29c09674338fccb16268f51a5f9a5b31.ppt

- Количество слайдов: 31

No 1 / 17 -Mar-18 PENOX - GROUP Group Introduction Lead & Lead Oxide Markets

No 1 / 17 -Mar-18 PENOX - GROUP Group Introduction Lead & Lead Oxide Markets

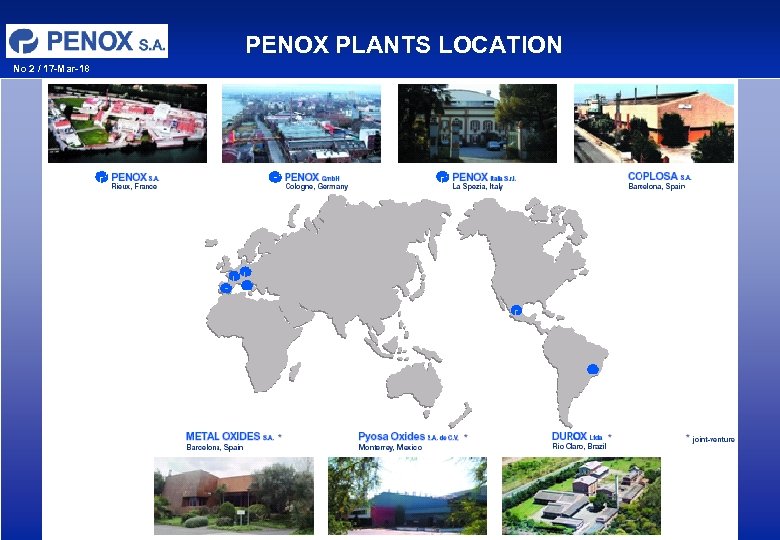

PENOX PLANTS LOCATION No 2 / 17 -Mar-18

PENOX PLANTS LOCATION No 2 / 17 -Mar-18

EXECUTIVE SUMMARY No 3 / 17 -Mar-18 • Penox (formerly Penarroya Oxide) is the largest European producer of chemical grade lead oxide (litharge and red lead), holding 20% of the global market, but with significantly higher market share in Europe. Its position in the North American market is growing via its 50% joint venture in Mexico and 20% joint venture in Brazil. • Penox was formed in 1994 by the merger of the leading Pb. O producers in Germany (Cologne), France (Rieux), Italy (La Spezia) and Spain (Barcelona). The combination created significant operational efficiencies and supported the needs of multinational clients to source their Pb. O needs from one supplier throughout Europe and North America with consistent quality. • Existing legislation treats Pb. O as a toxic material, but in its most significant applications there at present no viable substitute products. For the foreseeable future Pb. O will continue to be an essential component in the production of technical glass, plastics, batteries, stabilisers and certain pigments. Few companies can comply with the stringent environmental safety requirements imposed on Pb. O producers, creating a highly effective barrier of entry to new producers. Penox, thanks to its consistent investment and compliance with environmental safety measures, has been able to increase it’s market share all along the years. • Penox is also the technological world leader in the design of lead oxide plant and equipment. As well as providing its in-house needs, this has permitted Penox to generate significant business from the design, engineering and supply of lead oxide plant for third parties (to date mainly battery producers, where plant supplied is not employed in the manufacture of chemical grade oxides).

EXECUTIVE SUMMARY No 3 / 17 -Mar-18 • Penox (formerly Penarroya Oxide) is the largest European producer of chemical grade lead oxide (litharge and red lead), holding 20% of the global market, but with significantly higher market share in Europe. Its position in the North American market is growing via its 50% joint venture in Mexico and 20% joint venture in Brazil. • Penox was formed in 1994 by the merger of the leading Pb. O producers in Germany (Cologne), France (Rieux), Italy (La Spezia) and Spain (Barcelona). The combination created significant operational efficiencies and supported the needs of multinational clients to source their Pb. O needs from one supplier throughout Europe and North America with consistent quality. • Existing legislation treats Pb. O as a toxic material, but in its most significant applications there at present no viable substitute products. For the foreseeable future Pb. O will continue to be an essential component in the production of technical glass, plastics, batteries, stabilisers and certain pigments. Few companies can comply with the stringent environmental safety requirements imposed on Pb. O producers, creating a highly effective barrier of entry to new producers. Penox, thanks to its consistent investment and compliance with environmental safety measures, has been able to increase it’s market share all along the years. • Penox is also the technological world leader in the design of lead oxide plant and equipment. As well as providing its in-house needs, this has permitted Penox to generate significant business from the design, engineering and supply of lead oxide plant for third parties (to date mainly battery producers, where plant supplied is not employed in the manufacture of chemical grade oxides).

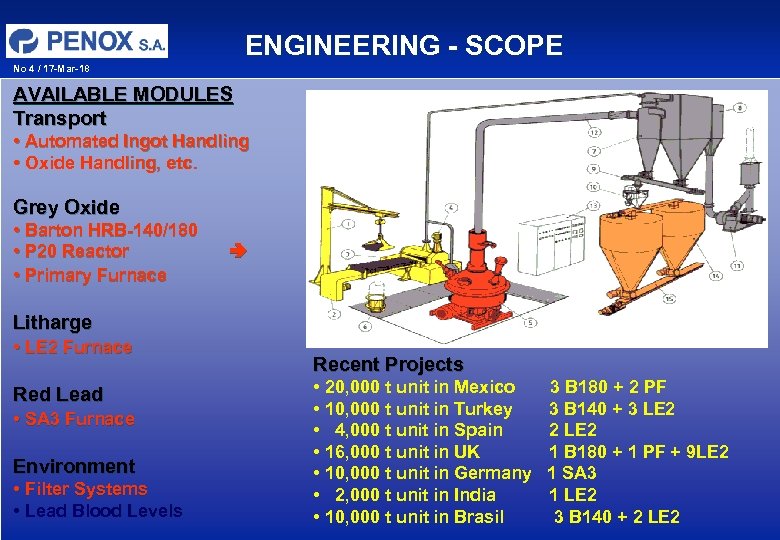

ENGINEERING - SCOPE No 4 / 17 -Mar-18 AVAILABLE MODULES Transport • Automated Ingot Handling • Oxide Handling, etc. Grey Oxide • Barton HRB-140/180 • P 20 Reactor • Primary Furnace Litharge • LE 2 Furnace Red Lead • SA 3 Furnace Environment • Filter Systems • Lead Blood Levels Recent Projects • 20, 000 t unit in Mexico 3 B 180 + 2 PF • 10, 000 t unit in Turkey 3 B 140 + 3 LE 2 • 4, 000 t unit in Spain 2 LE 2 • 16, 000 t unit in UK 1 B 180 + 1 PF + 9 LE 2 • 10, 000 t unit in Germany 1 SA 3 • 2, 000 t unit in India 1 LE 2 • 10, 000 t unit in Brasil 3 B 140 + 2 LE 2

ENGINEERING - SCOPE No 4 / 17 -Mar-18 AVAILABLE MODULES Transport • Automated Ingot Handling • Oxide Handling, etc. Grey Oxide • Barton HRB-140/180 • P 20 Reactor • Primary Furnace Litharge • LE 2 Furnace Red Lead • SA 3 Furnace Environment • Filter Systems • Lead Blood Levels Recent Projects • 20, 000 t unit in Mexico 3 B 180 + 2 PF • 10, 000 t unit in Turkey 3 B 140 + 3 LE 2 • 4, 000 t unit in Spain 2 LE 2 • 16, 000 t unit in UK 1 B 180 + 1 PF + 9 LE 2 • 10, 000 t unit in Germany 1 SA 3 • 2, 000 t unit in India 1 LE 2 • 10, 000 t unit in Brasil 3 B 140 + 2 LE 2

EUROPEAN Pb. O MARKET No 5 / 17 -Mar-18 LEAD OXIDE MARKET • Lead Oxide

EUROPEAN Pb. O MARKET No 5 / 17 -Mar-18 LEAD OXIDE MARKET • Lead Oxide

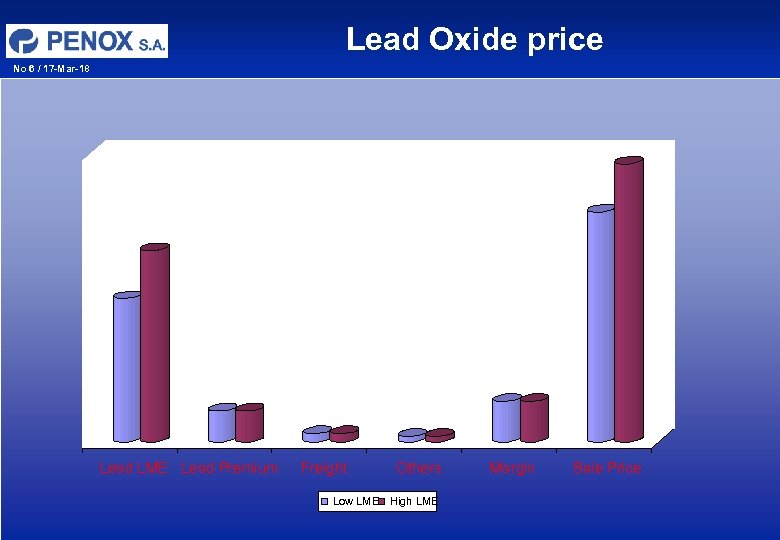

Lead Oxide price No 6 / 17 -Mar-18 Lead LME Lead Premium Freight Others Low LME High LME Margin Sale Price

Lead Oxide price No 6 / 17 -Mar-18 Lead LME Lead Premium Freight Others Low LME High LME Margin Sale Price

EUROPEAN LEAD MARKET No 7 / 17 -Mar-18 EUROPEAN LEAD MARKET 2004 situation

EUROPEAN LEAD MARKET No 7 / 17 -Mar-18 EUROPEAN LEAD MARKET 2004 situation

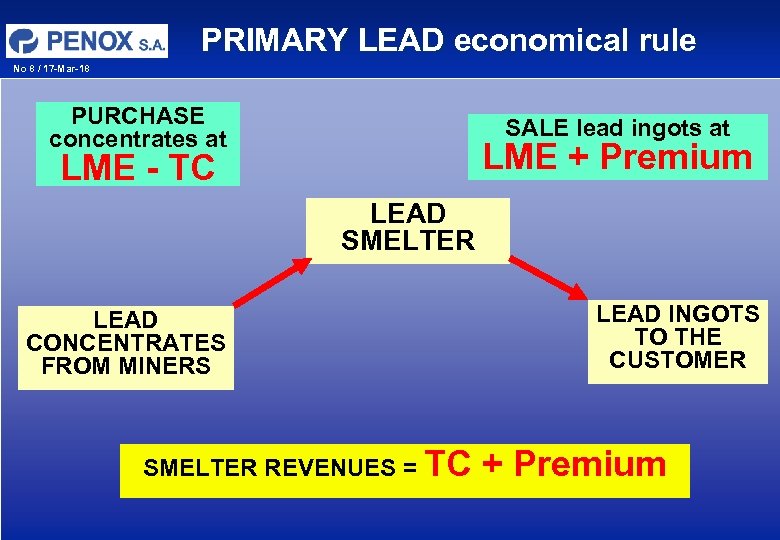

PRIMARY LEAD economical rule No 8 / 17 -Mar-18 PURCHASE concentrates at SALE lead ingots at LME + Premium LME - TC LEAD SMELTER LEAD CONCENTRATES FROM MINERS LEAD INGOTS TO THE CUSTOMER SMELTER REVENUES = TC + Premium

PRIMARY LEAD economical rule No 8 / 17 -Mar-18 PURCHASE concentrates at SALE lead ingots at LME + Premium LME - TC LEAD SMELTER LEAD CONCENTRATES FROM MINERS LEAD INGOTS TO THE CUSTOMER SMELTER REVENUES = TC + Premium

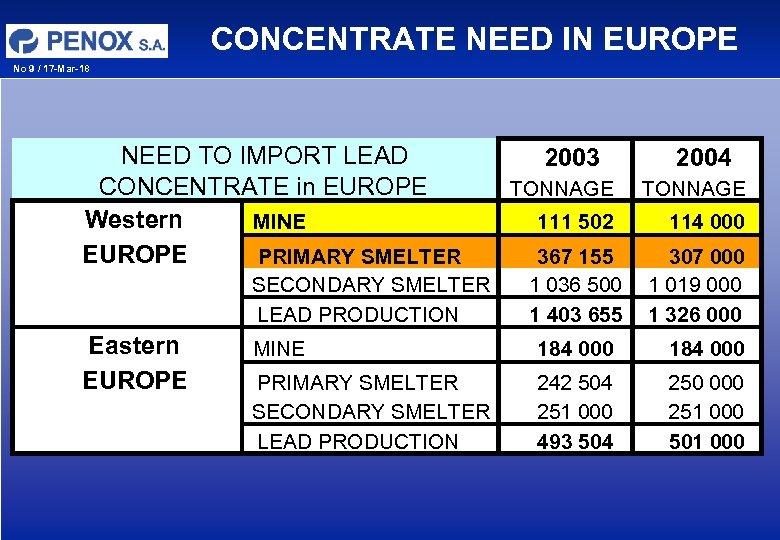

CONCENTRATE NEED IN EUROPE No 9 / 17 -Mar-18 NEED TO IMPORT LEAD CONCENTRATE in EUROPE Western MINE EUROPE PRIMARY SMELTER SECONDARY SMELTER LEAD PRODUCTION Eastern EUROPE 2003 2004 TONNAGE 111 502 114 000 367 155 1 036 500 1 403 655 307 000 1 019 000 1 326 000 MINE 184 000 PRIMARY SMELTER SECONDARY SMELTER LEAD PRODUCTION 242 504 251 000 493 504 250 000 251 000 501 000

CONCENTRATE NEED IN EUROPE No 9 / 17 -Mar-18 NEED TO IMPORT LEAD CONCENTRATE in EUROPE Western MINE EUROPE PRIMARY SMELTER SECONDARY SMELTER LEAD PRODUCTION Eastern EUROPE 2003 2004 TONNAGE 111 502 114 000 367 155 1 036 500 1 403 655 307 000 1 019 000 1 326 000 MINE 184 000 PRIMARY SMELTER SECONDARY SMELTER LEAD PRODUCTION 242 504 251 000 493 504 250 000 251 000 501 000

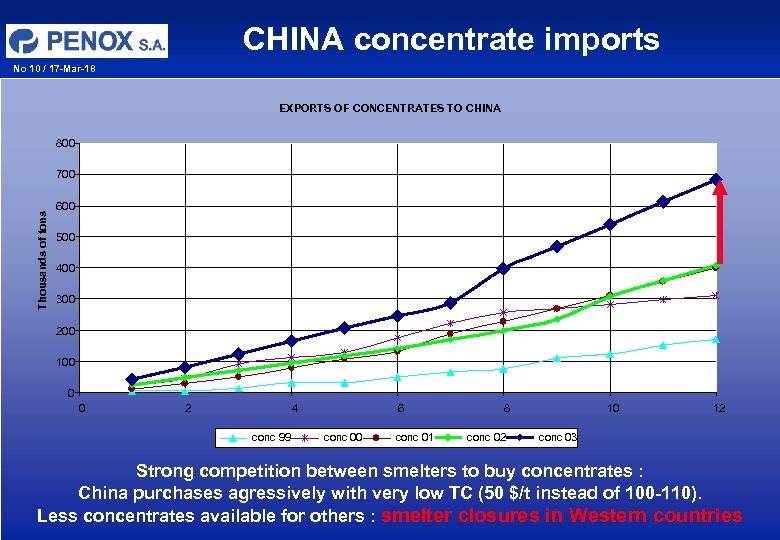

CHINA concentrate imports No 10 / 17 -Mar-18 EXPORTS OF CONCENTRATES TO CHINA 800 Thousands of tons 700 600 500 400 300 200 100 0 0 2 4 conc 99 6 conc 00 conc 01 8 conc 02 10 12 conc 03 Strong competition between smelters to buy concentrates : China purchases agressively with very low TC (50 $/t instead of 100 -110). Less concentrates available for others : smelter closures in Western countries

CHINA concentrate imports No 10 / 17 -Mar-18 EXPORTS OF CONCENTRATES TO CHINA 800 Thousands of tons 700 600 500 400 300 200 100 0 0 2 4 conc 99 6 conc 00 conc 01 8 conc 02 10 12 conc 03 Strong competition between smelters to buy concentrates : China purchases agressively with very low TC (50 $/t instead of 100 -110). Less concentrates available for others : smelter closures in Western countries

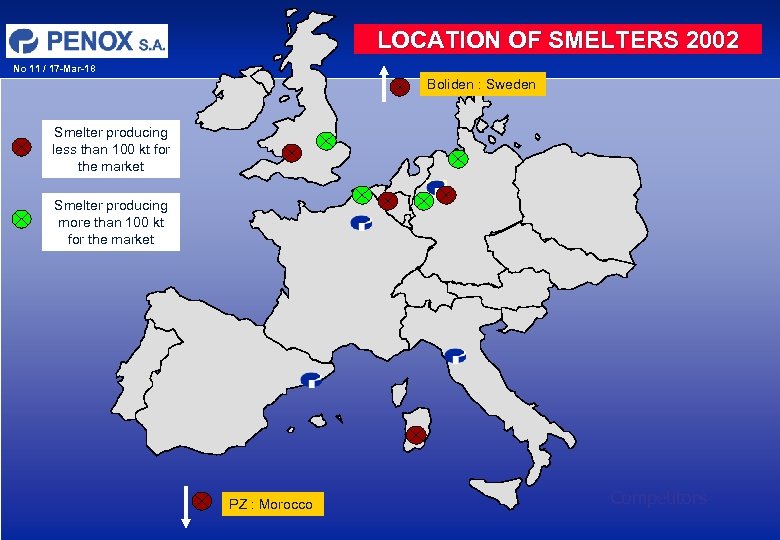

LOCATION OF SMELTERS 2002 No 11 / 17 -Mar-18 Boliden : Sweden Smelter producing less than 100 kt for the market Smelter producing more than 100 kt for the market PZ : Morocco Competitors

LOCATION OF SMELTERS 2002 No 11 / 17 -Mar-18 Boliden : Sweden Smelter producing less than 100 kt for the market Smelter producing more than 100 kt for the market PZ : Morocco Competitors

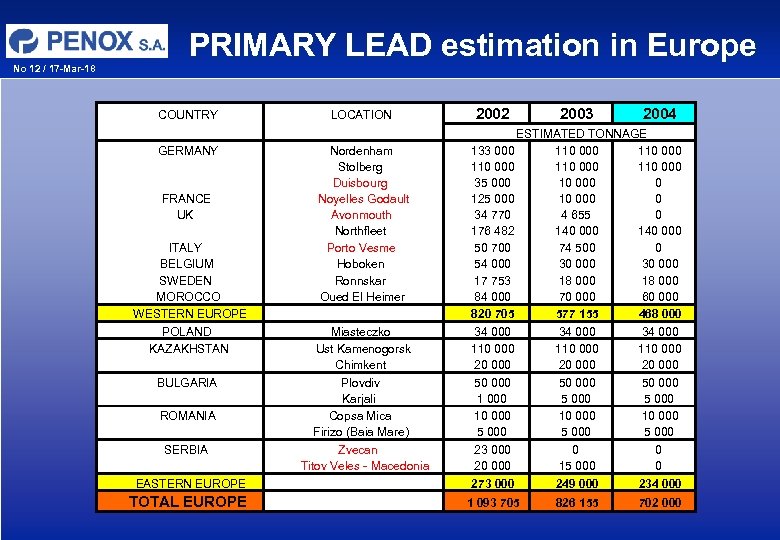

No 12 / 17 -Mar-18 PRIMARY LEAD estimation in Europe COUNTRY GERMANY FRANCE UK ITALY BELGIUM SWEDEN MOROCCO WESTERN EUROPE POLAND KAZAKHSTAN BULGARIA ROMANIA SERBIA EASTERN EUROPE TOTAL EUROPE LOCATION Nordenham Stolberg Duisbourg Noyelles Godault Avonmouth Northfleet Porto Vesme Hoboken Ronnskar Oued El Heimer Miasteczko Ust Kamenogorsk Chimkent Plovdiv Karjali Copsa Mica Firizo (Baia Mare) Zvecan Titov Veles - Macedonia 2002 2003 2004 ESTIMATED TONNAGE 133 000 110 000 110 000 35 000 10 000 0 125 000 10 000 0 34 770 4 655 0 176 482 140 000 50 700 74 500 0 54 000 30 000 17 753 18 000 84 000 70 000 60 000 820 705 577 155 468 000 34 000 110 000 20 000 50 000 1 000 5 000 10 000 5 000 23 000 0 0 20 000 15 000 0 273 000 249 000 234 000 1 093 705 826 155 702 000

No 12 / 17 -Mar-18 PRIMARY LEAD estimation in Europe COUNTRY GERMANY FRANCE UK ITALY BELGIUM SWEDEN MOROCCO WESTERN EUROPE POLAND KAZAKHSTAN BULGARIA ROMANIA SERBIA EASTERN EUROPE TOTAL EUROPE LOCATION Nordenham Stolberg Duisbourg Noyelles Godault Avonmouth Northfleet Porto Vesme Hoboken Ronnskar Oued El Heimer Miasteczko Ust Kamenogorsk Chimkent Plovdiv Karjali Copsa Mica Firizo (Baia Mare) Zvecan Titov Veles - Macedonia 2002 2003 2004 ESTIMATED TONNAGE 133 000 110 000 110 000 35 000 10 000 0 125 000 10 000 0 34 770 4 655 0 176 482 140 000 50 700 74 500 0 54 000 30 000 17 753 18 000 84 000 70 000 60 000 820 705 577 155 468 000 34 000 110 000 20 000 50 000 1 000 5 000 10 000 5 000 23 000 0 0 20 000 15 000 0 273 000 249 000 234 000 1 093 705 826 155 702 000

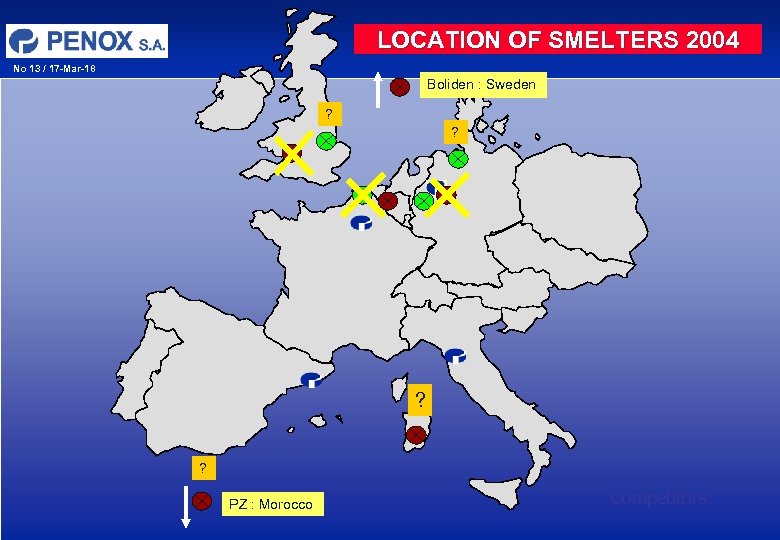

LOCATION OF SMELTERS 2004 No 13 / 17 -Mar-18 Boliden : Sweden ? ? PZ : Morocco Competitors

LOCATION OF SMELTERS 2004 No 13 / 17 -Mar-18 Boliden : Sweden ? ? PZ : Morocco Competitors

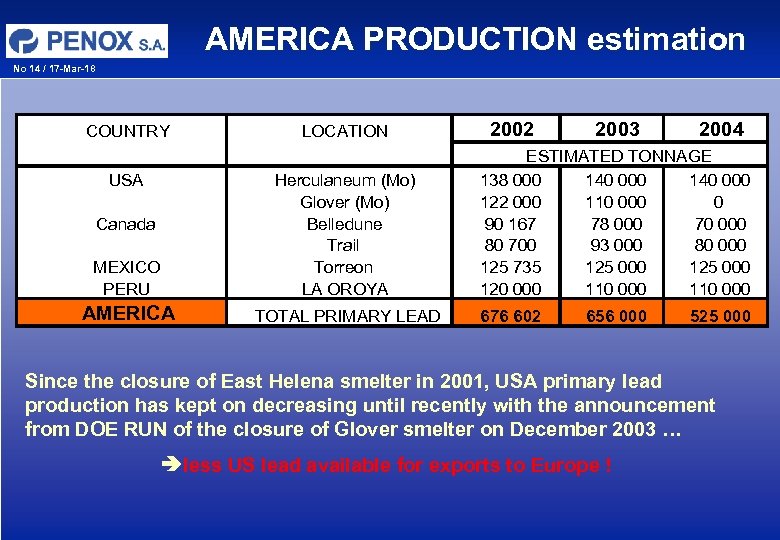

AMERICA PRODUCTION estimation No 14 / 17 -Mar-18 COUNTRY USA LOCATION MEXICO PERU Herculaneum (Mo) Glover (Mo) Belledune Trail Torreon LA OROYA AMERICA TOTAL PRIMARY LEAD Canada 2002 2003 2004 ESTIMATED TONNAGE 138 000 140 000 122 000 110 000 0 90 167 78 000 70 000 80 700 93 000 80 000 125 735 125 000 120 000 110 000 676 602 656 000 525 000 Since the closure of East Helena smelter in 2001, USA primary lead production has kept on decreasing until recently with the announcement from DOE RUN of the closure of Glover smelter on December 2003 … less US lead available for exports to Europe !

AMERICA PRODUCTION estimation No 14 / 17 -Mar-18 COUNTRY USA LOCATION MEXICO PERU Herculaneum (Mo) Glover (Mo) Belledune Trail Torreon LA OROYA AMERICA TOTAL PRIMARY LEAD Canada 2002 2003 2004 ESTIMATED TONNAGE 138 000 140 000 122 000 110 000 0 90 167 78 000 70 000 80 700 93 000 80 000 125 735 125 000 120 000 110 000 676 602 656 000 525 000 Since the closure of East Helena smelter in 2001, USA primary lead production has kept on decreasing until recently with the announcement from DOE RUN of the closure of Glover smelter on December 2003 … less US lead available for exports to Europe !

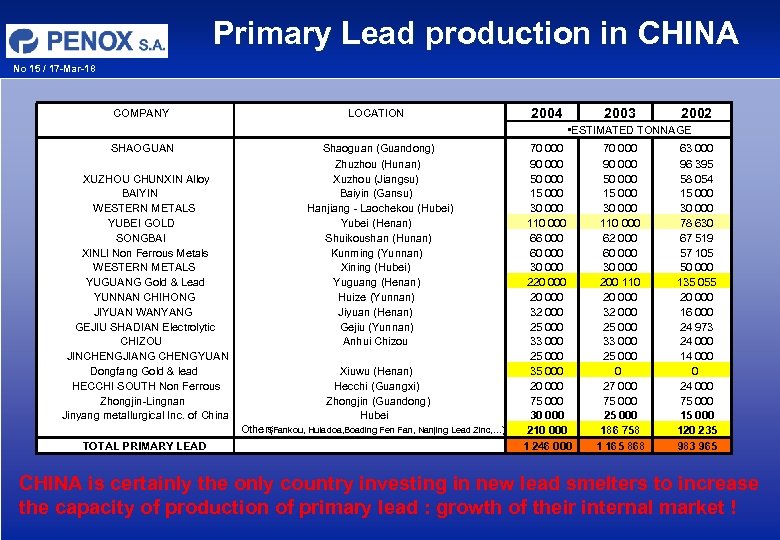

Primary Lead production in CHINA No 15 / 17 -Mar-18 COMPANY LOCATION 2004 2003 2002 • ESTIMATED TONNAGE SHAOGUAN XUZHOU CHUNXIN Alloy BAIYIN WESTERN METALS YUBEI GOLD SONGBAI XINLI Non Ferrous Metals WESTERN METALS YUGUANG Gold & Lead YUNNAN CHIHONG JIYUAN WANYANG GEJIU SHADIAN Electrolytic CHIZOU JINCHENGJIANG CHENGYUAN Dongfang Gold & lead HECCHI SOUTH Non Ferrous Zhongjin-Lingnan Jinyang metallurgical Inc. of China Shaoguan (Guandong) Zhuzhou (Hunan) Xuzhou (Jiangsu) Baiyin (Gansu) Hanjiang - Laochekou (Hubei) Yubei (Henan) Shuikoushan (Hunan) Kunming (Yunnan) Xining (Hubei) Yuguang (Henan) Huize (Yunnan) Jiyuan (Henan) Gejiu (Yunnan) Anhui Chizou Xiuwu (Henan) Hecchi (Guangxi) Zhongjin (Guandong) Hubei (Fankou, Huladoa, Boading Fen Fan, Nanjing Lead Zinc, …) Others TOTAL PRIMARY LEAD 70 000 90 000 50 000 15 000 30 000 110 000 66 000 60 000 30 000 220 000 32 000 25 000 33 000 25 000 35 000 20 000 75 000 30 000 210 000 1 246 000 70 000 90 000 50 000 15 000 30 000 110 000 62 000 60 000 30 000 200 110 20 000 32 000 25 000 33 000 25 000 0 27 000 75 000 25 000 186 758 1 165 868 63 000 96 395 58 054 15 000 30 000 78 630 67 519 57 105 50 000 135 055 20 000 16 000 24 973 24 000 14 000 0 24 000 75 000 120 235 983 965 CHINA is certainly the only country investing in new lead smelters to increase the capacity of production of primary lead : growth of their internal market !

Primary Lead production in CHINA No 15 / 17 -Mar-18 COMPANY LOCATION 2004 2003 2002 • ESTIMATED TONNAGE SHAOGUAN XUZHOU CHUNXIN Alloy BAIYIN WESTERN METALS YUBEI GOLD SONGBAI XINLI Non Ferrous Metals WESTERN METALS YUGUANG Gold & Lead YUNNAN CHIHONG JIYUAN WANYANG GEJIU SHADIAN Electrolytic CHIZOU JINCHENGJIANG CHENGYUAN Dongfang Gold & lead HECCHI SOUTH Non Ferrous Zhongjin-Lingnan Jinyang metallurgical Inc. of China Shaoguan (Guandong) Zhuzhou (Hunan) Xuzhou (Jiangsu) Baiyin (Gansu) Hanjiang - Laochekou (Hubei) Yubei (Henan) Shuikoushan (Hunan) Kunming (Yunnan) Xining (Hubei) Yuguang (Henan) Huize (Yunnan) Jiyuan (Henan) Gejiu (Yunnan) Anhui Chizou Xiuwu (Henan) Hecchi (Guangxi) Zhongjin (Guandong) Hubei (Fankou, Huladoa, Boading Fen Fan, Nanjing Lead Zinc, …) Others TOTAL PRIMARY LEAD 70 000 90 000 50 000 15 000 30 000 110 000 66 000 60 000 30 000 220 000 32 000 25 000 33 000 25 000 35 000 20 000 75 000 30 000 210 000 1 246 000 70 000 90 000 50 000 15 000 30 000 110 000 62 000 60 000 30 000 200 110 20 000 32 000 25 000 33 000 25 000 0 27 000 75 000 25 000 186 758 1 165 868 63 000 96 395 58 054 15 000 30 000 78 630 67 519 57 105 50 000 135 055 20 000 16 000 24 973 24 000 14 000 0 24 000 75 000 120 235 983 965 CHINA is certainly the only country investing in new lead smelters to increase the capacity of production of primary lead : growth of their internal market !

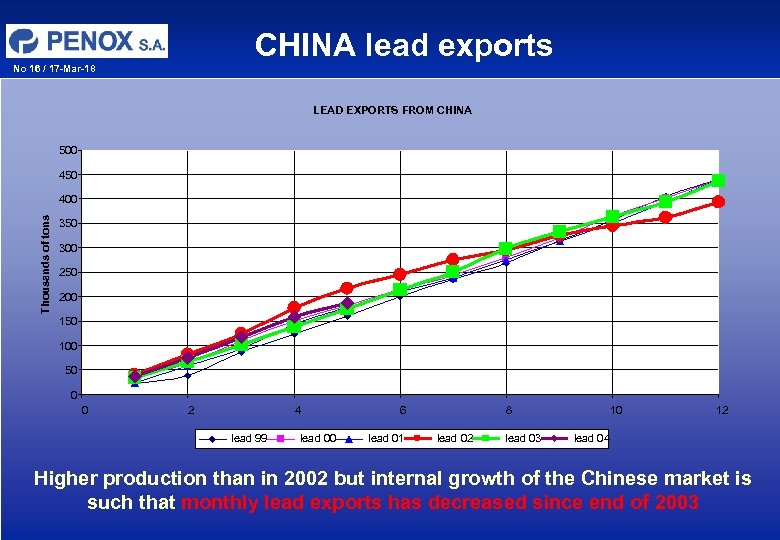

CHINA lead exports No 16 / 17 -Mar-18 LEAD EXPORTS FROM CHINA 500 450 Thousands of tons 400 350 300 250 200 150 100 50 0 0 2 4 lead 99 lead 00 6 lead 01 8 lead 02 lead 03 10 12 lead 04 Higher production than in 2002 but internal growth of the Chinese market is such that monthly lead exports has decreased since end of 2003

CHINA lead exports No 16 / 17 -Mar-18 LEAD EXPORTS FROM CHINA 500 450 Thousands of tons 400 350 300 250 200 150 100 50 0 0 2 4 lead 99 lead 00 6 lead 01 8 lead 02 lead 03 10 12 lead 04 Higher production than in 2002 but internal growth of the Chinese market is such that monthly lead exports has decreased since end of 2003

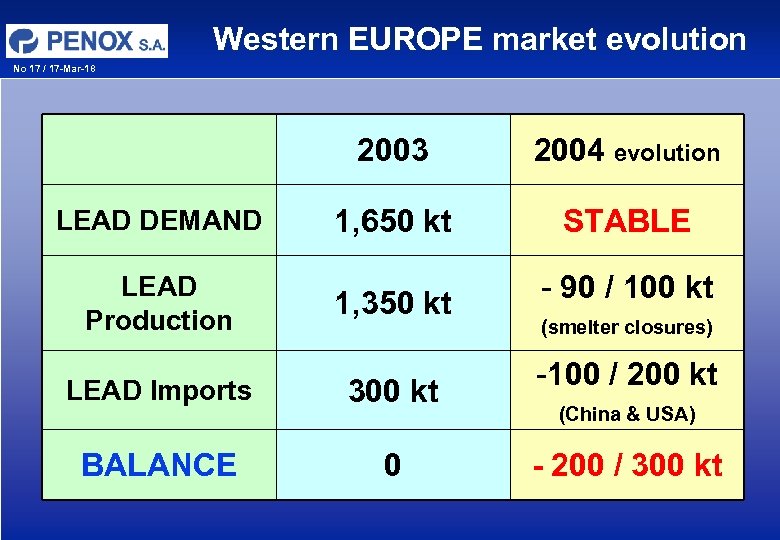

Western EUROPE market evolution No 17 / 17 -Mar-18 2003 LEAD DEMAND LEAD Production 2004 evolution 1, 650 kt STABLE 1, 350 kt LEAD Imports 300 kt BALANCE 0 - 90 / 100 kt (smelter closures) -100 / 200 kt (China & USA) - 200 / 300 kt

Western EUROPE market evolution No 17 / 17 -Mar-18 2003 LEAD DEMAND LEAD Production 2004 evolution 1, 650 kt STABLE 1, 350 kt LEAD Imports 300 kt BALANCE 0 - 90 / 100 kt (smelter closures) -100 / 200 kt (China & USA) - 200 / 300 kt

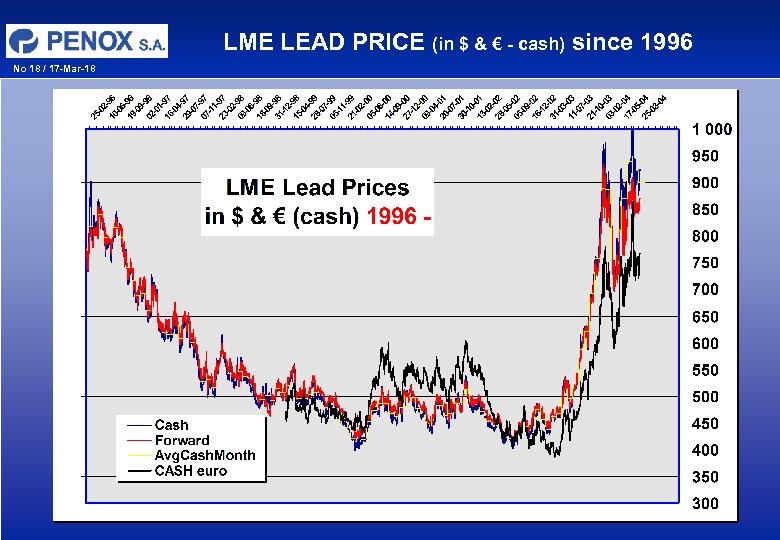

LME LEAD PRICE (in $ & € - cash) since 1996 No 18 / 17 -Mar-18

LME LEAD PRICE (in $ & € - cash) since 1996 No 18 / 17 -Mar-18

LME METALS PRICE EVOLUTION (since Jan 02) No 19 / 17 -Mar-18 3, 50 3, 00 2, 50 2, 00 1, 50 1, 00 0, 50 0, 00 janv-02 avr-02 juil-02 sept-02 Al déc-02 Cu mars-03 Ni juin-03 Pb sept-03 Sn Zn déc-03 mars-04 juin-04

LME METALS PRICE EVOLUTION (since Jan 02) No 19 / 17 -Mar-18 3, 50 3, 00 2, 50 2, 00 1, 50 1, 00 0, 50 0, 00 janv-02 avr-02 juil-02 sept-02 Al déc-02 Cu mars-03 Ni juin-03 Pb sept-03 Sn Zn déc-03 mars-04 juin-04

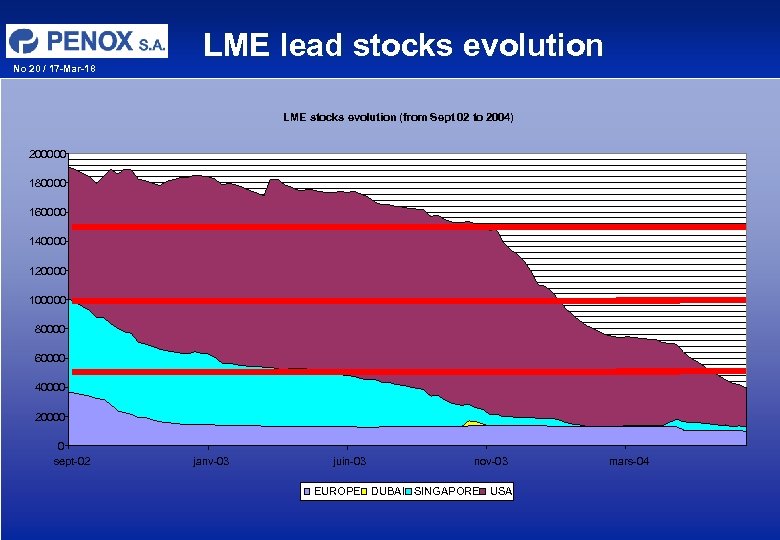

No 20 / 17 -Mar-18 LME lead stocks evolution LME stocks evolution (from Sept 02 to 2004) 200000 180000 160000 140000 120000 100000 80000 60000 40000 20000 0 sept-02 janv-03 juin-03 nov-03 EUROPE DUBAI SINGAPORE USA mars-04

No 20 / 17 -Mar-18 LME lead stocks evolution LME stocks evolution (from Sept 02 to 2004) 200000 180000 160000 140000 120000 100000 80000 60000 40000 20000 0 sept-02 janv-03 juin-03 nov-03 EUROPE DUBAI SINGAPORE USA mars-04

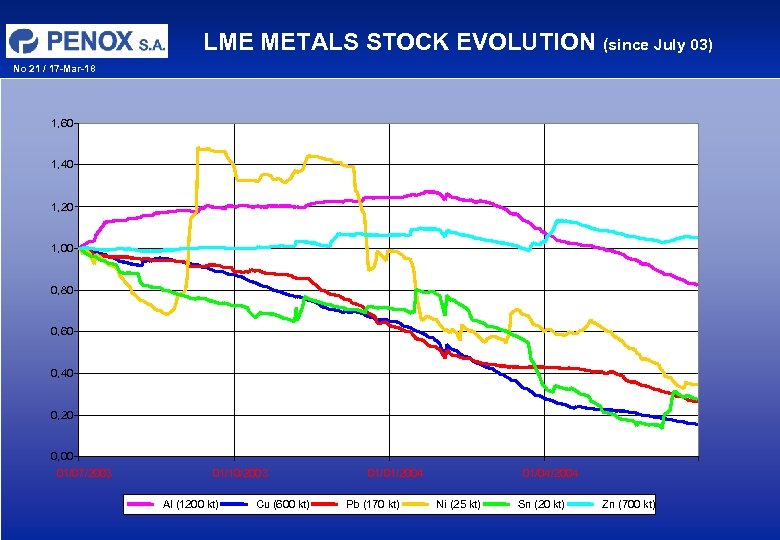

LME METALS STOCK EVOLUTION (since July 03) No 21 / 17 -Mar-18 1, 60 1, 40 1, 20 1, 00 0, 80 0, 60 0, 40 0, 20 0, 00 01/07/2003 01/10/2003 Al (1200 kt) Cu (600 kt) 01/01/2004 Pb (170 kt) 01/04/2004 Ni (25 kt) Sn (20 kt) Zn (700 kt)

LME METALS STOCK EVOLUTION (since July 03) No 21 / 17 -Mar-18 1, 60 1, 40 1, 20 1, 00 0, 80 0, 60 0, 40 0, 20 0, 00 01/07/2003 01/10/2003 Al (1200 kt) Cu (600 kt) 01/01/2004 Pb (170 kt) 01/04/2004 Ni (25 kt) Sn (20 kt) Zn (700 kt)

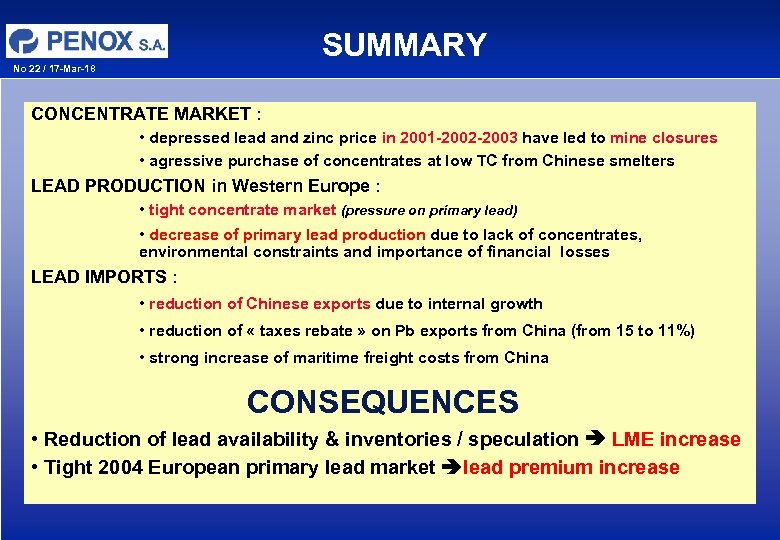

SUMMARY No 22 / 17 -Mar-18 CONCENTRATE MARKET : • depressed lead and zinc price in 2001 -2002 -2003 have led to mine closures • agressive purchase of concentrates at low TC from Chinese smelters LEAD PRODUCTION in Western Europe : • tight concentrate market (pressure on primary lead) • decrease of primary lead production due to lack of concentrates, environmental constraints and importance of financial losses LEAD IMPORTS : • reduction of Chinese exports due to internal growth • reduction of « taxes rebate » on Pb exports from China (from 15 to 11%) • strong increase of maritime freight costs from China CONSEQUENCES • Reduction of lead availability & inventories / speculation LME increase • Tight 2004 European primary lead market lead premium increase

SUMMARY No 22 / 17 -Mar-18 CONCENTRATE MARKET : • depressed lead and zinc price in 2001 -2002 -2003 have led to mine closures • agressive purchase of concentrates at low TC from Chinese smelters LEAD PRODUCTION in Western Europe : • tight concentrate market (pressure on primary lead) • decrease of primary lead production due to lack of concentrates, environmental constraints and importance of financial losses LEAD IMPORTS : • reduction of Chinese exports due to internal growth • reduction of « taxes rebate » on Pb exports from China (from 15 to 11%) • strong increase of maritime freight costs from China CONSEQUENCES • Reduction of lead availability & inventories / speculation LME increase • Tight 2004 European primary lead market lead premium increase

EUROPEAN LEAD OXIDE MARKET No 23 / 17 -Mar-18 LEAD OXIDE MARKET

EUROPEAN LEAD OXIDE MARKET No 23 / 17 -Mar-18 LEAD OXIDE MARKET

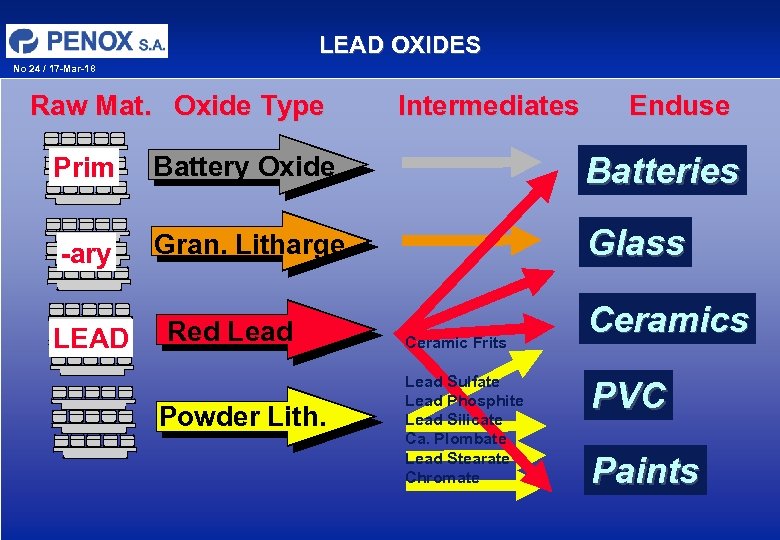

LEAD OXIDES No 24 / 17 -Mar-18 Raw Mat. Oxide Type Intermediates Enduse Prim Battery Oxide Batteries -ary Gran. Litharge Glass LEAD Red Lead Powder Lith. Ceramic Frits Lead Sulfate Lead Phosphite Lead Silicate Ca. Plombate Lead Stearate Chromate Ceramics PVC Paints

LEAD OXIDES No 24 / 17 -Mar-18 Raw Mat. Oxide Type Intermediates Enduse Prim Battery Oxide Batteries -ary Gran. Litharge Glass LEAD Red Lead Powder Lith. Ceramic Frits Lead Sulfate Lead Phosphite Lead Silicate Ca. Plombate Lead Stearate Chromate Ceramics PVC Paints

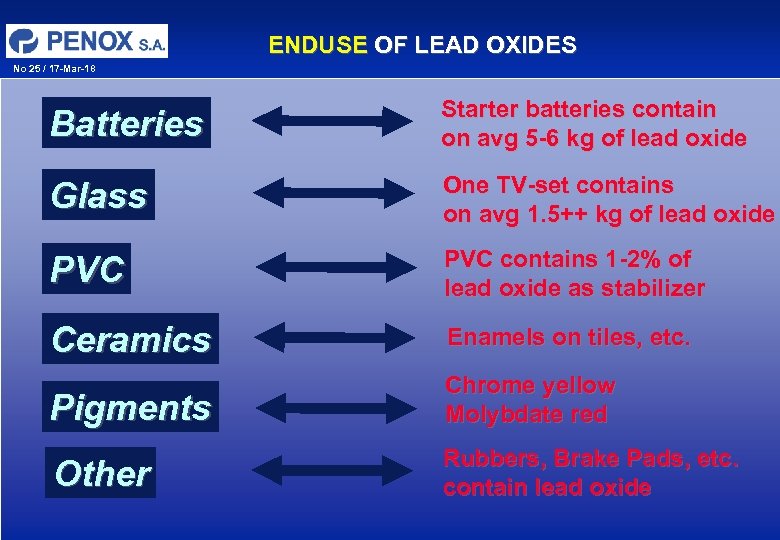

ENDUSE OF LEAD OXIDES No 25 / 17 -Mar-18 Batteries Starter batteries contain on avg 5 -6 kg of lead oxide Glass One TV-set contains on avg 1. 5++ kg of lead oxide PVC contains 1 -2% of lead oxide as stabilizer Ceramics Enamels on tiles, etc. Pigments Chrome yellow Molybdate red Other Rubbers, Brake Pads, etc. contain lead oxide

ENDUSE OF LEAD OXIDES No 25 / 17 -Mar-18 Batteries Starter batteries contain on avg 5 -6 kg of lead oxide Glass One TV-set contains on avg 1. 5++ kg of lead oxide PVC contains 1 -2% of lead oxide as stabilizer Ceramics Enamels on tiles, etc. Pigments Chrome yellow Molybdate red Other Rubbers, Brake Pads, etc. contain lead oxide

LEAD OXIDE MARKETS No 26 / 17 -Mar-18 AMERICA EUROPE 110 kt DECLINE 210 kt ASIA 400 kt TV glass Crystal PVC stab Ceramics Pigments Batteries Misc. DECLINE GROWING WORLD CONSUMPTION: 720 kt - CAPTIVE : 210 kt SALES WORLDWIDE: 510 kt PENOX SALES 2003: 120 kt

LEAD OXIDE MARKETS No 26 / 17 -Mar-18 AMERICA EUROPE 110 kt DECLINE 210 kt ASIA 400 kt TV glass Crystal PVC stab Ceramics Pigments Batteries Misc. DECLINE GROWING WORLD CONSUMPTION: 720 kt - CAPTIVE : 210 kt SALES WORLDWIDE: 510 kt PENOX SALES 2003: 120 kt

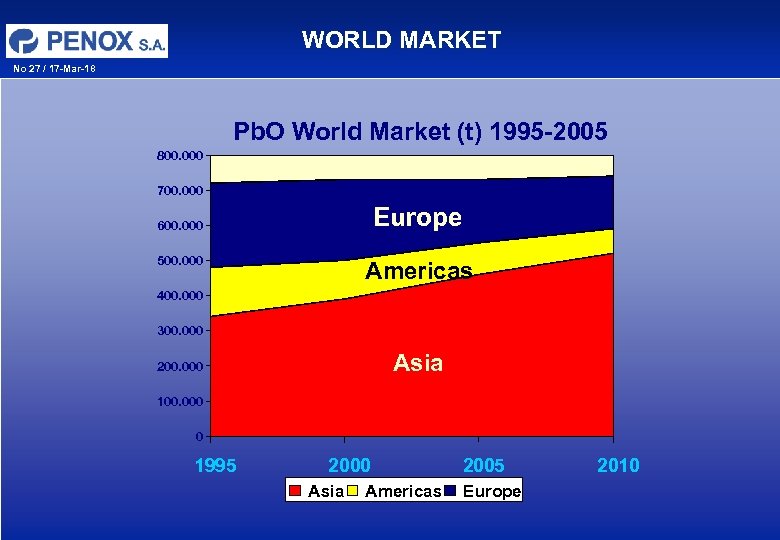

WORLD MARKET No 27 / 17 -Mar-18 Pb. O World Market (t) 1995 -2005 800. 000 700. 000 Europe 600. 000 500. 000 Americas 400. 000 300. 000 Asia 200. 000 100. 000 0 1995 2000 Asia Americas 2005 Europe 2010

WORLD MARKET No 27 / 17 -Mar-18 Pb. O World Market (t) 1995 -2005 800. 000 700. 000 Europe 600. 000 500. 000 Americas 400. 000 300. 000 Asia 200. 000 100. 000 0 1995 2000 Asia Americas 2005 Europe 2010

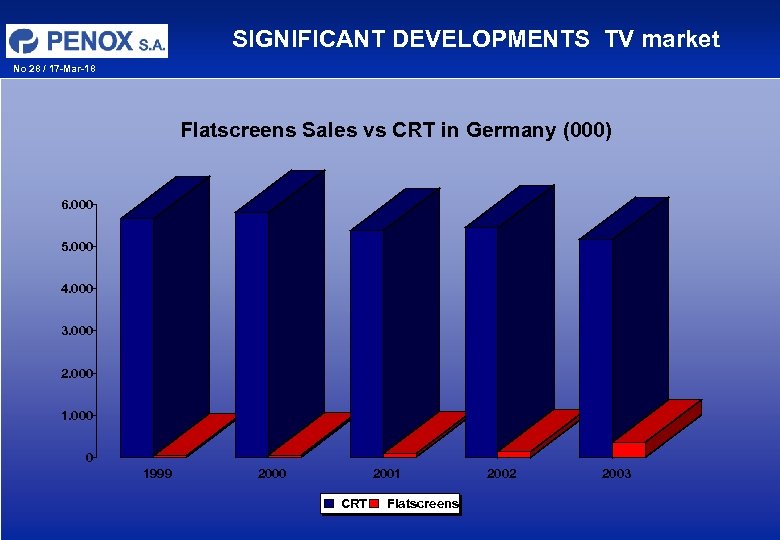

SIGNIFICANT DEVELOPMENTS TV market No 28 / 17 -Mar-18 Flatscreens Sales vs CRT in Germany (000) 6. 000 5. 000 4. 000 3. 000 2. 000 1. 000 0 1999 2000 2001 CRT Flatscreens 2002 2003

SIGNIFICANT DEVELOPMENTS TV market No 28 / 17 -Mar-18 Flatscreens Sales vs CRT in Germany (000) 6. 000 5. 000 4. 000 3. 000 2. 000 1. 000 0 1999 2000 2001 CRT Flatscreens 2002 2003

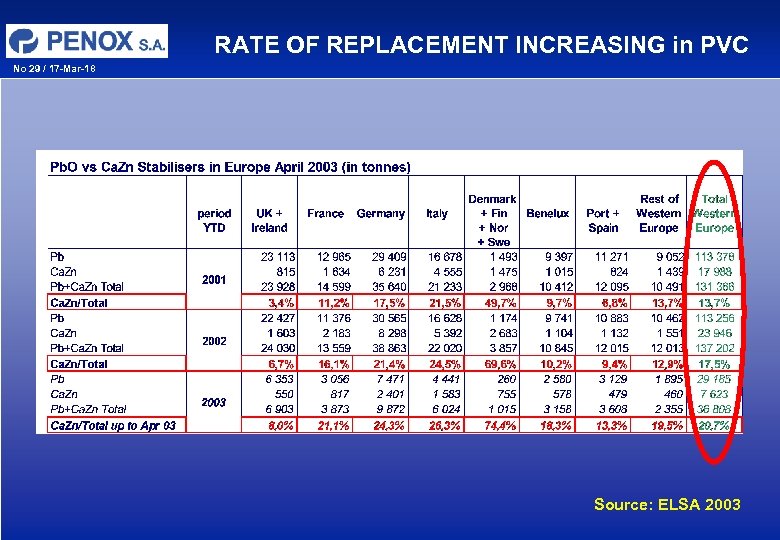

RATE OF REPLACEMENT INCREASING in PVC No 29 / 17 -Mar-18 Source: ELSA 2003

RATE OF REPLACEMENT INCREASING in PVC No 29 / 17 -Mar-18 Source: ELSA 2003

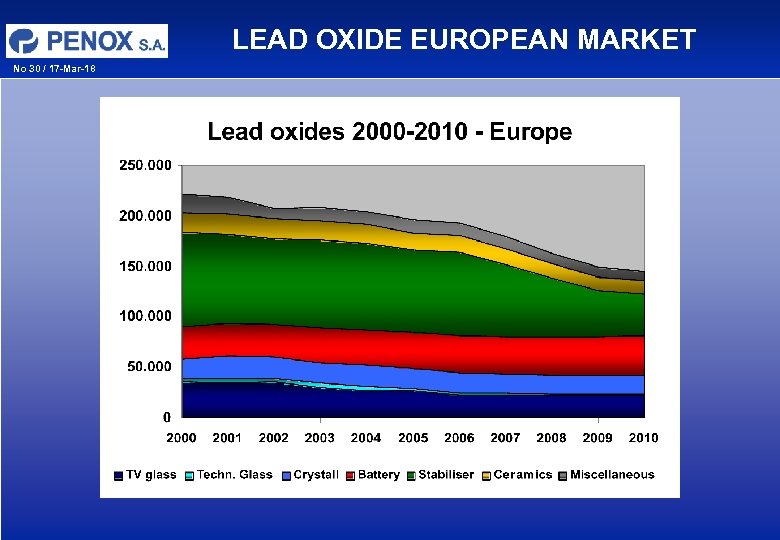

LEAD OXIDE EUROPEAN MARKET No 30 / 17 -Mar-18

LEAD OXIDE EUROPEAN MARKET No 30 / 17 -Mar-18

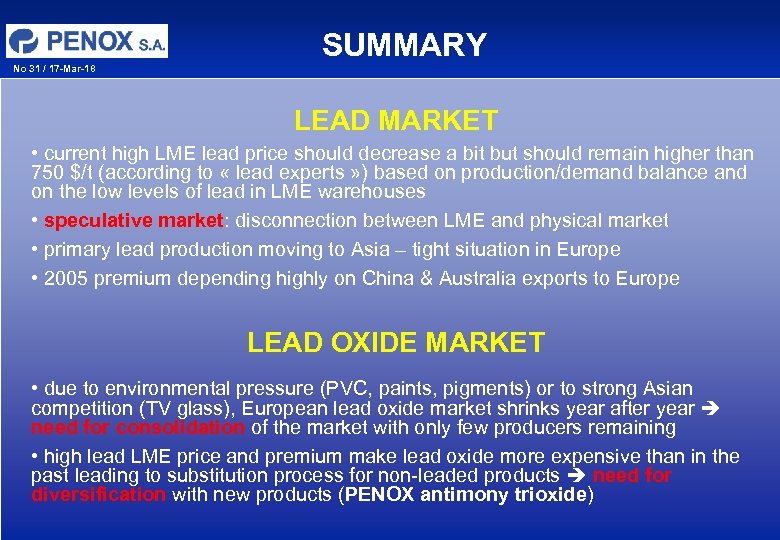

No 31 / 17 -Mar-18 SUMMARY LEAD MARKET • current high LME lead price should decrease a bit but should remain higher than 750 $/t (according to « lead experts » ) based on production/demand balance and on the low levels of lead in LME warehouses • speculative market: disconnection between LME and physical market • primary lead production moving to Asia – tight situation in Europe • 2005 premium depending highly on China & Australia exports to Europe LEAD OXIDE MARKET • due to environmental pressure (PVC, paints, pigments) or to strong Asian competition (TV glass), European lead oxide market shrinks year after year need for consolidation of the market with only few producers remaining • high lead LME price and premium make lead oxide more expensive than in the past leading to substitution process for non-leaded products need for diversification with new products (PENOX antimony trioxide)

No 31 / 17 -Mar-18 SUMMARY LEAD MARKET • current high LME lead price should decrease a bit but should remain higher than 750 $/t (according to « lead experts » ) based on production/demand balance and on the low levels of lead in LME warehouses • speculative market: disconnection between LME and physical market • primary lead production moving to Asia – tight situation in Europe • 2005 premium depending highly on China & Australia exports to Europe LEAD OXIDE MARKET • due to environmental pressure (PVC, paints, pigments) or to strong Asian competition (TV glass), European lead oxide market shrinks year after year need for consolidation of the market with only few producers remaining • high lead LME price and premium make lead oxide more expensive than in the past leading to substitution process for non-leaded products need for diversification with new products (PENOX antimony trioxide)