6eee561c2ae6dd04aba38e0068dffc2f.ppt

- Количество слайдов: 22

October 2012 ENROLL BY NOVEMBER 9! From Vandal. Web Employee Menu tab University of Idaho Employee Benefits link

Annual Enrollment for 2013 • Annual Enrollment begins on Monday, October 22 and ends on Friday, November 9 th • Elections will be effective on January 1, 2013 • Enroll online at the Annual Enrollment Website, www. uidaho. edu/humanresources/annualenrollment • Enrollment packets will be mailed to your home in October 1

2

Enrollment Information Site www. uidaho. edu/humanresources/annualenrollment Video Learn more about what’s changing and why Insert screenshot Link to Benefit Information Charts Guide 3

Watch for Enrollment Packet in October • Only employees with computer access received printed worksheets – Access costs and option information on the benefits enrollment website Worksheet [Insert worksheet screenshot] 4 Cover letter Guide

What we’ll cover today • What’s changing for 2013 – – – New prescription drug provider New eligibility category: Other Eligible Adults Medical plan contributions Reduction in Health Care Spending Account contribution Other changes • Learn more – 2013 benefit plans – Wellness offerings – Actions you should take during Annual Enrollment • Your resources – Print: one packet mailed to homes – Online: annual enrolment and ongoing benefits websites 5

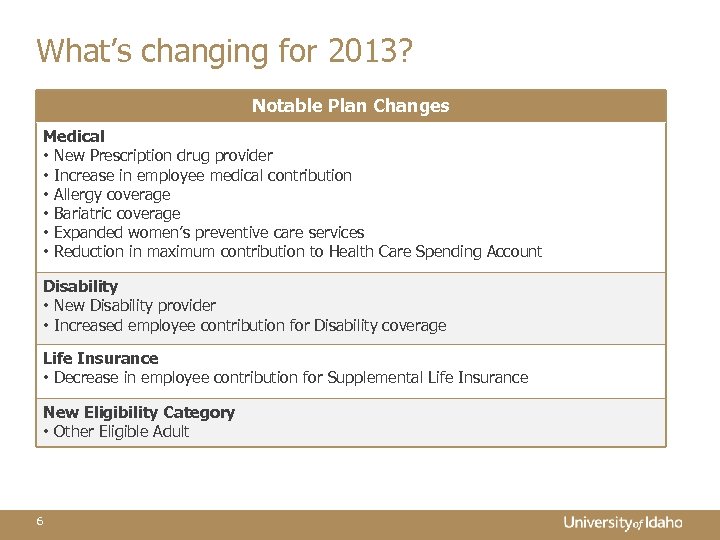

What’s changing for 2013? Notable Plan Changes Medical • New Prescription drug provider • Increase in employee medical contribution • Allergy coverage • Bariatric coverage • Expanded women’s preventive care services • Reduction in maximum contribution to Health Care Spending Account Disability • New Disability provider • Increased employee contribution for Disability coverage Life Insurance • Decrease in employee contribution for Supplemental Life Insurance New Eligibility Category • Other Eligible Adult 6

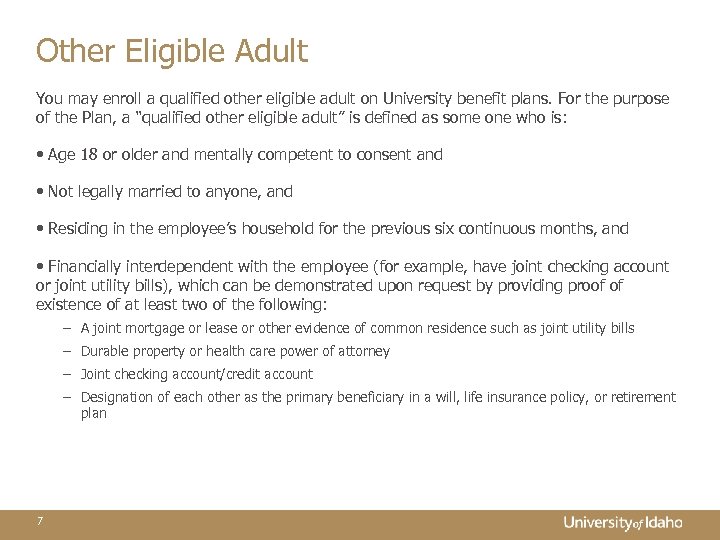

Other Eligible Adult You may enroll a qualified other eligible adult on University benefit plans. For the purpose of the Plan, a “qualified other eligible adult” is defined as some one who is: • Age 18 or older and mentally competent to consent and • Not legally married to anyone, and • Residing in the employee’s household for the previous six continuous months, and • Financially interdependent with the employee (for example, have joint checking account or joint utility bills), which can be demonstrated upon request by providing proof of existence of at least two of the following: – A joint mortgage or lease or other evidence of common residence such as joint utility bills – Durable property or health care power of attorney – Joint checking account/credit account – Designation of each other as the primary beneficiary in a will, life insurance policy, or retirement plan 7

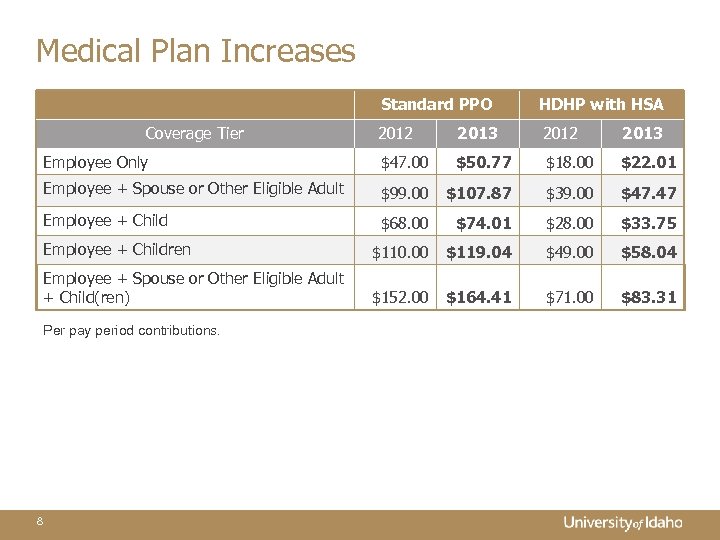

Medical Plan Increases Standard PPO HDHP with HSA 2012 2013 Employee Only $47. 00 $50. 77 $18. 00 $22. 01 Employee + Spouse or Other Eligible Adult $99. 00 $107. 87 $39. 00 $47. 47 Employee + Child $68. 00 $74. 01 $28. 00 $33. 75 Employee + Children $110. 00 $119. 04 $49. 00 $58. 04 Employee + Spouse or Other Eligible Adult + Child(ren) $152. 00 $164. 41 $71. 00 $83. 31 Coverage Tier Per pay period contributions. 8

Plan Overview 9

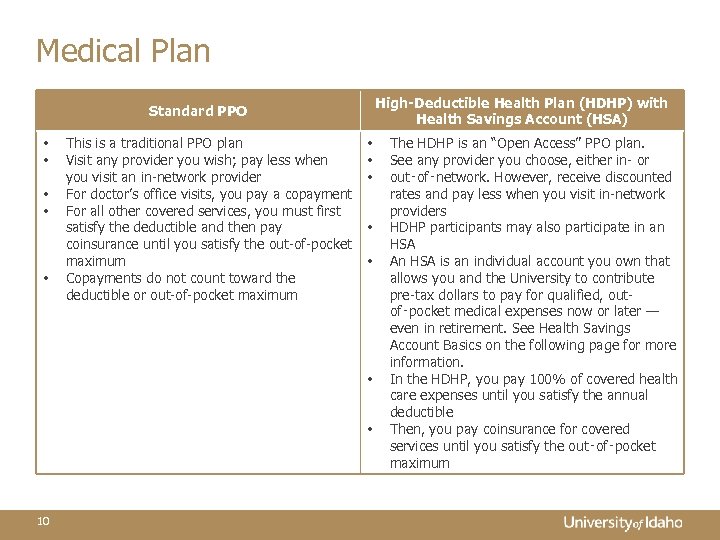

Medical Plan High-Deductible Health Plan (HDHP) with Health Savings Account (HSA) Standard PPO • • • This is a traditional PPO plan Visit any provider you wish; pay less when you visit an in-network provider For doctor’s office visits, you pay a copayment For all other covered services, you must first satisfy the deductible and then pay coinsurance until you satisfy the out-of-pocket maximum Copayments do not count toward the deductible or out-of-pocket maximum • • 10 The HDHP is an “Open Access” PPO plan. See any provider you choose, either in- or out‑of‑network. However, receive discounted rates and pay less when you visit in-network providers HDHP participants may also participate in an HSA An HSA is an individual account you own that allows you and the University to contribute pre-tax dollars to pay for qualified, outof‑pocket medical expenses now or later — even in retirement. See Health Savings Account Basics on the following page for more information. In the HDHP, you pay 100% of covered health care expenses until you satisfy the annual deductible Then, you pay coinsurance for covered services until you satisfy the out‑of‑pocket maximum

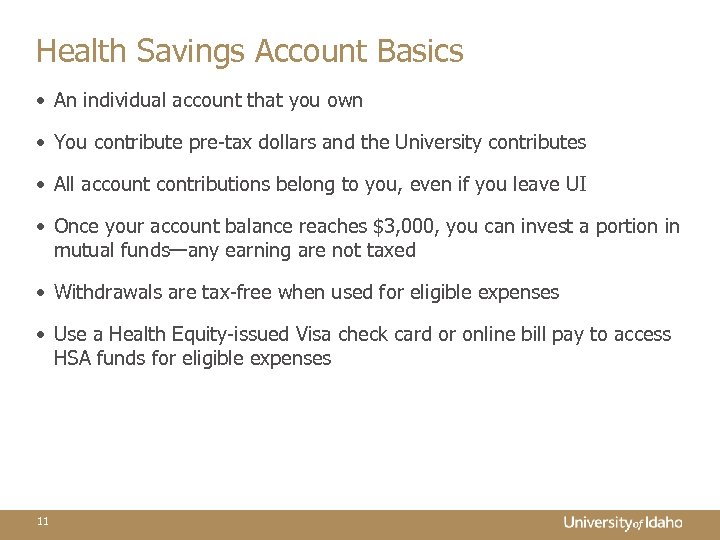

Health Savings Account Basics • An individual account that you own • You contribute pre-tax dollars and the University contributes • All account contributions belong to you, even if you leave UI • Once your account balance reaches $3, 000, you can invest a portion in mutual funds—any earning are not taxed • Withdrawals are tax-free when used for eligible expenses • Use a Health Equity-issued Visa check card or online bill pay to access HSA funds for eligible expenses 11

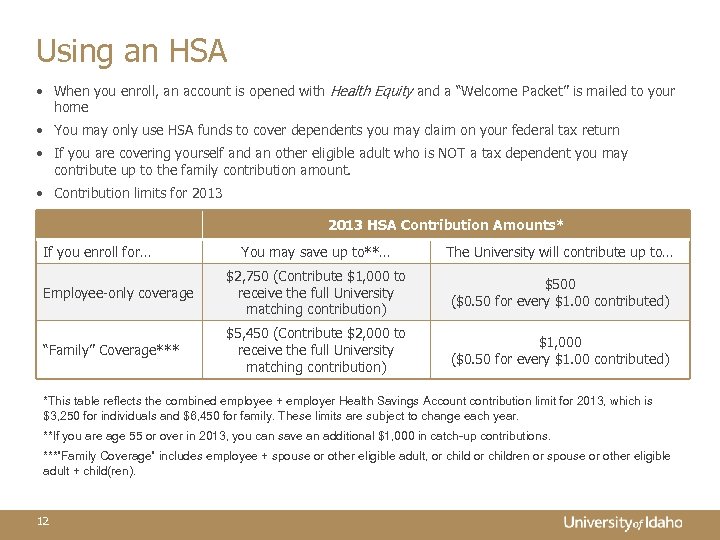

Using an HSA • When you enroll, an account is opened with Health Equity and a “Welcome Packet” is mailed to your home • You may only use HSA funds to cover dependents you may claim on your federal tax return • If you are covering yourself and an other eligible adult who is NOT a tax dependent you may contribute up to the family contribution amount. • Contribution limits for 2013 HSA Contribution Amounts* If you enroll for… You may save up to**… The University will contribute up to… Employee-only coverage $2, 750 (Contribute $1, 000 to receive the full University matching contribution) $500 ($0. 50 for every $1. 00 contributed) “Family” Coverage*** $5, 450 (Contribute $2, 000 to receive the full University matching contribution) $1, 000 ($0. 50 for every $1. 00 contributed) *This table reflects the combined employee + employer Health Savings Account contribution limit for 2013, which is $3, 250 for individuals and $6, 450 for family. These limits are subject to change each year. **If you are age 55 or over in 2013, you can save an additional $1, 000 in catch-up contributions. ***”Family Coverage” includes employee + spouse or other eligible adult, or children or spouse or other eligible adult + child(ren). 12

Prescription Drug Coverage NEW: CVS Caremark new pharmacy benefits manager • Same plan design as with Express Scripts • Retail and mail order options • You may need to ask your doctor to write a new script for on-going medications • Watch for a welcome letter and prescription ID card from CVS Caremark in December 13

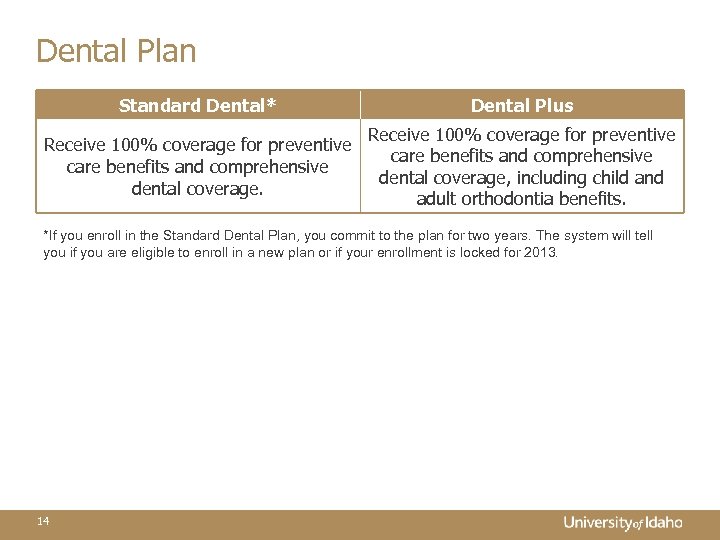

Dental Plan Standard Dental* Dental Plus Receive 100% coverage for preventive care benefits and comprehensive dental coverage, including child and adult orthodontia benefits. *If you enroll in the Standard Dental Plan, you commit to the plan for two years. The system will tell you if you are eligible to enroll in a new plan or if your enrollment is locked for 2013. 14

Vision Plan Vision Perfect Reimbursement Only Plan (Ameritas) Visit any provider you choose. Pay the full cost at the time of service and then submit a claim for reimbursement. Or, ask if your provider is willing to bill Ameritas directly and pay your provider the difference. 15 Vision Focus Network Plan (VSP) Visit any provider. However, you typically receive greater benefits for services and supplies you receive from VSP providers. When you use a non-VSP provider, pay the full cost at the time of service and then submit a claim for reimbursement.

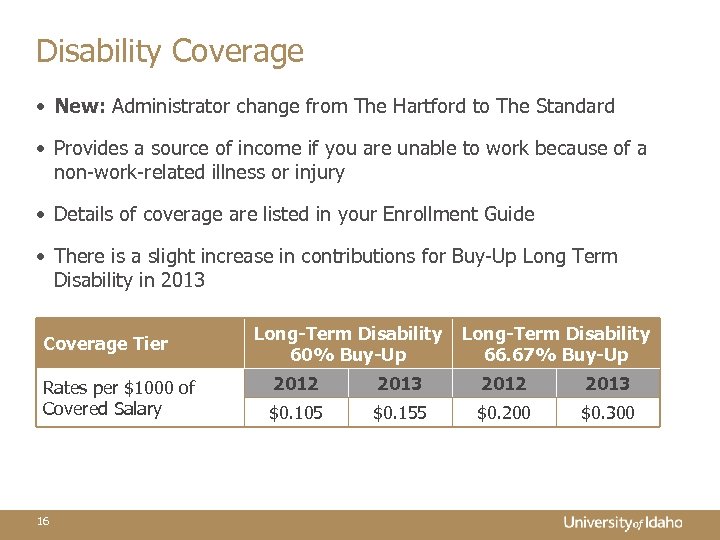

Disability Coverage • New: Administrator change from The Hartford to The Standard • Provides a source of income if you are unable to work because of a non-work-related illness or injury • Details of coverage are listed in your Enrollment Guide • There is a slight increase in contributions for Buy-Up Long Term Disability in 2013 Coverage Tier Rates per $1000 of Covered Salary 16 Long-Term Disability 60% Buy-Up Long-Term Disability 66. 67% Buy-Up 2012 2013 $0. 105 $0. 155 $0. 200 $0. 300

Life Insurance and AD&D • Basic Life • AD&D – University provided – Equal to one times your pay – You can elect coverage for yourself, your spouse or your family • Optional, Spouse and Dependent Life – You can elect additional coverage amounts for yourself, your spouse or your dependents • Contributions – Listed in your Enrollment Guide or on the University of Idaho Benefits Website – Tobacco use will affect your life insurance costs • Evidence of Insurability – Shows proof of good health – May be required for Disability and Life Insurance Coverage 17 – Protects you and your family in the event of death, loss of a limb or eyesight, or certain other conditions that may result from an accident – Coverage levels and contribution amounts are found in your Enrollment Guide or on the University of Idaho Benefits Website

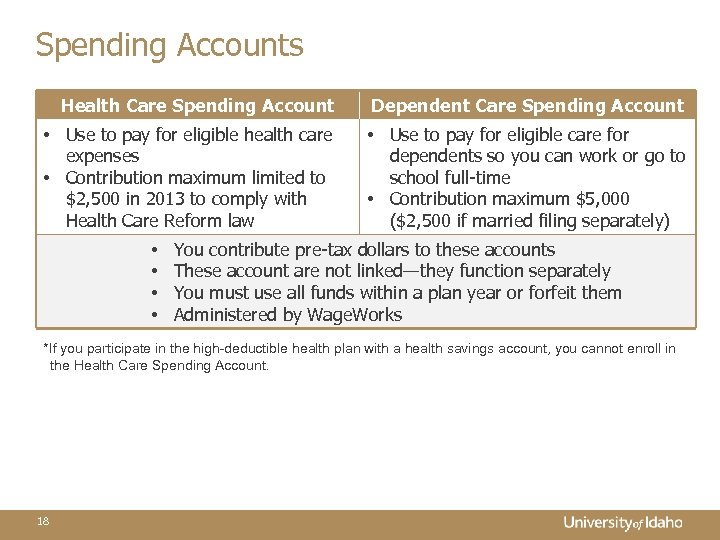

Spending Accounts Health Care Spending Account Dependent Care Spending Account • Use to pay for eligible health care expenses • Contribution maximum limited to $2, 500 in 2013 to comply with Health Care Reform law • Use to pay for eligible care for dependents so you can work or go to school full-time • Contribution maximum $5, 000 ($2, 500 if married filing separately) • • You contribute pre-tax dollars to these accounts These account are not linked—they function separately You must use all funds within a plan year or forfeit them Administered by Wage. Works *If you participate in the high-deductible health plan with a health savings account, you cannot enroll in the Health Care Spending Account. 18

Voluntary & Other Benefits • Auto and homeowners • Pre-paid legal and identity theft • AFLAC benefits • Employee Assistance Program – No cost to you – 8 free counseling sessions – Support with health & well-being, financial services and legal services 19

Wellness Resources* • The University offers the following wellness resources to help us all live a healthier life and control our health care costs. – – – – Wellness Fairs Employee Assistance Program Tobacco Cessation Support Well Connected Website Health Coaching Chronic Condition Management Nurse Hotline *Wellness fairs, EAP and tobacco cessation support available to all employees. Everything else only available to medical plan participants. 20

Enroll by November 9! From Vandal. Web Employee Menu tab University of Idaho Employee Benefits link 21

6eee561c2ae6dd04aba38e0068dffc2f.ppt