41a4009ded43d2fec15e39a171bf8985.ppt

- Количество слайдов: 35

NIGERIA’S INVESTMENT CLIMATE AND OPPORTUNITIES A PRESENTATION BY MS. LADI S. KATAGUM ACTING EXECUTIVE SECRETARY/CEO NIGERIAN INVESTMENT PROMOTION COMMISSION (NIPC) AT THE IES GLOBAL INVESTMENT CONFERENCE MARCH 22, 2016

Presentation Outline • Country Profile • Overview of Economic & Investment Environment of Nigeria i. Snap shot of Economic Environment ii. Analysis of Foreign Capital into Nigeria • Success Stories: Investment Trends • Policy Trust of Government • Framework for Doing Business in Nigeria • NIPC at a Glance i. Basic National Investment Legislations ii. Statutory & Additional Protection for FDIs • Strategic Role of NIPC in the Nigerian Economy • One-Stop Investment Centre (OSIC) • Investment Opportunities • Investment Incentives • Conclusion * Nigerian Investment Promotion Commission

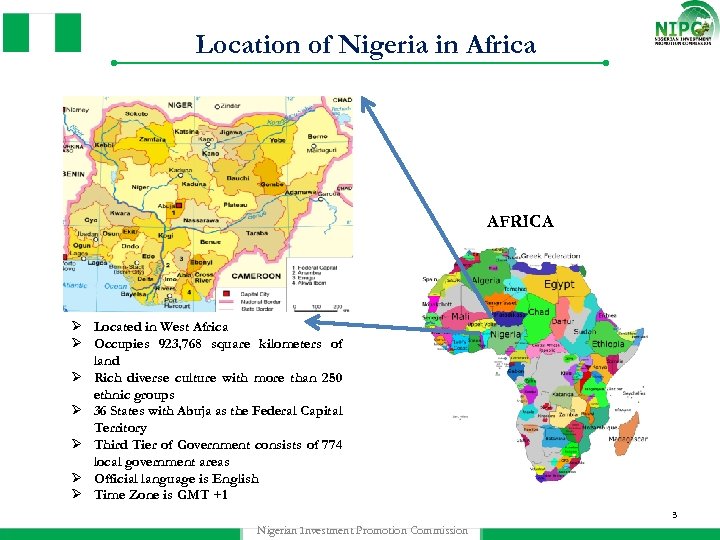

Location of Nigeria in Africa AFRICA Ø Located in West Africa Ø Occupies 923, 768 square kilometers of land Ø Rich diverse culture with more than 250 ethnic groups Ø 36 States with Abuja as the Federal Capital Territory Ø Third Tier of Government consists of 774 local government areas Ø Official language is English Ø Time Zone is GMT +1 3 Nigerian Investment Promotion Commission

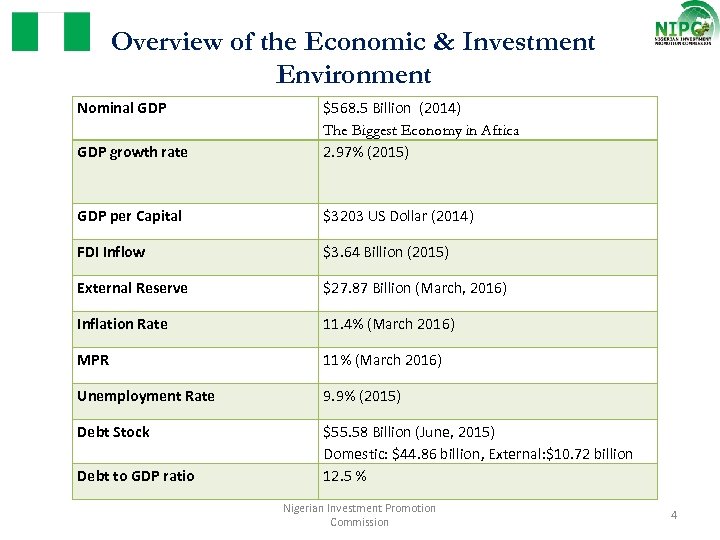

Overview of the Economic & Investment Environment Nominal GDP growth rate $568. 5 Billion (2014) The Biggest Economy in Africa 2. 97% (2015) GDP per Capital $3203 US Dollar (2014) FDI Inflow $3. 64 Billion (2015) External Reserve $27. 87 Billion (March, 2016) Inflation Rate 11. 4% (March 2016) MPR 11% (March 2016) Unemployment Rate 9. 9% (2015) Debt Stock $55. 58 Billion (June, 2015) Domestic: $44. 86 billion, External: $10. 72 billion 12. 5 % Debt to GDP ratio Nigerian Investment Promotion Commission 4

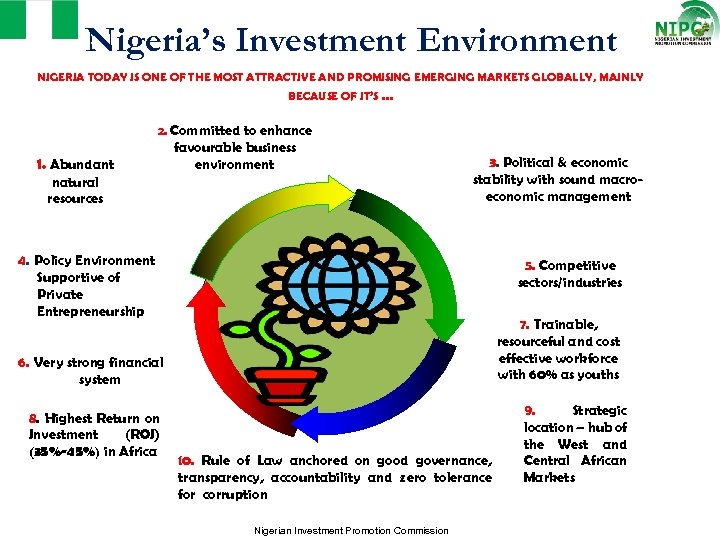

Nigeria’s Investment Environment NIGERIA TODAY IS ONE OF THE MOST ATTRACTIVE AND PROMISING EMERGING MARKETS GLOBALLY, MAINLY BECAUSE OF IT’S … 2. Committed to enhance 1. Abundant favourable business environment natural resources 3. Political & economic stability with sound macroeconomic management 4. Policy Environment Supportive of Private Entrepreneurship 6. Very strong financial system 8. Highest Return on Investment (ROI) (35%-45%) in Africa 10. Rule of Law anchored on good governance, transparency, accountability and zero tolerance for corruption Nigerian Investment Promotion Commission 5. Competitive sectors/industries 7. Trainable, resourceful and cost effective workforce with 60% as youths 9. Strategic location – hub of the West and Central African Markets

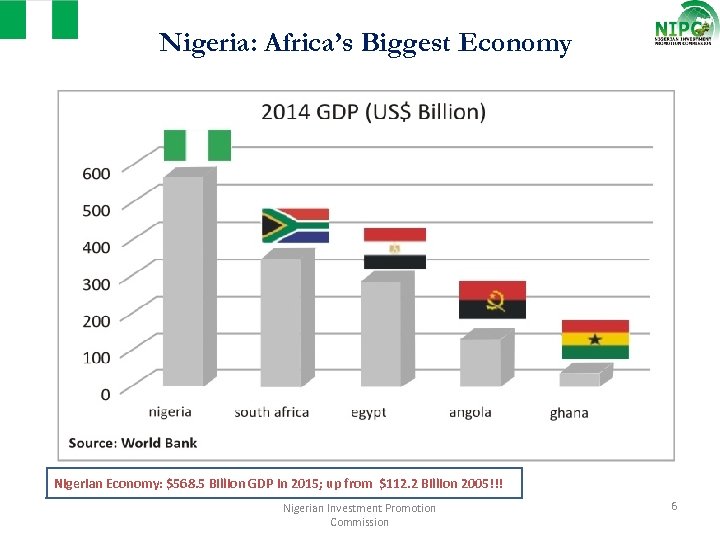

Nigeria: Africa’s Biggest Economy Nigerian Economy: $568. 5 Billion GDP in 2015; up from $112. 2 Billion 2005!!! Nigerian Investment Promotion Commission 6

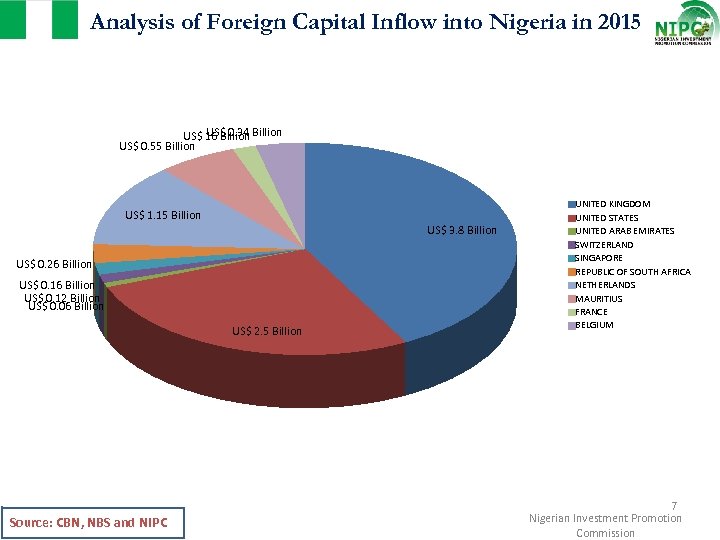

Analysis of Foreign Capital Inflow into Nigeria in 2015 US$ 0. 34 US$ 16 Billion US$ 0. 55 Billion US$ 1. 15 Billion US$ 3. 8 Billion US$ 0. 26 Billion US$ 0. 12 Billion US$ 0. 06 Billion US$ 2. 5 Billion Source: CBN, NBS and NIPC UNITED KINGDOM UNITED STATES UNITED ARAB EMIRATES SWITZERLAND SINGAPORE REPUBLIC OF SOUTH AFRICA NETHERLANDS MAURITIUS FRANCE BELGIUM 7 Nigerian Investment Promotion Commission

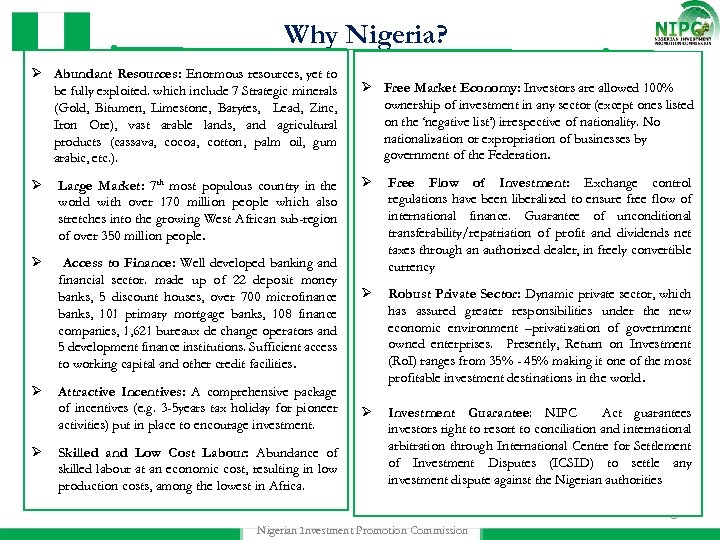

Why Nigeria? Ø Abundant Resources: Enormous resources, yet to be fully exploited. which include 7 Strategic minerals (Gold, Bitumen, Limestone, Barytes, Lead, Zinc, Iron Ore), vast arable lands, and agricultural products (cassava, cocoa, cotton, palm oil, gum arabic, etc. ). Ø Free Market Economy: Investors are allowed 100% ownership of investment in any sector (except ones listed on the ‘negative list’) irrespective of nationality. No nationalization or expropriation of businesses by government of the Federation. Ø Large Market: 7 th most populous country in the world with over 170 million people which also stretches into the growing West African sub-region of over 350 million people. Ø Ø Access to Finance: Well developed banking and financial sector. made up of 22 deposit money banks, 5 discount houses, over 700 microfinance banks, 101 primary mortgage banks, 108 finance companies, 1, 621 bureaux de change operators and 5 development finance institutions. Sufficient access to working capital and other credit facilities. Free Flow of Investment: Exchange control regulations have been liberalized to ensure free flow of international finance. Guarantee of unconditional transferability/repatriation of profit and dividends net taxes through an authorized dealer, in freely convertible currency Ø Robust Private Sector: Dynamic private sector, which has assured greater responsibilities under the new economic environment –privatization of government owned enterprises. Presently, Return on Investment (Ro. I) ranges from 35% - 45% making it one of the most profitable investment destinations in the world. Ø Investment Guarantee: NIPC Act guarantees investors right to resort to conciliation and international arbitration through International Centre for Settlement of Investment Disputes (ICSID) to settle any investment dispute against the Nigerian authorities Ø Ø Attractive Incentives: A comprehensive package of incentives (e. g. 3 -5 years tax holiday for pioneer activities) put in place to encourage investment. Skilled and Low Cost Labour: Abundance of skilled labour at an economic cost, resulting in low production costs, among the lowest in Africa. 8 Nigerian Investment Promotion Commission

Success Stories: Investment Trends in Nigerian Investment Promotion Commission 9

Policy Thrust of Government The Policy Trust of the Change Agenda of Federal Government is predicated on: § Rule of Law anchored on Good Governance and driven by uncommon sense of service § Transparency § Accountability § Zero-Tolerance for Corruption § Security of Lives and Properties § Firm Support and Productive Partnership with Organized Private Sector / Investors Nigerian Investment Promotion Commission *

Investment Policy Trust of Government • Provide a Predictable Macroeconomic Framework • Facilitate a Private Sector Driven Economy • Promote and attract value-added industrialization • Attract export-oriented Non-oil Sector FDI • Make FDI work for local the economy; i. e. job creation, supply-chain, out-sourcing etc • Facilitate Value Chain Development in all sectors • Develop a well integrated physical Infrastructure • Ensure fair competition and safeguard consumers’ interests Nigerian Investment Promotion Commission *

Framework for Doing Business in Nigeria (A) For establishing a new business in Nigeria the following processes are required: i. Incorporation with Corporate Affairs Commission (CAC). ii. Registration of business with foreign equity with the Nigerian Investment Promotion Commission ( NIPC). iii. Registration with Federal Inland Revenue Service (FIRS) (B) Required additional operating Licences /Permits in certain sectors: q. For Investment in Banking and Finance, a Licence from the Central Bank of Nigeria is required. q. Solid Minerals – a Licence from Federal Ministry of Mines & Steel Development, is required. 12

…Framework for Doing Business in Nigeria q Investments in Power generation and distribution, a licence from the Nigerian Energy Regulatory Commission (NERC) is required. q Information Communication Technology (ICT) : a licence with either Nigerian Information Technology Development Agency (NITDA) or Nigerian Communication Commission (NCC) is required. q Food and Pharmaceuticals – a licence with National Food and Drug Administration and Control (NAFDAC), is required. q Companies in manufacturing activities must obtain SONCAP Certification for its products from the Standard Organization of Nigeria (SON). q For any project that has environmental implications, a comprehensive Environmental Impact Assessment (EIA) must be submitted to the Federal Ministry of Environment. 13

NIPC AT A GLANCE q. Nigerian Investment Promotion Commission (NIPC) is a Federal Government Agency, established by Act of Parliament No. 16 of 1995 to encourage, promote and coordinate investments in the Nigerian economy q The Commission is empowered to develop investment friendly policies that are globally competitive and ensure the free flow of investment into all sectors of the economy q It serves as entry point into the Nigerian economy foreign investment q It identifies and target investors within and outside the country to invest in the economy q. It grants approvals on fiscal concessions on industry related incentives to investors q. NIPC is one of the few IPAs in Africa that coordinates the operations of the One Stop Investment Centre (OSIC) in a unique transparent and efficient manner 14

Basic National Investment Legislation The Nigerian Investment Promotion Commission (NIPC) Act 16 of 1995 – – Ownership of Business – 100% ownership assured except investment • listed under the ‘Negative ‘ lists • covered by the Nigerian Content and Cabotage Acts Investment Protection Guarantees • Non-expropriation of Investment: The NIPC Act 16 of 1995 guarantee that ‘no enterprise shall be nationalized or expropriated by any government of the federation’ The Foreign Exchange (Monitoring & Miscellaneous Provisions) Act 17 of 1995 – Repatriation of Profit • Under the Act 17 of 1995, investors are free to repatriate their profits and dividends net of taxes through any authorized dealer in freely convertible currency The Nigeria Export Processing Zone Authority (NEPZA) Act 63 of 1992 ◦ Licensing, Monitoring and Regulations of Free Trade Zones ◦ 100% foreign ownership of investment ◦ repatriation of capital, profit and dividend without restrictions The Nigeria Export Promotion Council (NEPC) Act 64 of 1992 ◦ Promotion of non-export in Nigeria ◦ Articulate and promote appropriate export incentives, policies and programmes Other sector specific regulatory legislations Nigerian Investment Promotion Commission *

Statutory Protection for FDIs Legal Protection/Guarantee of Investment in the NIPC Act – Protects against unlawful expropriation, and gives a guarantee of free transfer of funds. In the event of a dispute arising between a foreign investor and the government, the Act also opens access to international arbitration forums – Grants judicial determination of the amount of compensation to which the investor is entitled in accordance with international standards – Sets out the basic principles of a non-discriminatory access to both foreign and domestic investors, although it does not explicitly embody the principle of National Treatment Dispute Settlement Provision – NIPC Act also contains a dispute settlement clause that governs disputes arising between the authorities and both domestic and foreign investors. − By virtue of Article 26 of the Act, investors have the right to resort to conciliation and international arbitration through International Centre for Settlement of Investment Disputes (ICSID) to settle any investment dispute against the Nigerian authorities Protection of Intellectual Property (IP) rights − Nigeria has developed a fairly comprehensive, legal framework for protecting intellectual property rights. − Intellectual property rights give businesses an incentive to invest in research and development ultimately lead to the creation of innovative products. − It also provides the holders of the right with confidence to share new technologies in the context of joint ventures Ratification of Bilateral Treaties (BITs) − Government has renewed efforts to ratify all concluded BITs with partner countries so as to give the treaties full legal rights. − It adds additional layer of protection foreign investors and lower perceived political risk of investing in Nigeria * Nigerian Investment Promotion Commission

Additional Protection for FDIs Double Taxation Agreements (DTA) – Nigeria has entered into double taxation agreements (DTA) with a number of countries to provide relief from double taxation in relation to taxes imposed on profit taxable in Nigeria and any taxes of similar character imposed by the law of the country concerned Nigerian Investment Promotion Commission *

Strategic Role of NIPC in the Nigerian Economy q Advise and advocate for favourable investment policies to attract and support quality investments. q Organize Business and Investment Forum to create platform for marketing investment opportunities in Nigeria q After Care Services: Support existing investors in the expansion and improvement of their businesses q Intervene on behalf of investors to resolve “Concerns” about the investment climate: - Serve as the Secretariat of the Inter-Ministerial Committees on Investor After Care and, Doing Business & Competitiveness q Operate a good network of Zonal Offices to promote domestic investment and provide Aftercare Services to investors q Keep and update data base of investors for FDI tracking q Provide prompt and dedicated assistance to investors through dedicated Project Team. q NIPC through OSIC, provides pre-investment services, grants approvals, licenses, permits and Investment Information/Data etc to investors 18

One-Stop Investment Centre (OSIC) OSIC is the Federal Government’s strategy aimed at : • streamlining the investment procedures; • remove all bottlenecks in business legalization procedures; • provide prompt, efficient and transparent service; • coordinate investment facilitating agencies (26 Government Ministries and Agencies (MDAs) • Services at the Centre, include and not limited to: - - Business Incorporation/ Registration, - Grant of Approvals, - Permits/License and Investment Information & Data • More centers to be opened in Lagos, Port-Harcourt and Kano (All States of the Federation) 19

Investment Opportunities • Opportunities exist in all sectors of the economy, especially: Ø Agriculture & Agro Allied Ø Power/Energy Ø Solid Minerals Ø Information & Communication Technology (ICT) Ø Banking & Financial services Ø Pharmaceuticals and Health services Ø Tourism/Hospitality Ø Manufacturing Ø Waste Management etc Ø Maritime, Shipping and Ports Ø Oil & Gas (extractive and non-extractive) Ø Industrial Parks and Clusters

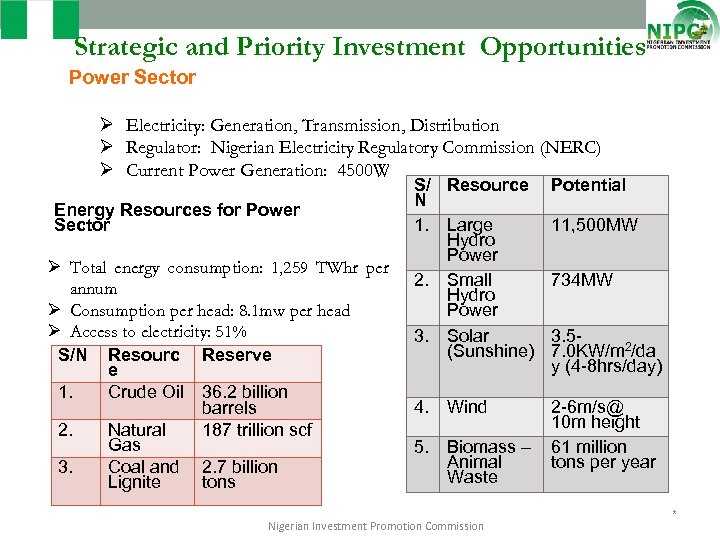

Strategic and Priority Investment Opportunities Power Sector Ø Electricity: Generation, Transmission, Distribution Ø Regulator: Nigerian Electricity Regulatory Commission (NERC) Ø Current Power Generation: 4500 W Energy Resources for Power Sector Ø Total energy consumption: 1, 259 TWhr per annum Ø Consumption per head: 8. 1 mw per head Ø Access to electricity: 51% S/N Resourc Reserve e 1. Crude Oil 36. 2 billion barrels 2. Natural 187 trillion scf Gas 3. Coal and 2. 7 billion Lignite tons S/ Resource N 1. Large Hydro Power 2. Small Hydro Power 3. Solar (Sunshine) 4. 5. Potential 11, 500 MW 734 MW 3. 57. 0 KW/m 2/da y (4 -8 hrs/day) Wind 2 -6 m/s@ 10 m height Biomass – 61 million Animal tons per year Waste Nigerian Investment Promotion Commission *

Investment Opportunities Continued Investment Opportunities in Power Ø Gas/Hydro/Coal Production – Nigeria needs 135 GW of capacity to supply a projected 230 m Nigerians in the next 20 years. Ø Power feedstock: Gas supply, coal supply – Nigeria needs to build power plants at 7 GW/year for the next 18 years. Ø Expansion of Transmission network Ø Renewable Energy

Investment Opportunities Continued Oil and Gas Sector OIL & GAS: Investment Opportunities Fertilizer Methanol Refineries Petro-chemicals Pharmaceuticals Gas Transmission and Processing Fertilizer Production Solid Minerals METAL AND SOLID MINERALS: Investment Opportunities Cement Auto Assembly Basic Minerals, e. g coal, gold etc Aluminum Chemicals Nigerian Investment Promotion Commission *

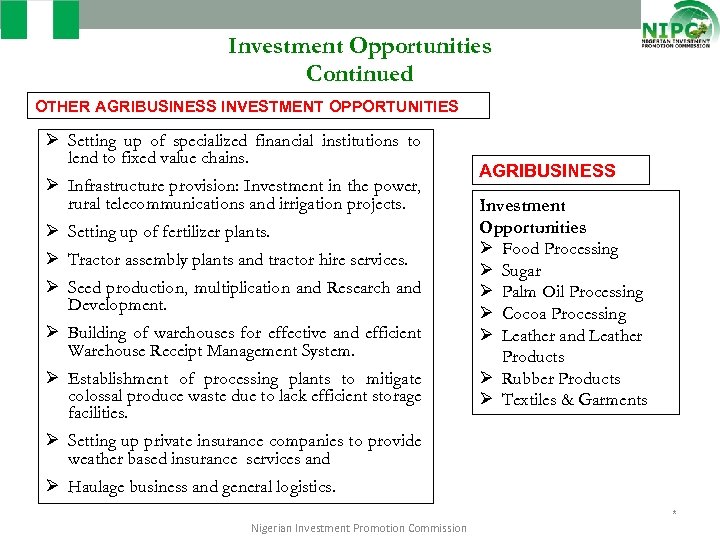

Investment Opportunities Continued OTHER AGRIBUSINESS INVESTMENT OPPORTUNITIES Ø Setting up of specialized financial institutions to lend to fixed value chains. Ø Infrastructure provision: Investment in the power, rural telecommunications and irrigation projects. Ø Setting up of fertilizer plants. Ø Tractor assembly plants and tractor hire services. Ø Seed production, multiplication and Research and Development. Ø Building of warehouses for effective and efficient Warehouse Receipt Management System. Ø Establishment of processing plants to mitigate colossal produce waste due to lack efficient storage facilities. AGRIBUSINESS Investment Opportunities Ø Food Processing Ø Sugar Ø Palm Oil Processing Ø Cocoa Processing Ø Leather and Leather Products Ø Rubber Products Ø Textiles & Garments Ø Setting up private insurance companies to provide weather based insurance services and Ø Haulage business and general logistics. Nigerian Investment Promotion Commission *

Investment Opportunities Continued Health Sector v It has been estimated that Nigerians spent between $500 million and $800 million on medical tourism per annum abroad in addition to local demands: v Top medical tourist destinations include India, Europe, the United States and the Persian Gulf v Although there are over 130 pharmaceutical companies in Nigeria, only 9 are listed on the stock exchange. Opportunities include: ØSpecialist hospitals ØDiagnostic centres and trauma centres ØAmbulances services ØMobile clinics, ØPharmaceutical manufacturing ØGeneric drugs and ØSmall holder specialist clinics etc.

Investment Opportunities: Transportation Road: § Aviation: Construction of roads and major bridges on BOT § Airport Terminal Concessions and Terminal Development on BOT § PPP of Major Highways on Design, Build, Maintain, Operate and Transfer (DBMOT) of Major economical viable routes § Runway Construction and Rehabilitation § Aircraft Maintenance Facilities § Total Asset Management of Some Core Network § Aviation Security and Safety Infrastructure § Aviation Security and Safety Training Quarry and Asphalt Plant § Integrated Airport Transportation System § In-Flight Catering Services and Infrastructure § Railway: Maritime and Ports: § Passenger Coaches § Greenfield Port Development (Lagos, Port Harcourt and Warri) § Station building and operations § Water Front Development/Inter-modal Jetties (Lagos and Calabar) § Port Infrastructure Expansion and Renewal § Dredging and Channel Maintenance § Inland Container Depots on BOOT § Development of River Ports for Inland Water Transportation § Greenfield Dockyard § Branded Cargo lines (e. g. for oil companies, flour mills steel companies, cement companies etc § New Track Construction on BOT Basis § Inter-modal facilities (Road/Rail/Sea Port) Nigerian Investment Promotion Commission 26

Investment Opportunities: Manufacturing Automotive The Nigerian Market for automobiles is substantial and can readily sustain an automobile industry § In 2012, the Country imported about $4 billion worth of automobiles of which about two thirds were pre-owned (UNCTAD) § A growing middle class of 40 million with a potential market of one million vehicles annually § Annual spending on vehicles import is over $3. 5 billion and still growing § Regional export potential into the West (ECOWAS) and Central African markets § Indigenous vehicle manufacturing company; Innoson Motors, currently manufactures SUVs, Transit Buses and Trucks § Presence of Nissan, Volkswagen, Toyota and KIA etc. have already established their presence in the automobile industry. 27

Investment Opportunities: Manufacturing Waste Management • Nigeria generates average of 70, 000 tonnes of wastes per day – Lagos State alone generates 10, 000 tonnes of wastes per day – Kano State also generates about 4, 000 tonnes of water per day • Solid waste management is a veritable source of income generation and employment • No meaningful modernized / environmental friendly waste management in place Opportunities: § Conversion of waste to fertilizer, methane gas, electricity etc § Establishment of waste transfer loading stations ü Waste recovery and bailing of re-use/re-cycling of waste for easy transportation to final disposal sites § Operation of wheeler bins and motorized street cleaners § Operation of compactors for efficient transport of refuse § Public Private Partnership 28

Investment Opportunities……Cont’d • Tourism & Entertainment • Nigeria’s Home Movie industry is the 3 rd largest in the world • Estimated revenues from this industry is in millions of US$ • Audience all over the world Opportunities: § Establishment of hotels and resorts near waterfalls, springs etc § Beach Tourism potentials in boating and sport fishing facilities § Heritage/Cultural Tourism Resources Development of slave trade relics § Wildlife Tourism Resources § Building of Tourist lodges § Marketing/Distribution of Nigerian Films Textiles & Garment • Nigerian’s Leather industry has only few large industrial manufacturers, and currently exports about US$600 million of primary leather products. • The major leather players are located in Kano, Kaduna and Aba 29

Investment Opportunities……Cont’d ICT Sector • Broadband - Deployment of terrestrial fibre-optics networks (including fibre over power lines) - Deployment of wireless broadband infrastructures - Satellite networks • End User Device - Assembly and manufacturing of personal computers, laptops and mobile devices • Value Added Services - Data centre deployment and management - Application hosting/cloud computing 30

Investment Opportunities……Cont’d ICT Sector • Entrepreneurship Developments - incubators/innovations hubs - Software development • Broadcast Infrastructure and devices - Signal distribution - Broadcast equipment supplies - Content aggregators, producers, distributors etc. • Postal services 31

Investment Opportunities……Cont’d Education Sector: • • • • Crèche and Nursery Schools Primary and secondary schools Vocational and Technical Schools for children with special needs such as autistic children etc. Educational Counseling Tertiary institutions like Polytechnics and Universities Book publishing Academic Journals, Academic Newspapers and Periodicals Educational and Academic Radio and Television stations Educational websites Educational and academic programs on radio and television Bookshops Educational tools and learning instruments. Educational computers etc. 32

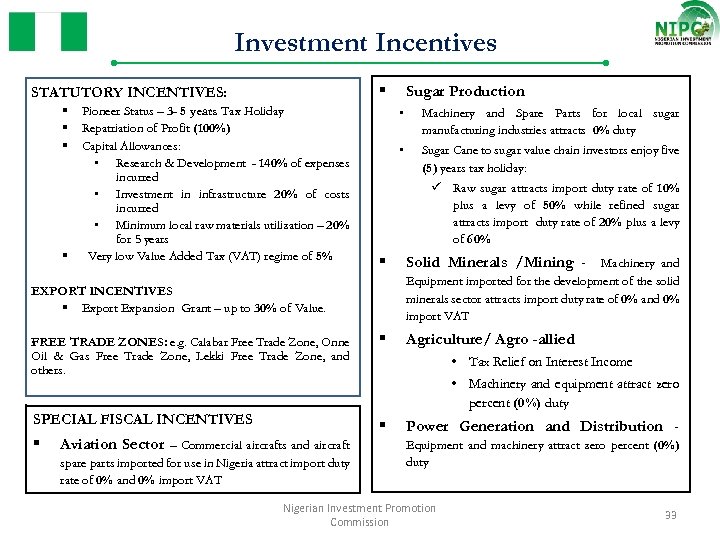

Investment Incentives § STATUTORY INCENTIVES: § Pioneer Status – 3 - 5 years Tax Holiday § Repatriation of Profit (100%) § Capital Allowances: • Research & Development - 140% of expenses incurred • Investment in infrastructure 20% of costs incurred • Minimum local raw materials utilization – 20% for 5 years § Very low Value Added Tax (VAT) regime of 5% • § Solid Minerals /Mining - Machinery and Equipment imported for the development of the solid minerals sector attracts import duty rate of 0% and 0% import VAT § SPECIAL FISCAL INCENTIVES § spare parts imported for use in Nigeria attract import duty rate of 0% and 0% import VAT Sugar Cane to sugar value chain investors enjoy five (5) years tax holiday: ü Raw sugar attracts import duty rate of 10% plus a levy of 50% while refined sugar attracts import duty rate of 20% plus a levy of 60% FREE TRADE ZONES: e. g. Calabar Free Trade Zone, Onne Oil & Gas Free Trade Zone, Lekki Free Trade Zone, and others. Aviation Sector – Commercial aircrafts and aircraft Machinery and Spare Parts for local sugar manufacturing industries attracts 0% duty • EXPORT INCENTIVES § Export Expansion Grant – up to 30% of Value. § Sugar Production Agriculture/ Agro -allied • Tax Relief on Interest Income • Machinery and equipment attract zero percent (0%) duty Power Generation and Distribution Equipment and machinery attract zero percent (0%) duty Nigerian Investment Promotion Commission 33

Conclusion Given the Investment friendly disposition of Nigeria, there is no better time than now to investment in the Africa’s most profitable and largest economy! The NIPC is ever positioned to give a hand-holding support to investors that have decided to make Nigeria their Preferred Investment Destination. We are your reliable partner for Successful Business in Nigeria! Nigerian Investment Promotion Commission

THANK YOU FOR YOUR ATTENTION Ms. Ladi S. Katagum Acting Executive Secretary/CEO, Nigerian Investment Promotion Commission (NIPC) Plot 1181 Aguiyi Ironsi Street Maitama District, Abuja, Nigeria Emails: osicinfodesk@nipc. gov. ng Website: www. nipc. gov. ng Visit NIPC Social Media: -Facebook. com/nipcng -Twitter. com/nipcng -Youtube. com/nipcng 35

41a4009ded43d2fec15e39a171bf8985.ppt