e49117ea1868403f65515286c9a94e99.ppt

- Количество слайдов: 17

Objective 2. 03 Analyze financial and legal aspects of home ownership

So you want to buy a house… • In order to buy a home most people will need to borrow money. This is called a mortgage. • A mortgage is a contract outlining the terms of a loan between the lender and the borrower

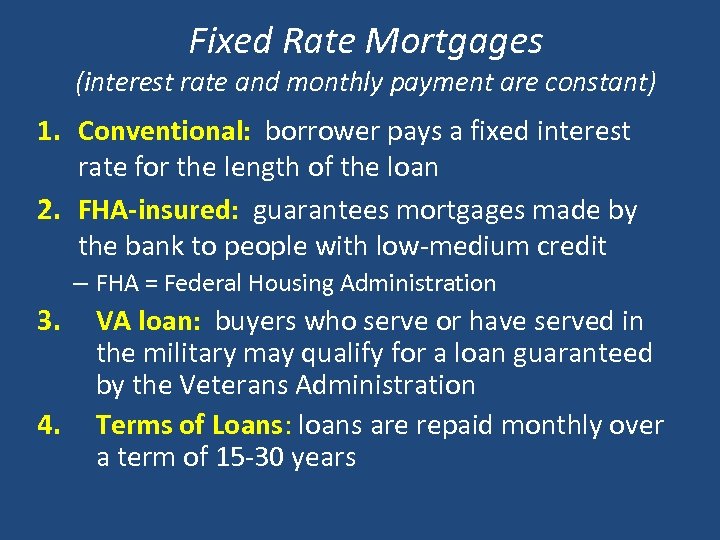

Fixed Rate Mortgages (interest rate and monthly payment are constant) 1. Conventional: borrower pays a fixed interest rate for the length of the loan 2. FHA-insured: guarantees mortgages made by the bank to people with low-medium credit – FHA = Federal Housing Administration 3. 4. VA loan: buyers who serve or have served in the military may qualify for a loan guaranteed by the Veterans Administration Terms of Loans: loans are repaid monthly over a term of 15 -30 years

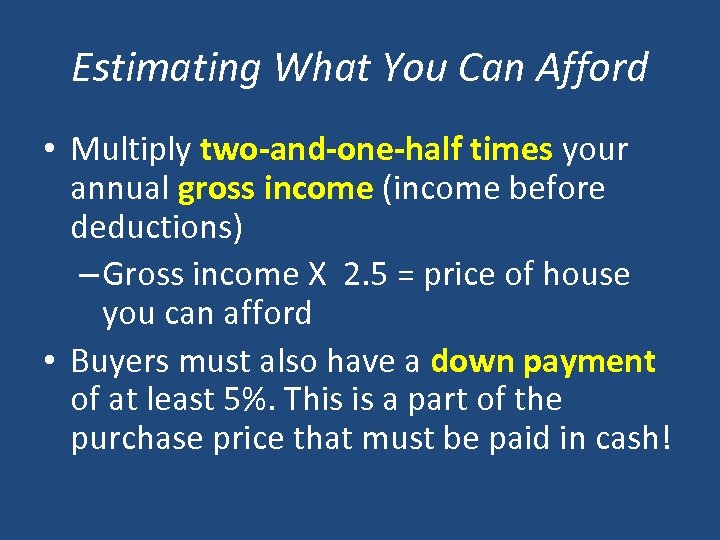

Estimating What You Can Afford • Multiply two-and-one-half times your annual gross income (income before deductions) – Gross income X 2. 5 = price of house you can afford • Buyers must also have a down payment of at least 5%. This is a part of the purchase price that must be paid in cash!

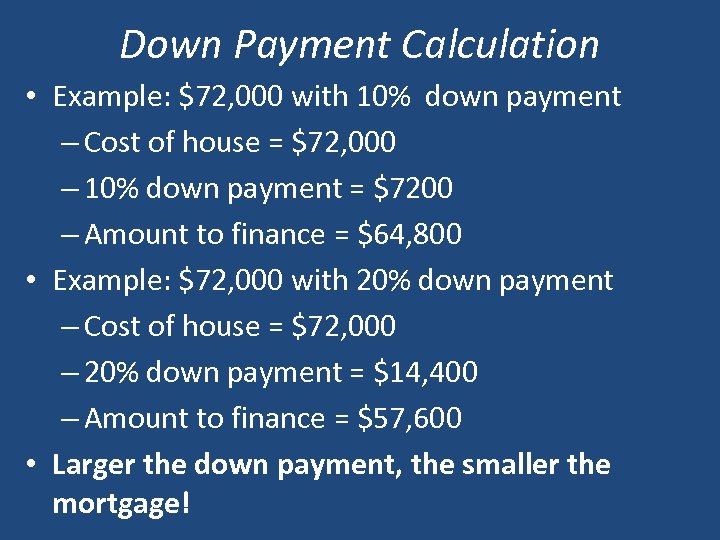

Down Payment Calculation • Example: $72, 000 with 10% down payment – Cost of house = $72, 000 – 10% down payment = $7200 – Amount to finance = $64, 800 • Example: $72, 000 with 20% down payment – Cost of house = $72, 000 – 20% down payment = $14, 400 – Amount to finance = $57, 600 • Larger the down payment, the smaller the mortgage!

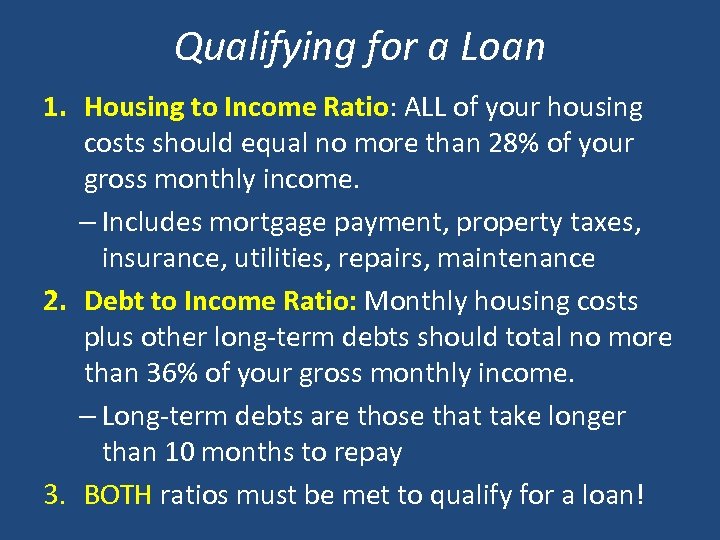

Qualifying for a Loan 1. Housing to Income Ratio: ALL of your housing Ratio costs should equal no more than 28% of your gross monthly income. – Includes mortgage payment, property taxes, insurance, utilities, repairs, maintenance 2. Debt to Income Ratio: Monthly housing costs plus other long-term debts should total no more than 36% of your gross monthly income. – Long-term debts are those that take longer than 10 months to repay 3. BOTH ratios must be met to qualify for a loan!

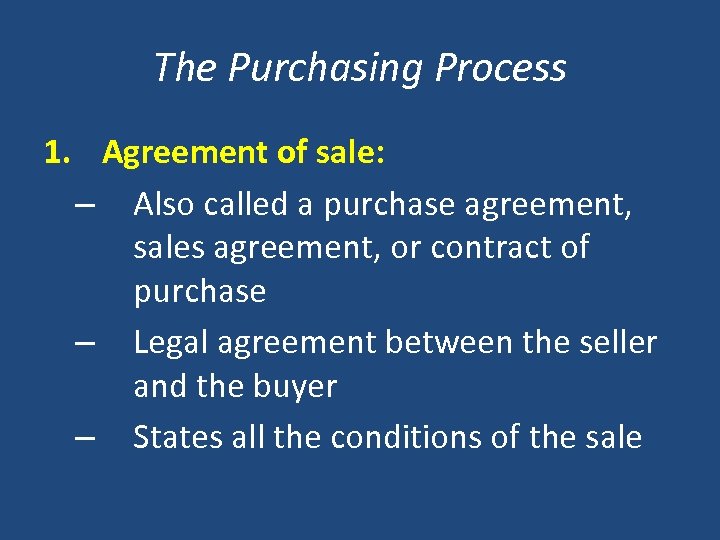

The Purchasing Process 1. Agreement of sale: – Also called a purchase agreement, sales agreement, or contract of purchase – Legal agreement between the seller and the buyer – States all the conditions of the sale

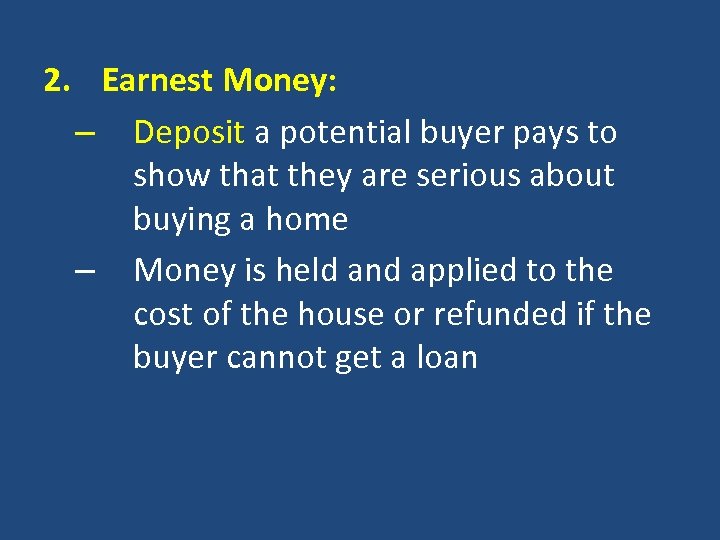

2. Earnest Money: – Deposit a potential buyer pays to show that they are serious about buying a home – Money is held and applied to the cost of the house or refunded if the buyer cannot get a loan

3. Abstract of title: – Also called a title search – A search of public records to make sure the seller is the true owner of the house – Makes sure there are no debts on the house 4. Survey: – Makes sure property lines are accurate

5. Inspections: –General home inspection (roof, heating and cooling systems, structural problems, safety issues) –Termite inspection 6. Secure a mortgage – Now, most buyers will become preapproved for a mortgage

7. Closing: – Closing is when the buyer takes ownership of the property – It involves the seller, the buyer, lawyers, and real estate agents – Closing costs are paid during the closing. This is cash paid by the buyer to cover the legal and financial costs of purchasing a home

Closing costs can include: – Origination fees: fee paid to the lender fees for processing the loan; usually 1% of mortgage – Appraisal fee: fee paid for determining the value of the property – Other fees for lawyers, real estate agents, etc. Some of the money will be held in escrow - money held in trust by a third party until a specified time - usually for property taxes and insurance

One Advantage of Owning • Usually a house will increase in value. • The difference between the market value of a house and the principle owed on the mortgage is called equity. – Market value – principle owed = equity

Equity Example Mary owns a house. She currently owes $90, 000 on her mortgage. She has decided to sell her house and buy a new one. Mary’s real estate agent sells Mary’s house for $140, 000 (market value). Mary paid off her mortgage of $90, 000 and had $50, 000 in equity. Mary used her equity as a down payment on a new home.

Advantages of Owning a Home • Sense of freedom and independence • Financial advantages: – Houses usually increase in value (equity) – Helps establish a good credit record in order to qualify for future loans – Interest and property taxes are deductible.

Disadvantages of Owning a Home • Strain on finances- property taxes, insurance, and maintenance • Uses up lots of your free time • Foreclosure if you get behind on monthly payments • Limited mobility.

WOULD YOU RATHER RENT OR OWN YOUR HOME? WHY?

e49117ea1868403f65515286c9a94e99.ppt