0bb74173b47d73c18d5e3c1c266da29d.ppt

- Количество слайдов: 23

Norges Bank Executive Board meeting 15 December 2004 1

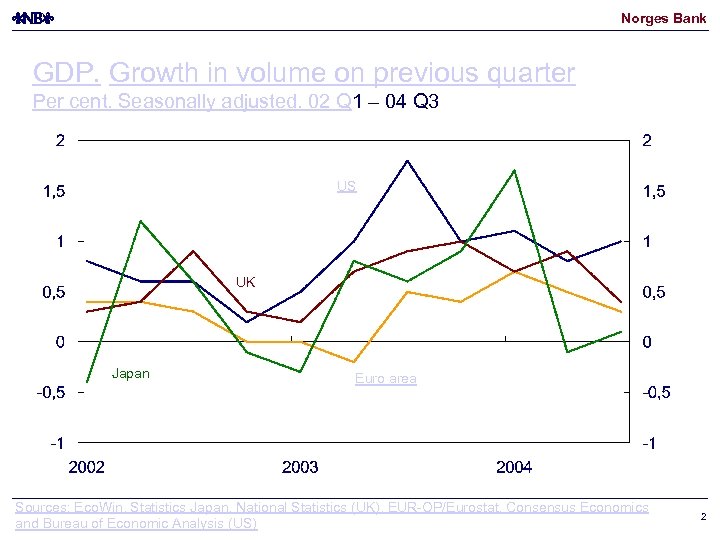

Norges Bank GDP. Growth in volume on previous quarter Per cent. Seasonally adjusted. 02 Q 1 – 04 Q 3 US UK Japan Euro area Sources: Eco. Win, Statistics Japan, National Statistics (UK), EUR-OP/Eurostat, Consensus Economics and Bureau of Economic Analysis (US) 2

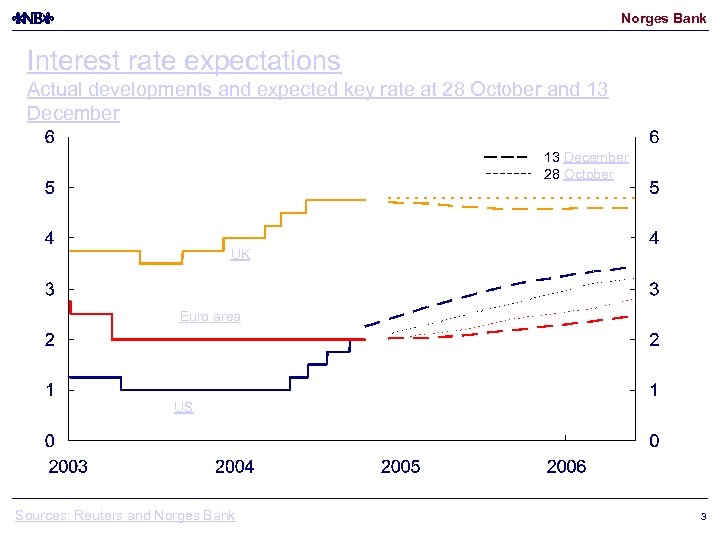

Norges Bank Interest rate expectations Actual developments and expected key rate at 28 October and 13 December 28 October UK Euro area US Sources: Reuters and Norges Bank 3

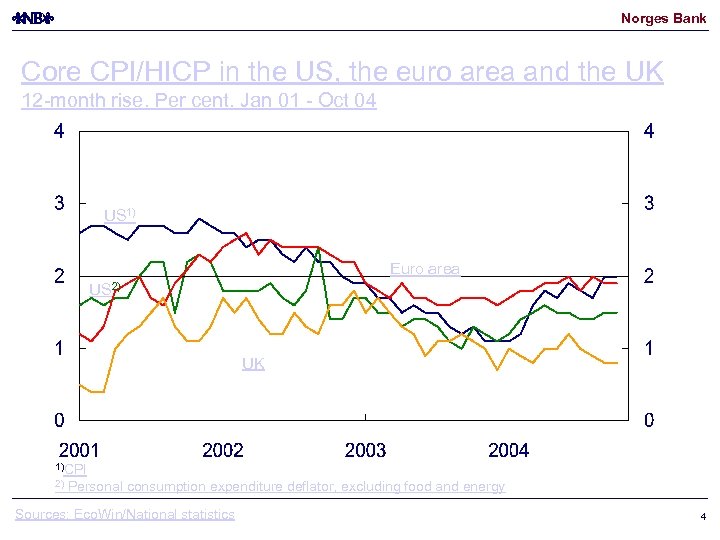

Norges Bank Core CPI/HICP in the US, the euro area and the UK 12 -month rise. Per cent. Jan 01 - Oct 04 US 1) Euro area US 2) UK 1)CPI 2) Personal consumption expenditure deflator, excluding food and energy Sources: Eco. Win/National statistics 4

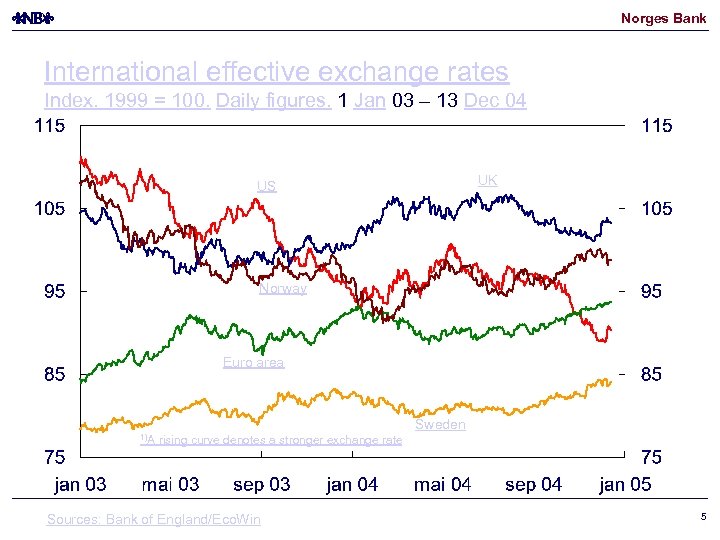

Norges Bank International effective exchange rates Index. 1999 = 100. Daily figures. 1 Jan 03 – 13 Dec 04 UK US Norway Euro area Sweden 1)A rising curve denotes a stronger exchange rate Sources: Bank of England/Eco. Win 5

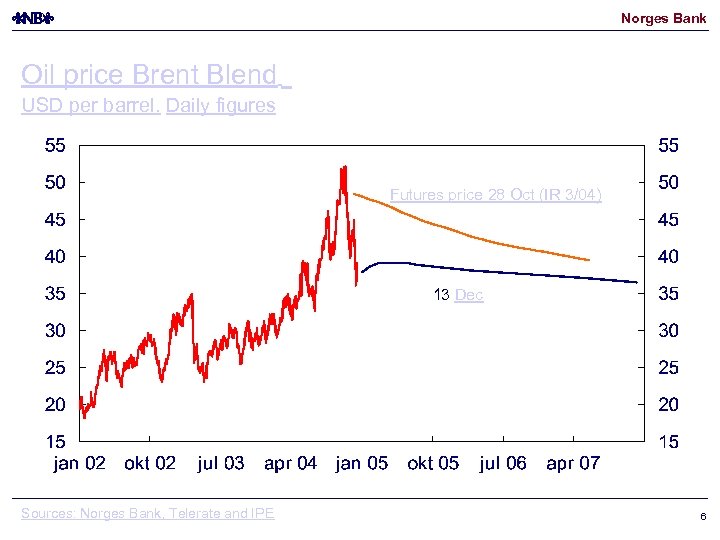

Norges Bank Oil price Brent Blend USD per barrel. Daily figures Futures price 28 Oct (IR 3/04) 13 Dec Sources: Norges Bank, Telerate and IPE 6

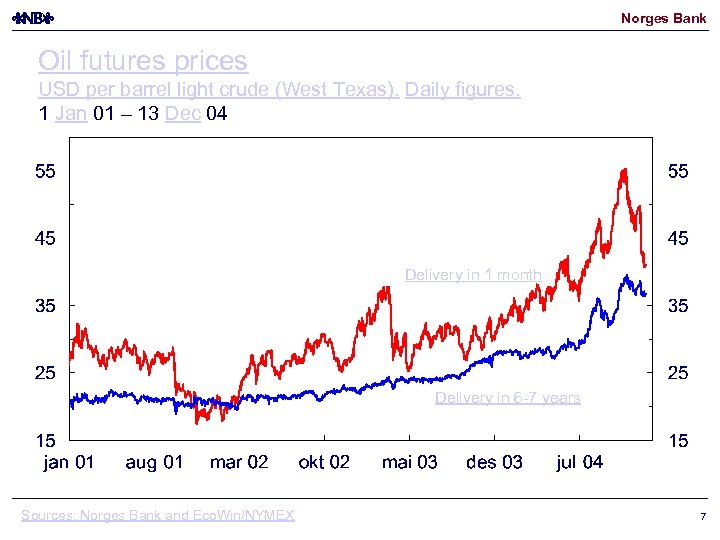

Norges Bank Oil futures prices USD per barrel light crude (West Texas). Daily figures. 1 Jan 01 – 13 Dec 04 Delivery in 1 month Delivery in 6 -7 years Sources: Norges Bank and Eco. Win/NYMEX 7

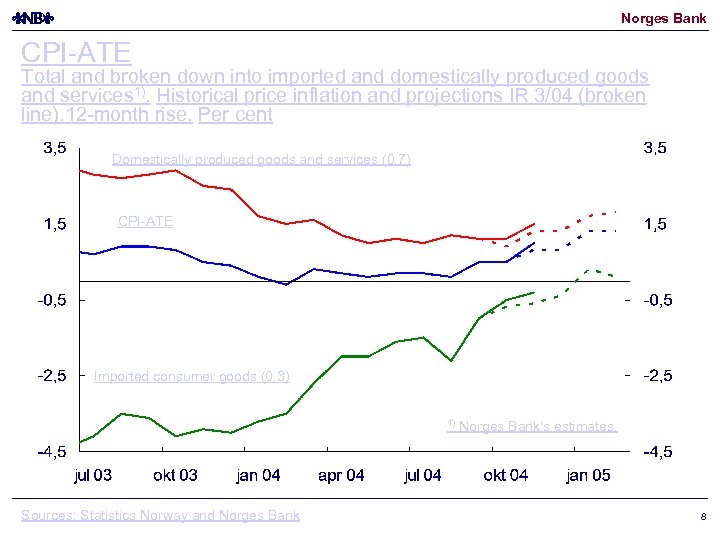

Norges Bank CPI-ATE Total and broken down into imported and domestically produced goods and services 1). Historical price inflation and projections IR 3/04 (broken line). 12 -month rise. Per cent Domestically produced goods and services (0. 7) CPI-ATE Imported consumer goods (0. 3) 1) Sources: Statistics Norway and Norges Bank's estimates. 8

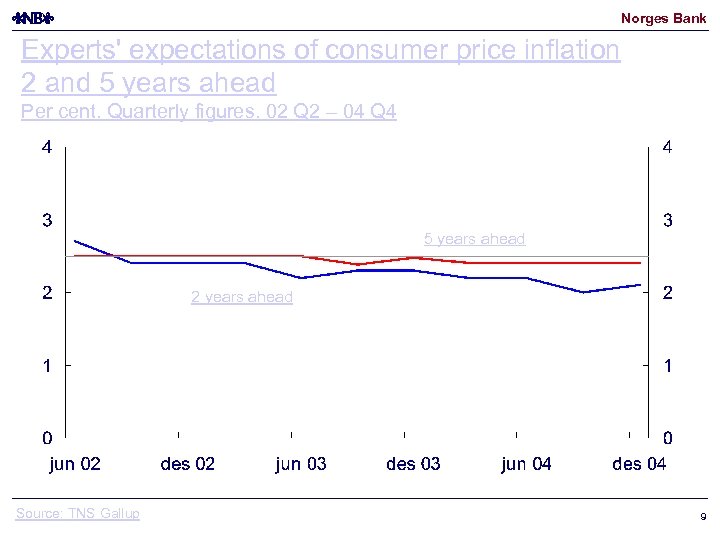

Norges Bank Experts' expectations of consumer price inflation 2 and 5 years ahead Per cent. Quarterly figures. 02 Q 2 – 04 Q 4 5 years ahead 2 years ahead Source: TNS Gallup 9

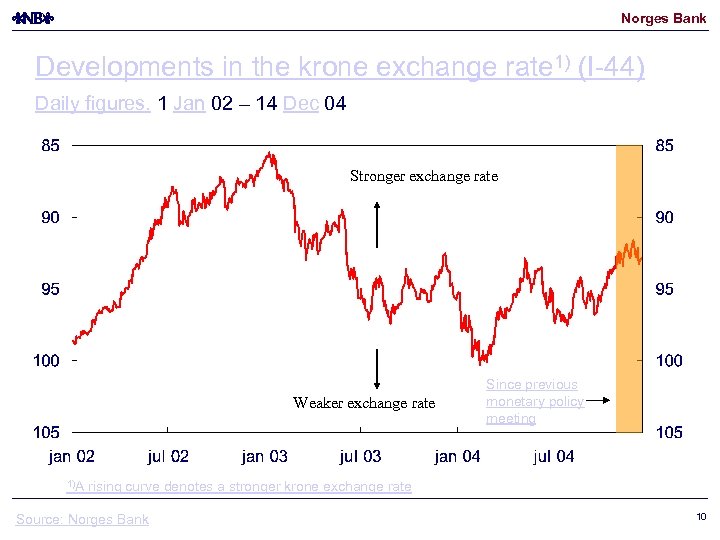

Norges Bank Developments in the krone exchange rate 1) (I-44) Daily figures. 1 Jan 02 – 14 Dec 04 Stronger exchange rate Weaker exchange rate 1)A Since previous monetary policy meeting rising curve denotes a stronger krone exchange rate Source: Norges Bank 10

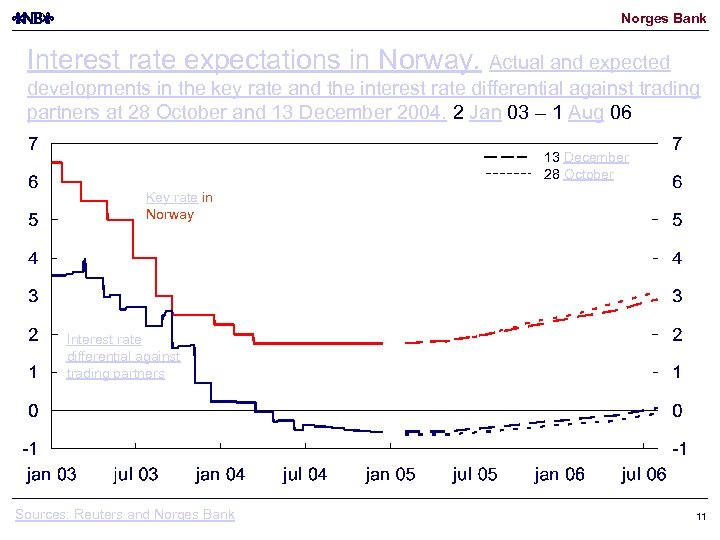

Norges Bank Interest rate expectations in Norway. Actual and expected developments in the key rate and the interest rate differential against trading partners at 28 October and 13 December 2004. 2 Jan 03 – 1 Aug 06 13 December 28 October Key rate in Norway Interest rate differential against trading partners Sources: Reuters and Norges Bank 11

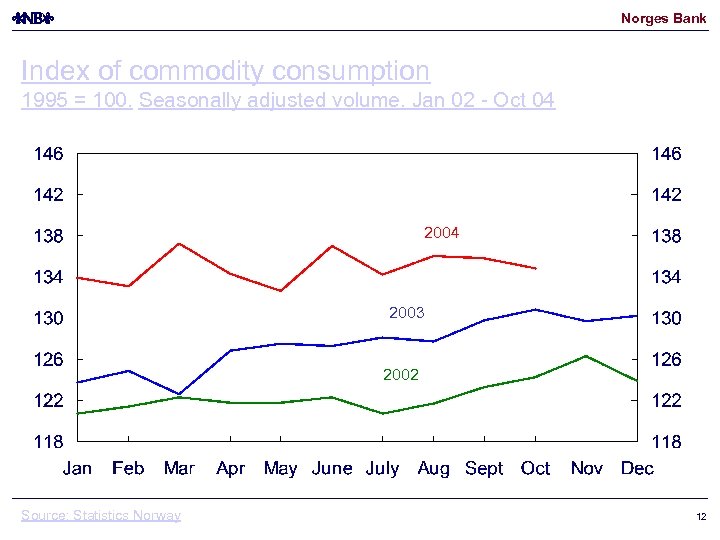

Norges Bank Index of commodity consumption 1995 = 100. Seasonally adjusted volume. Jan 02 - Oct 04 2003 2002 Source: Statistics Norway 12

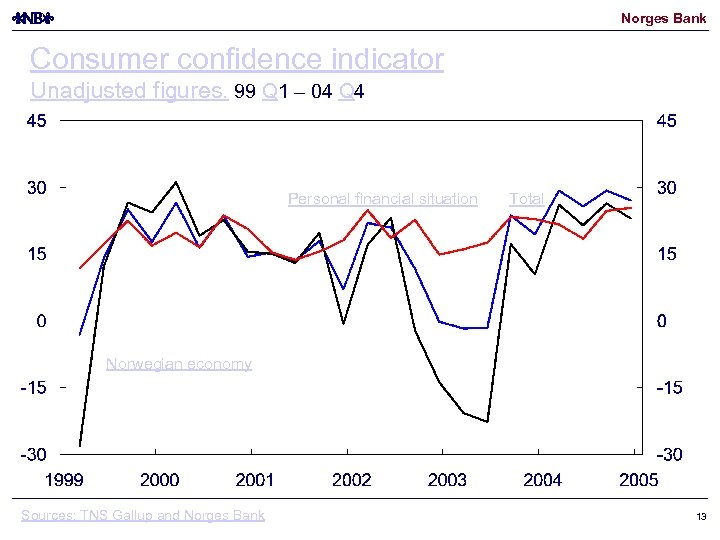

Norges Bank Consumer confidence indicator Unadjusted figures. 99 Q 1 – 04 Q 4 Personal financial situation Total Norwegian economy Sources: TNS Gallup and Norges Bank 13

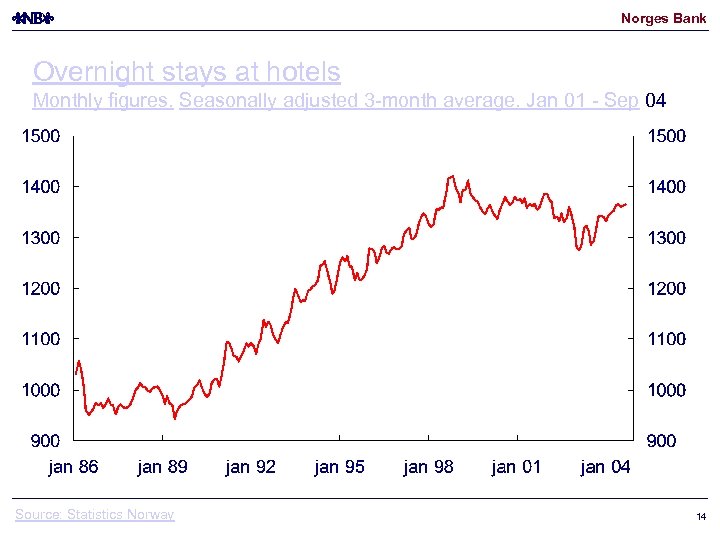

Norges Bank Overnight stays at hotels Monthly figures. Seasonally adjusted 3 -month average. Jan 01 - Sep 04 Source: Statistics Norway 14

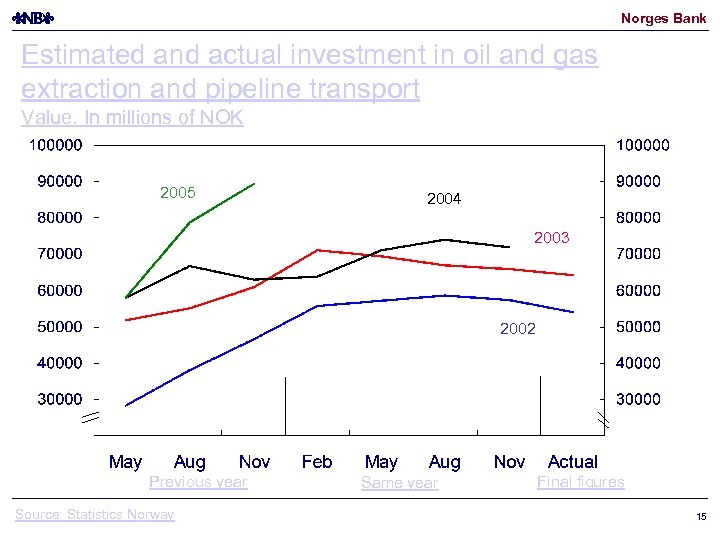

Norges Bank Estimated and actual investment in oil and gas extraction and pipeline transport Value. In millions of NOK 2005 2004 2003 2002 Previous year Source: Statistics Norway Same year Final figures 15

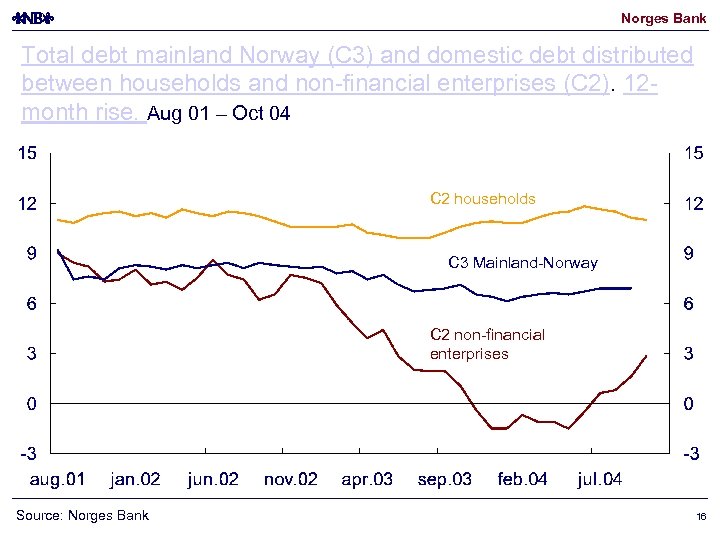

Norges Bank Total debt mainland Norway (C 3) and domestic debt distributed between households and non-financial enterprises (C 2). 12 month rise. Aug 01 – Oct 04 C 2 households C 3 Mainland-Norway C 2 non-financial enterprises Source: Norges Bank 16

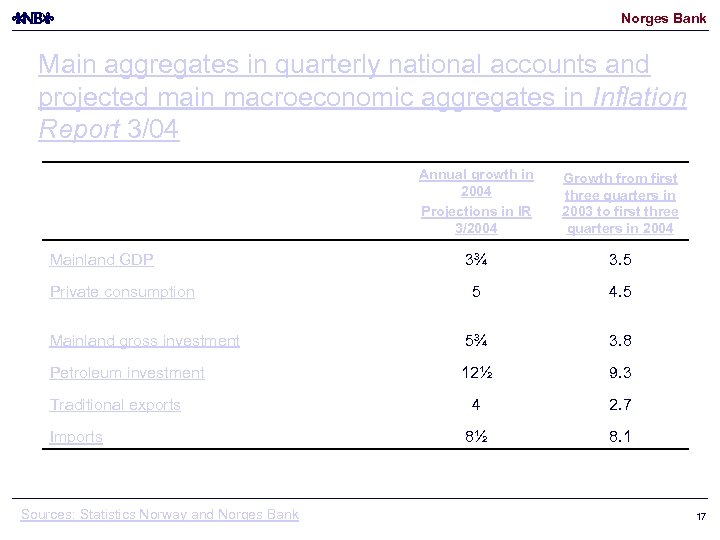

Norges Bank Main aggregates in quarterly national accounts and projected main macroeconomic aggregates in Inflation Report 3/04 Annual growth in 2004 Projections in IR 3/2004 Growth from first three quarters in 2003 to first three quarters in 2004 3¾ 3. 5 5 4. 5 Mainland gross investment 5¾ 3. 8 Petroleum investment 12½ 9. 3 4 2. 7 8½ 8. 1 Mainland GDP Private consumption Traditional exports Imports Sources: Statistics Norway and Norges Bank 17

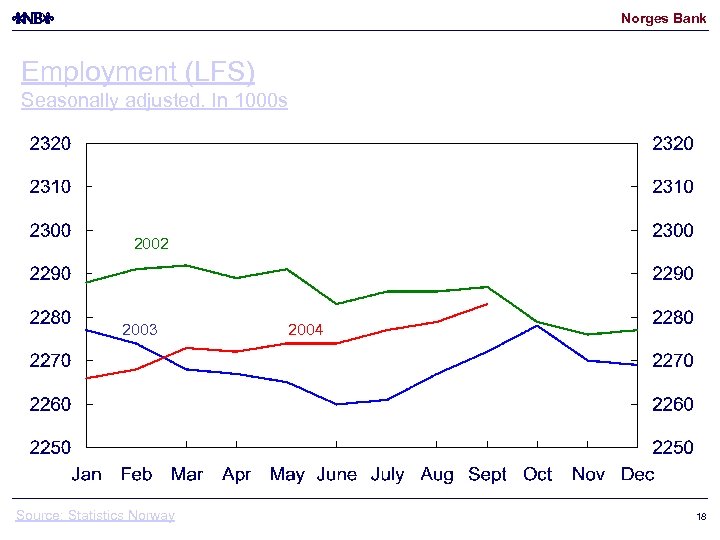

Norges Bank Employment (LFS) Seasonally adjusted. In 1000 s 2002 2003 Source: Statistics Norway 2004 18

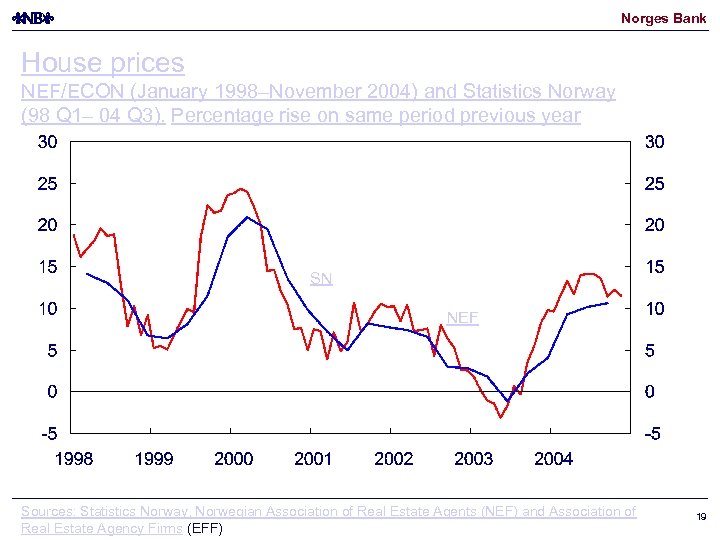

Norges Bank House prices NEF/ECON (January 1998–November 2004) and Statistics Norway (98 Q 1– 04 Q 3). Percentage rise on same period previous year SN NEF Sources: Statistics Norway, Norwegian Association of Real Estate Agents (NEF) and Association of Real Estate Agency Firms (EFF) 19

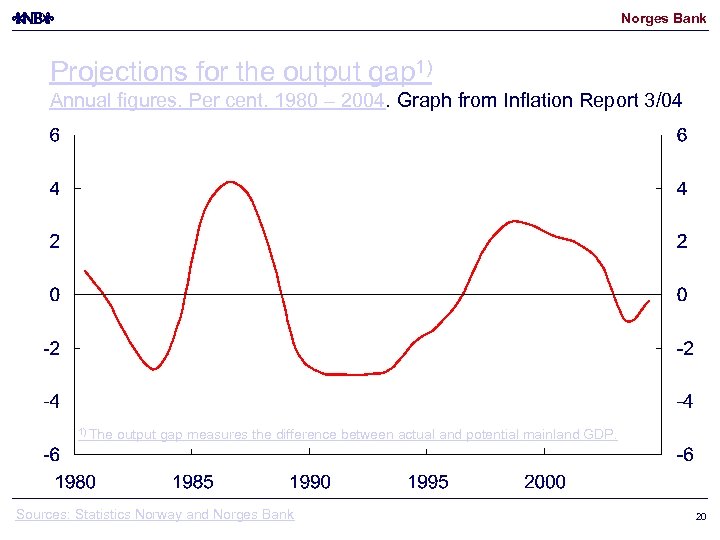

Norges Bank Projections for the output gap 1) Annual figures. Per cent. 1980 – 2004. Graph from Inflation Report 3/04 1) The output gap measures the difference between actual and potential mainland GDP. Sources: Statistics Norway and Norges Bank 20

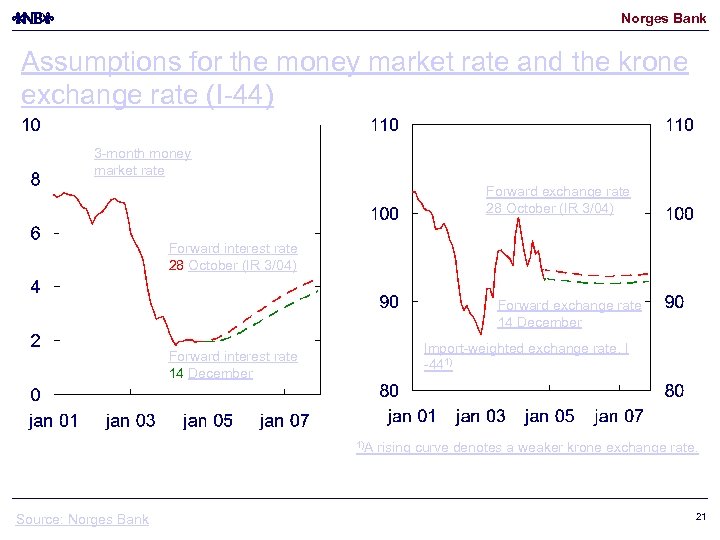

Norges Bank Assumptions for the money market rate and the krone exchange rate (I-44) 3 -month money market rate Forward exchange rate 28 October (IR 3/04) Forward interest rate 28 October (IR 3/04) Forward exchange rate 14 December Import-weighted exchange rate, I -441) Forward interest rate 14 December 1)A Source: Norges Bank rising curve denotes a weaker krone exchange rate. 21

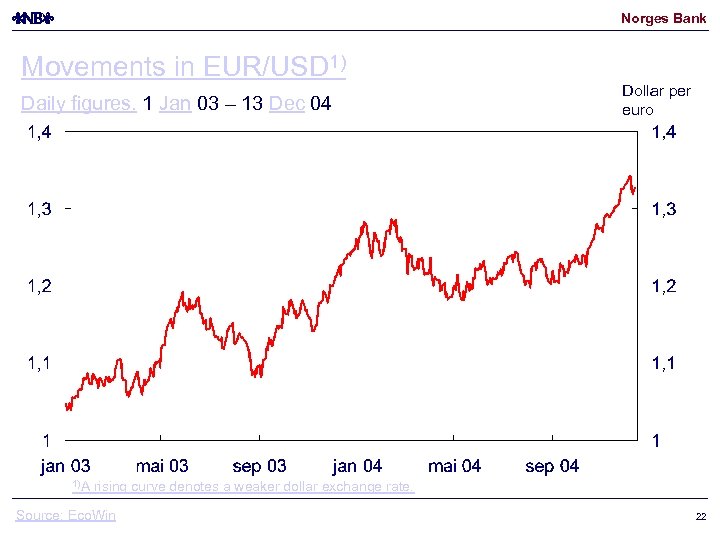

Norges Bank Movements in EUR/USD 1) Daily figures. 1 Jan 03 – 13 Dec 04 1)A Dollar per euro rising curve denotes a weaker dollar exchange rate. Source: Eco. Win 22

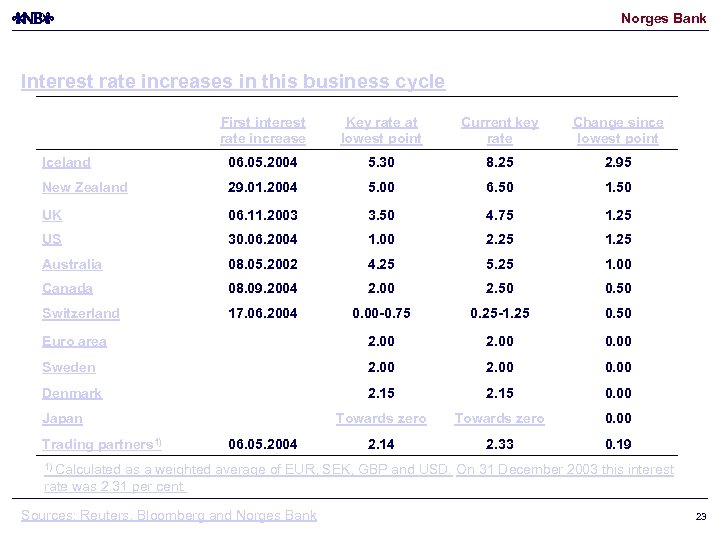

Norges Bank Interest rate increases in this business cycle First interest rate increase Key rate at lowest point Current key rate Change since lowest point Iceland 06. 05. 2004 5. 30 8. 25 2. 95 New Zealand 29. 01. 2004 5. 00 6. 50 1. 50 UK 06. 11. 2003 3. 50 4. 75 1. 25 US 30. 06. 2004 1. 00 2. 25 1. 25 Australia 08. 05. 2002 4. 25 5. 25 1. 00 Canada 08. 09. 2004 2. 00 2. 50 0. 50 Switzerland 17. 06. 2004 0. 00 -0. 75 0. 25 -1. 25 0. 50 Euro area 2. 00 0. 00 Sweden 2. 00 0. 00 Denmark 2. 15 0. 00 Towards zero 0. 00 2. 14 2. 33 0. 19 Japan Trading partners 1) 06. 05. 2004 1) Calculated as a weighted average of EUR, SEK, GBP and USD. On 31 December 2003 this interest rate was 2. 31 per cent. Sources: Reuters, Bloomberg and Norges Bank 23

0bb74173b47d73c18d5e3c1c266da29d.ppt