96c381d662e7d787455673469d2f90dc.ppt

- Количество слайдов: 30

NEW PRODUCTS MANAGEMENT Merle Crawford Anthony Di Benedetto 10 th Edition Mc. Graw-Hill/Irwin Copyright © 2011 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 18 Market Testing 18 -2

What Is Market Testing? • Market testing is not test marketing! • Test marketing is one of many forms of market testing — others include simulated test market, informal sale, minimarket, rollout. • Test marketing is also a much less common form now due to cost and time commitments and other drawbacks. 18 -3

Where We Are Today in Market Testing • Scanner systems allow for immediate collection of product sales data. • Mathematical sales forecasting models are readily available that can run on a relatively limited amount of data. • We are “building quality in, ” testing the marketing components of the product at early stages (ads, selling visuals, service contracts, package designs, etc. ) rather than testing the whole product at the end. • Increased competition puts greater pressure on managers to accelerate product cycle time. • Market testing is a team issue, not solely in the province of the market research department. 18 -4

Market Tests Must Have Teeth • Managers must be willing to take action based on market test results. • Negative market test results cannot be ignored just because the team is reluctant to kill the CEO’s pet project! • Insights gained at this stage include: – Solid sales forecasts with greater accuracy. – Diagnostic information to revise or refine any aspect of the launch. • To gather this information and not use it is asking for trouble! 18 -5

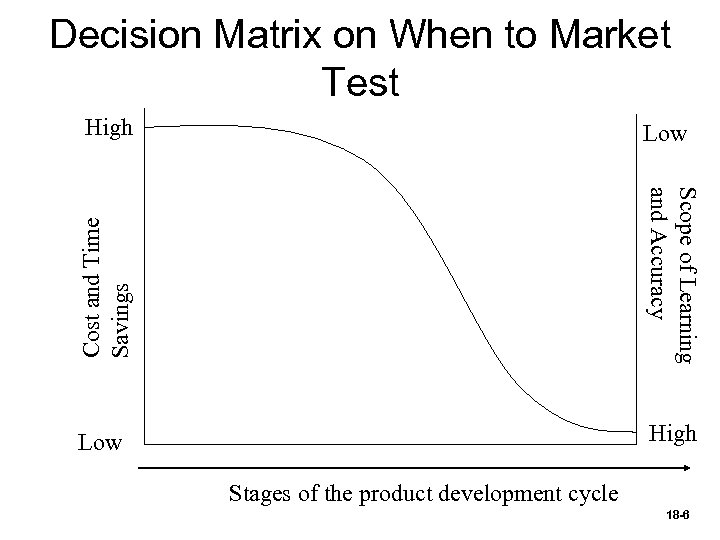

Decision Matrix on When to Market Test High Cost and Time Savings Low Scope of Learning and Accuracy Low High Stages of the product development cycle 18 -6

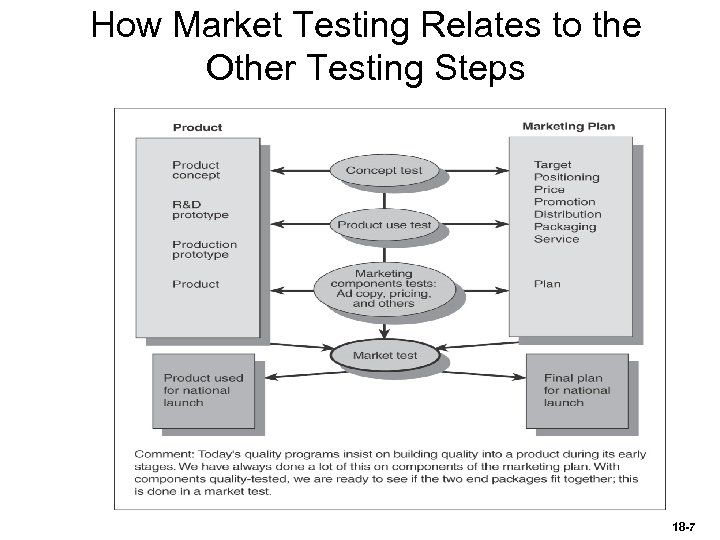

How Market Testing Relates to the Other Testing Steps 18 -7

Two Key Values Obtained from Market Testing • Solid forecasts of dollar and unit sales volume. • Diagnostic information to allow for revising and refining any aspect of the launch. 18 -8

Deciding Whether to Market Test • Any special twists on the launch? (limited time or budget, need to make high volume quickly) • What information is needed? (expected sales volumes, unknowns in manufacturing process, etc. ) • Costs (direct cost of test, cost of launch, lost revenue that an immediate national launch would have brought) • Nature of marketplace (competitive retaliation, customer demand) • Capability of testing methodologies (do they fit the managerial situation at hand) 18 -9

Types of Information That May Be Lacking • Manufacturing process: can we ramp-up from pilot production to full scale easily? • Vendors and resellers: will they do as they have promised in supporting the launch? • Servicing infrastructure: adequate? • Customers: will they buy and use the product as expected? • Cannibalization: what will be the extent? 18 -10

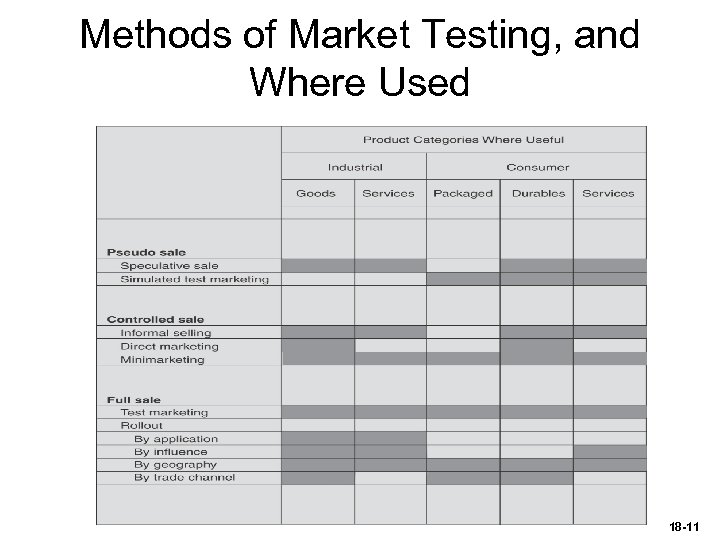

Methods of Market Testing, and Where Used 18 -11

Speculative Sale • Often used in business-to-business and consumer durables, similar to concept and product use tests. • Give full pitch on product, answer questions, discuss pricing, and ask: – “If we make this product available as I have described it, would you buy it? ” • Often conducted by regular salespeople calling on real target customers. 18 -12

Conditions for Speculative Sale • Where industrial firms have very close downstream relationships with key buyers. • Where new product work is technical, entrenched within a firm's expertise, and only little reaction is needed from the marketplace. • Where the adventure has very little risk, and thus a costlier method is not defendable. • Where the item is new (say, a new material or a completely new product type) and key diagnostics are needed. For example, what set of alternatives does the potential buyer see, or what possible applications come to mind first. 18 -13

Simulated Test Market (STM) • Create a false buying situation and observe what the customer does. • Follow-up with customer later to assess likely repeat sales. • Often used for consumer nondurables. 18 -14

Simulated Test Market Procedure • • Mall intercept. Self-administered questionnaire. Advertising stimuli. Mini-store shopping experience. Post-exposure questionnaire. Receive trial package. Phone followup and offer to buy more. 18 -15

Possible Drawbacks to STMs • Mathematical complexity • False conditions • Possibly faulty assumptions on data, such as number of stores that will make the product available • May not be applicable to totally new-to-themarket products, since no prior data available. • Does not test channel member response to the new product, only the final consumer 18 -16

Controlled Sale by Informal Selling • Used for business-to-business products, also consumer products sold directly to end users. • Train salespeople, give them the product and the selling materials, and have them make calls (in the field, or at trade shows). • Real presentations, and real sales, take place. 18 -17

Controlled Sale by Direct Marketing · More secrecy than by any other controlled sale method. · The feedback is almost instant. · Positioning and image development are easier because more information can be sent and more variations can be tested easily. · It is cheaper than the other techniques. · The technique matches today's growing technologies of credit card financing, telephone ordering, and database compilation. 18 -18

Controlled Sale by Minimarkets • Select a limited number of outlets — each store is a minicity or “minimarket. ” • Do not use regular local TV or newspaper advertising, but chosen outlets can advertise it in its own flyers. • Can do shelf displays, demonstrations. • Use rebate, mail-in premium, or some other method to get names of purchasers for later follow-up. 18 -19

Controlled Sale by Scanner Market Testing • Audit sales from grocery stores with scanner systems — over a few markets or national system. • Sample uses: – Can use the data as a mini-market test. – Can compare cities where differing levels of sales support are provided. – Can monitor a rollout from one region to the next. 18 -20

Minimarkets and Scanner Testing: IRI’s Behavior. Scan and Info. Scan • Cable TV interrupt privileges • Full record of what other media (such as magazines) go into each household • Family-by-family purchasing • Full record of 95 percent of all store sales of tested items from the check-out scanners • Immediate stocking/distribution in almost every store is assured by the research firm. Result: IRI knows almost every stimulus that hits each individual family, and it knows almost every change that takes place in each family's purchase habits. 18 -21

The Test Market • Several test market cities are selected. • Product is sold into those cities in the regular channels and advertised at representative levels in local media. • Once used to support the decision whether to launch a product, now more frequently used to determine how best to do so. 18 -22

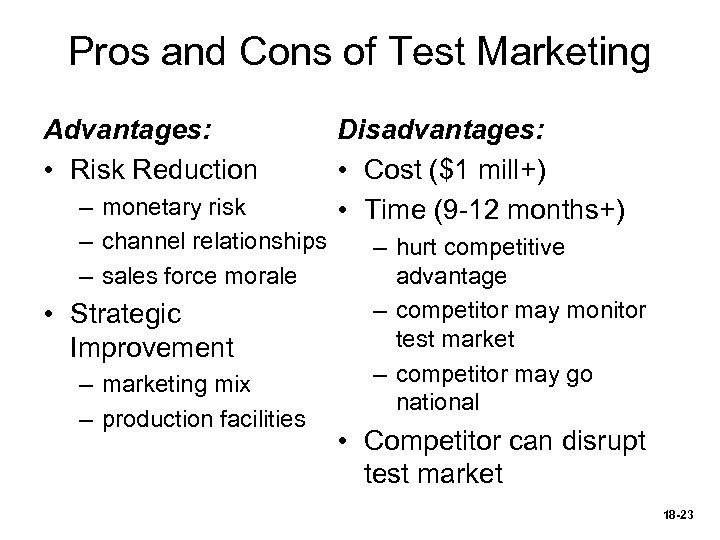

Pros and Cons of Test Marketing Advantages: • Risk Reduction – monetary risk – channel relationships – sales force morale • Strategic Improvement – marketing mix – production facilities Disadvantages: • Cost ($1 mill+) • Time (9 -12 months+) – hurt competitive advantage – competitor may monitor test market – competitor may go national • Competitor can disrupt test market 18 -23

A Risk of Test Marketing: “Showing Your Hand” • Kellogg tracked the sale of General Foods' Toast-Ems while they were in test market. Noting they were becoming popular, they went national quickly with Pop-Tarts before the General Foods' test market was over. • After having invented freeze-dried coffee, General Foods was testmarketing its own Maxim brand when Nestle bypassed them with Taster's Choice, which went on to be the leading brand. • While Procter & Gamble were busy test-marketing their soft chocolate chip cookies, both Nabisco and Keebler rolled out similar cookies nationwide. • The same thing happened with P&G’s Brigade toilet-bowl cleaner. It was in test marketing for three years, during which time both Vanish and Ty-D -Bol became established in the market. • General Foods' test market results for a new frozen baby food were very encouraging, until it was learned that most of the purchases were being made by competitors Gerber, Libby, and Heinz. 18 -24

The Current Role of Test Markets • Despite the cost and time commitments, traditional test markets still are used, especially if risks and uncertainties are high. • Starbucks did traditional test markets for Via instant coffee, as the risks were judged to be high and a failure could hurt overall Starbucks brand equity. – Was Via perceived as high-quality and worthy of the Starbucks brand? – Were Starbucks taste features delivered by an instant? – Were Starbucks customers skeptical of any instant? – Did Starbucks customers like the individual packet format? 18 -25

The Rollout • Select a limited area of the country (one or several cities or states, 25% of the market, etc. ) and monitor sales of product there. • Starting areas are not necessarily representative – The company may be able to get the ball rolling more easily there – The company may deliberately choose a hard area to sell in, to learn the pitfalls and what really drives success. • Decision point: when to switch to the full national launch. 18 -26

Types of Rollout • • By geography (including international) By application By influence By trade channel 18 -27

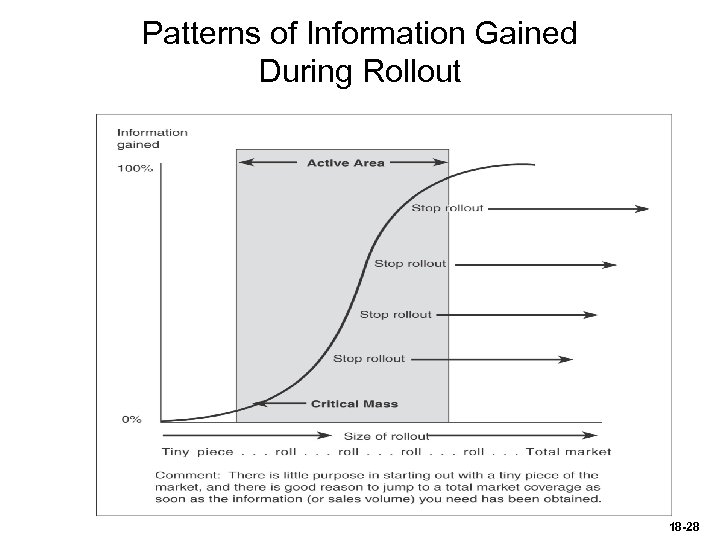

Patterns of Information Gained During Rollout 18 -28

Risks of Rollout • May need to invest in full-scale production facility early. • Competitors may move fast enough to go national while the rollout is still underway. • Problems getting into the distribution channel. • Lacks national publicity that a full-scale launch may generate. 18 -29

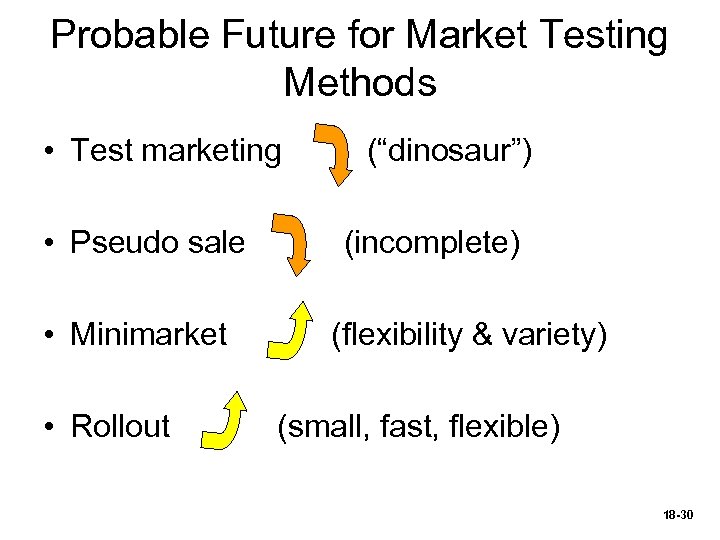

Probable Future for Market Testing Methods • Test marketing • Pseudo sale • Minimarket • Rollout (“dinosaur”) (incomplete) (flexibility & variety) (small, fast, flexible) 18 -30

96c381d662e7d787455673469d2f90dc.ppt