f6ed9d99b23e8436b40777fdbe43bba6.ppt

- Количество слайдов: 45

NIGERIA GOVERNOR’S FORUM INTERNALLY GENERATED REVENUE (IGR) CONFERENCE CASE STUDY OF EDO STATE By Oseni Elamah (FCTI, FCA, FCS, FCIArb, MNIM) Executive Chairman, Edo State Internal Revenue Service

NIGERIA GOVERNOR’S FORUM INTERNALLY GENERATED REVENUE (IGR) CONFERENCE CASE STUDY OF EDO STATE By Oseni Elamah (FCTI, FCA, FCS, FCIArb, MNIM) Executive Chairman, Edo State Internal Revenue Service

Preamble • The experience of tax and revenue administration in Edo State has been both challenging and interesting. However, these experiences have been met with a stoic resolve by the Comrade Adams Aliyu Oshiomhole administration to bring about a positive transformation in the lives and wellbeing of all Edo State citizens using IGR as a tool for development. • The Adams Aliyu Oshiomhole administration has made it a point of policy to de-emphasize on the dependence on Federal allocations by preaching the doctrine of fiscal self sustenance and the significance of Internally Generated Revenue (IGR) while emphasizing the critical role it plays in the success of any attempt at driving development in society.

Preamble • The experience of tax and revenue administration in Edo State has been both challenging and interesting. However, these experiences have been met with a stoic resolve by the Comrade Adams Aliyu Oshiomhole administration to bring about a positive transformation in the lives and wellbeing of all Edo State citizens using IGR as a tool for development. • The Adams Aliyu Oshiomhole administration has made it a point of policy to de-emphasize on the dependence on Federal allocations by preaching the doctrine of fiscal self sustenance and the significance of Internally Generated Revenue (IGR) while emphasizing the critical role it plays in the success of any attempt at driving development in society.

• The Comrade Governor has made it a point to note a good number of times that no society can do without IGR, hence the desire to see that the State is self sufficient in meeting its developmental needs even with minimal input from the centre. • Very few saw the wisdom of this drive a few years ago, but with the reality of the current global fiscal crisis and the dwindling global oil price, we all can now better appreciate the vision and wisdom of our Comrade Governor as it is a fact that Edo State remains one of the most viable states in the country in terms of sound economic and fiscal policies as attested to by the World Bank and other international financial partners. • It will interest us to note that prior to the Comrade Adams Oshiomhole administration, IGR in the State at best stood at about N 260 million monthly; even at this, a huge chunk of the generated revenue found its way into the pockets of some highly placed individuals as the revenue administration process was to a large extent privatized.

• The Comrade Governor has made it a point to note a good number of times that no society can do without IGR, hence the desire to see that the State is self sufficient in meeting its developmental needs even with minimal input from the centre. • Very few saw the wisdom of this drive a few years ago, but with the reality of the current global fiscal crisis and the dwindling global oil price, we all can now better appreciate the vision and wisdom of our Comrade Governor as it is a fact that Edo State remains one of the most viable states in the country in terms of sound economic and fiscal policies as attested to by the World Bank and other international financial partners. • It will interest us to note that prior to the Comrade Adams Oshiomhole administration, IGR in the State at best stood at about N 260 million monthly; even at this, a huge chunk of the generated revenue found its way into the pockets of some highly placed individuals as the revenue administration process was to a large extent privatized.

• However, all these were to change as the Oshiomhole administration revamped the IGR sector via far reaching policies and reforms. • Today, average monthly IGR stands at N 1. 5 billion and there is a huge potential for growth as the reforms continue to fashion out more ways of blocking the leakages in the revenue administration process through the introduction of sound strategies and leveraging on modern technological innovations. • One point that has always been at the forefront of the Oshiomhole administration is the fact that the society must learn to survive on taxes without oil revenue which is the major contributor to the Federal pool from which the federating units in the country get their allocations from.

• However, all these were to change as the Oshiomhole administration revamped the IGR sector via far reaching policies and reforms. • Today, average monthly IGR stands at N 1. 5 billion and there is a huge potential for growth as the reforms continue to fashion out more ways of blocking the leakages in the revenue administration process through the introduction of sound strategies and leveraging on modern technological innovations. • One point that has always been at the forefront of the Oshiomhole administration is the fact that the society must learn to survive on taxes without oil revenue which is the major contributor to the Federal pool from which the federating units in the country get their allocations from.

• With the monumental task of society building facing any responsible government, it is necessary, especially in these unpredictable times of global oil price volatility, to seek for ways to harness alternative sources of revenue generation to fund government, projects, programmes and policies. • Internally Generated Revenue is the primary tool employed by Governments to raise revenue for the development of all sectors of the economy and under the emerging global realities, societies that intend to get to the next level of development require their institutions to be strengthened and their systems to become more efficient. • It is in the light of the foregoing that we present a case study of Edo State and our experience in the administration of tax and revenue.

• With the monumental task of society building facing any responsible government, it is necessary, especially in these unpredictable times of global oil price volatility, to seek for ways to harness alternative sources of revenue generation to fund government, projects, programmes and policies. • Internally Generated Revenue is the primary tool employed by Governments to raise revenue for the development of all sectors of the economy and under the emerging global realities, societies that intend to get to the next level of development require their institutions to be strengthened and their systems to become more efficient. • It is in the light of the foregoing that we present a case study of Edo State and our experience in the administration of tax and revenue.

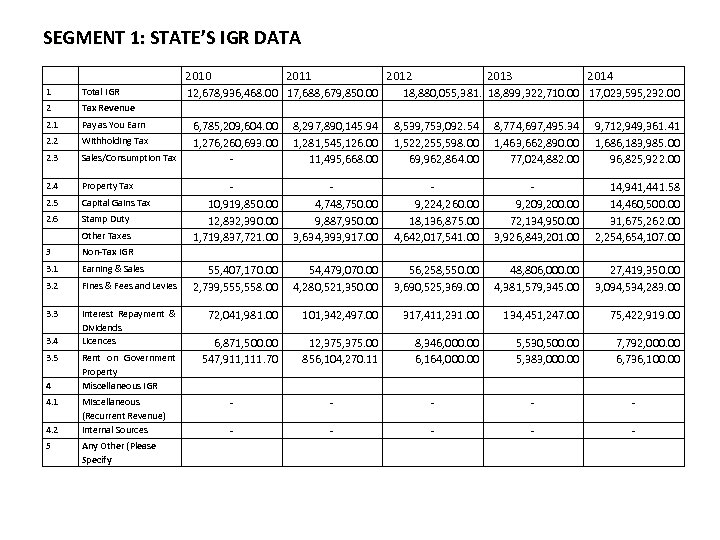

SEGMENT 1: STATE’S IGR DATA 2010 1 Total IGR 2 Pay as You Earn 2. 2 Withholding Tax 2. 3 Sales/Consumption Tax 2. 4 Property Tax 2. 5 Capital Gains Tax 2. 6 Stamp Duty 2012 2013 2014 Tax Revenue 2. 1 2011 Other Taxes 3 Earning & Sales 3. 2 Fines & Fees and Levies 3. 3 Interest Repayment & Dividends Licences 18, 880, 055, 381. 18, 899, 322, 710. 00 17, 023, 595, 232. 00 6, 785, 209, 604. 00 1, 276, 260, 693. 00 - 8, 297, 890, 145. 94 1, 281, 545, 126. 00 11, 495, 668. 00 8, 539, 753, 092. 54 1, 522, 255, 598. 00 69, 962, 864. 00 8, 774, 697, 495. 34 1, 463, 662, 890. 00 77, 024, 882. 00 9, 712, 949, 361. 41 1, 686, 183, 985. 00 96, 825, 922. 00 10, 919, 850. 00 12, 832, 390. 00 1, 719, 837, 721. 00 4, 748, 750. 00 9, 887, 950. 00 3, 634, 393, 917. 00 9, 224, 260. 00 18, 136, 875. 00 4, 642, 017, 541. 00 9, 200. 00 72, 134, 950. 00 3, 926, 843, 201. 00 14, 941, 441. 58 14, 460, 500. 00 31, 675, 262. 00 2, 254, 654, 107. 00 55, 407, 170. 00 2, 739, 555, 558. 00 54, 479, 070. 00 4, 280, 521, 350. 00 56, 258, 550. 00 3, 690, 525, 369. 00 48, 806, 000. 00 4, 381, 579, 345. 00 27, 419, 350. 00 3, 094, 534, 283. 00 72, 041, 981. 00 101, 342, 497. 00 317, 411, 231. 00 134, 451, 247. 00 75, 422, 919. 00 6, 871, 500. 00 547, 911, 111. 70 12, 375. 00 856, 104, 270. 11 8, 346, 000. 00 6, 164, 000. 00 5, 530, 500. 00 5, 383, 000. 00 7, 792, 000. 00 6, 736, 100. 00 Non-Tax IGR 3. 1 12, 678, 936, 468. 00 17, 688, 679, 850. 00 3. 4 3. 5 4 4. 1 4. 2 5 Rent on Government Property Miscellaneous IGR Miscellaneous (Recurrent Revenue) Internal Sources Any Other (Please Specify - - - - -

SEGMENT 1: STATE’S IGR DATA 2010 1 Total IGR 2 Pay as You Earn 2. 2 Withholding Tax 2. 3 Sales/Consumption Tax 2. 4 Property Tax 2. 5 Capital Gains Tax 2. 6 Stamp Duty 2012 2013 2014 Tax Revenue 2. 1 2011 Other Taxes 3 Earning & Sales 3. 2 Fines & Fees and Levies 3. 3 Interest Repayment & Dividends Licences 18, 880, 055, 381. 18, 899, 322, 710. 00 17, 023, 595, 232. 00 6, 785, 209, 604. 00 1, 276, 260, 693. 00 - 8, 297, 890, 145. 94 1, 281, 545, 126. 00 11, 495, 668. 00 8, 539, 753, 092. 54 1, 522, 255, 598. 00 69, 962, 864. 00 8, 774, 697, 495. 34 1, 463, 662, 890. 00 77, 024, 882. 00 9, 712, 949, 361. 41 1, 686, 183, 985. 00 96, 825, 922. 00 10, 919, 850. 00 12, 832, 390. 00 1, 719, 837, 721. 00 4, 748, 750. 00 9, 887, 950. 00 3, 634, 393, 917. 00 9, 224, 260. 00 18, 136, 875. 00 4, 642, 017, 541. 00 9, 200. 00 72, 134, 950. 00 3, 926, 843, 201. 00 14, 941, 441. 58 14, 460, 500. 00 31, 675, 262. 00 2, 254, 654, 107. 00 55, 407, 170. 00 2, 739, 555, 558. 00 54, 479, 070. 00 4, 280, 521, 350. 00 56, 258, 550. 00 3, 690, 525, 369. 00 48, 806, 000. 00 4, 381, 579, 345. 00 27, 419, 350. 00 3, 094, 534, 283. 00 72, 041, 981. 00 101, 342, 497. 00 317, 411, 231. 00 134, 451, 247. 00 75, 422, 919. 00 6, 871, 500. 00 547, 911, 111. 70 12, 375. 00 856, 104, 270. 11 8, 346, 000. 00 6, 164, 000. 00 5, 530, 500. 00 5, 383, 000. 00 7, 792, 000. 00 6, 736, 100. 00 Non-Tax IGR 3. 1 12, 678, 936, 468. 00 17, 688, 679, 850. 00 3. 4 3. 5 4 4. 1 4. 2 5 Rent on Government Property Miscellaneous IGR Miscellaneous (Recurrent Revenue) Internal Sources Any Other (Please Specify - - - - -

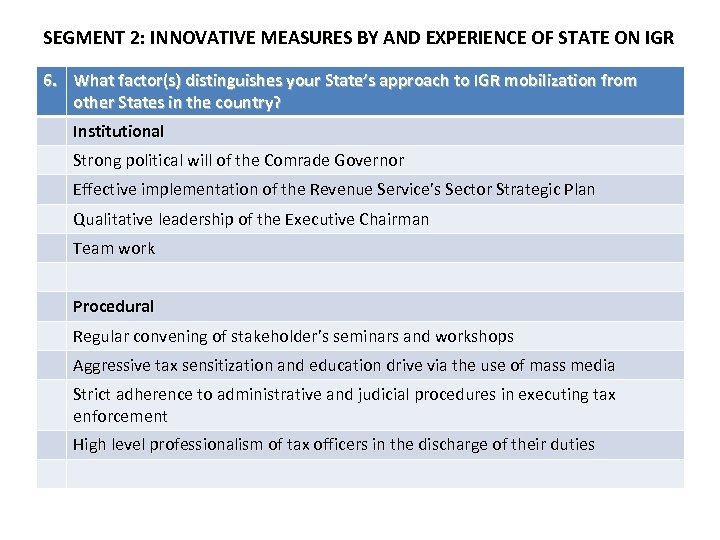

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 6. What factor(s) distinguishes your State’s approach to IGR mobilization from other States in the country? Institutional Strong political will of the Comrade Governor Effective implementation of the Revenue Service’s Sector Strategic Plan Qualitative leadership of the Executive Chairman Team work Procedural Regular convening of stakeholder’s seminars and workshops Aggressive tax sensitization and education drive via the use of mass media Strict adherence to administrative and judicial procedures in executing tax enforcement High level professionalism of tax officers in the discharge of their duties

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 6. What factor(s) distinguishes your State’s approach to IGR mobilization from other States in the country? Institutional Strong political will of the Comrade Governor Effective implementation of the Revenue Service’s Sector Strategic Plan Qualitative leadership of the Executive Chairman Team work Procedural Regular convening of stakeholder’s seminars and workshops Aggressive tax sensitization and education drive via the use of mass media Strict adherence to administrative and judicial procedures in executing tax enforcement High level professionalism of tax officers in the discharge of their duties

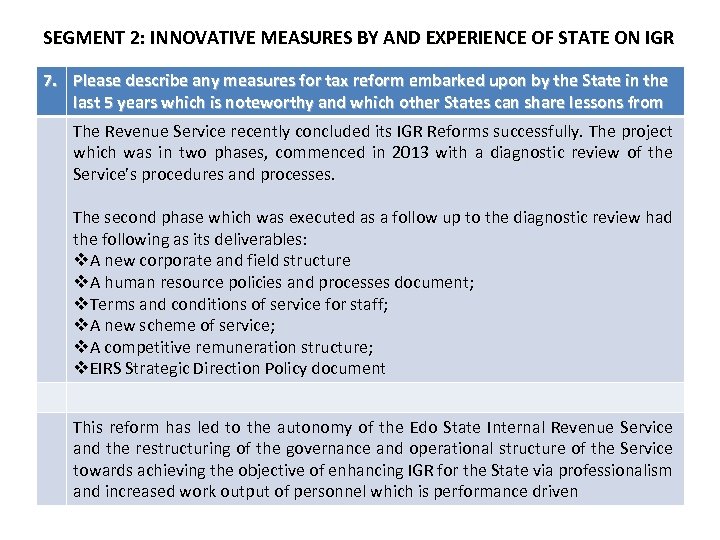

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 7. Please describe any measures for tax reform embarked upon by the State in the last 5 years which is noteworthy and which other States can share lessons from The Revenue Service recently concluded its IGR Reforms successfully. The project which was in two phases, commenced in 2013 with a diagnostic review of the Service’s procedures and processes. The second phase which was executed as a follow up to the diagnostic review had the following as its deliverables: v. A new corporate and field structure v. A human resource policies and processes document; v. Terms and conditions of service for staff; v. A new scheme of service; v. A competitive remuneration structure; v. EIRS Strategic Direction Policy document This reform has led to the autonomy of the Edo State Internal Revenue Service and the restructuring of the governance and operational structure of the Service towards achieving the objective of enhancing IGR for the State via professionalism and increased work output of personnel which is performance driven

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 7. Please describe any measures for tax reform embarked upon by the State in the last 5 years which is noteworthy and which other States can share lessons from The Revenue Service recently concluded its IGR Reforms successfully. The project which was in two phases, commenced in 2013 with a diagnostic review of the Service’s procedures and processes. The second phase which was executed as a follow up to the diagnostic review had the following as its deliverables: v. A new corporate and field structure v. A human resource policies and processes document; v. Terms and conditions of service for staff; v. A new scheme of service; v. A competitive remuneration structure; v. EIRS Strategic Direction Policy document This reform has led to the autonomy of the Edo State Internal Revenue Service and the restructuring of the governance and operational structure of the Service towards achieving the objective of enhancing IGR for the State via professionalism and increased work output of personnel which is performance driven

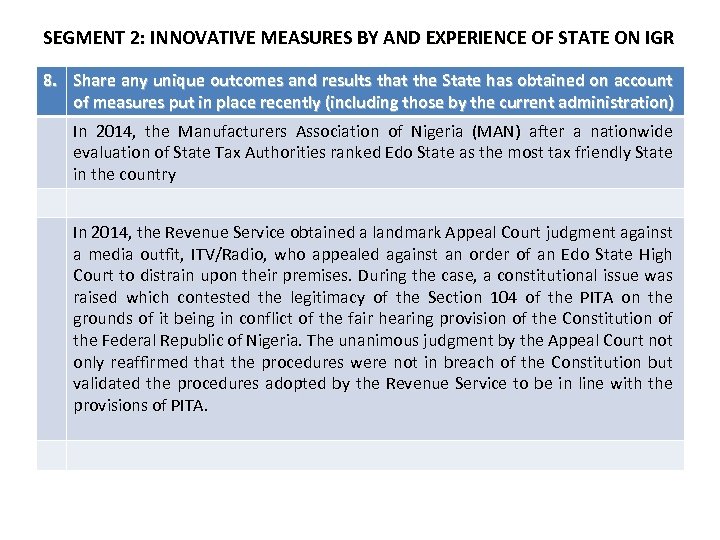

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 8. Share any unique outcomes and results that the State has obtained on account of measures put in place recently (including those by the current administration) In 2014, the Manufacturers Association of Nigeria (MAN) after a nationwide evaluation of State Tax Authorities ranked Edo State as the most tax friendly State in the country In 2014, the Revenue Service obtained a landmark Appeal Court judgment against a media outfit, ITV/Radio, who appealed against an order of an Edo State High Court to distrain upon their premises. During the case, a constitutional issue was raised which contested the legitimacy of the Section 104 of the PITA on the grounds of it being in conflict of the fair hearing provision of the Constitution of the Federal Republic of Nigeria. The unanimous judgment by the Appeal Court not only reaffirmed that the procedures were not in breach of the Constitution but validated the procedures adopted by the Revenue Service to be in line with the provisions of PITA.

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 8. Share any unique outcomes and results that the State has obtained on account of measures put in place recently (including those by the current administration) In 2014, the Manufacturers Association of Nigeria (MAN) after a nationwide evaluation of State Tax Authorities ranked Edo State as the most tax friendly State in the country In 2014, the Revenue Service obtained a landmark Appeal Court judgment against a media outfit, ITV/Radio, who appealed against an order of an Edo State High Court to distrain upon their premises. During the case, a constitutional issue was raised which contested the legitimacy of the Section 104 of the PITA on the grounds of it being in conflict of the fair hearing provision of the Constitution of the Federal Republic of Nigeria. The unanimous judgment by the Appeal Court not only reaffirmed that the procedures were not in breach of the Constitution but validated the procedures adopted by the Revenue Service to be in line with the provisions of PITA.

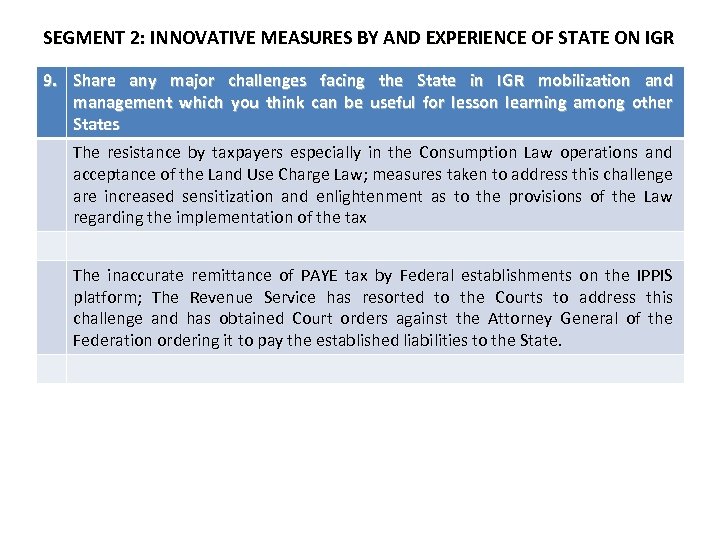

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 9. Share any major challenges facing the State in IGR mobilization and management which you think can be useful for lesson learning among other States The resistance by taxpayers especially in the Consumption Law operations and acceptance of the Land Use Charge Law; measures taken to address this challenge are increased sensitization and enlightenment as to the provisions of the Law regarding the implementation of the tax The inaccurate remittance of PAYE tax by Federal establishments on the IPPIS platform; The Revenue Service has resorted to the Courts to address this challenge and has obtained Court orders against the Attorney General of the Federation ordering it to pay the established liabilities to the State.

SEGMENT 2: INNOVATIVE MEASURES BY AND EXPERIENCE OF STATE ON IGR 9. Share any major challenges facing the State in IGR mobilization and management which you think can be useful for lesson learning among other States The resistance by taxpayers especially in the Consumption Law operations and acceptance of the Land Use Charge Law; measures taken to address this challenge are increased sensitization and enlightenment as to the provisions of the Law regarding the implementation of the tax The inaccurate remittance of PAYE tax by Federal establishments on the IPPIS platform; The Revenue Service has resorted to the Courts to address this challenge and has obtained Court orders against the Attorney General of the Federation ordering it to pay the established liabilities to the State.

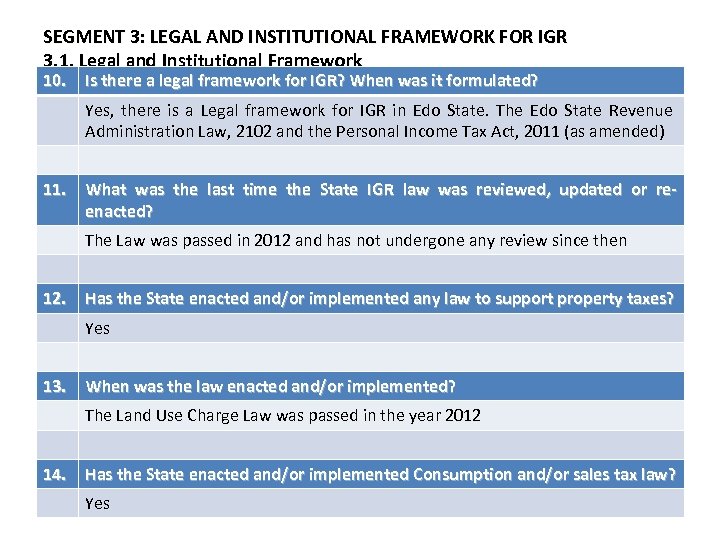

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 10. Is there a legal framework for IGR? When was it formulated? Yes, there is a Legal framework for IGR in Edo State. The Edo State Revenue Administration Law, 2102 and the Personal Income Tax Act, 2011 (as amended) 11. What was the last time the State IGR law was reviewed, updated or reenacted? The Law was passed in 2012 and has not undergone any review since then 12. Has the State enacted and/or implemented any law to support property taxes? Yes 13. When was the law enacted and/or implemented? The Land Use Charge Law was passed in the year 2012 14. Has the State enacted and/or implemented Consumption and/or sales tax law? Yes

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 10. Is there a legal framework for IGR? When was it formulated? Yes, there is a Legal framework for IGR in Edo State. The Edo State Revenue Administration Law, 2102 and the Personal Income Tax Act, 2011 (as amended) 11. What was the last time the State IGR law was reviewed, updated or reenacted? The Law was passed in 2012 and has not undergone any review since then 12. Has the State enacted and/or implemented any law to support property taxes? Yes 13. When was the law enacted and/or implemented? The Land Use Charge Law was passed in the year 2012 14. Has the State enacted and/or implemented Consumption and/or sales tax law? Yes

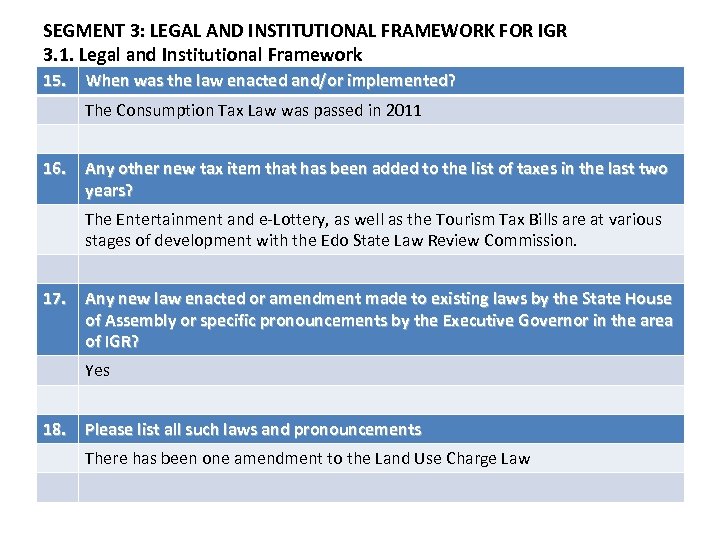

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 15. When was the law enacted and/or implemented? The Consumption Tax Law was passed in 2011 16. Any other new tax item that has been added to the list of taxes in the last two years? The Entertainment and e-Lottery, as well as the Tourism Tax Bills are at various stages of development with the Edo State Law Review Commission. 17. Any new law enacted or amendment made to existing laws by the State House of Assembly or specific pronouncements by the Executive Governor in the area of IGR? Yes 18. Please list all such laws and pronouncements There has been one amendment to the Land Use Charge Law

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 15. When was the law enacted and/or implemented? The Consumption Tax Law was passed in 2011 16. Any other new tax item that has been added to the list of taxes in the last two years? The Entertainment and e-Lottery, as well as the Tourism Tax Bills are at various stages of development with the Edo State Law Review Commission. 17. Any new law enacted or amendment made to existing laws by the State House of Assembly or specific pronouncements by the Executive Governor in the area of IGR? Yes 18. Please list all such laws and pronouncements There has been one amendment to the Land Use Charge Law

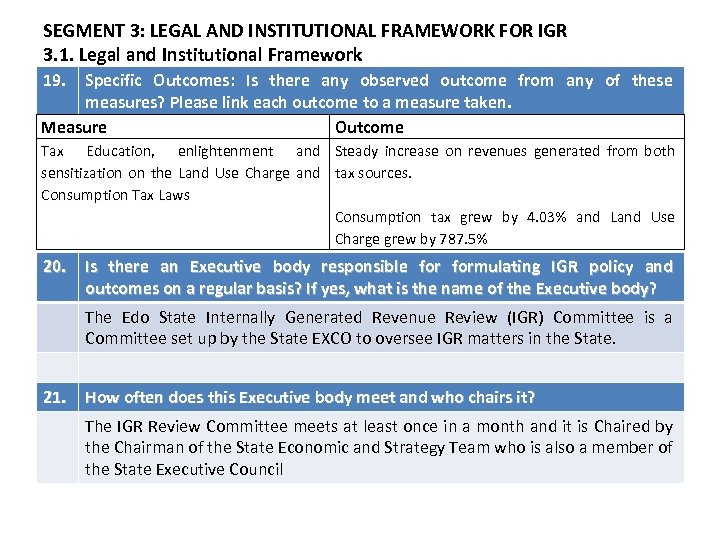

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 19. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. Measure Outcome Tax Education, enlightenment and Steady increase on revenues generated from both sensitization on the Land Use Charge and tax sources. Consumption Tax Laws Consumption tax grew by 4. 03% and Land Use Charge grew by 787. 5% 20. Is there an Executive body responsible formulating IGR policy and outcomes on a regular basis? If yes, what is the name of the Executive body? The Edo State Internally Generated Revenue Review (IGR) Committee is a Committee set up by the State EXCO to oversee IGR matters in the State. 21. How often does this Executive body meet and who chairs it? The IGR Review Committee meets at least once in a month and it is Chaired by the Chairman of the State Economic and Strategy Team who is also a member of the State Executive Council

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 19. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. Measure Outcome Tax Education, enlightenment and Steady increase on revenues generated from both sensitization on the Land Use Charge and tax sources. Consumption Tax Laws Consumption tax grew by 4. 03% and Land Use Charge grew by 787. 5% 20. Is there an Executive body responsible formulating IGR policy and outcomes on a regular basis? If yes, what is the name of the Executive body? The Edo State Internally Generated Revenue Review (IGR) Committee is a Committee set up by the State EXCO to oversee IGR matters in the State. 21. How often does this Executive body meet and who chairs it? The IGR Review Committee meets at least once in a month and it is Chaired by the Chairman of the State Economic and Strategy Team who is also a member of the State Executive Council

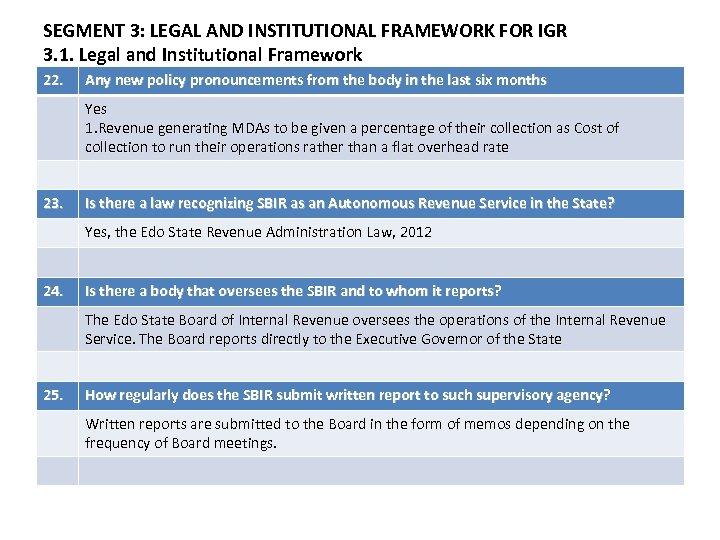

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 22. Any new policy pronouncements from the body in the last six months Yes 1. Revenue generating MDAs to be given a percentage of their collection as Cost of collection to run their operations rather than a flat overhead rate 23. Is there a law recognizing SBIR as an Autonomous Revenue Service in the State? Yes, the Edo State Revenue Administration Law, 2012 24. Is there a body that oversees the SBIR and to whom it reports? The Edo State Board of Internal Revenue oversees the operations of the Internal Revenue Service. The Board reports directly to the Executive Governor of the State 25. How regularly does the SBIR submit written report to such supervisory agency? Written reports are submitted to the Board in the form of memos depending on the frequency of Board meetings.

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 22. Any new policy pronouncements from the body in the last six months Yes 1. Revenue generating MDAs to be given a percentage of their collection as Cost of collection to run their operations rather than a flat overhead rate 23. Is there a law recognizing SBIR as an Autonomous Revenue Service in the State? Yes, the Edo State Revenue Administration Law, 2012 24. Is there a body that oversees the SBIR and to whom it reports? The Edo State Board of Internal Revenue oversees the operations of the Internal Revenue Service. The Board reports directly to the Executive Governor of the State 25. How regularly does the SBIR submit written report to such supervisory agency? Written reports are submitted to the Board in the form of memos depending on the frequency of Board meetings.

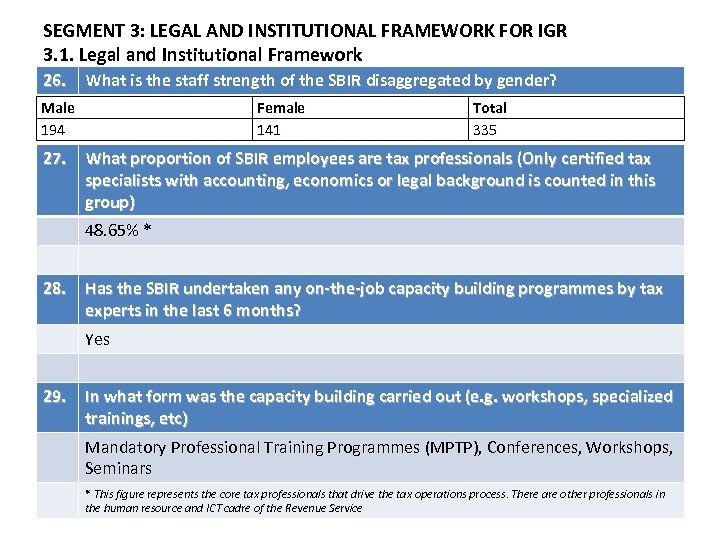

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 26. What is the staff strength of the SBIR disaggregated by gender? Male 194 27. Female 141 Total 335 What proportion of SBIR employees are tax professionals (Only certified tax specialists with accounting, economics or legal background is counted in this group) 48. 65% * 28. Has the SBIR undertaken any on-the-job capacity building programmes by tax experts in the last 6 months? Yes 29. In what form was the capacity building carried out (e. g. workshops, specialized trainings, etc) Mandatory Professional Training Programmes (MPTP), Conferences, Workshops, Seminars * This figure represents the core tax professionals that drive the tax operations process. There are other professionals in the human resource and ICT cadre of the Revenue Service

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 26. What is the staff strength of the SBIR disaggregated by gender? Male 194 27. Female 141 Total 335 What proportion of SBIR employees are tax professionals (Only certified tax specialists with accounting, economics or legal background is counted in this group) 48. 65% * 28. Has the SBIR undertaken any on-the-job capacity building programmes by tax experts in the last 6 months? Yes 29. In what form was the capacity building carried out (e. g. workshops, specialized trainings, etc) Mandatory Professional Training Programmes (MPTP), Conferences, Workshops, Seminars * This figure represents the core tax professionals that drive the tax operations process. There are other professionals in the human resource and ICT cadre of the Revenue Service

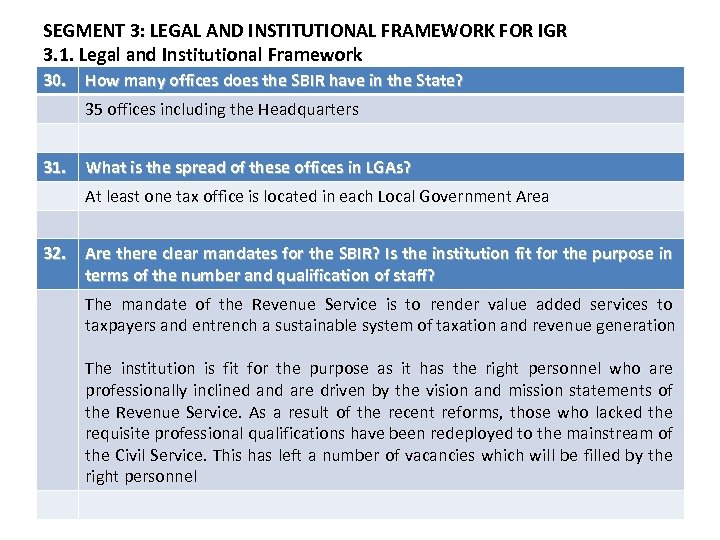

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 30. How many offices does the SBIR have in the State? 35 offices including the Headquarters 31. What is the spread of these offices in LGAs? At least one tax office is located in each Local Government Area 32. Are there clear mandates for the SBIR? Is the institution fit for the purpose in terms of the number and qualification of staff? The mandate of the Revenue Service is to render value added services to taxpayers and entrench a sustainable system of taxation and revenue generation The institution is fit for the purpose as it has the right personnel who are professionally inclined and are driven by the vision and mission statements of the Revenue Service. As a result of the recent reforms, those who lacked the requisite professional qualifications have been redeployed to the mainstream of the Civil Service. This has left a number of vacancies which will be filled by the right personnel

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 30. How many offices does the SBIR have in the State? 35 offices including the Headquarters 31. What is the spread of these offices in LGAs? At least one tax office is located in each Local Government Area 32. Are there clear mandates for the SBIR? Is the institution fit for the purpose in terms of the number and qualification of staff? The mandate of the Revenue Service is to render value added services to taxpayers and entrench a sustainable system of taxation and revenue generation The institution is fit for the purpose as it has the right personnel who are professionally inclined and are driven by the vision and mission statements of the Revenue Service. As a result of the recent reforms, those who lacked the requisite professional qualifications have been redeployed to the mainstream of the Civil Service. This has left a number of vacancies which will be filled by the right personnel

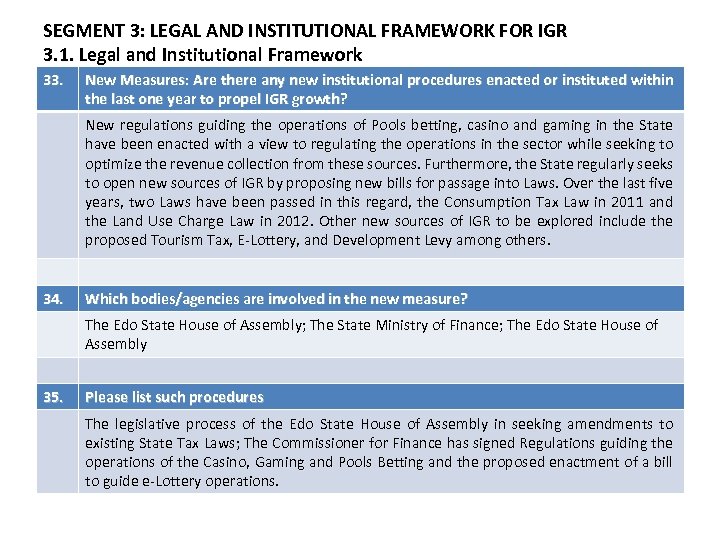

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 33. New Measures: Are there any new institutional procedures enacted or instituted within the last one year to propel IGR growth? New regulations guiding the operations of Pools betting, casino and gaming in the State have been enacted with a view to regulating the operations in the sector while seeking to optimize the revenue collection from these sources. Furthermore, the State regularly seeks to open new sources of IGR by proposing new bills for passage into Laws. Over the last five years, two Laws have been passed in this regard, the Consumption Tax Law in 2011 and the Land Use Charge Law in 2012. Other new sources of IGR to be explored include the proposed Tourism Tax, E-Lottery, and Development Levy among others. 34. Which bodies/agencies are involved in the new measure? The Edo State House of Assembly; The State Ministry of Finance; The Edo State House of Assembly 35. Please list such procedures The legislative process of the Edo State House of Assembly in seeking amendments to existing State Tax Laws; The Commissioner for Finance has signed Regulations guiding the operations of the Casino, Gaming and Pools Betting and the proposed enactment of a bill to guide e-Lottery operations.

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 33. New Measures: Are there any new institutional procedures enacted or instituted within the last one year to propel IGR growth? New regulations guiding the operations of Pools betting, casino and gaming in the State have been enacted with a view to regulating the operations in the sector while seeking to optimize the revenue collection from these sources. Furthermore, the State regularly seeks to open new sources of IGR by proposing new bills for passage into Laws. Over the last five years, two Laws have been passed in this regard, the Consumption Tax Law in 2011 and the Land Use Charge Law in 2012. Other new sources of IGR to be explored include the proposed Tourism Tax, E-Lottery, and Development Levy among others. 34. Which bodies/agencies are involved in the new measure? The Edo State House of Assembly; The State Ministry of Finance; The Edo State House of Assembly 35. Please list such procedures The legislative process of the Edo State House of Assembly in seeking amendments to existing State Tax Laws; The Commissioner for Finance has signed Regulations guiding the operations of the Casino, Gaming and Pools Betting and the proposed enactment of a bill to guide e-Lottery operations.

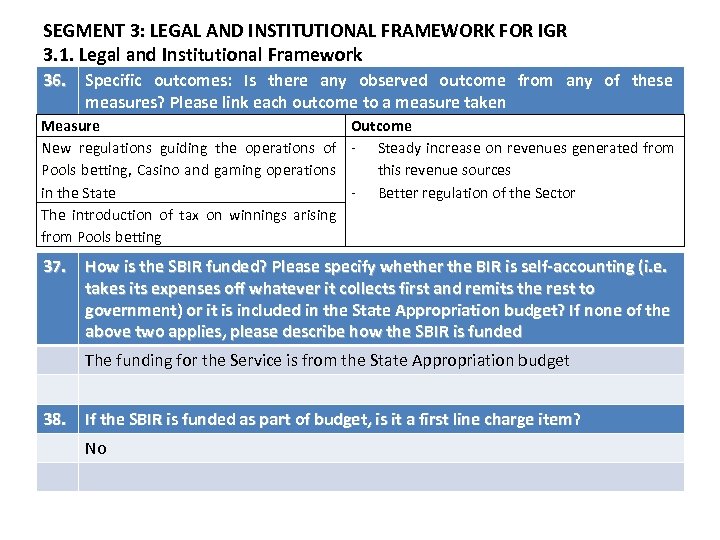

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 36. Specific outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken Measure Outcome New regulations guiding the operations of - Steady increase on revenues generated from Pools betting, Casino and gaming operations this revenue sources in the State - Better regulation of the Sector The introduction of tax on winnings arising from Pools betting 37. How is the SBIR funded? Please specify whether the BIR is self-accounting (i. e. takes its expenses off whatever it collects first and remits the rest to government) or it is included in the State Appropriation budget? If none of the above two applies, please describe how the SBIR is funded The funding for the Service is from the State Appropriation budget 38. If the SBIR is funded as part of budget, is it a first line charge item? No

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 36. Specific outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken Measure Outcome New regulations guiding the operations of - Steady increase on revenues generated from Pools betting, Casino and gaming operations this revenue sources in the State - Better regulation of the Sector The introduction of tax on winnings arising from Pools betting 37. How is the SBIR funded? Please specify whether the BIR is self-accounting (i. e. takes its expenses off whatever it collects first and remits the rest to government) or it is included in the State Appropriation budget? If none of the above two applies, please describe how the SBIR is funded The funding for the Service is from the State Appropriation budget 38. If the SBIR is funded as part of budget, is it a first line charge item? No

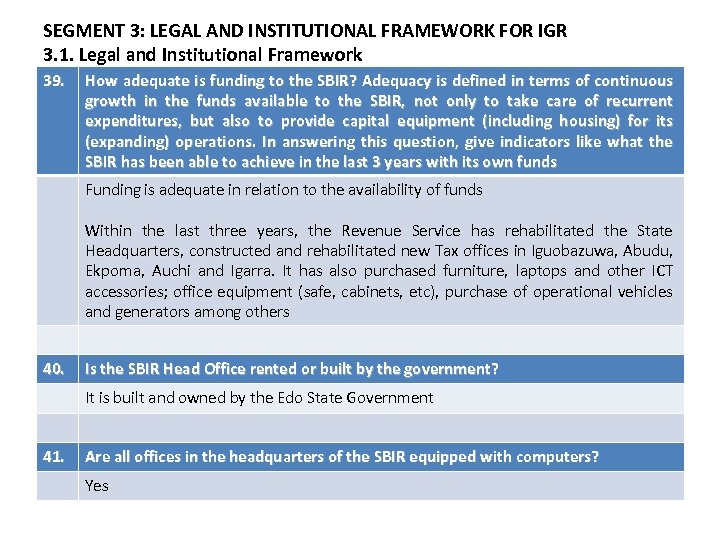

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 39. How adequate is funding to the SBIR? Adequacy is defined in terms of continuous growth in the funds available to the SBIR, not only to take care of recurrent expenditures, but also to provide capital equipment (including housing) for its (expanding) operations. In answering this question, give indicators like what the SBIR has been able to achieve in the last 3 years with its own funds Funding is adequate in relation to the availability of funds Within the last three years, the Revenue Service has rehabilitated the State Headquarters, constructed and rehabilitated new Tax offices in Iguobazuwa, Abudu, Ekpoma, Auchi and Igarra. It has also purchased furniture, laptops and other ICT accessories; office equipment (safe, cabinets, etc), purchase of operational vehicles and generators among others 40. Is the SBIR Head Office rented or built by the government? It is built and owned by the Edo State Government 41. Are all offices in the headquarters of the SBIR equipped with computers? Yes

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 39. How adequate is funding to the SBIR? Adequacy is defined in terms of continuous growth in the funds available to the SBIR, not only to take care of recurrent expenditures, but also to provide capital equipment (including housing) for its (expanding) operations. In answering this question, give indicators like what the SBIR has been able to achieve in the last 3 years with its own funds Funding is adequate in relation to the availability of funds Within the last three years, the Revenue Service has rehabilitated the State Headquarters, constructed and rehabilitated new Tax offices in Iguobazuwa, Abudu, Ekpoma, Auchi and Igarra. It has also purchased furniture, laptops and other ICT accessories; office equipment (safe, cabinets, etc), purchase of operational vehicles and generators among others 40. Is the SBIR Head Office rented or built by the government? It is built and owned by the Edo State Government 41. Are all offices in the headquarters of the SBIR equipped with computers? Yes

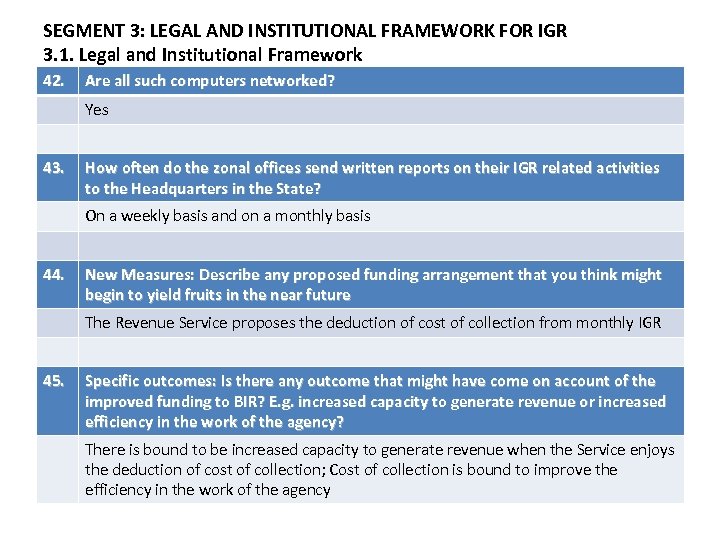

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 42. Are all such computers networked? Yes 43. How often do the zonal offices send written reports on their IGR related activities to the Headquarters in the State? On a weekly basis and on a monthly basis 44. New Measures: Describe any proposed funding arrangement that you think might begin to yield fruits in the near future The Revenue Service proposes the deduction of cost of collection from monthly IGR 45. Specific outcomes: Is there any outcome that might have come on account of the improved funding to BIR? E. g. increased capacity to generate revenue or increased efficiency in the work of the agency? There is bound to be increased capacity to generate revenue when the Service enjoys the deduction of cost of collection; Cost of collection is bound to improve the efficiency in the work of the agency

SEGMENT 3: LEGAL AND INSTITUTIONAL FRAMEWORK FOR IGR 3. 1. Legal and Institutional Framework 42. Are all such computers networked? Yes 43. How often do the zonal offices send written reports on their IGR related activities to the Headquarters in the State? On a weekly basis and on a monthly basis 44. New Measures: Describe any proposed funding arrangement that you think might begin to yield fruits in the near future The Revenue Service proposes the deduction of cost of collection from monthly IGR 45. Specific outcomes: Is there any outcome that might have come on account of the improved funding to BIR? E. g. increased capacity to generate revenue or increased efficiency in the work of the agency? There is bound to be increased capacity to generate revenue when the Service enjoys the deduction of cost of collection; Cost of collection is bound to improve the efficiency in the work of the agency

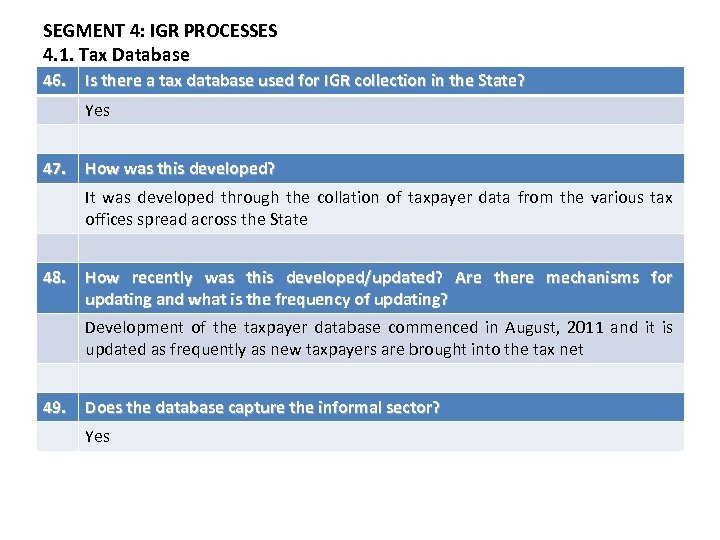

SEGMENT 4: IGR PROCESSES 4. 1. Tax Database 46. Is there a tax database used for IGR collection in the State? Yes 47. How was this developed? It was developed through the collation of taxpayer data from the various tax offices spread across the State 48. How recently was this developed/updated? Are there mechanisms for updating and what is the frequency of updating? Development of the taxpayer database commenced in August, 2011 and it is updated as frequently as new taxpayers are brought into the tax net 49. Does the database capture the informal sector? Yes

SEGMENT 4: IGR PROCESSES 4. 1. Tax Database 46. Is there a tax database used for IGR collection in the State? Yes 47. How was this developed? It was developed through the collation of taxpayer data from the various tax offices spread across the State 48. How recently was this developed/updated? Are there mechanisms for updating and what is the frequency of updating? Development of the taxpayer database commenced in August, 2011 and it is updated as frequently as new taxpayers are brought into the tax net 49. Does the database capture the informal sector? Yes

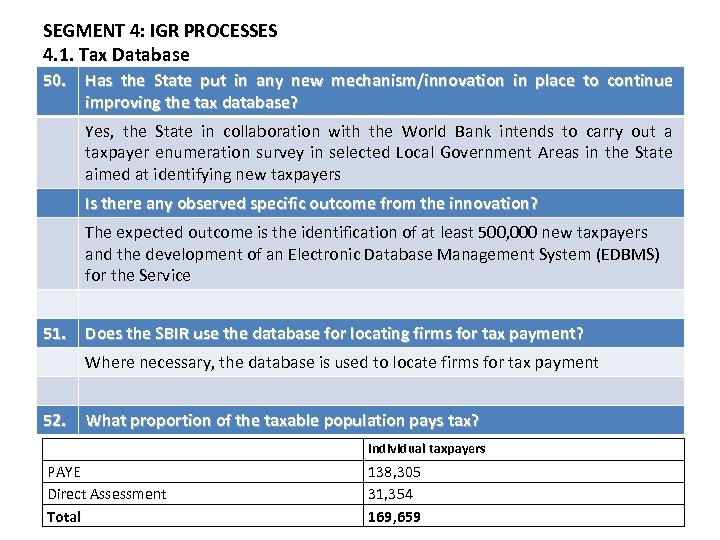

SEGMENT 4: IGR PROCESSES 4. 1. Tax Database 50. Has the State put in any new mechanism/innovation in place to continue improving the tax database? Yes, the State in collaboration with the World Bank intends to carry out a taxpayer enumeration survey in selected Local Government Areas in the State aimed at identifying new taxpayers Is there any observed specific outcome from the innovation? The expected outcome is the identification of at least 500, 000 new taxpayers and the development of an Electronic Database Management System (EDBMS) for the Service 51. Does the SBIR use the database for locating firms for tax payment? Where necessary, the database is used to locate firms for tax payment 52. What proportion of the taxable population pays tax? Individual taxpayers PAYE Direct Assessment Total 138, 305 31, 354 169, 659

SEGMENT 4: IGR PROCESSES 4. 1. Tax Database 50. Has the State put in any new mechanism/innovation in place to continue improving the tax database? Yes, the State in collaboration with the World Bank intends to carry out a taxpayer enumeration survey in selected Local Government Areas in the State aimed at identifying new taxpayers Is there any observed specific outcome from the innovation? The expected outcome is the identification of at least 500, 000 new taxpayers and the development of an Electronic Database Management System (EDBMS) for the Service 51. Does the SBIR use the database for locating firms for tax payment? Where necessary, the database is used to locate firms for tax payment 52. What proportion of the taxable population pays tax? Individual taxpayers PAYE Direct Assessment Total 138, 305 31, 354 169, 659

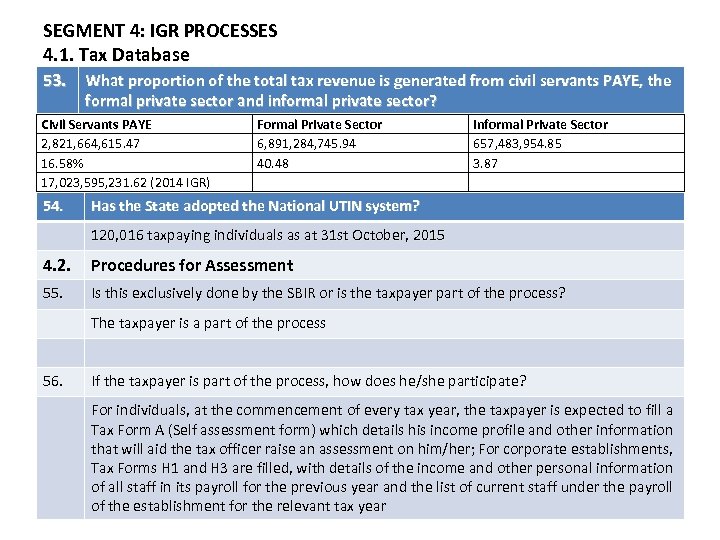

SEGMENT 4: IGR PROCESSES 4. 1. Tax Database 53. What proportion of the total tax revenue is generated from civil servants PAYE, the formal private sector and informal private sector? Civil Servants PAYE 2, 821, 664, 615. 47 16. 58% 17, 023, 595, 231. 62 (2014 IGR) 54. Formal Private Sector 6, 891, 284, 745. 94 40. 48 Informal Private Sector 657, 483, 954. 85 3. 87 Has the State adopted the National UTIN system? 120, 016 taxpaying individuals as at 31 st October, 2015 4. 2. Procedures for Assessment 55. Is this exclusively done by the SBIR or is the taxpayer part of the process? The taxpayer is a part of the process 56. If the taxpayer is part of the process, how does he/she participate? For individuals, at the commencement of every tax year, the taxpayer is expected to fill a Tax Form A (Self assessment form) which details his income profile and other information that will aid the tax officer raise an assessment on him/her; For corporate establishments, Tax Forms H 1 and H 3 are filled, with details of the income and other personal information of all staff in its payroll for the previous year and the list of current staff under the payroll of the establishment for the relevant tax year

SEGMENT 4: IGR PROCESSES 4. 1. Tax Database 53. What proportion of the total tax revenue is generated from civil servants PAYE, the formal private sector and informal private sector? Civil Servants PAYE 2, 821, 664, 615. 47 16. 58% 17, 023, 595, 231. 62 (2014 IGR) 54. Formal Private Sector 6, 891, 284, 745. 94 40. 48 Informal Private Sector 657, 483, 954. 85 3. 87 Has the State adopted the National UTIN system? 120, 016 taxpaying individuals as at 31 st October, 2015 4. 2. Procedures for Assessment 55. Is this exclusively done by the SBIR or is the taxpayer part of the process? The taxpayer is a part of the process 56. If the taxpayer is part of the process, how does he/she participate? For individuals, at the commencement of every tax year, the taxpayer is expected to fill a Tax Form A (Self assessment form) which details his income profile and other information that will aid the tax officer raise an assessment on him/her; For corporate establishments, Tax Forms H 1 and H 3 are filled, with details of the income and other personal information of all staff in its payroll for the previous year and the list of current staff under the payroll of the establishment for the relevant tax year

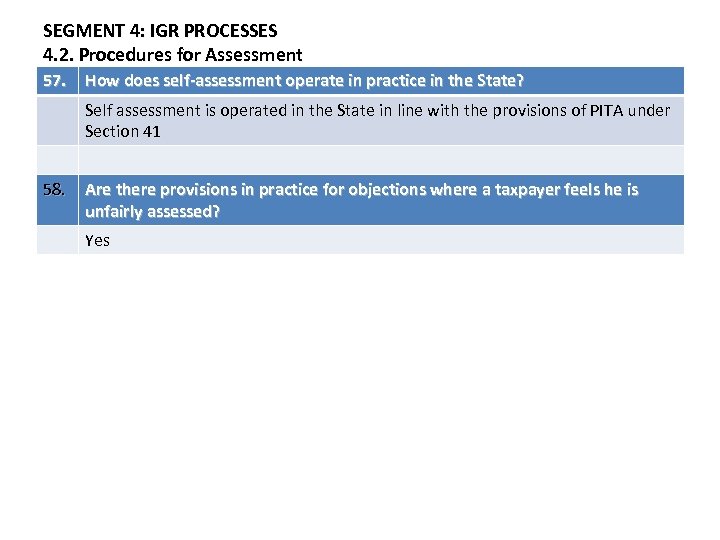

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 57. How does self-assessment operate in practice in the State? Self assessment is operated in the State in line with the provisions of PITA under Section 41 58. Are there provisions in practice for objections where a taxpayer feels he is unfairly assessed? Yes

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 57. How does self-assessment operate in practice in the State? Self assessment is operated in the State in line with the provisions of PITA under Section 41 58. Are there provisions in practice for objections where a taxpayer feels he is unfairly assessed? Yes

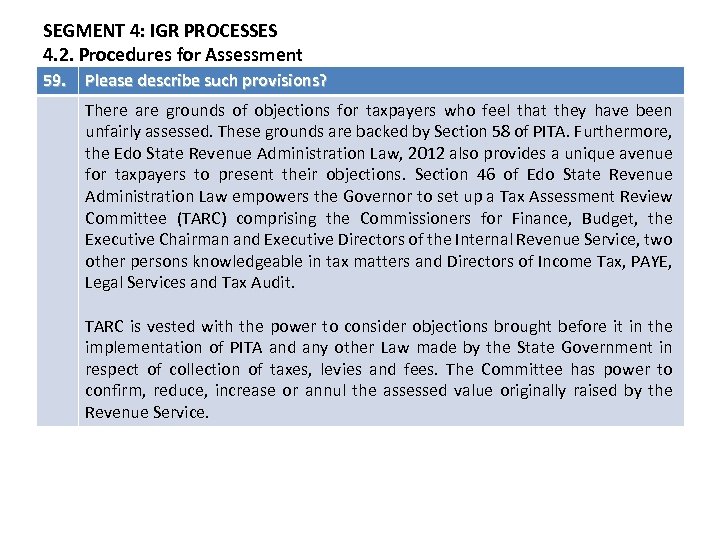

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 59. Please describe such provisions? There are grounds of objections for taxpayers who feel that they have been unfairly assessed. These grounds are backed by Section 58 of PITA. Furthermore, the Edo State Revenue Administration Law, 2012 also provides a unique avenue for taxpayers to present their objections. Section 46 of Edo State Revenue Administration Law empowers the Governor to set up a Tax Assessment Review Committee (TARC) comprising the Commissioners for Finance, Budget, the Executive Chairman and Executive Directors of the Internal Revenue Service, two other persons knowledgeable in tax matters and Directors of Income Tax, PAYE, Legal Services and Tax Audit. TARC is vested with the power to consider objections brought before it in the implementation of PITA and any other Law made by the State Government in respect of collection of taxes, levies and fees. The Committee has power to confirm, reduce, increase or annul the assessed value originally raised by the Revenue Service.

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 59. Please describe such provisions? There are grounds of objections for taxpayers who feel that they have been unfairly assessed. These grounds are backed by Section 58 of PITA. Furthermore, the Edo State Revenue Administration Law, 2012 also provides a unique avenue for taxpayers to present their objections. Section 46 of Edo State Revenue Administration Law empowers the Governor to set up a Tax Assessment Review Committee (TARC) comprising the Commissioners for Finance, Budget, the Executive Chairman and Executive Directors of the Internal Revenue Service, two other persons knowledgeable in tax matters and Directors of Income Tax, PAYE, Legal Services and Tax Audit. TARC is vested with the power to consider objections brought before it in the implementation of PITA and any other Law made by the State Government in respect of collection of taxes, levies and fees. The Committee has power to confirm, reduce, increase or annul the assessed value originally raised by the Revenue Service.

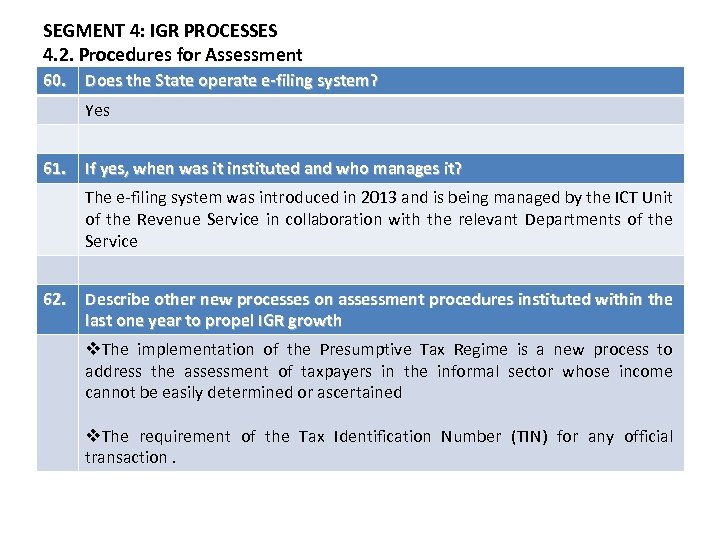

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 60. Does the State operate e-filing system? Yes 61. If yes, when was it instituted and who manages it? The e-filing system was introduced in 2013 and is being managed by the ICT Unit of the Revenue Service in collaboration with the relevant Departments of the Service 62. Describe other new processes on assessment procedures instituted within the last one year to propel IGR growth v. The implementation of the Presumptive Tax Regime is a new process to address the assessment of taxpayers in the informal sector whose income cannot be easily determined or ascertained v. The requirement of the Tax Identification Number (TIN) for any official transaction.

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 60. Does the State operate e-filing system? Yes 61. If yes, when was it instituted and who manages it? The e-filing system was introduced in 2013 and is being managed by the ICT Unit of the Revenue Service in collaboration with the relevant Departments of the Service 62. Describe other new processes on assessment procedures instituted within the last one year to propel IGR growth v. The implementation of the Presumptive Tax Regime is a new process to address the assessment of taxpayers in the informal sector whose income cannot be easily determined or ascertained v. The requirement of the Tax Identification Number (TIN) for any official transaction.

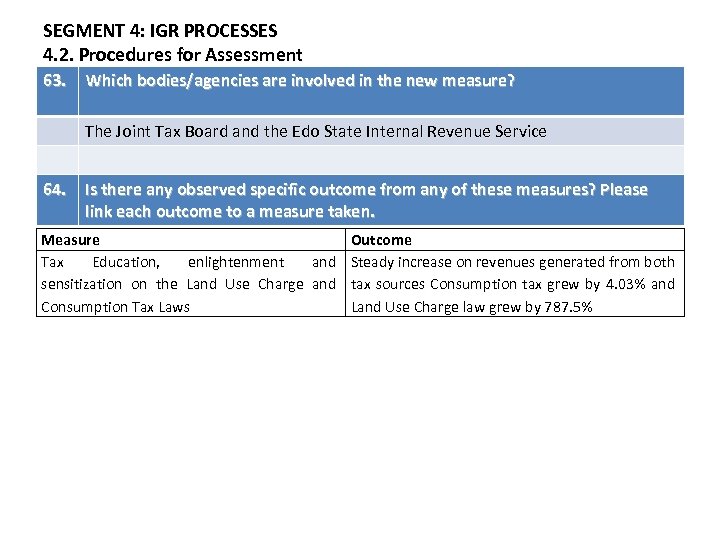

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 63. Which bodies/agencies are involved in the new measure? The Joint Tax Board and the Edo State Internal Revenue Service 64. Is there any observed specific outcome from any of these measures? Please link each outcome to a measure taken. Measure Tax Education, enlightenment and sensitization on the Land Use Charge and Consumption Tax Laws Outcome Steady increase on revenues generated from both tax sources Consumption tax grew by 4. 03% and Land Use Charge law grew by 787. 5%

SEGMENT 4: IGR PROCESSES 4. 2. Procedures for Assessment 63. Which bodies/agencies are involved in the new measure? The Joint Tax Board and the Edo State Internal Revenue Service 64. Is there any observed specific outcome from any of these measures? Please link each outcome to a measure taken. Measure Tax Education, enlightenment and sensitization on the Land Use Charge and Consumption Tax Laws Outcome Steady increase on revenues generated from both tax sources Consumption tax grew by 4. 03% and Land Use Charge law grew by 787. 5%

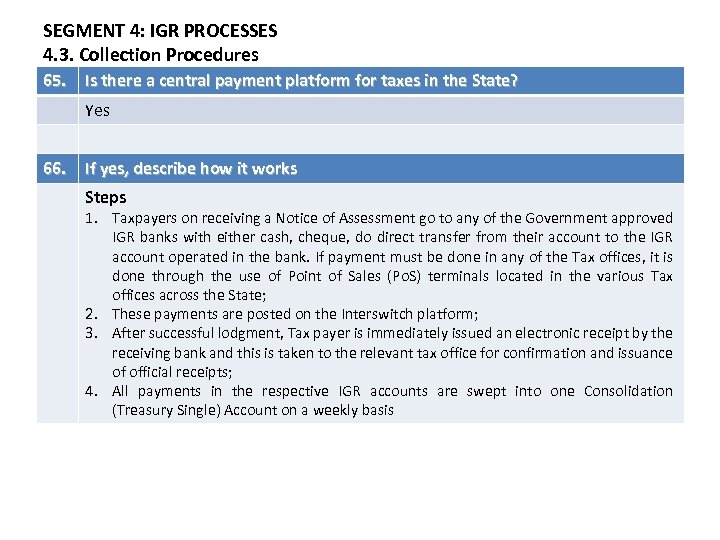

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 65. Is there a central payment platform for taxes in the State? Yes 66. If yes, describe how it works Steps 1. Taxpayers on receiving a Notice of Assessment go to any of the Government approved IGR banks with either cash, cheque, do direct transfer from their account to the IGR account operated in the bank. If payment must be done in any of the Tax offices, it is done through the use of Point of Sales (Po. S) terminals located in the various Tax offices across the State; 2. These payments are posted on the Interswitch platform; 3. After successful lodgment, Tax payer is immediately issued an electronic receipt by the receiving bank and this is taken to the relevant tax office for confirmation and issuance of official receipts; 4. All payments in the respective IGR accounts are swept into one Consolidation (Treasury Single) Account on a weekly basis

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 65. Is there a central payment platform for taxes in the State? Yes 66. If yes, describe how it works Steps 1. Taxpayers on receiving a Notice of Assessment go to any of the Government approved IGR banks with either cash, cheque, do direct transfer from their account to the IGR account operated in the bank. If payment must be done in any of the Tax offices, it is done through the use of Point of Sales (Po. S) terminals located in the various Tax offices across the State; 2. These payments are posted on the Interswitch platform; 3. After successful lodgment, Tax payer is immediately issued an electronic receipt by the receiving bank and this is taken to the relevant tax office for confirmation and issuance of official receipts; 4. All payments in the respective IGR accounts are swept into one Consolidation (Treasury Single) Account on a weekly basis

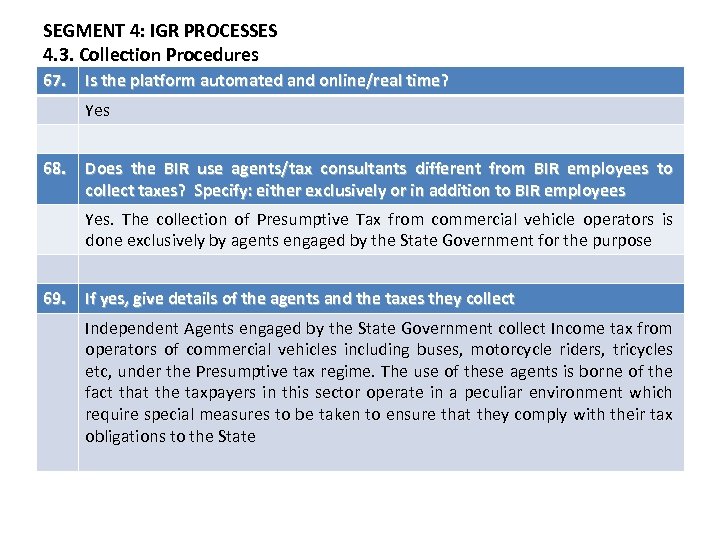

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 67. Is the platform automated and online/real time? Yes 68. Does the BIR use agents/tax consultants different from BIR employees to collect taxes? Specify: either exclusively or in addition to BIR employees Yes. The collection of Presumptive Tax from commercial vehicle operators is done exclusively by agents engaged by the State Government for the purpose 69. If yes, give details of the agents and the taxes they collect Independent Agents engaged by the State Government collect Income tax from operators of commercial vehicles including buses, motorcycle riders, tricycles etc, under the Presumptive tax regime. The use of these agents is borne of the fact that the taxpayers in this sector operate in a peculiar environment which require special measures to be taken to ensure that they comply with their tax obligations to the State

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 67. Is the platform automated and online/real time? Yes 68. Does the BIR use agents/tax consultants different from BIR employees to collect taxes? Specify: either exclusively or in addition to BIR employees Yes. The collection of Presumptive Tax from commercial vehicle operators is done exclusively by agents engaged by the State Government for the purpose 69. If yes, give details of the agents and the taxes they collect Independent Agents engaged by the State Government collect Income tax from operators of commercial vehicles including buses, motorcycle riders, tricycles etc, under the Presumptive tax regime. The use of these agents is borne of the fact that the taxpayers in this sector operate in a peculiar environment which require special measures to be taken to ensure that they comply with their tax obligations to the State

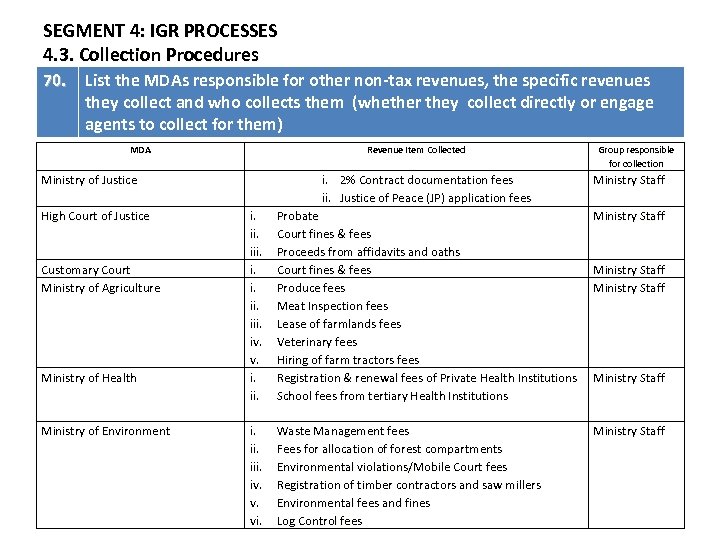

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 70. List the MDAs responsible for other non-tax revenues, the specific revenues they collect and who collects them (whether they collect directly or engage agents to collect for them) MDA Revenue Item Collected i. 2% Contract documentation fees ii. Justice of Peace (JP) application fees Ministry Staff i. iii. iv. v. i. ii. Probate Court fines & fees Proceeds from affidavits and oaths Court fines & fees Produce fees Meat Inspection fees Lease of farmlands fees Veterinary fees Hiring of farm tractors fees Registration & renewal fees of Private Health Institutions School fees from tertiary Health Institutions Ministry Staff i. iii. iv. v. vi. Waste Management fees Fees for allocation of forest compartments Environmental violations/Mobile Court fees Registration of timber contractors and saw millers Environmental fees and fines Log Control fees Ministry Staff Ministry of Justice High Court of Justice Customary Court Ministry of Agriculture Ministry of Health Ministry of Environment Group responsible for collection Ministry Staff

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 70. List the MDAs responsible for other non-tax revenues, the specific revenues they collect and who collects them (whether they collect directly or engage agents to collect for them) MDA Revenue Item Collected i. 2% Contract documentation fees ii. Justice of Peace (JP) application fees Ministry Staff i. iii. iv. v. i. ii. Probate Court fines & fees Proceeds from affidavits and oaths Court fines & fees Produce fees Meat Inspection fees Lease of farmlands fees Veterinary fees Hiring of farm tractors fees Registration & renewal fees of Private Health Institutions School fees from tertiary Health Institutions Ministry Staff i. iii. iv. v. vi. Waste Management fees Fees for allocation of forest compartments Environmental violations/Mobile Court fees Registration of timber contractors and saw millers Environmental fees and fines Log Control fees Ministry Staff Ministry of Justice High Court of Justice Customary Court Ministry of Agriculture Ministry of Health Ministry of Environment Group responsible for collection Ministry Staff

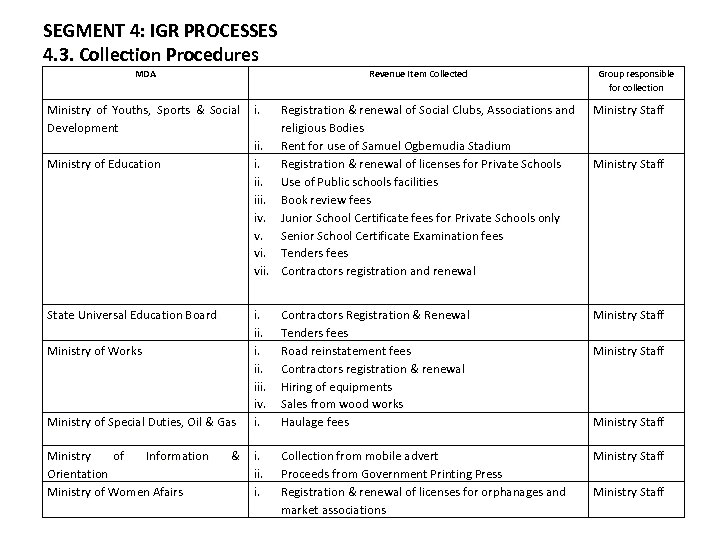

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures MDA Revenue Item Collected Ministry of Youths, Sports & Social i. Development ii. Ministry of Education i. iii. iv. v. vii. State Universal Education Board Ministry of Works Ministry of Special Duties, Oil & Gas Ministry of Information Orientation Ministry of Women Afairs i. ii. iii. iv. i. & i. i. Group responsible for collection Registration & renewal of Social Clubs, Associations and religious Bodies Rent for use of Samuel Ogbemudia Stadium Registration & renewal of licenses for Private Schools Use of Public schools facilities Book review fees Junior School Certificate fees for Private Schools only Senior School Certificate Examination fees Tenders fees Contractors registration and renewal Ministry Staff Contractors Registration & Renewal Tenders fees Road reinstatement fees Contractors registration & renewal Hiring of equipments Sales from wood works Haulage fees Ministry Staff Collection from mobile advert Proceeds from Government Printing Press Registration & renewal of licenses for orphanages and market associations Ministry Staff Ministry Staff

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures MDA Revenue Item Collected Ministry of Youths, Sports & Social i. Development ii. Ministry of Education i. iii. iv. v. vii. State Universal Education Board Ministry of Works Ministry of Special Duties, Oil & Gas Ministry of Information Orientation Ministry of Women Afairs i. ii. iii. iv. i. & i. i. Group responsible for collection Registration & renewal of Social Clubs, Associations and religious Bodies Rent for use of Samuel Ogbemudia Stadium Registration & renewal of licenses for Private Schools Use of Public schools facilities Book review fees Junior School Certificate fees for Private Schools only Senior School Certificate Examination fees Tenders fees Contractors registration and renewal Ministry Staff Contractors Registration & Renewal Tenders fees Road reinstatement fees Contractors registration & renewal Hiring of equipments Sales from wood works Haulage fees Ministry Staff Collection from mobile advert Proceeds from Government Printing Press Registration & renewal of licenses for orphanages and market associations Ministry Staff Ministry Staff

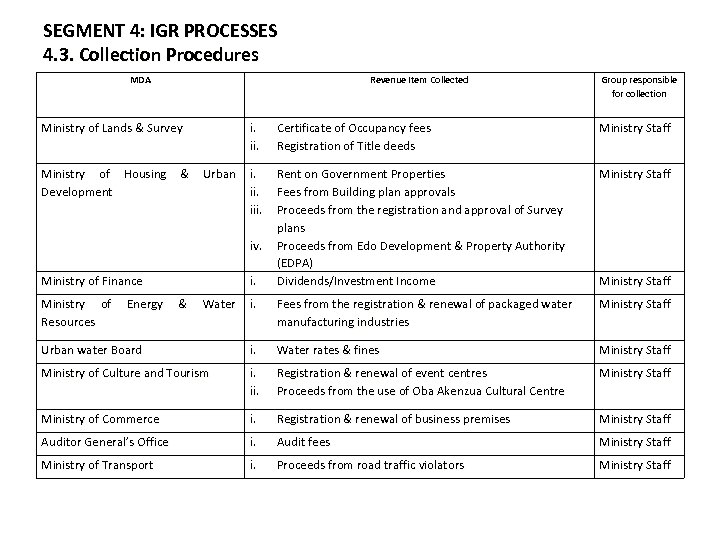

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures MDA Ministry of Lands & Survey Revenue Item Collected i. ii. Ministry of Housing & Urban i. Development ii. iii. iv. Ministry of Finance i. Ministry of Energy & Water i. Resources Group responsible for collection Certificate of Occupancy fees Registration of Title deeds Ministry Staff Rent on Government Properties Fees from Building plan approvals Proceeds from the registration and approval of Survey plans Proceeds from Edo Development & Property Authority (EDPA) Dividends/Investment Income Ministry Staff Fees from the registration & renewal of packaged water manufacturing industries Ministry Staff Urban water Board i. Water rates & fines Ministry Staff Ministry of Culture and Tourism i. ii. Registration & renewal of event centres Proceeds from the use of Oba Akenzua Cultural Centre Ministry Staff Ministry of Commerce i. Registration & renewal of business premises Ministry Staff Auditor General’s Office i. Audit fees Ministry Staff Ministry of Transport i. Proceeds from road traffic violators Ministry Staff

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures MDA Ministry of Lands & Survey Revenue Item Collected i. ii. Ministry of Housing & Urban i. Development ii. iii. iv. Ministry of Finance i. Ministry of Energy & Water i. Resources Group responsible for collection Certificate of Occupancy fees Registration of Title deeds Ministry Staff Rent on Government Properties Fees from Building plan approvals Proceeds from the registration and approval of Survey plans Proceeds from Edo Development & Property Authority (EDPA) Dividends/Investment Income Ministry Staff Fees from the registration & renewal of packaged water manufacturing industries Ministry Staff Urban water Board i. Water rates & fines Ministry Staff Ministry of Culture and Tourism i. ii. Registration & renewal of event centres Proceeds from the use of Oba Akenzua Cultural Centre Ministry Staff Ministry of Commerce i. Registration & renewal of business premises Ministry Staff Auditor General’s Office i. Audit fees Ministry Staff Ministry of Transport i. Proceeds from road traffic violators Ministry Staff

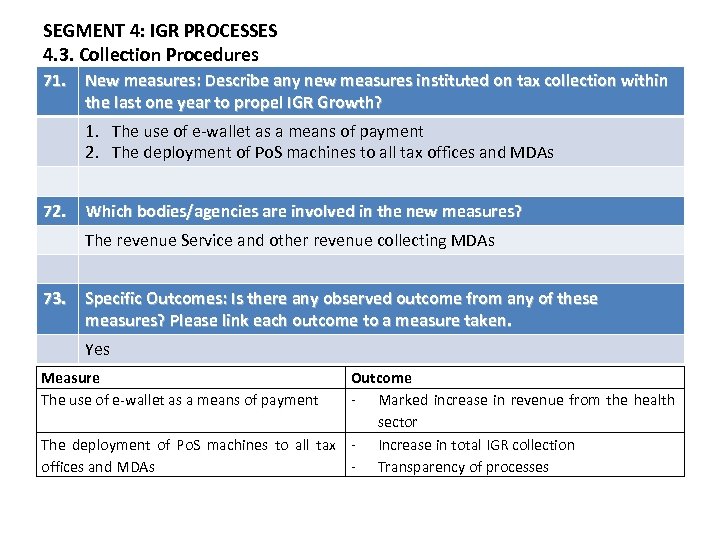

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 71. New measures: Describe any new measures instituted on tax collection within the last one year to propel IGR Growth? 1. The use of e-wallet as a means of payment 2. The deployment of Po. S machines to all tax offices and MDAs 72. Which bodies/agencies are involved in the new measures? The revenue Service and other revenue collecting MDAs 73. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. Yes Measure The use of e-wallet as a means of payment Outcome - Marked increase in revenue from the health sector The deployment of Po. S machines to all tax - Increase in total IGR collection offices and MDAs - Transparency of processes

SEGMENT 4: IGR PROCESSES 4. 3. Collection Procedures 71. New measures: Describe any new measures instituted on tax collection within the last one year to propel IGR Growth? 1. The use of e-wallet as a means of payment 2. The deployment of Po. S machines to all tax offices and MDAs 72. Which bodies/agencies are involved in the new measures? The revenue Service and other revenue collecting MDAs 73. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. Yes Measure The use of e-wallet as a means of payment Outcome - Marked increase in revenue from the health sector The deployment of Po. S machines to all tax - Increase in total IGR collection offices and MDAs - Transparency of processes

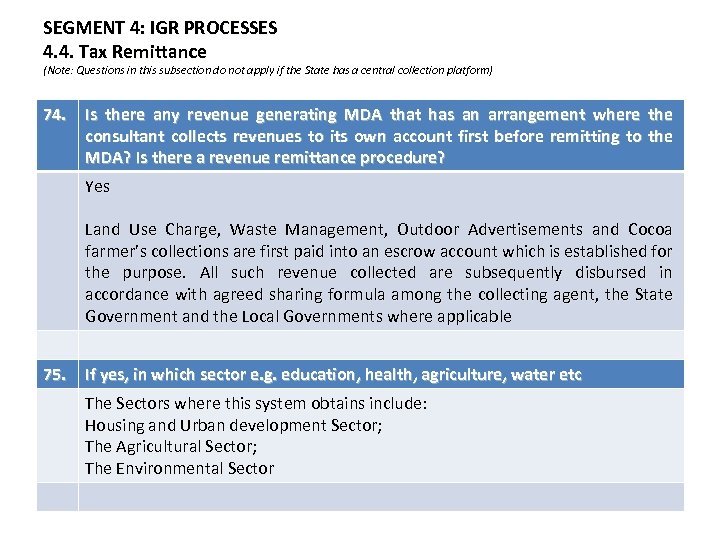

SEGMENT 4: IGR PROCESSES 4. 4. Tax Remittance (Note: Questions in this subsection do not apply if the State has a central collection platform) 74. Is there any revenue generating MDA that has an arrangement where the consultant collects revenues to its own account first before remitting to the MDA? Is there a revenue remittance procedure? Yes Land Use Charge, Waste Management, Outdoor Advertisements and Cocoa farmer’s collections are first paid into an escrow account which is established for the purpose. All such revenue collected are subsequently disbursed in accordance with agreed sharing formula among the collecting agent, the State Government and the Local Governments where applicable 75. If yes, in which sector e. g. education, health, agriculture, water etc The Sectors where this system obtains include: Housing and Urban development Sector; The Agricultural Sector; The Environmental Sector

SEGMENT 4: IGR PROCESSES 4. 4. Tax Remittance (Note: Questions in this subsection do not apply if the State has a central collection platform) 74. Is there any revenue generating MDA that has an arrangement where the consultant collects revenues to its own account first before remitting to the MDA? Is there a revenue remittance procedure? Yes Land Use Charge, Waste Management, Outdoor Advertisements and Cocoa farmer’s collections are first paid into an escrow account which is established for the purpose. All such revenue collected are subsequently disbursed in accordance with agreed sharing formula among the collecting agent, the State Government and the Local Governments where applicable 75. If yes, in which sector e. g. education, health, agriculture, water etc The Sectors where this system obtains include: Housing and Urban development Sector; The Agricultural Sector; The Environmental Sector

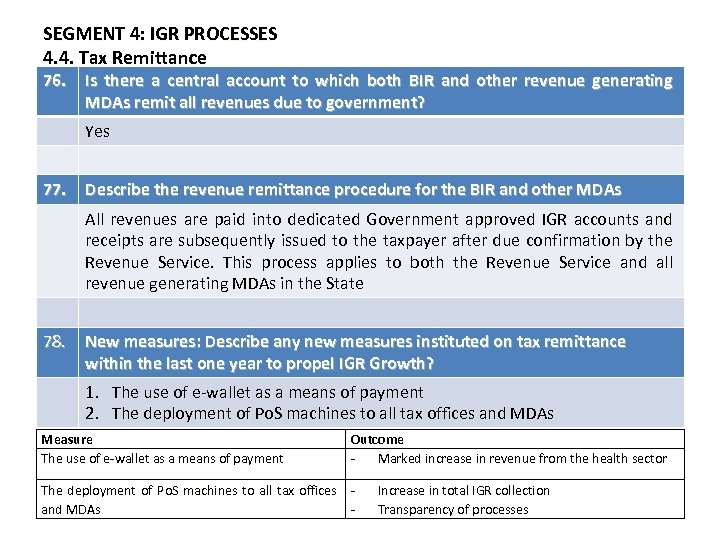

SEGMENT 4: IGR PROCESSES 4. 4. Tax Remittance 76. Is there a central account to which both BIR and other revenue generating MDAs remit all revenues due to government? Yes 77. Describe the revenue remittance procedure for the BIR and other MDAs All revenues are paid into dedicated Government approved IGR accounts and receipts are subsequently issued to the taxpayer after due confirmation by the Revenue Service. This process applies to both the Revenue Service and all revenue generating MDAs in the State 78. New measures: Describe any new measures instituted on tax remittance within the last one year to propel IGR Growth? 1. The use of e-wallet as a means of payment 2. The deployment of Po. S machines to all tax offices and MDAs Measure The use of e-wallet as a means of payment Outcome Marked increase in revenue from the health sector The deployment of Po. S machines to all tax offices and MDAs - Increase in total IGR collection Transparency of processes

SEGMENT 4: IGR PROCESSES 4. 4. Tax Remittance 76. Is there a central account to which both BIR and other revenue generating MDAs remit all revenues due to government? Yes 77. Describe the revenue remittance procedure for the BIR and other MDAs All revenues are paid into dedicated Government approved IGR accounts and receipts are subsequently issued to the taxpayer after due confirmation by the Revenue Service. This process applies to both the Revenue Service and all revenue generating MDAs in the State 78. New measures: Describe any new measures instituted on tax remittance within the last one year to propel IGR Growth? 1. The use of e-wallet as a means of payment 2. The deployment of Po. S machines to all tax offices and MDAs Measure The use of e-wallet as a means of payment Outcome Marked increase in revenue from the health sector The deployment of Po. S machines to all tax offices and MDAs - Increase in total IGR collection Transparency of processes

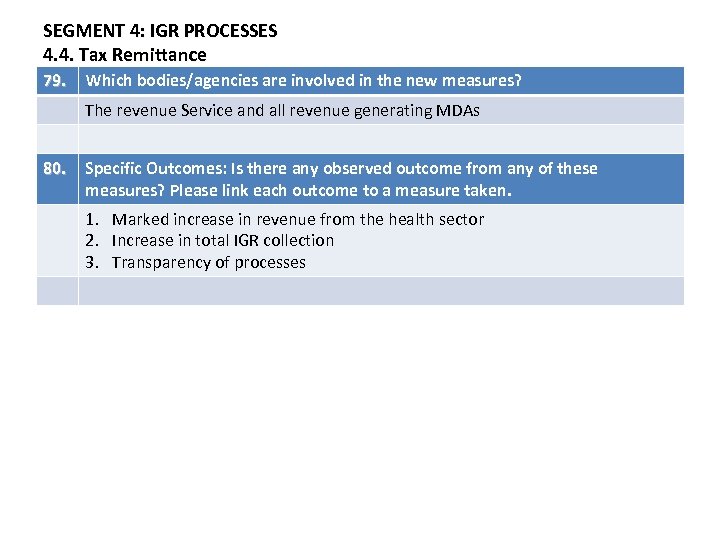

SEGMENT 4: IGR PROCESSES 4. 4. Tax Remittance 79. Which bodies/agencies are involved in the new measures? The revenue Service and all revenue generating MDAs 80. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. 1. Marked increase in revenue from the health sector 2. Increase in total IGR collection 3. Transparency of processes

SEGMENT 4: IGR PROCESSES 4. 4. Tax Remittance 79. Which bodies/agencies are involved in the new measures? The revenue Service and all revenue generating MDAs 80. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. 1. Marked increase in revenue from the health sector 2. Increase in total IGR collection 3. Transparency of processes

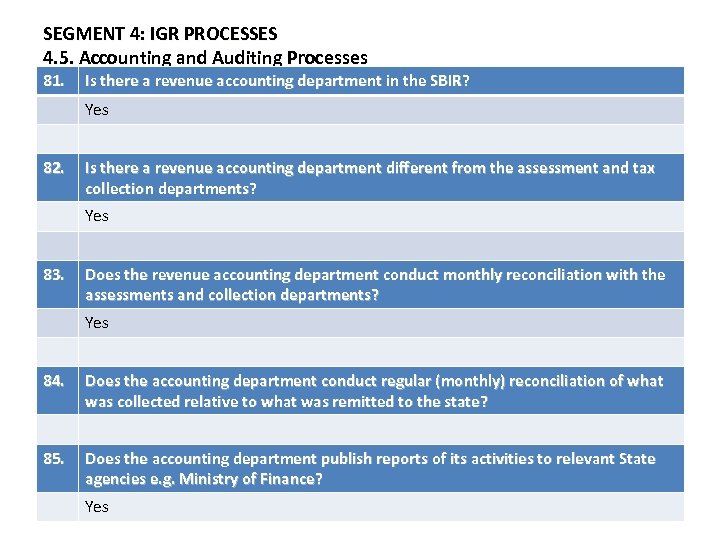

SEGMENT 4: IGR PROCESSES 4. 5. Accounting and Auditing Processes 81. Is there a revenue accounting department in the SBIR? Yes 82. Is there a revenue accounting department different from the assessment and tax collection departments? Yes 83. Does the revenue accounting department conduct monthly reconciliation with the assessments and collection departments? Yes 84. Does the accounting department conduct regular (monthly) reconciliation of what was collected relative to what was remitted to the state? 85. Does the accounting department publish reports of its activities to relevant State agencies e. g. Ministry of Finance? Yes

SEGMENT 4: IGR PROCESSES 4. 5. Accounting and Auditing Processes 81. Is there a revenue accounting department in the SBIR? Yes 82. Is there a revenue accounting department different from the assessment and tax collection departments? Yes 83. Does the revenue accounting department conduct monthly reconciliation with the assessments and collection departments? Yes 84. Does the accounting department conduct regular (monthly) reconciliation of what was collected relative to what was remitted to the state? 85. Does the accounting department publish reports of its activities to relevant State agencies e. g. Ministry of Finance? Yes

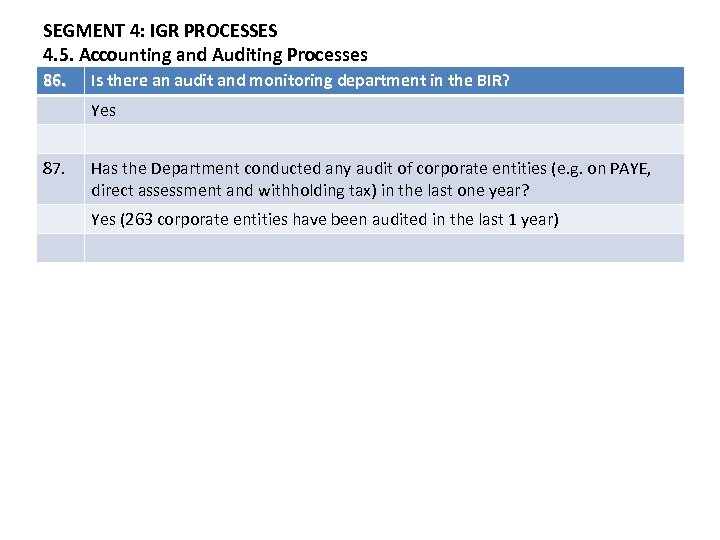

SEGMENT 4: IGR PROCESSES 4. 5. Accounting and Auditing Processes 86. Is there an audit and monitoring department in the BIR? Yes 87. Has the Department conducted any audit of corporate entities (e. g. on PAYE, direct assessment and withholding tax) in the last one year? Yes (263 corporate entities have been audited in the last 1 year)

SEGMENT 4: IGR PROCESSES 4. 5. Accounting and Auditing Processes 86. Is there an audit and monitoring department in the BIR? Yes 87. Has the Department conducted any audit of corporate entities (e. g. on PAYE, direct assessment and withholding tax) in the last one year? Yes (263 corporate entities have been audited in the last 1 year)

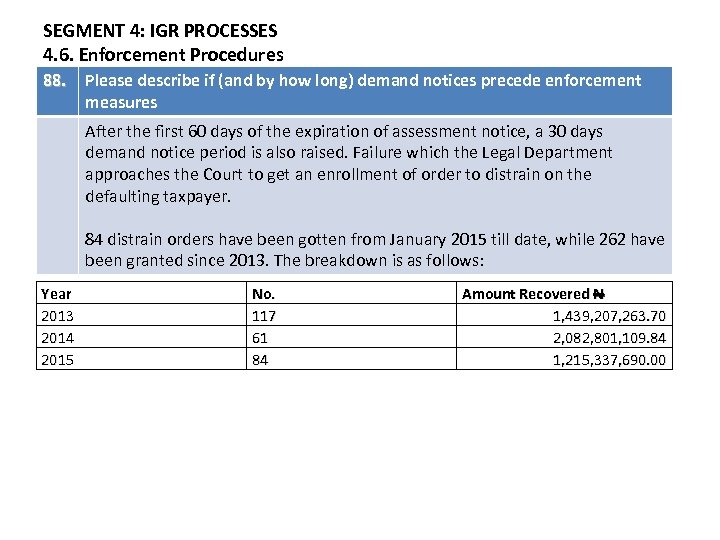

SEGMENT 4: IGR PROCESSES 4. 6. Enforcement Procedures 88. Please describe if (and by how long) demand notices precede enforcement measures After the first 60 days of the expiration of assessment notice, a 30 days demand notice period is also raised. Failure which the Legal Department approaches the Court to get an enrollment of order to distrain on the defaulting taxpayer. 84 distrain orders have been gotten from January 2015 till date, while 262 have been granted since 2013. The breakdown is as follows: Year 2013 2014 2015 No. 117 61 84 Amount Recovered N 1, 439, 207, 263. 70 2, 082, 801, 109. 84 1, 215, 337, 690. 00

SEGMENT 4: IGR PROCESSES 4. 6. Enforcement Procedures 88. Please describe if (and by how long) demand notices precede enforcement measures After the first 60 days of the expiration of assessment notice, a 30 days demand notice period is also raised. Failure which the Legal Department approaches the Court to get an enrollment of order to distrain on the defaulting taxpayer. 84 distrain orders have been gotten from January 2015 till date, while 262 have been granted since 2013. The breakdown is as follows: Year 2013 2014 2015 No. 117 61 84 Amount Recovered N 1, 439, 207, 263. 70 2, 082, 801, 109. 84 1, 215, 337, 690. 00

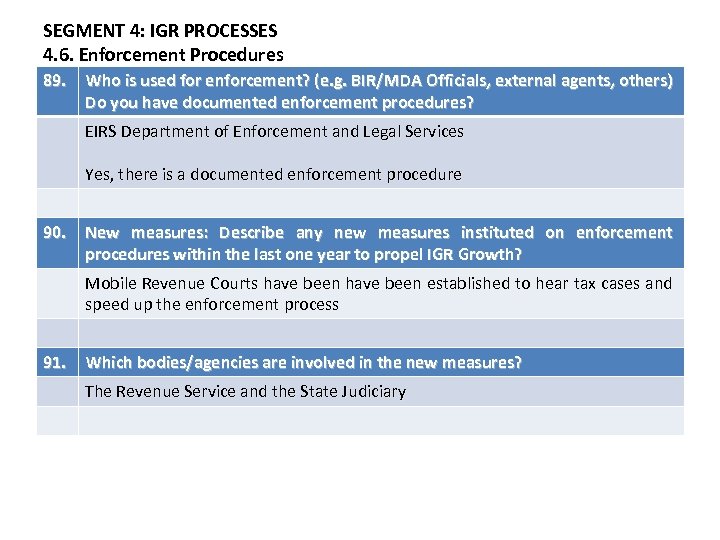

SEGMENT 4: IGR PROCESSES 4. 6. Enforcement Procedures 89. Who is used for enforcement? (e. g. BIR/MDA Officials, external agents, others) Do you have documented enforcement procedures? EIRS Department of Enforcement and Legal Services Yes, there is a documented enforcement procedure 90. New measures: Describe any new measures instituted on enforcement procedures within the last one year to propel IGR Growth? Mobile Revenue Courts have been established to hear tax cases and speed up the enforcement process 91. Which bodies/agencies are involved in the new measures? The Revenue Service and the State Judiciary

SEGMENT 4: IGR PROCESSES 4. 6. Enforcement Procedures 89. Who is used for enforcement? (e. g. BIR/MDA Officials, external agents, others) Do you have documented enforcement procedures? EIRS Department of Enforcement and Legal Services Yes, there is a documented enforcement procedure 90. New measures: Describe any new measures instituted on enforcement procedures within the last one year to propel IGR Growth? Mobile Revenue Courts have been established to hear tax cases and speed up the enforcement process 91. Which bodies/agencies are involved in the new measures? The Revenue Service and the State Judiciary

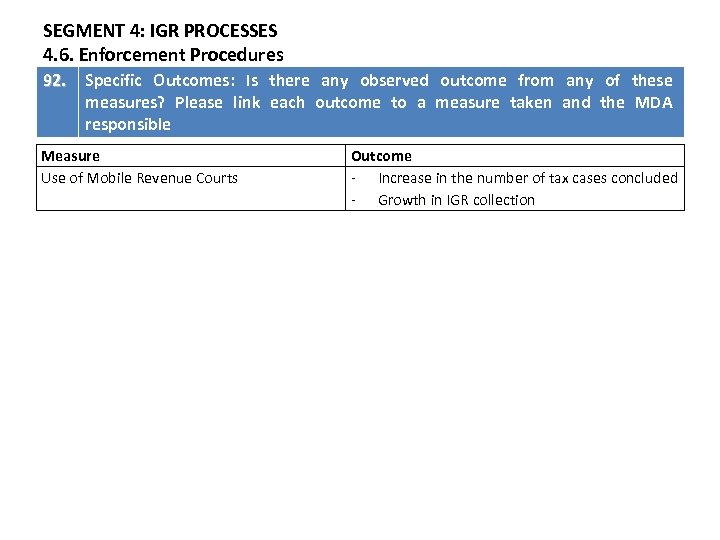

SEGMENT 4: IGR PROCESSES 4. 6. Enforcement Procedures 92. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken and the MDA responsible Measure Use of Mobile Revenue Courts Outcome - Increase in the number of tax cases concluded - Growth in IGR collection

SEGMENT 4: IGR PROCESSES 4. 6. Enforcement Procedures 92. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken and the MDA responsible Measure Use of Mobile Revenue Courts Outcome - Increase in the number of tax cases concluded - Growth in IGR collection

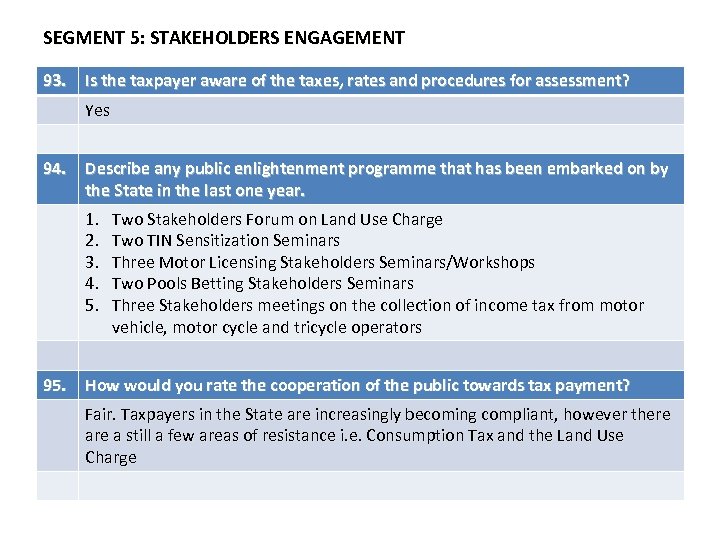

SEGMENT 5: STAKEHOLDERS ENGAGEMENT 93. Is the taxpayer aware of the taxes, rates and procedures for assessment? Yes 94. Describe any public enlightenment programme that has been embarked on by the State in the last one year. 1. 2. 3. 4. 5. 95. Two Stakeholders Forum on Land Use Charge Two TIN Sensitization Seminars Three Motor Licensing Stakeholders Seminars/Workshops Two Pools Betting Stakeholders Seminars Three Stakeholders meetings on the collection of income tax from motor vehicle, motor cycle and tricycle operators How would you rate the cooperation of the public towards tax payment? Fair. Taxpayers in the State are increasingly becoming compliant, however there a still a few areas of resistance i. e. Consumption Tax and the Land Use Charge

SEGMENT 5: STAKEHOLDERS ENGAGEMENT 93. Is the taxpayer aware of the taxes, rates and procedures for assessment? Yes 94. Describe any public enlightenment programme that has been embarked on by the State in the last one year. 1. 2. 3. 4. 5. 95. Two Stakeholders Forum on Land Use Charge Two TIN Sensitization Seminars Three Motor Licensing Stakeholders Seminars/Workshops Two Pools Betting Stakeholders Seminars Three Stakeholders meetings on the collection of income tax from motor vehicle, motor cycle and tricycle operators How would you rate the cooperation of the public towards tax payment? Fair. Taxpayers in the State are increasingly becoming compliant, however there a still a few areas of resistance i. e. Consumption Tax and the Land Use Charge

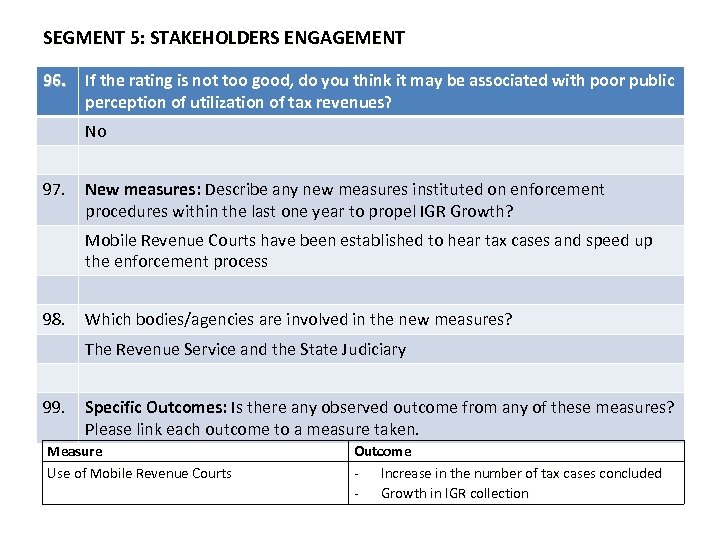

SEGMENT 5: STAKEHOLDERS ENGAGEMENT 96. If the rating is not too good, do you think it may be associated with poor public perception of utilization of tax revenues? No 97. New measures: Describe any new measures instituted on enforcement procedures within the last one year to propel IGR Growth? Mobile Revenue Courts have been established to hear tax cases and speed up the enforcement process 98. Which bodies/agencies are involved in the new measures? The Revenue Service and the State Judiciary 99. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. Measure Use of Mobile Revenue Courts Outcome - Increase in the number of tax cases concluded - Growth in IGR collection

SEGMENT 5: STAKEHOLDERS ENGAGEMENT 96. If the rating is not too good, do you think it may be associated with poor public perception of utilization of tax revenues? No 97. New measures: Describe any new measures instituted on enforcement procedures within the last one year to propel IGR Growth? Mobile Revenue Courts have been established to hear tax cases and speed up the enforcement process 98. Which bodies/agencies are involved in the new measures? The Revenue Service and the State Judiciary 99. Specific Outcomes: Is there any observed outcome from any of these measures? Please link each outcome to a measure taken. Measure Use of Mobile Revenue Courts Outcome - Increase in the number of tax cases concluded - Growth in IGR collection

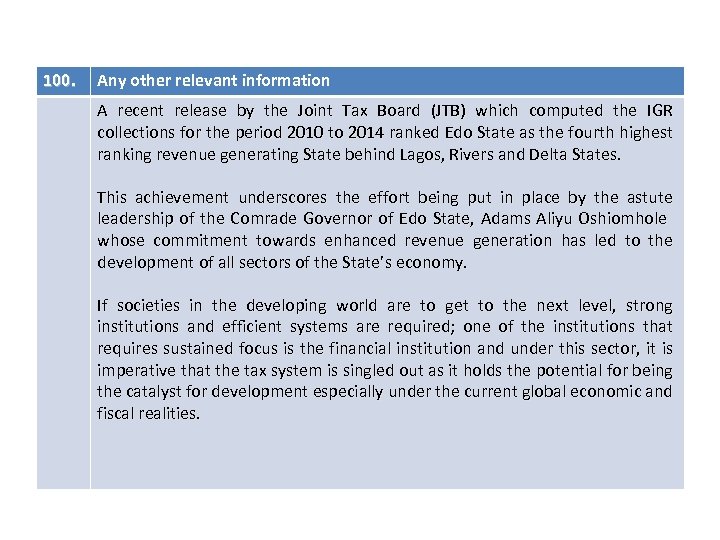

100. Any other relevant information A recent release by the Joint Tax Board (JTB) which computed the IGR collections for the period 2010 to 2014 ranked Edo State as the fourth highest ranking revenue generating State behind Lagos, Rivers and Delta States. This achievement underscores the effort being put in place by the astute leadership of the Comrade Governor of Edo State, Adams Aliyu Oshiomhole whose commitment towards enhanced revenue generation has led to the development of all sectors of the State’s economy. If societies in the developing world are to get to the next level, strong institutions and efficient systems are required; one of the institutions that requires sustained focus is the financial institution and under this sector, it is imperative that the tax system is singled out as it holds the potential for being the catalyst for development especially under the current global economic and fiscal realities.

100. Any other relevant information A recent release by the Joint Tax Board (JTB) which computed the IGR collections for the period 2010 to 2014 ranked Edo State as the fourth highest ranking revenue generating State behind Lagos, Rivers and Delta States. This achievement underscores the effort being put in place by the astute leadership of the Comrade Governor of Edo State, Adams Aliyu Oshiomhole whose commitment towards enhanced revenue generation has led to the development of all sectors of the State’s economy. If societies in the developing world are to get to the next level, strong institutions and efficient systems are required; one of the institutions that requires sustained focus is the financial institution and under this sector, it is imperative that the tax system is singled out as it holds the potential for being the catalyst for development especially under the current global economic and fiscal realities.

Thank you

Thank you