c0a4ebec790698067885695800086165.ppt

- Количество слайдов: 18

Novartis: An Analysis of the Ciba-Geigy and Sandoz Merger Team 10: Minjal Dharia - Stefanie Duda - Jennie Ma Andrew Schwartz - Siddharth Sekhri

AGENDA § History § Ciba Sandoz Background § Motivations and benefits of the merger § Merger process § Obstacles § The new company: Novartis AG § Challenges § Strategies § Opportunities § Financial performance to date

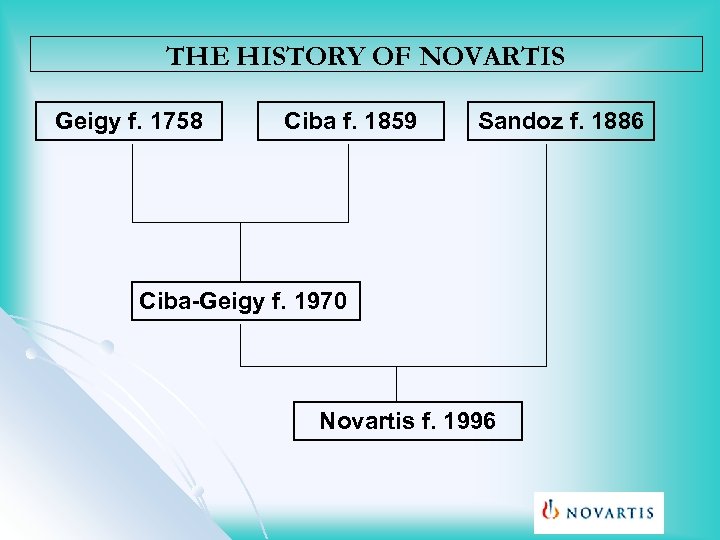

THE HISTORY OF NOVARTIS Geigy f. 1758 Ciba f. 1859 Sandoz f. 1886 Ciba-Geigy f. 1970 Novartis f. 1996

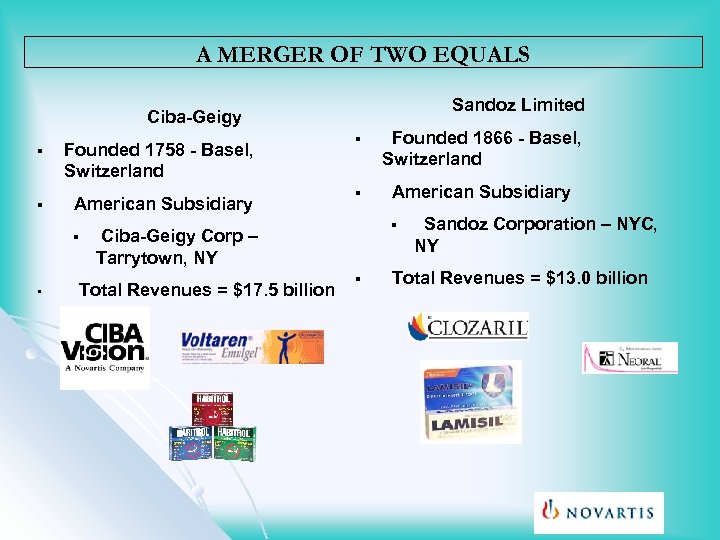

A MERGER OF TWO EQUALS Sandoz Limited Ciba-Geigy § Founded 1758 - Basel, Switzerland § American Subsidiary § • § Founded 1866 - Basel, Switzerland § American Subsidiary § Ciba-Geigy Corp – Tarrytown, NY Total Revenues = $17. 5 billion § Sandoz Corporation – NYC, NY Total Revenues = $13. 0 billion

STRATEGIC SIGNIFICANCE OF MERGER § Background of rapid structural change in pharmaceutical/ biotech market § Price pressures meant decreasing growth and margins of industry § Cost-containment efforts due to high development costs § Consolidation of suppliers gave them higher pricing power § Reach an optimum mix of business segments for synergy

MOTIVATION AND BENEFITS §Motivations § Shared commonalities in crop protection, seeds, agribusiness and animal health products § Jump to new business opportunities § Distance themselves from the unsure chemical markets §Benefits § Higher critical mass for key investments such as research & development § More efficient & broader marketing & distribution of products § Lower cost of financing, increased liquidity § Leaner organizational structure

THE MERGER PROCESS March-April 1996: Ciba and Sandoz announce merger plans and validate with shareholders. § § July 1996: The European Union approved the merger August 1996: U. S. Federal Trade Commission agreed to the formation of the new company in the fall of the same year. § §The merger is worth $27 billion- one of the largest in international business

THE MERGER PROCESS §Stock swap in which Ciba shareholders are paid a premium § Receive 1 1/15 for 1 share § Sandoz shareholders get 1 for 1 share §Sandoz shareholders obtained 55%, Ciba Geigy 45%. §Benefits of the deal: § Tax-free because both companies are Swiss § Cash outlay not required § Transaction structured as a share issue

OBSTACLES §The EU and the US FTC had concerns regarding the monopolistic nature of the mergers. § Required the demerger of the Specialty Chemicals Division of Ciba and the Construction Chemicals and animal health businesses of Sandoz §Ciba and Sandoz each had three classes of stock with varying voting rights at the start of the 1990 s. § Novartis had to transform the tangled equity structure into a single class of shares last year.

REGULATORY CONFLICTS/TRANSLATION EXPOSURE § Reconciling according to International Accounting Standards (IAS): § IAS rules allowed companies to write off goodwill rather than depreciating it § Allowed applying pooling-of-interest accounting rules to the $27 billion Ciba-Sandoz merger, which avoided charges for goodwillthe difference between the purchase price and book value of an asset.

REGULATORY CONFLICTS/TRANSLATION EXPOSURE § But, the U. S. accounting principles (GAAP) challenged both IAS rules: § The merger should include a restructuring charge for annual depreciation of 700 million Swiss Francs § Novartis had to follow US rules to list its shares in the US § Novartis would prepare its official accounts under IAS rules and offer U. S. investors a bridging statement with adjustments according to U. S. accounting principles in a footnotes § Cash flow and cash earnings per share would remain the same under both IAS and US GAAP.

NOVARTIS AG § Novartis = “re-birth” toward life sciences §Market § Value > $60 billion Standing segments of Healthcare (59%), Agrobusiness (27%), and Nutrition (27%) § §Largest worldwide marketer of crop protection chemicals § Second largest seed & animal health company § Second largest pharmaceuticals company in the world § § Sales = $13 billion 4. 5% share of global market sales

CHALLENGES Novartis promised annual savings of 1. 8 billion Swiss Francs § § Needed to get rid of 10, 000 jobs or 10% of the payroll § Needed to cut drug development time from 11 to 7 years § Needed three strong selling drugs annually §To match No. 1 Glaxo PLC §Soaring §Shares costs of biotech and genetic research tools are underrepresented in the US §Listed as ADRs on the NYSE

CULTURAL CLASH §Sandoz §Was autocratic and hierarchical §Operated most functions at the business segment level §Measured performance by EBIT and return on sales §Ciba §Was collegial and informal §Matrix §Used organization direct costing §Measured performance by division contribution §Novartis §Used Sandoz’s organizational system §Measured performance by EBIT and return on net assets

STRATEGIES § Sold off non-core business units § Boosted R&D spending § Sharpened marketing in the US §Increased §US sales force and advertising sales jumped to 43% of revenues §Made strategic acquisitions such as Pfizer’s drug Enablex, beating out Glaxo. Smith. Kline CEO Daniel L. Vasella

WILL NOVARTIS BUY ROCHE? § Bought a 20% share in May 2001 §Now owns 32. 7% § Would mean $45 billion in sales and 7% market share § Roche is opposed to any such merger §Remains to be seen how aggressive Novartis CEO Daniel L. Vasella will be.

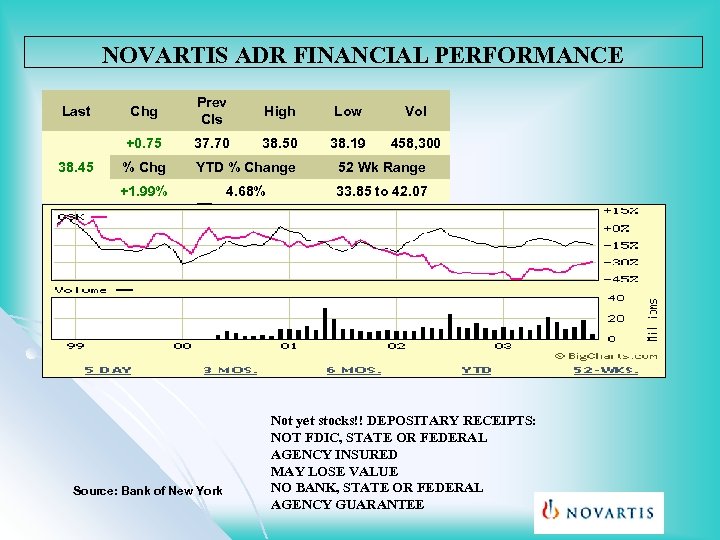

NOVARTIS ADR FINANCIAL PERFORMANCE Prev Cls High Low Vol 37. 70 38. 50 38. 19 458, 300 % Chg YTD % Change 52 Wk Range +1. 99% 38. 45 Chg +0. 75 Last 4. 68% 33. 85 to 42. 07 Source: Bank of New York Not yet stocks!! DEPOSITARY RECEIPTS: NOT FDIC, STATE OR FEDERAL AGENCY INSURED MAY LOSE VALUE NO BANK, STATE OR FEDERAL AGENCY GUARANTEE

QUESTIONS

c0a4ebec790698067885695800086165.ppt