b138c86cef6c6f766249971bc6c49bff.ppt

- Количество слайдов: 38

OECD Global Forum on Sustainable Development Financing Water and Environmental Infrastructure for All Opening Speech by Jamal Saghir Director, Energy and Water, The World Bank OECD Headquarters, Paris, 18 December 2003

TO KEEP IN MIND SOver 1 billion people without safe water, 2 b without sanitation SPervasive under-pricing and mismanagement of WSS services S 10% of the world's food is grown with water from aquifers which are being depleted faster than the rate of recharge. SWhat does this mean for ordinary people in the developing world? ØA farmer in Kenya: "Water is life and because we have no water, life is miserable. " ØA young man in Russia: "How can we sow anything without water? What will my cow drink? Water is our life. " ØAn old woman in Ethiopia: "We live hour to hour, wondering whether it will rain. " SIn many parts of the world, access to water distinguishes the poor from the non-poor.

AND In the next 15 minutes about 90 children in developing countries - six children per minute - will have died from disease caused by unsafe water and inadequate sanitation. SIn 1990, 3 million deaths worldwide were attributed to diarrhea but there were over 4 billion episodes, or more than a thousand times as many. Children under five are the most vulnerable, accounting for 55% of all episodes but for 85% of the deaths from diarrhoeal diseases. SMortality is high but morbidity is higher still.

Overview of Presentation S The Water Financing Challenge S Towards Realistic Solutions S Innovative IFI Financial Instruments: Follow-up of Camdessus/G 8 - June 2003 Evian meeting S What More Needs to be Done

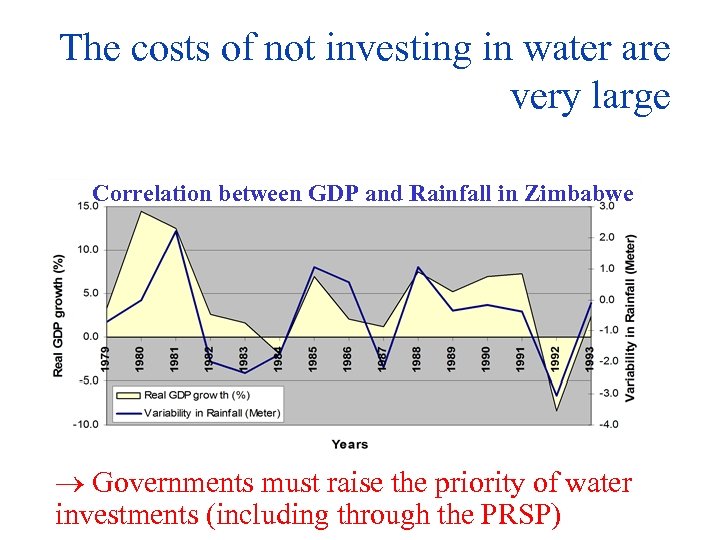

The costs of not investing in water are very large Correlation between GDP and Rainfall in Zimbabwe Governments must raise the priority of water investments (including through the PRSP)

The MDGs – A Startling Reminder of the Financing Challenge Ahead S Halve by 2015 the proportion of people without sustainable access to safe drinking water Investment needs per annum (B USD) ? S Halve by 2015 the proportion of people without access to basic sanitation S Translates into a doubling of investment needs from $15 billion to $30 billion per year for water supply & sanitation alone (as part of 180 B a year for all water) ?

The finance challenge - an uphill battle for developing world and infant sectors Current Coverage Years to Full Coverage at Annual Growth Rates 5% 10% 15% 30 years 13 years 8 years 50% 20 years 9 years 6 years 75% 8 years 4 years 2 years 100% Less Than One Year Assumes 1. 3 population growth rate.

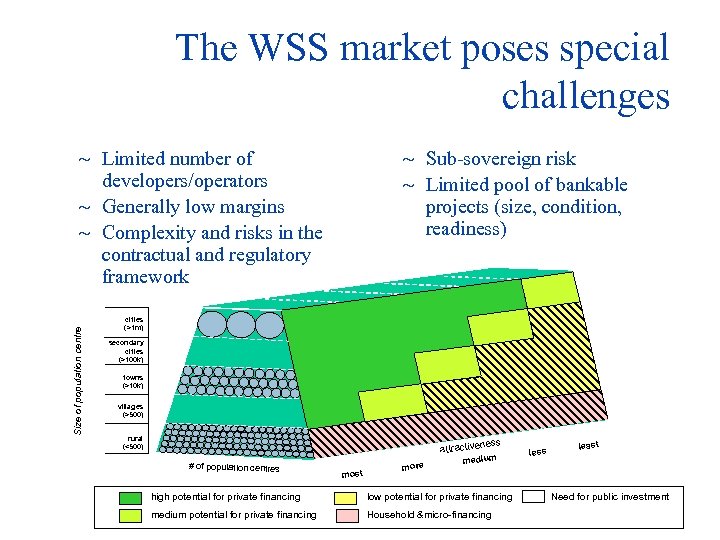

The WSS market poses special challenges Size of population centre ~ Limited number of developers/operators ~ Generally low margins ~ Complexity and risks in the contractual and regulatory framework ~ Sub-sovereign risk ~ Limited pool of bankable projects (size, condition, readiness) cities (>1 m) secondary cities (>100 k) towns (>10 k) villages (>500) rural (<500) ness attractive # of population centres most more medium high potential for private financing low potential for private financing medium potential for private financing Household µ-financing less least Need for public investment

Word Development Report 2004 Main Messages Services are failing poor people S They can work, the question is how? S By empowering poor people to S ~ Monitor and discipline service providers ~ Raise their voice in policymaking S By strengthening incentives for service providers to serve the poor

How are services failing poor people? Public spending benefits rich more than poor S Money fails to reach frontline service providers S ~ Uganda: only 13 percent of non-wage recurrent spending on primary education reached primary schools S Service quality is low for poor people ~ Bangladesh: absenteeism rates for doctors in primary health care centers: 74 percent ~ Zimbabwe: 13 percent of respondents gave as a reason for not delivering babies in public facilities that “nurses hit mothers during delivery” ~ Guinea: 70 percent of government drugs disappeared

Overview of presentation S The water financing challenge S Towards Realistic Solutions S Innovative IFI financial instruments: follow-up of Camdessus/G 8 S What more needs to be done

Are we Realistic? S S S 1. 2. 3. 4. 5. Investment needs are enormous Public funding stable or even decreasing International Aid is (and probably will remain) small percentage of WSS financing Thus how to fill the gap? The private sector? Taxpayers? Tariff? A combination? 1. LET’S DISCUSS THOSE ISSUES

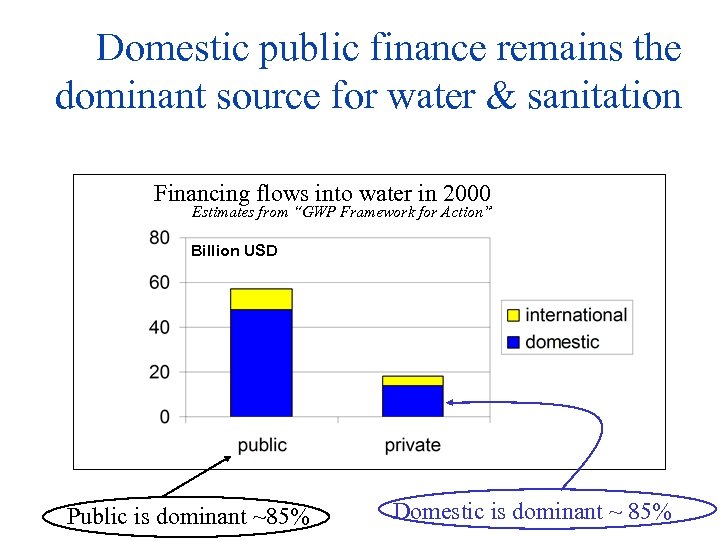

Domestic public finance remains the dominant source for water & sanitation Financing flows into water in 2000 Estimates from “GWP Framework for Action” Billion USD Public is dominant ~85% Domestic is dominant ~ 85%

Recent collapse of private flows to infrastructure Annual Private Investment in Infrastructure in 1990 -2002, in US$ billion 140 120 100 80 60 40 20 0 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Private investment in water supply and sanitation has been low Total (interternational) private investment in infrastructure in 1990 -2002 by sector and region, US$ billion

Reasons NOT to invest in the water business… 200% 150% Financial autonomy 100% 50% 0% Telecom Gas Power Degree of cost recovery Water

The financing paradox must be resolved Who Pays Consumers How Financed User Tariffs Govt. Subsidies Taxpayers Public or Private Debt

Overview of presentation S The water financing challenge S Towards realistic solutions S Innovative IFI financial Instruments: Follow-up of Camdessus/G 8 S What more needs to be done

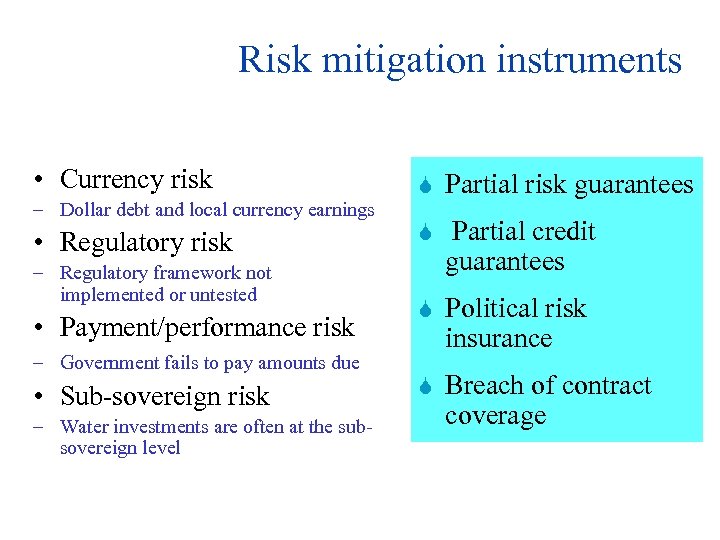

Risk mitigation instruments • Currency risk – Dollar debt and local currency earnings • Regulatory risk – Regulatory framework not implemented or untested • Payment/performance risk S Partial risk guarantees S Partial credit guarantees S Political risk insurance S Breach of contract coverage – Government fails to pay amounts due • Sub-sovereign risk – Water investments are often at the subsovereign level

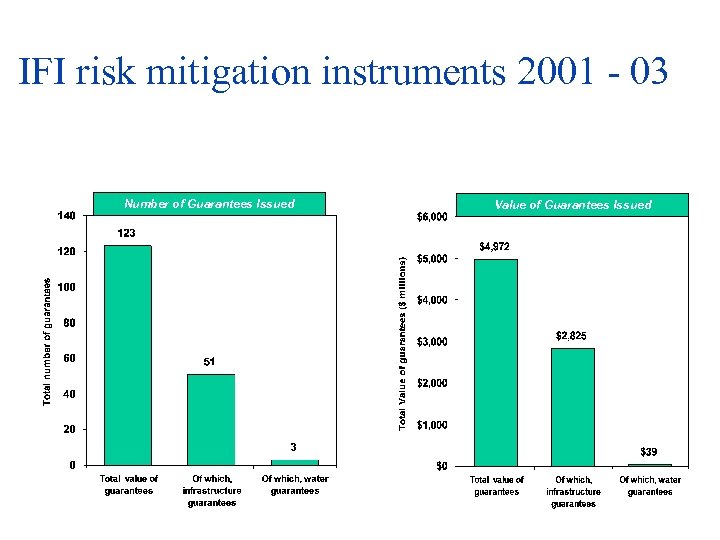

IFI risk mitigation instruments 2001 - 03 Number of Guarantees Issued Value of Guarantees Issued

Where risk mitigation can make a difference Adequately Creditworthy – Do Not Require Risk Mitigation S Near Creditworthiness S Marginally Creditworthy, but Reforming S Non Creditworthy and Low Performing S Risk Mitigation Instruments Could Be Effective

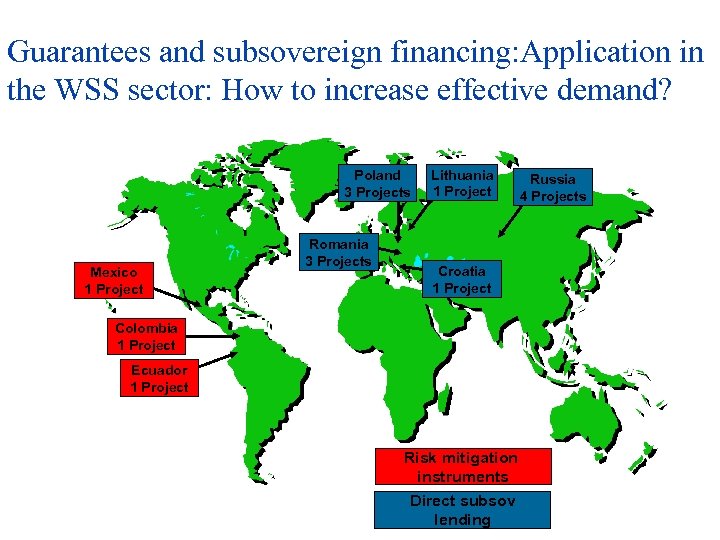

Guarantees and subsovereign financing: Application in the WSS sector: How to increase effective demand? Poland 3 Projects Mexico 1 Project Romania 3 Projects Lithuania 1 Project Croatia 1 Project Colombia 1 Project Ecuador 1 Project Risk mitigation instruments Direct subsov lending Russia 4 Projects

Overview of presentation S The water financing challenge S Towards realistic solutions S Innovative IFI financial instruments: follow-up of Camdessus/G 8 S What More Needs to be Done

1. Going Forward: Long-Term Sustainability: A Must S Improve Sector Performance – Closing the Revenue Gap is Key S With Decentralization, There is a Need to Bring in Local Governments as Key Stakeholders in the Financing of Water Investments – (ie. contributors of equity, guarantors, or direct borrowers) S Cost Recovery Critical: But At A Realistic Pace S The Use of Subsidies Should be Transparent and Primarily Aimed at Serving Poor Communities. S Make Use of All Sources of Financing – Public or Private and Create Framework Where Risks Are Properly Allocated and Bound By Enforceable Contracts.

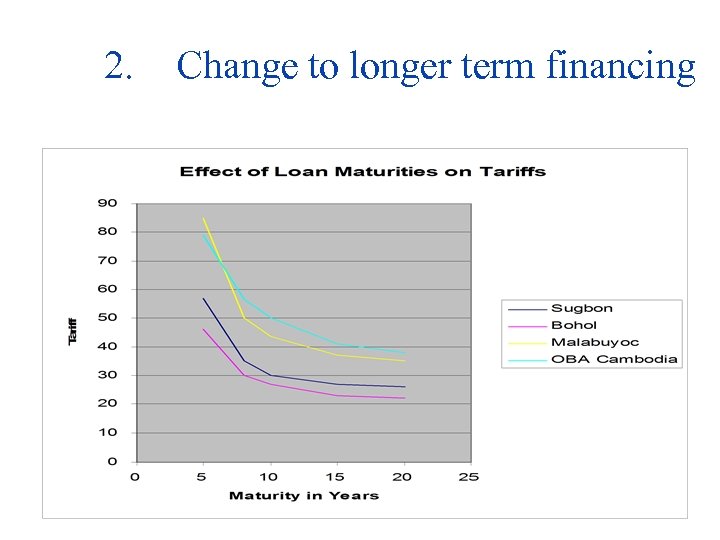

2. Change to longer term financing

3. Closing the Revenue Gap Only if sustainable cashflows, investments for expanding services can be attracted S Only few choices to finance investments S ~ Tariffs (consumers) ~ Taxes (tax payers) ~ Bilateral and multilateral aid – limited extend S So Move to cost-recovery: but at a realistic pace Predictable cash flow secure debt service investment loan better services

4. Effectively demand international funding The needs are obvious, but how to translate “needs” into “effective demand” S Lobby to get water into your PRSP S Develop bankable projects S Develop creditworthy utilities S Engage with public, private, communities and stakeholders S Nobody has “A or THE solution”. S Look at various ways and learn by doing

5. Redirect funds to the poor Stop subsidizing the rich, they can pay for themselves S Target subsidies better (subsidize connections rather than consumption) S Invest in differentiated service levels, giving consumers a choice S Decentralize funds (not only responsibilities) to local governments S

5. Improve Creditworthiness S Agreed programme of tariff increases, taking into account social considerations S Clear / predictable allocation from central/local tax revenues S Improved operational management/collections S Increase data availability to make informed decisions

6. Unbundle Finance And Management -Looking at Sustainable Hybrid Solutions Divestitures Finance Private Mixed Company Operating Company plc Concessions BOTs Public Corporatized Muni. Service Leases/Affermage Municipal Department Public Mgnt. Contracts Management Private Public & Private sector roles in the WSS sector:

An World Bank evolving model for Water Service Delivery Public Engagement Anywhere Along the Spectrum Private World Bank Group Combine Instruments IBRD/IDA Loans, Credits and Guarantees IFC Loans and Investments MIGA Guarantees Cost Recovery Critical But At A Realistic Pace Targeted Subsidies OK • For Connections • For Usage Charges

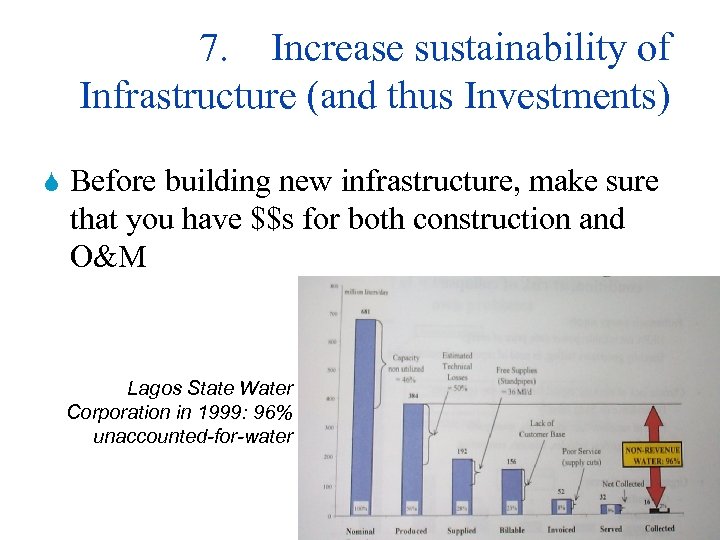

7. Increase sustainability of Infrastructure (and thus Investments) S Before building new infrastructure, make sure that you have $$s for both construction and O&M Lagos State Water Corporation in 1999: 96% unaccounted-for-water

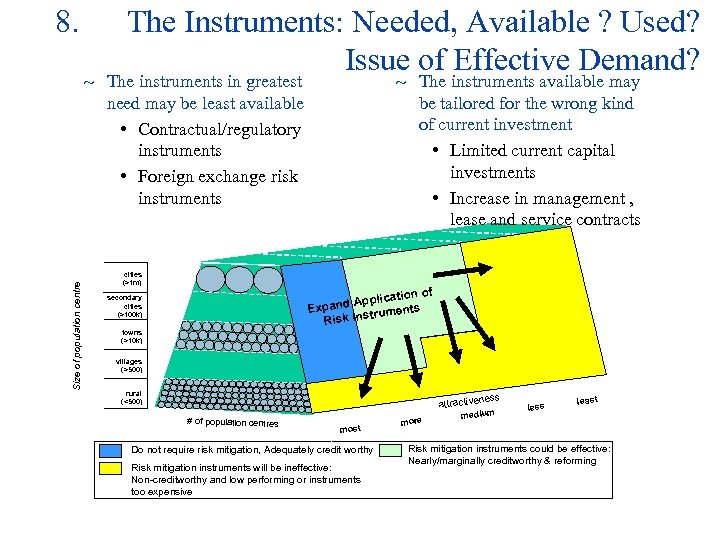

8. The Instruments: Needed, Available ? Used? Issue of Effective Demand? Size of population centre ~ The instruments in greatest need may be least available • Contractual/regulatory instruments • Foreign exchange risk instruments cities (>1 m) ~ The instruments available may be tailored for the wrong kind of current investment • Limited current capital investments • Increase in management , lease and service contracts ation of d Applic s Expan trument Risk Ins secondary cities (>100 k) towns (>10 k) villages (>500) rural (<500) attractive # of population centres most Do not require risk mitigation, Adequately credit worthy Risk mitigation instruments will be ineffective: Non-creditworthy and low performing or instruments too expensive more ness medium less least Risk mitigation instruments could be effective: Nearly/marginally creditworthy & reforming

Recapping (1) The Water Sector is Facing an Uphill Battle to Expand Coverage. S The Debate is Not Between Public or Private, But Improving Sector Performance and efficient quality service delivery to the poor at lowest cost S There is No Magic Solution! Cost Recovery is critical and Should Be the Foundation to A Sustainable Tariff Policy but At Realistic Pace S Targeted Subsidies OK S • For Connections For Usage Charges S If Utilized Prudently targeted subsidies and Long-Term Financing Can Contribute Significantly Towards Expanding Investments and service delivery S Public funding to shift from input based to output based financing •

Recapping (2) S S S S Mobilizing balanced mix of public and private funding sources – more innovative use of public funds and subsidies Powered by sustained cashflows instead of taxes Private funding to increasingly comprise local currency alternatives Make PPI contracts "pro-poor". A Fund Channeling and Governance Framework Based on the Appropriate Allocation of Risks and Third Party Agreements is the Mechanism Needed to Align Incentives and Improve Governance Partial Risk and Partial Credit Guarantees, IFC loan and Guarantees and MIGA instruments Hybrid Models Mixing Public - Private Finance and Management Options Offers a Pragmatic Approach in An Environment of Increased Perceived Risks.

And. . grow the economy Access to water and GDP Source: UN Millennium Project

Water high on the agenda: CSD 12 S S S Selected thematic cluster: water, sanitation and human settlements No more assessment and problem identifications and more promises The political and substantive outcomes of CSD 12 need to be transformed into specific Actions Provide Realistic Guidance and Actions on the Ground to improve efficiency and coherence of policies Focus on implementation, including identifying constraints and obstacles at the country level and possible approaches for implementation and scaling up Review and forward looking session; not a negotiating session ~ government and other stakeholders New York City, 19 -30 April

Thank you

b138c86cef6c6f766249971bc6c49bff.ppt