1629036d3b1cea561902c45495a77b22.ppt

- Количество слайдов: 28

November 2010

Safe Harbor Statement This presentation may contain forward-looking statements concerning Asia Pacific Wire & Cable Corporation. The actual results may differ materially depending on a number of risk factors including, but not limited to, the following: general economic and business conditions, development, shipment, market acceptance, additional competition from existing and new competitors, changes in technology or product techniques, and various other factors beyond its control. All forward-looking statements are expressly qualified in their entirety by this Cautionary Statement and the risk factors detailed in the Company's reports filed with the Securities and Exchange Commission. Asia Pacific Wire & Cable Corporation undertakes no duty to revise or update any forwardlooking statements to reflect events or circumstances after the date of this presentation. 1 www. apwcc. com

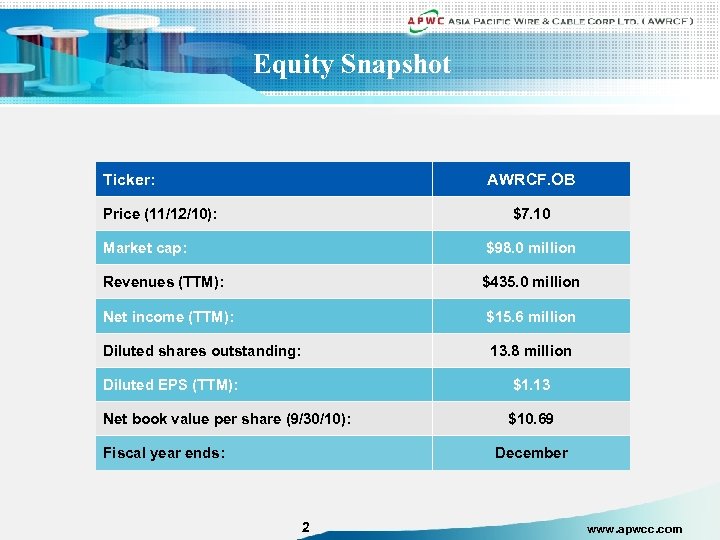

Equity Snapshot Ticker: AWRCF. OB Price (11/12/10): $7. 10 Market cap: $98. 0 million Revenues (TTM): $435. 0 million Net income (TTM): $15. 6 million Diluted shares outstanding: 13. 8 million Diluted EPS (TTM): $1. 13 Net book value per share (9/30/10): $10. 69 Fiscal year ends: December 2 www. apwcc. com

Investment Highlights u Market leader in several regional markets u Strong and growing underlying market demand u Broad geographic coverage offers diversification u Experienced and knowledgeable in-house sales and technical team u Improving financial performance including a return to profitability u Strong balance sheet, cash flow, and attractive valuation 3 www. apwcc. com

Company Overview 1 Founded in 1996 2 Headquartered in Taipei, Taiwan 3 Subsidiaries: China, Thailand, Singapore and Australia 4 Core business: manufacturing and distribution of wire and cable products 5 Additional services: project engineering of Supply, Delivery and Installation (SDI) services for power cables 6 Total number of employees: approximately 1, 710 4 www. apwcc. com

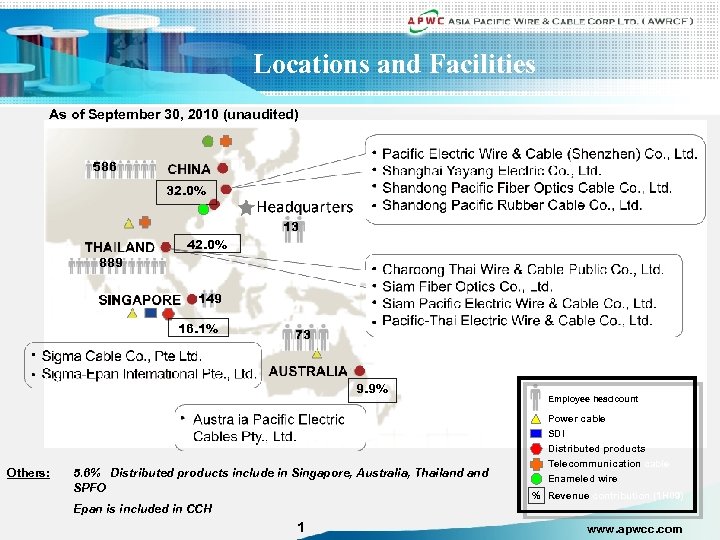

Locations and Facilities As of September 30, 2010 (unaudited) 586 32. 0% 13 73 42. 0% 889 149 16. 1% 73 9. 9% Employee headcount Power cable SDI project engineering Others: 5. 6% Distributed products include in Singapore, Australia, Thailand SPFO Distributed products Telecommunication cable Enameled wire % Revenue contribution (1 H 09) Epan is included in CCH 1 www. apwcc. com

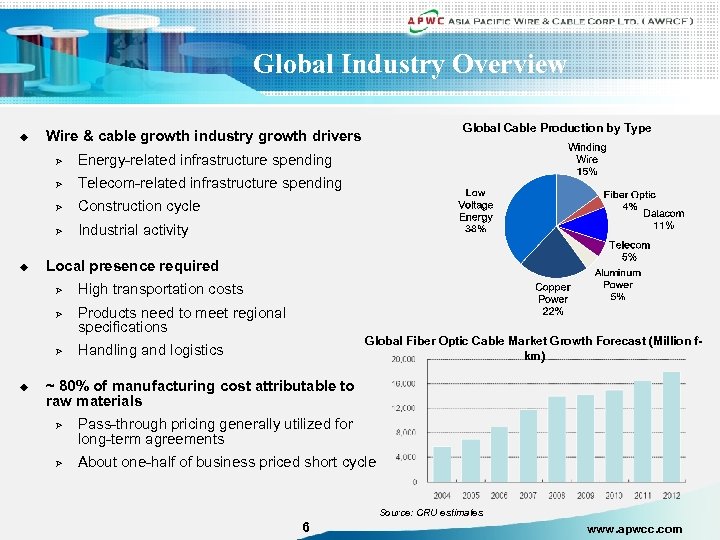

Global Industry Overview u Ø Energy-related infrastructure spending Ø Telecom-related infrastructure spending Ø Construction cycle Ø u Industrial activity Local presence required Ø Ø Ø u Global Cable Production by Type Wire & cable growth industry growth drivers High transportation costs Products need to meet regional specifications Global Fiber Optic Cable Market Growth Forecast (Million fkm) Handling and logistics ~ 80% of manufacturing cost attributable to raw materials Ø Ø Pass-through pricing generally utilized for long-term agreements About one-half of business priced short cycle Source: CRU estimates 6 www. apwcc. com

China Businesses u Long-term partnership with China Unicom Top Customers Ø Ø Ø Telecom carriers Toolmakers and appliances makers Mining companies Revenue ($ Millions) $180 $149 $160 $135 $140 CAGR = 14. 6% $120 $91 $100 $80 Ø Ø Ø $40 Enameled wire Telecom cable Fiber-optic cable Optical fiber (JV) Rubber cable $103 $114 $61 $60 Products $158 $36 $47 $46 $20 $0 2001 2002 2003 2004 2005 2006 2007 2008 2009 7 www. apwcc. com

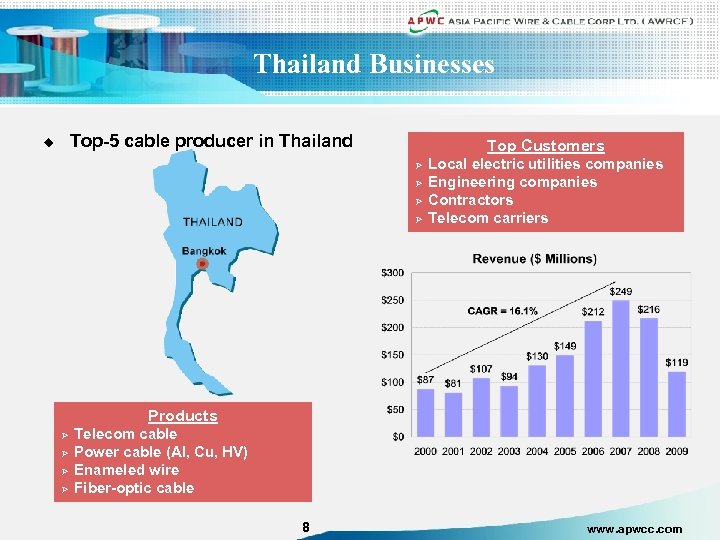

Thailand Businesses Top-5 cable producer in Thailand u Top Customers Ø Ø Local electric utilities companies Engineering companies Contractors Telecom carriers Products Ø Ø Telecom cable Power cable (Al, Cu, HV) Enameled wire Fiber-optic cable 8 www. apwcc. com

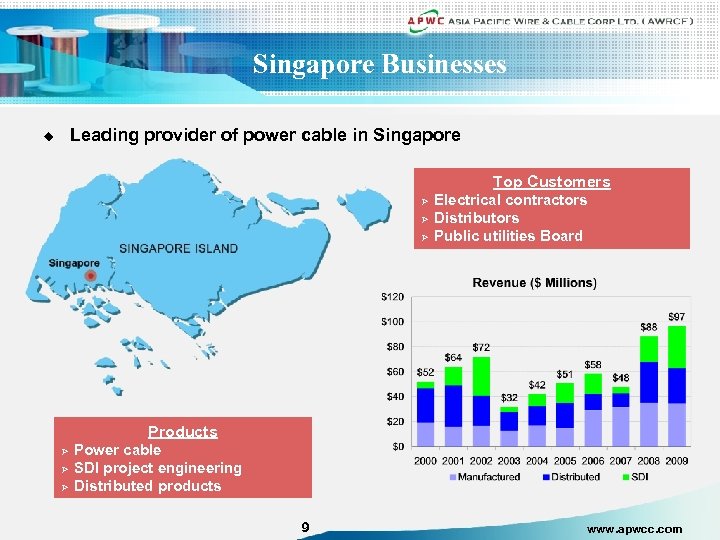

Singapore Businesses Leading provider of power cable in Singapore u Top Customers Ø Ø Ø Electrical contractors Distributors Public utilities Board Products Ø Ø Ø Power cable SDI project engineering Distributed products 9 www. apwcc. com

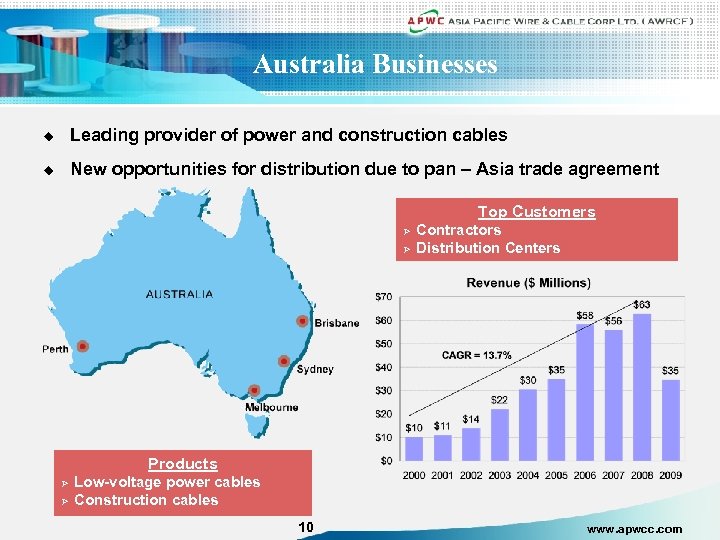

Australia Businesses u Leading provider of power and construction cables u New opportunities for distribution due to pan – Asia trade agreement Top Customers Ø Ø Contractors Distribution Centers Products Ø Ø Low-voltage power cables Construction cables 10 www. apwcc. com

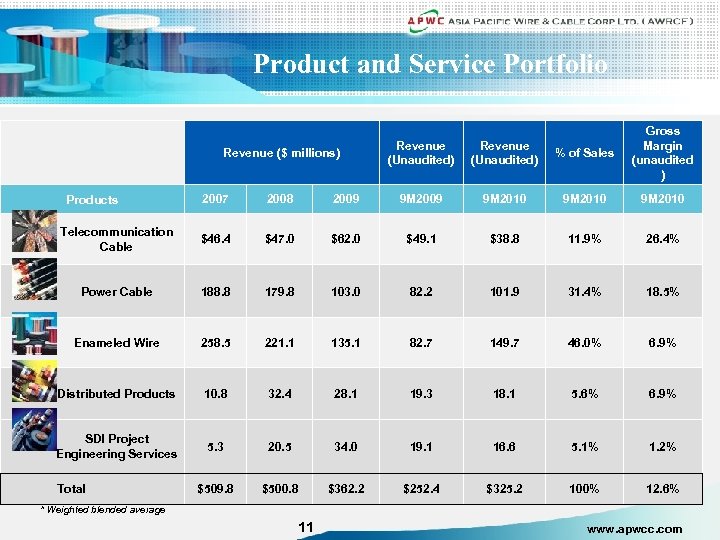

Product and Service Portfolio Revenue ($ millions) Revenue (Unaudited) % of Sales Gross Margin (unaudited ) 2007 2008 2009 9 M 2010 Telecommunication Cable $46. 4 $47. 0 $62. 0 $49. 1 $38. 8 11. 9% 26. 4% Power Cable 188. 8 179. 8 103. 0 82. 2 101. 9 31. 4% 18. 5% Enameled Wire 258. 5 221. 1 135. 1 82. 7 149. 7 46. 0% 6. 9% Distributed Products 10. 8 32. 4 28. 1 19. 3 18. 1 5. 6% 6. 9% SDI Project Engineering Services 5. 3 20. 5 34. 0 19. 1 16. 6 5. 1% 1. 2% $509. 8 $500. 8 $362. 2 $252. 4 $325. 2 100% 12. 6% Products Total * Weighted blended average 11 www. apwcc. com

Quality Assurance u ISO 9001: Quality Management System Certification u ISO 14001: Environmental Management System Certification u ISO 17025: Testing and Calibration Laboratories Certification u UL: Japan Industrial Standard u C. E. : Thailand Industrial Standard u ISO: Australian Quality Accredited 12 www. apwcc. com

Competitive Advantages Competitive Landscape Competitors include both independent domestic and foreign suppliers Local competitors have advantages in sales, R&D spending or financial resources Global competitors include Draka, Furukawa, Nexans, Prysmian, etc. Competitive Advantages Reliable product supply and distribution Superior product quality and performance Raw-material cost advantage over local producers Excellent customer service and knowledgeable sales and technical team First-mover advantage in key local markets 13 www. apwcc. com

Growth and Expansion Strategy China Ø Top growth opportunity for APWCC in the next few years Ø Increase capacity to meet market demand generate economies of scale Ø Drive marketing penetration into Shandong, Henan, Guangxi Sichuan, and Chongqing city, etc. Ø Develop new products and expand capacity Australia Ø Upgrade production facilities to increase efficiency and capacity Ø Increase product portfolio through offering imported products Thailand Ø Develop new cable products for auto, solar or other types of alternative energy Ø Upgrade and expand facilities for new government projects Ø Control production cost Singapore Ø Re-introduce Sigma's product to Southeast Asia market Ø Bring complete solutions to our customers and improve customer responsiveness Ø Explore new suppliers/partners in China for improved opportunities 14 www. apwcc. com

History of Revenue Growth 15 www. apwcc. com

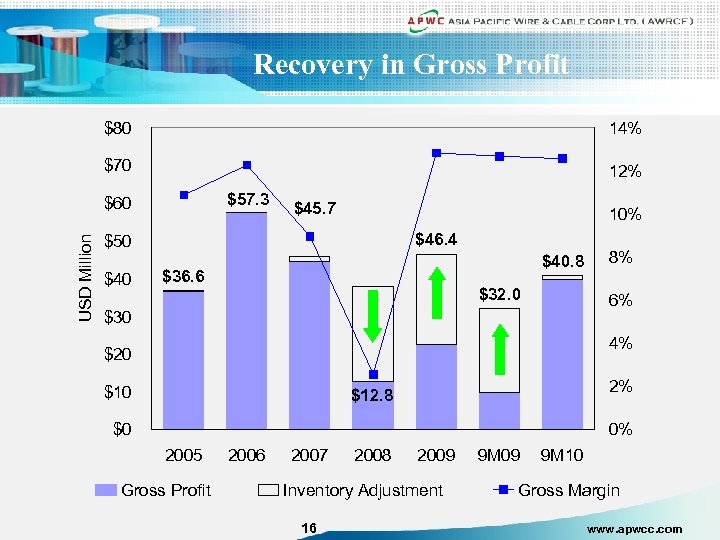

Recovery in Gross Profit $80 14% $70 12% $57. 3 USD Million $60 $45. 7 10% $46. 4 $50 $40. 8 $36. 6 $32. 0 8% 6% $30 4% $20 $10 2% $12. 8 $0 0% 2005 Gross Profit 2006 2007 2008 2009 Inventory Adjustment 16 9 M 09 9 M 10 Gross Margin www. apwcc. com

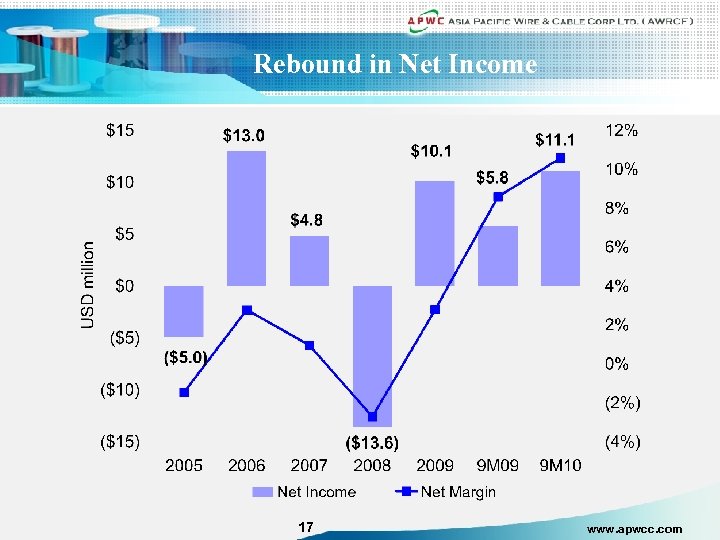

Rebound in Net Income 17 www. apwcc. com

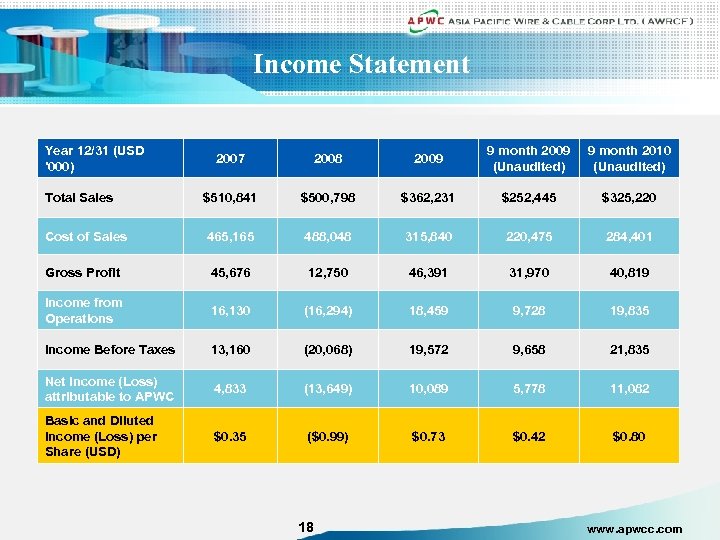

Income Statement Year 12/31 (USD '000) 2007 2008 2009 9 month 2009 (Unaudited) 9 month 2010 (Unaudited) Total Sales $510, 841 $500, 798 $362, 231 $252, 445 $325, 220 Cost of Sales 465, 165 488, 048 315, 840 220, 475 284, 401 Gross Profit 45, 676 12, 750 46, 391 31, 970 40, 819 Income from Operations 16, 130 (16, 294) 18, 459 9, 728 19, 835 Income Before Taxes 13, 160 (20, 068) 19, 572 9, 658 21, 835 Net Income (Loss) attributable to APWC 4, 833 (13, 649) 10, 089 5, 778 11, 082 Basic and Diluted Income (Loss) per Share (USD) $0. 35 ($0. 99) $0. 73 $0. 42 $0. 80 18 www. apwcc. com

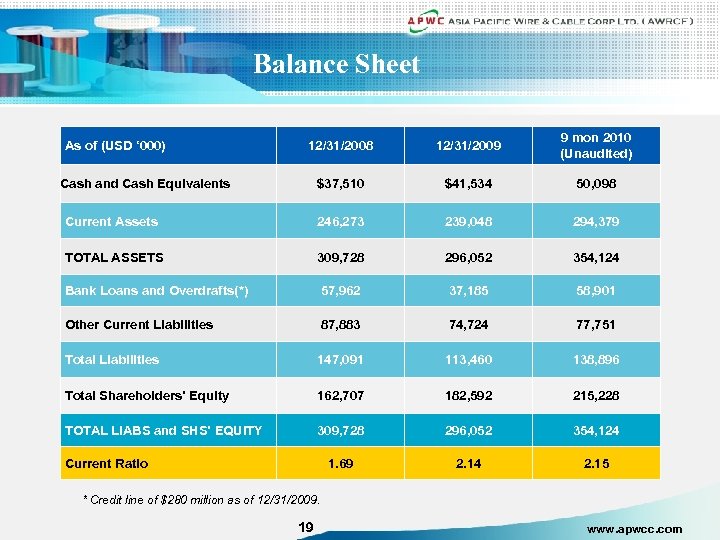

Balance Sheet 12/31/2008 12/31/2009 9 mon 2010 (Unaudited) $37, 510 $41, 534 50, 098 Current Assets 246, 273 239, 048 294, 379 TOTAL ASSETS 309, 728 296, 052 354, 124 Bank Loans and Overdrafts(*) 57, 962 37, 185 58, 901 Other Current Liabilities 87, 883 74, 724 77, 751 Total Liabilities 147, 091 113, 460 138, 896 Total Shareholders’ Equity 162, 707 182, 592 215, 228 TOTAL LIABS and SHS’ EQUITY 309, 728 296, 052 354, 124 1. 69 2. 14 2. 15 As of (USD ‘ 000) Cash and Cash Equivalents Current Ratio * Credit line of $280 million as of 12/31/2009. 19 www. apwcc. com

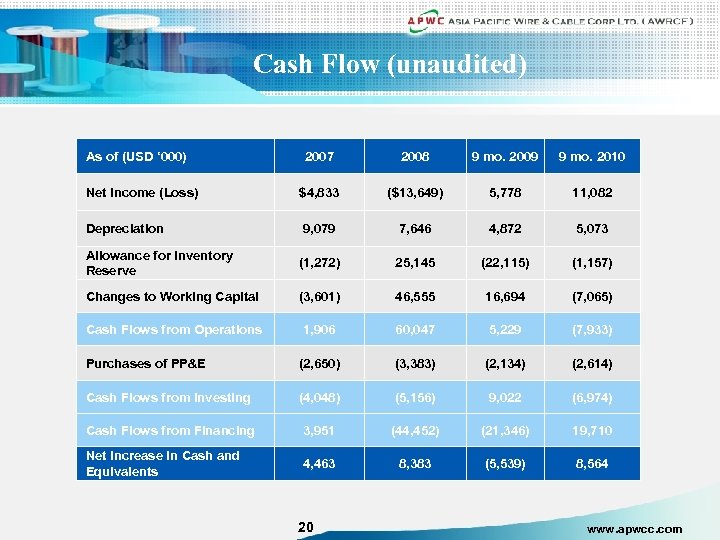

Cash Flow (unaudited) As of (USD ‘ 000) 2007 2008 9 mo. 2009 9 mo. 2010 Net Income (Loss) $4, 833 ($13, 649) 5, 778 11, 082 Depreciation 9, 079 7, 646 4, 872 5, 073 Allowance for Inventory Reserve (1, 272) 25, 145 (22, 115) (1, 157) Changes to Working Capital (3, 601) 46, 555 16, 694 (7, 065) Cash Flows from Operations 1, 906 60, 047 5, 229 (7, 933) Purchases of PP&E (2, 650) (3, 383) (2, 134) (2, 614) Cash Flows from Investing (4, 048) (5, 156) 9, 022 (6, 974) Cash Flows from Financing 3, 951 (44, 452) (21, 346) 19, 710 Net Increase in Cash and Equivalents 4, 463 8, 383 (5, 539) 8, 564 20 www. apwcc. com

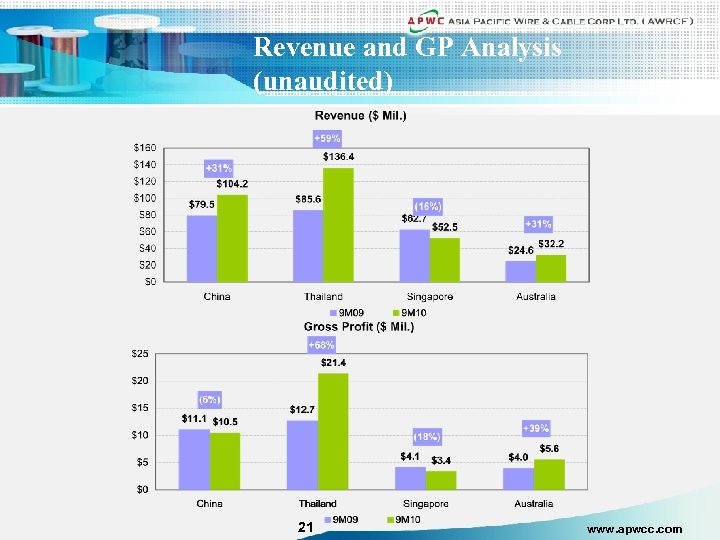

Revenue and GP Analysis (unaudited) 21 www. apwcc. com

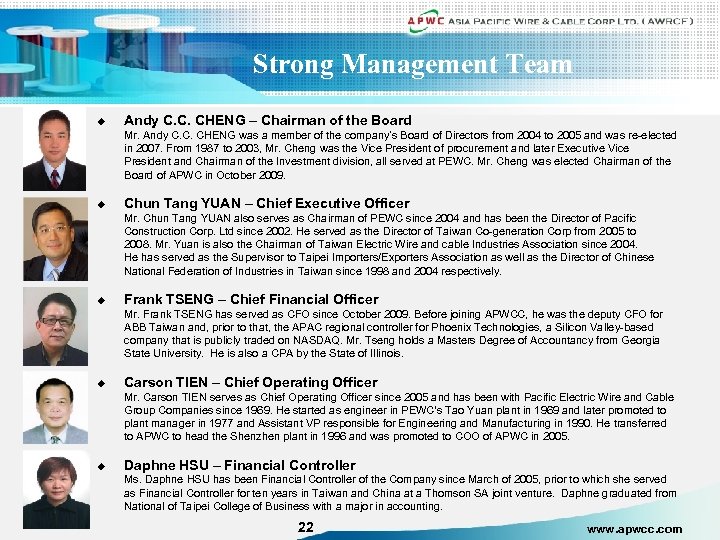

Strong Management Team u Andy C. C. CHENG – Chairman of the Board Mr. Andy C. C. CHENG was a member of the company’s Board of Directors from 2004 to 2005 and was re-elected in 2007. From 1987 to 2003, Mr. Cheng was the Vice President of procurement and later Executive Vice President and Chairman of the Investment division, all served at PEWC. Mr. Cheng was elected Chairman of the Board of APWC in October 2009. u Chun Tang YUAN – Chief Executive Officer Mr. Chun Tang YUAN also serves as Chairman of PEWC since 2004 and has been the Director of Pacific Construction Corp. Ltd since 2002. He served as the Director of Taiwan Co-generation Corp from 2005 to 2008. Mr. Yuan is also the Chairman of Taiwan Electric Wire and cable Industries Association since 2004. He has served as the Supervisor to Taipei Importers/Exporters Association as well as the Director of Chinese National Federation of Industries in Taiwan since 1998 and 2004 respectively. u Frank TSENG – Chief Financial Officer Mr. Frank TSENG has served as CFO since October 2009. Before joining APWCC, he was the deputy CFO for ABB Taiwan and, prior to that, the APAC regional controller for Phoenix Technologies, a Silicon Valley-based company that is publicly traded on NASDAQ. Mr. Tseng holds a Masters Degree of Accountancy from Georgia State University. He is also a CPA by the State of Illinois. u Carson TIEN – Chief Operating Officer Mr. Carson TIEN serves as Chief Operating Officer since 2005 and has been with Pacific Electric Wire and Cable Group Companies since 1969. He started as engineer in PEWC's Tao Yuan plant in 1969 and later promoted to plant manager in 1977 and Assistant VP responsible for Engineering and Manufacturing in 1990. He transferred to APWC to head the Shenzhen plant in 1996 and was promoted to COO of APWC in 2005. u Daphne HSU – Financial Controller Ms. Daphne HSU has been Financial Controller of the Company since March of 2005, prior to which she served as Financial Controller for ten years in Taiwan and China at a Thomson SA joint venture. Daphne graduated from National of Taipei College of Business with a major in accounting. 22 www. apwcc. com

Experienced Board Members u Anson Chan – Chairman of Audit Committee and Compensation Committee Member Mr. Anson Chan has been an independent member of the Company’s Board of Directors since 2007 and serves on the Audit Committee as its Chairman. He qualified as a CPA by the State of Illinois in U. S. A. in 1992. Mr. Chan is also a Managing Director of the Bonds Group of Companies and was a Senior Advisor to Elliott Associates from 2005 to 2008. u Yichin Lee – Audit Committee Member Dr. Yichin Lee has been an independent member of the Company’s Board of Directors since 2007 and serves on the Audit Committee. Dr. Lee is also the Managing Director of Giant Management Consulting LLC and an independent director of Giga Media Limited. Dr. Yichin Lee holds a doctorate degree in resource planning and management from Stanford University. Dr. Yichin Lee is not related to Mr. Michael C. Lee or Mr. Gai Poo Lee. 23 www. apwcc. com

Investment Highlights u Market leader in several regional markets u Strong and growing underlying market demand u Broad geographic coverage offers diversification u Experienced and knowledgeable in-house sales and technical team u Improving financial performance including a return to profitability u Strong balance sheet, cash flow, and attractive valuation 24 www. apwcc. com

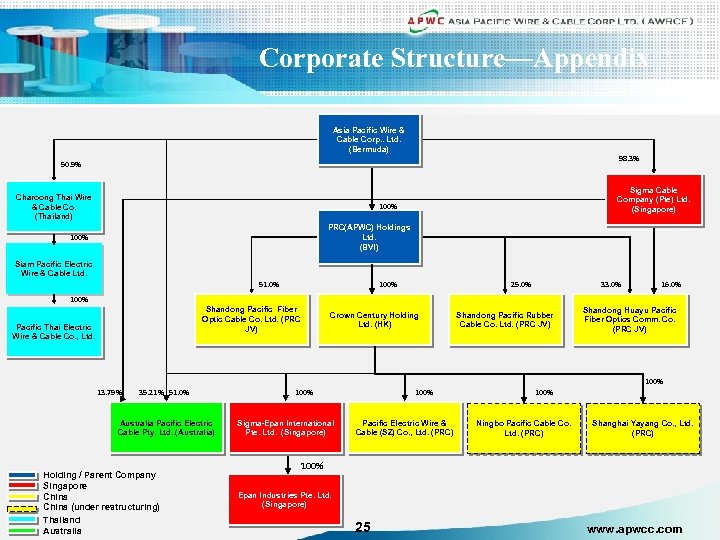

Corporate Structure—Appendix Asia Pacific Wire & Cable Corp. . Ltd. (Bermuda) 98. 3% 50. 9% Charoong Thai Wire & Cable Co. (Thailand) Sigma Cable Company (Pte) Ltd. (Singapore) 100% PRC(APWC) Holdings Ltd. (BVI) 100% Siam Pacific Electric Wire & Cable Ltd. 51. 0% 100% 25. 0% 33. 0% 16. 0% 100% Shandong Pacific Fiber Optic Cable Co. Ltd. (PRC JV) Pacific Thai Electric Wire & Cable Co. , Ltd. Crown Century Holding Ltd. (HK) Shandong Pacific Rubber Cable Co. Ltd. (PRC JV) Shandong Huayu Pacific Fiber Optics Comm. Co. (PRC JV) 100% 13. 79% 35. 21% 51. 0% Australia Pacific Electric Cable Pty. Ltd. (Australia) Holding / Parent Company Singapore China (under restructuring) Thailand Australia 100% Sigma-Epan International Pte. Ltd. (Singapore) 100% Pacific Electric Wire & Cable (SZ) Co. , Ltd. (PRC) 100% Ningbo Pacific Cable Co. Ltd. (PRC) Shanghai Yayang Co. , Ltd. (PRC) 100% Epan Industries Pte. Ltd. (Singapore) 25 www. apwcc. com

Contact Information Asia Pacific Wire & Cable Corporation Frank Tseng, Chief Financial Officer Phone: +886 (2) 2712 2558 ext. 66 Email: frank. tseng@apwcc. com www. apwcc. com Legal Counsel CCG Investor Relations Thompson Hine LLP John Harmon, CFA, Sr. Acct. Manager Auditor Phone: +86 -10 -6561 -6886 Ext. 807 Ernst & Young (Hong Kong) E-mail: john. harmon@ccgir. com Mr. Bryan Blake, MI Executive Phone: +1 -646 -833 -3416 E-mail: bryan. blake@ccgir. com www. ccgirasia. com 26 www. apwcc. com

1629036d3b1cea561902c45495a77b22.ppt