a8b1aaa74eab53b192bf96da94fdb400.ppt

- Количество слайдов: 47

New Methods in International Trade for SMEs – Application of Supply Chain Management and Electronic Data Interchange 中小企國際貿易新方法-應用供應 鏈及電子資訊交流方案 Connie Leung Head, Trade & Supply Chain Markets, Asia Pacific SWIFT

New Methods in International Trade for SMEs – Application of Supply Chain Management and Electronic Data Interchange 中小企國際貿易新方法-應用供應 鏈及電子資訊交流方案 Connie Leung Head, Trade & Supply Chain Markets, Asia Pacific SWIFT

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

Leader in secure global financial communication A co-operative organisation serving the financial industry W Worldwide S Society W A provider of highly Interbank I secure financial messaging services Financial F The financial Telecommunication body T standardisation HKTDC World SME Expo Dec 2008

Leader in secure global financial communication A co-operative organisation serving the financial industry W Worldwide S Society W A provider of highly Interbank I secure financial messaging services Financial F The financial Telecommunication body T standardisation HKTDC World SME Expo Dec 2008

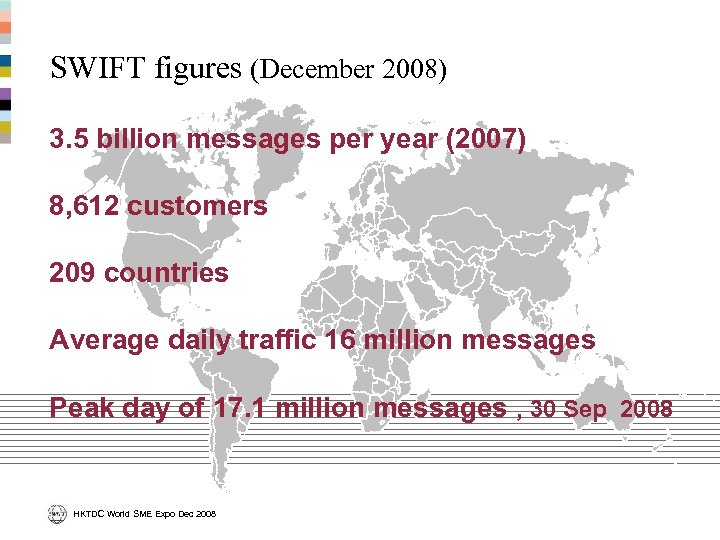

SWIFT figures (December 2008) 3. 5 billion messages per year (2007) 8, 612 customers 209 countries Average daily traffic 16 million messages Peak day of 17. 1 million messages , 30 Sep 2008 HKTDC World SME Expo Dec 2008

SWIFT figures (December 2008) 3. 5 billion messages per year (2007) 8, 612 customers 209 countries Average daily traffic 16 million messages Peak day of 17. 1 million messages , 30 Sep 2008 HKTDC World SME Expo Dec 2008

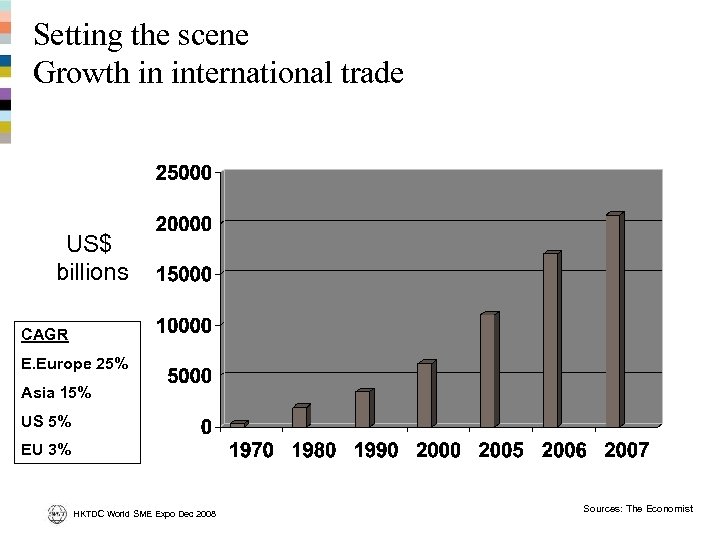

Setting the scene Growth in international trade US$ billions CAGR E. Europe 25% Asia 15% US 5% EU 3% HKTDC World SME Expo Dec 2008 Sources: The Economist

Setting the scene Growth in international trade US$ billions CAGR E. Europe 25% Asia 15% US 5% EU 3% HKTDC World SME Expo Dec 2008 Sources: The Economist

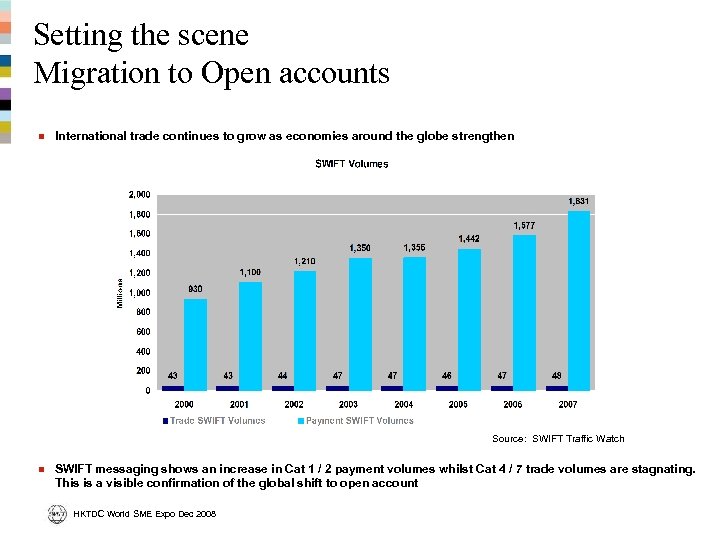

Setting the scene Migration to Open accounts n International trade continues to grow as economies around the globe strengthen Source: SWIFT Traffic Watch n SWIFT messaging shows an increase in Cat 1 / 2 payment volumes whilst Cat 4 / 7 trade volumes are stagnating. This is a visible confirmation of the global shift to open account HKTDC World SME Expo Dec 2008

Setting the scene Migration to Open accounts n International trade continues to grow as economies around the globe strengthen Source: SWIFT Traffic Watch n SWIFT messaging shows an increase in Cat 1 / 2 payment volumes whilst Cat 4 / 7 trade volumes are stagnating. This is a visible confirmation of the global shift to open account HKTDC World SME Expo Dec 2008

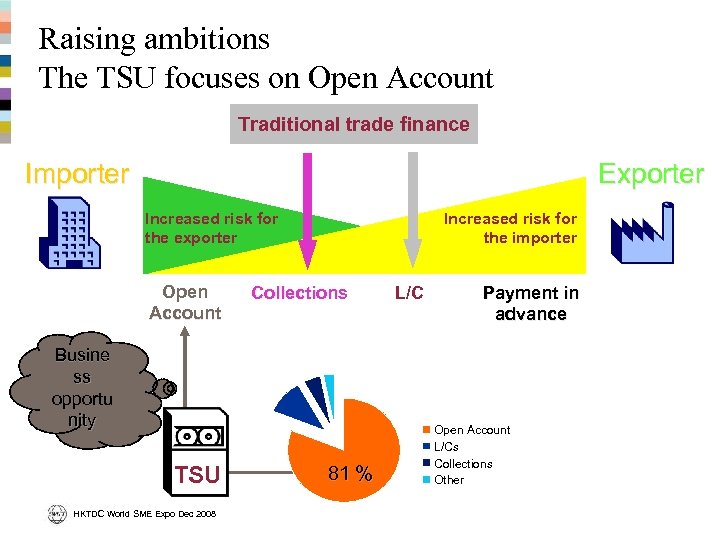

Raising ambitions The TSU focuses on Open Account Traditional trade finance Importer Exporter Increased risk for the exporter Open Account Increased risk for the importer Collections Busine ss opportu nity TSU HKTDC World SME Expo Dec 2008 81 % L/C Payment in advance Open Account L/Cs Collections Other

Raising ambitions The TSU focuses on Open Account Traditional trade finance Importer Exporter Increased risk for the exporter Open Account Increased risk for the importer Collections Busine ss opportu nity TSU HKTDC World SME Expo Dec 2008 81 % L/C Payment in advance Open Account L/Cs Collections Other

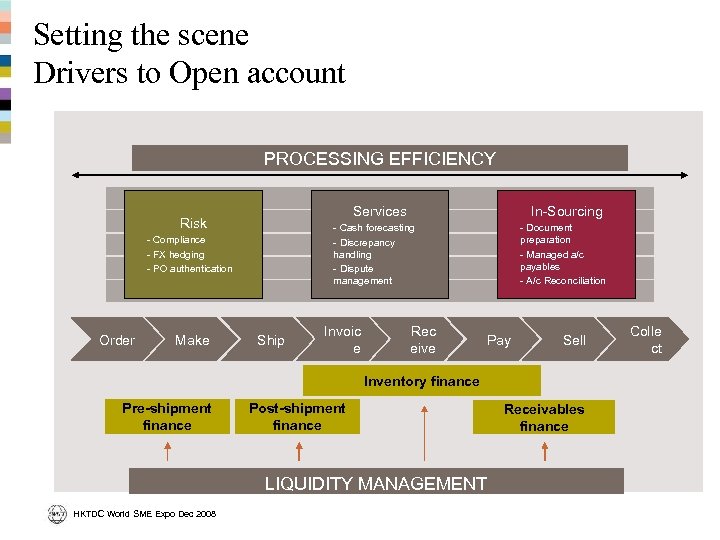

Setting the scene Drivers to Open account PROCESSING EFFICIENCY Services Risk - Compliance - FX hedging - PO authentication Order Make In-Sourcing - Cash forecasting - Discrepancy handling - Dispute management Ship Invoic e Rec eive - Document preparation - Managed a/c payables - A/c Reconciliation Pay Sell Inventory finance Pre-shipment finance Post-shipment finance LIQUIDITY MANAGEMENT HKTDC World SME Expo Dec 2008 Receivables finance Colle ct

Setting the scene Drivers to Open account PROCESSING EFFICIENCY Services Risk - Compliance - FX hedging - PO authentication Order Make In-Sourcing - Cash forecasting - Discrepancy handling - Dispute management Ship Invoic e Rec eive - Document preparation - Managed a/c payables - A/c Reconciliation Pay Sell Inventory finance Pre-shipment finance Post-shipment finance LIQUIDITY MANAGEMENT HKTDC World SME Expo Dec 2008 Receivables finance Colle ct

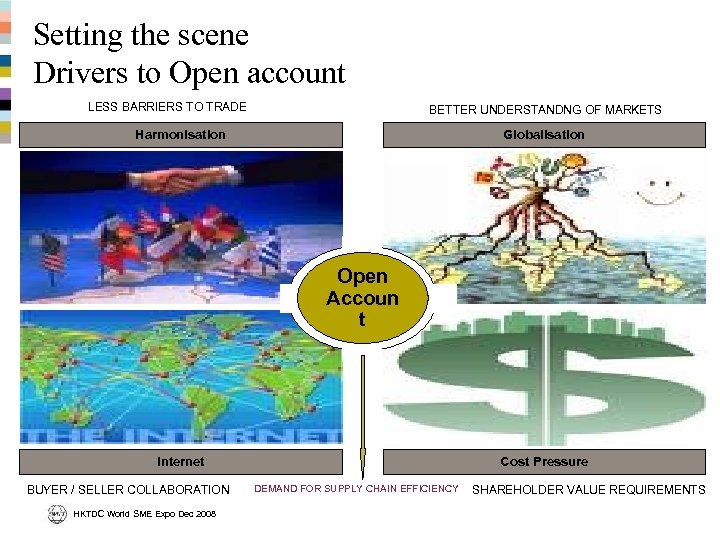

Setting the scene Drivers to Open account LESS BARRIERS TO TRADE BETTER UNDERSTANDNG OF MARKETS Harmonisation Globalisation Open Accoun t Internet BUYER / SELLER COLLABORATION HKTDC World SME Expo Dec 2008 Cost Pressure DEMAND FOR SUPPLY CHAIN EFFICIENCY SHAREHOLDER VALUE REQUIREMENTS

Setting the scene Drivers to Open account LESS BARRIERS TO TRADE BETTER UNDERSTANDNG OF MARKETS Harmonisation Globalisation Open Accoun t Internet BUYER / SELLER COLLABORATION HKTDC World SME Expo Dec 2008 Cost Pressure DEMAND FOR SUPPLY CHAIN EFFICIENCY SHAREHOLDER VALUE REQUIREMENTS

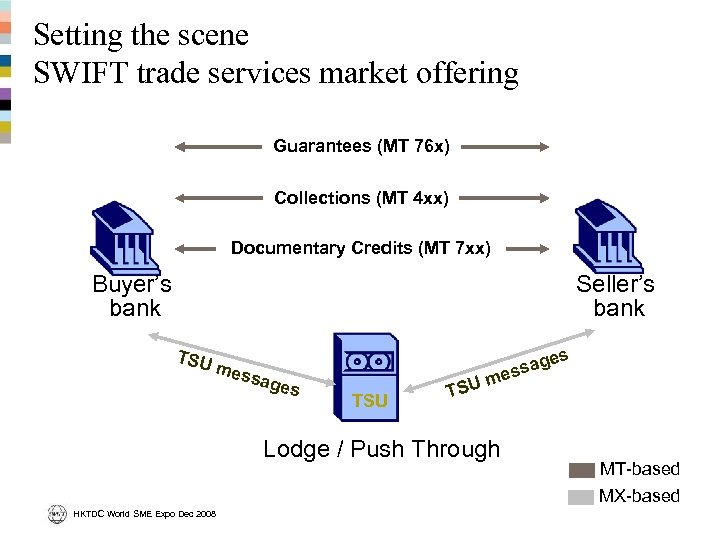

Setting the scene SWIFT trade services market offering Guarantees (MT 76 x) Collections (MT 4 xx) Documentary Credits (MT 7 xx) Buyer’s bank Seller’s bank TSU mes sage s es sag es TSU m TSU Lodge / Push Through MT-based MX-based HKTDC World SME Expo Dec 2008

Setting the scene SWIFT trade services market offering Guarantees (MT 76 x) Collections (MT 4 xx) Documentary Credits (MT 7 xx) Buyer’s bank Seller’s bank TSU mes sage s es sag es TSU m TSU Lodge / Push Through MT-based MX-based HKTDC World SME Expo Dec 2008

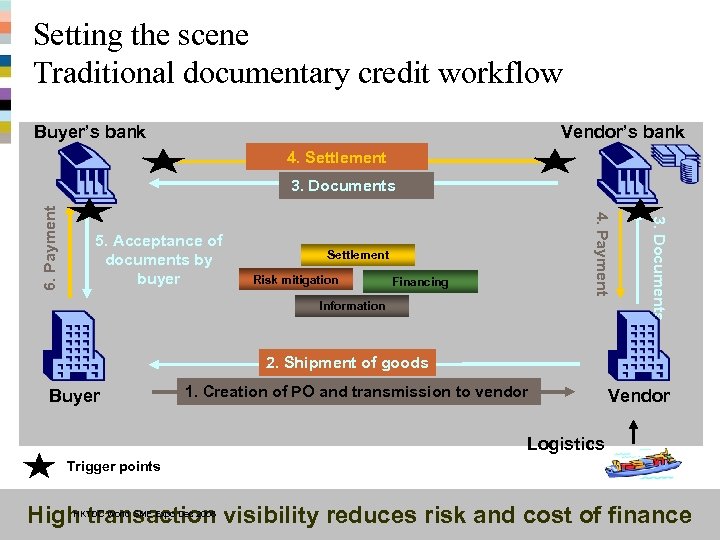

Setting the scene Traditional documentary credit workflow Buyer’s bank Vendor’s bank 4. Settlement Risk mitigation Financing Information 3. Documents 5. Acceptance of documents by buyer 4. Payment 6. Payment 3. Documents 2. Shipment of goods Buyer 1. Creation of PO and transmission to vendor Vendor Logistics Trigger points High transaction visibility reduces risk and cost of finance HKTDC World SME Expo Dec 2008

Setting the scene Traditional documentary credit workflow Buyer’s bank Vendor’s bank 4. Settlement Risk mitigation Financing Information 3. Documents 5. Acceptance of documents by buyer 4. Payment 6. Payment 3. Documents 2. Shipment of goods Buyer 1. Creation of PO and transmission to vendor Vendor Logistics Trigger points High transaction visibility reduces risk and cost of finance HKTDC World SME Expo Dec 2008

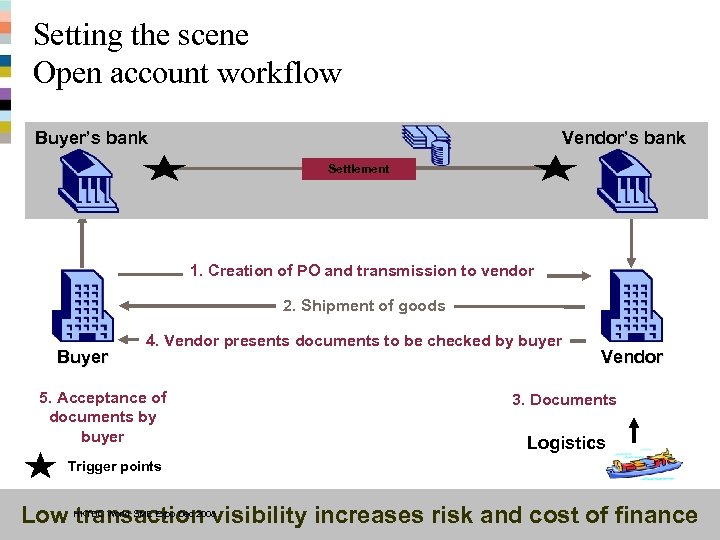

Setting the scene Open account workflow Buyer’s bank Vendor’s bank Settlement 1. Creation of PO and transmission to vendor 2. Shipment of goods Buyer 4. Vendor presents documents to be checked by buyer 5. Acceptance of documents by buyer Vendor 3. Documents Logistics Trigger points Low transaction visibility increases risk and cost of finance HKTDC World SME Expo Dec 2008

Setting the scene Open account workflow Buyer’s bank Vendor’s bank Settlement 1. Creation of PO and transmission to vendor 2. Shipment of goods Buyer 4. Vendor presents documents to be checked by buyer 5. Acceptance of documents by buyer Vendor 3. Documents Logistics Trigger points Low transaction visibility increases risk and cost of finance HKTDC World SME Expo Dec 2008

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

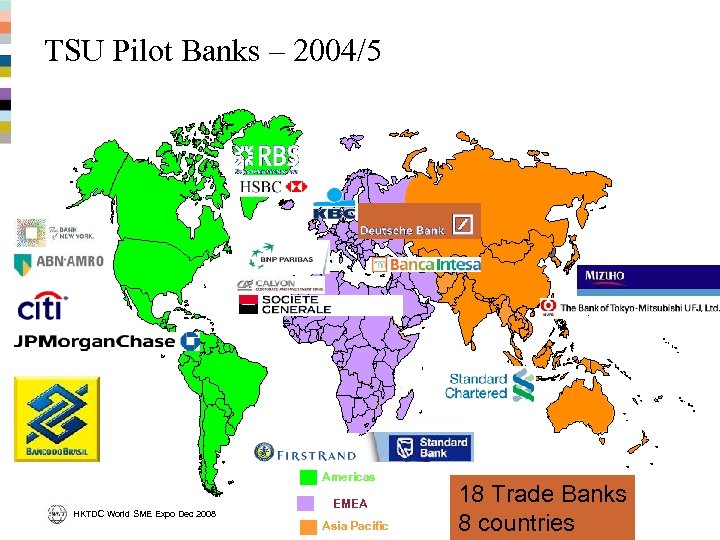

TSU Pilot Banks – 2004/5 Americas HKTDC World SME Expo Dec 2008 EMEA Asia Pacific 18 Trade Banks 8 countries

TSU Pilot Banks – 2004/5 Americas HKTDC World SME Expo Dec 2008 EMEA Asia Pacific 18 Trade Banks 8 countries

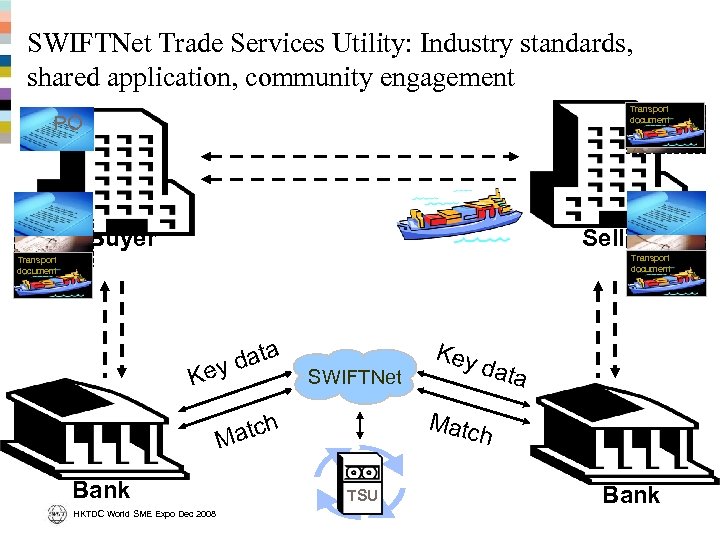

SWIFTNet Trade Services Utility: Industry standards, shared application, community engagement Transport document Inv PO Buyer Seller Transport document K data ey SWIFTNet HKTDC World SME Expo Dec 2008 data Matc atch M Bank Key h TSU Bank

SWIFTNet Trade Services Utility: Industry standards, shared application, community engagement Transport document Inv PO Buyer Seller Transport document K data ey SWIFTNet HKTDC World SME Expo Dec 2008 data Matc atch M Bank Key h TSU Bank

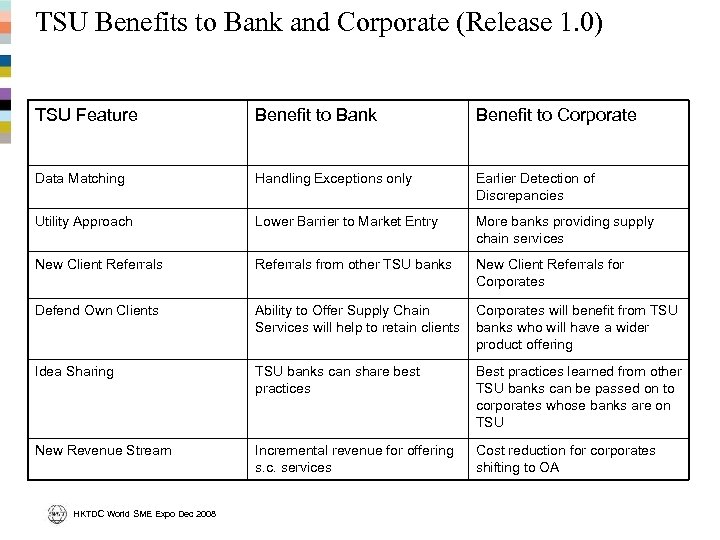

TSU Benefits to Bank and Corporate (Release 1. 0) TSU Feature Benefit to Bank Benefit to Corporate Data Matching Handling Exceptions only Earlier Detection of Discrepancies Utility Approach Lower Barrier to Market Entry More banks providing supply chain services New Client Referrals from other TSU banks New Client Referrals for Corporates Defend Own Clients Ability to Offer Supply Chain Services will help to retain clients Corporates will benefit from TSU banks who will have a wider product offering Idea Sharing TSU banks can share best practices Best practices learned from other TSU banks can be passed on to corporates whose banks are on TSU New Revenue Stream Incremental revenue for offering s. c. services Cost reduction for corporates shifting to OA HKTDC World SME Expo Dec 2008

TSU Benefits to Bank and Corporate (Release 1. 0) TSU Feature Benefit to Bank Benefit to Corporate Data Matching Handling Exceptions only Earlier Detection of Discrepancies Utility Approach Lower Barrier to Market Entry More banks providing supply chain services New Client Referrals from other TSU banks New Client Referrals for Corporates Defend Own Clients Ability to Offer Supply Chain Services will help to retain clients Corporates will benefit from TSU banks who will have a wider product offering Idea Sharing TSU banks can share best practices Best practices learned from other TSU banks can be passed on to corporates whose banks are on TSU New Revenue Stream Incremental revenue for offering s. c. services Cost reduction for corporates shifting to OA HKTDC World SME Expo Dec 2008

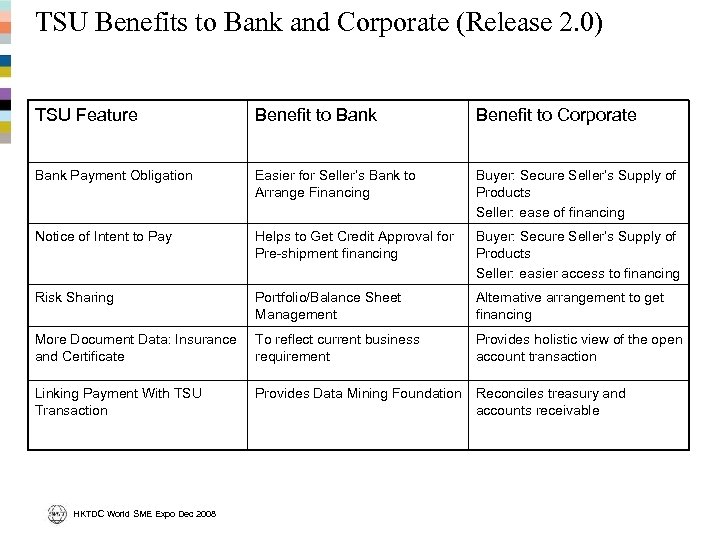

TSU Benefits to Bank and Corporate (Release 2. 0) TSU Feature Benefit to Bank Benefit to Corporate Bank Payment Obligation Easier for Seller’s Bank to Arrange Financing Buyer: Secure Seller’s Supply of Products Seller: ease of financing Notice of Intent to Pay Helps to Get Credit Approval for Pre-shipment financing Buyer: Secure Seller’s Supply of Products Seller: easier access to financing Risk Sharing Portfolio/Balance Sheet Management Alternative arrangement to get financing More Document Data: Insurance and Certificate To reflect current business requirement Provides holistic view of the open account transaction Linking Payment With TSU Transaction Provides Data Mining Foundation Reconciles treasury and accounts receivable HKTDC World SME Expo Dec 2008

TSU Benefits to Bank and Corporate (Release 2. 0) TSU Feature Benefit to Bank Benefit to Corporate Bank Payment Obligation Easier for Seller’s Bank to Arrange Financing Buyer: Secure Seller’s Supply of Products Seller: ease of financing Notice of Intent to Pay Helps to Get Credit Approval for Pre-shipment financing Buyer: Secure Seller’s Supply of Products Seller: easier access to financing Risk Sharing Portfolio/Balance Sheet Management Alternative arrangement to get financing More Document Data: Insurance and Certificate To reflect current business requirement Provides holistic view of the open account transaction Linking Payment With TSU Transaction Provides Data Mining Foundation Reconciles treasury and accounts receivable HKTDC World SME Expo Dec 2008

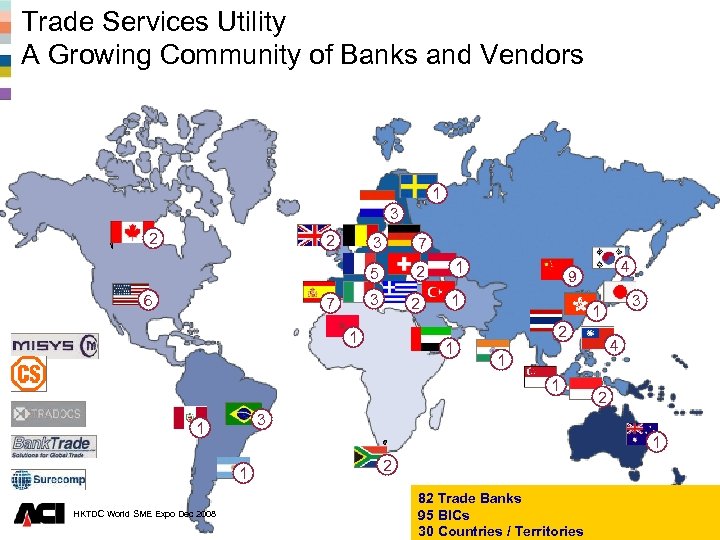

Trade Services Utility A Growing Community of Banks and Vendors 1 3 2 2 7 5 6 3 2 3 7 2 1 1 3 1 2 4 1 1 2 3 1 1 1 HKTDC World SME Expo Dec 2008 4 9 2 82 Trade Banks 95 BICs 30 Countries / Territories

Trade Services Utility A Growing Community of Banks and Vendors 1 3 2 2 7 5 6 3 2 3 7 2 1 1 3 1 2 4 1 1 2 3 1 1 1 HKTDC World SME Expo Dec 2008 4 9 2 82 Trade Banks 95 BICs 30 Countries / Territories

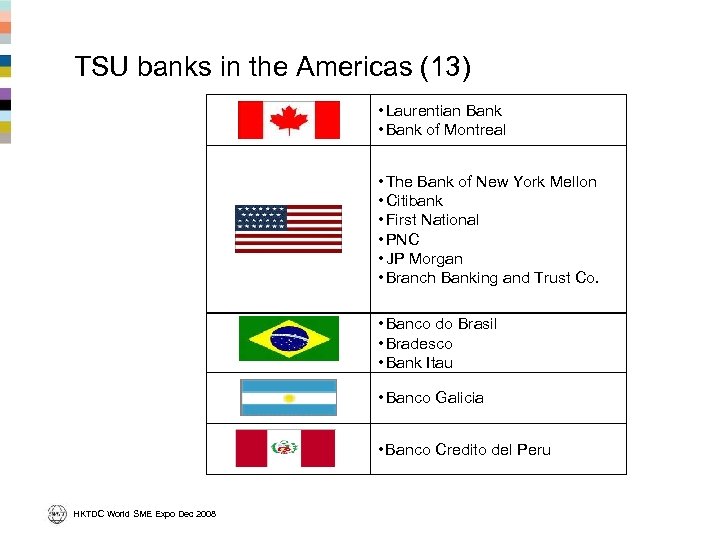

TSU banks in the Americas (13) • Laurentian Bank • Bank of Montreal • The Bank of New York Mellon • Citibank • First National • PNC • JP Morgan • Branch Banking and Trust Co. • Banco do Brasil • Bradesco • Bank Itau • Banco Galicia • Banco Credito del Peru HKTDC World SME Expo Dec 2008

TSU banks in the Americas (13) • Laurentian Bank • Bank of Montreal • The Bank of New York Mellon • Citibank • First National • PNC • JP Morgan • Branch Banking and Trust Co. • Banco do Brasil • Bradesco • Bank Itau • Banco Galicia • Banco Credito del Peru HKTDC World SME Expo Dec 2008

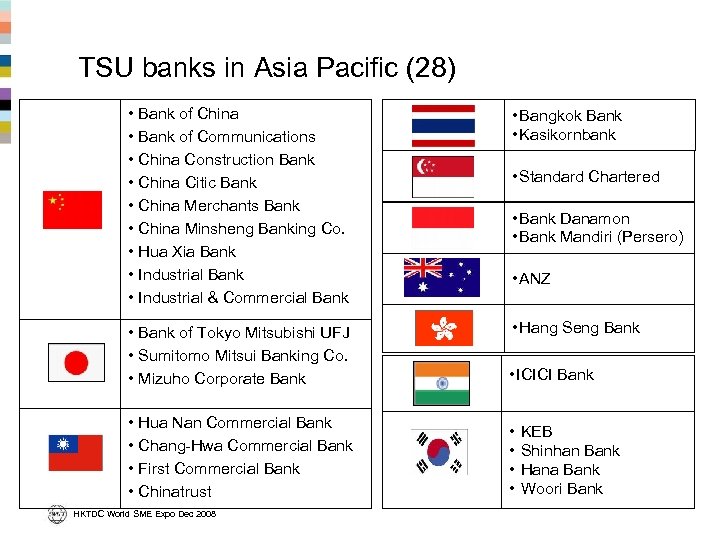

TSU banks in Asia Pacific (28) • Bank of China • Bank of Communications • China Construction Bank • China Citic Bank • China Merchants Bank • China Minsheng Banking Co. • Hua Xia Bank • Industrial & Commercial Bank • Bangkok Bank • Kasikornbank • Standard Chartered • Bank Danamon • Bank Mandiri (Persero) • ANZ • Hang Seng Bank • Bank of Tokyo Mitsubishi UFJ • Sumitomo Mitsui Banking Co. • Mizuho Corporate Bank • ICICI Bank • Hua Nan Commercial Bank • Chang-Hwa Commercial Bank • First Commercial Bank • Chinatrust • • HKTDC World SME Expo Dec 2008 KEB Shinhan Bank Hana Bank Woori Bank

TSU banks in Asia Pacific (28) • Bank of China • Bank of Communications • China Construction Bank • China Citic Bank • China Merchants Bank • China Minsheng Banking Co. • Hua Xia Bank • Industrial & Commercial Bank • Bangkok Bank • Kasikornbank • Standard Chartered • Bank Danamon • Bank Mandiri (Persero) • ANZ • Hang Seng Bank • Bank of Tokyo Mitsubishi UFJ • Sumitomo Mitsui Banking Co. • Mizuho Corporate Bank • ICICI Bank • Hua Nan Commercial Bank • Chang-Hwa Commercial Bank • First Commercial Bank • Chinatrust • • HKTDC World SME Expo Dec 2008 KEB Shinhan Bank Hana Bank Woori Bank

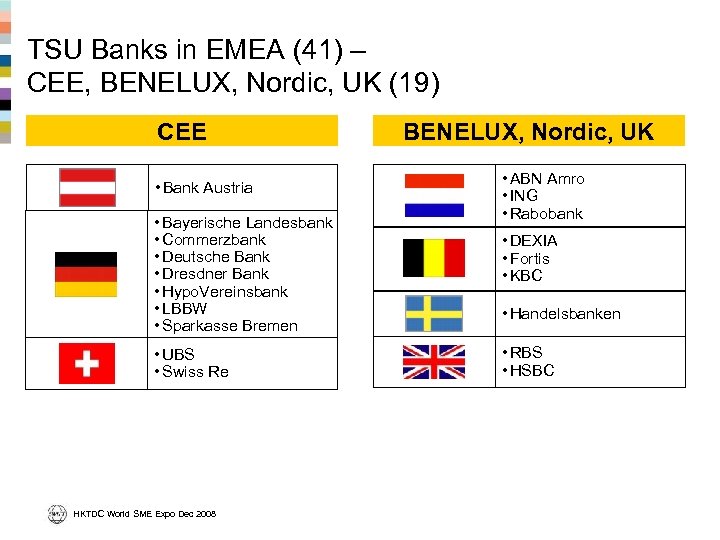

TSU Banks in EMEA (41) – CEE, BENELUX, Nordic, UK (19) CEE • Bank Austria • Bayerische Landesbank • Commerzbank • Deutsche Bank • Dresdner Bank • Hypo. Vereinsbank • LBBW • Sparkasse Bremen • UBS • Swiss Re HKTDC World SME Expo Dec 2008 BENELUX, Nordic, UK • ABN Amro • ING • Rabobank • DEXIA • Fortis • KBC • Handelsbanken • RBS • HSBC

TSU Banks in EMEA (41) – CEE, BENELUX, Nordic, UK (19) CEE • Bank Austria • Bayerische Landesbank • Commerzbank • Deutsche Bank • Dresdner Bank • Hypo. Vereinsbank • LBBW • Sparkasse Bremen • UBS • Swiss Re HKTDC World SME Expo Dec 2008 BENELUX, Nordic, UK • ABN Amro • ING • Rabobank • DEXIA • Fortis • KBC • Handelsbanken • RBS • HSBC

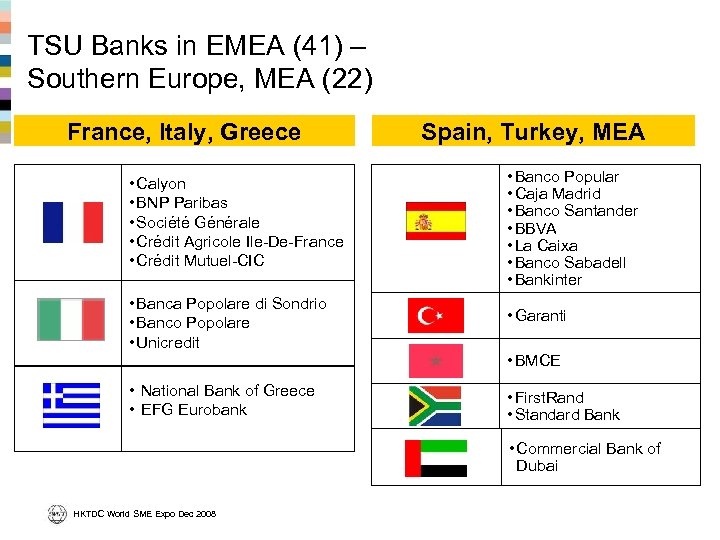

TSU Banks in EMEA (41) – Southern Europe, MEA (22) France, Italy, Greece Spain, Turkey, MEA • Calyon • BNP Paribas • Société Générale • Crédit Agricole Ile-De-France • Crédit Mutuel-CIC • Banco Popular • Caja Madrid • Banco Santander • BBVA • La Caixa • Banco Sabadell • Bankinter • Banca Popolare di Sondrio • Banco Popolare • Unicredit • Garanti • BMCE • National Bank of Greece • EFG Eurobank • First. Rand • Standard Bank • Commercial Bank of Dubai HKTDC World SME Expo Dec 2008

TSU Banks in EMEA (41) – Southern Europe, MEA (22) France, Italy, Greece Spain, Turkey, MEA • Calyon • BNP Paribas • Société Générale • Crédit Agricole Ile-De-France • Crédit Mutuel-CIC • Banco Popular • Caja Madrid • Banco Santander • BBVA • La Caixa • Banco Sabadell • Bankinter • Banca Popolare di Sondrio • Banco Popolare • Unicredit • Garanti • BMCE • National Bank of Greece • EFG Eurobank • First. Rand • Standard Bank • Commercial Bank of Dubai HKTDC World SME Expo Dec 2008

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

Market situation • Buyers/Sellers – Too many trade options : LC, OA, TT, Collections – Manual vs technology : own/banks systems, third party – No inter-operability of data, re-enter most of the time • Banks – Loss of revenue : LC vs Open Account – Lack of automation in OA, system only good for LC – Supply chain services are in demand • SWIFT – Bank-to-bank Document matching engine i. e. TSU – Bank need to build customer front end • Issues – High costs to invest into the customer front ends – Uncertain about the requirement from the industry HKTDC World SME Expo Dec 2008

Market situation • Buyers/Sellers – Too many trade options : LC, OA, TT, Collections – Manual vs technology : own/banks systems, third party – No inter-operability of data, re-enter most of the time • Banks – Loss of revenue : LC vs Open Account – Lack of automation in OA, system only good for LC – Supply chain services are in demand • SWIFT – Bank-to-bank Document matching engine i. e. TSU – Bank need to build customer front end • Issues – High costs to invest into the customer front ends – Uncertain about the requirement from the industry HKTDC World SME Expo Dec 2008

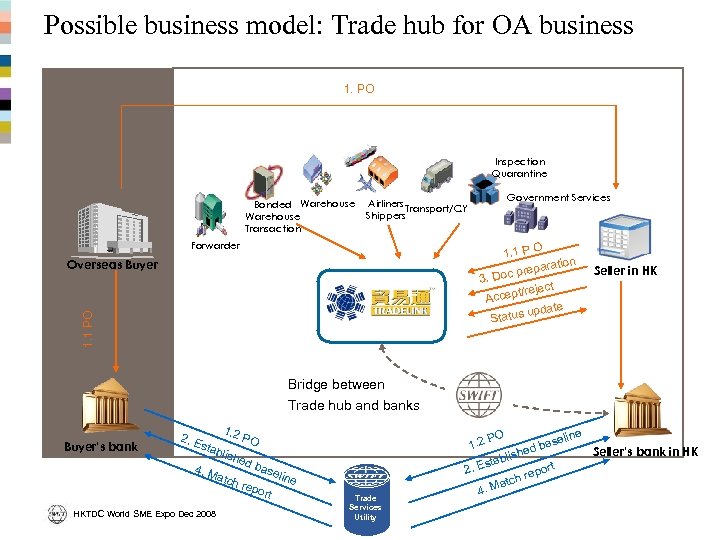

Possible business model: Trade hub for OA business 1. PO Inspection Quarantine Bonded Warehouse Transaction Airliners Transport/CY Shippers Forwarder Government Services 1. 1 P O n paratio oc pre 3. D t t/rejec Accep update Status 1. 1 PO Overseas Buyer Seller in HK Bridge between Trade hub and banks Buyer’s bank 2. E 1. 2 stab l ishe 4. M atch HKTDC World SME Expo Dec 2008 PO d ba repo seli rt ne Trade Services Utility line PO 1. 2 base d Seller’s bank in HK lishe stab 2. E port h re atc 4. M

Possible business model: Trade hub for OA business 1. PO Inspection Quarantine Bonded Warehouse Transaction Airliners Transport/CY Shippers Forwarder Government Services 1. 1 P O n paratio oc pre 3. D t t/rejec Accep update Status 1. 1 PO Overseas Buyer Seller in HK Bridge between Trade hub and banks Buyer’s bank 2. E 1. 2 stab l ishe 4. M atch HKTDC World SME Expo Dec 2008 PO d ba repo seli rt ne Trade Services Utility line PO 1. 2 base d Seller’s bank in HK lishe stab 2. E port h re atc 4. M

New Trends in International Trade for SMEs A Seamless Global Supply Chain Management Solution 11 December, 2008 26

New Trends in International Trade for SMEs A Seamless Global Supply Chain Management Solution 11 December, 2008 26

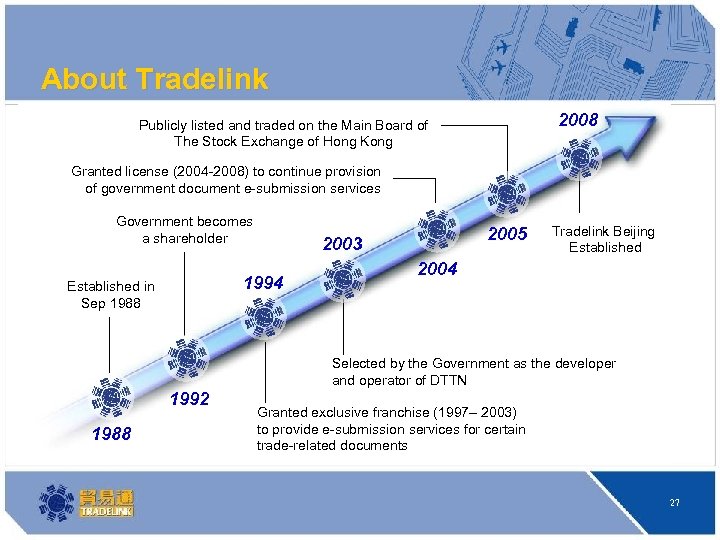

About Tradelink 2008 Publicly listed and traded on the Main Board of The Stock Exchange of Hong Kong Granted license (2004 -2008) to continue provision of government document e-submission services Government becomes a shareholder 2003 1994 Established in Sep 1988 2005 Tradelink Beijing Established 2004 Selected by the Government as the developer and operator of DTTN 1992 1988 Granted exclusive franchise (1997– 2003) to provide e-submission services for certain trade-related documents 27

About Tradelink 2008 Publicly listed and traded on the Main Board of The Stock Exchange of Hong Kong Granted license (2004 -2008) to continue provision of government document e-submission services Government becomes a shareholder 2003 1994 Established in Sep 1988 2005 Tradelink Beijing Established 2004 Selected by the Government as the developer and operator of DTTN 1992 1988 Granted exclusive franchise (1997– 2003) to provide e-submission services for certain trade-related documents 27

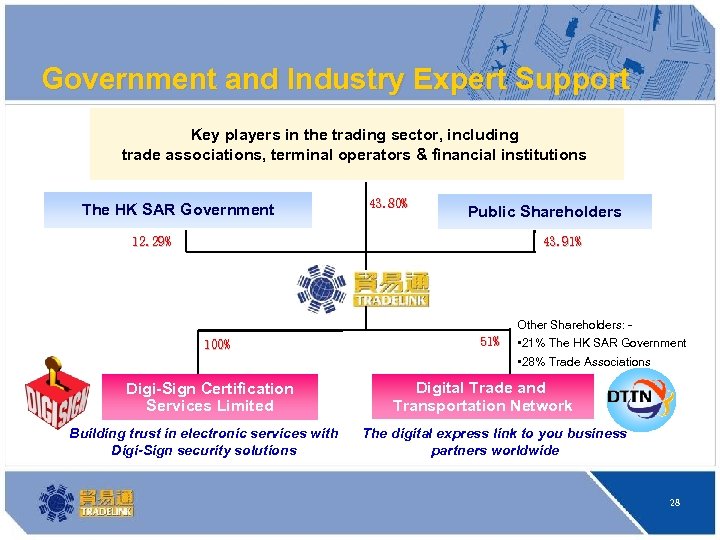

Government and Industry Expert Support Key players in the trading sector, including trade associations, terminal operators & financial institutions The HK SAR Government 43. 80% Public Shareholders 12. 29% 43. 91% Other Shareholders: - 100% Digi-Sign Certification Services Limited Building trust in electronic services with Digi-Sign security solutions 51% • 21% The HK SAR Government • 28% Trade Associations Digital Trade and Transportation Network The digital express link to you business partners worldwide 28

Government and Industry Expert Support Key players in the trading sector, including trade associations, terminal operators & financial institutions The HK SAR Government 43. 80% Public Shareholders 12. 29% 43. 91% Other Shareholders: - 100% Digi-Sign Certification Services Limited Building trust in electronic services with Digi-Sign security solutions 51% • 21% The HK SAR Government • 28% Trade Associations Digital Trade and Transportation Network The digital express link to you business partners worldwide 28

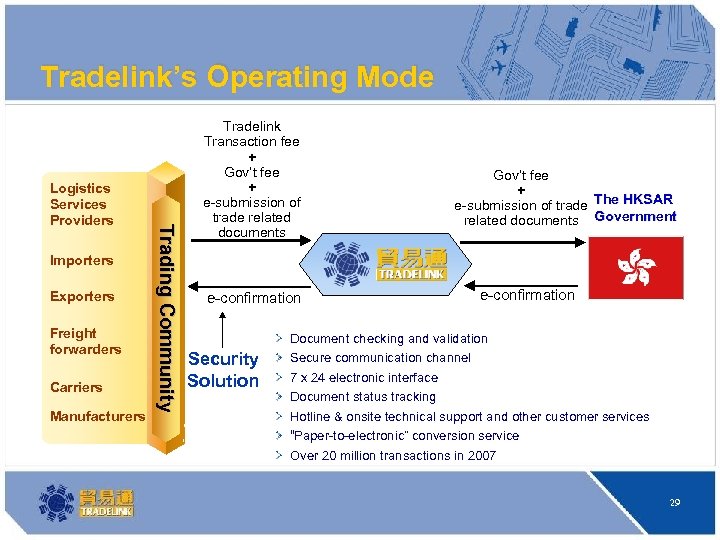

Tradelink’s Operating Mode Importers Exporters Freight forwarders Carriers Manufacturers Trading Community Logistics Services Providers Tradelink Transaction fee + Gov’t fee + e-submission of trade related documents Gov’t fee + e-submission of trade The HKSAR related documents Government e-confirmation Document checking and validation Security Solution Secure communication channel 7 x 24 electronic interface Document status tracking Hotline & onsite technical support and other customer services “Paper-to-electronic” conversion service Over 20 million transactions in 2007 29

Tradelink’s Operating Mode Importers Exporters Freight forwarders Carriers Manufacturers Trading Community Logistics Services Providers Tradelink Transaction fee + Gov’t fee + e-submission of trade related documents Gov’t fee + e-submission of trade The HKSAR related documents Government e-confirmation Document checking and validation Security Solution Secure communication channel 7 x 24 electronic interface Document status tracking Hotline & onsite technical support and other customer services “Paper-to-electronic” conversion service Over 20 million transactions in 2007 29

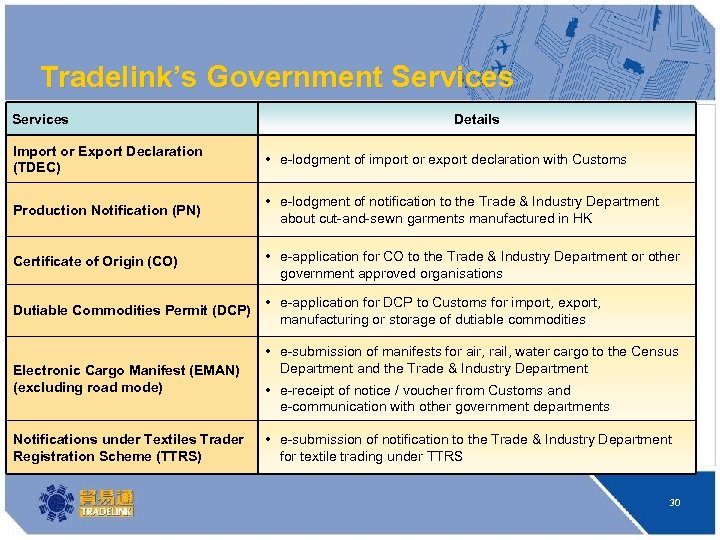

Tradelink’s Government Services Details Import or Export Declaration (TDEC) • e-lodgment of import or export declaration with Customs Production Notification (PN) • e-lodgment of notification to the Trade & Industry Department about cut-and-sewn garments manufactured in HK Certificate of Origin (CO) • e-application for CO to the Trade & Industry Department or other government approved organisations Dutiable Commodities Permit (DCP) • e-application for DCP to Customs for import, export, manufacturing or storage of dutiable commodities Electronic Cargo Manifest (EMAN) (excluding road mode) Notifications under Textiles Trader Registration Scheme (TTRS) • e-submission of manifests for air, rail, water cargo to the Census Department and the Trade & Industry Department • e-receipt of notice / voucher from Customs and e-communication with other government departments • e-submission of notification to the Trade & Industry Department for textile trading under TTRS 30

Tradelink’s Government Services Details Import or Export Declaration (TDEC) • e-lodgment of import or export declaration with Customs Production Notification (PN) • e-lodgment of notification to the Trade & Industry Department about cut-and-sewn garments manufactured in HK Certificate of Origin (CO) • e-application for CO to the Trade & Industry Department or other government approved organisations Dutiable Commodities Permit (DCP) • e-application for DCP to Customs for import, export, manufacturing or storage of dutiable commodities Electronic Cargo Manifest (EMAN) (excluding road mode) Notifications under Textiles Trader Registration Scheme (TTRS) • e-submission of manifests for air, rail, water cargo to the Census Department and the Trade & Industry Department • e-receipt of notice / voucher from Customs and e-communication with other government departments • e-submission of notification to the Trade & Industry Department for textile trading under TTRS 30

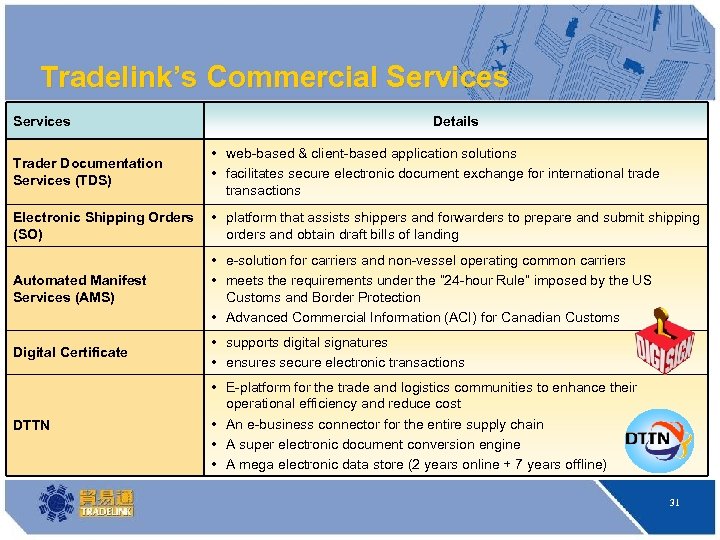

Tradelink’s Commercial Services Details Trader Documentation Services (TDS) • web-based & client-based application solutions • facilitates secure electronic document exchange for international trade transactions Electronic Shipping Orders (SO) • platform that assists shippers and forwarders to prepare and submit shipping orders and obtain draft bills of landing Automated Manifest Services (AMS) • e-solution for carriers and non-vessel operating common carriers • meets the requirements under the “ 24 -hour Rule” imposed by the US Customs and Border Protection • Advanced Commercial Information (ACI) for Canadian Customs Digital Certificate • supports digital signatures • ensures secure electronic transactions DTTN • E-platform for the trade and logistics communities to enhance their operational efficiency and reduce cost • An e-business connector for the entire supply chain • A super electronic document conversion engine • A mega electronic data store (2 years online + 7 years offline) 31

Tradelink’s Commercial Services Details Trader Documentation Services (TDS) • web-based & client-based application solutions • facilitates secure electronic document exchange for international trade transactions Electronic Shipping Orders (SO) • platform that assists shippers and forwarders to prepare and submit shipping orders and obtain draft bills of landing Automated Manifest Services (AMS) • e-solution for carriers and non-vessel operating common carriers • meets the requirements under the “ 24 -hour Rule” imposed by the US Customs and Border Protection • Advanced Commercial Information (ACI) for Canadian Customs Digital Certificate • supports digital signatures • ensures secure electronic transactions DTTN • E-platform for the trade and logistics communities to enhance their operational efficiency and reduce cost • An e-business connector for the entire supply chain • A super electronic document conversion engine • A mega electronic data store (2 years online + 7 years offline) 31

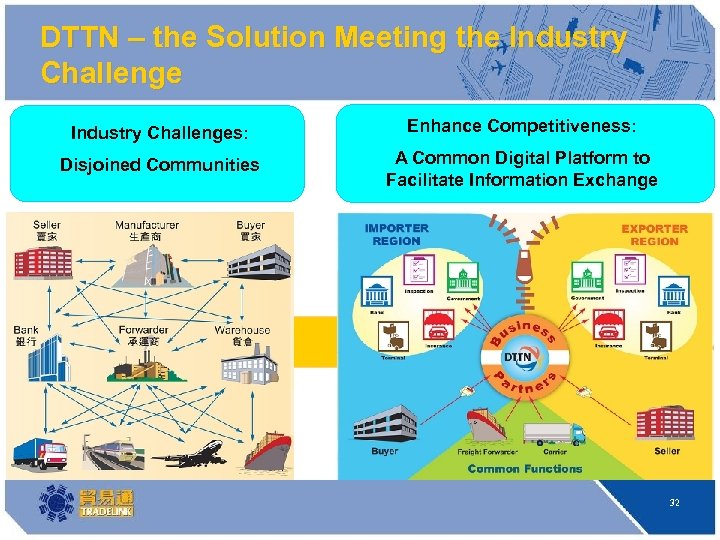

DTTN – the Solution Meeting the Industry Challenges: Enhance Competitiveness: Disjoined Communities A Common Digital Platform to Facilitate Information Exchange 32

DTTN – the Solution Meeting the Industry Challenges: Enhance Competitiveness: Disjoined Communities A Common Digital Platform to Facilitate Information Exchange 32

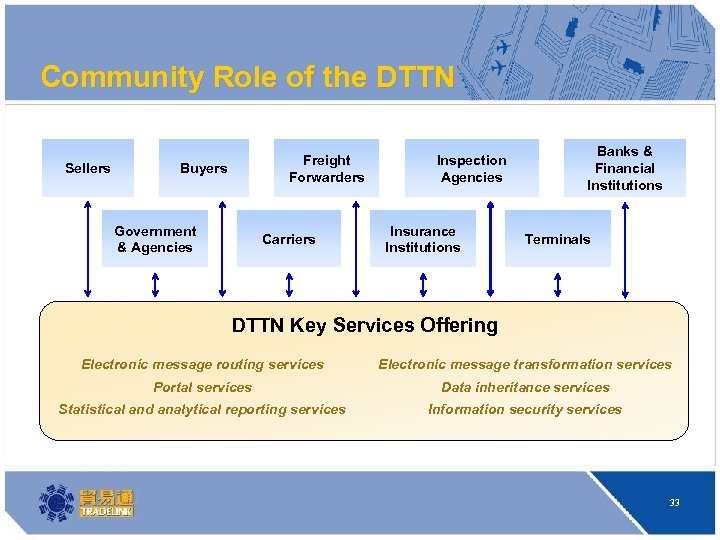

Community Role of the DTTN Sellers Freight Forwarders Buyers Government & Agencies Carriers Inspection Agencies Insurance Institutions Banks & Financial Institutions Terminals DTTN Key Services Offering Electronic message routing services Electronic message transformation services Portal services Data inheritance services Statistical and analytical reporting services Information security services 33

Community Role of the DTTN Sellers Freight Forwarders Buyers Government & Agencies Carriers Inspection Agencies Insurance Institutions Banks & Financial Institutions Terminals DTTN Key Services Offering Electronic message routing services Electronic message transformation services Portal services Data inheritance services Statistical and analytical reporting services Information security services 33

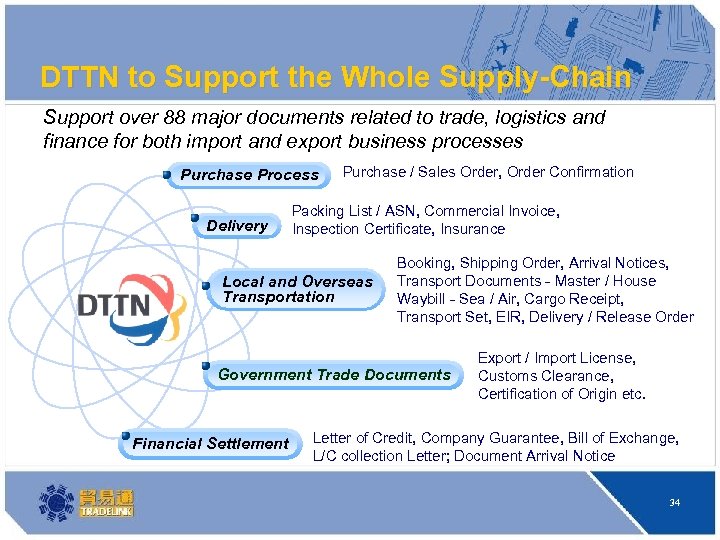

DTTN to Support the Whole Supply-Chain Support over 88 major documents related to trade, logistics and finance for both import and export business processes Purchase Process Delivery Purchase / Sales Order, Order Confirmation Packing List / ASN, Commercial Invoice, Inspection Certificate, Insurance Local and Overseas Transportation Booking, Shipping Order, Arrival Notices, Transport Documents - Master / House Waybill - Sea / Air, Cargo Receipt, Transport Set, EIR, Delivery / Release Order Government Trade Documents Financial Settlement Export / Import License, Customs Clearance, Certification of Origin etc. Letter of Credit, Company Guarantee, Bill of Exchange, L/C collection Letter; Document Arrival Notice 34

DTTN to Support the Whole Supply-Chain Support over 88 major documents related to trade, logistics and finance for both import and export business processes Purchase Process Delivery Purchase / Sales Order, Order Confirmation Packing List / ASN, Commercial Invoice, Inspection Certificate, Insurance Local and Overseas Transportation Booking, Shipping Order, Arrival Notices, Transport Documents - Master / House Waybill - Sea / Air, Cargo Receipt, Transport Set, EIR, Delivery / Release Order Government Trade Documents Financial Settlement Export / Import License, Customs Clearance, Certification of Origin etc. Letter of Credit, Company Guarantee, Bill of Exchange, L/C collection Letter; Document Arrival Notice 34

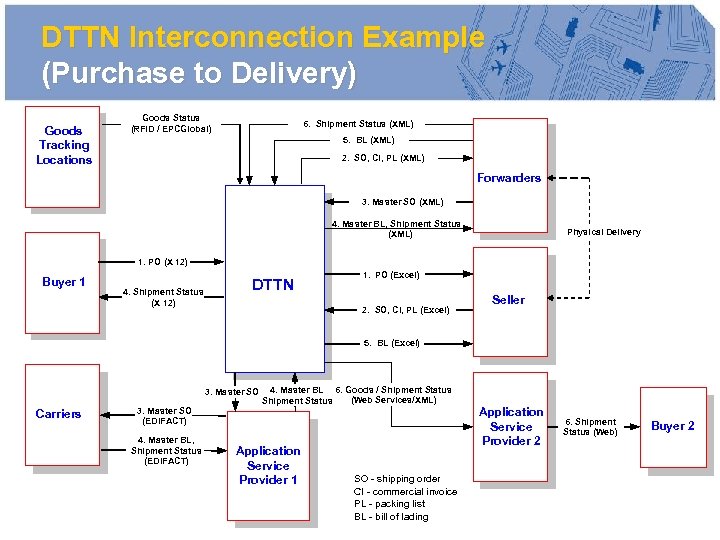

DTTN Interconnection Example (Purchase to Delivery) Goods Tracking Locations Goods Status (RFID / EPCGlobal) 6. Shipment Status (XML) 5. BL (XML) 2. SO, CI, PL (XML) Forwarders 3. Master SO (XML) 4. Master BL, Shipment Status (XML) Physical Delivery 1. PO (X 12) Buyer 1 4. Shipment Status (X 12) DTTN 1. PO (Excel) 2. SO, CI, PL (Excel) Seller 5. BL (Excel) 3. Master SO Carriers 3. Master SO (EDIFACT) 4. Master BL, Shipment Status (EDIFACT) 4. Master BL 6. Goods / Shipment Status (Web Services/XML) Shipment Status Application Service Provider 1 SO - shipping order CI - commercial invoice PL - packing list BL - bill of lading Application Service Provider 2 6. Shipment Status (Web) Buyer 2 35

DTTN Interconnection Example (Purchase to Delivery) Goods Tracking Locations Goods Status (RFID / EPCGlobal) 6. Shipment Status (XML) 5. BL (XML) 2. SO, CI, PL (XML) Forwarders 3. Master SO (XML) 4. Master BL, Shipment Status (XML) Physical Delivery 1. PO (X 12) Buyer 1 4. Shipment Status (X 12) DTTN 1. PO (Excel) 2. SO, CI, PL (Excel) Seller 5. BL (Excel) 3. Master SO Carriers 3. Master SO (EDIFACT) 4. Master BL, Shipment Status (EDIFACT) 4. Master BL 6. Goods / Shipment Status (Web Services/XML) Shipment Status Application Service Provider 1 SO - shipping order CI - commercial invoice PL - packing list BL - bill of lading Application Service Provider 2 6. Shipment Status (Web) Buyer 2 35

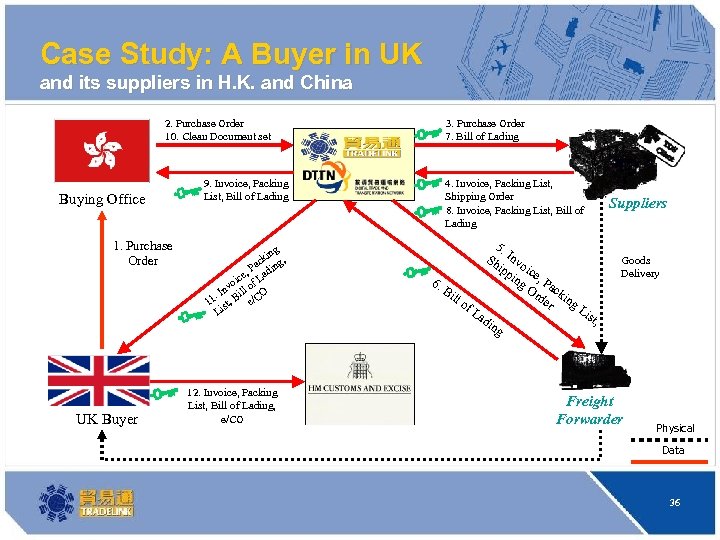

Case Study: A Buyer in UK and its suppliers in H. K. and China 2. Purchase Order 10. Clean Document set Buying Office 1. Purchase Order UK Buyer 9. Invoice, Packing List, Bill of Lading ck ng, a , P di ice f La o nv l o. I Bil /CO 11 ist, e L 12. Invoice, Packing List, Bill of Lading, e/CO 3. Purchase Order 7. Bill of Lading TDS 4. Invoice, Packing List, Shipping Order 8. Invoice, Packing List, Bill of Lading 5. Sh Invo ipp ic ing e, P 6. Or ack Bi ll o de ing r f. L Li st, ad ing Suppliers Goods Delivery Freight Forwarder Physical Data 36

Case Study: A Buyer in UK and its suppliers in H. K. and China 2. Purchase Order 10. Clean Document set Buying Office 1. Purchase Order UK Buyer 9. Invoice, Packing List, Bill of Lading ck ng, a , P di ice f La o nv l o. I Bil /CO 11 ist, e L 12. Invoice, Packing List, Bill of Lading, e/CO 3. Purchase Order 7. Bill of Lading TDS 4. Invoice, Packing List, Shipping Order 8. Invoice, Packing List, Bill of Lading 5. Sh Invo ipp ic ing e, P 6. Or ack Bi ll o de ing r f. L Li st, ad ing Suppliers Goods Delivery Freight Forwarder Physical Data 36

Extending Our Reach with Partners around the World Pan Asian E-Commerce Alliance Singapore, PRC, Thailand, Korea, Japan, Macau, Malaysia Other Regions: Australia, France, Spain, Mexico, United States, The Netherlands 37

Extending Our Reach with Partners around the World Pan Asian E-Commerce Alliance Singapore, PRC, Thailand, Korea, Japan, Macau, Malaysia Other Regions: Australia, France, Spain, Mexico, United States, The Netherlands 37

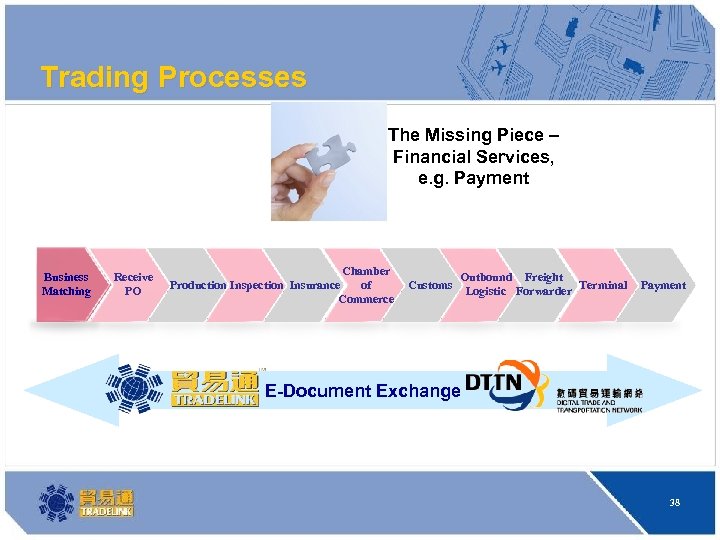

Trading Processes The Missing Piece – Financial Services, e. g. Payment Business Matching Receive PO Chamber of Production Inspection Insurance Commerce Customs Outbound Freight Terminal Logistic Forwarder Payment E-Document Exchange 38

Trading Processes The Missing Piece – Financial Services, e. g. Payment Business Matching Receive PO Chamber of Production Inspection Insurance Commerce Customs Outbound Freight Terminal Logistic Forwarder Payment E-Document Exchange 38

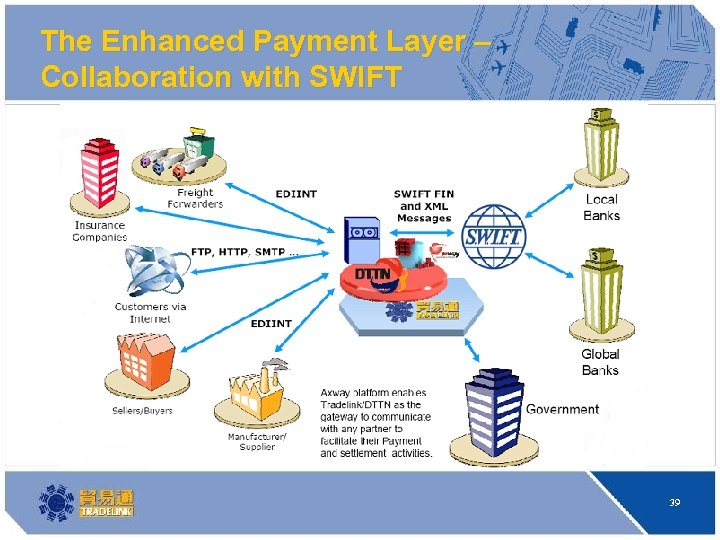

The Enhanced Payment Layer – Collaboration with SWIFT DTTN to provide possible docs/messages supporting transactions for payment/LC/open account related transactions 39

The Enhanced Payment Layer – Collaboration with SWIFT DTTN to provide possible docs/messages supporting transactions for payment/LC/open account related transactions 39

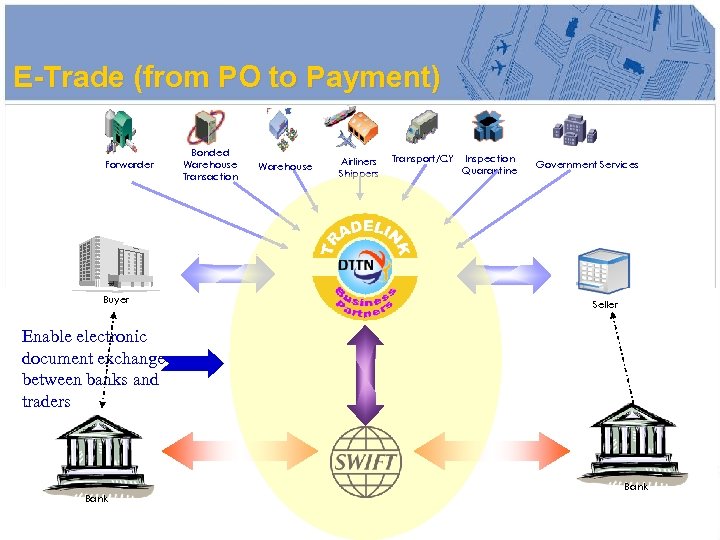

E-Trade (from PO to Payment) Forwarder Buyer Bonded Warehouse Transaction Warehouse Airliners Shippers Transport/CY Inspection Quarantine Government Services Seller Enable electronic document exchange between banks and traders Bank 40

E-Trade (from PO to Payment) Forwarder Buyer Bonded Warehouse Transaction Warehouse Airliners Shippers Transport/CY Inspection Quarantine Government Services Seller Enable electronic document exchange between banks and traders Bank 40

The Bridge between the Trading Industry and Banks Tradelink/DTTN-SWIFT connection – An electronic gateway for the communication between banks and traders Documents can be submitted to banks via the connection – E. g. Purchase Order, Commercial Invoice, Shipping Documents & etc A single channel to communicate with all trading parties, including banks Minimize data entry efforts Minimize data entry error No constraints on collection time and collection location 41

The Bridge between the Trading Industry and Banks Tradelink/DTTN-SWIFT connection – An electronic gateway for the communication between banks and traders Documents can be submitted to banks via the connection – E. g. Purchase Order, Commercial Invoice, Shipping Documents & etc A single channel to communicate with all trading parties, including banks Minimize data entry efforts Minimize data entry error No constraints on collection time and collection location 41

Benefits to Banks’ Customers A one-stop service for the whole trading process Facilitate data exchange among the involved parties Provide data inheritance and avoid duplicated data input Keep track of trading document status and invoice/payment status at a glance Increase transaction visibility Improve cash flow management Improve productivity throughout the supply chain Obtain more comprehensive services from bank 42

Benefits to Banks’ Customers A one-stop service for the whole trading process Facilitate data exchange among the involved parties Provide data inheritance and avoid duplicated data input Keep track of trading document status and invoice/payment status at a glance Increase transaction visibility Improve cash flow management Improve productivity throughout the supply chain Obtain more comprehensive services from bank 42

Thank You!! 43

Thank You!! 43

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

Agenda Setting the scene What is the Trade Services Utility (TSU)? Collaboration with Tradelink Supply Chain financing by HKTDC World SME Expo Dec 2008

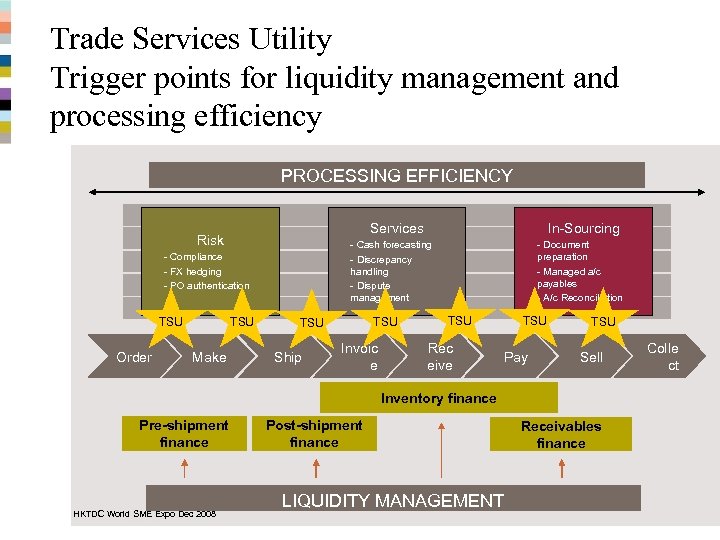

Trade Services Utility Trigger points for liquidity management and processing efficiency PROCESSING EFFICIENCY Services Risk - Cash forecasting - Discrepancy handling - Dispute management - Compliance - FX hedging - PO authentication TSU Order Make In-Sourcing TSU Ship Invoic e - Document preparation - Managed a/c payables - A/c Reconciliation TSU Rec eive TSU Pay TSU Sell Inventory finance Pre-shipment finance HKTDC World SME Expo Dec 2008 Post-shipment finance LIQUIDITY MANAGEMENT Receivables finance Colle ct

Trade Services Utility Trigger points for liquidity management and processing efficiency PROCESSING EFFICIENCY Services Risk - Cash forecasting - Discrepancy handling - Dispute management - Compliance - FX hedging - PO authentication TSU Order Make In-Sourcing TSU Ship Invoic e - Document preparation - Managed a/c payables - A/c Reconciliation TSU Rec eive TSU Pay TSU Sell Inventory finance Pre-shipment finance HKTDC World SME Expo Dec 2008 Post-shipment finance LIQUIDITY MANAGEMENT Receivables finance Colle ct

S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L J P M O R G A N - G L O B A L T R A D E S E R V I C E S Supply Chain Financing - Supplier Presentation

S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L J P M O R G A N - G L O B A L T R A D E S E R V I C E S Supply Chain Financing - Supplier Presentation

Thank You HKTDC World SME Expo Dec 2008

Thank You HKTDC World SME Expo Dec 2008