New Real Property Exclusion Chris Mc. Laughlin Associate Professor, UNC SOG mclaughlin@sog. unc. edu 919. 843. 9167 Fall 2015

New Real Property Exclusion Chris Mc. Laughlin Associate Professor, UNC SOG mclaughlin@sog. unc. edu 919. 843. 9167 Fall 2015

Over the past three years, which of these “Big Four” ACC football teams has won the most games? 1. Duke 2. UNC 3. NC State 4. Wake Forest 2

Over the past three years, which of these “Big Four” ACC football teams has won the most games? 1. Duke 2. UNC 3. NC State 4. Wake Forest 2

Who says we’re a basketball school? 3

Who says we’re a basketball school? 3

S. L. 2015 -223 H 168 G. S. 105 -277. 02 • New exclusion for improvements to real property that is held for sale 4

S. L. 2015 -223 H 168 G. S. 105 -277. 02 • New exclusion for improvements to real property that is held for sale 4

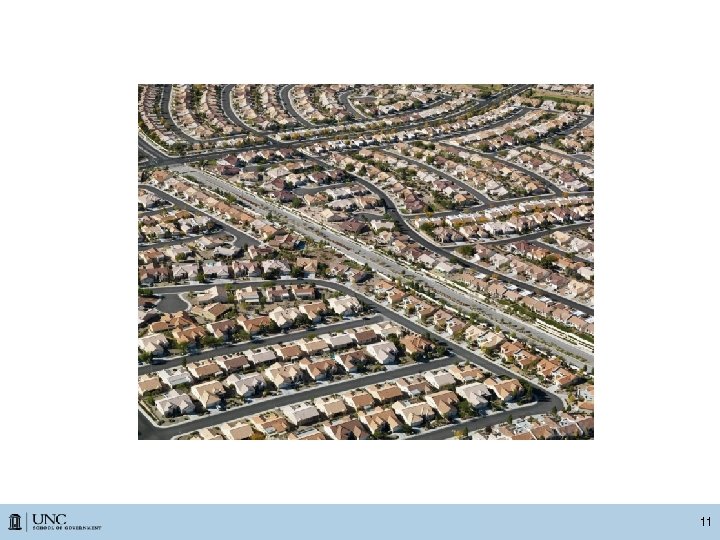

G. S. 105 -277. 02 • Real property held for sale – Commercial or Residential • Excludes property taxes on increases in value due to: – Subdivision – Non-structural improvements (grading, streets) – New home construction 5

G. S. 105 -277. 02 • Real property held for sale – Commercial or Residential • Excludes property taxes on increases in value due to: – Subdivision – Non-structural improvements (grading, streets) – New home construction 5

Residential Property 6

Residential Property 6

7

7

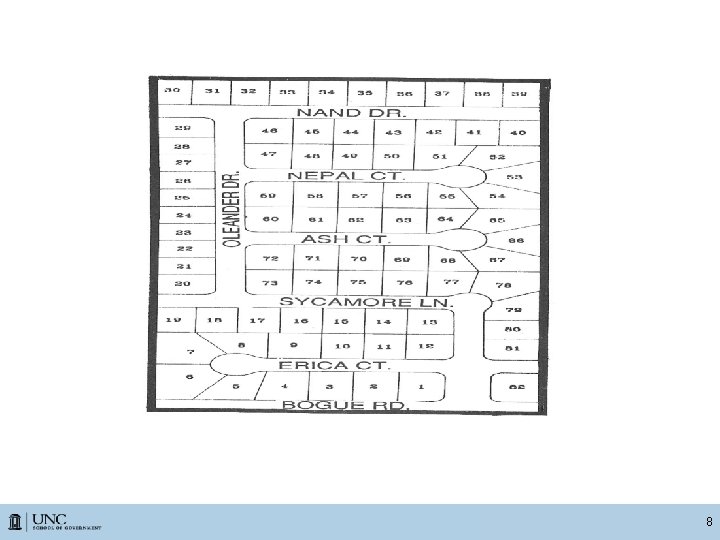

8

8

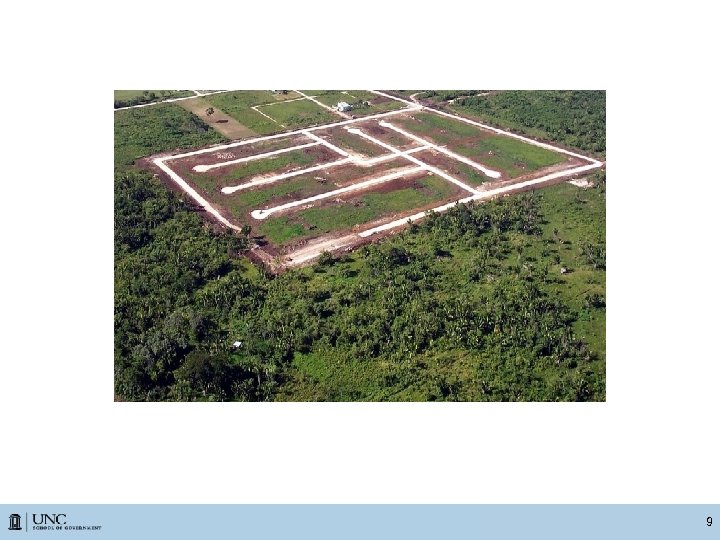

9

9

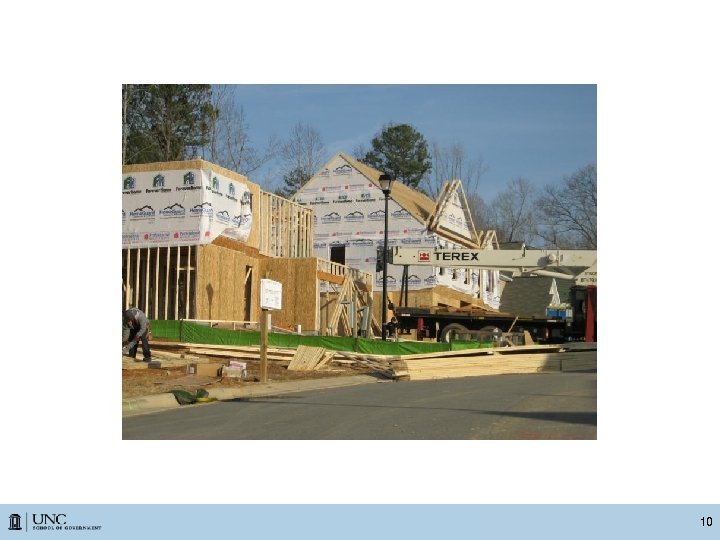

10

10

11

11

x 12

x 12

x 13

x 13

Commercial Property 14

Commercial Property 14

15

15

16

16

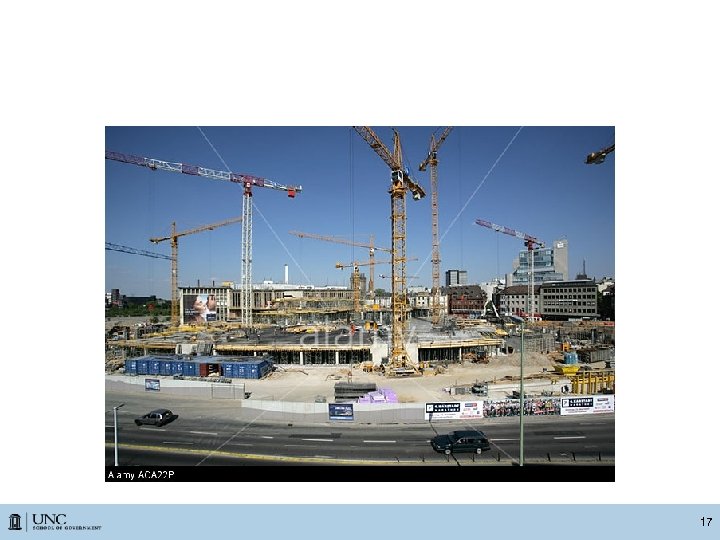

17

17

18

18

Residential Property: What is Excluded? • The taxes on the increase in value of property held for sale attributed to: 1. Subdivision 2. Non-structural improvements 3. Construction of 1 - or 2 -family houses 19

Residential Property: What is Excluded? • The taxes on the increase in value of property held for sale attributed to: 1. Subdivision 2. Non-structural improvements 3. Construction of 1 - or 2 -family houses 19

Residential Property: How Long is the Exclusion? • 3 years from the date the improved property was first listed 20

Residential Property: How Long is the Exclusion? • 3 years from the date the improved property was first listed 20

Residential Property: How Long is the Exclusion? • Parcel A subdivided and graded in July 2016 • Improved parcel first listed 2017 • Tax appraisal of improved Parcel A increases for 2017 -2018 year • Exclusion may cover 2017, 2018, and 2019 21

Residential Property: How Long is the Exclusion? • Parcel A subdivided and graded in July 2016 • Improved parcel first listed 2017 • Tax appraisal of improved Parcel A increases for 2017 -2018 year • Exclusion may cover 2017, 2018, and 2019 21

Residential Property: What Terminates the Exclusion? • Sale • Removal from the market • Lease to a tenant • Use for commercial purpose (model home) 22

Residential Property: What Terminates the Exclusion? • Sale • Removal from the market • Lease to a tenant • Use for commercial purpose (model home) 22

Residential Property: No Effect on Exclusion • Builder occupies house • Third-party occupies house for free? 23

Residential Property: No Effect on Exclusion • Builder occupies house • Third-party occupies house for free? 23

Commercial Property: What is Excluded? • The taxes on the increase in value of property held for sale attributed to: 1. Subdivision 2. Non-structural improvements 24

Commercial Property: What is Excluded? • The taxes on the increase in value of property held for sale attributed to: 1. Subdivision 2. Non-structural improvements 24

Commercial Property: How Long is the Exclusion? • 5 years from the date the improved property was first listed 25

Commercial Property: How Long is the Exclusion? • 5 years from the date the improved property was first listed 25

Commercial Property: What Terminates the Exclusion? • Issuance of building permit • Sale • Removal from market 26

Commercial Property: What Terminates the Exclusion? • Issuance of building permit • Sale • Removal from market 26

Differences Between Residential and Commercial Exclusion • Structural improvements only for residential • 3 years for residential • 5 years for commercial 27

Differences Between Residential and Commercial Exclusion • Structural improvements only for residential • 3 years for residential • 5 years for commercial 27

Similarities Between Residential and Commercial Exclusion • Builder: “a taxpayer engaged in the business of buying real property, making improvements to it, and then reselling it. ” • Annual application (GS 105 -282. 1) 28

Similarities Between Residential and Commercial Exclusion • Builder: “a taxpayer engaged in the business of buying real property, making improvements to it, and then reselling it. ” • Annual application (GS 105 -282. 1) 28

Similarities Between Residential and Commercial Exclusion • Applies to improvements made on after July 1, 2015 • 2016 first tax year available 29

Similarities Between Residential and Commercial Exclusion • Applies to improvements made on after July 1, 2015 • 2016 first tax year available 29

30

30