d7ef0ab29e52d7f4e2db02757507818c.ppt

- Количество слайдов: 40

Nowcasting Israel GDP Gil Dafnai , Jonathan Sidi Research Department, Bank of Israel

Nowcasting Israel GDP Gil Dafnai , Jonathan Sidi Research Department, Bank of Israel

§ § § Motivation : GDP data is being published at a six week lag after the end of the relevant quarter (and it is needed sooner). However : There is a lot of monthly data that is available before the policy meetings. Therefore : We use real-time monthly data in order to Nowcast the GDP 3 weeks ahead of publication.

§ § § Motivation : GDP data is being published at a six week lag after the end of the relevant quarter (and it is needed sooner). However : There is a lot of monthly data that is available before the policy meetings. Therefore : We use real-time monthly data in order to Nowcast the GDP 3 weeks ahead of publication.

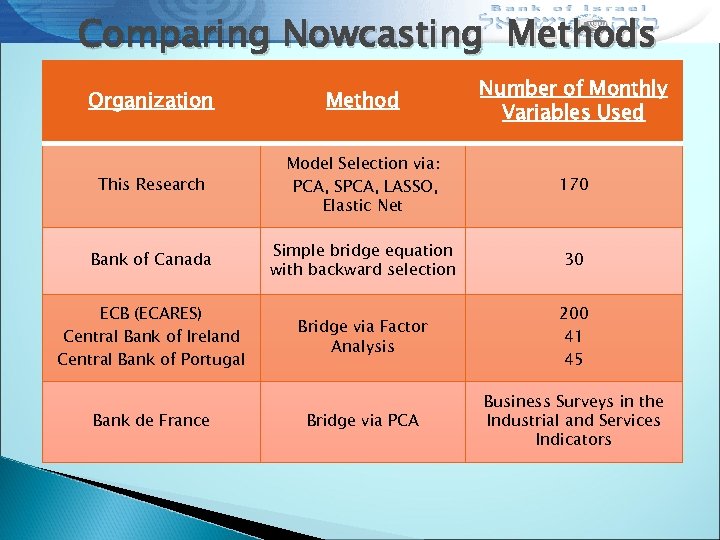

Comparing Nowcasting Methods Organization Method Number of Monthly Variables Used This Research Model Selection via: PCA, SPCA, LASSO, Elastic Net 170 Bank of Canada Simple bridge equation with backward selection 30 Bridge via Factor Analysis 200 41 45 Bridge via PCA Business Surveys in the Industrial and Services Indicators ECB (ECARES) Central Bank of Ireland Central Bank of Portugal Bank de France

Comparing Nowcasting Methods Organization Method Number of Monthly Variables Used This Research Model Selection via: PCA, SPCA, LASSO, Elastic Net 170 Bank of Canada Simple bridge equation with backward selection 30 Bridge via Factor Analysis 200 41 45 Bridge via PCA Business Surveys in the Industrial and Services Indicators ECB (ECARES) Central Bank of Ireland Central Bank of Portugal Bank de France

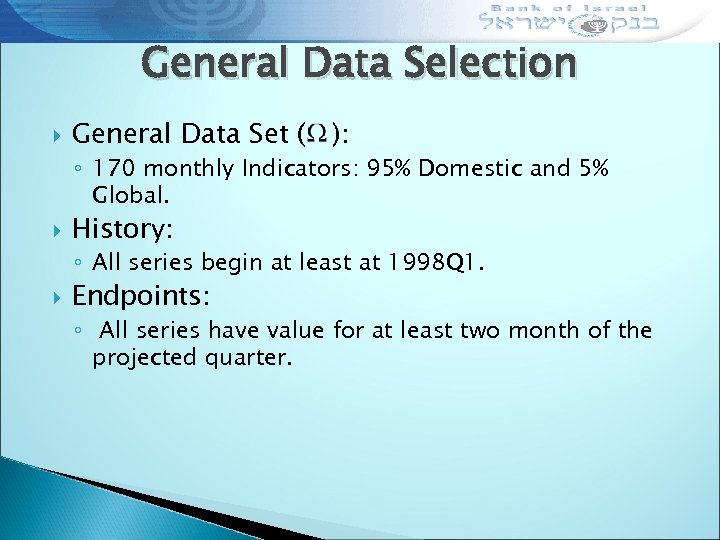

General Data Selection General Data Set ( ): ◦ 170 monthly Indicators: 95% Domestic and 5% Global. History: ◦ All series begin at least at 1998 Q 1. Endpoints: ◦ All series have value for at least two month of the projected quarter.

General Data Selection General Data Set ( ): ◦ 170 monthly Indicators: 95% Domestic and 5% Global. History: ◦ All series begin at least at 1998 Q 1. Endpoints: ◦ All series have value for at least two month of the projected quarter.

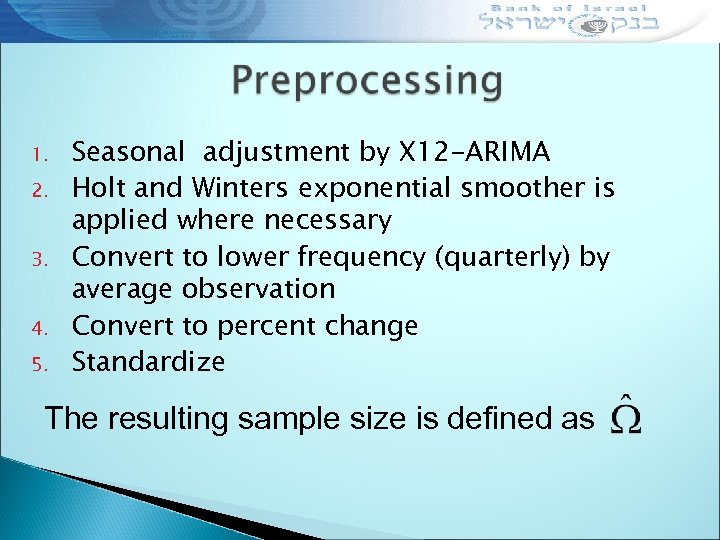

1. 2. 3. 4. 5. Seasonal adjustment by X 12 -ARIMA Holt and Winters exponential smoother is applied where necessary Convert to lower frequency (quarterly) by average observation Convert to percent change Standardize The resulting sample size is defined as

1. 2. 3. 4. 5. Seasonal adjustment by X 12 -ARIMA Holt and Winters exponential smoother is applied where necessary Convert to lower frequency (quarterly) by average observation Convert to percent change Standardize The resulting sample size is defined as

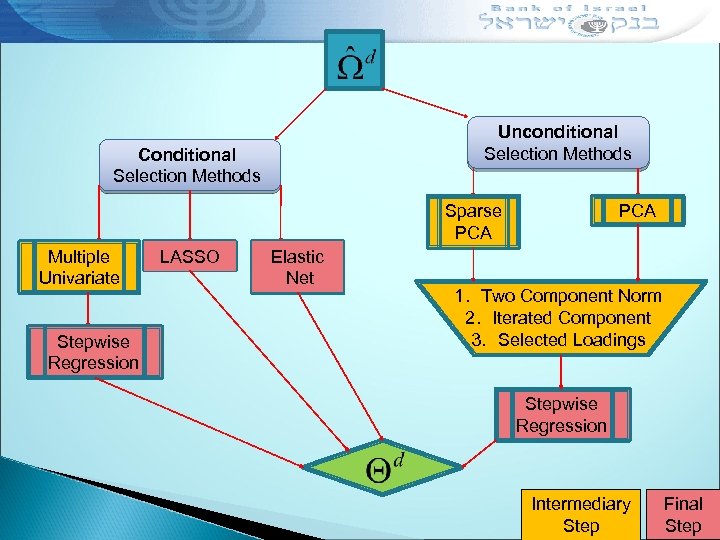

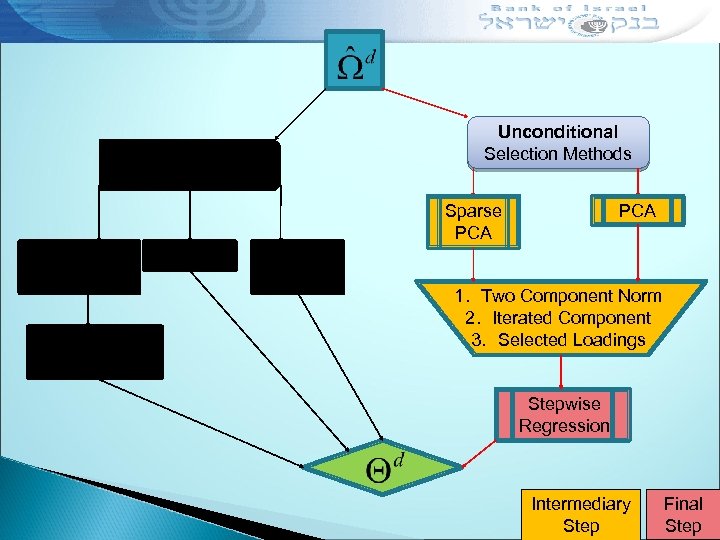

Unconditional Selection Methods Conditional Selection Methods Sparse PCA Multiple Univariate Stepwise Regression LASSO Elastic Net PCA 1. Two Component Norm 2. Iterated Component 3. Selected Loadings Stepwise Regression Intermediary Step Final Step

Unconditional Selection Methods Conditional Selection Methods Sparse PCA Multiple Univariate Stepwise Regression LASSO Elastic Net PCA 1. Two Component Norm 2. Iterated Component 3. Selected Loadings Stepwise Regression Intermediary Step Final Step

Multiple Univariate Regression Benchmark Method

Multiple Univariate Regression Benchmark Method

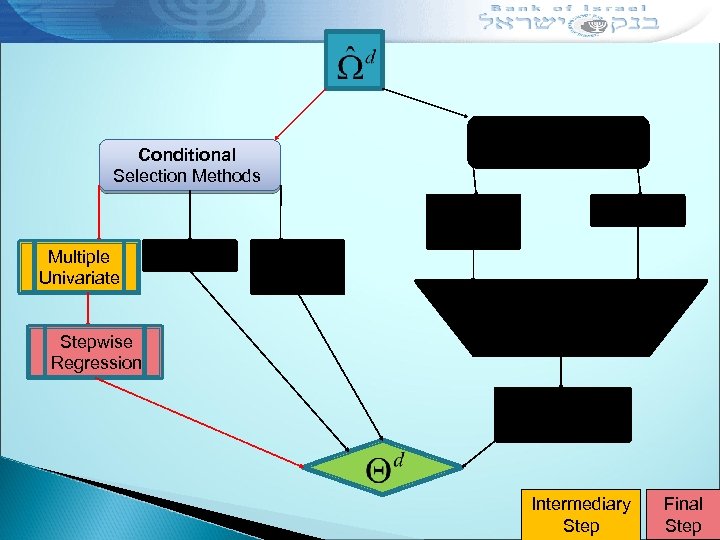

Unconditional Selection Methods Conditional Selection Methods Multiple Univariate LASSO Elastic Net Stepwise Regression Intermediary Step Final Step

Unconditional Selection Methods Conditional Selection Methods Multiple Univariate LASSO Elastic Net Stepwise Regression Intermediary Step Final Step

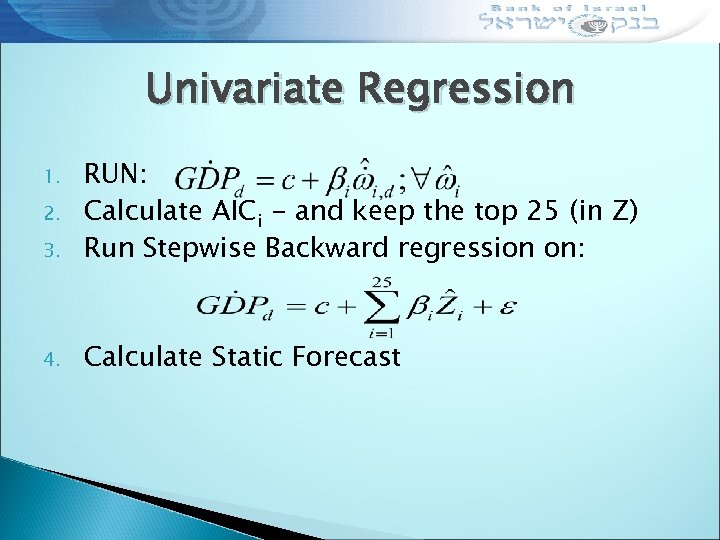

Univariate Regression 3. RUN: Calculate AICi - and keep the top 25 (in Z) Run Stepwise Backward regression on: 4. Calculate Static Forecast 1. 2.

Univariate Regression 3. RUN: Calculate AICi - and keep the top 25 (in Z) Run Stepwise Backward regression on: 4. Calculate Static Forecast 1. 2.

PCA and SPCA Unconditional Methods

PCA and SPCA Unconditional Methods

Unconditional Selection Methods Conditional Selection Methods Sparse PCA Multiple Univariate Stepwise Regression LASSO Elastic Net PCA 1. Two Component Norm 2. Iterated Component 3. Selected Loadings Stepwise Regression Intermediary Step Final Step

Unconditional Selection Methods Conditional Selection Methods Sparse PCA Multiple Univariate Stepwise Regression LASSO Elastic Net PCA 1. Two Component Norm 2. Iterated Component 3. Selected Loadings Stepwise Regression Intermediary Step Final Step

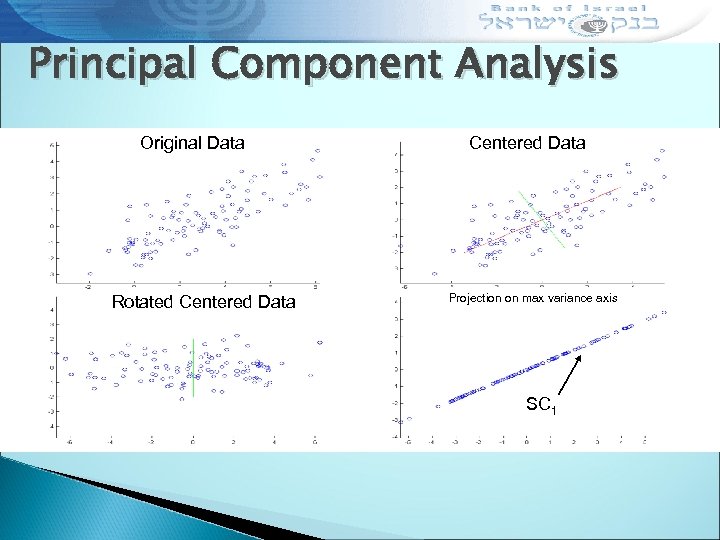

Principal Component Analysis Original Data Rotated Centered Data Projection on max variance axis SC 1

Principal Component Analysis Original Data Rotated Centered Data Projection on max variance axis SC 1

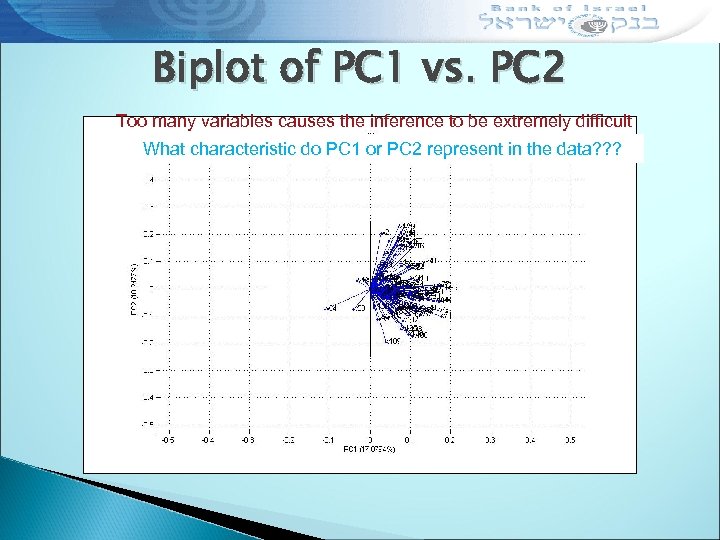

Biplot of PC 1 vs. PC 2 Too many variables causes the inference to be extremely difficult What characteristic do PC 1 or PC 2 represent in the data? ? ?

Biplot of PC 1 vs. PC 2 Too many variables causes the inference to be extremely difficult What characteristic do PC 1 or PC 2 represent in the data? ? ?

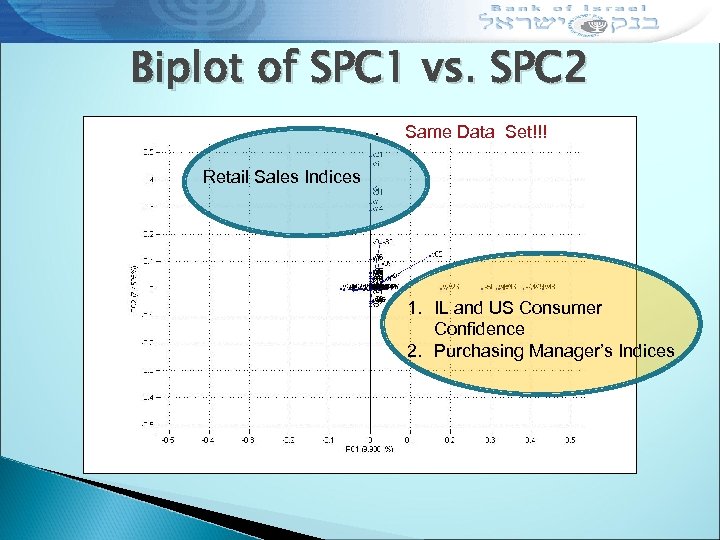

Biplot of SPC 1 vs. SPC 2 Same Data Set!!! Retail Sales Indices 1. IL and US Consumer Confidence 2. Purchasing Manager’s Indices

Biplot of SPC 1 vs. SPC 2 Same Data Set!!! Retail Sales Indices 1. IL and US Consumer Confidence 2. Purchasing Manager’s Indices

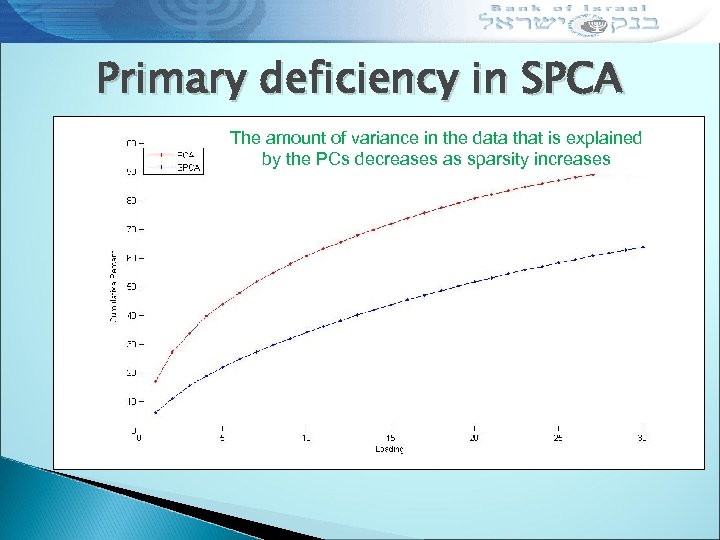

Primary deficiency in SPCA The amount of variance in the data that is explained by the PCs decreases as sparsity increases

Primary deficiency in SPCA The amount of variance in the data that is explained by the PCs decreases as sparsity increases

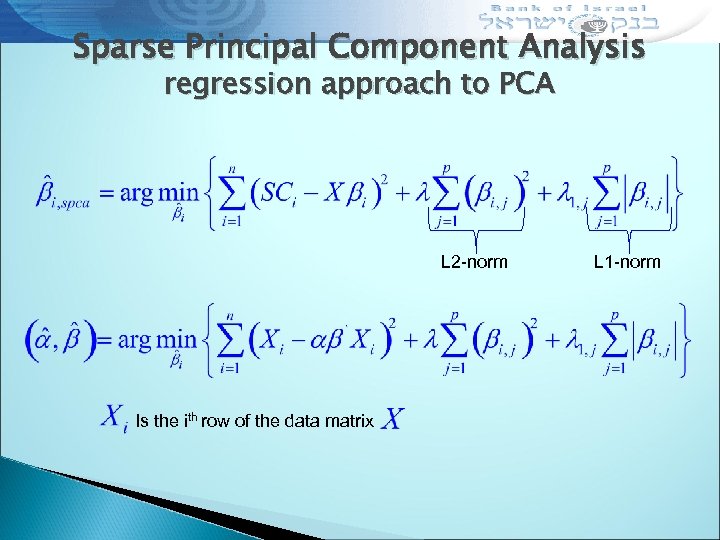

Sparse Principal Component Analysis regression approach to PCA L 2 -norm Is the ith row of the data matrix L 1 -norm

Sparse Principal Component Analysis regression approach to PCA L 2 -norm Is the ith row of the data matrix L 1 -norm

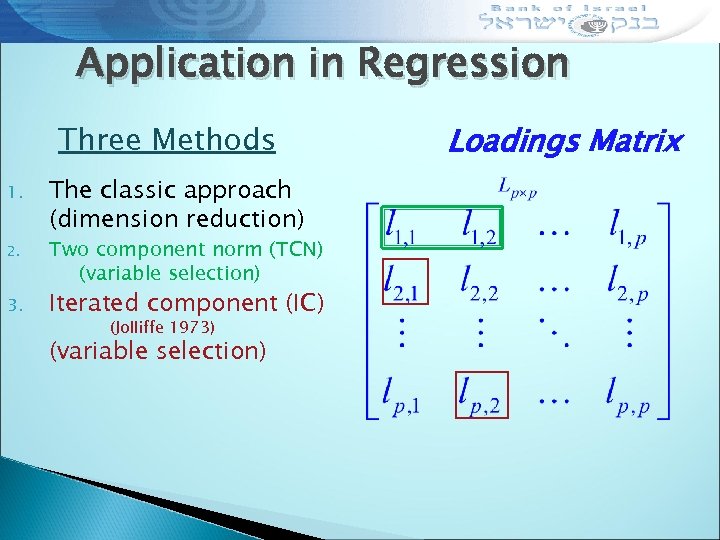

Application in Regression Three Methods 1. 2. 3. The classic approach (dimension reduction) Two component norm (TCN) (variable selection) Iterated component (IC) (Jolliffe 1973) (variable selection) Loadings Matrix

Application in Regression Three Methods 1. 2. 3. The classic approach (dimension reduction) Two component norm (TCN) (variable selection) Iterated component (IC) (Jolliffe 1973) (variable selection) Loadings Matrix

LASSO and Elastic Net Conditional Methods

LASSO and Elastic Net Conditional Methods

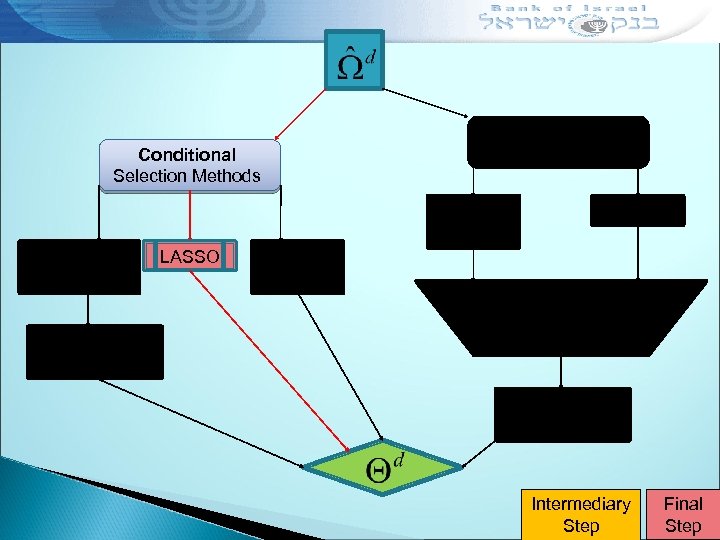

Unconditional Selection Methods Conditional Selection Methods Multiple Univariate LASSO Elastic Net Stepwise Regression Intermediary Step Final Step

Unconditional Selection Methods Conditional Selection Methods Multiple Univariate LASSO Elastic Net Stepwise Regression Intermediary Step Final Step

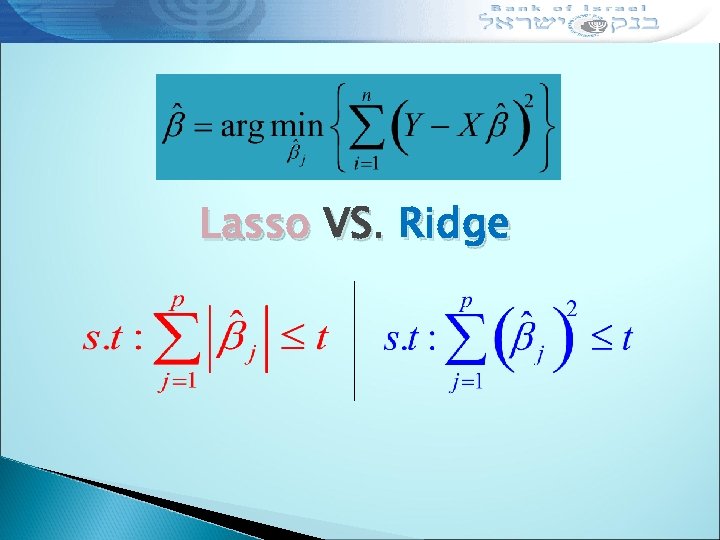

Lasso VS. Ridge

Lasso VS. Ridge

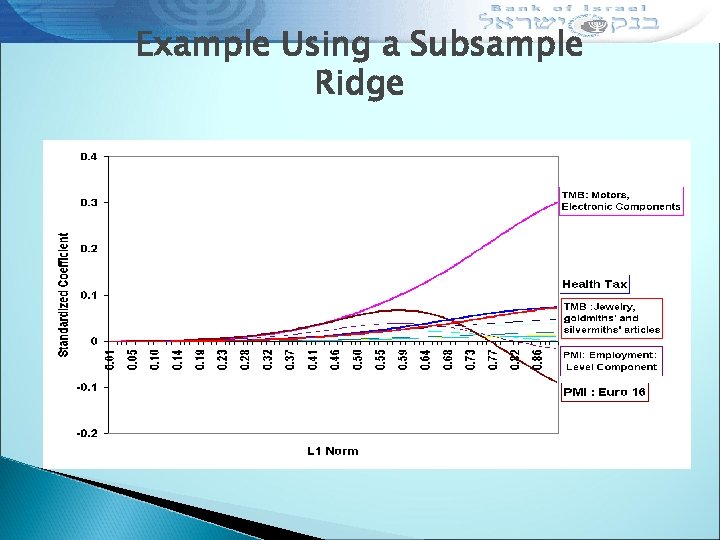

Example Using a Subsample Ridge

Example Using a Subsample Ridge

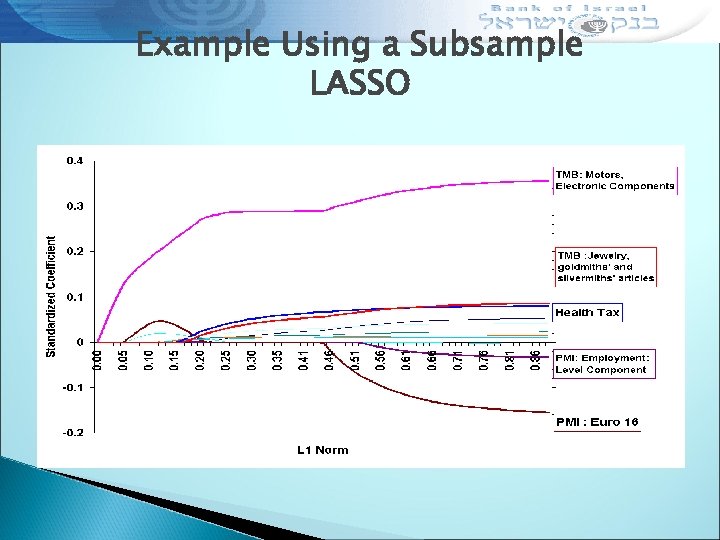

Example Using a Subsample LASSO

Example Using a Subsample LASSO

LASSO Conclusions 1. ◦ ◦ 2. ◦ ◦ ◦ Advantages General form of algorithm makes it applicable to many problems in econometrics. Ability to produce decomposition of variable contribution of the forecast. Shortcomings Can not select more then n variables If n>p then ridge is better No grouping

LASSO Conclusions 1. ◦ ◦ 2. ◦ ◦ ◦ Advantages General form of algorithm makes it applicable to many problems in econometrics. Ability to produce decomposition of variable contribution of the forecast. Shortcomings Can not select more then n variables If n>p then ridge is better No grouping

Unconditional Selection Methods Conditional Selection Methods Multiple Univariate LASSO Elastic Net Stepwise Regression Intermediary Step Final Step

Unconditional Selection Methods Conditional Selection Methods Multiple Univariate LASSO Elastic Net Stepwise Regression Intermediary Step Final Step

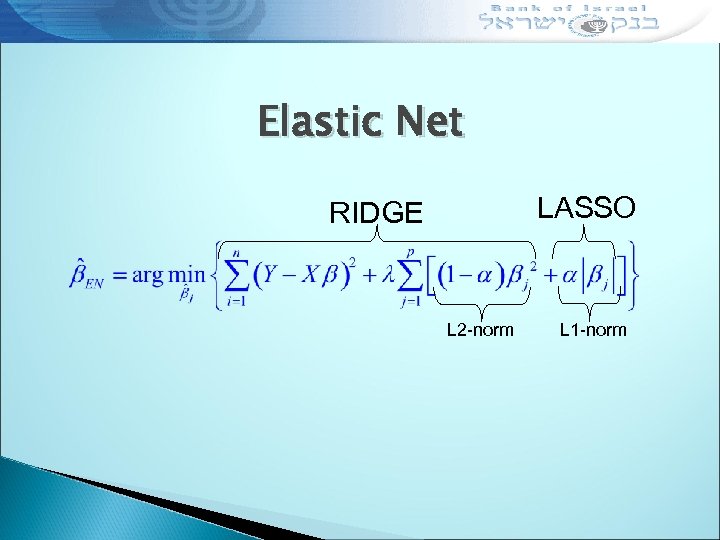

Elastic Net LASSO RIDGE L 2 -norm L 1 -norm

Elastic Net LASSO RIDGE L 2 -norm L 1 -norm

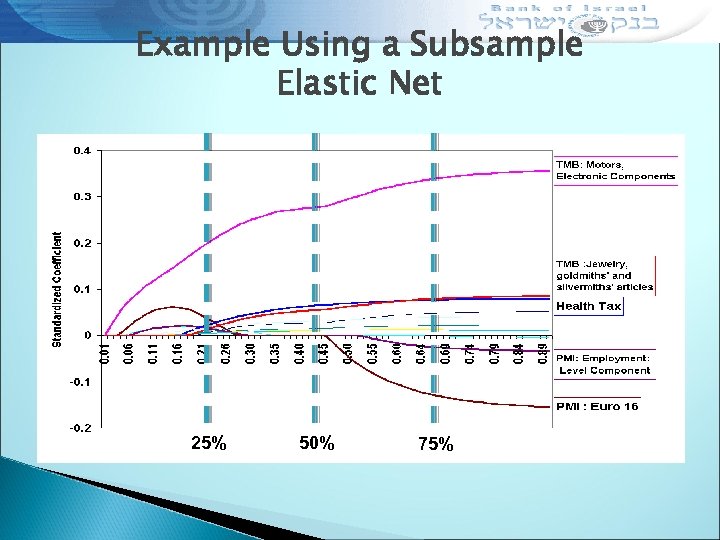

Example Using a Subsample Elastic Net 25% 50% 75%

Example Using a Subsample Elastic Net 25% 50% 75%

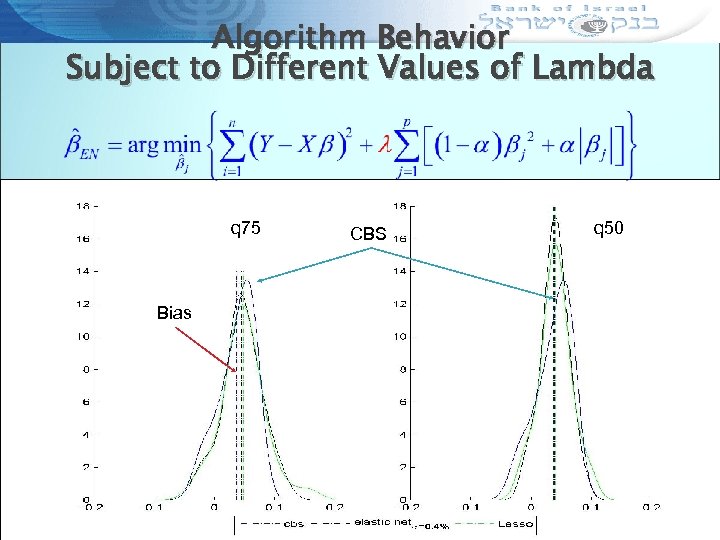

Algorithm Behavior Subject to Different Values of Lambda q 75 Bias CBS q 50

Algorithm Behavior Subject to Different Values of Lambda q 75 Bias CBS q 50

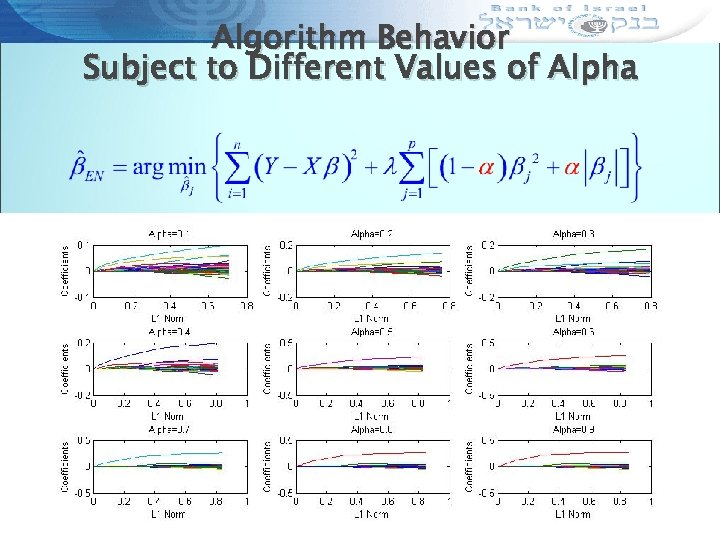

Algorithm Behavior Subject to Different Values of Alpha

Algorithm Behavior Subject to Different Values of Alpha

Results

Results

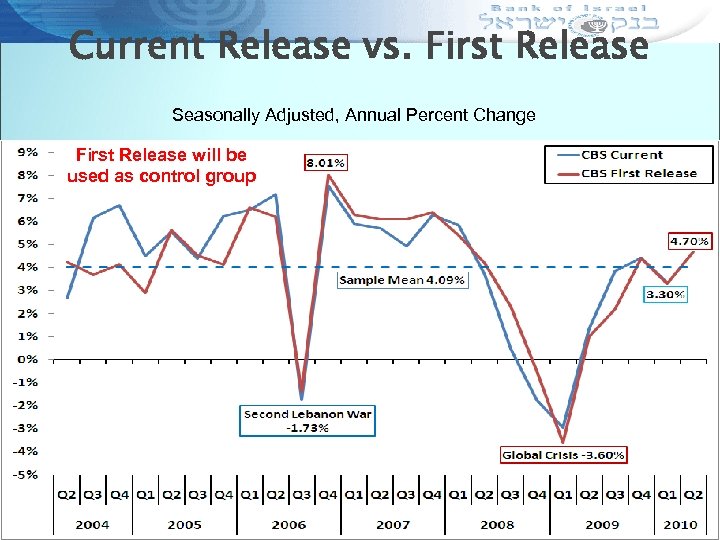

Current Release vs. First Release Seasonally Adjusted, Annual Percent Change First Release will be used as control group

Current Release vs. First Release Seasonally Adjusted, Annual Percent Change First Release will be used as control group

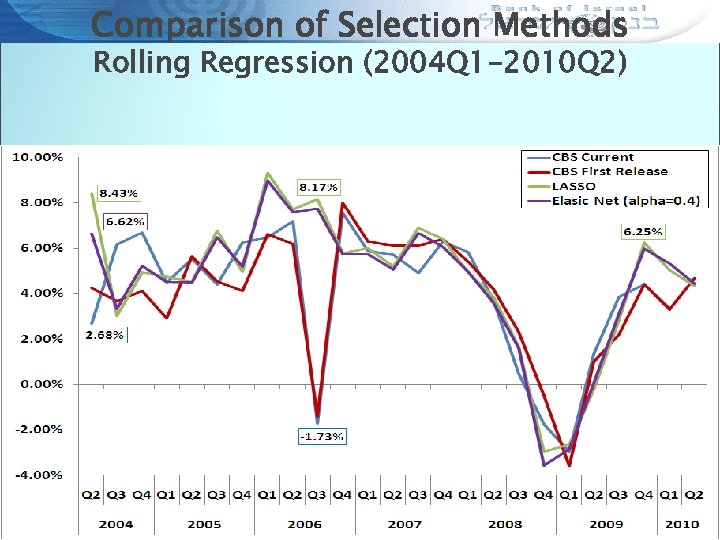

Comparison of Selection Methods Rolling Regression (2004 Q 1 -2010 Q 2)

Comparison of Selection Methods Rolling Regression (2004 Q 1 -2010 Q 2)

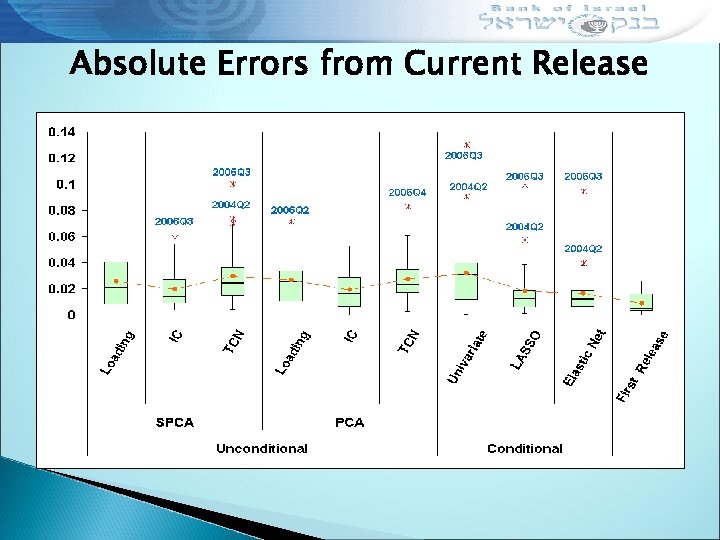

Absolute Errors from Current Release

Absolute Errors from Current Release

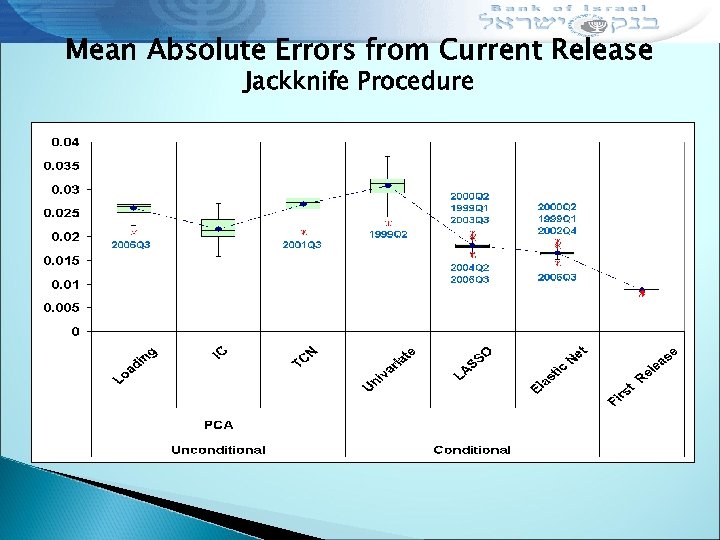

Mean Absolute Errors from Current Release Jackknife Procedure

Mean Absolute Errors from Current Release Jackknife Procedure

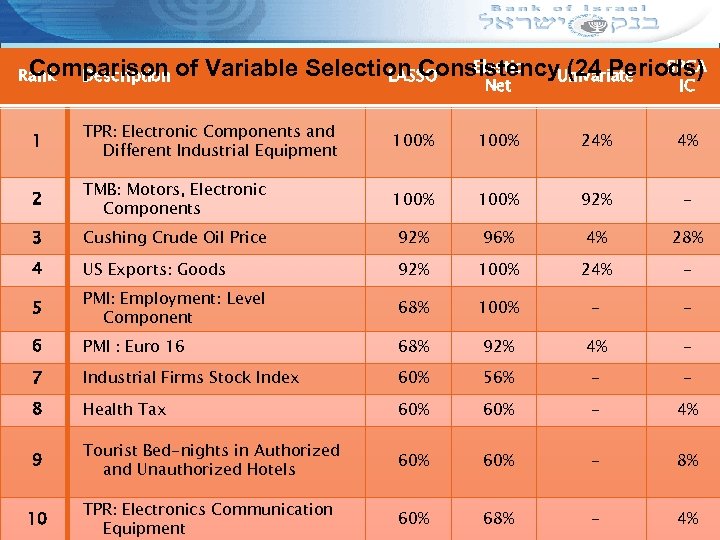

Comparison of Rank Description Elastic Variable Selection Consistency. Univariate SPCA (24 Periods) LASSO Net IC 1 TPR: Electronic Components and Different Industrial Equipment 100% 24% 4% 2 TMB: Motors, Electronic Components 100% 92% - 3 Cushing Crude Oil Price 92% 96% 4% 28% 4 US Exports: Goods 92% 100% 24% - 5 PMI: Employment: Level Component 68% 100% - - 6 PMI : Euro 16 68% 92% 4% - 7 Industrial Firms Stock Index 60% 56% - - 8 Health Tax 60% - 4% 9 Tourist Bed-nights in Authorized and Unauthorized Hotels 60% - 8% 10 TPR: Electronics Communication Equipment 60% 68% - 4%

Comparison of Rank Description Elastic Variable Selection Consistency. Univariate SPCA (24 Periods) LASSO Net IC 1 TPR: Electronic Components and Different Industrial Equipment 100% 24% 4% 2 TMB: Motors, Electronic Components 100% 92% - 3 Cushing Crude Oil Price 92% 96% 4% 28% 4 US Exports: Goods 92% 100% 24% - 5 PMI: Employment: Level Component 68% 100% - - 6 PMI : Euro 16 68% 92% 4% - 7 Industrial Firms Stock Index 60% 56% - - 8 Health Tax 60% - 4% 9 Tourist Bed-nights in Authorized and Unauthorized Hotels 60% - 8% 10 TPR: Electronics Communication Equipment 60% 68% - 4%

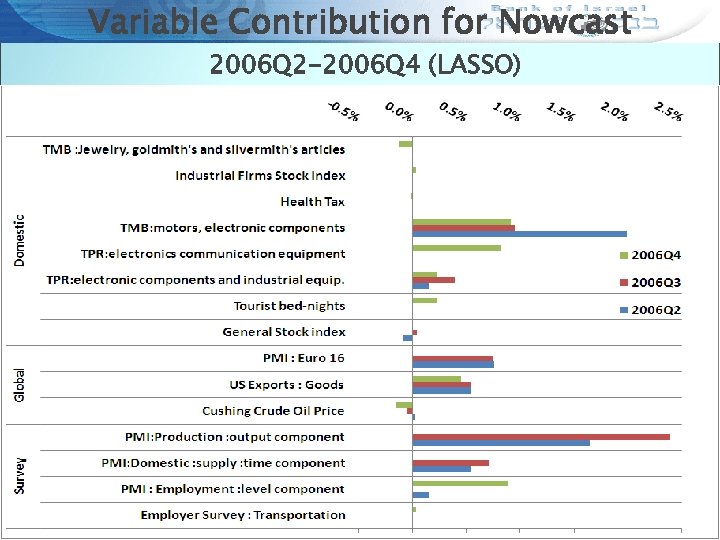

Variable Contribution for Nowcast 2006 Q 2 -2006 Q 4 (LASSO)

Variable Contribution for Nowcast 2006 Q 2 -2006 Q 4 (LASSO)

Tomer Kriaf Deriving the GDP from NA Identities Research Department, Bank of Israel

Tomer Kriaf Deriving the GDP from NA Identities Research Department, Bank of Israel

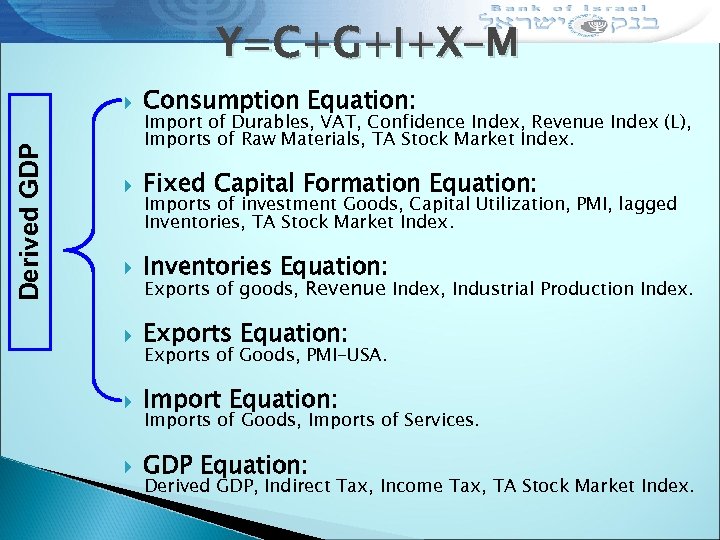

Y=C+G+I+X-M Derived GDP Consumption Equation: Fixed Capital Formation Equation: Inventories Equation: Exports Equation: Import Equation: GDP Equation: Import of Durables, VAT, Confidence Index, Revenue Index (L), Imports of Raw Materials, TA Stock Market Index. Imports of investment Goods, Capital Utilization, PMI, lagged Inventories, TA Stock Market Index. Exports of goods, Revenue Index, Industrial Production Index. Exports of Goods, PMI-USA. Imports of Goods, Imports of Services. Derived GDP, Indirect Tax, Income Tax, TA Stock Market Index.

Y=C+G+I+X-M Derived GDP Consumption Equation: Fixed Capital Formation Equation: Inventories Equation: Exports Equation: Import Equation: GDP Equation: Import of Durables, VAT, Confidence Index, Revenue Index (L), Imports of Raw Materials, TA Stock Market Index. Imports of investment Goods, Capital Utilization, PMI, lagged Inventories, TA Stock Market Index. Exports of goods, Revenue Index, Industrial Production Index. Exports of Goods, PMI-USA. Imports of Goods, Imports of Services. Derived GDP, Indirect Tax, Income Tax, TA Stock Market Index.

GDP Nowcasting Performance In Sample Out of Sample Actual

GDP Nowcasting Performance In Sample Out of Sample Actual

GDP Real Time Nowcasting Performance Path Forecast Real Time Nowcast CBS First Release CBS Current Release

GDP Real Time Nowcasting Performance Path Forecast Real Time Nowcast CBS First Release CBS Current Release

Thank You Gil Dafnai and Jonathan Sidi Research Department Bank of Israel

Thank You Gil Dafnai and Jonathan Sidi Research Department Bank of Israel