O E P A I M N C S COMPANIES

O E P A I M N C S COMPANIES

Limited Companies Aim: § Identify the characteristics of a Limited Companies Objectives: § Define the two types of Limited Companies § Give examples of types of Limited Companies § Explain 3 advantages of a Limited Companies § Explain 3 disadvantages of a Limited Companies

Limited Companies Aim: § Identify the characteristics of a Limited Companies Objectives: § Define the two types of Limited Companies § Give examples of types of Limited Companies § Explain 3 advantages of a Limited Companies § Explain 3 disadvantages of a Limited Companies

Limited Companies l l l A limited company has a separate legal identity to that of its owners. The owners of the company (the shareholders) have Limited Liability If the company goes bankrupt then the owners only lose the money that they have invested in the business (the value of their shares) and will not be forced to sell off their own personal assets

Limited Companies l l l A limited company has a separate legal identity to that of its owners. The owners of the company (the shareholders) have Limited Liability If the company goes bankrupt then the owners only lose the money that they have invested in the business (the value of their shares) and will not be forced to sell off their own personal assets

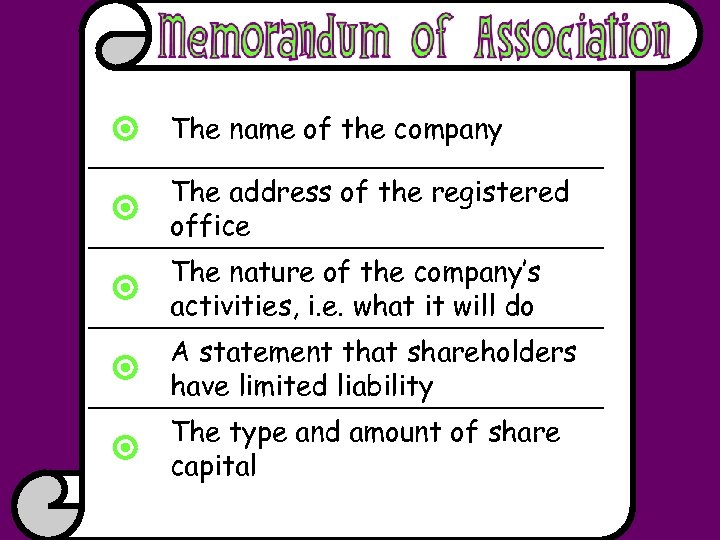

You need 2 documents • The Memorandum of Association • The Articles of Association

You need 2 documents • The Memorandum of Association • The Articles of Association

The name of the company The address of the registered office The nature of the company’s activities, i. e. what it will do A statement that shareholders have limited liability The type and amount of share capital

The name of the company The address of the registered office The nature of the company’s activities, i. e. what it will do A statement that shareholders have limited liability The type and amount of share capital

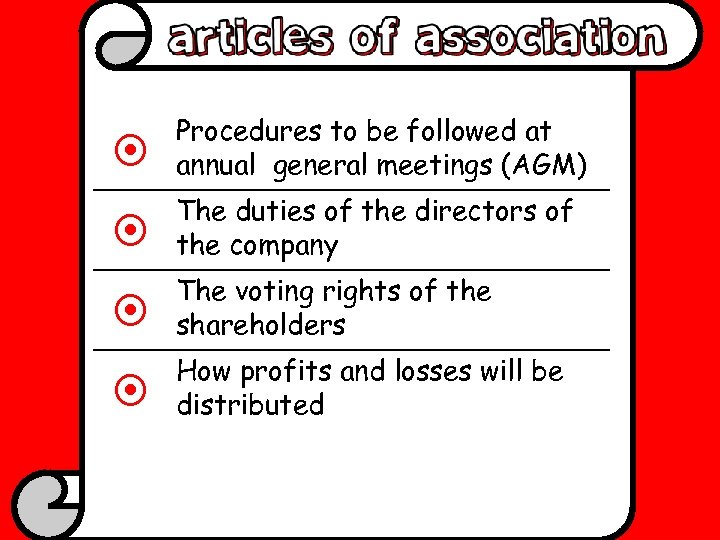

Procedures to be followed at annual general meetings (AGM) The duties of the directors of the company The voting rights of the shareholders How profits and losses will be distributed

Procedures to be followed at annual general meetings (AGM) The duties of the directors of the company The voting rights of the shareholders How profits and losses will be distributed

• These 2 documents have to be sent of to The Registrar of Companies at “Companies House” in Cardiff • A CERTIFICATE OF INCORPORATION can then be issued – this is the company’s birth certificate!!!

• These 2 documents have to be sent of to The Registrar of Companies at “Companies House” in Cardiff • A CERTIFICATE OF INCORPORATION can then be issued – this is the company’s birth certificate!!!

Limited Companies Private Limited Companies (LTD) Public Limited Companies (PLC) Very different from sole traders and partnerships

Limited Companies Private Limited Companies (LTD) Public Limited Companies (PLC) Very different from sole traders and partnerships

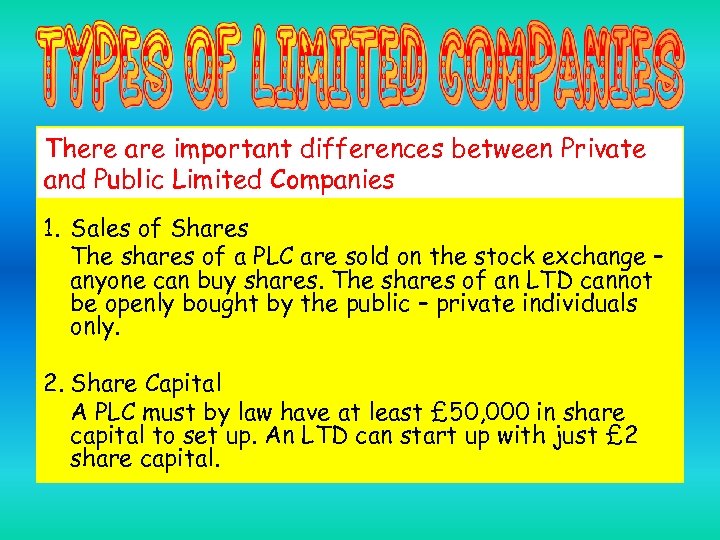

There are important differences between Private and Public Limited Companies 1. Sales of Shares The shares of a PLC are sold on the stock exchange – anyone can buy shares. The shares of an LTD cannot be openly bought by the public – private individuals only. 2. Share Capital A PLC must by law have at least £ 50, 000 in share capital to set up. An LTD can start up with just £ 2 share capital.

There are important differences between Private and Public Limited Companies 1. Sales of Shares The shares of a PLC are sold on the stock exchange – anyone can buy shares. The shares of an LTD cannot be openly bought by the public – private individuals only. 2. Share Capital A PLC must by law have at least £ 50, 000 in share capital to set up. An LTD can start up with just £ 2 share capital.

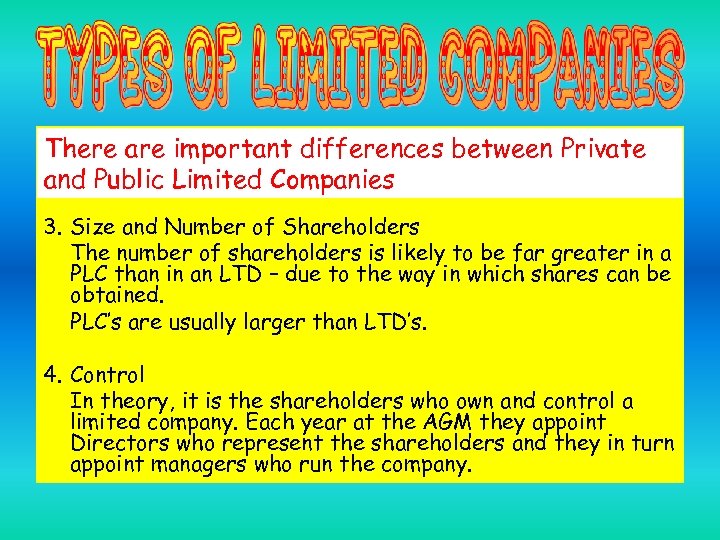

There are important differences between Private and Public Limited Companies 3. Size and Number of Shareholders The number of shareholders is likely to be far greater in a PLC than in an LTD – due to the way in which shares can be obtained. PLC’s are usually larger than LTD’s. 4. Control In theory, it is the shareholders who own and control a limited company. Each year at the AGM they appoint Directors who represent the shareholders and they in turn appoint managers who run the company.

There are important differences between Private and Public Limited Companies 3. Size and Number of Shareholders The number of shareholders is likely to be far greater in a PLC than in an LTD – due to the way in which shares can be obtained. PLC’s are usually larger than LTD’s. 4. Control In theory, it is the shareholders who own and control a limited company. Each year at the AGM they appoint Directors who represent the shareholders and they in turn appoint managers who run the company.

• In a limited co, directors are elected by shareholders at AGM • But in practice what shareholders want, what directors want, and what the managers decide to do might be different. • In a PLC the shareholders might not know the directors, managers, etc.

• In a limited co, directors are elected by shareholders at AGM • But in practice what shareholders want, what directors want, and what the managers decide to do might be different. • In a PLC the shareholders might not know the directors, managers, etc.

Shareholders (owners) Board of Directors (responsible to owners) Managers (day to day running of the business)

Shareholders (owners) Board of Directors (responsible to owners) Managers (day to day running of the business)

FITNESS FIRST LTD ALLIANCE BOOTS LTD NTL (CWC) LTD BRITISH HOME STORES LTD SPECSAVERS LTD SOMERFIELD LTD JOHN LEWIS PARTNERSHIP LTD COCO COLA COMPANY LTD NEW LOOK LTD PEACOCKS GROUP LTD WALKERS SNACK FOODS LTD ICELAND GROUP LTD MOONSOON ACCESSORIZE LTD MANCHESTER UNITED LTD UNITED BISCUITS (HOLDINGS) LTD

FITNESS FIRST LTD ALLIANCE BOOTS LTD NTL (CWC) LTD BRITISH HOME STORES LTD SPECSAVERS LTD SOMERFIELD LTD JOHN LEWIS PARTNERSHIP LTD COCO COLA COMPANY LTD NEW LOOK LTD PEACOCKS GROUP LTD WALKERS SNACK FOODS LTD ICELAND GROUP LTD MOONSOON ACCESSORIZE LTD MANCHESTER UNITED LTD UNITED BISCUITS (HOLDINGS) LTD

• • • Can get money by selling shares Firm is bigger Shareholders have limited liability Can employ specialists Control of the company cannot be lost to outsiders • Death/illness does not affect the company

• • • Can get money by selling shares Firm is bigger Shareholders have limited liability Can employ specialists Control of the company cannot be lost to outsiders • Death/illness does not affect the company

• • • Very expensive to set up Accounts are not private Shares can’t be sold on the stock market Incorporates – must be a separate legal company Profits have to be shared amongst all the shareholders > DIVIDENDS Not all decisions are made by managers

• • • Very expensive to set up Accounts are not private Shares can’t be sold on the stock market Incorporates – must be a separate legal company Profits have to be shared amongst all the shareholders > DIVIDENDS Not all decisions are made by managers

CADBURY PLC WETHERSPOON J. D. PLC LAURA ASHLEY PLC SAINSBURY(J) PLC COFFEE REPUBLIC PLC MARKS & SPENCER GROUP PLC CABLE & WIRELESS PLC

CADBURY PLC WETHERSPOON J. D. PLC LAURA ASHLEY PLC SAINSBURY(J) PLC COFFEE REPUBLIC PLC MARKS & SPENCER GROUP PLC CABLE & WIRELESS PLC

• Can get money by selling shares to the general public • Firm is big – easier to negotiate with suppliers • Shareholders have limited liability • Can employ specialists • Death/illness does not affect the company • Shares can be given to workers to motivate them

• Can get money by selling shares to the general public • Firm is big – easier to negotiate with suppliers • Shareholders have limited liability • Can employ specialists • Death/illness does not affect the company • Shares can be given to workers to motivate them

• • • Firms can be taken-over Accounts are not private Incorporates – must be a separate legal company Expensive to set up Have to share profits > by paying DIVIDENDS Not all decisions are made by owners

• • • Firms can be taken-over Accounts are not private Incorporates – must be a separate legal company Expensive to set up Have to share profits > by paying DIVIDENDS Not all decisions are made by owners

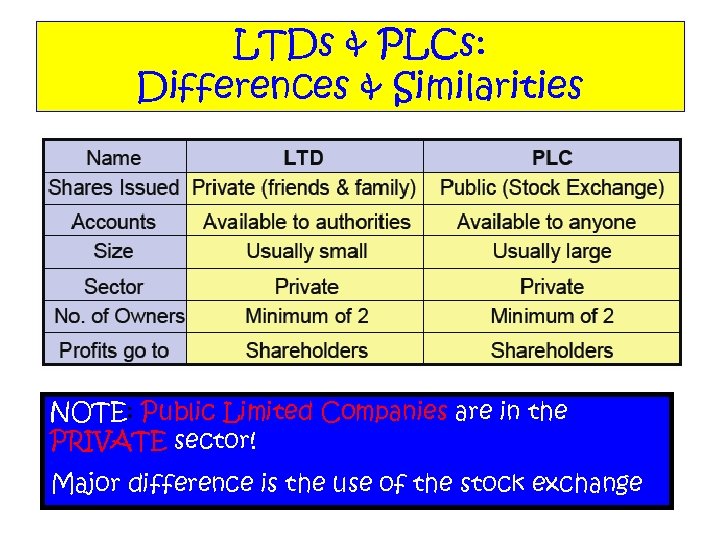

LTDs & PLCs: Differences & Similarities NOTE: Public Limited Companies are in the PRIVATE sector! Major difference is the use of the stock exchange

LTDs & PLCs: Differences & Similarities NOTE: Public Limited Companies are in the PRIVATE sector! Major difference is the use of the stock exchange

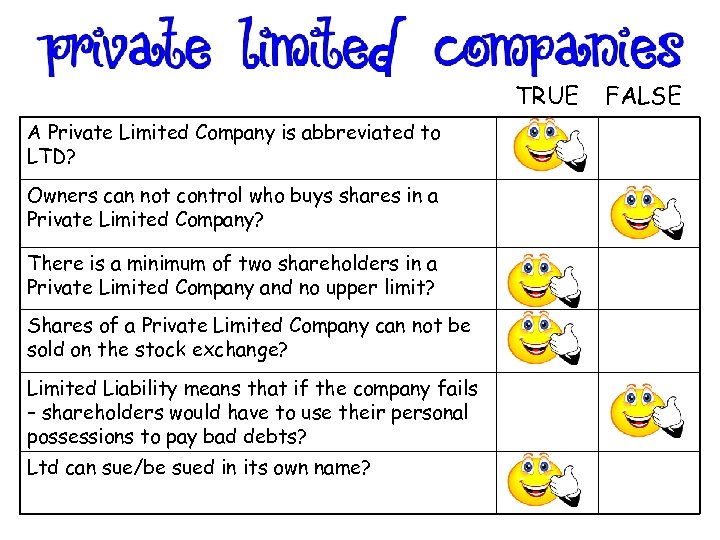

TRUE A Private Limited Company is abbreviated to LTD? Owners can not control who buys shares in a Private Limited Company? There is a minimum of two shareholders in a Private Limited Company and no upper limit? Shares of a Private Limited Company can not be sold on the stock exchange? Limited Liability means that if the company fails – shareholders would have to use their personal possessions to pay bad debts? Ltd can sue/be sued in its own name? FALSE

TRUE A Private Limited Company is abbreviated to LTD? Owners can not control who buys shares in a Private Limited Company? There is a minimum of two shareholders in a Private Limited Company and no upper limit? Shares of a Private Limited Company can not be sold on the stock exchange? Limited Liability means that if the company fails – shareholders would have to use their personal possessions to pay bad debts? Ltd can sue/be sued in its own name? FALSE

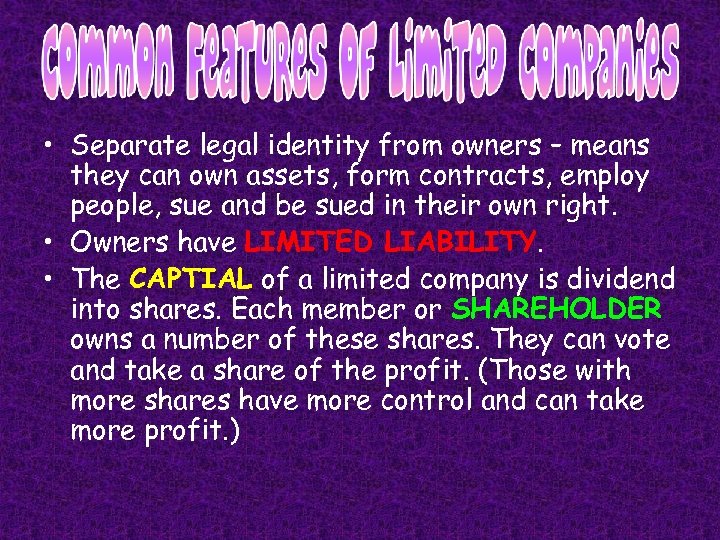

• Separate legal identity from owners – means they can own assets, form contracts, employ people, sue and be sued in their own right. • Owners have LIMITED LIABILITY. • The CAPTIAL of a limited company is dividend into shares. Each member or SHAREHOLDER owns a number of these shares. They can vote and take a share of the profit. (Those with more shares have more control and can take more profit. )

• Separate legal identity from owners – means they can own assets, form contracts, employ people, sue and be sued in their own right. • Owners have LIMITED LIABILITY. • The CAPTIAL of a limited company is dividend into shares. Each member or SHAREHOLDER owns a number of these shares. They can vote and take a share of the profit. (Those with more shares have more control and can take more profit. )

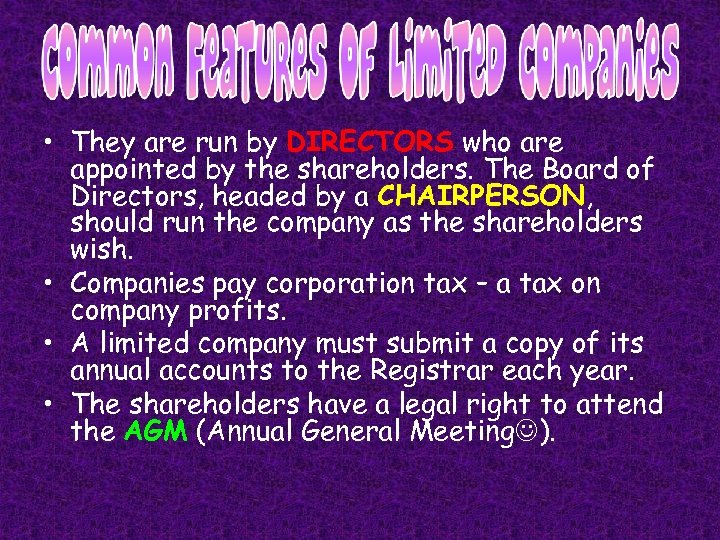

• They are run by DIRECTORS who are appointed by the shareholders. The Board of Directors, headed by a CHAIRPERSON, should run the company as the shareholders wish. • Companies pay corporation tax – a tax on company profits. • A limited company must submit a copy of its annual accounts to the Registrar each year. • The shareholders have a legal right to attend the AGM (Annual General Meeting ).

• They are run by DIRECTORS who are appointed by the shareholders. The Board of Directors, headed by a CHAIRPERSON, should run the company as the shareholders wish. • Companies pay corporation tax – a tax on company profits. • A limited company must submit a copy of its annual accounts to the Registrar each year. • The shareholders have a legal right to attend the AGM (Annual General Meeting ).

Essay: “Compare and contrast the different types of business ownership in the UK” Include the following: SOLE TRADERS - advantages and disadvantages PARTNERSHIPS - advantages and disadvantages PRIVATE Limited Companies - advantages and disadvantages PUBLIC Limited Companies - advantages and disadvantages Also state which businesses have unlimited liability and which have limited liability.

Essay: “Compare and contrast the different types of business ownership in the UK” Include the following: SOLE TRADERS - advantages and disadvantages PARTNERSHIPS - advantages and disadvantages PRIVATE Limited Companies - advantages and disadvantages PUBLIC Limited Companies - advantages and disadvantages Also state which businesses have unlimited liability and which have limited liability.

Answer the questions in FULL SENTENCES – look at the marks allocated to each question and use this as a guide as to how much detail needs to go into your answers.

Answer the questions in FULL SENTENCES – look at the marks allocated to each question and use this as a guide as to how much detail needs to go into your answers.

Unit 2 CLASSWORK ASSESSMENT TASK Peer Assessment GUIDANCE and ANSWER SHEET

Unit 2 CLASSWORK ASSESSMENT TASK Peer Assessment GUIDANCE and ANSWER SHEET

Question 1 A) Ownership – PLC …. shareholders Sole Trader … 1 individual B) Finance – PLC …sell shares to raise capital Sole Trader …Own Finance/Loans C) Profits – PLC … Goes to shareholders (Dividend ) Sole Trader …. Goes to 1 OWNER ONLY

Question 1 A) Ownership – PLC …. shareholders Sole Trader … 1 individual B) Finance – PLC …sell shares to raise capital Sole Trader …Own Finance/Loans C) Profits – PLC … Goes to shareholders (Dividend ) Sole Trader …. Goes to 1 OWNER ONLY

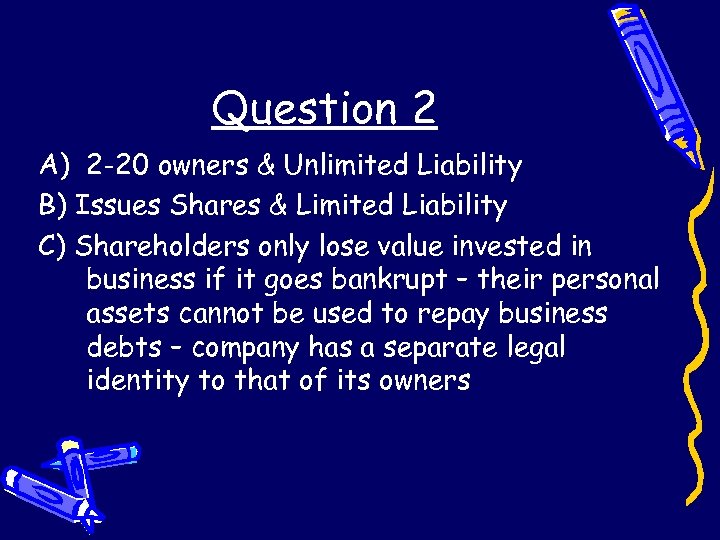

Question 2 A) 2 -20 owners & Unlimited Liability B) Issues Shares & Limited Liability C) Shareholders only lose value invested in business if it goes bankrupt – their personal assets cannot be used to repay business debts – company has a separate legal identity to that of its owners

Question 2 A) 2 -20 owners & Unlimited Liability B) Issues Shares & Limited Liability C) Shareholders only lose value invested in business if it goes bankrupt – their personal assets cannot be used to repay business debts – company has a separate legal identity to that of its owners

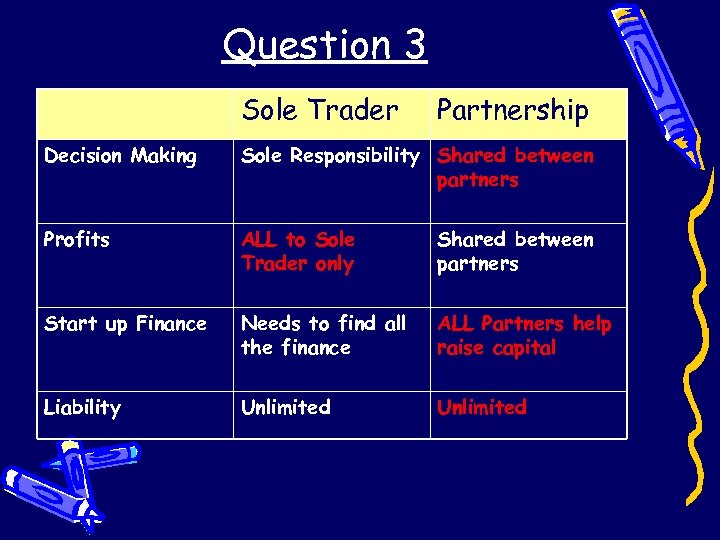

Question 3 Sole Trader Partnership Decision Making Sole Responsibility Shared between partners Profits ALL to Sole Trader only Shared between partners Start up Finance Needs to find all the finance ALL Partners help raise capital Liability Unlimited

Question 3 Sole Trader Partnership Decision Making Sole Responsibility Shared between partners Profits ALL to Sole Trader only Shared between partners Start up Finance Needs to find all the finance ALL Partners help raise capital Liability Unlimited

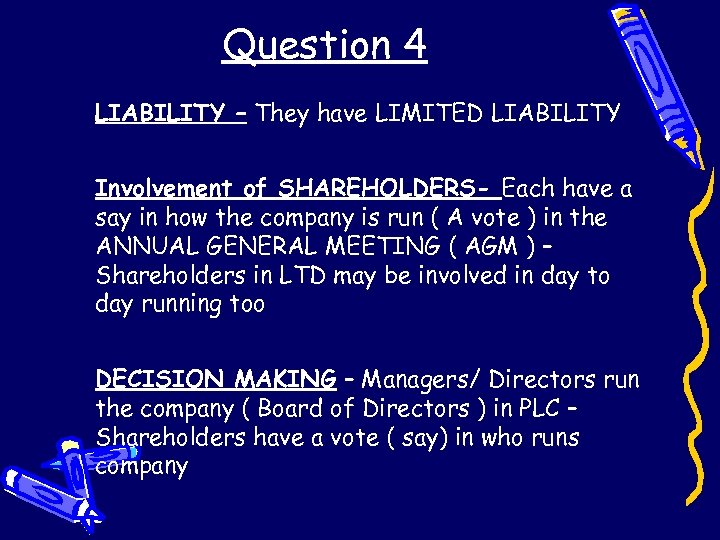

Question 4 LIABILITY – They have LIMITED LIABILITY Involvement of SHAREHOLDERS- Each have a say in how the company is run ( A vote ) in the ANNUAL GENERAL MEETING ( AGM ) – Shareholders in LTD may be involved in day to day running too DECISION MAKING – Managers/ Directors run the company ( Board of Directors ) in PLC – Shareholders have a vote ( say) in who runs company

Question 4 LIABILITY – They have LIMITED LIABILITY Involvement of SHAREHOLDERS- Each have a say in how the company is run ( A vote ) in the ANNUAL GENERAL MEETING ( AGM ) – Shareholders in LTD may be involved in day to day running too DECISION MAKING – Managers/ Directors run the company ( Board of Directors ) in PLC – Shareholders have a vote ( say) in who runs company