Презентация Microsoft PowerPoint.pptx

- Количество слайдов: 26

NON-BANK FINANCIAL INSTITUTIONS

Non-Bank Financial Institutions Insurance-type Life and property and casualty Pension funds Asset management firms and funds Securities firms Others Finance companies Mortgage bankers Government-sponsored agencies

Insurance Liabilities Promise to pay depending on contingency Life - Pay upon death, or retirement › Property and casualty - Pay on occurrence of accident or loss due to theft or hazard (fire, weather, earthquake, flood) › Differences between life and accident Life probabilities known with accuracy › Casualty has two risks: incidence and severity ›

Insurance Services Life and annuity contract Probabilities usually not influenced by insured Cash flows from coverage are predictable Cancellations, lapses, policy loans Casualty contract Period short Policy-holders influence the incidence and severity of claims

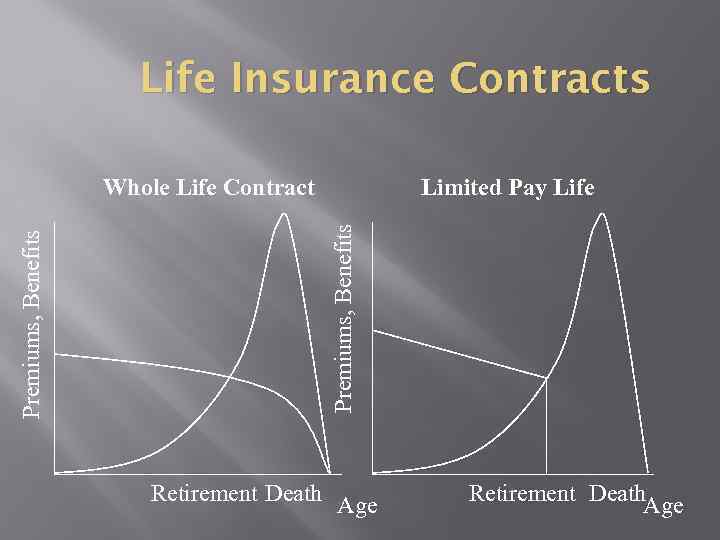

Life Insurance Contracts Limited Pay Life Premiums, Benefits Whole Life Contract Retirement Death Age Retirement Death. Age

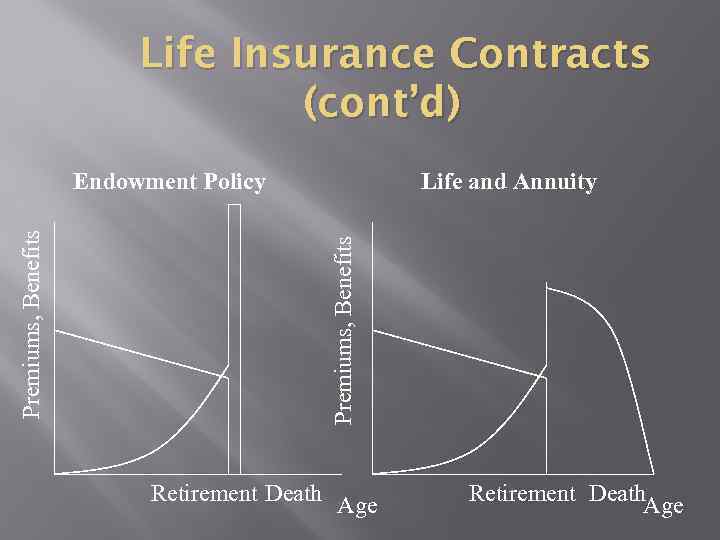

Life Insurance Contracts (cont’d) Life and Annuity Premiums, Benefits Endowment Policy Retirement Death Age Retirement Death. Age

Insurance Distribution Life insurance Ordinary Group Industrial Credit Independent agents Economics of insurance marketing Compensation of agents and brokers Political power in the insurance industry

Insurance Company Income Revenue: Premium income Earned premiums Investment income Expenses: Policy Benefits and Losses Direct payments to claimants Loss expenses (evaluation, processing) Marketing expenses Non-interest expense Labor and related expenses Communication, fees

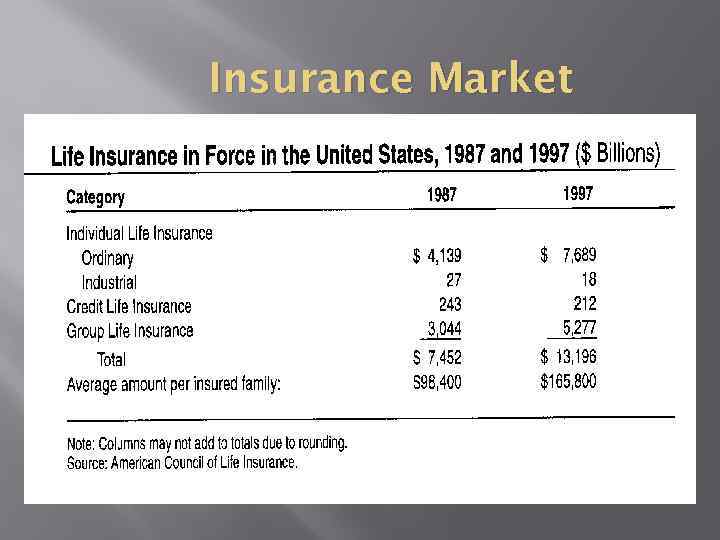

Insurance Market

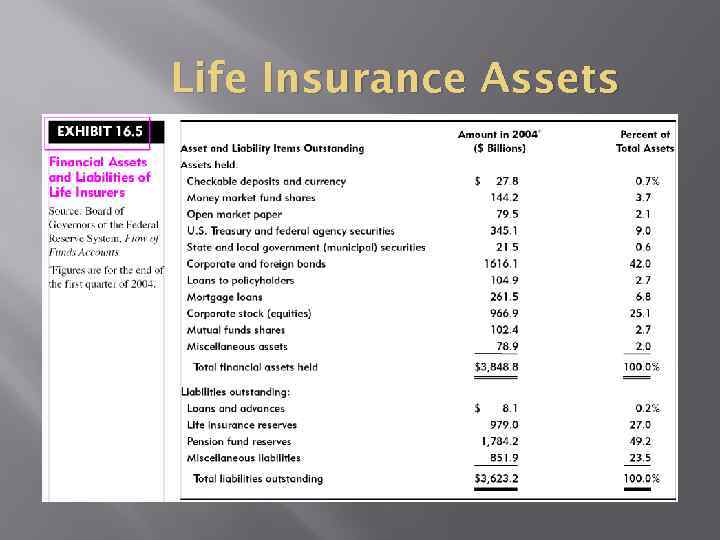

Life Insurance Assets

Role of Insurance Equity in insurance is sometimes referred to as surplus since it represents premium collections above claims payments Income is approximately: Premiums + investment income – claims Income/loss adds to/subtracts from equity Equity or surplus absorbs large surges in claims as in catastrophes (e. g. Katrina)

Insurance Balance Sheets Balance sheet: liabilities are insurance reserves, unearned premiums, and surplus (plus equity capital) Assets are investments in corporate and municipal bonds, real estate, equities, Balance sheet management consists of matching asset risks to liability risks Many liabilities have long tails or durations

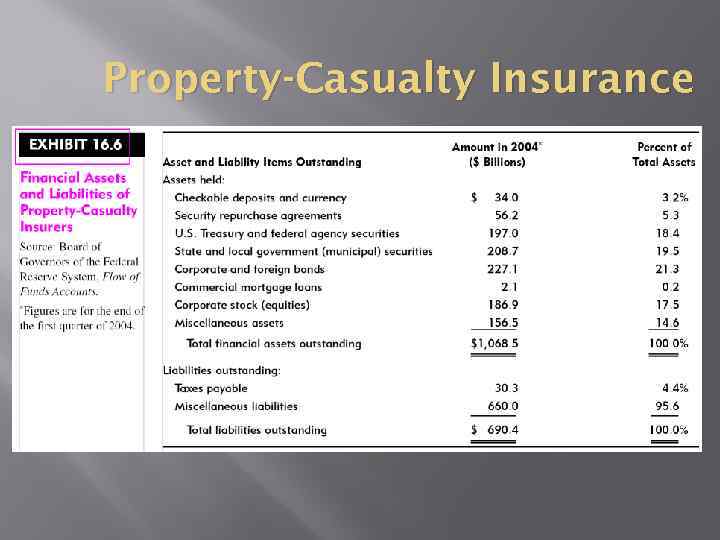

Property-Casualty Insurance

Contrast Life/Casualty Insurance Probabilities of claims in life insurance are well known (vital statistics yield accurate actuarial estimates) Moral hazard limited in life insurance Dollar claims in casualty insurance are affected by incidence and severity of damages and may have more systematic risk

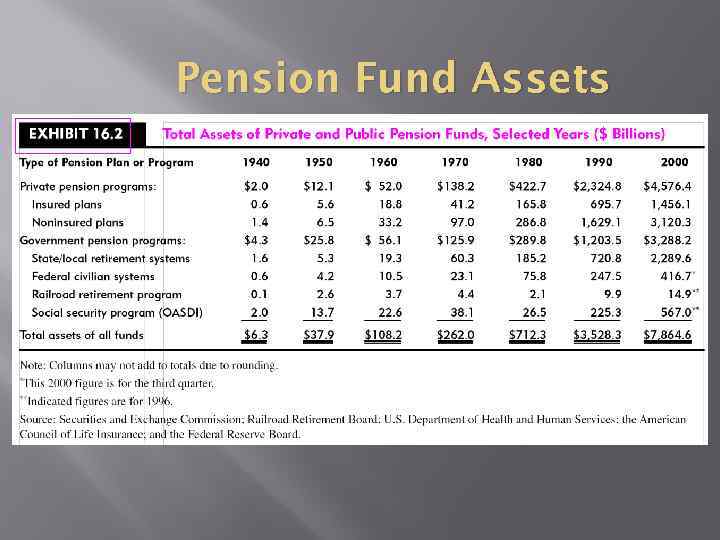

Pension Funds Private versus state and local government Defined benefit versus defined contribution Self-directed pension plans Pensions, taxes, and responsibilities Corporate tax treatment Personal tax treatment Corporate responsibilities under ERISA

Pension Fund Assets

Asset Management Economics of the industry Performance measurement Principal-agent problems A “temporary” disequilibrium Historical perspective Services provided by asset managers Issues in asset management

Asset Management Firms Revenue: Management Fees Based on assets under management Expenses: Research Costs Analysts (labor expense) Data and computer expenses Marketing expenses Non-interest expense Overhead labor and related expenses Communication, fees

Securities Firms Brokers Find buyers for sellers Organize markets Dealers Provide liquidity to market Hold inventories and take price risk Securities originators Design and place financial instruments for primary market issuers

Brokers and Investment Banking Full-line firms offer retail and institutional trading, securities origination and financial advisory services, and market-making services Clearing brokers (e. g. Bear Stearns) present securities for settlement Wire houses transmit orders to other firms for execution

Investment Banking Bulge bracket firms (e. g. Morgan Stanley) are largest investment banking firms Regional firms (e. g. Wedbush Morgan) operate in local markets Boutique firms specialize in certain types of transactions (e. g high tech or health care) Terms are not mutually exclusive

Securities Firm Income Revenue: Commissions Fees - Advisory, investment banking, asset management Expenses: Gains (and losses) and interest Labor costs Communications and space Clearing fees Borrowing costs

Finance Companies Three basic types Captive finance companies (owned by manufacturer, e. g. GMAC) Commercial finance companies and financial firm affiliates (owned by banks or other financial firms, e. g. Foothill Group) Consumer or personal finance companies (specialized in high-risk finance, like Household Finance) Funding sources - Bank credit, commercial paper, affiliate company financing

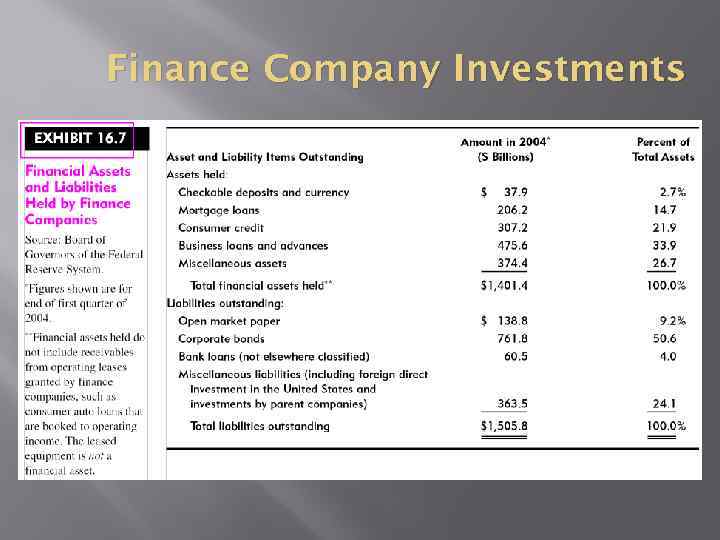

Finance Company Investments

Asset-Pools Origination › Government-sponsored agencies (GSEs) Federal National Mortgage Association (FNMA or Fannie May) Federal Home Loan Mortgage Corporation (FHLMC or Freddie Mac) Student Loan Marketing Corporation (SLMC or Sallie May) › Private originators Servicing fees and costs › Transactions in servicing portfolios ›

Other Financial Firms Mortgage banks Information and advisory firms Clearing firms and depositories Exchanges and communication networks Clear differences between types are eroding, but traditionally were due to Regulation, taxation, and charters › Specialization and expertise › Historical evolution ›

Презентация Microsoft PowerPoint.pptx