51ea4a196d1d71bb8002f476568d8ad0.ppt

- Количество слайдов: 63

Observations From 30 Years John R. Baker Attorney at Law 1 -800 -447 -1985 jrbaker@iastate. edu Photos by USDA NRCS

Why don’t we Plan? • Too Complicated • Don’t like to Plan • Facing our own Mortality

PLANNING Plans are nothing: planning is everything Dwight D. Eisenhower

Farming or Owning Farmland? • Owing farm land does not the same as operating a farm business. • The term “family farm” is an undefined term. • If inheriting farm land creates a farmer then inheriting law books creates a lawyer.

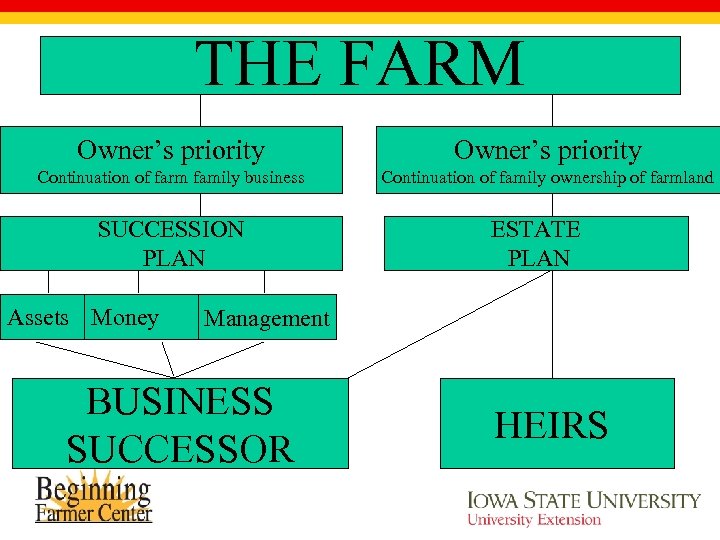

THE FARM Owner’s priority Continuation of farm family business Continuation of family ownership of farmland SUCCESSION PLAN Assets Money ESTATE PLAN Management BUSINESS SUCCESSOR HEIRS

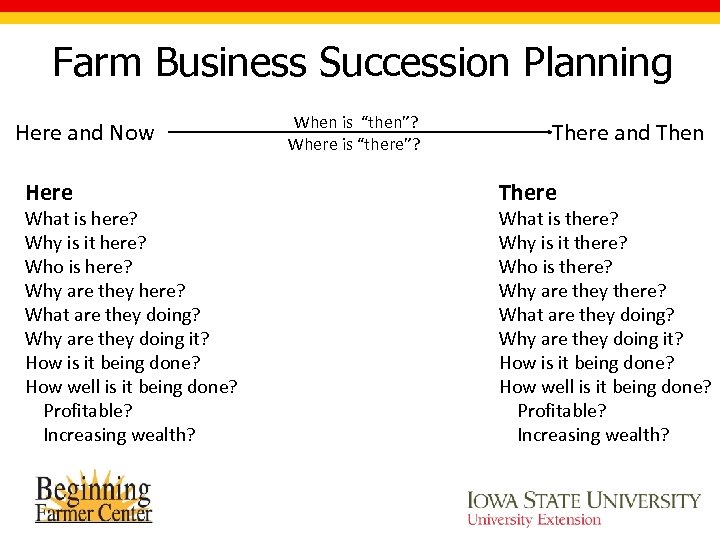

Farm Business Succession Planning Here and Now Here What is here? Why is it here? Who is here? Why are they here? What are they doing? Why are they doing it? How is it being done? How well is it being done? Profitable? Increasing wealth? When is “then”? Where is “there”? There and Then There What is there? Why is it there? Who is there? Why are they there? What are they doing? Why are they doing it? How is it being done? How well is it being done? Profitable? Increasing wealth?

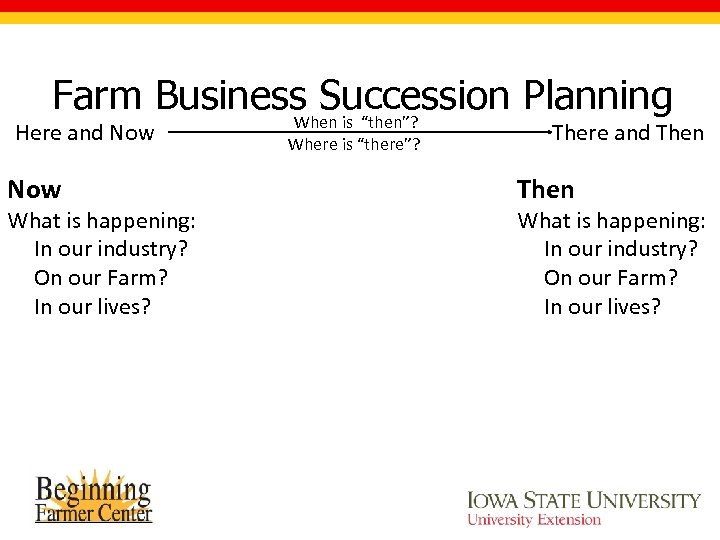

Farm Business Succession Planning When is “then”? Here and Now What is happening: In our industry? On our Farm? In our lives? Where is “there”? There and Then What is happening: In our industry? On our Farm? In our lives?

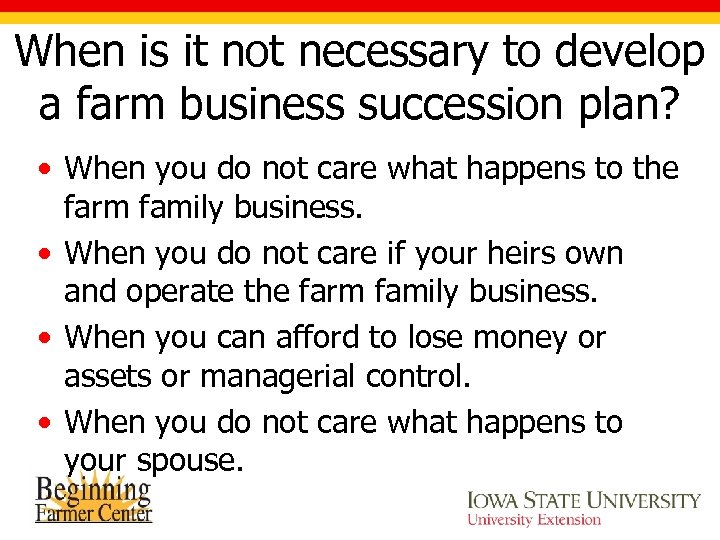

When is it not necessary to develop a farm business succession plan? • When you do not care what happens to the farm family business. • When you do not care if your heirs own and operate the farm family business. • When you can afford to lose money or assets or managerial control. • When you do not care what happens to your spouse.

Planning is deciding Ø How long the will the transition last Ø What management decisions are made by the successor Ø Which assets are transferred and when Ø When does the owner retire and what retirement means Ø Identifying the source of retirement income

What Do We Really Know About Farm Business Succession Planning? What does the research tell us?

FARMTRANSFERS • An international collaboration initiated by Professor Andrew Errington (deceased), The University of Plymouth, England John R. Baker, Beginning Farmer Center, Iowa State University.

FARMTRANSFERS • Over 16, 500 farmers have completed the copyrighted FARMTRANSFERS questionnaire. Data is collected through a postal questionnaire covering basic background information about the farm (e. g. , size, tenure, and enterprise structure) and farm family demographics (e. g. , age and household composition).

FARMTRANSFERS • Detailed information is also recorded regarding retirement and succession plans, sources of advice and information, and the delegation of decision making responsibility between the principal farmer and his or her successor(s).

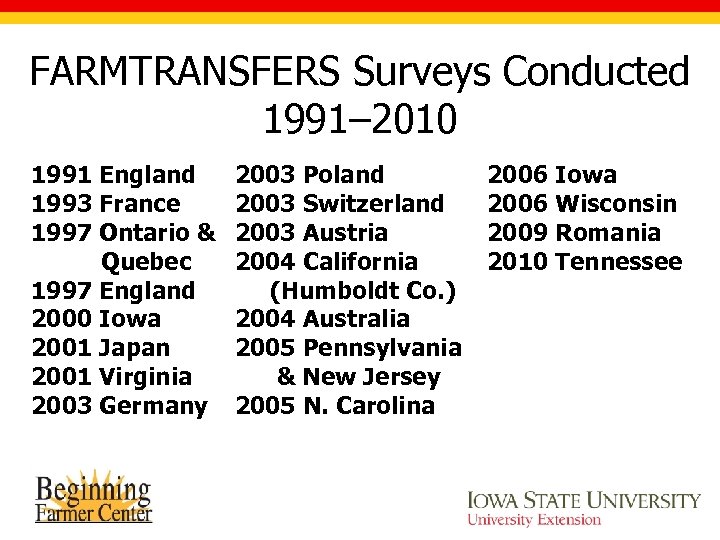

FARMTRANSFERS Surveys Conducted 1991– 2010 1991 England 1993 France 1997 Ontario & Quebec 1997 England 2000 Iowa 2001 Japan 2001 Virginia 2003 Germany 2003 Poland 2003 Switzerland 2003 Austria 2004 California (Humboldt Co. ) 2004 Australia 2005 Pennsylvania & New Jersey 2005 N. Carolina 2006 Iowa 2006 Wisconsin 2009 Romania 2010 Tennessee

Iowa • In 2006 a mail survey was sent to 2, 847 farmers throughout Iowa. There were 972 responses returned (34 percent). • In 2000 1, 548 surveys were mailed with 418 responses (27 percent).

Iowa: 2002 and 2006 YEAR 2000 2006 Average of operator 54. 3 56 Farming is principal occupation 68% 54% Average size of farms (acres) 350 446

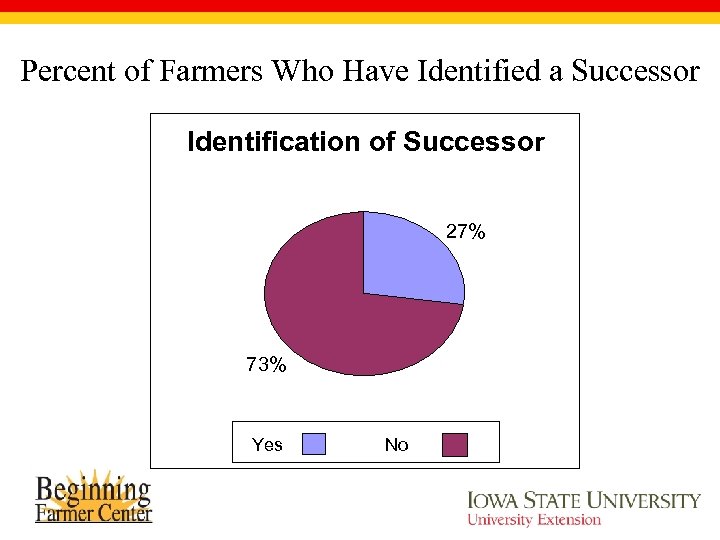

Percent of Farmers Who Have Identified a Successor Identification of Successor 27% 73% Yes No

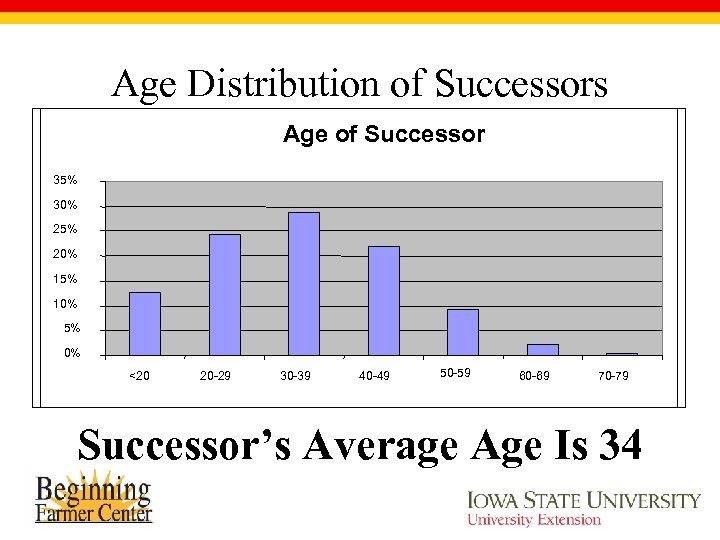

Age Distribution of Successors Age of Successor 35% 30% 25% 20% 15% 10% 5% 0% <20 20 -29 30 -39 40 -49 50 -59 60 -69 70 -79 Successor’s Average Age Is 34

Definitions Inheritance The transfer of land other farm business assets to a succeeding generation upon the death of the owner of those assets. Succession The transfer of managerial control of the farm business to the succeeding generation during the life of the owner of the business. Retirement The withdrawal of labor to and managerial control of the business by the owner.

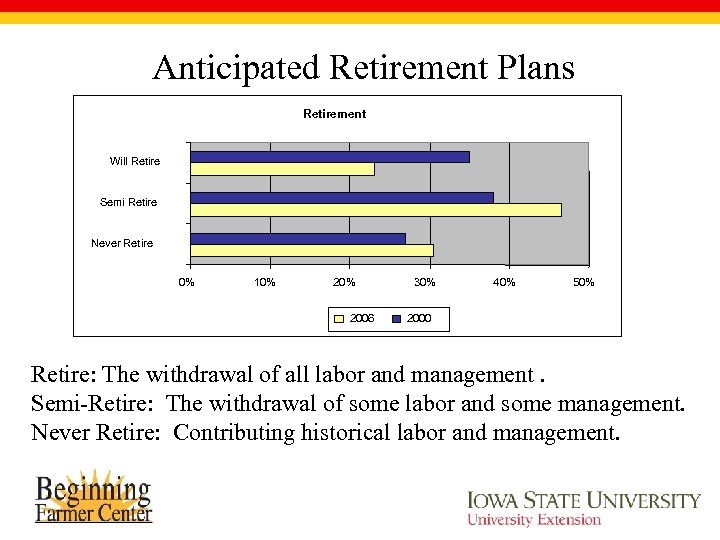

Anticipated Retirement Plans Retirement Will Retire Semi Retire Never Retire 0% 10% 2006 30% 40% 50% 2000 Retire: The withdrawal of all labor and management. Semi-Retire: The withdrawal of some labor and some management. Never Retire: Contributing historical labor and management.

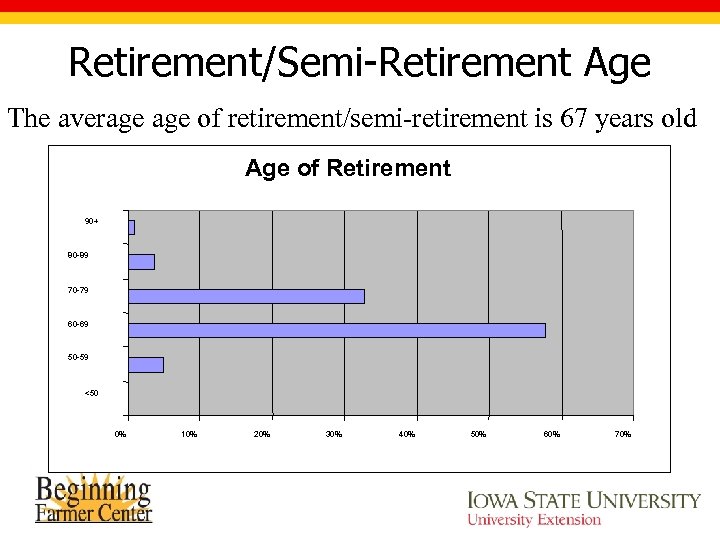

Retirement/Semi-Retirement Age The average of retirement/semi-retirement is 67 years old Age of Retirement 90+ 80 -89 70 -79 60 -69 50 -59 <50 0% 10% 20% 30% 40% 50% 60% 70%

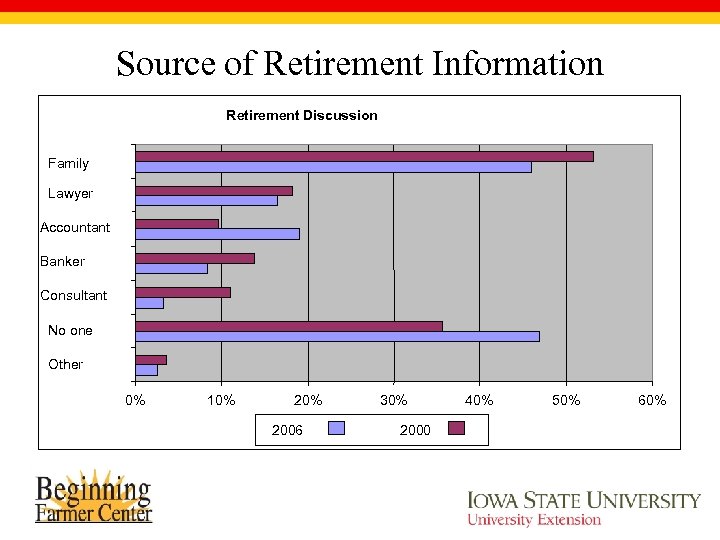

Source of Retirement Information Retirement Discussion Family Lawyer Accountant Banker Consultant No one Other 0% 10% 2006 30% 2000 40% 50% 60%

Sources Anticipated Retirement Income

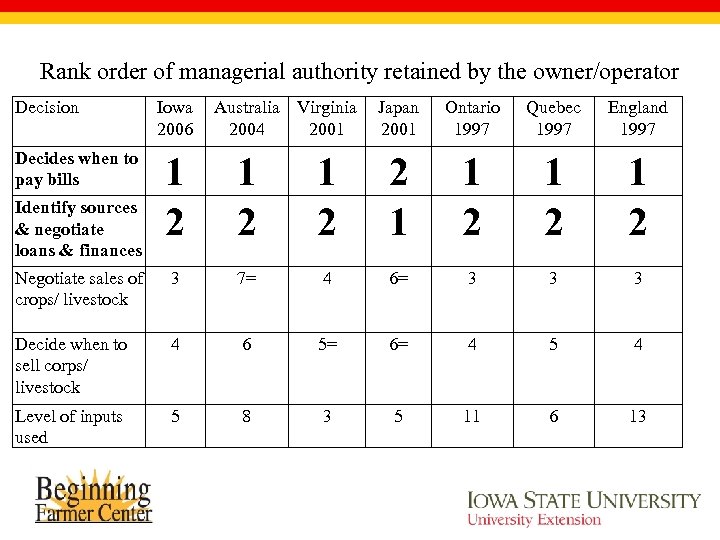

Rank order of managerial authority retained by the owner/operator Decision Decides when to pay bills Iowa 2006 Australia Virginia 2004 2001 Japan 2001 Ontario 1997 Quebec 1997 England 1997 1 2 1 2 2 1 1 2 1 2 Negotiate sales of crops/ livestock 3 7= 4 6= 3 3 3 Decide when to sell corps/ livestock 4 6 5= 6= 4 5 4 Level of inputs used 5 8 3 5 11 6 13 Identify sources & negotiate loans & finances

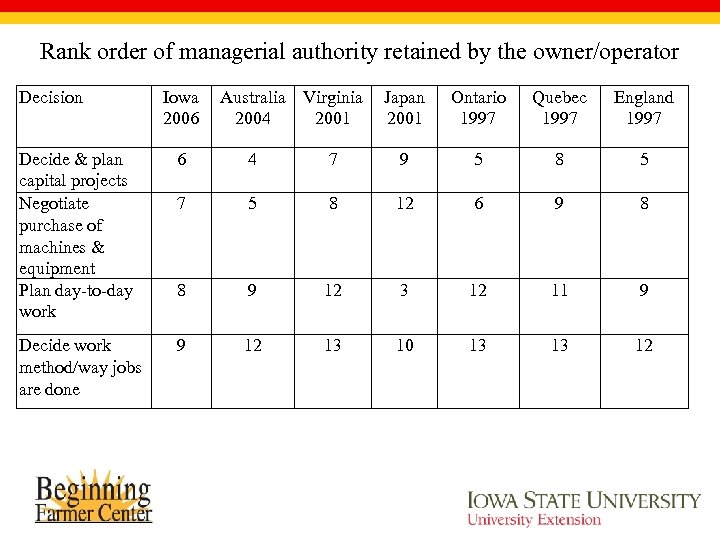

Rank order of managerial authority retained by the owner/operator Decision Iowa 2006 Australia Virginia 2004 2001 Japan 2001 Ontario 1997 Quebec 1997 England 1997 Decide & plan capital projects Negotiate purchase of machines & equipment Plan day-to-day work 6 4 7 9 5 8 5 7 5 8 12 6 9 8 8 9 12 3 12 11 9 Decide work method/way jobs are done 9 12 13 10 13 13 12

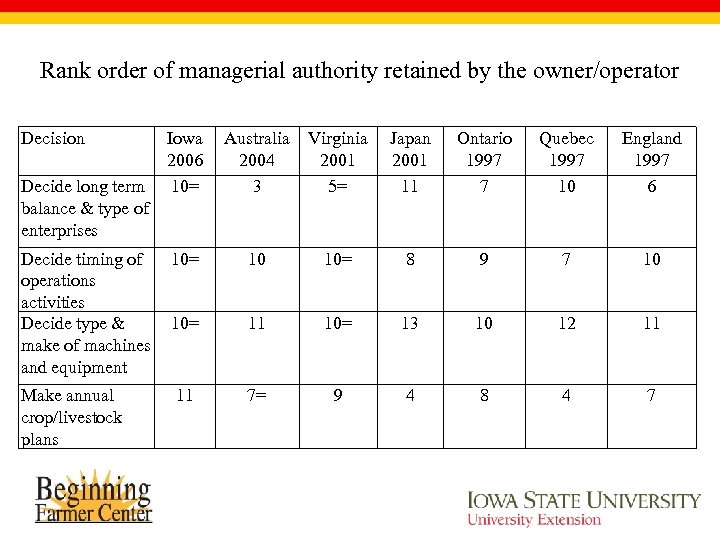

Rank order of managerial authority retained by the owner/operator Decision Iowa 2006 10= Australia 2004 3 Virginia 2001 5= Japan 2001 11 Ontario 1997 7 Quebec 1997 10 England 1997 6 Decide timing of operations activities Decide type & make of machines and equipment 10= 10 10= 8 9 7 10 10= 11 10= 13 10 12 11 Make annual crop/livestock plans 11 7= 9 4 8 4 7 Decide long term balance & type of enterprises

NOT EVERYTHING THAT CAN BE COUNTED COUNTS AND NOT EVERYTHING THE COUNTS CAN BE COUNTED. Albert Einstein (1879 – 1955)

The Family Business • A family business conflates the family system and the business system. • The more closely family members work together the more difficult the conversation about the business becomes. • Expectation and assumptions are made and remain unspoken.

Two Different Systems • The FAMILY system – Attributes of a successful family • Loving • Loyal • Affectionate • Supportive • Empathetic • Understanding • Enduring • Communicative

Two Different Systems • The BUSINESS system – Attributes of a successful business • Efficient • Profitable • Goal Directed • Effective • Aggressive • Evaluative • Innovative • Proficient

The Failures • Failure to treat the farm as a business. • Failure of the owner to retire. • Failure of the owner to transfer managerial authority, responsibility and accountability. • Failure to develop an equitable estate plan. • Failure to develop a coherent succession plan.

We don't see things as they are, we see them as we are. Anais Nin (1903 – 1977)

Conversation Confusion • • • TIMING LOCATION ROLE VOCABULARY CONFLICT

Conversation Confusion • Timing – When will the conversation be held? Usually it is during a holiday meal when every one is present. The family is operating in the family system and attempting to discuss issues that are in the business system.

Conversation Confusion • Location – Where does the conversation take place? Usually at the largest table in the parents house. Dad sits were he always sits and each child sits where they always sit. Mom is in the kitchen arranging coffee and cookies. The family system overlays the business conversation.

Conversation Confusion • Role – What is the role of the individuals involved in the conversation? A conversation about the farm family business requires the individuals to assume the role of business principles and not the role of Dad or Mom or Son or Daughter or In-law or Brother or Sister or Niece or Nephew or Cousin or Grandchild or Grandparent.

Conversation Confusion • VOCABULARY – What is the appropriate vocabulary for the conversation? A conversation about business requires the use of a business vocabulary. A conversation about family allows the use of a family vocabulary. “The limits of my language are the limits of my mind. All I know is what I have words for. ” Ludwig Wittgenstein (Austrian philosopher 1889 -1951)

Conversation Confusion • CONFLICT – What happens when a conflict arises? In a conflict communication is fractured, the participants are at impasse, they avoid one another and emotions are heightened. The participants lapse into their respective family system roles and the family system vocabulary is employed.

Treating the Farm as a Business • Identify which system is appropriate for the situation. • Operate in the appropriate system. • Hold regularly scheduled business meetings that have agendas and ground rules. • Hold business meetings at a business location not a family location.

Treating the Farm as a Business • Identify for yourself and others the role you are assuming. • Develop written job descriptions for all roles in the farm family business. • Learn and use the vocabulary of business. • Learn and use the necessary skills to resolve conflicts.

What’s It Worth If You Stay On The Farm?

“I’ve spent my entire life paying off my uncles. Now I’ll spend the rest of my life paying off my brothers. ” English farmer, Devon, UK 2002

Dad and Mom have asked Sarah to come back and eventually take over the farm family business. They have offered Sarah an annual salary of $52, 000 per year. Sarah has one sister and two brothers. None are interested in taking over the farm family business. Dad and Mom have always said that they will treat all their children equally.

Mom and Dad have told Sarah that she will receive $250 per week and that each of her sibling will receive $250. Sarah, her sister and her brothers have been treated equally. Does this sound fair? If it is not fair during the life of the owner then what makes an equal division fair after the death of the owner?

KEY CONCEPT Compensation = Contribution

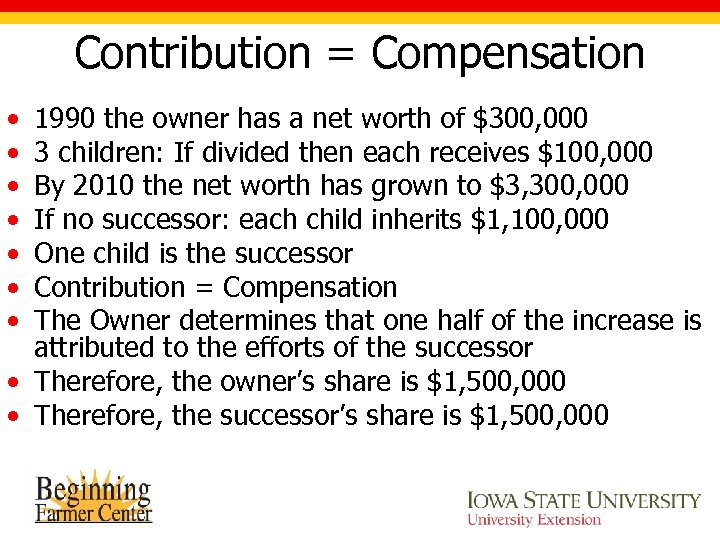

Contribution = Compensation • • 1990 the owner has a net worth of $300, 000 3 children: If divided then each receives $100, 000 By 2010 the net worth has grown to $3, 300, 000 If no successor: each child inherits $1, 100, 000 One child is the successor Contribution = Compensation The Owner determines that one half of the increase is attributed to the efforts of the successor • Therefore, the owner’s share is $1, 500, 000 • Therefore, the successor’s share is $1, 500, 000

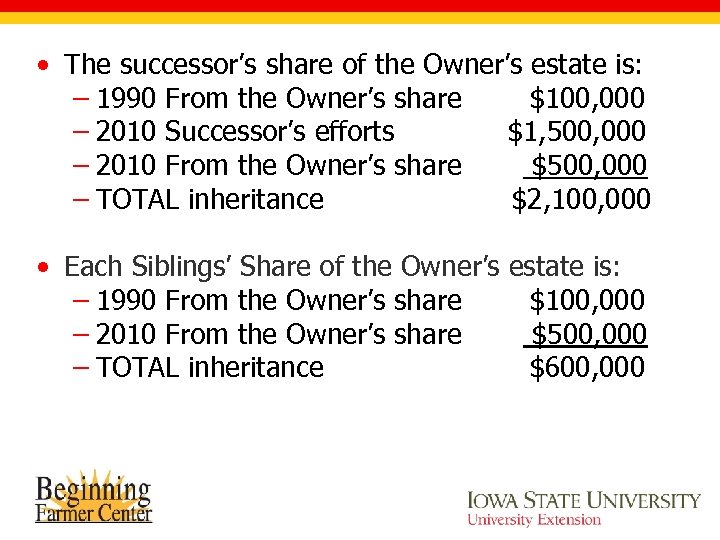

• The successor’s share of the Owner’s estate is: – 1990 From the Owner’s share $100, 000 – 2010 Successor’s efforts $1, 500, 000 – 2010 From the Owner’s share $500, 000 – TOTAL inheritance $2, 100, 000 • Each Siblings’ Share of the Owner’s estate is: – 1990 From the Owner’s share $100, 000 – 2010 From the Owner’s share $500, 000 – TOTAL inheritance $600, 000

Equitable Division of Property • Equal is not always fair. • An equitable division allows the On-Farm Heir to be compensated for the increase in the wealth they have created and protected. • An equitable division also gives the On-Farm heir a greater chance of being able to maintain the farm family business.

Basics for compensation of the On-Farm Heir? • Time • Market price of labor • Value Added to Farm • Preserved wealth

Case Study The Miller family is a typical Iowa family who own and operate a farm family business and they want it to continue for another generation. Only one of their children is interested in farming.

The Miller’s • Denny and Mary: Farmers in Smallville, IA. • Denny farms with his father, Tom. • 3 children: Chris, Kevin and Kathy. – Only Kevin wants to farm. • Mary and Denny love all their children and wonder how to divide assets when they are gone.

The Miller’s: Part One • Kevin is 21 and has a cattle herd of 10. • He is in college and will finish this year. • Since he hasn’t contributed to the farm, no compensation is needed • Equal division would be fair because Kevin hasn’t done anything “extra. ”

The Miller’s: Part Two • Mary and Denny are 65. • Kevin is 41 and is married to Grace w/ 3 children: . • Denny and Kevin have been farming together for 20 years. • Kevin makes some management decisions. • 2, 000 acres are farmed by Denny and Kevin. • Their herds have grown significantly. • How do we value Kevin’s contribution to the farm?

Factors to Consider 1. What value has Kevin added to the farm? 2. What value has Denny added because he knows Kevin is going to take over? 3. Has Kevin built assets on Denny’s land? 4. What amount should Kevin receive for management decisions? 5. Has Kevin made repairs, improvements to property?

The Miller’s: Part Three • Denny’s dad, Tom, passes away. • Denny is having back problems and finds it hard to ride tractor. • Kevin’s daughter, Jessica, and her husband want to come back and farm. • Half of cash leases have been transferred to Kevin’s name. • Kevin has taken over the hay operation and all management tasks. • Denny is slowly phasing out of the business. • How do we value Kevin’s contribution to the farm?

Factors to Consider: • • The value has Kevin added to the farm. Kevin’s assets that are on Denny’s property. The physical work does Kevin do on Denny’s land. Compensation for Kevin being the farm as manager for Denny and Mary. • Compensation for record keeping. • Wealth preserved because of Kevin’s presence. (i. e. living in a farm house that would have deteriorated)? • Personal services performed by Kevin and Grace

The Miller’s: Stage Four • Denny dies; Mary’s health declines rapidly • Kevin and Grace help her w/ almost everything; i. e. chores, doctor visits, cooking meals, laundry, etc. • Cows are gone; Kevin uses buildings, shop, grain bins, etc. on farm • Kevin received all Denny’s machinery. • Mary now owns the entire land because her and Denny had a joint tenancy. • How do we value Kevin and Grace’s extra work on the farm and caring for Mary?

Factors to Consider • Would the farm business still exist without Kevin? • Would Mary be in a nursing home if Grace and Kevin didn’t care for her? • Are Kevin and Grace receiving other benefits by staying on the farm? • How much value has Kevin added to the farm? • Is Kevin the managing the entire business? • Increased profits due to Kevin’s management?

Now, how do we value? • There is no exact formula to do this! • However, we can place values on services and increase in wealth/value/etc. • Once values have been determined, we can multiply this by the number of years worked by Kevin.

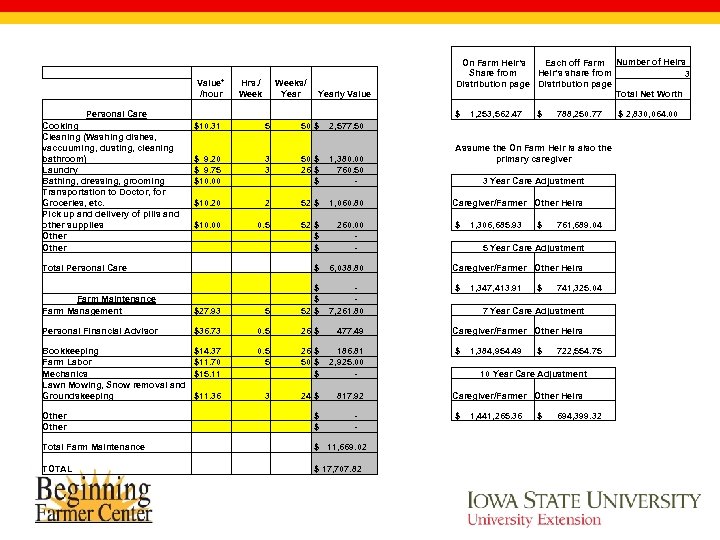

Value* /hour Personal Care Cooking Cleaning (Washing dishes, vaccuuming, dusting, cleaning bathroom) Laundry Bathing, dressing, grooming Transportation to Doctor, for Groceries, etc. Pick up and delivery of pills and other supplies Other $10. 31 Total Personal Care Hrs. / Weeks/ Yearly Value 5 $ 9. 20 $ 9. 75 $10. 00 3 3 $10. 20 2 50 $ 2, 577. 50 $ 1, 380. 00 26 $ 760. 50 $ - On Farm Heir's Each off Farm Number of Heirs Share from Heir's share from 3 Distribution page Total Net Worth $ 1, 253, 562. 47 $ 788, 250. 77 Assume the On Farm Heir is also the primary caregiver 3 Year Care Adjustment 52 $ 1, 060. 80 Caregiver/Farmer Other Heirs 52 $ 260. 00 $ - $ 1, 306, 685. 93 $ 6, 038. 80 $27. 93 5 $ - 52 $ 7, 261. 80 $ 1, 347, 413. 91 Farm Maintenance Farm Management Personal Financial Advisor $36. 73 0. 5 26 $ 477. 49 Caregiver/Farmer Other Heirs Bookkeeping Farm Labor Mechanics Lawn Mowing, Snow removal and Groundskeeping $14. 37 $11. 70 $15. 11 0. 5 5 26 $ 186. 81 50 $ 2, 925. 00 $ - $ 1, 384, 954. 49 24 $ 817. 92 Caregiver/Farmer Other Heirs Other $ - Total Farm Maintenance $ 11, 669. 02 TOTAL $ 17, 707. 82 $10. 00 $11. 36 0. 5 3 $ 761, 689. 04 5 Year Care Adjustment Caregiver/Farmer Other Heirs $ 741, 325. 04 7 Year Care Adjustment $ 722, 554. 75 10 Year Care Adjustment $ 1, 441, 265. 36 $ 694, 399. 32 $ 2, 830, 064. 00

Presented by: John R. Baker Attorney at Law jrbaker@iastate. edu 1 -800 -447 -1985

51ea4a196d1d71bb8002f476568d8ad0.ppt