48281f35a9d9a81f3c5946430d9b40fe.ppt

- Количество слайдов: 60

New Ireland Assurance Provider of choice in the Life and Pensions Market NUI GALWAY PENSION & RETIREMENT PLANNING PRESENTATION- AVCs 9. 30 11. 30 14. 15 Presenters: Noel Hackett - QFA Senior Pension Consultant Dearbhla Cullen- New Ireland Assurance Galway State Street Global Advisors Senior Relationship Manager | SSg. A | Wednesday, 24 th June 2015

New Ireland Assurance Provider of choice in the Life and Pensions Market NUI GALWAY PENSION & RETIREMENT PLANNING PRESENTATION- AVCs 9. 30 11. 30 14. 15 Presenters: Noel Hackett - QFA Senior Pension Consultant Dearbhla Cullen- New Ireland Assurance Galway State Street Global Advisors Senior Relationship Manager | SSg. A | Wednesday, 24 th June 2015

Who Should I Contact: Pensions Office NUI Galway Ph: Email: (091) 495028 ext: 5028 pensions@nuigalway. ie OR Noel Hackett, QFA, Pensions Consultant New Ireland Assurance, Atlanta House, 36 Dominick Street, Galway Tel: (091) 563023 Mobile: 086 - 8186163 Email: Noel. hackett@newireland. ie

Who Should I Contact: Pensions Office NUI Galway Ph: Email: (091) 495028 ext: 5028 pensions@nuigalway. ie OR Noel Hackett, QFA, Pensions Consultant New Ireland Assurance, Atlanta House, 36 Dominick Street, Galway Tel: (091) 563023 Mobile: 086 - 8186163 Email: Noel. hackett@newireland. ie

About New Ireland Assurance • New Ireland is a leading Life Assurance Company in Ireland • Provides life assurance, pensions & investment solutions to over 500, 000 customers • Established almost 100 years ago, New Ireland was the first wholly Irish owned company to transact business in Ireland • New Ireland remains Irish owned to this day as part of the Bank of Ireland Group 3

About New Ireland Assurance • New Ireland is a leading Life Assurance Company in Ireland • Provides life assurance, pensions & investment solutions to over 500, 000 customers • Established almost 100 years ago, New Ireland was the first wholly Irish owned company to transact business in Ireland • New Ireland remains Irish owned to this day as part of the Bank of Ireland Group 3

• • New Ireland employs over 1, 100 people with the main Head Office on Dawson Street for over 85 years • 4 The Company has gone from strength to strength, from just £ 1, 000 in assets in 1918 to over € 13. 4 billion today (Feb 2014) Have world class investment partners for our existing single manager portfolios including State Street Global Advisors Ireland, Bank of New York Mellon Asset Management and Kleinwort Benson Investors

• • New Ireland employs over 1, 100 people with the main Head Office on Dawson Street for over 85 years • 4 The Company has gone from strength to strength, from just £ 1, 000 in assets in 1918 to over € 13. 4 billion today (Feb 2014) Have world class investment partners for our existing single manager portfolios including State Street Global Advisors Ireland, Bank of New York Mellon Asset Management and Kleinwort Benson Investors

Agenda 1. Your Main NUI Galway Pension Schemes 2. Sample Pension Benefit Statement- Scope for Notional Years and AVCs 3 ESMA Risk Rating Scale 1 -7 4. The Finance Act 2015 and changes that may affect you 5 Investment Market Update and Investment Outlook for 2015 Dearbhla Cullen SSg. A 6 Fund Choice, Fund Manager, Fund Performance and Fund availability under your AVC Scheme 5

Agenda 1. Your Main NUI Galway Pension Schemes 2. Sample Pension Benefit Statement- Scope for Notional Years and AVCs 3 ESMA Risk Rating Scale 1 -7 4. The Finance Act 2015 and changes that may affect you 5 Investment Market Update and Investment Outlook for 2015 Dearbhla Cullen SSg. A 6 Fund Choice, Fund Manager, Fund Performance and Fund availability under your AVC Scheme 5

Benefits at Retirement At retirement your benefits will come from: - – State Pension ( PRSI Contributions) – NUIG Scheme (s) – Purchase of Notional Years – Additional Voluntary Contributions ( AVCs ) – Personal Accumulated wealth/savings inheritances 6

Benefits at Retirement At retirement your benefits will come from: - – State Pension ( PRSI Contributions) – NUIG Scheme (s) – Purchase of Notional Years – Additional Voluntary Contributions ( AVCs ) – Personal Accumulated wealth/savings inheritances 6

NUIG Pension Scheme • Defined Benefit Scheme • Scheme provides – Pension – Lump Sum ( Gratuity ) – Spouses Pension – Increases during course of payment – Death in Service Benefit • Actual benefits depend on when you joined • Please refer to your NUIG Annual Benefit Statement. • ( Individual Consultations with Noel Hackett) 7

NUIG Pension Scheme • Defined Benefit Scheme • Scheme provides – Pension – Lump Sum ( Gratuity ) – Spouses Pension – Increases during course of payment – Death in Service Benefit • Actual benefits depend on when you joined • Please refer to your NUIG Annual Benefit Statement. • ( Individual Consultations with Noel Hackett) 7

Key Dates • Pre 95 – no state pension, higher pension through NUIG • Post 95 - employees pay PRSI and receive: – State Pension – Lower pension from NUIG • 2004 • Future employees have minimum RA of 65 • Immediate early retirement pension available to: – Existing employees from 50 – New employees from 55 – 2013 - Career Average Earnings 8

Key Dates • Pre 95 – no state pension, higher pension through NUIG • Post 95 - employees pay PRSI and receive: – State Pension – Lower pension from NUIG • 2004 • Future employees have minimum RA of 65 • Immediate early retirement pension available to: – Existing employees from 50 – New employees from 55 – 2013 - Career Average Earnings 8

State Pension • • • From 2014 – Single Person: – Married Couple: € 230. 30 per week € 383. 80 Applies to all employees who joined since 1995 State Pension 2014 2021 2028 from age 66 from age 67 from age 68 (Social Welfare will pay Job Assist or other S/W payment- where for whatever reason S/W payment not allowed, a Supplementary Pension maybe paid by NUIG ) 9

State Pension • • • From 2014 – Single Person: – Married Couple: € 230. 30 per week € 383. 80 Applies to all employees who joined since 1995 State Pension 2014 2021 2028 from age 66 from age 67 from age 68 (Social Welfare will pay Job Assist or other S/W payment- where for whatever reason S/W payment not allowed, a Supplementary Pension maybe paid by NUIG ) 9

Early Retirement Was always allowed but only as a deferred pension Changes from 2004 – Existing employees from 50 – New entrants from 55 – Immediate pension payable – Early payment reduction 10

Early Retirement Was always allowed but only as a deferred pension Changes from 2004 – Existing employees from 50 – New entrants from 55 – Immediate pension payable – Early payment reduction 10

Bridging the Gap - 2 Options Purchase of Notional Years of Service Through NUI Galway Pensions Office AVC Scheme Through New Ireland Assurance 11

Bridging the Gap - 2 Options Purchase of Notional Years of Service Through NUI Galway Pensions Office AVC Scheme Through New Ireland Assurance 11

Notional Years • Employee can buy “notional years” • Defined Benefit basis • Must buy year with all the “trimmings” – – 12 Pension Gratuity Spouses Pension Increases

Notional Years • Employee can buy “notional years” • Defined Benefit basis • Must buy year with all the “trimmings” – – 12 Pension Gratuity Spouses Pension Increases

AVC Scheme • • 13 Tax Relief Tax free growth Fund Choice Flexibility Options at retirement Inheritance Tax Planning Fund for tax free lump sum, taxable lump sum

AVC Scheme • • 13 Tax Relief Tax free growth Fund Choice Flexibility Options at retirement Inheritance Tax Planning Fund for tax free lump sum, taxable lump sum

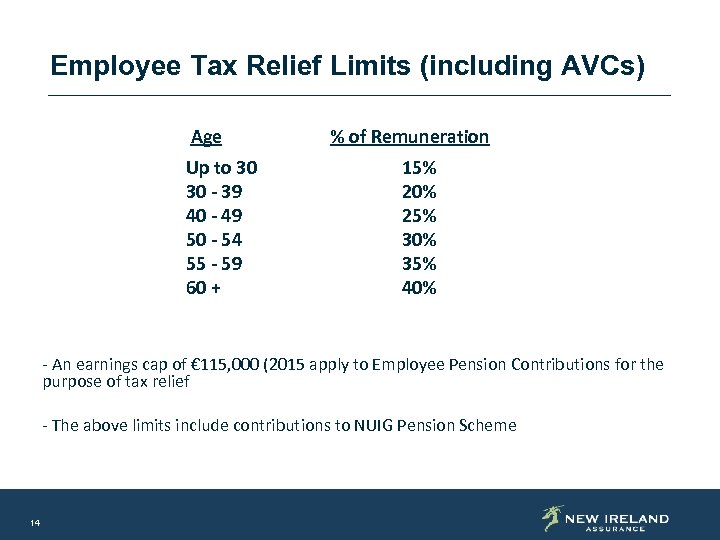

Employee Tax Relief Limits (including AVCs) Age Up to 30 30 - 39 40 - 49 50 - 54 55 - 59 60 + % of Remuneration 15% 20% 25% 30% 35% 40% - An earnings cap of € 115, 000 (2015 apply to Employee Pension Contributions for the purpose of tax relief - The above limits include contributions to NUIG Pension Scheme 14

Employee Tax Relief Limits (including AVCs) Age Up to 30 30 - 39 40 - 49 50 - 54 55 - 59 60 + % of Remuneration 15% 20% 25% 30% 35% 40% - An earnings cap of € 115, 000 (2015 apply to Employee Pension Contributions for the purpose of tax relief - The above limits include contributions to NUIG Pension Scheme 14

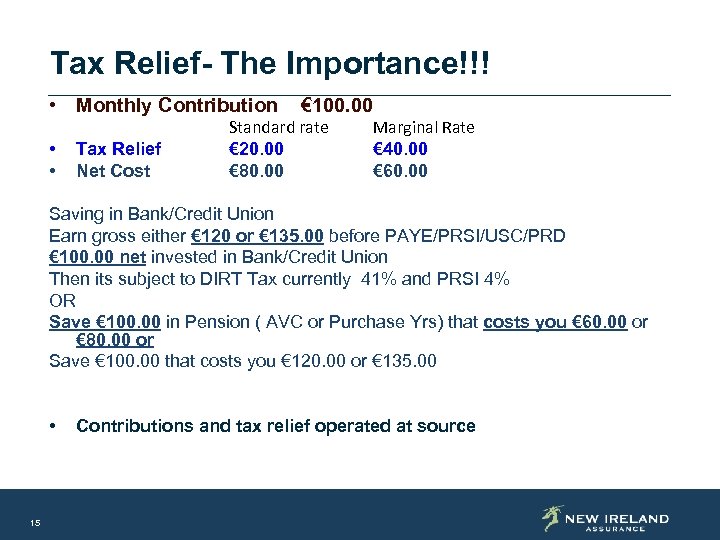

Tax Relief- The Importance!!! • Monthly Contribution • • Tax Relief Net Cost € 100. 00 Standard rate € 20. 00 € 80. 00 Marginal Rate € 40. 00 € 60. 00 Saving in Bank/Credit Union Earn gross either € 120 or € 135. 00 before PAYE/PRSI/USC/PRD € 100. 00 net invested in Bank/Credit Union Then its subject to DIRT Tax currently 41% and PRSI 4% OR Save € 100. 00 in Pension ( AVC or Purchase Yrs) that costs you € 60. 00 or € 80. 00 or Save € 100. 00 that costs you € 120. 00 or € 135. 00 • 15 Contributions and tax relief operated at source

Tax Relief- The Importance!!! • Monthly Contribution • • Tax Relief Net Cost € 100. 00 Standard rate € 20. 00 € 80. 00 Marginal Rate € 40. 00 € 60. 00 Saving in Bank/Credit Union Earn gross either € 120 or € 135. 00 before PAYE/PRSI/USC/PRD € 100. 00 net invested in Bank/Credit Union Then its subject to DIRT Tax currently 41% and PRSI 4% OR Save € 100. 00 in Pension ( AVC or Purchase Yrs) that costs you € 60. 00 or € 80. 00 or Save € 100. 00 that costs you € 120. 00 or € 135. 00 • 15 Contributions and tax relief operated at source

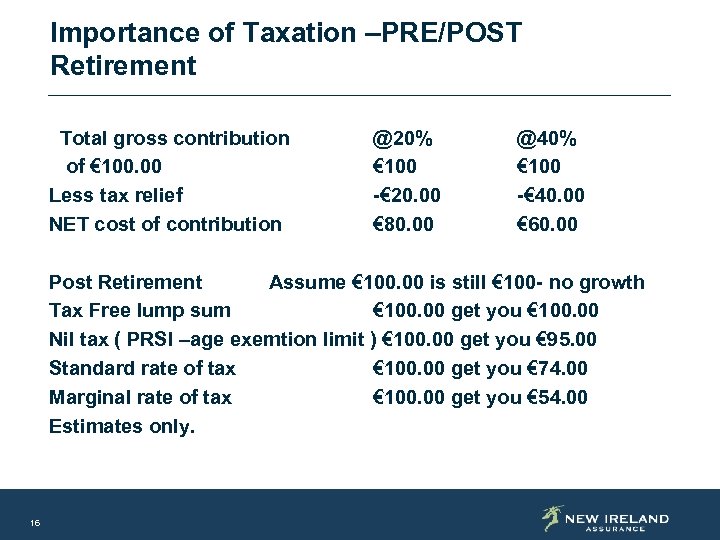

Importance of Taxation –PRE/POST Retirement Total gross contribution of € 100. 00 Less tax relief NET cost of contribution @20% € 100 -€ 20. 00 € 80. 00 @40% € 100 -€ 40. 00 € 60. 00 Post Retirement Assume € 100. 00 is still € 100 - no growth Tax Free lump sum € 100. 00 get you € 100. 00 Nil tax ( PRSI –age exemtion limit ) € 100. 00 get you € 95. 00 Standard rate of tax € 100. 00 get you € 74. 00 Marginal rate of tax € 100. 00 get you € 54. 00 Estimates only. 16

Importance of Taxation –PRE/POST Retirement Total gross contribution of € 100. 00 Less tax relief NET cost of contribution @20% € 100 -€ 20. 00 € 80. 00 @40% € 100 -€ 40. 00 € 60. 00 Post Retirement Assume € 100. 00 is still € 100 - no growth Tax Free lump sum € 100. 00 get you € 100. 00 Nil tax ( PRSI –age exemtion limit ) € 100. 00 get you € 95. 00 Standard rate of tax € 100. 00 get you € 74. 00 Marginal rate of tax € 100. 00 get you € 54. 00 Estimates only. 16

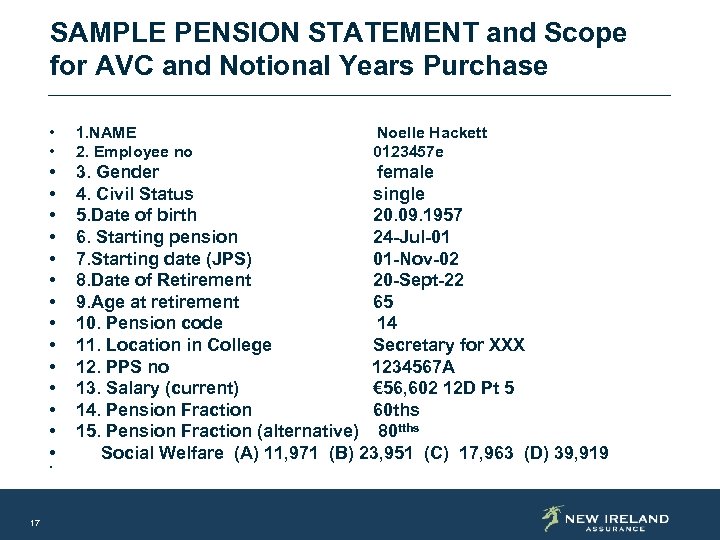

SAMPLE PENSION STATEMENT and Scope for AVC and Notional Years Purchase • • 1. NAME 2. Employee no • • • • 3. Gender female 4. Civil Status single 5. Date of birth 20. 09. 1957 6. Starting pension 24 -Jul-01 7. Starting date (JPS) 01 -Nov-02 8. Date of Retirement 20 -Sept-22 9. Age at retirement 65 10. Pension code 14 11. Location in College Secretary for XXX 12. PPS no 1234567 A 13. Salary (current) € 56, 602 12 D Pt 5 14. Pension Fraction 60 ths 15. Pension Fraction (alternative) 80 tths Social Welfare (A) 11, 971 (B) 23, 951 (C) 17, 963 (D) 39, 919 • 17 Noelle Hackett 0123457 e

SAMPLE PENSION STATEMENT and Scope for AVC and Notional Years Purchase • • 1. NAME 2. Employee no • • • • 3. Gender female 4. Civil Status single 5. Date of birth 20. 09. 1957 6. Starting pension 24 -Jul-01 7. Starting date (JPS) 01 -Nov-02 8. Date of Retirement 20 -Sept-22 9. Age at retirement 65 10. Pension code 14 11. Location in College Secretary for XXX 12. PPS no 1234567 A 13. Salary (current) € 56, 602 12 D Pt 5 14. Pension Fraction 60 ths 15. Pension Fraction (alternative) 80 tths Social Welfare (A) 11, 971 (B) 23, 951 (C) 17, 963 (D) 39, 919 • 17 Noelle Hackett 0123457 e

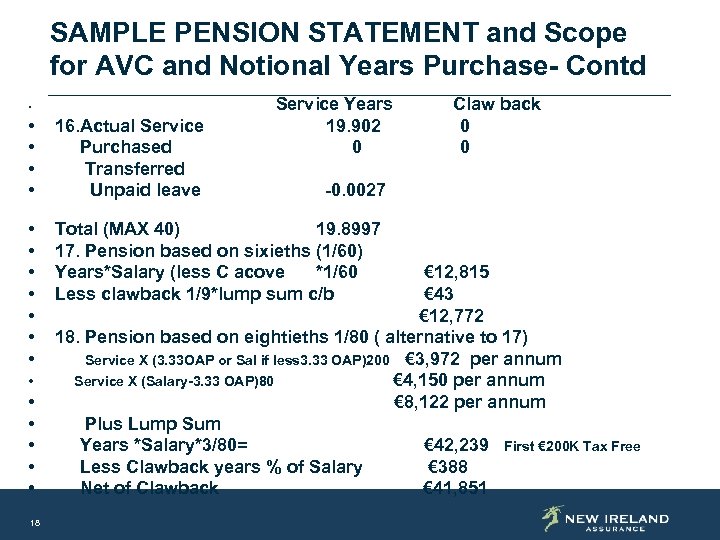

SAMPLE PENSION STATEMENT and Scope for AVC and Notional Years Purchase- Contd • Service Years 19. 902 0 • • 16. Actual Service Purchased Transferred Unpaid leave • • Total (MAX 40) 19. 8997 17. Pension based on sixieths (1/60) Years*Salary (less C acove *1/60 Less clawback 1/9*lump sum c/b • • • 18 Claw back 0 0 -0. 0027 € 12, 815 € 43 € 12, 772 18. Pension based on eightieths 1/80 ( alternative to 17) Service X (3. 33 OAP or Sal if less 3. 33 OAP)200 € 3, 972 per annum Service X (Salary-3. 33 OAP)80 € 4, 150 per annum € 8, 122 per annum Plus Lump Sum Years *Salary*3/80= € 42, 239 First € 200 K Tax Free Less Clawback years % of Salary € 388 Net of Clawback € 41, 851

SAMPLE PENSION STATEMENT and Scope for AVC and Notional Years Purchase- Contd • Service Years 19. 902 0 • • 16. Actual Service Purchased Transferred Unpaid leave • • Total (MAX 40) 19. 8997 17. Pension based on sixieths (1/60) Years*Salary (less C acove *1/60 Less clawback 1/9*lump sum c/b • • • 18 Claw back 0 0 -0. 0027 € 12, 815 € 43 € 12, 772 18. Pension based on eightieths 1/80 ( alternative to 17) Service X (3. 33 OAP or Sal if less 3. 33 OAP)200 € 3, 972 per annum Service X (Salary-3. 33 OAP)80 € 4, 150 per annum € 8, 122 per annum Plus Lump Sum Years *Salary*3/80= € 42, 239 First € 200 K Tax Free Less Clawback years % of Salary € 388 Net of Clawback € 41, 851

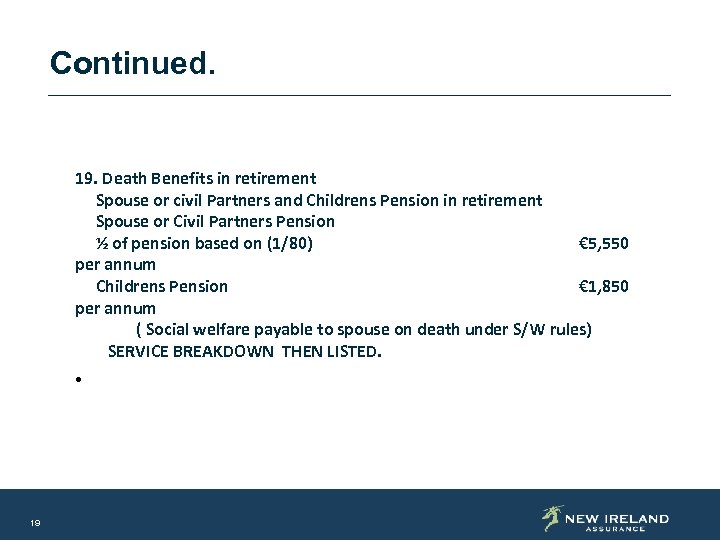

Continued. 19. Death Benefits in retirement Spouse or civil Partners and Childrens Pension in retirement Spouse or Civil Partners Pension ½ of pension based on (1/80) € 5, 550 per annum Childrens Pension € 1, 850 per annum ( Social welfare payable to spouse on death under S/W rules) SERVICE BREAKDOWN THEN LISTED. • 19

Continued. 19. Death Benefits in retirement Spouse or civil Partners and Childrens Pension in retirement Spouse or Civil Partners Pension ½ of pension based on (1/80) € 5, 550 per annum Childrens Pension € 1, 850 per annum ( Social welfare payable to spouse on death under S/W rules) SERVICE BREAKDOWN THEN LISTED. • 19

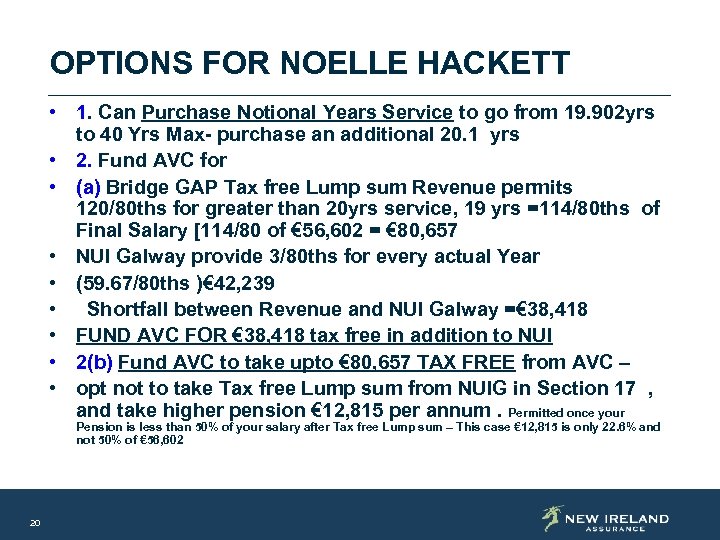

OPTIONS FOR NOELLE HACKETT • 1. Can Purchase Notional Years Service to go from 19. 902 yrs to 40 Yrs Max- purchase an additional 20. 1 yrs • 2. Fund AVC for • (a) Bridge GAP Tax free Lump sum Revenue permits 120/80 ths for greater than 20 yrs service, 19 yrs =114/80 ths of Final Salary [114/80 of € 56, 602 = € 80, 657 • NUI Galway provide 3/80 ths for every actual Year • (59. 67/80 ths )€ 42, 239 • Shortfall between Revenue and NUI Galway =€ 38, 418 • FUND AVC FOR € 38, 418 tax free in addition to NUI • 2(b) Fund AVC to take upto € 80, 657 TAX FREE from AVC – • opt not to take Tax free Lump sum from NUIG in Section 17 , and take higher pension € 12, 815 per annum. Permitted once your Pension is less than 50% of your salary after Tax free Lump sum – This case € 12, 815 is only 22. 6% and not 50% of € 56, 602 20

OPTIONS FOR NOELLE HACKETT • 1. Can Purchase Notional Years Service to go from 19. 902 yrs to 40 Yrs Max- purchase an additional 20. 1 yrs • 2. Fund AVC for • (a) Bridge GAP Tax free Lump sum Revenue permits 120/80 ths for greater than 20 yrs service, 19 yrs =114/80 ths of Final Salary [114/80 of € 56, 602 = € 80, 657 • NUI Galway provide 3/80 ths for every actual Year • (59. 67/80 ths )€ 42, 239 • Shortfall between Revenue and NUI Galway =€ 38, 418 • FUND AVC FOR € 38, 418 tax free in addition to NUI • 2(b) Fund AVC to take upto € 80, 657 TAX FREE from AVC – • opt not to take Tax free Lump sum from NUIG in Section 17 , and take higher pension € 12, 815 per annum. Permitted once your Pension is less than 50% of your salary after Tax free Lump sum – This case € 12, 815 is only 22. 6% and not 50% of € 56, 602 20

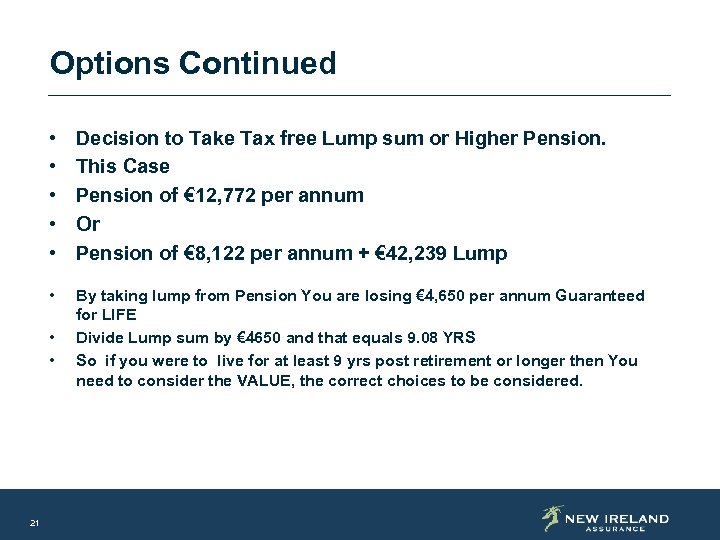

Options Continued • • • Decision to Take Tax free Lump sum or Higher Pension. This Case Pension of € 12, 772 per annum Or Pension of € 8, 122 per annum + € 42, 239 Lump • By taking lump from Pension You are losing € 4, 650 per annum Guaranteed for LIFE Divide Lump sum by € 4650 and that equals 9. 08 YRS So if you were to live for at least 9 yrs post retirement or longer then You need to consider the VALUE, the correct choices to be considered. • • 21

Options Continued • • • Decision to Take Tax free Lump sum or Higher Pension. This Case Pension of € 12, 772 per annum Or Pension of € 8, 122 per annum + € 42, 239 Lump • By taking lump from Pension You are losing € 4, 650 per annum Guaranteed for LIFE Divide Lump sum by € 4650 and that equals 9. 08 YRS So if you were to live for at least 9 yrs post retirement or longer then You need to consider the VALUE, the correct choices to be considered. • • 21

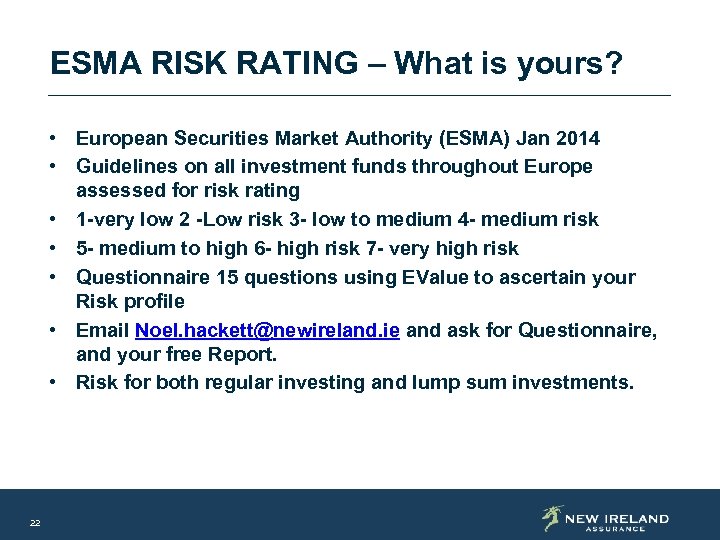

ESMA RISK RATING – What is yours? • European Securities Market Authority (ESMA) Jan 2014 • Guidelines on all investment funds throughout Europe assessed for risk rating • 1 -very low 2 -Low risk 3 - low to medium 4 - medium risk • 5 - medium to high 6 - high risk 7 - very high risk • Questionnaire 15 questions using EValue to ascertain your Risk profile • Email Noel. hackett@newireland. ie and ask for Questionnaire, and your free Report. • Risk for both regular investing and lump sum investments. 22

ESMA RISK RATING – What is yours? • European Securities Market Authority (ESMA) Jan 2014 • Guidelines on all investment funds throughout Europe assessed for risk rating • 1 -very low 2 -Low risk 3 - low to medium 4 - medium risk • 5 - medium to high 6 - high risk 7 - very high risk • Questionnaire 15 questions using EValue to ascertain your Risk profile • Email Noel. hackett@newireland. ie and ask for Questionnaire, and your free Report. • Risk for both regular investing and lump sum investments. 22

2015 Finance Act- Main changes • • 23 Pension Levy 0. 15% in 2015 - Abolished in 2016 Standard Fund Personal Threshold to € 2 m Defined Benefit Changes DIRT Tax 41% plus 4% PRSI Inheritance Tax Threshold Gift Tax Age Exemption Limit @ Retirement

2015 Finance Act- Main changes • • 23 Pension Levy 0. 15% in 2015 - Abolished in 2016 Standard Fund Personal Threshold to € 2 m Defined Benefit Changes DIRT Tax 41% plus 4% PRSI Inheritance Tax Threshold Gift Tax Age Exemption Limit @ Retirement

AVC Account- Pensions on line Facility • • www. newireland. ie Pension Schemes On Line (PSOL ) To track your own pension account Secure access to your account Values updated daily New Ireland Investment Centre http: //fundcentre. newireland. ie • Up to date priceperformance information • Monthly factsheets – include asset split, fund size etc • Graph performance of funds 24

AVC Account- Pensions on line Facility • • www. newireland. ie Pension Schemes On Line (PSOL ) To track your own pension account Secure access to your account Values updated daily New Ireland Investment Centre http: //fundcentre. newireland. ie • Up to date priceperformance information • Monthly factsheets – include asset split, fund size etc • Graph performance of funds 24

“Would you tell me, please, which way I ought to go from here? ” “That depends a good deal on where you want to get to”, said the cat - Lewis Carroll, Alice in Wonderland 25

“Would you tell me, please, which way I ought to go from here? ” “That depends a good deal on where you want to get to”, said the cat - Lewis Carroll, Alice in Wonderland 25

Lets begin by reminding ourselves of the cornerstone questions of any investment decision…. . Objectives: What do Timeframe: Risk Profile: you want to achieve? How long do you have to achieve it? How much risk can/will you take to achieve it? Every aspect of investment advice should revolve around always being aware of your views on each of the three key points above! 26

Lets begin by reminding ourselves of the cornerstone questions of any investment decision…. . Objectives: What do Timeframe: Risk Profile: you want to achieve? How long do you have to achieve it? How much risk can/will you take to achieve it? Every aspect of investment advice should revolve around always being aware of your views on each of the three key points above! 26

The events of 2008 still fresh in our memories! Ø Ø Ø Ø Sept. 8 th Sept. 14 th Sept 15 th Sept 16 th Sept 18 th Fannie Mae & Freddie Mac under government control. Lehman's files for bankruptcy Bank of America purchases Merrill Lynch Fed takes 80% stake in AIG for $85 bn Lloyds TSB takes over of HBOS Central Banks globally pump $180 bn of liquidity into the market Market ban on short selling Sept 19 th Paulson announces ‘Troubled Asset Relief Program’ – markets soar Sept 21 st Goldman's Sachs & Morgan Stanley become Bank holding companies Sept 26 th Overnight collapse of Washington Mutual in the biggest US bank failure ever. Sept 29 th Announcement that Bradford & Bingley and Fortis are being nationalised. Citigroup agrees to buy Wachovia's banking business. Sept 30 th News that Irish government will guarantee all deposits and debt of main credit institutions for 2 years US Lawmakers vote against proposed treasury rescue package ob ct nd A 27 r!! e en th am c O e

The events of 2008 still fresh in our memories! Ø Ø Ø Ø Sept. 8 th Sept. 14 th Sept 15 th Sept 16 th Sept 18 th Fannie Mae & Freddie Mac under government control. Lehman's files for bankruptcy Bank of America purchases Merrill Lynch Fed takes 80% stake in AIG for $85 bn Lloyds TSB takes over of HBOS Central Banks globally pump $180 bn of liquidity into the market Market ban on short selling Sept 19 th Paulson announces ‘Troubled Asset Relief Program’ – markets soar Sept 21 st Goldman's Sachs & Morgan Stanley become Bank holding companies Sept 26 th Overnight collapse of Washington Mutual in the biggest US bank failure ever. Sept 29 th Announcement that Bradford & Bingley and Fortis are being nationalised. Citigroup agrees to buy Wachovia's banking business. Sept 30 th News that Irish government will guarantee all deposits and debt of main credit institutions for 2 years US Lawmakers vote against proposed treasury rescue package ob ct nd A 27 r!! e en th am c O e

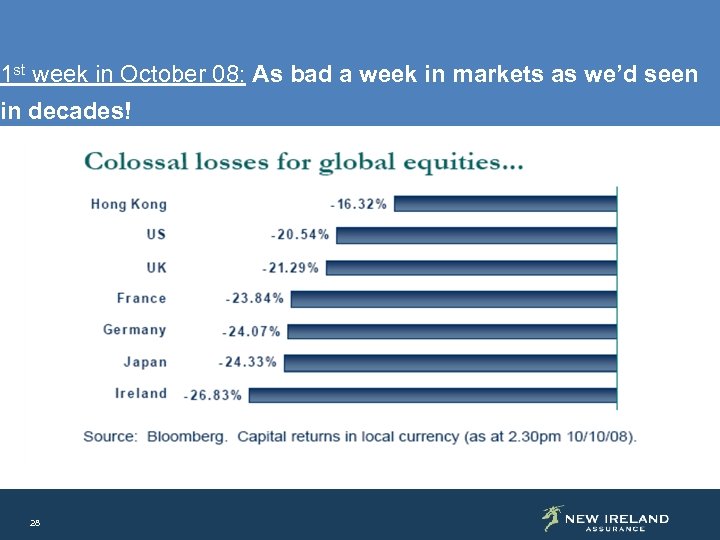

1 st week in October 08: As bad a week in markets as we’d seen in decades! 28

1 st week in October 08: As bad a week in markets as we’d seen in decades! 28

This left many Investors very nervous about their future finances, long after the market began to recover! Is it safe to Come back out? “Both optimists and pessimists contribute to society, the optimist invents the airplane, the pessimist the parachute”…. George Bernard Shaw 29

This left many Investors very nervous about their future finances, long after the market began to recover! Is it safe to Come back out? “Both optimists and pessimists contribute to society, the optimist invents the airplane, the pessimist the parachute”…. George Bernard Shaw 29

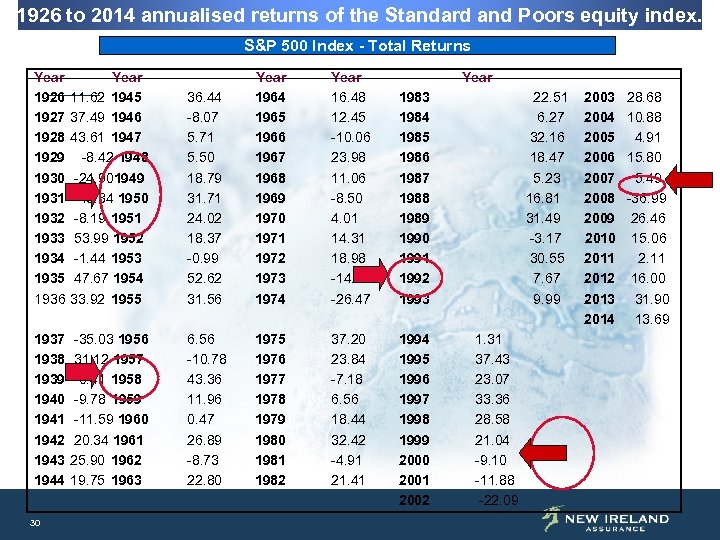

1926 to 2014 annualised returns of the Standard and Poors equity index. S&P 500 Index - Total Returns Year 1926 11. 62 1945 1927 37. 49 1946 1928 43. 61 1947 1929 -8. 42 1948 1930 -24. 901949 1931 -43. 34 1950 1932 -8. 19 1951 1933 53. 99 1952 1934 -1. 44 1953 1935 47. 67 1954 1936 33. 92 1955 1937 1938 1939 1940 1941 1942 1943 1944 30 -35. 03 1956 31. 12 1957 -0. 41 1958 -9. 78 1959 -11. 59 1960 20. 34 1961 25. 90 1962 19. 75 1963 36. 44 -8. 07 5. 71 5. 50 18. 79 31. 71 24. 02 18. 37 -0. 99 52. 62 31. 56 Year 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 Year 16. 48 12. 45 -10. 06 23. 98 11. 06 -8. 50 4. 01 14. 31 18. 98 -14. 66 -26. 47 6. 56 -10. 78 43. 36 11. 96 0. 47 26. 89 -8. 73 22. 80 1975 1976 1977 1978 1979 1980 1981 1982 37. 20 23. 84 -7. 18 6. 56 18. 44 32. 42 -4. 91 21. 41 Year 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 22. 51 6. 27 32. 16 18. 47 5. 23 16. 81 31. 49 -3. 17 30. 55 7. 67 9. 99 1. 31 37. 43 23. 07 33. 36 28. 58 21. 04 -9. 10 -11. 88 -22. 09 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 28. 68 10. 88 4. 91 15. 80 5. 49 -36. 99 26. 46 15. 06 2. 11 16. 00 31. 90 13. 69

1926 to 2014 annualised returns of the Standard and Poors equity index. S&P 500 Index - Total Returns Year 1926 11. 62 1945 1927 37. 49 1946 1928 43. 61 1947 1929 -8. 42 1948 1930 -24. 901949 1931 -43. 34 1950 1932 -8. 19 1951 1933 53. 99 1952 1934 -1. 44 1953 1935 47. 67 1954 1936 33. 92 1955 1937 1938 1939 1940 1941 1942 1943 1944 30 -35. 03 1956 31. 12 1957 -0. 41 1958 -9. 78 1959 -11. 59 1960 20. 34 1961 25. 90 1962 19. 75 1963 36. 44 -8. 07 5. 71 5. 50 18. 79 31. 71 24. 02 18. 37 -0. 99 52. 62 31. 56 Year 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 Year 16. 48 12. 45 -10. 06 23. 98 11. 06 -8. 50 4. 01 14. 31 18. 98 -14. 66 -26. 47 6. 56 -10. 78 43. 36 11. 96 0. 47 26. 89 -8. 73 22. 80 1975 1976 1977 1978 1979 1980 1981 1982 37. 20 23. 84 -7. 18 6. 56 18. 44 32. 42 -4. 91 21. 41 Year 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 22. 51 6. 27 32. 16 18. 47 5. 23 16. 81 31. 49 -3. 17 30. 55 7. 67 9. 99 1. 31 37. 43 23. 07 33. 36 28. 58 21. 04 -9. 10 -11. 88 -22. 09 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 28. 68 10. 88 4. 91 15. 80 5. 49 -36. 99 26. 46 15. 06 2. 11 16. 00 31. 90 13. 69

Cash funds offer little in terms of return…. . 2011 > 5% 31 2012 > 4% 2013. 5% 2014. 25%

Cash funds offer little in terms of return…. . 2011 > 5% 31 2012 > 4% 2013. 5% 2014. 25%

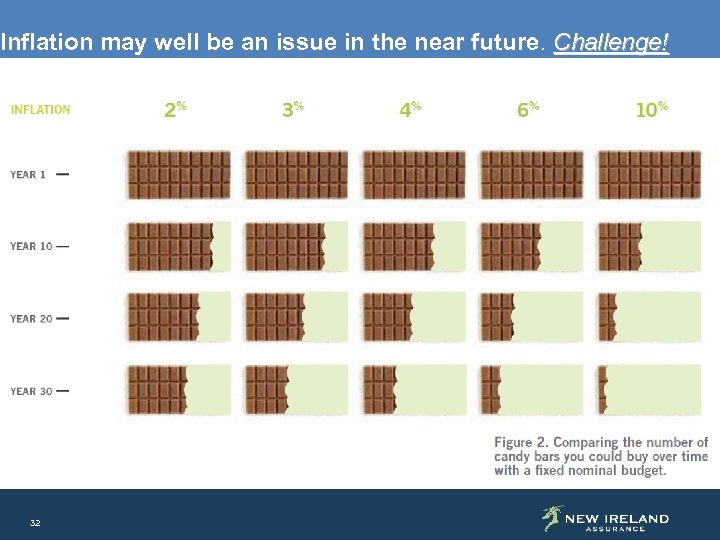

Inflation may well be an issue in the near future. Challenge! 32

Inflation may well be an issue in the near future. Challenge! 32

But we still only have a finite number of assets in which to invest! Equities Deposit s Property Bonds 33 Propert y Alternative s

But we still only have a finite number of assets in which to invest! Equities Deposit s Property Bonds 33 Propert y Alternative s

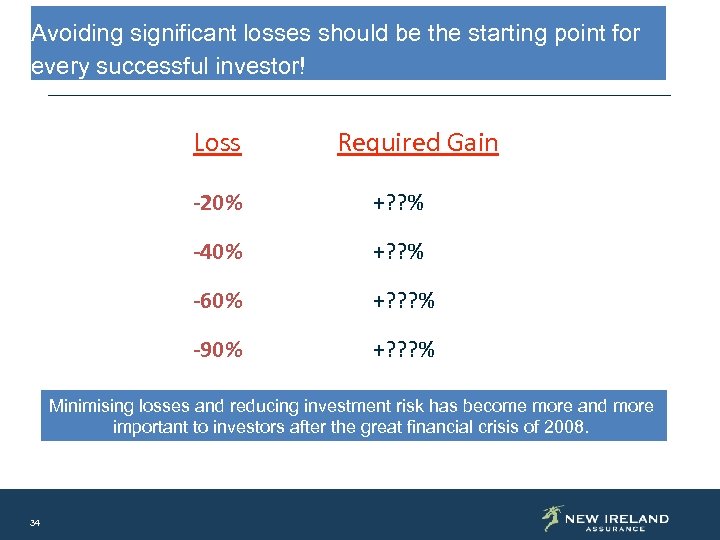

Avoiding significant losses should be the starting point for every successful investor! Loss Required Gain -20% +? ? % -40% +? ? % -60% +? ? ? % -90% +? ? ? % Minimising losses and reducing investment risk has become more and more important to investors after the great financial crisis of 2008. 34

Avoiding significant losses should be the starting point for every successful investor! Loss Required Gain -20% +? ? % -40% +? ? % -60% +? ? ? % -90% +? ? ? % Minimising losses and reducing investment risk has become more and more important to investors after the great financial crisis of 2008. 34

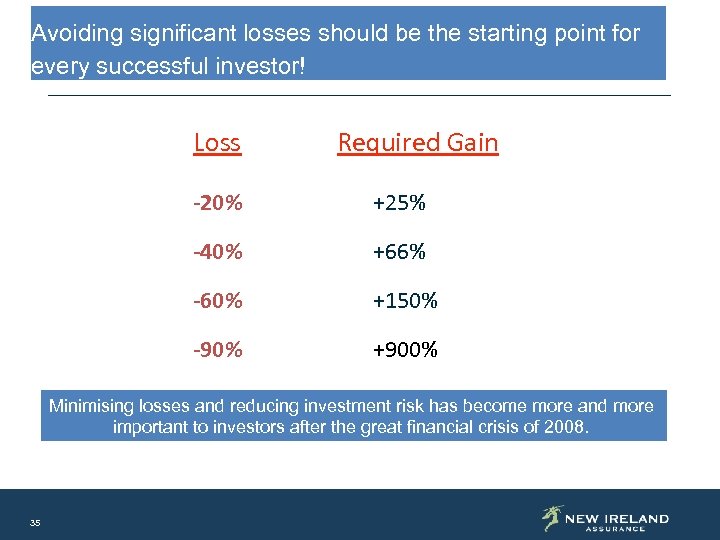

Avoiding significant losses should be the starting point for every successful investor! Loss Required Gain -20% +25% -40% +66% -60% +150% -90% +900% Minimising losses and reducing investment risk has become more and more important to investors after the great financial crisis of 2008. 35

Avoiding significant losses should be the starting point for every successful investor! Loss Required Gain -20% +25% -40% +66% -60% +150% -90% +900% Minimising losses and reducing investment risk has become more and more important to investors after the great financial crisis of 2008. 35

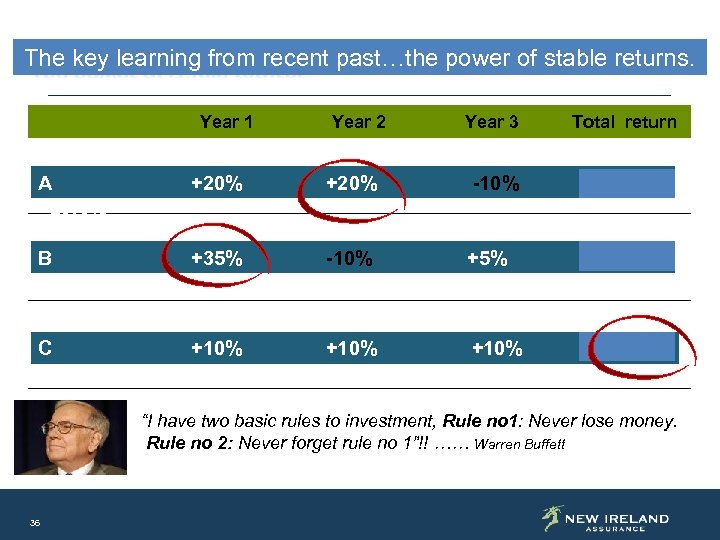

The key learning from recent past…the power of stable returns. Year 1 Year 2 Year 3 Total return A A +29. 6% +20% -10% +29. 6% B +35% -10% +5% +27. 6% C C +33. 1% +10% +10% +33. 1% B “I have two basic rules to investment, Rule no 1: Never lose money. Rule no 2: Never forget rule no 1”!! …… Warren Buffett Source: Newton 36

The key learning from recent past…the power of stable returns. Year 1 Year 2 Year 3 Total return A A +29. 6% +20% -10% +29. 6% B +35% -10% +5% +27. 6% C C +33. 1% +10% +10% +33. 1% B “I have two basic rules to investment, Rule no 1: Never lose money. Rule no 2: Never forget rule no 1”!! …… Warren Buffett Source: Newton 36

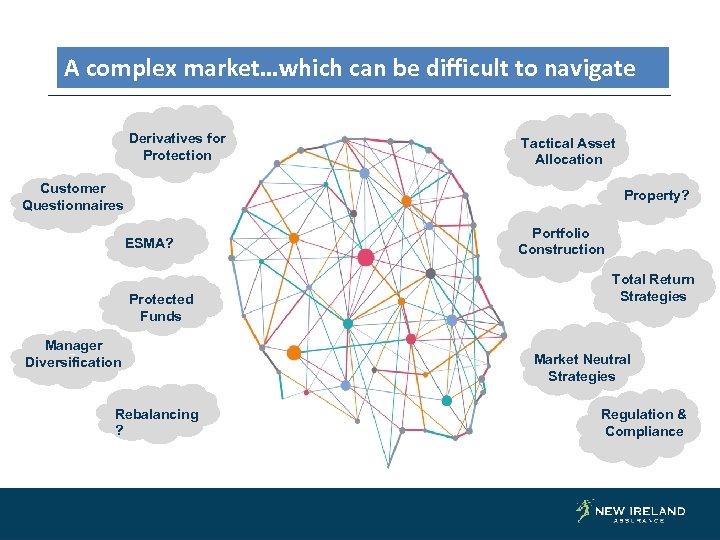

A complex market…which can be difficult to navigate Derivatives for Protection Tactical Asset Allocation Customer Questionnaires Property? ESMA? Protected ¯ Funds Manager ¯ Diversification Rebalancing ? 37 Portfolio Construction Total Return Strategies Market Neutral Strategies Regulation & Compliance

A complex market…which can be difficult to navigate Derivatives for Protection Tactical Asset Allocation Customer Questionnaires Property? ESMA? Protected ¯ Funds Manager ¯ Diversification Rebalancing ? 37 Portfolio Construction Total Return Strategies Market Neutral Strategies Regulation & Compliance

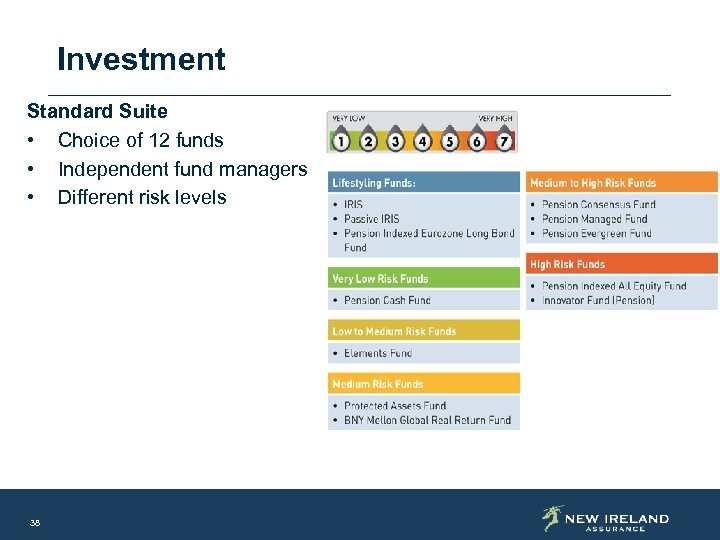

Investment Standard Suite • Choice of 12 funds • Independent fund managers • Different risk levels 38

Investment Standard Suite • Choice of 12 funds • Independent fund managers • Different risk levels 38

SSg. A — A True Global Player • € 2. 0 Trillion in Asset Under Management 1 • Over 400 investment professionals • 27 Global Offices; 9 Investment Centres • 24 Hour Trading Rankings: # 1 Global Endowment/Foundation Assets 2 # 1 Sovereign Wealth Fund Assets 2 # 2 Worldwide Institutional Assets 2 Key Stats: • We Manage Money for 9 of the Top 10 S&P 500 Companies 3 • We Manage Money for 6 of the Top 20 Wealthiest Countries in the World 3 AUM is $2. 15 Trillion. This AUM includes the assets of the SPDR Gold Trust (approx. $37. 1 as of 30 September 2013). for which State Street Global Markets, LLC, an affiliate of State Street Global Advisors, serves as the marketing agent. Please note that AUM totals are unaudited. 2 Pensions & Investments, 31 December 2012. 3 Source: SSg. A, as of 31 December 2013. S&P 500 top 10 by market capitalization as of 31 December 2013. 1 39 IREPRS-0681

SSg. A — A True Global Player • € 2. 0 Trillion in Asset Under Management 1 • Over 400 investment professionals • 27 Global Offices; 9 Investment Centres • 24 Hour Trading Rankings: # 1 Global Endowment/Foundation Assets 2 # 1 Sovereign Wealth Fund Assets 2 # 2 Worldwide Institutional Assets 2 Key Stats: • We Manage Money for 9 of the Top 10 S&P 500 Companies 3 • We Manage Money for 6 of the Top 20 Wealthiest Countries in the World 3 AUM is $2. 15 Trillion. This AUM includes the assets of the SPDR Gold Trust (approx. $37. 1 as of 30 September 2013). for which State Street Global Markets, LLC, an affiliate of State Street Global Advisors, serves as the marketing agent. Please note that AUM totals are unaudited. 2 Pensions & Investments, 31 December 2012. 3 Source: SSg. A, as of 31 December 2013. S&P 500 top 10 by market capitalization as of 31 December 2013. 1 39 IREPRS-0681

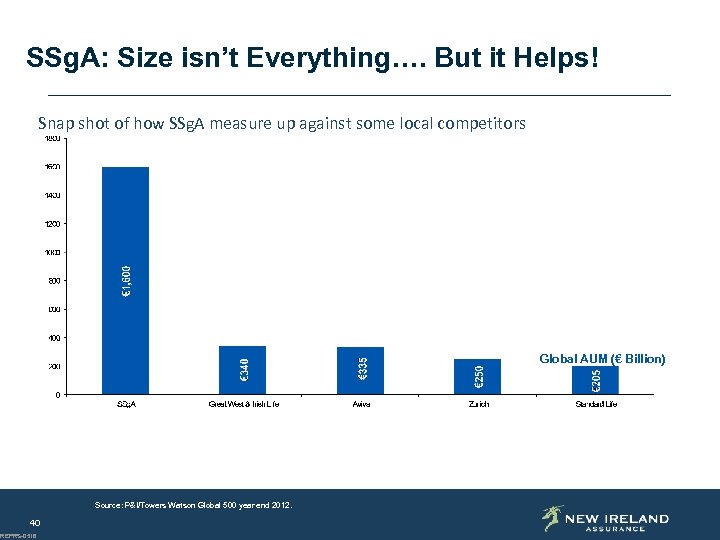

SSg. A: Size isn’t Everything…. But it Helps! Snap shot of how SSg. A measure up against some local competitors Global AUM (€ Billion) Source: P&I/Towers Watson Global 500 year end 2012. 40 IREPRS-0516

SSg. A: Size isn’t Everything…. But it Helps! Snap shot of how SSg. A measure up against some local competitors Global AUM (€ Billion) Source: P&I/Towers Watson Global 500 year end 2012. 40 IREPRS-0516

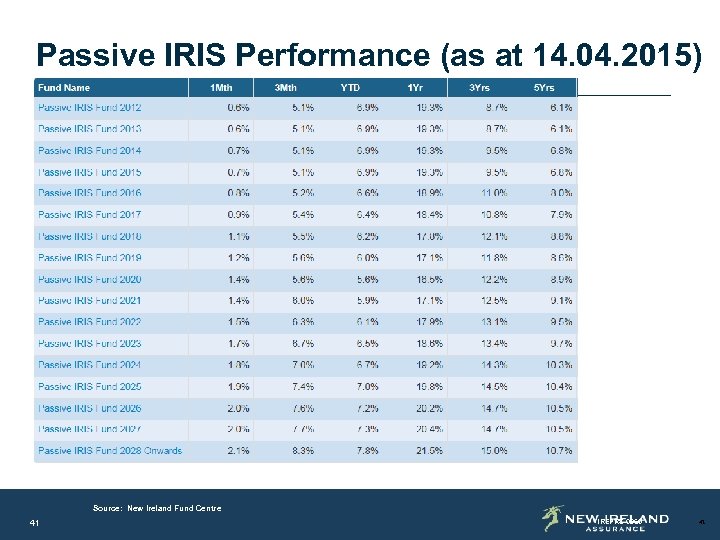

Passive IRIS Performance (as at 14. 04. 2015) Source: New Ireland Fund Centre as at 14 April 2015. Past performance is not a guarantee of future results. Performance returns for periods of less than one year are not annualized. The performance figures contained herein are provided on a gross of fees basis and do not reflect the deduction of advisory or other fees which could reduce the return. The performance includes the reinvestment of dividends and other corporate earnings and is calculated in in Euro. Source: New Ireland Fund Centre 41 IREPRS-0960 41

Passive IRIS Performance (as at 14. 04. 2015) Source: New Ireland Fund Centre as at 14 April 2015. Past performance is not a guarantee of future results. Performance returns for periods of less than one year are not annualized. The performance figures contained herein are provided on a gross of fees basis and do not reflect the deduction of advisory or other fees which could reduce the return. The performance includes the reinvestment of dividends and other corporate earnings and is calculated in in Euro. Source: New Ireland Fund Centre 41 IREPRS-0960 41

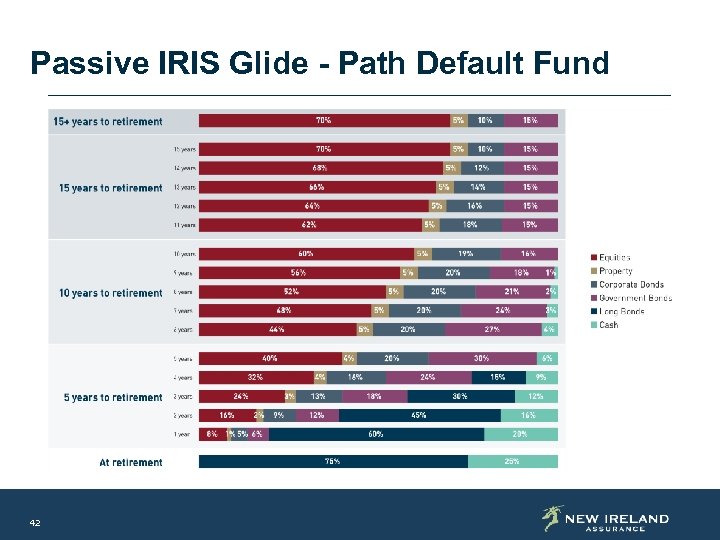

Passive IRIS Glide - Path Default Fund 42

Passive IRIS Glide - Path Default Fund 42

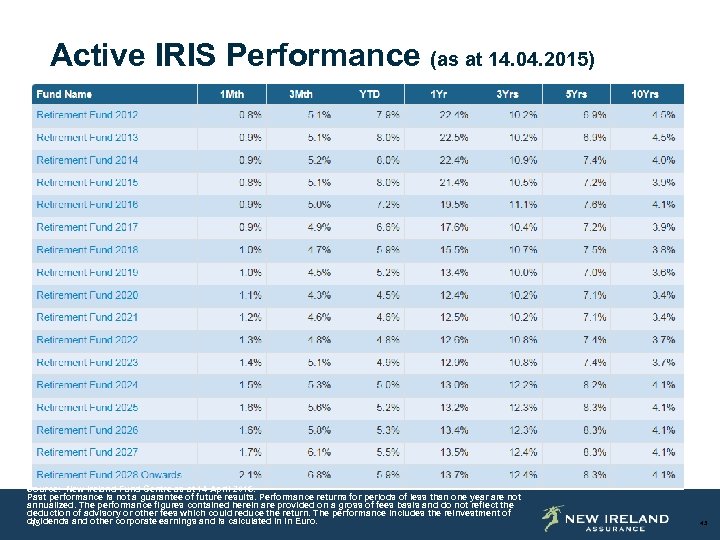

Active IRIS Performance (as at 14. 04. 2015) Source: New Ireland Fund Centre as at 14 April 2015. Past performance is not a guarantee of future results. Performance returns for periods of less than one year are not annualized. The performance figures contained herein are provided on a gross of fees basis and do not reflect the deduction of advisory or other fees which could reduce the return. The performance includes the reinvestment of dividends and other corporate earnings and is calculated in in Euro. 43 43

Active IRIS Performance (as at 14. 04. 2015) Source: New Ireland Fund Centre as at 14 April 2015. Past performance is not a guarantee of future results. Performance returns for periods of less than one year are not annualized. The performance figures contained herein are provided on a gross of fees basis and do not reflect the deduction of advisory or other fees which could reduce the return. The performance includes the reinvestment of dividends and other corporate earnings and is calculated in in Euro. 43 43

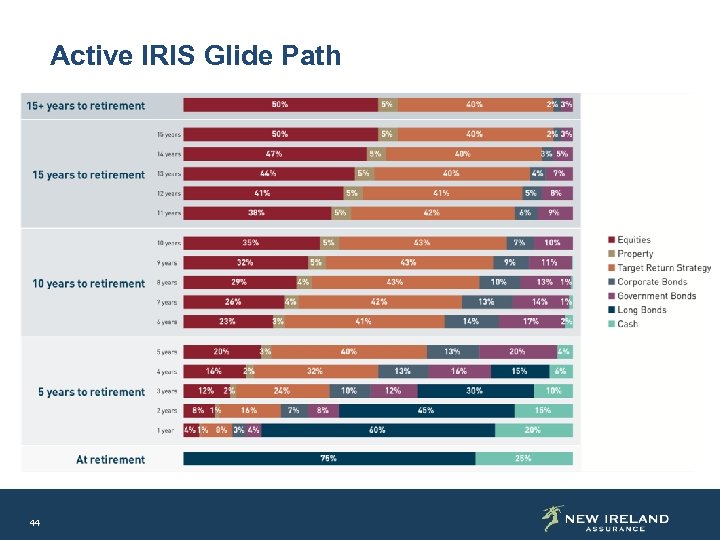

Active IRIS Glide Path 44

Active IRIS Glide Path 44

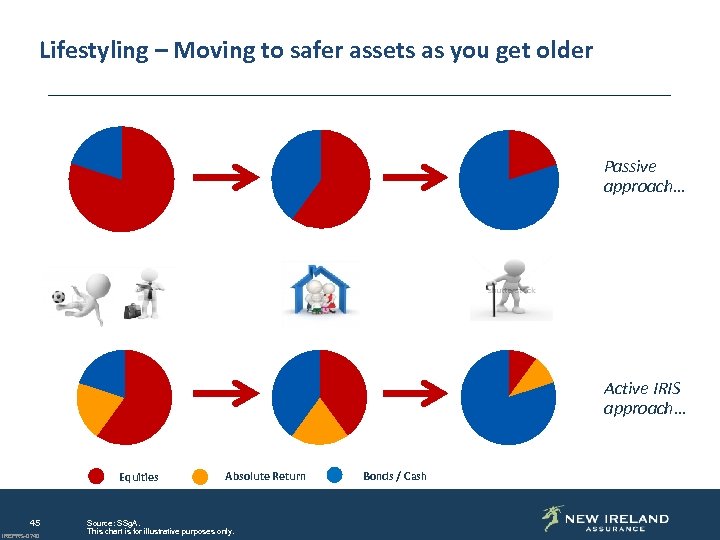

A Different Approach… Lifestyling – Moving to safer assets as you get older Passive approach… Active IRIS approach… Equities 45 IREPRS-0740 Absolute Return Source: SSg. A. This chart is for illustrative purposes only. Bonds / Cash

A Different Approach… Lifestyling – Moving to safer assets as you get older Passive approach… Active IRIS approach… Equities 45 IREPRS-0740 Absolute Return Source: SSg. A. This chart is for illustrative purposes only. Bonds / Cash

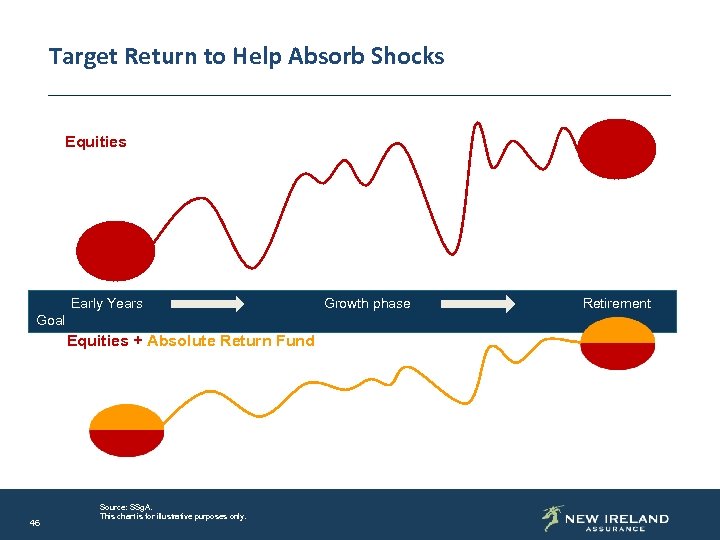

Target Return to Help Absorb Shocks Equities Early Years Goal Equities + Absolute Return Fund 46 Source: SSg. A. This chart is for illustrative purposes only. Growth phase Retirement

Target Return to Help Absorb Shocks Equities Early Years Goal Equities + Absolute Return Fund 46 Source: SSg. A. This chart is for illustrative purposes only. Growth phase Retirement

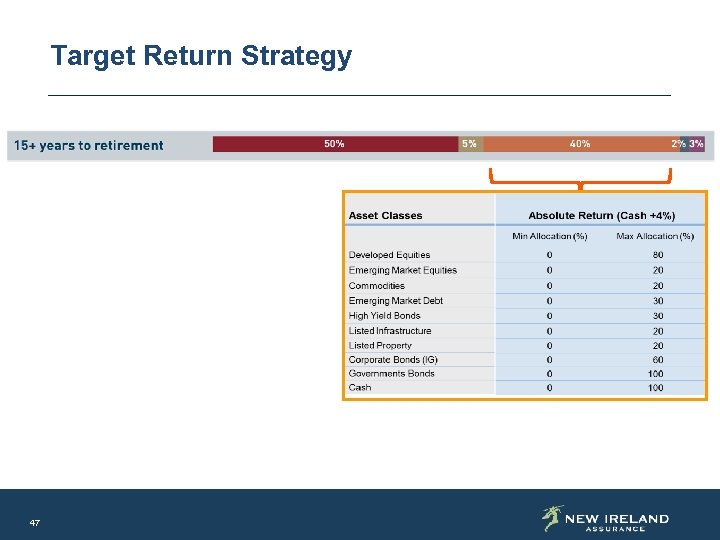

Target Return Strategy 47

Target Return Strategy 47

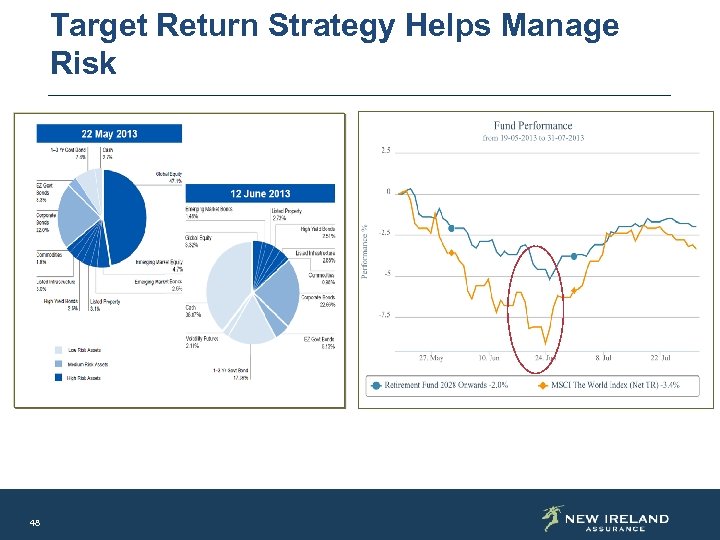

Target Return Strategy Helps Manage Risk 48

Target Return Strategy Helps Manage Risk 48

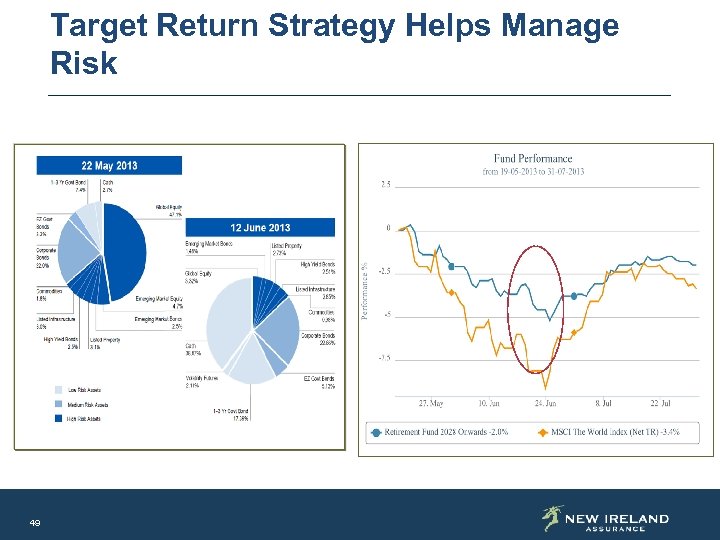

Target Return Strategy Helps Manage Risk 49

Target Return Strategy Helps Manage Risk 49

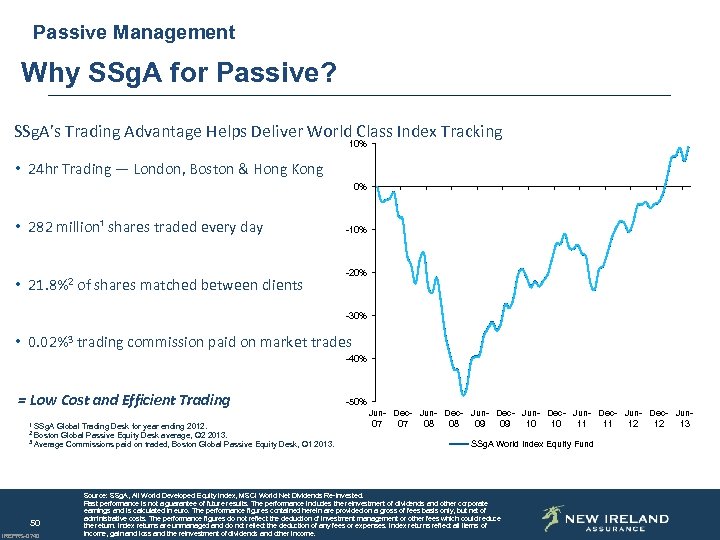

Passive Management Why SSg. A for Passive? SSg. A’s Trading Advantage Helps Deliver World Class Index Tracking 10% • 24 hr Trading — London, Boston & Hong Kong 0% • 282 million¹ shares traded every day • 21. 8%2 of shares matched between clients -10% -20% -30% • 0. 02%3 trading commission paid on market trades -40% = Low Cost and Efficient Trading SSg. A Global Trading Desk for year ending 2012. Boston Global Passive Equity Desk average, Q 2 2013. 3 Average Commissions paid on traded, Boston Global Passive Equity Desk, Q 1 2013. 1 -50% Jun- Dec- Jun- Dec- Jun 07 07 08 08 09 09 10 10 11 11 12 12 13 2 50 IREPRS-0740 SSg. A World Index Equity Fund Source: SSg. A, All World Developed Equity Index, MSCI World Net Dividends Re-invested. Past performance is not a guarantee of future results. The performance includes the reinvestment of dividends and other corporate earnings and is calculated in euro. The performance figures contained herein are provided on a gross of fees basis only, but net of administrative costs. The performance figures do not reflect the deduction of investment management or other fees which could reduce the return. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

Passive Management Why SSg. A for Passive? SSg. A’s Trading Advantage Helps Deliver World Class Index Tracking 10% • 24 hr Trading — London, Boston & Hong Kong 0% • 282 million¹ shares traded every day • 21. 8%2 of shares matched between clients -10% -20% -30% • 0. 02%3 trading commission paid on market trades -40% = Low Cost and Efficient Trading SSg. A Global Trading Desk for year ending 2012. Boston Global Passive Equity Desk average, Q 2 2013. 3 Average Commissions paid on traded, Boston Global Passive Equity Desk, Q 1 2013. 1 -50% Jun- Dec- Jun- Dec- Jun 07 07 08 08 09 09 10 10 11 11 12 12 13 2 50 IREPRS-0740 SSg. A World Index Equity Fund Source: SSg. A, All World Developed Equity Index, MSCI World Net Dividends Re-invested. Past performance is not a guarantee of future results. The performance includes the reinvestment of dividends and other corporate earnings and is calculated in euro. The performance figures contained herein are provided on a gross of fees basis only, but net of administrative costs. The performance figures do not reflect the deduction of investment management or other fees which could reduce the return. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

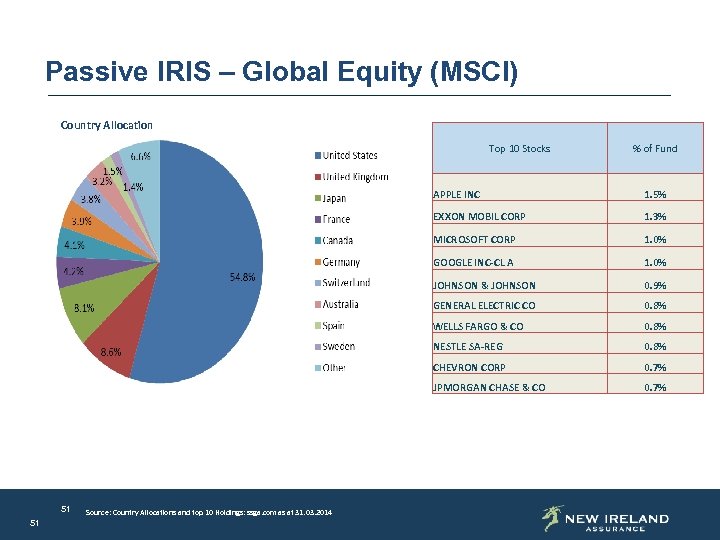

Passive IRIS – Global Equity (MSCI) Country Allocation Top 10 Stocks % of Fund APPLE INC EXXON MOBIL CORP 1. 0% JOHNSON & JOHNSON 0. 9% GENERAL ELECTRIC CO 0. 8% WELLS FARGO & CO 0. 8% NESTLE SA-REG 0. 8% CHEVRON CORP 0. 7% JPMORGAN CHASE & CO Source: Country Allocations and top 10 Holdings: ssga. com as at 31. 03. 2014 1. 0% GOOGLE INC-CL A 51 1. 3% MICROSOFT CORP 51 1. 5% 0. 7%

Passive IRIS – Global Equity (MSCI) Country Allocation Top 10 Stocks % of Fund APPLE INC EXXON MOBIL CORP 1. 0% JOHNSON & JOHNSON 0. 9% GENERAL ELECTRIC CO 0. 8% WELLS FARGO & CO 0. 8% NESTLE SA-REG 0. 8% CHEVRON CORP 0. 7% JPMORGAN CHASE & CO Source: Country Allocations and top 10 Holdings: ssga. com as at 31. 03. 2014 1. 0% GOOGLE INC-CL A 51 1. 3% MICROSOFT CORP 51 1. 5% 0. 7%

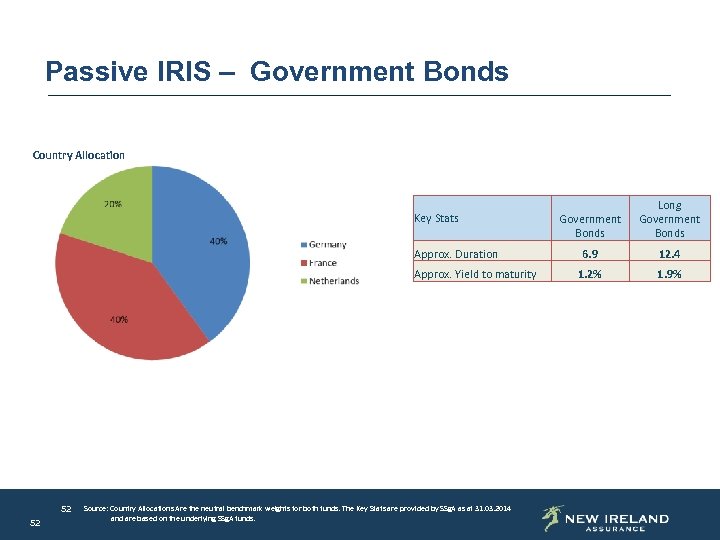

Passive IRIS – Government Bonds Country Allocation Key Stats Approx. Duration Approx. Yield to maturity 52 52 Source: Country Allocations Are the neutral benchmark weights for both funds. The Key Stats are provided by SSg. A as at 31. 03. 2014 and are based on the underlying SSg. A funds. Government Bonds Long Government Bonds 6. 9 12. 4 1. 2% 1. 9%

Passive IRIS – Government Bonds Country Allocation Key Stats Approx. Duration Approx. Yield to maturity 52 52 Source: Country Allocations Are the neutral benchmark weights for both funds. The Key Stats are provided by SSg. A as at 31. 03. 2014 and are based on the underlying SSg. A funds. Government Bonds Long Government Bonds 6. 9 12. 4 1. 2% 1. 9%

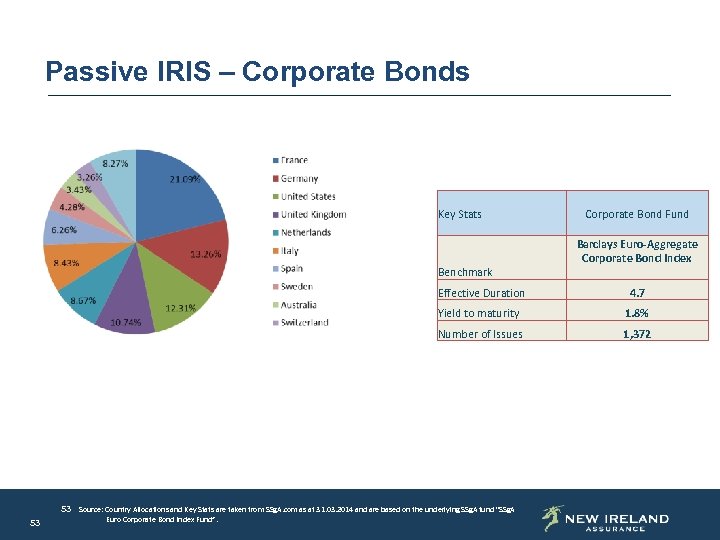

Passive IRIS – Corporate Bonds Key Stats Benchmark Corporate Bond Fund Barclays Euro-Aggregate Corporate Bond Index Effective Duration 4. 7 Yield to maturity 1. 8% Number of Issues 1, 372 53 Source: Country Allocations and Key Stats are taken from SSg. A. com as at 31. 03. 2014 and are based on the underlying SSg. A fund “SSg. A 53 Euro Corporate Bond Index Fund”.

Passive IRIS – Corporate Bonds Key Stats Benchmark Corporate Bond Fund Barclays Euro-Aggregate Corporate Bond Index Effective Duration 4. 7 Yield to maturity 1. 8% Number of Issues 1, 372 53 Source: Country Allocations and Key Stats are taken from SSg. A. com as at 31. 03. 2014 and are based on the underlying SSg. A fund “SSg. A 53 Euro Corporate Bond Index Fund”.

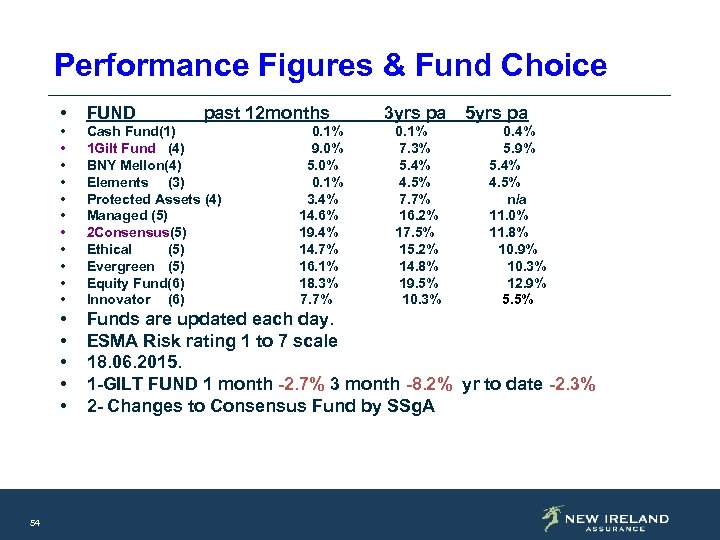

Performance Figures & Fund Choice • • • Cash Fund(1) 1 Gilt Fund (4) BNY Mellon(4) Elements (3) Protected Assets (4) Managed (5) 2 Consensus(5) Ethical (5) Evergreen (5) Equity Fund(6) Innovator (6) • • • 54 FUND Funds are updated each day. ESMA Risk rating 1 to 7 scale 18. 06. 2015. 1 -GILT FUND 1 month -2. 7% 3 month -8. 2% yr to date -2. 3% 2 - Changes to Consensus Fund by SSg. A past 12 months 0. 1% 9. 0% 5. 0% 0. 1% 3. 4% 14. 6% 19. 4% 14. 7% 16. 1% 18. 3% 7. 7% 3 yrs pa 0. 1% 7. 3% 5. 4% 4. 5% 7. 7% 16. 2% 17. 5% 15. 2% 14. 8% 19. 5% 10. 3% 5 yrs pa 0. 4% 5. 9% 5. 4% 4. 5% n/a 11. 0% 11. 8% 10. 9% 10. 3% 12. 9% 5. 5%

Performance Figures & Fund Choice • • • Cash Fund(1) 1 Gilt Fund (4) BNY Mellon(4) Elements (3) Protected Assets (4) Managed (5) 2 Consensus(5) Ethical (5) Evergreen (5) Equity Fund(6) Innovator (6) • • • 54 FUND Funds are updated each day. ESMA Risk rating 1 to 7 scale 18. 06. 2015. 1 -GILT FUND 1 month -2. 7% 3 month -8. 2% yr to date -2. 3% 2 - Changes to Consensus Fund by SSg. A past 12 months 0. 1% 9. 0% 5. 0% 0. 1% 3. 4% 14. 6% 19. 4% 14. 7% 16. 1% 18. 3% 7. 7% 3 yrs pa 0. 1% 7. 3% 5. 4% 4. 5% 7. 7% 16. 2% 17. 5% 15. 2% 14. 8% 19. 5% 10. 3% 5 yrs pa 0. 4% 5. 9% 5. 4% 4. 5% n/a 11. 0% 11. 8% 10. 9% 10. 3% 12. 9% 5. 5%

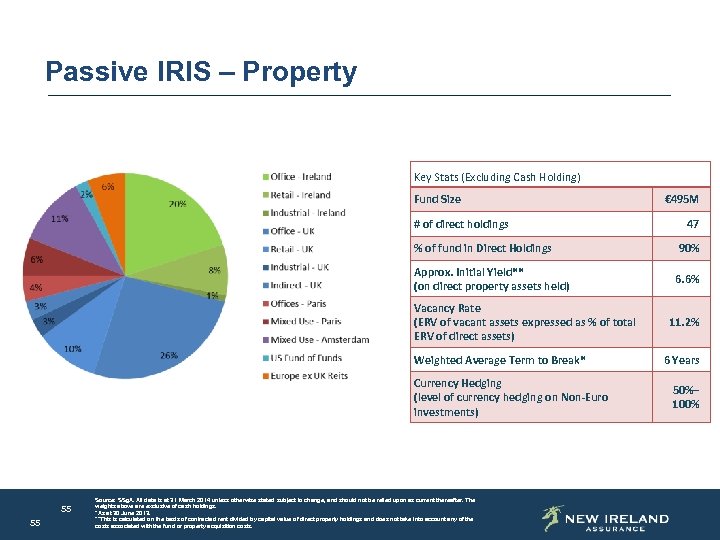

Passive IRIS – Property Key Stats (Excluding Cash Holding) Fund Size # of direct holdings € 495 M 47 % of fund in Direct Holdings 90% Approx. Initial Yield** (on direct property assets held) 6. 6% Vacancy Rate (ERV of vacant assets expressed as % of total ERV of direct assets) Weighted Average Term to Break* Currency Hedging (level of currency hedging on Non-Euro investments) 55 55 Source: SSg. A. All data is at 31 March 2014 unless otherwise stated subject to change, and should not be relied upon as current thereafter. The weights above are exclusive of cash holdings. *As at 30 June 2013. **This is calculated on the basis of contracted rent divided by capital value of direct property holdings and does not take into account any of the costs associated with the fund or property acquisition costs. 11. 2% 6 Years 50%– 100%

Passive IRIS – Property Key Stats (Excluding Cash Holding) Fund Size # of direct holdings € 495 M 47 % of fund in Direct Holdings 90% Approx. Initial Yield** (on direct property assets held) 6. 6% Vacancy Rate (ERV of vacant assets expressed as % of total ERV of direct assets) Weighted Average Term to Break* Currency Hedging (level of currency hedging on Non-Euro investments) 55 55 Source: SSg. A. All data is at 31 March 2014 unless otherwise stated subject to change, and should not be relied upon as current thereafter. The weights above are exclusive of cash holdings. *As at 30 June 2013. **This is calculated on the basis of contracted rent divided by capital value of direct property holdings and does not take into account any of the costs associated with the fund or property acquisition costs. 11. 2% 6 Years 50%– 100%

Passive IRIS – Cash - Primarily invested in AAA Rated SSg. A Liquidity Fund - Over 75 different Cash Instruments held with over 40 different large Financial Institutions - Weighted Average Maturity of Cash Instruments is 38 Days - Primary Focus is on Safety and Liquidity 56 56 Source: Stats taken from SSg. A. com as at 31. 03. 2014 – SSg. A EUR Liquidity Fund

Passive IRIS – Cash - Primarily invested in AAA Rated SSg. A Liquidity Fund - Over 75 different Cash Instruments held with over 40 different large Financial Institutions - Weighted Average Maturity of Cash Instruments is 38 Days - Primary Focus is on Safety and Liquidity 56 56 Source: Stats taken from SSg. A. com as at 31. 03. 2014 – SSg. A EUR Liquidity Fund

So lets finish by looking at the correct investment process. 1. Your Goals objectives 5. Regular Review 4. Investment Fund choice 57 2. Your Risk Profile 3. Asset Allocation

So lets finish by looking at the correct investment process. 1. Your Goals objectives 5. Regular Review 4. Investment Fund choice 57 2. Your Risk Profile 3. Asset Allocation

What Should I Do Next? Contact: Pensions Office NUI Galway Ph: Email: (091) 495028 ext: 5028 pensions@nuigalway. ie or Noel Hackett, QFA, Pensions Consultant New Ireland Assurance, Atlanta House, 36 Dominick Street, Galway Tel: (091) 563023 Mobile: 086 - 8186163 Email: Noel. hackett@newireland. ie 58

What Should I Do Next? Contact: Pensions Office NUI Galway Ph: Email: (091) 495028 ext: 5028 pensions@nuigalway. ie or Noel Hackett, QFA, Pensions Consultant New Ireland Assurance, Atlanta House, 36 Dominick Street, Galway Tel: (091) 563023 Mobile: 086 - 8186163 Email: Noel. hackett@newireland. ie 58

Any Questions? Thank You for attending 59

Any Questions? Thank You for attending 59

Individual Consultations Available Noel Hackett will be available (9 – 5 pm) for Confidential Individual Consultations Concourse Room AC 203 (near Smokeys/BOI ) Thurs 25 th June 2015 & Friday 26 th June 2015 Contact: Karen Costello/ Jacqueline Joyce Extn 5901/5028 Karen. costello@nuigalway. ie Jacqueline. joyce@nuigalway. ie 60

Individual Consultations Available Noel Hackett will be available (9 – 5 pm) for Confidential Individual Consultations Concourse Room AC 203 (near Smokeys/BOI ) Thurs 25 th June 2015 & Friday 26 th June 2015 Contact: Karen Costello/ Jacqueline Joyce Extn 5901/5028 Karen. costello@nuigalway. ie Jacqueline. joyce@nuigalway. ie 60