36459cb746eaca891f3c527b8fded0d4.ppt

- Количество слайдов: 63

No boom, no bust Global Economic & Market Outlook Riga May 15, 2015 Harald Magnus Andreassen +47 23 23 82 60 hma@swedbank. no

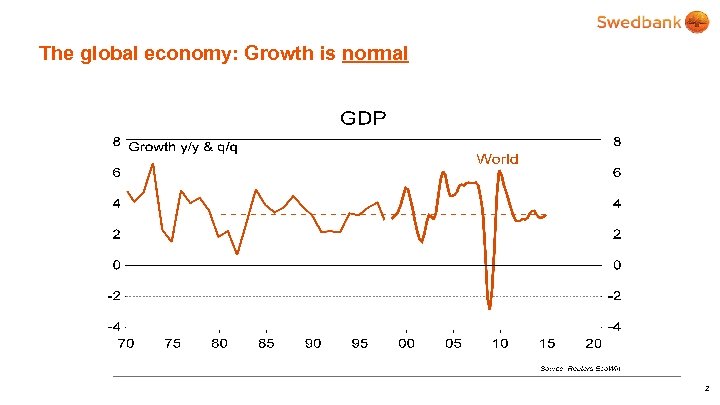

The global economy: Growth is normal 2

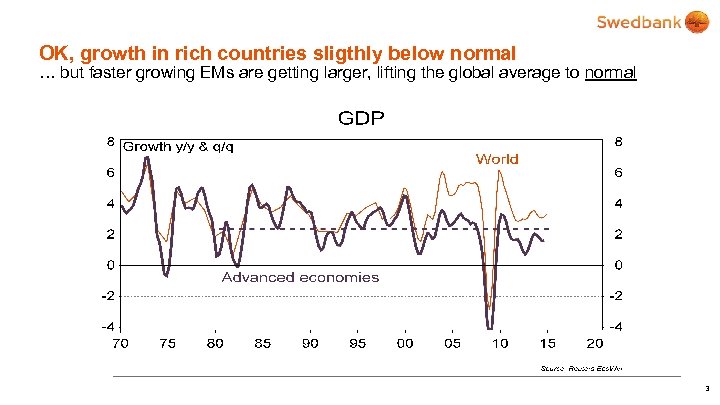

OK, growth in rich countries sligthly below normal … but faster growing EMs are getting larger, lifting the global average to normal 3

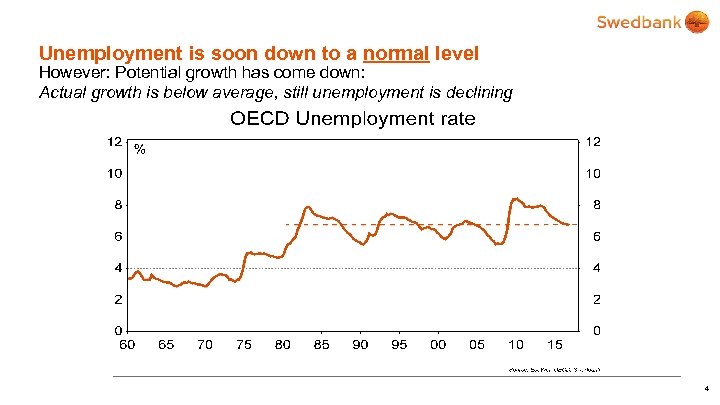

Unemployment is soon down to a normal level However: Potential growth has come down: Actual growth is below average, still unemployment is declining 4

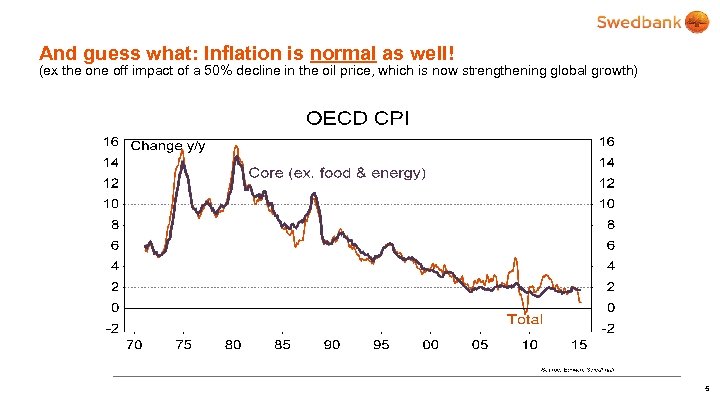

And guess what: Inflation is normal as well! (ex the one off impact of a 50% decline in the oil price, which is now strengthening global growth) 5

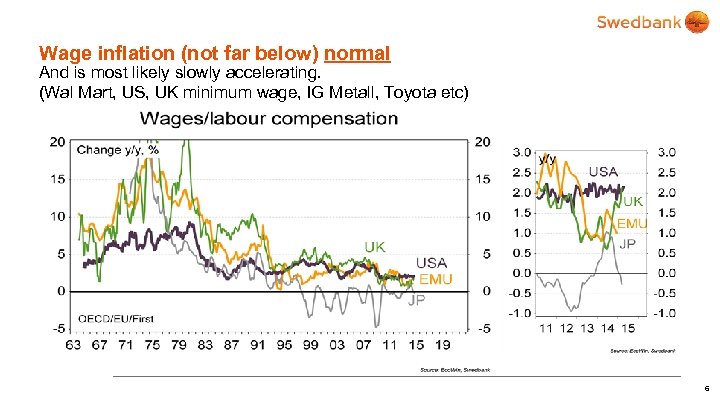

Wage inflation (not far below) normal And is most likely slowly accelerating. (Wal Mart, US, UK minimum wage, IG Metall, Toyota etc) 6

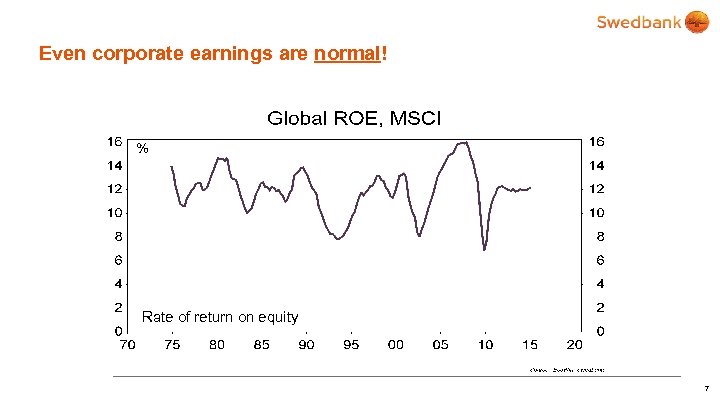

Even corporate earnings are normal! Rate of return on equity 7

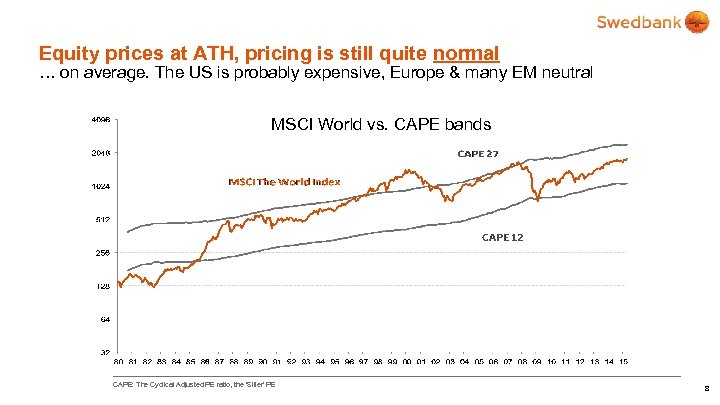

Equity prices at ATH, pricing is still quite normal … on average. The US is probably expensive, Europe & many EM neutral MSCI World vs. CAPE bands CAPE: The Cyclical Adjusted PE ratio, the ‘Siller’ PE 8

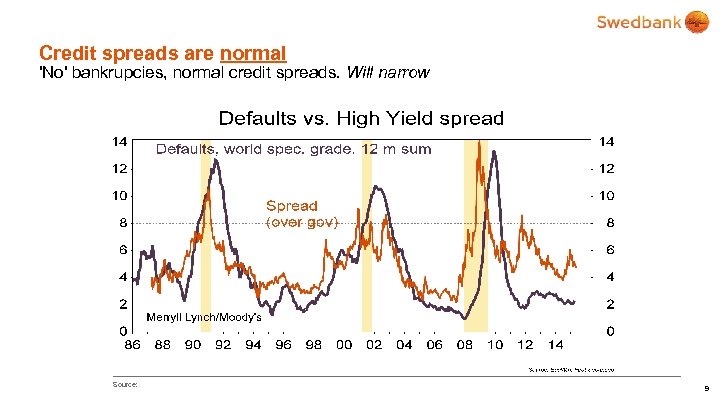

Credit spreads are normal 'No' bankrupcies, normal credit spreads. Will narrow Source: 9

So, is everything normal then? 10

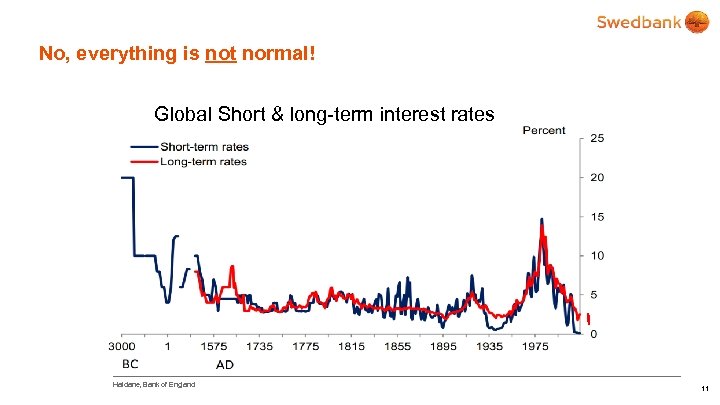

No, everything is not normal! Global Short & long-term interest rates Haldane, Bank of England 11

Should you be afraid of the big (bad) bond bull? The ’only’ important question for investors today: What do bond yields say about the future? 12

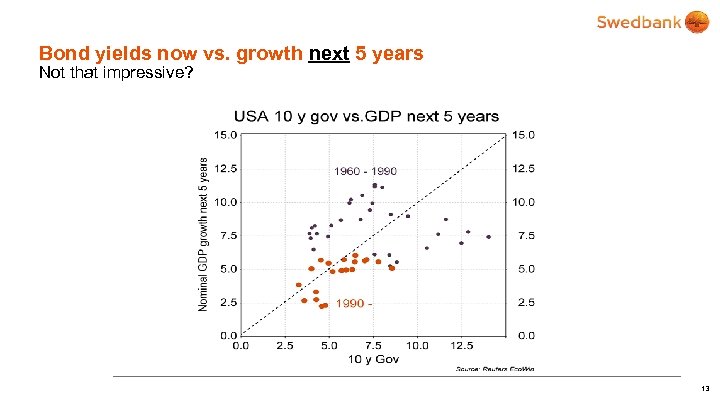

Bond yields now vs. growth next 5 years Not that impressive? 13

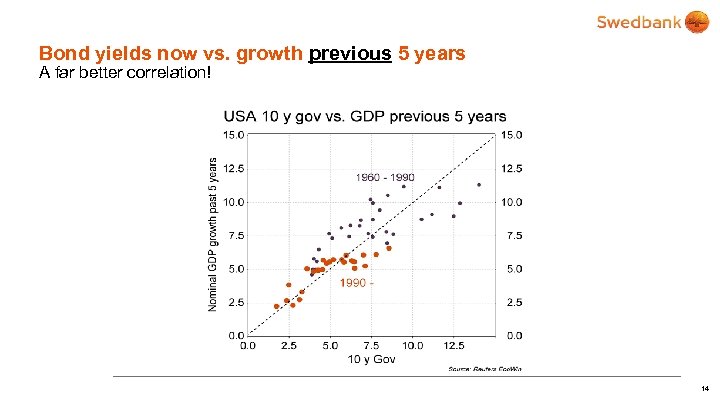

Bond yields now vs. growth previous 5 years A far better correlation! 14

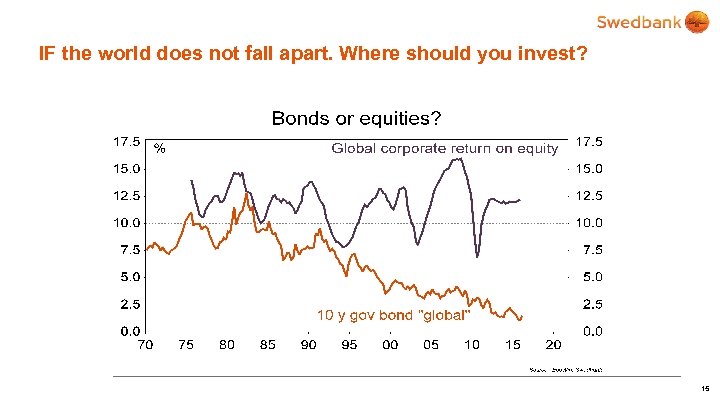

IF the world does not fall apart. Where should you invest? 15

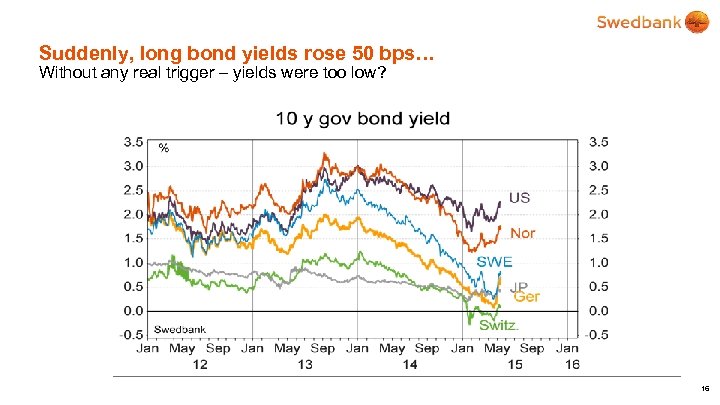

Suddenly, long bond yields rose 50 bps… Without any real trigger – yields were too low? 16

Secular stagnation ahead? Some arguments are OK, but how serious will it be? • Productivity – growth has declined! Technology (too little of it, the end of history) – Technology (too much of it, ’automatisation’ -> long term, structural unemployment) – Too low investments, private & public (infrastructure) after the financial crisis – • Demographics/human capital – growth is declining Working age population growth slowing & more old, less productive workers – Education (peak/declining) – Inequality (social capital, conflicts) – 17

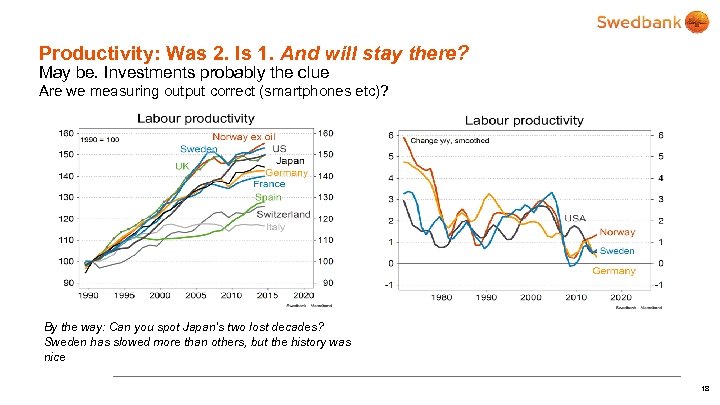

Productivity: Was 2. Is 1. And will stay there? May be. Investments probably the clue Are we measuring output correct (smartphones etc)? By the way: Can you spot Japan’s two lost decades? Sweden has slowed more than others, but the history was nice 18

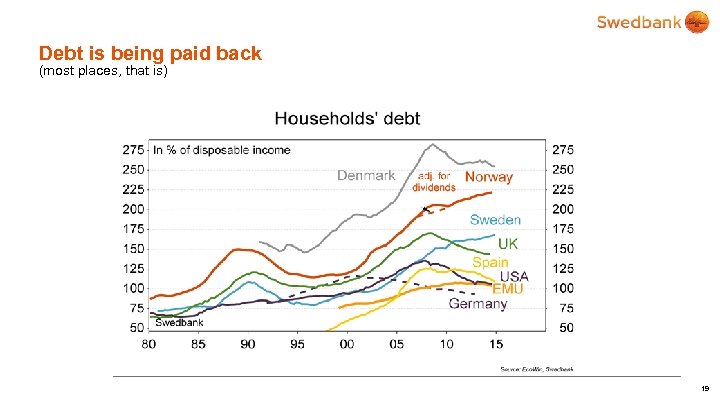

Debt is being paid back (most places, that is) 19

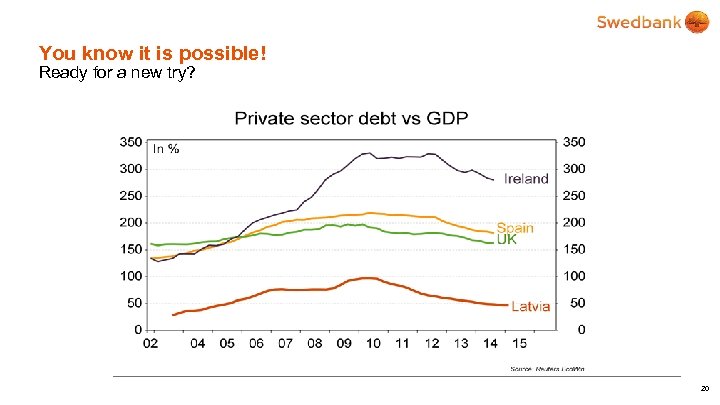

You know it is possible! Ready for a new try? 20

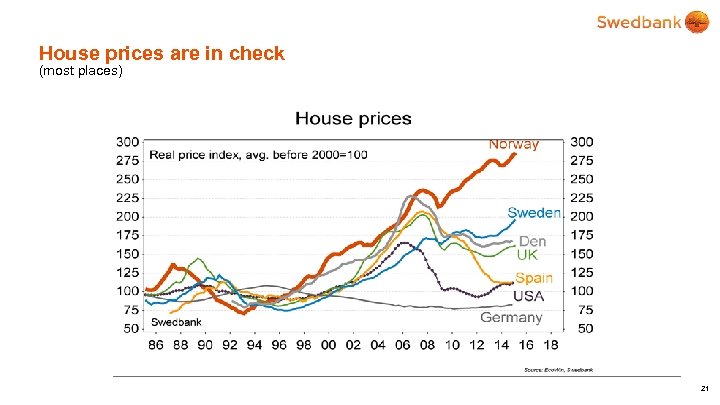

House prices are in check (most places) 21

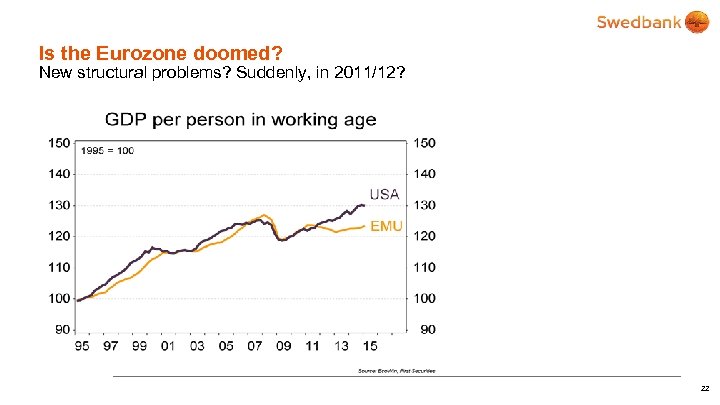

Is the Eurozone doomed? New structural problems? Suddenly, in 2011/12? 22

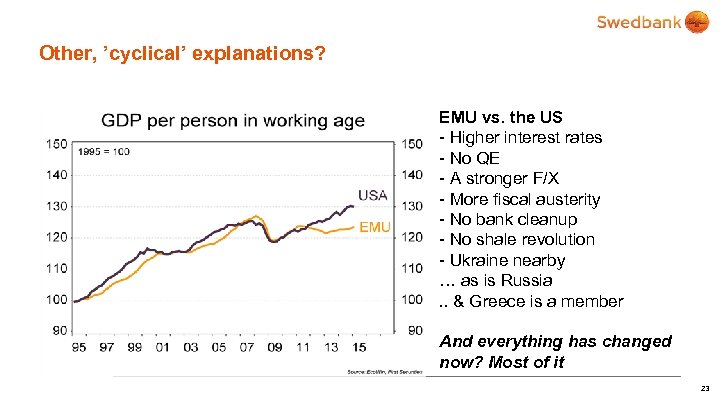

Other, ’cyclical’ explanations? EMU vs. the US - Higher interest rates - No QE - A stronger F/X - More fiscal austerity - No bank cleanup - No shale revolution - Ukraine nearby … as is Russia. . & Greece is a member And everything has changed now? Most of it 23

Two players. Just one left . . but he is a hard player. Still, the game has become (too) expensive for him? However, there are risks left. . Russian exports to EMU: 15% of GDP European exports to Russia: 1% of GDP. . Now down 40%, has cut GDP by 0. 5% 24

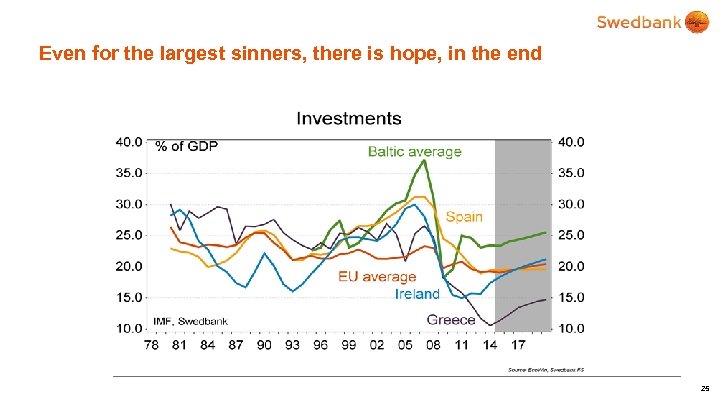

Even for the largest sinners, there is hope, in the end 25

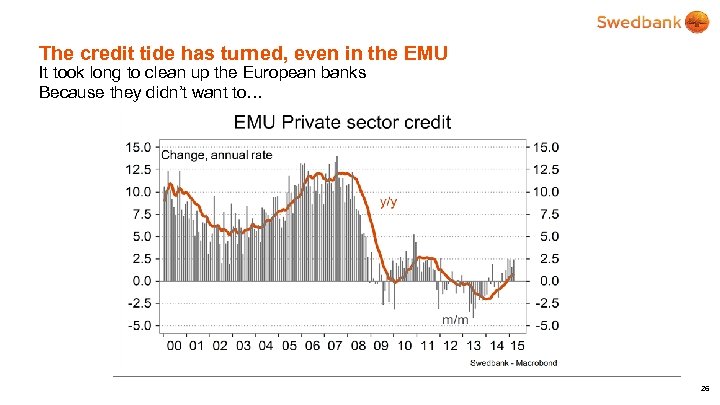

The credit tide has turned, even in the EMU It took long to clean up the European banks Because they didn’t want to… 26

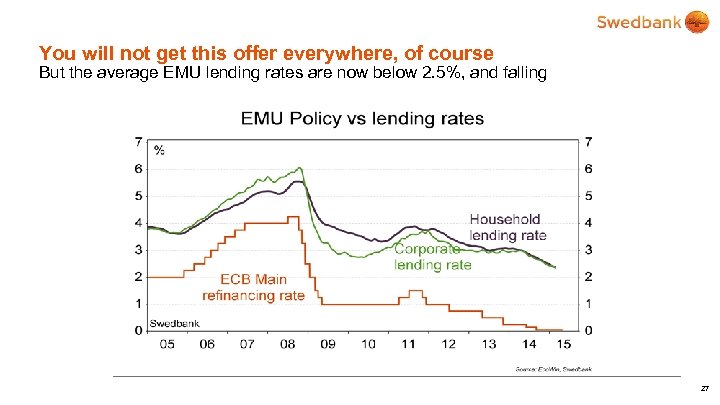

You will not get this offer everywhere, of course But the average EMU lending rates are now below 2. 5%, and falling 27

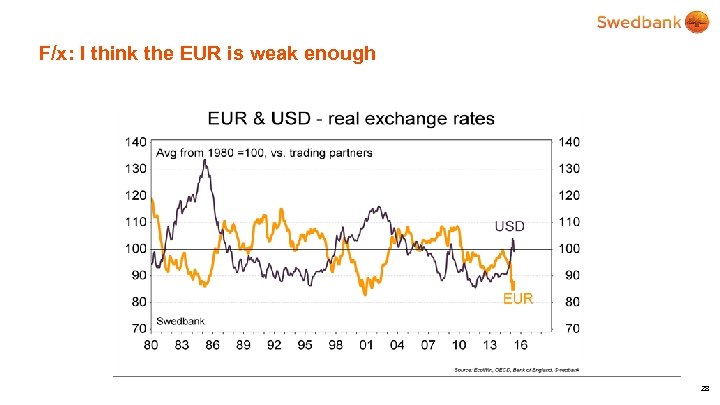

F/x: I think the EUR is weak enough 28

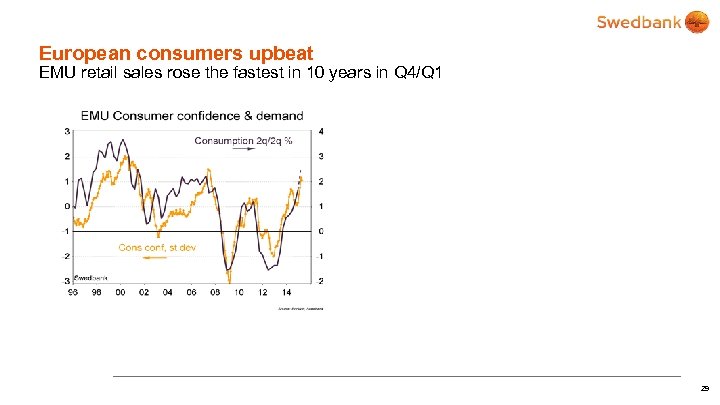

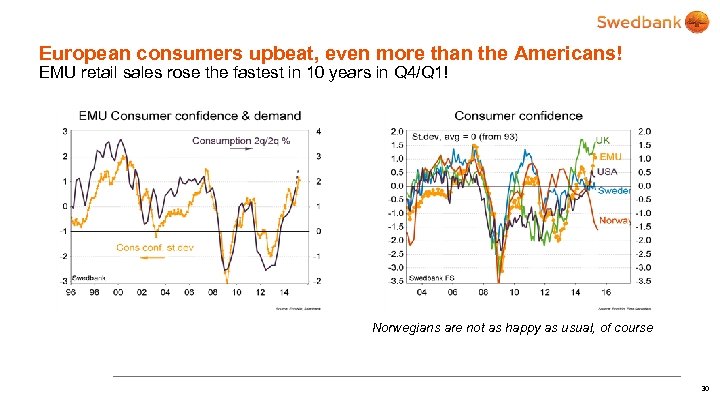

European consumers upbeat EMU retail sales rose the fastest in 10 years in Q 4/Q 1 29

European consumers upbeat, even more than the Americans! EMU retail sales rose the fastest in 10 years in Q 4/Q 1! Norwegians are not as happy as usual, of course 30

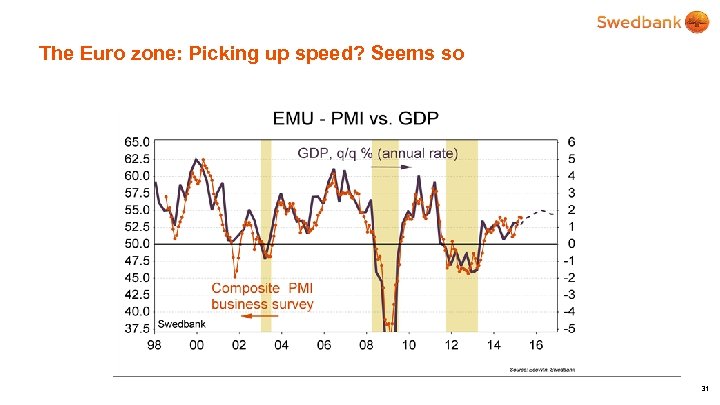

The Euro zone: Picking up speed? Seems so 31

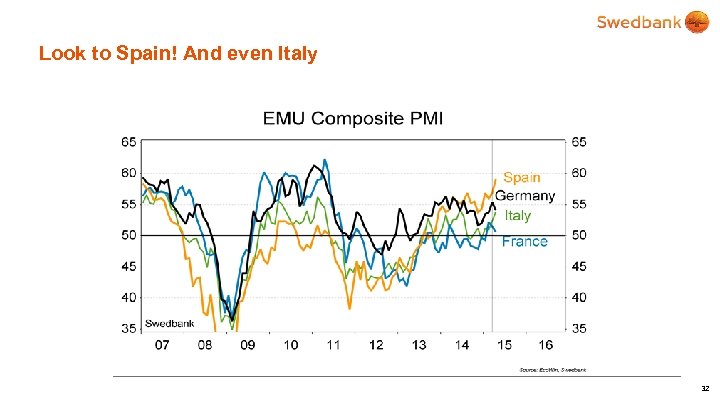

Look to Spain! And even Italy 32

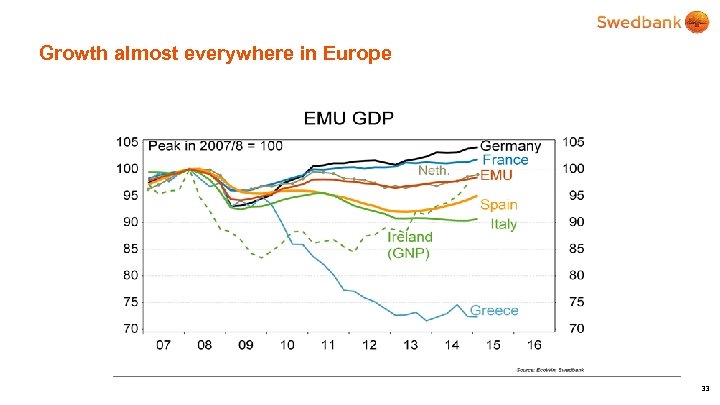

Growth almost everywhere in Europe 33

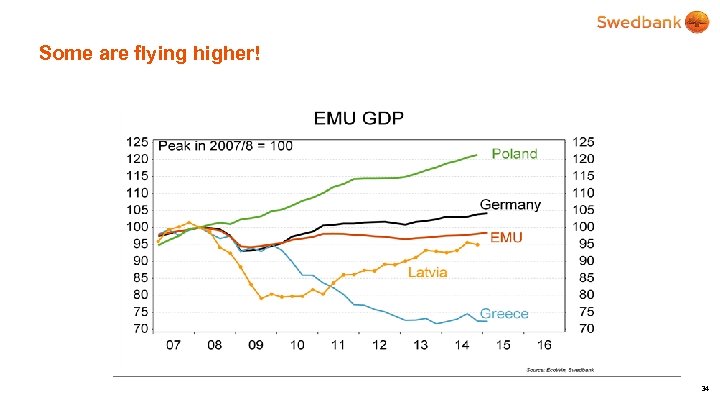

Some are flying higher! 34

CEE: Ok, ex Russia (& Hungary in April) 37

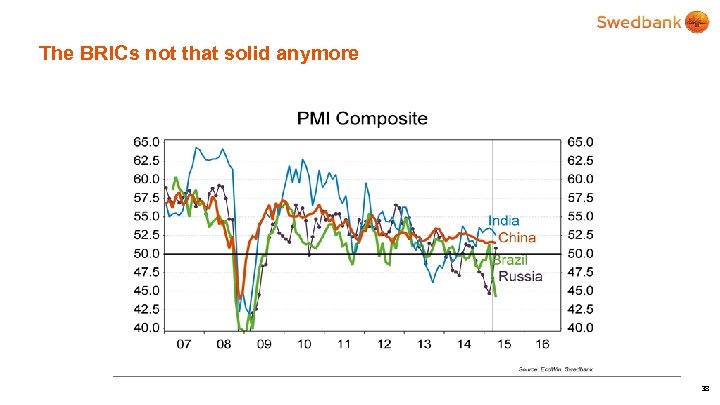

The BRICs not that solid anymore 38

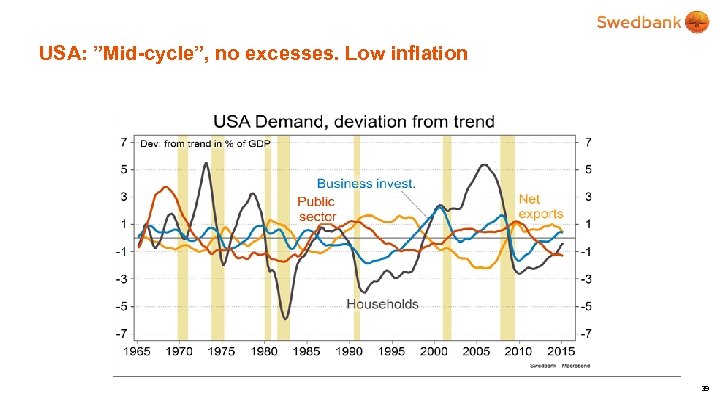

USA: ”Mid-cycle”, no excesses. Low inflation 39

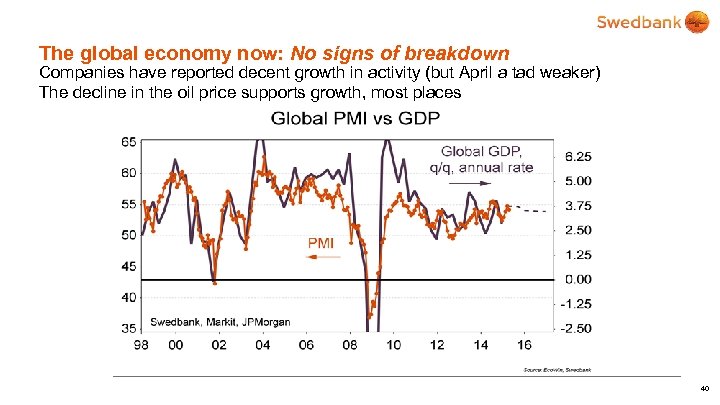

The global economy now: No signs of breakdown Companies have reported decent growth in activity (but April a tad weaker) The decline in the oil price supports growth, most places 40

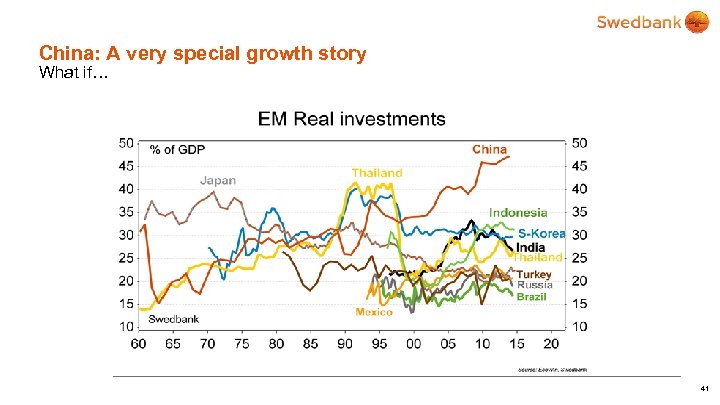

China: A very special growth story What if… 41

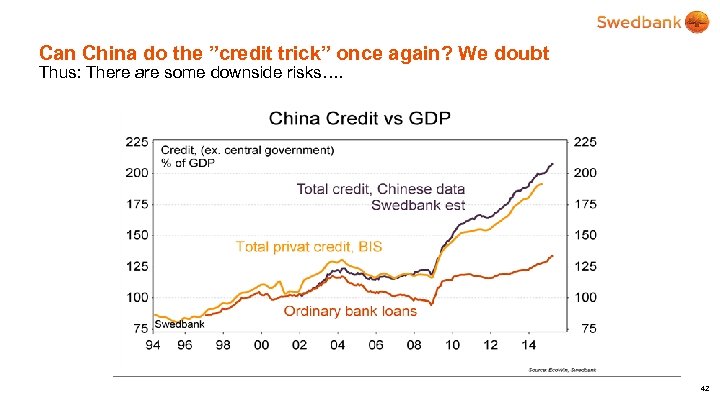

Can China do the ”credit trick” once again? We doubt Thus: There are some downside risks…. 42

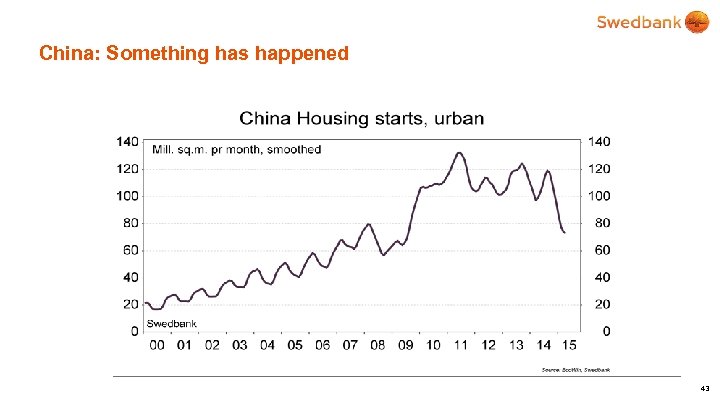

China: Something has happened 43

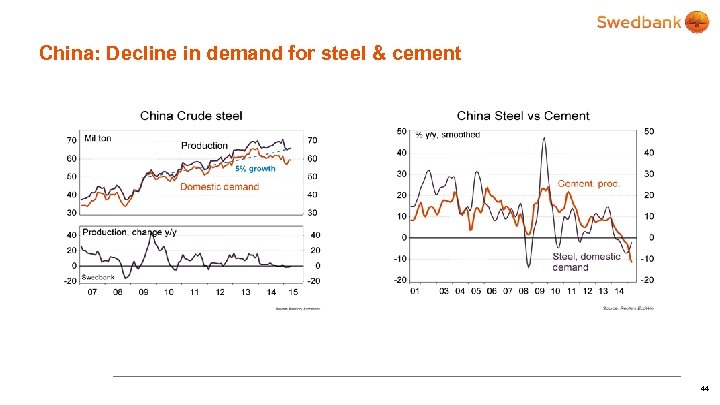

China: Decline in demand for steel & cement 44

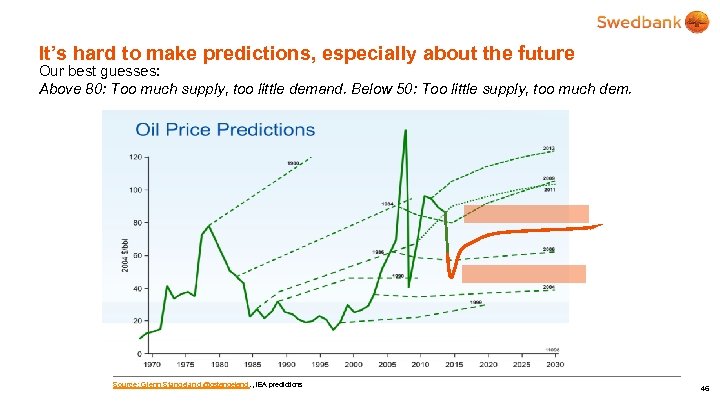

It’s hard to make predictions, especially about the future Here are the IEA’s forecasts Source: Glenn Stangeland @gstangeland. , IEA predictions 45

It’s hard to make predictions, especially about the future Our best guesses: Above 80: Too much supply, too little demand. Below 50: Too little supply, too much dem. Source: Glenn Stangeland @gstangeland. , IEA predictions 46

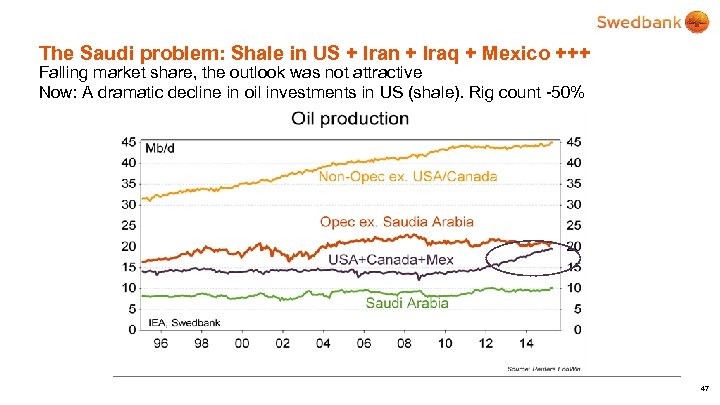

The Saudi problem: Shale in US + Iran + Iraq + Mexico +++ Falling market share, the outlook was not attractive Now: A dramatic decline in oil investments in US (shale). Rig count -50% 47

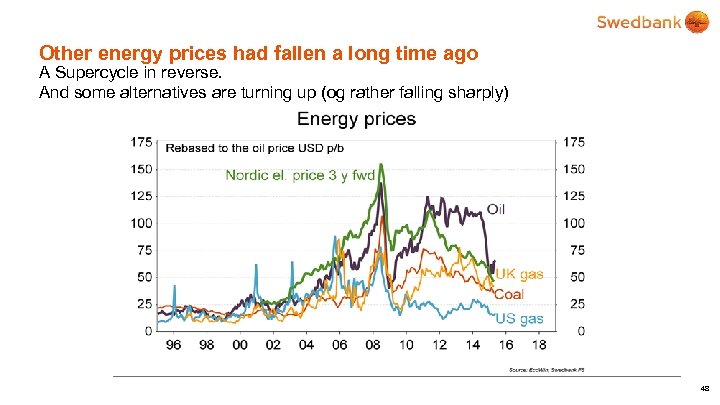

Other energy prices had fallen a long time ago A Supercycle in reverse. And some alternatives are turning up (og rather falling sharply) 48

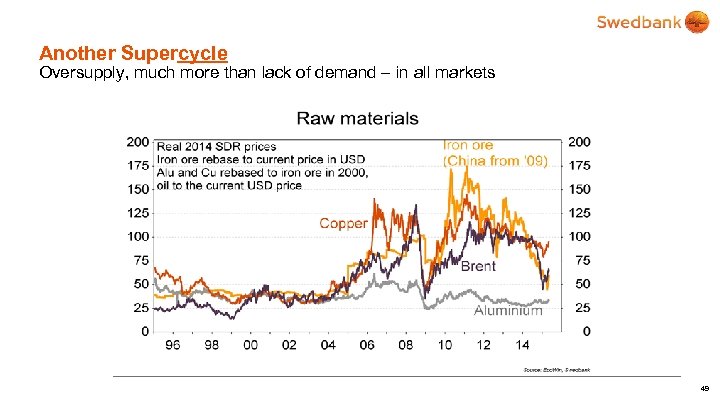

Another Supercycle Oversupply, much more than lack of demand – in all markets 49

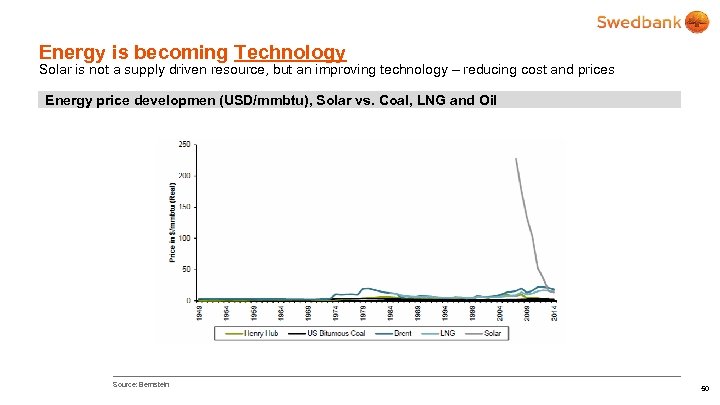

Energy is becoming Technology Solar is not a supply driven resource, but an improving technology – reducing cost and prices Energy price developmen (USD/mmbtu), Solar vs. Coal, LNG and Oil Source: Bernstein 50

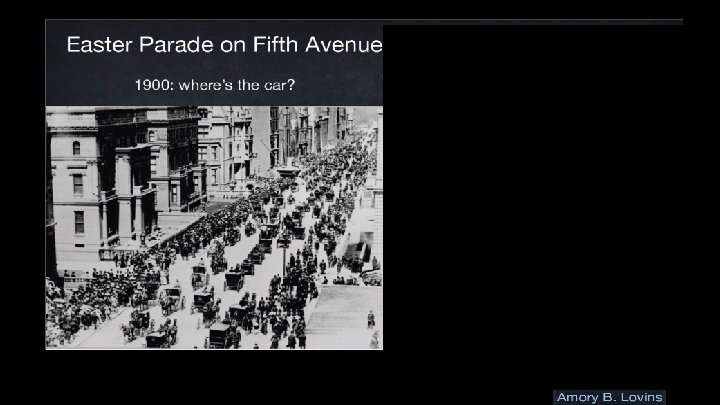

51

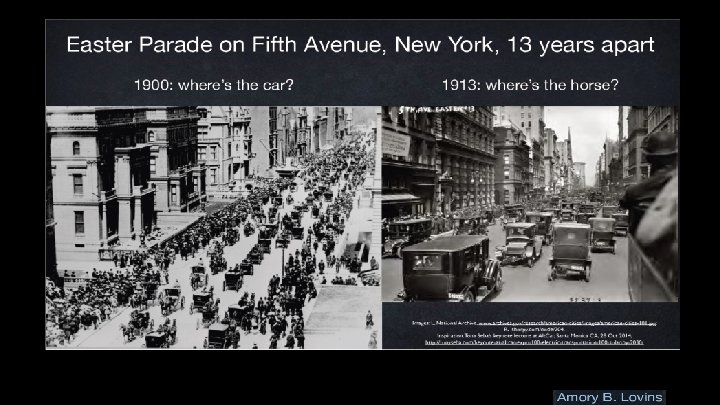

52

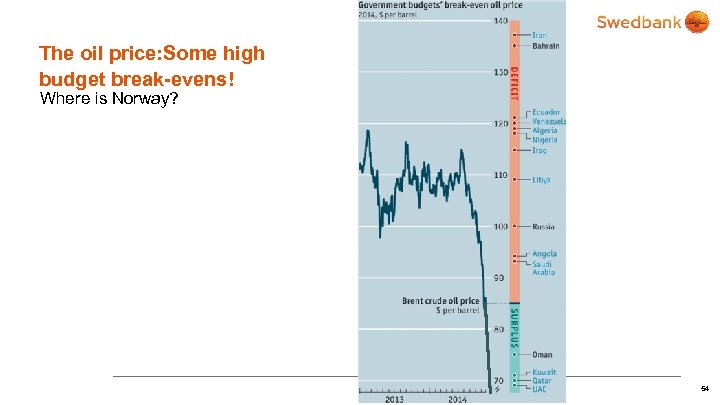

The oil price: Some high budget break-evens! Where is Norway? 54

Norway is here!!” 0 Norway 55

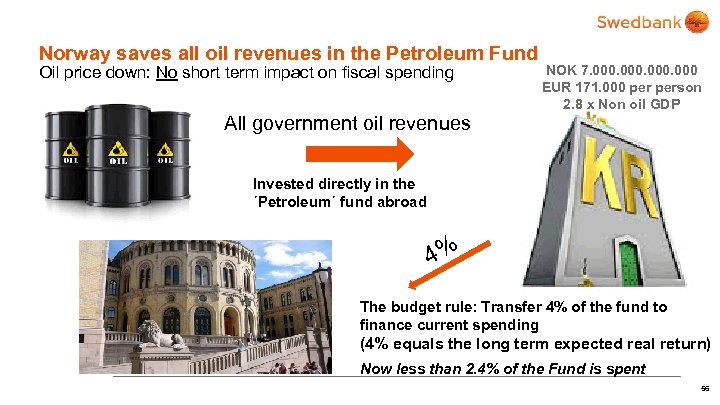

Norway saves all oil revenues in the Petroleum Fund Oil price down: No short term impact on fiscal spending NOK 7. 000 EUR 171. 000 person 2. 8 x Non oil GDP All government oil revenues Invested directly in the ´Petroleum´ fund abroad 4% The budget rule: Transfer 4% of the fund to finance current spending (4% equals the long term expected real return) Now less than 2. 4% of the Fund is spent 56

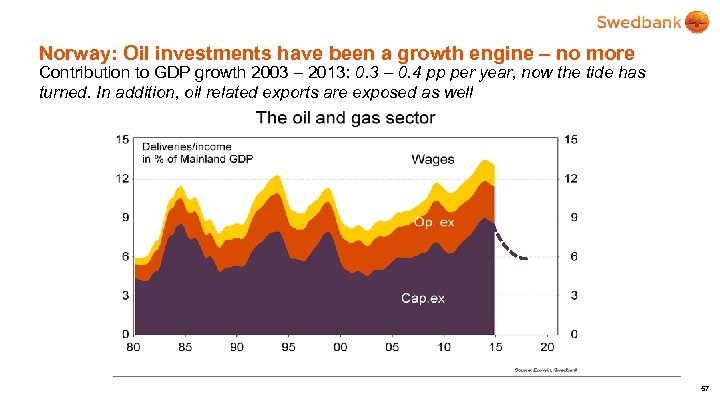

Norway: Oil investments have been a growth engine – no more Contribution to GDP growth 2003 – 2013: 0. 3 – 0. 4 pp per year, now the tide has turned. In addition, oil related exports are exposed as well 57

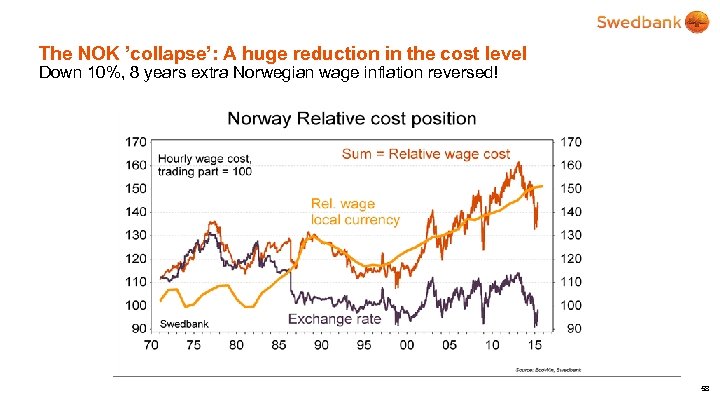

The NOK ’collapse’: A huge reduction in the cost level Down 10%, 8 years extra Norwegian wage inflation reversed! 58

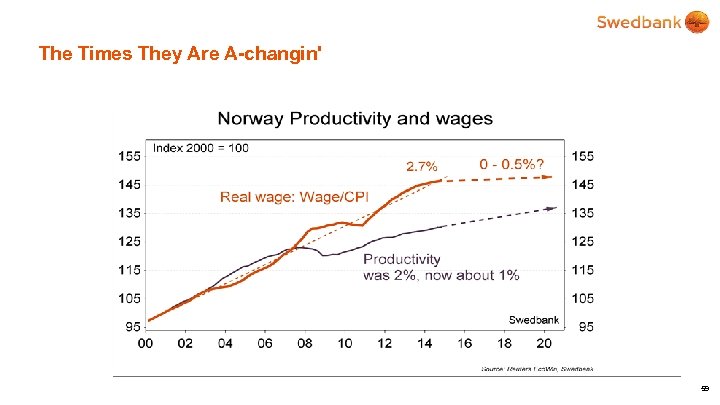

The Times They Are A-changin' 59

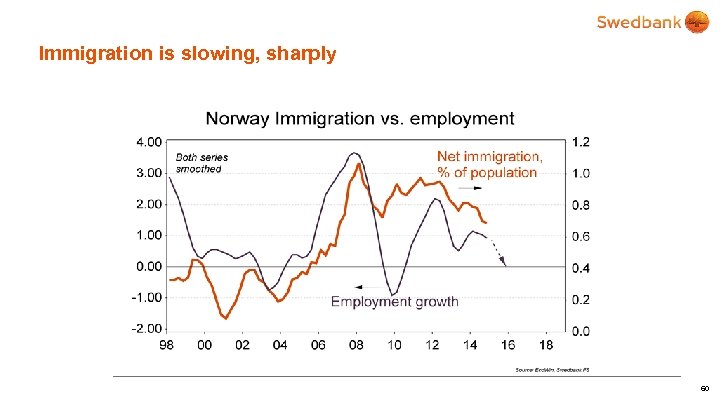

Immigration is slowing, sharply 60

Look to Sweden: What a strange land! • • • Growth is OK Unemployment is falling – because participation rates are increasing, from ATH Inflation is quite normal The SEK f/x is quite weak House prices are soaring, debt growth accelerating Construction on the way up (but still low) • And the central bank signal rate is -0, 25% - the bank is buying some government bonds too • We think the outlook is OK (but imbalances might be building up) – Household demand (consumption & housing) on the way up 61

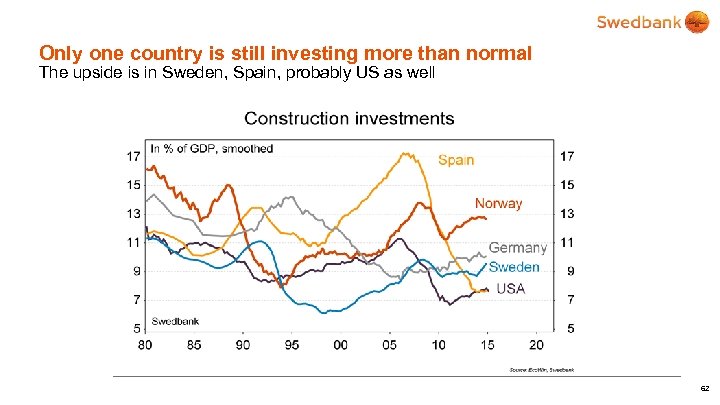

Only one country is still investing more than normal The upside is in Sweden, Spain, probably US as well 62

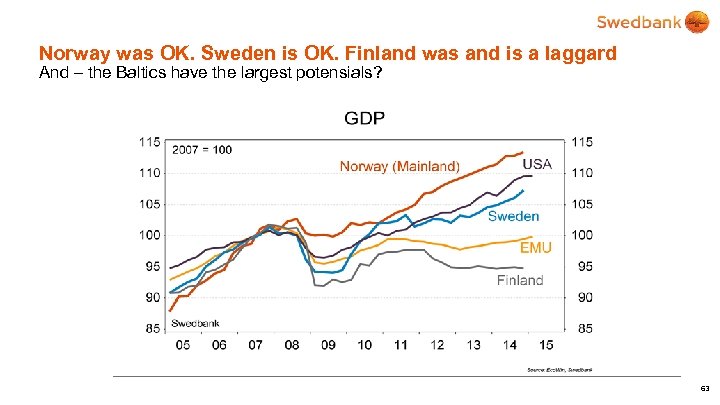

Norway was OK. Sweden is OK. Finland was and is a laggard And – the Baltics have the largest potensials? 63

Where to sell & where to invest • The Eurozone is not dead • The US is mid cycle, not mature • China has peaked, raw materials still exposed • Norway has peaked too but will not collapse • Sweden on the way up, Finland not • Buy the EUR, SEK, equities & corporate bonds • Sell the USD, government bonds 64

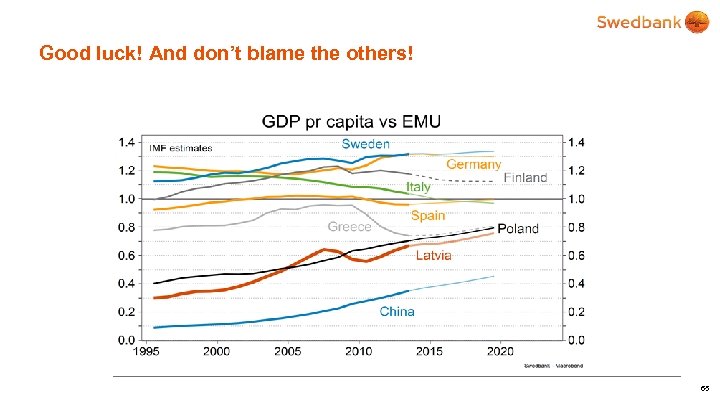

Good luck! And don’t blame the others! 65

No boom, no bust Riga May 15, 2015 Harald Magnus Andreassen +47 23 23 82 60 hma@swedbank. no

36459cb746eaca891f3c527b8fded0d4.ppt