b6a2f9a0d12b8efdf4d55cce725da924.ppt

- Количество слайдов: 27

New Services and Opportunities in the Telecom Industry Bruce Bowden | 15 Octobre 2004 |

New Services and Opportunities in the Telecom Industry Bruce Bowden | 15 Octobre 2004 |

Agenda § French fixed telecoms market environment § Overview of neuf telecom § New services 2

Agenda § French fixed telecoms market environment § Overview of neuf telecom § New services 2

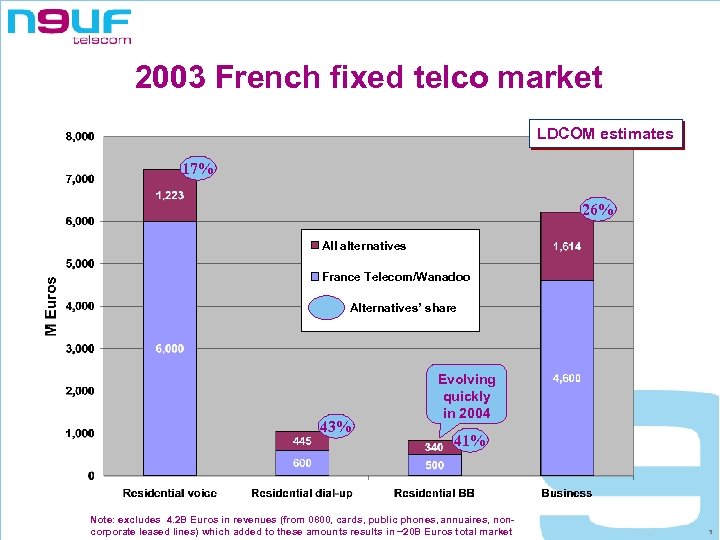

2003 French fixed telco market LDCOM estimates 17% 26% All alternatives France Telecom/Wanadoo Alternatives’ share 43% Evolving quickly in 2004 41% Note: excludes 4. 2 B Euros in revenues (from 0800, cards, public phones, annuaires, noncorporate leased lines) which added to these amounts results in ~20 B Euros total market 3

2003 French fixed telco market LDCOM estimates 17% 26% All alternatives France Telecom/Wanadoo Alternatives’ share 43% Evolving quickly in 2004 41% Note: excludes 4. 2 B Euros in revenues (from 0800, cards, public phones, annuaires, noncorporate leased lines) which added to these amounts results in ~20 B Euros total market 3

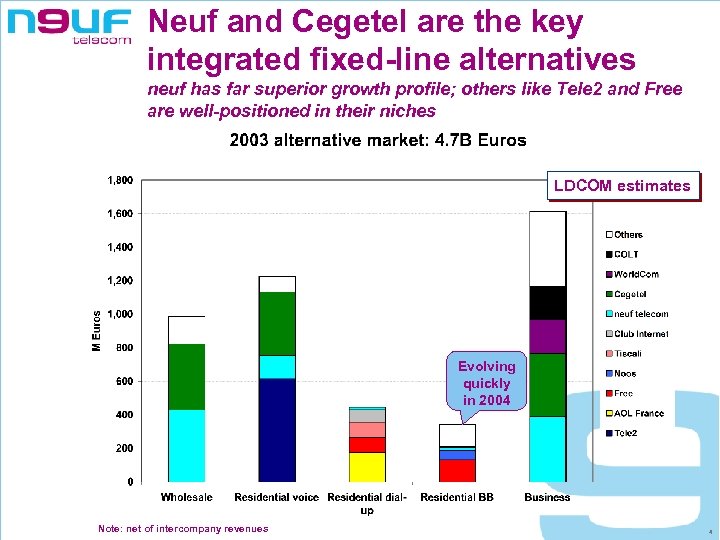

Neuf and Cegetel are the key integrated fixed-line alternatives neuf has far superior growth profile; others like Tele 2 and Free are well-positioned in their niches LDCOM estimates Evolving quickly in 2004 Note: net of intercompany revenues 4

Neuf and Cegetel are the key integrated fixed-line alternatives neuf has far superior growth profile; others like Tele 2 and Free are well-positioned in their niches LDCOM estimates Evolving quickly in 2004 Note: net of intercompany revenues 4

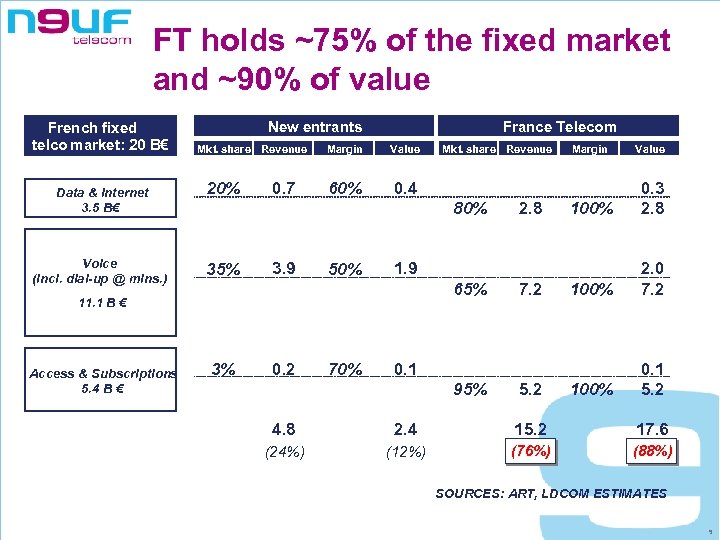

FT holds ~75% of the fixed market and ~90% of value French fixed telco market: 20 B€ New entrants Mkt. share Revenue Data & Internet 3. 5 B€ 20% Voice (incl. dial-up @ mins. ) 35% 0. 7 France Telecom Margin Value 60% 0. 4 80% 3. 9 50% 65% 3% 0. 2 70% 2. 8 Margin Value 100% 0. 3 2. 8 100% 2. 0 7. 2 100% 0. 1 5. 2 1. 9 11. 1 B € Access & Subscriptions 5. 4 B € Mkt. share Revenue 7. 2 0. 1 95% 5. 2 4. 8 2. 4 15. 2 17. 6 (24%) (12%) (76%) (88%) SOURCES: ART, LDCOM ESTIMATES 5

FT holds ~75% of the fixed market and ~90% of value French fixed telco market: 20 B€ New entrants Mkt. share Revenue Data & Internet 3. 5 B€ 20% Voice (incl. dial-up @ mins. ) 35% 0. 7 France Telecom Margin Value 60% 0. 4 80% 3. 9 50% 65% 3% 0. 2 70% 2. 8 Margin Value 100% 0. 3 2. 8 100% 2. 0 7. 2 100% 0. 1 5. 2 1. 9 11. 1 B € Access & Subscriptions 5. 4 B € Mkt. share Revenue 7. 2 0. 1 95% 5. 2 4. 8 2. 4 15. 2 17. 6 (24%) (12%) (76%) (88%) SOURCES: ART, LDCOM ESTIMATES 5

Agenda § French fixed telecoms market environment § Overview of neuf telecom § New services 6

Agenda § French fixed telecoms market environment § Overview of neuf telecom § New services 6

Who is neuf telecom? § A growing alternative operator in the shrinking French fixed telco market § A profitable challenger: net income positive for 1 H 04 § The company with the most unbundled ADSL lines in Europe § #2 fixed-line telco for French enterprises § A leading innovator in broadband services 7

Who is neuf telecom? § A growing alternative operator in the shrinking French fixed telco market § A profitable challenger: net income positive for 1 H 04 § The company with the most unbundled ADSL lines in Europe § #2 fixed-line telco for French enterprises § A leading innovator in broadband services 7

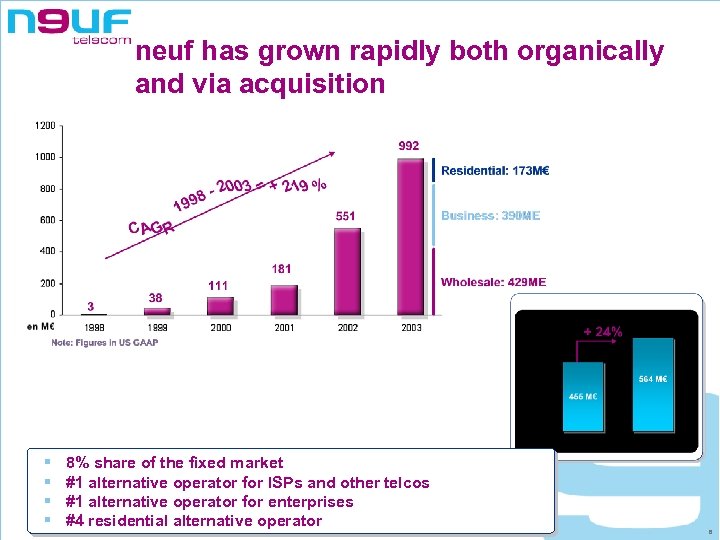

neuf has grown rapidly both organically and via acquisition § § 8% share of the fixed market #1 alternative operator for ISPs and other telcos #1 alternative operator for enterprises #4 residential alternative operator 8

neuf has grown rapidly both organically and via acquisition § § 8% share of the fixed market #1 alternative operator for ISPs and other telcos #1 alternative operator for enterprises #4 residential alternative operator 8

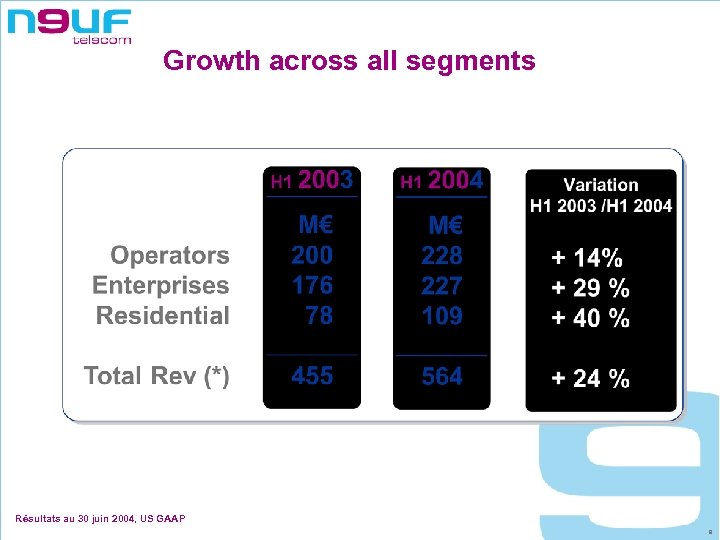

Growth across all segments Résultats au 30 juin 2004, US GAAP 9

Growth across all segments Résultats au 30 juin 2004, US GAAP 9

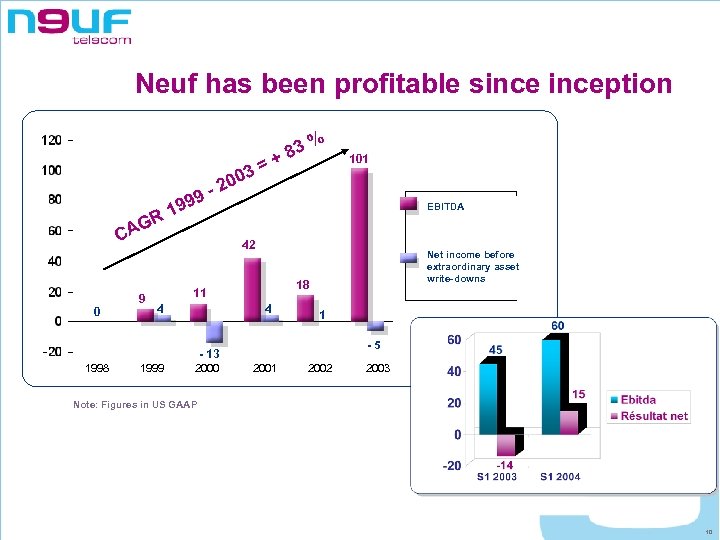

Neuf has been profitable sinception 3= R G CA 0 9 999 1 200 - % 3 +8 101 EBITDA 42 18 11 4 Net income before extraordinary asset write-downs 4 1 -5 - 13 1998 1999 2000 2001 2002 2003 Note: Figures in US GAAP 10

Neuf has been profitable sinception 3= R G CA 0 9 999 1 200 - % 3 +8 101 EBITDA 42 18 11 4 Net income before extraordinary asset write-downs 4 1 -5 - 13 1998 1999 2000 2001 2002 2003 Note: Figures in US GAAP 10

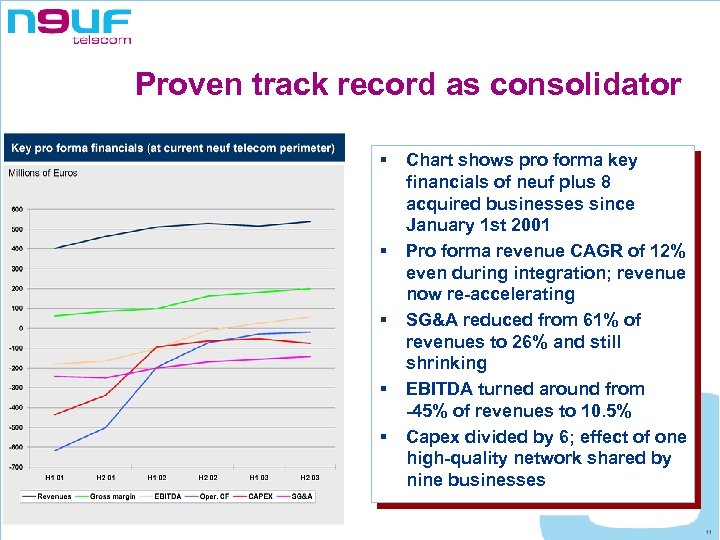

Proven track record as consolidator § § § Chart shows pro forma key financials of neuf plus 8 acquired businesses since January 1 st 2001 Pro forma revenue CAGR of 12% even during integration; revenue now re-accelerating SG&A reduced from 61% of revenues to 26% and still shrinking EBITDA turned around from -45% of revenues to 10. 5% Capex divided by 6; effect of one high-quality network shared by nine businesses 11

Proven track record as consolidator § § § Chart shows pro forma key financials of neuf plus 8 acquired businesses since January 1 st 2001 Pro forma revenue CAGR of 12% even during integration; revenue now re-accelerating SG&A reduced from 61% of revenues to 26% and still shrinking EBITDA turned around from -45% of revenues to 10. 5% Capex divided by 6; effect of one high-quality network shared by nine businesses 11

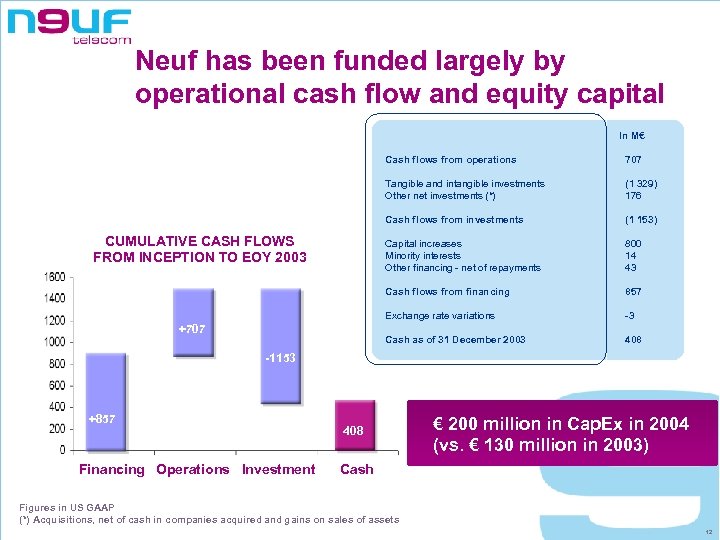

Neuf has been funded largely by operational cash flow and equity capital In M€ Cash flows from operations Tangible and intangible investments Other net investments (*) (1 153) Capital increases Minority interests Other financing - net of repayments 800 14 43 Cash flows from financing 857 Exchange rate variations -3 Cash as of 31 December 2003 +707 (1 329) 176 Cash flows from investments CUMULATIVE CASH FLOWS FROM INCEPTION TO EOY 2003 707 408 -1153 +857 Financing Operations Investment 408 € 200 million in Cap. Ex in 2004 (vs. € 130 million in 2003) Cash Figures in US GAAP (*) Acquisitions, net of cash in companies acquired and gains on sales of assets 12

Neuf has been funded largely by operational cash flow and equity capital In M€ Cash flows from operations Tangible and intangible investments Other net investments (*) (1 153) Capital increases Minority interests Other financing - net of repayments 800 14 43 Cash flows from financing 857 Exchange rate variations -3 Cash as of 31 December 2003 +707 (1 329) 176 Cash flows from investments CUMULATIVE CASH FLOWS FROM INCEPTION TO EOY 2003 707 408 -1153 +857 Financing Operations Investment 408 € 200 million in Cap. Ex in 2004 (vs. € 130 million in 2003) Cash Figures in US GAAP (*) Acquisitions, net of cash in companies acquired and gains on sales of assets 12

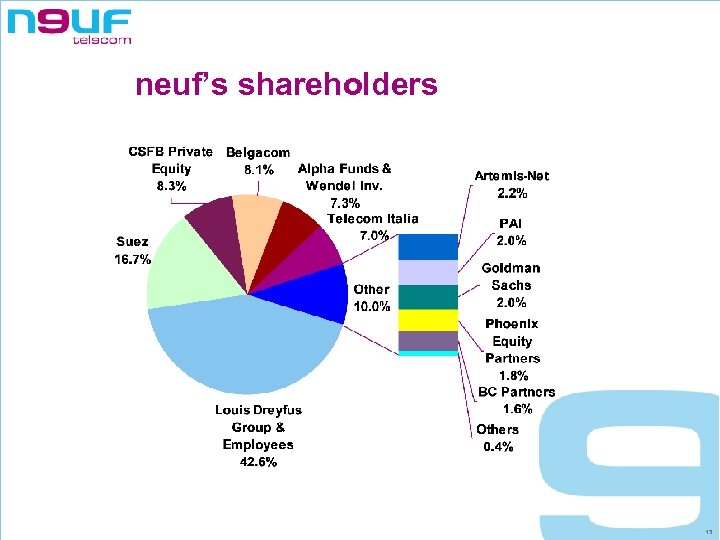

neuf’s shareholders 13

neuf’s shareholders 13

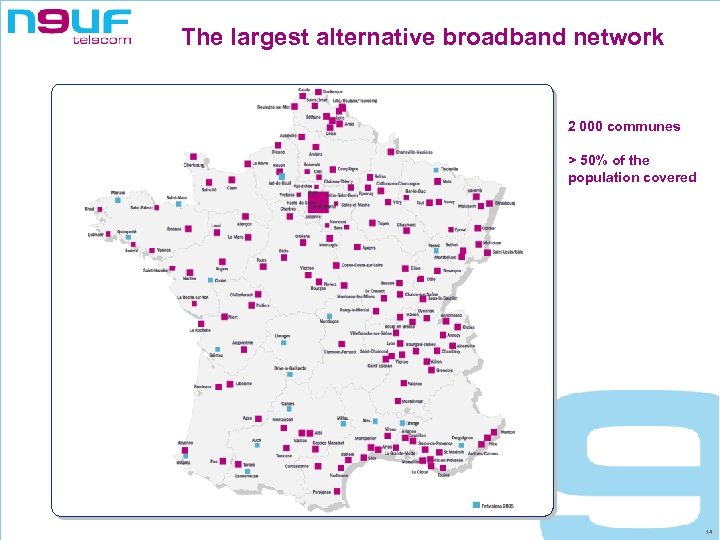

The largest alternative broadband network 2 000 communes > 50% of the population covered Liste des villes demandée 14

The largest alternative broadband network 2 000 communes > 50% of the population covered Liste des villes demandée 14

Agenda § French fixed telecoms market environment § Overview of neuf telecom § New services 15

Agenda § French fixed telecoms market environment § Overview of neuf telecom § New services 15

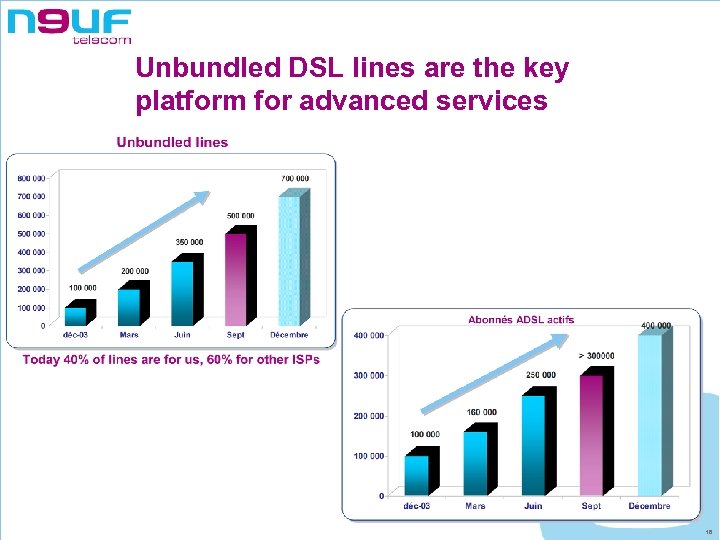

Unbundled DSL lines are the key platform for advanced services 16

Unbundled DSL lines are the key platform for advanced services 16

Where do we go from here? 17

Where do we go from here? 17

Faster § Broadband up to 25 Mbps § Priced based on « free » backhaul § Using a technology already built into our network (same chassis, new chipset) § Commercial launch in early 2005 Virtual fiber to the home 18

Faster § Broadband up to 25 Mbps § Priced based on « free » backhaul § Using a technology already built into our network (same chassis, new chipset) § Commercial launch in early 2005 Virtual fiber to the home 18

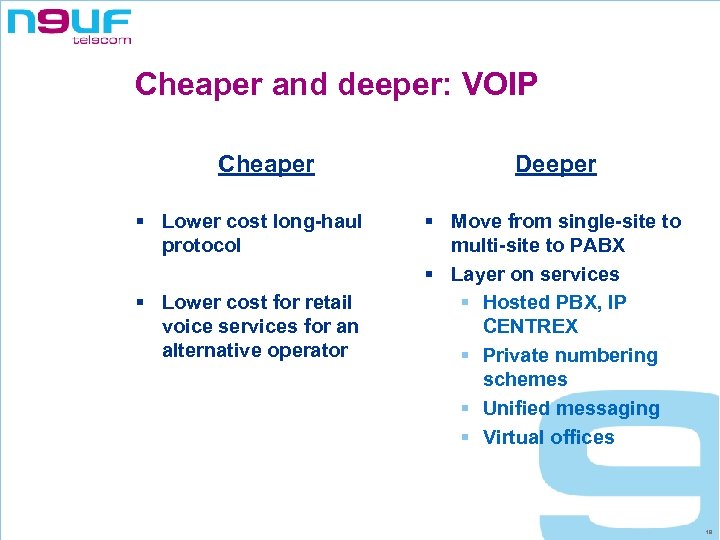

Cheaper and deeper: VOIP Cheaper § Lower cost long-haul protocol § Lower cost for retail voice services for an alternative operator Deeper § Move from single-site to multi-site to PABX § Layer on services § Hosted PBX, IP CENTREX § Private numbering schemes § Unified messaging § Virtual offices 19

Cheaper and deeper: VOIP Cheaper § Lower cost long-haul protocol § Lower cost for retail voice services for an alternative operator Deeper § Move from single-site to multi-site to PABX § Layer on services § Hosted PBX, IP CENTREX § Private numbering schemes § Unified messaging § Virtual offices 19

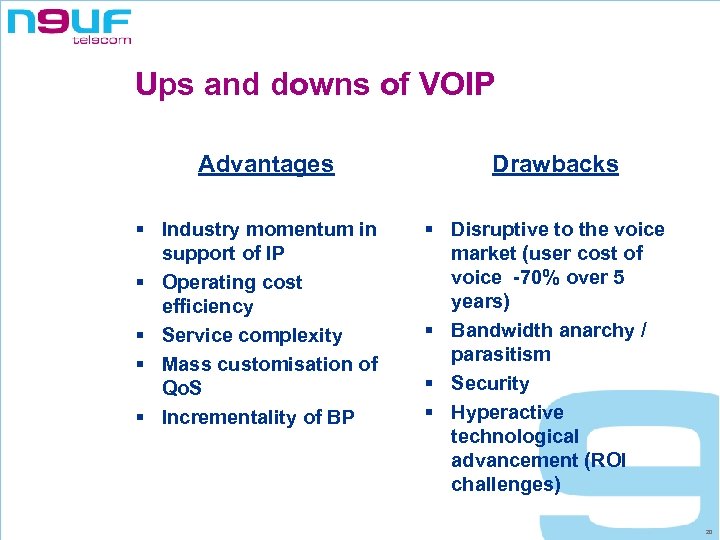

Ups and downs of VOIP Advantages § Industry momentum in support of IP § Operating cost efficiency § Service complexity § Mass customisation of Qo. S § Incrementality of BP Drawbacks § Disruptive to the voice market (user cost of voice -70% over 5 years) § Bandwidth anarchy / parasitism § Security § Hyperactive technological advancement (ROI challenges) 20

Ups and downs of VOIP Advantages § Industry momentum in support of IP § Operating cost efficiency § Service complexity § Mass customisation of Qo. S § Incrementality of BP Drawbacks § Disruptive to the voice market (user cost of voice -70% over 5 years) § Bandwidth anarchy / parasitism § Security § Hyperactive technological advancement (ROI challenges) 20

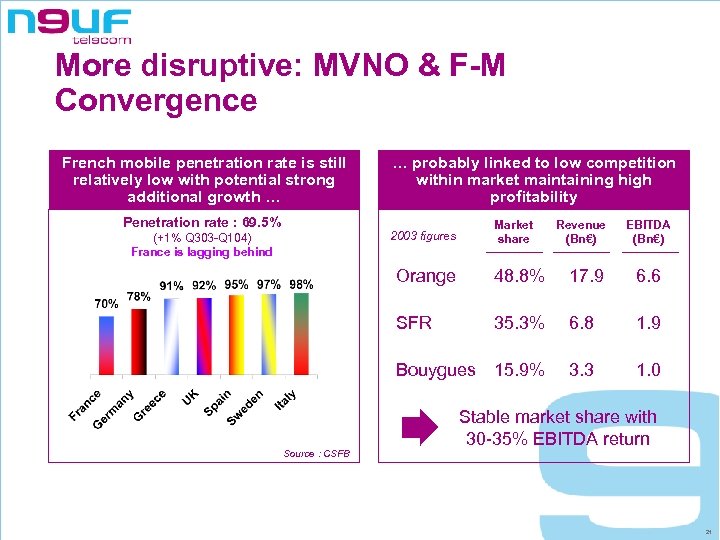

More disruptive: MVNO & F-M Convergence French mobile penetration rate is still relatively low with potential strong additional growth … Penetration rate : 69. 5% … probably linked to low competition within market maintaining high profitability 2003 figures (+1% Q 303 -Q 104) France is lagging behind Market share Revenue (Bn€) EBITDA (Bn€) Orange 17. 9 6. 6 SFR 35. 3% 6. 8 1. 9 Bouygues 15. 9% Source : CSFB 48. 8% 3. 3 1. 0 Stable market share with 30 -35% EBITDA return 21

More disruptive: MVNO & F-M Convergence French mobile penetration rate is still relatively low with potential strong additional growth … Penetration rate : 69. 5% … probably linked to low competition within market maintaining high profitability 2003 figures (+1% Q 303 -Q 104) France is lagging behind Market share Revenue (Bn€) EBITDA (Bn€) Orange 17. 9 6. 6 SFR 35. 3% 6. 8 1. 9 Bouygues 15. 9% Source : CSFB 48. 8% 3. 3 1. 0 Stable market share with 30 -35% EBITDA return 21

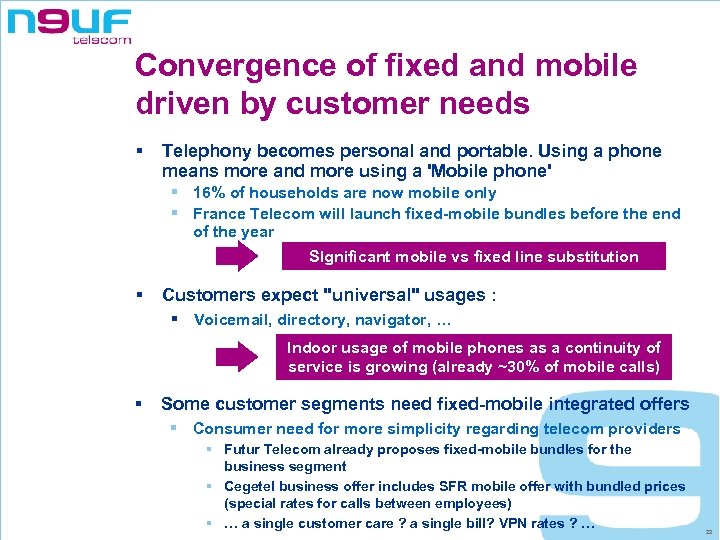

Convergence of fixed and mobile driven by customer needs § Telephony becomes personal and portable. Using a phone means more and more using a 'Mobile phone' § 16% of households are now mobile only § France Telecom will launch fixed-mobile bundles before the end of the year SIgnificant mobile vs fixed line substitution § Customers expect "universal" usages : § Voicemail, directory, navigator, … Indoor usage of mobile phones as a continuity of service is growing (already ~30% of mobile calls) § Some customer segments need fixed-mobile integrated offers § Consumer need for more simplicity regarding telecom providers § Futur Telecom already proposes fixed-mobile bundles for the business segment § Cegetel business offer includes SFR mobile offer with bundled prices (special rates for calls between employees) § … a single customer care ? a single bill? VPN rates ? … 22

Convergence of fixed and mobile driven by customer needs § Telephony becomes personal and portable. Using a phone means more and more using a 'Mobile phone' § 16% of households are now mobile only § France Telecom will launch fixed-mobile bundles before the end of the year SIgnificant mobile vs fixed line substitution § Customers expect "universal" usages : § Voicemail, directory, navigator, … Indoor usage of mobile phones as a continuity of service is growing (already ~30% of mobile calls) § Some customer segments need fixed-mobile integrated offers § Consumer need for more simplicity regarding telecom providers § Futur Telecom already proposes fixed-mobile bundles for the business segment § Cegetel business offer includes SFR mobile offer with bundled prices (special rates for calls between employees) § … a single customer care ? a single bill? VPN rates ? … 22

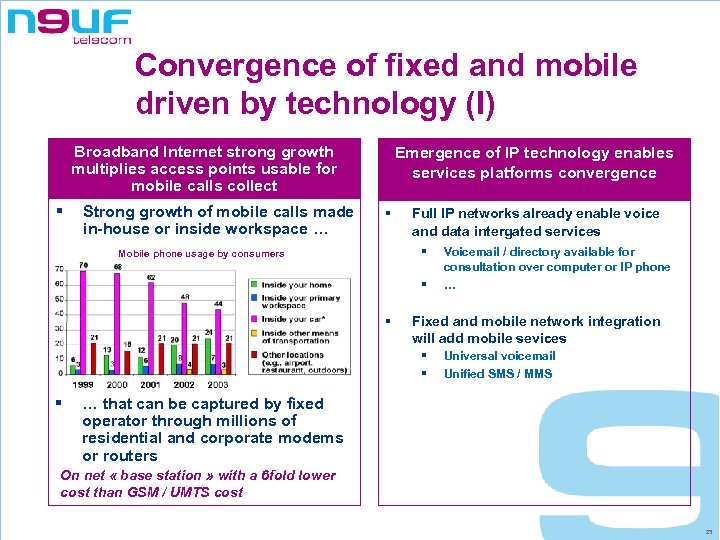

Convergence of fixed and mobile driven by technology (I) Broadband Internet strong growth multiplies access points usable for mobile calls collect § Strong growth of mobile calls made in-house or inside workspace … Emergence of IP technology enables services platforms convergence § Full IP networks already enable voice and data intergated services § Mobile phone usage by consumers § § Fixed and mobile network integration will add mobile sevices § § § Voicemail / directory available for consultation over computer or IP phone … Universal voicemail Unified SMS / MMS … that can be captured by fixed operator through millions of residential and corporate modems or routers On net « base station » with a 6 fold lower cost than GSM / UMTS cost 23

Convergence of fixed and mobile driven by technology (I) Broadband Internet strong growth multiplies access points usable for mobile calls collect § Strong growth of mobile calls made in-house or inside workspace … Emergence of IP technology enables services platforms convergence § Full IP networks already enable voice and data intergated services § Mobile phone usage by consumers § § Fixed and mobile network integration will add mobile sevices § § § Voicemail / directory available for consultation over computer or IP phone … Universal voicemail Unified SMS / MMS … that can be captured by fixed operator through millions of residential and corporate modems or routers On net « base station » with a 6 fold lower cost than GSM / UMTS cost 23

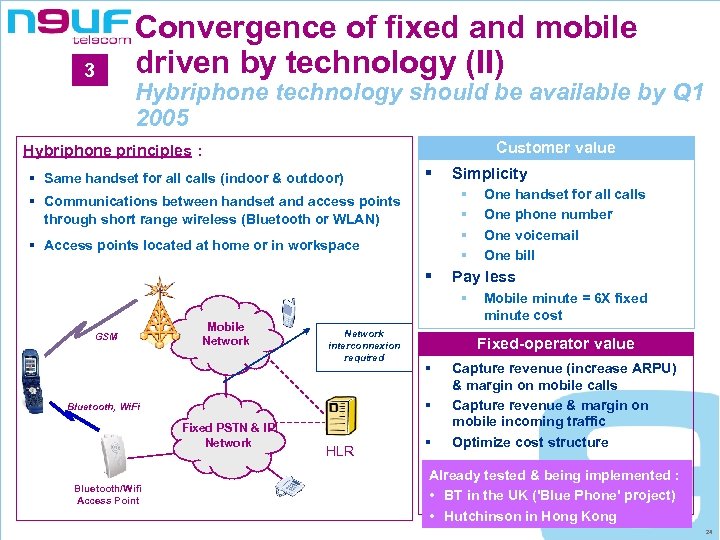

3 Convergence of fixed and mobile driven by technology (II) Hybriphone technology should be available by Q 1 2005 Customer value Hybriphone principles : § Same handset for all calls (indoor & outdoor) § Simplicity § § § Communications between handset and access points through short range wireless (Bluetooth or WLAN) § Access points located at home or in workspace § Pay less § GSM Mobile Network interconnexion required Fixed PSTN & IP Network Bluetooth/Wifi Access Point OSP HLR Mobile minute = 6 X fixed minute cost Fixed-operator value § § Bluetooth, Wi. Fi One handset for all calls One phone number One voicemail One bill § Capture revenue (increase ARPU) & margin on mobile calls Capture revenue & margin on mobile incoming traffic Optimize cost structure Already tested & being implemented : • BT in the UK ('Blue Phone' project) • Hutchinson in Hong Kong 24

3 Convergence of fixed and mobile driven by technology (II) Hybriphone technology should be available by Q 1 2005 Customer value Hybriphone principles : § Same handset for all calls (indoor & outdoor) § Simplicity § § § Communications between handset and access points through short range wireless (Bluetooth or WLAN) § Access points located at home or in workspace § Pay less § GSM Mobile Network interconnexion required Fixed PSTN & IP Network Bluetooth/Wifi Access Point OSP HLR Mobile minute = 6 X fixed minute cost Fixed-operator value § § Bluetooth, Wi. Fi One handset for all calls One phone number One voicemail One bill § Capture revenue (increase ARPU) & margin on mobile calls Capture revenue & margin on mobile incoming traffic Optimize cost structure Already tested & being implemented : • BT in the UK ('Blue Phone' project) • Hutchinson in Hong Kong 24

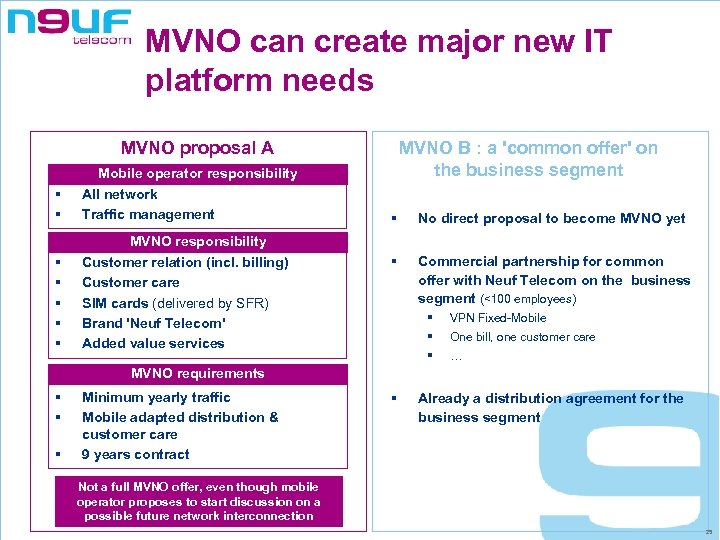

MVNO can create major new IT platform needs MVNO B : a 'common offer' on the business segment MVNO proposal A § § Mobile operator responsibility All network Traffic management § § § MVNO responsibility Customer relation (incl. billing) Customer care SIM cards (delivered by SFR) Brand 'Neuf Telecom' Added value services § No direct proposal to become MVNO yet § Commercial partnership for common offer with Neuf Telecom on the business segment (<100 employees) § § § VPN Fixed-Mobile One bill, one customer care … MVNO requirements § § § Minimum yearly traffic Mobile adapted distribution & customer care 9 years contract § Already a distribution agreement for the business segment Not a full MVNO offer, even though mobile operator proposes to start discussion on a possible future network interconnection 25

MVNO can create major new IT platform needs MVNO B : a 'common offer' on the business segment MVNO proposal A § § Mobile operator responsibility All network Traffic management § § § MVNO responsibility Customer relation (incl. billing) Customer care SIM cards (delivered by SFR) Brand 'Neuf Telecom' Added value services § No direct proposal to become MVNO yet § Commercial partnership for common offer with Neuf Telecom on the business segment (<100 employees) § § § VPN Fixed-Mobile One bill, one customer care … MVNO requirements § § § Minimum yearly traffic Mobile adapted distribution & customer care 9 years contract § Already a distribution agreement for the business segment Not a full MVNO offer, even though mobile operator proposes to start discussion on a possible future network interconnection 25

More content-rich: Starting this Fall in unbundled zones 40 chains in digital quality Paired with digital terrestrial TV (Télévision Numérique Terrestre or TNT) … and a few surprises … 26

More content-rich: Starting this Fall in unbundled zones 40 chains in digital quality Paired with digital terrestrial TV (Télévision Numérique Terrestre or TNT) … and a few surprises … 26

27

27