7ebf86b940aa6daa0c1878daaebf23eb.ppt

- Количество слайдов: 20

NORD POOL Market Integration: Nordic Countries APEx 2003 Conference, Catagena de Indias – Colombia, October 14 & 15 -2003 Torger Lien, President & CEO Nord Pool ASA

NORD POOL Market Integration: Nordic Countries APEx 2003 Conference, Catagena de Indias – Colombia, October 14 & 15 -2003 Torger Lien, President & CEO Nord Pool ASA

Regional challenges n n n 4 4 5 5 Countries Governments with changing policy Legislations Regulators and FSA’s TSO’s Grid’s with reasonably good connections AND ONE MARKET Copyright Nord Pool ASA 2002

Regional challenges n n n 4 4 5 5 Countries Governments with changing policy Legislations Regulators and FSA’s TSO’s Grid’s with reasonably good connections AND ONE MARKET Copyright Nord Pool ASA 2002

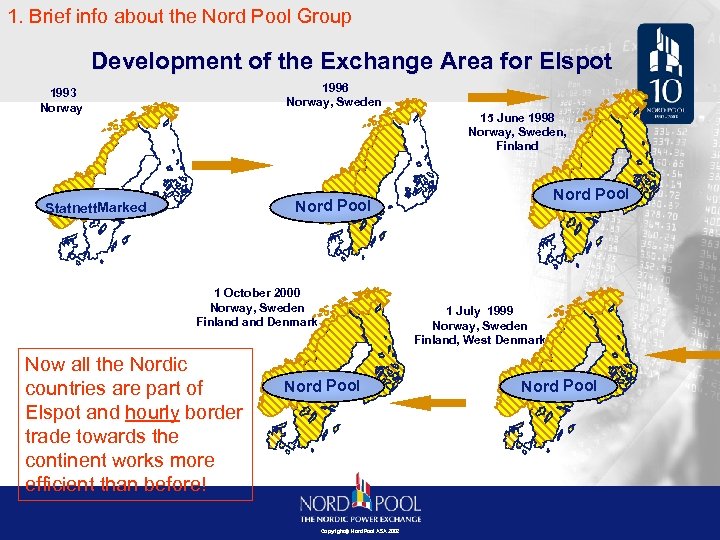

1. Brief info about the Nord Pool Group Development of the Exchange Area for Elspot 1996 Norway, Sweden 1993 Norway 15 June 1998 Norway, Sweden, Finland Nord Pool Statnett. Marked 1 October 2000 Norway, Sweden Finland Denmark Now all the Nordic countries are part of Elspot and hourly border trade towards the continent works more efficient than before! 1 July 1999 Norway, Sweden Finland, West Denmark Nord Pool Copyright Nord Pool ASA 2002 Nord Pool

1. Brief info about the Nord Pool Group Development of the Exchange Area for Elspot 1996 Norway, Sweden 1993 Norway 15 June 1998 Norway, Sweden, Finland Nord Pool Statnett. Marked 1 October 2000 Norway, Sweden Finland Denmark Now all the Nordic countries are part of Elspot and hourly border trade towards the continent works more efficient than before! 1 July 1999 Norway, Sweden Finland, West Denmark Nord Pool Copyright Nord Pool ASA 2002 Nord Pool

Nord Pool’s Participants February 2003 (Legal Entities) Finland 39 Norway 157 UK 10 Sweden 80 Denmark 22 Germany 4 USA 2 The Netherlands 3 Belgium France 1 Switzerland 1 1 Copyright Nord Pool ASA 2002 Total: 321 Italy 1

Nord Pool’s Participants February 2003 (Legal Entities) Finland 39 Norway 157 UK 10 Sweden 80 Denmark 22 Germany 4 USA 2 The Netherlands 3 Belgium France 1 Switzerland 1 1 Copyright Nord Pool ASA 2002 Total: 321 Italy 1

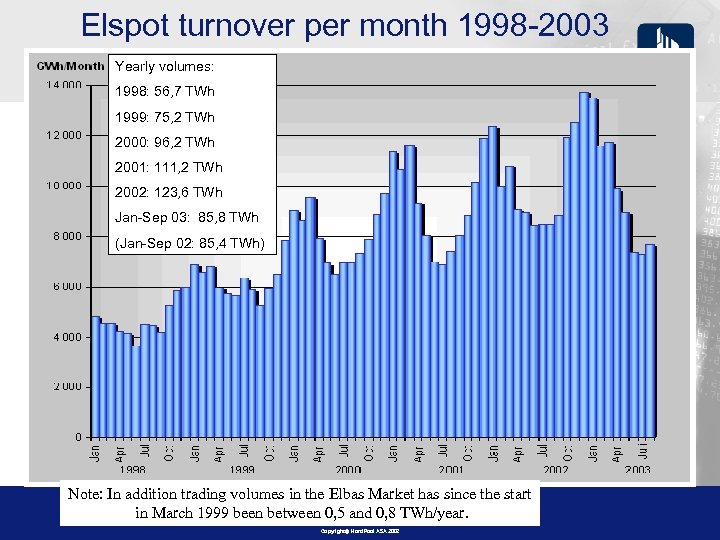

Elspot turnover per month 1998 -2003 Yearly volumes: 1998: 56, 7 TWh 1999: 75, 2 TWh 2000: 96, 2 TWh 2001: 111, 2 TWh 2002: 123, 6 TWh Jan-Sep 03: 85, 8 TWh (Jan-Sep 02: 85, 4 TWh) Note: In addition trading volumes in the Elbas Market has since the start in March 1999 been between 0, 5 and 0, 8 TWh/year. Copyright Nord Pool ASA 2002

Elspot turnover per month 1998 -2003 Yearly volumes: 1998: 56, 7 TWh 1999: 75, 2 TWh 2000: 96, 2 TWh 2001: 111, 2 TWh 2002: 123, 6 TWh Jan-Sep 03: 85, 8 TWh (Jan-Sep 02: 85, 4 TWh) Note: In addition trading volumes in the Elbas Market has since the start in March 1999 been between 0, 5 and 0, 8 TWh/year. Copyright Nord Pool ASA 2002

System Operators’ (TSOs) vs. the Nord Pool Group’s roles in the Nordic Power Market System Operator (TSO) Within the hour The Nordic Power Exchange - Nord Pool Trading and Clearing – physical and financial The next day Next day up to four years ahead Regulating service The Spot Market The Financial Market • Balancing between production and consumption real-time • Balance settlement of BRCs afterwards on measured and reported values Physical delivery Planned balance Hourly contracts Elspot (and Elbas) Run by Nord Pool Spot AS Price hedging (for physical Spot) Risk Management Financial contracts Elspot prices underlying products Daily--yearly contracts, Options Run by Nord Pool ASA Clearing services run by Nord Pool Clearing ASA Copyright Nord Pool ASA 2002

System Operators’ (TSOs) vs. the Nord Pool Group’s roles in the Nordic Power Market System Operator (TSO) Within the hour The Nordic Power Exchange - Nord Pool Trading and Clearing – physical and financial The next day Next day up to four years ahead Regulating service The Spot Market The Financial Market • Balancing between production and consumption real-time • Balance settlement of BRCs afterwards on measured and reported values Physical delivery Planned balance Hourly contracts Elspot (and Elbas) Run by Nord Pool Spot AS Price hedging (for physical Spot) Risk Management Financial contracts Elspot prices underlying products Daily--yearly contracts, Options Run by Nord Pool ASA Clearing services run by Nord Pool Clearing ASA Copyright Nord Pool ASA 2002

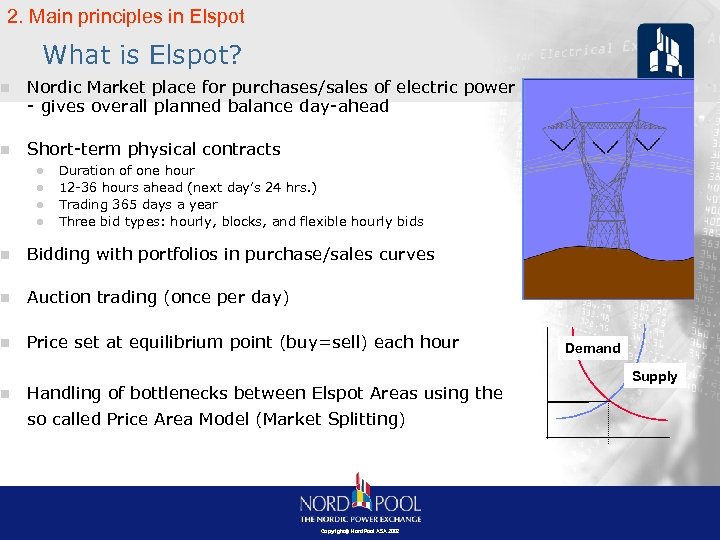

2. Main principles in Elspot What is Elspot? n Nordic Market place for purchases/sales of electric power - gives overall planned balance day-ahead n Short-term physical contracts l l Duration of one hour 12 -36 hours ahead (next day’s 24 hrs. ) Trading 365 days a year Three bid types: hourly, blocks, and flexible hourly bids n Bidding with portfolios in purchase/sales curves n Auction trading (once per day) n Price set at equilibrium point (buy=sell) each hour n Handling of bottlenecks between Elspot Areas using the so called Price Area Model (Market Splitting) Copyright Nord Pool ASA 2002 Demand Supply

2. Main principles in Elspot What is Elspot? n Nordic Market place for purchases/sales of electric power - gives overall planned balance day-ahead n Short-term physical contracts l l Duration of one hour 12 -36 hours ahead (next day’s 24 hrs. ) Trading 365 days a year Three bid types: hourly, blocks, and flexible hourly bids n Bidding with portfolios in purchase/sales curves n Auction trading (once per day) n Price set at equilibrium point (buy=sell) each hour n Handling of bottlenecks between Elspot Areas using the so called Price Area Model (Market Splitting) Copyright Nord Pool ASA 2002 Demand Supply

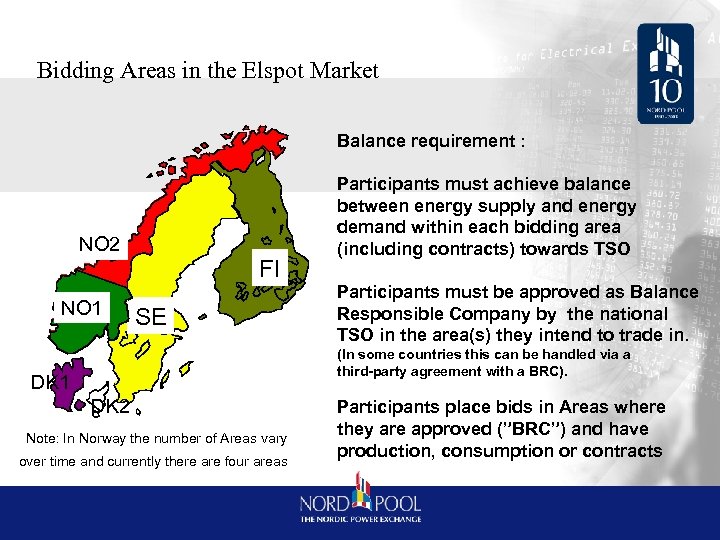

Bidding Areas in the Elspot Market Balance requirement : NO 2 E NO 1 FI SE Participants must achieve balance between energy supply and energy demand within each bidding area (including contracts) towards TSO Participants must be approved as Balance Responsible Company by the national TSO in the area(s) they intend to trade in. (In some countries this can be handled via a third-party agreement with a BRC). DK 1 DK 2 Note: In Norway the number of Areas vary over time and currently there are four areas Participants place bids in Areas where they are approved (”BRC”) and have production, consumption or contracts

Bidding Areas in the Elspot Market Balance requirement : NO 2 E NO 1 FI SE Participants must achieve balance between energy supply and energy demand within each bidding area (including contracts) towards TSO Participants must be approved as Balance Responsible Company by the national TSO in the area(s) they intend to trade in. (In some countries this can be handled via a third-party agreement with a BRC). DK 1 DK 2 Note: In Norway the number of Areas vary over time and currently there are four areas Participants place bids in Areas where they are approved (”BRC”) and have production, consumption or contracts

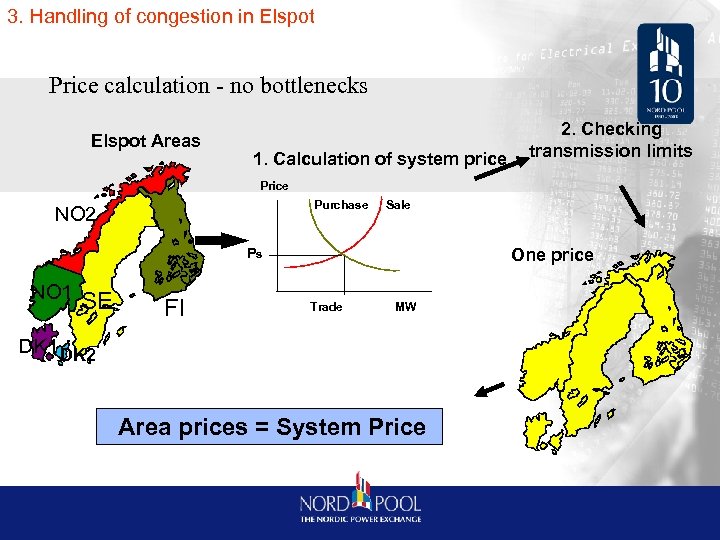

3. Handling of congestion in Elspot Price calculation - no bottlenecks Elspot Areas 1. Calculation of system price 2. Checking transmission limits Price Purchase NO 2 Sale One price Ps E NO 1 SE FI Trade MW DK 1 DK 2 Area prices = System Price

3. Handling of congestion in Elspot Price calculation - no bottlenecks Elspot Areas 1. Calculation of system price 2. Checking transmission limits Price Purchase NO 2 Sale One price Ps E NO 1 SE FI Trade MW DK 1 DK 2 Area prices = System Price

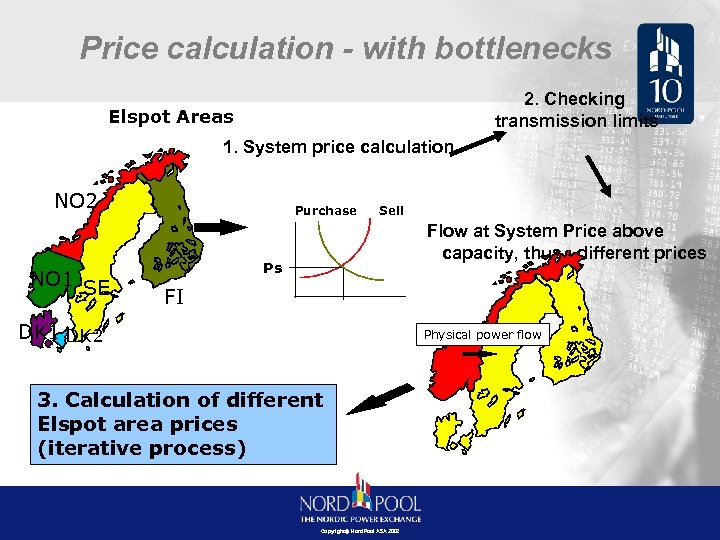

Price calculation - with bottlenecks 2. Checking transmission limits Elspot Areas 1. System price calculation NO 2 E NO 1 SE Purchase Sell Flow at System Price above capacity, thus different prices Ps FI DK 1 DK 2 Physical power flow 3. Calculation of different Elspot area prices (iterative process) Copyright Nord Pool ASA 2002

Price calculation - with bottlenecks 2. Checking transmission limits Elspot Areas 1. System price calculation NO 2 E NO 1 SE Purchase Sell Flow at System Price above capacity, thus different prices Ps FI DK 1 DK 2 Physical power flow 3. Calculation of different Elspot area prices (iterative process) Copyright Nord Pool ASA 2002

Calculation of area prices when bottlenecks occur Example: System Price calculation results in a flow from Sweden to Norway above capacity (C). System Price D S Price Area Sweden D Swe +exp S Swe Price Area Norway S Nor +imp D Norway price System Price Sweden price C C n Solution like above: Flow is ”geared down” to max. transmission capacity (C) by the price-mechanism. Export (Swe) and import (Nor) will be equal to available capacity (C). n Result: Norway price > System price > Sweden price Participants are always credited/debited according to the Area Prices. Copyright Nord Pool ASA 2002

Calculation of area prices when bottlenecks occur Example: System Price calculation results in a flow from Sweden to Norway above capacity (C). System Price D S Price Area Sweden D Swe +exp S Swe Price Area Norway S Nor +imp D Norway price System Price Sweden price C C n Solution like above: Flow is ”geared down” to max. transmission capacity (C) by the price-mechanism. Export (Swe) and import (Nor) will be equal to available capacity (C). n Result: Norway price > System price > Sweden price Participants are always credited/debited according to the Area Prices. Copyright Nord Pool ASA 2002

Elspot prices for Oslo, Stockholm and System 1996 - 2003 Copyright Nord Pool ASA 2002

Elspot prices for Oslo, Stockholm and System 1996 - 2003 Copyright Nord Pool ASA 2002

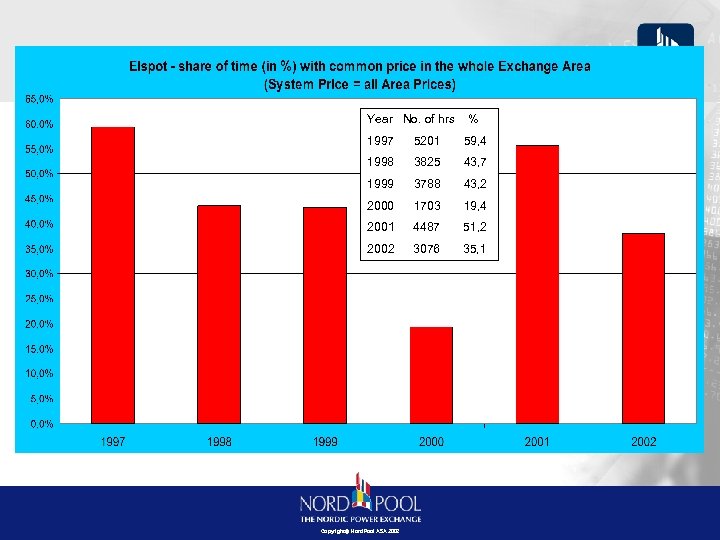

Year No. of hrs % 1997 5201 59, 4 1998 3825 43, 7 1999 3788 43, 2 2000 1703 19, 4 2001 4487 51, 2 2002 3076 35, 1 Copyright Nord Pool ASA 2002

Year No. of hrs % 1997 5201 59, 4 1998 3825 43, 7 1999 3788 43, 2 2000 1703 19, 4 2001 4487 51, 2 2002 3076 35, 1 Copyright Nord Pool ASA 2002

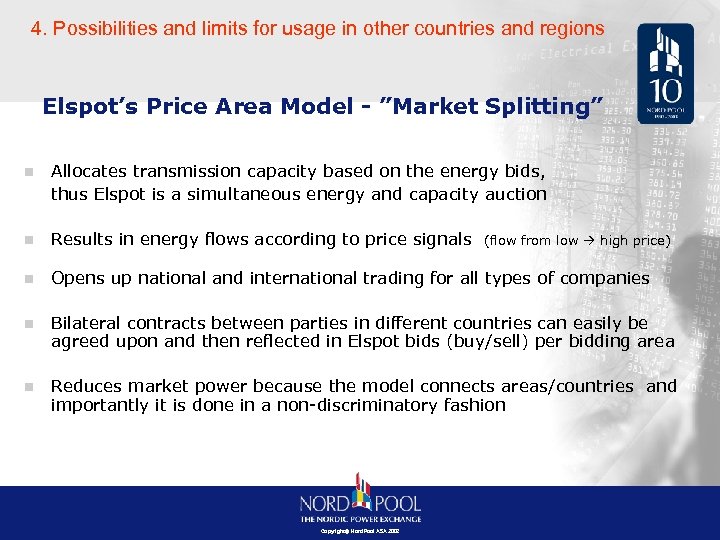

4. Possibilities and limits for usage in other countries and regions Elspot’s Price Area Model - ”Market Splitting” n Allocates transmission capacity based on the energy bids, thus Elspot is a simultaneous energy and capacity auction n Results in energy flows according to price signals n Opens up national and international trading for all types of companies n Bilateral contracts between parties in different countries can easily be agreed upon and then reflected in Elspot bids (buy/sell) per bidding area n Reduces market power because the model connects areas/countries and importantly it is done in a non-discriminatory fashion Copyright Nord Pool ASA 2002 (flow from low high price)

4. Possibilities and limits for usage in other countries and regions Elspot’s Price Area Model - ”Market Splitting” n Allocates transmission capacity based on the energy bids, thus Elspot is a simultaneous energy and capacity auction n Results in energy flows according to price signals n Opens up national and international trading for all types of companies n Bilateral contracts between parties in different countries can easily be agreed upon and then reflected in Elspot bids (buy/sell) per bidding area n Reduces market power because the model connects areas/countries and importantly it is done in a non-discriminatory fashion Copyright Nord Pool ASA 2002 (flow from low high price)

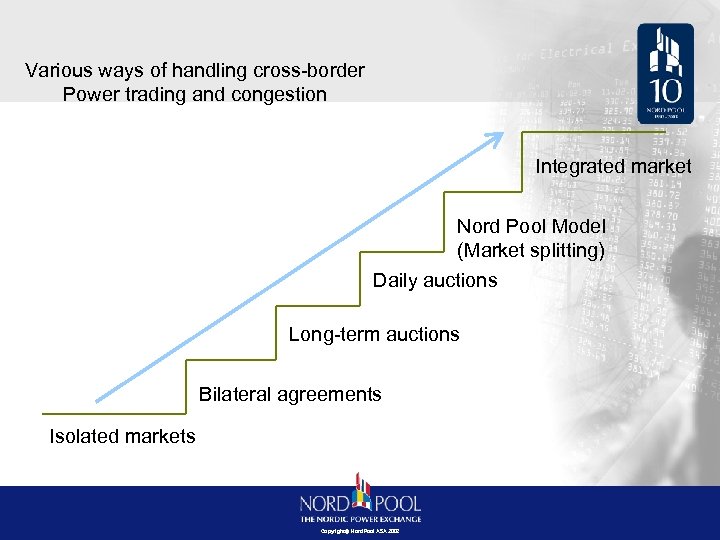

Various ways of handling cross-border Power trading and congestion Integrated market Nord Pool Model (Market splitting) Daily auctions Long-term auctions Bilateral agreements Isolated markets Copyright Nord Pool ASA 2002

Various ways of handling cross-border Power trading and congestion Integrated market Nord Pool Model (Market splitting) Daily auctions Long-term auctions Bilateral agreements Isolated markets Copyright Nord Pool ASA 2002

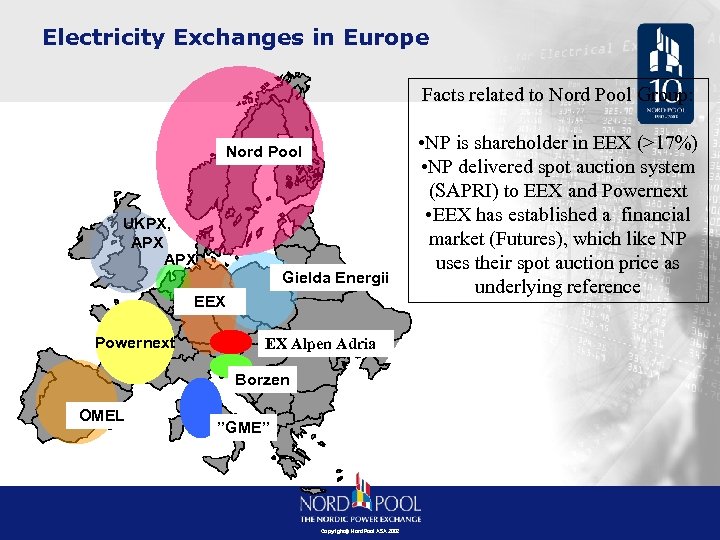

Electricity Exchanges in Europe Facts related to Nord Pool Group: Nord Pool UKPX, APX Gielda Energii EEX Powernext EX Alpen Adria Borzen OMEL ”GME” Copyright Nord Pool ASA 2002 • NP is shareholder in EEX (>17%) • NP delivered spot auction system (SAPRI) to EEX and Powernext • EEX has established a financial market (Futures), which like NP uses their spot auction price as underlying reference

Electricity Exchanges in Europe Facts related to Nord Pool Group: Nord Pool UKPX, APX Gielda Energii EEX Powernext EX Alpen Adria Borzen OMEL ”GME” Copyright Nord Pool ASA 2002 • NP is shareholder in EEX (>17%) • NP delivered spot auction system (SAPRI) to EEX and Powernext • EEX has established a financial market (Futures), which like NP uses their spot auction price as underlying reference

Copyright Nord Pool ASA 2002

Copyright Nord Pool ASA 2002

European integration ? n n n Market areas to be connected Real competition on supply and demand Harmonised legislation and regulatory framework Equal knowledge to price sensitive information Harmonisation between regulators and / or common regulator Sincere political willingness to implement a common market Copyright Nord Pool ASA 2002

European integration ? n n n Market areas to be connected Real competition on supply and demand Harmonised legislation and regulatory framework Equal knowledge to price sensitive information Harmonisation between regulators and / or common regulator Sincere political willingness to implement a common market Copyright Nord Pool ASA 2002

For further information, please visit: www. nordpool. com

For further information, please visit: www. nordpool. com