e95d38dc1a8122946b614a58b0fc71a3.ppt

- Количество слайдов: 40

New Studies in Relative Price Strength Charles D. Kirkpatrick II, CMT www. charleskirkpatrick. com kirkco@capecod. net

New Studies in Relative Price Strength Charles D. Kirkpatrick II, CMT www. charleskirkpatrick. com kirkco@capecod. net

What I’m Going to Cover 1. Look at old studies from book “Beat the Market” 2. Assess how the triggers developed then have behaved since 3. Review market direction methods 4. Show new market direction methods 5. Show new factors 6. Adjust old and new factors for new data base

What I’m Going to Cover 1. Look at old studies from book “Beat the Market” 2. Assess how the triggers developed then have behaved since 3. Review market direction methods 4. Show new market direction methods 5. Show new factors 6. Adjust old and new factors for new data base

Old Tests Period 1998 – 2006 8, 073 stocks weekly 290, 594 weekly observations Projected relative strength percentile out 3, 6, and 12 months into the future to measure performance of stock’s weekly relative price and price-to-sales percentile. • Summarized results. • Decided on optimal buy and sell triggers. • •

Old Tests Period 1998 – 2006 8, 073 stocks weekly 290, 594 weekly observations Projected relative strength percentile out 3, 6, and 12 months into the future to measure performance of stock’s weekly relative price and price-to-sales percentile. • Summarized results. • Decided on optimal buy and sell triggers. • •

Old Studies Best Screen from book: “Beat the Market” – Best list from all stocks that have a market cap > $1 billion. – Price above ten, and relative price strength only calculated on stocks that have traded about $5 for 26 weeks. – Relative price strength percentile > 97 for buy, < 52 for sell (price screen). – Relative price-to-sales ratio < 42 to buy, > 67 to sell (value screen).

Old Studies Best Screen from book: “Beat the Market” – Best list from all stocks that have a market cap > $1 billion. – Price above ten, and relative price strength only calculated on stocks that have traded about $5 for 26 weeks. – Relative price strength percentile > 97 for buy, < 52 for sell (price screen). – Relative price-to-sales ratio < 42 to buy, > 67 to sell (value screen).

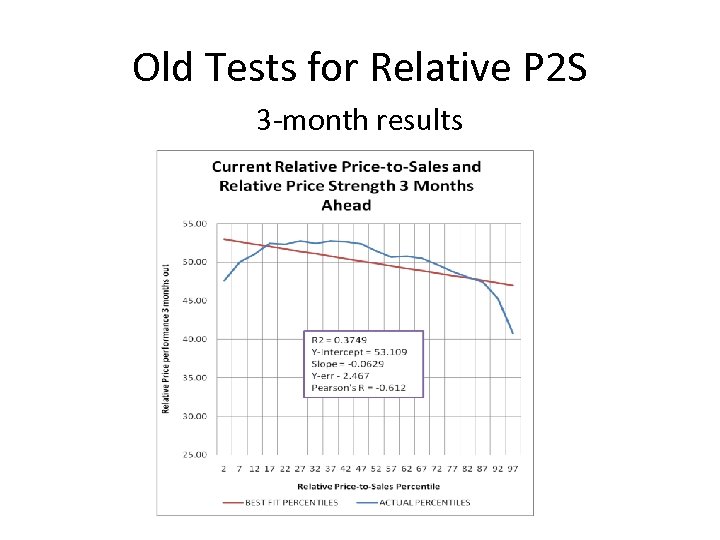

Old Tests for Relative P 2 S 3 -month results

Old Tests for Relative P 2 S 3 -month results

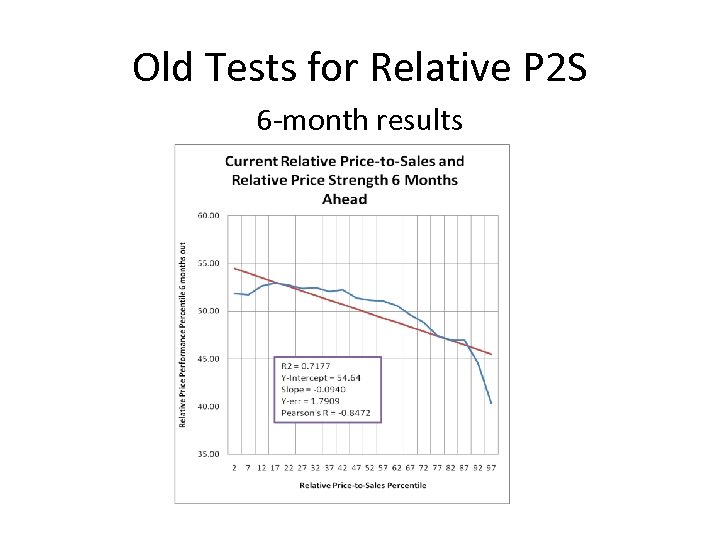

Old Tests for Relative P 2 S 6 -month results

Old Tests for Relative P 2 S 6 -month results

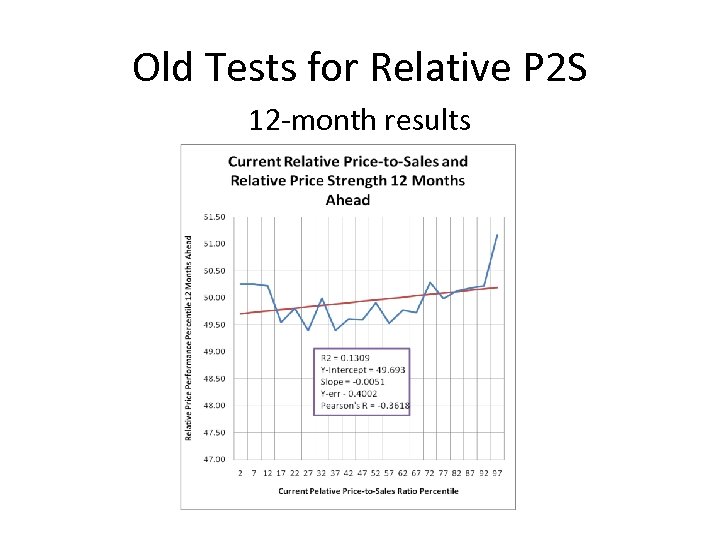

Old Tests for Relative P 2 S 12 -month results

Old Tests for Relative P 2 S 12 -month results

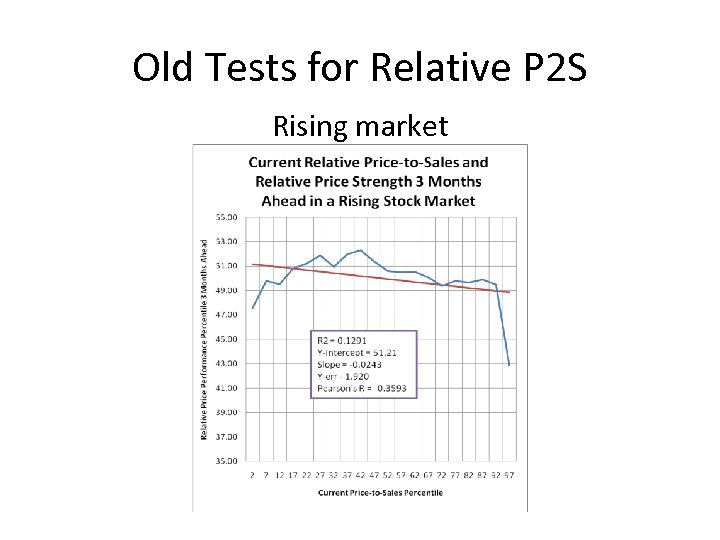

Old Tests for Relative P 2 S Rising market

Old Tests for Relative P 2 S Rising market

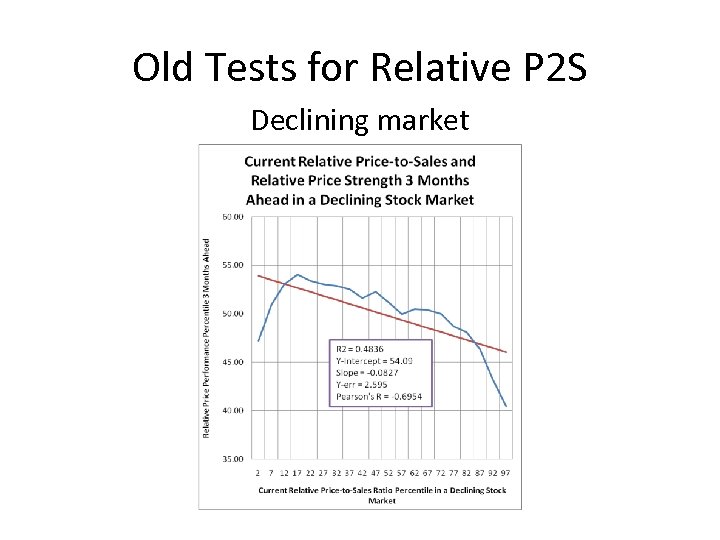

Old Tests for Relative P 2 S Declining market

Old Tests for Relative P 2 S Declining market

Old Tests for Relative P 2 S Results: – Relative price to sales was a viable selection criteria with statistically useful results. – Stocks with relative P 2 S percentiles greater than 42 and less than 17 were the best picks. – Stocks with relative P 2 S percentiles greater than 67 should be deleted from any portfolio.

Old Tests for Relative P 2 S Results: – Relative price to sales was a viable selection criteria with statistically useful results. – Stocks with relative P 2 S percentiles greater than 42 and less than 17 were the best picks. – Stocks with relative P 2 S percentiles greater than 67 should be deleted from any portfolio.

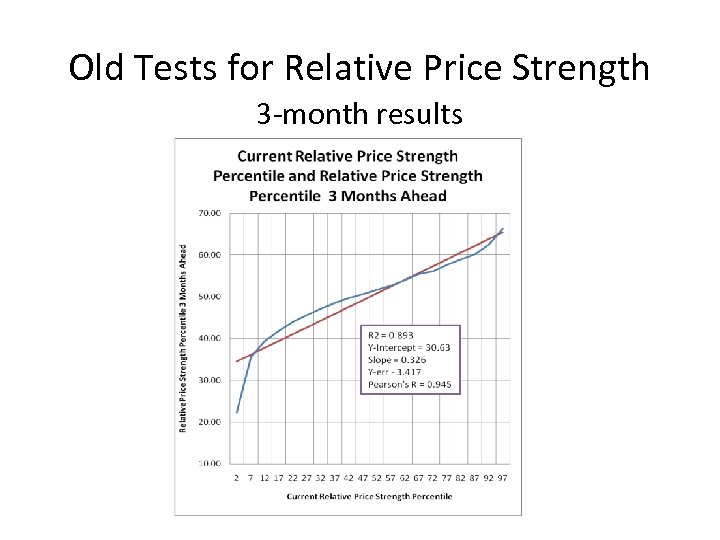

Old Tests for Relative Price Strength 3 -month results

Old Tests for Relative Price Strength 3 -month results

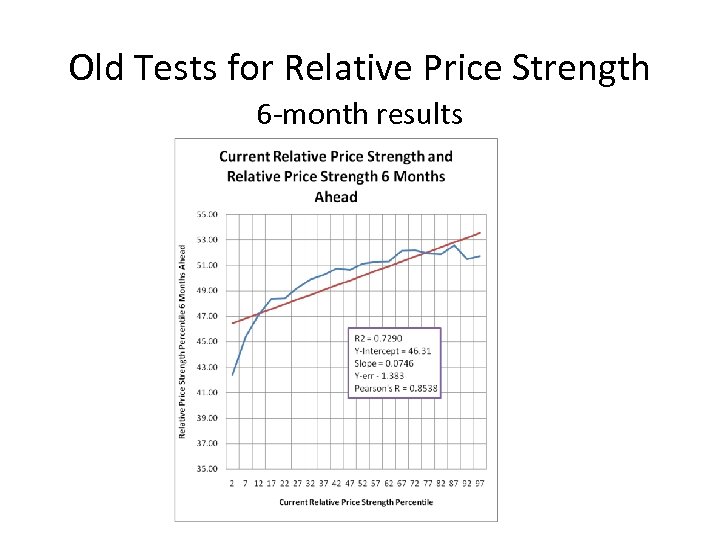

Old Tests for Relative Price Strength 6 -month results

Old Tests for Relative Price Strength 6 -month results

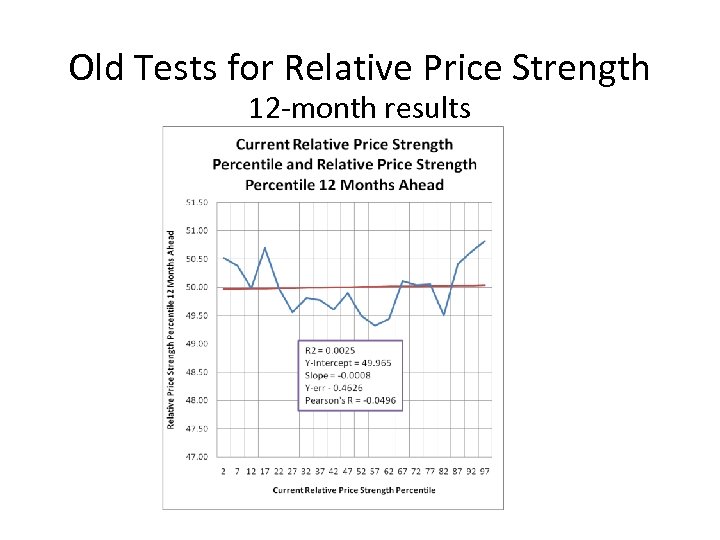

Old Tests for Relative Price Strength 12 -month results

Old Tests for Relative Price Strength 12 -month results

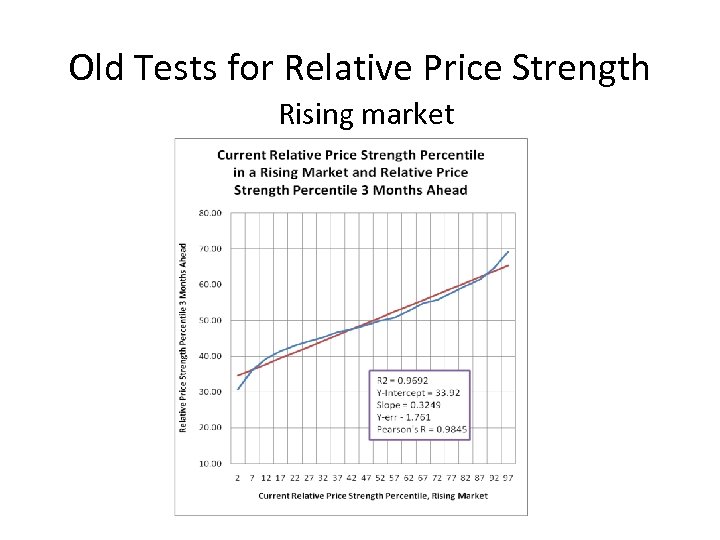

Old Tests for Relative Price Strength Rising market

Old Tests for Relative Price Strength Rising market

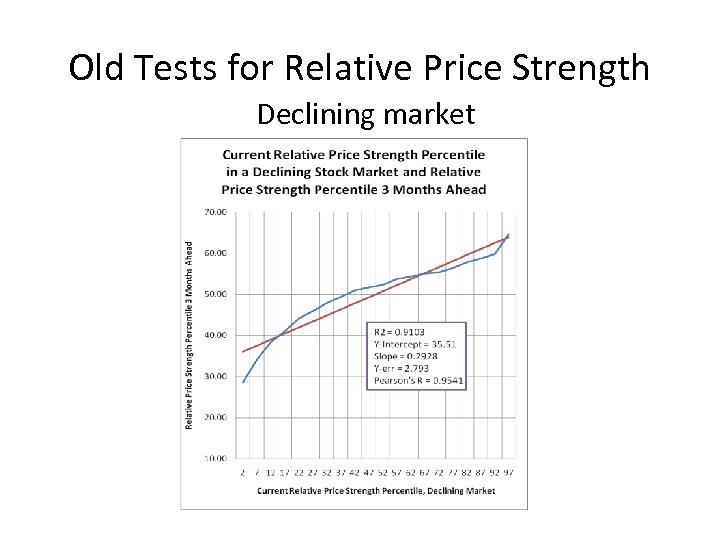

Old Tests for Relative Price Strength Declining market

Old Tests for Relative Price Strength Declining market

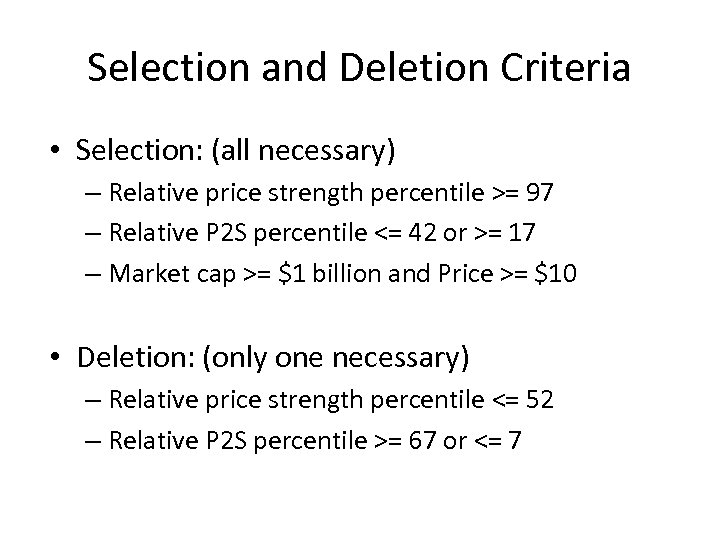

Selection and Deletion Criteria • Selection: (all necessary) – Relative price strength percentile >= 97 – Relative P 2 S percentile <= 42 or >= 17 – Market cap >= $1 billion and Price >= $10 • Deletion: (only one necessary) – Relative price strength percentile <= 52 – Relative P 2 S percentile >= 67 or <= 7

Selection and Deletion Criteria • Selection: (all necessary) – Relative price strength percentile >= 97 – Relative P 2 S percentile <= 42 or >= 17 – Market cap >= $1 billion and Price >= $10 • Deletion: (only one necessary) – Relative price strength percentile <= 52 – Relative P 2 S percentile >= 67 or <= 7

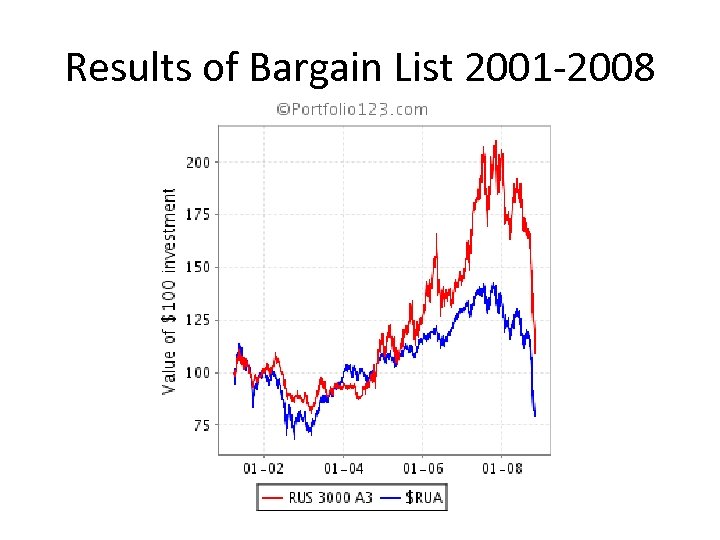

Results of Bargain List 2001 -2008

Results of Bargain List 2001 -2008

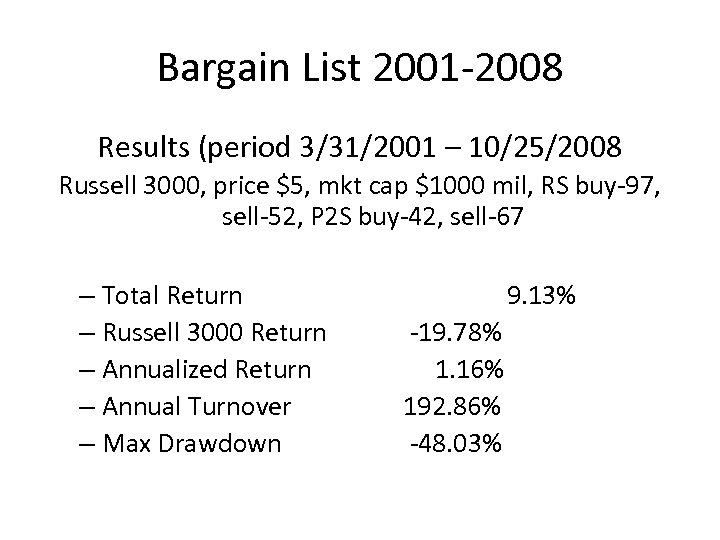

Bargain List 2001 -2008 Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $5, mkt cap $1000 mil, RS buy-97, sell-52, P 2 S buy-42, sell-67 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 9. 13% -19. 78% 1. 16% 192. 86% -48. 03%

Bargain List 2001 -2008 Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $5, mkt cap $1000 mil, RS buy-97, sell-52, P 2 S buy-42, sell-67 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 9. 13% -19. 78% 1. 16% 192. 86% -48. 03%

Market Risk • Can use moving average crossovers • Sliding in and out – 25% on cross of 13 -week sma – 25% on cross of 26 -week sma – 50% on cross of 52 -week sma • Golden cross – 100% on 50 -day crossing the 200 -day sma

Market Risk • Can use moving average crossovers • Sliding in and out – 25% on cross of 13 -week sma – 25% on cross of 26 -week sma – 50% on cross of 52 -week sma • Golden cross – 100% on 50 -day crossing the 200 -day sma

Problems • List performance (equity curve) – flat • Number of stocks fluctuates with signals • Too few stocks and too high initial price (done to limit number of stocks in list to a small number) • Price limit for RS calculation too high (s/b < $5) • Many stocks not deleted soon enough • Comparison to market not equivalent (apples to apples) • Drawdown still large • Market risk not sensitive (sluggish to turn)

Problems • List performance (equity curve) – flat • Number of stocks fluctuates with signals • Too few stocks and too high initial price (done to limit number of stocks in list to a small number) • Price limit for RS calculation too high (s/b < $5) • Many stocks not deleted soon enough • Comparison to market not equivalent (apples to apples) • Drawdown still large • Market risk not sensitive (sluggish to turn)

Solution Market Risk • Use Russell 3000 as the universe and performance comparison. • Run random selection of Russell 3000 stocks and test market risk avoidance methods. (Result should be method that can be used in any portfolio selection model). • Make criteria sensitive to market turns.

Solution Market Risk • Use Russell 3000 as the universe and performance comparison. • Run random selection of Russell 3000 stocks and test market risk avoidance methods. (Result should be method that can be used in any portfolio selection model). • Make criteria sensitive to market turns.

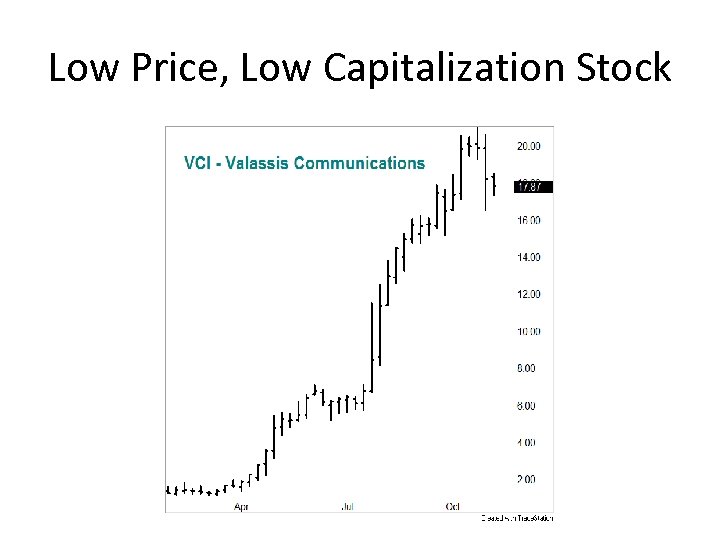

Low Price, Low Capitalization Stock

Low Price, Low Capitalization Stock

Solution Stock Selection and Deletion • • • Lower minimum price to $2 Lower minimum market cap to $100 million Lower back testing price to $0. 01 Adjust RS selection and deletion triggers Adjust P 2 S selection and deletion triggers Add a percentage stop to cover periods between weeks

Solution Stock Selection and Deletion • • • Lower minimum price to $2 Lower minimum market cap to $100 million Lower back testing price to $0. 01 Adjust RS selection and deletion triggers Adjust P 2 S selection and deletion triggers Add a percentage stop to cover periods between weeks

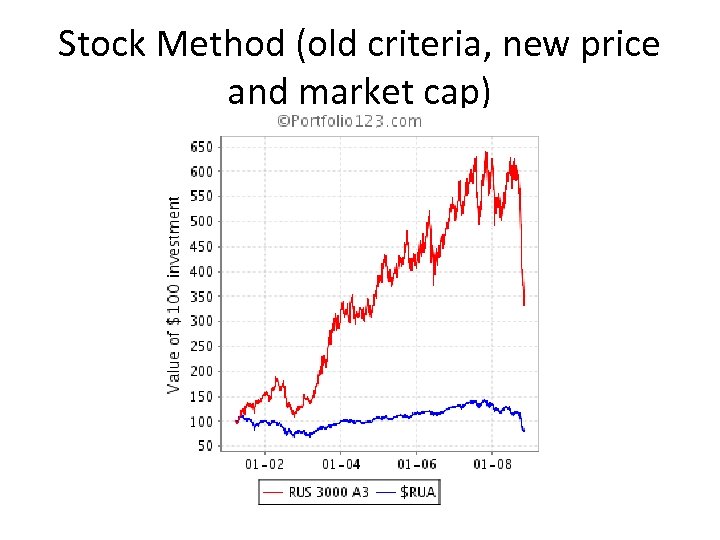

Stock Method (old criteria, new price and market cap)

Stock Method (old criteria, new price and market cap)

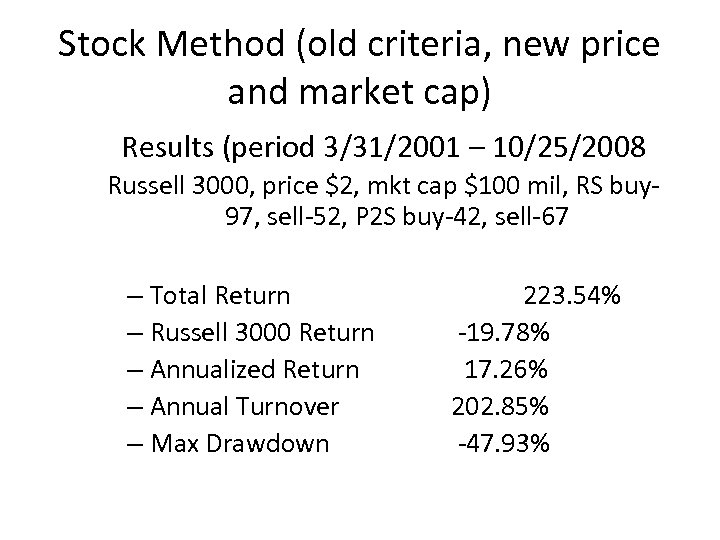

Stock Method (old criteria, new price and market cap) Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, RS buy 97, sell-52, P 2 S buy-42, sell-67 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 223. 54% -19. 78% 17. 26% 202. 85% -47. 93%

Stock Method (old criteria, new price and market cap) Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, RS buy 97, sell-52, P 2 S buy-42, sell-67 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 223. 54% -19. 78% 17. 26% 202. 85% -47. 93%

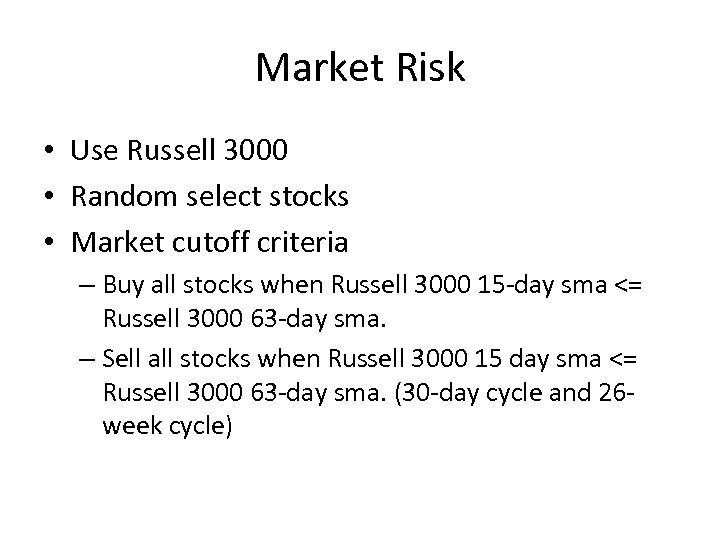

Market Risk • Use Russell 3000 • Random select stocks • Market cutoff criteria – Buy all stocks when Russell 3000 15 -day sma <= Russell 3000 63 -day sma. – Sell all stocks when Russell 3000 15 day sma <= Russell 3000 63 -day sma. (30 -day cycle and 26 week cycle)

Market Risk • Use Russell 3000 • Random select stocks • Market cutoff criteria – Buy all stocks when Russell 3000 15 -day sma <= Russell 3000 63 -day sma. – Sell all stocks when Russell 3000 15 day sma <= Russell 3000 63 -day sma. (30 -day cycle and 26 week cycle)

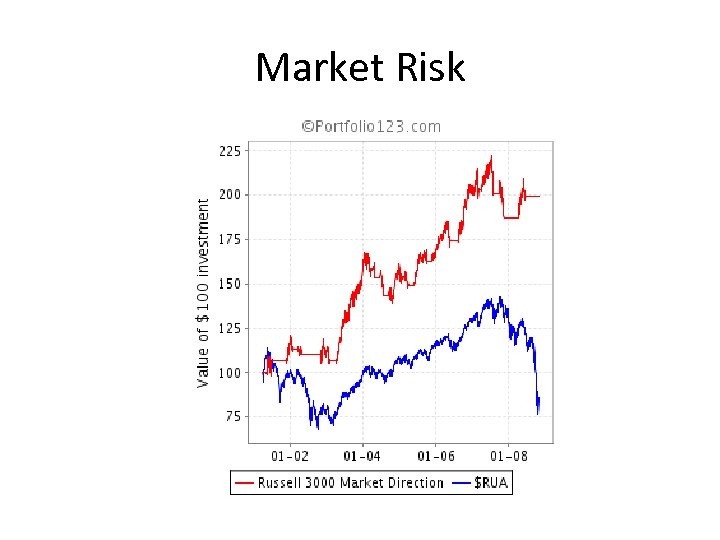

Market Risk

Market Risk

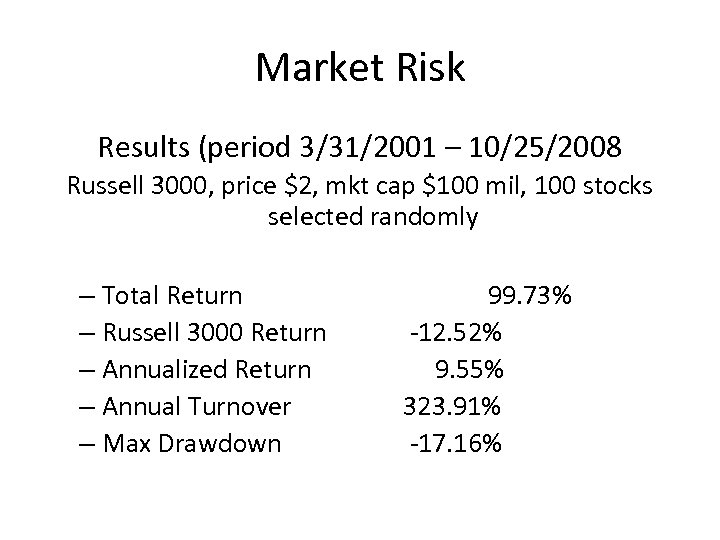

Market Risk Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, 100 stocks selected randomly – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 99. 73% -12. 52% 9. 55% 323. 91% -17. 16%

Market Risk Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, 100 stocks selected randomly – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 99. 73% -12. 52% 9. 55% 323. 91% -17. 16%

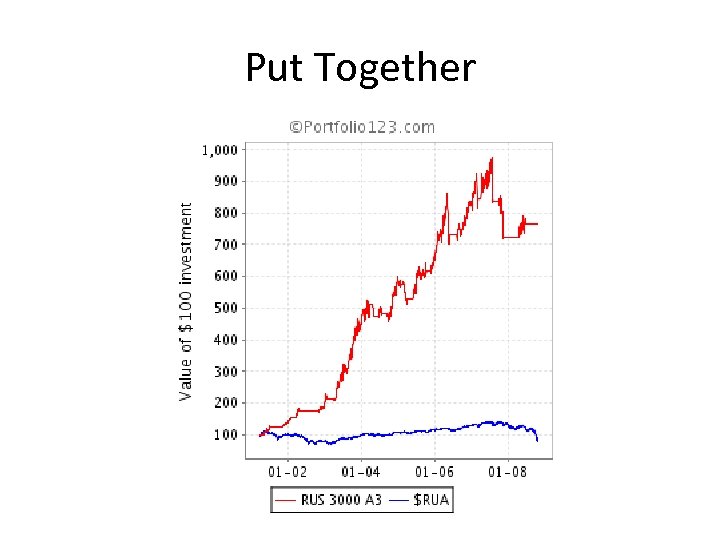

Put Together

Put Together

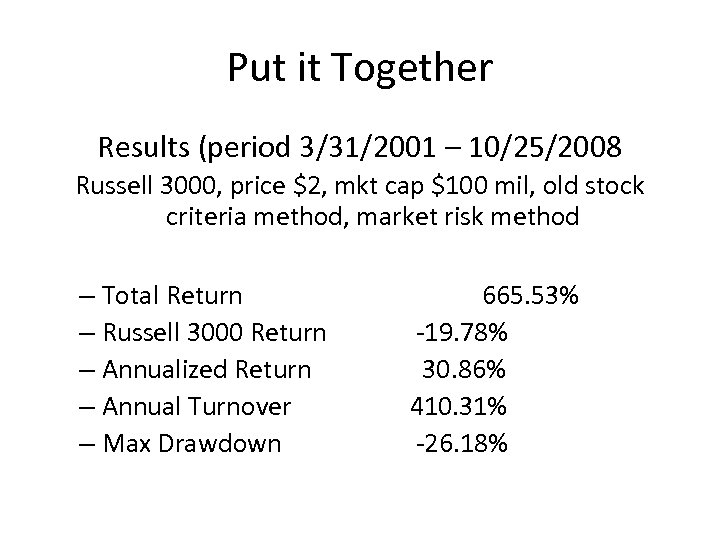

Put it Together Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, old stock criteria method, market risk method – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 665. 53% -19. 78% 30. 86% 410. 31% -26. 18%

Put it Together Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, old stock criteria method, market risk method – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 665. 53% -19. 78% 30. 86% 410. 31% -26. 18%

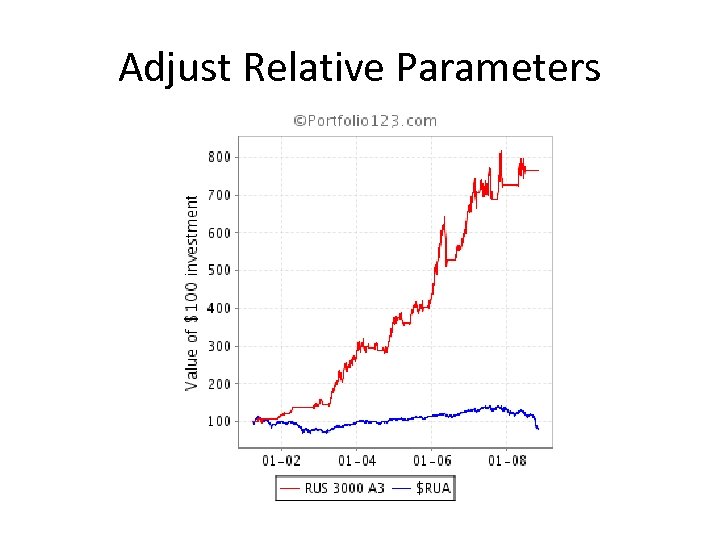

Adjust Relative Parameters

Adjust Relative Parameters

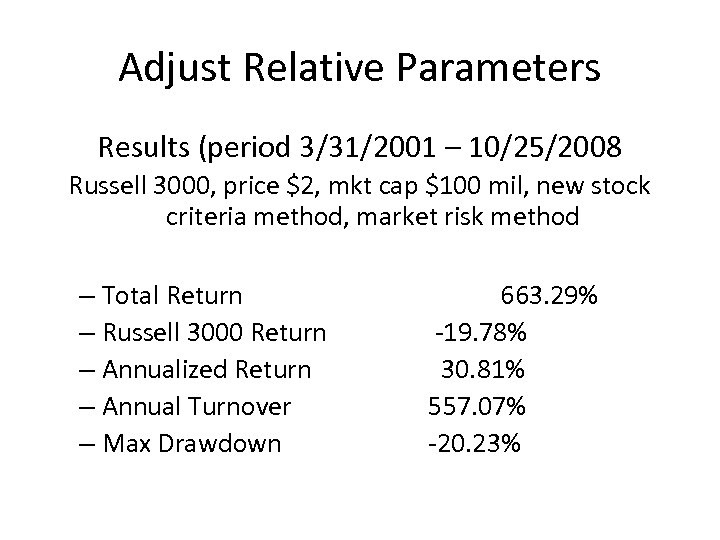

Adjust Relative Parameters Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, new stock criteria method, market risk method – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 663. 29% -19. 78% 30. 81% 557. 07% -20. 23%

Adjust Relative Parameters Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, new stock criteria method, market risk method – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 663. 29% -19. 78% 30. 81% 557. 07% -20. 23%

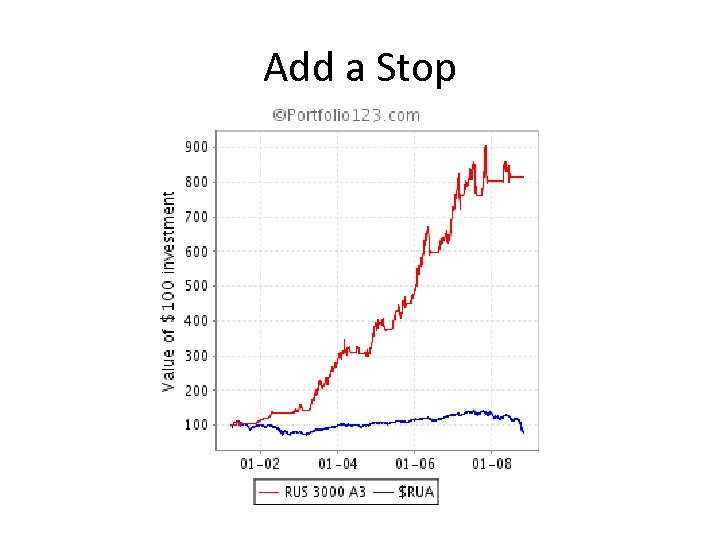

Add a Stop

Add a Stop

Add a Stop Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, new stock criteria method, market risk method, % stop – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 714. 01% -19. 78% 31. 93% 932. 44% -13. 46%

Add a Stop Results (period 3/31/2001 – 10/25/2008 Russell 3000, price $2, mkt cap $100 mil, new stock criteria method, market risk method, % stop – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 714. 01% -19. 78% 31. 93% 932. 44% -13. 46%

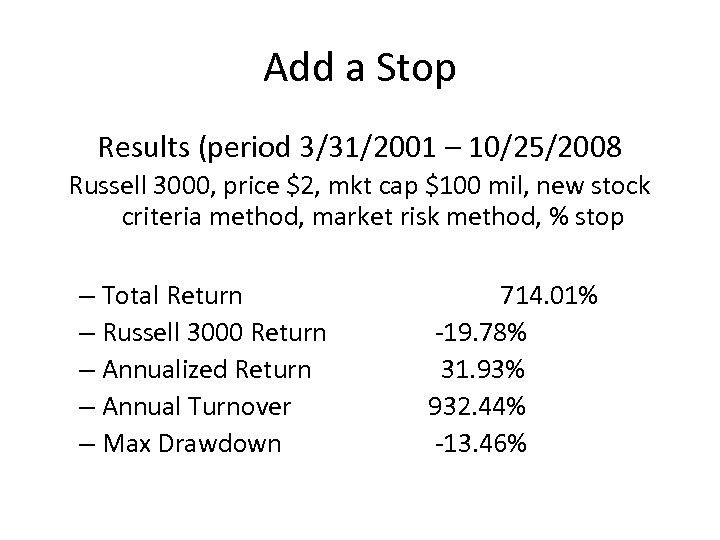

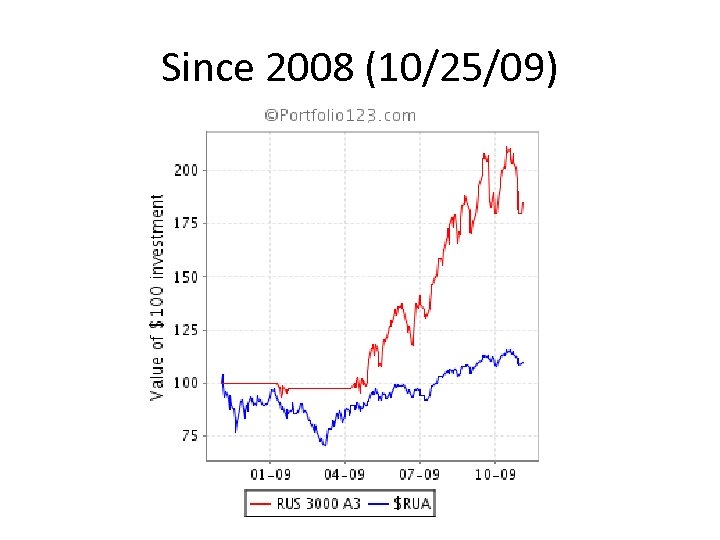

Summary Method Total Return Orig method 9. 13% Adj price, mkt cap 223. 54% Market method 99. 73% Together 655. 53% Adj parameters 663. 29% Add sell stop 714. 01% Max DD -48. 03 -47. 93 -17. 16 -26. 18 -20. 23 -13. 45 Ratio 0. 2 4. 7 5. 8 25. 0 32. 8 53. 1

Summary Method Total Return Orig method 9. 13% Adj price, mkt cap 223. 54% Market method 99. 73% Together 655. 53% Adj parameters 663. 29% Add sell stop 714. 01% Max DD -48. 03 -47. 93 -17. 16 -26. 18 -20. 23 -13. 45 Ratio 0. 2 4. 7 5. 8 25. 0 32. 8 53. 1

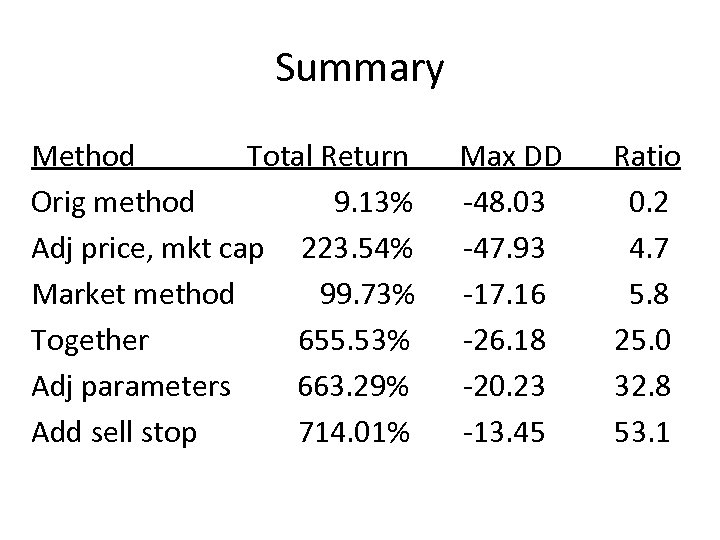

Since 2008 (10/25/09)

Since 2008 (10/25/09)

Since 2008 Results (period 10/24/2008 – 10/25/2008 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 84. 82% 9. 48% 84. 9% 1164. 41% -14. 93%

Since 2008 Results (period 10/24/2008 – 10/25/2008 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 84. 82% 9. 48% 84. 9% 1164. 41% -14. 93%

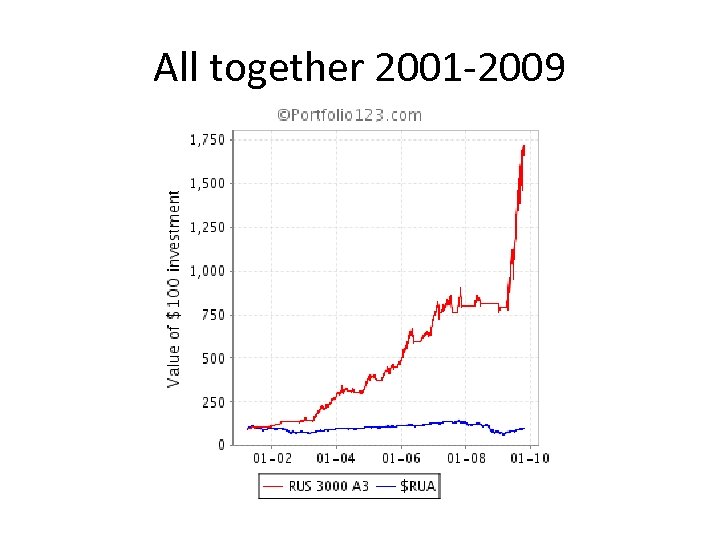

All together 2001 -2009

All together 2001 -2009

All together 2001 -2009 Results (period 3/31/2001 – 10/25/2009 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 1, 570. 23% 0. 80% 38. 93% 1, 013. 58% -15. 74%

All together 2001 -2009 Results (period 3/31/2001 – 10/25/2009 – Total Return – Russell 3000 Return – Annualized Return – Annual Turnover – Max Drawdown 1, 570. 23% 0. 80% 38. 93% 1, 013. 58% -15. 74%

New Studies in Relative Price Strength Charles D. Kirkpatrick II, CMT www. charleskirkpatrick. com kirkco@capecod. net

New Studies in Relative Price Strength Charles D. Kirkpatrick II, CMT www. charleskirkpatrick. com kirkco@capecod. net