eb6d1821c08b73d9b43af3757f9c1e7a.ppt

- Количество слайдов: 23

New York State and the Emerging Federal Healthcare Reform Blueprint Peter Newell and Danielle Holahan United Hospital Fund July 31, 2009 1

New York State and the Emerging Federal Healthcare Reform Blueprint Peter Newell and Danielle Holahan United Hospital Fund July 31, 2009 1

Overview • New York’s strengths are also our vulnerabilities • Progress in New York • Profile of New York’s Uninsured • Federal HCR and Medicaid/CHIP • Federal HCR and Insurance Exchange • Concluding thoughts 2

Overview • New York’s strengths are also our vulnerabilities • Progress in New York • Profile of New York’s Uninsured • Federal HCR and Medicaid/CHIP • Federal HCR and Insurance Exchange • Concluding thoughts 2

Mapping New York’s Progress • CHP expansion to 400% FPL – An additional 40, 000 uninsured children are now eligible – 310, 000 uninsured children were already eligible for CHP and Medicaid • FHP expansion to 200% FPL (contingent on federal approval) – An estimated 500, 000 uninsured adults would be newly eligible – 800, 000 uninsured adults already eligible for Medicaid and FHP • Simplification reforms – New York’s reforms accomplish most of what a state can do independently; further steps require federal authority • FHP buy-in • Statewide Enrollment Center Eligibility estimates are from the Urban Institute based on data from the 2008 Annual Social and Economic Supplement of the Current Population Survey. 3

Mapping New York’s Progress • CHP expansion to 400% FPL – An additional 40, 000 uninsured children are now eligible – 310, 000 uninsured children were already eligible for CHP and Medicaid • FHP expansion to 200% FPL (contingent on federal approval) – An estimated 500, 000 uninsured adults would be newly eligible – 800, 000 uninsured adults already eligible for Medicaid and FHP • Simplification reforms – New York’s reforms accomplish most of what a state can do independently; further steps require federal authority • FHP buy-in • Statewide Enrollment Center Eligibility estimates are from the Urban Institute based on data from the 2008 Annual Social and Economic Supplement of the Current Population Survey. 3

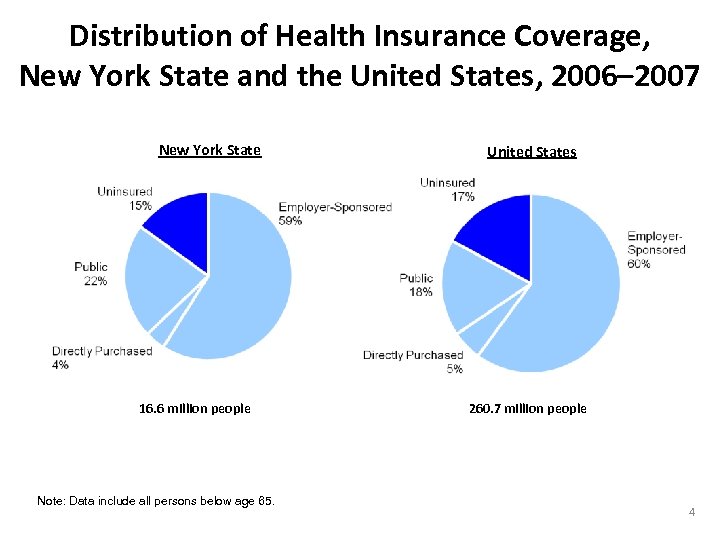

Distribution of Health Insurance Coverage, New York State and the United States, 2006– 2007 New York State 16. 6 million people Note: Data include all persons below age 65. United States 260. 7 million people 4

Distribution of Health Insurance Coverage, New York State and the United States, 2006– 2007 New York State 16. 6 million people Note: Data include all persons below age 65. United States 260. 7 million people 4

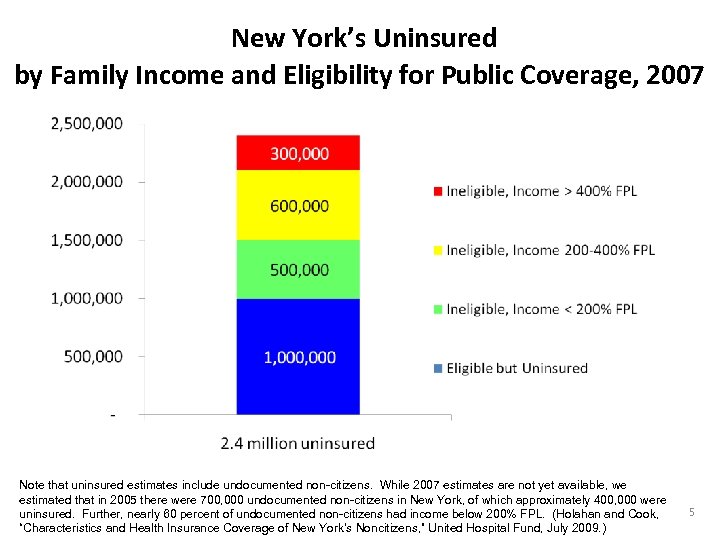

New York’s Uninsured by Family Income and Eligibility for Public Coverage, 2007 Note that uninsured estimates include undocumented non-citizens. While 2007 estimates are not yet available, we estimated that in 2005 there were 700, 000 undocumented non-citizens in New York, of which approximately 400, 000 were uninsured. Further, nearly 60 percent of undocumented non-citizens had income below 200% FPL. (Holahan and Cook, “Characteristics and Health Insurance Coverage of New York’s Noncitizens, ” United Hospital Fund, July 2009. ) 5

New York’s Uninsured by Family Income and Eligibility for Public Coverage, 2007 Note that uninsured estimates include undocumented non-citizens. While 2007 estimates are not yet available, we estimated that in 2005 there were 700, 000 undocumented non-citizens in New York, of which approximately 400, 000 were uninsured. Further, nearly 60 percent of undocumented non-citizens had income below 200% FPL. (Holahan and Cook, “Characteristics and Health Insurance Coverage of New York’s Noncitizens, ” United Hospital Fund, July 2009. ) 5

Emerging Federal Blueprint: Medicaid and CHIP-Related Provisions • Individual mandate • New federal minimum eligibility levels • State “maintenance of effort” requirements • Medicaid-eligibles cannot enroll through the Exchange* • CHIP-eligibles can enroll through the Exchange *Exception for certain childless adults. 6

Emerging Federal Blueprint: Medicaid and CHIP-Related Provisions • Individual mandate • New federal minimum eligibility levels • State “maintenance of effort” requirements • Medicaid-eligibles cannot enroll through the Exchange* • CHIP-eligibles can enroll through the Exchange *Exception for certain childless adults. 6

Medicaid Expansion • Medicaid eligibility expanded to minimum level (100/133/150 percent of federal poverty) for all non-elderly* • State “maintenance of effort” requirement (including coverage provided through waivers) • Enhanced federal financing for newly eligible populations and some currently eligible populations • Medicaid-eligible population is unlikely to be eligible for subsidized coverage in the Insurance Exchange *Exclusions for non-citizens remain. 7

Medicaid Expansion • Medicaid eligibility expanded to minimum level (100/133/150 percent of federal poverty) for all non-elderly* • State “maintenance of effort” requirement (including coverage provided through waivers) • Enhanced federal financing for newly eligible populations and some currently eligible populations • Medicaid-eligible population is unlikely to be eligible for subsidized coverage in the Insurance Exchange *Exclusions for non-citizens remain. 7

Medicaid Enrollment and Retention • Universal coverage – especially with an individual mandate – requires that Medicaid enrollment and retention be simplified • Unclear how simplification will be addressed in HCR bills • States will need federal approval for most simplification reforms: – Changes to citizenship documentation requirement in Medicaid and CHIP – Allow longer enrollment periods (e. g. , 24 -month) and continuous eligibility within the enrollment period – Use data matching to simplify enrollment and renewal, including automated renewal – Extend enrollment options (e. g. , ELE, continuous eligibility) to adults • States need clarification and reassurance about eligibility error 8

Medicaid Enrollment and Retention • Universal coverage – especially with an individual mandate – requires that Medicaid enrollment and retention be simplified • Unclear how simplification will be addressed in HCR bills • States will need federal approval for most simplification reforms: – Changes to citizenship documentation requirement in Medicaid and CHIP – Allow longer enrollment periods (e. g. , 24 -month) and continuous eligibility within the enrollment period – Use data matching to simplify enrollment and renewal, including automated renewal – Extend enrollment options (e. g. , ELE, continuous eligibility) to adults • States need clarification and reassurance about eligibility error 8

Medicaid Financing Issues • States are required to maintain eligibility levels in effect June 2009 (including eligibility provided through waivers) – NY may get enhanced match for some existing expansion populations • Cost of maintaining current eligibility levels will be greater if: – Participation rates increase (with individual mandate) – Provider payment rates increase (to increase access)* • Two approaches to expanding coverage to 200% FPL: – NY’s Family Health Plus waiver proposal – Federal health care reform. This population would likely be eligible for federallysubsidized coverage through the Exchange (in 2013). But, there is no guarantee that coverage would be the same as FHP • Permanent counter-cyclical federal financing? – Significant cost implications if enhanced match ends January 2011, as expected *Possible increased federal support for primary care payment rate increases. 9

Medicaid Financing Issues • States are required to maintain eligibility levels in effect June 2009 (including eligibility provided through waivers) – NY may get enhanced match for some existing expansion populations • Cost of maintaining current eligibility levels will be greater if: – Participation rates increase (with individual mandate) – Provider payment rates increase (to increase access)* • Two approaches to expanding coverage to 200% FPL: – NY’s Family Health Plus waiver proposal – Federal health care reform. This population would likely be eligible for federallysubsidized coverage through the Exchange (in 2013). But, there is no guarantee that coverage would be the same as FHP • Permanent counter-cyclical federal financing? – Significant cost implications if enhanced match ends January 2011, as expected *Possible increased federal support for primary care payment rate increases. 9

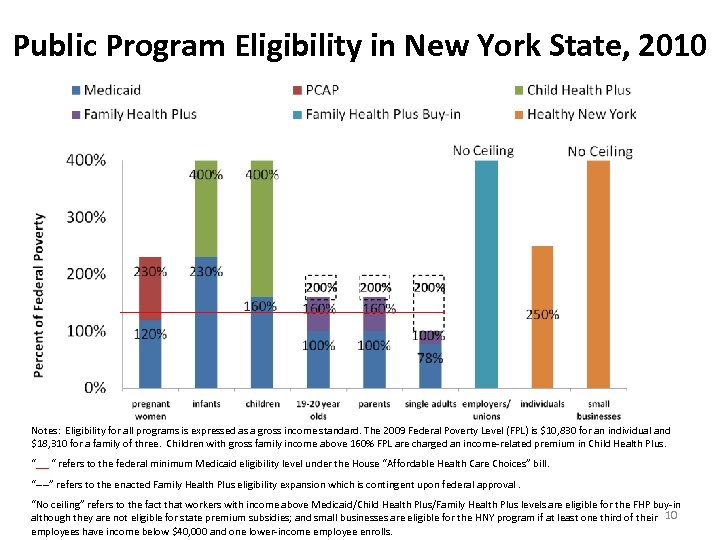

Public Program Eligibility in New York State, 2010 Notes: Eligibility for all programs is expressed as a gross income standard. The 2009 Federal Poverty Level (FPL) is $10, 830 for an individual and $18, 310 for a family of three. Children with gross family income above 160% FPL are charged an income-related premium in Child Health Plus. “ “ refers to the federal minimum Medicaid eligibility level under the House “Affordable Health Care Choices” bill. “----” refers to the enacted Family Health Plus eligibility expansion which is contingent upon federal approval. “No ceiling” refers to the fact that workers with income above Medicaid/Child Health Plus/Family Health Plus levels are eligible for the FHP buy-in although they are not eligible for state premium subsidies; and small businesses are eligible for the HNY program if at least one third of their 10 employees have income below $40, 000 and one lower-income employee enrolls.

Public Program Eligibility in New York State, 2010 Notes: Eligibility for all programs is expressed as a gross income standard. The 2009 Federal Poverty Level (FPL) is $10, 830 for an individual and $18, 310 for a family of three. Children with gross family income above 160% FPL are charged an income-related premium in Child Health Plus. “ “ refers to the federal minimum Medicaid eligibility level under the House “Affordable Health Care Choices” bill. “----” refers to the enacted Family Health Plus eligibility expansion which is contingent upon federal approval. “No ceiling” refers to the fact that workers with income above Medicaid/Child Health Plus/Family Health Plus levels are eligible for the FHP buy-in although they are not eligible for state premium subsidies; and small businesses are eligible for the HNY program if at least one third of their 10 employees have income below $40, 000 and one lower-income employee enrolls.

Medicaid and Exchange Options for Non-Citizens • No Medicaid-related changes expected under federal reform: – No change on “ 5 -year bar” from Medicaid – No changes to ease barriers to enrollment in Medicaid for eligible noncitizens • Documented non-citizens are eligible for subsidized coverage through the Exchange • Exchange could provide needed connection to subsidized and unsubsidized coverage options • Undocumented population excluded from reform 11

Medicaid and Exchange Options for Non-Citizens • No Medicaid-related changes expected under federal reform: – No change on “ 5 -year bar” from Medicaid – No changes to ease barriers to enrollment in Medicaid for eligible noncitizens • Documented non-citizens are eligible for subsidized coverage through the Exchange • Exchange could provide needed connection to subsidized and unsubsidized coverage options • Undocumented population excluded from reform 11

Medicaid/CHIP and the Exchange • Coordination of eligibility determination for Medicaid and subsidies through the Exchange – So no one “falls through the cracks” – To assure smooth transitions between the two as income changes • Possible role(s) for: – – State and local Medicaid offices Enrollment Center Facilitated enrollers Existing “connectors” (e. g. , “Enroll NY” or “my. Benefits”) • Issues if Medicaid eligible population is allowed to enroll in the Exchange over time: – Demonstrate sufficient network capacity – Challenges of providing Medicaid wraparound • CHIP-eligibles can/must enroll through the Exchange; CHIP expires in 2013 when Exchange is operational 12

Medicaid/CHIP and the Exchange • Coordination of eligibility determination for Medicaid and subsidies through the Exchange – So no one “falls through the cracks” – To assure smooth transitions between the two as income changes • Possible role(s) for: – – State and local Medicaid offices Enrollment Center Facilitated enrollers Existing “connectors” (e. g. , “Enroll NY” or “my. Benefits”) • Issues if Medicaid eligible population is allowed to enroll in the Exchange over time: – Demonstrate sufficient network capacity – Challenges of providing Medicaid wraparound • CHIP-eligibles can/must enroll through the Exchange; CHIP expires in 2013 when Exchange is operational 12

Summary of Key Medicaid-Related Issues for New York • Medicaid maintenance of effort requirement • Eligible but uninsured • How individual mandate will work for lowincome and Medicaid-eligible populations • Coverage for population below 200% FPL • Non-citizens 13

Summary of Key Medicaid-Related Issues for New York • Medicaid maintenance of effort requirement • Eligible but uninsured • How individual mandate will work for lowincome and Medicaid-eligible populations • Coverage for population below 200% FPL • Non-citizens 13

Reading the Tea Leaves on Federal Healthcare Reform Amidst a lot of uncertainty, some educated guesses: • Insurance Market Reforms; • Individual mandate with affordability exemption, enforced through tax code, and subsidies; • Employer pay or play mandate; • Small employer tax credits; • Individuals purchase through an Exchange, with gradual expansion to groups; • Phase-in of national benefit package with cost-sharing tiers; and • Non-compliant existing products grandfathered 14

Reading the Tea Leaves on Federal Healthcare Reform Amidst a lot of uncertainty, some educated guesses: • Insurance Market Reforms; • Individual mandate with affordability exemption, enforced through tax code, and subsidies; • Employer pay or play mandate; • Small employer tax credits; • Individuals purchase through an Exchange, with gradual expansion to groups; • Phase-in of national benefit package with cost-sharing tiers; and • Non-compliant existing products grandfathered 14

Insurance Market Reforms: Nation Moves Towards New York – But Some Challenges Remain • No Issues Here: Ø Ø Guaranteed issue/guaranteed renewability No medical underwriting, no pre-existing condition exclusions No gender or industry factors Consumer protections/appeal rights • But What About Ø State Pre-emption? Ø Year round open enrollment or HIPAA-like special enrollment? Ø Age bands – 7. 5: 1 (Senate Finance) or 2: 1 (House/Senate HELP) or 1: 1 (New York)? Ø New national benefit package and grandfathering existing products? 15

Insurance Market Reforms: Nation Moves Towards New York – But Some Challenges Remain • No Issues Here: Ø Ø Guaranteed issue/guaranteed renewability No medical underwriting, no pre-existing condition exclusions No gender or industry factors Consumer protections/appeal rights • But What About Ø State Pre-emption? Ø Year round open enrollment or HIPAA-like special enrollment? Ø Age bands – 7. 5: 1 (Senate Finance) or 2: 1 (House/Senate HELP) or 1: 1 (New York)? Ø New national benefit package and grandfathering existing products? 15

The Exchange: Lynchpin for Federal Reform • National, state or regional (NYC, NJ and CT)? • “Fleamarket” or “The Market”: How much leverage will Exchange have – RFPs and Bids? • Electronic marketplace for products with benefits meeting federal standards, enrollment, premium collection (TPA function) • Other potential duties: Ø Quality Data Ø Payment Reform (ACOs, Medical Homes, Essential Community Provider contracting) Ø Ombudsman Ø Facilitated Enroller/Navigator Ø Risk Adjustor 16

The Exchange: Lynchpin for Federal Reform • National, state or regional (NYC, NJ and CT)? • “Fleamarket” or “The Market”: How much leverage will Exchange have – RFPs and Bids? • Electronic marketplace for products with benefits meeting federal standards, enrollment, premium collection (TPA function) • Other potential duties: Ø Quality Data Ø Payment Reform (ACOs, Medical Homes, Essential Community Provider contracting) Ø Ombudsman Ø Facilitated Enroller/Navigator Ø Risk Adjustor 16

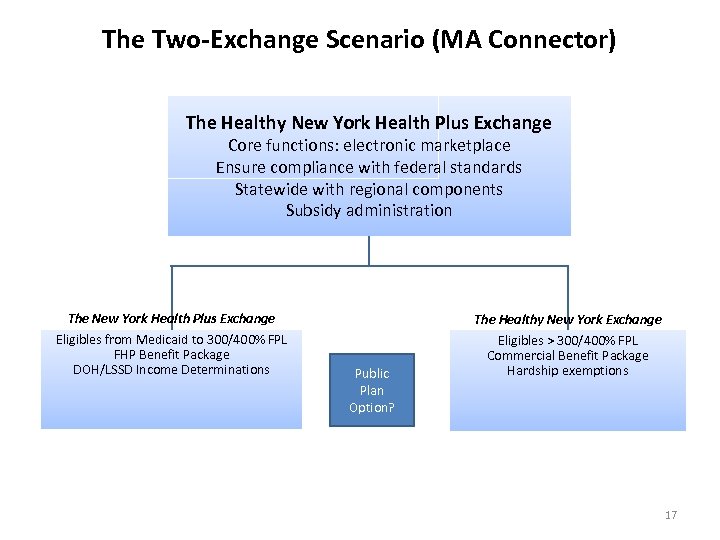

The Two-Exchange Scenario (MA Connector) The Healthy New York Health Plus Exchange Core functions: electronic marketplace Ensure compliance with federal standards Statewide with regional components Subsidy administration The New York Health Plus Exchange The Healthy New York Exchange Eligibles from Medicaid to 300/400% FPL FHP Benefit Package DOH/LSSD Income Determinations Eligibles > 300/400% FPL Commercial Benefit Package Hardship exemptions Public Plan Option? 17

The Two-Exchange Scenario (MA Connector) The Healthy New York Health Plus Exchange Core functions: electronic marketplace Ensure compliance with federal standards Statewide with regional components Subsidy administration The New York Health Plus Exchange The Healthy New York Exchange Eligibles from Medicaid to 300/400% FPL FHP Benefit Package DOH/LSSD Income Determinations Eligibles > 300/400% FPL Commercial Benefit Package Hardship exemptions Public Plan Option? 17

Two-Exchange Scenario – Threshold Issues • Extend the two-tier healthcare system, with longstanding issues about quality, access to specialty care, academic medical centers, provider payment systems, etc. • Capacity of “public” system to absorb 1 million new enrollees and 1 million EBU? Is public system the best place for them to enter market? • Pooling: How will new enrollees be pooled? Ø Will they be integrated with five existing pools (MMC, FHP, DP, SG and HNY)? Ø Impact of Medicaid actuarial soundness rule? Ø What about badly broken Direct Pay pool with new individual mandate? • Risk adjustment: MMC rate-setting v. Reg 146 • HCRA surcharges, covered lives, Section 332 assessments, Reg 146 assessments, premium taxes, etc. 18

Two-Exchange Scenario – Threshold Issues • Extend the two-tier healthcare system, with longstanding issues about quality, access to specialty care, academic medical centers, provider payment systems, etc. • Capacity of “public” system to absorb 1 million new enrollees and 1 million EBU? Is public system the best place for them to enter market? • Pooling: How will new enrollees be pooled? Ø Will they be integrated with five existing pools (MMC, FHP, DP, SG and HNY)? Ø Impact of Medicaid actuarial soundness rule? Ø What about badly broken Direct Pay pool with new individual mandate? • Risk adjustment: MMC rate-setting v. Reg 146 • HCRA surcharges, covered lives, Section 332 assessments, Reg 146 assessments, premium taxes, etc. 18

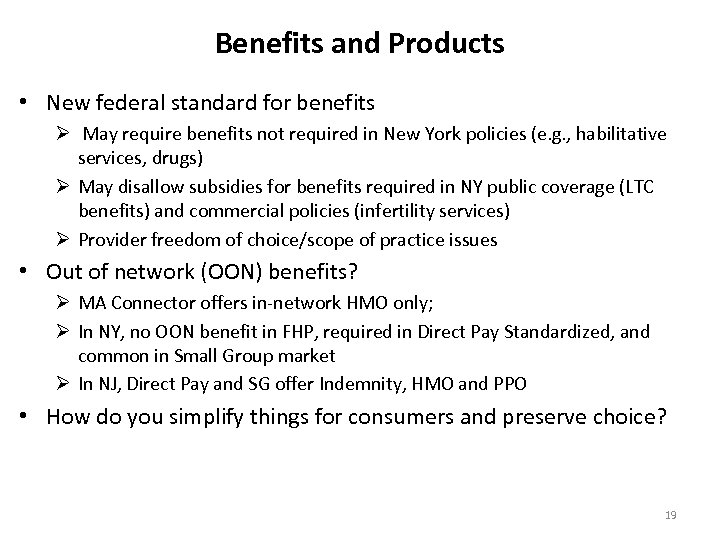

Benefits and Products • New federal standard for benefits Ø May require benefits not required in New York policies (e. g. , habilitative services, drugs) Ø May disallow subsidies for benefits required in NY public coverage (LTC benefits) and commercial policies (infertility services) Ø Provider freedom of choice/scope of practice issues • Out of network (OON) benefits? Ø MA Connector offers in-network HMO only; Ø In NY, no OON benefit in FHP, required in Direct Pay Standardized, and common in Small Group market Ø In NJ, Direct Pay and SG offer Indemnity, HMO and PPO • How do you simplify things for consumers and preserve choice? 19

Benefits and Products • New federal standard for benefits Ø May require benefits not required in New York policies (e. g. , habilitative services, drugs) Ø May disallow subsidies for benefits required in NY public coverage (LTC benefits) and commercial policies (infertility services) Ø Provider freedom of choice/scope of practice issues • Out of network (OON) benefits? Ø MA Connector offers in-network HMO only; Ø In NY, no OON benefit in FHP, required in Direct Pay Standardized, and common in Small Group market Ø In NJ, Direct Pay and SG offer Indemnity, HMO and PPO • How do you simplify things for consumers and preserve choice? 19

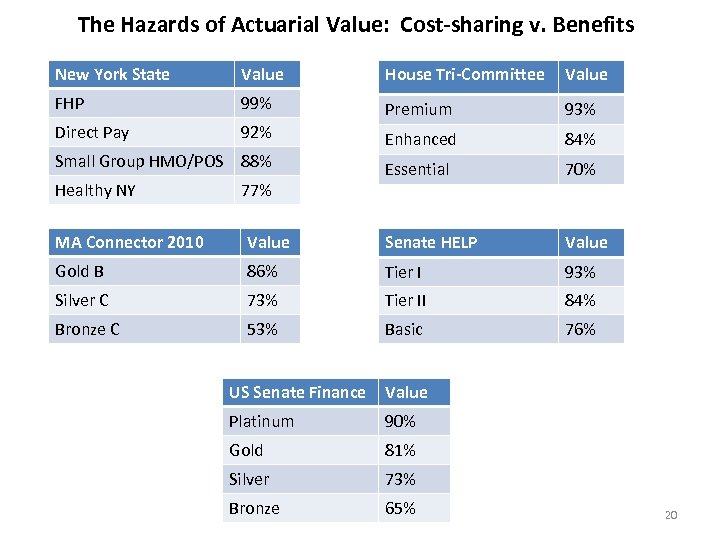

The Hazards of Actuarial Value: Cost-sharing v. Benefits New York State Value House Tri-Committee Value FHP 99% Premium 93% Direct Pay 92% Enhanced 84% Essential 70% Small Group HMO/POS 88% Healthy NY 77% MA Connector 2010 Value Senate HELP Value Gold B 86% Tier I 93% Silver C 73% Tier II 84% Bronze C 53% Basic 76% US Senate Finance Value Platinum 90% Gold 81% Silver 73% Bronze 65% 20

The Hazards of Actuarial Value: Cost-sharing v. Benefits New York State Value House Tri-Committee Value FHP 99% Premium 93% Direct Pay 92% Enhanced 84% Essential 70% Small Group HMO/POS 88% Healthy NY 77% MA Connector 2010 Value Senate HELP Value Gold B 86% Tier I 93% Silver C 73% Tier II 84% Bronze C 53% Basic 76% US Senate Finance Value Platinum 90% Gold 81% Silver 73% Bronze 65% 20

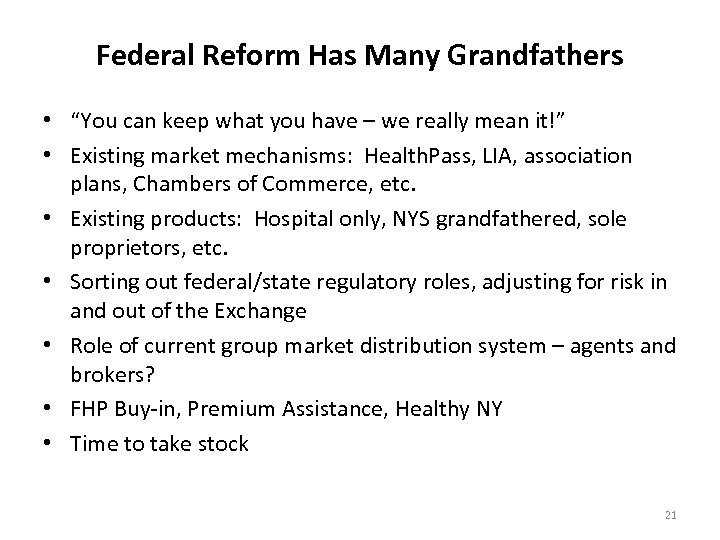

Federal Reform Has Many Grandfathers • “You can keep what you have – we really mean it!” • Existing market mechanisms: Health. Pass, LIA, association plans, Chambers of Commerce, etc. • Existing products: Hospital only, NYS grandfathered, sole proprietors, etc. • Sorting out federal/state regulatory roles, adjusting for risk in and out of the Exchange • Role of current group market distribution system – agents and brokers? • FHP Buy-in, Premium Assistance, Healthy NY • Time to take stock 21

Federal Reform Has Many Grandfathers • “You can keep what you have – we really mean it!” • Existing market mechanisms: Health. Pass, LIA, association plans, Chambers of Commerce, etc. • Existing products: Hospital only, NYS grandfathered, sole proprietors, etc. • Sorting out federal/state regulatory roles, adjusting for risk in and out of the Exchange • Role of current group market distribution system – agents and brokers? • FHP Buy-in, Premium Assistance, Healthy NY • Time to take stock 21

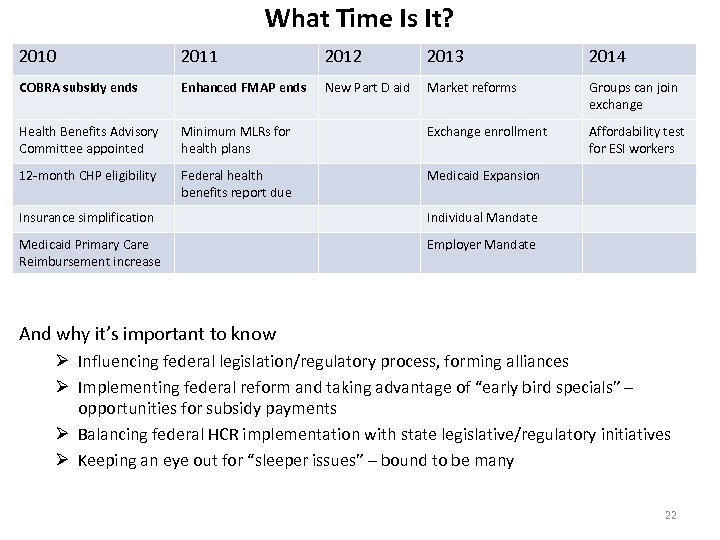

What Time Is It? 2010 2011 2012 2013 2014 COBRA subsidy ends Enhanced FMAP ends New Part D aid Market reforms Groups can join exchange Health Benefits Advisory Committee appointed Minimum MLRs for health plans Exchange enrollment Affordability test for ESI workers 12 -month CHP eligibility Federal health benefits report due Medicaid Expansion Insurance simplification Individual Mandate Medicaid Primary Care Reimbursement increase Employer Mandate And why it’s important to know Ø Influencing federal legislation/regulatory process, forming alliances Ø Implementing federal reform and taking advantage of “early bird specials” – opportunities for subsidy payments Ø Balancing federal HCR implementation with state legislative/regulatory initiatives Ø Keeping an eye out for “sleeper issues” – bound to be many 22

What Time Is It? 2010 2011 2012 2013 2014 COBRA subsidy ends Enhanced FMAP ends New Part D aid Market reforms Groups can join exchange Health Benefits Advisory Committee appointed Minimum MLRs for health plans Exchange enrollment Affordability test for ESI workers 12 -month CHP eligibility Federal health benefits report due Medicaid Expansion Insurance simplification Individual Mandate Medicaid Primary Care Reimbursement increase Employer Mandate And why it’s important to know Ø Influencing federal legislation/regulatory process, forming alliances Ø Implementing federal reform and taking advantage of “early bird specials” – opportunities for subsidy payments Ø Balancing federal HCR implementation with state legislative/regulatory initiatives Ø Keeping an eye out for “sleeper issues” – bound to be many 22

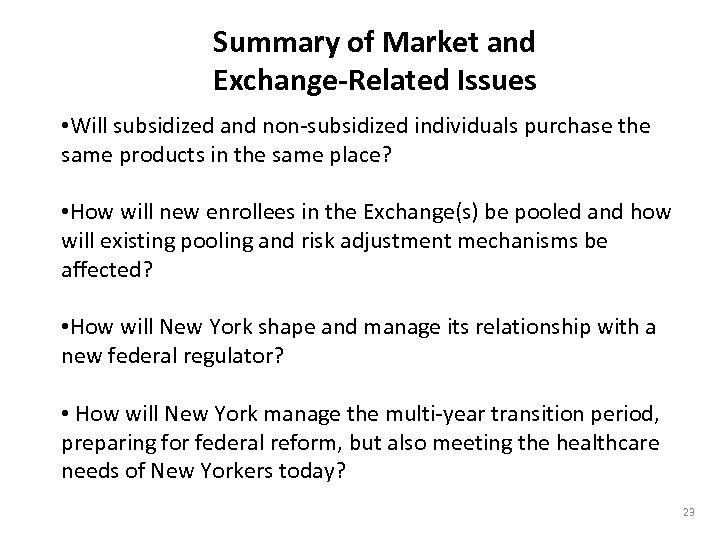

Summary of Market and Exchange-Related Issues • Will subsidized and non-subsidized individuals purchase the same products in the same place? • How will new enrollees in the Exchange(s) be pooled and how will existing pooling and risk adjustment mechanisms be affected? • How will New York shape and manage its relationship with a new federal regulator? • How will New York manage the multi-year transition period, preparing for federal reform, but also meeting the healthcare needs of New Yorkers today? 23

Summary of Market and Exchange-Related Issues • Will subsidized and non-subsidized individuals purchase the same products in the same place? • How will new enrollees in the Exchange(s) be pooled and how will existing pooling and risk adjustment mechanisms be affected? • How will New York shape and manage its relationship with a new federal regulator? • How will New York manage the multi-year transition period, preparing for federal reform, but also meeting the healthcare needs of New Yorkers today? 23