36bd5aa1c8063e8e9a2967e170167b8f.ppt

- Количество слайдов: 67

Office of Housing Voucher Programs Implementation of 2011 Appropriations Housing Choice Voucher Program June 6, 2011

Office of Housing Voucher Programs Implementation of 2011 Appropriations Housing Choice Voucher Program June 6, 2011

Purpose of This Broadcast • Review the provisions of the 2011 Appropriations Act – renewals, incrementals, administrative fees • Explain the CY 2011 Housing Choice Voucher Program funding allocations • Identify the requirements for PHA requests for additional funding under the HAP Set-Aside

Purpose of This Broadcast • Review the provisions of the 2011 Appropriations Act – renewals, incrementals, administrative fees • Explain the CY 2011 Housing Choice Voucher Program funding allocations • Identify the requirements for PHA requests for additional funding under the HAP Set-Aside

CY 2011 HAP and Admin Fee Funding • Public Law 112 -10 enacted April 15, 2011 • URL: http//thomas. loc. gov/home/approp/app 11. html • funded via 6 Continuing Resolutions before the law was passed: – Provided funding at 2010 appropriated level – Continued 2010 appropriations requirements – January thru June disbursements equaled 1/12 of CY 2010 eligibility and set-aside plus funds for first time renewals l

CY 2011 HAP and Admin Fee Funding • Public Law 112 -10 enacted April 15, 2011 • URL: http//thomas. loc. gov/home/approp/app 11. html • funded via 6 Continuing Resolutions before the law was passed: – Provided funding at 2010 appropriated level – Continued 2010 appropriations requirements – January thru June disbursements equaled 1/12 of CY 2010 eligibility and set-aside plus funds for first time renewals l

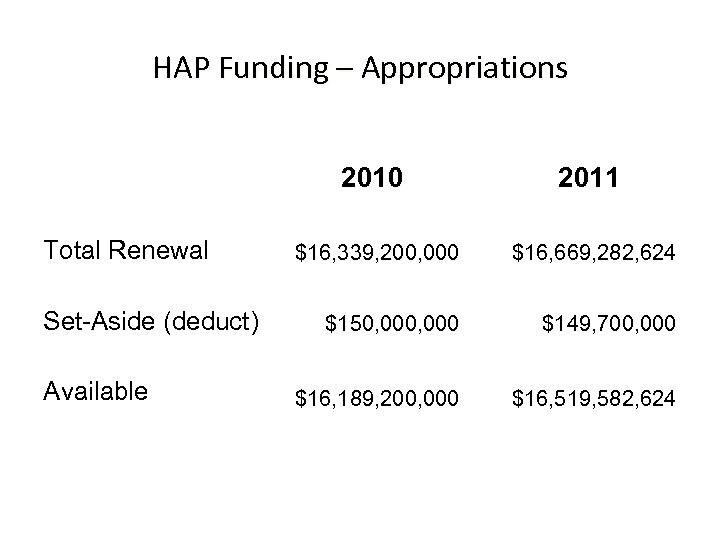

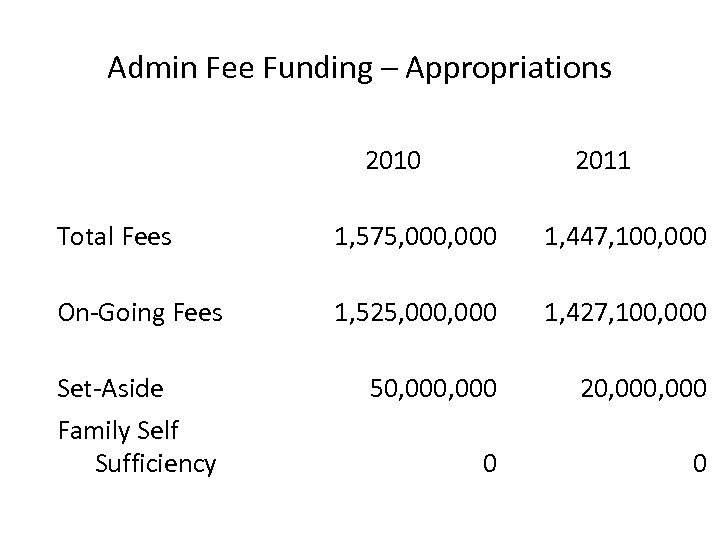

HAP Funding – Appropriations 2010 Total Renewal Set-Aside (deduct) Available 2011 $16, 339, 200, 000 $16, 669, 282, 624 $150, 000 $149, 700, 000 $16, 189, 200, 000 $16, 519, 582, 624

HAP Funding – Appropriations 2010 Total Renewal Set-Aside (deduct) Available 2011 $16, 339, 200, 000 $16, 669, 282, 624 $150, 000 $149, 700, 000 $16, 189, 200, 000 $16, 519, 582, 624

HAP Funding – Provisions • Basic Funding Eligibility Components – FFY 2010 actual verified HAP Costs from VMS – Adjustments for HAP Costs for first time renewals, to fund a total of 12 months – Allowance for Family Self-Sufficiency escrow deposits – Application of Renewal Funding Annual Adjustment Factor

HAP Funding – Provisions • Basic Funding Eligibility Components – FFY 2010 actual verified HAP Costs from VMS – Adjustments for HAP Costs for first time renewals, to fund a total of 12 months – Allowance for Family Self-Sufficiency escrow deposits – Application of Renewal Funding Annual Adjustment Factor

HAP Funding – Provisions Basic Funding Eligibility Components – Adjustment for Transfers to or from the PHA – Eligibility for DHAP to HCV and THU to HCV Voucher Renewals – VASH Renewals – Application of national pro-ration factor

HAP Funding – Provisions Basic Funding Eligibility Components – Adjustment for Transfers to or from the PHA – Eligibility for DHAP to HCV and THU to HCV Voucher Renewals – VASH Renewals – Application of national pro-ration factor

HAP Funding - Provisions • Re-benchmarking, based on FFY 2010 validated cost data from VMS – October 2009 thru September 2010 • Including all categories of HAP Expense except 5 Year Mainstream • Including expenses for VASH vouchers leased • Including total HAP expenses for contracts effective after the first of the month

HAP Funding - Provisions • Re-benchmarking, based on FFY 2010 validated cost data from VMS – October 2009 thru September 2010 • Including all categories of HAP Expense except 5 Year Mainstream • Including expenses for VASH vouchers leased • Including total HAP expenses for contracts effective after the first of the month

HAP Funding - Provisions – Deduction for over-leased unit months – Including funding for disaster vouchers expired 12/31/2010

HAP Funding - Provisions – Deduction for over-leased unit months – Including funding for disaster vouchers expired 12/31/2010

HAP Funding – Provisions • VMS Data Integrity Efforts – To ensure HUD uses the final, accurate FFY 2010 HAP costs for every PHA – PHAs were advised of the deadline for submitting all data and data changes to VMS for FFY 2010 and Oct thru Dec 2010 – April 25 – for use in renewal and setaside calculations – Data sustained the regular on-line edits and was reviewed off line at the FMC

HAP Funding – Provisions • VMS Data Integrity Efforts – To ensure HUD uses the final, accurate FFY 2010 HAP costs for every PHA – PHAs were advised of the deadline for submitting all data and data changes to VMS for FFY 2010 and Oct thru Dec 2010 – April 25 – for use in renewal and setaside calculations – Data sustained the regular on-line edits and was reviewed off line at the FMC

HAP Funding – Provisions • VMS Data Integrity Efforts – Database further reviewed at HQ by identifying missing items and monthly entries out of range for each PHA’s norm - reasonableness – FMC contacted PHAs with questionable or missing data to resolve all issues – Database finalized for CY 2011 funding calculations

HAP Funding – Provisions • VMS Data Integrity Efforts – Database further reviewed at HQ by identifying missing items and monthly entries out of range for each PHA’s norm - reasonableness – FMC contacted PHAs with questionable or missing data to resolve all issues – Database finalized for CY 2011 funding calculations

HAP Funding – Provisions • VMS Data Integrity Efforts: – No further data changes considered unless directed by HUD – No further data extracts from VMS – PHAs should still update data as needed, but base for CY 2011 funding will not be changed

HAP Funding – Provisions • VMS Data Integrity Efforts: – No further data changes considered unless directed by HUD – No further data extracts from VMS – PHAs should still update data as needed, but base for CY 2011 funding will not be changed

HAP Funding - Process • April 25 reviewed data is the starting point • Adjustments for 1 st time renewal of HOPE VI, tenant protection and incremental vouchers – To provide funding through 12/31/2011 for vouchers that are not represented for 12 months in the VMS data – First time renewal funding consists of initial funding, leaseup period, actual costs from VMS, and additional months required • Lease-up and additional months funding provided at the higher of the initial funding rate or VMS FFY 2010 average per unit cost

HAP Funding - Process • April 25 reviewed data is the starting point • Adjustments for 1 st time renewal of HOPE VI, tenant protection and incremental vouchers – To provide funding through 12/31/2011 for vouchers that are not represented for 12 months in the VMS data – First time renewal funding consists of initial funding, leaseup period, actual costs from VMS, and additional months required • Lease-up and additional months funding provided at the higher of the initial funding rate or VMS FFY 2010 average per unit cost

HAP Funding – Process • Example: TP increment with initial term April 1, 2010 thru March 31, 2011 • 2011 funding will consist of: – Original Funding 1/11 thru 3/11 3 mo – Funding based on VMS data for 7/10 to 9/10 included in re-benchmarking 3 mo -- Funding to cover lease-up period of 4/10 thru 6/10, not assumed in VMS 3 mo -- Funding for total months not covered above 3 mo

HAP Funding – Process • Example: TP increment with initial term April 1, 2010 thru March 31, 2011 • 2011 funding will consist of: – Original Funding 1/11 thru 3/11 3 mo – Funding based on VMS data for 7/10 to 9/10 included in re-benchmarking 3 mo -- Funding to cover lease-up period of 4/10 thru 6/10, not assumed in VMS 3 mo -- Funding for total months not covered above 3 mo

HAP Funding - Process • Adjustment for deposits to participants’ FSS escrow accounts (1 of 2 provisions) – Data from PIC – participants and monthly deposit amounts – Based on October thru December 2010 new accounts, with December deposits used as the base for the 12 months to be funded – Used both active and historical PIC data – Prior escrows (FFY 2010) are already in the rebenchmarking expenses via VMS reporting

HAP Funding - Process • Adjustment for deposits to participants’ FSS escrow accounts (1 of 2 provisions) – Data from PIC – participants and monthly deposit amounts – Based on October thru December 2010 new accounts, with December deposits used as the base for the 12 months to be funded – Used both active and historical PIC data – Prior escrows (FFY 2010) are already in the rebenchmarking expenses via VMS reporting

HAP Funding - Process • 2011 Renewal Funding AAF applied – Renewal Funding AAFs published and posted • Two AAF tables this year – Applied an inflation factor to the AAF to account for time lag between end of re-benchmarking period on 9/30/10 and start of funding period on 1/1/11

HAP Funding - Process • 2011 Renewal Funding AAF applied – Renewal Funding AAFs published and posted • Two AAF tables this year – Applied an inflation factor to the AAF to account for time lag between end of re-benchmarking period on 9/30/10 and start of funding period on 1/1/11

HAP Funding Process • Adjustment for Transfers In or Out – Factored after application of AAF to ensure AAF of initial PHA is applied to its costs – Divesting PHA’s VMS costs within FFY 2010 and prior to the transfer are added to Receiving PHA’s VMS costs

HAP Funding Process • Adjustment for Transfers In or Out – Factored after application of AAF to ensure AAF of initial PHA is applied to its costs – Divesting PHA’s VMS costs within FFY 2010 and prior to the transfer are added to Receiving PHA’s VMS costs

HAP Funding - Process • Addition of DHAP to HCV Vouchers Renewal from CY 2010 – Converted to regular Vouchers for CY 2010; no adjustment needed or made for CY 2011 • Addition of DHAP to HCV Vouchers Renewal from CY 2011 – Only for voucher issued prior to 1/1/2010 and initial leased prior to May 2010 – Renewal eligibility based on each PHA’s December 2010 leasing of these vouchers

HAP Funding - Process • Addition of DHAP to HCV Vouchers Renewal from CY 2010 – Converted to regular Vouchers for CY 2010; no adjustment needed or made for CY 2011 • Addition of DHAP to HCV Vouchers Renewal from CY 2011 – Only for voucher issued prior to 1/1/2010 and initial leased prior to May 2010 – Renewal eligibility based on each PHA’s December 2010 leasing of these vouchers

HAP Funding - Process – Renewal per unit funding based on higher of reported costs for these vouchers or the PHA’s program-wide FFY 2010 HAP costs • Addition of THU to HCV Vouchers Renewal – Funded through 12/31/2010 and then renewed as regular vouchers – Renewal eligibility based on each PHA’s December 2010 leasing of these vouchers – Renewal per unit funding based on higher of reported costs for these vouchers or the PHA’s program-wide FFY 2010 HAP costs

HAP Funding - Process – Renewal per unit funding based on higher of reported costs for these vouchers or the PHA’s program-wide FFY 2010 HAP costs • Addition of THU to HCV Vouchers Renewal – Funded through 12/31/2010 and then renewed as regular vouchers – Renewal eligibility based on each PHA’s December 2010 leasing of these vouchers – Renewal per unit funding based on higher of reported costs for these vouchers or the PHA’s program-wide FFY 2010 HAP costs

HAP Funding - Process • Result of these calculations is PHA’s 2011 renewal eligibility • Based on the total national eligibility and appropriated amount, a pro-ration factor will be set and applied to all PHAs’ eligibility to determine prorated eligibility, which is the funding amount – downward pro-ration is expected to be minimal • 2011 Appropriations Act does not provide for an NRA offset, and none was taken

HAP Funding - Process • Result of these calculations is PHA’s 2011 renewal eligibility • Based on the total national eligibility and appropriated amount, a pro-ration factor will be set and applied to all PHAs’ eligibility to determine prorated eligibility, which is the funding amount – downward pro-ration is expected to be minimal • 2011 Appropriations Act does not provide for an NRA offset, and none was taken

HAP Funding - Process • MTW Agencies – Funded per the terms of the PHAs’ individual agreements – Pro-rated at same percentage as all other PHAs – Per 2011 Act, MTW agencies may use appropriated funds to lease vouchers in excess of baseline, but will not be funded for the excess leasing

HAP Funding - Process • MTW Agencies – Funded per the terms of the PHAs’ individual agreements – Pro-rated at same percentage as all other PHAs – Per 2011 Act, MTW agencies may use appropriated funds to lease vouchers in excess of baseline, but will not be funded for the excess leasing

HAP Funding - Process • 60 day completion requirement per appropriations act • Detailed funding allocation calculations will be provided to each PHA with an explanation of each step – Allocation Letter – Calculations – Notes explaining each data item in the calculations

HAP Funding - Process • 60 day completion requirement per appropriations act • Detailed funding allocation calculations will be provided to each PHA with an explanation of each step – Allocation Letter – Calculations – Notes explaining each data item in the calculations

HAP Funding - Process • Key Points – Letter references Appropriations Act Implementation notice – expected to be issued by June 6, 2011 as PIH Notice 2011 -27; posted on HUD web – Letter identifies total funding – Costs will not be updated for eligibility calculation except at HUD direction

HAP Funding - Process • Key Points – Letter references Appropriations Act Implementation notice – expected to be issued by June 6, 2011 as PIH Notice 2011 -27; posted on HUD web – Letter identifies total funding – Costs will not be updated for eligibility calculation except at HUD direction

HAP Funding - Process • Key Points: – Appropriated HAP funds may not be used to support leasing above baseline – Appropriated HAP funds may not be used for any other purposes – Administrative fees will be earned based on PHA leasing – Set-aside funding will be processed in accordance with details in the Notice

HAP Funding - Process • Key Points: – Appropriated HAP funds may not be used to support leasing above baseline – Appropriated HAP funds may not be used for any other purposes – Administrative fees will be earned based on PHA leasing – Set-aside funding will be processed in accordance with details in the Notice

HAP Funding - Process • Disbursements for January thru June 2011 were based on 1/12 of CY 2010 eligibility plus set-aside award and monthly renewal amounts needed for new units • Front load funding has been provided as needed, if a PHA has insufficient funds (BA and NRA) to support present HAP contracts • Front load funding is an advance disbursement of CY 2011 eligibility, not additional eligibility

HAP Funding - Process • Disbursements for January thru June 2011 were based on 1/12 of CY 2010 eligibility plus set-aside award and monthly renewal amounts needed for new units • Front load funding has been provided as needed, if a PHA has insufficient funds (BA and NRA) to support present HAP contracts • Front load funding is an advance disbursement of CY 2011 eligibility, not additional eligibility

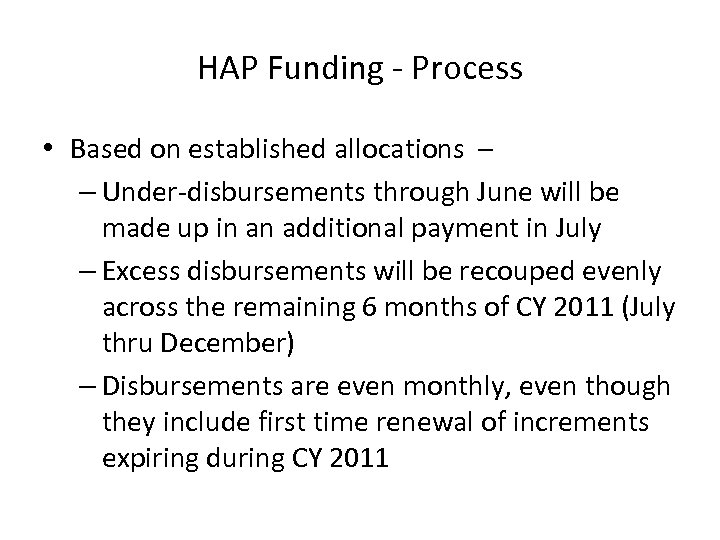

HAP Funding - Process • Based on established allocations – – Under-disbursements through June will be made up in an additional payment in July – Excess disbursements will be recouped evenly across the remaining 6 months of CY 2011 (July thru December) – Disbursements are even monthly, even though they include first time renewal of increments expiring during CY 2011

HAP Funding - Process • Based on established allocations – – Under-disbursements through June will be made up in an additional payment in July – Excess disbursements will be recouped evenly across the remaining 6 months of CY 2011 (July thru December) – Disbursements are even monthly, even though they include first time renewal of increments expiring during CY 2011

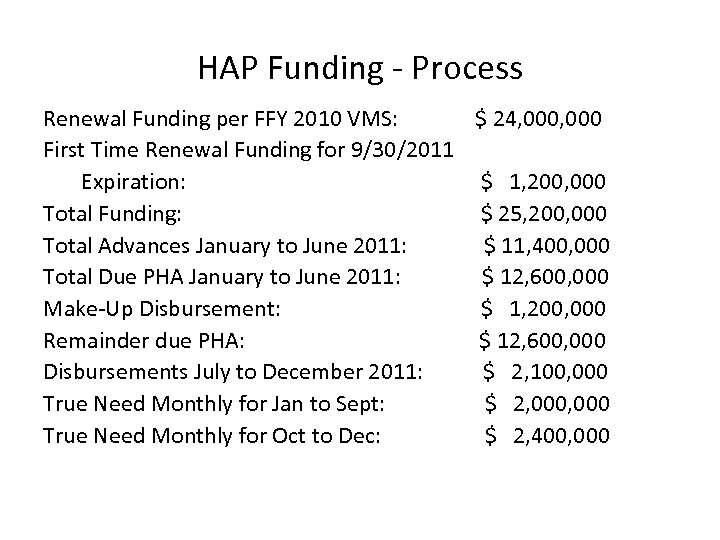

HAP Funding - Process Renewal Funding per FFY 2010 VMS: $ 24, 000 First Time Renewal Funding for 9/30/2011 Expiration: $ 1, 200, 000 Total Funding: $ 25, 200, 000 Total Advances January to June 2011: $ 11, 400, 000 Total Due PHA January to June 2011: $ 12, 600, 000 Make-Up Disbursement: $ 1, 200, 000 Remainder due PHA: $ 12, 600, 000 Disbursements July to December 2011: $ 2, 100, 000 True Need Monthly for Jan to Sept: $ 2, 000 True Need Monthly for Oct to Dec: $ 2, 400, 000

HAP Funding - Process Renewal Funding per FFY 2010 VMS: $ 24, 000 First Time Renewal Funding for 9/30/2011 Expiration: $ 1, 200, 000 Total Funding: $ 25, 200, 000 Total Advances January to June 2011: $ 11, 400, 000 Total Due PHA January to June 2011: $ 12, 600, 000 Make-Up Disbursement: $ 1, 200, 000 Remainder due PHA: $ 12, 600, 000 Disbursements July to December 2011: $ 2, 100, 000 True Need Monthly for Jan to Sept: $ 2, 000 True Need Monthly for Oct to Dec: $ 2, 400, 000

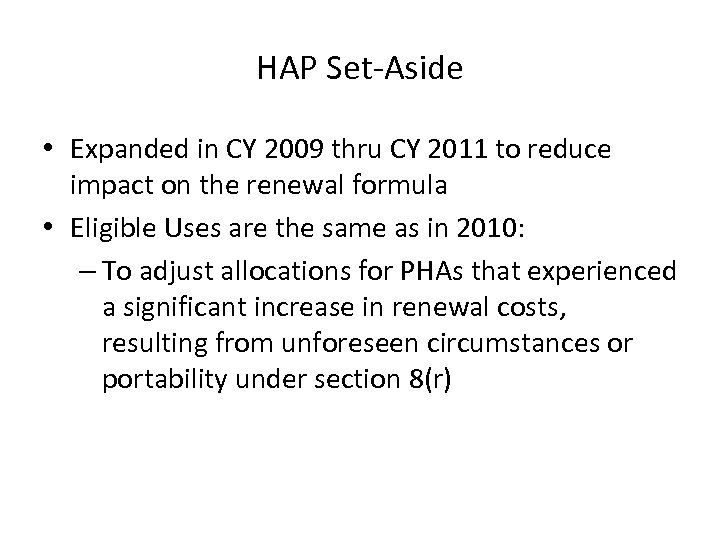

HAP Set-Aside • Expanded in CY 2009 thru CY 2011 to reduce impact on the renewal formula • Eligible Uses are the same as in 2010: – To adjust allocations for PHAs that experienced a significant increase in renewal costs, resulting from unforeseen circumstances or portability under section 8(r)

HAP Set-Aside • Expanded in CY 2009 thru CY 2011 to reduce impact on the renewal formula • Eligible Uses are the same as in 2010: – To adjust allocations for PHAs that experienced a significant increase in renewal costs, resulting from unforeseen circumstances or portability under section 8(r)

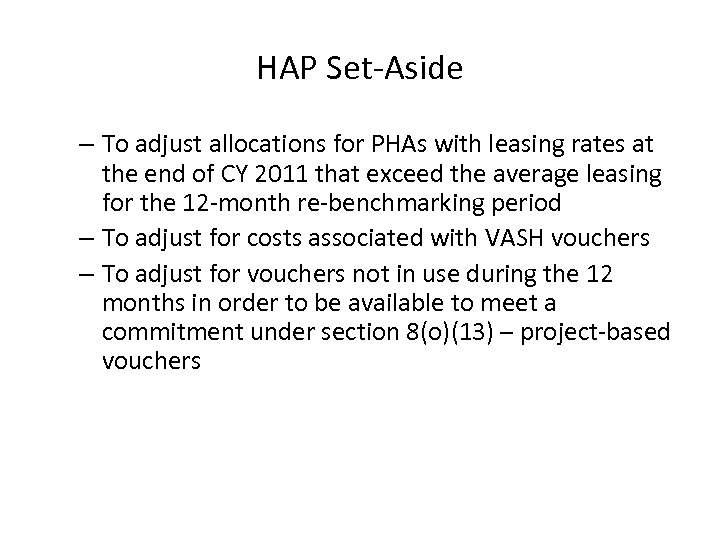

HAP Set-Aside – To adjust allocations for PHAs with leasing rates at the end of CY 2011 that exceed the average leasing for the 12 -month re-benchmarking period – To adjust for costs associated with VASH vouchers – To adjust for vouchers not in use during the 12 months in order to be available to meet a commitment under section 8(o)(13) – project-based vouchers

HAP Set-Aside – To adjust allocations for PHAs with leasing rates at the end of CY 2011 that exceed the average leasing for the 12 -month re-benchmarking period – To adjust for costs associated with VASH vouchers – To adjust for vouchers not in use during the 12 months in order to be available to meet a commitment under section 8(o)(13) – project-based vouchers

HAP Set-Aside • Exact procedures and application formats are provided in Notice PIH 2011 -27 • Applications are due to HUD HQ by 5: 00 pm on June 23, 2011 – Overnight (tracked) mail recommended – E-mails and faxes not acceptable – Do not submit to FMC or field office • PHAs are required to apply for each category for which they want consideration and provide the documentation required

HAP Set-Aside • Exact procedures and application formats are provided in Notice PIH 2011 -27 • Applications are due to HUD HQ by 5: 00 pm on June 23, 2011 – Overnight (tracked) mail recommended – E-mails and faxes not acceptable – Do not submit to FMC or field office • PHAs are required to apply for each category for which they want consideration and provide the documentation required

HAP Set-Aside Unforeseen Circumstances – PHA must submit: • • Attachment A from Notice 2011 -27 Written justification Evidence to support justification PHA calculation of the 2011 increased cost Portability – PHA must submit: • Attachment A • No other documentation required – HUD will determine eligibility based on VMS data • Eligibility for average port paid cost in excess of 110% program-wide average cost

HAP Set-Aside Unforeseen Circumstances – PHA must submit: • • Attachment A from Notice 2011 -27 Written justification Evidence to support justification PHA calculation of the 2011 increased cost Portability – PHA must submit: • Attachment A • No other documentation required – HUD will determine eligibility based on VMS data • Eligibility for average port paid cost in excess of 110% program-wide average cost

HAP Set-Aside • Additional Leasing – PHA must submit: – Attachment A – No other documentation required – HUD will determine eligibility based on leasing per VMS • HUD VASH – Attachment A – Evidence that 2011 anticipated VASH HAP costs exceed VASH funds (provide calculation of costs that exceed available funding)

HAP Set-Aside • Additional Leasing – PHA must submit: – Attachment A – No other documentation required – HUD will determine eligibility based on leasing per VMS • HUD VASH – Attachment A – Evidence that 2011 anticipated VASH HAP costs exceed VASH funds (provide calculation of costs that exceed available funding)

HAP Set-Aside • Project Based Vouchers – PHA must submit: – Attachment A – Attachment B for each project – Executed AHAPs – Executed HAPs or statement by PHA that none have been executed yet

HAP Set-Aside • Project Based Vouchers – PHA must submit: – Attachment A – Attachment B for each project – Executed AHAPs – Executed HAPs or statement by PHA that none have been executed yet

HAP Set-Aside • General Issues from Prior Years: – Failure to provide signed Attachment A or B – Failure to mark on Attachment A the category(ies) for which the PHA is applying – Incorrect PHA number on Attachment A or B – Submissions received after the deadline

HAP Set-Aside • General Issues from Prior Years: – Failure to provide signed Attachment A or B – Failure to mark on Attachment A the category(ies) for which the PHA is applying – Incorrect PHA number on Attachment A or B – Submissions received after the deadline

HAP Set-Aside • Issues for Unforeseen Circumstances: – PHA failed to provide a direct link between the U/C and how it impacted the PHA’s HCV program costs – PHA failed to provide the calculated amount needed and/or did not provide documentation to support the calculated amount

HAP Set-Aside • Issues for Unforeseen Circumstances: – PHA failed to provide a direct link between the U/C and how it impacted the PHA’s HCV program costs – PHA failed to provide the calculated amount needed and/or did not provide documentation to support the calculated amount

HAP Set-Aside – U/C Example – PHAs that have experienced significant cost increases due to an unforeseeable rise in rental costs above that increase anticipated by the Renewal Funding AAFs provided by HUD; documentation could include: • Evidence of increased rents • Identification of affected contracts in the PHA’s HCV program • Calculation of the increased cost required

HAP Set-Aside – U/C Example – PHAs that have experienced significant cost increases due to an unforeseeable rise in rental costs above that increase anticipated by the Renewal Funding AAFs provided by HUD; documentation could include: • Evidence of increased rents • Identification of affected contracts in the PHA’s HCV program • Calculation of the increased cost required

HAP Set-Aside – U/C Example – PHAs experiencing an increase in HAP per unit cost (PUC) in comparison to the pro-rated funded HAP PUC for CY 2011, due to economic conditions resulting in decreased total tenant payments; documentation could include: • Actual per unit tenant payments and HAP costs experienced by the PHA in CY 2011 • Calculation of increased cost required

HAP Set-Aside – U/C Example – PHAs experiencing an increase in HAP per unit cost (PUC) in comparison to the pro-rated funded HAP PUC for CY 2011, due to economic conditions resulting in decreased total tenant payments; documentation could include: • Actual per unit tenant payments and HAP costs experienced by the PHA in CY 2011 • Calculation of increased cost required

HAP Set-Aside • Issues for Project Based Vouchers: – PHA failed to provide signed AHAP/HAP in its entirety (including exhibits) to support the number of unit withheld due to the commitment – PHA failed to provide Attachment B with the number of vouchers held from leasing each month for the specific PB commitment – PHA failed to provide separate Attachment B and documents for each project-based commitment

HAP Set-Aside • Issues for Project Based Vouchers: – PHA failed to provide signed AHAP/HAP in its entirety (including exhibits) to support the number of unit withheld due to the commitment – PHA failed to provide Attachment B with the number of vouchers held from leasing each month for the specific PB commitment – PHA failed to provide separate Attachment B and documents for each project-based commitment

HAP Set-Aside • Issues for Project Based Vouchers: – PHA requested funding for an existing housing project based commitment, which is not eligible since there is no reason to withhold vouchers from leasing

HAP Set-Aside • Issues for Project Based Vouchers: – PHA requested funding for an existing housing project based commitment, which is not eligible since there is no reason to withhold vouchers from leasing

HAP Set-Aside • All complete and timely applications will be reviewed for eligibility and to determine eligible funding amounts • Excess NRA funds will be applied to eligibility, to ensure set-aside funds are used where they are eligible and needed • If eligible requests exceed funds available, some or all categories will be pro-rated • Process will be completed as quickly as possible

HAP Set-Aside • All complete and timely applications will be reviewed for eligibility and to determine eligible funding amounts • Excess NRA funds will be applied to eligibility, to ensure set-aside funds are used where they are eligible and needed • If eligible requests exceed funds available, some or all categories will be pro-rated • Process will be completed as quickly as possible

HAP – Use of Funds • 2011 HAP funds, same as 2005 thru 2010, may only be used for eligible HAP expenses for unit months up to baseline – Rental or homeownership subsidy payments – Utility reimbursements – FSS escrow deposits

HAP – Use of Funds • 2011 HAP funds, same as 2005 thru 2010, may only be used for eligible HAP expenses for unit months up to baseline – Rental or homeownership subsidy payments – Utility reimbursements – FSS escrow deposits

HAP – Use of Funds • Eligible uses are the same as when HUD held excess funds in the program reserve • Only difference: where the funds are held – PHA – and they can be used for eligible costs without requesting HUD approval • Any portion remaining at year’s end must be deposited to the NRA

HAP – Use of Funds • Eligible uses are the same as when HUD held excess funds in the program reserve • Only difference: where the funds are held – PHA – and they can be used for eligible costs without requesting HUD approval • Any portion remaining at year’s end must be deposited to the NRA

HAP – Use of Funds • Interest earned on investment of NRA funds accrues as program receipts – belongs to the program • HAP and NRA funds may not be used for prior year deficits or any other purpose, including – Administrative costs – Public housing expenses – Other housing expenses

HAP – Use of Funds • Interest earned on investment of NRA funds accrues as program receipts – belongs to the program • HAP and NRA funds may not be used for prior year deficits or any other purpose, including – Administrative costs – Public housing expenses – Other housing expenses

HAP – Use of Funds • Any funds which have been used for other purposes or transferred out of the NRA must be returned – no exceptions • PHAs that have diverted funds may be subject to administrative fee sanctions or other actions • HUD’s calculation of NRA balances assumes all HAP funds provided were used for eligible HAP purposes and reported in VMS or are in the NRA

HAP – Use of Funds • Any funds which have been used for other purposes or transferred out of the NRA must be returned – no exceptions • PHAs that have diverted funds may be subject to administrative fee sanctions or other actions • HUD’s calculation of NRA balances assumes all HAP funds provided were used for eligible HAP purposes and reported in VMS or are in the NRA

Tenant Protection Funds - Provisions • $109, 780, 000 for all purposes • Eligible for PH demolition/disposition, multifamily conversions, Mod Rehab replacements; Section 202 re-financing • Vouchers provided for all units occupied during previous 24 months that cease to be available as assisted housing

Tenant Protection Funds - Provisions • $109, 780, 000 for all purposes • Eligible for PH demolition/disposition, multifamily conversions, Mod Rehab replacements; Section 202 re-financing • Vouchers provided for all units occupied during previous 24 months that cease to be available as assisted housing

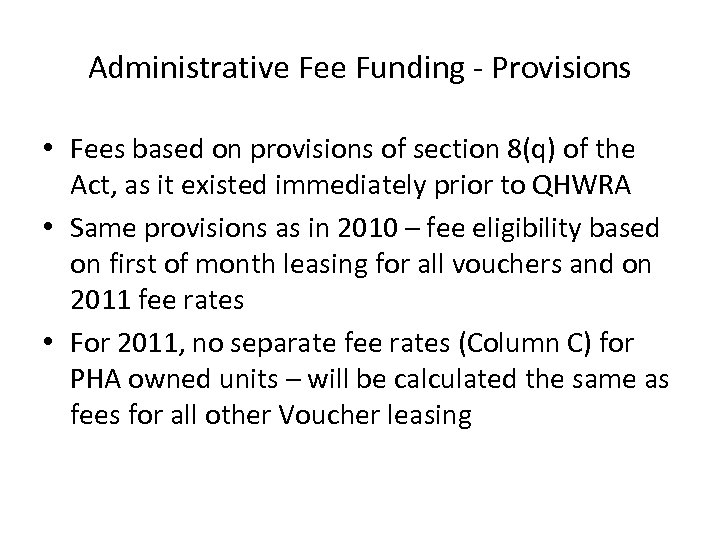

Admin Fee Funding – Appropriations 2010 2011 Total Fees 1, 575, 000 1, 447, 100, 000 On-Going Fees 1, 525, 000 1, 427, 100, 000 50, 000 20, 000 0 0 Set-Aside Family Self Sufficiency

Admin Fee Funding – Appropriations 2010 2011 Total Fees 1, 575, 000 1, 447, 100, 000 On-Going Fees 1, 525, 000 1, 427, 100, 000 50, 000 20, 000 0 0 Set-Aside Family Self Sufficiency

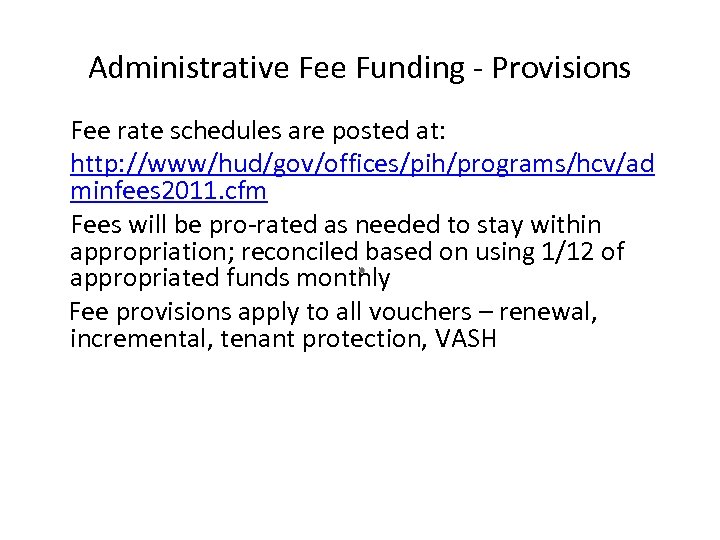

Administrative Fee Funding - Provisions • Fees based on provisions of section 8(q) of the Act, as it existed immediately prior to QHWRA • Same provisions as in 2010 – fee eligibility based on first of month leasing for all vouchers and on 2011 fee rates • For 2011, no separate fee rates (Column C) for PHA owned units – will be calculated the same as fees for all other Voucher leasing

Administrative Fee Funding - Provisions • Fees based on provisions of section 8(q) of the Act, as it existed immediately prior to QHWRA • Same provisions as in 2010 – fee eligibility based on first of month leasing for all vouchers and on 2011 fee rates • For 2011, no separate fee rates (Column C) for PHA owned units – will be calculated the same as fees for all other Voucher leasing

Administrative Fee Funding - Provisions Fee rate schedules are posted at: http: //www/hud/gov/offices/pih/programs/hcv/ad minfees 2011. cfm Fees will be pro-rated as needed to stay within appropriation; reconciled based on using 1/12 of appropriated funds monthly Fee provisions apply to all vouchers – renewal, incremental, tenant protection, VASH

Administrative Fee Funding - Provisions Fee rate schedules are posted at: http: //www/hud/gov/offices/pih/programs/hcv/ad minfees 2011. cfm Fees will be pro-rated as needed to stay within appropriation; reconciled based on using 1/12 of appropriated funds monthly Fee provisions apply to all vouchers – renewal, incremental, tenant protection, VASH

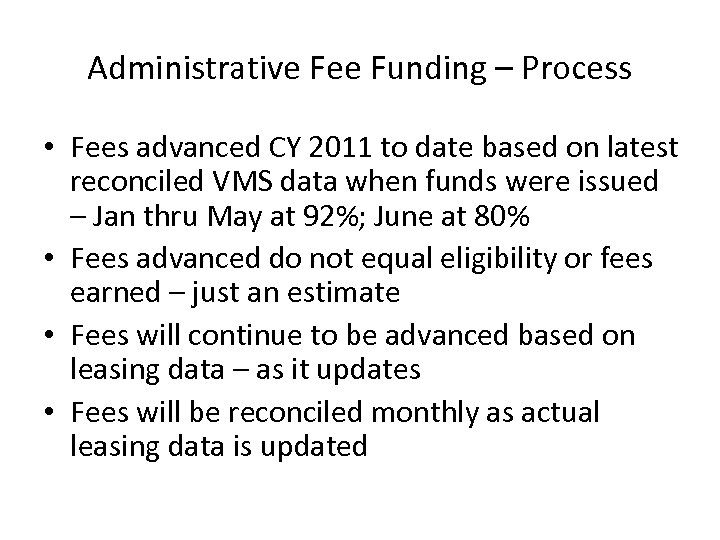

Administrative Fee Funding – Process • Fees advanced CY 2011 to date based on latest reconciled VMS data when funds were issued – Jan thru May at 92%; June at 80% • Fees advanced do not equal eligibility or fees earned – just an estimate • Fees will continue to be advanced based on leasing data – as it updates • Fees will be reconciled monthly as actual leasing data is updated

Administrative Fee Funding – Process • Fees advanced CY 2011 to date based on latest reconciled VMS data when funds were issued – Jan thru May at 92%; June at 80% • Fees advanced do not equal eligibility or fees earned – just an estimate • Fees will continue to be advanced based on leasing data – as it updates • Fees will be reconciled monthly as actual leasing data is updated

Administrative Fee Funding - Process • Average reconciled pro-ration for CY 2011 expected to be approximately 83% • Fee set-aside will be used for: – Homeownership incentive fees – One time special fees for Housing conversion tenant protection actions ($200 per occupied unit) – Program specific audits as required – PHAs in need of additional funds to administer their program (remainder)

Administrative Fee Funding - Process • Average reconciled pro-ration for CY 2011 expected to be approximately 83% • Fee set-aside will be used for: – Homeownership incentive fees – One time special fees for Housing conversion tenant protection actions ($200 per occupied unit) – Program specific audits as required – PHAs in need of additional funds to administer their program (remainder)

Administrative Fee Funding – Process • Blended Rates – PHA must request; no justification required – Calculation based on location of participants per PIC – No reconciliation required – Request to: Financial Management Division (HQ) by June 23

Administrative Fee Funding – Process • Blended Rates – PHA must request; no justification required – Calculation based on location of participants per PIC – No reconciliation required – Request to: Financial Management Division (HQ) by June 23

Controlling Administrative Costs • HUD recognizes PHA challenges when admin fees are severely reduced – Fee reduction does not mean PHAs can immediately shed costs – HUD cannot adjust level of admin fees available – only funds appropriated for fees may be used • HUD working to identify ways for PHAs to reduce admin burdens and streamline business to cut costs

Controlling Administrative Costs • HUD recognizes PHA challenges when admin fees are severely reduced – Fee reduction does not mean PHAs can immediately shed costs – HUD cannot adjust level of admin fees available – only funds appropriated for fees may be used • HUD working to identify ways for PHAs to reduce admin burdens and streamline business to cut costs

Controlling Administrative Costs • Notice forthcoming to remind PHAs of options currently available: – Verify the correction of HQS deficiencies remotely, via photographs or vendor receipts, for annual or interim inspections (not initial or for project-based units) – Separate the annual HQS inspection from the annual reexamination of income – to enable PHA to group inspections geographically – Streamline the reexamination process and verification procedures – Pool resources with other PHAs for specific administrative functions, such as inspections

Controlling Administrative Costs • Notice forthcoming to remind PHAs of options currently available: – Verify the correction of HQS deficiencies remotely, via photographs or vendor receipts, for annual or interim inspections (not initial or for project-based units) – Separate the annual HQS inspection from the annual reexamination of income – to enable PHA to group inspections geographically – Streamline the reexamination process and verification procedures – Pool resources with other PHAs for specific administrative functions, such as inspections

Controlling Administrative Costs • A utility model is on-line to assist PHAs in setting utility allowances, which can save time and effort: http: //www. huduser. org/portal/resources/utilmodel. html • HUD’s 2012 budget request proposed legislative action: – three-year income certification for fixed income families – PHAs to approve exception payment standards for disabled households, up to 120% – THESE ARE PROPOSALS ONLY AT THIS TIME • HUD is reviewing program policy/regs and PHA suggestions for reforms aimed at reducing administrative complexity and streamlining requirements

Controlling Administrative Costs • A utility model is on-line to assist PHAs in setting utility allowances, which can save time and effort: http: //www. huduser. org/portal/resources/utilmodel. html • HUD’s 2012 budget request proposed legislative action: – three-year income certification for fixed income families – PHAs to approve exception payment standards for disabled households, up to 120% – THESE ARE PROPOSALS ONLY AT THIS TIME • HUD is reviewing program policy/regs and PHA suggestions for reforms aimed at reducing administrative complexity and streamlining requirements

Family Self-Sufficiency Coordinators • $59, 880, 000 for 2011 • Since the FSS funds are not administrative fees for 2011, a NOFA was required - applications due June 8 • PHAs may use administrative fee funds and request a frontload of fees to cover FSS coordinator costs until FSS funds are received • All 2010 awards have been announced

Family Self-Sufficiency Coordinators • $59, 880, 000 for 2011 • Since the FSS funds are not administrative fees for 2011, a NOFA was required - applications due June 8 • PHAs may use administrative fee funds and request a frontload of fees to cover FSS coordinator costs until FSS funds are received • All 2010 awards have been announced

2011 Incremental Funding • VASH - $49, 900, 000 – Guidance forthcoming – Anticipate issuing invitations based on VA/HUD determination of needs of homeless veterans • No Family Unification or Non-Elderly Disabled funding for 2011

2011 Incremental Funding • VASH - $49, 900, 000 – Guidance forthcoming – Anticipate issuing invitations based on VA/HUD determination of needs of homeless veterans • No Family Unification or Non-Elderly Disabled funding for 2011

2011 Incremental Funding • Appropriations language for VASH requires continued use of the vouchers for the intended population upon turnover • This restriction also applies to vouchers provided for VASH, FUP and Non-Elderly Disabled populations under the 2008, 2009 and 2010 Appropriations Acts

2011 Incremental Funding • Appropriations language for VASH requires continued use of the vouchers for the intended population upon turnover • This restriction also applies to vouchers provided for VASH, FUP and Non-Elderly Disabled populations under the 2008, 2009 and 2010 Appropriations Acts

Managing HAP Funds • PHAs must monitor leasing and HAP costs – Ensure effective use of BA and NRA funds – Ensure current leasing levels can be supported within funds available and known attrition – HUD cannot provide additional funds to PHAs that overspend and experience shortfall – HUD does not fund 100% of baseline units, but allocates funds based on the re-benchmark period alone

Managing HAP Funds • PHAs must monitor leasing and HAP costs – Ensure effective use of BA and NRA funds – Ensure current leasing levels can be supported within funds available and known attrition – HUD cannot provide additional funds to PHAs that overspend and experience shortfall – HUD does not fund 100% of baseline units, but allocates funds based on the re-benchmark period alone

Managing HAP Funds • Track monthly and YTD leasing and costs as compared to unit months and Budget Authority available • Project unit months and BA available for the balance of the year and adjust program activities accordingly • Utilize tool to be posted on web to project leasing, funds and actions affecting costs (attrition, success rate) – seek field office assistance as needed • PHAs may request frontloading of HAP funds to support cash flow

Managing HAP Funds • Track monthly and YTD leasing and costs as compared to unit months and Budget Authority available • Project unit months and BA available for the balance of the year and adjust program activities accordingly • Utilize tool to be posted on web to project leasing, funds and actions affecting costs (attrition, success rate) – seek field office assistance as needed • PHAs may request frontloading of HAP funds to support cash flow

Projection Spreadsheet • Purpose: – To support projections of funding, leasing and spending over 2 year period – To assist PHAs to decide number of vouchers to issue, which leads to leasing/costs • Goal: – Achieve optimal use of program – Avoid cyclical swings of lease-up and attrition – stabilize the program – Eliminate need for abrupt cutbacks affecting participants

Projection Spreadsheet • Purpose: – To support projections of funding, leasing and spending over 2 year period – To assist PHAs to decide number of vouchers to issue, which leads to leasing/costs • Goal: – Achieve optimal use of program – Avoid cyclical swings of lease-up and attrition – stabilize the program – Eliminate need for abrupt cutbacks affecting participants

Projection Spreadsheet • Common Cyclical Pattern/Problem: – PHA is below baseline and funding, so PHA leases up late in CY 1 – PHA starts CY 2 leased above CY 2 funding level (based on CY 1 average) and it cannot be sustained, so PHA reduces thru attrition – PHA then starts CY 3 below baseline and funds again (based on CY 2 average), and cycle repeats • Solution: Plan across multiple years by projecting funding, leasing, costs and the effects of PHA decisions

Projection Spreadsheet • Common Cyclical Pattern/Problem: – PHA is below baseline and funding, so PHA leases up late in CY 1 – PHA starts CY 2 leased above CY 2 funding level (based on CY 1 average) and it cannot be sustained, so PHA reduces thru attrition – PHA then starts CY 3 below baseline and funds again (based on CY 2 average), and cycle repeats • Solution: Plan across multiple years by projecting funding, leasing, costs and the effects of PHA decisions

Projection Spreadsheet • Projections based on interacting variables supported by the spreadsheet – user can test scenarios to see what leasing and costs would result – supports successful program management: – Success rate (% of vouchers that result in leases) – Turnover rate (% of participants leaving the program each year) – Issuance to Leasing (% of vouchers leased within standard time frames or the average time in months to leasing) – Per Unit Cost (monthly HAP expenses / leases)

Projection Spreadsheet • Projections based on interacting variables supported by the spreadsheet – user can test scenarios to see what leasing and costs would result – supports successful program management: – Success rate (% of vouchers that result in leases) – Turnover rate (% of participants leaving the program each year) – Issuance to Leasing (% of vouchers leased within standard time frames or the average time in months to leasing) – Per Unit Cost (monthly HAP expenses / leases)

Projection Spreadsheet • Caution: – Accuracy of the projections depends on the accuracy of the variables entered – PHAs must carefully track the variables monthly, so accurate values are entered – If the data is less reliable, PHA must leave a larger margin for error – Historic data is valuable but does not always continue – review frequently!

Projection Spreadsheet • Caution: – Accuracy of the projections depends on the accuracy of the variables entered – PHAs must carefully track the variables monthly, so accurate values are entered – If the data is less reliable, PHA must leave a larger margin for error – Historic data is valuable but does not always continue – review frequently!

Projection Spreadsheet • Funding Estimates: – Apply anticipated appropriations requirements and anticipate a pro-ration level – Actual funding will depend on funds appropriated, so the user can test various levels – There is no guarantee that the spreadsheet estimates will be the actual funding amounts

Projection Spreadsheet • Funding Estimates: – Apply anticipated appropriations requirements and anticipate a pro-ration level – Actual funding will depend on funds appropriated, so the user can test various levels – There is no guarantee that the spreadsheet estimates will be the actual funding amounts

Projection Spreadsheet • Key Variable relevant to funding methodologies can be tested: – Re-benchmarking period (CY or FFY) – default is FFY – Set-Aside provided for last quarter leasing (yes or no) – default is Yes – NRA Offset as a percent of funding – default is None • Administrative Fees’ projections also provided • Full User’s Guide provided • Web Address: http: //portal. hud. gov/hudportal/HUD? src=/program_offices/public_india n_housing/programs/hcv

Projection Spreadsheet • Key Variable relevant to funding methodologies can be tested: – Re-benchmarking period (CY or FFY) – default is FFY – Set-Aside provided for last quarter leasing (yes or no) – default is Yes – NRA Offset as a percent of funding – default is None • Administrative Fees’ projections also provided • Full User’s Guide provided • Web Address: http: //portal. hud. gov/hudportal/HUD? src=/program_offices/public_india n_housing/programs/hcv

Managing HAP Funds • If a PHA anticipates a shortfall for CY 2011 and is not working with the Shortfall Prevention Team, contact your financial analyst at your field office or the FMC • If a PHA anticipates a shortfall for CY 2011, or SPT alerts the PHA to a shortfall, and PHA may qualify for set-aside, PHA must apply – not automatic if referred

Managing HAP Funds • If a PHA anticipates a shortfall for CY 2011 and is not working with the Shortfall Prevention Team, contact your financial analyst at your field office or the FMC • If a PHA anticipates a shortfall for CY 2011, or SPT alerts the PHA to a shortfall, and PHA may qualify for set-aside, PHA must apply – not automatic if referred

Questions after the broadcast may be submitted to: PIH. Financial. Management. Division@HUD. GOV Questions and Answers applicable to many or all PHAs will be posted on the web site.

Questions after the broadcast may be submitted to: PIH. Financial. Management. Division@HUD. GOV Questions and Answers applicable to many or all PHAs will be posted on the web site.