f9fdbcf6fc3e206f7c056d0a696e0c9f.ppt

- Количество слайдов: 23

North American Oil and Gas Pipelines: Redrawing the Map 27 th USAEE/IAEE North American Conference September 16 – 19, 2007 Stephen J. J. Letwin Executive Vice President

North American Oil and Gas Pipelines: Redrawing the Map 27 th USAEE/IAEE North American Conference September 16 – 19, 2007 Stephen J. J. Letwin Executive Vice President

Agenda n Enbridge Overview n Crude Oil Pipeline Story n Natural Gas Pipeline Story n New Pipeline Construction Risks 2

Agenda n Enbridge Overview n Crude Oil Pipeline Story n Natural Gas Pipeline Story n New Pipeline Construction Risks 2

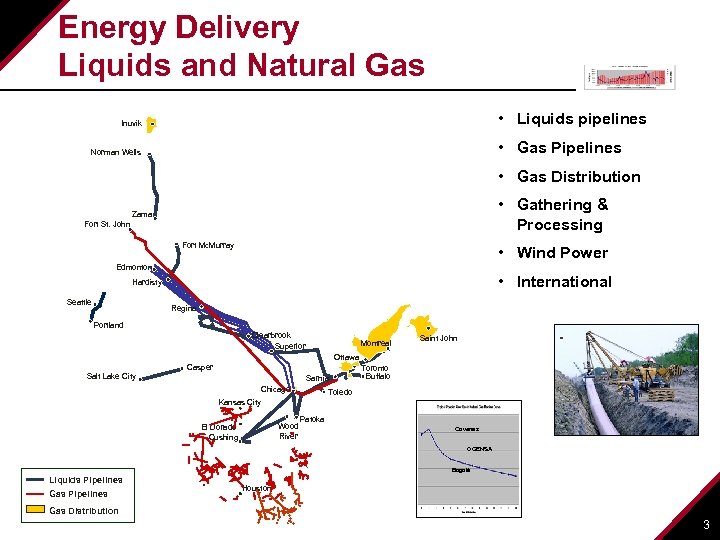

Energy Delivery Liquids and Natural Gas • Liquids pipelines Inuvik • Gas Pipelines Norman Wells • Gas Distribution • Gathering & Processing Zama Fort St. John Fort Mc. Murray • Wind Power Edmonton • International Hardisty Seattle Regina Portland Clearbrook Superior Montreal Saint John Ottawa Salt Lake City Casper Sarnia Chicago Toronto Buffalo Toledo Spain Kansas City Wood River El Dorado Cushing Patoka Covenas OCENSA Bogotá Liquids Pipelines Gas Pipelines Houston Gas Distribution 3

Energy Delivery Liquids and Natural Gas • Liquids pipelines Inuvik • Gas Pipelines Norman Wells • Gas Distribution • Gathering & Processing Zama Fort St. John Fort Mc. Murray • Wind Power Edmonton • International Hardisty Seattle Regina Portland Clearbrook Superior Montreal Saint John Ottawa Salt Lake City Casper Sarnia Chicago Toronto Buffalo Toledo Spain Kansas City Wood River El Dorado Cushing Patoka Covenas OCENSA Bogotá Liquids Pipelines Gas Pipelines Houston Gas Distribution 3

Crude Oil Pipline Story 4

Crude Oil Pipline Story 4

North American Crude Oil Pipelines 5

North American Crude Oil Pipelines 5

Historical Flow Pattern 6

Historical Flow Pattern 6

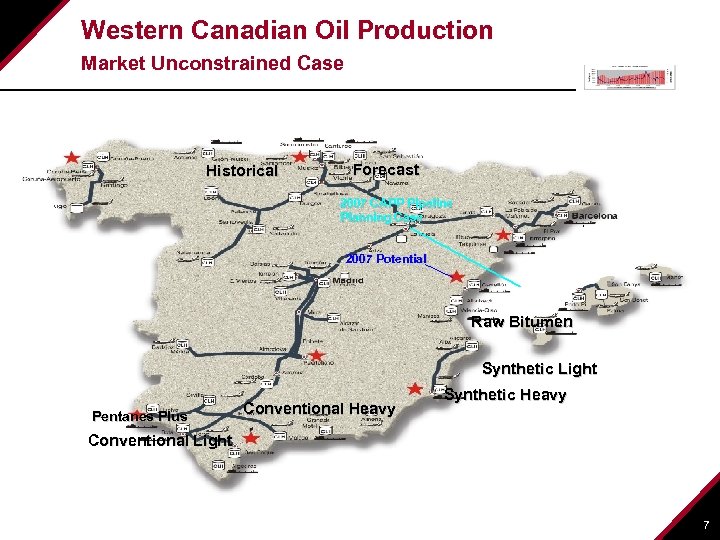

Western Canadian Oil Production Market Unconstrained Case Historical Forecast 2007 CAPP Pipeline Planning Case 2007 Potential Raw Bitumen Synthetic Light Pentanes Plus Conventional Heavy Synthetic Heavy Conventional Light 7

Western Canadian Oil Production Market Unconstrained Case Historical Forecast 2007 CAPP Pipeline Planning Case 2007 Potential Raw Bitumen Synthetic Light Pentanes Plus Conventional Heavy Synthetic Heavy Conventional Light 7

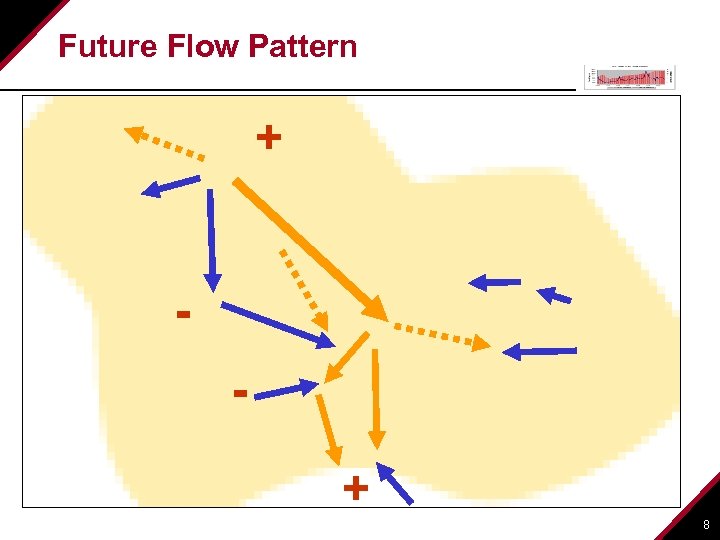

Future Flow Pattern + + 8

Future Flow Pattern + + 8

Liquids Strategy Broadening Market Access Norman Wells Enbridge/Lakehead System Other Pipelines Refineries: Canadian Supplied Zama No/Limited Cdn Supply Fort Mc. Murray Tanker Port Hardisty Edmonton Puget Sound Great Falls Clearbrook Billings Salt Lake City San Francisco Bakersfield Casper Sinclair Toronto St. Paul Chicago Cheyenne Denver Los Angeles Artesia Mc. Pherson El Dorado Coffeyville Ponca City Cushing Borger/Sunray Montreal Superior Mandan Wood River Buffalo Detroit Toledo Lima Canton Robinson Patoka Tulsa Catlettsburg Memphis Ardmore El Paso Big Spring Houston Port Arthur Lake Charles Texas City New Orleans Freeport Corpus Christi 9

Liquids Strategy Broadening Market Access Norman Wells Enbridge/Lakehead System Other Pipelines Refineries: Canadian Supplied Zama No/Limited Cdn Supply Fort Mc. Murray Tanker Port Hardisty Edmonton Puget Sound Great Falls Clearbrook Billings Salt Lake City San Francisco Bakersfield Casper Sinclair Toronto St. Paul Chicago Cheyenne Denver Los Angeles Artesia Mc. Pherson El Dorado Coffeyville Ponca City Cushing Borger/Sunray Montreal Superior Mandan Wood River Buffalo Detroit Toledo Lima Canton Robinson Patoka Tulsa Catlettsburg Memphis Ardmore El Paso Big Spring Houston Port Arthur Lake Charles Texas City New Orleans Freeport Corpus Christi 9

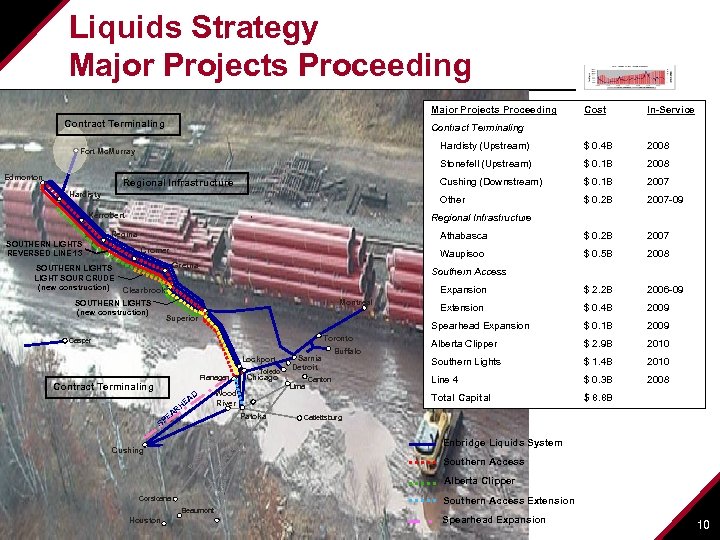

Liquids Strategy Major Projects Proceeding 2008 $ 0. 1 B 2008 Cushing (Downstream) $ 0. 1 B 2007 Other $ 0. 2 B 2007 -09 Athabasca $ 0. 2 B 2007 Waupisoo $ 0. 5 B 2008 Expansion $ 2. 2 B 2006 -09 Extension $ 0. 4 B 2009 Spearhead Expansion $ 0. 1 B 2009 Alberta Clipper $ 2. 9 B 2010 Southern Lights $ 1. 4 B 2010 Line 4 $ 0. 3 B 2008 Total Capital Regional Infrastructure Hardisty Kerrobert $ 8. 8 B Regional Infrastructure Regina Cromer SOUTHERN LIGHTS LIGHT SOUR CRUDE (new construction) $ 0. 4 B Stonefell (Upstream) SOUTHERN LIGHTS REVERSED LINE 13 In-Service Contract Terminaling Fort Mc. Murray Edmonton Cost Hardisty (Upstream) Contract Terminaling Gretna Southern Access Clearbrook Montreal SOUTHERN LIGHTS (new construction) Superior Toronto Casper Lockport Flanagan Contract Terminaling AD il ob M Cap line id V all ey n. M xo Ex Corsicana Beaumont Houston Lima Patoka SP Sarnia Detroit Chicago Wood River E RH EA Cushing Toledo Buffalo Canton Catlettsburg Enbridge Liquids System Southern Access Alberta Clipper Southern Access Extension Spearhead Expansion 10

Liquids Strategy Major Projects Proceeding 2008 $ 0. 1 B 2008 Cushing (Downstream) $ 0. 1 B 2007 Other $ 0. 2 B 2007 -09 Athabasca $ 0. 2 B 2007 Waupisoo $ 0. 5 B 2008 Expansion $ 2. 2 B 2006 -09 Extension $ 0. 4 B 2009 Spearhead Expansion $ 0. 1 B 2009 Alberta Clipper $ 2. 9 B 2010 Southern Lights $ 1. 4 B 2010 Line 4 $ 0. 3 B 2008 Total Capital Regional Infrastructure Hardisty Kerrobert $ 8. 8 B Regional Infrastructure Regina Cromer SOUTHERN LIGHTS LIGHT SOUR CRUDE (new construction) $ 0. 4 B Stonefell (Upstream) SOUTHERN LIGHTS REVERSED LINE 13 In-Service Contract Terminaling Fort Mc. Murray Edmonton Cost Hardisty (Upstream) Contract Terminaling Gretna Southern Access Clearbrook Montreal SOUTHERN LIGHTS (new construction) Superior Toronto Casper Lockport Flanagan Contract Terminaling AD il ob M Cap line id V all ey n. M xo Ex Corsicana Beaumont Houston Lima Patoka SP Sarnia Detroit Chicago Wood River E RH EA Cushing Toledo Buffalo Canton Catlettsburg Enbridge Liquids System Southern Access Alberta Clipper Southern Access Extension Spearhead Expansion 10

Natural Gas Pipeline Story 11

Natural Gas Pipeline Story 11

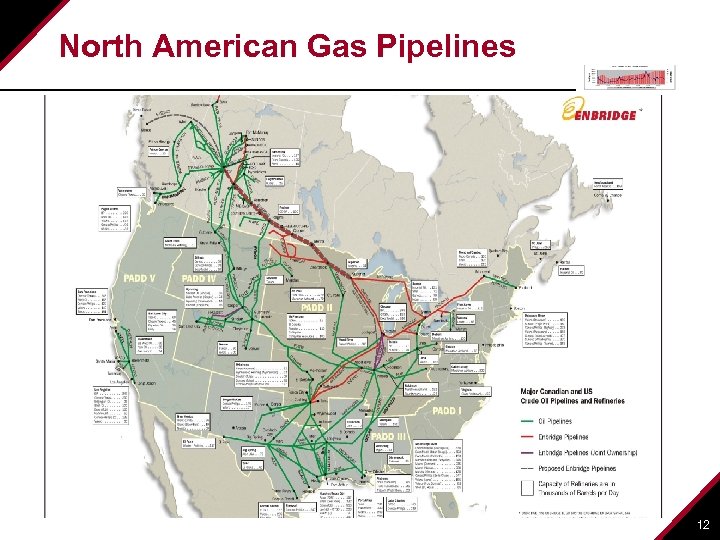

North American Gas Pipelines 12

North American Gas Pipelines 12

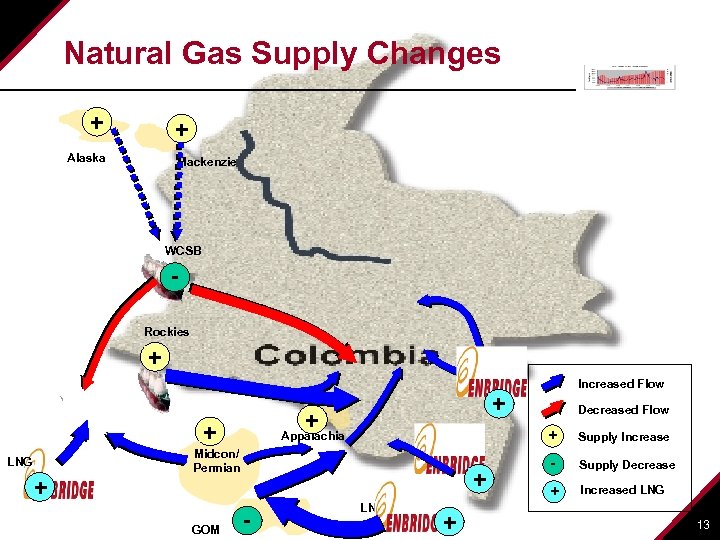

Natural Gas Supply Changes + + Alaska Mackenzie WCSB Rockies + Increased Flow + + Appalachia Midcon/ Permian LNG + + GOM - Decreased Flow LNG + Supply Increase - Supply Decrease + Increased LNG 13

Natural Gas Supply Changes + + Alaska Mackenzie WCSB Rockies + Increased Flow + + Appalachia Midcon/ Permian LNG + + GOM - Decreased Flow LNG + Supply Increase - Supply Decrease + Increased LNG 13

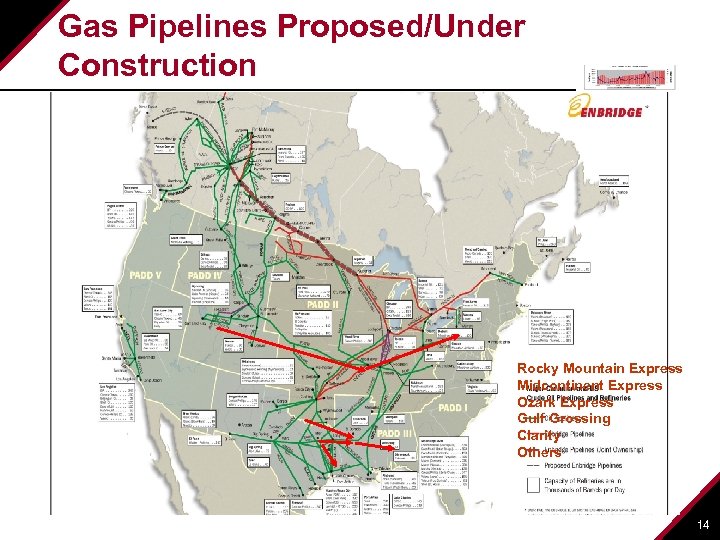

Gas Pipelines Proposed/Under Construction Rocky Mountain Express Midcontinent Express Ozark Express Gulf Grossing Clarity Others 14

Gas Pipelines Proposed/Under Construction Rocky Mountain Express Midcontinent Express Ozark Express Gulf Grossing Clarity Others 14

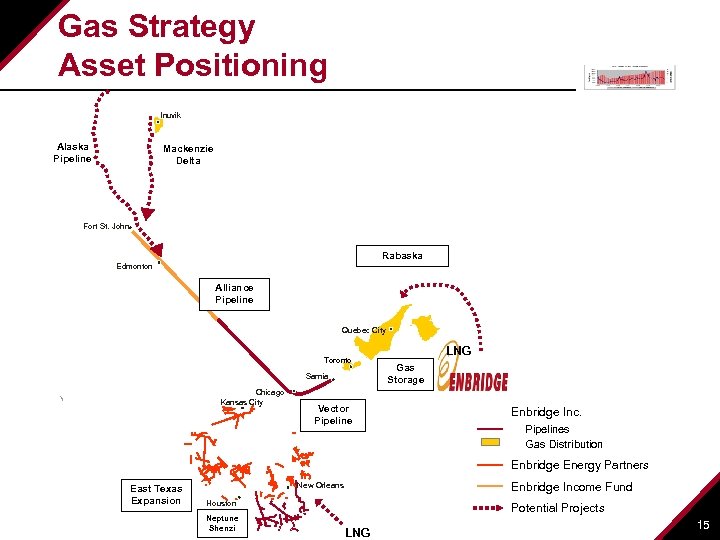

Gas Strategy Asset Positioning Inuvik Alaska Pipeline Mackenzie Delta Fort St. John Rabaska Edmonton Alliance Pipeline Quebec City Toronto Sarnia Chicago Kansas City Vector Pipeline LNG Gas Storage Enbridge Inc. Pipelines Gas Distribution Enbridge Energy Partners East Texas Expansion Enbridge Income Fund New Orleans Houston Neptune Shenzi Potential Projects LNG 15

Gas Strategy Asset Positioning Inuvik Alaska Pipeline Mackenzie Delta Fort St. John Rabaska Edmonton Alliance Pipeline Quebec City Toronto Sarnia Chicago Kansas City Vector Pipeline LNG Gas Storage Enbridge Inc. Pipelines Gas Distribution Enbridge Energy Partners East Texas Expansion Enbridge Income Fund New Orleans Houston Neptune Shenzi Potential Projects LNG 15

Pipeline Project Risk 16

Pipeline Project Risk 16

North American Pipeline Construction n Potential Pipeline Requirements* * Estimate as of Jan ‘ 07 17

North American Pipeline Construction n Potential Pipeline Requirements* * Estimate as of Jan ‘ 07 17

New Pipeline Project Risks n Supply/Demand n Construction costs n Environment n Competition n Regulatory n Operating 18

New Pipeline Project Risks n Supply/Demand n Construction costs n Environment n Competition n Regulatory n Operating 18

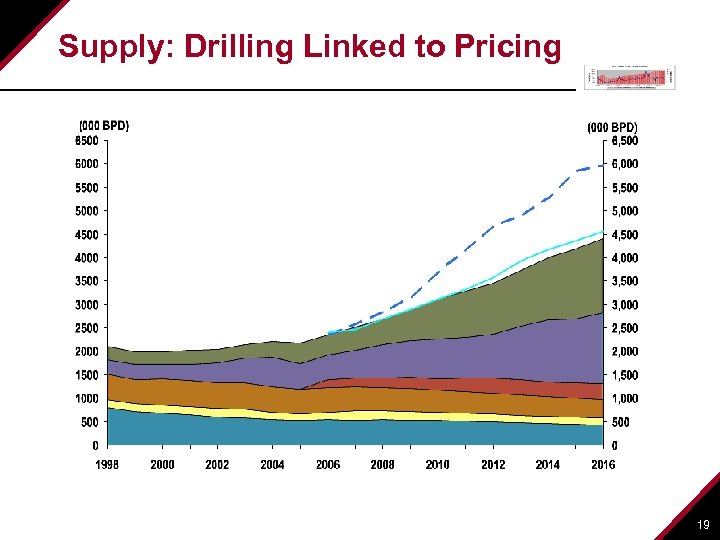

Supply: Drilling Linked to Pricing 19

Supply: Drilling Linked to Pricing 19

Future supply linked to continued drilling 20

Future supply linked to continued drilling 20

Construction Pressures n Steel – High Chinese Demand n Pipe Mill Space – 3, 200 miles/year capacity for 24”+ n Lay Costs – Only 25 Spreads available n Right of Way – Higher congestion, more vocal opposition n Workforce – Retiring skilled labor not being replaced 21

Construction Pressures n Steel – High Chinese Demand n Pipe Mill Space – 3, 200 miles/year capacity for 24”+ n Lay Costs – Only 25 Spreads available n Right of Way – Higher congestion, more vocal opposition n Workforce – Retiring skilled labor not being replaced 21

Risk Strategies n Strong project management n Joint Ventures n Long term agreements n Take or Pay Contracts n Legislative stability 22

Risk Strategies n Strong project management n Joint Ventures n Long term agreements n Take or Pay Contracts n Legislative stability 22

North American Oil and Gas Pipelines: Redrawing the Map Stephen J. J. Letwin Executive Vice President Gas Transportation & international

North American Oil and Gas Pipelines: Redrawing the Map Stephen J. J. Letwin Executive Vice President Gas Transportation & international