6b51c7f9e2016cddc295dcab6801c996.ppt

- Количество слайдов: 35

Non Life insurance Directive 1973/239 – 1988/357 – 1992/49 and other provisions Directive 1991/674 Bakιda, Azәrbaycan -- Bazar ertәsi 12 mart 2012 ACP -- Élie Sibony, François Tempé 1

Non Life insurance Directive 1973/239 – 1988/357 – 1992/49 and other provisions Directive 1991/674 Bakιda, Azәrbaycan -- Bazar ertәsi 12 mart 2012 ACP -- Élie Sibony, François Tempé 1

Abbreviations § § § bp : bullet point MS : Member State (of the EU) NL : (depending on the context) Non-life, Non-life directive RSM : Required Solvency Margin TP : technical provision EU : European Union 2

Abbreviations § § § bp : bullet point MS : Member State (of the EU) NL : (depending on the context) Non-life, Non-life directive RSM : Required Solvency Margin TP : technical provision EU : European Union 2

Summary Introduction 1. Large risks 2. Provisions in Non Life 3. Non Life prudential requirements 4. Approximation q Introduction § About half of the directive (1973/239 consolidated) is devoted to the conditions for authorization (essentially the process of licencing). The rest deals essentially with prudential requirements. It also includes conditions for exercise of business and lists the « large risks » . Non Life Assurance 3

Summary Introduction 1. Large risks 2. Provisions in Non Life 3. Non Life prudential requirements 4. Approximation q Introduction § About half of the directive (1973/239 consolidated) is devoted to the conditions for authorization (essentially the process of licencing). The rest deals essentially with prudential requirements. It also includes conditions for exercise of business and lists the « large risks » . Non Life Assurance 3

1. LARGE RISKS (NL 973/239 - article 5 ) 1/ are the risks classified in the following insurance classes: q Insurance class 4 : railway (all damage to or loss of q q q railway rolling stock) Insurance cl. 5 : Aircraft (all damage to or loss of aircraft) Insurance cl. 6 : Ships Insurance cl. 7 : Goods in transit Insurance cl. 11 : Aircraft liability (all liability arising out of the use of aircraft, including carrier’s liability) Insurance cl. 12 : liability for ships (sea, lake and river and canal vessels) 2/ If the policy holder is engaged to professionaly in an industrial or commercial activity, are the following risks: q Insurance cl. 14 : credit q Insurance cl. 15 : suretyship 4

1. LARGE RISKS (NL 973/239 - article 5 ) 1/ are the risks classified in the following insurance classes: q Insurance class 4 : railway (all damage to or loss of q q q railway rolling stock) Insurance cl. 5 : Aircraft (all damage to or loss of aircraft) Insurance cl. 6 : Ships Insurance cl. 7 : Goods in transit Insurance cl. 11 : Aircraft liability (all liability arising out of the use of aircraft, including carrier’s liability) Insurance cl. 12 : liability for ships (sea, lake and river and canal vessels) 2/ If the policy holder is engaged to professionaly in an industrial or commercial activity, are the following risks: q Insurance cl. 14 : credit q Insurance cl. 15 : suretyship 4

3/ are the risks classified under insurance classes 3 (Land vehicles), 8 (Fire and natural forces), 9 (Other damage to property), 10 (Motor vehicle liability), 13 (General liability) and 16 (Miscellaneous financial loss) in so far as the policy-holder exceeds the limits of at least two of the following three criteria: — balance-sheet total: 6, 2 million €, — net turnover: 12, 8 million €, — average number of employees during the financial year: 250 5

3/ are the risks classified under insurance classes 3 (Land vehicles), 8 (Fire and natural forces), 9 (Other damage to property), 10 (Motor vehicle liability), 13 (General liability) and 16 (Miscellaneous financial loss) in so far as the policy-holder exceeds the limits of at least two of the following three criteria: — balance-sheet total: 6, 2 million €, — net turnover: 12, 8 million €, — average number of employees during the financial year: 250 5

1. LARGE RISKS The directives conduct to make a distinction between « mass risks » and « large risks » . q A criteria defining large risks in the directive 1988/357 should also define risks likely to be covered under Community co-insurance arrangements. 6

1. LARGE RISKS The directives conduct to make a distinction between « mass risks » and « large risks » . q A criteria defining large risks in the directive 1988/357 should also define risks likely to be covered under Community co-insurance arrangements. 6

1. LARGE RISKS: The law applicable to the contract Is the law applicable the law of the Member State where the policy holder has his administrative residence ? Is the law applicable the law of the Member State where the risk is situated ? Art. 7 a) if these 2 locations are the same (administrative residence and risk location), the law applicable is the law of this MS. Art 7 b) When policy holder’s administrative residence and risk are not located in the same MS, the parties can choose to apply either the law of the MS in which the risk is located or the law of the country in which the policy holder has its residence. 7

1. LARGE RISKS: The law applicable to the contract Is the law applicable the law of the Member State where the policy holder has his administrative residence ? Is the law applicable the law of the Member State where the risk is situated ? Art. 7 a) if these 2 locations are the same (administrative residence and risk location), the law applicable is the law of this MS. Art 7 b) When policy holder’s administrative residence and risk are not located in the same MS, the parties can choose to apply either the law of the MS in which the risk is located or the law of the country in which the policy holder has its residence. 7

1. LARGE RISKS q c) if the policy holder has a commercial / industrial activity and where the contract covers >=2 risks related to these activities situated in different MS, freedom of choice of the law: the MS where the risk is situated or the MS where the policy holder has his administrative residence. q d) and e) if the MS grants greater freedom of choice of the law applicable, the parties can take advantage of this freedom. q In the case of large risks, the parties to the contract may choose any law (1988/357 art. 7). 8

1. LARGE RISKS q c) if the policy holder has a commercial / industrial activity and where the contract covers >=2 risks related to these activities situated in different MS, freedom of choice of the law: the MS where the risk is situated or the MS where the policy holder has his administrative residence. q d) and e) if the MS grants greater freedom of choice of the law applicable, the parties can take advantage of this freedom. q In the case of large risks, the parties to the contract may choose any law (1988/357 art. 7). 8

1. LARGE RISKS q Art. 26: « large risks » are the risks which may be covered by way of Community co-insurance. q The provisions of the 1 st directive (1973/239 consolidated) shall apply to the leading insurance. q A consequence of these rules: « large risks » can be submitted to the control of the MS where the insurer is established and not where the risk is situated. Explanation: in an integrated market such as EU market, those policyholders who do not need the special protection in the MS in which a risk is situated special protection —inter alia because of their size or the nature of the risk—, should be granted complete freedom to choose the law applicable to their insurance contract (1992/49) (17) 9

1. LARGE RISKS q Art. 26: « large risks » are the risks which may be covered by way of Community co-insurance. q The provisions of the 1 st directive (1973/239 consolidated) shall apply to the leading insurance. q A consequence of these rules: « large risks » can be submitted to the control of the MS where the insurer is established and not where the risk is situated. Explanation: in an integrated market such as EU market, those policyholders who do not need the special protection in the MS in which a risk is situated special protection —inter alia because of their size or the nature of the risk—, should be granted complete freedom to choose the law applicable to their insurance contract (1992/49) (17) 9

1. LARGE RISKS q On the contrary, for « mass risks » , the supervision is conducted by the MS where the risk is situated. 10

1. LARGE RISKS q On the contrary, for « mass risks » , the supervision is conducted by the MS where the risk is situated. 10

2. NON LIFE PROVISIONS Prudential rules and principles 11

2. NON LIFE PROVISIONS Prudential rules and principles 11

2. NON LIFE PROVISIONS Technical provisions must be sufficient q Principle (art. 56) : the amount of technical provisions must at all time be such that an insurer can meet any liabilities arising out of insurance contracts as far as can reasonably be foreseen. 12

2. NON LIFE PROVISIONS Technical provisions must be sufficient q Principle (art. 56) : the amount of technical provisions must at all time be such that an insurer can meet any liabilities arising out of insurance contracts as far as can reasonably be foreseen. 12

2. NON LIFE PROVISIONS q PROVISIONS FOR UNEARNED PREMIUMS (Dir. 1991/674 – art. 25) = the amount representing that part of gross premiums writen which is to be allocated to the following financial year or to subsequent financial years. Example : on august 31, a contract is subscribed for 1 year and for a 1000 € premium PFUP = ? The PFUP shall in principal be computed separately fo each case but statistical methods possible 13

2. NON LIFE PROVISIONS q PROVISIONS FOR UNEARNED PREMIUMS (Dir. 1991/674 – art. 25) = the amount representing that part of gross premiums writen which is to be allocated to the following financial year or to subsequent financial years. Example : on august 31, a contract is subscribed for 1 year and for a 1000 € premium PFUP = ? The PFUP shall in principal be computed separately fo each case but statistical methods possible 13

2. NON LIFE PROVISIONS q The provision for unexpired risks (PFUR) referred to in art. 26 is a provision that aims at covering unsufficient tariffs ; it shall be computed on the basis of claims and administrative expenses likely to arise after the end of the financial year from contracts concluded before that date, in so far as their estimated value (cf. loss ratio) exceeds the PFUP and any premium receivable under those contracts. q Example : Loss ratio : 110% (included expenses) PFUP : 1000 => PFUR = 100 14

2. NON LIFE PROVISIONS q The provision for unexpired risks (PFUR) referred to in art. 26 is a provision that aims at covering unsufficient tariffs ; it shall be computed on the basis of claims and administrative expenses likely to arise after the end of the financial year from contracts concluded before that date, in so far as their estimated value (cf. loss ratio) exceeds the PFUP and any premium receivable under those contracts. q Example : Loss ratio : 110% (included expenses) PFUP : 1000 => PFUR = 100 14

q The provision for unearned premiums can include the provision for unexpired risks if it is not material. Otherwise, if it’s material, it shall be disclosed separately (1991/674).

q The provision for unearned premiums can include the provision for unexpired risks if it is not material. Otherwise, if it’s material, it shall be disclosed separately (1991/674).

2. NON LIFE PROVISIONS q CLAIMS OUTSTANDING (art. 28) = the total estimated ultimate cost […] of settling all claims arising from events which have occured up to the end of the financial year, whether reported or not, less the amounts already paid in respect of such claims It shall include Remark: In several countries, as France, insurers can not take account of investment income to discount claims outstanding provisions as allowed by 91/674. 16

2. NON LIFE PROVISIONS q CLAIMS OUTSTANDING (art. 28) = the total estimated ultimate cost […] of settling all claims arising from events which have occured up to the end of the financial year, whether reported or not, less the amounts already paid in respect of such claims It shall include Remark: In several countries, as France, insurers can not take account of investment income to discount claims outstanding provisions as allowed by 91/674. 16

q In principle, a provision shall be computed separately for each case (claim by claim) on the basis of the costs still expected to arise q Statistical methods can however be used if they result in an adequate provision. q In France, outstanding claims must be computed claim by claim for each case. Statistical method can only be used to estimate the claims IBNR related to outstanding claims.

q In principle, a provision shall be computed separately for each case (claim by claim) on the basis of the costs still expected to arise q Statistical methods can however be used if they result in an adequate provision. q In France, outstanding claims must be computed claim by claim for each case. Statistical method can only be used to estimate the claims IBNR related to outstanding claims.

q The estimation of IBNR provision shall be determined having regard to past experience as to the number and magnitude of claims reported after the balance sheet date (see for approximation the template C 10 in France). q Outstanding claims must include claims settlements costs, irrespective of their origin (internal or external). q In the balance sheet, recoverable amounts shall be deducted from the provision for claims outstanding and shall be estimated on a prudent basis. q Where benefits resulting from a claim must be paid in the form of annuity, the amounts to be set aside for that purpose shall be calculated by recognized actuarial method.

q The estimation of IBNR provision shall be determined having regard to past experience as to the number and magnitude of claims reported after the balance sheet date (see for approximation the template C 10 in France). q Outstanding claims must include claims settlements costs, irrespective of their origin (internal or external). q In the balance sheet, recoverable amounts shall be deducted from the provision for claims outstanding and shall be estimated on a prudent basis. q Where benefits resulting from a claim must be paid in the form of annuity, the amounts to be set aside for that purpose shall be calculated by recognized actuarial method.

q Regarding discounting Conditions : - The expected average date for the settlement of claims is at least 4 years after the accounting date - The discounting is effected on a recognized prudential basis; the competent authority must be given advance notification of any change in method - Insurer must take into account all the factors that could cause increases in that cost - The undertaking as adequate data at its disposal to construct a reliable model of the rate of claims settlement - the rate of interest used does not exceed a prudent estimate of the investment income from assets invested as a provision for claims during the period necessary for the payment of such claims. Moreover, it must be < Max (investment income rate for the last 5 years ; investment income during the last year preceding BS date)

q Regarding discounting Conditions : - The expected average date for the settlement of claims is at least 4 years after the accounting date - The discounting is effected on a recognized prudential basis; the competent authority must be given advance notification of any change in method - Insurer must take into account all the factors that could cause increases in that cost - The undertaking as adequate data at its disposal to construct a reliable model of the rate of claims settlement - the rate of interest used does not exceed a prudent estimate of the investment income from assets invested as a provision for claims during the period necessary for the payment of such claims. Moreover, it must be < Max (investment income rate for the last 5 years ; investment income during the last year preceding BS date)

2. NON LIFE PROVISIONS q Provisions for bonuses and rebates (art. 29, L & NL) = Amounts intended for policyholders or contract beneficiaries by way of bonuses and rebates […] 20

2. NON LIFE PROVISIONS q Provisions for bonuses and rebates (art. 29, L & NL) = Amounts intended for policyholders or contract beneficiaries by way of bonuses and rebates […] 20

2. NON LIFE PROVISIONS q Equalization provision (art. 30) = any amounts set aside in compliance with legal or administrative requirements to equalize fluctuations in loss ratios in future years or to provide for special risks (generally low frequency risks such as hail, etc) 21

2. NON LIFE PROVISIONS q Equalization provision (art. 30) = any amounts set aside in compliance with legal or administrative requirements to equalize fluctuations in loss ratios in future years or to provide for special risks (generally low frequency risks such as hail, etc) 21

q Other technical provisions Mathematical provisions for annuities paid for disabled

q Other technical provisions Mathematical provisions for annuities paid for disabled

3. NON LIFE PRUDENTIAL REQUIREMENTS Required Solvency Margin 23

3. NON LIFE PRUDENTIAL REQUIREMENTS Required Solvency Margin 23

3. Non Life Prudential Requirements q Required Solvency Margin (NL. art. 16 a). § RSM is the sum of various elements that are calculated depending on the insurance class (as defined in Annex I, L. p. 67) the contracts belong to (L. art. 28. 1). § For « general » non life contracts — that is, contracts that do not belong to insurance classes 11, 12 and 13 — RSM is the higher of two following results: a) Premium basis. → Max (gross written premiums ; gross earned premiums) (1) → The amount so obtained shall be divided into 2 portions, the 1 st portion extended up to € 50 Million, the 2 nd comprising the excess. (1 a) and (1 b) Life Assurance 24

3. Non Life Prudential Requirements q Required Solvency Margin (NL. art. 16 a). § RSM is the sum of various elements that are calculated depending on the insurance class (as defined in Annex I, L. p. 67) the contracts belong to (L. art. 28. 1). § For « general » non life contracts — that is, contracts that do not belong to insurance classes 11, 12 and 13 — RSM is the higher of two following results: a) Premium basis. → Max (gross written premiums ; gross earned premiums) (1) → The amount so obtained shall be divided into 2 portions, the 1 st portion extended up to € 50 Million, the 2 nd comprising the excess. (1 a) and (1 b) Life Assurance 24

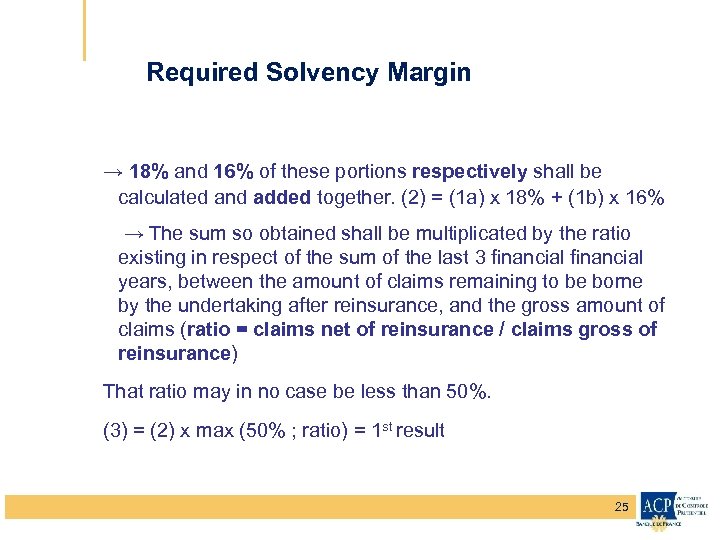

Required Solvency Margin → 18% and 16% of these portions respectively shall be calculated and added together. (2) = (1 a) x 18% + (1 b) x 16% → The sum so obtained shall be multiplicated by the ratio existing in respect of the sum of the last 3 financial years, between the amount of claims remaining to be borne by the undertaking after reinsurance, and the gross amount of claims (ratio = claims net of reinsurance / claims gross of reinsurance) That ratio may in no case be less than 50%. (3) = (2) x max (50% ; ratio) = 1 st result 25

Required Solvency Margin → 18% and 16% of these portions respectively shall be calculated and added together. (2) = (1 a) x 18% + (1 b) x 16% → The sum so obtained shall be multiplicated by the ratio existing in respect of the sum of the last 3 financial years, between the amount of claims remaining to be borne by the undertaking after reinsurance, and the gross amount of claims (ratio = claims net of reinsurance / claims gross of reinsurance) That ratio may in no case be less than 50%. (3) = (2) x max (50% ; ratio) = 1 st result 25

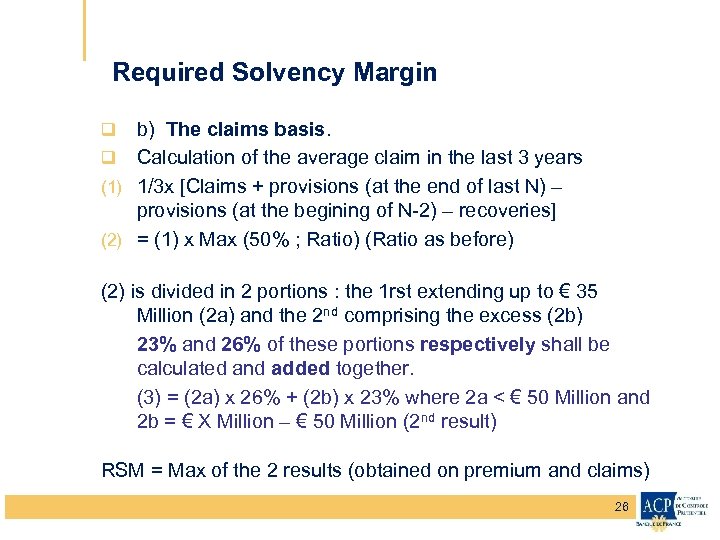

Required Solvency Margin b) The claims basis. q Calculation of the average claim in the last 3 years (1) 1/3 x [Claims + provisions (at the end of last N) – provisions (at the begining of N-2) – recoveries] (2) = (1) x Max (50% ; Ratio) (Ratio as before) q (2) is divided in 2 portions : the 1 rst extending up to € 35 Million (2 a) and the 2 nd comprising the excess (2 b) 23% and 26% of these portions respectively shall be calculated and added together. (3) = (2 a) x 26% + (2 b) x 23% where 2 a < € 50 Million and 2 b = € X Million – € 50 Million (2 nd result) RSM = Max of the 2 results (obtained on premium and claims) 26

Required Solvency Margin b) The claims basis. q Calculation of the average claim in the last 3 years (1) 1/3 x [Claims + provisions (at the end of last N) – provisions (at the begining of N-2) – recoveries] (2) = (1) x Max (50% ; Ratio) (Ratio as before) q (2) is divided in 2 portions : the 1 rst extending up to € 35 Million (2 a) and the 2 nd comprising the excess (2 b) 23% and 26% of these portions respectively shall be calculated and added together. (3) = (2 a) x 26% + (2 b) x 23% where 2 a < € 50 Million and 2 b = € X Million – € 50 Million (2 nd result) RSM = Max of the 2 results (obtained on premium and claims) 26

4. APPROXIMATION A concrete case with prudential and accounting templates (see also Excel file) 27

4. APPROXIMATION A concrete case with prudential and accounting templates (see also Excel file) 27

4. APPROXIMATION OF NON LIFE DIRECTIVES q The supervision is operated on site and off site q On site and off site supervision requires the delivery of regular documents by undertakings (annual accounts, supervisory returns) q This information can be put in some templates that have to be sent yearly, or quarterly etc (depending on the information) q The information has to be monitored. In particular, it must match with the accounts which are disclosed 28

4. APPROXIMATION OF NON LIFE DIRECTIVES q The supervision is operated on site and off site q On site and off site supervision requires the delivery of regular documents by undertakings (annual accounts, supervisory returns) q This information can be put in some templates that have to be sent yearly, or quarterly etc (depending on the information) q The information has to be monitored. In particular, it must match with the accounts which are disclosed 28

RESULTS BY LINES OF BUSINESS (C 1) q This template looks similar to a document which is disclosed in the annex to the accounts q But it also contains information that are not available to the public such as expenses for claims and recoveries management, or such as recoveries forecasts q Also, the disclosed document contains the provisions’ changes whereas the C 1 template countains the provisions at the begining and closing of the financial year q Lastly, this template contains more details on reinsurance results. q It has to be matched with the balance sheet and P&L. q See Excel file 29

RESULTS BY LINES OF BUSINESS (C 1) q This template looks similar to a document which is disclosed in the annex to the accounts q But it also contains information that are not available to the public such as expenses for claims and recoveries management, or such as recoveries forecasts q Also, the disclosed document contains the provisions’ changes whereas the C 1 template countains the provisions at the begining and closing of the financial year q Lastly, this template contains more details on reinsurance results. q It has to be matched with the balance sheet and P&L. q See Excel file 29

The C 5, a template to analyse and monitor the covering of technical liabilities See Excel file C 5 has to match with the balance sheet, P & L accounts and C 1 30

The C 5, a template to analyse and monitor the covering of technical liabilities See Excel file C 5 has to match with the balance sheet, P & L accounts and C 1 30

The C 6, a template to monitor the calculation of RSM and ASM See Excel file This template has to match with the balance sheet, profit & loss account and C 1 31

The C 6, a template to monitor the calculation of RSM and ASM See Excel file This template has to match with the balance sheet, profit & loss account and C 1 31

The C 11: premiums attached by claims incurred years The principle is to attach the informations by incurred year of claims Contents : q Table A : evolution of the numbers of claims attached by incurred year q Table B : claims, payments and outstanding provisions attached by incurred year q Table C : recoveries and forecast of recoveries attached by incurred year q Table D : costs of the settlement of claims and recoveries attached by IY 32

The C 11: premiums attached by claims incurred years The principle is to attach the informations by incurred year of claims Contents : q Table A : evolution of the numbers of claims attached by incurred year q Table B : claims, payments and outstanding provisions attached by incurred year q Table C : recoveries and forecast of recoveries attached by incurred year q Table D : costs of the settlement of claims and recoveries attached by IY 32

C 11 (2) – Excel file This template, inter alia, enables the supervisor to analyse the sufficiency of outstanding claims provisions q Bonuses and maluses on outstanding provisions, reoveries forecasts and settlement of claims and recoveries can be calculated for each incurred year q Possibility to analyse the provisions by a liquiditative method / cadency method q C 11 has to match with C 1, C 10 and C 5 and balance sheet 33

C 11 (2) – Excel file This template, inter alia, enables the supervisor to analyse the sufficiency of outstanding claims provisions q Bonuses and maluses on outstanding provisions, reoveries forecasts and settlement of claims and recoveries can be calculated for each incurred year q Possibility to analyse the provisions by a liquiditative method / cadency method q C 11 has to match with C 1, C 10 and C 5 and balance sheet 33

The C 10 : loss ratio q This template permits to analyse the evolution of loss ratio, by claims incurred year q This template also permits to analyse how provisions for premiums are liquidated: that is, whether the sum {premiums written during the year plus provision for premiums at the end of the year} is higher, or lower, than the provision for premiums at the end of last year q C 10 has to match with the C 1, C 5, C 11 and balance sheet See Excel file 34

The C 10 : loss ratio q This template permits to analyse the evolution of loss ratio, by claims incurred year q This template also permits to analyse how provisions for premiums are liquidated: that is, whether the sum {premiums written during the year plus provision for premiums at the end of the year} is higher, or lower, than the provision for premiums at the end of last year q C 10 has to match with the C 1, C 5, C 11 and balance sheet See Excel file 34

Questions? Contact: François Tempé / Elie Sibony francois. tempe@acp. banque-france. fr elie. sibony@acp. banque-france. fr 35

Questions? Contact: François Tempé / Elie Sibony francois. tempe@acp. banque-france. fr elie. sibony@acp. banque-france. fr 35