16e58e7b9be6d7e533f3ec36c0c3d15f.ppt

- Количество слайдов: 42

News From Washington Susan Gaffney Director, Federal Liaison Center GFOA

News From Washington Susan Gaffney Director, Federal Liaison Center GFOA

Government Finance Officers Association • Get Involved! • GFOA President-Elect, Chris Morrill • Committee Applications: Summer 2

Government Finance Officers Association • Get Involved! • GFOA President-Elect, Chris Morrill • Committee Applications: Summer 2

Overview • Federal Budget • Headlines Creating Legislative Interest – Public Pensions – Bankruptcy – Municipal Bond Market • • 3% Withholding Tax Legislation Implementation of the Dodd-Frank Act SEC Activities 3

Overview • Federal Budget • Headlines Creating Legislative Interest – Public Pensions – Bankruptcy – Municipal Bond Market • • 3% Withholding Tax Legislation Implementation of the Dodd-Frank Act SEC Activities 3

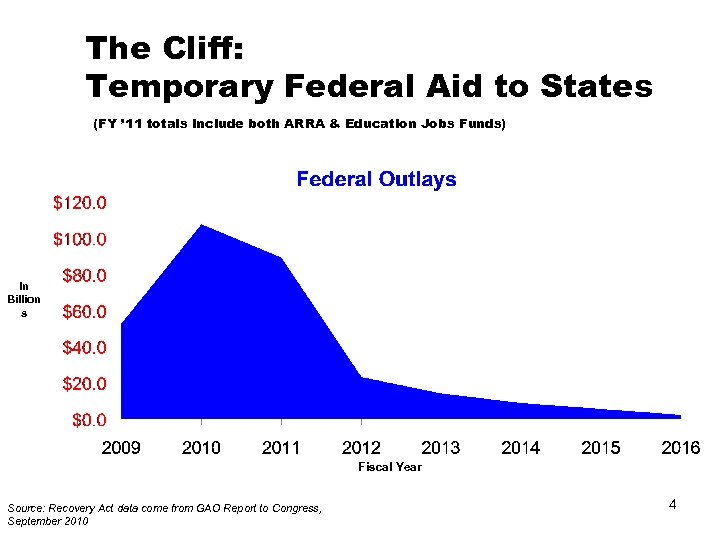

The Cliff: Temporary Federal Aid to States (FY ’ 11 totals include both ARRA & Education Jobs Funds) In Billion s Fiscal Year Source: Recovery Act data come from GAO Report to Congress, September 2010 4

The Cliff: Temporary Federal Aid to States (FY ’ 11 totals include both ARRA & Education Jobs Funds) In Billion s Fiscal Year Source: Recovery Act data come from GAO Report to Congress, September 2010 4

Federal Budget: FY 11 • H. R. 1473: Slashed nearly $40 billion from Federal Programs – CDBG ( Community Development Block Grant) will be funded at $3. 3 billion, $600 million less than fiscal year 2010 – HOME program loses nearly $200 million in funding – Federal Highway Program is cut by nearly $900 million, while funding for high speed rail would be eliminated – Nearly $1 billion in cuts to workforce training programs • Measure Includes $528 million for the National Infrastructure Investment Grants Program • Choice Neighborhoods and Sustainable Communities Programs Each Funded at $100 Million • $700 million for President Obama’s Race to the Top Education Reform Initiative 5

Federal Budget: FY 11 • H. R. 1473: Slashed nearly $40 billion from Federal Programs – CDBG ( Community Development Block Grant) will be funded at $3. 3 billion, $600 million less than fiscal year 2010 – HOME program loses nearly $200 million in funding – Federal Highway Program is cut by nearly $900 million, while funding for high speed rail would be eliminated – Nearly $1 billion in cuts to workforce training programs • Measure Includes $528 million for the National Infrastructure Investment Grants Program • Choice Neighborhoods and Sustainable Communities Programs Each Funded at $100 Million • $700 million for President Obama’s Race to the Top Education Reform Initiative 5

President’s Proposed FY 12 Budget: • $3. 7 trillion Proposed Budget for FY 2012 – Freezes federal spending – Tax increases for high income earners • State and Local Govt. Reductions: – Cutting $300 million from the Community Development Block Grant Program – $350 million cut to Community Service Block Grant – $2. 5 billion cut to Low Income Home Energy Assistance Program (LIHEAP) – $600 million cut in public safety grant programs that assist state and local govt. law enforcement – $947 cut to grants for State Clean Water and Drinking Water Revolving funds • Funding Increases in Transportation and Education – $556 billion six-year surface transportation reauthorization proposal – $30 billion for National Infrastructure Bank – $900 million funding for a new round of “Race to the Top” education grants • Permanently reinstate the Build America Bonds (BABs) program at a lower 28% subsidy rate 6

President’s Proposed FY 12 Budget: • $3. 7 trillion Proposed Budget for FY 2012 – Freezes federal spending – Tax increases for high income earners • State and Local Govt. Reductions: – Cutting $300 million from the Community Development Block Grant Program – $350 million cut to Community Service Block Grant – $2. 5 billion cut to Low Income Home Energy Assistance Program (LIHEAP) – $600 million cut in public safety grant programs that assist state and local govt. law enforcement – $947 cut to grants for State Clean Water and Drinking Water Revolving funds • Funding Increases in Transportation and Education – $556 billion six-year surface transportation reauthorization proposal – $30 billion for National Infrastructure Bank – $900 million funding for a new round of “Race to the Top” education grants • Permanently reinstate the Build America Bonds (BABs) program at a lower 28% subsidy rate 6

House FY 12 Proposal • $3. 5 Trillion in Total Spending • Returns Non-Discretionary Spending to Pre- FY 08 levels – Low-Income Home Energy Assistance Program to historical levels: Acceptance of President’s Proposal • $4 Trillion in Program Cuts/10 years – Community Development Block Grants: Reduced sharply from more than $4 billion to $1. 5 billion – 2/3 Affect Low Income Programs • • Repeals Health Care Law Changes Medicaid Into Block Grant Program Highest Individual and Corporate Tax Rate = 25% Changes to Medicare Program 7

House FY 12 Proposal • $3. 5 Trillion in Total Spending • Returns Non-Discretionary Spending to Pre- FY 08 levels – Low-Income Home Energy Assistance Program to historical levels: Acceptance of President’s Proposal • $4 Trillion in Program Cuts/10 years – Community Development Block Grants: Reduced sharply from more than $4 billion to $1. 5 billion – 2/3 Affect Low Income Programs • • Repeals Health Care Law Changes Medicaid Into Block Grant Program Highest Individual and Corporate Tax Rate = 25% Changes to Medicare Program 7

Do They Come Together? • The Battle of the Bulge: FY 12 • Debt Ceiling Limit • Do Tax & Entitlement Reforms Get Addressed? 8

Do They Come Together? • The Battle of the Bulge: FY 12 • Debt Ceiling Limit • Do Tax & Entitlement Reforms Get Addressed? 8

Headlines = Legislation • • Legislation Allowing States to File for Bankruptcy Federal Public Pension Disclosure Standards No Bailout for States Muni Bond Disclosure/Tower Amendment 9

Headlines = Legislation • • Legislation Allowing States to File for Bankruptcy Federal Public Pension Disclosure Standards No Bailout for States Muni Bond Disclosure/Tower Amendment 9

Headlines = Legislation • Congressional Hearings – House Oversight Committee – House Judiciary Committee – Senate Budget Committee – Senate Finance Committee 10

Headlines = Legislation • Congressional Hearings – House Oversight Committee – House Judiciary Committee – Senate Budget Committee – Senate Finance Committee 10

Public Pensions • The Public Employee Pension Transparency Act, H. R. 567 and S. 347 – Federal Reporting of Public Pension Liabilities • Riskless Return Model – If a public pension fund does meet these standards to the Treasury’s satisfaction, any government that is served by the fund will not be able to: • Issue tax exempt bonds • Receive BABs or other direct subsidy bond payments 11

Public Pensions • The Public Employee Pension Transparency Act, H. R. 567 and S. 347 – Federal Reporting of Public Pension Liabilities • Riskless Return Model – If a public pension fund does meet these standards to the Treasury’s satisfaction, any government that is served by the fund will not be able to: • Issue tax exempt bonds • Receive BABs or other direct subsidy bond payments 11

No Bailouts! • S. Res 188 • No State Bailouts Resolution – Bans federal bailouts of financially struggling states – Fed govt should “take no action to redeem, assume, or gurantee State debt” • Senator Kirk (IL) and 15 other Senators 12

No Bailouts! • S. Res 188 • No State Bailouts Resolution – Bans federal bailouts of financially struggling states – Fed govt should “take no action to redeem, assume, or gurantee State debt” • Senator Kirk (IL) and 15 other Senators 12

Munis / Tower Amendment • Prohibits SEC and MSRB from directly or indirectly requiring issuers to file documents with those entities prior to the sale of bonds. • SEC May Want: – Greater control of muni accounting standards – More timely disclosure – Interim Disclosure Requirements 13

Munis / Tower Amendment • Prohibits SEC and MSRB from directly or indirectly requiring issuers to file documents with those entities prior to the sale of bonds. • SEC May Want: – Greater control of muni accounting standards – More timely disclosure – Interim Disclosure Requirements 13

3% Withholding • 3% Withholding and Annual Reporting Requirement on Government Payments • Begins January 1, 2013 • Applies to Governments That Spend > $100 m/year on Goods and Services • Governments must withhold 3% of payment made to all vendors (with some exemptions) and remit that 3% to the federal government • All Payments to All Vendors Must be Reported Annually to the IRS • Unfunded Mandate 14

3% Withholding • 3% Withholding and Annual Reporting Requirement on Government Payments • Begins January 1, 2013 • Applies to Governments That Spend > $100 m/year on Goods and Services • Governments must withhold 3% of payment made to all vendors (with some exemptions) and remit that 3% to the federal government • All Payments to All Vendors Must be Reported Annually to the IRS • Unfunded Mandate 14

![3% Withholding • IRS Final Regulations [26 CFR Part 31. 3402(t)] – – $10, 3% Withholding • IRS Final Regulations [26 CFR Part 31. 3402(t)] – – $10,](https://present5.com/presentation/16e58e7b9be6d7e533f3ec36c0c3d15f/image-15.jpg) 3% Withholding • IRS Final Regulations [26 CFR Part 31. 3402(t)] – – $10, 000 Threshold Existing Contracts Exempt if Not Materially Modified Proposing all Contracts > 1/1/2014 Abide by Law Determining $100, 000 Threshold • All payments, including under $10, 000 except salary & fringe benefits • Average four of the five accounting year ending in 2011 or the FY ending in 2011 • No penalties in place until 1/1/2014 for failure to withhold as long as entity has made good faith effort to comply 15

3% Withholding • IRS Final Regulations [26 CFR Part 31. 3402(t)] – – $10, 000 Threshold Existing Contracts Exempt if Not Materially Modified Proposing all Contracts > 1/1/2014 Abide by Law Determining $100, 000 Threshold • All payments, including under $10, 000 except salary & fringe benefits • Average four of the five accounting year ending in 2011 or the FY ending in 2011 • No penalties in place until 1/1/2014 for failure to withhold as long as entity has made good faith effort to comply 15

3% Withholding • IRS Final Regulations – Payment Card Transactions Exempt Until Additional Guidance is Developed – $10, 000 Payment-by-Payment Threshold – Requirements Only apply to Prime Contractor – Govt. Entity Must Withhold Even if Payment Agent is Used 16

3% Withholding • IRS Final Regulations – Payment Card Transactions Exempt Until Additional Guidance is Developed – $10, 000 Payment-by-Payment Threshold – Requirements Only apply to Prime Contractor – Govt. Entity Must Withhold Even if Payment Agent is Used 16

3% Withholding • IRS Final Regulations: Exemptions – Other govt. entities, tax-exempt organizations, tribal govts, and foreign govts – Interest Payments – Purchase or Lease of Real Property – Public Assistance / Welfare Payments – Payments to a govt. employee • Reimbursement of travel expense to employee – – Grant Funds Loan Gurantees Stock / Bond Purchases Debt Repayment 17

3% Withholding • IRS Final Regulations: Exemptions – Other govt. entities, tax-exempt organizations, tribal govts, and foreign govts – Interest Payments – Purchase or Lease of Real Property – Public Assistance / Welfare Payments – Payments to a govt. employee • Reimbursement of travel expense to employee – – Grant Funds Loan Gurantees Stock / Bond Purchases Debt Repayment 17

3% Withholding • Reporting Requirements – Form 945: – Form 1099 - MISC • Deposits – Follow Employment Tax Rules 18

3% Withholding • Reporting Requirements – Form 945: – Form 1099 - MISC • Deposits – Follow Employment Tax Rules 18

Repeal 3% Withholding Law • S. 89 and S. 164: No VA Co-Sponsors • H. R. 674 – – Rep. Connolly Rep. Moran Rep. Rigell Rep. Wittman • CBO: Delay implementation for 3 years • Website Repeal. Withholding. Now. com 19

Repeal 3% Withholding Law • S. 89 and S. 164: No VA Co-Sponsors • H. R. 674 – – Rep. Connolly Rep. Moran Rep. Rigell Rep. Wittman • CBO: Delay implementation for 3 years • Website Repeal. Withholding. Now. com 19

Tax Legislation • Major Tax Reform – Gang of Six Five (including Sen. Warner) – Eliminating Tax Exemption on Municipal Bonds • President’s Deficit Commission • Wyden-Coats Legislation – Eliminating State and Local Tax Deductions – Changes to Property Tax Deductions – When? 20

Tax Legislation • Major Tax Reform – Gang of Six Five (including Sen. Warner) – Eliminating Tax Exemption on Municipal Bonds • President’s Deficit Commission • Wyden-Coats Legislation – Eliminating State and Local Tax Deductions – Changes to Property Tax Deductions – When? 20

Tax-Exempt Bonds • Expired ARRA Bond Provisions – – – BABs Recovery Zone Bonds Bank Qualified Debt $30 Million Limit Private Activity Bonds Exempt from AMT Federal Home Loan Banks Member Banks Able to Offer Letters of Credit • What to Expect in 2011 – H. R. 992 - Reinstate ARRA Bond Provisions – S. 1016 - Permanent $30 M BQ Limit 21

Tax-Exempt Bonds • Expired ARRA Bond Provisions – – – BABs Recovery Zone Bonds Bank Qualified Debt $30 Million Limit Private Activity Bonds Exempt from AMT Federal Home Loan Banks Member Banks Able to Offer Letters of Credit • What to Expect in 2011 – H. R. 992 - Reinstate ARRA Bond Provisions – S. 1016 - Permanent $30 M BQ Limit 21

Pre-Emption of State and Local Taxes • Federal Pre-Emption of Communication Taxes – H. R. 1002 • Digital Goods Legislation H. R. 1860 and S. 971 • Simplifying Business Activity Taxes – H. R. 1439 • Federal Pre-Emption of State and Local Hotel & Rental Car Taxes/Fees • H. R. 1864 – Prohibits States from Applying Their Income Tax on Nonresident Workers, < 30 days • Allowing Local Governments to Participate in Federal Offset Program • VA members on House Judiciary Committee: – Rep. Forbes, Rep. Goodlatte, Rep. Scott 22

Pre-Emption of State and Local Taxes • Federal Pre-Emption of Communication Taxes – H. R. 1002 • Digital Goods Legislation H. R. 1860 and S. 971 • Simplifying Business Activity Taxes – H. R. 1439 • Federal Pre-Emption of State and Local Hotel & Rental Car Taxes/Fees • H. R. 1864 – Prohibits States from Applying Their Income Tax on Nonresident Workers, < 30 days • Allowing Local Governments to Participate in Federal Offset Program • VA members on House Judiciary Committee: – Rep. Forbes, Rep. Goodlatte, Rep. Scott 22

Pre-Emption of Telecommunication Taxes • H. R. 1002 Wireless Tax Fairness Act of 2011 – Pre-empt for 5 years S/L Governments Ability to Tax Wireless Communications at a Higher Rate Than Other Businesses • Legislation would preempt state and local taxing authority and represent a federal intrusion into historically-protected state and local tax classifications • Lead other industries to seek similar special federal protection from state and local taxes and could create a direct threat to the fiscal health of state and local governments 23

Pre-Emption of Telecommunication Taxes • H. R. 1002 Wireless Tax Fairness Act of 2011 – Pre-empt for 5 years S/L Governments Ability to Tax Wireless Communications at a Higher Rate Than Other Businesses • Legislation would preempt state and local taxing authority and represent a federal intrusion into historically-protected state and local tax classifications • Lead other industries to seek similar special federal protection from state and local taxes and could create a direct threat to the fiscal health of state and local governments 23

Internet Sales Tax Collection § Federal Legislation? – Provides for Mandatory Collection of Taxes on Remote Sales • States Looking to Solve Problem, Independent of Federal Action – New York’s Amazon. com law • VA Activities 24

Internet Sales Tax Collection § Federal Legislation? – Provides for Mandatory Collection of Taxes on Remote Sales • States Looking to Solve Problem, Independent of Federal Action – New York’s Amazon. com law • VA Activities 24

Dodd-Frank Act: What it Means for State and Local Governments • • • Municipal Advisors Uniform Ratings Increased Oversight of Credit Rating Agencies MSRB Changes GASB Funding Regulating Derivatives Market Asset Securitization Definition Municipal Securities Studies Office of Municipal Securities 2525

Dodd-Frank Act: What it Means for State and Local Governments • • • Municipal Advisors Uniform Ratings Increased Oversight of Credit Rating Agencies MSRB Changes GASB Funding Regulating Derivatives Market Asset Securitization Definition Municipal Securities Studies Office of Municipal Securities 2525

SEC Municipal Advisor Rule • SEC Proposed Rule Defining “Municipal Advisors” • All New SEC and MSRB Municipal Advisor Rules Would Apply • Elected Officials and Government Workers Exempt From Definition • SEC Proposes Including Appointed Members of State and Local Governing Boards, Where Bond and Investment Issues are Discussed, to Be Defined as Financial Advisors • Would Also Include Members of Public Pension Boards • GFOA Opposes this Broad Definition 26

SEC Municipal Advisor Rule • SEC Proposed Rule Defining “Municipal Advisors” • All New SEC and MSRB Municipal Advisor Rules Would Apply • Elected Officials and Government Workers Exempt From Definition • SEC Proposes Including Appointed Members of State and Local Governing Boards, Where Bond and Investment Issues are Discussed, to Be Defined as Financial Advisors • Would Also Include Members of Public Pension Boards • GFOA Opposes this Broad Definition 26

Regulation of Municipal Advisors • MSRB Regulation of Financial Advisors, Swap Advisors, Guaranteed Investment Contract Brokers, Solicitors, Finders, Third Party Marketers, Public Pension Placement Agent, and other Market Intermediaries • Rules Seek to Prohibit Fraudulent and Manipulative Practices, Require Fair Treatment of Municipal Entities, Restrict Real and Perceived Conflicts of Interest, and Provide for Professional Standards and Continuing Education • MSRB Registration Required • Fiduciary Duty Standard Mandated for Both Dealer and 27 Non-dealer Advisors 27

Regulation of Municipal Advisors • MSRB Regulation of Financial Advisors, Swap Advisors, Guaranteed Investment Contract Brokers, Solicitors, Finders, Third Party Marketers, Public Pension Placement Agent, and other Market Intermediaries • Rules Seek to Prohibit Fraudulent and Manipulative Practices, Require Fair Treatment of Municipal Entities, Restrict Real and Perceived Conflicts of Interest, and Provide for Professional Standards and Continuing Education • MSRB Registration Required • Fiduciary Duty Standard Mandated for Both Dealer and 27 Non-dealer Advisors 27

Rating Agencies • Must Use Consistent Rating Requirements Across all Products • Subject to Greater Liability • SEC has Two Years to Mitigate Conflicts of Interest • References to Credit Ratings Will be Removed from Federal Regulations • Impact on State and Local Governments 2828

Rating Agencies • Must Use Consistent Rating Requirements Across all Products • Subject to Greater Liability • SEC has Two Years to Mitigate Conflicts of Interest • References to Credit Ratings Will be Removed from Federal Regulations • Impact on State and Local Governments 2828

Additional MSRB Authority • Changed From “Protect Investors” to “Protect Investors and Municipal Entities” • MSRB may develop information systems with ability to charge reasonable fees (except on issuers and obligated persons) • Ability to charge “commercially reasonable fees” for subscription products 2929

Additional MSRB Authority • Changed From “Protect Investors” to “Protect Investors and Municipal Entities” • MSRB may develop information systems with ability to charge reasonable fees (except on issuers and obligated persons) • Ability to charge “commercially reasonable fees” for subscription products 2929

MSRB Board Composition • The new law changes the composition of the MSRB Board, requiring that it be composed of a majority of public members as of October 1, 2010 • MSRB Board must include at least one bank, one brokerdealer, one municipal entity, one issuer, one investor (institutional or retail), one municipal advisor and one member of the public • All must have knowledge of the municipal securities industry • VA Board Members: – – Sheryl D. Bailey Deputy County Administrator for Management Services Chesterfield County, Virginia John E. Petersen Professor of Public Policy and Finance, George Mason University Arlington, Virginia 3030

MSRB Board Composition • The new law changes the composition of the MSRB Board, requiring that it be composed of a majority of public members as of October 1, 2010 • MSRB Board must include at least one bank, one brokerdealer, one municipal entity, one issuer, one investor (institutional or retail), one municipal advisor and one member of the public • All must have knowledge of the municipal securities industry • VA Board Members: – – Sheryl D. Bailey Deputy County Administrator for Management Services Chesterfield County, Virginia John E. Petersen Professor of Public Policy and Finance, George Mason University Arlington, Virginia 3030

Enhanced MSRB • Ability to provide guidance and assistance to fellow regulators in the enforcement of, and examination for, compliance with MSRB rules • Ability to assess regulated entities for late submissions of data or other information pursuant to MSRB rules • Fine sharing with SEC and FINRA • FINRA required to seek guidance regarding MSRB rule interpretations • Provides for enhanced communication between MSRB and FINRA regarding enforcement activities 3131

Enhanced MSRB • Ability to provide guidance and assistance to fellow regulators in the enforcement of, and examination for, compliance with MSRB rules • Ability to assess regulated entities for late submissions of data or other information pursuant to MSRB rules • Fine sharing with SEC and FINRA • FINRA required to seek guidance regarding MSRB rule interpretations • Provides for enhanced communication between MSRB and FINRA regarding enforcement activities 3131

GASB Funding • Allows SEC to Direct FINRA to Establish a Fee on Bond Issuances to be Collected by its Members (Dealers) to Fund the GASB – Does NOT provide SEC or FINRA with direct or indirect oversight over GASB budget or agenda – Fees can only be used to support GASB efforts to establish accounting standards according to GAAP – Fees provided to GASB’s will be equal to their budget, as approved by the FAF • Forthcoming Proposal: In May, SEC Directed FINRA to establish fee 3232

GASB Funding • Allows SEC to Direct FINRA to Establish a Fee on Bond Issuances to be Collected by its Members (Dealers) to Fund the GASB – Does NOT provide SEC or FINRA with direct or indirect oversight over GASB budget or agenda – Fees can only be used to support GASB efforts to establish accounting standards according to GAAP – Fees provided to GASB’s will be equal to their budget, as approved by the FAF • Forthcoming Proposal: In May, SEC Directed FINRA to establish fee 3232

Derivatives Provisions • Effective October 1, 2010, all swap advisors of state and local governments and other governmental entities (such as governmental pension funds) must be registered with the SEC; this includes swap dealers serving as advisors • The MSRB will have the authority to write rules for swap advisors, such as rules on professional qualifications, payto-play, fiduciary duty and fair dealing • State and local governments and other governmental entities must have advisors that are independent of their swap dealers to provide advice on the fair pricing and appropriateness of the swap transactions • Information reporting is required for all swaps 33

Derivatives Provisions • Effective October 1, 2010, all swap advisors of state and local governments and other governmental entities (such as governmental pension funds) must be registered with the SEC; this includes swap dealers serving as advisors • The MSRB will have the authority to write rules for swap advisors, such as rules on professional qualifications, payto-play, fiduciary duty and fair dealing • State and local governments and other governmental entities must have advisors that are independent of their swap dealers to provide advice on the fair pricing and appropriateness of the swap transactions • Information reporting is required for all swaps 33

Asset Securitization • Language in the Act does NOT provide municipal securities with a FULL exemption of asset backed securities requirements/definition • Agency Rulemaking has proposed excluding municipals from Asset Backed Securities 3434

Asset Securitization • Language in the Act does NOT provide municipal securities with a FULL exemption of asset backed securities requirements/definition • Agency Rulemaking has proposed excluding municipals from Asset Backed Securities 3434

Studies: Muni Market • GASB Funding: Completed 1/2011 – GASB is Underfunded • Municipal Bond Trading Transparency: Due 1/2012 • Issuer Disclosure and the Tower Amendment: Due 7/2012 3535

Studies: Muni Market • GASB Funding: Completed 1/2011 – GASB is Underfunded • Municipal Bond Trading Transparency: Due 1/2012 • Issuer Disclosure and the Tower Amendment: Due 7/2012 3535

Office of Municipal Securities • Office of Municipal Securities Elevated to Report Directly to the SEC Chairman • Duties Include: – Administer SEC rules affecting municipal market – Coordinate with MSRB on rulemaking and enforcement • SEC Internal Study Questioned Formation of Office 3636

Office of Municipal Securities • Office of Municipal Securities Elevated to Report Directly to the SEC Chairman • Duties Include: – Administer SEC rules affecting municipal market – Coordinate with MSRB on rulemaking and enforcement • SEC Internal Study Questioned Formation of Office 3636

SEC Activities • SEC Field Hearings: Municipal Securities – Two Held in 2010 – Additional Hearings Likely in 2011 – Changes to SEC Rules (e. g. , 15 c 2 -12) • Material Events Notices • Applies to Variable Rate Debt • Eliminates ‘Materiality’ Definition – Legislative Requests • Tower Amendment • Direct Oversight Over Issuers • SEC Muni and Public Pension Enforcement Office • Greater SEC/IRS Cooperation 37

SEC Activities • SEC Field Hearings: Municipal Securities – Two Held in 2010 – Additional Hearings Likely in 2011 – Changes to SEC Rules (e. g. , 15 c 2 -12) • Material Events Notices • Applies to Variable Rate Debt • Eliminates ‘Materiality’ Definition – Legislative Requests • Tower Amendment • Direct Oversight Over Issuers • SEC Muni and Public Pension Enforcement Office • Greater SEC/IRS Cooperation 37

MSRB - EMMA • New Voluntary Fields, May 23 • Follow GASB or FASB • Within Your CDA it States You Will Submit Annual Filings 120 or 150 Days After End of Your Fiscal Year • GFOA BP Recommends Not Entering This Info • Submit Links to Financial and Budget Information on Your Own Web Site • Submitting POS Documents • Submitting Advance Refunding Documents 38

MSRB - EMMA • New Voluntary Fields, May 23 • Follow GASB or FASB • Within Your CDA it States You Will Submit Annual Filings 120 or 150 Days After End of Your Fiscal Year • GFOA BP Recommends Not Entering This Info • Submit Links to Financial and Budget Information on Your Own Web Site • Submitting POS Documents • Submitting Advance Refunding Documents 38

Changes to Money Market Mutual Funds Regulations • Proposal to Eliminate Reference to Ratings • Stable vs. Floating NAV • SEC Roundtable, May 14 39

Changes to Money Market Mutual Funds Regulations • Proposal to Eliminate Reference to Ratings • Stable vs. Floating NAV • SEC Roundtable, May 14 39

Regulatory Issues • Treasury/IRS Issues – Issuers Holding Own ARS, May Work Through IRS VCAP – Relaxing Arbitrage Rebate Rules – BABs Oversight • Receiving BABs Subsidies (June 30 Webinar) – IRS Compliance Questionnaires: Advance Refundings • Debt Ceiling & SLGS – SLGS Window Closed 40

Regulatory Issues • Treasury/IRS Issues – Issuers Holding Own ARS, May Work Through IRS VCAP – Relaxing Arbitrage Rebate Rules – BABs Oversight • Receiving BABs Subsidies (June 30 Webinar) – IRS Compliance Questionnaires: Advance Refundings • Debt Ceiling & SLGS – SLGS Window Closed 40

What Can You Do NOW? • Reach Out to Senators and Representatives to Support Repeal of 3% Withholding Law • Reach out to Senators and Representatives and Oppose Nunes/Burr Legislation • Reach out to Senators and Representatives About the Importance of Tax-Exempt Bonds 41

What Can You Do NOW? • Reach Out to Senators and Representatives to Support Repeal of 3% Withholding Law • Reach out to Senators and Representatives and Oppose Nunes/Burr Legislation • Reach out to Senators and Representatives About the Importance of Tax-Exempt Bonds 41

Federal Liaison Center • Staff and Issues of Expertise: – Susan Gaffney: taxes, municipal bonds, budget, banking, and general outreach – Barrie Tabin Berger: pensions and retirement, health care, communications, budget 202 -393 -8020 42

Federal Liaison Center • Staff and Issues of Expertise: – Susan Gaffney: taxes, municipal bonds, budget, banking, and general outreach – Barrie Tabin Berger: pensions and retirement, health care, communications, budget 202 -393 -8020 42