7e29981137550bec8991aaae0f71f498.ppt

- Количество слайдов: 48

OC Traders 02/28/09 Orange County Investools Users Group Rowena St. Moritz

OC Traders 02/28/09 Orange County Investools Users Group Rowena St. Moritz

Volatility after the Options Industry Council’s Workshop on Volatility Rowena St. Moritz

Volatility after the Options Industry Council’s Workshop on Volatility Rowena St. Moritz

Volatility Reflects Price Changes n Volatility reflects fluctuations in the price n Not necessarily an uptrend n Not necessarily a downtrend n Greater fluctuations = greater volatility 02/28/09 Rowena St. Moritz 3

Volatility Reflects Price Changes n Volatility reflects fluctuations in the price n Not necessarily an uptrend n Not necessarily a downtrend n Greater fluctuations = greater volatility 02/28/09 Rowena St. Moritz 3

Volatility Two Types of Volatility 1. Historical Volatility 2. Implied Volatility 02/28/09 Rowena St. Moritz 4

Volatility Two Types of Volatility 1. Historical Volatility 2. Implied Volatility 02/28/09 Rowena St. Moritz 4

Historical Volatility Rowena St. Moritz

Historical Volatility Rowena St. Moritz

Historical Volatility n Past volatility, usually annual n An observed fact, not a prediction n Is no guarantee of future volatility n Usually based on daily closing prices 02/28/09 Rowena St. Moritz 6

Historical Volatility n Past volatility, usually annual n An observed fact, not a prediction n Is no guarantee of future volatility n Usually based on daily closing prices 02/28/09 Rowena St. Moritz 6

Historical Volatility n Annualized Standard Deviation (SD) of daily price changes, expressed in percent n The percent amount is relative change, up or down, from the average price n Stocks, options, indexes and sectors have historical volatility 02/28/09 Rowena St. Moritz 7

Historical Volatility n Annualized Standard Deviation (SD) of daily price changes, expressed in percent n The percent amount is relative change, up or down, from the average price n Stocks, options, indexes and sectors have historical volatility 02/28/09 Rowena St. Moritz 7

Historical Volatility n Annualized Standard Deviation (SD) of daily price changes, expressed in percent n Prices within 1 SD ~ 68% of the time n Prices within 2 SDs ~ 95% of the time n Prices within 3 SDs ~ 99% of the time 02/28/09 Rowena St. Moritz 8

Historical Volatility n Annualized Standard Deviation (SD) of daily price changes, expressed in percent n Prices within 1 SD ~ 68% of the time n Prices within 2 SDs ~ 95% of the time n Prices within 3 SDs ~ 99% of the time 02/28/09 Rowena St. Moritz 8

Historical Volatility Illustration n If a stock has an average closing price of $100 and 25% historical volatility, then statistically ~ 68% of the time (1 SD) Price was within + or - $25 ($75 to $125) ~ 95% of the time (2 SDs) Price was within + or - $50 ($50 to $150) ~ 99% of the time (3 SDs) Price was within + or - $75 ($25 to $175) 02/28/09 Rowena St. Moritz 9

Historical Volatility Illustration n If a stock has an average closing price of $100 and 25% historical volatility, then statistically ~ 68% of the time (1 SD) Price was within + or - $25 ($75 to $125) ~ 95% of the time (2 SDs) Price was within + or - $50 ($50 to $150) ~ 99% of the time (3 SDs) Price was within + or - $75 ($25 to $175) 02/28/09 Rowena St. Moritz 9

Historical Volatility n Available at http: //www. optionseducation. org/quotes/ n Enter the equity symbol n Click on “Historical Volatility” 02/28/09 Rowena St. Moritz 10

Historical Volatility n Available at http: //www. optionseducation. org/quotes/ n Enter the equity symbol n Click on “Historical Volatility” 02/28/09 Rowena St. Moritz 10

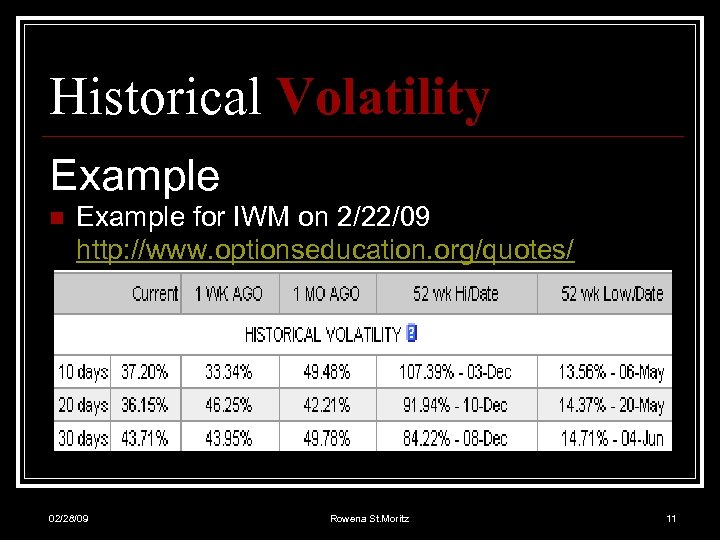

Historical Volatility Example n Example for IWM on 2/22/09 http: //www. optionseducation. org/quotes/ 02/28/09 Rowena St. Moritz 11

Historical Volatility Example n Example for IWM on 2/22/09 http: //www. optionseducation. org/quotes/ 02/28/09 Rowena St. Moritz 11

Historical Volatility Indexes, Sectors, Stocks, and Options have it n Some sectors may have lower or higher volatility levels, but… n Volatility often changes, even when spread across sectors or indexes n Volatility of stocks within sectors may vary 02/28/09 Rowena St. Moritz 12

Historical Volatility Indexes, Sectors, Stocks, and Options have it n Some sectors may have lower or higher volatility levels, but… n Volatility often changes, even when spread across sectors or indexes n Volatility of stocks within sectors may vary 02/28/09 Rowena St. Moritz 12

Implied Volatility Rowena St. Moritz

Implied Volatility Rowena St. Moritz

Implied Volatility n Implied volatility is what people often mean when they just say “volatility” n It is expected volatility, a guess n It is a subjective prediction n It is an assumption about a stock’s volatility up to the option’s expiration 02/28/09 Rowena St. Moritz 14

Implied Volatility n Implied volatility is what people often mean when they just say “volatility” n It is expected volatility, a guess n It is a subjective prediction n It is an assumption about a stock’s volatility up to the option’s expiration 02/28/09 Rowena St. Moritz 14

Implied Volatility n By definition, it implies a stock’s future volatility, but… n Implied volatility is a feature only of options 02/28/09 Rowena St. Moritz 15

Implied Volatility n By definition, it implies a stock’s future volatility, but… n Implied volatility is a feature only of options 02/28/09 Rowena St. Moritz 15

Implied Volatility Only Options Have It n Stocks do not have implied volatility Stocks have historic volatility only n Options do have implied volatility Calls have implied volatility n Puts have implied volatility n 02/28/09 Rowena St. Moritz 16

Implied Volatility Only Options Have It n Stocks do not have implied volatility Stocks have historic volatility only n Options do have implied volatility Calls have implied volatility n Puts have implied volatility n 02/28/09 Rowena St. Moritz 16

Implied Volatility n Can be at great variance with historical volatility n Is not necessarily right or wrong n May change abruptly and significantly n An option’s implied volatility can change without a change in the underlying stock’s price 02/28/09 Rowena St. Moritz 17

Implied Volatility n Can be at great variance with historical volatility n Is not necessarily right or wrong n May change abruptly and significantly n An option’s implied volatility can change without a change in the underlying stock’s price 02/28/09 Rowena St. Moritz 17

Implied Volatility n Predicts a range of future possible stock prices n Higher volatility = greater range of possible stock prices n Lower volatility = smaller range of possible stock prices 02/28/09 Rowena St. Moritz 18

Implied Volatility n Predicts a range of future possible stock prices n Higher volatility = greater range of possible stock prices n Lower volatility = smaller range of possible stock prices 02/28/09 Rowena St. Moritz 18

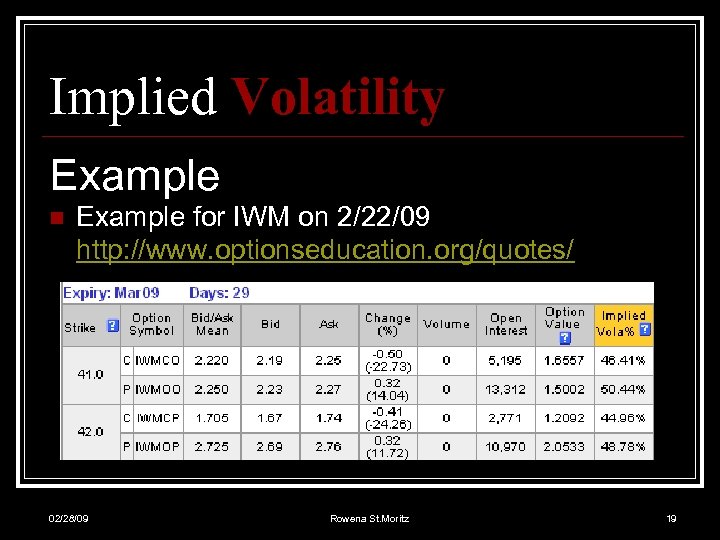

Implied Volatility Example n Example for IWM on 2/22/09 http: //www. optionseducation. org/quotes/ 02/28/09 Rowena St. Moritz 19

Implied Volatility Example n Example for IWM on 2/22/09 http: //www. optionseducation. org/quotes/ 02/28/09 Rowena St. Moritz 19

Implied Volatility n Index Options’ Implied Volatility Symbols n S&P 500 30 -day implied volatility VIX is what people usually mean by “the” volatility index n Dow Jones Industrial Avg 30 -day implied volatility VXD n Nasdaq 100 30 -day implied volatility VXN n Russell 2000 30 -day implied volatility RVX 02/28/09 Rowena St. Moritz 20

Implied Volatility n Index Options’ Implied Volatility Symbols n S&P 500 30 -day implied volatility VIX is what people usually mean by “the” volatility index n Dow Jones Industrial Avg 30 -day implied volatility VXD n Nasdaq 100 30 -day implied volatility VXN n Russell 2000 30 -day implied volatility RVX 02/28/09 Rowena St. Moritz 20

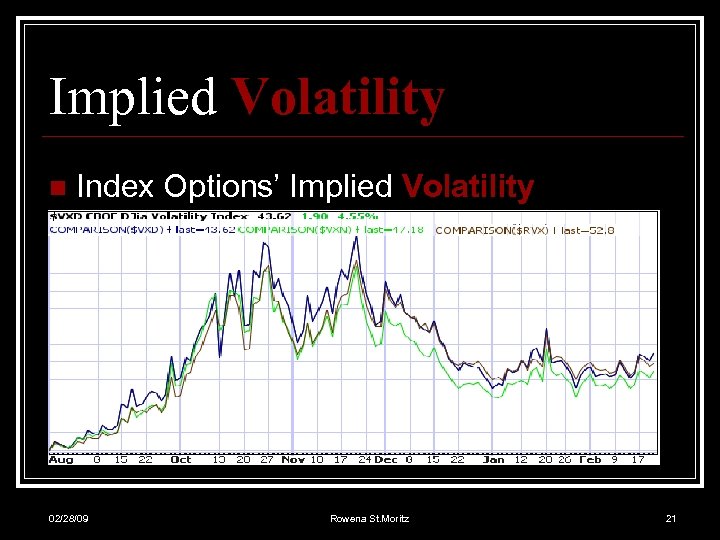

Implied Volatility n Index Options’ Implied Volatility 02/28/09 Rowena St. Moritz 21

Implied Volatility n Index Options’ Implied Volatility 02/28/09 Rowena St. Moritz 21

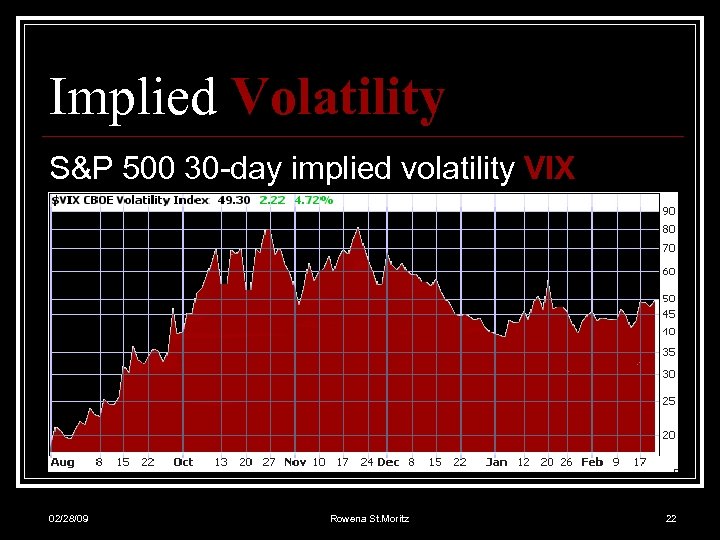

Implied Volatility S&P 500 30 -day implied volatility VIX 02/28/09 Rowena St. Moritz 22

Implied Volatility S&P 500 30 -day implied volatility VIX 02/28/09 Rowena St. Moritz 22

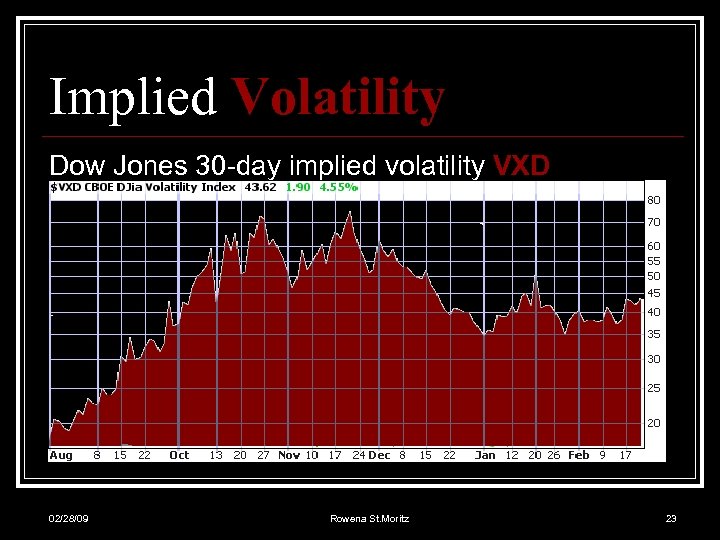

Implied Volatility Dow Jones 30 -day implied volatility VXD 02/28/09 Rowena St. Moritz 23

Implied Volatility Dow Jones 30 -day implied volatility VXD 02/28/09 Rowena St. Moritz 23

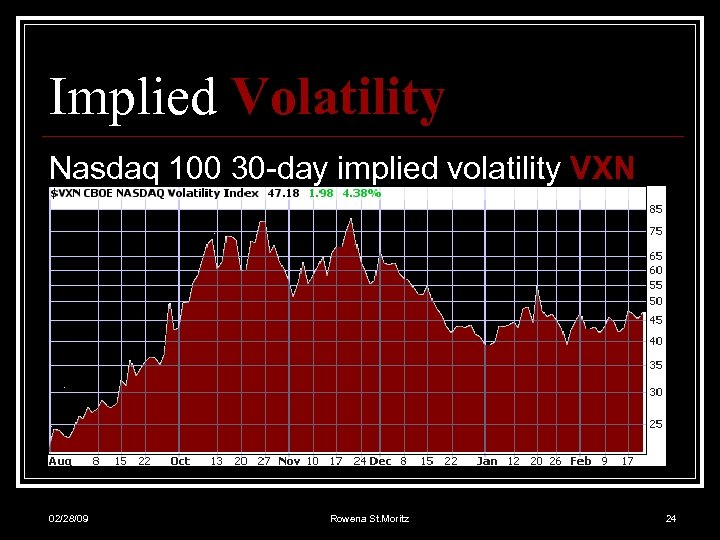

Implied Volatility Nasdaq 100 30 -day implied volatility VXN 02/28/09 Rowena St. Moritz 24

Implied Volatility Nasdaq 100 30 -day implied volatility VXN 02/28/09 Rowena St. Moritz 24

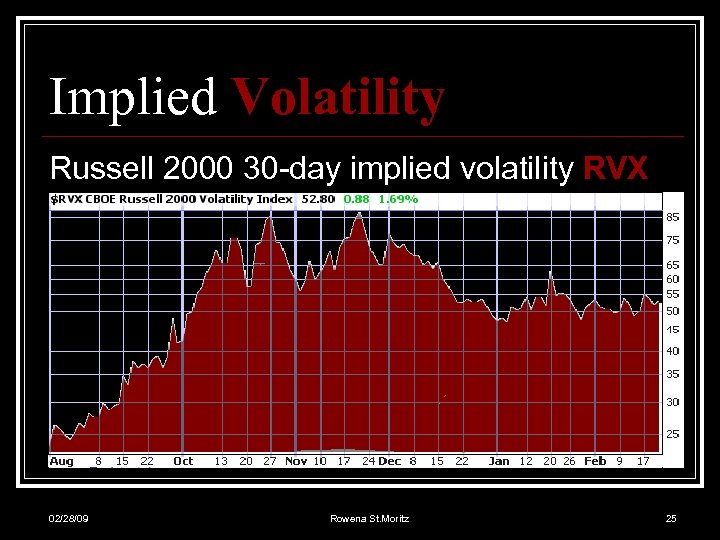

Implied Volatility Russell 2000 30 -day implied volatility RVX 02/28/09 Rowena St. Moritz 25

Implied Volatility Russell 2000 30 -day implied volatility RVX 02/28/09 Rowena St. Moritz 25

Implied Volatility Things that affect implied volatility n n General stock market psychology Economic data, Federal Reserve actions, and other news Change in the implied volatility of other option classes within the same industry sector Market activity (volume) 02/28/09 Rowena St. Moritz 26

Implied Volatility Things that affect implied volatility n n General stock market psychology Economic data, Federal Reserve actions, and other news Change in the implied volatility of other option classes within the same industry sector Market activity (volume) 02/28/09 Rowena St. Moritz 26

Implied Volatility Things that increase implied volatility Rising volume n Drop in price n Bad news n Nearing an announcement (e. g. earnings) n 02/28/09 Rowena St. Moritz 27

Implied Volatility Things that increase implied volatility Rising volume n Drop in price n Bad news n Nearing an announcement (e. g. earnings) n 02/28/09 Rowena St. Moritz 27

Implied Volatility Things that decrease implied volatility Declining volume n Rise in price n Good news n After an announcement (e. g. earnings) n 02/28/09 Rowena St. Moritz 28

Implied Volatility Things that decrease implied volatility Declining volume n Rise in price n Good news n After an announcement (e. g. earnings) n 02/28/09 Rowena St. Moritz 28

Price and Implied Volatility Rowena St. Moritz

Price and Implied Volatility Rowena St. Moritz

Price and Implied Volatility An Option’s price has two components 1. Intrinsic value 2. Time value 02/28/09 Rowena St. Moritz 30

Price and Implied Volatility An Option’s price has two components 1. Intrinsic value 2. Time value 02/28/09 Rowena St. Moritz 30

Price and Implied Volatility Option’s Time Value n Time until expiration (known) n Cost of money (known or predictable) n Interest n Dividends n Volatility (unpredictable) n As the cost of money approaches zero, volatility is a greater portion of time value 02/28/09 Rowena St. Moritz 31

Price and Implied Volatility Option’s Time Value n Time until expiration (known) n Cost of money (known or predictable) n Interest n Dividends n Volatility (unpredictable) n As the cost of money approaches zero, volatility is a greater portion of time value 02/28/09 Rowena St. Moritz 31

Price and Implied Volatility n Implied Volatility = Risk n Implied Volatility affects option premium n Higher volatility means higher option premium n Lower volatility means lower option premium 02/28/09 Rowena St. Moritz 32

Price and Implied Volatility n Implied Volatility = Risk n Implied Volatility affects option premium n Higher volatility means higher option premium n Lower volatility means lower option premium 02/28/09 Rowena St. Moritz 32

Price and Implied Volatility n Higher volatility n Sellers want more for their increased risk n Buyers pay more n Lower volatility n Sellers take less for their decreased risk n Buyers pay less 02/28/09 Rowena St. Moritz 33

Price and Implied Volatility n Higher volatility n Sellers want more for their increased risk n Buyers pay more n Lower volatility n Sellers take less for their decreased risk n Buyers pay less 02/28/09 Rowena St. Moritz 33

Price and Implied Volatility n As stock volatility increases, the price of calls and puts generally increases n As stock volatility decreases, the price of calls and puts generally decreases 02/28/09 Rowena St. Moritz 34

Price and Implied Volatility n As stock volatility increases, the price of calls and puts generally increases n As stock volatility decreases, the price of calls and puts generally decreases 02/28/09 Rowena St. Moritz 34

Price and Implied Volatility n If you are long a call or a put, then you want the option’s implied volatility to increase so that the option’s price will go up n If you are short a call or a put, then you want the option’s implied volatility to decrease so that the option’s price will go down 02/28/09 Rowena St. Moritz 35

Price and Implied Volatility n If you are long a call or a put, then you want the option’s implied volatility to increase so that the option’s price will go up n If you are short a call or a put, then you want the option’s implied volatility to decrease so that the option’s price will go down 02/28/09 Rowena St. Moritz 35

Price and Implied Volatility’s Effect on Options n Greatest nominal (dollar) effect on ATM Calls and Puts (because they have the greatest time value) n Greatest percentage effect on OTM Calls and Puts n Least effect on ITM Calls and Puts because they have so little time value 02/28/09 Rowena St. Moritz 36

Price and Implied Volatility’s Effect on Options n Greatest nominal (dollar) effect on ATM Calls and Puts (because they have the greatest time value) n Greatest percentage effect on OTM Calls and Puts n Least effect on ITM Calls and Puts because they have so little time value 02/28/09 Rowena St. Moritz 36

Vega and Implied Volatility Rowena St. Moritz

Vega and Implied Volatility Rowena St. Moritz

Vega and Implied Volatility Vega is “one of the Greeks” n Vega is theoretical - in reality, price changes may differ from those predicted by Vega n Vega’s value decreases with time n Stock has zero Vega 02/28/09 Rowena St. Moritz 38

Vega and Implied Volatility Vega is “one of the Greeks” n Vega is theoretical - in reality, price changes may differ from those predicted by Vega n Vega’s value decreases with time n Stock has zero Vega 02/28/09 Rowena St. Moritz 38

Vega and Implied Volatility n Vega is expressed in dollars/cents n Shows expected option price change for a 1%-point change in implied volatility n Can be expressed per option or per contract n Spreads and other complex positions have a net vega (positive for long positions and negative for short positions) 02/28/09 Rowena St. Moritz 39

Vega and Implied Volatility n Vega is expressed in dollars/cents n Shows expected option price change for a 1%-point change in implied volatility n Can be expressed per option or per contract n Spreads and other complex positions have a net vega (positive for long positions and negative for short positions) 02/28/09 Rowena St. Moritz 39

Vega and Implied Volatility Illustration of Implied Volatility’s relationship to Vega n $80 Call is $3. 50 ($350 per contract) n Implied Volatility is 35% and Vega is $. 15 n If underlying equity’s price remains unchanged n If Implied Volatility rises 1 point, the contract price is expected to rise $15 to $365 n If Implied Volatility falls 1 point, the contract price is expected to fall $15 to $335 02/28/09 Rowena St. Moritz 40

Vega and Implied Volatility Illustration of Implied Volatility’s relationship to Vega n $80 Call is $3. 50 ($350 per contract) n Implied Volatility is 35% and Vega is $. 15 n If underlying equity’s price remains unchanged n If Implied Volatility rises 1 point, the contract price is expected to rise $15 to $365 n If Implied Volatility falls 1 point, the contract price is expected to fall $15 to $335 02/28/09 Rowena St. Moritz 40

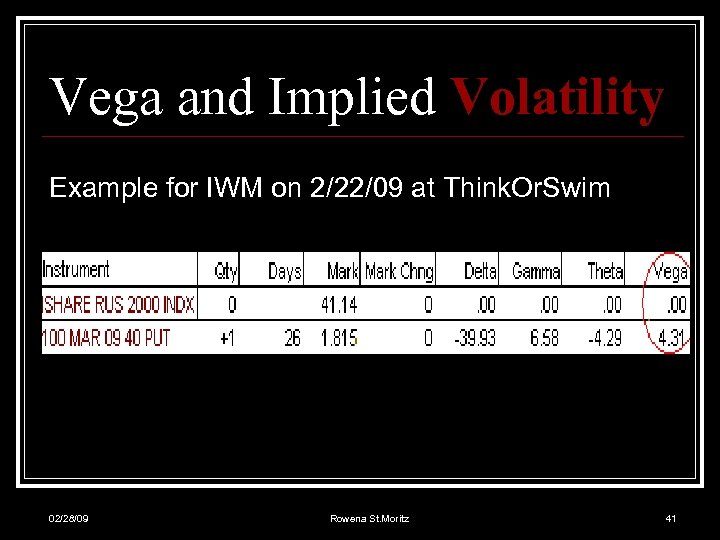

Vega and Implied Volatility Example for IWM on 2/22/09 at Think. Or. Swim 02/28/09 Rowena St. Moritz 41

Vega and Implied Volatility Example for IWM on 2/22/09 at Think. Or. Swim 02/28/09 Rowena St. Moritz 41

Vega and Implied Volatility Explanation of Example for IWM on 2/22/09 at To. S n $40 IWM March Put is $1. 815 n Implied Volatility is 52. 35% n Vega is 4. 31 per contract or $. 0431 for the option n If IWM’s price is unchanged and Implied Volatility n Rises 1 pt, contract price is expected to rise to $185. 81 n Falls 1 pt, contract price is expected to fall to $177. 19 02/28/09 Rowena St. Moritz 42

Vega and Implied Volatility Explanation of Example for IWM on 2/22/09 at To. S n $40 IWM March Put is $1. 815 n Implied Volatility is 52. 35% n Vega is 4. 31 per contract or $. 0431 for the option n If IWM’s price is unchanged and Implied Volatility n Rises 1 pt, contract price is expected to rise to $185. 81 n Falls 1 pt, contract price is expected to fall to $177. 19 02/28/09 Rowena St. Moritz 42

Vega and Implied Volatility Vega’s Bell Curve n Vega is greatest on ATM Calls and ATM Puts (because they have the greatest time value) n Vega is smaller on OTM Calls and OTM Puts n Vega is smallest on ITM Calls and ITM Puts 02/28/09 Rowena St. Moritz 43

Vega and Implied Volatility Vega’s Bell Curve n Vega is greatest on ATM Calls and ATM Puts (because they have the greatest time value) n Vega is smaller on OTM Calls and OTM Puts n Vega is smallest on ITM Calls and ITM Puts 02/28/09 Rowena St. Moritz 43

Conclusions Rowena St. Moritz

Conclusions Rowena St. Moritz

Conclusions Buy Low and Sell High n Refers to volatility as well as price n Sell options during high volatility n Buy options during low volatility 02/28/09 Rowena St. Moritz 45

Conclusions Buy Low and Sell High n Refers to volatility as well as price n Sell options during high volatility n Buy options during low volatility 02/28/09 Rowena St. Moritz 45

Conclusions Buy Low Volatility and Sell High Volatility n If earnings are coming out and the stock’s volatility is up n n n You believe that the stock’s price will skyrocket after the earnings announcement You want to buy a Call to profit from the price increase Consider selling a Put, instead of buying a Call n You can buy back the Put right after volatility drops n Even if the stock’s price doesn’t rise, you may profit from decreased volatility – you can be wrong and still profit 02/28/09 Rowena St. Moritz 46

Conclusions Buy Low Volatility and Sell High Volatility n If earnings are coming out and the stock’s volatility is up n n n You believe that the stock’s price will skyrocket after the earnings announcement You want to buy a Call to profit from the price increase Consider selling a Put, instead of buying a Call n You can buy back the Put right after volatility drops n Even if the stock’s price doesn’t rise, you may profit from decreased volatility – you can be wrong and still profit 02/28/09 Rowena St. Moritz 46

Conclusions Thinkorswim’s recommendations on volatility n When volatility is low and rising n n n Purchase Calendar Spreads Purchase Double Diagonal Spreads When volatility is high and falling n Sell Iron Condors n Sell Vertical Spreads 02/28/09 Rowena St. Moritz 47

Conclusions Thinkorswim’s recommendations on volatility n When volatility is low and rising n n n Purchase Calendar Spreads Purchase Double Diagonal Spreads When volatility is high and falling n Sell Iron Condors n Sell Vertical Spreads 02/28/09 Rowena St. Moritz 47

The End Rowena St. Moritz

The End Rowena St. Moritz