cb4493b2846b04bdc24d37c5991e4c4a.ppt

- Количество слайдов: 18

New Market Realities: Opportunities and Challenges Nikolay Egorov Director General, NDC Member of AECSD ACSDA Leadership Forum October 6 – 9, 2009 Santiago, Chile

New Market Realities: Opportunities and Challenges Nikolay Egorov Director General, NDC Member of AECSD ACSDA Leadership Forum October 6 – 9, 2009 Santiago, Chile

Agenda • AECSD evolution • NDC strategic development

Agenda • AECSD evolution • NDC strategic development

Association Members AECSD was established in 2001. The Association incorporates 12 depositories from 10 CIS countries: Central Depository of Armenia The National Depository Center (Azerbaijan) Republican Central Securities Depository (Republic of Belarus) Georgian Central Securities Depository National Securities Depository of Moldova Central Securities Depository (Kazakhstan) Central Depository (Kyrgyzstan) State CSD of the Republic of Uzbekistan Interregional Stock Union (Ukraine) The National Depository of Ukraine Depository Clearing Company (Russian Federation) The National Depository Center (Russian Federation)

Association Members AECSD was established in 2001. The Association incorporates 12 depositories from 10 CIS countries: Central Depository of Armenia The National Depository Center (Azerbaijan) Republican Central Securities Depository (Republic of Belarus) Georgian Central Securities Depository National Securities Depository of Moldova Central Securities Depository (Kazakhstan) Central Depository (Kyrgyzstan) State CSD of the Republic of Uzbekistan Interregional Stock Union (Ukraine) The National Depository of Ukraine Depository Clearing Company (Russian Federation) The National Depository Center (Russian Federation)

Objectives • Harmonization of the regulatory framework • Establishment of depository links among the members to support cross-border securities transactions • Standardization of the technologies for the depository operation, procedures for depository transaction processing, and rules and regulations governing the depositories' activities • Adoption of international messaging standards for depository transactions and their use in the national practice • Development of Electronic Document Interchange • Supporting a coordinated process to enable the Association members to integrate into the global depository system

Objectives • Harmonization of the regulatory framework • Establishment of depository links among the members to support cross-border securities transactions • Standardization of the technologies for the depository operation, procedures for depository transaction processing, and rules and regulations governing the depositories' activities • Adoption of international messaging standards for depository transactions and their use in the national practice • Development of Electronic Document Interchange • Supporting a coordinated process to enable the Association members to integrate into the global depository system

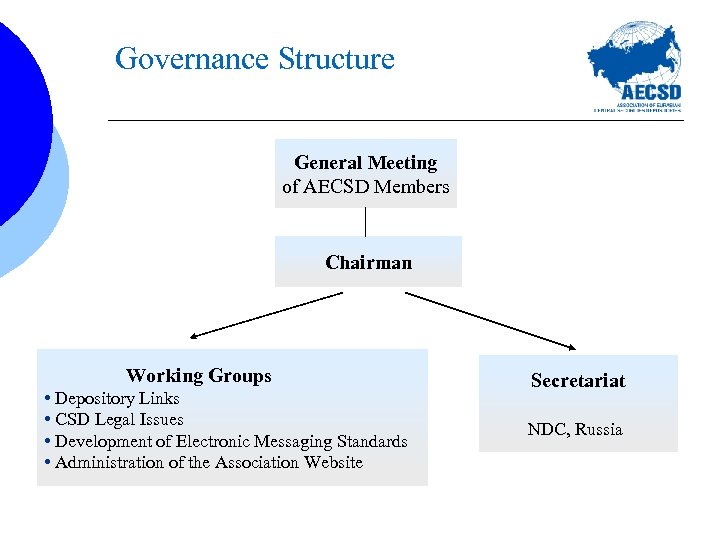

Governance Structure General Meeting of AECSD Members Chairman Working Groups • Depository Links • CSD Legal Issues • Development of Electronic Messaging Standards • Administration of the Association Website Secretariat NDC, Russia

Governance Structure General Meeting of AECSD Members Chairman Working Groups • Depository Links • CSD Legal Issues • Development of Electronic Messaging Standards • Administration of the Association Website Secretariat NDC, Russia

Working Groups Activities • Report “Correspondent accounts of non-residents in depositories of the Association of Eurasian Central Securities Depositories” (October 2008) • Report “Clearing Activities in AECSD Member Countries” (October 2008 ) • Corporate actions survey (October 2009)

Working Groups Activities • Report “Correspondent accounts of non-residents in depositories of the Association of Eurasian Central Securities Depositories” (October 2008) • Report “Clearing Activities in AECSD Member Countries” (October 2008 ) • Corporate actions survey (October 2009)

International Activities of the Association • An observer status in ECSDA, AMEDA and ACG • Participation in international conferences and forums (CSD 10, Annual Russian Securities Forum, SIBOS etc. ) • Organizing and holding seminars and trainings on depository and clearing services for Association members • Proposal on cross-membership of AECSD and ACSDA as observers

International Activities of the Association • An observer status in ECSDA, AMEDA and ACG • Participation in international conferences and forums (CSD 10, Annual Russian Securities Forum, SIBOS etc. ) • Organizing and holding seminars and trainings on depository and clearing services for Association members • Proposal on cross-membership of AECSD and ACSDA as observers

VI International AECSD Conference Tashkent, Republic of Uzbekistan 15 -16 October, 2009 Main Agenda of the Conference: • The role of depository in the issuer's corporate actions in AECSD • Record-keeping of rights for securities: from depository to custodian • Regional markets during the crisis period: does the crisis generate ideas or obstacles

VI International AECSD Conference Tashkent, Republic of Uzbekistan 15 -16 October, 2009 Main Agenda of the Conference: • The role of depository in the issuer's corporate actions in AECSD • Record-keeping of rights for securities: from depository to custodian • Regional markets during the crisis period: does the crisis generate ideas or obstacles

Agenda • AECSD evolution • NDC strategic development

Agenda • AECSD evolution • NDC strategic development

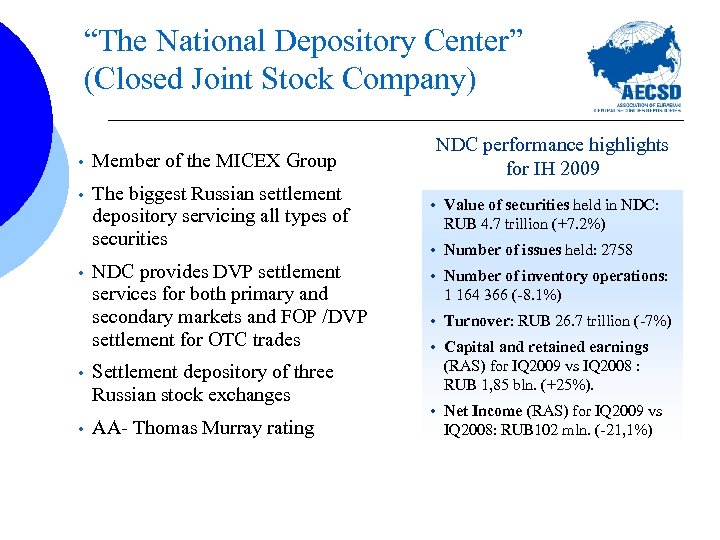

“The National Depository Center” (Closed Joint Stock Company) • Member of the MICEX Group • The biggest Russian settlement depository servicing all types of securities • • • NDC provides DVP settlement services for both primary and secondary markets and FOP /DVP settlement for OTC trades Settlement depository of three Russian stock exchanges AA- Thomas Murray rating NDC performance highlights for IH 2009 • Value of securities held in NDC: RUB 4. 7 trillion (+7. 2%) • Number of issues held: 2758 • Number of inventory operations: 1 164 366 (-8. 1%) • Turnover: RUB 26. 7 trillion (-7%) • Capital and retained earnings (RAS) for IQ 2009 vs IQ 2008 : RUB 1, 85 bln. (+25%). • Net Income (RAS) for IQ 2009 vs IQ 2008: RUB 102 mln. (-21, 1%)

“The National Depository Center” (Closed Joint Stock Company) • Member of the MICEX Group • The biggest Russian settlement depository servicing all types of securities • • • NDC provides DVP settlement services for both primary and secondary markets and FOP /DVP settlement for OTC trades Settlement depository of three Russian stock exchanges AA- Thomas Murray rating NDC performance highlights for IH 2009 • Value of securities held in NDC: RUB 4. 7 trillion (+7. 2%) • Number of issues held: 2758 • Number of inventory operations: 1 164 366 (-8. 1%) • Turnover: RUB 26. 7 trillion (-7%) • Capital and retained earnings (RAS) for IQ 2009 vs IQ 2008 : RUB 1, 85 bln. (+25%). • Net Income (RAS) for IQ 2009 vs IQ 2008: RUB 102 mln. (-21, 1%)

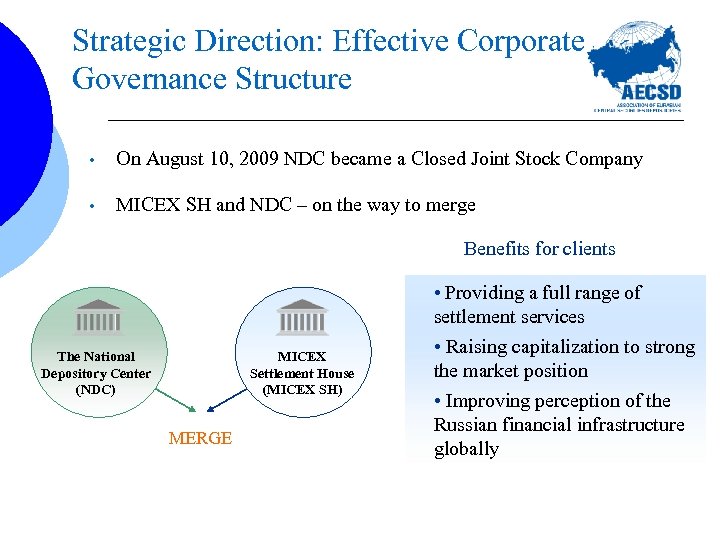

Strategic Direction: Effective Corporate Governance Structure • On August 10, 2009 NDC became a Closed Joint Stock Company • MICEX SH and NDC – on the way to merge Benefits for clients • Providing a full range of The National Depository Center (NDC) MICEX Settlement House (MICEX SH) MERGE settlement services • Raising capitalization to strong the market position • Improving perception of the Russian financial infrastructure globally

Strategic Direction: Effective Corporate Governance Structure • On August 10, 2009 NDC became a Closed Joint Stock Company • MICEX SH and NDC – on the way to merge Benefits for clients • Providing a full range of The National Depository Center (NDC) MICEX Settlement House (MICEX SH) MERGE settlement services • Raising capitalization to strong the market position • Improving perception of the Russian financial infrastructure globally

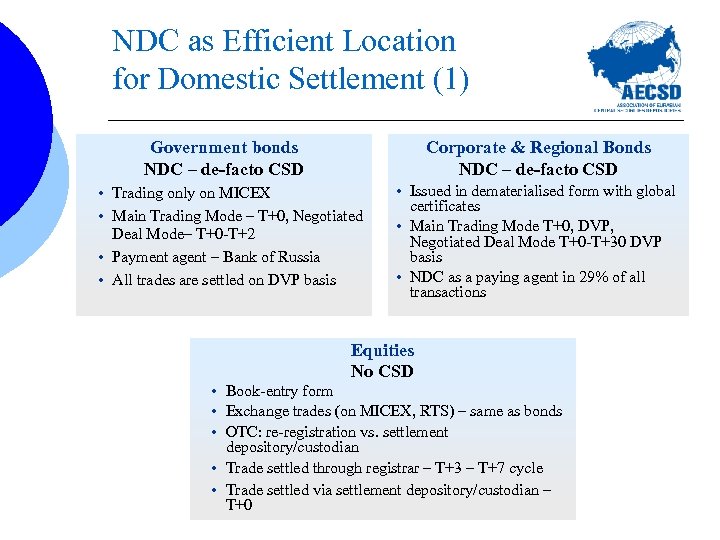

NDC as Efficient Location for Domestic Settlement (1) Government bonds NDC – de-facto CSD Corporate & Regional Bonds NDC – de-facto CSD • Trading only on MICEX • Main Trading Mode – T+0, Negotiated Deal Mode– T+0 -T+2 • Payment agent – Bank of Russia • All trades are settled on DVP basis • Issued in dematerialised form with global certificates • Main Trading Mode T+0, DVP, Negotiated Deal Mode T+0 -T+30 DVP basis • NDC as a paying agent in 29% of all transactions Equities No CSD • Book-entry form • Exchange trades (on MICEX, RTS) – same as bonds • OTC: re-registration vs. settlement depository/custodian • Trade settled through registrar – T+3 – T+7 cycle • Trade settled via settlement depository/custodian – T+0

NDC as Efficient Location for Domestic Settlement (1) Government bonds NDC – de-facto CSD Corporate & Regional Bonds NDC – de-facto CSD • Trading only on MICEX • Main Trading Mode – T+0, Negotiated Deal Mode– T+0 -T+2 • Payment agent – Bank of Russia • All trades are settled on DVP basis • Issued in dematerialised form with global certificates • Main Trading Mode T+0, DVP, Negotiated Deal Mode T+0 -T+30 DVP basis • NDC as a paying agent in 29% of all transactions Equities No CSD • Book-entry form • Exchange trades (on MICEX, RTS) – same as bonds • OTC: re-registration vs. settlement depository/custodian • Trade settled through registrar – T+3 – T+7 cycle • Trade settled via settlement depository/custodian – T+0

NDC as Efficient Location for Domestic Settlement (2) Speedy Settlement Scheme (SSS) • • • NDC and ING Wholesale Banking project SSS - a temporary scheme, like NDC-DCC Bridge, will be replaced by more sophisticated CSD settlement services STP Fixed fee Blue chips Non-exclusive scheme SSS was created to allow faster settlements and faster links with various markets

NDC as Efficient Location for Domestic Settlement (2) Speedy Settlement Scheme (SSS) • • • NDC and ING Wholesale Banking project SSS - a temporary scheme, like NDC-DCC Bridge, will be replaced by more sophisticated CSD settlement services STP Fixed fee Blue chips Non-exclusive scheme SSS was created to allow faster settlements and faster links with various markets

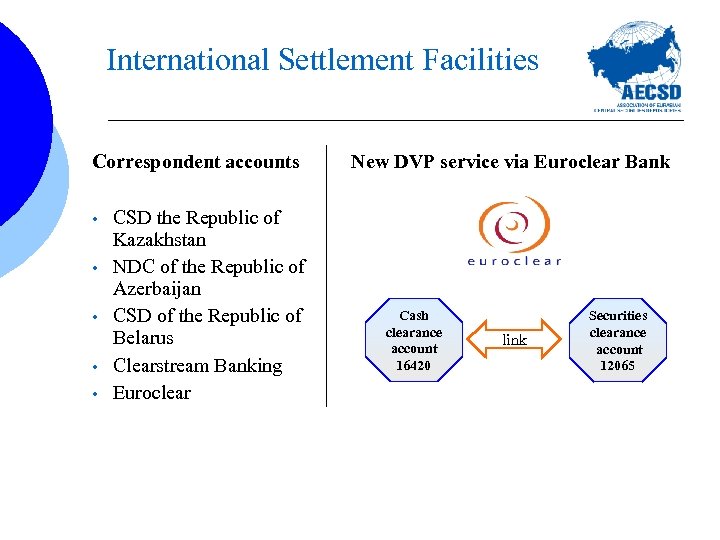

International Settlement Facilities Correspondent accounts • • • CSD the Republic of Kazakhstan NDC of the Republic of Azerbaijan CSD of the Republic of Belarus Clearstream Banking Euroclear New DVP service via Euroclear Bank Сash clearance account 16420 link Securities clearance account 12065

International Settlement Facilities Correspondent accounts • • • CSD the Republic of Kazakhstan NDC of the Republic of Azerbaijan CSD of the Republic of Belarus Clearstream Banking Euroclear New DVP service via Euroclear Bank Сash clearance account 16420 link Securities clearance account 12065

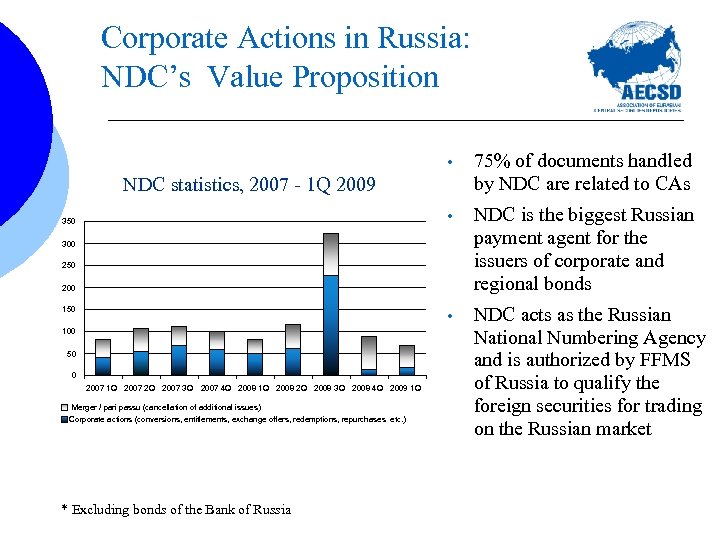

Corporate Actions in Russia: NDC’s Value Proposition • 75% of documents handled by NDC are related to CAs • NDC is the biggest Russian payment agent for the issuers of corporate and regional bonds • NDC acts as the Russian National Numbering Agency and is authorized by FFMS of Russia to qualify the foreign securities for trading on the Russian market NDC statistics, 2007 - 1 Q 2009 350 300 250 200 150 100 50 0 2007 1 Q 2007 2 Q 2007 3 Q 2007 4 Q 2008 1 Q 2008 2 Q 2008 3 Q 2008 4 Q 2009 1 Q Merger / pari passu (cancellation of additional issues) Corporate actions (conversions, entitlements, exchange offers, redemptions, repurchases etc. ) * Excluding bonds of the Bank of Russia

Corporate Actions in Russia: NDC’s Value Proposition • 75% of documents handled by NDC are related to CAs • NDC is the biggest Russian payment agent for the issuers of corporate and regional bonds • NDC acts as the Russian National Numbering Agency and is authorized by FFMS of Russia to qualify the foreign securities for trading on the Russian market NDC statistics, 2007 - 1 Q 2009 350 300 250 200 150 100 50 0 2007 1 Q 2007 2 Q 2007 3 Q 2007 4 Q 2008 1 Q 2008 2 Q 2008 3 Q 2008 4 Q 2009 1 Q Merger / pari passu (cancellation of additional issues) Corporate actions (conversions, entitlements, exchange offers, redemptions, repurchases etc. ) * Excluding bonds of the Bank of Russia

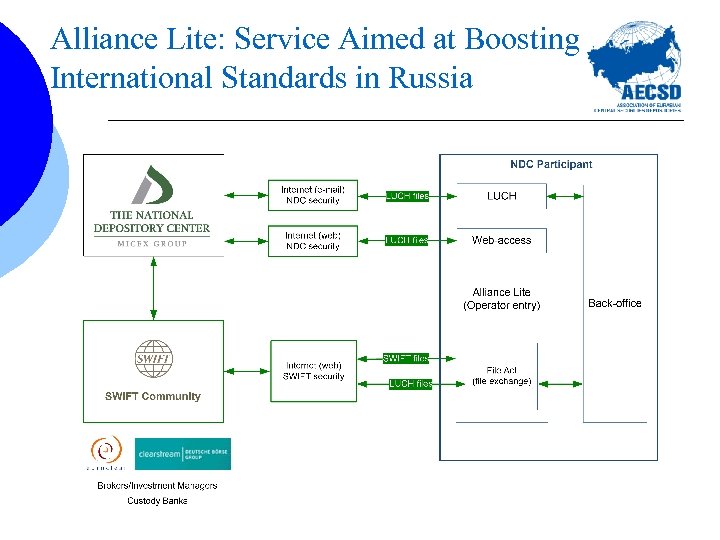

Alliance Lite: Service Aimed at Boosting International Standards in Russia

Alliance Lite: Service Aimed at Boosting International Standards in Russia

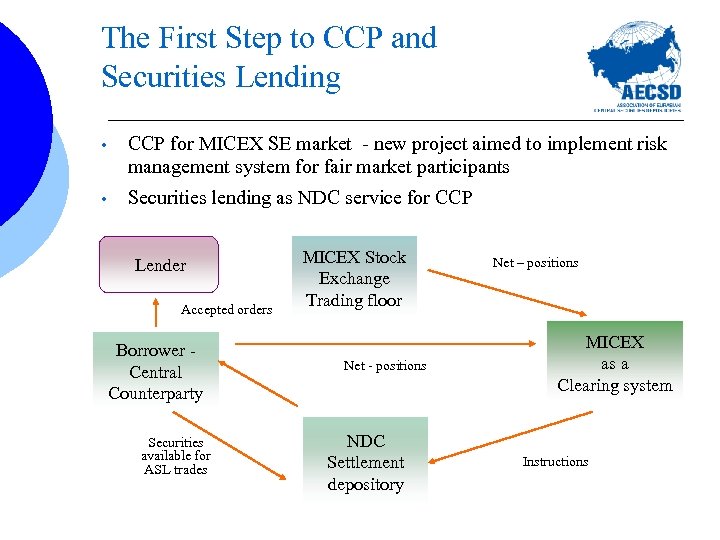

The First Step to CCP and Securities Lending • CCP for MICEX SE market - new project aimed to implement risk management system for fair market participants • Securities lending as NDC service for CCP Lender Accepted orders Borrower Central Counterparty Securities available for ASL trades MICEX Stock Exchange Trading floor Net - positions NDC Settlement depository Net – positions MICEX as a Clearing system Instructions

The First Step to CCP and Securities Lending • CCP for MICEX SE market - new project aimed to implement risk management system for fair market participants • Securities lending as NDC service for CCP Lender Accepted orders Borrower Central Counterparty Securities available for ASL trades MICEX Stock Exchange Trading floor Net - positions NDC Settlement depository Net – positions MICEX as a Clearing system Instructions

Contact Information • • AECSD Secretary The National Depository Center 13, bldg 1, Mashkova St. , Moscow, 105062, Russia Tel. : +7 (495) 232 -0513 E-mail: aecsd@aecsd. com AECSD Website: www. aecsd. com Thank you for attention!

Contact Information • • AECSD Secretary The National Depository Center 13, bldg 1, Mashkova St. , Moscow, 105062, Russia Tel. : +7 (495) 232 -0513 E-mail: aecsd@aecsd. com AECSD Website: www. aecsd. com Thank you for attention!