51a69104c7dec35d2b39783e2c0de909.ppt

- Количество слайдов: 44

New Foreign National Student / Employee Orientation Office of International Affairs Welcomes you to UTMB & Galveston Island! Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

New Foreign National Student / Employee Orientation Office of International Affairs Welcomes you to UTMB & Galveston Island! Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

AGENDA Introductions: I. - Office of International Affairs - Finance Payroll Services UTMB Initialization Process II. Legal Documents III. Miscellaneous topics pertaining to New Foreign National Employees III. United States Basic Tax Concepts, Rules & Regulations Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

AGENDA Introductions: I. - Office of International Affairs - Finance Payroll Services UTMB Initialization Process II. Legal Documents III. Miscellaneous topics pertaining to New Foreign National Employees III. United States Basic Tax Concepts, Rules & Regulations Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I. UTMB Initialization process: • Employee identification badge • Institutional new employee orientation (and exit interview) • Local community information: See handouts included in packet: * Galveston Newcomers Useful Websites * Galveston Chamber of Commerce New Resident Information Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I. UTMB Initialization process: • Employee identification badge • Institutional new employee orientation (and exit interview) • Local community information: See handouts included in packet: * Galveston Newcomers Useful Websites * Galveston Chamber of Commerce New Resident Information Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

II. LEGAL DOCUMENTS Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

II. LEGAL DOCUMENTS Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

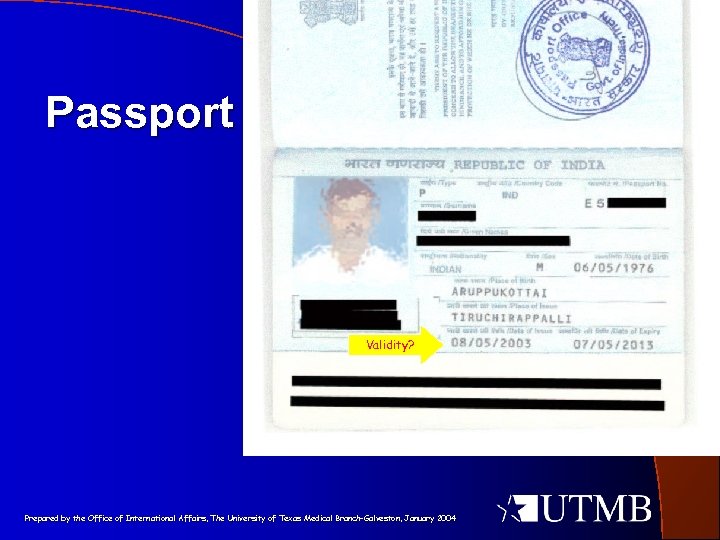

Passport Validity? Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Passport Validity? Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

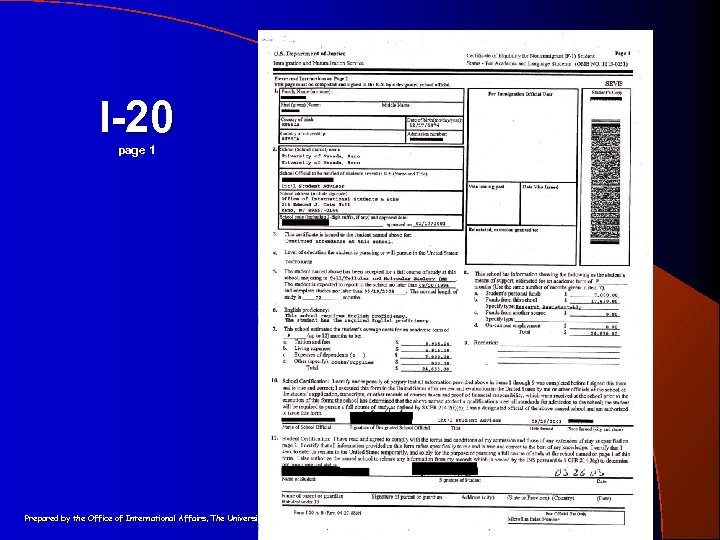

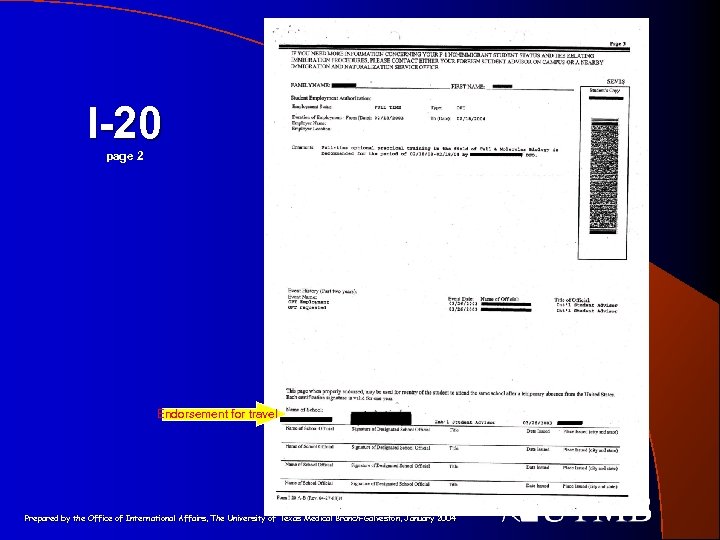

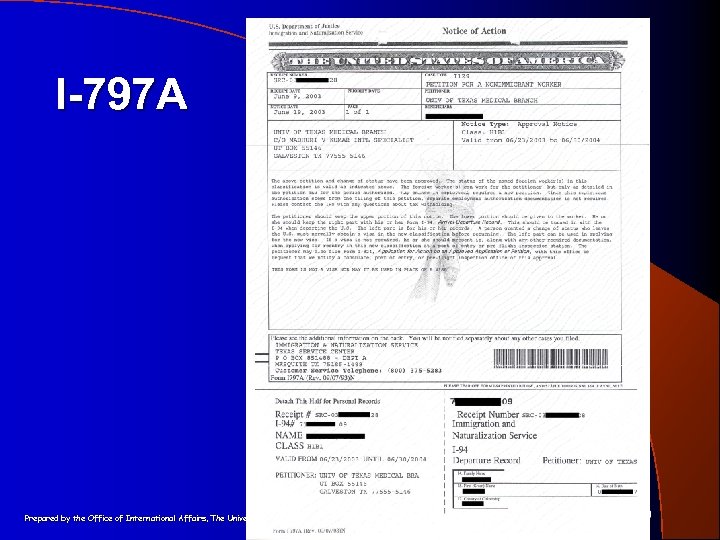

Basic Forms associated with various types of visas ü These basic Forms are required to apply for a visa at a U. S. consulate/embassy. They are NOT visas • Form DS-2019 (formerly IAP-66), Certificate of Eligibility for Exchange Visitor (J-1) Status. • Form I-20, Certificate of Eligibility for Non-immigrant (F-1) Student. • Form I-797 A / I-797 B, USCIS Approval Notice for Nonimmigrant (H, O, TN) status. ü These forms determine the visa status and length of authorized stay to complete your objective in the U. S. under a particular non-immigrant visa classification. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Basic Forms associated with various types of visas ü These basic Forms are required to apply for a visa at a U. S. consulate/embassy. They are NOT visas • Form DS-2019 (formerly IAP-66), Certificate of Eligibility for Exchange Visitor (J-1) Status. • Form I-20, Certificate of Eligibility for Non-immigrant (F-1) Student. • Form I-797 A / I-797 B, USCIS Approval Notice for Nonimmigrant (H, O, TN) status. ü These forms determine the visa status and length of authorized stay to complete your objective in the U. S. under a particular non-immigrant visa classification. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

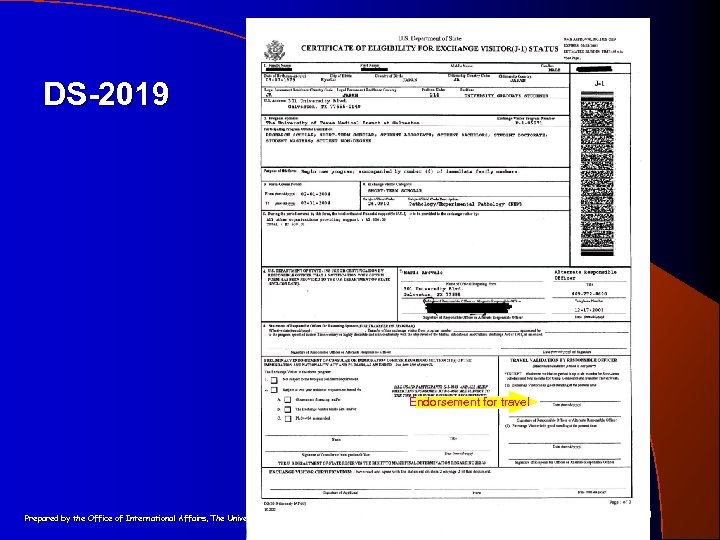

DS-2019 Endorsement for travel Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

DS-2019 Endorsement for travel Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I-20 page 1 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I-20 page 1 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I-20 page 2 Endorsement for travel Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I-20 page 2 Endorsement for travel Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I-797 A Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I-797 A Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

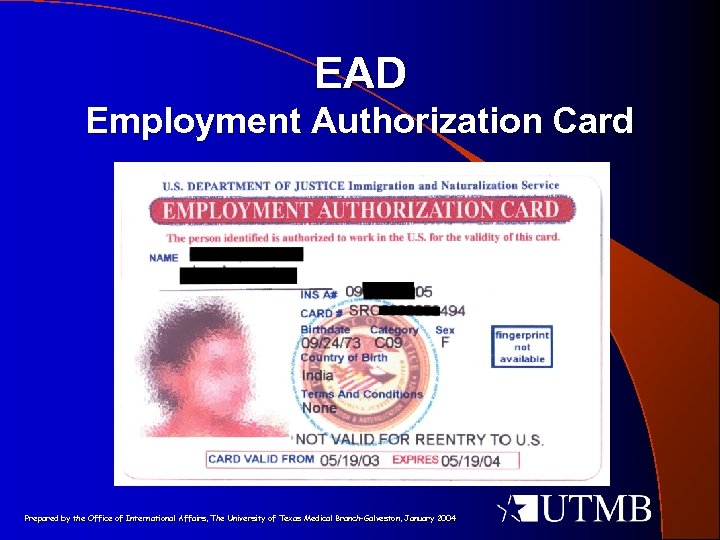

Visa Classification ü This refers to the type of visa under which you were admitted and the specific regulations governing your stay in the U. S. ü It is your responsibility to be aware of rules and regulations that apply to you while in the U. S. based on your visa classification. ü You must comply with the primary purpose of your current visa status. ü Please consult your advisor at the Office of International Affairs well in advance of any change of activities or objectives. ü In some cases a change of visa classification may be required to preserve your legal permission to remain and/or work in the U. S. ü Dependent visa classifications that do not permit employment include: F-2, H-4, O-3 and TD. Dependents on J-2 visas are eligible to work only upon obtaining an Employment Authorization Document (EAD) from the USCIS. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Visa Classification ü This refers to the type of visa under which you were admitted and the specific regulations governing your stay in the U. S. ü It is your responsibility to be aware of rules and regulations that apply to you while in the U. S. based on your visa classification. ü You must comply with the primary purpose of your current visa status. ü Please consult your advisor at the Office of International Affairs well in advance of any change of activities or objectives. ü In some cases a change of visa classification may be required to preserve your legal permission to remain and/or work in the U. S. ü Dependent visa classifications that do not permit employment include: F-2, H-4, O-3 and TD. Dependents on J-2 visas are eligible to work only upon obtaining an Employment Authorization Document (EAD) from the USCIS. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

US Visa Stamp / J-2 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

US Visa Stamp / J-2 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

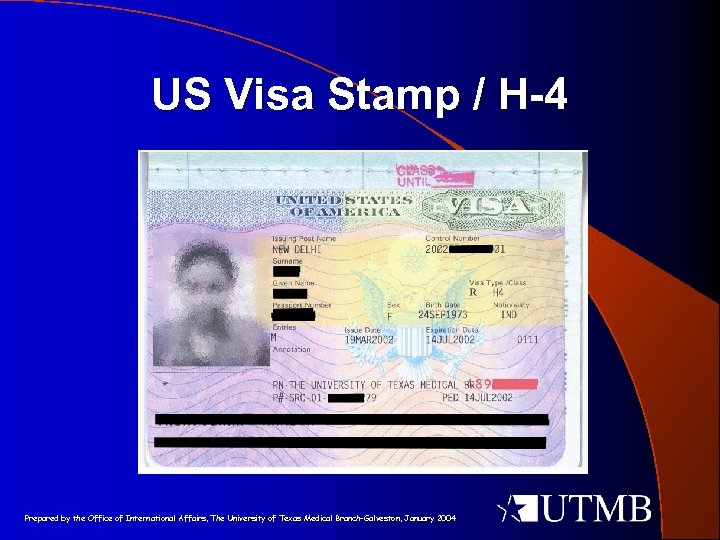

US Visa Stamp / H-4 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

US Visa Stamp / H-4 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

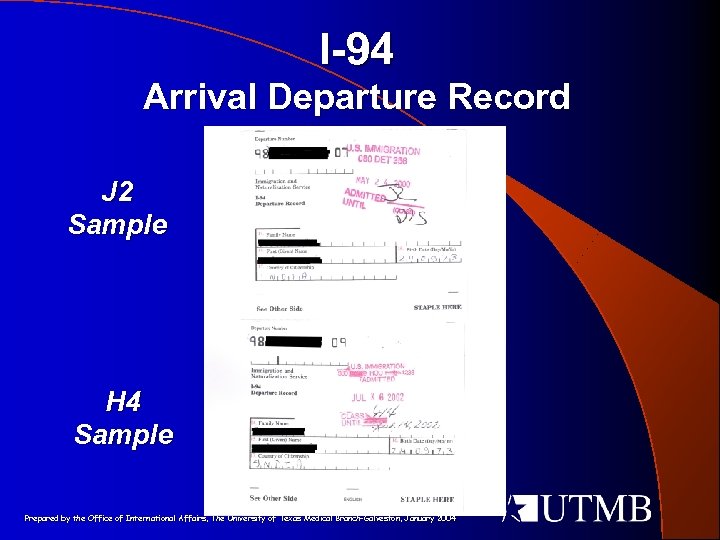

I-94 Arrival Departure Record J 2 Sample H 4 Sample Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

I-94 Arrival Departure Record J 2 Sample H 4 Sample Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

EAD Employment Authorization Card Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

EAD Employment Authorization Card Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

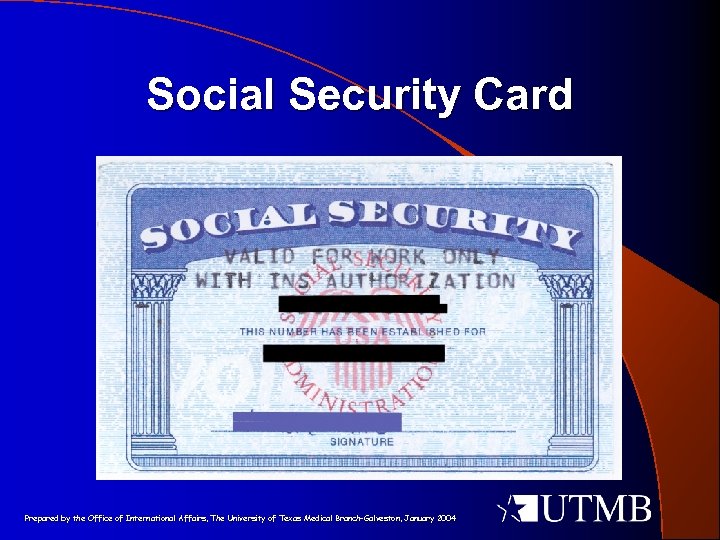

Social Security Card Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Social Security Card Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

ITIN Individual Taxpayer Identification Number You need a Taxpayer Identification Number (ITIN) if you: • Will claim income that is exempt under a treaty (may apply in advance), or • Are claimed as a dependent on someone's tax return (may apply only when filing tax return in which dependents are included). Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

ITIN Individual Taxpayer Identification Number You need a Taxpayer Identification Number (ITIN) if you: • Will claim income that is exempt under a treaty (may apply in advance), or • Are claimed as a dependent on someone's tax return (may apply only when filing tax return in which dependents are included). Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Texas Driver License Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Texas Driver License Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

III. MISCELLANEOUS TOPICS Pertaining to New Foreign National Employees Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

III. MISCELLANEOUS TOPICS Pertaining to New Foreign National Employees Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Traveling Abroad • Travel abroad, especially when a new visa is required, should be carefully considered before final plans are made. • Visit the web page of the United States Consulate or Embassy where you will apply for your visa to determine whether procedures have changed. • State Department security clearances are still required for certain visa applicants, delaying visa issuance by a minimum of 4 -6 weeks. • Security clearance is only valid for 12 months Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Traveling Abroad • Travel abroad, especially when a new visa is required, should be carefully considered before final plans are made. • Visit the web page of the United States Consulate or Embassy where you will apply for your visa to determine whether procedures have changed. • State Department security clearances are still required for certain visa applicants, delaying visa issuance by a minimum of 4 -6 weeks. • Security clearance is only valid for 12 months Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Automatic Visa Revalidation • Department of State (DOS) regulations permit certain non-immigrants to re-enter the United States after a visit of 30 -day or less to Canada or Mexico with an expired U. S. visa. • As of 2002 new regulations cancel automatic revalidation for two classes of persons: 1. All persons traveling on passports issued by Iraq, Iran, Syria, Libya, Sudan, North Korea and Cuba 2. All persons who visit a U. S. consulate in Canada, Mexico, or adjacent islands and submit an application there for a new nonimmigrant visa Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Automatic Visa Revalidation • Department of State (DOS) regulations permit certain non-immigrants to re-enter the United States after a visit of 30 -day or less to Canada or Mexico with an expired U. S. visa. • As of 2002 new regulations cancel automatic revalidation for two classes of persons: 1. All persons traveling on passports issued by Iraq, Iran, Syria, Libya, Sudan, North Korea and Cuba 2. All persons who visit a U. S. consulate in Canada, Mexico, or adjacent islands and submit an application there for a new nonimmigrant visa Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

US-VISIT Program • The United States Visitor and Immigrant Status Indicator Technology (US-VISIT) program records the entry and exit of non-US citizens into and out of the United States, at US international air and sea ports. • Collects biometric identifiers through digital photograph and fingerprints from all arriving visitors. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

US-VISIT Program • The United States Visitor and Immigrant Status Indicator Technology (US-VISIT) program records the entry and exit of non-US citizens into and out of the United States, at US international air and sea ports. • Collects biometric identifiers through digital photograph and fingerprints from all arriving visitors. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

SEVIS • • • 1. 2. 3. The Student and Exchange Visitor Information System is a shared government database to track F-1, M-1 and J-1 non-immigrants. UTMB is responsible for reporting information to SEVIS. It is your responsibility to REPORT to OIA (J-1) or Enrollment Services (F-1): Any local address change within 10 days of change. Early completion of a degree program, changes in major or academic level, BEFORE the date the change is effective Changes in job title, salary and/or employing department at UTMB, BEFORE the date the change is effective Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

SEVIS • • • 1. 2. 3. The Student and Exchange Visitor Information System is a shared government database to track F-1, M-1 and J-1 non-immigrants. UTMB is responsible for reporting information to SEVIS. It is your responsibility to REPORT to OIA (J-1) or Enrollment Services (F-1): Any local address change within 10 days of change. Early completion of a degree program, changes in major or academic level, BEFORE the date the change is effective Changes in job title, salary and/or employing department at UTMB, BEFORE the date the change is effective Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Health Insurance • All F-1 / F-2 and J-1 / J-2 visa holders are required to have medical insurance for the duration of the program. At a minimum: 1. Medical benefits of at least $50, 000 person, per accident or illness. Basic health insurance coverage is provided for all full-time, regular employees of UTMB. 2. Repatriation of remains coverage in the amount of US $7, 500 person. 3. Medical evacuation expenses in the amount of US $10, 000 person. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Health Insurance • All F-1 / F-2 and J-1 / J-2 visa holders are required to have medical insurance for the duration of the program. At a minimum: 1. Medical benefits of at least $50, 000 person, per accident or illness. Basic health insurance coverage is provided for all full-time, regular employees of UTMB. 2. Repatriation of remains coverage in the amount of US $7, 500 person. 3. Medical evacuation expenses in the amount of US $10, 000 person. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Office of International Affairs Consult the Office of International Affairs regarding these issues or any other situations that may affect your visa status, employment eligibility, or tax status. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004 Don’t be caught off guard!

Office of International Affairs Consult the Office of International Affairs regarding these issues or any other situations that may affect your visa status, employment eligibility, or tax status. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004 Don’t be caught off guard!

Office of International Affairs Staff • Maggie Pinson, Manager: mapinson@utmb. edu • Maria C. Arevalo, International Consultant: mcareval@utmb. edu • Rosemary Fredericksen, Immigration Advisor: tfreder@utmb. edu • Madhuri V. Kumar, Immigration Advisor: mvkumar@utmb. edu • Jackie Lynch, Admin. Secretary: jdlynch@utmb. edu / (409) 772 -3733 Web site: http: //utmb. edu/international/ Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Office of International Affairs Staff • Maggie Pinson, Manager: mapinson@utmb. edu • Maria C. Arevalo, International Consultant: mcareval@utmb. edu • Rosemary Fredericksen, Immigration Advisor: tfreder@utmb. edu • Madhuri V. Kumar, Immigration Advisor: mvkumar@utmb. edu • Jackie Lynch, Admin. Secretary: jdlynch@utmb. edu / (409) 772 -3733 Web site: http: //utmb. edu/international/ Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

IV. UNITED STATES BASIC TAX CONCEPTS, RULES & REGULATIONS Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

IV. UNITED STATES BASIC TAX CONCEPTS, RULES & REGULATIONS Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Federal Income Tax (FIT) 1. U. S. tax year is calendar year: January through December. 2. Employers deduct certain amounts of tax from employee’s pay to send to the U. S. government (IRS). 3. Employers issue IRS Form W-2 by January of each year showing income and tax withheld. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Federal Income Tax (FIT) 1. U. S. tax year is calendar year: January through December. 2. Employers deduct certain amounts of tax from employee’s pay to send to the U. S. government (IRS). 3. Employers issue IRS Form W-2 by January of each year showing income and tax withheld. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

…Cont. Federal Income Tax (FIT) 4. Most tax returns are due by April 15 each year. 5. The tax return determines whether tax is owed or a tax refund will be made to the employee. 6. Nonresident aliens for tax purposes are taxed differently than U. S. residents for tax purposes. 7. Nonresidents for tax purposes include: Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

…Cont. Federal Income Tax (FIT) 4. Most tax returns are due by April 15 each year. 5. The tax return determines whether tax is owed or a tax refund will be made to the employee. 6. Nonresident aliens for tax purposes are taxed differently than U. S. residents for tax purposes. 7. Nonresidents for tax purposes include: Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

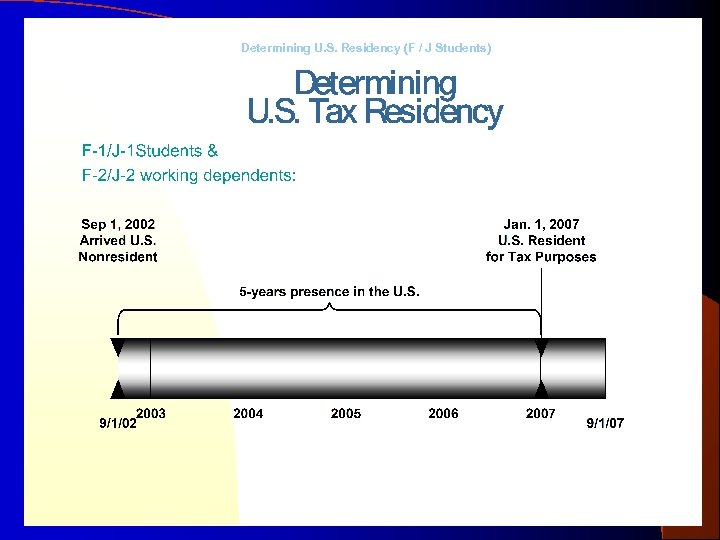

Determining U. S. Residency (F / J Students) Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Determining U. S. Residency (F / J Students) Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

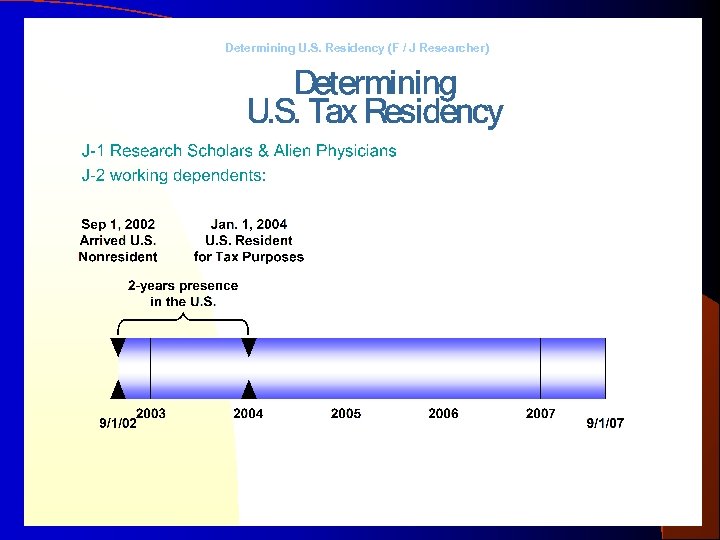

Determining U. S. Residency (F / J Researcher) Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Determining U. S. Residency (F / J Researcher) Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

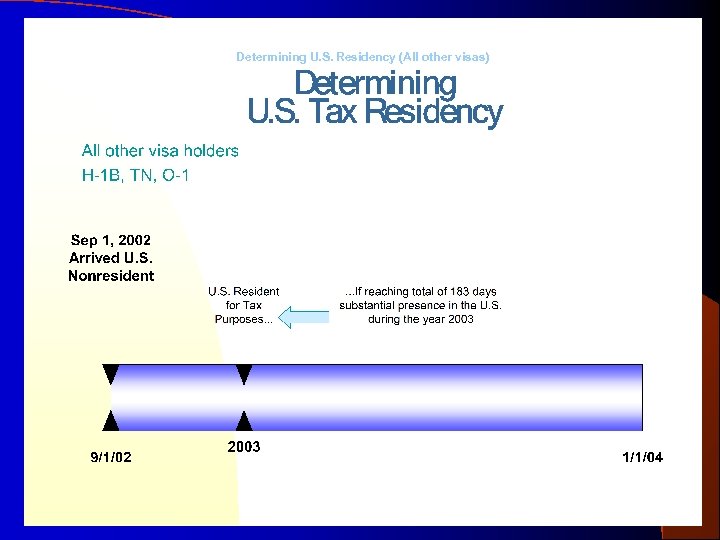

Determining U. S. Residency (All other visas) Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Determining U. S. Residency (All other visas) Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

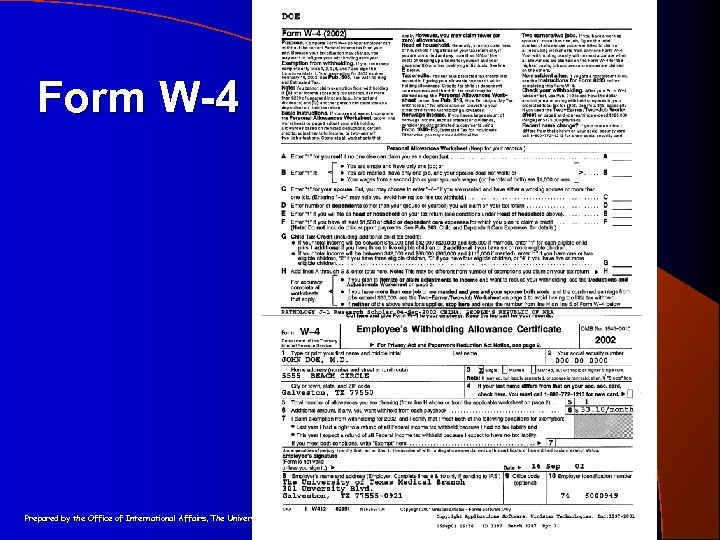

Form W-4 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Form W-4 Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

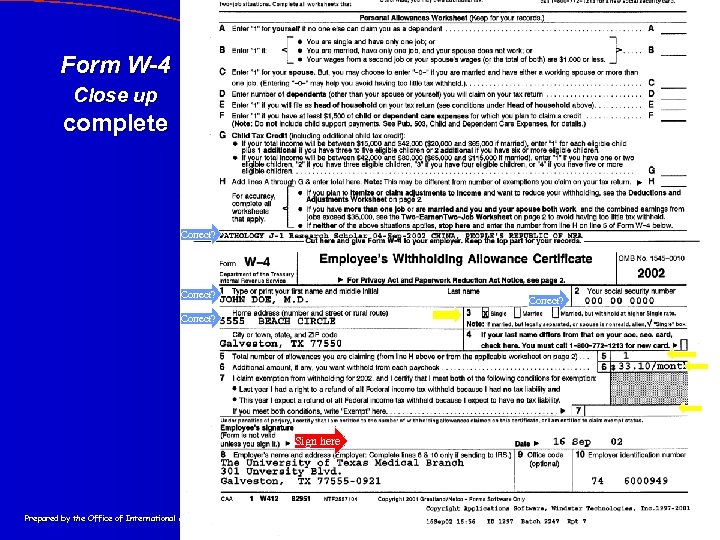

Form W-4 Close up complete Correct? Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Form W-4 Close up complete Correct? Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

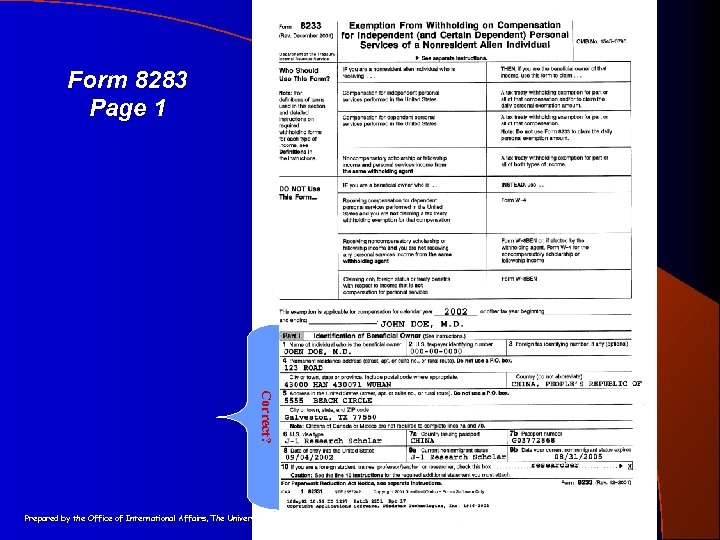

Form 8283 Page 1 Correct? Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Form 8283 Page 1 Correct? Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

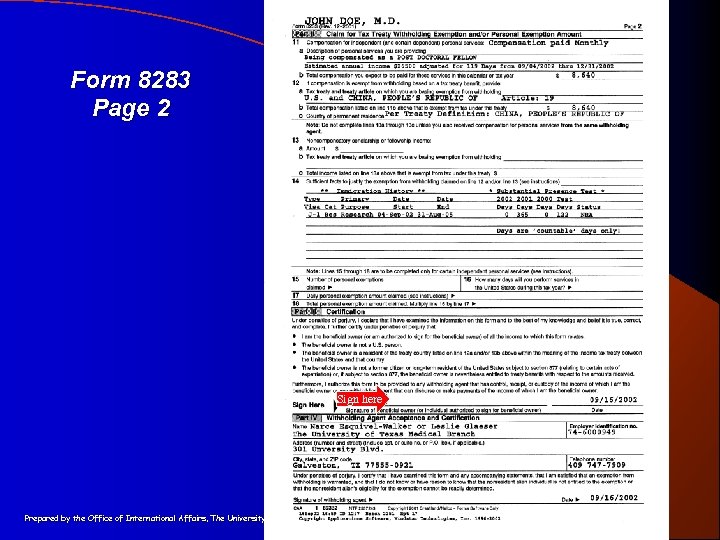

Form 8283 Page 2 Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Form 8283 Page 2 Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

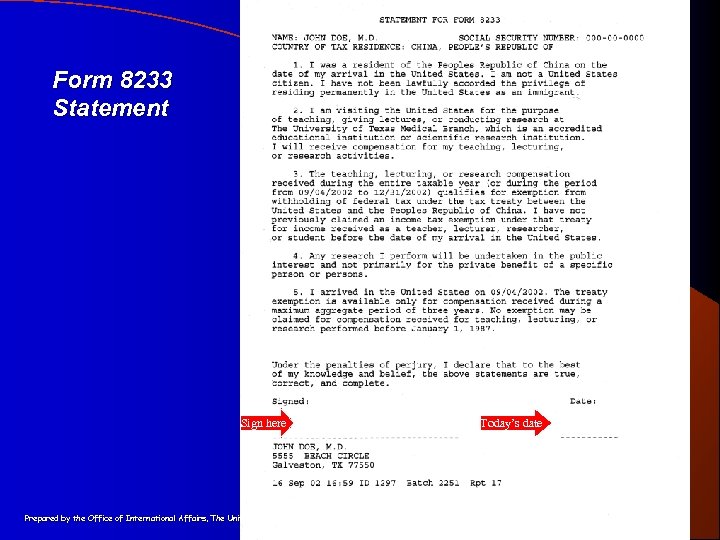

Form 8233 Statement Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004 Today’s date

Form 8233 Statement Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004 Today’s date

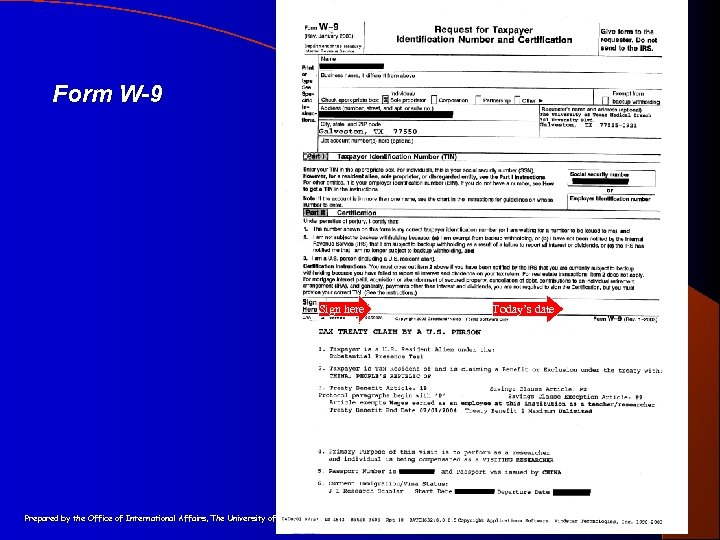

Form W-9 Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004 Today’s date

Form W-9 Sign here Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004 Today’s date

Social Security Tax (also called FICA and FUTA) 1. Social Security Tax is a retirement tax that, like federal income tax, is deducted from pay. 2. F-1 Students and J-1 Exchange Visitors who are “nonresidents for tax purposes” are not required to pay Social Security tax. • F-1 & J-1 students must begin paying social security tax in their sixth calendar year of presence, unless continuing as a full time student. J-1 exchange visitors must pay social security tax in their third calendar year of presence. • 3. All other visa holders with income in the U. S. must pay this tax even though they will not retire in the U. S. or receive Social Security benefits. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Social Security Tax (also called FICA and FUTA) 1. Social Security Tax is a retirement tax that, like federal income tax, is deducted from pay. 2. F-1 Students and J-1 Exchange Visitors who are “nonresidents for tax purposes” are not required to pay Social Security tax. • F-1 & J-1 students must begin paying social security tax in their sixth calendar year of presence, unless continuing as a full time student. J-1 exchange visitors must pay social security tax in their third calendar year of presence. • 3. All other visa holders with income in the U. S. must pay this tax even though they will not retire in the U. S. or receive Social Security benefits. Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

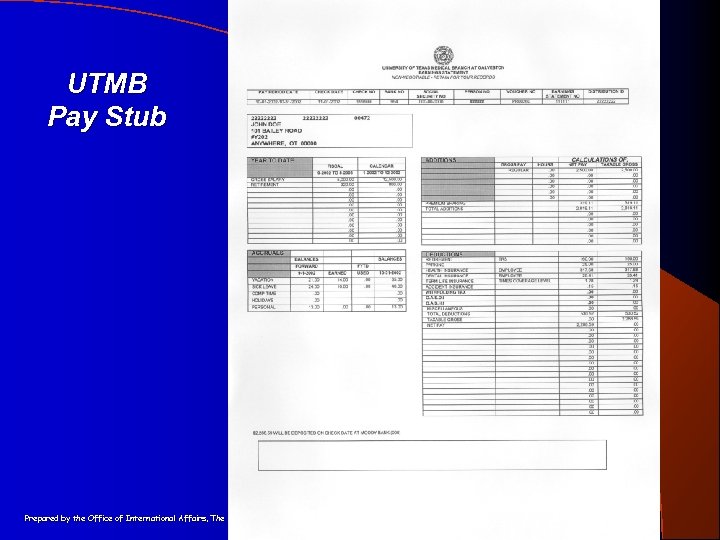

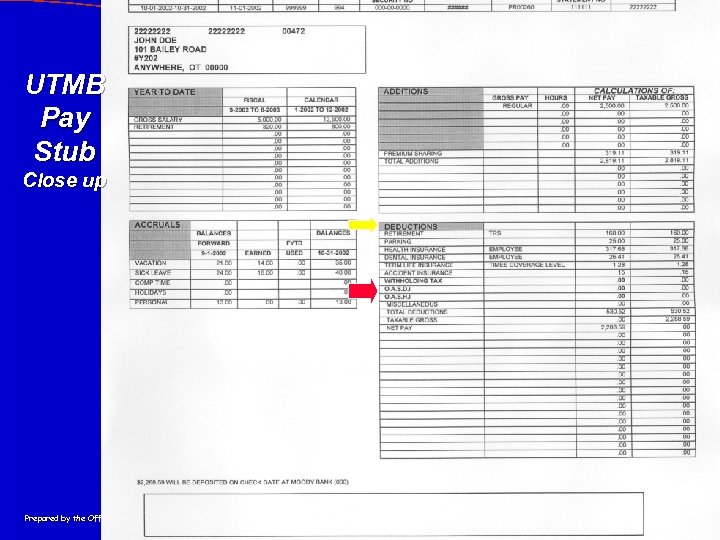

UTMB Pay Stub Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

UTMB Pay Stub Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

UTMB Pay Stub Close up Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

UTMB Pay Stub Close up Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Where Can I Go for More Information? 1. 2. 3. 4. 5. 6. Pay Check Issues or Errors: UTMB Payroll Services Narce Esquivel-Walker (409) 747 -7954 General Tax Information: IRS Web Site: http: //www. irs. gov/ Information (IRS), International Division, 1 (800) 829 -3903 IRS Withholding Calculator: http: //www. irs. ustreas. gov/individuals/page/0, , id=14806, 00. html Income Tax Treaties: Treaties http: //www. irs. gov/businesses/corporations/article/0, , id=96739, 0 0. html UTMB Volunteer Income Tax Assistance (VITA) Program, Program February - April 15 (ext. 23733). Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Where Can I Go for More Information? 1. 2. 3. 4. 5. 6. Pay Check Issues or Errors: UTMB Payroll Services Narce Esquivel-Walker (409) 747 -7954 General Tax Information: IRS Web Site: http: //www. irs. gov/ Information (IRS), International Division, 1 (800) 829 -3903 IRS Withholding Calculator: http: //www. irs. ustreas. gov/individuals/page/0, , id=14806, 00. html Income Tax Treaties: Treaties http: //www. irs. gov/businesses/corporations/article/0, , id=96739, 0 0. html UTMB Volunteer Income Tax Assistance (VITA) Program, Program February - April 15 (ext. 23733). Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Questions? Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

Questions? Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

How did we do today? Please complete our “session evaluation” Thank you! Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004

How did we do today? Please complete our “session evaluation” Thank you! Prepared by the Office of International Affairs, The University of Texas Medical Branch-Galveston, January 2004