0debec26dbe3c7cf035e9c028d107db2.ppt

- Количество слайдов: 14

NS 4053 Spring Term 2017 Balanced/Unbalanced Growth

Balanced/Unbalanced Growth I • Many contemporary disputes repeat themes from midtwentieth-century debates, balanced growth versus unbalanced growth • Sometimes the debate is semantic – what is balance? • Rigid formula with all sectors growing at same rate? • More flexible that some attention be given to all major sectors? • Other issues in the debates • What are the relative merits of strategies of gradualism vs. a big push? • Is capital or entrepreneurship the major limitation to growth? 2

Balanced/Unbalanced Growth II • Balanced growth • Synchronized application of capital to a wide range of different industries • One way of escaping from the vicious circle of poverty • Early theories were pessimistic about exports, so usually applied to sectors of the domestic economy • Big Push Thesis • Advocates of synchronized application of capital to all major sectors support the big push thesis • Argue a strategy of gradualism is domed failure • Substantial effort is essential to overcome the inertia inherent in a stagnant economy • Analogy to a car being stuck in snow – will not move with a gradually increasing push – needs a big push • Led Tony Blair to call for a big, big push forward in Africa 3

Balanced/Unbalanced Growth III • • • Early versions based on idea that the factors that contribute to growth like demand investment in infrastructure do not increase smoothly, but are subject to sizable jumps or indivisibilities Indivisibilities result from flaws created in investment market by external economies Cost advantages rendered free by one producer to another These benefits spill over to society as a whole or to some member of it rather than the investor concerned. Example – increased production from investment in the steel industry will benefit other industries as well • Greater output stimulates demand for iron, coal and transport • Lower costs may make vehicles and aluminum cheaper • • • Other industries may benefit later by hiring laborers who acquired skills in the mills Thus the social profitability of this investment exceeds its private profitability – Unless government intervenes, total private investment will be too 4 low

Balanced/Unbalanced Growth III • Indivisibility in Infrastructure: • Need whole system – cannot increase incrementally • • Can’t build a smaller Aswan Dam or shorter Monterrey-Mexico City telegraph line Indivisibility in demand • Arises from the interdependence of investment decisions Prospective investors uncertain whether output from project will find a market • The workers in an individual project will not buy all of that product • However investment in a wide variety of industries will create enough purchasing power to buy the available increase in supply • Return on individual project may be 5% with high uncertainty. • Investment on a broad front increased return to 15% with greater certainty • What is not true for the individual factory is true for the complementary system of many enterprises • The new producers are each other’s customers and create additional markets through increased incomes • Complementary demand reduces risk of not finding a market increases incentive to invest 5

Balanced/Unbalanced Growth IV • Possible Examples • Situations today where world trade is costly – landlocked countries like Bolivia • Domestic agriculture or exports may not be sufficient for industrialization • So economies need large domestic markets • Historic examples: • Colombia’s tobacco export boom failed to lead to widespread economic development as incomes went to a few plantation owners who spent on luxury imorts • Later from 1880 -1915 boom in coffee exports, grown on small family enterprises benefited large numbers who demanded domestic manufacturers • For industrialization, incomes from the leading sector must be broadly distributed, providing demand for manufacturing. 6

Balanced/Unbalanced Growth V • Critique Balanced Growth • Advocated of balanced growth emphasize a varied package of industrial investment often at the expense of investment in agriculture • Comparative advantage suggests that a country cannot grow rapidly if it fails to specialize where production is most efficient • Recent experience of developing countries suggests they cannot neglect agricultural investment if they are: • to feed their populations, • supply industrial inputs and • earn foreign currency 7

Balanced/Unbalanced Growth VI • Critique Balanced Growth cont. : • Infrastructure is not as indivisible as advocates imply. • Roads, rivers, canals, or air traffic can substitute for railroads • Roads my be dirt, graveled or paved and various widths • Power plants can differ greatly in size. Controversy in Iraq over state of art power grids or small generators • Large infrasture facilities, although perhaps economical at high leves of development are not essential for growth • Resources required for carrying out strategy vast • If country had these resources, probably wouldn’t be undeveloped • Where will country obtain the capital, skilled labor and materials needed for such an expansion • Although new industries may be complementary on the demand side, they are competitors for limited resources on 8 the supply side.

Balanced/Unbalanced Growth VII • Advocates of balanced growth often assume the country starts from scratch • In reality every country starts from a position that reflects previous investment decisions • Thus at any time there are highly desirable investment programs that are not balanced in themselves but are well integrated with existing capital imbalances • The strategy was tarnished by the widespread evidence that developing countries have grown rapidly without any attempt at massive investments in the wide range of industries that advocates considered essential 9

Balanced/Unbalanced Growth VIII • Hirschman’s strategy of imbalance • Part of economic strategy for Iraqi reconstruction • Idea that unbalanced investment to complement existing imbalances. • He contends that deliberately unbalancing the economy, in line with a predesigned strategy is the best path for growth • Argues that the big push thesis may make interesting reading for economists, but most countries don’t have the skills or resources needed to launch such a massive effort • The major shortage in most developing countries is not the supply of savings but the decision to invest by entrepreneurs, the risk takers and decision makers • Hirschman believes poor countries need a development strategy that spurs investment decisions. • He suggests that because resources and abilities are limited, a big push is sensible only in strategically selected industries 10

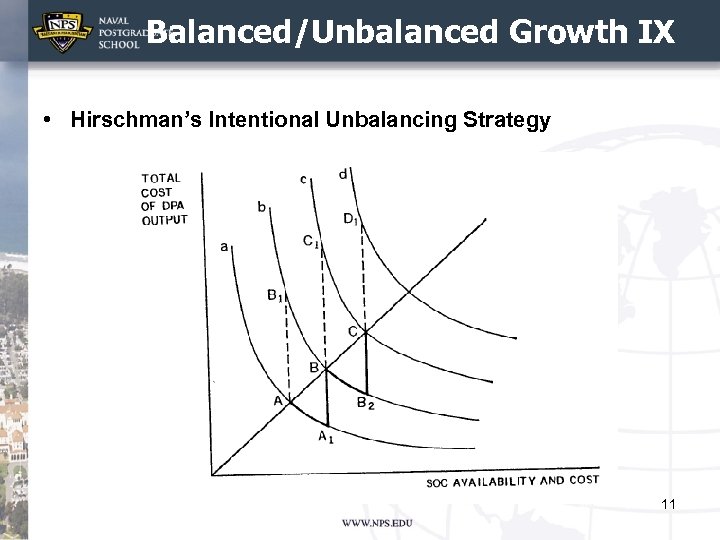

Balanced/Unbalanced Growth IX • Hirschman’s Intentional Unbalancing Strategy 11

Balanced/Unbalanced Growth X • Growth then spreads from one sector to another – similar to Rostow’s concept of leading and following sectors • While Unbalanced Growth advocates usually stress the advantages of free markets, they often restrict this to areas outside of investment • Example – Profitability of projects a function of the order in which they are taken • Truck factory = return of 10% and steel factory 8% • If interest rate is 9% then invest in truck factory • Later as a result of this investment returns on the steel factory increase to 10% so investment then in that industry 12

Balanced/Unbalanced Growth XI • Or might get situation where: • Establishing a steel factory would increase the returns in the truck factory from 10% to 16% • Society would be better off investing in the steel sector first and the truck enterprise second rather than making independent decisions based on the market • Planners need to consider the interdependence of investment projects so that they maximize overall social profitability • Need to make the investment that spurs the greatest amount of new investment decisions • Investments should occur in industries that have the greatest linkages including backward and forward linkages 13

Balanced/Unbalanced Growth XII • Criticisms of unbalanced growth strategy • As in balanced growth case, many types of infrastructure – may be cheaper to have smaller projects utilized fully than large projects that are underutilized – white elephants • Assumes that there is a lack of decision making in the private sector, but that the government has no trouble in this regard • Japan grew through the reverse mechanism – entrepreneurs invested and then pressured the government to alleviate bottlenecks • However Mexico after the Revolution in the early 1900 s found government unbalancing accelerated growth • Often not as clear cut where the greatest shortage of decision making lies – public or private sectors. • Eventually both strategies lead to balance 14

0debec26dbe3c7cf035e9c028d107db2.ppt