309b638699a263d3b40734cc6745ce5a.ppt

- Количество слайдов: 30

Offices: Update this slide with your disclosure statement, remove this comment, and submit the entire workshop to your BD. Understanding the 8 th District Electrical Pension Fund A workshop for IBEW Members in Participating Locals Presented by:

Offices: Update this slide with your disclosure statement, remove this comment, and submit the entire workshop to your BD. Understanding the 8 th District Electrical Pension Fund A workshop for IBEW Members in Participating Locals Presented by:

Offices: Update this slide with your broker dealer’s name in the third paragraph and remove this comment. This information is provided for educational purposes only. The information is intended to be generic in nature and should not be applied or relied upon in any particular situation without the advice of your tax, legal and/or your financial advisor. Financial advisors affiliated with the Hanson Mc. Clain Retirement Network specialize in assisting Unionized company employees with their retirement choices; however, they, nor the firms they are associated with, are affiliated, endorsed, nor retained by any company. This workshop is not intended to induce you to retire. Securities offered through

Offices: Update this slide with your broker dealer’s name in the third paragraph and remove this comment. This information is provided for educational purposes only. The information is intended to be generic in nature and should not be applied or relied upon in any particular situation without the advice of your tax, legal and/or your financial advisor. Financial advisors affiliated with the Hanson Mc. Clain Retirement Network specialize in assisting Unionized company employees with their retirement choices; however, they, nor the firms they are associated with, are affiliated, endorsed, nor retained by any company. This workshop is not intended to induce you to retire. Securities offered through

Topics of Discussion • Pension Plan Highlights • Distribution Options • Retirement Scenarios • The IPRO® • How We Can Help 3

Topics of Discussion • Pension Plan Highlights • Distribution Options • Retirement Scenarios • The IPRO® • How We Can Help 3

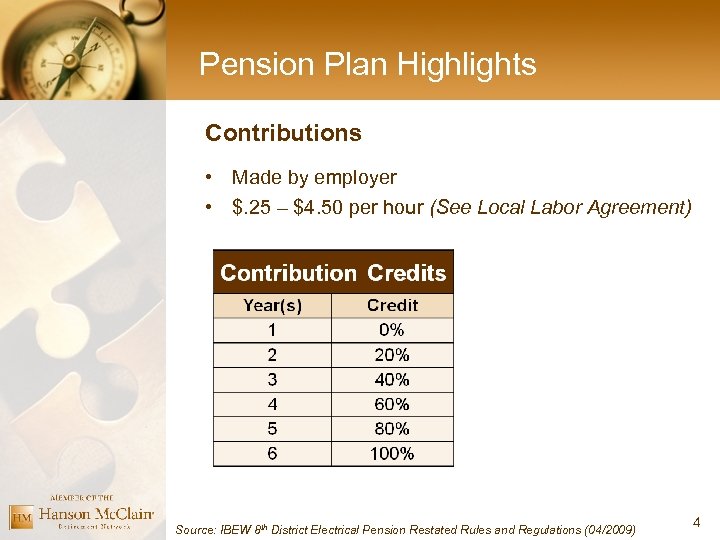

Pension Plan Highlights Contributions • Made by employer • $. 25 – $4. 50 per hour (See Local Labor Agreement) Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 4

Pension Plan Highlights Contributions • Made by employer • $. 25 – $4. 50 per hour (See Local Labor Agreement) Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 4

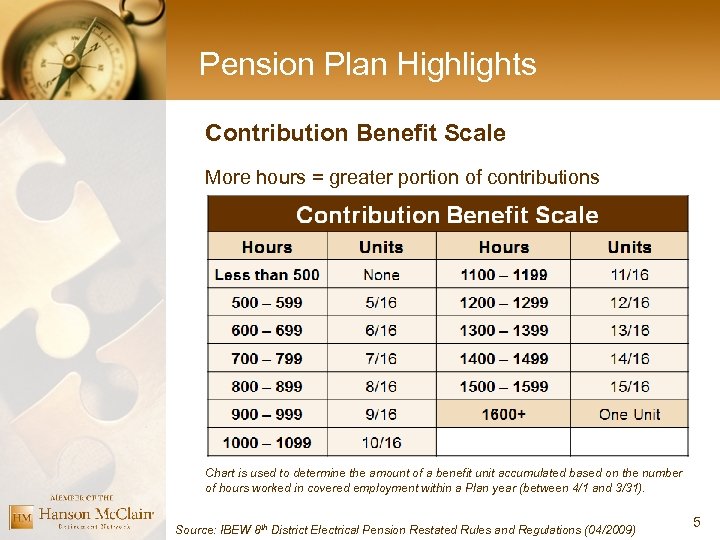

Pension Plan Highlights Contribution Benefit Scale More hours = greater portion of contributions Chart is used to determine the amount of a benefit unit accumulated based on the number of hours worked in covered employment within a Plan year (between 4/1 and 3/31). Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 5

Pension Plan Highlights Contribution Benefit Scale More hours = greater portion of contributions Chart is used to determine the amount of a benefit unit accumulated based on the number of hours worked in covered employment within a Plan year (between 4/1 and 3/31). Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 5

Pension Plan Highlights Regular Pension Plan Are you eligible to retire? Regular Pension • Age 65 • Highest 30 Benefit Units • Distribution rate per Benefit Unit value § 3. 1% distribution rate (4/1/1977 – 3/31/2007) § 2. 3% distribution rate (4/1/2007 – 6/30/2009) § 1. 5% distribution rate (7/1/2009 – Present) Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 6

Pension Plan Highlights Regular Pension Plan Are you eligible to retire? Regular Pension • Age 65 • Highest 30 Benefit Units • Distribution rate per Benefit Unit value § 3. 1% distribution rate (4/1/1977 – 3/31/2007) § 2. 3% distribution rate (4/1/2007 – 6/30/2009) § 1. 5% distribution rate (7/1/2009 – Present) Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 6

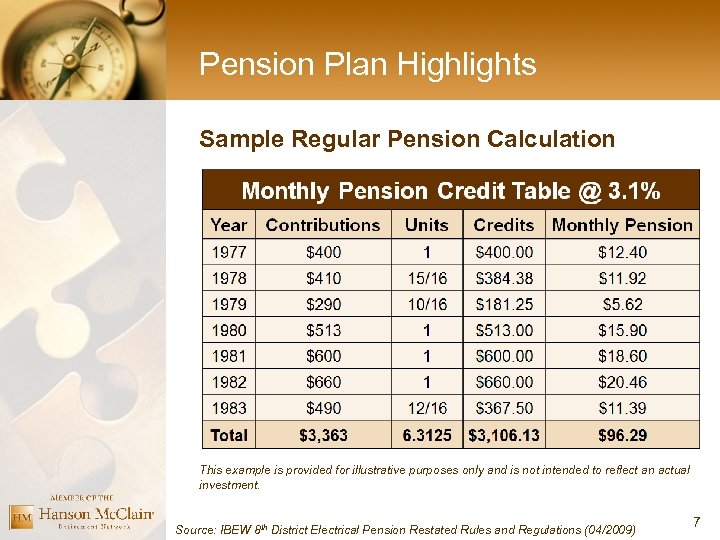

Pension Plan Highlights Sample Regular Pension Calculation This example is provided for illustrative purposes only and is not intended to reflect an actual investment. Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 7

Pension Plan Highlights Sample Regular Pension Calculation This example is provided for illustrative purposes only and is not intended to reflect an actual investment. Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 7

Pension Plan Highlights Service Pension Eligibility: • At least 55 years of age and under age 65 • 30+ years of Credited Service Benefit calculation: • Determine regular pension for participant at age 65 • Minus total reduction from the regular pension § Between ages 55 – 60 • Payment reduced by ½% per month under age 62 § Between ages 60 – 62 • Payment reduced by ¼% per month under age 62 § Over age 62 (No reductions) Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 8

Pension Plan Highlights Service Pension Eligibility: • At least 55 years of age and under age 65 • 30+ years of Credited Service Benefit calculation: • Determine regular pension for participant at age 65 • Minus total reduction from the regular pension § Between ages 55 – 60 • Payment reduced by ½% per month under age 62 § Between ages 60 – 62 • Payment reduced by ¼% per month under age 62 § Over age 62 (No reductions) Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 8

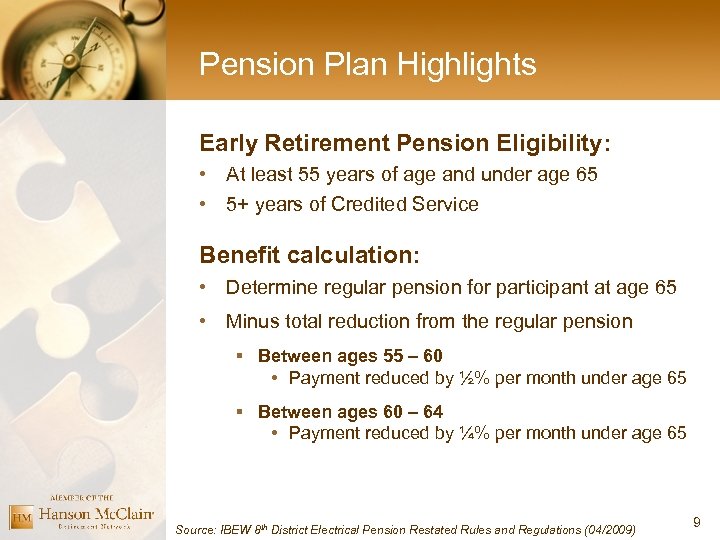

Pension Plan Highlights Early Retirement Pension Eligibility: • At least 55 years of age and under age 65 • 5+ years of Credited Service Benefit calculation: • Determine regular pension for participant at age 65 • Minus total reduction from the regular pension § Between ages 55 – 60 • Payment reduced by ½% per month under age 65 § Between ages 60 – 64 • Payment reduced by ¼% per month under age 65 Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 9

Pension Plan Highlights Early Retirement Pension Eligibility: • At least 55 years of age and under age 65 • 5+ years of Credited Service Benefit calculation: • Determine regular pension for participant at age 65 • Minus total reduction from the regular pension § Between ages 55 – 60 • Payment reduced by ½% per month under age 65 § Between ages 60 – 64 • Payment reduced by ¼% per month under age 65 Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 9

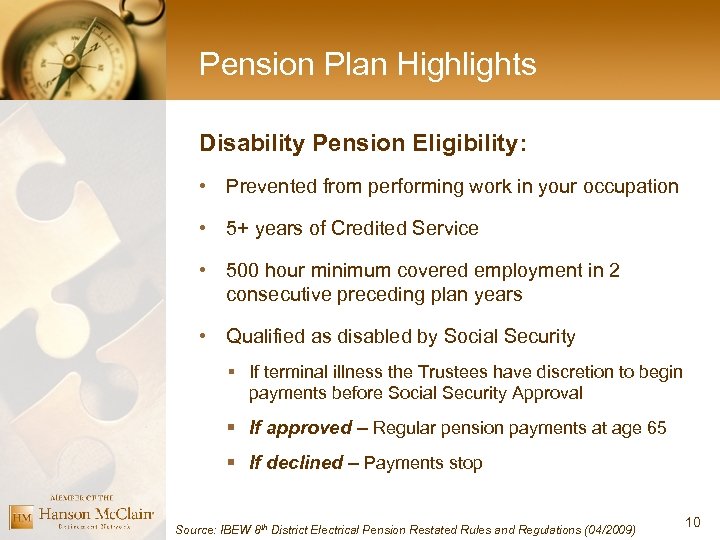

Pension Plan Highlights Disability Pension Eligibility: • Prevented from performing work in your occupation • 5+ years of Credited Service • 500 hour minimum covered employment in 2 consecutive preceding plan years • Qualified as disabled by Social Security § If terminal illness the Trustees have discretion to begin payments before Social Security Approval § If approved – Regular pension payments at age 65 § If declined – Payments stop Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 10

Pension Plan Highlights Disability Pension Eligibility: • Prevented from performing work in your occupation • 5+ years of Credited Service • 500 hour minimum covered employment in 2 consecutive preceding plan years • Qualified as disabled by Social Security § If terminal illness the Trustees have discretion to begin payments before Social Security Approval § If approved – Regular pension payments at age 65 § If declined – Payments stop Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 10

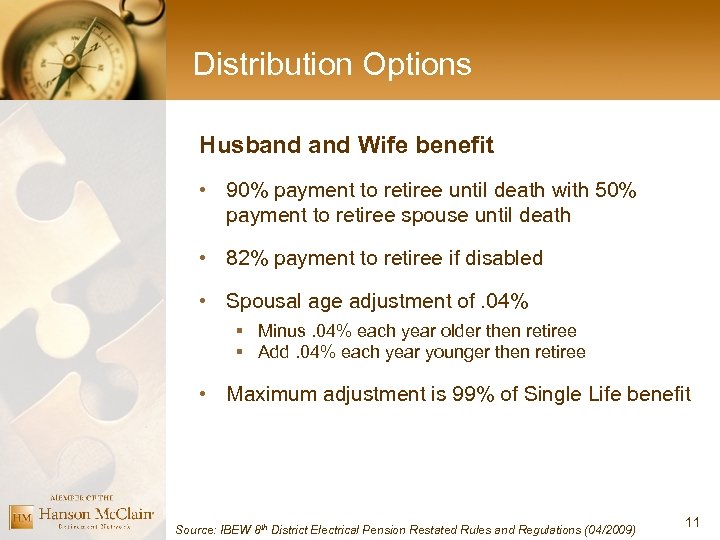

Distribution Options Husband Wife benefit • 90% payment to retiree until death with 50% payment to retiree spouse until death • 82% payment to retiree if disabled • Spousal age adjustment of. 04% § Minus. 04% each year older then retiree § Add. 04% each year younger then retiree • Maximum adjustment is 99% of Single Life benefit Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 11

Distribution Options Husband Wife benefit • 90% payment to retiree until death with 50% payment to retiree spouse until death • 82% payment to retiree if disabled • Spousal age adjustment of. 04% § Minus. 04% each year older then retiree § Add. 04% each year younger then retiree • Maximum adjustment is 99% of Single Life benefit Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 11

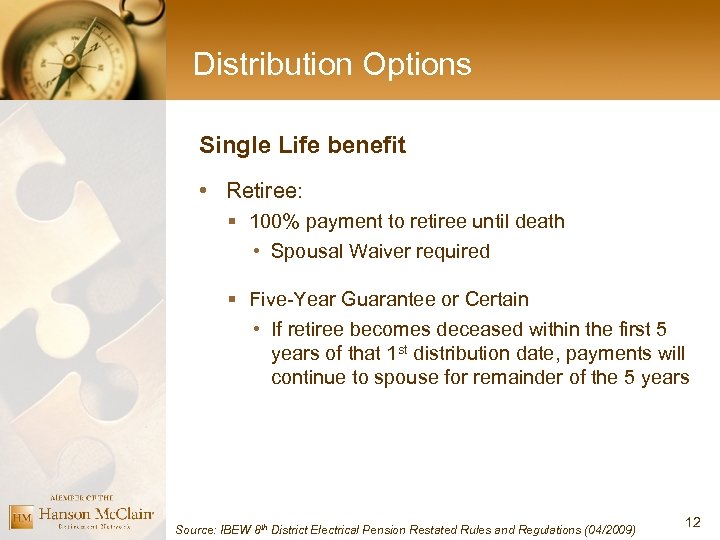

Distribution Options Single Life benefit • Retiree: § 100% payment to retiree until death • Spousal Waiver required § Five-Year Guarantee or Certain • If retiree becomes deceased within the first 5 years of that 1 st distribution date, payments will continue to spouse for remainder of the 5 years Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 12

Distribution Options Single Life benefit • Retiree: § 100% payment to retiree until death • Spousal Waiver required § Five-Year Guarantee or Certain • If retiree becomes deceased within the first 5 years of that 1 st distribution date, payments will continue to spouse for remainder of the 5 years Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 12

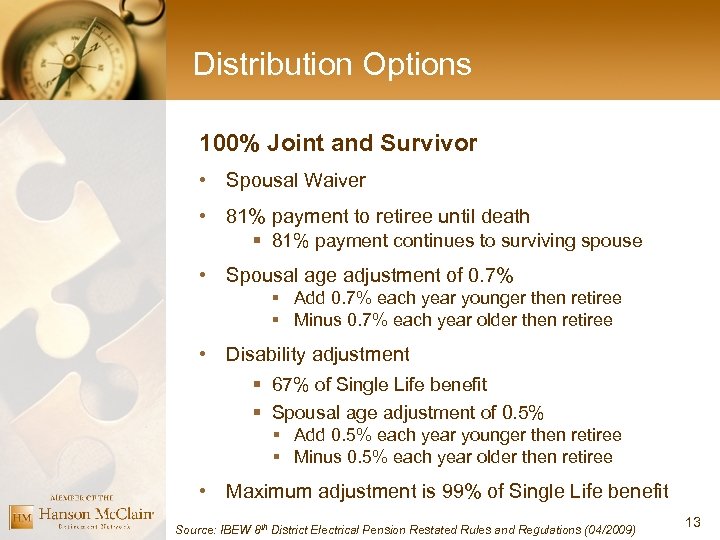

Distribution Options 100% Joint and Survivor • Spousal Waiver • 81% payment to retiree until death § 81% payment continues to surviving spouse • Spousal age adjustment of 0. 7% § Add 0. 7% each year younger then retiree § Minus 0. 7% each year older then retiree • Disability adjustment § 67% of Single Life benefit § Spousal age adjustment of 0. 5% § Add 0. 5% each year younger then retiree § Minus 0. 5% each year older then retiree • Maximum adjustment is 99% of Single Life benefit Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 13

Distribution Options 100% Joint and Survivor • Spousal Waiver • 81% payment to retiree until death § 81% payment continues to surviving spouse • Spousal age adjustment of 0. 7% § Add 0. 7% each year younger then retiree § Minus 0. 7% each year older then retiree • Disability adjustment § 67% of Single Life benefit § Spousal age adjustment of 0. 5% § Add 0. 5% each year younger then retiree § Minus 0. 5% each year older then retiree • Maximum adjustment is 99% of Single Life benefit Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 13

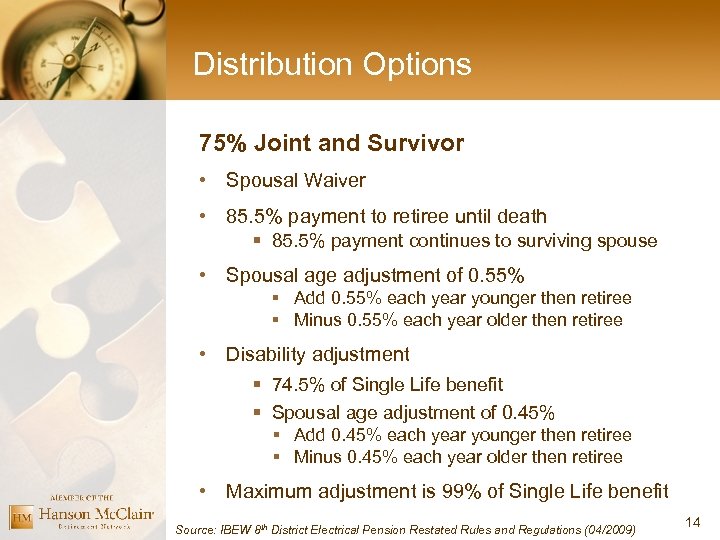

Distribution Options 75% Joint and Survivor • Spousal Waiver • 85. 5% payment to retiree until death § 85. 5% payment continues to surviving spouse • Spousal age adjustment of 0. 55% § Add 0. 55% each year younger then retiree § Minus 0. 55% each year older then retiree • Disability adjustment § 74. 5% of Single Life benefit § Spousal age adjustment of 0. 45% § Add 0. 45% each year younger then retiree § Minus 0. 45% each year older then retiree • Maximum adjustment is 99% of Single Life benefit Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 14

Distribution Options 75% Joint and Survivor • Spousal Waiver • 85. 5% payment to retiree until death § 85. 5% payment continues to surviving spouse • Spousal age adjustment of 0. 55% § Add 0. 55% each year younger then retiree § Minus 0. 55% each year older then retiree • Disability adjustment § 74. 5% of Single Life benefit § Spousal age adjustment of 0. 45% § Add 0. 45% each year younger then retiree § Minus 0. 45% each year older then retiree • Maximum adjustment is 99% of Single Life benefit Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 14

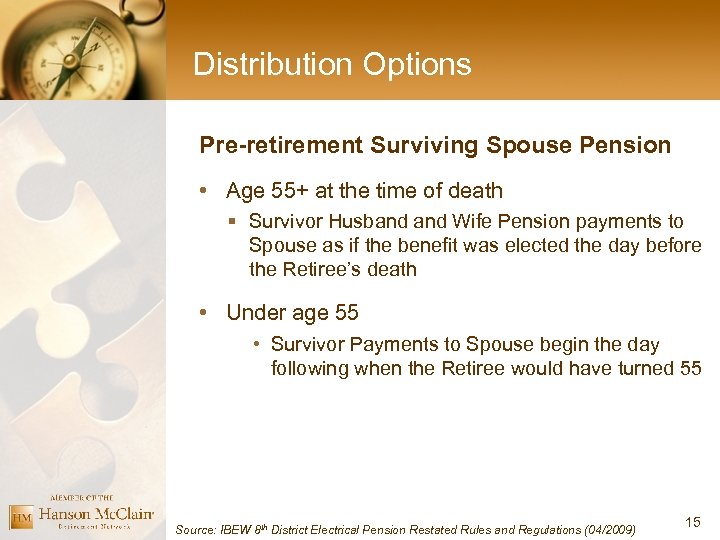

Distribution Options Pre-retirement Surviving Spouse Pension • Age 55+ at the time of death § Survivor Husband Wife Pension payments to Spouse as if the benefit was elected the day before the Retiree’s death • Under age 55 • Survivor Payments to Spouse begin the day following when the Retiree would have turned 55 Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 15

Distribution Options Pre-retirement Surviving Spouse Pension • Age 55+ at the time of death § Survivor Husband Wife Pension payments to Spouse as if the benefit was elected the day before the Retiree’s death • Under age 55 • Survivor Payments to Spouse begin the day following when the Retiree would have turned 55 Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 15

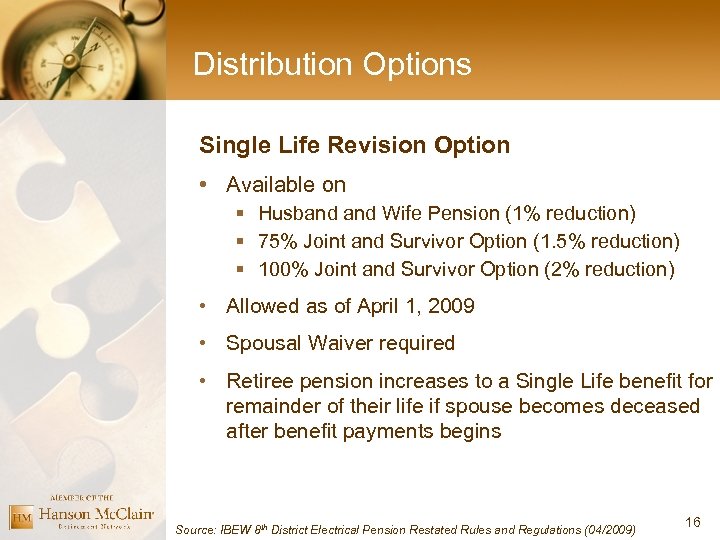

Distribution Options Single Life Revision Option • Available on § Husband Wife Pension (1% reduction) § 75% Joint and Survivor Option (1. 5% reduction) § 100% Joint and Survivor Option (2% reduction) • Allowed as of April 1, 2009 • Spousal Waiver required • Retiree pension increases to a Single Life benefit for remainder of their life if spouse becomes deceased after benefit payments begins Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 16

Distribution Options Single Life Revision Option • Available on § Husband Wife Pension (1% reduction) § 75% Joint and Survivor Option (1. 5% reduction) § 100% Joint and Survivor Option (2% reduction) • Allowed as of April 1, 2009 • Spousal Waiver required • Retiree pension increases to a Single Life benefit for remainder of their life if spouse becomes deceased after benefit payments begins Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 16

Distribution Options Direct Rollover • Tax-free transfer § IRA § Qualified Retirement Plan • Receive all or any portion of the balance to the credit of the participant / retiree • Spousal Waiver required Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 17

Distribution Options Direct Rollover • Tax-free transfer § IRA § Qualified Retirement Plan • Receive all or any portion of the balance to the credit of the participant / retiree • Spousal Waiver required Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 17

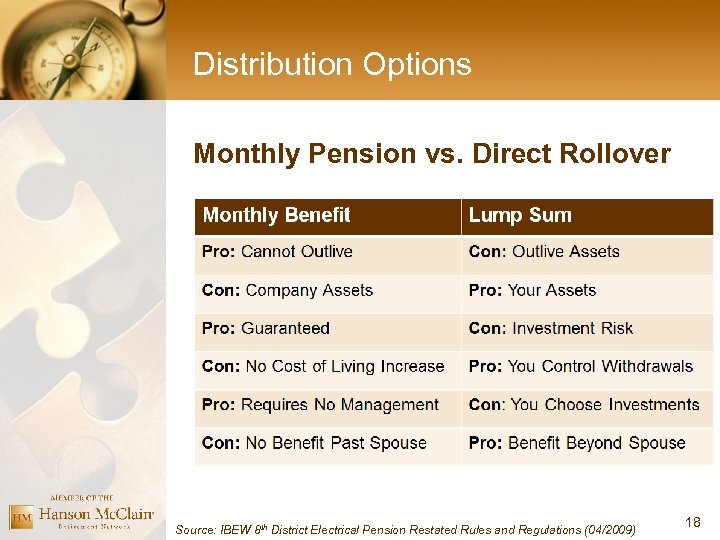

Distribution Options Monthly Pension vs. Direct Rollover Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 18

Distribution Options Monthly Pension vs. Direct Rollover Source: IBEW 8 th District Electrical Pension Restated Rules and Regulations (04/2009) 18

IRS Rules and Regulations Avoiding the 10% IRS Withdrawal Penalty • Company Savings Plans • Death • Disability • Separation from service • 55 or older in year of retirement • IRAs • • • Death Disability 1 st time house purchase Qualified educational expenses Substantially equal periodic payments - 72(t) Source: IRS Section 72(t) 19

IRS Rules and Regulations Avoiding the 10% IRS Withdrawal Penalty • Company Savings Plans • Death • Disability • Separation from service • 55 or older in year of retirement • IRAs • • • Death Disability 1 st time house purchase Qualified educational expenses Substantially equal periodic payments - 72(t) Source: IRS Section 72(t) 19

IRS Rules and Regulations Substantially Equal Periodic Payments: Rule 72(t) • Equal payments at least annually • Based on Life expectancy • Federal Mid-term Rate • 5 years or 59½, whichever is longer • One time change allowed Source: IRS Section 72(t) 20

IRS Rules and Regulations Substantially Equal Periodic Payments: Rule 72(t) • Equal payments at least annually • Based on Life expectancy • Federal Mid-term Rate • 5 years or 59½, whichever is longer • One time change allowed Source: IRS Section 72(t) 20

72(t) Distributions: Important Points to Remember • Distributions modified (except for death or disability) before the longer of five (5) years or age 59 ½, will be subject to the 10% penalty tax, plus interest. • Past performance is no guarantee of future performance. There is a risk that the principal balance of the client's account could be exhausted in the event that the distributions exceed the net earnings and growth of the investments. • Clients who live beyond their normal life expectancy may find their account values have been completely depleted. • The 72(t) distributions are subject to federal and state income taxes. • Please consult a tax advisor for specific tax advice. 21

72(t) Distributions: Important Points to Remember • Distributions modified (except for death or disability) before the longer of five (5) years or age 59 ½, will be subject to the 10% penalty tax, plus interest. • Past performance is no guarantee of future performance. There is a risk that the principal balance of the client's account could be exhausted in the event that the distributions exceed the net earnings and growth of the investments. • Clients who live beyond their normal life expectancy may find their account values have been completely depleted. • The 72(t) distributions are subject to federal and state income taxes. • Please consult a tax advisor for specific tax advice. 21

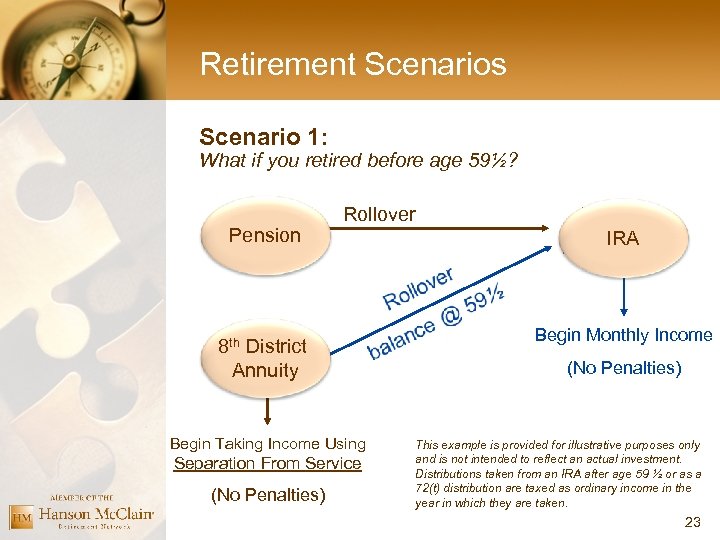

Retirement Scenarios Scenario 1: What if you retired before age 59½? John Smith § Retired from the company at age 57 § Elected the Direct Rollover option § Needs limited income § Eligible for IRS Separation From Service rule (for those who are at least 55 in the year they retire, but are not yet 59½) 22

Retirement Scenarios Scenario 1: What if you retired before age 59½? John Smith § Retired from the company at age 57 § Elected the Direct Rollover option § Needs limited income § Eligible for IRS Separation From Service rule (for those who are at least 55 in the year they retire, but are not yet 59½) 22

Retirement Scenarios Scenario 1: What if you retired before age 59½? Pension Rollover 8 th District Annuity Begin Taking Income Using Separation From Service (No Penalties) IRA Begin Monthly Income (No Penalties) This example is provided for illustrative purposes only and is not intended to reflect an actual investment. Distributions taken from an IRA after age 59 ½ or as a 72(t) distribution are taxed as ordinary income in the year in which they are taken. 23

Retirement Scenarios Scenario 1: What if you retired before age 59½? Pension Rollover 8 th District Annuity Begin Taking Income Using Separation From Service (No Penalties) IRA Begin Monthly Income (No Penalties) This example is provided for illustrative purposes only and is not intended to reflect an actual investment. Distributions taken from an IRA after age 59 ½ or as a 72(t) distribution are taxed as ordinary income in the year in which they are taken. 23

Retirement Scenarios Scenario 2: What if you retired after age 60? Mary Jones § Retired from the company at age 63 § Elected the Direct Rollover option § Needs limited income § Not eligible for IRS Separation From Service rule (since Mary will not be at least 55 in the year she retires) 24

Retirement Scenarios Scenario 2: What if you retired after age 60? Mary Jones § Retired from the company at age 63 § Elected the Direct Rollover option § Needs limited income § Not eligible for IRS Separation From Service rule (since Mary will not be at least 55 in the year she retires) 24

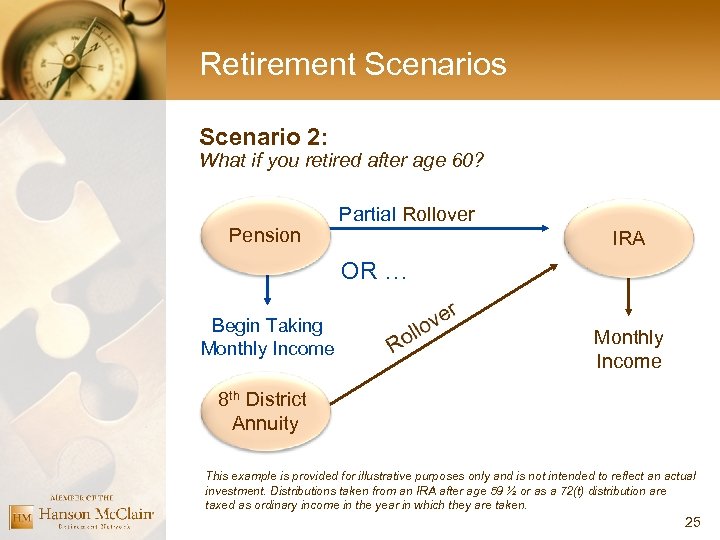

Retirement Scenarios Scenario 2: What if you retired after age 60? Pension Partial Rollover IRA OR … Begin Taking Monthly Income 8 th District Annuity This example is provided for illustrative purposes only and is not intended to reflect an actual investment. Distributions taken from an IRA after age 59 ½ or as a 72(t) distribution are taxed as ordinary income in the year in which they are taken. 25

Retirement Scenarios Scenario 2: What if you retired after age 60? Pension Partial Rollover IRA OR … Begin Taking Monthly Income 8 th District Annuity This example is provided for illustrative purposes only and is not intended to reflect an actual investment. Distributions taken from an IRA after age 59 ½ or as a 72(t) distribution are taxed as ordinary income in the year in which they are taken. 25

The IPRO® After Attending This Workshop: What happens next? The Independent Personal Retirement Overview (IPRO) § Designed exclusively for telecom employees § Helps evaluate your current financial situation § Projects various retirement scenarios § Analyzes your pension and savings plans § Provides a list of “action items” § Provided to you at no charge 26

The IPRO® After Attending This Workshop: What happens next? The Independent Personal Retirement Overview (IPRO) § Designed exclusively for telecom employees § Helps evaluate your current financial situation § Projects various retirement scenarios § Analyzes your pension and savings plans § Provides a list of “action items” § Provided to you at no charge 26

The IPRO® The IPRO Appointment: What should you bring? Pin Code Investment Statements Goals, Objectives, Concerns 27

The IPRO® The IPRO Appointment: What should you bring? Pin Code Investment Statements Goals, Objectives, Concerns 27

How We Can Help Our Services: What kind of support can you expect? • Free consultations • Free resource • Educational workshops • Assist with your transition • Manage your investments 28

How We Can Help Our Services: What kind of support can you expect? • Free consultations • Free resource • Educational workshops • Assist with your transition • Manage your investments 28

How We Can Help Planning for Your Retirement: What should you be thinking about? Deciding When to Retire § Do I have enough money? § Am I eligible to retire? § Do I want to retire, or find another job? Choosing a Financial Advisory Firm § Do they want to sell me a product? § Separation From Service: Do they know about it? § Do they know my pension and savings plans? Schedule Your IPRO Appointment! 29

How We Can Help Planning for Your Retirement: What should you be thinking about? Deciding When to Retire § Do I have enough money? § Am I eligible to retire? § Do I want to retire, or find another job? Choosing a Financial Advisory Firm § Do they want to sell me a product? § Separation From Service: Do they know about it? § Do they know my pension and savings plans? Schedule Your IPRO Appointment! 29

Offices: Update this slide with your company name, contact information and disclosure statement, and remove this comment.

Offices: Update this slide with your company name, contact information and disclosure statement, and remove this comment.