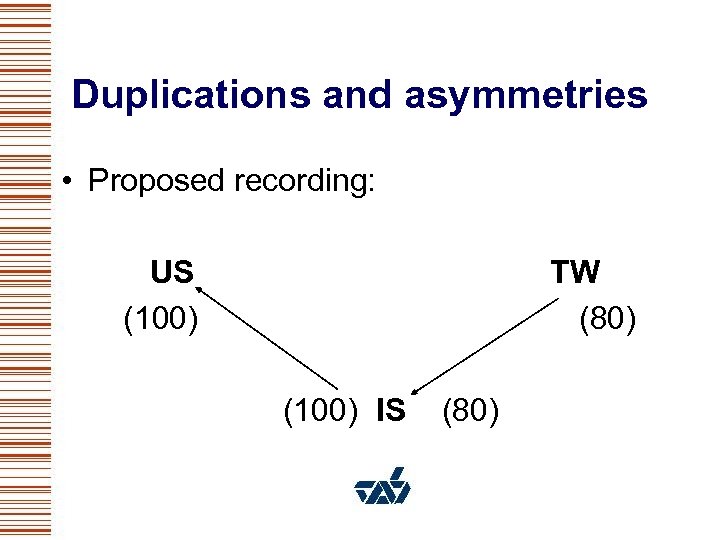

Duplications and asymmetries • Proposed recording: US TW (100) (80) (100) IS (80)

Duplications and asymmetries • Goods under outsourced production in the compiling economy (to BOP): IL exports imports US +100 TW +80

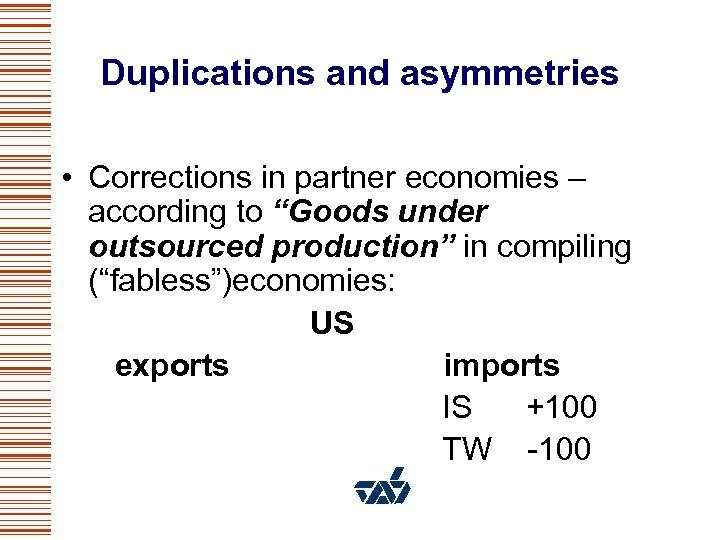

Duplications and asymmetries • Corrections in partner economies – according to “Goods under outsourced production” in compiling (“fabless”)economies: US exports imports IS +100 TW -100

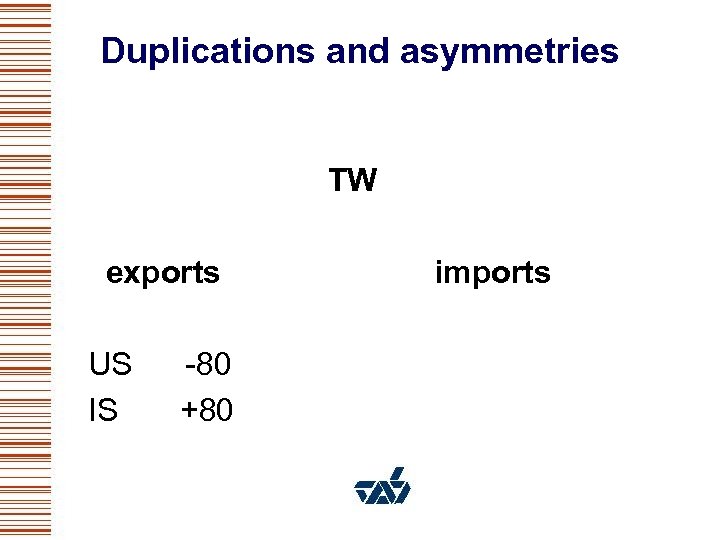

Duplications and asymmetries TW exports imports US -80 IS +80

a2194b7eb93eb1794cddb8b3bbad8ce1.ppt