ecbe943139f264136a4d8ef3edb27fd1.ppt

- Количество слайдов: 41

NHS Supply Chain Segmentation Analysis Jahanara Choudhury Geoff Ellis Delivering value to the NHS

NHS Supply Chain Segmentation Analysis Jahanara Choudhury Geoff Ellis Delivering value to the NHS

Background information Delivering value to the NHS

Background information Delivering value to the NHS

An introduction The Department of Health (Do. H) engaged with industry to identify and appoint an organisation to fulfil a set of key objectives: Ø Ø Ø • • Centralising procurement Achieving value for money for the NHS Reducing management costs Managing financial risk Making the most effective use of resources DHL appointed 1 st October 2006 to manage on behalf of the Do. H an organisation – NHS Supply Chain is the integration of NHS Logistics, Part of NHS Pa. SA and DHL / / NHS Supply Chain has exclusive scope from the UK Department of Health covering over £ 5 bn of market. This represents over 28% of NHS procurement spend. Delivering value to the NHS

An introduction The Department of Health (Do. H) engaged with industry to identify and appoint an organisation to fulfil a set of key objectives: Ø Ø Ø • • Centralising procurement Achieving value for money for the NHS Reducing management costs Managing financial risk Making the most effective use of resources DHL appointed 1 st October 2006 to manage on behalf of the Do. H an organisation – NHS Supply Chain is the integration of NHS Logistics, Part of NHS Pa. SA and DHL / / NHS Supply Chain has exclusive scope from the UK Department of Health covering over £ 5 bn of market. This represents over 28% of NHS procurement spend. Delivering value to the NHS

Who do we work with? • NHS Supply Chain works with around 600 trusts to provide an end-to-end supply chain service or one of our key services: – – – – Acute care trusts primary care trusts mental health organisations ambulance service private sector service providers collaborative procurement hubs patients in their homes. Delivering value to the NHS

Who do we work with? • NHS Supply Chain works with around 600 trusts to provide an end-to-end supply chain service or one of our key services: – – – – Acute care trusts primary care trusts mental health organisations ambulance service private sector service providers collaborative procurement hubs patients in their homes. Delivering value to the NHS

Our customers Delivering value to the NHS

Our customers Delivering value to the NHS

Product categories • • • Food and kitchen office products, print and stationery uniforms, clothing and linen furniture and office equipment medical and facility furniture lab/pathology products and equipment medical supplies medical and surgical equipment operating theatre supplies patient appliances maintenance capital equipment. Delivering value to the NHS

Product categories • • • Food and kitchen office products, print and stationery uniforms, clothing and linen furniture and office equipment medical and facility furniture lab/pathology products and equipment medical supplies medical and surgical equipment operating theatre supplies patient appliances maintenance capital equipment. Delivering value to the NHS

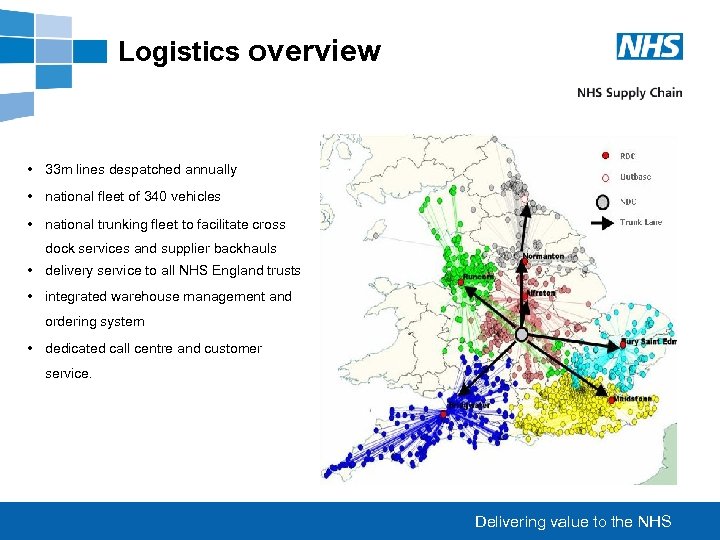

Logistics overview • 33 m lines despatched annually • national fleet of 340 vehicles • national trunking fleet to facilitate cross dock services and supplier backhauls • delivery service to all NHS England trusts • integrated warehouse management and ordering system • dedicated call centre and customer service. Delivering value to the NHS

Logistics overview • 33 m lines despatched annually • national fleet of 340 vehicles • national trunking fleet to facilitate cross dock services and supplier backhauls • delivery service to all NHS England trusts • integrated warehouse management and ordering system • dedicated call centre and customer service. Delivering value to the NHS

Logistics overview Core logistics services offering: • 51, 000 product lines • consolidated service using a combination of stock, cross dock, co-ordinated direct delivery and patient home delivery service • break bulk to specific order requirements, e. g. ward, department, clinic, home • 48 hour service or 24 hour for critical care, eg theatres • 98% availability, 99% on critical lines • 98% delivery on time measured to within +/- 30 minutes of promise • five hour emergency response when needed. Delivering value to the NHS

Logistics overview Core logistics services offering: • 51, 000 product lines • consolidated service using a combination of stock, cross dock, co-ordinated direct delivery and patient home delivery service • break bulk to specific order requirements, e. g. ward, department, clinic, home • 48 hour service or 24 hour for critical care, eg theatres • 98% availability, 99% on critical lines • 98% delivery on time measured to within +/- 30 minutes of promise • five hour emergency response when needed. Delivering value to the NHS

Summary Delivering value to the NHS

Summary Delivering value to the NHS

Key facts • We supply to over 250, 000 NHS requisition points • we deliver to over 10, 000 delivery locations • we service 120, 000 patients in their own home • our catalogue range covers over 610, 000 different products • we manage over 4 million NHS orders every year, servicing over 30 million order lines • we send out only 52 invoices a year to each trust • dedicated and closed loop transport fleet. Delivering value to the NHS

Key facts • We supply to over 250, 000 NHS requisition points • we deliver to over 10, 000 delivery locations • we service 120, 000 patients in their own home • our catalogue range covers over 610, 000 different products • we manage over 4 million NHS orders every year, servicing over 30 million order lines • we send out only 52 invoices a year to each trust • dedicated and closed loop transport fleet. Delivering value to the NHS

Commercial arrangements • NHS trusts are not obliged to use NHS Supply Chain • Prices will include a margin as they have previously • Cost base transferred from Department of Health for NHS Logistics Authority and NHS PASA; increased by new recruitment • No underwrite of profit for DHL but upper cap in place. Delivering value to the NHS

Commercial arrangements • NHS trusts are not obliged to use NHS Supply Chain • Prices will include a margin as they have previously • Cost base transferred from Department of Health for NHS Logistics Authority and NHS PASA; increased by new recruitment • No underwrite of profit for DHL but upper cap in place. Delivering value to the NHS

Why do we need to segment? • • To drive increased cost efficiency and profitable sales growth by migrating customers towards best in class behaviours To ensure we selling the right items to the right people Theatre / Surgical Services Medical Food & Facilities • Increase return on investment through targeted sales and marketing Clinical Markets • To ensure our service development meets customers needs Capital & Maintenance Delivering value to the NHS

Why do we need to segment? • • To drive increased cost efficiency and profitable sales growth by migrating customers towards best in class behaviours To ensure we selling the right items to the right people Theatre / Surgical Services Medical Food & Facilities • Increase return on investment through targeted sales and marketing Clinical Markets • To ensure our service development meets customers needs Capital & Maintenance Delivering value to the NHS

Customer segmentation • • Initial segmentation conducted to understand the user group of every single requisition point on our system - >100, 000 points reviewed and labelled Identification of 91 customer departments Analysis of 4 million transactions across 10, 000 requisition points as a sample to understand buying behavioural types across those segments, undertaken by a consultancy with segmentation expertise Review of outputs and qualification of findings Delivering value to the NHS

Customer segmentation • • Initial segmentation conducted to understand the user group of every single requisition point on our system - >100, 000 points reviewed and labelled Identification of 91 customer departments Analysis of 4 million transactions across 10, 000 requisition points as a sample to understand buying behavioural types across those segments, undertaken by a consultancy with segmentation expertise Review of outputs and qualification of findings Delivering value to the NHS

Contract Segmentation • • Phase 2 of segmentation based on products analysis 26 million transaction records analysed over a one year time frame Analysis of all classifications of trusts broken down into each region and classification Departmental contract segmentation completed 316 contracts analysed with over 51, 000 individual products 6 clusters created incorporating profitability, market value and transactional activity Customer information analysed at trust and department level Delivering value to the NHS

Contract Segmentation • • Phase 2 of segmentation based on products analysis 26 million transaction records analysed over a one year time frame Analysis of all classifications of trusts broken down into each region and classification Departmental contract segmentation completed 316 contracts analysed with over 51, 000 individual products 6 clusters created incorporating profitability, market value and transactional activity Customer information analysed at trust and department level Delivering value to the NHS

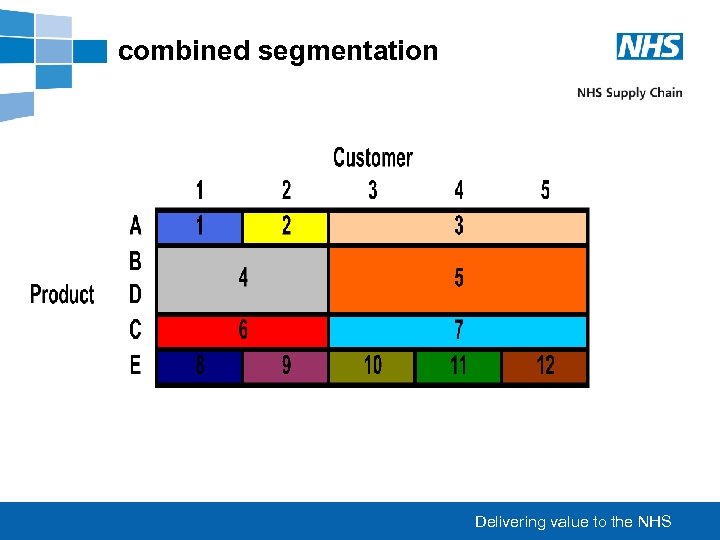

2 D Segmentation • The combination of segmentation by Product & by Customer • • • Review of outputs and qualification of findings Identification of 13 behavioural types/segments Next ready to start to use results to drive business strategies – Understand develop strategy for each segment – Influence multiple buying behaviours of each segment and migrate towards best in class Delivering value to the NHS

2 D Segmentation • The combination of segmentation by Product & by Customer • • • Review of outputs and qualification of findings Identification of 13 behavioural types/segments Next ready to start to use results to drive business strategies – Understand develop strategy for each segment – Influence multiple buying behaviours of each segment and migrate towards best in class Delivering value to the NHS

The Use of PASW (or even SPSS!) Geoff Ellis Delivering value to the NHS

The Use of PASW (or even SPSS!) Geoff Ellis Delivering value to the NHS

Segmentation aim • A 2 D segmentation • Each product belongs to a segment • Each Customer belongs to a segment • Each combination of product & Customer belongs to a unique segment Delivering value to the NHS

Segmentation aim • A 2 D segmentation • Each product belongs to a segment • Each Customer belongs to a segment • Each combination of product & Customer belongs to a unique segment Delivering value to the NHS

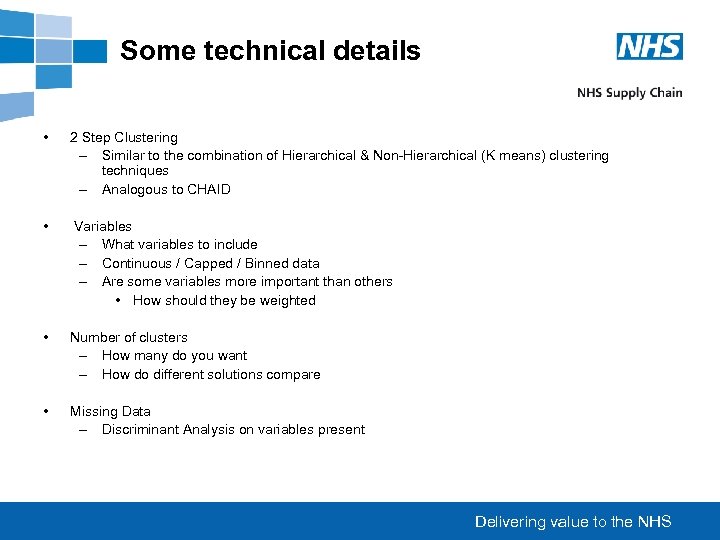

Some technical details • 2 Step Clustering – Similar to the combination of Hierarchical & Non-Hierarchical (K means) clustering techniques – Analogous to CHAID • Variables – What variables to include – Continuous / Capped / Binned data – Are some variables more important than others • How should they be weighted • Number of clusters – How many do you want – How do different solutions compare • Missing Data – Discriminant Analysis on variables present Delivering value to the NHS

Some technical details • 2 Step Clustering – Similar to the combination of Hierarchical & Non-Hierarchical (K means) clustering techniques – Analogous to CHAID • Variables – What variables to include – Continuous / Capped / Binned data – Are some variables more important than others • How should they be weighted • Number of clusters – How many do you want – How do different solutions compare • Missing Data – Discriminant Analysis on variables present Delivering value to the NHS

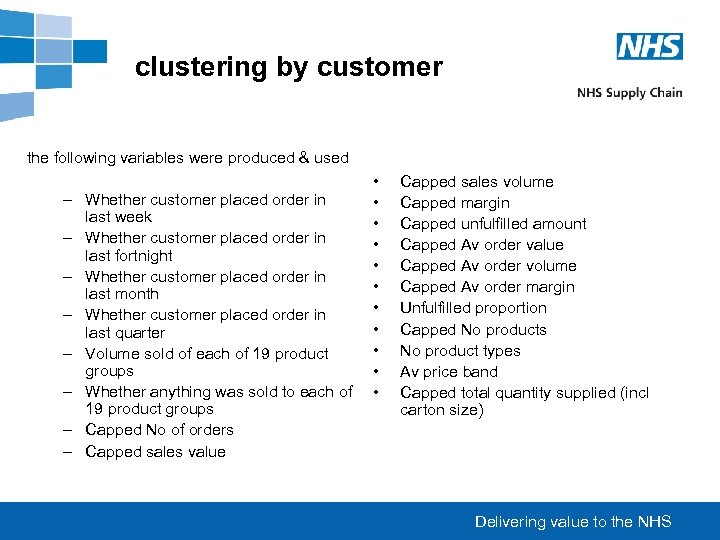

clustering by customer the following variables were produced & used – Whether customer placed order in last week – Whether customer placed order in last fortnight – Whether customer placed order in last month – Whether customer placed order in last quarter – Volume sold of each of 19 product groups – Whether anything was sold to each of 19 product groups – Capped No of orders – Capped sales value • • • Capped sales volume Capped margin Capped unfulfilled amount Capped Av order value Capped Av order volume Capped Av order margin Unfulfilled proportion Capped No products No product types Av price band Capped total quantity supplied (incl carton size) Delivering value to the NHS

clustering by customer the following variables were produced & used – Whether customer placed order in last week – Whether customer placed order in last fortnight – Whether customer placed order in last month – Whether customer placed order in last quarter – Volume sold of each of 19 product groups – Whether anything was sold to each of 19 product groups – Capped No of orders – Capped sales value • • • Capped sales volume Capped margin Capped unfulfilled amount Capped Av order value Capped Av order volume Capped Av order margin Unfulfilled proportion Capped No products No product types Av price band Capped total quantity supplied (incl carton size) Delivering value to the NHS

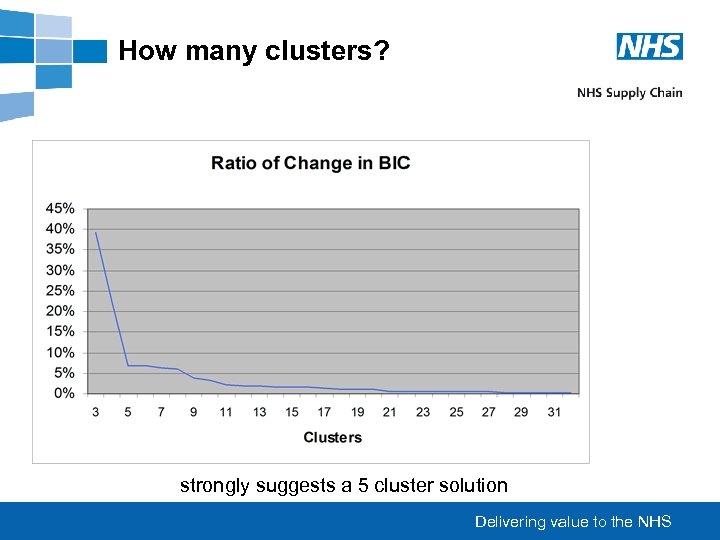

How many clusters? strongly suggests a 5 cluster solution Delivering value to the NHS

How many clusters? strongly suggests a 5 cluster solution Delivering value to the NHS

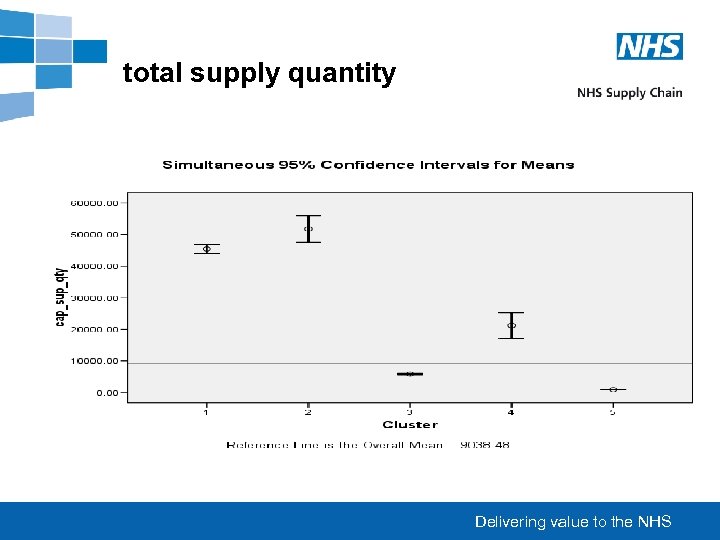

total supply quantity Delivering value to the NHS

total supply quantity Delivering value to the NHS

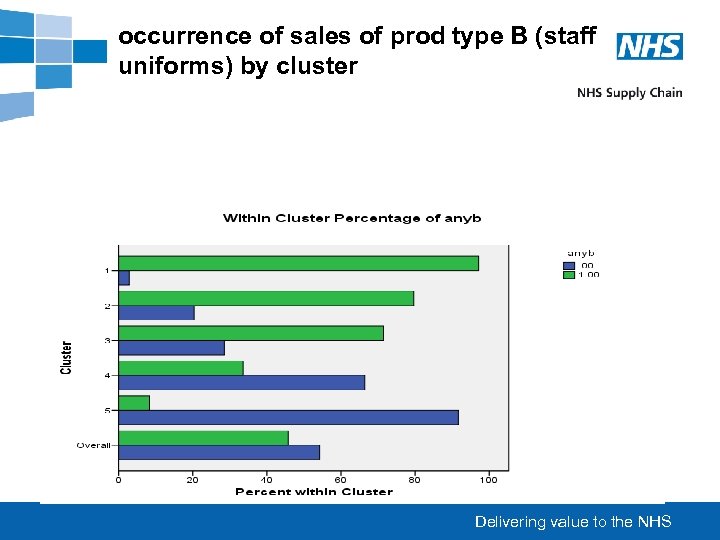

occurrence of sales of prod type B (staff uniforms) by cluster Delivering value to the NHS

occurrence of sales of prod type B (staff uniforms) by cluster Delivering value to the NHS

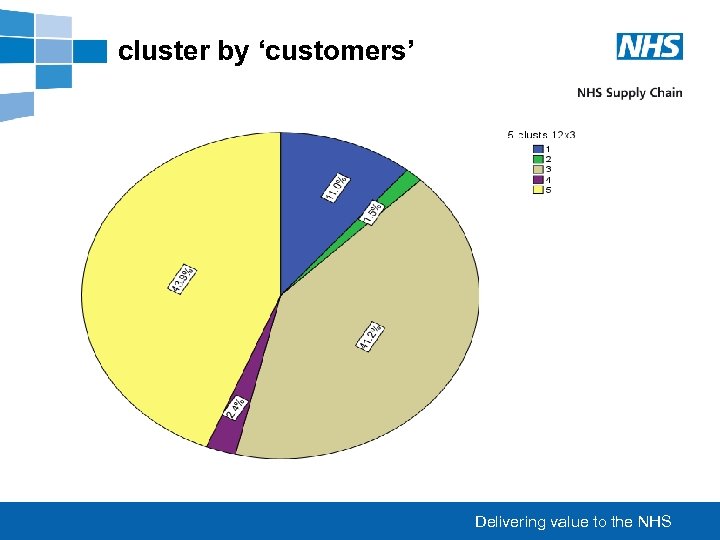

cluster by ‘customers’ Delivering value to the NHS

cluster by ‘customers’ Delivering value to the NHS

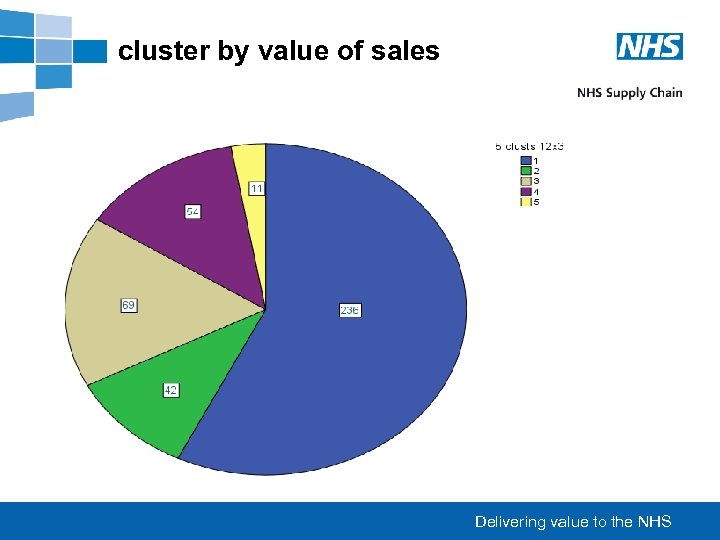

cluster by value of sales Delivering value to the NHS

cluster by value of sales Delivering value to the NHS

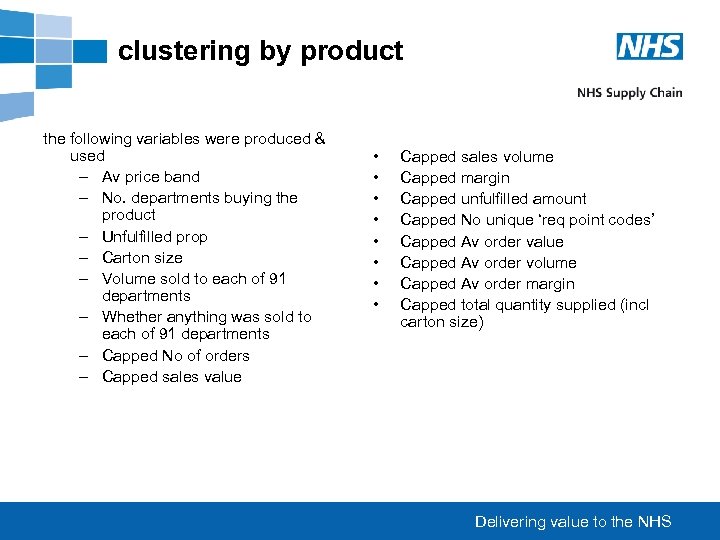

clustering by product the following variables were produced & used – Av price band – No. departments buying the product – Unfulfilled prop – Carton size – Volume sold to each of 91 departments – Whether anything was sold to each of 91 departments – Capped No of orders – Capped sales value • • Capped sales volume Capped margin Capped unfulfilled amount Capped No unique ‘req point codes’ Capped Av order value Capped Av order volume Capped Av order margin Capped total quantity supplied (incl carton size) Delivering value to the NHS

clustering by product the following variables were produced & used – Av price band – No. departments buying the product – Unfulfilled prop – Carton size – Volume sold to each of 91 departments – Whether anything was sold to each of 91 departments – Capped No of orders – Capped sales value • • Capped sales volume Capped margin Capped unfulfilled amount Capped No unique ‘req point codes’ Capped Av order value Capped Av order volume Capped Av order margin Capped total quantity supplied (incl carton size) Delivering value to the NHS

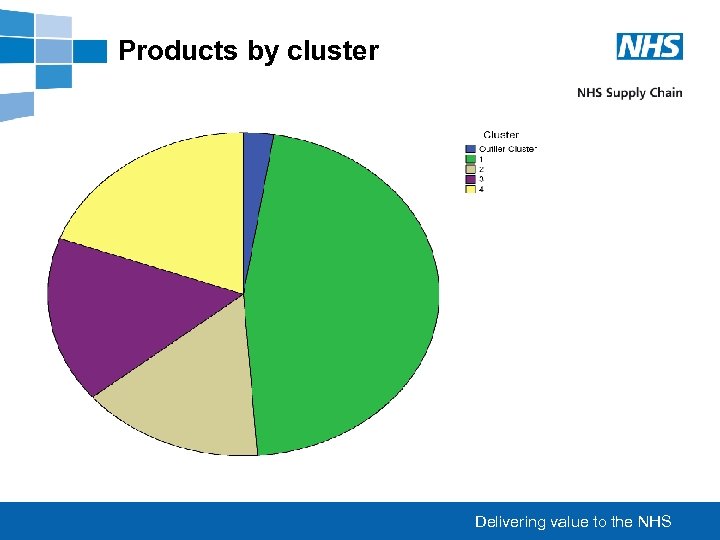

Products by cluster Delivering value to the NHS

Products by cluster Delivering value to the NHS

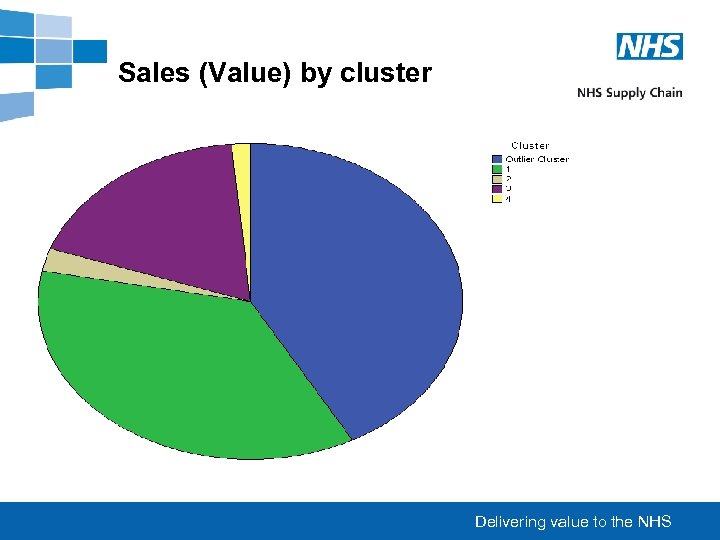

Sales (Value) by cluster Delivering value to the NHS

Sales (Value) by cluster Delivering value to the NHS

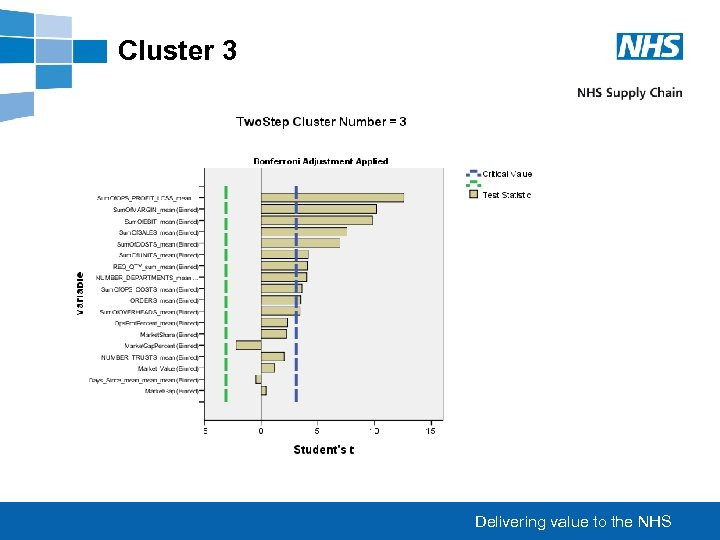

Cluster 3 Delivering value to the NHS

Cluster 3 Delivering value to the NHS

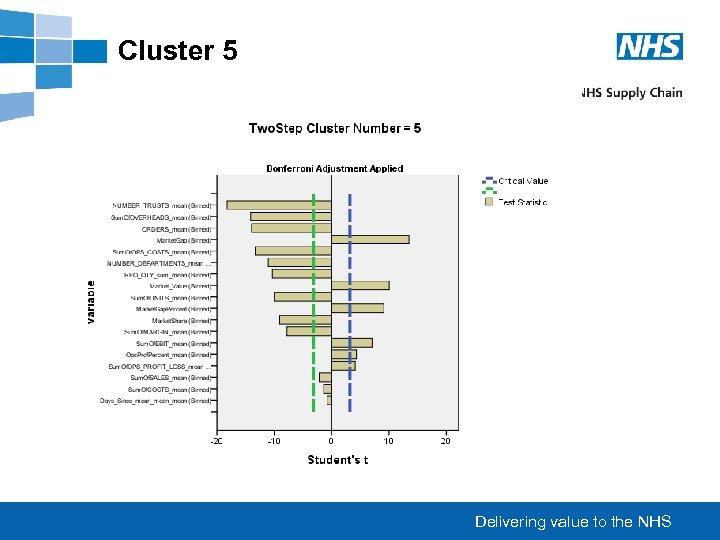

Cluster 5 Delivering value to the NHS

Cluster 5 Delivering value to the NHS

combined segmentation Delivering value to the NHS

combined segmentation Delivering value to the NHS

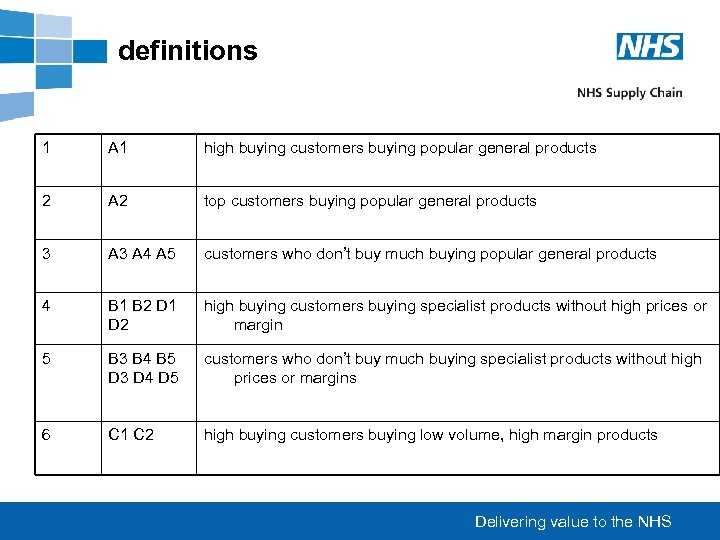

definitions 1 A 1 high buying customers buying popular general products 2 A 2 top customers buying popular general products 3 A 4 A 5 customers who don’t buy much buying popular general products 4 B 1 B 2 D 1 D 2 high buying customers buying specialist products without high prices or margin 5 B 3 B 4 B 5 D 3 D 4 D 5 customers who don’t buy much buying specialist products without high prices or margins 6 C 1 C 2 high buying customers buying low volume, high margin products Delivering value to the NHS

definitions 1 A 1 high buying customers buying popular general products 2 A 2 top customers buying popular general products 3 A 4 A 5 customers who don’t buy much buying popular general products 4 B 1 B 2 D 1 D 2 high buying customers buying specialist products without high prices or margin 5 B 3 B 4 B 5 D 3 D 4 D 5 customers who don’t buy much buying specialist products without high prices or margins 6 C 1 C 2 high buying customers buying low volume, high margin products Delivering value to the NHS

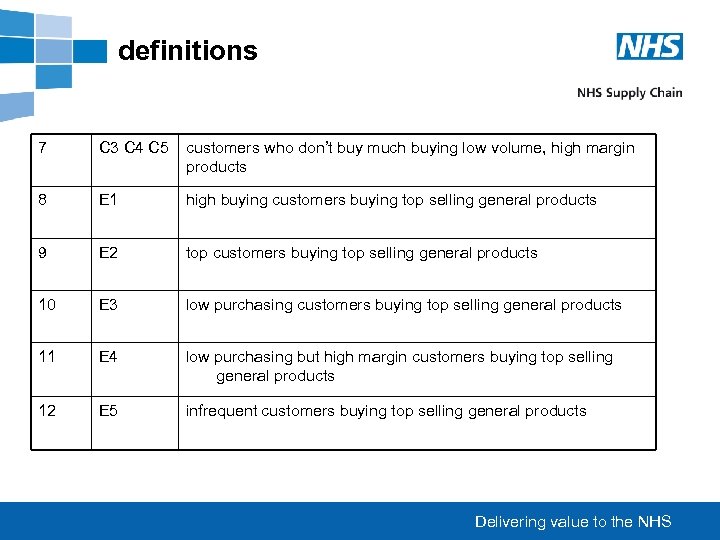

definitions 7 C 3 C 4 C 5 customers who don’t buy much buying low volume, high margin products 8 E 1 high buying customers buying top selling general products 9 E 2 top customers buying top selling general products 10 E 3 low purchasing customers buying top selling general products 11 E 4 low purchasing but high margin customers buying top selling general products 12 E 5 infrequent customers buying top selling general products Delivering value to the NHS

definitions 7 C 3 C 4 C 5 customers who don’t buy much buying low volume, high margin products 8 E 1 high buying customers buying top selling general products 9 E 2 top customers buying top selling general products 10 E 3 low purchasing customers buying top selling general products 11 E 4 low purchasing but high margin customers buying top selling general products 12 E 5 infrequent customers buying top selling general products Delivering value to the NHS

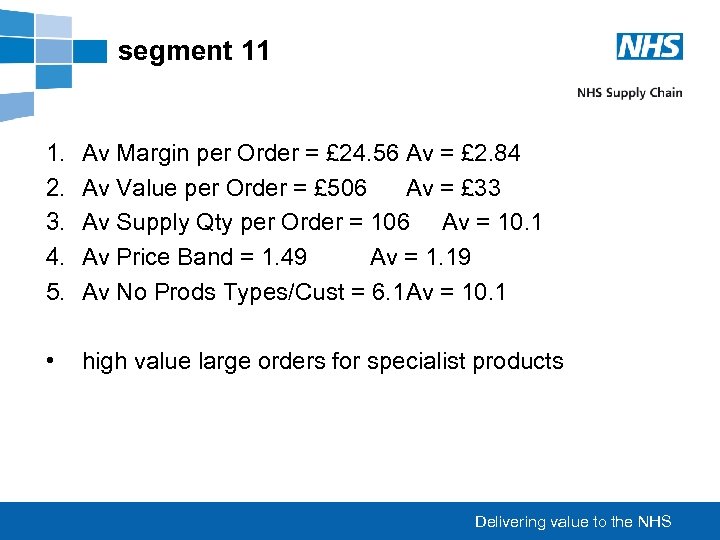

segment 11 1. 2. 3. 4. 5. Av Margin per Order = £ 24. 56 Av = £ 2. 84 Av Value per Order = £ 506 Av = £ 33 Av Supply Qty per Order = 106 Av = 10. 1 Av Price Band = 1. 49 Av = 1. 19 Av No Prods Types/Cust = 6. 1 Av = 10. 1 • high value large orders for specialist products Delivering value to the NHS

segment 11 1. 2. 3. 4. 5. Av Margin per Order = £ 24. 56 Av = £ 2. 84 Av Value per Order = £ 506 Av = £ 33 Av Supply Qty per Order = 106 Av = 10. 1 Av Price Band = 1. 49 Av = 1. 19 Av No Prods Types/Cust = 6. 1 Av = 10. 1 • high value large orders for specialist products Delivering value to the NHS

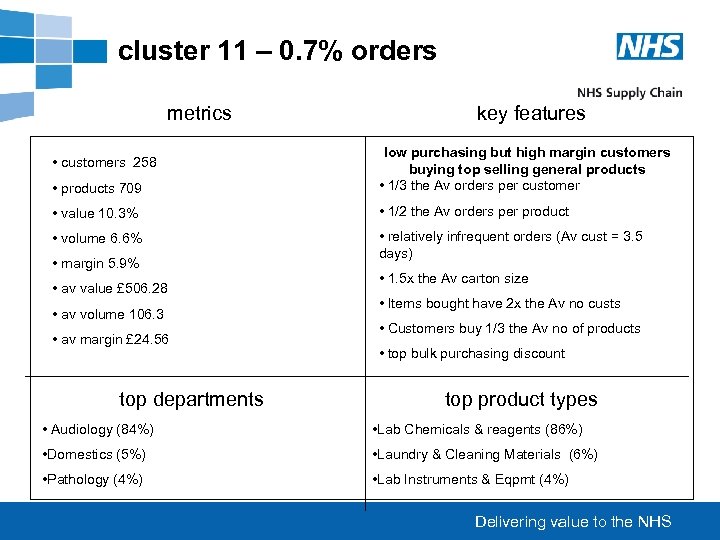

cluster 11 – 0. 7% orders metrics key features • products 709 low purchasing but high margin customers buying top selling general products • 1/3 the Av orders per customer • value 10. 3% • 1/2 the Av orders per product • volume 6. 6% • relatively infrequent orders (Av cust = 3. 5 days) • customers 258 • margin 5. 9% • av value £ 506. 28 • av volume 106. 3 • av margin £ 24. 56 top departments • 1. 5 x the Av carton size • Items bought have 2 x the Av no custs • Customers buy 1/3 the Av no of products • top bulk purchasing discount top product types • Audiology (84%) • Lab Chemicals & reagents (86%) • Domestics (5%) • Laundry & Cleaning Materials (6%) • Pathology (4%) • Lab Instruments & Eqpmt (4%) Delivering value to the NHS

cluster 11 – 0. 7% orders metrics key features • products 709 low purchasing but high margin customers buying top selling general products • 1/3 the Av orders per customer • value 10. 3% • 1/2 the Av orders per product • volume 6. 6% • relatively infrequent orders (Av cust = 3. 5 days) • customers 258 • margin 5. 9% • av value £ 506. 28 • av volume 106. 3 • av margin £ 24. 56 top departments • 1. 5 x the Av carton size • Items bought have 2 x the Av no custs • Customers buy 1/3 the Av no of products • top bulk purchasing discount top product types • Audiology (84%) • Lab Chemicals & reagents (86%) • Domestics (5%) • Laundry & Cleaning Materials (6%) • Pathology (4%) • Lab Instruments & Eqpmt (4%) Delivering value to the NHS

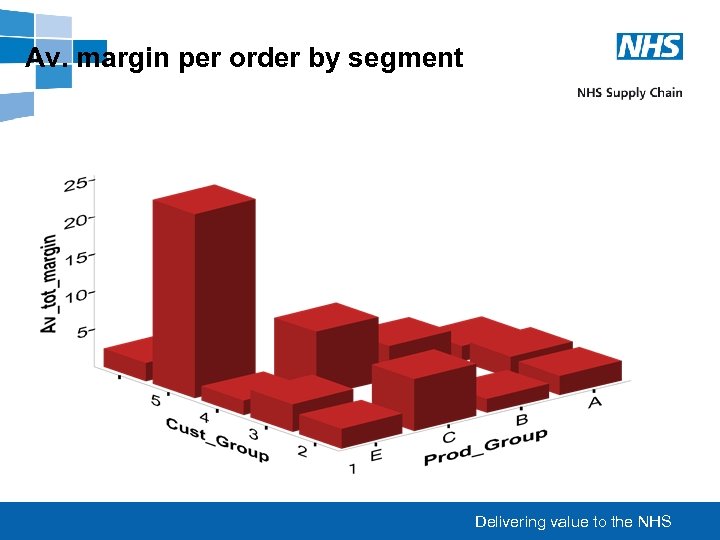

Av. margin per order by segment Delivering value to the NHS

Av. margin per order by segment Delivering value to the NHS

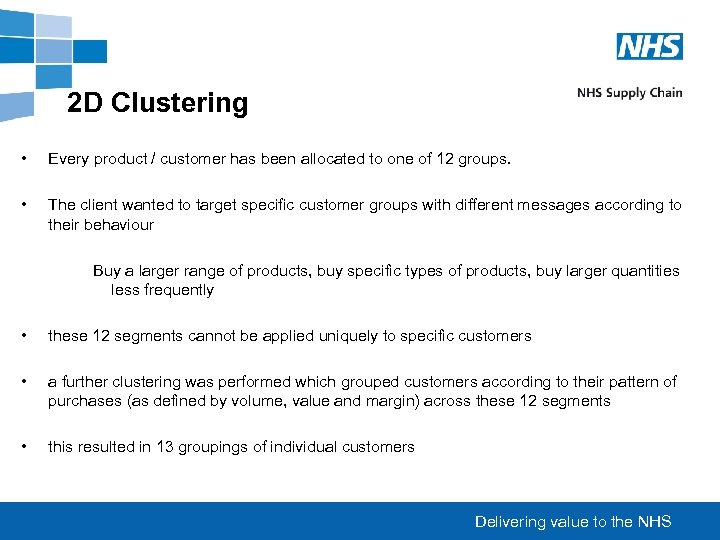

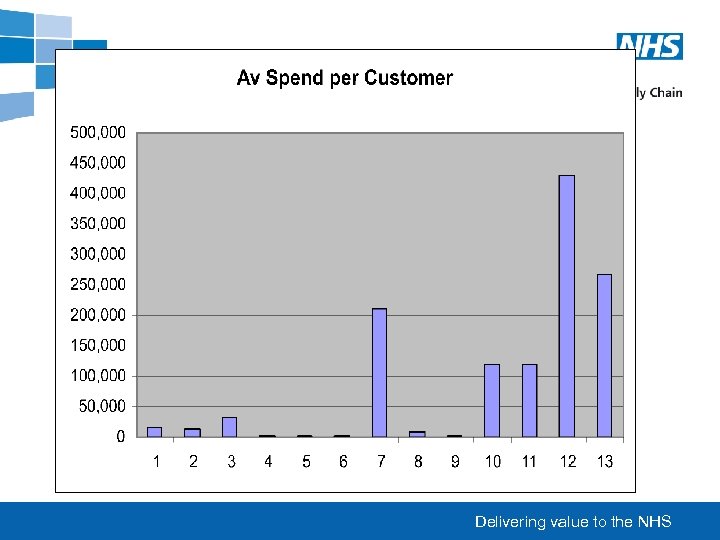

2 D Clustering • Every product / customer has been allocated to one of 12 groups. • The client wanted to target specific customer groups with different messages according to their behaviour Buy a larger range of products, buy specific types of products, buy larger quantities less frequently • these 12 segments cannot be applied uniquely to specific customers • a further clustering was performed which grouped customers according to their pattern of purchases (as defined by volume, value and margin) across these 12 segments • this resulted in 13 groupings of individual customers Delivering value to the NHS

2 D Clustering • Every product / customer has been allocated to one of 12 groups. • The client wanted to target specific customer groups with different messages according to their behaviour Buy a larger range of products, buy specific types of products, buy larger quantities less frequently • these 12 segments cannot be applied uniquely to specific customers • a further clustering was performed which grouped customers according to their pattern of purchases (as defined by volume, value and margin) across these 12 segments • this resulted in 13 groupings of individual customers Delivering value to the NHS

Delivering value to the NHS

Delivering value to the NHS

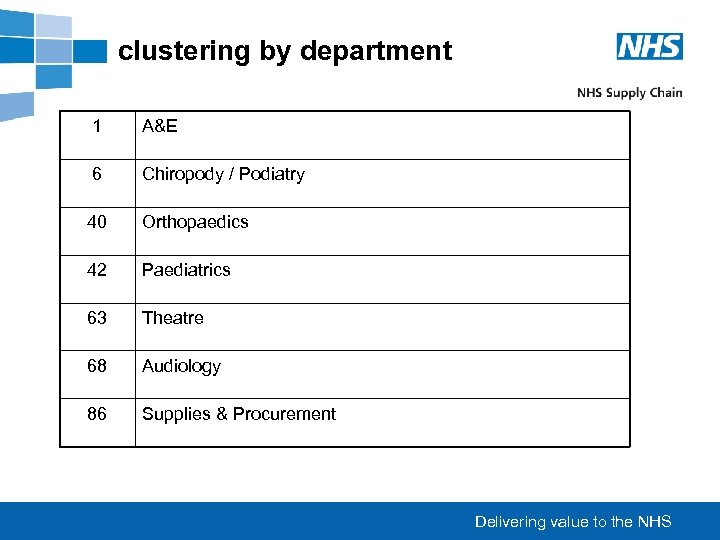

clustering by department 1 A&E 6 Chiropody / Podiatry 40 Orthopaedics 42 Paediatrics 63 Theatre 68 Audiology 86 Supplies & Procurement Delivering value to the NHS

clustering by department 1 A&E 6 Chiropody / Podiatry 40 Orthopaedics 42 Paediatrics 63 Theatre 68 Audiology 86 Supplies & Procurement Delivering value to the NHS

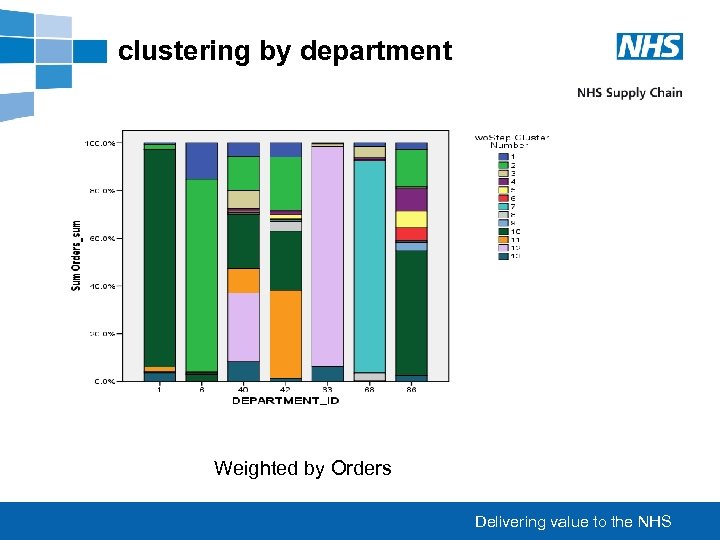

clustering by department Weighted by Orders Delivering value to the NHS

clustering by department Weighted by Orders Delivering value to the NHS

Targeted Marketing • By hospital (postcode) & department • A full day workshop with all marketing staff • Where are they now? • Where would we like them to be that’s feasible? • Resulted in 11 specifically targeted marketing and communication plans Delivering value to the NHS

Targeted Marketing • By hospital (postcode) & department • A full day workshop with all marketing staff • Where are they now? • Where would we like them to be that’s feasible? • Resulted in 11 specifically targeted marketing and communication plans Delivering value to the NHS

Any Questions? Delivering value to the NHS

Any Questions? Delivering value to the NHS