7da8029b6ec4aaf3bf7ceeaf851c481e.ppt

- Количество слайдов: 49

Objections/Suggestions on ARR/Tariff filings by APTransco & DISCOMS Presentation by K. Raghu, Associate President, APSEB Engineers’ Association

This presentation consists of 1. Violations observed in the Merit Order Dispatch 2. Factors which may affect actual revenue gap 3. Need for review of Power Purchase Agreements. 4. Investments by APTransco/ DISCOMS and growing interest burden. 5. Gas allocation and avoidable burden. 6. PPA with APGENCO 7. Reform Program

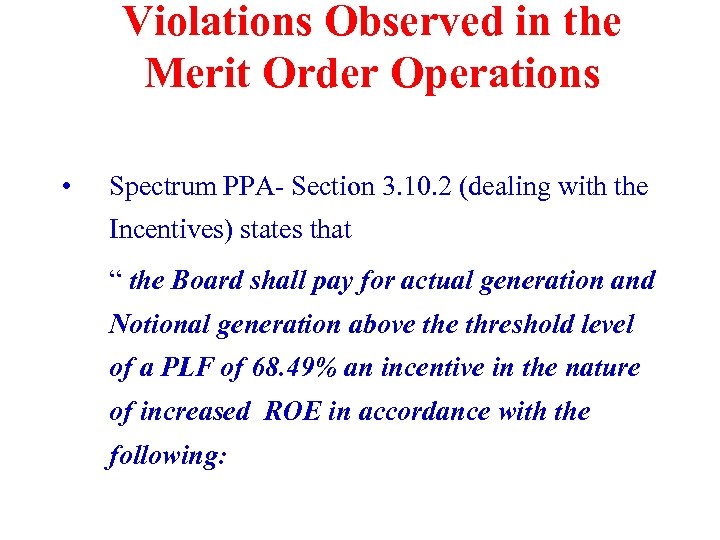

Violations Observed in the Merit Order Operations • Spectrum PPA- Section 3. 10. 2 (dealing with the Incentives) states that “ the Board shall pay for actual generation and Notional generation above threshold level of a PLF of 68. 49% an incentive in the nature of increased ROE in accordance with the following:

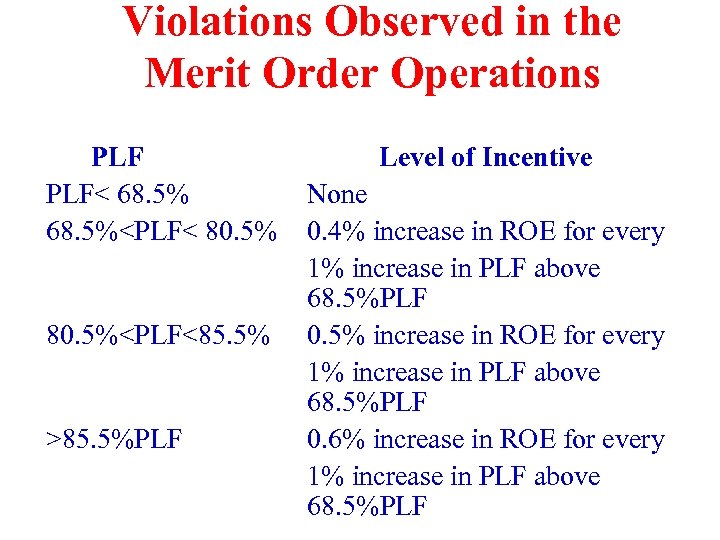

Violations Observed in the Merit Order Operations PLF< 68. 5%<PLF< 80. 5%<PLF<85. 5% >85. 5%PLF Level of Incentive None 0. 4% increase in ROE for every 1% increase in PLF above 68. 5%PLF 0. 5% increase in ROE for every 1% increase in PLF above 68. 5%PLF 0. 6% increase in ROE for every 1% increase in PLF above 68. 5%PLF

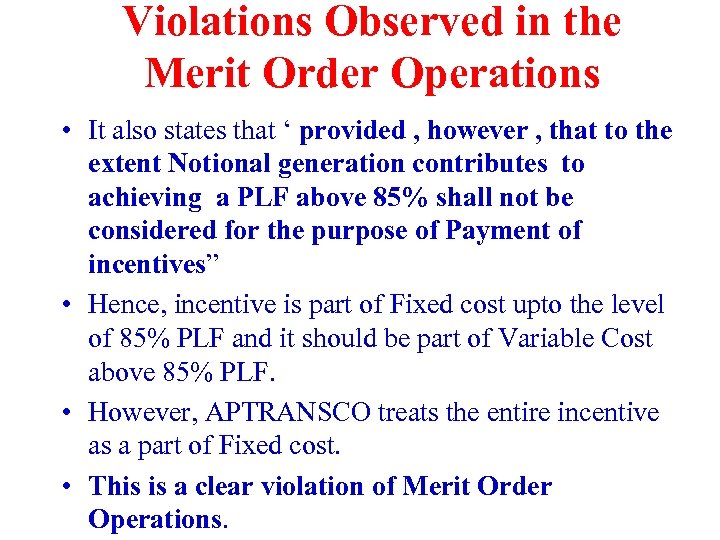

Violations Observed in the Merit Order Operations • It also states that ‘ provided , however , that to the extent Notional generation contributes to achieving a PLF above 85% shall not be considered for the purpose of Payment of incentives” • Hence, incentive is part of Fixed cost upto the level of 85% PLF and it should be part of Variable Cost above 85% PLF. • However, APTRANSCO treats the entire incentive as a part of Fixed cost. • This is a clear violation of Merit Order Operations.

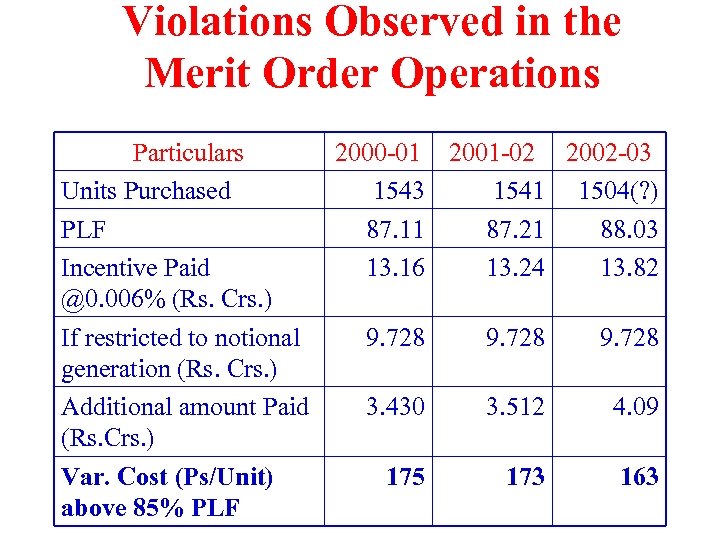

Violations Observed in the Merit Order Operations Particulars 2000 -01 2001 -02 2002 -03 Units Purchased 1543 1541 1504(? ) PLF 87. 11 87. 21 88. 03 Incentive Paid 13. 16 13. 24 13. 82 @0. 006% (Rs. Crs. ) If restricted to notional 9. 728 generation (Rs. Crs. ) Additional amount Paid 3. 430 3. 512 4. 09 (Rs. Crs. ) Var. Cost (Ps/Unit) 175 173 163 above 85% PLF

Violations Observed in the Merit Order Operations • Thus energy from IPPs has two tariffs for the merit order operations – upto 85% PLF, where incentive has to be added to the Fixed cost – above 85% PLF, where incentive has to be added to the Variable cost. • It appears that the APTransco has not made this distinction. • The same principle is applicable for the other IPP projects.

Violations Observed in the Merit Order Operations • It is also not clear how Lanco project was paid incentive for the operations using Naphtha. • APTransco has paid an amount of Rs 0. 40 crore to the Lanco Kondapally project during 2002 -03 as an incentive. • Why incentive is paid for the operations involving alternate fuel?

Factors which may affect the actual revenue gap • The total revenue gap projected by the APTRANSCO and DISCOMS is Rs 2882 Cr. • Several factors, such as, change in consumer mix, fall in hydro generation are affecting actual revenue gap at the end of the Year, than what is projected at the beginning of the year. • This year also some more factors are likely to increase the gap between the revenue and expenditure. They are:

Factors which may affect the actual revenue gap 1. BST projected by APTRANSCO is Rs 2. 07, where as the average power purchase cost shown by the DISCOMS is only Rs 1. 961. – Additional power purchase expenditure to the DISCOMs is 3802. 7 X (2. 07 -1. 961)= Rs 414. 49 Crore. 2. Wheeling charges: APTRANSCO claimed an amount of Rs 215 Crore from the proposed wheeling charge of Rs 1. 00/ unit.

Factors which may affect the actual revenue gap – This may not be realised, Since APTRANSCO in its proposal on wheeling charges has considered the component of power purchase cost to be average cost of its purchases from all the sources. – However, this should be taken as the higher of the following two 1. Cost of Power purchase from the MOD. 2. Actual revenue that is realised for the additional units supplied to compensate for the losses to the Consumers of wheeled energy under the existing agreements.

Factors which may affect the actual revenue gap – Also, the income from wheeling projected by the APTransco from the existing wheeling charges ( 13 paise/ unit) should be deducted from the total revenue from wheeling charges, to arrive at additional revenue from the revised wheeling charges. – We would like to know from the Licensee • what is the amount of energy consumed by the wheeled consumers, above their allocated share? • And what is the amount realised from this additional energy sold to these consumers at present?

Factors which may affect the actual revenue gap – We feel APTRANSCO may not realise the amount projected in the ARR, as the amount collected would not be sufficient to meet the additional liability due to the burden of loss compensation. 3. No returns: APTransco and DISCOMS have not claimed any returns for its operations for the current and ensuing years. – APTransco/DISCOMS have claimed that they would forego returns with the intention to keep any tariff increases required to bridge the gap to minimum and unavoidable levels only. – It is not necessary for APTransco to play the role of the Govt. and forego legitimate claims on revenue requirements. – If govt. decides not to place any additional burden on the Consumers, it should compensate for the gap in the form of additional subsidy.

Factors which may affect the actual revenue gap – The purpose of Reforms is to run the Licensees on commercial lines. – This is also against the ESA, 1948 , which provides for the min. ROR of 3% on net fixed assets. – This amount is approximately equal to Rs 200 crore. 4. Dismantling of Administered Pricing Mechanism: – Govt. has decided to dismantle the APM for LNG and petrolium products. – If APM is dismantled for Natural gas , the additional burden on APTRANSCO is more than Rs 550 crore, as all the IPP projects are gas based ones. 5. 24 Hour supply to Rural consumers: APTransco has announced that it will supply electricity to rural consumers 24 Hours a day from Aug’ 2002.

Factors which may affect the actual revenue gap – This will increase the burden of power purchase to APTransco without commensurate returns from these consumer categories. – The loss due to supply of electricity to the subsidized sections is of the order of Rs 100 Crore. ( Assuming the cost to serve to be Rs 4. 50/unit and realisation of Rs 1. 50 / unit, and total additional supply to rural consumers is about 300 MU) 6. Revenue from inter-state sales: – APTransco has claimed that it may realise Rs 350 Crore from inter-state sales. – This may not be realised, considering the fact that already many states are facing the problem of surplus energy.

Factors which may affect the actual revenue gap – We request the Licensee to declare the plans of Inter state sales. – In this connection, We also request the Licensee to study the impact of third party sales out side the state as allowed in the MOAs for the some short gestation projects, on its future marketing plans. – The shortfall from inter state sales will be of the order Rs 100 Cr.

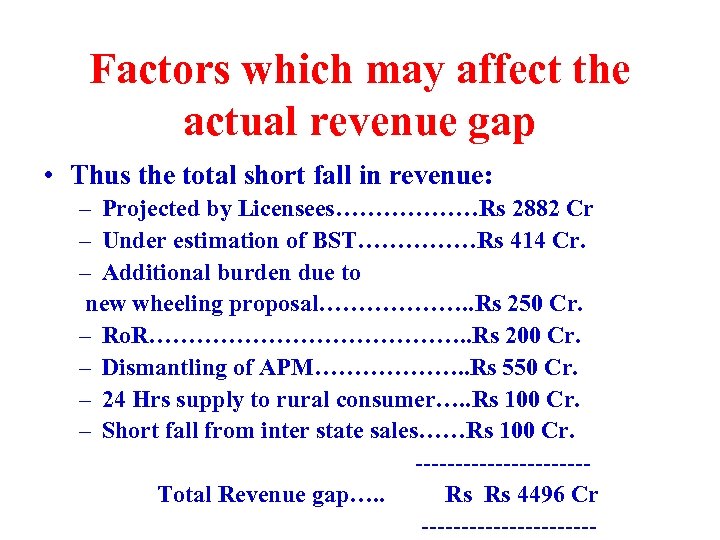

Factors which may affect the actual revenue gap • Thus the total short fall in revenue: – Projected by Licensees………………Rs 2882 Cr – Under estimation of BST……………Rs 414 Cr. – Additional burden due to new wheeling proposal………………. . Rs 250 Cr. – Ro. R…………………. . Rs 200 Cr. – Dismantling of APM………………. . Rs 550 Cr. – 24 Hrs supply to rural consumer…. . Rs 100 Cr. – Short fall from inter state sales……Rs 100 Cr. -----------Total Revenue gap…. . Rs Rs 4496 Cr -----------

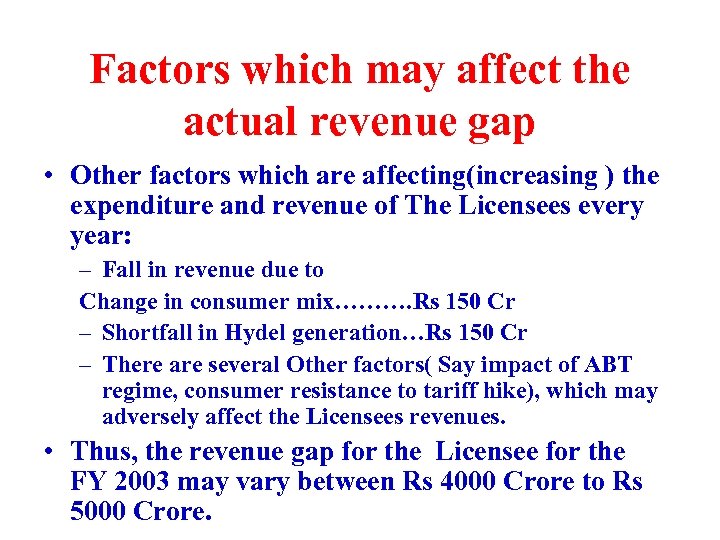

Factors which may affect the actual revenue gap • Other factors which are affecting(increasing ) the expenditure and revenue of The Licensees every year: – Fall in revenue due to Change in consumer mix………. Rs 150 Cr – Shortfall in Hydel generation…Rs 150 Cr – There are several Other factors( Say impact of ABT regime, consumer resistance to tariff hike), which may adversely affect the Licensees revenues. • Thus, the revenue gap for the Licensee for the FY 2003 may vary between Rs 4000 Crore to Rs 5000 Crore.

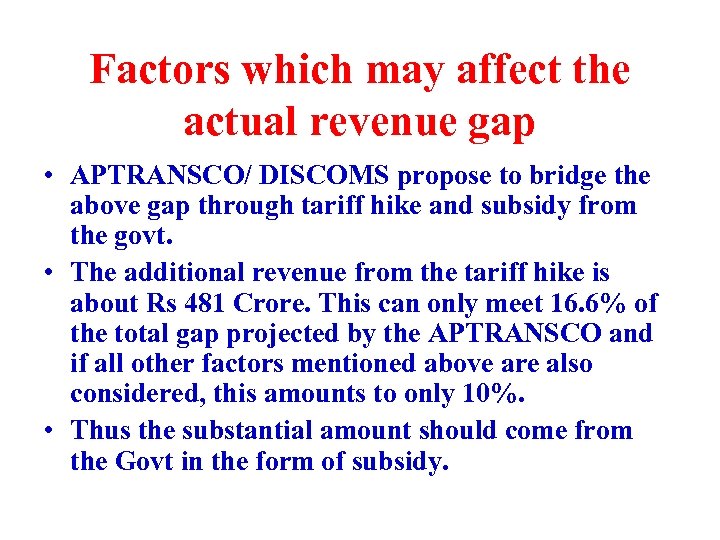

Factors which may affect the actual revenue gap • APTRANSCO/ DISCOMS propose to bridge the above gap through tariff hike and subsidy from the govt. • The additional revenue from the tariff hike is about Rs 481 Crore. This can only meet 16. 6% of the total gap projected by the APTRANSCO and if all other factors mentioned above are also considered, this amounts to only 10%. • Thus the substantial amount should come from the Govt in the form of subsidy.

Factors which may affect the actual revenue gap • It is very clear from the above that tariff hike can not be the solution for the present crises faced by the Licensees, and we should identify the causes for the present situation and try to address them. • Blind pursuance of the ‘reform program’, without understanding the nature and working of the power sector and ignoring the social realities will only land us in a Orissa like situation.

Need for review of PPAs • There is a need for review of all Power Purchase Agreements with the IPPs for the following reasons: 1. Violation of GOI norms: For ex: while the GOI guidelines provide for 16% return on equity for the entire year, the IPPs are being paid the above amount in 12 equal parts on monthly basis. This is resulting in additional payment to the IPPs. 2. Harmful provisions in the PPA: – Comptroller and Auditor General in its reports on GVK and Spectrum projects has identified several provisions which are harmful to the consumers, and recommended for the review of these PPAs.

Need for review of PPAs – The Commission has also agreed with some of the above issues raised in its order on PPA between APTRANSCO and BPL Project. – Godbole committee also had identified several issues which burden the consumers. For ex: Fuel arbitrage I. e. difference between the cost of fuel actually consumed and as provided in the PPA based on calorific value. – Inflated Capital costs: For similar capacity of projects, there is abnormal difference with regard to the capital cost. – For Ex: BSES 220 MW………Rs 700 Crore. GVK 216 MW……Rs 870 crore. Spectrum. 208 MW… 748 Crore.

Need for review of PPAs – The BSES project is a new project and GVK and Spectrum projects are completed long ago, still having higher capital cost. The above figures may further go up if revised capital cost proposals are approved by the CEA. – Even the purchase of energy based on uniform fixed cost / unit , as provided in PPAs with short gestation projects appear to be on higher side. 3. Interest rates offered by the financial institutions have drastically reduced. Hence this may be taken into consideration to restructure the debt portion of the capital cost of IPPs to minimise the Forex risk and lessen the debt repayment obligation. In view of the above, we request the Commission to review all the PPAs with IPPs.

Why APTransco is sympathetic to IPPs? 1. Wheeling charges: – APTRANSCO has requested the Commission to approve a wheeling charge of Rs 1. 00/ unit. – This is based on its expenditure for the year 2001 -02. – The actual expenditure for the year 2001 -02 is more than approved by the Commission, and the expenditure for the year 2002 -03 has further gone up. – It is not clear why APTRANSCO has preferred not to claim revised wheeling charge based on the revised expenditure. – Moreover, in the original proposals on wheeling charges APTRANSCO has not taken burden of cross subsidy into consideration.

Why APTransco is sympathetic to IPPs? 2. Fixed charge for GVK and Spectrum projects: – APTRANSCO has stated that it is adopting the existing fixed cost level of Rs 195 crore for GVK project and Rs 183 crore for the Spectrum project for the ensuing year also. – This is in view of the revised proposals submitted by the IPPs to the CEA for the fixed cost revision. – If the revised fixed cost is not approved by the CEA, this will result in higher payments to the. IPPs in the form of interest on these additional amounts paid. 3. Incentive payments to the Lanco project: – APTransco has paid an amount of Rs 0. 40 crore as incentive to the Lanco for the units produced with fuel Naphtha. – What is the need to pay incentives when energy is produced with alternate fuel?

Investments and Growing interest Burden • Interest payments approved by APERC for the year 2001 -02…… Rs 470 crore. • Revised estimate of interest payments for the year 2001 -02…… Rs 495 Crore. • Interest payment projected for the year 2002 -03…………Rs 730 Crore. • From the above it is clear that the burden of interest is growing year after year on APTRANSCO.

Investments and Growing interest Burden • We feel this burden is due to the investments made by the APTRANSCO which are not prudent. For Ex: For the year 2002 -03 APTRANSCO has proposed the following investments: – On BPL Transmission Scheme…………. . Rs 50 crore. – On Krishnapatnam Transmission scheme. . Rs 40 crore. – On SGP-I …………………Rs 50 crore – On SGP-II…………………Rs 20 crore.

Investments and Growing interest Burden • Among the above projects, – PPA with BPL has not been consented to by the Commission. – PPAs with Krishnapatnam and other SGP projects have not been approved by the Commission yet. – In light of the revised load forecasts, the need for above schemes is to be examined. • Also, in its strategy paper on Power, Govt. of AP claimed that Rs 890 Crore is requiered to reduce 1% technical loss.

Investments and Growing interest Burden • The reduction in power purchase cost due to the above is …………. . Rs. 80 crore. • However, the interest burden on the investments is(@16% rate of interest………. . . Rs 134 crore. • If investments are made in the name of system improvements, future capacity requirements etc, . . . without regard to returns from these investments…the entire system may collapse unable to recover the costs.

Investments and Growing interest Burden • Even in Orissa huge investments are made on Transmission and Distribution network, but failed to recover the costs leading to collapse of the entire system. • In view of the above, we request the Commission to review the entire investment of APTRANSCO and Discoms.

Gas allocation-avoidable burden • The discrimination shown in allocation of gas had adversely affected the finances of the Licensee and resulted in additional burden on the consumers. • Non-existing projects like GVK (extension), Konaseema, Vemagiri and Goutami have been recommended by the Govt. AP for allocation of gas and have subsequently been awarded firm allocation by the GOI. • On the other hand, existing plants like APGPCL, Lanco Kondapally do not have firm allocation to their full capacity, forcing them to depend on alternate fuel like Naphtha, resulting in higher variable cost. • The additional burden due to non-availability of gas to Lanco project is Rs 234 Crore from Lanco project alone.

Gas allocation-avoidable burden • Hence huge savings can be achieved if gas is allocated to the existing projects. • In light of the above, we request the Commission to direct the Govt of AP to recommend GOI to re -allocate gas to existing plants from non-existing plants which have already obtained gas allocation on firm basis. • In the event of firm allocation of gas to these existing projects based on Govt. recommendations, the PPAs may be revised to see that no incentives are paid for extra PLFs that are achieved with the availability of additional gas.

PPA with APGENCO • At present APGENCO is not allowed to get ROE, incentives and recover depreciation from the sale of energy to APTRANSCO. • It is stated that the above practice may be continued for the next year, except that the depreciation may be allowed to the extent of debt redemption obligations. • This is not in the interest of the APGENCO which is the best performing utility in the country. • For IPPs whose cost of supply of energy is much higher than the APGENCO are allowed to get all the above benefits.

PPA with APGENCO • Lanco project got an ‘incentive’ for producing energy at Rs 5. 93 / unit making mockery of the very word incentive. • On the other hand , APGENCO units which are achieving national awards for their performance are facing the threat of Closure/ backing down. • Hence, we request the Commission to put an end to this discriminatory treatment and allow the APGENCO to function on commercial lines. • A portion of variable cost from APGENCO units may be treated as Incentive to be included in the Fixed cost to protect the highly efficient APGENCO units from the threat of closure/ backing down.

Allow Returns to APTRANSCO and DISCOMS • APTransco and DISCOMS have not claimed any returns for their operations for the current and ensuing years. – APTransco/DISCOMS have claimed that they would forego returns with the intention to keep any tariff increases required to bridge the gap to minimum and unavoidable levels only. – It is not necessary for APTransco to play the role of the Govt. and forego legitimate claims on revenue requirements. – If govt. decides not to place any additional burden on the Consumers, it should compensate for the gap in the form of additional subsidy.

Allow Returns to APTRANSCO and DISCOMS – The purpose of Reforms is to run the Licensees on commercial lines. – This is also against the ESA, 1948 , which provides for the min. ROR of 3% on net fixed assets. – Even the performance of APTRANSCO and DISCOMS on revenue front is exceptional, taking the total revenue collections from about Rs 4800 crore to Rs 6226 crore in two years. – However the financial crises faced by the Licensees is due to the factors which are beyond its control and lie with the “ Reform” program initiated by the Govt. of AP. – Hence, Licensees should be allowed to get Returns.

Some important Issues 1. Government subsidy: The Commission in its Tariff Order for 2001 -02 directed the Govt of AP, to provide subsidy to the DISCOMS directly in view of the proposed Privatisation of distribution to avoid cash flow problems to the future private companies. However, in view of the experience of Orissa, where the private Distribution companies defaulting payment to the Gridco, it is interest of the Consumers to route the Govt subsidy through the APTRANSCO.

Some important Issues 2. Variable cost of RTS of APGENCO and NPTC’s Ramagundam station: – It is not clear how the variable cost of NTPC’s Ramagundam station is Rs 1. 49/ unit where as the variable cost of RTS of APGENCO is only Rs 1. 02/ unit, since both the stations are located in the same region. – Moreover, NTPC’s station is large in capacity which should have resulted in lowering of variable cost.

Some important Issues 3. The Commission has imposed ban on third party sales to protect the interests of the consumers. – – The purpose of the above ban is to prevent the subsidizing sections from leaving the APTRANSCO’s fold. It is strange that APTRANSCO has projected cost of supply from LVS power at Rs 9. 74/ Unit for the current year, and it proposes to pay an amount of Rs 35 Crore towards fixed charges without purchasing a single unit from the MPP. Thus the purpose of imposing the ban got defeated, and is only helping the private parties. We request the Commission to see that the decision to ban third party sales will not harm the interests of the Licensee and the consumers.

Some important Issues 4. MOAs with Financial Institutions: – – – The contents of the MOAs signed by the Govt of AP and APTRANSCO with the financial institutions in favour of Gas based projects are not made public. It is not clear whether the APTRANSCO has taken approval from the Commission to sign the above MOAs. It was admitted by the CMD/APTRANSCO in one of the public hearings conducted by the Commission that the MOAs allowed for the third party sales outside state, and he also stated that the above matter is not within the jurisdiction of the APERC as the sales are outside the state.

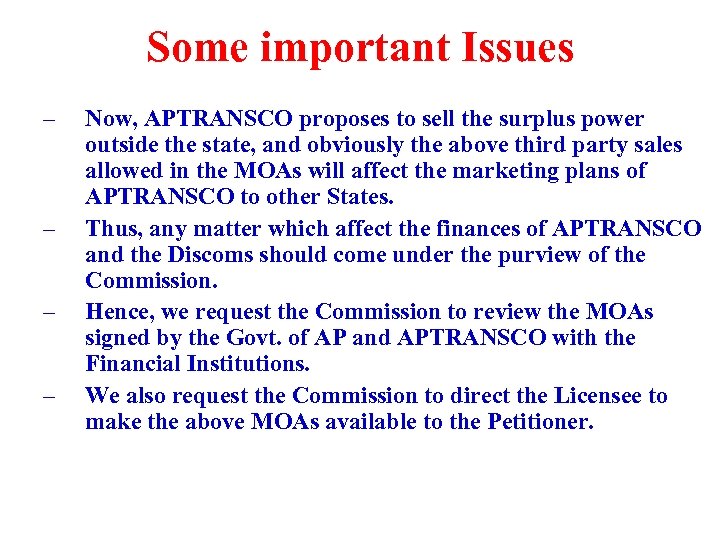

Some important Issues – – Now, APTRANSCO proposes to sell the surplus power outside the state, and obviously the above third party sales allowed in the MOAs will affect the marketing plans of APTRANSCO to other States. Thus, any matter which affect the finances of APTRANSCO and the Discoms should come under the purview of the Commission. Hence, we request the Commission to review the MOAs signed by the Govt. of AP and APTRANSCO with the Financial Institutions. We also request the Commission to direct the Licensee to make the above MOAs available to the Petitioner.

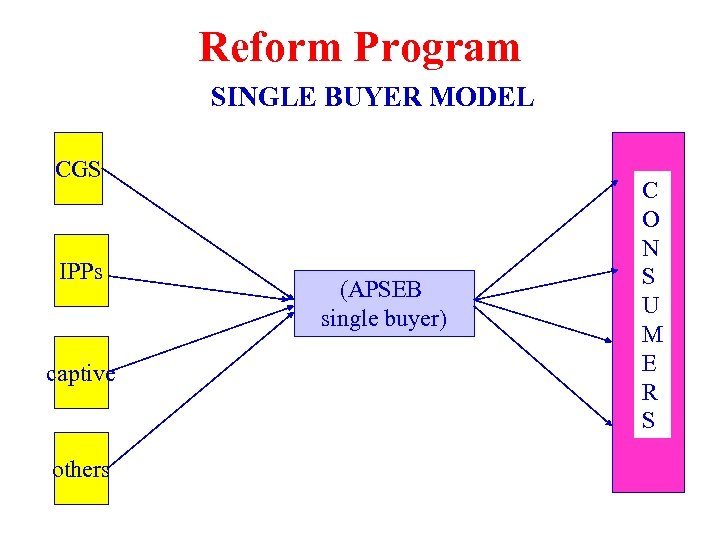

Reform Program SINGLE BUYER MODEL CGS IPPs captive others (APSEB single buyer) C O N S U M E R S

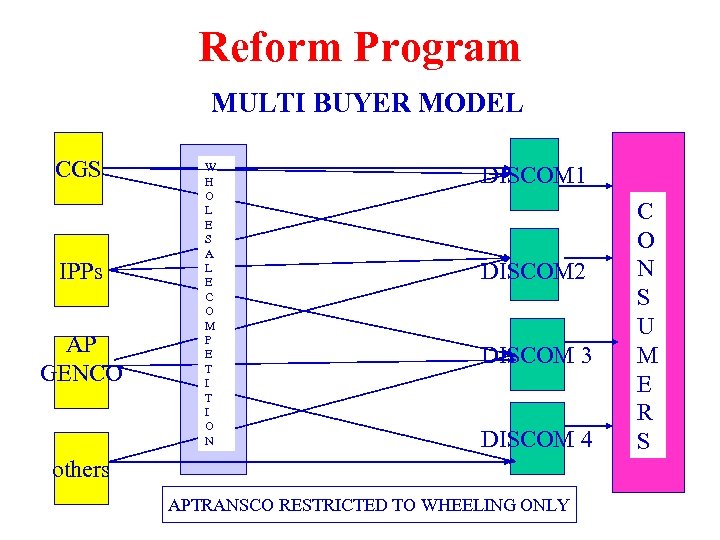

Reform Program MULTI BUYER MODEL CGS IPPs AP GENCO W H O L E S A L E C O M P E T I O N DISCOM 1 DISCOM 2 DISCOM 3 DISCOM 4 others APTRANSCO RESTRICTED TO WHEELING ONLY C O N S U M E R S

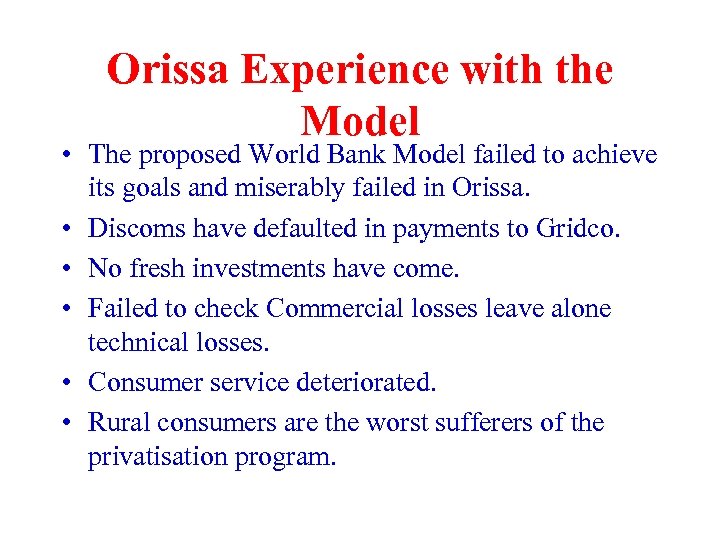

Orissa Experience with the Model • The proposed World Bank Model failed to achieve its goals and miserably failed in Orissa. • Discoms have defaulted in payments to Gridco. • No fresh investments have come. • Failed to check Commercial losses leave alone technical losses. • Consumer service deteriorated. • Rural consumers are the worst sufferers of the privatisation program.

Orissa Experience with the Model • Competition remained a myth. • Distribution companies tried to hide their profits and actual reduction of losses. • Benefits of efficiency improvements have not percolated to the consumers. • Private Discoms inflated their costs. For ex: cost of Earth rod which was about Rs 400/- prior to reforms was inflated to Rs 40000/- after reforms. (MPSEB Engineers’ Association Report).

Orissa Experience with the Model • In the absence of real competition and effective check from civil society institutions and consumers, private companies exploited the consumers.

Whither Andhra Pradesh Power Sector? • Go. AP in its strategy paper on Power, has stated that it will privatise atleast one distribution company during 2002 -03. • If the Govt. goes ahead with the privatisation policy, the power sector of AP will get into much bigger crises. • In view of the above, we request the Commission to recommend to the Govt. of AP to review the entire reform process, and make amends wherever necessary.

Prayer to the Commission We request the Commission to: 1. To review the Merit Order Operations. 2. To consider all the factors which will increase the revenue gap, and direct the Govt. to compensate APTRANSCO/DISCOMS with suitable subsidy. 3. To review all the existing PPAs with the IPPs. 4. To review the investments that are being made as part of the Reform Program. 5. To review the MOAs signed by the Govt. of AP and APTRANSCO with the Financial Institutions. 6. Not to discriminate APGENCO and allow returns to APTRANSCO and DISCOMS. 7. To recommend to the Govt. of AP to review the entire reform program and make suitable amends wherever necessary.

Thank you APSEB Engineers’ Association

7da8029b6ec4aaf3bf7ceeaf851c481e.ppt