25b23f8bd9df960854f60bb26b69bc7d.ppt

- Количество слайдов: 12

November 2007 1

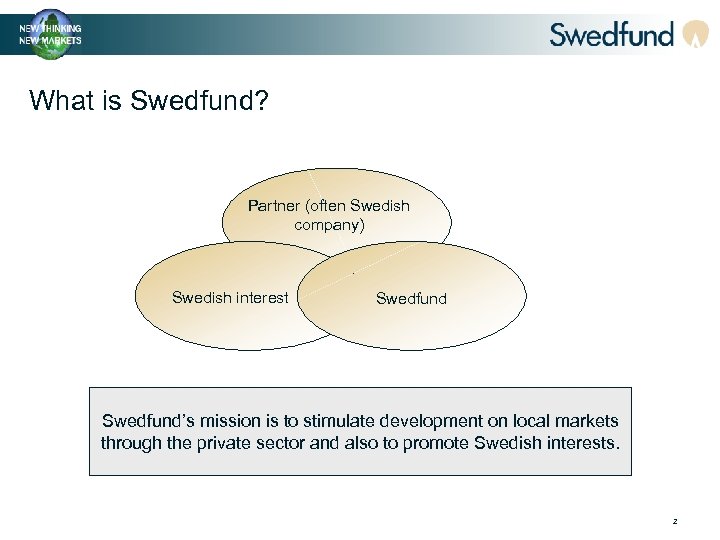

What is Swedfund? Partner (often Swedish company) Swedish interest Swedfund’s mission is to stimulate development on local markets through the private sector and also to promote Swedish interests. 2

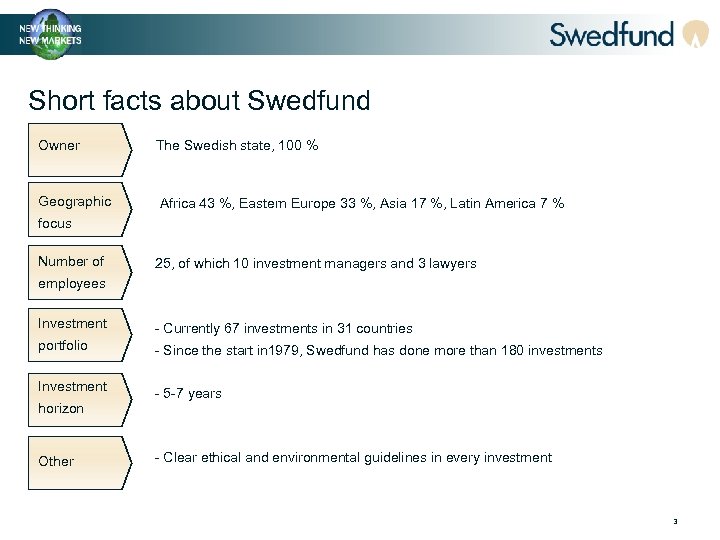

Short facts about Swedfund Owner The Swedish state, 100 % Geographic Africa 43 %, Eastern Europe 33 %, Asia 17 %, Latin America 7 % focus Number of 25, of which 10 investment managers and 3 lawyers employees Investment - Currently 67 investments in 31 countries portfolio - Since the start in 1979, Swedfund has done more than 180 investments Investment horizon Other - 5 -7 years - Clear ethical and environmental guidelines in every investment 3

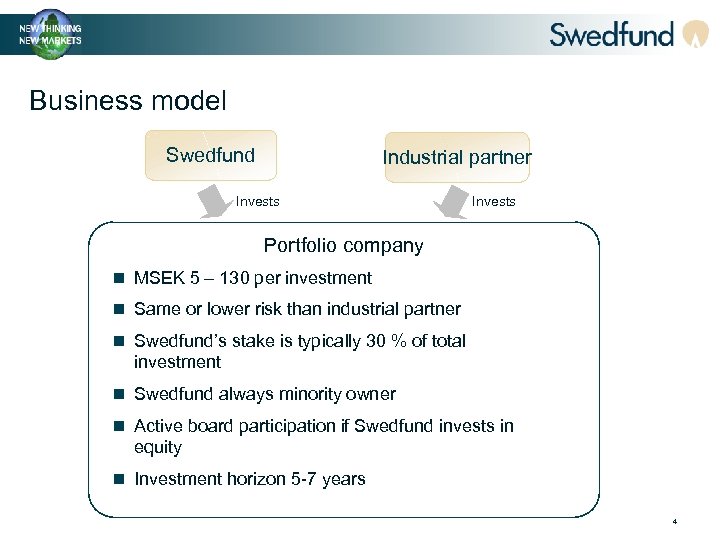

Business model Swedfund Industrial partner Invests Portfolio company n MSEK 5 – 130 per investment n Same or lower risk than industrial partner n Swedfund’s stake is typically 30 % of total investment n Swedfund always minority owner n Active board participation if Swedfund invests in equity n Investment horizon 5 -7 years 4

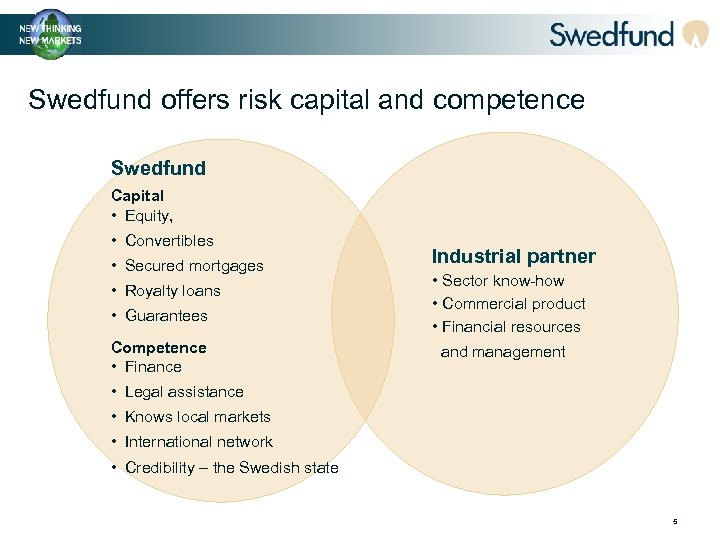

Swedfund offers risk capital and competence Swedfund Capital • Equity, • Convertibles • Secured mortgages • Royalty loans • Guarantees Competence • Finance Industrial partner • Sector know-how • Commercial product • Financial resources and management • Legal assistance • Knows local markets • International network • Credibility – the Swedish state 5

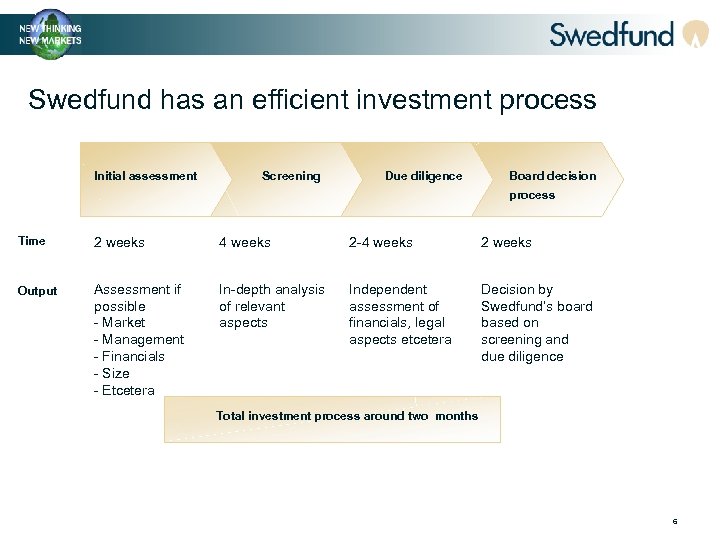

Swedfund has an efficient investment process Initial assessment Screening Due diligence Board decision process Time 2 weeks 4 weeks 2 -4 weeks 2 weeks Output Assessment if possible - Market - Management - Financials - Size - Etcetera In-depth analysis of relevant aspects Independent assessment of financials, legal aspects etcetera Decision by Swedfund’s board based on screening and due diligence Total investment process around two months 6

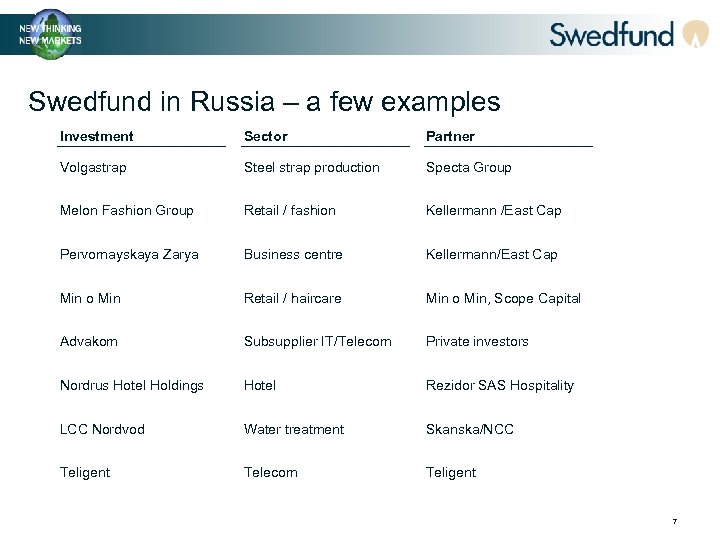

Swedfund in Russia – a few examples Investment Sector Partner Volgastrap Steel strap production Specta Group Melon Fashion Group Retail / fashion Kellermann /East Cap Pervomayskaya Zarya Business centre Kellermann/East Cap Min o Min Retail / haircare Min o Min, Scope Capital Advakom Subsupplier IT/Telecom Private investors Nordrus Hotel Holdings Hotel Rezidor SAS Hospitality LCC Nordvod Water treatment Skanska/NCC Teligent Telecom Teligent 7

Steel strap production in Kostroma, Russia Volgastrap, Russia n Steel strap production for industrial clients (2005) n Industrial partner: Specta Group AG n Total investment: 19. 1 MEUR • Secured loans 11. 7 MEUR (SF, FF, IMB) • Equity 7. 4 MEUR (Specta, SF, FF*) SF=Swedfund, FF=Finnfund, IMB=International Moscow Bank 8

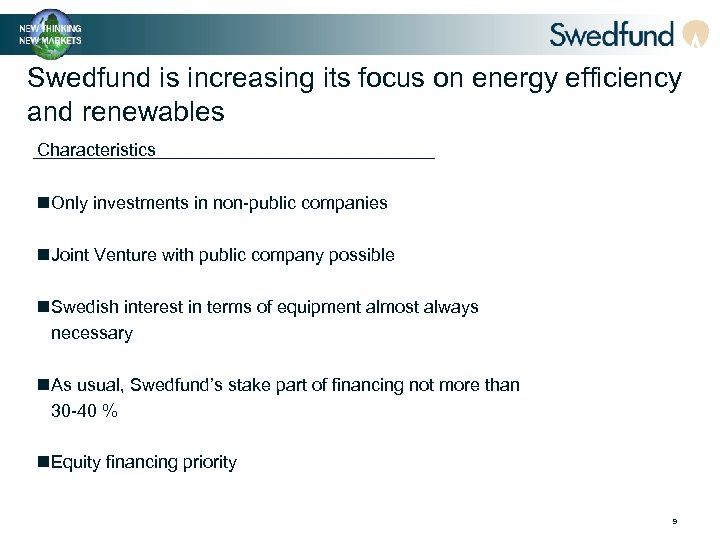

Swedfund is increasing its focus on energy efficiency and renewables Characteristics n. Only investments in non-public companies n. Joint Venture with public company possible n. Swedish interest in terms of equipment almost always necessary n. As usual, Swedfund’s stake part of financing not more than 30 -40 % n. Equity financing priority 9

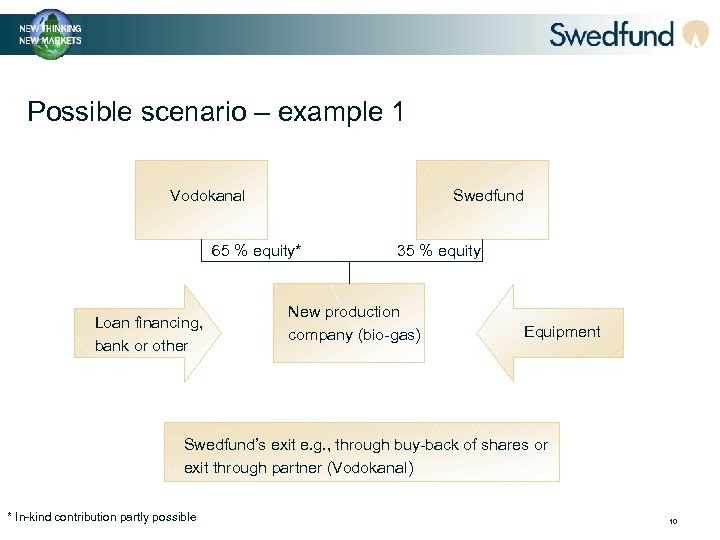

Possible scenario – example 1 Vodokanal Swedfund 65 % equity* Loan financing, bank or other 35 % equity New production company (bio-gas) Equipment Swedfund’s exit e. g. , through buy-back of shares or exit through partner (Vodokanal) * In-kind contribution partly possible 10

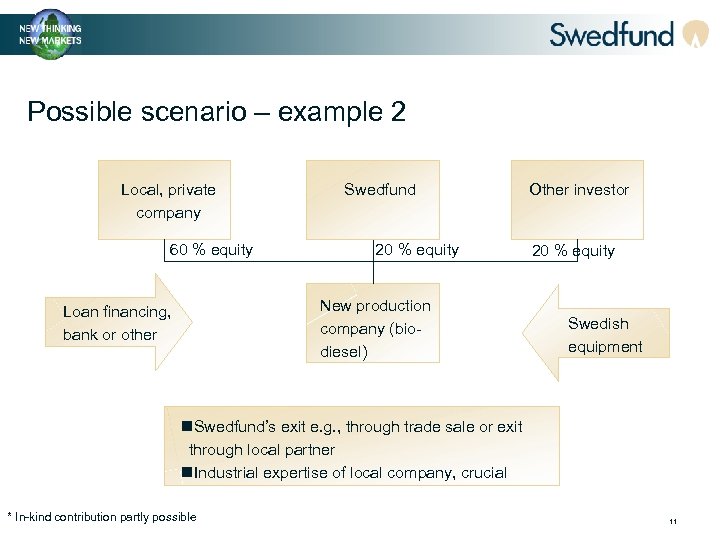

Possible scenario – example 2 Local, private company 60 % equity Swedfund 20 % equity New production company (biodiesel) Loan financing, bank or other Other investor 20 % equity Swedish equipment n. Swedfund’s exit e. g. , through trade sale or exit through local partner n. Industrial expertise of local company, crucial * In-kind contribution partly possible 11

Possible scenario – example 3 Your project? 12

25b23f8bd9df960854f60bb26b69bc7d.ppt