e31a3ef16f78feb64bf4c2b2fb9234fa.ppt

- Количество слайдов: 29

Non-student (External) Accounts Receivable System

NON-STUDENT A/R Current A/R Processing Functions • Decentralized system allows departments to manage their own receivables • Payments are sent to a lockbox which is processed centrally • Accounting entries are automatically generated through Edocs which can be routed for approval or as an “FYI”

NON-STUDENT A/R • Billing Organization: Department that provides goods and/or services to external customers. Responsible for creating and mailing invoices to customers. Each Billing Organization reports to a Processing Organization. • Processing Organization: Centralized unit that processes payments for Accounts Receivable invoices created by one or more Billing Organization. Each Processing Organization has a bank lockbox to which customer payments are sent.

NON-STUDENT A/R • A/R Processing Flow – Billing Org generates & mails invoice – “Remit to” address with tear strip is provided with invoice – Customer mails payment with strip to lockbox. – Bank transmits funds to appropriate clearing account sends paperwork to processing org – Processing Org applies funds to invoice or allocates to an account

NON-STUDENT A/R • A/R DOCUMENTS – Customer (CUS)—Billing or Proc Org – Invoice (INV)—Billing or Proc Org – Credit Memo (CRM)—Billing or Proc Org – Cash Control (CTRL)—Proc Org – Application (APP)—Proc Org – Organization Options and Accounting Defaults (OOPT & OADF) – Proc Org

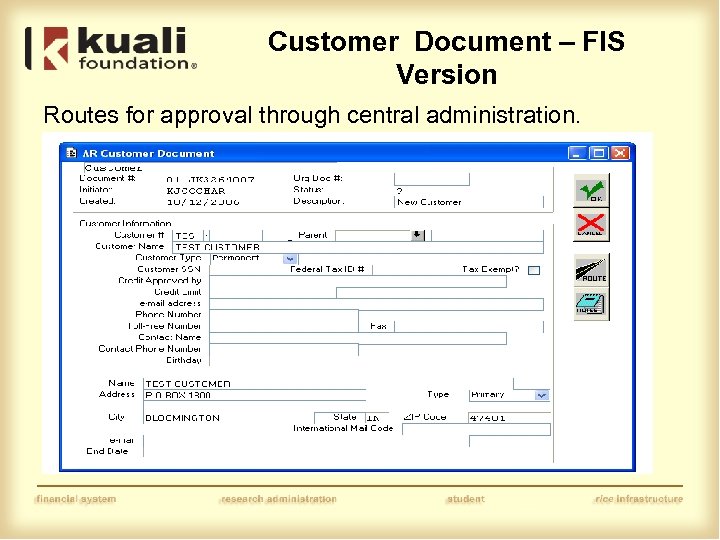

Customer Document – FIS Version Routes for approval through central administration.

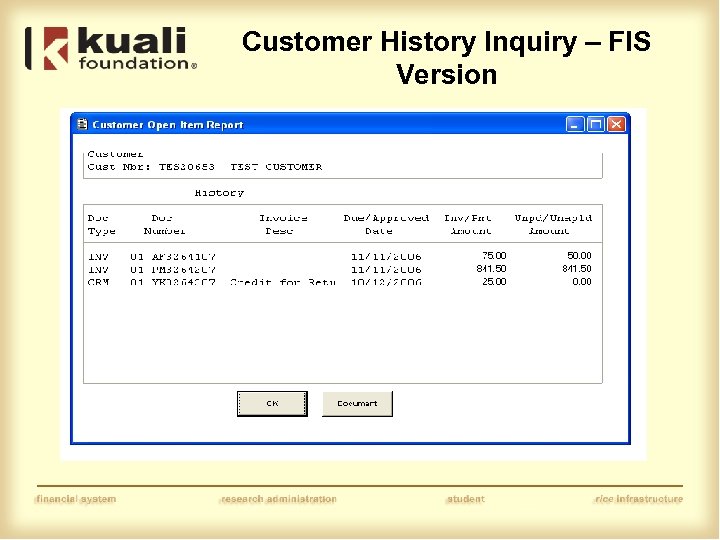

Customer History Inquiry – FIS Version

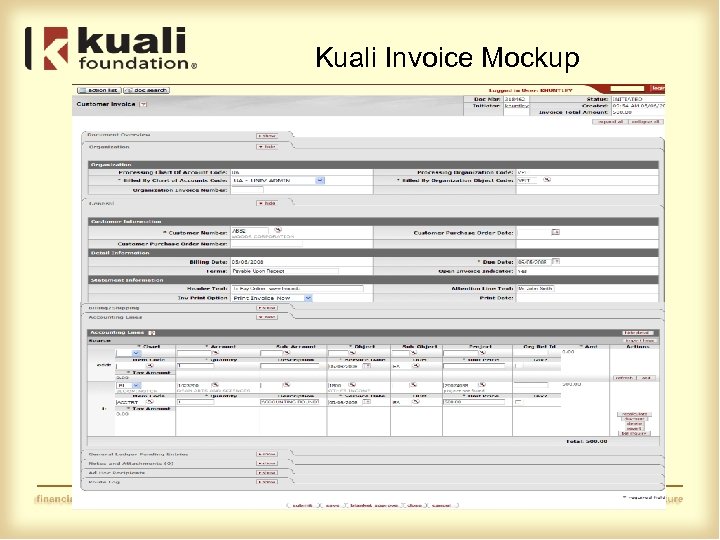

Kuali Invoice Mockup

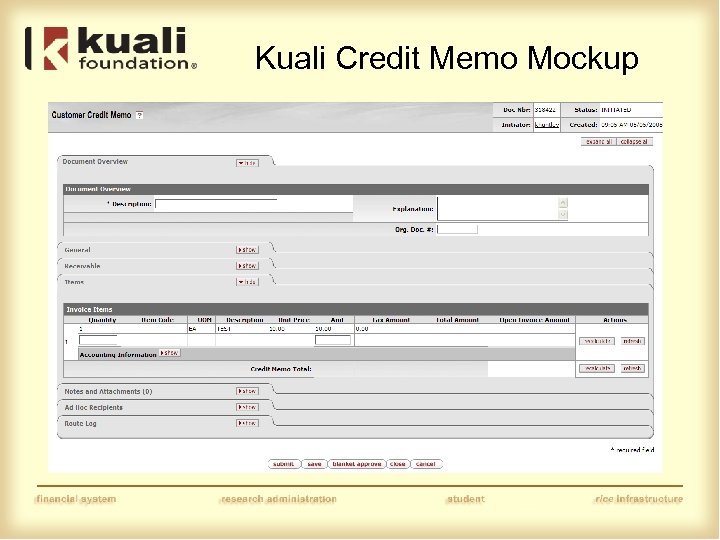

Kuali Credit Memo Mockup

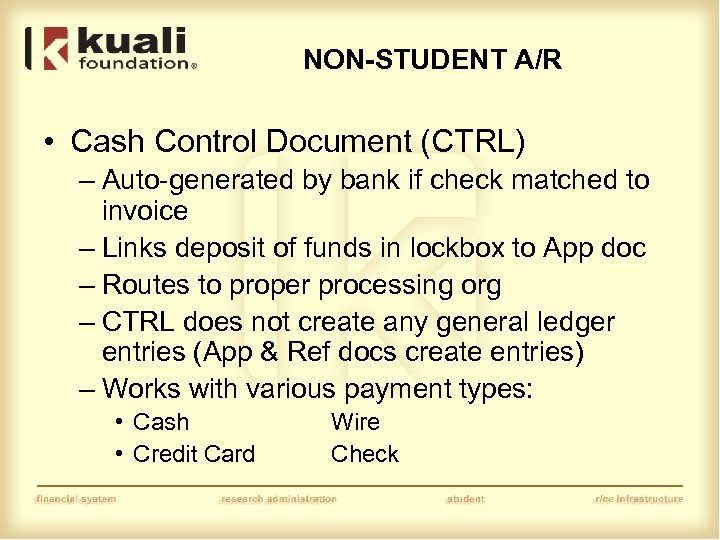

NON-STUDENT A/R • Cash Control Document (CTRL) – Auto-generated by bank if check matched to invoice – Links deposit of funds in lockbox to App doc – Routes to proper processing org – CTRL does not create any general ledger entries (App & Ref docs create entries) – Works with various payment types: • Cash • Credit Card Wire Check

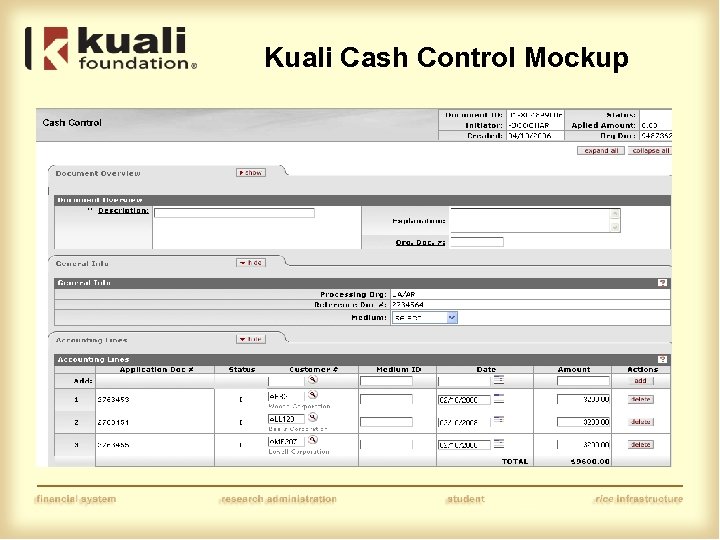

Kuali Cash Control Mockup

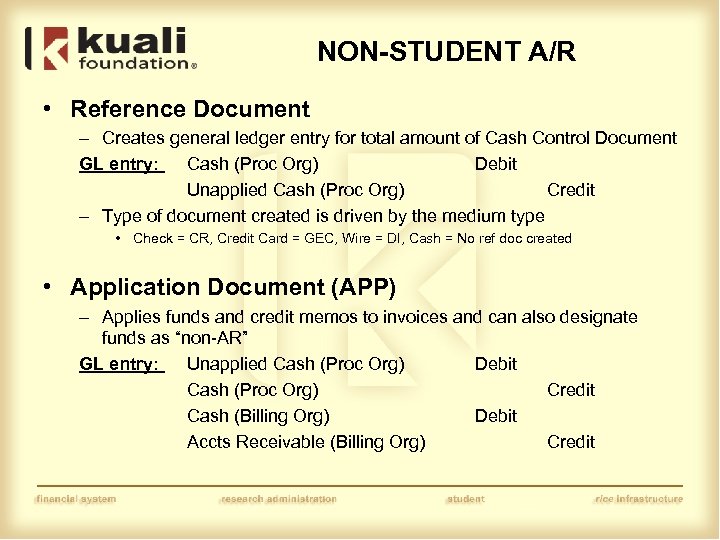

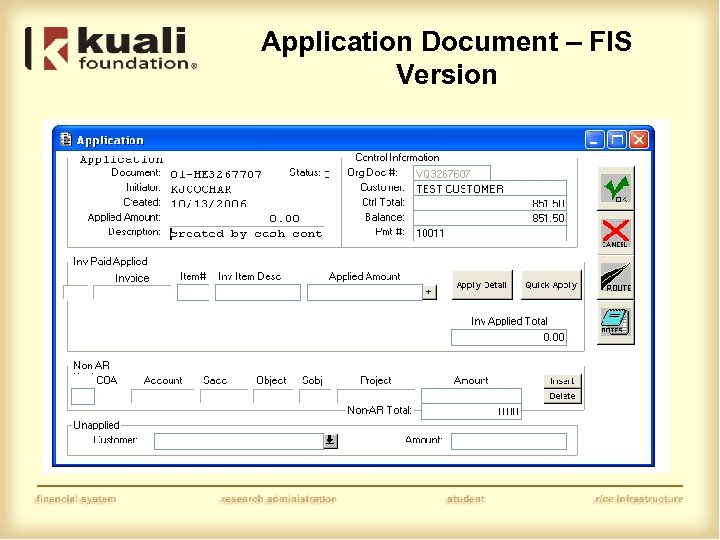

NON-STUDENT A/R • Reference Document – Creates general ledger entry for total amount of Cash Control Document GL entry: Cash (Proc Org) Debit Unapplied Cash (Proc Org) Credit – Type of document created is driven by the medium type • Check = CR, Credit Card = GEC, Wire = DI, Cash = No ref doc created • Application Document (APP) – Applies funds and credit memos to invoices and can also designate funds as “non-AR” GL entry: Unapplied Cash (Proc Org) Debit Cash (Proc Org) Credit Cash (Billing Org) Debit Accts Receivable (Billing Org) Credit

Application Document – FIS Version

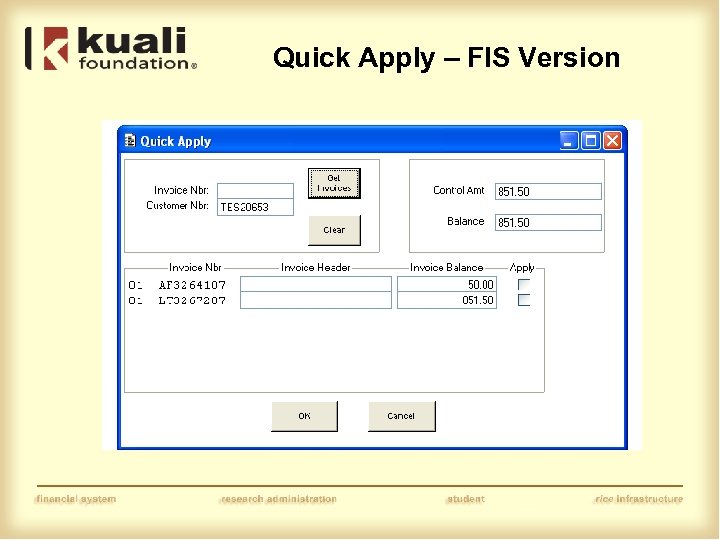

Quick Apply – FIS Version

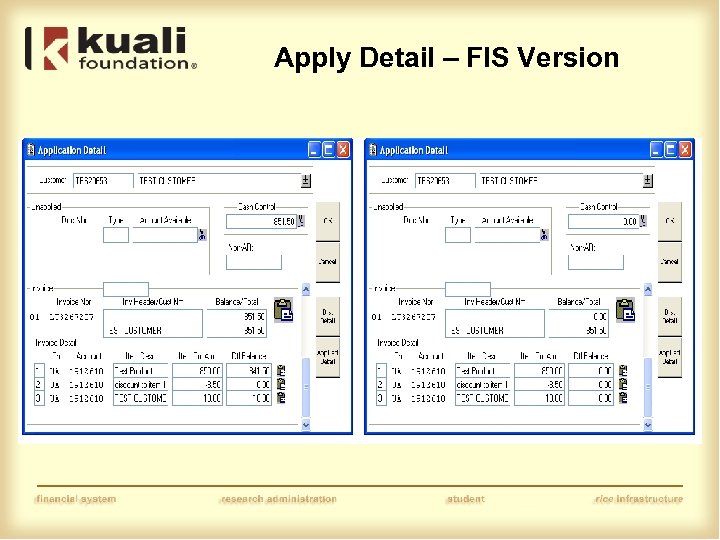

Apply Detail – FIS Version

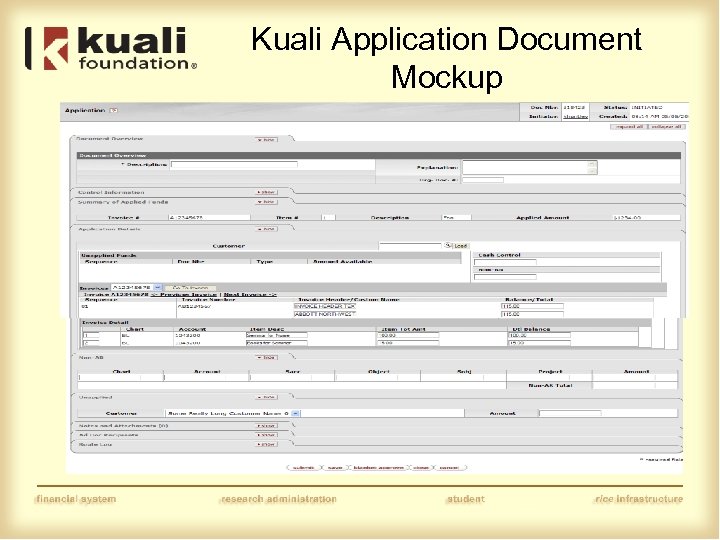

Kuali Application Document Mockup

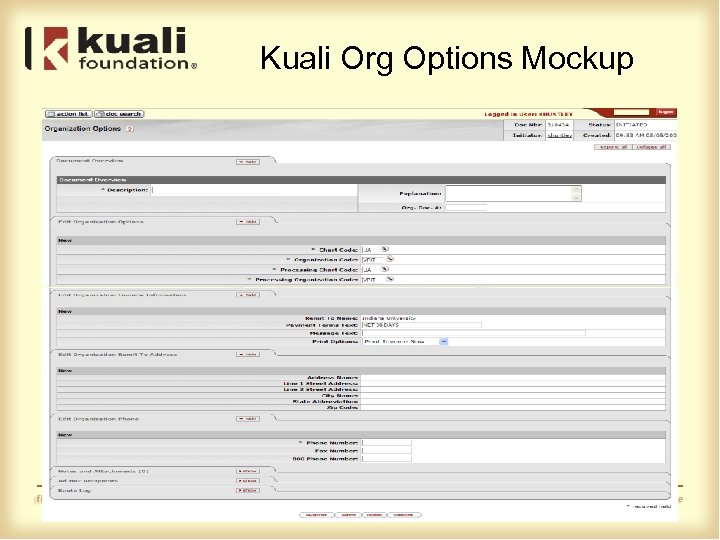

Kuali Org Options Mockup

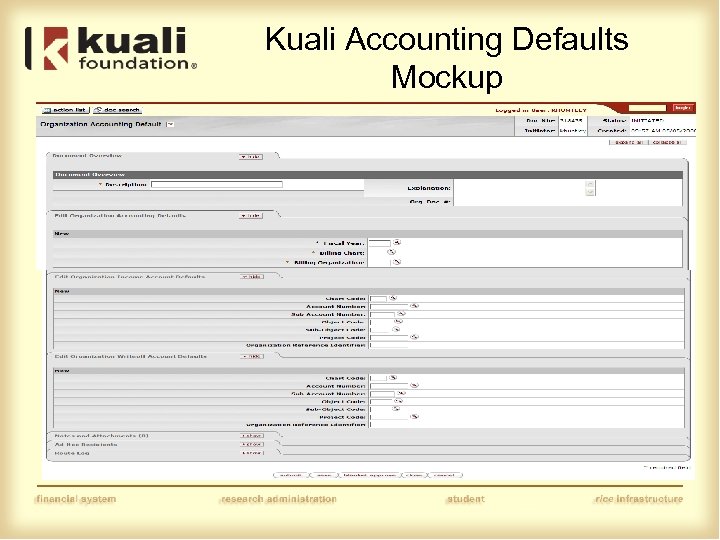

Kuali Accounting Defaults Mockup

NON-STUDENT A/R • A/R Functions – On-screen Aged Customer Listing – Customer Search – Lockbox Processing – Create Invoice Item Codes – Print Invoices in Batch

NON-STUDENT A/R Release 3. 0 Enhancements

Data Enhancements • (AR/H 2) Convert Customer Data to KFS A/R in bulk • (AR/H 3) Retrospective Aging Report

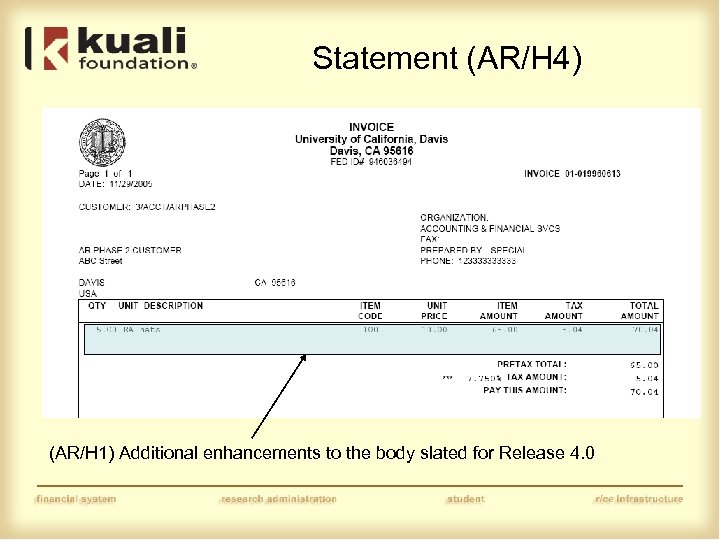

Statement (AR/H 4) (AR/H 1) Additional enhancements to the body slated for Release 4. 0

A/R Objt/Acct Flexibility • Add an institutional setting: – Permit the user to enter a receivable accounting line on the invoice document, or – Use the A/R object code from the Chart table and the chart/account from the revenue accounting line (traditional IU FIS behavior) or – Set the A/R object code based on the Sub-fund group of the revenue account (designated in System Parameters)

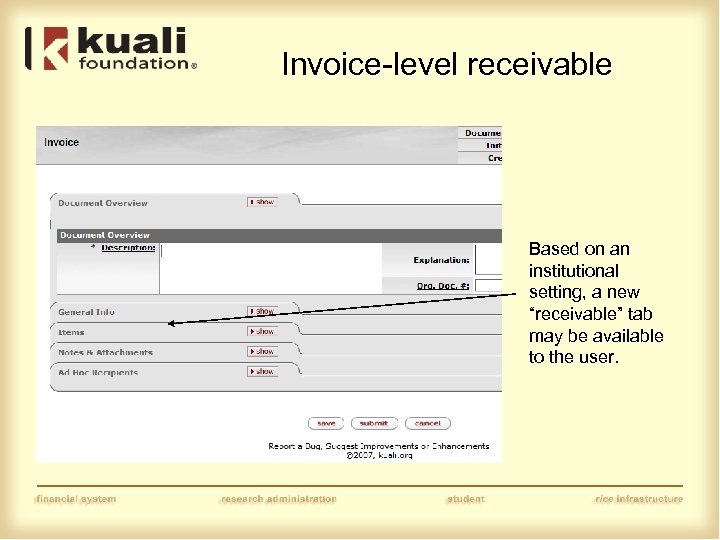

Invoice-level receivable Based on an institutional setting, a new “receivable” tab may be available to the user.

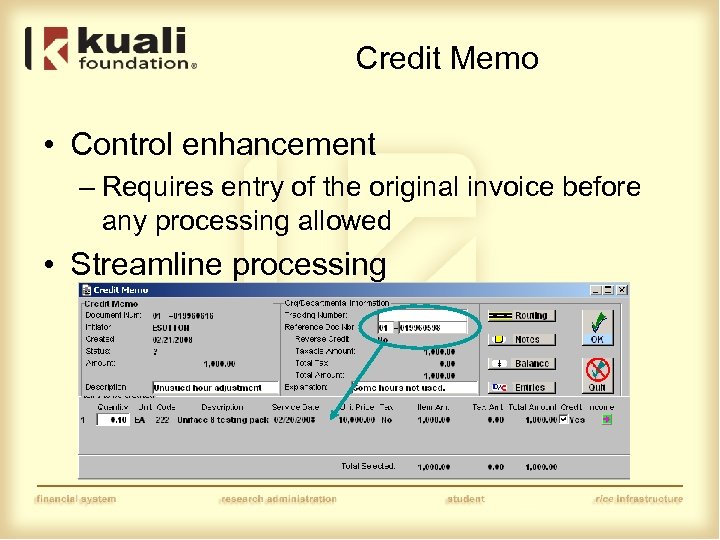

Credit Memo • Control enhancement – Requires entry of the original invoice before any processing allowed • Streamline processing

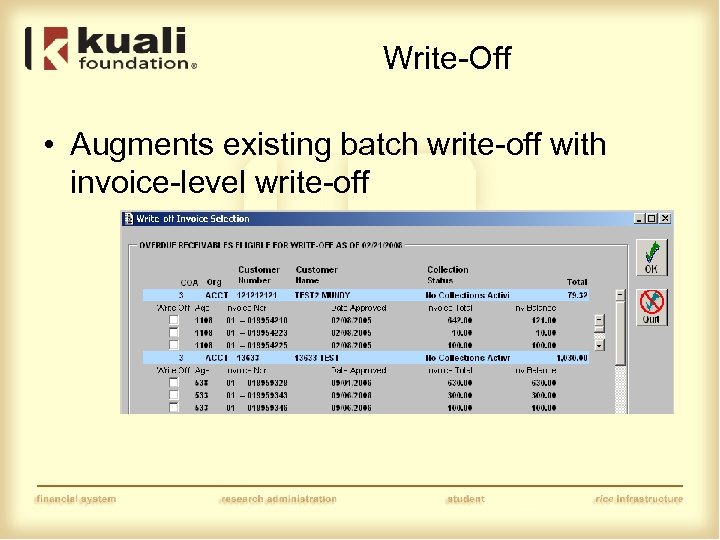

Write-Off • Augments existing batch write-off with invoice-level write-off

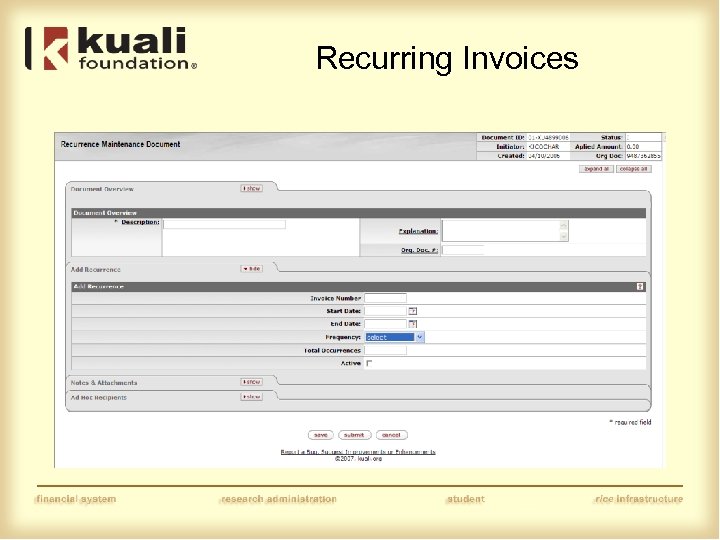

Recurring Invoices

Enhancements After Release 3. 0

Requested for Release 4. 0 • Statement/Invoice design (1, 400 hrs) – Primarily to support extramural receivables • Invoice feeding (1, 000 hrs) • Support for centralized collection activity (1, 800 hours) • Streamline of customer duplicate/overpayment processing (700 hours) • Tracking of memo “unbilled” amounts (400 hours)

e31a3ef16f78feb64bf4c2b2fb9234fa.ppt