6aede3001892aa36d3ff5aa2ffa0f00a.ppt

- Количество слайдов: 24

NHH M&A – key processes and case studies Nov 7, 2013

NHH M&A – key processes and case studies Nov 7, 2013

M&A – today’s topics 1. Introduction – M&A in investment banking 2. The auction – how to maximize value 3. Case study – auction process 4. Public offer – how do delist a company 5. Case study – public offer

M&A – today’s topics 1. Introduction – M&A in investment banking 2. The auction – how to maximize value 3. Case study – auction process 4. Public offer – how do delist a company 5. Case study – public offer

M&A in investment banking 1. Sell side 2. Buy-side private company 3. Buy-side public company 4. Defense/”sell-side” public company Complex, often transformational process for management of the buyer and the target

M&A in investment banking 1. Sell side 2. Buy-side private company 3. Buy-side public company 4. Defense/”sell-side” public company Complex, often transformational process for management of the buyer and the target

Sell side process – the auction 1. Know the buyers 2. Prepare – know what you selling 3. Keep tension and momentum 4. Never end up with one buyer at any time in the process

Sell side process – the auction 1. Know the buyers 2. Prepare – know what you selling 3. Keep tension and momentum 4. Never end up with one buyer at any time in the process

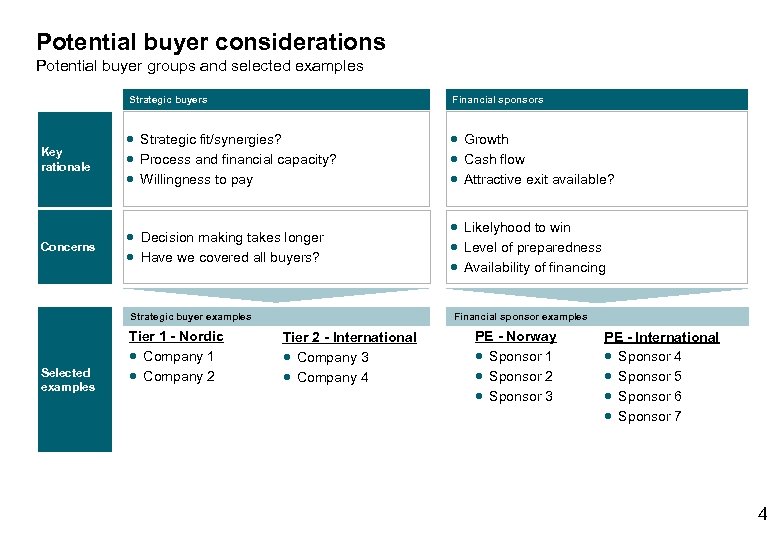

Potential buyer considerations Potential buyer groups and selected examples Strategic buyers Financial sponsors Key rationale Strategic fit/synergies? Process and financial capacity? Willingness to pay Growth Cash flow Attractive exit available? Concerns Decision making takes longer Have we covered all buyers? Likelyhood to win Level of preparedness Availability of financing Strategic buyer examples Selected examples Tier 1 - Nordic Company 1 Company 2 Financial sponsor examples Tier 2 - International Company 3 Company 4 PE - Norway Sponsor 1 Sponsor 2 Sponsor 3 PE - International Sponsor 4 Sponsor 5 Sponsor 6 Sponsor 7 4

Potential buyer considerations Potential buyer groups and selected examples Strategic buyers Financial sponsors Key rationale Strategic fit/synergies? Process and financial capacity? Willingness to pay Growth Cash flow Attractive exit available? Concerns Decision making takes longer Have we covered all buyers? Likelyhood to win Level of preparedness Availability of financing Strategic buyer examples Selected examples Tier 1 - Nordic Company 1 Company 2 Financial sponsor examples Tier 2 - International Company 3 Company 4 PE - Norway Sponsor 1 Sponsor 2 Sponsor 3 PE - International Sponsor 4 Sponsor 5 Sponsor 6 Sponsor 7 4

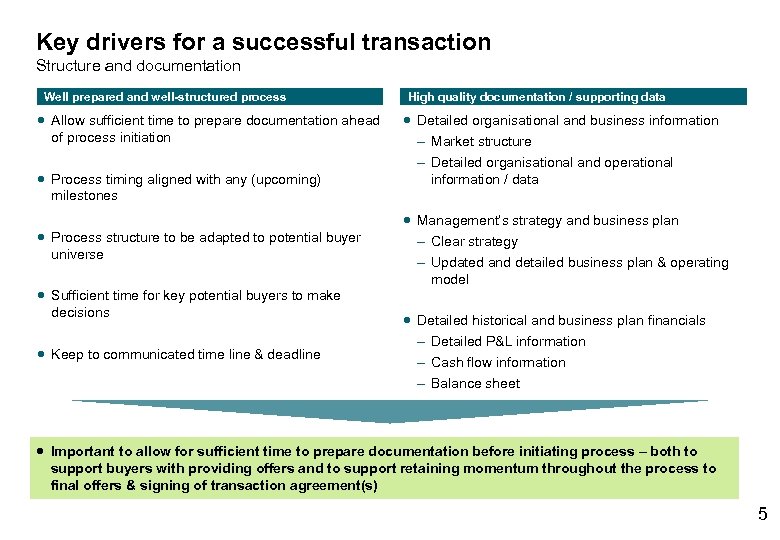

Key drivers for a successful transaction Structure and documentation Well prepared and well-structured process Allow sufficient time to prepare documentation ahead of process initiation Process timing aligned with any (upcoming) milestones Process structure to be adapted to potential buyer universe Sufficient time for key potential buyers to make decisions Keep to communicated time line & deadline High quality documentation / supporting data Detailed organisational and business information – Market structure – Detailed organisational and operational information / data Management’s strategy and business plan – Clear strategy – Updated and detailed business plan & operating model Detailed historical and business plan financials – Detailed P&L information – Cash flow information – Balance sheet Important to allow for sufficient time to prepare documentation before initiating process – both to support buyers with providing offers and to support retaining momentum throughout the process to final offers & signing of transaction agreement(s) 5

Key drivers for a successful transaction Structure and documentation Well prepared and well-structured process Allow sufficient time to prepare documentation ahead of process initiation Process timing aligned with any (upcoming) milestones Process structure to be adapted to potential buyer universe Sufficient time for key potential buyers to make decisions Keep to communicated time line & deadline High quality documentation / supporting data Detailed organisational and business information – Market structure – Detailed organisational and operational information / data Management’s strategy and business plan – Clear strategy – Updated and detailed business plan & operating model Detailed historical and business plan financials – Detailed P&L information – Cash flow information – Balance sheet Important to allow for sufficient time to prepare documentation before initiating process – both to support buyers with providing offers and to support retaining momentum throughout the process to final offers & signing of transaction agreement(s) 5

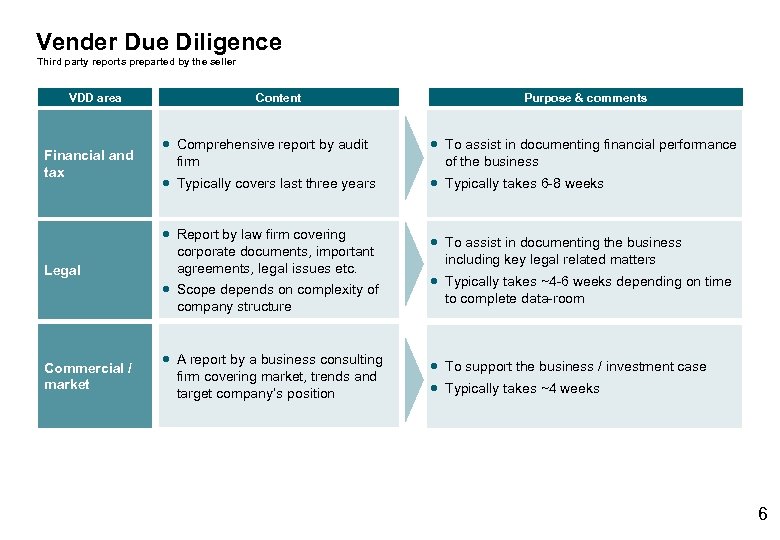

Vender Due Diligence Third party reports preparted by the seller VDD area Financial and tax Legal Content Comprehensive report by audit firm To assist in documenting financial performance of the business Typically covers last three years Typically takes 6 -8 weeks Report by law firm covering corporate documents, important agreements, legal issues etc. To assist in documenting the business including key legal related matters Scope depends on complexity of company structure Commercial / market Purpose & comments A report by a business consulting firm covering market, trends and target company’s position Typically takes ~4 -6 weeks depending on time to complete data-room To support the business / investment case Typically takes ~4 weeks 6

Vender Due Diligence Third party reports preparted by the seller VDD area Financial and tax Legal Content Comprehensive report by audit firm To assist in documenting financial performance of the business Typically covers last three years Typically takes 6 -8 weeks Report by law firm covering corporate documents, important agreements, legal issues etc. To assist in documenting the business including key legal related matters Scope depends on complexity of company structure Commercial / market Purpose & comments A report by a business consulting firm covering market, trends and target company’s position Typically takes ~4 -6 weeks depending on time to complete data-room To support the business / investment case Typically takes ~4 weeks 6

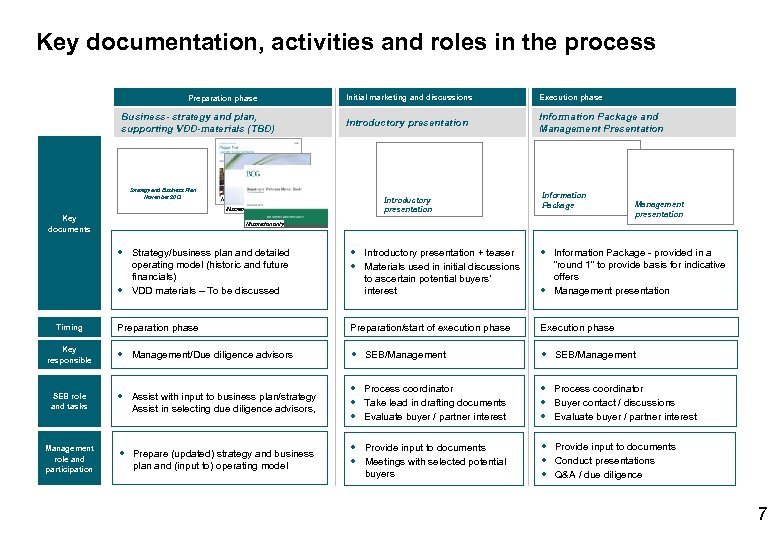

Key documentation, activities and roles in the process Preparation phase Business- strategy and plan, supporting VDD-materials (TBD) Strategy and Business Plan November 2013 Illustration only Key documents Initial marketing and discussions Execution phase Introductory presentation Information Package and Management Presentation Introductory presentation Information Package Management presentation Illustration only Strategy/business plan and detailed operating model (historic and future financials) VDD materials – To be discussed Introductory presentation + teaser Materials used in initial discussions to ascertain potential buyers’ interest Information Package - provided in a “round 1” to provide basis for indicative offers Management presentation Preparation phase Preparation/start of execution phase Execution phase Management/Due diligence advisors SEB/Management SEB role and tasks Assist with input to business plan/strategy Assist in selecting due diligence advisors, Process coordinator Take lead in drafting documents Evaluate buyer / partner interest Process coordinator Buyer contact / discussions Evaluate buyer / partner interest Management role and participation Prepare (updated) strategy and business plan and (input to) operating model Provide input to documents Meetings with selected potential buyers Provide input to documents Conduct presentations Q&A / due diligence Timing Key responsible 7

Key documentation, activities and roles in the process Preparation phase Business- strategy and plan, supporting VDD-materials (TBD) Strategy and Business Plan November 2013 Illustration only Key documents Initial marketing and discussions Execution phase Introductory presentation Information Package and Management Presentation Introductory presentation Information Package Management presentation Illustration only Strategy/business plan and detailed operating model (historic and future financials) VDD materials – To be discussed Introductory presentation + teaser Materials used in initial discussions to ascertain potential buyers’ interest Information Package - provided in a “round 1” to provide basis for indicative offers Management presentation Preparation phase Preparation/start of execution phase Execution phase Management/Due diligence advisors SEB/Management SEB role and tasks Assist with input to business plan/strategy Assist in selecting due diligence advisors, Process coordinator Take lead in drafting documents Evaluate buyer / partner interest Process coordinator Buyer contact / discussions Evaluate buyer / partner interest Management role and participation Prepare (updated) strategy and business plan and (input to) operating model Provide input to documents Meetings with selected potential buyers Provide input to documents Conduct presentations Q&A / due diligence Timing Key responsible 7

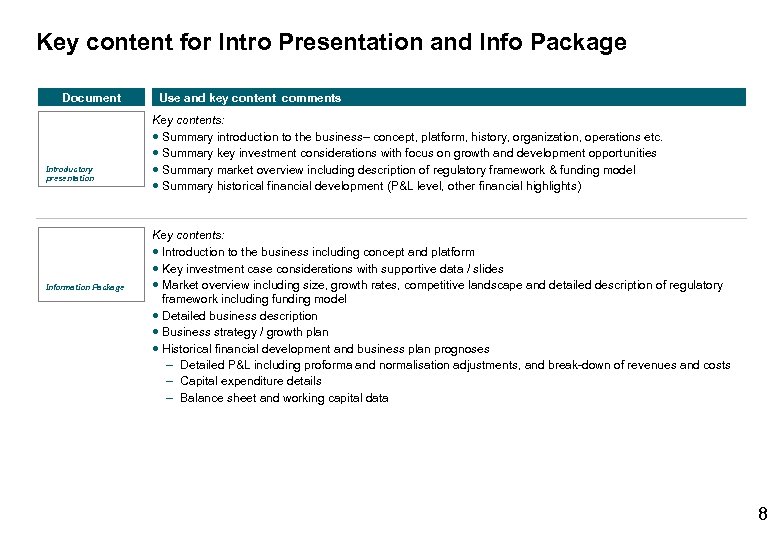

Key content for Intro Presentation and Info Package Document Introductory presentation Information Package Use and key content comments Key contents: Summary introduction to the business– concept, platform, history, organization, operations etc. Summary key investment considerations with focus on growth and development opportunities Summary market overview including description of regulatory framework & funding model Summary historical financial development (P&L level, other financial highlights) Key contents: Introduction to the business including concept and platform Key investment case considerations with supportive data / slides Market overview including size, growth rates, competitive landscape and detailed description of regulatory framework including funding model Detailed business description Business strategy / growth plan Historical financial development and business plan prognoses – Detailed P&L including proforma and normalisation adjustments, and break-down of revenues and costs – Capital expenditure details – Balance sheet and working capital data 8

Key content for Intro Presentation and Info Package Document Introductory presentation Information Package Use and key content comments Key contents: Summary introduction to the business– concept, platform, history, organization, operations etc. Summary key investment considerations with focus on growth and development opportunities Summary market overview including description of regulatory framework & funding model Summary historical financial development (P&L level, other financial highlights) Key contents: Introduction to the business including concept and platform Key investment case considerations with supportive data / slides Market overview including size, growth rates, competitive landscape and detailed description of regulatory framework including funding model Detailed business description Business strategy / growth plan Historical financial development and business plan prognoses – Detailed P&L including proforma and normalisation adjustments, and break-down of revenues and costs – Capital expenditure details – Balance sheet and working capital data 8

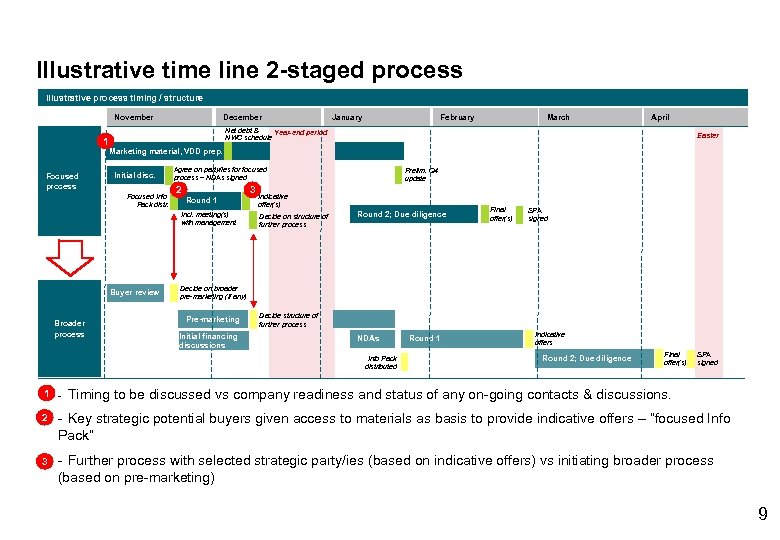

Illustrative time line 2 -staged process Illustrative process timing / structure November 1 Focused process December February Initial disc. April Easter Agree on party/ies for focused process – NDAs signed 2 3 Round 1 Incl. meeting(s) with management Buyer review Prelim. Q 4 update Indicative offer(s) Decide on structure of further process Round 2; Due diligence Final offer(s) SPA signed Decide on broader pre-marketing (if any) Pre-marketing Initial financing discussions Decide structure of further process NDAs Info Pack distributed 1 - March Marketing material, VDD prep. Focused Info Pack distr. Broader process January Net debt & Year-end period NWC schedule Round 1 Indicative offers Round 2; Due diligence Final offer(s) SPA signed Timing to be discussed vs company readiness and status of any on-going contacts & discussions. 2 - Key strategic potential buyers given access to materials as basis to provide indicative offers – “focused Info Pack” - Further process with selected strategic party/ies (based on indicative offers) vs initiating broader process 3 (based on pre-marketing) 9

Illustrative time line 2 -staged process Illustrative process timing / structure November 1 Focused process December February Initial disc. April Easter Agree on party/ies for focused process – NDAs signed 2 3 Round 1 Incl. meeting(s) with management Buyer review Prelim. Q 4 update Indicative offer(s) Decide on structure of further process Round 2; Due diligence Final offer(s) SPA signed Decide on broader pre-marketing (if any) Pre-marketing Initial financing discussions Decide structure of further process NDAs Info Pack distributed 1 - March Marketing material, VDD prep. Focused Info Pack distr. Broader process January Net debt & Year-end period NWC schedule Round 1 Indicative offers Round 2; Due diligence Final offer(s) SPA signed Timing to be discussed vs company readiness and status of any on-going contacts & discussions. 2 - Key strategic potential buyers given access to materials as basis to provide indicative offers – “focused Info Pack” - Further process with selected strategic party/ies (based on indicative offers) vs initiating broader process 3 (based on pre-marketing) 9

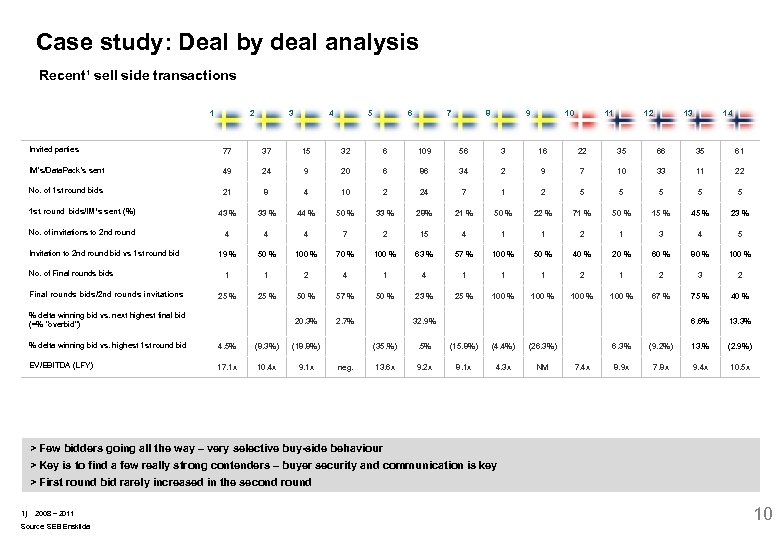

Case study: Deal by deal analysis Recent¹ sell side transactions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Invited parties 77 37 15 32 6 109 56 3 16 22 35 66 35 61 IM’s/Data. Pack’s sent 49 24 9 20 6 86 34 2 9 7 10 33 11 22 No. of 1 st round bids 21 8 4 10 2 24 7 1 2 5 5 5 1 st round bids/IM’s sent (%) 43 % 33 % 44 % 50 % 33 % 28% 21 % 50 % 22 % 71 % 50 % 15 % 45 % 23 % No. of invitations to 2 nd round 4 4 4 7 2 15 4 1 1 2 1 3 4 5 19 % 50 % 100 % 70 % 100 % 63 % 57 % 100 % 50 % 40 % 20 % 60 % 80 % 100 % 1 1 2 4 1 1 1 2 3 2 Final rounds bids/2 nd rounds invitations 25 % 50 % 57 % 50 % 23 % 25 % 100 % 67 % 75 % 40 % % delta winning bid vs. next highest final bid (=% "overbid") 20. 3% 2. 7% 32. 9% 6. 6% 13. 3% % delta winning bid vs. highest 1 st round bid 4. 5% (8. 3%) (18. 8%) (35. %) . 5% (15. 8%) (4. 4%) (26. 3%) 6. 3% (9. 2%) 13. % (2. 9%) EV/EBITDA (LFY) 17. 1 x 10. 4 x 9. 1 x 13. 6 x 9. 2 x 8. 1 x 4. 3 x NM 7. 4 x 8. 9 x 7. 8 x 9. 4 x 10. 5 x Invitation to 2 nd round bid vs 1 st round bid No. of Final rounds bids neg. > Few bidders going all the way – very selective buy-side behaviour > Key is to find a few really strong contenders – buyer security and communication is key > First round bid rarely increased in the second round 1) 2008 – 2011 Source: SEB Enskilda 10

Case study: Deal by deal analysis Recent¹ sell side transactions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Invited parties 77 37 15 32 6 109 56 3 16 22 35 66 35 61 IM’s/Data. Pack’s sent 49 24 9 20 6 86 34 2 9 7 10 33 11 22 No. of 1 st round bids 21 8 4 10 2 24 7 1 2 5 5 5 1 st round bids/IM’s sent (%) 43 % 33 % 44 % 50 % 33 % 28% 21 % 50 % 22 % 71 % 50 % 15 % 45 % 23 % No. of invitations to 2 nd round 4 4 4 7 2 15 4 1 1 2 1 3 4 5 19 % 50 % 100 % 70 % 100 % 63 % 57 % 100 % 50 % 40 % 20 % 60 % 80 % 100 % 1 1 2 4 1 1 1 2 3 2 Final rounds bids/2 nd rounds invitations 25 % 50 % 57 % 50 % 23 % 25 % 100 % 67 % 75 % 40 % % delta winning bid vs. next highest final bid (=% "overbid") 20. 3% 2. 7% 32. 9% 6. 6% 13. 3% % delta winning bid vs. highest 1 st round bid 4. 5% (8. 3%) (18. 8%) (35. %) . 5% (15. 8%) (4. 4%) (26. 3%) 6. 3% (9. 2%) 13. % (2. 9%) EV/EBITDA (LFY) 17. 1 x 10. 4 x 9. 1 x 13. 6 x 9. 2 x 8. 1 x 4. 3 x NM 7. 4 x 8. 9 x 7. 8 x 9. 4 x 10. 5 x Invitation to 2 nd round bid vs 1 st round bid No. of Final rounds bids neg. > Few bidders going all the way – very selective buy-side behaviour > Key is to find a few really strong contenders – buyer security and communication is key > First round bid rarely increased in the second round 1) 2008 – 2011 Source: SEB Enskilda 10

Europris case study

Europris case study

Public-to-private – the buyer’s dilemma 1. Takeover premium 2. New issue discount 3. How can you make money?

Public-to-private – the buyer’s dilemma 1. Takeover premium 2. New issue discount 3. How can you make money?

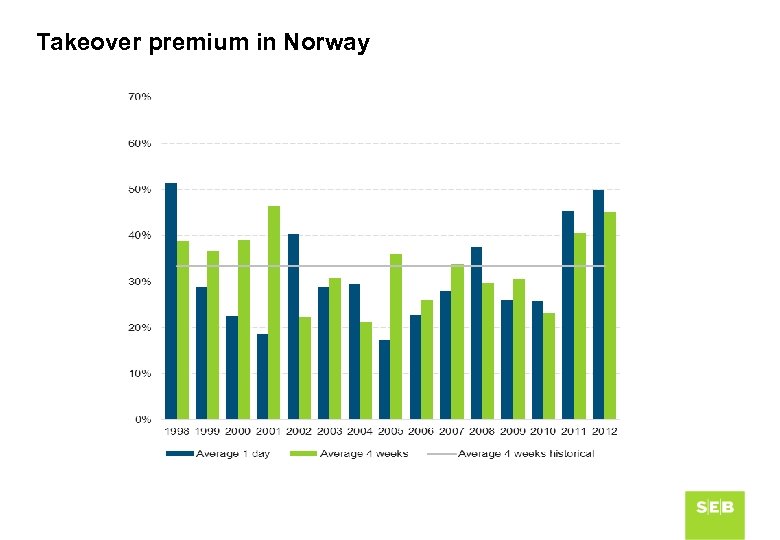

Takeover premium in Norway

Takeover premium in Norway

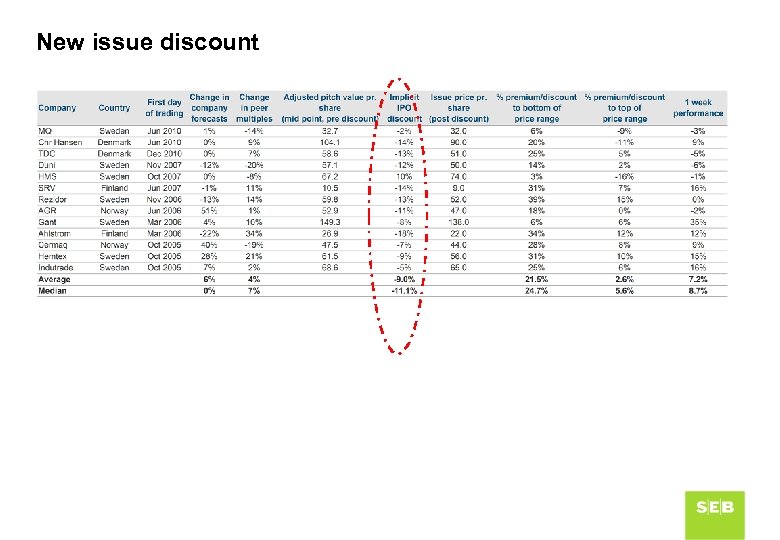

New issue discount

New issue discount

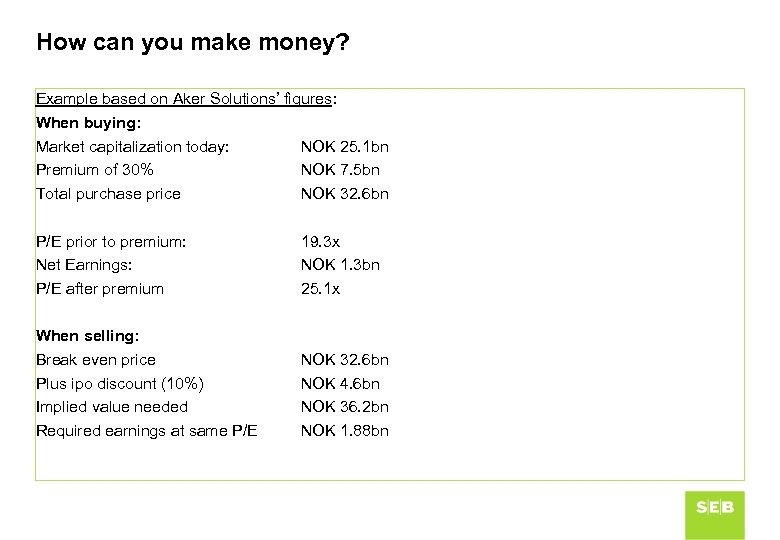

How can you make money? Example based on Aker Solutions’ figures: When buying: Market capitalization today: NOK 25. 1 bn Premium of 30% NOK 7. 5 bn Total purchase price NOK 32. 6 bn P/E prior to premium: Net Earnings: P/E after premium 19. 3 x NOK 1. 3 bn 25. 1 x When selling: Break even price Plus ipo discount (10%) Implied value needed Required earnings at same P/E NOK 32. 6 bn NOK 4. 6 bn NOK 36. 2 bn NOK 1. 88 bn

How can you make money? Example based on Aker Solutions’ figures: When buying: Market capitalization today: NOK 25. 1 bn Premium of 30% NOK 7. 5 bn Total purchase price NOK 32. 6 bn P/E prior to premium: Net Earnings: P/E after premium 19. 3 x NOK 1. 3 bn 25. 1 x When selling: Break even price Plus ipo discount (10%) Implied value needed Required earnings at same P/E NOK 32. 6 bn NOK 4. 6 bn NOK 36. 2 bn NOK 1. 88 bn

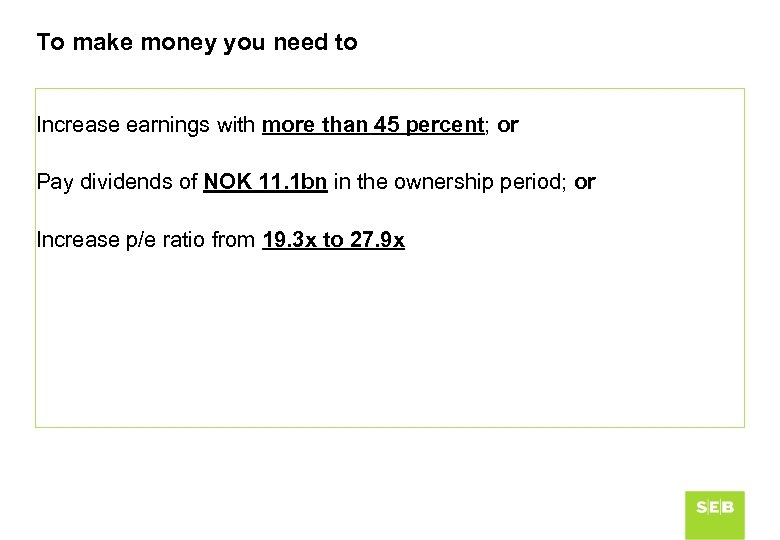

To make money you need to Increase earnings with more than 45 percent; or Pay dividends of NOK 11. 1 bn in the ownership period; or Increase p/e ratio from 19. 3 x to 27. 9 x

To make money you need to Increase earnings with more than 45 percent; or Pay dividends of NOK 11. 1 bn in the ownership period; or Increase p/e ratio from 19. 3 x to 27. 9 x

Process – a limiting necessity 1. Process prior to announcement 2. Post announcement transaction steps

Process – a limiting necessity 1. Process prior to announcement 2. Post announcement transaction steps

Pre-announcement strategies 1. Friendly approach 2. Secure pre-acceptances 3. Blocking stake 4. Majority stake

Pre-announcement strategies 1. Friendly approach 2. Secure pre-acceptances 3. Blocking stake 4. Majority stake

Takeover considerations – general alternatives Alternative 1: Friendly approach to Target Board Intention to launch a bid Offer price level (vs. disclosure obligations) Conduct (limited? ) DD prior to launch Following DD, secure pre-acceptances (buy shares? ); and Board recommendation Launch voluntary offer Alternative 2: Secure pre-acceptances before contacting Board Secure pre-acceptances from key shareholders Inform Board shortly prior to launch Launch voluntary offer, subject to DD Conduct a due diligence in the acceptance period Subsequent mandatory offer and compulsory acquisition 19

Takeover considerations – general alternatives Alternative 1: Friendly approach to Target Board Intention to launch a bid Offer price level (vs. disclosure obligations) Conduct (limited? ) DD prior to launch Following DD, secure pre-acceptances (buy shares? ); and Board recommendation Launch voluntary offer Alternative 2: Secure pre-acceptances before contacting Board Secure pre-acceptances from key shareholders Inform Board shortly prior to launch Launch voluntary offer, subject to DD Conduct a due diligence in the acceptance period Subsequent mandatory offer and compulsory acquisition 19

Takeover considerations – general alternatives Alternative 3: Acquire blocking stake before contacting Board Acquire up to 33. 3% of the outstanding shares Friendly approach to Target Board Intention to launch a bid Offer price level (vs. disclosure obligations) Alternative 4: Acquire majority stake before launch Acquire a 50. 1% shareholding (alternatively more than the mandatory offer threshold of 33. 3%) Launch mandatory offer No conditions allowed Compulsory acquisition if thr Offeror acquires more than 90% 20

Takeover considerations – general alternatives Alternative 3: Acquire blocking stake before contacting Board Acquire up to 33. 3% of the outstanding shares Friendly approach to Target Board Intention to launch a bid Offer price level (vs. disclosure obligations) Alternative 4: Acquire majority stake before launch Acquire a 50. 1% shareholding (alternatively more than the mandatory offer threshold of 33. 3%) Launch mandatory offer No conditions allowed Compulsory acquisition if thr Offeror acquires more than 90% 20

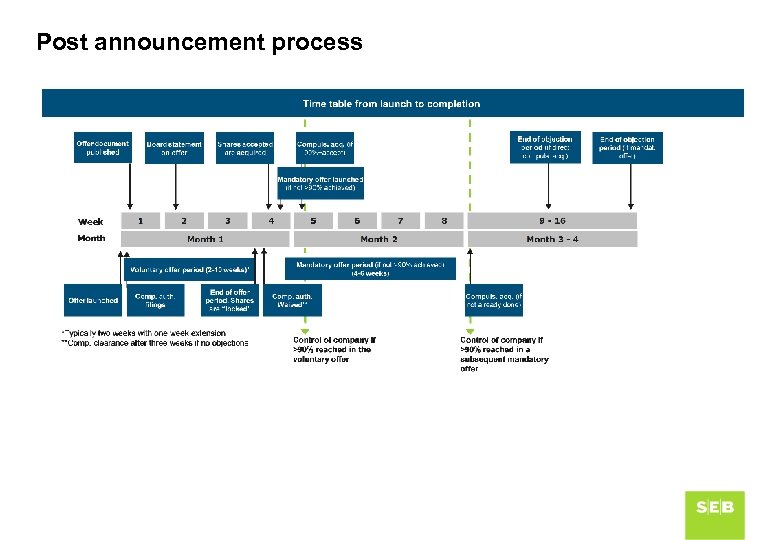

Post announcement process

Post announcement process

Conclusion Public takeovers carries significant cost You need either a plan, synergies or cash that others don’t have to be successful Even if you do everyting right – others may destroy your value creation opportunity throughout the process

Conclusion Public takeovers carries significant cost You need either a plan, synergies or cash that others don’t have to be successful Even if you do everyting right – others may destroy your value creation opportunity throughout the process

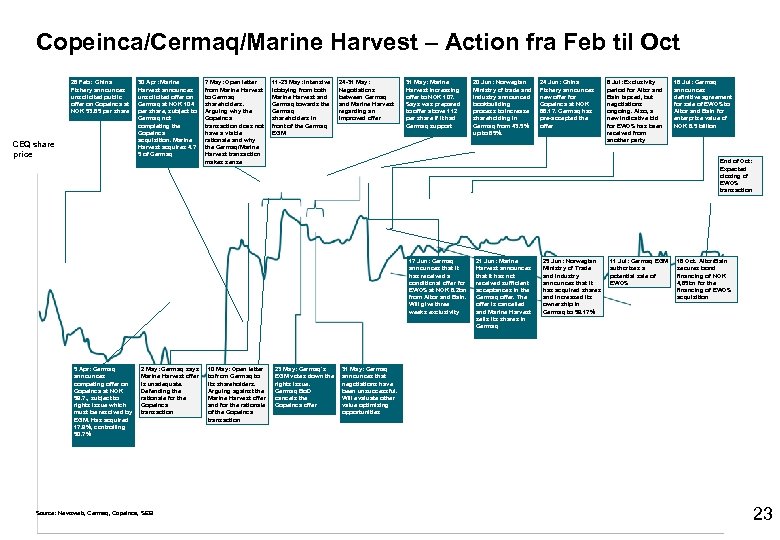

Copeinca/Cermaq/Marine Harvest – Action fra Feb til Oct 26 Feb: China Fishery announces unsolicited public offer on Copeinca at NOK 53. 85 per share CEQ share price 30 Apr: Marine Harvest announces unsolicited offer on Cermaq at NOK 104 per share, subject to Cermaq not completing the Copeinca acquisition. Marine Harvest acquires 4. 7 5 of Cermaq 7 May: Open letter from Marine Harvest to Cermaq shareholders. Arguing why the Copeinca transaction does not have a viable rationale and why the Cermaq/Marine Harvest transaction makes sense 11 -23 May: intensive lobbying from both Marine Harvest and Cermaq towards the Cermaq shareholders in front of the Cermaq EGM 24 -31 May: Negotiations between Cermaq and Marine Harvest regarding an improved offer 31 May: Marine Harvest increasing offer to NOK 107. Says was prepared to offer above 112 per share if it had Cermaq support 2 May: Cermaq says Marine Harvest offer is unadequate. Defending the rationale for the Copeinca transaction Source: Newsweb, Cermaq, Copeinca, SEB 10 May: Open letter to from Cermaq to its shareholders. Arguing against the Marine Harvest offer and for the rationale of the Copeinca transaction 24 Jun: China Fishery announces new offer for Copeinca at NOK 68. 17. Cermaq has pre-accepted the offer 8 Jul: Exclusivity period for Altor and Bain lapsed, but negotiations ongoing. Also, a new indicative bid for EWOS has been received from another party 18 Jul: Cermaq announces definitive agreement for sale of EWOS to Altor and Bain for enterprise value of NOK 6. 5 billion End of Oct: Expected closing of EWOS transaction 17 Jun: Cermaq announces that it has received a conditional offer for EWOS at NOK 6. 2 bn from Altor and Bain. Will give three weeks exclusivity 5 Apr: Cermaq announces competing offer on Copeinca at NOK 59. 7. , subject to rights issue which must be resolved by EGM. Has acquired 17. 9%, controlling 50. 7% 20 Jun: Norwegian Ministry of trade and Industry announced bookbuilding process to increase shareholding in Cermaq from 43. 5% up to 65%. 23 May: Cermaq’s EGM votes down the rights issue. Cermaq Bo. D cancels the Copeinca offer 21 Jun: Marine Harvest announces that it has not received sufficient acceptances in the Cermaq offer. The offer is cancelled and Marine Harvest sells its shares in Cermaq 25 Jun: Norwegian Ministry of Trade and Industry announces that it has acquired shares and increased its ownership in Cermaq to 59. 17% 11 Jul: Cermaq EGM authorizes a potential sale of EWOS 16 Oct. Altor/Bain secures bond financing of NOK 4, 65 bn for the financing of EWOS acquisition 31 May: Cermaq announces that negotiations have been unsuccessful. Will evaluate other value optimizing opportunities 23

Copeinca/Cermaq/Marine Harvest – Action fra Feb til Oct 26 Feb: China Fishery announces unsolicited public offer on Copeinca at NOK 53. 85 per share CEQ share price 30 Apr: Marine Harvest announces unsolicited offer on Cermaq at NOK 104 per share, subject to Cermaq not completing the Copeinca acquisition. Marine Harvest acquires 4. 7 5 of Cermaq 7 May: Open letter from Marine Harvest to Cermaq shareholders. Arguing why the Copeinca transaction does not have a viable rationale and why the Cermaq/Marine Harvest transaction makes sense 11 -23 May: intensive lobbying from both Marine Harvest and Cermaq towards the Cermaq shareholders in front of the Cermaq EGM 24 -31 May: Negotiations between Cermaq and Marine Harvest regarding an improved offer 31 May: Marine Harvest increasing offer to NOK 107. Says was prepared to offer above 112 per share if it had Cermaq support 2 May: Cermaq says Marine Harvest offer is unadequate. Defending the rationale for the Copeinca transaction Source: Newsweb, Cermaq, Copeinca, SEB 10 May: Open letter to from Cermaq to its shareholders. Arguing against the Marine Harvest offer and for the rationale of the Copeinca transaction 24 Jun: China Fishery announces new offer for Copeinca at NOK 68. 17. Cermaq has pre-accepted the offer 8 Jul: Exclusivity period for Altor and Bain lapsed, but negotiations ongoing. Also, a new indicative bid for EWOS has been received from another party 18 Jul: Cermaq announces definitive agreement for sale of EWOS to Altor and Bain for enterprise value of NOK 6. 5 billion End of Oct: Expected closing of EWOS transaction 17 Jun: Cermaq announces that it has received a conditional offer for EWOS at NOK 6. 2 bn from Altor and Bain. Will give three weeks exclusivity 5 Apr: Cermaq announces competing offer on Copeinca at NOK 59. 7. , subject to rights issue which must be resolved by EGM. Has acquired 17. 9%, controlling 50. 7% 20 Jun: Norwegian Ministry of trade and Industry announced bookbuilding process to increase shareholding in Cermaq from 43. 5% up to 65%. 23 May: Cermaq’s EGM votes down the rights issue. Cermaq Bo. D cancels the Copeinca offer 21 Jun: Marine Harvest announces that it has not received sufficient acceptances in the Cermaq offer. The offer is cancelled and Marine Harvest sells its shares in Cermaq 25 Jun: Norwegian Ministry of Trade and Industry announces that it has acquired shares and increased its ownership in Cermaq to 59. 17% 11 Jul: Cermaq EGM authorizes a potential sale of EWOS 16 Oct. Altor/Bain secures bond financing of NOK 4, 65 bn for the financing of EWOS acquisition 31 May: Cermaq announces that negotiations have been unsuccessful. Will evaluate other value optimizing opportunities 23